Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex21-1.htm |

| EX-32.2 - EXHIBIT 32.2 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex31-1.htm |

| EX-10.64 - EXHIBIT 10.64 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex10-64.htm |

| EX-10.63 - EXHIBIT 10.63 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex10-63.htm |

| EX-10.62 - EXHIBIT 10.62 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex10-62.htm |

| EX-10.61 - EXHIBIT 10.61 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex10-61.htm |

| EX-10.60 - EXHIBIT 10.60 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex10-60.htm |

| EX-10.59 - EXHIBIT 10.59 - HUI YING FINANCIAL HOLDINGS Corp | s105689_ex10-59.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 333-201037

Sino Fortune Holding Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 35-2507568 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

|

Room 2403, Shanghai Mart Tower 2299 West Yan’an Road, Changning District Shanghai, China |

200336 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: +86 21-23570077

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of the last business day of the Company’s most recently completed second fiscal quarter, there was no active public trading for its shares of common stock on OTC QB. Since the Company’s revenue is less than $50 million during the fiscal year ended 2016, the Company is a smaller reporting company.

As of April 12, 2017, there were 361,820,246 shares of the Company’s common stock issued and outstanding.

SINO FORTUNE HOLDING CORPORATION

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2016

TABLE OF CONTENTS

| 2 |

Except where the context otherwise requires and for purposes of this Annual Report on Form 10-K only:

| · | “we,” “us,” “our company,” “our,” “the Company” and “Sino Fortune” refer to Sino Fortune Holding Corporation. |

| · | “China”, “Chinese” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this report only, Hong Kong, Macau and Taiwan; |

| · | all references to “RMB” or “Chinese Yuan” is to the legal currency of the People’s Republic of China; |

| · | all references to “U.S. dollars,” “dollars,” “USD” or “$” are to the legal currency of the United States; and |

| · | “peer-to-peer lending service providers” refers to marketplaces connecting borrowers and investors; |

| · | “variable interest entity” or “VIE” is to our variable interest entity, Benefactum Alliance Business Consultant (Beijing) Co., Ltd , that is 100% owned by PRC citizens, that holds the business operation licenses or approvals, and generally operates our various websites and mobile applications for our internet businesses or other businesses in which foreign investment is restricted or prohibited, and is consolidated into our consolidated financial statements in accordance with U.S. GAAP as if it were our wholly-owned subsidiary |

Amounts may not always add to the totals due to rounding.

Unless otherwise noted, all translations from Chinese Yuan to U.S. dollars using the exchange rate refers to the exchange rate quoted on http://www.xe.com on March 28, 2017, which was RMB 6.8724 to the $1.00. We make no representation that the Chinese Yuan amounts referred to in this Report could have been or could be converted into U.S. dollars at any particular rate or at all.

Note Regarding Forward-Looking Statements

This Report contains “forward-looking statements,” which are statements that relate to future events or our future operational or financial performance or prospects that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our financial statements and the related notes that are included herein.

| 3 |

| Item 1. | Business. |

Overview

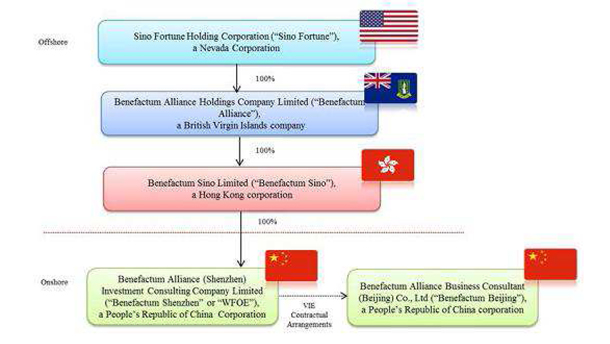

We are a holding company that, through our wholly-owned subsidiaries, Benefactum Alliance Holdings Company Limited, a British Virgin Islands company (“Benefactum Alliance”), Benefactum Sino Limited, a Hong Kong company (“Benefactum Sino”) and Benefactum Alliance (Shenzhen) Investment Consulting Company Limited, a People’s Republic of China company (“Benefactum Shenzhen” or “WFOE”) and our contractually controlled and managed company, Benefactum Alliance Business Consultant (Beijing) Co., Ltd., a People’s Republic of China company (“Benefactum Beijing”), operate an electronic online financial platform, www.hyjf.com, which is designed to match investors with small and medium-sized enterprises (“SMEs”) and individual borrowers in China. We believe our services provide an effective financial credit facility solution to under-served SME and individual borrowers. From the launch of our marketplace in December 2013 through December 31, 2016, we have facilitated over RMB 10.33 billion (approximately $1.5 billion) in loans. As of December 31, 2016, we had more than 200,000 registered investors and 12 institutional partners.

We generate revenue from our services in connection with matching investors with individual and SME borrowers. We typically charge borrowers a service fee of between 1.5% and 3% of the loan amount depending on the term of the loan. Additionally we charge a 0.3% monthly maintenance fee of the loan amount on active accounts (i.e. accounts with outstanding loans). We are an online lending marketplace only and do not use our own capital to invest in loans facilitated through our marketplace.

Due to PRC legal restrictions on foreign ownership and investment in, among other areas, value-added telecommunications services, which include internet content providers, or ICPs, we, similar to all other entities with foreign-incorporated holding company structures operating in our industry in China, have to operate our internet businesses and other businesses in which foreign investment is restricted or prohibited in the PRC through wholly foreign-owned enterprises, majority-owned entities and variable interest entities.

Accordingly, we plan to continue operating our online financial platform in China through Benefactum Beijing, which is wholly-owned by two Chinese shareholders.

The contractual arrangements between WFOE and Benefactum Beijing collectively enable us to exercise effective control over, and realize substantially all of the economic risks and benefits arising from Benefactum Beijing. See “Corporate History and Structure — Contractual Arrangements with Benefactum Beijing.” The contractual arrangements may not be as effective in providing operational control as direct ownership. See “Risk Factors — Risks Related to Our Corporate Structure.” As a result, we include the financial results of Benefactum Beijing in our consolidated financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, as if it were our wholly-owned subsidiary.

We conduct our business primarily in Beijing, Shanghai and Shandong Province, People’s Republic of China. Our principal executive offices are located at Rooms 2401, 2402, 2403, 2404 and 2412 on 2299 Yan’an West Road, Shanghai, China.

Corporate History and Structure

We were incorporated as “Tapioca Corp.” in the State of Nevada on April 18, 2014. We were previously in the business of selling bubble tea from mobile stands in Romania. However, we have not been very successful in implementing our business plan and only recognized $1,180 in revenue for the year ended December 31, 2015 and no revenues and operations since then. Accordingly, we were re-classified as a “shell company” under Rule 405 of the Securities Act of 1933, as amended.

On February 22, 2016, Slav Serghei, our previous sole director, President, Treasurer and Secretary, and holder of 3,500,000 shares of the Company’s common stock representing approximately 64% of our issued and outstanding securities, entered into a stock purchase agreement to sell his shares equally to Ms. Zhixian Jiang and Mr. Zhenqi Zhao for an aggregate cash consideration of $182,400 (the “Sale”). The Sale was consummated on March 2, 2016.

| 4 |

As a result of the Sale on March 2, 2016, a change in control occurred in the Board of Directors and executive management of the Company. Slav Serghei, our previous sole director, President, Treasurer and Secretary resigned from all of his positions with the Company effective March 1, 2016. Concurrently therewith, Mr. Jing Xie was appointed to serve as our then sole director, Chief Executive Officer, Chief Financial Officer and Secretary.

Effective April 18, 2016, we amended our Articles of Incorporation (i) to change our name from “Tapioca Corp.” to “Sino Fortune Holding Corporation”; (ii) to increase our authorized capital stock from 75,000,000 shares to 3,000,000,000 shares; and (iii) to designate 10,000,000 of our authorized capital stock as preferred stock (the “Preferred Stock”), with the designations, rights, preferences or other variations of each class or series within each class of the shares of Preferred Stock be designated by the Board of Directors at a later time without shareholder approval.

On May 13, 2016, we entered into a share exchange agreement (the “Share Exchange Agreement”) and on September 14, 2016, we entered into an amendment to the Share Exchange Agreement (the “Amendment”) with Benefactum Alliance and all the shareholders of Benefactum Alliance, namely, Mr. Bodang Liu, Avis Genesis Inc. and Manor Goldie Inc. (each a “Shareholder” and collectively the “Shareholders”), to acquire all the issued and outstanding capital stock of Benefactum Alliance in exchange for the issuance to the Shareholders an aggregate of 337,500,000 restricted shares of our common stock (the “Reverse Merger”).The Reverse Merger closed on September 29, 2016.

Immediately after the closing of the Reverse Merger, we had a total of 342,960,000 issued and outstanding shares of common stock, all of which are held by the Shareholders. As a result of the Reverse Merger, Benefactum Alliance is now our wholly-owned subsidiary.

Upon closing of the Reverse Merger, Mr. Jing Xie resigned from all officers and director positions he held with the Company and Mr. Bodang Liu was appointed as the Chief Executive Officer and sole director of the Company. In addition, Ms. Wei Zheng was appointed as the Chief Financial Officer of the Company.

Benefactum Alliance is a holding company incorporated under the laws of British Virgin Islands on March 15, 2016. On April 7, 2016, Benefactum Alliance incorporated Benefactum Sino in Hong Kong SAR. Benefactum Sino, in turn, incorporated Benefactum Shenzhen, or the WFOE in the People’s Republic of China with a registered capital of RMB100,000 on April 21, 2016. WFOE has entered into a series of contractual agreements with Benefactum Beijing, a company incorporated in the People’s Republic of China on September 10, 2013 with a registered capital of RMB50,000,000.

The following diagram illustrates our current corporate structure:

| 5 |

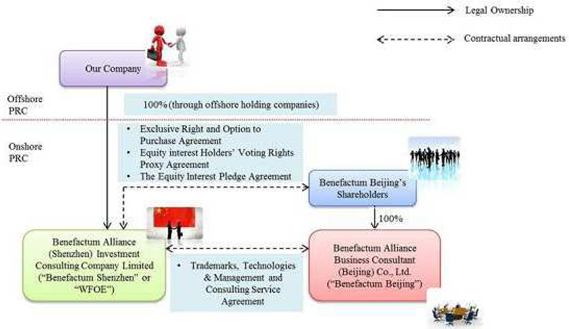

Contractual Arrangements with Benefactum Beijing

Due to PRC legal restrictions on foreign ownership and investment in value-added telecommunications services, and internet content provision services in particular, we currently conduct these activities through Benefactum Beijing, which we effectively control through a series of contractual arrangements. These contractual arrangements allow us to:

| · | exercise effective control over Benefactum Beijing; |

| · | receive substantially all of the economic benefits of Benefactum Beijing; and |

| · | have an exclusive option to purchase all or part of the equity interests in Benefactum Beijing when and to the extent permitted by PRC law. |

As a result of these contractual arrangements, we have become the primary beneficiary of Benefactum Beijing, and we treat Benefactum Beijing as our variable interest entity under U.S. GAAP. We have consolidated the financial results of Benefactum Beijing in our consolidated financial statements in accordance with U.S. GAAP.

The following is a simplified illustration of the ownership structure and contractual arrangements that we have in place for Benefactum Beijing and a summary of the currently effective contractual arrangements by and among our wholly-owned subsidiary, Benefactum Shenzhen, our consolidated variable interest entity, Benefactum Beijing, and the shareholders of Benefactum Beijing.

Each of the contractual agreements is described in detail below:

| 6 |

Trademarks, Technologies & Management and Consulting Service Agreement

Pursuant to the Trademarks, Technologies & Management and Consulting Service Agreement between WFOE and Benefactum Beijing, Benefactum Beijing has transferred all its rights to its trademarks, technologies and other intellectual property to WFOE. Additionally, Benefactum Beijing has engaged WFOE as its exclusive management consultant to provide client management, marketing counseling, corporate management, finance consulting and personnel training services. As consideration for the provision of such services, Benefactum Beijing pays WFOE a management and consulting fee equivalent to its net profits after tax.

The Trademarks, Technologies & Management and Consulting Service Agreement remains effective until the date when the WFOE terminates this agreement or when Benefactum Beijing ceases to exist.

The Equity Interest Pledge Agreement

Under the Equity Interest Pledge Agreement by and among WFOE, the shareholders of Benefactum Beijing (the “Benefactum Beijing Shareholders”) and Benefactum Beijing, WFOE has lent RMB200 to the Benefactum Beijing Shareholders, who, in turn, pledged all of their equity interests in Benefactum Beijing to WFOE to guarantee the performance of their obligations to repay the loan. The term of the loan is for 100 years and repayment of the loan can only occur on the loan maturity date or if WFOE decides to receive the repayment.

Under the terms of the agreement, WFOE, as pledgee, will be entitled to all the dividends generated by the pledged equity interests.

Exclusive Right and Option to Purchase Agreement

Under the Exclusive Right and Option to Purchase Agreement, the Benefactum Beijing Shareholders irrevocably granted WFOE an exclusive option to purchase all assets and equity interests of Benefactum Beijing. The purchase price for the said assets and equity interests shall be the lowest price allowed by the laws and regulations of the People’s Republic of China.

When WFOE considers it necessary, feasible under the laws and regulations of the People’s Republic of China and mandatory at the request of the U.S. Securities and Exchange Commission, WFOE shall exercise this exclusive right and option. When excising its exclusive right, WFOE shall serve written notice to the Benefactum Beijing Shareholders. Within 7 days of receiving the written notice from WFOE, the Benefactum Beijing Shareholders and Benefactum Beijing shall provide necessary assistance to transfer the assets and equity interest.

| 7 |

Equity Interest Holders’ Voting Rights Proxy Agreement

Under the Equity Interest Holders’ Voting Rights Proxy Agreement, the Benefactum Beijing Shareholders have agreed to authorize a representative/representatives designated by WFOE to exercise their voting rights at a general meeting of equity interest holders of Benefactum Beijing to, amongst other things, appoint the Chairman and directors of Benefactum Beijing. Additionally, the Benefactum Beijing Shareholders have undertaken not to transfer any of their equity interests except to either WFOE or its representative(s). The term of this agreement shall be the same term as the Equity Interest Pledge Agreement.

Recent Developments

On October 18, 2016, we entered into subscription agreements with an aggregate of two hundred and seven (207) investors (the “Investors”) for the purchase and sale of an aggregate of 18,860,246 shares of common stock of the Company, at prices ranging from $0.40 to $0.41 and $0.425 per share for total gross proceeds of RMB 51,252,322 (approximately, $7,878,670) (the “Offering”). The proceeds from the Offering will be used for general corporate purposes, including infrastructure, product development, marketing, investments and sales and working capital. We completed this Offering pursuant to Rule 903 of Regulation S of the Securities Act on the basis that the sale of the shares was completed in “offshore transactions”, as defined in Rule 902(h) of Regulation S. We did not engage in any “directed selling efforts”, as defined in Regulation S, in the United States in connection with the sale of the shares. The investors represented to us that the investors were not U.S. persons, as defined in Regulation S, and were not acquiring the shares for the account or benefit of a U.S. person.

In connection with the Offering, the Investors also agreed to place the shares issued in the Offering in an escrow account until October 18, 2018.

On November 7 and December 16, 2016, we entered into two short-term entrusted financial management contracts with Shandong Wenye Investment Co., Ltd. (“Wenye”). Pursuant to the contracts, we entrusted RMB 50 million (approximately $7.52 million) and RMB 7 million (or approximately $1.0 million) to Wenye to make investments in purchasing principal guaranteed wealth products for the Company. The term of the contracts is six months from the date of execution and can be extended for additional six months with both parties’ consent. Wenye and its shareholders provided an irrevocable guaranty on the return of principal and payment of 5% investment return and will be jointly and severally liable for the payment.

In March 2017, we engaged Jiangxi Bank to provide fund depository services for our marketplace, pursuant to which Jiangxi Bank will set up separate accounts for borrowers and investors, and assume fund depository functions including settlement, accounting and safeguarding online lending capital. Third-party payment agents operate as the payment channels and only transfer funds to and from fund depository accounts. Relevant Chinese regulations require us to enter into fund depository agreement with only one commercial bank to provide fund depository services. For more details, see “Regulations on Peer-to-Peer Lending Service Provider.”

Our Business

We are a holding company that, through our wholly-owned subsidiaries, Benefactum Alliance, Benefactum Sino and Benefactum Shenzhen and our contractually controlled and managed company, Benefactum Beijing, operate an electronic online financial platform, www.hyjf.com(“website”), which is designed to match investors with SME and individual borrowers in China. We have developed user-friendly mobile applications for borrowers and investors (“mobile apps”, collectively with our website, the “platform”), which enable borrowers and investors alike to access our platform at any time or location that is convenient. We launched our first mobile application in September 2015. In 2015 and 2016, we facilitated over RMB55.53 million ($8.08 million)and RMB1.28 billion ($186.25 million) in loans through our mobile apps, respectively, representing 1.67% and 22.54 % of the total amount of loans facilitated through our marketplace in the respective periods.

We generate revenue from our services in connection with matching investors with individual and SME borrowers. We typically charge borrowers a service fee of between 1.5% to 3% of the loan amount, depending on various factors, including, but not limited to, the term of the loan. Additionally we charge a 0.3% monthly maintenance fee of the loan amount on active accounts (i.e. accounts with outstanding loans). We are an online lending marketplace only and do not use our own capital to invest in loans facilitated through our marketplace.

Our platform is also accessible to those who act as guarantors for the loans to our borrowers (“third party cooperative partners”). Apart from acting as guarantors on loans from our platform, these third party cooperative partners may, if they so choose, also use our platform for purposes of transferring their creditor rights on loans made by them outside our platform (“outside loans”). For this service, we charge these third party cooperative partners similar service fees and maintenance fees.

| 8 |

We currently have 12 third-party cooperative partners, consisting of pawn shops, loan companies and guarantee companies that frequently serve as guarantors of loans on our platform.

The following diagram illustrates our current business model:

Our Marketplace

Our platform embraces the significant opportunities presented by a financial system that leaves many creditworthy individuals and SMEs underserved. Our platform matches borrowers with investors by having the qualified borrowers’ profiles readily available for investors. Once the investor decides to proceed with a specific loan, and once an investor accepts the terms of the loan, our system automatically generates electronic loan contracts for execution. Once the closing conditions are satisfied, our system directs the investors to the third party payment platform to consummate the loan.

In addition, our platform allows third party cooperative partners to assign outstanding loans to other registered investor on our platform.

The loans we facilitate are usually short term loans with terms ranging from one month to twelve months and interest rates ranging from 6.5% to 14%.

Loan Transaction Process

We provide a streamlined application process combining both online and offline features. To borrowers and investors alike, we have designed the process to appear simple, seamless and efficient utilizing sophisticated, proprietary technology to make it possible. The entire process from posting the loan application on our platform to disbursement of funds lasts no more than 19 days but typically takes 3-5 days. Below is a description of the steps in a typical online loan transaction.

| 9 |

Step 1: Online Application Submission and Initial Assessment.

In order to access the services provided by our online financial platform, potential borrowers would have to open an account with us and complete an online loan application form.

Our risk control department will determine whether the potential borrower meets our minimum requirements based on initial discussions between our risk control department and the prospective borrower. We evaluate each borrower’s application and decide if we should process his/her application on a case-by-case basis. As part of this process, we conduct an analysis of the borrower’s financial conditions, loan amount and term, business industry and proposed use of the funds.

If the prospective borrower meets our minimum requirements, then the application will be forwarded to our third-party cooperative partners who will guarantee the borrower’s loan after reviewing its application materials.

As an alternative, the borrower may also propose a third-party guarantor to guarantee the repayment of its loan. In these instances, we also conduct an assessment of the referred guarantor’s credit-worthiness and financial standing using the same matrix as that for the borrower. The third party guarantor will be jointly and severally liable with the borrower for its debt.

In some instances, we may deem certain prospective borrowers to be credit-worthy, and if we determine that a guarantor is not necessary, we may then directly contact them for additional documentation to support their application. These application materials will be then be forwarded to our risk management department.

Typically, as part of this process, prospective borrowers will be asked for documents to prove their identity and financial standing, including but not limited to business licenses, tax reports, audited financial statements and appraisal reports (for enterprise borrowers), national identification card and bank statements (for individual borrowers).

Step 2: Offline Anti-Fraud Investigation and Credit Assessment

Our risk control department then reviews all the borrower application materials and conducts its own due diligence, including third party verification and onsite visits, and a review of the sufficiency of collateral provided. Our risk management model utilizes big data capabilities to systematically evaluate a borrower’s credit characteristics.

Upon verifying the authentication of the documents submitted by the borrower, we will assign a credit score to the borrower based on its credit history, the business it is in and its assets. Borrowers who do not meet our minimum grade of 70 (out of 100) will have their application denied.

We have stringent requirements for the collateral in order to protect the investors’ interests better. Generally, we only accept collaterals that are adequate to repay the loan amount and highly liquid. Those who intend to use real estate to secure their loans will first need to have the real estate appraised by qualified appraisers. The loan amount cannot be more than 80% of the value of the real estate.

Although we typically do not accept personal property as collateral, we may do so under exceptional circumstances and only with personal property that will be pledged and only where the loan amount is no more than 70% of the appraised value of the personal property.

Step 3: Approval

Once the borrower is approved, we will categorize the borrower’s credit facility into one or more of the following loan products and post it on our platform:

| 10 |

| Product | Target Investors |

Term of Loan |

Expected Return |

Minimum investment amount (RMB) |

Maximum investment amount (RMB) |

Fund-raising period |

Repayment of Loan (for borrowers) |

Assignability (Yes/No) | ||||||||

| Xin Shou Hui | For investors who have made no investments in any products on our platform | 30 days | Generally 10% | 100 | 10,000 | No more than 19 days | Repay capital with interest when the loan is due | No | ||||||||

| Hui Zhi Tou | For all registered platform users | One – twelve months | 6.5% - 12% | 1 | - | No more than 19 days | Repay capital with interest when the loan is due | Yes, but only after holding this product for at least 30 days | ||||||||

| Hui Xiao Fei | For all registered platform users | 12 months | 14% | 1 | - | No more than 19 days | Repay fixed average capital plus interest every month | Yes, but only after holding this product for at least 30 days | ||||||||

| Zun Xiang Hui | Premium customers and private business customers | 6–12 months | 12% | 100,000 | - | No more than 19 days | Repay capital with interest when the loan is due | Yes, but only after holding this product for at least 30 days | ||||||||

| Hui Zhuan Rang* | For all registered platform users | Depending on the investment products | N/A | 1 | - | N/A | Repay capital with interest when the loan is due | Yes, but only after holding this product for at least 30 days and there will be a 0.5% assigning fee |

*Hui Zhuan Rang is a service that allows investors to transfer their creditors’ rights. The minimum outstanding loan amount requirement before creditor rights may be transferred is not less than RMB 1,000. After holding an investment product for at least 30 days, the investor may then transfer this product at a price of at least 95% of the original price.

We will also post the relevant third party guarantor’s information and its letter of guarantee.

The information is accessible to all investors who have registered on our platform. They will have the option of accepting the credit facility per the terms offered online.

Once a credit facility is accepted by an investor, our platform automatically prepares the necessary loan documents for execution by the parties online. The electronic signatures generated on platform are certified by China Financial Certification Authority, a financial security certification authority designated by People’s Bank of China.

| 11 |

Step 4: Funding

We have contracted with a licensed third party online payment service, Hui Fu Tian Xia Limited Company (“ChinaPnR”), to assist in the disbursement and repayment of loans. Both investor and borrower open accounts with ChinaPnR and authorize ChinaPnR to manage their accounts. The investor will fund the loan amount in his/her account under ChinaPnR, which would then disburse this loan amount to the borrower net of our service fees, which it will remit to us.

When the borrower repays the loan to ChinaPnR, he/she will deposit the monthly account maintenance fee along with the principal loan amount and interest. ChinaPnR will then disburse the principal loan amount and interest back to investor and account maintenance fee to us.

Currently, investors are not charged for the service provided by ChinaPnR. However, individual borrowers are charged a processing fee by ChinaPnR in the amount of 0.11% to 0.25% (which varies depending on the bank they use) of the loan amount when it is deposited in their ChinaPnR account. For SME borrowers, they pay RMB 10 per deposit. When borrowers withdraw money from their ChinaPnR account, they would have to pay a processing fee of 0.05% of the withdrawing amount plus RMB1 or just RMB1, depending on how soon they wish for the withdrawal to be effected. When the loan is repaid to ChinaPnR, ChinaPnR will disburse the loan and interest back to the investor.

Step 5: Post-Funding Supervisory

Our risk control department will continue to supervise the borrowers’ financial activities and condition post funding. In the event of any material development resulting in a negative turn in a borrower’s financial standing and potential ability to repay its loan, our management will determine the proper action to take to avert or minimize the risk of non-payment.

A week before the loan is due, the risk control department will inform ChinaPnR, our third-party cooperative partners and the borrower and supervise the repayment of the loan.

Step 6: Collections

Our platform is capable of monitoring and tracking payment activity. With built-in payment tracking functionality and automated missed payment notifications, the platform allows us to monitor the performance of outstanding loans on a real-time basis. Although we are not exposed to credit risks, we assist the investors in collection as a service to the investors.

In the event of a non- or partial repayment of a loan by the borrower, the third party guarantor will primarily be responsible for the payment of the outstanding amount.

In the event the third party guarantor defaults on the payment, we will pay the investor the sum owed from the reserve fund (See description of Reserve Fund below) and then commence our collection proceeding. We may assist the guarantor with the sale or auction of collateral or directly initiate actions to recover payment from the guarantor and/or borrower.

Third Party Cooperative Partners Loan Assignment Process

The process described above also applies to our third party cooperative partners (“Creditor Partner(s)”) that seek to sell their rights as creditors on third party loans with third party borrowers (“Original Borrowers”). While the transaction process for Creditor Partners is largely similar to those for individuals and SME borrowers, there are certain procedural differences, as follows:

Step 1: Online Application Submission and Initial Assessment.

Similar to individual and SME borrowers, Creditor Partners are required to open an account with us and send us the applications materials before a third party loan may be listed and sold on our platform. However, as we have established cooperative relationships with these Creditor Partners, a prior determination has already been made that they have met our minimum requirements and no additional verification is conducted during the application process. Nonetheless, we re-evaluate these partners’ creditability from time to time, usually every one to three months.

| 12 |

Step 2: Offline Anti-Fraud Investigation and Credit Assessment

Since these Creditor Partners use our platform in order to transfer their rights on third party loans that were made outside of our platform, they are responsible for conducting their own due diligence investigation in the Original Borrower’s credit-worthiness. Nonetheless, our risk control department will also conduct its own due diligence on the creditor’s rights sought to be sold and the Original Borrower’s credit-worthiness, using the same standards discussed above. As part of this process, our risk control department will review the loan contract between the Creditor Partner and the Original Borrower to determine whether the Original Borrower has agreed to the proposed sale of creditor’s rights. We will then directly contact the Original Borrower to ensure that they have received notice of proposed sale from the Creditor Partner.

Step 3: Approval

Once the Creditor Partner is approved, we will categorize the partner’s credit facility into one or more of the loan products discussed under “Step 3: Approval” above and post the loan on our platform. Investors will then have access to information regarding the Original Borrower, the rights that are being transferred, the collateral that secures the amounts borrowed and other details related to the right to transfer. We will also post the Creditor Partner’s “letter of promise”, which promises that they will pay off the loan principal and interest when the loan matures.

Once a credit facility is accepted by an investor, our platform automatically prepares the necessary assignment documents for execution by the parties online.

Steps 4 to 6; Funding, Post-Funding Supervisory and Collections

The procedures of Funding, Post-Funding Supervisory and Collections are similar with those discussed above for individuals and SME’s. However, because the Creditor Partners usually have a high credit-rating because of their pre-established cooperative relationship with us, and because the loans from the Original Borrowers are secured by collaterals or guarantors, we do not require them to provide additional guarantees when they seek to sell their creditor rights on our platform. Therefore, in the event the Creditor Partner defaults on the payment, we will pay the investor the sum owed from the reserve fund (See description of Reserve Fund below).

Fees

We typically charge borrowers and Creditor Partners a service fee of between 1.5% to 3% of the loan amount (or proceeds of sale of the creditors’ rights, as the case may be) depending on, among other things, the term of the loan. The service fee is payable when the borrowers or Creditor Partners receive the loans (or in the case of Creditor Partners, the proceeds of the sale of their creditors’ rights) in their accounts with ChinaPnR, which will separate the service fee from the loan amount (or proceeds of sale, as the case may be) and send it to our account. Additionally we charge a monthly maintenance fee of 0.3% of the loan amount on active accounts (i.e. accounts with outstanding loans). The maintenance fee is payable when the borrower or Creditor Partner repays its loan. In addition to the loan amount, they would have to deposit the 0.3% maintenance fee to their accounts with ChinaPnR, which will send the loan repayment to the investors’ accounts and maintenance fee to our account. Currently, we do not charge any service fees to our investors.

Risk Management

Traditional risk management tools and the types of consumer finance data available in developed economies, such as widely available consumer credit reporting services, are currently at an early stage of development in China. We believe our industry leading risk management capabilities provide us with a competitive advantage in attracting capital to our marketplace by providing investors with the comfort that they are investing in high quality loans through a sustainable marketplace.

| 13 |

We manage the credit risk on behalf of the investors primarily in the following:

| i. | We evaluate the borrower’s repayment ability via our pre-transaction credit assessment and fraud detection using our big data credit assessment system. Our risk management model utilizes big data capabilities to automatically evaluate a borrower’s credit characteristics. Potential borrowers who do not meet our credit assessment grade will be denied loans. |

| ii. | We offer a risk reserve fund which is 2-5% of all the credit extended to the borrowers. |

| iii. | Each loan transaction facilitated on our platform is guaranteed by a third party guarantor who is jointly and severally liable for the loan and/or secured by collateral provided by borrowers. |

In addition, our risk control department monitors the borrowers’ financial activities and condition post funding. In the event of any material development resulting in a negative turn in a borrower’s financial standing and potential ability to repay its loan, our management will determine the proper action to take to avert or minimize the risk of non-payment.

Finally, if enforcement action needs to be taken, we will assist the investors in taking all legal recourse against the defaulted party. As an intermediary between the borrower and the investor, we deem ourselves to be independent from the debtor-creditor relationship and do not believe that we are a proper party to any lawsuits arising from the borrowers’ and/or guarantors’ defaults. However, we may offer necessary assistance to the investors, such as by disclosing the information of the borrowers and/or guarantors, provided that such disclosure is permitted under any relevant agreement and pertinent laws.

Reserve Fund

In order to better protect our investors’ interests, we have a risk reserve fund which generally equates to 2-5% of all credit extended to borrowers. This reserve account is maintained with the China Construction Bank. Under our risk reserve fund arrangement, if a loan is delinquent for a certain period of time, usually within 3 business days, we will withdraw a sum from the risk reserve fund to repay the investor.

Prior to an application for credit being made on our platform, borrower (or if a guarantor is needed for the borrower, the guarantor) is required to provide an amount equal to 2-5% of the amount being loaned, which shall be deposited directly into the reserve fund account. If the borrower cannot be matched with an investor within the fundraising period (usually 19, all amounts deposited by the borrower or guarantor, as the case may be, into the risk reserve fund will be returned. If the borrower is successfully matched with an investor, then the risk reserve fund will also be refunded to the borrowers if the loan is paid in full at maturity.

In the case that a borrower defaults in repaying the loan when it is due, we will advise the guarantor of such default. If the guarantor cannot make the repayment within the period as stipulated (usually 3 days), we will withdraw a sum equivalent to the outstanding loan amount from the risk reserve fund to repay investors within three business days.

When more than one loan becomes delinquent and the borrower and/or guarantor fail(s) to repay investors, we will use the risk reserve fund to cover the loans in the order in which they become due. If the reserve fund is insufficient to repay investors, the fund shall be allocated on a pro rata basis. The defaulting borrower and/or guarantor is/are obligated to reimburse the risk reserve fund account up to the outstanding loan amount owed with interest and penalty at a rate of 0.06% per day on the outstanding loan amount.

We have not experienced any default of loans since the launch of our platform. As of December 31, 2016, our risk reserve fund was approximately RMB 50.68 million ($7.3 million).

| 14 |

Our Products

As discussed above (under step 3 of the transaction process), we categorize the borrower’s credit facility into one or more of loan products and post it on our platform. Those products include Hui Zhi Tou, Xin Shou Hui, Zun Xiang Hui, Hui Xiao Fei, and Hui Zhuan Rang. For more detail regarding these products, please refer to the table listed under the “Step 3: Approval” of the transaction process.

Customers

Our customers comprise mainly of Chinese individuals and SMEs. All our investors are individuals while our borrowers include both individuals and SMEs. Our SME borrower clients are mainly from the heavy industry, wholesale, public transportation and restaurant industries. No one customer or group of customers accounts for 10% or more of our revenue. For the year ended December 31, 2016, SME borrowers and individual borrowers accounted for approximately 82% and 18% of the loan amounts facilitated through our platform, respectively.

Currently, most of our borrowers are in Shanghai, Shandong, Inner Mongolia, Anhui and Henan provinces. Currently, most of our investors are currently in Shandong province.

Marketing

We acquire borrowers and investors primarily via two means, our own platform and referrals from third party guarantors. The general public may get access to our platform and submit a borrower profile online. We also acquire borrowers through referrals from financial institutions we partner with. As of December 31, 2016, we have entered into cooperation agreements with six pawn shops in Shandong, Jilin, Inner Mongolia, Hubei provinces, three guarantor institutions, one micro credit company, one asset management company, and one financial leasing company. Additionally, in April 2016, Benefactum Beijing and Shanghai Nami Financial Consulting Co., Ltd (“Nami”) entered into a co-operative agreement, pursuant to which Nami will refer potential investors to Benefactum Beijing, and in turn Benefactum Beijing will pay Nami a service fee based on the amount of loans it refers to Benefactum Beijing.

Seasonality

We experience seasonality in our business, reflecting seasonal fluctuations in internet usage and traditional personal consumption patterns, as our individual borrowers typically use their borrowing proceeds to finance their personal consumption needs. For example, we generally experience lower transaction value on our online consumer finance marketplace during national holidays in China, particularly during the Chinese New Year holiday season in the first quarter of each year. While our rapid growth has somewhat masked this seasonality, our results of operations could be affected by such seasonality in the future.

Employees

As of March 28, 2017, we have 135 employees, located in Shanghai, Beijing and Shandong province in China. The following table sets forth the number of our employees by function as of the same date:

| Functional Area | Number of Employees | % of Total | ||

| Senior management | 4 | 7.96% | ||

| Product and service | 8 | 5.93% | ||

| Marketing | 12 | 8.89% | ||

| Human resources and administrative | 19 | 14.07% | ||

| IT | 48 | 35.56% | ||

| Accounting | 6 | 4.44% | ||

| Legal | 3 | 2.22% | ||

| Risk management | 16 | 11.85% | ||

| Operations | 19 | 14.07% | ||

| Total | 135 | 100% |

| 15 |

As required by regulations in China, we participate in various employee social security plans that are organized by local governments, including pension, unemployment insurance, childbirth insurance, work-related injury insurance, medical insurance and housing insurance. We are required under Chinese law to make contributions to employee benefit plans at specified percentages of the salaries, bonuses and certain allowances of our employees, up to a maximum amount specified by the local government from time to time.

We believe that we maintain a good working relationship with our employees and to date, we have not experienced any significant labor disputes.

Competition

The online financial platform industry in China is intensely competitive and we compete with other online financial platforms. In light of the low barriers of entry in the online consumer finance industry, more players may enter this market which would result in increasing competition. We anticipate that more established internet, technology and financial services companies that possess large, existing user bases, substantial financial resources and established distribution channels may enter the market in the future. Based on our research conducted in the database of Wang Dai Zhi Jia, a third-party information platform that specializes in providing information in the internet finance industry, we believe the following companies are our major competitors in the various business segments set forth below:

Shanghai Lujiazui International Financial Assets Trading Market Inc. (“Lujin”) - Lujin is the only financial assets trading information service platform that runs its practice through the trading platform of the State Counsel of China. It provides investment and financing service to SMEs and individuals. As of December 31, 2016, it had approximately 29.9 million registered users. Lujin offers what is known as “financial instruments beneficial rights transfer” information services to financial and non-financial companies. Financial instruments beneficial rights transfer is a process in which the borrowers (usually companies) pledge their bank acceptance bills, and then transfer the beneficial interests to investors. Lujin’s role is an informational intermediary between the holders of bank acceptance bills and the investors.

Yirendai Ltd. – Yirendai is a leading online consumer financial platform in China connecting investors and individual borrowers. According to Yirendai Reports, they facilitated RMB 32.30 billion ($4.70 billion) in loans from their inception in March 2012 through December 31, 2016.Leveraging the extensive experience of their parent company CreditEase, they have large client bases consisting of underserved investors and individual borrowers in China.

Dianrong.com – Dianrong focuses its business in online credit assessment and loaning. It provides its clients with discount rates for obtaining a loan and favorable rates of return for making an investment.

Yooli.com – Yooli provides its clients with financial products that mostly focusing on the microfinance between individuals. Yooli’s online platform connects potential investors to safe and secured individual financial products, which allows them to manage their idle funds and earn a monthly return from their investment.

We also compete with other financial products and companies that attract borrowers, investors or both. With respect to borrowers, we compete with other online financial platform and traditional financial institutions, such as consumer finance business units in commercial banks, credit card issuers and other consumer finance companies. With respect to investors, we primarily compete with other investment products and asset classes, such as equities, bonds, investment trust products, bank savings accounts and real estate.

Intellectual Property

Trademark

Our business is dependent on a combination of trademarks, trademark application, trade secrets and industry know-how, copyright and patent, in order to protect our intellectual property rights. We have submitted trademark and patent applications for “Benefactum Beijing” in mainland China.

| 16 |

Set forth below is a detailed description of our trademarks under application.

| Country | Trademark | Application Number | Classes* | Status |

| Mainland China |  |

19915412 | 9 | In process |

| Mainland China |  |

19915413 | 35 | In process |

| Mainland China |  |

19915414 | 36 | In process |

| Mainland China |  |

19915415 |

38 | In process |

| Mainland China |  |

19915411 | 42 | In process |

| Mainland China |  |

16773973 | 36 | Approved |

| Mainland China |  |

16774073 | 36 | Approved |

| Mainland China |  |

17945485 | 36 | Approved |

|

Mainland China |

|

19915410 | 38 | In process |

| Mainland China |  |

22745837 | 9 | In process |

| Mainland China |  |

22746011 |

35 | In process |

| Mainland China |  |

22745940 |

42 | In process |

| Mainland China |  |

22746083 | 45 | In process |

| Mainland China |  |

21086887 | 35 | In process |

| Mainland China |  |

21087273 | 36 | In process |

| Mainland China |  |

21087465 | 42 | In process |

| Mainland China |  |

21086924 | 35 | In process |

| Mainland China |  |

21087202 | 36 | In process |

| Mainland China |  |

21087447 | 42 | In process |

| Mainland China |  |

21087006 | 35 | In process |

| Mainland China |  |

21087162 | 36 | In process |

| Mainland China |  |

21087531 | 42 | In process |

| Mainland China |  |

21086842 | 35 | In process |

| Mainland China |  |

21087304 | 36 | In process |

| Mainland China |  |

21087424 | 42 | In process |

| 17 |

* Classes

Class 9

Scientific, nautical, surveying, photographic, cinematographic, optical, weighing, measuring, signaling, checking (supervision), life-saving and teaching apparatus and instruments; apparatus and instruments for conducting, switching, transforming, accumulating, regulating or controlling electricity; apparatus for recording, transmission or reproduction of sound or images; magnetic data carriers, recording discs; compact discs, DVDs and other digital recording media; mechanisms for coin-operated apparatus; cash registers, calculating machines, data processing equipment, computers; computer software; fire-extinguishing apparatus.

Class 35

Advertising; business management; business administration; office functions.

Class 36

Instalment loans; capital investment; financial loans; financial evaluation (insurance, banking, real estate); financial service; financial management; mortgage loan; financial analysis; financial consultation; fund investment.

Class 38

Telecommunications services; chat room services; portal services; e-mail services; providing user access to the Internet; radio and television broadcasting.

Class 42

Scientific and technological services and research and design relating thereto; industrial analysis and research services; design and development of computer hardware and software; computer programming; installation, maintenance and repair of computer software; computer consultancy services; design, drawing and commissioned writing for the compilation of web sites; creating, maintaining and hosting the web sites of others; design services.

Patent

As of the date of this report, we have submitted ten patent applications. Set forth below is a detailed description of our patents under application.

| Country | Patent | Application Number |

Type | Status | ||||

| Mainland China | The Certifying System, Device and Method that Are Based on the Random Instructive Distribution | 201610401023.2 | Invention | In process | ||||

| Mainland China | The Certifying System that Are Based on the Random Instructive Distribution | 201620551196.8 | Utility model | In process | ||||

| Mainland China | The Random Encrypted Physical Information Block-Chain Secured Method, System and Device | 201610401213.4 | Invention | In process | ||||

| Mainland China | The Random Encrypted Physical Information Block-Chain Secured Device |

201620551307.5 |

Utility model | In process | ||||

| Mainland China | The Community Block Polypeptide Chain and Intelligent Processing System | 201610441383.5 | Invention | In process | ||||

| Mainland China | The Community Block Polypeptide Chain and Intelligent Processing Device | 201610441834.5 | Invention | In process | ||||

| Mainland China | Physical Information Random Verification Block-Chain Secured Method, System and Device | 201610472450.X | Invention | In process | ||||

| Mainland China | The Certifying System, Device and Method that Are Based on the Local Node Random Instructive Distribution | 201610479798.1 | Invention | In process | ||||

| Mainland China | A Block Chain Consensus and Synchronization Method, System and Device | 201610501761.4 | Invention | In process | ||||

| Mainland China | Asymmetrical Encrypted Block Chain Identification Verification Method and Device | 201610413635.3 | Invention | In progress |

| 18 |

In addition, Benefactum Beijing operates an electronic online financial platform at our website www.hyjf.com.

Copyright

As of the date of this report, we have registered with National Copyright Administration of China six pieces of our artwork and received a Copyright Certificate for each of them. Set forth below is a detailed description of our copyrights.

Artwork Copyright

| Country | Name of Work | Work | Registration Number | Type |

| Mainland China | Hui Ying Jin Fu (Whale) |  |

2016 – F – 00288618 | Artwork |

| Mainland China | Hui Ying Jin Fu APP |  |

2016 – F – 002886187 | Artwork |

| Mainland China | Jin Ding Hui Ju |  |

2016 – F – 00337813 | Artwork |

| Mainland China | Si Hai Yi Xin |  |

2016 – F –00337814 | Artwork |

| Mainland China | Zhong Guo Jin Kong |  |

2016 – F – 00338579 | Artwork |

| Mainland China | Hui Ju Tian Xia |  |

2016 – F – 00338580 | Artwork |

| 19 |

Software Copyright

| Country | Name of Work | Date of First Publication and Date of Registration |

Registration Number | Type | ||||

| Mainland China | Hui Ying Jing Fu Financial Investment Platform |

January 19, 2016; August 4, 2016 |

2016SR205944 | Computer software | ||||

| Mainland China | Hui Ying Jing Fu Investment Management System (WeChat version) |

June 28, 2016; August 18, 2016 |

2016SR224313 | Computer software | ||||

| Mainland China | Hui Ying Jing Fu Mobile Client Access Software (Android) |

March 20, 2016; August 18, 2016 |

2016SR224323 | Computer software | ||||

| Mainland China | Hui Ying Jing Fu Mobile Client Access Software (ios) |

March 20, 2016; August 1, 2016 |

2016SR199404 | Computer software |

Domain Name

Benefactum Beijing has two domain names, www.hyjf.com and www.huiyingdai.com. Both domain names lead to one website,www.hyjf.com, and they have the same ICP Record No.: 13050958.

Benefactum Beijing registered its website, www.hyjf.com, with the Ministry of Industry and Information Technology (Record No. 13050958) for the provision of non-commercial internet information services on August 28, 2015. Prior to August 17, 2016, because our website only provides online users with free public and commonly-shared financial information, it is categorized as a non-commercial information service provider under Chinese law, and therefore a simple website registration is wholly compliant and sufficient for Benefactum Beijing to carry out its business operations.

However, on August 17, 2016, The Interim Measures for the Administration of Business Activities of Online Lending Information Intermediaries (the “Interim Measures”) were promulgated with immediate effect and require all peer-to-peer lending platforms to apply for value-added telecommunications business licenses in accordance with the relevant provisions of telecommunications authorities after filing with a local financial regulator. Although the Interim Measures took effect on August 17, 2016, peer-to-peer platforms are given up to 12 months to adjust their practices to comply with them. For more details, please see “Regulations - Regulations on Value-Added Telecommunication Services” and “Regulations on Peer-to-Peer Lending Service Provider”).

Regulation

This section sets forth a summary of the most significant rules and regulations that affect our business activities in China.

As an online financial platform connecting investors with individual borrowers, we are regulated by various government authorities, including, among others:

| · | the Ministry of Industry and Information Technology, or the MIIT, regulating the telecommunications and telecommunications-related activities, including, but not limited to, the internet information services and other value-added telecommunication services; |

| · | the People’s Bank of China, or the PBOC, as the central bank of China, regulating the formation and implementation of monetary policy, issuing the currency, supervising the commercial banks and assisting the administration of the financing; |

| · | China Banking Regulatory Commission, or the CBRC, regulating financial institutions and promulgating the regulations related to the administration of financial institutions. |

| 20 |

| · | the Ministry of Public Security, taking the lead in security supervision of the internet services of internet lending information intermediaries, and penalizing violations of laws and regulations on network security, and cracking down on financial crimes and relevant crimes involved in internet lending. |

| · | the State Internet Information Office, supervising financial information services and the content of internet information. |

Regulations Relating to Foreign Investment

The Draft PRC Foreign Investment Law

In January 2015, the PRC Ministry of Commerce (“MOC” or “MOFCOM”) published a discussion draft of the proposed Foreign Investment Law for public review and comments. The draft law purports to change the existing “case-by-case” approval regime to a “filing or approval” procedure for foreign investments in China. The State Council will determine a list of industry categories that are subject to special administrative measures, which is referred to as a “negative list,” consisting of a list of industry categories where foreign investments are strictly prohibited, or the “prohibited list” and a list of industry categories where foreign investments are subject to certain restrictions, or the “restricted list.” Foreign investments in business sectors outside of the “negative list” will only be subject to a filing procedure, in contrast to the existing prior approval requirements, whereas foreign investments in any industry categories that are on the “restricted list” must apply for approval from the foreign investment administration authority.

The draft for the first time defines a foreign investor not only based on where it is incorporated or organized, but also by using the standard of “actual control.” The draft specifically provides that entities established in China, but “controlled” by foreign investors will be treated as FIEs (“Foreign Invested Enterprises”). Once an entity is considered to be an FIE, it may be subject to the foreign investment restrictions in the “restricted list” or prohibitions set forth in the “prohibited list.” If an FIE proposes to conduct business in an industry subject to foreign investment restrictions in the “restricted list,” the FIE must go through a market entry clearance by the MOC before being established. If an FIE proposes to conduct business in an industry subject to foreign investment prohibitions in the “prohibited list,” it must not engage in the business. However, an FIE that conducts business in an industry that is in the “restricted list,” upon market entry clearance, may apply in writing for being treated as a PRC domestic investment if it is ultimately “controlled” by PRC government authorities and its affiliates and/or PRC citizens. In this connection, “control” is broadly defined in the draft law to cover the following summarized categories: (i) holding 50% or more of the voting rights of the subject entity; (ii) holding less than 50% of the voting rights of the subject entity but having the power to secure at least 50% of the seats on the board or other equivalent decision making bodies, or having the voting power to exert material influence on the board, the shareholders’ meeting or other equivalent decision making bodies; or (iii) having the power to exert decisive influence, via contractual or trust arrangements, over the subject entity’s operations, financial matters or other key aspects of business operations. According to the draft, variable interest entities would also be deemed as FIEs, if they are ultimately “controlled” by foreign investors, and be subject to restrictions on foreign investments. However, the draft law has not taken a position on what actions will be taken with respect to the existing companies with the “variable interest entity” structure, whether or not these companies are controlled by Chinese parties.

The draft emphasizes on the security review requirements, whereby all foreign investments that jeopardize or may jeopardize national security must be reviewed and approved in accordance with the security review procedure. In addition, the draft imposes stringent ad hoc and periodic information reporting requirements on foreign investors and the applicable FIEs. Aside from investment implementation report and investment amendment report that are required at each investment and alteration of investment specifics, an annual report is mandatory, and large foreign investors meeting certain criteria are required to report on a quarterly basis. Any company found to be non-compliant with these information reporting obligations may potentially be subject to fines and/or administrative or criminal liabilities, and the persons directly responsible may be subject to criminal liabilities.

| 21 |

In September 2016, the Standing Committee of the National People’s Congress (the “SCNPC”) published The Decision on Amending Four Laws including the Law of the People’s Republic of China on Wholly Foreign-owned Enterprises (the “Decision”). According to the Decision, one provision is added to the Foreign Invested Enterprise Law, Sino-Foreign Joint Venture Law, Sino-Foreign Cooperative Enterprise Law and the Law on Protection of Investment by Taiwanese Compatriots. Under this new provision, foreign investments in business sectors outside of the “negative list” will only be subject to a filing procedure, in contrast to the existing prior approval requirements, whereas foreign investments in any industry categories that are on the “restricted list” must apply for approval from the foreign investment administration authority. This Decision means that the existing “case-by-case” approval regime has been changed to a “filing or approval” procedure for non-”negative list” foreign investments in China.

Also in September 2016, the MOC drafted The Provisional Measures for Filing Administration for the Establishment and Changes of Foreign-invested Enterprises for public review and comments.

The draft is now open for public review and comments. It is still uncertain when the draft would be signed into law and whether the final version would have any substantial changes from the draft. When the Foreign Investment Law becomes effective, the trio of existing laws regulating foreign investment in China, namely, the Sino-foreign Equity Joint Venture Enterprise Law, the Sino-foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-invested Enterprise Law, together with their implementation rules and ancillary regulations, will be abolished. See “Risk Factors—Risks related to Doing Business in China—“Substantial uncertainties exist with respect to the enactment timetable, interpretation and implementation of draft PRC Foreign Investment Law””.

Industry Catalog Relating to Foreign Investment

Investment activities in the PRC by foreign investors are principally governed by the Guidance Catalog of Industries for Foreign Investment, or the Catalog, which was promulgated and is amended from time to time by the MOC and the National Development and Reform Commission. Industries listed in the Catalog are divided into three categories: encouraged, restricted and prohibited. Industries not listed in the Catalog are generally deemed as constituting a fourth “permitted” category. Establishment of wholly foreign-owned enterprises is generally allowed in encouraged and permitted industries. Some restricted industries are limited to equity or contractual joint ventures, while in some cases Chinese partners are required to hold the majority interests in such joint ventures. In addition, restricted category projects are subject to higher-level government approvals. Foreign investors are not allowed to invest in industries in the prohibited category. Industries not listed in the Catalog are generally open to foreign investment unless specifically restricted by other PRC regulations.

Our PRC subsidiary, Benefactum Shenzhen is mainly engaged in providing investment and financing consultations and technical services, which fall into the “encouraged” or “permitted” category under the Catalog. Benefactum Shenzhen has obtained all material approvals required for its business operations. However, industries such as value-added telecommunication services (except e-commerce), including internet information services, are restricted from foreign investment. We provide the value-added telecommunication services that are in the “restricted” category through our consolidated variable interest entity, Benefactum Beijing.

Regulations on Loans between Individuals

The PRC Contract Law governs the formation, validity, performance, enforcement and assignment of contracts. The PRC Contract Law confirms the validity of loan agreement between individuals and provides that the loan agreement becomes effective when the individual lender provides the loan to the individual borrower. The PRC Contract Law requires that the interest rates charged under the loan agreement must not violate the applicable provisions of the PRC laws and regulations. In accordance with the Provisions on Several Issues Concerning Laws Applicable to Trials of Private Lending Cases issued by the Supreme People’s Court on August 6, 2015, or the Private Lending Judicial Interpretations, which came into effect on September 1, 2015, private lending is defined as financing between individuals, legal entities and other organizations. When private loans between individuals are paid by wire transfer, through online peer-to-peer lending platforms or by other similar means, the loan contracts between individuals are deemed to be validated upon the deposit of funds to the borrower’s account. In the event that the loans are made through an online peer-to-peer lending platform and the platform only provides intermediary services, the courts shall dismiss the claims of the parties concerned against the platform demanding the repayment of loans by the platform as guarantors. However, if the online peer-to-peer lending service provider guarantees repayment of the loans as evidenced by its web page, advertisements or other media, or the court is provided with other proof, the lender’s claim alleging that the peer-to-peer lending service provider shall assume the obligations of a guarantor will be upheld by the courts. The Private Lending Judicial Interpretations also provide that agreements between the lender and borrower on loans with interest rates below 24% per annum are valid and enforceable. As to loans with interest rates per annum between 24% and 36%, if the interest on the loans has already been paid to the lender, and so long as such payment has not damaged the interest of the state, the community and any third parties, the courts will turn down the borrower’s request to demand the return of the interest payment. If the annual interest rate of a private loan is higher than 36%, the excess will not be enforced by the courts. A certain percentage of the loan transactions facilitated over our platform are between individuals currently. The fixed interest rates for the term loans on our platform currently range from 6.5% to 14%.The transaction fee rates we charge borrowers for our services range from 1.5% to 3%. The interest rate component, which is stipulated in the loan agreements, does not and is not expected to exceed the mandatory limit for loan interest rates.

| 22 |

Pursuant to the PRC Contract Law, a creditor may assign its rights under an agreement to a third party, provided that the debtor is notified. Upon due assignment of the creditor’s rights, the assignee is entitled to the creditor’s rights and the debtor must perform the relevant obligations under the agreement for the benefit of the assignee. We operate a secondary loan market on our platform where investors can transfer the loans they hold to other investors before the loan reaches maturity. To facilitate the assignment of the loans, the loan agreement applicable to the lenders and borrowers specifically provides that a lender has the right to assign his/her rights under the loan agreement to any third parties and the borrower agrees to such assignment.

In addition, according to the PRC Contract Law, an intermediation contract is a contract whereby an intermediary presents to its client an opportunity for entering into a contract or provides the client with other intermediary services in connection with the conclusion of a contract, and the client pays the intermediary service fees. Our business of connecting investors with individual borrowers may constitute intermediary service, and our service agreements with borrowers and investors may be deemed as intermediation contracts under the PRC Contract Law. Pursuant to the PRC Contract Law, an intermediary must provide true information relating to the proposed contract. If an intermediary conceals any material fact intentionally or provides false information in connection with the conclusion of the proposed contract, which results in harm to the client’s interests, the intermediary may not claim for service fees and is liable for the damages caused.

Regulations on Illegal Fund-Raising

Raising funds by entities or individuals from the general public must be conducted in strict compliance with applicable PRC laws and regulations to avoid administrative and criminal liabilities. The Measures for the Banning of Illegal Financial Institutions and Illegal Financial Business Operations promulgated by the State Council in July 1998, and the Notice on Relevant Issues Concerning the Penalty on Illegal Fund-Raising issued by the General Office of the State Council in July 2007, explicitly prohibit illegal public fund-raising. The main features of illegal public fund-raising include: (i) illegally soliciting and raising funds from the general public by means of issuing stocks, bonds, lotteries or other securities without obtaining the approval of relevant authorities, (ii) promising a return of interest or profits or investment returns in cash, properties or other forms within a specified period of time, and (iii) using a legitimate form to disguise the unlawful purpose.

To further clarify the criminal charges and punishments relating to illegal public fund-raising, the Supreme People’s Court promulgated the Judicial Interpretations to Issues Concerning Applications of Laws for Trial of Criminal Cases on Illegal Fund-Raising, or the Illegal Fund-Raising Judicial Interpretations, which came into force in January 2011. The Illegal Fund-Raising Judicial Interpretations provide that a public fund-raising will constitute a criminal offense related to “illegally soliciting deposits from the public” under the PRC Criminal Law, if it meets all the following four criteria: (i) the fund-raising has not been approved by the relevant authorities or is concealed under the guise of legitimate acts; (ii) the fund-raising employs general solicitation or advertising such as social media, promotion meetings, leafleting and SMS advertising; (iii) the fundraiser promises to repay, after a specified period of time, the capital and interests, or investment returns in cash, properties in kind and other forms; and (iv) the fund-raising targets at the general public as opposed to specific individuals. An illegal fund-raising activity will be fined or prosecuted in the event that it constitutes a criminal offense. Pursuant to the Illegal Fund-Raising Judicial Interpretations, an offender that is an entity will be subject to criminal liabilities, if it illegally solicits deposits from the general public or illegally solicits deposits in disguised form (i) with the amount of deposits involved exceeding RMB1,000,000 ($154,373), (ii) with over 150 fund-raising targets involved, or (iii) with the direct economic loss caused to fund-raising targets exceeding RMB500,000 ($77,187), or (iv) the illegal fund-raising activities have caused baneful influences to the public or have led to other severe consequences. An individual offender is also subject to criminal liabilities but with lower thresholds. In addition, an individual or an entity who has aided in illegal fund-raising from the general public and charges fees including but not limited to agent fees, rewards, rebates and commission, constitute an accomplice of the crime of illegal fund-raising. In accordance with the Opinions of the Supreme People’s Court, the Supreme People’s Procurator and the Ministry of Public Security on Several Issues concerning the Application of Law in the Illegal Fund-Raising Criminal Cases, the administrative proceeding for determining the nature of illegal fund-raising activities is not a prerequisite procedure for the initiation of criminal proceeding concerning the crime of illegal fund-raising, and the administrative departments’ failure in determining the nature of illegal fund-raising activities does not affect the investigation, prosecution and trial of cases concerning the crime of illegal fund-raising.

| 23 |

We have taken measures to avoid conducting any activities that are prohibited under the illegal-funding related laws and regulations. We act as a platform for borrowers and investors and are not a party to the loans facilitated through our platform. In addition, we do not directly receive any funds from investors in our own accounts as funds loaned through our platform are deposited into and settled by a third-party online payment service Hui Fu Tian Xia Limited Company.

Regulations on Peer-to-Peer Lending Service Provider