Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bison Merger Sub I, LLC | d364496d8k.htm |

Investor Presentation MARCH 2017 Exhibit 99.1 |

1 Forward-Looking Statements This presentation contains forward-looking statements. These statements can be identified by the use of forward-looking

terminology including “will,” “may,”

“believe,” “expect,” “anticipate,” “estimate,” “continue,” or other similar words. These statements discuss future expectations including company growth expectations, demand for our products, expectations regarding future prices, capacity

expansion plans, market trends, liquidity, transportation

services, commercial product launches and research and development plans and may contain projections of financial condition or of results of operations, or state other “forward-looking” information. These

forward-looking statements involve risks and

uncertainties. Many of these risks are beyond management’s control. When considering these forward-looking statements, you should keep in mind the risk factors, Management’s Discussion and Analysis of Financial Condition and Results of

Operations, and other

cautionary statements in the company’s SEC filings.

Forward-looking statements are not guarantees of future performance or an assurance that our current assumptions or projections are valid. Our actual results and plans could differ materially from those

expressed in any forward-

looking statements. We undertake no obligation to publicly update any

forward-looking statements, whether as a result of new information or future events, except as required by law. This presentation includes certain non-GAAP financial measures, including EBITDA and Adjusted EBITDA. These non-GAAP

financial measures are used as supplemental financial

measures by our management to evaluate our operating performance and compare the results of our operations from period to period without regard to the impact of our financing methods, capital structure or

non-operating income and expenses. Adjusted EBITDA is

also used by our lenders to evaluate our compliance with covenants. We believe that these measures are meaningful to our investors to enhance their understanding of our financial performance. These measures should be considered

supplemental to and not a substitute for financial

information prepared in accordance with GAAP and may differ from similarly titled measures used by other companies. For a reconciliation of such measures to the most directly comparable GAAP term, please see the appendix

of this presentation.

FORWARD LOOKING INFORMATION

NON-GAAP

FINANCIAL MEASURES |

2 Two Complementary Business Segments FAIRMOUNT SANTROL 2.5 28% 6.4 72% 2016 VOLUMES (million tons) Proppant Solutions Oil & Gas Markets Resin-Coated Proppants Propel SSP ® Tier 1 Northern White Sand Tier 2 Texas Gold Sand Industrial & Recreational (I&R) Foundry, Glass, Sports & Recreation, Building and Filtration Markets Resin-Coated Sand Custom Blending High-Purity Sand Enhanced Resin Complementary markets throughout business cycles Complementary products to leverage asset base |

Core Differentiators for Long-Term Value Creation |

4 Commitment to People, Planet & Prosperity Technology & Innovation Broad Product Portfolio Operational Scale & Efficiencies Extensive Distribution and Unit Train Capabilities Core Differentiators for Long-Term Value Creation FAIRMOUNT SANTROL |

“Staying True” to All 3 Pillars of Sustainable Development

_____________________

Source: Company website and corporate filings

Safety rates above industry

averages since 2007

> 3,700 participants in

learning opportunity

courses

> 76,000 paid volunteer

hours since 2011; >75%

participation in 2016

27 zero waste to landfill

facilities

Reduced 90% of waste

sent to landfills since

2009 Planted nearly 500,000 trees to offset greenhouse gases to neutral since 2011 Material annual net benefits from SD projects since 2012 80% of Family Members participated in Financial Wellness Course in 2015 Since 2014, our safety record has resulted in an Experience Modification Rate (EMR) 40% below industry average, further reducing overall costs 5 FAIRMOUNT SANTROL |

PRODUCT PORTFOLIO Deliver value to most technically demanding customers 6 Innovation Throughout Our Organization TECHNOLOGY & INNOVATION OPERATIONS Leveraging proprietary manufacturing processes ADMINISTRATION & TECHNICAL SERVICES Using innovation across both Proppant Solutions and I&R Continual innovation in all aspects of organization is core to Fairmount Santrol

Patented & proprietary resins

Innovative and cost-effective coated

products for all well temperature and

closure conditions as well as for Foundry

Castings

Proprietary coating processes for Resin-

Coated Sands and SSP

Proprietary mining & sand processing

Vertical integration enabling manufacturing

of proprietary resins

Continuous improvement and tech support

of existing products

Origin-destination pairing optimization to

reduce logistics costs, including the

utilization of unit trains |

Propel SSP ® – Enhanced Productivity Driven by Design Optimization 7 Field Trial Stats 100+ wells 20+ E&Ps Bakken/ Three Forks Canadian Bakken Codell/ Niobrara Mississippian Lime Utica Marcellus Eagle Ford Escondido Uinta Permian Pinedale Future Growth via Propel SSP 350 ® (brackish & produced water markets) +21% Months Months Field Trial Areas Case Study Eagle Ford +45% TECHNOLOGY & INNOVATION |

8 Propel SSP ® – Operational Efficiency and Flexibility TECHNOLOGY & INNOVATION Significant operational efficiency and flexibility compared to traditional well designs:

Allows service companies to increase utilization of their own

resources; important as completion resources

tighten Propel SSP 350

®

product line extension allows for flexibility in water usage, including

brackish and produced water

-50%

-50%

-20%

0% -100% -20% -20% -80% -100% -100% -100% -90% -80% -70% -60% -50% -40% -30% -20% -10% 0% Water Usage Pumping Time Additive Usage Water Heating Screenouts Slickwater Crosslinked Gel |

99.9% pure silica 9 Only Integrated I&R Sand and Resin Solutions Provider BROAD PRODUCT PORTFOLIO – INDUSTRIAL & RECREATIONAL PRODUCTS/ CHARACTERISTICS TARGET MARKETS Construction Foundries Glass manufacturing Golf courses Colored play sand Sports turf Water filtration +200 engineered sand- based resin products Construction Foundries Expert custom blends of minerals, aggregates, colorants, epoxies and polymers Construction Specialty products Sports & recreation HIGHER VALUE-ADD HIGH-PURITY SANDS ENGINEERED RESIN-COATED SANDS CUSTOM BLENDING HIGH-PERFORMANCE RESIN SYSTEMS High-quality traditional foundry resin systems and proprietary resin development for advanced resin-coated proppants Foundries |

High-Purity Northern White Silica Sands Tier 2 regional sand Precured Resin-Coated Sand Highest strength Increased flowback protection Curable Resin- Coated Sand Highest flowback protection Increased strength Texas Gold® Frac Sand Tier 1 99.8% pure silica 10 Products to Address All Well Environments Proppant coating that enhances well productivity and operational efficiency through improved proppant transport and frac geometry optimization PRODUCTS/ APPLICATIONS Lower-cost, API-certified sand applications High-temperature / high-pressure wells where the proppant needs extra strength & fines encapsulation Wells where flowback is a challenge Medium cost, delivers higher productivity versus regional sands In any well to optimize water, chemical and horsepower required to place the targeted proppant volume and mesh size RAW SAND Propel SSP ® HIGHER PRODUCTIVITY RESIN-COATED SAND TRANSPORT TECHNOLOGY HIGHER CRUSH STRENGTH BROAD PRODUCT PORTFOLIO – PROPPANT SOLUTIONS CHARACTERISTICS |

11 Broad Asset Base Provides Flexibility and Efficiency OPERATIONAL SCALE & EFFICIENCIES Nearly 750 million tons of proven reserves, allowing for long-term organic growth Locations, grade mixes and logistic capabilities provide flexibility Low-cost Wedron facility represents over 60% of active frac sand capacity Ability to reopen idled facilities quickly and with minimal investment to add roughly 2 million tons of annual frac sand capacity Greenfield site in Katemcy, TX or expansion of current facilities available to increase capacity 1.6 million tons of active annual coating capacity FAIRMOUNT SANTROL ACTIVE ANNUAL CAPACITY (in millions of tons) Wedron Voca Menomonie Maiden Rock Brewer - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 Active Q1 2017 15.4 I&R (3 plants) |

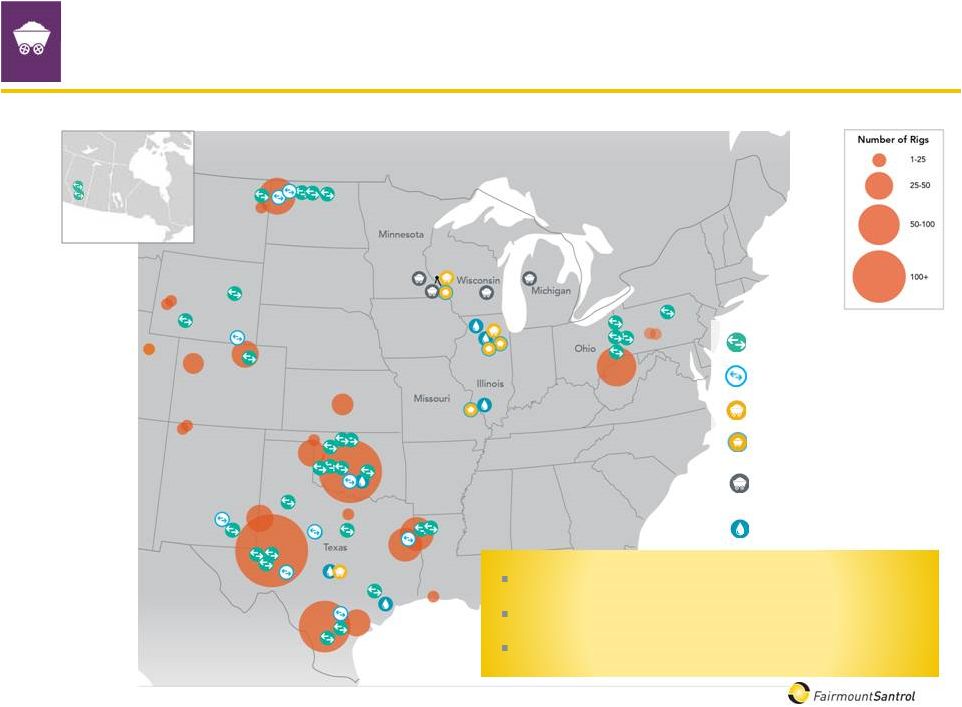

12 Logistics Footprint in All Key Basins OPERATIONAL SCALE & EXTENSIVE DISTRIBUTION Canada FMSA Terminal FMSA Mining & Processing Unit Train Destination Unit Train Origin (Mining & Processing) Idled and Closed Mining & Processing 42 destinations in heart of basins Significant barriers to re-create network Terminals closer to wells reduces last-mile costs Coating Operation |

13 Leveraging Our Unit Train Capabilities 9 unit-train capable terminals 2 additional unit train terminals in process Unit trains can lower delivered cost by $6-$10/ton and increase delivery speed

Unit trains increase rail car turns and overall efficiency of rail car

fleet 0%

20% 40% 60% 80% 2014 2015 2016 PERCENTAGE OF NORTHERN WHITE SAND SHIPPED VIA UNIT TRAIN EXTENSIVE DISTRIBUTION AND UNIT TRAIN CAPABILITIES |

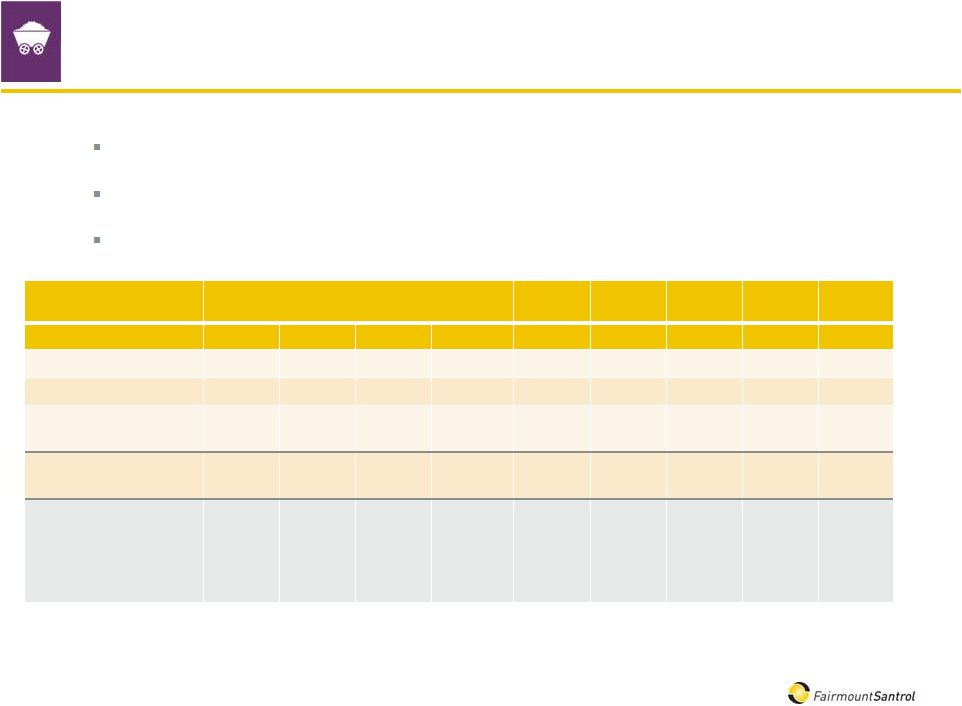

14 Rail Car Update Currently 2,100 cars in storage Expect all cars to be out of storage by end of 2017 Deliveries deferred until 2020 and 2021 can be pulled forward if necessary at lower rates

2016 2017 2018 2019 2020 2021 Q1 Q2 Q3 Q4 Entering Fleet 0 50 100 0 200 0 0 1,050 650 Expiring Leases¹ -190 -130 -120 -70 -780 -1,050 -1,350 0 0 Expected Change in Rail Cars -190 -80 -20 -70 -580 -1,050 -1,350 1,050 650 Ending Cars in Fleet (include cust cars) 10,300 10,220 10,200 10,130 9,550 8,500 7,150 8,200 8,850 Avg. Cars in Storage 3,800 3,750 3,050 2,950 Cost Associated with Excess Rail Cars ~$8M ~$8M ~$6.5M ~$5.2M Excess cost / ton ~$5.00 ~$6.25 ~$3.75 ~$2.85 1 – Between 2017 & 2019, FMSA controls 76% (2,200 / 2,900) of railcar lease expirations

EXTENSIVE DISTRIBUTION AND UNIT TRAIN CAPABILITIES

|

Performance Update |

2.6 2.6 3.4 1.8 2.2 2.6 3 3.4 3.8 773 455 509 200 400 600 800 16 Solid Performance Under Challenging Market Conditions PERFORMANCE UPDATE Sources: (1) Baker Hughes (2) FMSA Demand Estimates FMSA FRAC SAND VOLUMES (in millions of tons) AVERAGE U.S. LAND RIG COUNT FRAC SAND MARKET VOLUMES (2) (in millions of tons) 1H16 2H16 +12% 8.2 8.8 5 6 7 8 9 10 +26% +29% -41% -15% +3% 2H15 1H16 2H16 2H15 1H16 2H16 2H15 Key differentiators contributed to outperformance in 2016 (1) 7.0 |

17 Solid Results in I&R Markets I&R expected to show continued solid demand led by Glass, Building Products and

Sports & Recreation

PERFORMANCE UPDATE

VOLUME (in millions of tons) 2015 2016 GROSS PROFIT ($ in millions) 2015 2016 7.5 8 8.5 9 $35 $40 $45 $50 |

18 Financial Update Fourth-quarter 2016 results Proppant Solutions volumes of 1.8 million tons, up 5% sequentially Fine grades continued to bump up against capacity Revenues of $140.5 million, up 10% sequentially, aided by 5% pricing increase in Proppant Solutions

Proppant

Solutions gross margin per ton increased to $9.26 from $3.62 in the

prior quarter, helped by increased volumes and price

improvement along with the implementation of previously announced operational cost efficiencies and lower rail car costs Adjusted EBITDA of $11.7 million PERFORMANCE UPDATE |

Looking Ahead |

Improving proppant market with continued positive tailwinds Current rig count significantly above 2016 average Increasing proppant intensity per well, driven by longer laterals and more proppant per stage

In addition to industry tailwinds, FMSA also experiencing:

Renewed

focus

on productivity and flowback protection driving volume growth for value added proppants, as well as a renewal of tempered product sales in gas plays Increasing interest in coarser grade sands AVERAGE PROPPANT TONS PER U.S. HORIZONTAL WELL LOOKING AHEAD Positive Tailwinds for the Proppant Market 20 Sources: (1) Baker Hughes (2) FMSA estimates based on public E&P presentations and internal estimates + PacWest Consulting Partners

U.S. HORIZONTAL LAND RIG COUNT

~ +75% -

+80% 4,400 - 4,800 5,100 - 5,500 ~ +15% - +20% 2,500 - 2,700 2014 2016 2017 Est. 300 350 400 450 500 550 600 650 700 (1) (2) |

21 Financial Outlook First-quarter 2017 outlook Total expected volumes of 2.6 - 2.7 million tons, Proppant Solutions up low double digits Continued capacity constraints on fine grades; restart of Brewer, MO and Maiden Rock, WI will add

modest capacity toward end of Q1

Total sales expected to be in a range of $165 -

$175 million

Q1 pricing increase on raw frac

sand expected to be 10% excluding changes in mix from Q4

Total Q1 mix will have higher percentage of FOB Mine and coarser

grades, which are expected to increase volumes and

somewhat offset average price per ton growth Adjusted

EBITDA expected to be in a range of $17 - $20

million Second-quarter 2017 outlook

Restart of Brewer and Maiden Rock will add 2.3 million tons of annual

capacity by middle of Q2 Q2 raw sand pricing increases

expected to surpass Q1 price increases assuming consistent mix

PERFORMANCE UPDATE |

22 Industry Leader Well-Positioned for Growth WHY INVEST IN FMSA? Technology & innovation Broad product portfolio Operational scale & efficiencies Distribution & unit train capabilities Higher rig counts Increased proppant intensity per well More focus on well productivity and flowback protection Continued solid demand in I&R STRONG MARKET DRIVERS KEY LONG-TERM DIFFERENTIATORS AND VALUE CREATORS Commitment to People, Planet & Prosperity |

Appendix |

24 Appendix: Reconciliation of Non-GAAP Financial Measures Adjusted EBITDA (in thousands) 2016 2015 Net loss $(19,905) $(90,831) Interest expense, net 15,324 16,077 Provision (benefit) for income taxes (655) (13,996) Depreciation, depletion, and amortization expense 17,875 18,995 EBITDA $12,639 $(69,755) Non-cash stock compensation expense 1,504 (2,655) Impairment charges 2,494 69,545 Restructuring charges 263 Loss on disposal of fixed assets 7,288 Deferred financing cost write-off 2,618 Gain on debt repurchase (8,178) Transaction expenses & other charges 630 Adjusted EBITDA $11,707 $4,686 Three Months Ended Dec 31, |

25 Appendix: Total Facility Map Coating Operations Mining & Processing Oil & Gas Terminals Unit Train Destination U.S. OPERATIONS LOGISTICS NETWORK Industrial & Recreational Terminals Unit Train Origin Headquarters Research & Development Specialty Products Resin Manufacturing Administrative/Sales Offices |