Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TIPTREE INC. | ex99112312016er.htm |

| 8-K - 8-K - TIPTREE INC. | a8ker12312016.htm |

March 2017

Financial information for year ended December 31, 2016

NASDAQ: TIPT

INVESTOR PRESENTATION - 2016

Exhibit 99.2

1

LIMITATIONS ON THE USE OF INFORMATION

This presentation has been prepared by Tiptree Inc. and its consolidated subsidiaries (“Tiptree", "the Company" or "we”) solely for informational purposes, and not for the

purpose of updating any information or forecast with respect to Tiptree, its subsidiaries or any of its affiliates or any other purpose. Tiptree reports a non-controlling interest in

TFP that is not owned by Tiptree and certain other operating subsidiaries that are not wholly owned. Unless otherwise noted, all information is of Tiptree on a consolidated basis

before non-controlling interest. Neither Tiptree nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the

information contained herein and no such party shall have any liability for such information. These materials and any related oral statements are not all-inclusive and shall not

be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Performance information is historical and is

not indicative of, nor does it guarantee future results. There can be no assurance that similar performance may be experienced in the future.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains "forward-looking statements" which involve risks, uncertainties and contingencies, many of which are beyond Tiptree's control, which may cause actual

results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained herein that are not clearly historical

in nature are forward-looking, and the words "anticipate," "believe," "estimate," "expect,“ “intend,” “may,” “might,” "plan," “project,” “should,” "target,“ “will,” or similar

expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree's plans, objectives,

expectations and intentions. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which

are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual

results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section

entitled “Risk Factors” in Tiptree’s Annual Report on Form 10-K, and as described in the Tiptree’s other filings with the SEC. Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could

cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could

affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking

statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake

no obligation to update any forward-looking statements.

MARKET AND INDUSTRY DATA

Certain market data and industry data used in this presentation were obtained from reports of governmental agencies and industry publications and surveys. We believe the

data from third-party sources to be reliable based upon our management’s knowledge of the industry, but have not independently verified such data and as such, make no

guarantees as to its accuracy, completeness or timeliness.

NOT AN OFFER OR A SOLICIATION

This document does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with Tiptree, its subsidiaries or its affiliates.

The information in this document is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any

jurisdiction or country where such distribution or use would be contrary to local law or regulation.

NON-GAAP MEASURES

In this document, we sometimes use financial measures derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S.

generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under the SEC rules. These non-GAAP financial measures

supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Management's reasons for using these non-GAAP financial measures and

the reconciliations to their most directly comparable GAAP financial measures are posted in the Appendix.

DISCLAIMERS

OVERVIEW & FINANCIAL RESULTS

Key Highlights

3

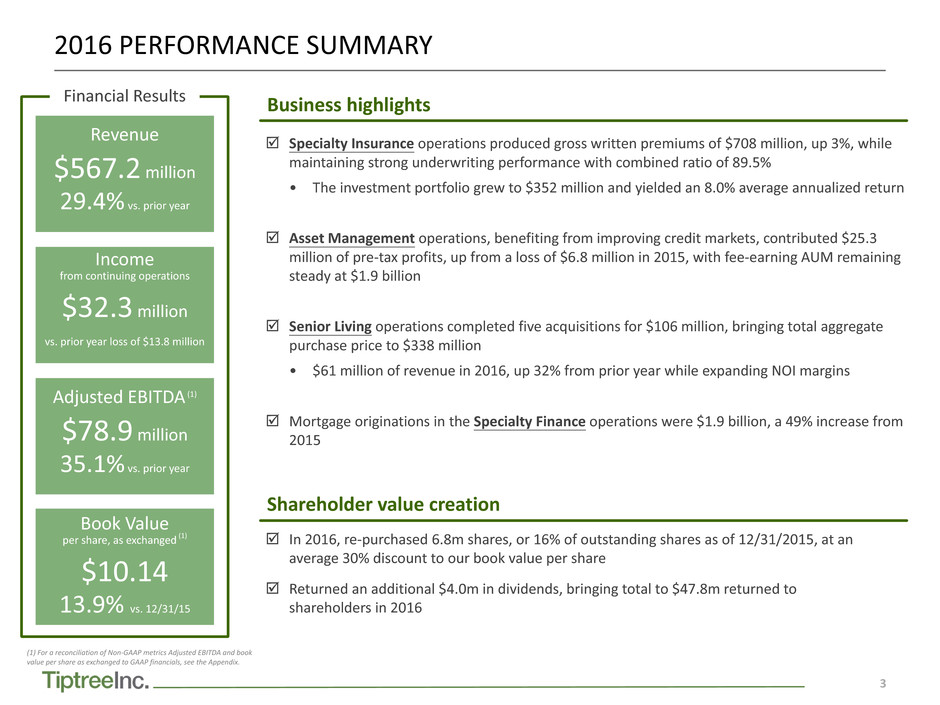

Revenue

$567.2 million

29.4% vs. prior year

Adjusted EBITDA (1)

$78.9 million

35.1% vs. prior year

Book Value

per share, as exchanged (1)

$10.14

13.9% vs. 12/31/15

Income

from continuing operations

$32.3 million

vs. prior year loss of $13.8 million

2016 PERFORMANCE SUMMARY

þ Specialty Insurance operations produced gross written premiums of $708 million, up 3%, while

maintaining strong underwriting performance with combined ratio of 89.5%

• The investment portfolio grew to $352 million and yielded an 8.0% average annualized return

þ Asset Management operations, benefiting from improving credit markets, contributed $25.3

million of pre-tax profits, up from a loss of $6.8 million in 2015, with fee-earning AUM remaining

steady at $1.9 billion

þ Senior Living operations completed five acquisitions for $106 million, bringing total aggregate

purchase price to $338 million

• $61 million of revenue in 2016, up 32% from prior year while expanding NOI margins

þ Mortgage originations in the Specialty Finance operations were $1.9 billion, a 49% increase from

2015

þ In 2016, re-purchased 6.8m shares, or 16% of outstanding shares as of 12/31/2015, at an

average 30% discount to our book value per share

þ Returned an additional $4.0m in dividends, bringing total to $47.8m returned to

shareholders in 2016

Business highlights

Shareholder value creation

(1) For a reconciliation of Non-GAAP metrics Adjusted EBITDA and book

value per share as exchanged to GAAP financials, see the Appendix.

Financial Results

4

2014 2015 2016

$(0.10)

$0.17

$0.78

($ in millions, except per share information)

2014 2015 2016

Market Enterprise Value (2) $503.5 $381.9 $380.7

TTM Adjusted EBITDA $58.9 $58.4 $78.9

Implied market EV multiple 8.5x 6.5x 4.8x

Book Enterprise Value (3) $541.1 $500.3 $526.1

Implied book EV multiple 9.2x 8.6x 6.7x

Diluted earnings per class A share

IMPROVING FINANCIAL PERFORMANCE

Tiptree enterprise value

• Focused, re-investment in core businesses

• Improved financial results in each operating segment

• Re-purchased 6.8m shares in 2016, or 16% of 12/31/15

outstanding, at an average 30% discount to book value

per share

(1) See the appendix for a reconciliation of book value per share as exchanged and Adjusted EBITDA

(2) Market Enterprise Value = share price on final day of each quarter multiplied by total Class A & B shares,

plus Secured Corporate Credit Agreements, plus preferred trust securities, plus NCI - other, less cash

(3) Book Enterprise Value = Total Stockholders Equity plus Secured Corporate Credit Agreements and

preferred trust securities, less cash

Operational drivers

Book value per share (1)

as exchanged

Adjusted EBITDA (1)

2014 2015 2016

$9.00 $8.90

$10.14

2014 2015 2016

$58.9 $58.4

$78.9

Total shares

outstanding

41.60 42.95 36.44

5

SEGMENT PERFORMANCE SUMMARY

43.3

60.5

(6.8)

25.3

6.6

10.5

5.9

10.5

(23.2) (27.9)

$32.5 (2)

($ in millions)

Senior Living

Corporate & Other

Specialty Finance

Specialty Insurance

Asset Management

$25.9

$78.9 Total: $20.5m increase

$58.4

(1) Adjusted EBITDA includes income from continuing and discontinued operations - see appendix for reconciliation.

(2) Discontinued Operations includes PFG operations and gain on sale for 2015

Pre-tax income

from continuing operations

Adjusted EBITDA(1)

The key drivers for improvement in performance include:

+ Specialty Insurance: revenue growth driven by increases in net written

premiums with improved investment income supporting growth in

earnings

+ Asset Management: increases driven by recovery of fair market valuations

and higher distributions on CLO sub-notes, combined with increases in

management incentive fees

+ Senior Living: improved margins at existing properties and addition of

rental and related income from acquisitions increased overall revenues

+ Specialty Finance: growth in mortgage origination volumes and gain on

sale margins as a result of strong market conditions and increased

production headcount

- Corporate: higher compensation, audit and consulting expenses driven by

efforts to improve financial infrastructure and increased incentive

compensation due to substantially improved performance

þ All material weaknesses remediated and our Corporate

infrastructure is substantially in place

32.0

46.8

(6.8)

25.3

(9.5)

(5.8)

6.3

8.2

$43.4

(34.4)

-$12.4

(31.1)

$43.3

$(12.4)

Senior Living

Specialty Finance

Specialty Insurance

Asset Management

Corporate & Other

Total: $55.7m increase

20162015

20162015

Year Ended December 31, 2016

KEY PERFORMANCE HIGHLIGHTS

7

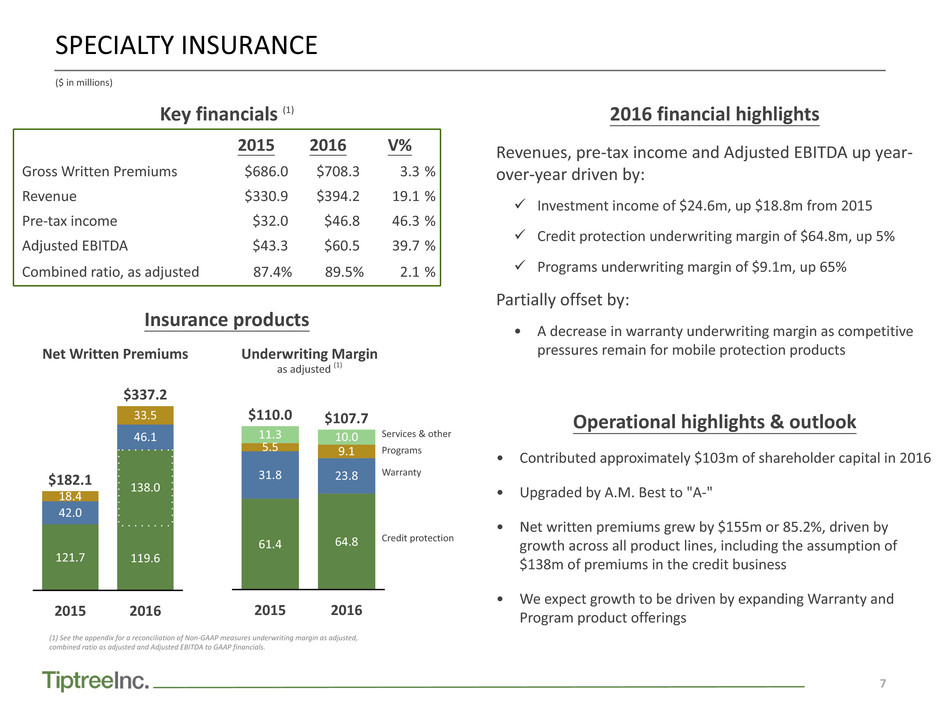

Key financials (1) 2016 financial highlights

Revenues, pre-tax income and Adjusted EBITDA up year-

over-year driven by:

ü Investment income of $24.6m, up $18.8m from 2015

ü Credit protection underwriting margin of $64.8m, up 5%

ü Programs underwriting margin of $9.1m, up 65%

Partially offset by:

• A decrease in warranty underwriting margin as competitive

pressures remain for mobile protection products

Operational highlights & outlook

• Contributed approximately $103m of shareholder capital in 2016

• Upgraded by A.M. Best to "A-"

• Net written premiums grew by $155m or 85.2%, driven by

growth across all product lines, including the assumption of

$138m of premiums in the credit business

• We expect growth to be driven by expanding Warranty and

Program product offerings

2015 2016 V%

Gross Written Premiums $686.0 $708.3 3.3 %

Revenue $330.9 $394.2 19.1 %

Pre-tax income $32.0 $46.8 46.3 %

Adjusted EBITDA $43.3 $60.5 39.7 %

Combined ratio, as adjusted 87.4% 89.5% 2.1 %

(1) See the appendix for a reconciliation of Non-GAAP measures underwriting margin as adjusted,

combined ratio as adjusted and Adjusted EBITDA to GAAP financials.

Underwriting Margin

as adjusted (1)

SPECIALTY INSURANCE

($ in millions)

Insurance products

Net Written Premiums

2015 2016

121.7 119.6

138.0

42.0

46.1

18.4

$182.1

33.5

$337.2

2015 2016

61.4 64.8

31.8 23.8

5.5 9.1

11.3

$110.0

10.0

$107.7

Programs

Warranty

Credit protection

Services & other

8

SPECIALTY INSURANCE - INVESTMENT PORTFOLIO

($ in millions)

Interest expense

Realized gains (losses)

Net Investment

Income

Unrealized gains

• Loans - $2.7

• Equities - $7.3

Investment income

Overview

We actively manage our investment portfolio to achieve a

balance of two primary objectives:

• Cash and liquid short and medium term securities to cover

near-term claims obligations

• Enhanced risk-adjusted returns through selective

alternative investments with a focus on longer-term

repeatable net investment income

2014 2015 2016

Cash & cash equivalents $11.1 $13.9 $26.0

Available for sale securities, at fair value 171.1 184.7 146.2

Equity securities, at fair value — 3.8 48.6

Loans, at fair value, net (2) — 60.1 103.9

Real estate, net — 2.2 23.6

Other investments 3.8 4.2 4.0

Net investments (2) $186.0 $268.9 $352.3

5.5

13.01.6

$5.7

10.0

(0.6)

4.7

(0.8) (3.2)

$24.6

20162015

2.5% 8.0% Average Annualized

Yield % (3)

2016 highlights

• Net investments grew $83.4 million, or 31% from year-

end 2015

• Significant improvement in our average annualized yield

driven by increased allocation to higher returning assets

Investments (1)

(1) See the appendix for a reconciliation of Non-GAAP measures net investments and net portfolio income to GAAP financials.

(2) Net of non-recourse asset based financing of $146.5 million and $54.0 million for 2016 and 2015, respectively

(3) Average Annualized Yield % represents the ratio of net investment income, realized and unrealized gains (losses) less investment

portfolio interest expense to the average of the prior five quarters total investments less investment portfolio debt plus cash.

9

As adjusted revenue components (1)

2016 financial highlights

Significant year-over-year improvement in pre-tax

income

• Fee revenue increases primarily driven by incentive fees on

older vintage CLOs

• $2.6m of unrealized and realized gains contributed positive

earnings

Recent developments and outlook

Recent sales reduced investments in CLOs to $41.4m

as of January 2017

Continuing to pursue growth opportunities

• Leveraging performance to target raising funds in other

vehicles or managed accounts

Key financials (1)

ASSET MANAGEMENT

2.6

15.7 14.7

15.7

12.0 10.7

12.2

9.0

3.6

2.9

(10.1)

(29.1)

-$0.1

$36.0

Other income

Distributions (sub-notes)

Unrealized & realized

gains (losses)

20152014

Average net assets,

at fair value$103.6$143.9

1) See the appendix for a reconciliation of Adjusted EBITDA and As Adjusted Revenue to GAAP financials.

(2) AUM is estimated and unaudited. Consists of NOPCB for CLOs, excludes Credit Opportunities Fund as it

was not earning third party fees as of 12/31/2016.

$(0.1) $33.4

2015 2016 $V

Fee-earning AUM(2) ($B) $1.9 $1.9 $0.0

Revenue $6.8 $13.1 $6.3

Income attributable to CLOs $(6.9) $20.3 $27.2

Pre-tax Income $(6.8) $25.3 $32.1

Adjusted EBITDA $(6.8) $25.3 $32.1

2016

$81.6

$26.6

Management &

incentive fees

As Adjusted Revenues

($ in millions)

10

2015 2016

$6.5

$7.7

Key financials (1) 2016 highlights and outlook

Improvement in pre-tax income of 38.9% primarily driven by

increases in rental revenue which outpaced higher depreciation

& other expenses from recently acquired properties

Adjusted EBITDA of $10.5m, up 59.1% driven by improving NOI

margins and acquisitions

Expect to see continued EBITDA growth through:

ü NOI improvement driven by increases in occupancy rates,

property improvements and expense management

ü Additional property acquisitions - Completed 2 acquisitions

in Jan/Feb for $24.7m aggregate purchase price

NOI by product

SENIOR LIVING

($ in millions)

(1) For explanation of Adjusted EBITDA, NOI, NOI Margin % and reconciliation

to GAAP real estate segment pre-tax income, see the Appendix.

(2) Includes accumulated depreciation and in-place lease amortization.

2015 2016

$38.9

$52.0

$9.6

$14.5

Managed properties Triple net leases

Revenues Net Operating Income

NOI

margin %

27.8% 24.6%

(1)

2015 2016 V%

Revenue $46.1 $60.7 31.7 %

Pre-tax income $(9.5) $(5.8) 38.9 %

Adjusted EBITDA $6.6 $10.5 59.1 %

Net Operating Income (NOI) $16.1 $22.1 37.3 %

Accumulated depreciation(2) $24.1 $38.2 58.5 %

Property type 2014 2015 2016*

Managed properties 106.6 135.7 220.3

NNN leases 42.7 97.2 106.6

Total purchase price $149.3 $232.9 $326.9

Debt outstanding 108.2 166.7 240.8

Average ownership 84.9% 87.8% 86.0%

Number of properties 13 24 28

Property overview

*Excludes $11.5m of real estate managed by Care and owned by our insurance subsidiary

11

Revenue

Adjusted EBITDA

WELL POSITIONED FOR 2017 AND BEYOND

Performance is expected to benefit from:

• Continued growth in specialty insurance written premiums

• Improvements in long-term, net investment income as our specialty

insurance investment portfolio grows with written premiums

• Increasing NOI in our senior living operations through stabilizing

existing properties and acquisitions

• A reduction in expenses over time as a result of improved corporate

infrastructure

• Re-investing capital from non-core asset sales into our businesses

2015 2016

$438.5

$567.2

2015 2016

25.9

$78.9

32.5

$58.4

2016 highlights

ü Significant improvement in financial performance

ü Further progress on moving toward more stable, repeatable earnings

ü Returned $47.8 million to shareholders through buy-backs and dividends

ü Continued to re-invest in core businesses

(1)

(1) See the appendix for a reconciliation of Adjusted EBITDA to GAAP financials.

Discontinued

operations

Continuing

operations

Looking ahead ...

APPENDIX

13

Management uses EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. The Company believes that use of these financial measures on a consolidated basis and for each segment

provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period, to analyze a company’s ability to service its debt and

to facilitate comparison among companies. The Company believes segment EBITDA and Adjusted EBITDA provides additional supplemental information to compare results among our segments. Adjusted

EBITDA is also used in determining incentive compensation for the Company’s executive officers. These measures are not a measurement of financial performance or liquidity under GAAP and should

not be considered as an alternative or substitute for net income. The Company’s presentation of these measures may differ from similarly titled non-GAAP financial measures used by other companies.

The Company defines EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income taxes and consolidated depreciation and amortization expense

as presented in its financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt incurred in the ordinary course of its subsidiaries’ business

operations, (ii) adjust for the effect of purchase accounting, (iii) add back significant acquisition related costs, (iv) adjust for significant relocation costs and (v) any significant one-time expenses.

NON-GAAP RECONCILIATIONS - EBITDA AND ADJUSTED EBITDA

($ in thousands, unaudited) Year Ended December 31,

2016 2015 2014

Net income (loss) available to Class A common stockholders $ 25,320 $ 5,779 $ (1,710)

Add: net (loss) income attributable to noncontrolling interests 7,018 3,023 6,294

Less: net income from discontinued operations — 22,618 $ 7,937

Income (loss) from Continuing Operations of the Company $ 32,338 $ (13,816) $ (3,353)

Consolidated interest expense 29,701 23,491 12,541

Consolidated income taxes 10,978 1,377 4,141

Consolidated depreciation and amortization expense 28,468 45,124 $ 11,945

EBITDA from Continuing Operations $ 101,485 $ 56,176 $ 25,274

Consolidated non-corporate and non-acquisition related interest expense(1) (19,183) (11,861) (7,265)

Effects of Purchase Accounting (2) (5,054) (24,166) —

Non-cash fair value adjustments (3) 2,693 (1,300) —

Significant acquisition expenses (4) 711 1,859 6,121

Separation expense adjustments (5) (1,736) 5,209 —

Adjusted EBITDA from Continuing Operations of the Company $ 78,916 $ 25,917 $ 24,130

Income from Discontinued Operations of the Company $ — $ 22,618 $ 7,937

Consolidated interest expense — 5,226 11,475

Consolidated income taxes — 3,796 5,525

Consolidated depreciation and amortization expense — 862 4,379

EBITDA from Discontinued Operations $ — $ 32,502 $ 29,316

Significant relocation costs (6) — — 5,477

Adjusted EBITDA from Discontinued Operations of the Company $ — $ 32,502 $ 34,793

Adjusted EBITDA of the Company $ 78,916 $ 58,419 $ 58,923

(1) The consolidated non-corporate and non-acquisition related interest expense is subtracted from EBITDA to arrive at Adjusted EBITDA. This includes interest expense associated with asset-specific debt at subsidiaries in the specialty insurance, asset

management, senior living and specialty finance segments.

(2) Following the purchase accounting adjustments, current period expenses associated with deferred costs were more favorably stated and current period income associated with deferred revenues were less favorably stated. Thus, the purchase

accounting effect related to Fortegra increased EBITDA above what the historical basis of accounting would have generated. The impact of this purchase accounting adjustments have been reversed to reflect an adjusted EBITDA without such purchase

accounting effect.

(3) For our senior living segment, Adjusted EBITDA excludes the impact of the change of fair value of interest rate swaps hedging the debt at the property level. For Reliance, Adjusted EBITDA excludes the impact of changes in contingent earn-outs.

(4) Acquisition costs include legal, taxes, banker fees and other costs associated with senior living acquisitions in 2016 and 2015 and the Fortegra acquisition in 2014.

(5) Consists of payments pursuant to a separation agreement, dated as of November 10, 2015.

(6) Significant relocation costs for discontinued operations included expenses incurred in connection with the move of PFAS’s physical location from New Jersey to Philadelphia for the year ended December 31, 2014.

14

Management uses EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. The Company believes that consolidated EBITDA and Adjusted EBITDA on a consolidated basis and for each

segment provide supplemental information useful to investors as it is frequently used by the financial community to analyze performance period to period, to analyze a company’s ability to service

its debt and to facilitate comparison among companies. The Company believes segment EBITDA and Adjusted EBITDA provides additional supplemental information to compare results among our

segments. Beginning in 2016 the Company Adjusted EBITDA will also be used in determining incentive compensation for the Company’s executive officers. These measures are not a measurement

of financial performance or liquidity under GAAP and should not be considered as an alternative or substitute for net income. The Company’s presentation of these measures may differ from similarly

titled non-GAAP financial measures used by other companies. The Company defines EBITDA as GAAP net income of the Company adjusted to add consolidated interest expense, consolidated income

taxes and consolidated depreciation and amortization expense as presented in its financial statements and Adjusted EBITDA as EBITDA adjusted to (i) subtract interest expense on asset-specific debt

incurred in the ordinary course of its subsidiaries’ business operations, (ii) adjust for the effect of purchase accounting, (iii) add back significant acquisition related costs, (iv) adjust for significant

relocation costs and (v) any significant one-time expenses.

NON-GAAP RECONCILIATIONS - EBITDA AND ADJUSTED EBITDA

Segment EBITDA and Adjusted EBITDA - Years Ended December 31, 2016, 2015 and 2014

($ in thousands) Specialty insurance Asset management Senior living Specialty finance Corporate and other Total

2016 2015 2014 2016 2015 2014 2016 2015 2014 2016 2015 2014 2016 2015 2014 2016 2015 2014

Pre-tax income/(loss) $ 46,804 $ 32,012 $ (3,171) $ 25,264 $ (6,753) $ 18,191 $ (5,824) $ (9,535) $ 3,171 $ 8,170 $ 6,265 $(1,962) $(31,098) $(34,428) $(15,441) $ 43,316 $(12,439) $ 788

Add back:

Interest expense 9,244 6,968 637 746 539 1,595 8,691 6,796 4,111 6,290 3,558 1,530 4,730 5,630 4,668 29,701 23,491 12,541

Depreciation and

amortization expenses 13,184 29,673 4,265 — — — 14,166 14,546 7,181 870 760 499 248 145 — 28,468 45,124 11,945

Segment EBITDA $ 69,232 $ 68,653 $ 1,731 $ 26,010 $ (6,214) $ 19,786 $ 17,033 $ 11,807 $ 14,463 $15,330 $10,583 $ 67 $(26,120) $(28,653) $(10,773) $101,485 $ 56,176 $25,274

EBITDA adjustments:

Asset-specific debt

interest (3,652) (1,138) (29) (746) (539) (1,595) (8,691) (6,796) (4,111) (6,094) (3,388) (1,530) — — — (19,183) (11,861) (7,265)

Effects of purchase

accounting (5,054) (24,166) — — — — — — — — — — — — — (5,054) (24,166) —

Non-cash fair value

adjustments — — — — — — 1,416 — — 1,277 (1,300) — — — — 2,693 (1,300) —

Significant acquisition

expenses — — 6,121 — — — 711 1,579 — — — — — 280 — 711 1,859 6,121

Separation expenses — — — — — — — — — — — — (1,736) 5,209 — (1,736) 5,209 —

Segment Adjusted

EBITDA $ 60,526 $ 43,349 $ 7,823 $ 25,264 $ (6,753) $ 18,191 $ 10,469 $ 6,590 $ 10,352 $10,513 $ 5,895 $(1,463) $(27,856) $(23,164) $(10,773) $ 78,916 $ 25,917 $24,130

15

NON-GAAP RECONCILIATIONS - BOOK VALUE PER SHARE, AS EXCHANGED

Management uses Book value per share, as exchanged, which is a non-GAAP financial measure. As exchanged assumes full exchange of the limited partners units of TFP for Tiptree Class A common

stock. Management believes the use of this financial measure provides supplemental information useful to investors as it is frequently used by the financial community to analyze company growth on

a relative per share basis.

Tiptree’s book value per share, as exchanged, was $10.14 as of December 31, 2016 compared with $8.90 as of December 31, 2015. Total stockholders’ equity, net of other non-controlling interests for

the Company was $369.5 million as of December 31, 2016, which comprised total stockholders’ equity of $390.1 million adjusted for $20.6 million attributable to non-controlling interest at certain

operating subsidiaries that are not wholly owned by the Company, such as Siena, Luxury and Care. Total stockholders’ equity, net of other non-controlling interests for the Company was $382.1 million

as of December 31, 2015, which comprised total stockholders’ equity of $397.7 million adjusted for $15.6 million attributable to non-controlling interest at subsidiaries that are not wholly owned by

the Company. Additionally, the Company’s book value per share is based upon Class A common shares outstanding, plus Class A common stock issuable upon exchange of partnership units of TFP

which is equal to the number of Class B outstanding shares. The total shares as of December 31, 2016 and December 31, 2015 were 36.4 million and 42.9 million, respectively.

(1) As of December 31, 2016, excludes 6,596,000 shares of Class A common stock held by subsidiaries of the Company. See Note 24—Earnings per Share, in the Form 10-K for December 31, 2016, for further discussion of potential dilution from warrants.

(2) Dilution impact from options in the money on Book Value per share is $0.19 per share as of December 31, 2016; Options expire June 30, 2017

Year ended December 31,

($ in thousands, unaudited, except per share information) 2016 2015 2014 2013 2012

Total stockholders’ equity $ 390,144 $ 397,694 $ 401,621 $ 396,900 $ 342,318

Less non-controlling interest - other 20,636 15,576 27,015 20,200 6,771

Total stockholders equity, net of non-controlling interests - other $ 369,508 $ 382,118 $ 374,606 $ 376,700 $ 335,547

Total Class A shares outstanding (1) 28,388 34,900 31,830 10,556 10,226

Total Class B shares outstanding 8,049 8,049 9,770 30,969 30,969

Total shares outstanding 36,437 42,949 41,601 41,525 41,195

Book value per share, as exchanged (2) $ 10.14 $ 8.90 $ 9.00 $ 9.07 $ 8.15

16

NON-GAAP RECONCILIATIONS - SPECIALTY INSURANCE

The following table provides a reconciliation between as adjusted underwriting margin and pre-tax income for the fiscal years ended December 31, 2016 and 2015. We generally limit the underwriting

risk we assume through the use of both reinsurance (e.g., quota share and excess of loss) and retrospective commission agreements with our partners (e.g., commissions paid adjust based on the

actual underlying losses incurred), which manage and mitigate our risk. Period-over-period comparisons of revenues are often impacted by the PORCs and clients’ choice as to whether to retain risk,

specifically with respect to the relationship between service and administration expenses and ceding commissions, both components of revenue, and the offsetting policy and contract benefits and

commissions paid to our partners and reinsurers. Generally, when losses are incurred, the risk which is retained by our partners and reinsurers is reflected in a reduction in commissions paid. In order

to better explain to investors the net financial impact of the risk retained by the Company of the insurance contracts written and the impact on profitability, we use the Non-GAAP metric - As Adjusted

Underwriting Margin. For the same reasons that we adjust our combined ratio for the effects of purchase accounting, VOBA impacts can also mask the actual relationship between revenues earned

and the offsetting reductions in commissions paid, and thus the period over period net financial impact of the risk retained by the Company. Expressed as a percentage, the combined ratio represents

the relationship of policy and contract benefits, commission expense (net of ceding commissions), employee compensation and benefits, and other expenses to net earned premiums, service and

administrative fees, and other income. Investors use this ratio to evaluate our ability to profitably underwrite the risks we assume over time and manage our operating costs. As such, we believe that

presenting underwriting margin and the combined ratio provides useful information to investors and aligns more closely to how management measures the underwriting performance of the business.

Year Ended December 31,

($ in thousands, unaudited) GAAP Non-GAAP adjustments Non-GAAP - As Adjusted

Revenues: 2016 2015 2016 2015 2016 2015

Net earned premiums $ 229,436 $ 166,265 $ — $ — $ 229,436 $ 166,265

Service and administrative fees 109,348 106,525 5,638 19,518 114,986 126,043

Ceding commissions 24,784 43,217 416 3,410 25,200 46,627

Other income 2,859 8,361 — — 2,859 8,361

Less underwriting expenses:

Policy and contract benefits 106,784 86,312 — — 106,784 86,312

Commission expense 147,253 105,751 10,745 45,166 157,998 150,917

Underwriting Margin - Non-GAAP $ 112,390 $ 132,305 $ (4,691) $ (22,238) $ 107,699 $ 110,067

Less operating expenses:

Employee compensation and benefits 37,937 38,786 — — 37,937 38,786

Other expenses 32,964 31,386 363 1,928 33,327 33,314

Combined Ratio 87.9% 77.9% — — 89.5% 87.4%

Plus investment revenues:

Net investment income 12,981 5,455 — — 12,981 5,455

Net realized and unrealized gains 14,762 1,065 — — 14,762 1,065

Less other expenses:

Interest expense 9,244 6,968 — — 9,244 6,968

Depreciation and amortization expenses 13,184 29,673 (3,282) (19,320) 9,902 10,353

Pre-tax income (loss) $ 46,804 $ 32,012 $ (1,772) $ (4,846) 45,032 27,166

17

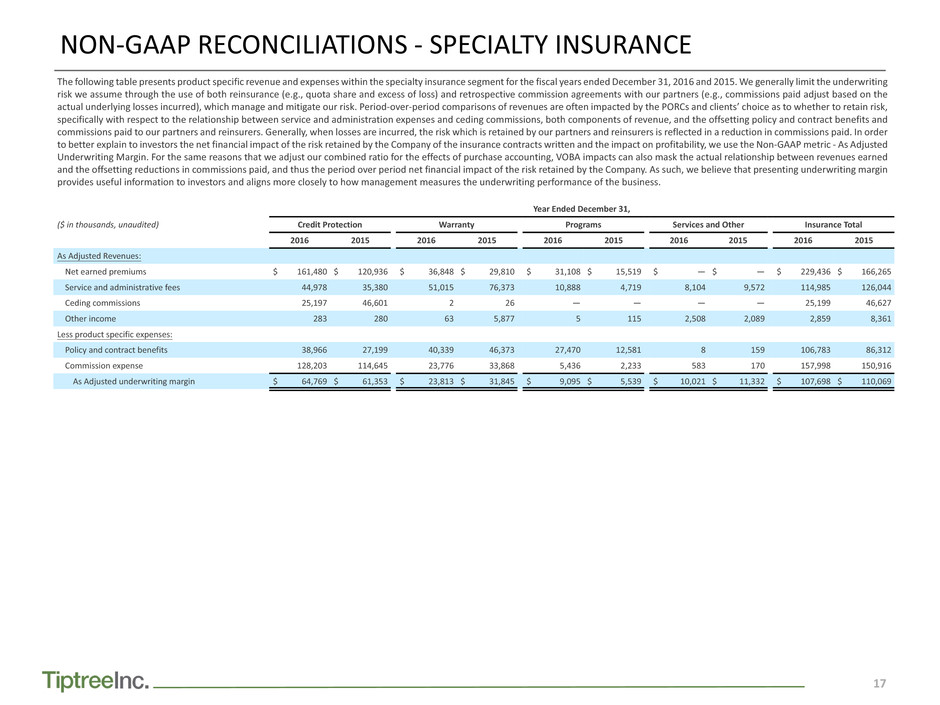

NON-GAAP RECONCILIATIONS - SPECIALTY INSURANCE

The following table presents product specific revenue and expenses within the specialty insurance segment for the fiscal years ended December 31, 2016 and 2015. We generally limit the underwriting

risk we assume through the use of both reinsurance (e.g., quota share and excess of loss) and retrospective commission agreements with our partners (e.g., commissions paid adjust based on the

actual underlying losses incurred), which manage and mitigate our risk. Period-over-period comparisons of revenues are often impacted by the PORCs and clients’ choice as to whether to retain risk,

specifically with respect to the relationship between service and administration expenses and ceding commissions, both components of revenue, and the offsetting policy and contract benefits and

commissions paid to our partners and reinsurers. Generally, when losses are incurred, the risk which is retained by our partners and reinsurers is reflected in a reduction in commissions paid. In order

to better explain to investors the net financial impact of the risk retained by the Company of the insurance contracts written and the impact on profitability, we use the Non-GAAP metric - As Adjusted

Underwriting Margin. For the same reasons that we adjust our combined ratio for the effects of purchase accounting, VOBA impacts can also mask the actual relationship between revenues earned

and the offsetting reductions in commissions paid, and thus the period over period net financial impact of the risk retained by the Company. As such, we believe that presenting underwriting margin

provides useful information to investors and aligns more closely to how management measures the underwriting performance of the business.

Year Ended December 31,

($ in thousands, unaudited) Credit Protection Warranty Programs Services and Other Insurance Total

2016 2015 2016 2015 2016 2015 2016 2015 2016 2015

As Adjusted Revenues:

Net earned premiums $ 161,480 $ 120,936 $ 36,848 $ 29,810 $ 31,108 $ 15,519 $ — $ — $ 229,436 $ 166,265

Service and administrative fees 44,978 35,380 51,015 76,373 10,888 4,719 8,104 9,572 114,985 126,044

Ceding commissions 25,197 46,601 2 26 — — — — 25,199 46,627

Other income 283 280 63 5,877 5 115 2,508 2,089 2,859 8,361

Less product specific expenses:

Policy and contract benefits 38,966 27,199 40,339 46,373 27,470 12,581 8 159 106,783 86,312

Commission expense 128,203 114,645 23,776 33,868 5,436 2,233 583 170 157,998 150,916

As Adjusted underwriting margin $ 64,769 $ 61,353 $ 23,813 $ 31,845 $ 9,095 $ 5,539 $ 10,021 $ 11,332 $ 107,698 $ 110,069

18

The investment portfolio consists of assets contributed by Tiptree, cash generated from operations, and from insurance premiums written. The investment portfolio of our regulated insurance

companies, captive reinsurance company and warranty business are subject to different regulatory considerations, including with respect to types of assets, concentration limits, affiliate transactions

and the use of leverage. Our investment strategy is designed to achieve attractive risk-adjusted returns across select asset classes, sectors and geographies while maintaining adequate liquidity to

meet our claims payment obligations.

In managing our investment portfolio we analyze net investments and net portfolio income, which are non-GAAP measures. Our presentation of net investments equals total investments plus cash

and cash equivalents minus asset based financing of investments. Our presentation of net portfolio income equals net investment income plus realized and unrealized gains and losses and minus

interest expense associated with asset based financing of investments. Net investments and net portfolio income are used to calculate average annualized yield, which management uses to analyze

the profitability of our investment portfolio. Management believes this information is useful since it allows investors to evaluate the performance of our investment portfolio based on the capital at

risk and on a non-consolidated basis. Our calculation of net investments and net portfolio income may differ from similarly titled non-GAAP financial measures used by other companies. Net investments

and net portfolio income are not measures of financial performance or liquidity under GAAP and should not be considered a substitute for total investments or net investment income.

NON-GAAP RECONCILIATIONS - SPECIALTY INSURANCE

($ in thousands, unaudited) Year Ended December 31,

2016 2015 2014

Total Investments $ 472,800 $ 308,965 $ 174,900

Investment portfolio debt (146,544) (54,011) —

Cash and cash equivalents 26,020 13,909 11,072

Net investments - Non-GAAP $ 352,276 $ 268,863 $ 185,972

Net investment income 12,981 5,455 279

Realized gains (losses) 4,720 (568) 5

Unrealized gains (losses) 10,042 1,633 —

Interest expense (3,155) (832) —

Net portfolio income - Non-GAAP $ 24,588 $ 5,688 $ 284

Average Annualized Yield % (1) 8.0% 2.5% NM%

(1) Average Annualized Yield % represents the ratio of net investment income, realized and unrealized gains (losses) less investment portfolio interest expense to the average of the prior five quarters total investments less investment portfolio debt plus cash.

NM% represents “not meaningful” as the results in the table represent one month of Fortegra income.

19

NON-GAAP RECONCILIATIONS - ASSET MANAGEMENT

The Company earns revenues from CLOs under management, whether consolidated or deconsolidated, which include fees earned for managing the CLOs, distributions received from the Company’s

holdings of subordinated notes issued by the CLOs and realized and unrealized gains and losses from the Company’s holdings of subordinated notes. The revenue associated with the management

fees and distributions earned and gains and losses on the subordinated notes attributable to the consolidated CLOs are reported as “net income (loss) attributable to the consolidated CLOs” in the

Company’s financial statements. The table below shows the Company’s share of the results attributable to the CLOs, which were consolidated, on a deconsolidated basis. This presentation is a non-

GAAP measure. Management believes this information is helpful for period-over-period comparative purposes as certain of our CLOs were consolidated for only some of the periods presented below.

In addition, the Non-GAAP presentation allows investors the ability to calculate management fees as a percent of AUM, a common measure used by investors to evaluate asset managers, and which

is one of the performance measures upon which management is compensated. While consolidation versus deconsolidation impacts the presentation of revenues, it does not impact expenses or pre-

tax income.

Year Ended December 31,

($ in thousands, unaudited) GAAP Non-GAAP adjustments Non-GAAP - As Adjusted

2016 2015 2014 2016 2015 2014 2016 2015 2014

Revenues:

Management fee income $ 9,400 $ 6,524 $ 259 $ 2,752 $ 4,131 $ 11,770 $ 12,152 $ 10,655 $ 12,029

Distributions — — — 15,725 14,676 15,720 15,725 14,676 15,720

Net realized and unrealized gains (losses) 66 (3,599) (2,143) 2,510 (25,480) (7,965) 2,576 (29,079) (10,108)

Other income 3,648 3,845 9,002 (733) (216) — 2,915 3,629 9,002

Total revenues $ 13,114 $ 6,770 $ 7,118 $ 20,254 $ (6,889) $ 19,525 $ 33,368 $ (119) $ 26,643

20

NON-GAAP RECONCILIATIONS - SENIOR LIVING

In addition to Adjusted EBITDA, we also evaluate performance of our senior living segment based on net operating income (“NOI”), which is a non-GAAP measure. NOI is a common non-GAAP measure

in the real estate industry used to evaluate property level operations. We consider NOI an important supplemental measure to evaluate the operating performance of our senior living segment because

it allows investors, analysts and our management to assess our unlevered property-level operating results and to compare our operating results between periods and to the operating results of other

senior living companies on a consistent basis. It is also the basis upon which the management fees paid to the operators of our Managed Properties are calculated, and is a significant component of

the compensation paid to Care’s management team. We define NOI as rental and related revenue less property operating expense. Property operating expenses and resident fees and services are

not relevant to Triple Net Lease Properties since we do not manage the underlying operations and substantially all expenses are passed through to the tenant. Our calculation of NOI may differ from

similarly titled non-GAAP financial measures used by other companies. NOI is not a measure of financial performance or liquidity under GAAP and should not be considered a substitute for pre-tax

income.

(1) NOI Margin % is the relationship between Segment NOI and rental and related revenue.

($ in thousands, unaudited) Year Ended December 31, 2016 Year Ended December 31, 2015 Year Ended December 31, 2014

NNN

Operations

Managed

Properties

Senior Living

Total

NNN

Operations

Managed

Properties

Senior Living

Total

NNN

Operations

Managed

Properties

Senior Living

Total

Rental and related revenue $ 7,663 $ 51,973 $ 59,636 $ 6,515 $ 38,857 $ 45,372 $ 3,892 $ 16,350 $ 20,242

Less: Property operating expenses 37,502 37,502 29,279 29,279 10,571 10,571

Segment NOI $ 7,663 $ 14,471 $ 22,134 $ 6,515 $ 9,578 $ 16,093 $ 3,892 $ 5,779 $ 9,671

Segment NOI Margin % (1) 27.8% 24.6% 35.3%

Other income $ 1,095 $ 757 $ 9,039

Less: Expenses

Interest expense 8,691 6,796 4,111

Payroll and employee commissions 2,702 2,181 2,185

Depreciation and amortization 14,166 14,546 7,182

Other expenses 3,494 2,862 2,061

Pre-tax income (loss) $ (5,824) $ (9,535) $ 3,171