Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Bison Merger Sub I, LLC | d121619dex991.htm |

| EX-23.1 - EX-23.1 - Bison Merger Sub I, LLC | d121619dex231.htm |

| EX-21.1 - EX-21.1 - Bison Merger Sub I, LLC | d121619dex211.htm |

| EX-95.1 - EX-95.1 - Bison Merger Sub I, LLC | d121619dex951.htm |

| EX-31.1 - EX-31.1 - Bison Merger Sub I, LLC | d121619dex311.htm |

| EX-32.2 - EX-32.2 - Bison Merger Sub I, LLC | d121619dex322.htm |

| EX-31.2 - EX-31.2 - Bison Merger Sub I, LLC | d121619dex312.htm |

| EX-10.30 - EX-10.30 - Bison Merger Sub I, LLC | d121619dex1030.htm |

| EX-32.1 - EX-32.1 - Bison Merger Sub I, LLC | d121619dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-36670

FAIRMOUNT SANTROL HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 34-1831554 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

8834 Mayfield Road

Chesterland, Ohio 44026

(Address of Principal Executive Offices) (Zip Code)

(800) 255-7263

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(g) of the Securities Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Securities Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file report pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of common stock held by non-affiliates of the registrant computed by reference to the last sales price, $8.19 as reported on the New York Stock Exchange, of such common stock as of the closing of trading on June 30, 2015: $1,322,138,301

Number of shares of Common Stock outstanding, par value $0.01 per share, as of March 6, 2016: 161,433,248

DOCUMENTS INCORPORATED BY REFERENCE

| Part III of Form 10-K |

Certain sections of the Proxy Statement for the 2016 Annual Meeting of Stockholders of Fairmount Santrol Holdings Inc. |

Table of Contents

Fairmount Santrol Holdings Inc. and Subsidiaries

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2015

Table of Contents

Introduction to Part I, Item 1A and Item 3, and Part II, Item 7

We define various terms to simplify the presentation of information in this Annual Report on Form 10-K (this “Report”). Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “Fairmount Santrol,” “our business” and “our company” refer to Fairmount Santrol Holdings Inc. and its consolidated subsidiaries and predecessor companies. We use Adjusted EBITDA herein as a non-GAAP measure of our financial performance. See further discussion of Adjusted EBITDA at Item 7 – Management’s Discussion and Analysis.

FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Report are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

| • | the level of activity in the oil and gas industries; |

| • | the level of cash flows generated to provide adequate liquidity to meet our debt obligations; |

| • | increasing costs or a lack of dependability or availability of transportation services or infrastructure and geographic shifts in demand; |

| • | our rights and ability to mine our properties and our renewal or receipt of the required permits and approvals from governmental authorities and other third parties; |

| • | decreased demand for sand-based proppants or the development of either effective alternative proppants or new processes to replace hydraulic fracturing; |

| • | fluctuations in and continuing pressure on market-based pricing; |

| • | our ability to complete greenfield development or expansion projects, or our ability to realize the benefits if we do complete them; |

| • | our ability to protect our intellectual property rights; |

| • | our ability to successfully develop and market Propel SSP; |

| • | our ability to succeed in competitive markets; |

| • | loss of, or reduction in, business from our largest customers; |

| • | our exposure to the credit risk of our customers and any potential material nonpayment or nonperformance by our customers; |

| • | fluctuations in demand for industrial and recreational sand; |

| • | operating risks that are beyond our control, such as changes in the price and availability of transportation, natural gas or electricity; unusual or unexpected geological formations or pressures; cave-ins, pit wall failures or rock falls; or unanticipated ground, grade or water conditions; |

| • | our dependence on our Wedron Silica sand-mining facility for a significant portion of our sales; |

1

Table of Contents

| • | the availability of raw materials to support our manufacturing of resin-coated proppants; |

| • | diminished access to water; |

| • | challenges to our title to our mineral properties and water rights; |

| • | our ability to successfully complete acquisitions or integrate acquired businesses; |

| • | our ability to make capital expenditures to maintain, develop and increase our asset base and our ability to obtain needed capital or financing on satisfactory terms, including financing for existing commitments such as future railcar deliveries; |

| • | substantial indebtedness and pension obligations; |

| • | restrictions imposed by our indebtedness on our current and future operations; |

| • | the accuracy of our estimates of our mineral reserves; |

| • | substantial costs of mine closures; |

| • | a shortage of skilled labor and rising labor costs in the mining industry; |

| • | increases in the prices of, or interruptions in the supply of, natural gas and electricity, or any other energy sources; |

| • | our ability to attract and retain key personnel; |

| • | our ability to maintain satisfactory labor relations; |

| • | silica-related health issues and corresponding litigation; |

| • | our ability to maintain effective quality control systems at our mining, processing and production facilities; |

| • | fluctuations in our sales and results of operations due to seasonality and other factors; |

| • | interruptions or failures in our information technology systems; |

| • | failure to comply with the provisions of the Foreign Corrupt Practices Act (FCPA); |

| • | significant impairment losses related to goodwill in relation to our acquisition of assets from FTS International Services, LLC (FTSI); |

| • | the impact of a terrorist attack or armed conflict; |

| • | cybersecurity breaches; |

| • | our failure to maintain adequate internal controls; |

| • | extensive and evolving environmental, mining, health and safety, licensing, reclamation and other regulation (and changes in their enforcement or interpretation); |

| • | our ability to acquire, maintain or renew financial assurances related to the reclamation and restoration of mining property; and |

| • | other factors disclosed in the section entitled “Risk Factors” and elsewhere in this Report. |

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Report. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly

2

Table of Contents

qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our other SEC filings and public communications. You should evaluate all forward-looking statements made in this Report in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Report are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Our Company

Business Overview

As of December 31, 2015, we are one of the world’s largest providers of sand-based proppant solutions and for nearly 40 years have been a pioneer in the development of high performance proppants used by Exploration & Production (“E&P”) companies to enhance the productivity of their oil and gas wells. We offer the broadest range of proppants available in the market today, including high quality sand and a variety of resin-coated products. All of our frac sand exceeds American Petroleum Institute (“API”) specifications. Additionally, for more than 120 years, we and our predecessor companies have provided high quality sand-based products, strong technical leadership and applications knowledge to end users in the Industrial & Recreational (“I&R”) markets.

As one of the industry leaders, our asset base includes 798 million tons of proven and probable mineral reserves, which we believe is one of the largest reserve bases in the industry. Due to the continuing challenging conditions in the oil and gas markets, we continue to adjust our operational footprint to minimize our costs and consolidate into the lowest-cost footprint possible. As of March 2016, we have 11 sand processing facilities (7 of which are active) with 14.8 million tons of annual sand processing capacity. In 2015, we closed our sand processing facility in Readfield, Wisconsin and Wexford, Michigan and idled our facilities in Brewer, Missouri, Shakopee, Minnesota, and Hager City, Wisconsin. We also have 10 coating facilities (6 of which are active) with 2.3 million tons of annual coating capacity. Our coating facilities include operations in Mexico, Denmark and China, through which we serve international oil and gas markets. In 2015, we closed our resin-coating facility in Bridgman, Michigan and idled resin-coating facilities in Voca, Texas and Cutler, Illinois and an SSP-coating facility in Fresno, Texas.

As one of the nation’s longest continuously operating mining organizations, we have developed a strong commitment to environmental stewardship and to the three pillars of Sustainable Development: People, Planet and Prosperity. Our strong commitment to safety is reflected in the health and safety of our employees and is illustrated by our achieving a consistently low recordable incident rate among our similarly sized industrial sand competitors as well as one of the lowest rates for all those reporting in the Industrial Mining Association of North America. Since 2011, our employees have demonstrated our commitment to our communities by donating nearly 67,000 hours of company-paid volunteer hours, as well as significant personal volunteer hours, into the communities in which we live and operate. We are focused on environmental stewardship, and 30 of our facilities now generate zero waste to landfills. Additionally, we executed upon annual initiatives to reduce our carbon emissions and have planted over 395,000 trees since 2011 in order to offset our remaining Tier I and Tier 2 emissions. We believe adhering to sustainable development principles is not only the right thing to do, but also results in a higher level of engagement and commitment from our employees, better relationships with our communities and, as a result, a stronger base from which to pursue profitable growth over the long-term. Abiding by these guiding principles, our corporate motto is “Do Good. Do Well.”

In the early 1980s, we pioneered investment in large scale proppant production capacity, leveraging our early industry relationships with Halliburton and a predecessor company to Baker Hughes. Since then, our business,

3

Table of Contents

and particularly our Proppant Solutions segment, has grown significantly. Over a period of nearly 40 years, Fairmount Santrol has built a vertically integrated operation that combines mining, sand processing, resin manufacturing and coating operations with a broad logistics network and state-of-the-art research and development capabilities. In the past few years, we also have invested nearly $500 million to acquire mineral reserves, raw and resin-coated sand processing capacity, additional distribution terminals, a long-term supply agreement, and a new coated proppant technology. Our ability to integrate and leverage our asset base to provide comprehensive proppant solutions has allowed us to become a long-term, trusted partner to our customers.

We are capable of Class I railroad deliveries to each of North America’s major oil and gas producing basins and also have the flexibility to ship our product via barge, marine terminals and trucks to reach our customers as needed. We operate an integrated logistics platform consisting of 43 proppant distribution terminals and a fleet of approximately 10,100 railcars (net of subleases). We have expanded our unit train capabilities to now include two production facilities and seven in-basin terminals, which reduce freight costs and improve cycle times for our railcar fleet. In order to better align our logistics network with customer demand and to reduce costs, we discontinued activity at ten transloading terminals and opened seven new terminals in 2015.

Our operations are organized into two segments based on the primary end markets we serve: (i) Proppant Solutions and (ii) Industrial & Recreational (I&R) Products. Our Proppant Solutions segment predominantly provides sand-based proppants for use in hydraulic fracturing operations throughout the U.S. and Canada, Argentina, Mexico, China, northern Europe and the United Arab Emirates. Our I&R segment provides raw, coated, and custom blended sands to the foundry, building products, glass, turf and landscape and filtration industries primarily in North America. We believe our two market segments are complementary. Our ability to sell to a wide range of customers across multiple end markets allows us to maximize the recovery of our reserve base within our mining operations and to reduce the cyclicality of our earnings.

In 2015, our Proppant Solutions segment sold 6.2 million tons of proppant with revenues of $710 million (86% of total company revenues) and contribution margin of $71 million, which represent decreases of 14%, 42%, and 84%, respectively, from 2014. Proppants represented approximately 91% and 87% of total company revenues for 2014 and 2013, respectively. For 2015, our I&R Products segment had sales volume of 2.3 million tons with revenues of $119 million and contribution margin of $25 million, which represent decreases of 5%, 5%, and 27%, respectively, from 2014.

Corporate History

We were incorporated as a Delaware corporation in 1986. Our predecessor companies began operations over 120 years ago. In August 2010, we partnered with American Securities LLC (“American Securities”) when affiliated funds managed by American Securities (collectively with American Securities, the “AS Group”) acquired indirect control over ASP FML Holdings, LLC (“ASP FML”), who acquired 51% of our stock (the “AS Group Acquisition”).

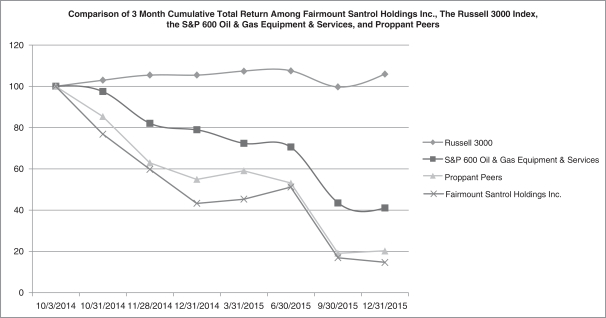

On October 3, 2014, we completed an Initial Public Offering of 25 million shares of our common stock at an offering price of $16.00 per share for aggregate proceeds of $400 million (the “IPO”). Our shareholders received net proceeds of approximately $379 million after deducting $21 million of underwriting discounts and commissions. We are listed under the ticker symbol “FMSA” on the New York Stock Exchange.

Our corporate headquarters is located at 8834 Mayfield Road, Chesterland, Ohio 44026. Our telephone number is (800) 255-7263. Our company website is www.fairmountsantrol.com. We make available free of charge our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we file or furnish such reports to the Securities and Exchange Commission (the “SEC”). The information on our website is not incorporated by reference in or considered to be a part of this Annual Report on Form 10-K.

4

Table of Contents

Our Competitive Strengths

We believe we distinguish ourselves from other proppant providers through the following capabilities:

Industry-Leading Asset Base. Our industry-leading asset base includes 798 million tons of proven mineral reserves, 11 sand processing facilities (7 of which are active) with 14.8 million tons of annual sand processing capacity, and 10 coating facilities (6 of which are active) with 2.3 million tons of annual coating capacity. We serve international markets through our coating facilities in Mexico, Denmark, and China.

Leading Proppant Producer; Broadest Product Suite. We have a broad suite of products that address a vast majority of the proppant market. We are one of the largest producers of API-spec raw frac sand and we believe we have among the largest production capacities of both raw frac sand and resin-coated sand. Our raw sand product suite includes all mesh sizes of high performing Northern White frac sand and our branded Texas Gold API-spec brown frac sand, which has a delivered cost advantage to certain basins, including the Eagle Ford, Permian Basin and East Texas. Our portfolio of resin-coated products provides a range of strength, flowback, and conductivity characteristics, the strongest of which offers characteristics similar to lightweight ceramic proppant. Our product breadth allows us to offer a comprehensive proppant solution across a broad range of well characteristics and our scale provides us with the flexibility to fill large individual orders, often on short notice. As proppant consumption per well has increased through 2015, we believe that our scale and product breadth allow us to be more flexible than our competitors and provides us with a competitive advantage.

Efficient Operations and Economies of Scale. Our vertically integrated operations, low production costs and low maintenance capital expenditures have enabled us to generate strong margins and cash flows over an extended period. We own a substantial majority of our reserves (royalties were less than 0.2% of sales in 2015), and our processing plants are located on or in close proximity to rail access, reducing the need for on-road transportation and minimizing product movement costs. Our integrated logistics management expertise and geographically-advantaged facility network enables us to reliably ship products by the most cost-effective method available.

One of the Industry’s Largest Captive Terminal Footprint and Broadest Logistics Capabilities. In recent years, oilfield service companies increasingly sought proppant suppliers with logistics capabilities to deliver product in-basin. We sell our proppants directly to customers in all of North America’s major oil and gas producing basins through our 43 active proppant distribution terminals, which collectively comprise one of the largest logistics networks in the sector. In 2015, approximately 75% of our North American proppant volume was sold at one of our distribution terminals. We ship our products via all of North America’s Class I railroads in our fleet of more than 10,100 railcars (net of subleases), which includes approximately 1,200 railcars made available to us from our customers. We have expanded our unit train capabilities to two of our processing facilities and seven of our in-basin terminals. We expect that these unit train capabilities will significantly reduce freight costs and improve cycle times for our railcar fleet. We also have the flexibility to ship our product via barge and trucks to multiple basins. Importantly, approximately 75% of our terminals are exclusive to us. In contrast to commingled terminals, which support proppant logistics for multiple vendors, our captive terminals enable us to better ensure timely delivery of proppants to our customers and position us to capture incremental spot demand at the terminal site. Taken together, we believe the significant scale our distribution network, its geographic scope, and our captive terminal strategy provide us with a competitive advantage.

Trusted Partner to our Customers. We are a trusted partner and have significant long-term relationships with each of the four largest oilfield service companies, as well as many small and mid-sized service companies. These customer relationships are driven by our ability to enhance our customers’ operations and profitability by delivering a full suite of high-quality proppant products, where, when and as-needed. These benefits also extend to the E&P companies serviced by our service company customers, who directly benefit from the enhanced well productivity that our products offer. We believe our customers value the ability of our substantial scale, product diversity and extensive logistics network to meet their evolving proppant needs.

5

Table of Contents

Focus on Innovation and New Product Development. We have a history of collaborating with our customers to develop innovative solutions to enhance the effectiveness of well completions, from conventional wells to the most complex, multi-stage, horizontal wells. Our vertically-integrated model allows us to participate in each phase of proppant development, manufacturing, and delivery and provides us with a unique perspective into the current and future needs of our customers. These developments include value-added products such as OptiProp, SLC, THS, PowerProp and CoolSet, each with uniquely tailored down-hole performance characteristics. After acquiring the technology that underlies Propel SSP in April 2013, our team has refined the technology and manufacturing techniques, and received patent protection for a portion of the technology in early 2016. We now are capable of producing Propel SSP in two manufacturing plants. Propel SSP is currently undergoing field trials with wells in seven domestic basins, as well as our first export transport outside North America. Using data supporting enhanced hydrocarbon recoveries, our technical sales team works closely with market participants to demonstrate the value proposition of our performance proppants in order to stimulate market demand.

Experienced Management Team Aligned with Shareholders. We have an experienced leadership team with extensive industry knowledge and a proven track record of profitable growth. Many members of our executive management team have been at Fairmount Santrol for 20 years or more. Our founders remain active advisors to our management and are members of our Board of Directors. Our management, employees, founders, and Board of Directors currently own nearly 60% our outstanding common stock. Accordingly, our executive management team and our employees are aligned with our investors and highly incentivized to pursue long-term, profitable growth and a high return on capital deployed.

Our Strategy

Our objective is to create long-term and sustainable value for our stakeholders. We intend to pursue this objective through the execution of the following strategies:

| • | Proactively maintain low cost operations. We have significant experience in operating sand mines and processing and coating plants and believe that our costs of production compare very favorably to our competition. In recent years, we have made investments in unit train-capable destinations at two production facilities and seven in-basin terminals in order to reduce delivery costs and improve the efficiency of our railcar fleet. We have invested in operating and logistics technology and processes to enable us to reduce costs and optimize the sourcing from our various plants to our network of terminals in order to maximize profitability and better serve our customers. Further, as demand for proppants declined in 2015, we proactively closed or idled higher-cost, excess capacity in order to consolidate our operations into a more cost-effective footprint. In addition, we have taken actions to reduce selling, general and administrative costs, balancing cost reductions with maintaining capabilities to capture growth when demand for proppant recovers. We will continue to take actions as market conditions warrant to improve our low cost operating position. |

| • | Prudently Increase Reserves and Processing Capacity. We have historically grown our reserves and mining and processing capacities by developing greenfield sites, expanding existing facilities and acquiring operating assets and reserves. In 2014, we undertook a project of ensuring that adequate productive capacity would be available to meet the then-projected customer demand and expanded the annual production capacity at our Wedron, Illinois facility by 0.5 million tons and the effective capacity of our Voca, Texas (which produces our Texas Gold frac sand) by 0.5 million tons. In order to leverage our low cost capacity and to secure unit train capability, we substantially completed expansion of our Wedron, Illinois facility by 3 million tons in 2015 and we expect it to become fully operational in the second quarter of 2016. In addition to these expansions, we control, or have an option to control, additional reserves on several properties that produce both Northern White and Texas Gold raw frac sand. |

| • | Logistics Capabilities. We believe that our market-leading delivery infrastructure and capabilities provide significant value to our customers as certain of our customers lack effective delivery |

6

Table of Contents

| infrastructures for getting proppant to the basin. As of December 31, 2015, we have 43 active proppant distribution terminals located in all major oil and gas producing basins in the U.S. Our unit train capabilities allow us to deliver product to our terminals efficiently and, subject to market conditions, we will continue to enhance our unit train capabilities to reduce freight costs and improve cycle times for our rail car fleet. For customers with their own delivery infrastructure, our unit train capabilities allow us to deliver product to their terminals cost-effectively. As of December 31, 2015, we have a total fleet of approximately 10,100 railcars (net of subleases) to support our delivery capabilities. During 2015, declining demand coupled with the delivery of previously ordered railcars has caused us to have more railcars than we need to operate the business. As of December 31, 2015, we had approximately 4,500 railcars in storage. In order to proactively manage our railcar inventory, we reached an agreement in 2015 with railcar suppliers to defer all of the 2016-scheduled deliveries to 2017 and 2018 in exchange for an acceleration of approximately 600 railcars into 2015 in order to take advantage of certain lease financing commitments. We also continue to sublease railcars and have approximately 2,900 railcar leases scheduled to expire during 2016 and 2017. |

| • | Increase Market Penetration of Our Resin-Coated Proppants. We believe that resin-coated proppants offer compelling performance advantages relative to other proppants. Our field data indicates that high quality resin-coated proppants enhance oil and gas reservoir conductivity compared to raw frac sand and is a cost-effective alternative to light weight ceramic proppants. Field data also indicates that resin-coated proppants reduce proppant flow back. Our resin-coating capacity is the largest in the industry, providing our customers assurance of supply. Due to its superior performance and value-added processing, our resin-coated products continue to generate a higher per ton profit as compared to our raw frac sand. We will continue to work with market participants by hosting technical sales meetings, obtaining field data, and producing scientific papers which highlight the value proposition of resin-coated proppant. Through these efforts, we will seek to increase overall market penetration of our resin-coated proppant and to displace competing resin-coated proppants. In 2015, we experienced a decline in demand for resin-coated proppants, as customers attempted to lower well completion costs. |

| • | Develop and Commercialize High Performance Proprietary Proppants. We have a history of developing innovative technologies that increase the effectiveness of well completions, from conventional wells to the most complex, multi-stage horizontal wells. We have a new state-of-the-art research and development facility and a team of scientists, material engineers and process engineers focused on developing innovative and proprietary proppants. As a result of our commitment, our new product development record is strong. For example, we successfully developed and commercialized CoolSet, a curable resin-coated sand proppant that bonds at low temperatures with no chemical activators. We also are currently conducting an increasing number of field trials for Propel SSP, a self-suspending proppant. We have established commercial processing capability for this product. A patent for certain of the Propel SSP technology was received in early 2016. We are maintaining a regular dialogue with our customers regarding evolving product needs and maintain a robust pipeline of new products in various stages of development. |

| • | Execute all of our Corporate Initiatives with a Commitment to Customers, Employees and Communities. Our corporate culture emphasizes People, Planet and Prosperity, and our strategy of sustainable development defines our approach to operations and community engagement. We work to minimize our environmental impact and continue to find ways to reduce waste while also reducing operating costs. We are honored to receive recognition from our communities for our focus on sustainable mining practices, reclamation and community investment. We believe that positive community engagement is both a privilege and a responsibility, and that it enhances our ability to recruit and retain employees, obtain mining and other operating permits and strengthen relationships with our customers. Our corporate motto is “Do Good. Do Well” and we intend to continue to execute our growth strategy with a focus on sustainable development. |

7

Table of Contents

INDUSTRY

Overview

The silica sand industry consists of businesses that are involved in the mining, processing, and sale of silica sand and silica sand-based products. Monocrystalline silica, also referred to as “silica,” “industrial sand and gravel,” “silica sand,” and “quartz sand,” is a term applied to sands and gravels containing a high percentage of silica (also known as silicon dioxide or SiO2) in the form of quartz. Monocrystalline silica deposits with widely varying physical characteristics occur throughout the United States, but mines and processing facilities are typically developed near rail infrastructure which facilitates access to markets. Other factors affecting the feasibility of monocrystalline silica production include deposit composition, product quality specifications, land-use, environmental regulation, permitting requirements, access to electricity, gas and water, and production expertise and know-how.

The low relative cost and special properties of monocrystalline silica—chemistry, purity, grain size, color, inertness, hardness, and resistance to high temperatures—make it critical to a variety of industries and end-use markets, including the production of molds and cores for metal castings, glass production, and the manufacturing of building products. In particular, monocrystalline silica is a key input in the hydraulic fracturing techniques used in the development of oil and gas resource basins.

Frac Sand Extraction, Processing, and Distribution

Raw frac sand is a naturally occurring mineral that is mined and processed. While the specific extraction method utilized depends primarily on the geologic conditions, most raw frac sand is mined using conventional open-pit extraction methods. The composition, depth, and chemical purity of the sand also dictate the processing method and equipment utilized. For example, broken rock from a sandstone deposit may require one, two, or three stages of crushing to produce sand grains that meet API specifications. In contrast, unconsolidated deposits may require little or no crushing during the excavation process. After extraction, raw frac sand is washed with water to remove fine impurities such as clay and organic particles, with additional procedures used when contaminants are not easily removable. The final steps in the production process involve the drying and screening of the raw frac sand according to mesh size.

Most frac sand is shipped in bulk from the processing facility to customers by truck, rail or barge. Because transportation costs represent a significant portion of the overall delivered product cost, shipping in large quantities, particularly when shipping over long distances, provides a significant cost advantage to the suppliers, which highlights the importance of rail or barge access for low cost delivery. As a result, facility location and logistics capabilities are an important consideration for suppliers and customers. In addition, we believe that, over time, the largest proppant customers would prefer to consolidate their purchases across a smaller group of suppliers with robust logistics capabilities and a broad offering of high performance proppants.

Oil and Gas Proppant Market

Advances in oil and gas extraction techniques, such as horizontal drilling and hydraulic fracturing, have allowed for significantly greater extraction of oil and gas trapped within shale formations. The hydraulic fracturing process consists of pumping fluids down a well at pressures sufficient to create fractures in the targeted hydrocarbon-bearing rock formation in order to increase the flow rate of hydrocarbons from the well. A granular material, called proppant, is suspended and transported in the fluid and fills the fracture, “propping” it open once high-pressure pumping stops. The proppant-filled fracture creates a conductive channel through which the hydrocarbons can flow more freely from the formation into the wellbore and then to the surface. Proppants therefore perform the vital function of promoting the flow, or conductivity, of hydrocarbons over a well’s productive life. In fracturing a well, operators select a proppant that is transportable into the fracture, is compatible with frac and wellbore fluids, permits acceptable cleanup of frac fluids and can resist proppant flowback. In addition, the proppant must be resistant to crushing under the earth’s closure stress and reservoir temperature.

8

Table of Contents

There are three primary types of proppant that are utilized in the hydraulic fracturing process: raw frac sand, resin-coated sand and manufactured ceramic beads. Customers choose among these proppant types based on the geology of the reservoir, expected well pressures, proppant flowback concerns, and product cost. Given the price differences between the various proppant products and well-specific considerations, E&P companies are continually evaluating the optimal mix of lower-cost, lower-conductivity frac sand and higher-cost, higher-conductivity resin-coated sand and ceramics in order to best address the geology of the well and to maximize well productivity and economic returns.

Proppant Characteristics

Proppants must meet stringent technical specifications set forth by the API including, among others, coarseness, crush resistance, sphericity, roundness, acid solubility, purity, and turbidity. These characteristics are of particular importance because they have a significant impact on hydrocarbon conductivity, and ultimately the production rate and profitability of a well. Conductivity is a function of the permeability of the proppant and the width of the fracture, which dictates the proppant’s ability to prop open a fracture and allow hydrocarbons to flow. Some of the key characteristics impacting conductivity are:

Coarseness. Proppant grain size is critical to hydraulic fracturing operations in order to satisfy down-hole conditions and well-completion design. Mesh size is used to describe proppant grain size and is determined by sieving the proppant through screens with uniform openings corresponding to the desired grain size. The vast majority of products range from 12 to 100 mesh (representing the number of openings per linear inch on a sizing screen) and include standard sizes, such as 12/20, 16/30, 20/40, 30/50 and 40/70. In general, notwithstanding strength characteristics, a larger and more uniformly distributed proppant size will result in higher permeability and conductivity.

Crush Resistance. Crush resistance is an important factor in fracturing applications where downhole pressures intensify. Proppant crush results in finer particles, or “fines,” which reduce permeability in the proppant pack and narrow the fracture width, all leading to reduced conductivity. Generally, the more pure the grain and the smaller its size, the better the proppant’s crush resistance. Resin-coated sand proppants have a higher resistance to crush and are suitable for intermediate to high pressure closure stress of up to 12,000 psi, and ceramics have the greatest resistance to crush and are suitable for intermediate to the highest pressure closure stress of up to 15,000 psi.

Proppant Shape and Uniformity. Proppant shape influences proppant pack space, permeability, and conductivity. For optimal long-term conductivity, the proppant particles should have an optimized spherical shape and roundness (roundness is a measure of the relative sharpness of corners and curvatures), as well as uniform size and shape distribution.

Low Acid Solubility. There are various frac-related applications wherein the proppant may come into contact with acid. Therefore, proppant stability in acidic environments can be an important attribute.

Purity. The greater the monocrystalline silica composition in a grain of silica sand, the stronger the grain and the lower instances of chemical reactions.

Turbidity. Turbidity is a measure of the level of particles or fines in the proppant, such as silt and clay. High turbidity can be an indication of poor proppant manufacturing, transportation or handling practices, or inherent geological characteristics of the ultimate sand reserves. High-turbidity proppants can interfere with fractures, negatively impacting conductivity.

9

Table of Contents

Proppant Types

Comparison of Key Proppant Characteristics

The following table sets forth what we believe to be the key comparative characteristics of our products and the three primary types of proppant:

| Raw Frac Sand | Resin-coated | Ceramics | ||||

| Products and Characteristics |

• Natural Resource |

• Raw frac sand substrate with resin coating |

• Manufactured product | |||

| • Primary Types include Northern White, Brown |

• Coating increases crush resistance |

• Typically highest crush resistance | ||||

| • Quality of sand varies widely depending on source |

• Bond together to prevent proppant flowback |

|||||

| Relative Crush Resistance(1) |

Up to 6,000 psi | Up to 10,000 psi | Up to 15,000 psi | |||

| Fairmount Santrol Product(2) |

Yes | Yes | No(2) | |||

| (1) | Crush resistance within a product category will vary by differing proppant characteristics including, size, roundness, purity, type of coating, etc. For purposes of relative comparability, we are showing recommended well pressures for 20/40 Northern White raw frac sand, 20/40 THS and OptiProp (Fairmount’s resin-coated sand products), and 20/40 high strength ceramics. |

| (2) | Fairmount Santrol’s PowerProp product competes with lightweight ceramics offered by competitors. |

Raw Frac Sand

Of the three primary types of proppant, raw frac sand represents the lowest cost and largest volume of proppant supplied to oilfield service providers and operators. Raw frac sand is ideally suited for wells with relatively lower levels of closure pressure. Generally, raw frac sand is produced and sold in whole grain (unground) form. There are two broad types of API spec raw frac sand: Northern White and brown, both of which are produced by Fairmount Santrol.

Northern White frac sand is considered to be the highest quality raw frac sand available and is known for its high crush resistance, roundness and sphericity and monocrystalline grain structure. Northern White frac sand exists predominantly in the upper Midwest region of the United States (including Wisconsin, Illinois and Minnesota). Fairmount Santrol’s Northern White sand is a spherical monocrystalline that is 99.8%+ pure-quartz and has superior conductivity and crush resistance compared to other types of raw frac sand.

Brown sand is less monocrystalline in nature and more angular than Northern White sand. Brown sand consists of both API and non-API spec material. API-spec brown sand, such as Fairmount Santrol’s Texas Gold sand, is mined from the Hickory Formation near Brady, Texas. Brown sand typically has lower crush resistance than Northern White, but is often sufficient for lower pressure wells. Due to its proximity to the well, Fairmount’s Texas Gold has a meaningful delivered cost advantage into key basins in South and West Texas, including the Eagle Ford Shale and the Permian Basin.

Resin-coated Sand

Resin-coated frac sand consists of raw frac sand that is coated with a resin that increases the sand’s crush resistance and reduces the likelihood of crushed sand dispersing throughout the fracture. Resin-coated sand withstands significant reservoir pressures and results in higher conductivity than raw frac sand. Consequently,

10

Table of Contents

resin-coated sand is ideally suited for wells with intermediate to high levels of closure stress, or for wells where reducing proppant flowback is a key consideration. By reducing proppant flowback, resin-coated sand reduces the potential downtime and cost of a well as well as increasing long-term productivity of the well.

Manufactured Ceramic Proppant

Manufactured ceramic proppant is a product of comparatively consistent size and spherical shape that typically offers the highest crush resistance relative to other types of proppants.

Proppant Industry Demand Trends

Over the past decade, E&P companies increasingly focused on exploiting the vast hydrocarbon reserves contained in North America’s oil and gas reservoirs. Using advanced techniques, such as horizontal drilling and hydraulic fracturing, North American production of oil and gas has grown rapidly as the development of horizontal drilling technologies has evolved. More recently, E&P companies increased their focus on optimizing the use of proppant as a critical component of these efforts to improve well productivity and maximize their returns on invested capital.

This focus on efficiency and profitability led to new development techniques, such as increased use of pad drilling which resulted in a greater number of wells drilled per rig, and incorporated longer lateral lengths and shorter intervals between frac stages, which resulted in more fracturing stages per well. In addition, the amount of proppant used per stage increased dramatically, compounding the increase in total demand for proppant.

As a result of these trends, North American demand for all proppants increased rapidly over the past ten years. This growth was fueled by the continued increase in both wells drilled and proppant used per well. Individual wells were being completed with as much as 20,000 tons of proppant, or 60 to 100 railcars. This represented a significant increase in the usage of proppant per well over just a few years ago and was driven by improved recovery rates for E&P companies at higher levels of proppant intensity.

Starting in the fourth quarter of 2014 and continuing through 2015, increasing global supply of oil, in conjunction with decline in global oil demand, has created downward pressure on crude oil prices. As a result, various operators have cut back on drilling and capital programs, resulting in significantly reduced rig counts. Therefore, according to Baker Hughes rig count data, North American rig counts have fallen considerably from 2,360 in September 2014 to 826 in December 2015, which has resulted in reduced drilling activity and negatively impacted the demand for proppants. Further, lower crude oil prices have caused E&P companies to seek ways to reduce operating costs, which has further reduced demand for our value-added products such as resin-coated proppants. We believe that the completion of wells that have been drilled and increased proppant usage per well will continue to help partially offset reduced demand for proppants from lower drilling activity in 2015 and beyond. It is unclear when global oil prices will begin to recover, leading to increased drilling activity and demand for proppants, but we believe that North American drilling activity and demand for proppants will grow over the long term.

Proppant Industry Supply Trends

To keep pace with rapidly growing demand, the available supply of proppant increased in 2014 through new entrants and capacity expansions of existing suppliers. However, according to the U.S. Energy Information Administration, as a result of the increasing global supply of oil, the world supply of liquid fuels now exceeds demand. This has resulted in downward pressure on the selling price of proppants, as well as the closing or idling of industry capacity in 2015. However, a portion of market supply consists of lower quality (“Tier 3”) sand, the demand for which will likely fall before demand for higher quality Northern White (“Tier 1”) and API Brown (“Tier 2”) sands. All of our reserves consist of Tiers 1 and 2 sands. The effectiveness of additional market supply also will be impacted by the suppliers’ ability to deliver product cost effectively where customers want it. To the

11

Table of Contents

extent that effective supply exceeds demand in the near term, there may be downward pressure on the selling price of proppants.

Other Proppant Products

We offer proppant products in each of the most common API-specified proppant categories, which we believe address a vast majority of the proppant market.

Northern White Frac Sand. Our Northern White frac sand is mined from deposits located in our Illinois, Wisconsin and Minnesota facilities. These reserves are generally characterized by high purity, significant roundness and sphericity, and low turbidity. All of our Northern White raw sand proppant products meet the standards set by the API.

API-Spec Brown Frac Sand. Our API-spec brown sand reserves are located in Texas and marketed under the name “Texas Gold.” Our Texas Gold frac sand has lower crush resistance than our Northern White frac sand, but it is an effective solution for low pressure wells. These reserves are in close proximity to major oil and gas producing basins in Texas, including the Eagle Ford Shale and the Permian Basin, which provides them with a significant transportation cost advantage relative to API-spec frac sand sourced from more distant locations.

Resin-coated Proppant. We coat a portion of our API-spec produced sand with resin to enhance its performance as a proppant using proprietary resin formulations and coating technologies. Our resin-coated proppants are generally used in higher temperature and higher pressure well environments and are marketed to end users who require increased conductivity in higher pressure wells, high crush resistance, and/or enhanced flow back control in order to enhance the productivity of their wells.

Our resin-coated sand products are sold as both tempered (or pre-cured) and curable (or bonding) products. Curable resin-coated sand bonds down hole as the formation heat causes neighboring resin-coated sand grains to polymerize with one another locking proppant into place. This prevents proppant from flowing back out of the fracture when the oil or natural gas well is turned on. For certain resin products, the resin’s chemical properties are triggered by the introduction of an activator into the frac fluid. Tempered products do not require activation because they are not intended to bond, rather bring additional strength to the proppant. We formulate, manufacture, and sell activators which work with the specific chemistry of our resins.

We manufacture proprietary coatings designed to address the evolving needs of our customers, and have recently invested significantly in our research and development and technical marketing capabilities to maximize the sales of our coated products. We also coat ceramic product purchased from third-party suppliers. This product is marketed as HyperProp and has the strength characteristics of ceramic and the flowback performance characteristics of resin-coated sand.

Proprietary Performance Products

Propel SSP. Our patented Propel SSP product utilizes a polymer coating applied to a proppant substrate. Upon contact with water, the coating hydrates and swells rapidly to create a hydrogel around the proppant substrate. The hydrogel layer, which is primarily water, is attached to the proppant particle and provides a nearly threefold increase in the hydrostatic radius of the proppant. Initial test results indicate that the lower specific gravity allows greater volumes of proppant and/or coarser mesh sizes coated with Propel SSP to be carried deep into the fracture, which in turn allow more hydrocarbons to escape into the wellbore. This technology reduces or eliminates the need for certain frac fluid additives, including guar, which are used to enhance the transport of proppants into the geologic formation.

12

Table of Contents

Our Product Delivery

We have established an oil and gas logistics network that we believe is highly responsive to our customers’ needs. One of the most important purchasing criteria of our proppant customers is our ability to deliver the products our customers demand at their desired time and location. We believe we have one of the industry’s largest distribution footprints with 43 active oil and gas distribution terminals. We also have a railcar fleet of approximately 10,100 railcars as of December 31, 2015, providing us the flexibility for delivering product to our locations in-basin when customers require it. We believe we are one of the few proppant producers capable of Class I railroad deliveries to each of North America’s major oil and gas-producing basins. In 2015, we shipped approximately 75% of our North American proppant volume through our terminal network. However, customers have recently shown a shift from in-basin deliveries to FOB plant purchases; the percentage of in-basin deliveries declined from over 85% in the first quarter of 2015 to approximately 65% in the fourth quarter of 2015.

The ability to ship proppant through unit trains is becoming increasingly important in order to cost-effectively provide the large quantities of product required by evolving well completion methods. We have unit train capabilities at two of our production facilities and seven of our terminals and shipped over 200 unit trains of product in 2015. The production unit train capability allows our customers that prefer to purchase the product FOB plant to efficiently ship the proppant to their own facilities. As a result the weakened demand for proppant in the declining oil and gas market, we have approximately 4,500 railcars in storage.

I&R Industry Trends

Demand in the I&R end markets is relatively stable and is primarily influenced by key macroeconomic drivers such as housing starts, light vehicle sales, repair and remodel activity, and industrial production. The economic downturn beginning in 2008 decreased demand in the foundry, building products, and glassmaking end markets, however, the recent economic recovery has significantly increased demand in these same end markets. The primary end markets served by our I&R segment are foundry, building products, sports and recreation, glassmaking, and filtration.

Our I&R Products

Foundry. We currently supply the foundry industry with multiple grades of high purity, round, angular, and sub-angular sands for molding and core-making applications, with products sold primarily in the U.S., Canada, Mexico, Japan, and China. Foundry sands are characterized by high purity, round and sub-angular sands precisely screened to perform under a variety of metal casting conditions. These factors dictate the refractory level and physical characteristics of the mold and core, which have a significant effect on the quality of the castings produced in the foundry. Our resin binders provide the necessary bonding of molds and cores in casting applications and are designed to improve overall productivity and environment conditions in the workplace.

Our extensive production experience and technical knowledge of the foundry industry have driven several industry advances. For example, we have developed our Signature Series of low smoke, low odor resin-coated sands that provide lower overall emissions while providing a safer and more favorable work environment. Our expertise with resin-coated sands enables us to provide coated sand for molds and cores where exceptional dimensional accuracy and surface finish are required.

We believe we were the first sand operator to blend sands, which has proven extremely successful for specialty iron and aluminum applications. As foundries continue to utilize higher cost binders to improve the quality of their castings, minimize the use of binders which also reduces overall environmental impact, the industry continues to demand higher quality sands to realize the value of these binders. Our chemists and technicians support these applications with customized products that minimize binder usage, resulting in lower costs to foundries and higher prices for our products.

13

Table of Contents

Glass. We provide a wide variety of high purity, low iron silica sands to the glass market. The glass industry uses industrial sand consumption for the production of windows, electronic display screens, photovoltaic panels, glass bottles, and other glass products.

Building Products. Various grades and types of our sands are used for roofing shingles, asphalt, industrial flooring ballast sand, bridge decking, pipe lining, and tank underlayment. We also work with our customers to blend minerals and chemicals to create colored flooring aggregates, concrete countertops, grout and plaster.

Sports and Recreation. We are a leading supplier of various turf and landscape infill products to contractors, municipalities, nurseries, and mass merchandisers. Our turf products are used in multiple major sporting venues, including First Energy Stadium, PNC Park, Notre Dame Stadium, and Progressive Field. In addition, we are a significant supplier of bunker sand, top dressing sands, and all-purpose sands to golf clubs and landscape contractors throughout North America. Our sands are also supplied to horse tracks and training facilities. We also provide colored sand to a variety of major retailers for use as play sand and arts and crafts.

Filtration. We provide high-quality industrial sands and gravels in a wide variety of water and wastewater filtration applications. Over the past several years, we increased our focus on the filtration market. Our full range of products are monitored with an active statistical process control program to ensure compliance with all government and customer specifications, including the American Water Works and National Sanitation Foundation standards. Due to our efforts, we have emerged as a leader in sand and gravel products for private, public, and institutional water filtration systems.

Our Customers

Since our inception, we have remained focused on developing and sustaining a loyal, diversified customer base. Currently, we maintain long-term contracts with many of the largest North American oilfield service companies. We believe the strength of our customer base is driven by our collaborative approach to product innovation and development, reputation for high-quality products, and extensive logistics network. Certain of our top customer relationships date back over 30 years. We have approximately 80 customers for our oil and gas proppants and over 850 customers across all our end markets. For the years ended December 31, 2015 and 2014, our top two customers, Halliburton and FTSI, collectively, accounted for approximately 43% and 36%, respectively, of our total sales revenues.

We primarily sell products under supply agreements with terms that vary by contract. Certain of the agreements require the customer to purchase a specified percentage of its proppant requirements from us. Other agreements require the customer to purchase a minimum volume of proppant from us. These minimum volume contracts typically include a “take-or-pay” or “take-or-penalty” provision which triggers certain penalties if the purchased volume does not meet the required minimums.

Research and Development and Technical Innovation

We have a history of partnering with our customers to develop innovative solutions to enhance the effectiveness of well completions, from conventional shallow wells to the most complex, multi-stage, horizontal wells. The nature of our vertically integrated model allows us to participate in each phase of proppant manufacturing and delivery and provides us a unique perspective into the current and future needs of our customers. Our technical sales team works closely with market participants to demonstrate the value proposition our proppants offer and stimulate market demand using data indicating enhanced hydrocarbon recoveries.

14

Table of Contents

The table below summarizes some of our most significant product innovations:

| Innovation |

Year | Result | ||

| CoolSet | 2014 | Eliminates need for an activator for well temperatures as low as 100°F | ||

| Self-Suspending Proppant | 2013 | Improves hydraulic fracturing efficiency by allowing proppant to transport further into the fracture, substantially increasing fracture length and improving productivity of well performance | ||

| PowerProp | 2010 | Technology that delivers strength and performance characteristics similar to a light-weight ceramic (patent-pending) | ||

| Bio-based Binder System | 2010 | Technology for use in metal casting industry (patent-pending) | ||

| Bio-Balls | 2006 | Water soluble ball sealers that are environmentally safe and do not require retrieval after treatment | ||

| Encapsulated Curable Proppant | 1997 | High performance resin-coated proppant used in flow-back control | ||

| Dual Coat Technology | 1995 | Dual coat curable resin-coated sand for enhanced conductivity and flowback control | ||

Our research and development team consists of 22 scientists, engineers, and technicians, with seven of them holding Ph.D.’s located at three locations in Sugar Land, Texas, Ottawa, Illinois, and Detroit, Michigan. During 2015, 2014, and 2013, we spent $5 million, $6 million, and $5 million, respectively, on research and development.

After acquiring the technology that underlies Propel SSP in April 2013, our team has worked to further develop the technology and manufacturing techniques of our Propel SSP product with robust storage and handling characteristics. Propel SSP continues to undergo extensive field trials with key customers with successful results (increased productivity and reduced operating costs). Propel SSP relies on a hydrogel polymer coating attached to a proppant substrate. When mixed with water, the coating hydrates and swells rapidly to create a hydrogel around the proppant substrate, which provides a nearly threefold increase in the hydrostatic radius of the proppant. Lab results show that the lower specific gravity, while maintaining crush strength, allows greater volumes of proppant and/or coarser mesh sizes coated with Propel SSP to be carried deep into the fractures, in turn allowing more hydrocarbons to flow into the wellbore. This technology reduces or eliminates the need for certain frac fluid additives, including friction reducer, guar gum, and crosslinkers, which are used to enhance the transport of proppants into the geologic formation. Based on lab and field tests, we believe Propel SSP technology is applicable at a wide range of well temperatures.

In 2014, we commercialized CoolSet, a new proppant product that provides effective flowback resistance without using any activator at temperatures as low as 100°F. This type of proppant is particularly suitable for low-temperature wells found in shale plays such as Permian, MidCon, and Canada.

Acquisitions

Throughout our history, we have made and successfully integrated strategic acquisitions in order to strengthen our market leadership position. In 2013 we acquired certain assets of FTSI, SSP LLC, and Great Plains and have completed over 20 acquisitions over the past 20 years.

15

Table of Contents

Competition

There are numerous large and small producers in all sand producing regions of the United States with whom we compete. Our main competitors in the raw frac sand market include Badger Mining Corporation, CARBO Ceramics, Inc., Emerge Energy Services LP, Hi-Crush Partners LP, Preferred Sands LLC, Unimin Corporation, and U.S. Silica Holdings, Inc. Many new entrants to the raw frac sand market compete on an FOB-plant basis and lack comparable transportation infrastructure to meet customer demands in-basin. Our main competitors in the coated products market include Momentive Performance Materials Inc., Unimin Corporation, Atlas Resin Proppants LLC, Preferred Sands LLC, CARBO Ceramics, and U.S. Silica Holdings, Inc. The most important factors on which we compete in both markets are product quality, performance, sand and proppant characteristics, transportation capabilities, proximity of supply to well site, reliability of supply, and price. Our substantial competitors across both markets are U.S. Silica Holdings, Inc., Unimin Corporation, and Badger Mining Corporation (which owns Atlas Resin Proppants LLC). We believe we are uniquely positioned to utilize our scale of raw sand production to supply high-quality substrate for coated products and leverage our transportation infrastructure for reliable delivery in-basin.

Due to increased demand for sand based proppants in the years leading up to 2015, there had been an increase in the number of frac sand producers. Moreover, as a result of this increased demand, existing frac sand producers have added to or expanded their frac sand production capacity, thereby increasing competition. Demand for sand-based proppants is closely linked to proppant consumption patterns for the completion of oil and natural gas wells in North America. These consumption patterns in a particular basin are influenced by numerous factors, including the price of hydrocarbons, the drilling rig count, and hydraulic fracturing activity levels, including the number of stages completed and the amount of proppant used per stage. Further, these consumption patterns are also influenced by the location, quality, selling price and availability of sand-based proppants and other types of proppants such as ceramic proppant. Selling prices for sand-based proppants vary by basin and are determined based on supply and demand dynamics within each basin.

As a result of increasing global supply of oil, the demand for proppant has decreased since the end of 2014 and through 2015, resulting in proppant oversupply and downward pressure on proppant selling prices. It is unclear when the oil and gas markets and proppant markets will recover. This has caused some proppant producers to exit the market and others, including us, to adjust operations and minimize costs.

Competitors in the I&R markets include some of our larger proppant competitors such as Unimin Corporation and U.S. Silica Holdings, Inc. but also typically include smaller, local or regional producers of sand and gravel.

Employees

As of December 31, 2015, we employed a workforce of 821 employees. We believe our culture of “People, Planet and Prosperity” has enabled us to achieve a long-tenured workforce and good relations with our workforce.

We maintain an active dialogue with employees and provide salaried and hourly employees a comprehensive benefits package including medical, life, and accident insurance, incentive bonus programs, a 401(k) plan with an employer match and discretionary employer contribution, as well as educational assistance. Certain employees are also eligible for stock-based compensation programs that are designed to encourage long-term performance aligned with Company objectives.

As of December 31, 2015, approximately 126 of our domestic employees are parties to collective bargaining contracts. We believe we have strong relationships with and maintain an active dialogue with union representatives. We have historically been able to successfully extend and renegotiate collective bargaining agreements as they expire.

16

Table of Contents

Seasonality

Our business is affected to some extent by seasonal fluctuations in weather that impact our production levels and our customers’ business needs. For example, our proppant sales levels are lower in the first and fourth quarters due to lower market demand as adverse weather tends to slow oil and gas operations to varying degrees depending on the severity of the weather. Our inability to mine and process frac sand year round at our surface mines in northern states results in a seasonal build-up of inventory as we excavate excess sand to build a stockpile that will feed our drying facilities during the winter months. Additionally, in the second and third quarters, we sell more sand to our customers in the I&R end markets due to the seasonal rise in demand driven by more favorable weather conditions.

Intellectual Property

Our intellectual property consists primarily of patents, trade secrets, know-how, trademarks, including our name “Fairmount Santrol,” and products such as “PowerProp,” “Propel SSP,” “HyperProp,” and “CoolSet.” We hold numerous U.S. and foreign-granted patents that are still in force as well as many U.S. and foreign patent applications that are still pending. We own patents in each of our major, differentiated proppant product lines, except CoolSet and HyperProp. We have not granted any third-party rights with respect to our patents. The majority of our patents have an expiration date after 2025. We have not yet filed a patent for CoolSet and our patents for HyperProp have recently expired. In early 2016, we received a patent on certain of the Propel SSP technology and have additional patents pending. With respect to trade secrets and know-how, our extensive experience with a variety of different products enables us to offer our customers a wide range of proppants for their particular application.

An investment in our securities involves significant risks. You should carefully consider the risks described below, together with the financial and other information contained in this Report, as well as the information discussed under the section entitled, “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” in evaluating us, our business and your investment in us. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flows, and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

Our business and financial performance depend on the level of activity in the oil and gas industries.

Approximately 86% of our revenues for the year ended December 31, 2015 were derived from sales to companies in the oil and gas industry. As a result, our operations are materially dependent on the levels of activity in oil and gas exploration, development, and production. More specifically, the demand for the proppants we produce is closely related to the number of oil and gas wells completed in geological formations where sand-based proppants are used in fracturing activities. These activity levels are affected by both short- and long-term trends in oil and gas prices, among other factors.

In recent years, oil and gas prices and, therefore, the level of exploration, development, and production activity, have experienced significant fluctuations. Worldwide economic, political, and military events, including war, terrorist activity, events in the Middle East, and initiatives by the Organization of the Petroleum Exporting Countries (“OPEC”) and other large non-OPEC producers have contributed, and are likely to continue to contribute, to price and volume volatility. For example, beginning in September 2014 and continuing through 2015, increasing global supply of oil, in conjunction with weakened demand from slowing economic growth in the Eurozone and China, has created downward pressure on crude oil prices resulting in reduced demand for our

17

Table of Contents

products and pressure to reduce our product prices. If these conditions persist, this may adversely impact our ability to meeting our debt obligations. Furthermore, the availability of key resources that impact drilling activity has experienced significant fluctuations and could impact product demand.

A prolonged reduction in oil and gas prices would generally depress the level of oil and gas exploration, development, production, and well completion activity and may result in a corresponding decline in the demand for the proppants we produce. Such a decline would have a material adverse effect on our business, results of operations, and financial condition, and we may not be able to meet our debt obligations. The commercial development of economically-viable alternative energy sources could have a similar effect. In addition, certain U.S. federal income tax deductions currently available with respect to oil and gas exploration and development, including the repeal of the percentage depletion allowance for oil and gas properties, may be eliminated as a result of proposed legislation. Any future decreases in the rate at which oil and gas reserves are discovered or developed, whether due to the passage of legislation, increased governmental regulation leading to limitations, or prohibitions on exploration and drilling activity, including hydraulic fracturing, or other factors, could have a material adverse effect on our business and financial condition, even in a stronger oil and natural gas price environment.

Our substantial indebtedness could adversely affect our financial flexibility and our competitive position.

Our substantial level of indebtedness increases the risk that we may be unable to generate cash sufficient to pay amounts due in respect of our indebtedness, or refinance that indebtedness on favorable terms. As of December 31, 2015, we had approximately $1.24 billion of outstanding long-term debt (including the current portion of long-term debt) with a portion of this debt ($156 million) due at March 17, 2017. Our substantial indebtedness could have other important consequences to you and significant effects on our business. For example, it could:

| • | increase our vulnerability to adverse changes in general economic, industry and competitive conditions; |

| • | require us to dedicate a substantial portion of our cash flow from operations to make payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | restrict us from exploiting business opportunities; |

| • | make it more difficult to satisfy our financial obligations, including payments on our indebtedness; |

| • | place us at a disadvantage compared to our competitors that have less debt; and |

| • | limit our ability to borrow additional funds for working capital, capital expenditures, railcar or other future purchase commitments, acquisitions, debt service requirements, execution of our business strategy, or other general corporate purposes. |

Increasing logistics costs, a lack of dependability or availability of transportation services or infrastructure, and geographic shifts in demand could have a material adverse effect on our business.

Transportation and handling costs are a significant component of the total delivered cost of our products. In many instances, transportation costs can represent 70 to 80% of the delivered cost of frac sand. The high relative cost of transportation could favor suppliers located in close proximity to the customer. In addition, as we continue to expand our sand-based proppant production, we will need increased investment in transportation infrastructure, including terminals and railcars. We contract with truck, rail, ship, and barge services to move sand-based proppants from our production facilities to distribution terminals. Labor disputes, derailments, adverse weather conditions or other environmental events, increased railcar congestion, and other changes to rail freight systems

18

Table of Contents

could interrupt or limit available transportation services or result in a significant increase in transportation service rates. Increased costs resulting from these types of events that we are not able to pass on to our customers could impair our ability to deliver our products economically to our customers or to expand our markets. Accordingly, because we are so dependent on rail infrastructure, if there are disruptions of the rail transportation services utilized by us or our customers, and we or our customers are unable to find alternative transportation providers to transport our products, our business and results of operations could be adversely affected. Further, declining volumes could result in additional railcar over-capacity, which would lead to railcar storage fees while, at the same time, we would continue to incur lease costs for those railcars in storage.