Attached files

| file | filename |

|---|---|

| EX-10.34 - EXHIBIT 10.34 - ClubCorp Holdings, Inc. | cch-20151229xex1034.htm |

| EX-23.1 - EXHIBIT 23.1 - ClubCorp Holdings, Inc. | cch-20151229xex231.htm |

| EX-10.35 - EXHIBIT 10.35 - ClubCorp Holdings, Inc. | cch-20151229xex1035.htm |

| EX-32.2 - EXHIBIT 32.2 - ClubCorp Holdings, Inc. | cch-20151229xex322.htm |

| EX-31.1 - EXHIBIT 31.1 - ClubCorp Holdings, Inc. | cch-20151229xex311.htm |

| EX-31.2 - EXHIBIT 31.2 - ClubCorp Holdings, Inc. | cch-20151229xex312.htm |

| EX-32.1 - EXHIBIT 32.1 - ClubCorp Holdings, Inc. | cch-20151229xex321.htm |

| EX-21 - EXHIBIT 21 - ClubCorp Holdings, Inc. | cch-20151229xex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 29, 2015.

or

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number 001-36074

ClubCorp Holdings, Inc.

(Exact name of registrant as specified in its charter)

Nevada | 20-5818205 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3030 LBJ Freeway, Suite 600 | ||

Dallas, Texas | 75234 | |

(Address of principal executive offices) | (Zip Code) | |

(972) 243-6191

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.01 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o | |

Non-accelerated filer o | Smaller reporting company o | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant, based on the closing price of $23.64 per share as reported on June 16, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter) was $1,039,723,940.

As of February 19, 2016, the registrant had 65,248,354 shares of common stock outstanding, with a par value of $0.01.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2016 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days of December 29, 2015 are incorporated by reference herein into Part III, Items 10 through 14, of this Annual Report.

TABLE OF CONTENTS

Page | ||

PART I

ITEM 1. BUSINESS

Throughout this annual report on Form 10-K (“Form 10-K”), we refer to ClubCorp Holdings, Inc., together with its subsidiaries, as “we”, “us”, “our”, “ClubCorp” or the “Company”. Our fiscal year consists of a 52/53 week period ending on the last Tuesday of December. References to fiscal years 2015, 2014, and 2013 relate to the 52-week fiscal years ended December 29, 2015 and December 30, 2014, and the 53-week fiscal year ended December 31, 2013, respectively.

Summary

We are a membership-based leisure business and a leading owner-operator of private golf and country clubs and business, sports and alumni clubs in North America. As of December 29, 2015, our portfolio of 207 owned or operated clubs, with over 183,000 memberships, served over 430,000 individual members. Our facilities are located in 26 states, the District of Columbia and two foreign countries. ClubCorp began with one country club in Dallas, Texas with the premise of providing a first-class club membership experience. We later expanded to encompass multiple locations, making us one of the first companies to enter into the business of professional ownership and operation of private golf and country clubs. In 1966, we established our first business club with the belief that we could profitably apply our principle of delivering quality service and member satisfaction in a related line of business. In December 2006, we were acquired by affiliates of KSL Capital Partners, LLC (“KSL”), a private equity firm specializing in travel and leisure businesses. In September 2013, ClubCorp became a public equity filer on the New York Stock Exchange (the “NYSE”) under the stock symbol “MYCC”.

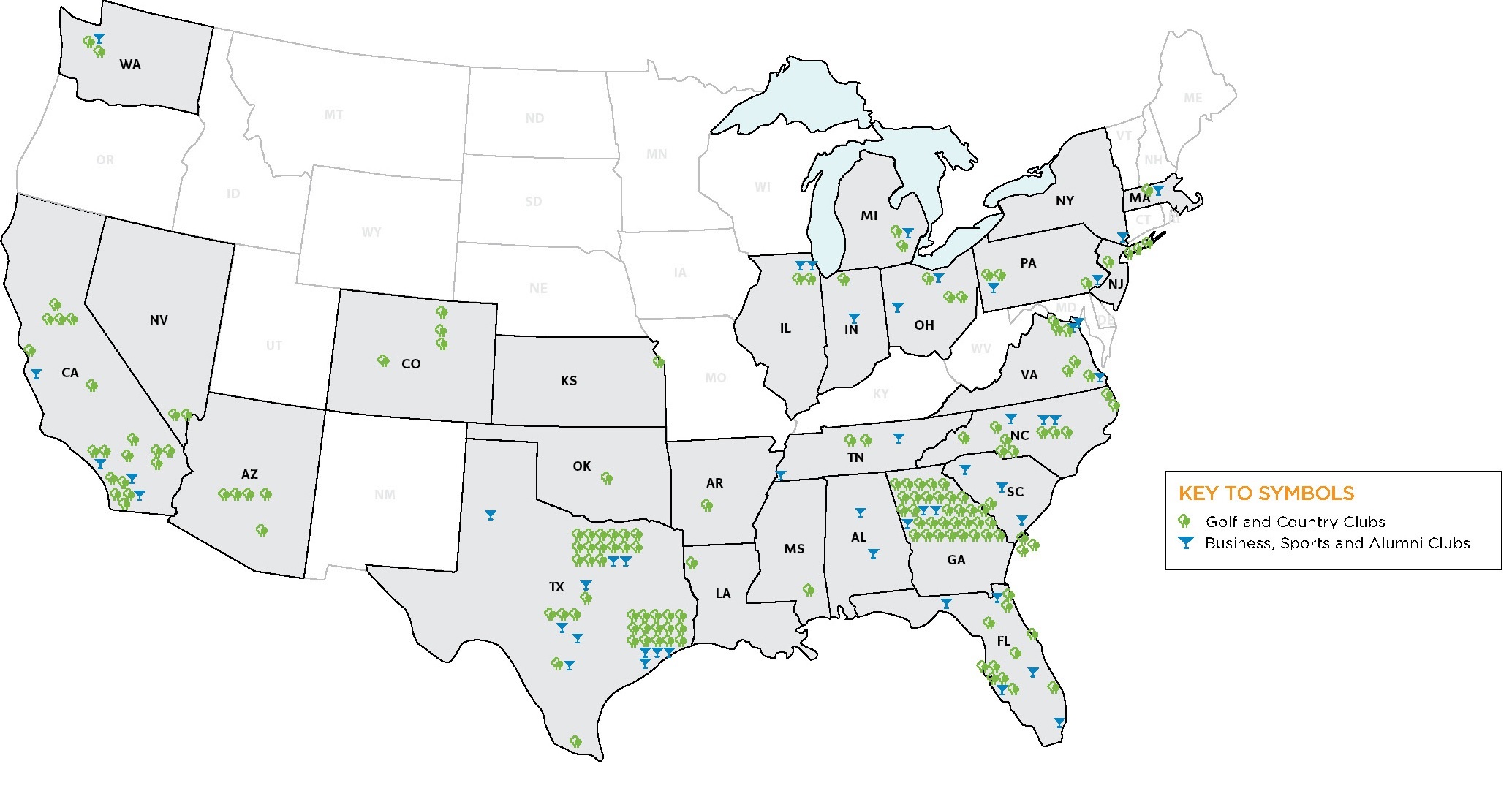

ClubCorp’s Diverse Portfolio of Owned and Operated Clubs

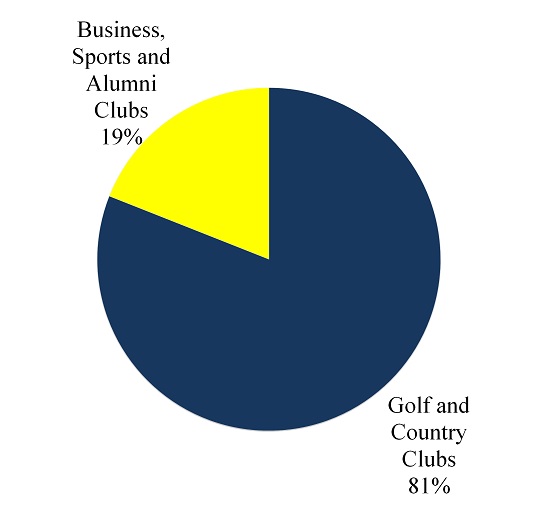

Our operations are organized into two principal business segments: (1) golf and country clubs and (2) business, sports and alumni clubs. For fiscal year 2015, golf and country clubs accounted for 81% of our total club revenue and business, sports and alumni clubs accounted for 19% of our total club revenue.

Our golf and country club segment includes a broad variety of clubs designed to appeal to a diverse group of individuals and families who lead an active lifestyle and seek a nearby outlet for golf, tennis, swimming and other activities. We are the largest owner of private golf and country clubs in the United States and own the underlying real estate for 124 of our 158 golf and country clubs (consisting of over 29 thousand acres of real estate). We own, lease or operate through joint ventures 148 golf and country clubs and manage 10 golf and country clubs. Our golf and country clubs include 133 private country clubs, 16 semi-private clubs and nine public golf courses. Our golf and country clubs are designed to appeal to the entire family, fostering member loyalty which we believe allows us to capture a greater share of our member households’ discretionary leisure spending.

Our business, sports and alumni club segment is designed to provide our members with private upscale locations where they can work, network and socialize. We own, lease or operate through a joint venture 46 business, sports and alumni clubs and manage three business, sports and alumni clubs. Our business, sports and alumni clubs include 30 business clubs, 11

4

business and sports clubs, six alumni clubs, and two sports clubs. Our business clubs are generally located in office towers or business complexes and cater to business executives, professionals and entrepreneurs with a desire to entertain clients, expand their business networks, work and socialize. Our sports clubs include a variety of fitness and racquet facilities. Our alumni clubs are associated with universities with large alumni networks, and are designed to provide a connection between the university and its alumni and faculty. For example, the Baylor Club, which opened during fiscal year 2014, is located in the recently constructed football stadium of Baylor University and serves as a gathering spot for alumni, faculty and staff, along with the Waco, Texas professional, civic and social community.

For fiscal years 2010 to 2015, total revenue and adjusted EBITDA increased by 8.9% and 9.3%, respectively, on a compounded annual basis. We execute three primary growth strategies: (1) organic growth, (2) reinvention and (3) acquisitions.

Organic growth. As the largest owner-operator of private golf and country clubs in the United States, we believe that our expansive portfolio of clubs allows us to drive membership growth by providing a compelling value proposition through product variety. In 1999, we began leveraging the breadth and geographic diversity of our clubs by offering our members various upgrade offerings to take advantage of our portfolio of clubs and variety of amenities. We have created membership programming, such as our Optimal Network Experience (“O.N.E.”) product which provides members access to benefits and special offerings in their local community, network-wide and beyond, in addition to benefits at their home club. We offer our members privileges throughout our collection of clubs, and we believe that our diverse facilities, recreational offerings and social programming enhance our ability to attract and retain members across a number of demographic groups. We also have alliances with other clubs, resorts and facilities located worldwide through which our members can enjoy additional access, discounts, special offerings and privileges outside of our owned and operated clubs. As of December 29, 2015, approximately 50% of our memberships were enrolled in one or more of our upgrade programs, and associated incremental dues revenue, on a consolidated basis, relating to our upgrade programs accounted for approximately $49.5 million of our total dues revenue for fiscal year 2015.

Reinvention. Through a combination of consumer research, experimentation, capital investment and relevant programming, we have sought to “reinvent” the modern club experience to promote greater usage of our facilities. We believe that higher usage results in additional ancillary spend, such as food and beverage purchases, and improved member retention. For fiscal years 2007 through 2015, we have invested more than $586.0 million of capital to better position and maintain our clubs in their respective markets. This represents an investment of approximately 8.2% of our total revenues, for such period, to reinvent, upgrade, maintain, replace and build new and existing facilities and amenities focused on enhancing our members’ experience. From 2007 through 2015, we “reinvented” 52 golf and country clubs and 23 business, sports and alumni clubs through capital investment. In fiscal year 2016, we plan to invest approximately $20.6 million on major reinvention projects across our same-store clubs. Additionally, we plan to invest approximately $20.3 million to reinvent certain recently acquired clubs. These planned renovations will bring a mixture of contemporary, indoor and outdoor dining, resort-style pool amenities, enhanced private event space and improved golf practice and fitness facilities designed to improve our members’ experience.

Acquisitions. We believe the ability to offer access to our collection of clubs provides us a significant competitive advantage in pursuing acquisitions and that the fragmented nature of the private club industry presents significant opportunities for us to expand our portfolio by leveraging our operational expertise and by taking advantage of market conditions. On September 30, 2014, we completed the acquisition of Sequoia Golf (“Sequoia Golf”) for a purchase price of $260.0 million, net of cash acquired and after customary closing adjustments. On the date of acquisition, Sequoia Golf was comprised of 30 owned golf and country clubs and 20 leased or managed clubs. Following the acquisition, our network of private clubs increased, expanding the geographic cluster model and solidifying market penetration in Atlanta, Georgia and Houston, Texas. In addition, from fiscal year 2010 through 2015, we have spent approximately $128.0 million to acquire 23 other golf and country clubs and over $6.5 million to develop two new alumni clubs, further expanding our portfolio of clubs and broadening the reach of our network. We believe there are many attractive acquisition opportunities available and we continually evaluate and selectively pursue these opportunities to expand our business.

5

As shown in the following charts, for fiscal year 2015, golf and country clubs accounted for 81% of our total club revenue and business, sports and alumni clubs accounted for 19% of our total club revenue. The following charts provide a breakdown of total revenues for fiscal year 2015. Membership dues totaled $492.6 million, representing 47.0% of our total revenues.

Club Revenue by Segment | Total Revenue by Type |

|  |

General

Membership-Based Leisure Business with Significant Recurring Revenue. We operate with the central purpose of building relationships and enriching the lives of our members. We focus on creating a dynamic and exciting setting for our members by providing them an environment in which they can engage in a variety of leisure, recreational, social and networking activities. We believe our clubs have become an integral part of many of our members’ lives and, as a result, the vast majority of our members retain their memberships each year, even during the recession that primarily impacted us during 2008-2010 (the “recession”).

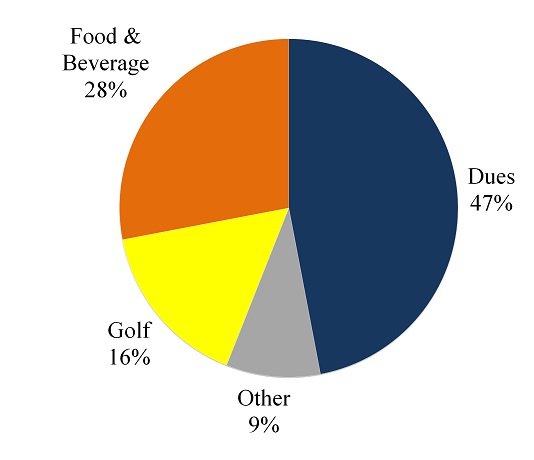

Our large base of memberships creates a stable recurring revenue stream. As of December 29, 2015, our owned and operated clubs had over 183,000 memberships, including over 430,000 individual members. For fiscal year 2015, membership dues totaled $492.6 million, representing 47.0% of our total revenues. During the same time period, our membership retention was 83.0% in golf and country clubs and 76.9% in business, sports and alumni clubs for a blended retention rate of 80.9%. The following charts present our membership counts and annualized retention rates for our two business segments for the past 10 years:

6

Membership Counts and Annualized Retention Rates

The proven strength and resiliency of our mass affluent membership base from peak to trough is an attractive attribute of our business. We believe that if our members remain satisfied with their club experience, they will remain loyal and frequent users of our clubs, reducing our sensitivity to adverse economic conditions and providing us with operating leverage in favorable economic conditions.

Further, according to our fiscal year 2015 data, the average number of visits per same store membership at one of our clubs is 33 visits per year with an average spend of $4,648 per year, including dues. The average number of visits per same store golf membership at one of our clubs is 58 visits per year with an average spend of $8,360 per year, including dues. Revenue per average membership has steadily increased over the past five years growing 5.4% on a compounded basis and totaling $5,014, $5,237, $5,591, $5,692 and $5,837 for fiscal years 2011, 2012, 2013, 2014 and 2015, respectively. For all fiscal years presented, we calculate average membership using the same store membership count at the beginning and end of the relevant fiscal year which excludes clubs acquired through the Sequoia Golf acquisition on September 30, 2014.

We believe that the demographics of our mass affluent membership base are also an important attribute of our business. According to data provided by Buxton, a database and mapping service, based on the addresses of our members, an analysis of our golf and country club members, excluding certain managed clubs acquired in the Sequoia Golf acquisition, indicates that they have an average annual household income of $180,000 to $200,000 and a primary home value of $520,000 to $610,000. An analysis from the same database of our business, sports and alumni club members indicates that they have an average annual household income of $150,000 to $175,000 and a primary home value of $435,000 to $540,000. We believe that these demographic profiles are more resilient during economic downturns than the general population.

Nationally-Recognized and Award-Winning Clubs. Our golf and country clubs, with approximately 198 18-hole course equivalents as of December 29, 2015, represent the core assets of our company and are strategically concentrated in sunbelt markets and other major metropolitan areas. We believe that our clubs are among the top private golf clubs within their respective markets based on the quality of our facilities, breadth of amenities and number of relevant programs and events. These clubs are anchored by our golf courses, of which approximately one third are designed by some of the world’s best-known golf course architects, including Jack Nicklaus, Arnold Palmer, Tom Fazio, Pete Dye, Arthur Hills, Gary Player, Robert

7

von Hagge, Bruce Devlin and Robert Trent Jones. Likewise, a number of our clubs have won national and local awards and have appeared on national and local “best of” lists for golf, tennis and dining including:

• | Firestone Country Club in Akron, Ohio—“Top 50 Private Clubs” (2010‑2011 Golf World) |

• | LPGA International in Daytona Beach, Florida—“America’s Top 50 Courses for Women” (2013 Golf Digest) |

• | Aspen Glen Club in Carbondale, Colorado, Southern Trace Country Club in Shreveport, Louisiana, The Hills Country Club at Lakeway in Austin, Texas, Firestone Country Club in Akron, Ohio, Diamante Country Club in Hot Springs Village, Arkansas and Oak Tree Country Club in Edmond, Oklahoma—each named in their respective states “Best-in-State” (2014 Golf Digest) |

• | Brookhaven Country Club in Dallas, Texas—“Best Overall Family Club” in Dallas/Fort Worth and “The Best in Private Clubs” List (2014 Avid Golfer Magazine) |

• | Vista Vallarta Club de Golf in Puerto Vallarta, Mexico—“Best Caribbean and Mexico Courses” (2014 Golfweek) |

The operations and maintenance of our golf courses and facilities have led to our selection as host of several high-profile events, leading to local and national media recognition as well as event revenue, club utilization and membership sales. In the past year, the following events were played at our courses:

• | The World Golf Championships—Bridgestone Invitational at Firestone Country Club in Akron, Ohio |

• | The Insperity Invitational (Champions Tour)—The Woodlands Country Club Tournament Course in The Woodlands, Texas |

• | The LPGA ANA Inspiration (formerly the Kraft Nabisco Championship)—Mission Hills Country Club in Rancho Mirage, California |

• | The LPGA Volunteers of America North Texas Shootout—Las Colinas Country Club in Irving, Texas |

• | The Web.com Midwest Classic Presented by Cadillac at Nicklaus Golf Club—LionsGate in Overland Park, Kansas |

Outside of our golf offering, our clubs provide a variety of additional amenities and services that we believe appeal to the whole family, such as well-appointed clubhouses, a variety of dining venues, event and meeting spaces, tennis facilities, exercise studios, personal training, spa services, resort-style pools and water features and outdoor gathering spaces. We offer over 800 tennis courts across 90 clubs, and our Brookhaven Country Club features a nationally-recognized private tennis facility.

Many of our 49 business, sports and alumni clubs are located in the heart of the nation’s influential business districts, with locations in 15 of the top 25 metropolitan statistical areas, and offer an urban location for professionals to network with colleagues, conduct business and socialize with friends. We believe our business clubs are choice locations for regional and local business and civic receptions with business amenities to support these events. These clubs also host numerous upscale private events, such as weddings, bar and bat mitzvahs and holiday parties. These events generate traffic flow through our clubs, helping to drive membership sales and club utilization. In addition, the six alumni clubs we operate offer a unique setting for alumni and faculty to share common heritage and experiences.

Expansive Portfolio of Clubs and Alliances Providing Scale. As the largest owner-operator of private golf and country clubs in the United States, we believe that our expansive portfolio of clubs allows us to drive membership growth by providing a compelling value proposition through product variety. By clustering our clubs, many of our members have local access to both urban business-focused clubs as well as suburban family-oriented clubs. For an incremental monthly charge, our reciprocal access program gives our members access to our owned and operated clubs, as well as the facilities of others with which we have an alliance relationship, both domestically and internationally. For example, a member of one of our Dallas-Fort Worth area clubs who participates in the O.N.E. offering could travel to Palm Springs, California and play at the Dinah Shore Tournament Course at our Mission Hills Country Club. As of December 29, 2015, approximately 50% of our memberships were enrolled in one or more of our upgrade programs, as compared to approximately 39% of memberships as of the end of the prior fiscal year. Further, at the 152 clubs that offer O.N.E., approximately 71% of our golf memberships were enrolled in one or more of our upgrade programs. Incremental dues revenue, on a consolidated basis, relating to our upgrade programs accounted for approximately $49.5 million of our total dues revenue for fiscal year 2015, compared to approximately $37.6 million for fiscal year 2014. By providing members with numerous services and amenities that extend beyond their home clubs

8

to all of the clubs we own and operate and the clubs with which we have alliances, we believe we can drive membership growth and create a key market differentiator which would be difficult for our competitors to replicate. We believe we have an opportunity to increase our revenue related to upgrade programs as we continue to introduce these products to our clubs, including recently acquired clubs.

Our established alliances feature leisure-oriented businesses including hotels such as The Ritz-Carlton, Hotel Del Coronado, Mandarin Oriental, and Omni Hotels and Resorts including La Costa Resort and Spa, and Barton Creek Resort & Spa; ski resorts such as Squaw Valley, Vail and Whistler Blackcomb; and restaurants such as Emeril Lagasse and The Capital Grille, as well as numerous other venues worldwide that provide discounts, upgrades and complimentary items or services. For example, our members receive 10% or more off best-available rates at select hotels and resorts, as well as special access and VIP packages to events such as The Masters and the U.S. Open Golf and Tennis Championships.

We believe the size of our portfolio of clubs provides us with significant economies of scale, creating operational synergies across our clubs and enabling us to consolidate our human resources, sales and marketing, accounting and technology departments. We also benefit from centralized purchasing to receive preferred pricing on supplies, equipment and insurance.

Diversification. As a result of our size and geographic diversity, our operating revenues and cash flows are not reliant on any one club or geographic region. Our 10 largest clubs by revenue accounted for 19.2% of our club revenues for fiscal year 2015, as shown in the following chart:

Club | Location | Revenue (in thousands) | % of Club Revenue | ||||||

Firestone Country Club | Ohio | $ | 25,981 | 2.5 | % | ||||

The Clubs of Kingwood at Kingwood | Texas | 22,644 | 2.2 | % | |||||

Coto De Caza Golf & Racquet Club | California | 22,111 | 2.1 | % | |||||

Mission Hills Country Club | California | 21,763 | 2.1 | % | |||||

Gleneagles Country Club | Texas | 21,543 | 2.1 | % | |||||

Stonebriar Country Club | Texas | 20,310 | 2.0 | % | |||||

The Woodlands Country Club Palmer Course & Tennis Center | Texas | 18,164 | 1.7 | % | |||||

Brookhaven Country Club | Texas | 17,577 | 1.7 | % | |||||

The Hills Country Club at Lakeway | Texas | 14,787 | 1.4 | % | |||||

Braemar Country Club | California | 14,415 | 1.4 | % | |||||

$ | 199,295 | 19.2 | % | ||||||

We have strategic concentrations of golf and country clubs in Texas, California and Georgia, representing 31.0%, 17.8% and 10.5%, respectively, of total club revenue for fiscal year 2015. While we have greater presence in these states where climates are typically conducive to year-round play, we believe that the broad geographic distribution of our portfolio of clubs helps mitigate the impact of adverse regional weather patterns and fluctuations in regional economic conditions. To allow for maximization of golf rounds, we employ a corporate director of agronomy and regional golf superintendents who oversee our strong agronomic practices, helping to extend golf play throughout the climate zones in which we operate.

Ownership and Control of Golf and Country Clubs. We own the underlying real estate of 124 of our 158 golf and country clubs and believe we have an advantage over other clubs as we retain the ability to maximize the value of our clubs and business. By owning the real estate underlying our clubs, we have been able to implement capital plans that inure to our benefit and generate positive returns on our investments. Owning many of our assets also gives us the flexibility to recycle our capital by selling underperforming clubs or non-essential tracts of land.

Seasoned Management Team. We have a highly experienced professional management team. Our seven current executive officers had a combined 198 years of related career experience, including on average 23 years of hospitality and club specific experience through the end of fiscal year 2015. Eric Affeldt has served as President and Chief Executive Officer for ClubCorp since December 2006 and has over 25 years of experience leading golf and resort companies, including as president and chief executive officer of KSL Fairways Golf Corporation, as well as general manager for Doral Golf Resort & Spa in Miami and PGA West and La Quinta Resort & Club in California. Curt McClellan, our Chief Financial Officer and Treasurer, has been with our company since November 2008 and is responsible for leading the corporate finance and accounting teams. Our Chief Operating Officer, Mark Burnett, has over 27 years of experience managing golf and country clubs and leading golf and resort companies, including serving as chief operating officer for American Golf Corporation and president and chief executive officer and chief operating officer of KSL Fairways Golf Corporation.

9

We have also attracted and retained qualified general managers for our clubs. Our club general managers average approximately 10 years of service with us. These managers are tasked with the day-to-day responsibility of running the clubs and executing the strategic direction of senior management.

Our management team continues to drive new membership sales, mitigate attrition and generate cash flows by delivering value to our members through modernization and enhancement of our clubs and upgrade programs, improving operating efficiencies and expanding our portfolio through acquisitions.

Business Strategy

Attracting and retaining members while increasing member usage by providing the highest quality club experience are the biggest drivers of our revenue growth. We execute three primary growth strategies: (1) organic growth, (2) reinvention and (3) acquisitions.

Organic growth. Our organic growth strategy is focused on employing an experienced membership sales force, leveraging our portfolio and alliance offerings and developing new and relevant programming.

Employ Experienced Membership Sales Force—We employ approximately 200 club-based, professional sales personnel who are further supported by an array of regional and corporate sales and marketing teams. Our sales team receives comprehensive initial and ongoing sales training through our internally developed “Bell Notes” training program that we believe addresses all elements of the sales process from member prospecting to closing the sale and onboarding the new member. Our sales efforts are driven at an individual club, regional and national level. Club level membership sales are targeted to individual households in the local community and bolstered by referrals from existing members, real estate brokers and developers. Regional sales management ensures sales plan execution and identifies additional prospecting opportunities that match the demographic data of existing club members such as household income or the propensity to play golf. Our national sales and marketing teams are led by four corporate professionals who each have more than 20 years of tenure and collectively have over 100 years of experience with us. Their efforts include creating core and strategic membership offerings and corporate rate memberships.

We periodically obtain feedback from our membership base to effectively understand current membership demographics and preferences to better target member prospects. For example, in 2012, with the improving macro-economic environment, we launched a national family legacy program that allows members to invite extended family to join any of our clubs with promotional pricing. As of December 29, 2015, we had approximately 1,700 memberships enrolled in this program. In April 2009, we implemented regional young executive programs, primarily in our Dallas and Houston clubs, with special pricing that feature multi-club access and professional networking events. As of December 29, 2015, we had over 2,300 memberships enrolled in the young executive programs. We believe our well-trained and incentivized sales team will continue to drive membership growth, and we believe we are well-positioned to capitalize on improving economic conditions.

Leverage Our Portfolio and Alliance Offerings—We offer a variety of products, services and amenities through upgrade offerings that provide members access to our portfolio of clubs and leverage our alliances with other clubs, resorts and facilities both domestically and internationally.

In fiscal year 2010, we strategically introduced our O.N.E. product and have continued to market it aggressively across most of our golf and country clubs. O.N.E. is a product that combines what we refer to as “comprehensive club, community and world benefits”. With this offering, members typically receive 50% off a la carte dining at their home club; preferential offerings to clubs in their community (including those owned by us), as well as at local spas, restaurants and other venues; and complimentary privileges to more than 300 golf and country, business, sporting and athletic clubs when traveling outside of their community with additional offerings and discounts to more than 1,000 renowned hotels, resorts, restaurants and entertainment venues. These programs are designed to increase our recurring monthly revenues while providing a value proposition to our members that helps drive increased usage of our facilities. 152 of our clubs offer O.N.E. to their members. Over 55% of our new members have joined under our O.N.E. offering at clubs where it is offered as compared to 35% of new members who purchased upgraded product offerings prior to the introduction of the O.N.E. offering. Further, approximately 75% of our new golf members joined under our O.N.E. offering at clubs where it is offered. For fiscal years 2010 to 2015, use of our facilities by members outside of their home club increased by 59%, excluding clubs acquired under the Sequoia Golf acquisition, as a result of the introduction of the O.N.E. offering. Food and beverage revenues increased 41% from fiscal years 2010 to 2015, excluding clubs acquired under the Sequoia Golf acquisition, which we largely attribute to our enhanced dining venues and offerings, including the O.N.E. product, the recovering economy and greater consumer spend. We continue to evaluate opportunities for further expansion of the O.N.E. product into additional geographic areas and acquired clubs.

10

We have established alliances with other leisure-oriented businesses, whereby members of our clubs have usage privileges or receive special pricing at such properties. We target alliances with recognized brands that appeal to our members. According to the 2013 U.S. Affluent Travel and Leisure report by Resonance, the Ritz-Carlton, with whom we have an alliance, is ranked in the top five preferred brands for affluent households and is the premier brand for high net worth households. Other leading brand alliances include but are not limited to La Costa Resort and Spa, Barton Creek Resort & Spa and other Omni hotels and resorts, Pinehurst Resort, hotels such as Hotel Del Coronado and Mandarin Oriental, ski resorts such as Squaw Valley, Vail and Whistler-Blackcomb, and restaurants such as Emeril Lagasse and The Capital Grille, as well as numerous other alliances that provide discounts, complimentary upgrades, services or items. The benefits offered are generally paid for by our members at the time of use. We have revenue sharing arrangements with some of these properties, and we do not incur any fees or additional costs to enter into such alliances.

We market and promote our member benefits through our in-house marketing tools, including member e-newsletters and e-communications, our internally developed online Benefits Finder, other social media applications and our quarterly-distributed proprietary Private Clubs magazine. Our strategic alliance partners also support our marketing efforts with targeted advertisement, including direct mail. We make reservations convenient for members by providing an in-house concierge (ClubLine), and by offering access to an inventory of VIP tickets through our own web portal (TicketLine). Members may also directly access discounted hotel rates of up to 40% off retail rates at thousands of hotels worldwide through an online tool (Find Hotels) connecting members to a wholesale travel company with whom we have an alliance arrangement. We continually seek additional reciprocal arrangements and alliances with other hospitality-oriented businesses that can further enhance our members’ variety of choices extending beyond their home club.

Develop New and Relevant Programming—Members who frequently utilize our facilities typically tend to spend more at our clubs and remain members longer. As a result, we believe that there are significant opportunities to increase operating revenues by making our clubs more relevant to our members. We use a reporting tool we refer to as the “Member Dashboard” to analyze and drive member activity and club utilization. The Member Dashboard identifies members’ visits and allows us to personally engage with our members and encourage them to use their club and its amenities. We capture a member’s interest profile when the member joins a club and we study member usage patterns and obtain feedback from our members periodically to keep our offerings relevant to members’ changing lifestyles. Our goal is to provide numerous opportunities for all members and their families to utilize our facilities.

Key elements of our strategy have included making our golf and country clubs more family friendly and accessible. To make it more convenient for members to learn the game of golf, we have expanded practice facilities, enhanced teaching programs and created “Fastee Courses” where tees are placed forward to shorten the yardage of each hole to ease play and reduce the time commitment. We have also added family-oriented water recreation facilities in our pool areas, refitted fitness centers and redesigned our food and beverage outlets to be more contemporary and casual allowing for anytime usage. Many of our golf and country clubs offer summer camps and other youth programming, including junior golf leagues and swim teams. We believe these program offerings have been well received by both new and existing members, with an increase in ancillary revenue, excluding clubs acquired through the Sequoia Golf acquisition, of 3.5% for fiscal year 2015 compared to fiscal year 2014 and 2.6% for fiscal year 2014 compared to fiscal year 2013.

Many of our facilities contain significant banquet and catering facilities for use by both members and non-members alike. We host events ranging from weddings, to bar and bat mitzvahs, to business meetings, to civic organization gatherings, which often serve as the first introduction of our clubs to prospective members. Our extensive portfolio of business, sports and alumni clubs also provides our members access to a network of other civic and business leaders, and our clubs endeavor to host high profile social and civic events in order to become central to the community in which we operate.

Members also participate in clubs within their club, whereby members with similar interests come together for recreational, educational, charitable, social and business-oriented purposes. We believe this reinforces the club becoming integral to the lives of our members. Our individual clubs also benefit from member participation on their board of governors and numerous committees providing us valuable feedback and recommendations for further improvements to our program offerings. We will continue to promote activities and events occurring at members’ home clubs, and believe we can further tailor our programming to address members’ particular preferences and interests.

Reinvention. We believe our ability to conceptualize, fund and execute club reinventions gives us a significant competitive advantage over member-owned and individual privately-owned clubs, which may have difficulty gaining member consensus and financial backing to execute such improvements. In 2007, we embarked on the “reinvention” of our clubs through strategic capital investment projects designed to drive membership sales, facility usage and member retention. We believe this strategy results in increased member visits during various parts of the day for both business and pleasure, allowing our clubs to serve multiple purposes depending on the individual needs of our members. Additionally, our investments have enabled us to make appropriate price adjustments.

11

Elements of reinvention capital expenditures include “Touchdown Rooms”, which are small private meeting rooms allowing members to hold impromptu private meetings while leveraging the other services of their club. “Anytime Lounges” provide a contemporary and casual atmosphere to work and network, while “Media Rooms” provide state-of-the-art facilities to enjoy various forms of entertainment. Additional reinvention elements include refitted fitness centers, enhanced pool area amenities such as shade cabanas, pool slides and splash pads, redesigned golf practice areas for use by beginners to avid golfers, and newly created or updated indoor and outdoor dining and social gathering areas designed to take advantage of the expansive views and natural beauty of our clubs.

From fiscal years 2007 to 2015, we invested more than $586.0 million, or approximately 8.2% of total revenue, to reinvent, upgrade, maintain, replace and build new and existing facilities and amenities. Much of our invested capital included adding reinvention elements to many of our clubs, including the construction or remodeling of approximately 21 fitness facilities and 94 dining venues, the addition of seven family-oriented outdoor water related amenities and improvements to approximately 1,700 holes of golf. As of December 29, 2015, 75 of our clubs, including 52 golf and country clubs and 23 business, sports and alumni clubs, were considered “major reinvention” clubs and received significant reinvention capital. We define “major reinvention” clubs as those clubs receiving $750,000 or more gross capital spend on a project basis.

Examples of major reinvention clubs include but are not limited to:

•Firestone Country Club in Akron, Ohio

•Gleneagles Country Club in Dallas, Texas

•Coto De Caza Golf & Racquet Club in Coto De Caza, California

•Cardinal Club in Raleigh, North Carolina

•The University of Texas Club in Austin, Texas

•The Houston Club in Houston, Texas

•The City Club Los Angeles in Los Angeles, California

•The Woodlands Country Club Palmer Course & Tennis Center in Houston, Texas

•Prestonwood Country Club - The Creek in Dallas, Texas

•Prestonwood Country Club - The Hills in Dallas, Texas

We believe the benefits of reinvention include an increase in revenue as a result of an increase in member usage, increase in member spend per visit, and an increase in new memberships. For instance, the recent renovation at Canyon Creek Country Club near Dallas, Texas is an example of how we profit from major renovation projects. From 2013 through 2014, we invested approximately $1.6 million to renovate the club as part of our reinvention strategy. We believe this investment contributed to a 16.1% and 3.8% increase in revenue and membership count, respectively, for fiscal year 2015, compared to pre-construction revenue and membership count for fiscal year 2013. Additionally, we believe the reinvention contributed to a 28.3% improvement in adjusted EIBTDA for fiscal year 2015, compared to adjusted EBITDA for fiscal year 2013.

At our business clubs, we have benefited from landlord contributions towards the cost of our business club reinvention. Landlords often see our clubs as amenities that improve the building’s overall appeal for its tenants and, as such, are willing to help fund improvements. From fiscal years 2007 through 2015, we received landlord contributions at 21 of our 23 reinvented business, sports and alumni clubs totaling approximately $29.4 million, representing approximately 38% of the total reinvention investment in our business, sports and alumni clubs. Additionally, we expect approximately $3.3 million in tenant improvement allowances attributable to reinvention projects occurring during fiscal year 2016 under the terms of the respective lease agreements. We believe that these leasehold improvements also favorably position us to capitalize on the improving economy.

The reinvention capital investments made at The University of Texas Club in Austin, Texas, further demonstrate how we profited from such projects. From 2013 through 2014, we invested approximately $3.1 million to reinvent the club. We believe this investment contributed to a 6.6% and 29.2% increase in revenue and adjusted EBITDA, respectively, for fiscal year 2015, compared to pre-construction revenue and adjusted EBITDA for fiscal year 2013.

12

Our reinvention concept is based on consumer research, through which we analyzed how members were using our facilities, why members joined and why some subsequently resigned. This research was utilized to develop physical and programming changes to better suit our members’ preferences and needs. Based on visits per average membership, in fiscal year 2015, our members visited our same store reinvented golf and country clubs an average of 29.1% more frequently than members of non-reinvented clubs and members visited our same store reinvented business, sports and alumni clubs an average of 15.8% more frequently than non-reinvented clubs.

During fiscal years 2015 and 2014, we spent $32.7 million and $32.1 million, respectively, of capital on major reinvention projects. We believe these additional major reinvention projects represent opportunities to increase revenues and generate a positive return on our investment, although we cannot guarantee such returns. In 2016, we plan to invest approximately $20.6 million on major reinvention projects across our same-store clubs. Additionally, we plan to invest approximately $20.3 million to reinvent certain recently acquired clubs. We will continue to identify and prioritize capital projects for fiscal years 2016 and beyond to add reinvention elements.

Acquisitions. Acquisitions allow us to expand our portfolio and network offerings. We believe the ability to offer access to our collection of clubs provides us a significant competitive advantage in pursuing acquisitions. Newly acquired clubs may also generally benefit from additional capital and implementation of our reinvention strategy. We believe that the unique benefits that we have to offer, such as a policy which does not assess members for capital improvements as well as our ability to consummate acquisitions and improve operations, provide us a unique competitive advantage in pursuing potential transactions. We believe there are many attractive acquisition opportunities available and we continually evaluate and selectively pursue these opportunities to expand our business. We actively communicate with other club operators, their lenders and boards of directors who may seek to dispose of their club properties or combine membership rosters at a single club location. We also evaluate joint ventures and management opportunities that allow us to expand our operations and increase our recurring revenue base without substantial capital outlay. When we do make strategic acquisitions, we do so only after an evaluation to satisfy ourselves that we can add value given our external growth experience, facility assessment capabilities, operational expertise and economies of scale. For example, in the second fiscal quarter of 2013, we acquired Oak Tree Golf & Country Club, a private country club located in Edmond, Oklahoma, for approximately $10.2 million, including $5.0 million of assumed debt, and subsequently invested $3.4 million in reinvention elements. Revenues increased approximately 31.9% for fiscal year 2015 compared to fiscal year 2012, the last complete fiscal year prior to our acquisition. Additionally, the club's membership count increased 42.4% from the second quarter of 2013 to December 29, 2015. During fiscal year 2015, the club contributed $3.4 million in adjusted EBITDA.

13

From fiscal years 2010 through 2015, we have spent approximately $128.0 million to acquire the 23 golf and country clubs shown in the table below.

Year | Club | Location | Number of Clubs | Number of Holes | ||||

2010 | Country Club of the South | Georgia | 1 | 18 | ||||

2011 | The Hamlet Golf & Country Club Willow Creek Golf & Country Club Wind Watch Golf & Country Club | New York | 3 | 54 | ||||

Canterwood Golf & Country Club | Washington | 1 | 18 | |||||

2012 | Hartefeld National Golf Club | Pennsylvania | 1 | 18 | ||||

2013 | Oak Tree Country Club | Oklahoma | 1 | 36 | ||||

Cherry Valley Country Club | New Jersey | 1 | 18 | |||||

Chantilly National Golf & Country Club | Virginia | 1 | 18 | |||||

2014 | Prestonwood Country Club - The Creek Prestonwood Country Club - The Hills | Texas | 2 | 36 | ||||

TPC Piper Glen | North Carolina | 1 | 18 | |||||

TPC Michigan | Michigan | 1 | 18 | |||||

Oro Valley Country Club | Arizona | 1 | 18 | |||||

2015 | Ravinia Green Country Club | Illinois | 1 | 18 | ||||

Rolling Green Country Club | Illinois | 1 | 18 | |||||

Bermuda Run Country Club | North Carolina | 1 | 36 | |||||

Brookfield Country Club | Georgia | 1 | 18 | |||||

Firethorne Country Club | North Carolina | 1 | 18 | |||||

Ford's Colony Country Club | Virginia | 1 | 54 | |||||

Legacy Golf Club at Lakewood Ranch (subsequently divested) | Florida | 1 | 18 | |||||

Temple Hills Country Club | Tennessee | 1 | 27 | |||||

Bernardo Heights Country Club | California | 1 | 18 | |||||

Additionally, from fiscal years 2010 through 2015, we spent over $6.5 million to develop two new alumni clubs. Subsequent to December 29, 2015, on February 2, 2016, we purchased Marsh Creek Country Club, a private golf club in St. Augustine, Florida.

In addition to the acquisitions shown above, on September 30, 2014, we completed the acquisition of Sequoia Golf for a purchase price of $260.0 million, net of $5.6 million of cash acquired and after customary closing adjustments including net working capital. On the date of acquisition, Sequoia Golf was comprised of 30 owned golf and country clubs and 20 clubs which were leased or managed. The acquisition increased our network of private clubs, expanded the geographic cluster model, and solidified market penetration in Atlanta, Georgia and Houston, Texas.

In addition to our domestic initiatives, we believe there is a market to extend our private club expertise through international management arrangements. As of December 29, 2015, we managed two business clubs in China; one in Beijing and one in Hangzhou. Going forward, we will consider selectively expanding our international operations.

14

Industry and Market Opportunity

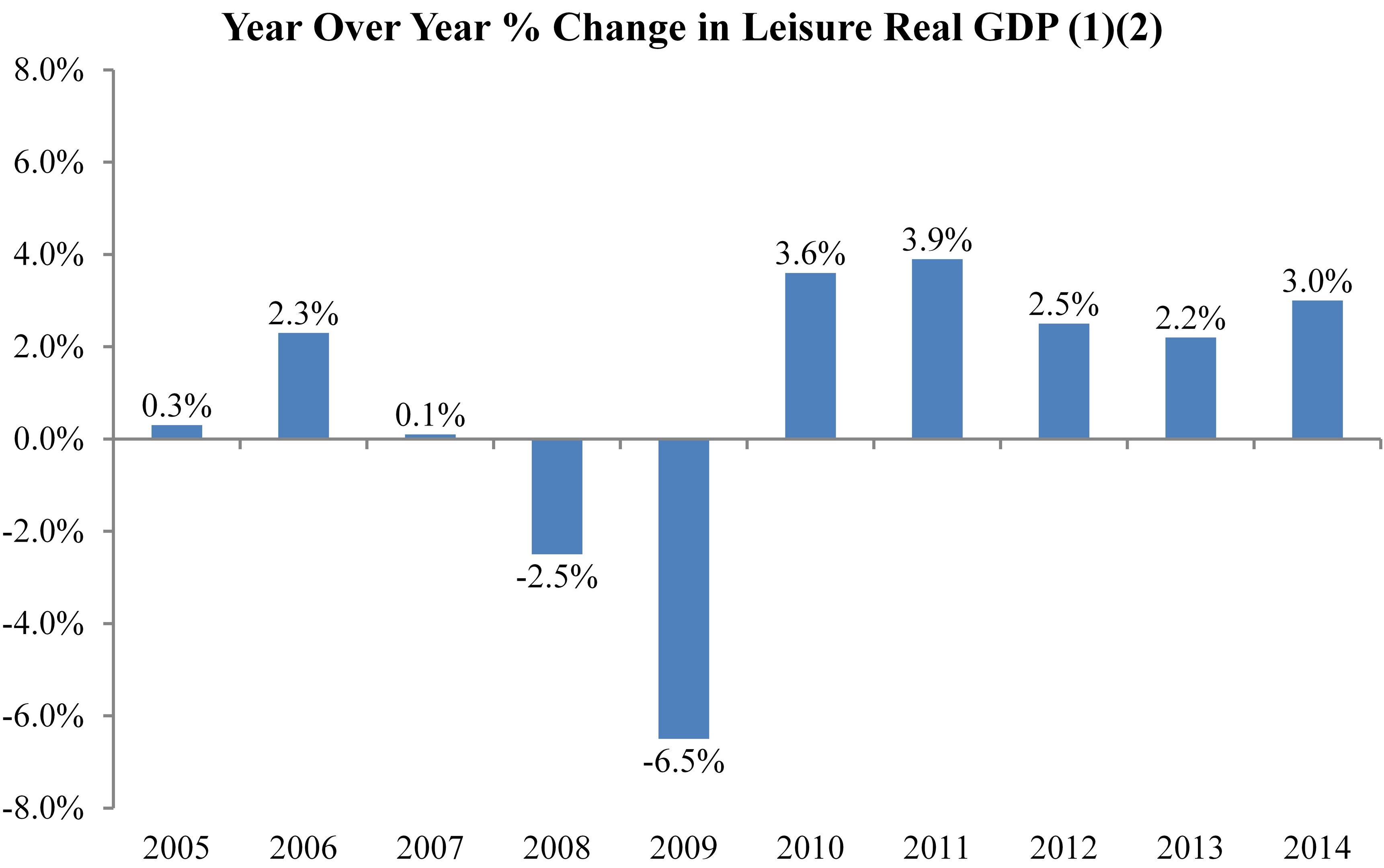

Our company is a membership-based leisure business closely tied to consumer discretionary spending. We believe that we compete for these discretionary consumer dollars against such businesses as amusement parks, spectator sports, ski and mountain resorts, fitness and recreational sports centers, gaming and casinos, hotels and restaurants. We believe that we will benefit from the recovery taking place in the leisure industry as evidenced by recent trends in gross domestic product (“GDP”) growth within our industry. According to the latest Bureau of Economic Analysis (“BEA”) data, from 2013 to 2014, leisure and hospitality industry’s GDP growth increased by 3.0%.

| |

______________________ | |

Source: Bureau of Economic Analysis. | |

(1) | Leisure represents the BEA defined industry of arts, entertainment, recreation, accommodation and food services. |

(2) | GDP represents value added; according to the BEA, value added by industry is a measure of the contribution of each industry to the nation’s GDP. |

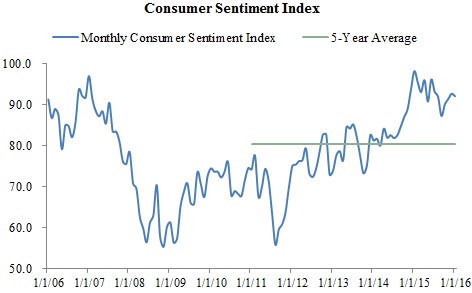

Favorable Macro-Economic Trends. We believe that our industry and business are generally affected by macro-economic conditions and trends. Evidence of those trends from calendar year 2008 to 2015 include the S&P 500 increasing 167%, home sales volume (including new home and existing home sales) increasing from 9.8 million to 11.5 million, according to the Bureau of the Census and the National Association of Realtors, median home prices of existing homes increasing from $175,000 in 2008 to $224,100 at the end of December 2015, according to the National Association of Realtors, and the consumer discretionary spend increasing from $10.0 trillion to $12.4 trillion, as reported by the BEA. We believe that as the economy continues to recover from the recession lows, our industry will continue to benefit. For most of the past two years, the consumer sentiment index has remained above its five year average, according to Thomson Reuters/University of Michigan. We believe that as consumer confidence and disposable income increase, our clubs will benefit from increased leisure and discretionary dollars spent as individuals and families look to expand recreational activities and social interactions.

15

|  |

______________________ | ______________________ |

Source: Thomson Reuters and University of Michigan. | Source: Bureau of Economic Analysis. |

Improving Real Estate Conditions. We believe improving economic conditions and improvements in local housing markets reinforce the foundation for membership growth. Although some of the metropolitan areas where we operate clubs were disproportionately affected by the recession, related to the decline in home prices and increase in foreclosure rates, our membership base remained resilient, which we believe can be attributed to our favorable membership demographics. Economic indicators, such as increased consumer confidence, discretionary spending and home sales and construction, support an environment where we believe prospective members will choose to join our clubs.

Membership growth is, in part, driven by sales of homes in neighborhoods where our clubs are located as those who purchase homes in those areas are more likely to join the neighboring country club. For example, membership at Trophy Club Country Club, near Dallas, Texas, increased 22% from 2010 to 2015, during which time the local municipality approved more than 1,300 new home construction permits for neighborhoods located within a 20 mile radius of the club.

In our business, sports and alumni clubs segment, improvements in the commercial leasing market support the attraction of new members. For example, in 2011, occupancy in the Urban Centre Towers in Tampa Bay, Florida, where our Centre Club is located, was 77.7%. As of December 30, 2014, occupancy had increased to 88.4%, and our membership count at the Centre Club increased 13.3% over the same period. We believe our alumni clubs are less impacted by local economic conditions as the membership tends to draw from a larger geographical area.

Affluent Demographic. According to data provided by Buxton, a database and mapping service, our members reside in locations where the average household income is in excess of $150,000. According to the Resonance Report for 2013, which relies on estimates from the Bureau of Labor Statistics, households with income of $150,000 or greater account for 36% of all consumer spending on social, recreation and health club memberships. We believe this mass affluent demographic’s share of discretionary spending is beneficial to our business.

Golf Industry Overview

The operational and financial performance of our clubs has been, and we believe will continue to be, influenced by local, regional and national U.S. macro-economic trends. We primarily own and operate private golf and country clubs for which we believe demand is generally more resilient to economic cycles than public golf facilities and other hospitality assets, which we believe can be attributed to our favorable membership demographics.

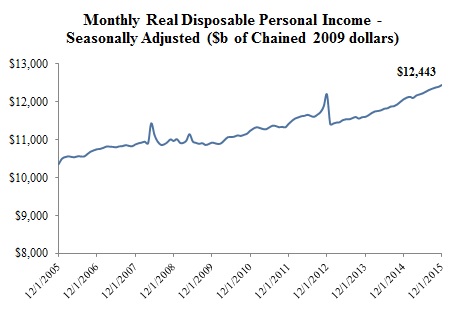

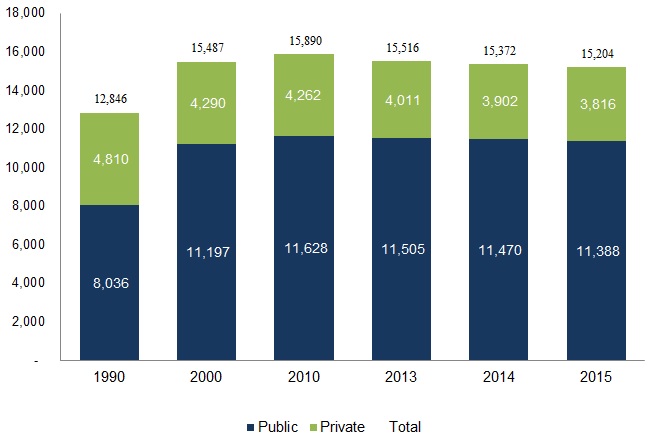

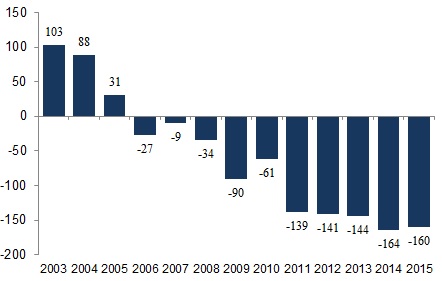

Golf Industry Trends. We believe that golf industry trends are favorable to our private club membership model. The golf industry is characterized by varied ownership structures, including properties owned by corporations, member equity owners, developers, municipalities and others. Reports prepared by the National Golf Foundation (“NGF”) show that during the 1990’s and early 2000’s, the industry suffered an overbuilding of public golf facilities. Over 3,160 public golf facilities opened from 1990 through 2000, increasing the supply of public golf by 39%. Golfer growth could not keep pace with the new supply generated during this time period. NGF also reports that 2015 represented the tenth consecutive year in which total facility closures outnumbered openings, with a net reduction of 160 18-hole equivalent courses in 2015. Based on the latest count by NGF, 2015 year-end U.S. golf supply totaled 15,204 facilities comprised of 11,388 public facilities and 3,816 private golf clubs.

16

Golf Facilities in The U.S. | Net Change in Total Golf Course Supply |

|  |

______________________ | ______________________ |

Source: National Golf Foundation | Source: National Golf Foundation |

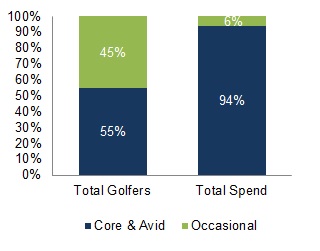

Golfer Trends. According to NGF estimates, core and avid golfers represent more than 55% of total golfers and represented approximately 94.0% of the $26.3 billion spent on golf in 2012. We believe that core and avid golfers are the most likely golfers to become private club members and according to private club trends last reported by NGF, private golf clubs have an average golfer spend of approximately $2,000 per year versus public courses that have an average golfer spend of approximately $650 per year. Further, NGF has reported that the typical private club member is 55 years old with an annual household income of approximately $125,000 whereas the typical public golfer is 47 years old with an annual household income of approximately $95,000.

According to publications by NGF, the private golf club industry captures a more affluent segment of baby boomers than the industry as a whole, and we believe baby boomers will play a significant role in the future of the golf industry. Further, NGF believes that there is a pipeline of qualified member prospects with similar characteristics as our current members and almost half of total golfers are under the age of 40.

Spend per Golfer | Golfers by Age |

|  |

______________________ | ______________________ |

Source: National Golf Foundation | Source: National Golf Foundation |

Business Club Industry Overview

While there is no specific industry designation for our business, sports and alumni clubs, we believe utilization of our clubs is comparable to the restaurant and hospitality industries. Our business clubs are located in 15 of the top 25 Metropolitan

17

Statistical Areas ranked by population. Our business clubs include dining rooms, bar areas and private meeting rooms which allow members to entertain clients, conduct business and host social and corporate events.

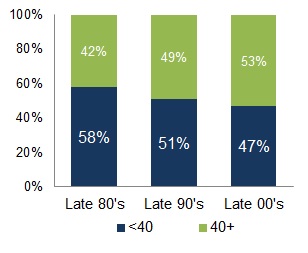

We believe that a favorable economic backdrop increases business activity (as measured by corporate profits and the success of the capital markets) and will positively affect the demand for our business clubs. According to the BEA, corporate profits from current production (also known as operating or economic profits) increased 1.7% in 2014 and 2.0% in 2013. Similarly, the S&P 500 Index, a proxy for the performance of the broader public equity capital markets, has recently witnessed significant returns. On a total return basis, the S&P 500 is up 55% over the past three years.

|

______________________ |

Source: Bureau of Economic Analysis. |

We anticipate that a continued influx of jobs into our key markets of operations will drive increased demand for our food and beverage and hospitality amenities and offerings. We believe the locations of our business clubs, which also serve as anchors to commercial towers and business centers, position us to capture increased spend from the growing work force that is recovering from the recession. Additionally, as business activity increases for working professionals, we believe private corporate sponsored events are likely to become more sought after.

Competition

While our principal direct competitors are other golf, country or business clubs with similar facilities, we also compete for discretionary leisure spending with other types of recreational facilities and forms of entertainment including restaurants, sports attractions, hotels and vacation travel.

We are the largest owner-operator of private golf and country clubs in the United States, with more than twice as many private golf and country clubs as the closest competitor, according to NGF. Overall, the golf industry is a highly fragmented competitive landscape with approximately 3,800 private golf clubs in the United States, of which approximately 16% were under corporate management according to NGF’s 2015 year-end data. The data further concludes that the top 10 golf management companies, including ClubCorp, owned or managed over 300 golf clubs, or about 9% of the total private golf club market at the end of calendar year 2015. In fact, according to NGF, at the end of 2015 only three other companies owned or operated 25 or more private golf clubs in the United States with Troon Golf LLC, Century Golf Partners and U.S. Air Force Services Agency reporting a total of 62, 26, and 25, respectively.

We believe most of our competition is regionally or locally based and the level of competition for any one of our clubs depends on its location and proximity to other golf facilities relative to the location of our members. In several of our strategically concentrated markets, such as those in Texas, Georgia and California, our ownership of multiple facilities allows us to offer access to multiple clubs both locally and beyond. While others have attempted to create their own access and benefit programs, we believe our product offerings would be difficult to replicate on a similar scale, given the size of our portfolio of clubs, geographic diversity of our clubs and our numerous alliances with other clubs, resorts and facilities.

Competition for our business, sports and alumni clubs is dependent on the individual market, and the needs of the individual member. For members looking for a private dining experience, nearby restaurants are our primary competition. For members looking for places to conduct business, our competition includes other facilities that provide meeting space such as hotels and convention centers as well as places such as fast casual restaurants and coffee bars, where people can conveniently meet and conduct informal meetings and access the internet. For people looking for a place to hold a private party such as a wedding, our competition includes other catering facilities such as hotels and resort facilities.

18

Seasonality

We consider the year-round recurring dues revenue stream to be one of the primary advantages of private club ownership. Golf and country club operations are seasonal in nature, with peak season beginning in mid-May and running through mid-September in most regions. Usage at our golf and country clubs declines significantly during the first and fourth fiscal quarters, when colder temperatures and shorter days reduce the demand for outdoor activities. However, the seasonality of revenues for many of our golf and country clubs is partially mitigated by our strategic concentration in regions with traditionally warmer climates such as Texas, Georgia and California. While nearly all of our golf and country clubs experience at least some seasonality, due to the recurring nature of our year-round membership dues income, seasonality has a muted impact on our overall performance as compared to daily fee public golf facilities. Many of our golf and country clubs also offer other amenities such as dining, indoor tennis and fitness facilities, which provide revenue streams that are typically less affected by seasonality than our golf operations revenues. Our business clubs are less seasonal in nature, but typically generate a greater share of their annual revenues in the fourth quarter due to the holiday and year-end party season. In addition, the first, second and third fiscal quarters each consist of twelve weeks, whereas the fourth fiscal quarter consists of sixteen or seventeen weeks of operations. As a result of these factors, we usually generate a disproportionate share of our revenues and cash flows in the second, third and fourth fiscal quarters of each year and have lower revenues and profits in the first fiscal quarter.

Sales and Marketing

We promote our clubs through extensive marketing and sales programs that are designed to appeal to our existing members, prospective members or underrepresented demographic groups. For example, we responded to the younger age of prospective members in the industry with targeted membership programs for young executives. We have also designed programming and events geared toward women and invested in family amenities that broaden the appeal of our clubs. Additionally, we advertise through social media and print advertisements in a variety of national, regional and local magazines and newspapers. We also showcase our facilities, products and services through our award-winning quarterly lifestyle magazine, Private Clubs. Private Clubs has won or been recognized as a finalist for the MAGGIE Award for Best Magazine in the Associations/Trade & Consumer Division each year since 2009. We distribute our magazine to our member households, clubs and strategic alliance partners who subscribe, in order to showcase our facilities, products and services and other content relevant to our current and prospective members. Recent technology advancements include the mobile edition of our Private Clubs magazine, mobile tee times and electronic billing.

In 2015, our clubs served as the site of several national and regional golf events and received national awards and recognition. Three clubs received national television coverage while serving as the site of high-profile golf events, including: Firestone Country Club, site of the World Golf Championships - Bridgestone Invitational; Mission Hills Country Club, site of the LPGA ANA Inspiration (one of the four major tournaments on the LPGA Tour); and Las Colinas Country Club, site of the LPGA Volunteers of America North Texas Shootout. Other significant golf events held at our clubs included the Web.com Midwest Classic at Nicklaus Golf Club at Lionsgate and the Insperity Invitational (Champions Tour) at The Woodlands Country Club Tournament Course.

Regulation

Environmental, Health and Safety. Our facilities and operations are subject to a number of environmental laws. As a result, we may be required to incur costs to comply with the requirements of these laws, such as those relating to water resources, discharges to air, water and land, the handling and disposal of solid and hazardous waste, and the cleanup of properties affected by regulated materials. Under these and other environmental requirements, we may be required to investigate and clean up hazardous or toxic substances or chemical releases from current or formerly owned or operated facilities. Environmental laws typically impose cleanup responsibility and liability without regard to whether the relevant entity knew of or caused the presence of the contaminants. We use certain substances and generate certain wastes that may be deemed hazardous or toxic under such laws, and from time to time have incurred, and in the future may incur, costs related to cleaning up contamination resulting from historical uses of certain of our current or former properties or our treatment, storage or disposal of wastes at facilities owned by others. Our facilities are also subject to risks associated with mold, asbestos and other indoor building contaminants. The costs of investigation, remediation or removal of regulated materials may be substantial, and the presence of those substances, or the failure to remediate a property properly, may impair our ability to use, transfer or obtain financing for our property. We may be required to incur costs to remediate potential environmental hazards, mitigate environmental risks in the future, or comply with other environmental requirements.

In addition, in order to improve, upgrade or expand some of our golf and country clubs, we may be subject to environmental review under the National Environmental Policy Act and, for projects in California, the California Environmental Quality Act. Both acts require that a specified government agency study any proposal for potential

19

environmental impacts and include in its analysis various alternatives. Our improvement proposals may not be approved or may be approved with modifications that substantially increase the cost or decrease the desirability of implementing the project.

We are also subject to regulation by the United States Occupational Safety and Health Administration and similar health and safety laws in other jurisdictions. These regulations impact a number of aspects of operations, including golf course maintenance and food handling and preparation.

Zoning and Land Use. The ownership and operation of our facilities, as well as our re-development and expansion of clubs, subjects us to federal, state and local laws regulating zoning, land development, land use, building design and construction, and other real estate-related laws and regulations.

Access. Our facilities and operations are subject to the Americans with Disabilities Act of 1990, as amended by the ADA Amendments Act of 2008 (the “ADA”). The rules implementing the ADA include additional compliance requirements for golf facilities and recreational areas. The ADA generally requires that we remove architectural barriers when readily achievable so that our facilities are made accessible to people with disabilities. Noncompliance could result in imposition of fines or an award of damages to private litigants. Federal legislation or regulations may further amend the ADA to impose more stringent requirements with which we would have to comply.

Other. We are also subject to various local, state and federal laws, regulations and administrative practices affecting our business. We must comply with provisions regulating health and safety standards, equal employment, minimum wages, and licensing requirements and regulations for the sale of food and alcoholic beverages.

Employees

As of February 19, 2016, we had approximately 17,800 employees, of which 14,350 are located at our golf and country clubs, 3,000 are located at our business, sports and alumni clubs and 450 are part of our corporate and regional staff. Other than golf course maintenance staff at two of our clubs, all of our employees are non-union. We believe we have a good working relationship with our employees and have yet to experience an interruption of business as a result of labor disputes.

Insurance

We believe that our properties are covered by adequate property, casualty and commercial liability insurance with what we believe are commercially reasonable deductibles and limits for our industry. We also carry other insurance, including directors and officers liability insurance, fiduciary coverage and workers’ compensation. Changes in the insurance market over the past few years have increased the risk that affordable insurance may not be available to us in the future. While we believe that our insurance coverage is adequate, if we were held liable for amounts and claims exceeding the limits of our insurance coverage or outside the scope of our insurance coverage, our business, results of operations and financial condition could be materially and adversely affected.

Intellectual Property

We have registered or claim ownership of a variety of trade names, service marks, copyrights and trademarks for use in our business, including, but not limited to: Associate Club; Associate Clubs; Building Relationships and Enriching Lives; Canongate Golf Clubs; ClubCater; ClubCorp; ClubCorp Charity Classic; ClubCorp Resorts; Club Corporation of America; ClubLine; Club Resorts; Club Without Walls; Fastee Course; Membercard; My Club. My Community. My World.; Private Clubs; The Best Serving The Best; The Society; The World Leader in Private Clubs; and Warm Welcomes, Magic Moments and Fond Farewells. While there can be no assurance that we can maintain registration or ownership for the marks, we are not currently aware of any facts that would negatively impact our continuing use of any of the above trade names, service marks or trademarks. We consider our intellectual property rights to be important to our business and actively defend and enforce them.

Geographic Information

Financial information about geographic area is set forth in Note 14 of the Notes to Consolidated Financial Statements under Part II, Item 8: “Financial Statements” of this annual report on Form 10-K.

20

Available Information

We file with or furnish to the Securities and Exchange Commission (“SEC”) reports, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”). These reports are available free of charge on our corporate website (www.clubcorp.com) as soon as reasonably practicable after such materials are electronically filed with or furnished to the SEC. From time to time, we use our corporate website as a channel of distribution for material information about the Company. Investors and other interested persons should routinely check our website for such information. Information provided on our website is not part of this Form 10-K or our other filings. Copies of any materials we file with the SEC can be obtained at www.sec.gov or at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the public reference room is available by calling the SEC at 1-800-SEC-0330.

ITEM 1A. RISK FACTORS

Risks Relating to Our Business

We may not be able to attract and retain club members, which could harm our business, financial condition and results of operations.

Our success depends on our ability to attract and retain members at our clubs and maintain or increase usage of our facilities. Changes in consumer tastes and preferences, particularly those affecting the popularity of golf and private dining, and other social and demographic trends could adversely affect our business. Historically, we have experienced varying levels of membership enrollment and attrition rates and, in certain areas, decreased levels of usage of our facilities. Significant periods where attrition rates exceed enrollment rates or where facilities usage is below historical levels would have a material adverse effect on our business, results of operations and financial condition. For fiscal year 2015, 47.0% of our total revenues came from recurring membership dues. For the same period, 23.1% of our business, sports and alumni club memberships (approximately 14,300 memberships) and 17.0% of our golf and country club memberships (approximately 19,600 memberships) were resigned. After the addition of new memberships, on a same store basis, our business, sports and alumni clubs experienced a (1.2)% net loss in memberships, excluding managed clubs and a (1.2)% net loss in memberships for managed clubs. Our golf and country clubs, also on a same store basis, experienced a 0.4% net gain in memberships, excluding managed clubs and a 3.3% net gain in memberships for managed clubs. If we cannot attract new members or retain our existing members, our business, financial condition and results of operations could be harmed.

Changes in consumer spending patterns, particularly discretionary expenditures for leisure, recreation and travel, are susceptible to factors beyond our control that may reduce demand for our products and services.

Consumer spending patterns, particularly discretionary expenditures for leisure, recreation and travel, are particularly susceptible to factors beyond our control that may reduce demand for our products and services, including demand for memberships, golf, vacation and business travel and food and beverage sales. These factors include:

• | low consumer confidence; |

• | depressed housing prices; |

• | changes in the desirability of particular locations, residential neighborhoods, office space or travel patterns of members; |

• | decreased corporate budgets and spending and cancellations, deferrals or renegotiations of group business (e.g., industry conventions); |

• | natural disasters, such as earthquakes, tornadoes, hurricanes, wildfires and floods; |

• | outbreaks of pandemic or contagious diseases; |

• | war, terrorist activities or threats and heightened travel security measures instituted in response to these events; |

• | the financial condition of the airline, automotive and other transportation-related industries and its impact on travel; and |

21

• | volatility in energy prices and the impact on consumers employed within energy-related industries. |

These factors and other global, national and regional conditions can adversely affect, and from time to time have adversely affected, individual properties, particular regions or our business as a whole. For example, during the recession, many businesses dramatically decreased the number of corporate events and meetings hosted at facilities such as convention centers, hotels, business clubs, golf clubs, resorts and retreats in an effort to cut costs and in response to public opinion relating to excess corporate spending, which negatively impacted the amount of business for such facilities, including certain of our facilities. Any one or more of these factors could limit or reduce demand or the rates our clubs are able to charge for memberships or services, which could harm our business and results of operations.

Economic recessions or downturns could negatively affect our business, financial condition and results of operations.

A substantial portion of our revenue is derived from discretionary or leisure spending by our members and guests and such spending can be particularly sensitive to changes in general economic conditions. The recession led to slower economic activity, increased unemployment, concerns about inflation and energy costs, decreased business and consumer confidence, reduced corporate profits and capital spending, adverse business conditions and lower levels of liquidity in many financial markets, which negatively affected our business, financial condition and results of operations. For example, for fiscal years 2015, 2014, 2013, 2012 and 2011, we experienced annualized attrition (i.e., members who resign) in membership count of 17.0%, 16.3%, 16.3%, 16.4% and 15.9%, respectively, in our golf and country clubs (excluding the impact of Sequoia Golf memberships in fiscal year 2014) and 23.1%, 22.7%, 22.8%, 22.9% and 23.5%, respectively, in our business, sports and alumni clubs. A renewed economic downturn in the United States, or in geographic areas in which we have strategic concentrations of clubs, may lead to increases in unemployment and loss of consumer confidence which may translate into resignations of existing members, a decrease in the rate of new memberships and reduced spending by our members. As a result, our business, financial condition and results of operations may be materially adversely affected by a renewed economic downturn.