Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ClubCorp Holdings, Inc. | a2016avendrafs.htm |

| EX-32.2 - EXHIBIT 32.2 - ClubCorp Holdings, Inc. | cch-20161227x10kaxex322.htm |

| EX-32.1 - EXHIBIT 32.1 - ClubCorp Holdings, Inc. | cch-20161227x10kaxex321.htm |

| EX-31.2 - EXHIBIT 31.2 - ClubCorp Holdings, Inc. | cch-20161227x10kaxex312.htm |

| EX-31.1 - EXHIBIT 31.1 - ClubCorp Holdings, Inc. | cch-20161227x10kaxex311.htm |

| EX-23.2 - EXHIBIT 23.2 - ClubCorp Holdings, Inc. | cch-20161227x10kaxex232.htm |

| EX-10.43 - EXHIBIT 10.43 - ClubCorp Holdings, Inc. | cch-20161227x10kaxex1043.htm |

| 10-K/A - 10-K/A - ClubCorp Holdings, Inc. | holdings-20161227x10ka.htm |

AVENDRA, LLC AND SUBSIDIARIES

Unaudited Consolidated Financial Statements

December 31, 2014 and 2013

AVENDRA, LLC AND SUBSIDIARIES

Unaudited

Consolidated Balance Sheets

December 31, 2014 and 2013

Assets 2014 2013

Current assets:

Cash and cash equivalents $ 3,285,608 7,388,958

Short-term investments 9,520,672 9,513,131

Accounts receivable, net 47,235,571 46,087,952

Restricted cash and investments 1,976,417 1,676,354

Prepaid expenses and other current assets 1,214,064 1,237,118

Total current assets 63,232,332 65,903,513

Restricted investments, net of current portion 18,943,406 30,969,210

Property and equipment, net 2,742,034 2,192,914

Goodwill and intangible assets 137,046 152,274

Other assets 31,123 22,450

Total assets $ 85,085,941 99,240,361

Liabilities and Members’ Deficit

Current liabilities:

Related party note payable $ 2,450,000 2,450,000

Accounts payable and accrued expenses 2,564,529 2,012,441

Accrued compensation 6,895,529 7,849,665

Due to customers 32,132,488 30,907,784

Accrued incentive compensation 33,899,771 29,043,471

Total current liabilities 77,942,317 72,263,361

Note payable, net of current portion — 2,450,000

Other long-term liabilities 25,989,618 36,523,101

Total liabilities 103,931,935 111,236,462

Commitments and contingencies

Members’ deficit (18,845,994) (11,996,101)

Total liabilities and members’ deficit $ 85,085,941 99,240,361

See accompanying notes to unaudited consolidated financial statements.

2

AVENDRA, LLC AND SUBSIDIARIES

Unaudited

Consolidated Statements of Operations and Comprehensive Income

Years ended December 31, 2014 and 2013

2014 2013

Revenue $ 104,496,612 98,701,443

Operating expenses:

General and administrative 59,648,077 56,194,814

Depreciation and amortization 791,462 1,428,089

Total operating expenses 60,439,539 57,622,903

Income from operations 44,057,073 41,078,540

Other gain, net 1,794,134 3,413,568

Income before income taxes 45,851,207 44,492,108

Provision for income taxes 315,926 294,534

Net income $ 45,535,281 44,197,574

Comprehensive income:

Net income $ 45,535,281 44,197,574

Other comprehensive income (loss):

Foreign currency translation adjustment (263,083) (143,250)

Comprehensive income $ 45,272,198 44,054,325

See accompanying notes to unaudited consolidated financial statements.

3

AVENDRA, LLC AND SUBSIDIARIES

Unaudited

Consolidated Statements of Members’ Deficit

Years ended December 31, 2014 and 2013

Accumulated

other

Members’ Accumulated comprehensive

capital deficit Sub-total income (loss) Total

Balance at December 31, 2012 $ 7,022,284 (10,989,781) (3,967,497) 150,405 (3,817,092)

Member distributions — (52,000,000) (52,000,000) — (52,000,000)

Interest on loan due to AHI — (185,792) (185,792) — (185,792)

Buyback of membership units (47,541) — (47,541) — (47,541)

Other comprehensive income (loss):

Foreign currency translation adjustment — — — (143,250) (143,250)

Net income — 44,197,574 44,197,574 — 44,197,574

Balance at December 31, 2013 6,974,743 (18,977,999) (12,003,256) 7,155 (11,996,101)

Member distributions — (52,000,000) (52,000,000) — (52,000,000)

Interest on loan due to AHI — (122,092) (122,092) — (122,092)

Buyback of membership units — — — —

Other comprehensive income (loss):

Foreign currency translation adjustment — — — (263,082) (263,082)

Net income — 45,535,281 45,535,281 — 45,535,281

Balance at December 31, 2014 $ 6,974,743 (25,564,810) (18,590,067) (255,927) (18,845,994)

See accompanying notes to unaudited consolidated financial statements.

4

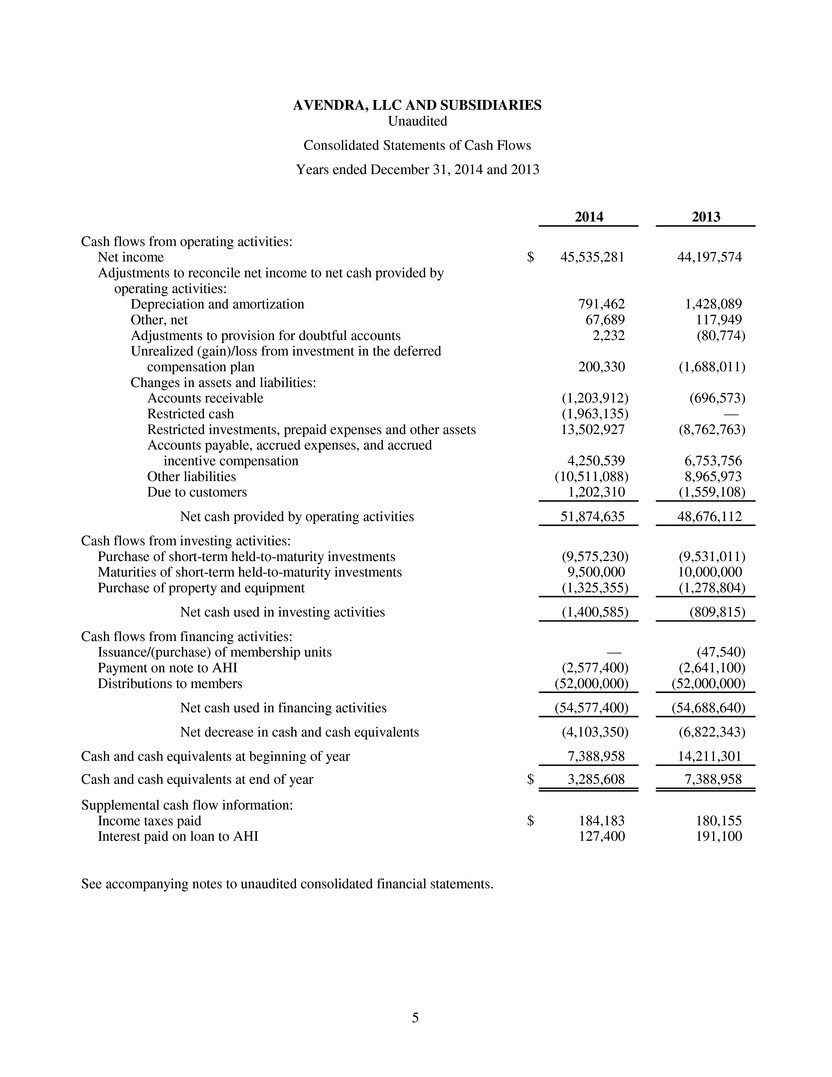

AVENDRA, LLC AND SUBSIDIARIES

Unaudited

Consolidated Statements of Cash Flows

Years ended December 31, 2014 and 2013

2014 2013

Cash flows from operating activities:

Net income $ 45,535,281 44,197,574

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization 791,462 1,428,089

Other, net 67,689 117,949

Adjustments to provision for doubtful accounts 2,232 (80,774)

Unrealized (gain)/loss from investment in the deferred

compensation plan 200,330 (1,688,011)

Changes in assets and liabilities:

Accounts receivable (1,203,912) (696,573)

Restricted cash (1,963,135) —

Restricted investments, prepaid expenses and other assets 13,502,927 (8,762,763)

Accounts payable, accrued expenses, and accrued

incentive compensation 4,250,539 6,753,756

Other liabilities (10,511,088) 8,965,973

Due to customers 1,202,310 (1,559,108)

Net cash provided by operating activities 51,874,635 48,676,112

Cash flows from investing activities:

Purchase of short-term held-to-maturity investments (9,575,230) (9,531,011)

Maturities of short-term held-to-maturity investments 9,500,000 10,000,000

Purchase of property and equipment (1,325,355) (1,278,804)

Net cash used in investing activities (1,400,585) (809,815)

Cash flows from financing activities:

Issuance/(purchase) of membership units — (47,540)

Payment on note to AHI (2,577,400) (2,641,100)

Distributions to members (52,000,000) (52,000,000)

Net cash used in financing activities (54,577,400) (54,688,640)

Net decrease in cash and cash equivalents (4,103,350) (6,822,343)

Cash and cash equivalents at beginning of year 7,388,958 14,211,301

Cash and cash equivalents at end of year $ 3,285,608 7,388,958

Supplemental cash flow information:

Income taxes paid $ 184,183 180,155

Interest paid on loan to AHI 127,400 191,100

See accompanying notes to unaudited consolidated financial statements.

5

6

(1) Summary of Significant Accounting Policies

(a) Description of Business

Avendra, LLC (Avendra or the Company) is a Delaware limited liability company under the terms of

the Limited Liability Company Agreement of Avendra, LLC, as amended (the LLC Agreement). The

Company is an independent hospitality procurement and supply chain organization that provides its

customers with supply chain efficiencies and savings through aggregating purchasing volume,

utilizing hospitality industry knowledge, and providing supply chain assurance services. The

Company is 99.92% owned by a group of hotel and golf course management companies with the

remaining 0.08% owned by employees and former employees (collectively referred to as Members).

Avendra provides procurement services primarily for the hospitality industry throughout North

America, Latin America, and the Caribbean. A large portion of the Company’s business is conducted

with the Founders and their managed hotels and clubs (the Founder Properties). The Company has

contracts and agreements with distributors and manufacturers covering the procurement of a broad

range of merchandise and services. The Company’s customers are provided access to the pricing

negotiated with the suppliers as part of these contracts.

Except for the Company’s Avendra Replenishment, LLC subsidiary (Avendra Replenishment), the

majority of the purchasing activities resulting from the Company’s contracts are conducted directly

between the Company’s customers and the suppliers under terms negotiated by Avendra with those

suppliers. The Company is not a direct party to these purchasing transactions and the Company does

not maintain or purchase inventory.

Avendra Replenishment was established to serve as an intermediary between the Company’s

customers and certain suppliers for the procurement of operating equipment. Typically, these

transactions are replacement equipment orders for individual hotels.

(b) Formation of the Company and Limitation on Liability

Pursuant to the terms of the LLC agreement, no member is personally liable for any debt, obligation,

or liability of the Company. The LLC Agreement is perpetual in term, subject to the dissolution

provisions provided in the LLC Agreement. The LLC Agreement provides certain preferences to the

members in the event of dissolution, certain distributions of Company property, the incorporation of

the Company, or an initial public offering, among other events.

(c) Equity Transaction

On November 30, 2010, Avendra Holdings, Inc. (AHI) redeemed its ownership in Avendra, LLC.

AHI is owned by the Founders in proportions substantially equivalent to the Founders’ ownership in

Avendra. The sale of AHI’s ownership interest, for a total aggregate redemption price of

$12,250,000, is payable in five equal installments on each anniversary of the agreement date

commencing November 30, 2011 and ending November 30, 2015. In addition, interest on the

principal amount accrues from the agreement date and is payable annually, in arrears, to AHI on

each anniversary of the agreement date commencing November 30, 2011 at a fixed rate of 2.6% per

annum. Avendra had a current note payable of $2,450,000 as of December 31, 2014, and a current

note payable of $2,450,000 and a long-term note payable of $2,450,000 as of December 31, 2013.

Due to the related party nature of the ownership of AHI and Avendra, the redemption amount and all

interest associated with the note are reflected as a charge to equity.

7

(d) Principles of Consolidation

The consolidated financial statements include the financial statements of Avendra, LLC and its two

wholly owned subsidiaries, Avendra Canada, Inc. and Avendra Replenishment. All significant

intercompany balances and transactions have been eliminated in consolidation.

(e) Revenue Recognition

The Company derives revenue from customers primarily in two forms: (1) service fees as a

percentage of purchases made by the Company’s customers (Spend), with any supplier allowances in

excess of negotiated fee amounts being returned to customers; or, (2) the retention of supplier

allowances. The applicable form of revenue is delineated in the customer contracts. Revenue

calculations are based on Spend. Revenue from service fees is recognized at the rate specified per

customer contract in the period that Spend occurs. Revenue from allowances is recognized at the rate

specified per product or service in each applicable supplier contract in the period that the associated

Spend occurs. Spend information is based on reporting from suppliers. When Spend reports are not

yet received, the Company estimates the Spend, allowances, and related revenue based on historical

data or information provided by the supplier.

The Company’s Avendra Replenishment subsidiary places orders on behalf of its customers, pays

the supplier and assumes customer credit risk; however, the Company does not take title or

possession of the related inventory, nor are any applicable product warranties the responsibility of

Avendra. The Company applies a markup to the wholesale cost for each order and recognizes that

markup as replenishment revenue when the related product is shipped to the customer from the

vendor. Replenishment revenue is recognized net based on the mark-up.

Certain suppliers prepay allowances in advance of completion of the related procurement process

from which the allowances are derived. These prepayments are recorded as unearned allowances and

recognized as revenue in the period in which the related purchases are made. The Company records

these amounts as unearned allowances in due to customers and other long-term liabilities in the

accompanying consolidated balance sheets. Unearned allowances were approximately $1,326,000

and $891,000 for the years ended December 31, 2014 and 2013, respectively.

(f) Cash and Cash Equivalents and Short-Term Investments

The Company considers short-term, highly liquid investments with original maturities of three

months or less to be cash equivalents.

The Company’s internal investment policy is to maintain a weighted average maturity of

U.S. Treasuries and GSE’s (Government-Sponsored Entities) of not more than 7.5 months. These

short-term investments are classified as held-to-maturity securities and are reflected as current assets

on the balance sheet. The purchases and maturities of these investments are presented gross in cash

flow from investing activities.

(g) Accounts Receivable

Allowances are recognized and billed at the rate specified per product or service in each applicable

supplier contract. Accounts receivable primarily represent billed and unbilled allowances due. Billed

receivables are recorded at the invoiced amount. The majority of unbilled receivables represent

amounts that were earned, but not invoiced at year end. Accounts receivable include certain amounts

billed on behalf of customers whose service fees are based on a percentage of Spend. These amounts

are excluded from revenue and a corresponding amount is reflected as a component of the due to

customers’ liability. The allowance for doubtful accounts is the Company’s best estimate of the

amount of probable credit losses in the Company’s existing accounts receivable. The Company

determines the allowance based on historical and expected write-offs and based on customer specific

8

circumstances. The Company reviews its allowance for doubtful accounts quarterly. Past due

balances meeting certain criteria are reviewed individually for collectability. All other balances are

reviewed on a pooled basis. Account balances are charged against the allowance after all means of

collection have been exhausted and the potential for recovery is considered remote. The Company

does not have any off-balance-sheet credit exposure related to its customers.

The Company also records a rebate realization reserve, which is the Company’s best estimate of the

amount of probable adjustments based upon differences in allowance calculations between the

Company and the supplier in the Company’s existing accounts receivable. Due to inherent

complexities in the data accumulation, billing, and subsequent reconciliation processes, this reserve

account adjusts aggregate receivables to the best estimate of net realizable value.

(h) Restricted Cash

The Company records as restricted cash any cash that is restricted in its use by the Company’s

executed contracts and is not immediately available for use. Restricted cash of approximately

$1,963,000 as of December 31, 2014 was recorded on the Company’s balance sheet. The restricted

cash consists of funding received as a result of an agreement entered into in 2014 where the

Company is acting as a purchasing agent with respect to the purchases of pre-opening Operating

Supplies and Equipment (OS&E) on behalf of a customer. The Company also records an offsetting

liability for the OS&E ordered and due to suppliers once products are received.

(i) Restricted Investments

Total restricted investments were approximately $18,957,000 and $32,646,000 at December 31,

2014 and 2013, respectively. The restricted investments represent deferred compensation associated

with the Unit Appreciation Right (UAR) program related to the Company’s cash dividends, in

addition to salary and bonus deferrals by highly compensated employees (see note 6(b) and 6(c)).

These amounts are invested in a range of funds including money market, high quality bond, and

equity mutual funds based on the employees’ elections. These investments are considered trading

securities and are marked-to-market each month based on the change in the funds’ quoted market

value. Any realized or unrealized gain/loss and any interest income are recognized in Other gains

from investments in the deferred compensation plans with an offsetting entry to employee costs, on

the Company’s consolidated statements of operations and comprehensive income. These amounts are

also recorded in restricted investments with an offsetting entry to accrued incentive compensation

and other long-term liabilities on the Company’s consolidated balance sheets. For the years ended

December 31, 2014 and 2013, the Company recorded a net gain of approximately $1,230,000 and

$2,998,000, respectively, interest income of approximately $521,000 and $423,000, respectively,

resulting in an increase to employee costs of approximately $1,751,000 and $3,421,000, respectively.

(j) Property and Equipment

Property and equipment are stated at cost less accumulated depreciation and amortization.

Depreciation and amortization are calculated using the straight-line method over the following useful

lives:

Furniture and fixtures 5 years

Computer equipment 3–5 years

Computer software 5 years

Leasehold improvements Shorter of useful

life or remaining

lease term

9

(k) Goodwill

The Company was formed in connection with the contribution of certain assets, which were recorded

at fair value. As part of the transaction, the Company recorded goodwill representing the future

economic benefits arising from other assets acquired in a business combination that were not

individually identified and separately recognized.

In January 2014, FASB issued ASU No. 2014-02, Intangibles-Goodwill and Other (Topic 350):

Accounting for Goodwill, a consensus of the Private Company Council (ASU 2014-02). This ASU

allows an accounting alternative for the subsequent measurement of goodwill for all entities except

for public business entities, not-for-profit entities and certain employee benefit plans. An entity

within the scope of the amendments that elects the accounting alternative in this ASU should

amortize goodwill on a straight-line basis over 10 years, or less than 10 years if the entity

demonstrates that another useful life is more appropriate. An entity that elects the accounting

alternative is further required to make an accounting policy election to test goodwill for impairment

at either the entity level or the reporting unit level. Goodwill should be tested for impairment when a

triggering event occurs that indicates that the fair value of an asset may be below its carrying

amount. The disclosures required under this alternative are similar to existing U.S. GAAP. The

accounting alternative, if elected, should be applied prospectively to goodwill existing as of the

beginning of the period of adoption and to new goodwill recognized in annual periods beginning

after December 15, 2014, and to interim periods within annual periods beginning after December 15,

2015.

Effective January 1, 2014, the Company elected to adopt ASU 2014-02 and recorded goodwill

amortization expense of $15,200 for the year ended December 31, 2014. Total goodwill for the years

ended December 31, 2014 and 2013 was $137,000 and $152,000, respectively, and is included in

other assets in the consolidated balance sheets. The Company will test goodwill for impairment at

the entity level; however, no triggering events were identified during 2014.

(l) Income Taxes

The Company has elected limited liability company status and, as such, is not directly subject to

U.S. federal and most state income taxes. Instead, the members are responsible for income taxes on

their proportionate share of Avendra’s taxable income. Members are also entitled to a proportionate

share of tax deductions and credits. Certain states do not recognize the limited liability company

status, and accordingly, the Company is responsible for state income taxes in these states. Avendra

Canada, Inc. is incorporated in Canada and is subject to taxes under Canadian tax regulations.

The Company recognizes the effect of income tax positions only if those positions are more likely

than not of being sustained. Recognized income tax positions are measured at the largest amount that

is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in

the period in which the change in judgment occurs. The Company records interest and penalties

related to uncertain tax positions in the provision for income taxes on the consolidated statements of

operations and comprehensive income. The Company has assessed its tax positions as of

December 31, 2014. As of December 31, 2014 and 2013, the total amount accrued for uncertain tax

positions including interest and penalties is approximately $167,000 and $157,000, respectively, and

is included in accounts payable and accrued expenses in the consolidated balance sheets.

The provision for income taxes of approximately $316,000 and $295,000 for the years ended

December 31, 2014 and 2013, respectively, relates primarily to those states which do not recognize

the limited liability company status. There were no material deferred taxes as a result of these state

income taxes; however, the Company had net operating loss carryforwards for Avendra Canada Inc.

for the years ended December 31, 2014 and 2013, of approximately $1,000,000 and $1,300,000,

respectively, in U.S. equivalents, which creates a deferred tax asset that the Company has recorded.

10

The Company believes it is unlikely that results of future operations will generate sufficient taxable

income to realize the deferred tax asset. Accordingly, the Company has recorded a full valuation

allowance at December 31, 2014 and 2013.

(m) Equity-Based Compensation Plans

The Company has a unit appreciation rights (UAR) plan (see note 6(b)). The Company has elected to

continue to apply the intrinsic-value-based method of measuring periodic compensation expense

related to the UAR plan. Compensation expense is measured by the amount of appreciation of the

rights in excess of the base price as determined by the enterprise value of the Company at year end,

as approved by the Board of Managers.

(n) Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with

U.S. generally accepted accounting principles requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period.

The estimates involve judgment with respect to, among other things, various future factors, which

are difficult to predict and are beyond the control of the Company. Significant estimates include the

allowance for doubtful accounts, enterprise value from equity-based compensation under the UAR

Plan, and the amount of certain allowances to be received from suppliers for purchases made during

the year. Accordingly, actual amounts could differ from these estimates.

(o) Impairment of Long-Lived Assets

The Company did not have any impairment of long-lived assets during the years ended

December 31, 2014 and 2013. Long-lived assets, such as property and equipment are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amounts of an

asset may not be recoverable.

(p) Fair Value of Financial Instruments

Management believes that the carrying values of cash and cash equivalents, short-term investments,

accounts receivable, accounts payable and accrued expenses, and other liabilities approximate fair

values because of the short maturity of these financial instruments. The AHI note payable is between

related parties. Standard discounted cash flow models were used in determining the value of AHI’s

ownership. The note payable balance at December 31, 2014 and 2013 represents the undiscounted

contractual obligation under this note.

(q) Foreign Currency Translation

The functional currency of the Company’s Canadian subsidiary is the Canadian dollar. Accordingly,

all assets and liabilities of the subsidiary are translated using exchange rates in effect at the end of

the period, and revenue and costs are translated using average exchange rates for the period. The

related translation adjustments are reported in accumulated other comprehensive income (loss),

included in the consolidated statement of operations and comprehensive income and as a component

of members’ deficit.

Translation gains and losses arising from transactions denominated in a currency other than the

functional currency of the entity involved are included in net income reported on the consolidated

statements of operations and comprehensive income.

11

(2) Related Party Transactions

The Founder Procurement Services Agreements (PSAs), effective from January 1, 2011 to December 31,

2014 were renewed on December 31, 2014 for a 4-year term expiring December 31, 2018.

The Company had $18,225,000 and $18,678,000 due to Founders and $1,639,000 and $1,640,000 due

from Founders at December 31, 2014 and 2013, respectively. The due from amounts are included as a

component of accounts receivable, net in the accompanying consolidated balance sheets. The due to

amounts are included as a component of the due to customers’ liability in the accompanying consolidated

balance sheets.

The Company had an outstanding balance on a note payable at December 31, 2014 and 2013, of

$2,450,000 and $4,900,000, respectively, to AHI, a related party. See note 1(c).

(3) Accounts Receivable

The components of accounts receivable, net at December 31, 2014 and 2013 were as follows:

2014 2013

Billed accounts receivable $ 14,541,011 11,216,803

Unbilled accounts receivable 29,505,655 31,670,102

Replenishment accounts receivable 3,635,884 3,663,039

Less allowance for doubtful accounts/realization reserve (446,979) (461,992)

$ 47,235,571 46,087,952

Management believes that all unbilled accounts receivable, net of the realization reserve, will be collected

within one year.

(4) Property and Equipment

The components of property and equipment, net at December 31, 2014 and 2013 were as follows:

2014 2013

Computer quipment $ 5,832,144 4,911,543

Computer software 8,726,781 8,409,279

Leasehold improvements 634,949 634,949

Furniture and fixtures 1,056,227 1,035,179

Total 16,250,101 14,990,950

Less accumulated depreciation and amortization (13,508,067) (12,798,036)

$ 2,742,034 2,192,914

(5) Leases

The Company is obligated under several noncancelable operating leases, primarily for office space and

equipment, with original terms from three to ten years. These leases generally contain renewal options for

periods ranging from three to five years, and require the Company to pay certain operating costs such as

maintenance and insurance. Rental expense for operating leases during the years ended December 31, 2014

and 2013 was approximately $1,736,000 and $1,683,000, respectively.

Effective December 2007, the Company renewed its headquarters lease for a 10-year term. The lease

includes an improvement allowance of $1,048,950, which is reflected as a reduction to the total rent

payments due under the lease and recognized on a straight-line basis over the term of the lease.

12

Future minimum lease payments under noncancelable operating leases with initial or remaining lease terms

in excess of one year as of December 31, 2014 are:

2015 $ 1,731,419

2016 1,763,914

2017 1,807,970

Thereafter —

Total minimum lease payments $ 5,303,303

(6) Employee Benefit Plans

(a) Unit Appreciation Rights Plan

In 2004, the Company approved the “2004 UAR Plan” to provide for the annual issuance of UAR’s

to senior-level employees. In 2007, the Company, as approved by Avendra’s Compensation

Committee, modified the 2004 UAR Plan to compensate UAR holders for the impact on the

Company’s valuation of the periodic cash distributions that are made to its Members. In 2012, the

Company approved a new “2012 UAR Plan,” which modified the methodology for valuing future

grants to be based on growth in the year-end enterprise valuation only. Therefore, the compensation

for the impact of the periodic cash distributions will no longer apply to grants under the 2012 plan.

The actual fair value of the Company, as determined by a third party equity sale transaction or

market valuation, might differ significantly from management’s internal December 31, 2014 estimate

of enterprise valuation.

In 2014, under the 2012 UAR Plan, the Company issued 893,262 UAR’s with a weighted average

base price of $7.96 and an effective date of June 30, 2014 for vesting purposes. In 2013, under the

2012 UAR Plan, the Company issued 874,000 UAR’s with a weighted average base price of $7.15

and an effective date of June 30, 2013 for vesting purposes. The rights vest over four years from the

respective effective date. The rights issued prior to 2012, have an expiration date of 10 years after the

grant date, and the rights issued in 2012 and thereafter have an expiration date of five years after the

grant date.

Compensation cost of approximately $17,470,000 and $13,380,000 has been recognized for

outstanding UAR’s in the accompanying consolidated financial statements for the years ended

December 31, 2014 and 2013, respectively. The compensation cost was based on an estimated fair

value of the vested UAR’s, as determined by the Board of Managers, of the appreciation rights in

excess of the base price of the right granted. As of December 31, 2014 and 2013, a short-term

liability of approximately $33,900,000 and $29,043,000, respectively, and a long-term liability of

approximately $3,132,000 and $1,482,000, respectively, have been recognized for the UAR plan

under accrued incentive compensation current liabilities and other long-term liabilities in the

consolidated balance sheets.

13

UAR activity during the periods indicated is as follows:

Weighted

Number of average

UAR’s base price

2004 UAR Plan:

Balance, December 31, 2012 6,243,193 $ 3.68

Granted — —

Forfeited/canceled — —

Exercised (187,250) 2.64

Balance, December 31, 2013 6,055,943 3.72

Granted — —

Forfeited/canceled (11,750) 4.52

Exercised (394,750) 2.73

Balance, December 31, 2014 5,649,443 $ 3.78

Weighted

Number of average

UAR’s base price

2012 UAR Plan:

Balance, December 31, 2012 1,010,000 $ 6.00

Granted 874,00 7.15

Forfeited/canceled (11,2 0) 6.31

Exercised — —

Balance, December 31, 2013 1,872,750 6.70

Granted 893,262 7.96

Forfeited/canceled (63,000) 6.78

Exercised — —

Balance, December 31, 2014 2,703,012 $ 7.12

(b) Deferred Compensation Plan

Effective December 16, 2003, the Company established a plan for the purpose of allowing highly

compensated employees to defer certain compensation (Employee Contributions). The Company’s

obligations to the participants are unsecured, and therefore, the participants are treated as general

unsecured creditors. Participants are fully vested in the amounts in their respective deferred

compensation accounts. Payments typically become payable upon separation from the Company in

either a lump sum or equal installments over a 5-year period. The Deferred Compensation Plan

(the Plan), under the 2004 UAR Plan, also provides UAR grantees with deferred compensation in

respect to the cash distributions made to the Company’s Members (Employer Contributions). The

2004 UAR Plan provides a credit to UAR grantees for member cash distributions for outstanding

grants issued prior to 2012. The UAR credit is determined by the amount of the cash distribution

divided by the total units outstanding at the time of the distribution multiplied by the number of

UAR’s outstanding. The cash contribution is made for vested UAR’s and is included in restricted

investments on the Company’s consolidated financial statements. Upon separation from the

Company, the vested amounts are payable to the UAR grantee within 90 days.

In the Company’s consolidated financial statements, both the Employer and Employee Contributions

to the Plan, as well as the related investment earnings, are recorded in assets as a restricted

14

investment with an offsetting liability for the obligations to the Plan participants. For the years ended

December 31, 2014 and 2013, the restricted investment and the liability each totaled approximately

$18,957,000 and $32,646,000, respectively, of which approximately $13,000 and $1,676,000 were

recorded as short-term for 2014 and 2013, respectively.

The Employee Contributions and the vested portion of the Employer Contributions from its 2004

UAR Plan are in participant-directed brokerage accounts, and consist of money market, bond, and

equity funds. The quoted market value of bond and equity funds is the unit of account used by the

Company to measure these investments. Money market funds are valued at cost, which approximates

fair value.

Markets for Other Significant

identical observable unobservable

December 31, assets inputs inputs

2014 (Level 1) (Level 2) (Level 3)

Financial assets investments:

Money market $ 2,431,308 2,431,308 — —

Fixed income and equities 16,525,380 16,525,380

Total $ 18,956,688 18,956,688 — —

Markets for Other Significant

identical observable unobservable

December 31, assets inputs inputs

2013 (Level 1) (Level 2) (Level 3)

Financial assets investments:

Money market $ 3,935,971 3,935,971 — —

Fixed income and equities 28,709,593 28,709,593

Total $ 32,645,564 32,645,564 — —

(c) 401(k) Plan

The Company contributes to a 401(k) plan covering substantially all of its employees. Employer

contributions are computed based on the employees’ qualifying compensation and totaled

approximately $723,000 and $705,000 for the years ended December 31, 2014 and 2013,

respectively.

(d) Profit Sharing Program

Under the Company’s Profit Sharing Incentive Program, the Board of Managers determines each

year what percent of net profit, if any, as defined by the Board of Managers, is to be allocated to this

plan. The award vests 25% per year over four years and vested portions are paid annually. For 2014

and 2013, the Board of Managers approved a contribution equal to a 2.75% and 3% allocation,

respectively, of net profit. For the years ended December 31, 2014 and 2013, expense of

approximately $1,074,000 and $1,295,000, respectively, was recognized under this plan. The

accrued liability for this plan for the years ended December 31, 2014 and 2013 was approximately

$3,751,000 and $3,588,000, respectively and is included in accrued compensation for the related

short-term liability and in other long-term liabilities for the related long-term liability in the

consolidated balance sheets. For the years ended December 31, 2014 and 2013, the short-term

liability was $906,000 and $820,000, respectively, and the long-term liability was $2,845,000 and

$2,768,000, respectively.

15

(7) Legal Proceedings

The Company is involved in various claims and legal actions arising in the ordinary course of business. In

the opinion of management, the ultimate disposition of these matters will not have a material adverse effect

on the Company’s consolidated financial position, results of operations, or liquidity.

(8) Business and Credit Concentrations

The Company operates primarily in the hospitality industry, and accordingly, a change in the overall

demand for hotel rooms will lead to a corresponding change in the procurement needs of hotels, which

could directly impact the amount of revenue earned by the Company. Lack of demand for hotel rooms and

other events affecting the hospitality industry may significantly impact the Company’s future revenue

streams. Alternatively, increased demand for hotel rooms may significantly positively impact the

Company’s future revenue streams. Also, during the year ended December 31, 2013, approximately 31%

of the Company’s revenue was attributed to three major customers. One of the three major customers’

contracts was not renewed for 2014, but it did not have a significant impact on the Company’s earnings.

For the year ended December 31, 2014, approximately 28.0% of the Company’s revenue was attributable

to three major customers. Any significant decrease or increase in the amount of Spend for these customers

may significantly impact the Company’s future revenue streams.

The Company contracts with several hundred suppliers and is generally not dependent upon any one

supplier to provide products or services to its customers. However, a limited number of the Company’s

suppliers provide services that would be difficult to replace in the short term, should those suppliers cease

to do business with the Company or cease to operate.

Financial instruments that potentially subject the Company to credit risk include accounts receivable and

cash and cash equivalents. The Company extends credit to customers for purchases through Avendra

Replenishment on an unsecured basis in the normal course of business, and to date has not experienced

significant losses on accounts receivable. The Company’s cash deposits often exceed federally insured

limits. The Company has not experienced any losses in its depository accounts and management believes

that the Company is not exposed to any significant credit risks involving depository relationships.

(9) Subsequent Events

The Company has evaluated events subsequent to the balance sheet date through April 20, 2015, the date

the financial statements were available to be issued, and determined there have not been any events that

have occurred that would require adjustments to or disclosure in the consolidated financial statements.