Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Steadfast Income REIT, Inc. | a8kestvaluepersharepresent.htm |

Steadfast Income REIT, Inc.

Valuation

and Portfolio Update

As of

December 31, 2016

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

The information contained herein should be read in conjunction with, and is qualified by, the information in the Steadfast Income

REIT, Inc., Inc. ("Steadfast Income REIT” or the “Company”) Annual Report on Form 10-K for the year ended December 31,

2016, filed with the Securities and Commission Exchange (the "SEC") on March 16, 2017 (the "Annual Report"), including the

"Risk Factors” section contained in the Annual Report.

Forward-Looking Statements

Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal

Private Securities Litigation Reform Act of 1995. Steadfast Income REIT intends that such forward-looking statements be

subject to the sale harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of

Steadfast Income REIT and members of its management team. as well as the assumptions on which such statements are

based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates, " "believes," "estimates,"

"expects," "plans," "intends," "should," or similar expressions. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date they are made. Steadfast Income REIT undertakes no obligation to

update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or

changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks

and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking

statements. Steadfast Income REIT makes no representation or warranty (express or implied) about the accuracy of any such

forward-looking statements. These statements are based on a number of assumptions involving the judgment of management.

The appraisal methodology for Steadfast Income REIT's real estate properties was performed by CBRE Capital Advisors, Inc.,

an independent, third-party real estate valuation firm (“CBRE"). Even small changes to the assumptions used to determine the

estimated value per share could result in significant differences in the appraised values of Steadfast Income REIT's real estate

properties and the estimated value per share. Actual events may cause the value and returns on Steadfast Income REIT's

investments to be less than that used for purposes of Steadfast Income REIT's estimated value per share.

Forward-Looking Statements

2

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

As of December 31, 2016

Total Capital Raised (including DRP): $775.4 Million

Total Acquisitions (Purchase Price): $1.64 Billion

Total Number of Assets: 65 Assets

Total Rental Units: 16,709

States: 11

Total Leverage (loan to value): 60.8%

Occupancy: 94%

Portfolio Overview

3

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

Third-Party Valuation

• Steadfast Income REIT engaged CBRE to perform appraisals of the Company’s real estate

properties and, through an affiliate, to provide a range of the estimated value per share of the

Company’s common stock (the "EVPS Range''). CBRE utilized its appraisals of Steadfast

Income REIT 's real estate properties and valuations performed by the Steadfast Income

REIT’s external advisor, Steadfast Income Advisor, LLC (the “Advisor”) of the REIT's cash,

other assets, mortgage debt and other liabilities, which are disclosed in the Annual Report, to

determine the EVPS Range.

• The estimated value per share is based on the estimated value of the REIT's assets less the

estimated value of the REIT's liabilities divided by the number of shares outstanding, all as of

December 31, 2016. The estimated value per share approximates the mid-range value of the

EVPS range as indicated in CBRE's valuation report, was recommended by the Advisor and is

based on CBRE's appraisals and the Advisor's valuations.

• CBRE primarily relied on the discounted cash flow analysis method to appraise the real estate

properties, but used and considered other methods, including a direct capitalization and a sales

comparison approach.

• Steadfast Income REIT expects to continue updating the estimated value per share annually,

utilizing an independent valuation firm.

Valuation Information

4

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

Estimated $ Values as of December 31, 2016 and December 31, 2015

Valuation Summary

5

A

sset

s

Lia

b

ilitie

s

$1,988,400,000

$32,076,582

$34,533,491

$2,055,010,073

$1,118,126,231

$51,665,674

$8,278,117

$1,178,070,022

$876,940,051

Real Estate

Cash

Other Assets

Total Assets

Mortgage Debt

Other Liabilities

Incentive fee

Total Liabilities

Net Equity

Estimated Value

$2,014,340,000

$66,224,027

$65,175,883

$2,145,739,910

$1,197,015,105

$54,790,262

$6,540,119

$1,258,345,486

$887,394,424

As of 12/31/2016 As of 12/31/2015

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

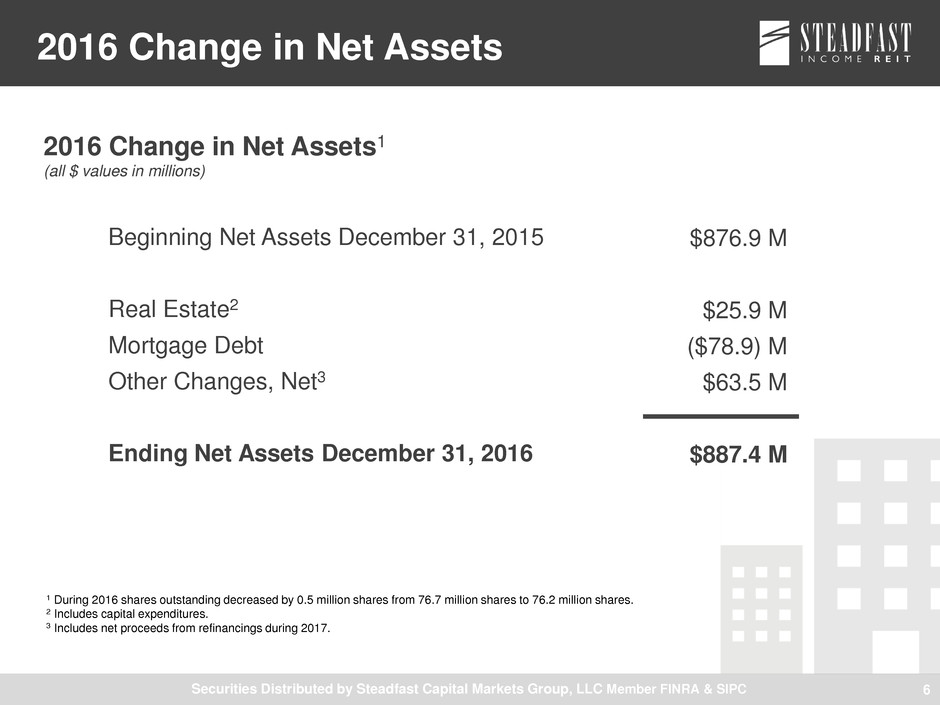

Beginning Net Assets December 31, 2015

Real Estate2

Mortgage Debt

Other Changes, Net3

Ending Net Assets December 31, 2016

2016 Change in Net Assets

6

1 During 2016 shares outstanding decreased by 0.5 million shares from 76.7 million shares to 76.2 million shares.

2 Includes capital expenditures.

3 Includes net proceeds from refinancings during 2017.

2016 Change in Net Assets1

(all $ values in millions)

$876.9 M

$25.9 M

($78.9) M

$63.5 M

$887.4 M

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

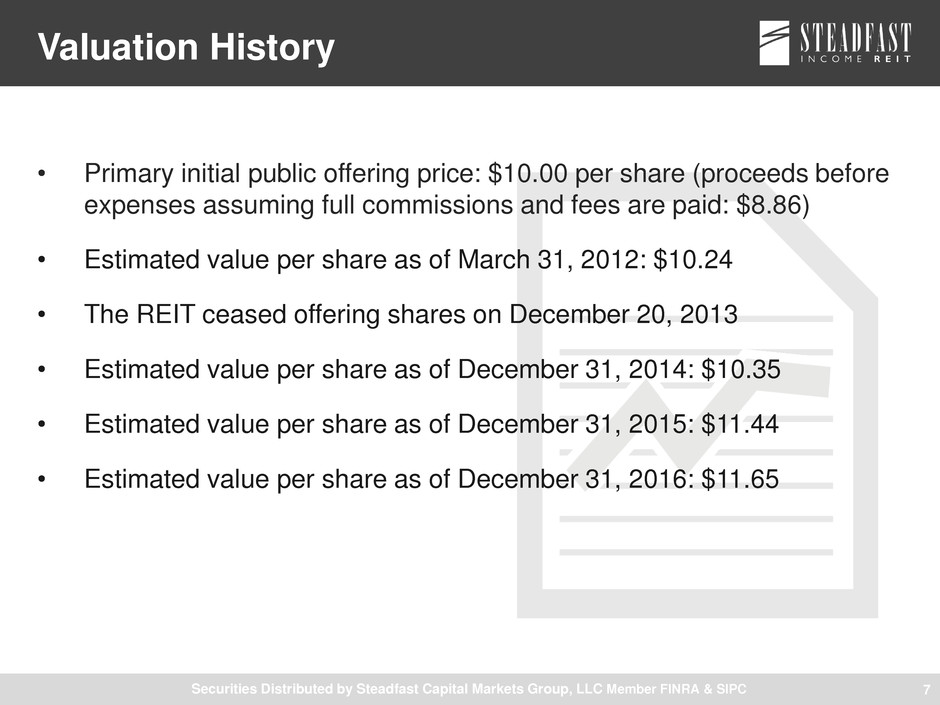

Valuation History

• Primary initial public offering price: $10.00 per share (proceeds before

expenses assuming full commissions and fees are paid: $8.86)

• Estimated value per share as of March 31, 2012: $10.24

• The REIT ceased offering shares on December 20, 2013

• Estimated value per share as of December 31, 2014: $10.35

• Estimated value per share as of December 31, 2015: $11.44

• Estimated value per share as of December 31, 2016: $11.65

7

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

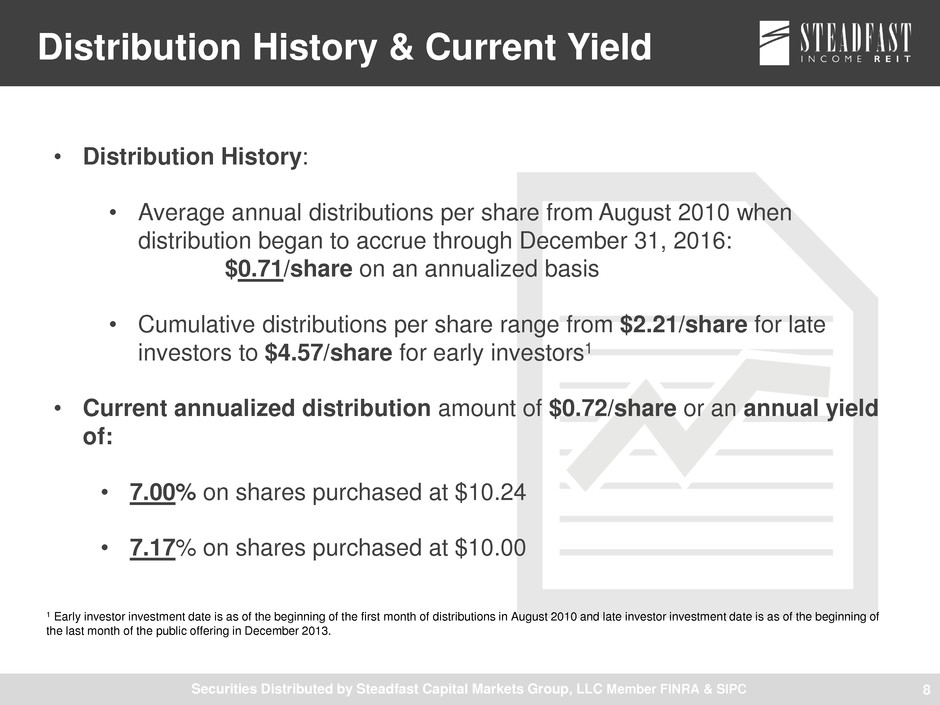

• Distribution History:

• Average annual distributions per share from August 2010 when

distribution began to accrue through December 31, 2016:

$0.71/share on an annualized basis

• Cumulative distributions per share range from $2.21/share for late

investors to $4.57/share for early investors1

• Current annualized distribution amount of $0.72/share or an annual yield

of:

• 7.00% on shares purchased at $10.24

• 7.17% on shares purchased at $10.00

Distribution History & Current Yield

8

1 Early investor investment date is as of the beginning of the first month of distributions in August 2010 and late investor investment date is as of the beginning of

the last month of the public offering in December 2013.

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

Steadfast Income REIT provides an estimated value per share to assist broker-dealers that participated in its public offerings in meeting their

customer account statement reporting obligations. This valuation was performed in accordance with the provisions of and comply with the

IPA Valuation Guidelines. As with any valuation methodology, the methodologies used are based upon a number of estimates and

assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different

estimated value per share of Steadfast Income REIT's common stock, and this difference could be significant. The estimated value per

share is not audited and does not represent the fair value of the REIT's assets less the fair value of the REIT's liabilities according to GAAP.

Accordingly, with respect to the estimated value per share, Steadfast Income REIT can give no assurance that:

• a stockholder would be able to resell his or her shares at the estimated value per share;

• a stockholder would ultimately realize distributions per share equal to the Company’s estimated value per share upon liquidation

of the Company’s assets and settlement of its liabilities or a sale of the Company;

• the Company’s shares of common stock would trade at the estimated value per share on a national securities exchange;

• another independent third-party appraiser or third-party valuation firm would agree with the Company’s estimated value per

share; or

• the methodology used to determine the Company’s estimated value per share would be acceptable to FINRA or for compliance

with ERISA reporting requirements.

The estimated value per share as of December 31, 2016 is based on the estimated value of Steadfast Income REIT's assets less the

estimated value of the REIT's liabilities divided by the number of shares outstanding, all as of December 31, 2016. The value of Steadfast

Income REIT's shares will fluctuate over time in response to developments related to individual assets in its portfolio and the management of

those assets, in response to the real estate and finance markets and due to other factors. The estimated value per share does not reflect a

discount for the fact that Steadfast Income REIT is externally managed, nor does it reflect a real estate portfolio premium/discount versus the

sum of the individual property values. The estimated value per share also does not take into account estimated disposition costs and fees for

real estate properties, debt prepayment penalties that could apply upon the prepayment of certain of the REIT's debt obligations or the

impact of restrictions on the assumption of debt. Steadfast Income REIT currently expects to utilize an independent valuation firm to update

the estimated value per share as of December 31, 2017.

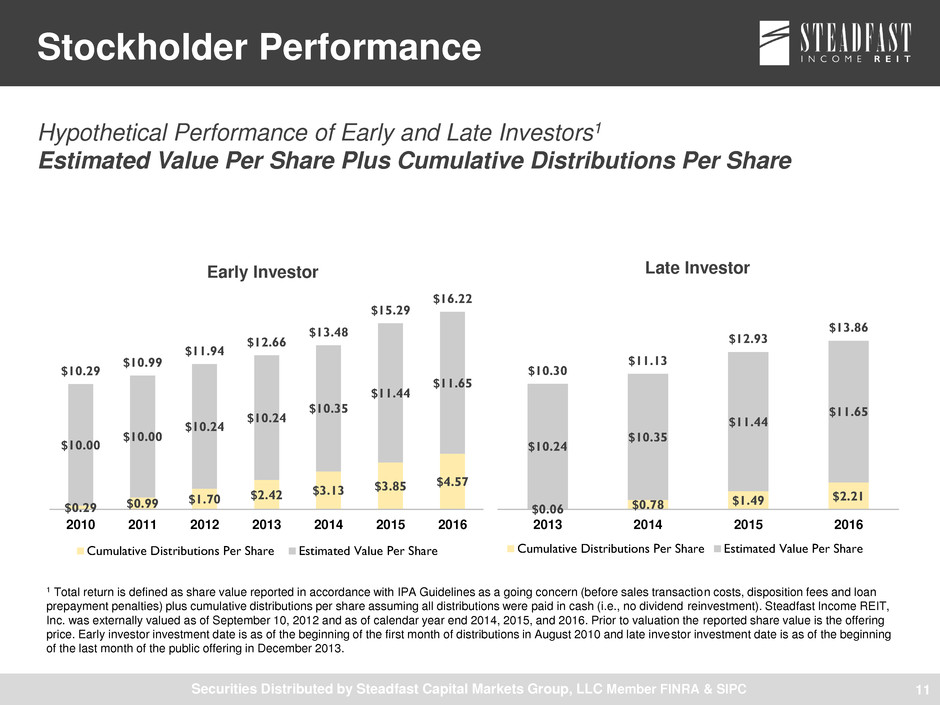

Stockholder Performance

9

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

Stockholder Performance

Hypothetical Performance of Early and Late Investors

Estimated Value Per Share Plus Cumulative Distributions Per Share

Estimated Value Per Share As of

December 31, 2016

Cumulative Distributions Per Share

Received through December 31, 2016

Sum of Estimated Value Per Share

and Cumulative Distributions Per Share

Received through December 31, 2016

Early Investor: Invested When Distributions Began to Accrue

(August 2010)

$11.65 $4.57 $16.22

Late Investor: Invested at Close of Public Offering

(December 2013)

$11.65 $2.21 $13.86

10

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

Stockholder Performance

Hypothetical Performance of Early and Late Investors1

Estimated Value Per Share Plus Cumulative Distributions Per Share

11

1 Total return is defined as share value reported in accordance with IPA Guidelines as a going concern (before sales transaction costs, disposition fees and loan

prepayment penalties) plus cumulative distributions per share assuming all distributions were paid in cash (i.e., no dividend reinvestment). Steadfast Income REIT,

Inc. was externally valued as of September 10, 2012 and as of calendar year end 2014, 2015, and 2016. Prior to valuation the reported share value is the offering

price. Early investor investment date is as of the beginning of the first month of distributions in August 2010 and late investor investment date is as of the beginning

of the last month of the public offering in December 2013.

$0.29 $0.99

$1.70 $2.42

$3.13 $3.85

$4.57

$10.00

$10.00

$10.24

$10.24

$10.35

$11.44

$11.65

$10.29

$10.99

$11.94

$12.66

$13.48

$15.29

$16.22

2010 2011 2012 2013 2014 2015 2016

Early Investor

Cumulative Distributions Per Share Estimated Value Per Share

$0.06 $0.78

$1.49 $2.21

$10.24

$10.35

$11.44

$11.65

$10.30

$11.13

$12.93

$13.86

2013 2014 2015 2016

Late Investor

Cumulative Distributions Per Share Estimated Value Per Share

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

2017 Goals & Objective

• Undertake renovations at certain assets to create additional

stockholder value

• Maintain portfolio occupancy

• Increase portfolio net cash flow

• Grow portfolio NAV

12

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

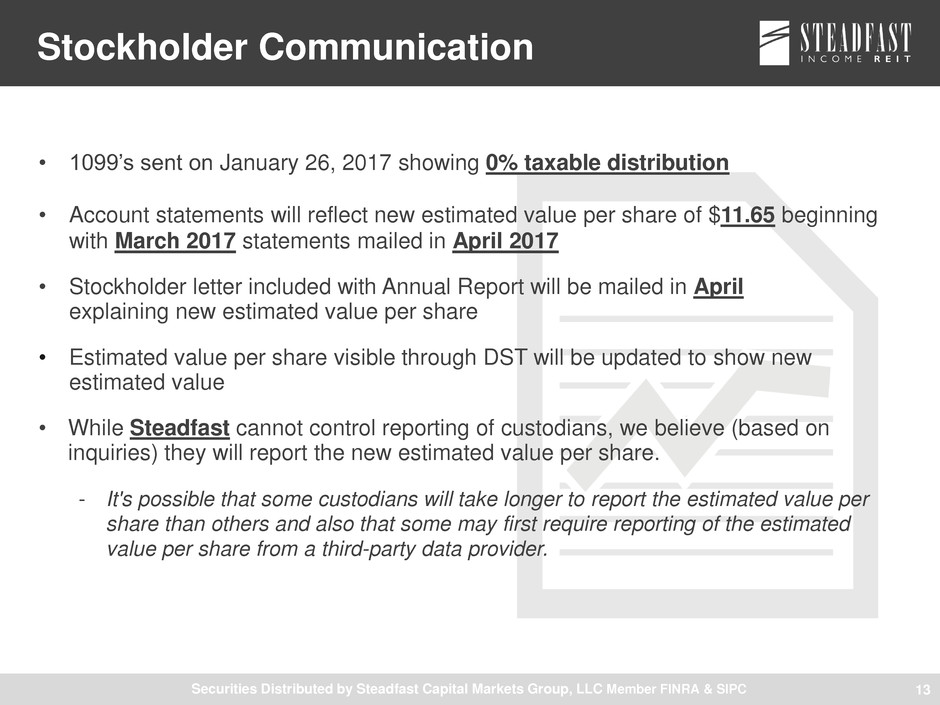

Stockholder Communication

• 1099’s sent on January 26, 2017 showing 0% taxable distribution

• Account statements will reflect new estimated value per share of $11.65 beginning

with March 2017 statements mailed in April 2017

• Stockholder letter included with Annual Report will be mailed in April

explaining new estimated value per share

• Estimated value per share visible through DST will be updated to show new

estimated value

• While Steadfast cannot control reporting of custodians, we believe (based on

inquiries) they will report the new estimated value per share.

- It's possible that some custodians will take longer to report the estimated value per

share than others and also that some may first require reporting of the estimated

value per share from a third-party data provider.

13

Securities Distributed by Steadfast Capital Markets Group, LLC Member FINRA & SIPC

Thank you!

If you have any questions,

contact your financial advisor

or contact us at:

Steadfast Capital Markets Group, LLC

18100 Von Karman, Suite 500

Irvine, CA 92612

(877) 525-7264

14