Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - JANUS CAPITAL GROUP INC | a2231243zex-31_2.htm |

| EX-31.1 - EX-31.1 - JANUS CAPITAL GROUP INC | a2231243zex-31_1.htm |

| EX-10.22 - EX-10.22 - JANUS CAPITAL GROUP INC | a2231243zex-10_22.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15253

Janus Capital Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

43-1804048 (I.R.S. Employer Identification No.) |

|

151 Detroit Street, Denver, Colorado (Address of principal executive offices) |

80206 (Zip Code) |

(303) 333-3863

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|---|---|---|

| Common Stock, $ 0.01 Per Share Par Value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2016, the aggregate market value of common equity held by non-affiliates was $2,595,834,364. As of February 10, 2017, there were 184,300,141 shares of the Company's common stock, $0.01 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

This Amendment No. 1 to Form 10-K (this "Amendment") amends the Annual Report on Form 10-K for Janus Capital Group Inc. for the year ended December 31, 2016 originally filed on February 16, 2017 (the "Original Filing"). We are filing this Amendment to present the information required under Part III of Form 10-K, and to amend Part IV, Item 15 to file Exhibit 10.22. In addition, as required by Rule 12b-15 under the Exchange Act, new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amendment under Part IV, Item 15.

Other than as set forth above, no other items or sub-items of the Original Filing are being revised by this Amendment. Information in the Original Filing is generally stated as of December 31, 2016, and this Amendment does not reflect any subsequent information or events other than those described above.

Capitalized terms not otherwise defined in this Amendment shall have the meanings ascribed to them in the Original Filing.

1

Item 10. Directors, Executive Officers and Corporate Governance

Directors

Jeffrey J. Diermeier, Eugene Flood, Jr., J. Richard Fredericks, Deborah R. Gatzek, Lawrence E. Kochard, Arnold A. Pinkston, Glenn S. Schafer, Richard M. Weil, Billie I. Williamson, and Tatsusaburo Yamamoto are the current directors of the Company, holding office until the 2017 annual shareholders meeting or until their successors are elected and qualify. Ages shown below are as of February 24, 2017.

| Director | Skills and Qualifications | |

| Jeffrey J. Diermeier, 64 | In determining that Mr. Diermeier should serve as a director of the Company, the Board of Directors identified Mr. Diermeier's extensive oversight experience related to financial reporting and corporate governance standards as a trustee of the Board of the Financial Accounting Foundation, CFA Institute experience, mutual fund and investment adviser oversight experience while at UBS, corporate oversight as a member of several boards of directors and committees, and his general executive management experience at UBS and its predecessor entity. | |

| Company | ||

• Director of the Company since March 2008 Other current experience • Director of the University of Wisconsin Foundation (a non-profit fundraising and endowment management organization) and former chairman of its investment committee • Director of Adams Street Partners (a private equity firm) since January 2011 • Co-owner and Chairman of L.B. White Company (a heating equipment manufacturer) since 2010 Previous experience • Trustee of the Board of the Financial Accounting Foundation (oversees the Financial Accounting Standards Board and the Government Accounting Standards Board) from January 2009 to December 2015, and Chairman of the Trustees from November 2012 to December 2015 • President and Chief Executive Officer of the CFA Institute (a non-profit educational organization for investment professionals) from 2005 to January 2009 • Advisory board member of Stairway Partners, LLC (a registered investment adviser) from March 2005 to December 2012 and currently a minority owner • Chief Investment Officer of UBS Global Asset Management from 2000 to 2004; prior to that, beginning in 1975, worked on the buy-side, principally overseeing asset allocations and running the fundamental equity team • Chartered Financial Analyst designation |

2

| Director | Skills and Qualifications | |

| Eugene Flood, Jr., 61 | In determining that Mr. Flood should serve as a director of the Company, the Board of Directors identified Mr. Flood's extensive investment management, mutual fund and investment adviser experience as a trustee for CREF and TIAA-CREF, his senior management experience with Smith Breeden Associates and Morgan Stanley, and his economic-focused academic background. Mr. Flood has a Ph.D. in Economics from the Massachusetts Institute of Technology. | |

| Company | ||

• Director of the Company since January 2014 Other current experience • Director of Research Corporation for Science Advancement since 2015 • Member of Board of Trustees of the Financial Accounting Foundation since January 2016 • Chairman, Advisory Board, Institute for Global Health and Infectious Diseases, University of North Carolina, Chapel Hill • Managing Partner, Next Sector Capital, LLC • Member of Steering Board of the Eshelman Institute, the Eshelman School of Pharmacy, University of North Carolina, Chapel Hill Previous experience • Director of The Foundation for the Carolinas, a non-profit group, from 2012 to 2015 • Executive Vice President of TIAA-CREF from 2011 until his retirement in 2012 • Member of the CREF Board of Trustees and TIAA-CREF Mutual Fund Board of Trustees for seven years, chairing the investment committee • President and Chief Executive Officer of Smith Breeden Associates (a North Carolina-based fixed income asset manager) for 12 years • A range of trading and investment positions with Morgan Stanley from 1987 to 1999 • Assistant Professor of Finance at Stanford Business School from 1982 to 1987 |

3

| Director | Skills and Qualifications | |

| J. Richard Fredericks, 71 | In determining that Mr. Fredericks should serve as a director of the Company, the Board of Directors identified Mr. Fredericks' extensive investment management, security analyst, and investment banking experience and his corporate oversight experience as a member of several boards of directors. | |

| Company | ||

• Director of the Company since October 2006 Other current experience • Managing Director of the money management firm Main Management LLC • Director of Cadence Bancorp LLC • Member of the Library of Congress Trust Fund Board since 2004 • Director on the boards of several non-profit organizations Previous experience • International advisory board member of Komatsu Ltd. from 2003 to 2005 • Director of Chiron Corporation until it was acquired by Novartis International AG from February 2003 to April 2006 • U.S. Ambassador to both Switzerland and Liechtenstein from 1999 to 2001 • Director of BanCorp Hawaii in 1999 • Banc of America Securities (formerly Montgomery Securities), initially as a partner and later as Senior Managing Director, from 1977 to 1999 |

4

| Director | Skills and Qualifications | |

| Deborah R. Gatzek, 68 |

In determining that Ms. Gatzek should serve as a director of the Company, the Board of Directors identified Ms. Gatzek's extensive experience in mutual fund, broker dealer, investment adviser, and corporate governance matters in her roles

as the chief legal adviser at ING Americas and Franklin Resources; as a partner at Stradley, Ronan, Stevens & Young; and as special counsel for the SEC. The Board of Directors also considered her legal, academic, and general executive

management experiences in senior and executive positions at ING Americas; Franklin Resources; and Stradley, Ronan, Stevens & Young. Ms. Gatzek's experience with public company filings, business practices, and strategies also benefits

the Board. Company • Director of the Company since March 2004 Other current experience • Securities law attorney • Serves on the boards of three non-profit organizations • Principal, Oversight and Governance Solutions, LLC Previous experience • Chief Counsel to the Mutual Fund and Broker Dealer subsidiaries of ING Americas (an investment management firm) from 2001 to 2003 • Partner at the law firm of Stradley, Ronan, Stevens & Young from 2000 to 2001 • Senior Vice President and General Counsel of Franklin Resources, Inc. (an investment management firm) from 1983 through 1999 • Special Counsel for the SEC and Regional Counsel for FINRA |

5

| Director | Skills and Qualifications | |

| Lawrence E. Kochard, 60 |

In determining that Mr. Kochard should serve as a director of the Company, the Board of Directors identified Mr. Kochard's extensive experience related to investment management, investment adviser oversight, general executive management

and his economic-focused academic background while a senior executive officer on the investment teams of University of Virginia, Georgetown University, Virginia Retirement System, Fannie Mae, and The Goldman Sachs Group. Mr. Kochard has a Ph.D.

in Economics from the University of Virginia. Company • Director of the Company since March 2008 Other current experience • Chief Executive Officer of the University of Virginia Investment Management Company since January 2011 • Member of the Investment Advisory Committee of the Virginia Retirement System since March 2011 • Member of the Board and Chair of the Investment Committee for the Virginia Environmental Endowment since April 2013 • Member of the Board of the Virginia Commonwealth University Investment Management Company since May 2015 Previous experience • Chairman of the College of William & Mary Investment Committee from October 2005 to October 2011 • Chief Investment Officer for Georgetown University from 2004 to 2010 • Managing Director of Equity and Hedge Fund Investments for the Virginia Retirement System from 2001 to 2004 • Assistant Professor of Finance at the McIntire School of Commerce at the University of Virginia from 1999 to 2001 • Financial analysis and planning, corporate finance, and capital markets roles with DuPont de Nemours and Company, Fannie Mae, and The Goldman Sachs Group, Inc. • Chartered Financial Analyst designation |

6

| Director | Skills and Qualifications | |

| Arnold A. Pinkston, 58 |

In determining that Mr. Pinkston should serve as a director of the Company, the Board of Directors identified Mr. Pinkston's significant experience in the development, implementation, and coordination of business strategies, enterprise

risk management, and corporate ethics practices, and his expertise in corporate and board of directors governance and corporate compliance in his roles as Executive Vice President and General Counsel at Allergan, Inc., Senior Vice President and

General Counsel at Beckman Coulter, Inc., and Vice President and Deputy General Counsel of Eli Lilly and Company, and as a member of several boards of directors. Company • Director of the Company since January 2016 Other current experience • Director, Sustainability Accounting Standards Board since January 2016 Previous experience • Executive Vice President and General Counsel for Allergan, Inc. from October 2011 to March 2015 • Senior Vice President, General Counsel, and Secretary for Beckman Coulter from November 2005 to May 2011 • Vice President for Eli Lilly and Company from March 1994 to November 2005 • Deputy General Counsel for Eli Lilly and Company from January 1999 to November 2001 and February 2003 to November 2005 • Director of OneOC, a non-profit company, from 2008 to 2015 and Chairman from 2013 to 2014 • Director of St Vincent Health hospital system from 2003 to 2005 • Director of Indianapolis Local Public Improvement Bond Bank from 2002 to 2005 • Director of Innocentive, Inc., a crowd source innovative solutions company, from 2003 to 2005 • Director of Southwest Autism Research Center from 1998 to 1999 • Director of Valley Big Brothers and Big Sisters, a non-profit company, from 1996 to 1998 • Director of Bay Area Urban League, a non-profit company, from 1993 to 1995 |

7

| Director | Skills and Qualifications | |

| Glenn S. Schafer, 67 |

In determining that Mr. Schafer should serve as a director of the Company, the Board of Directors identified Mr. Schafer's extensive accounting and financial experience as a former Chief Financial Officer at Pacific Life, investment and

capital management experience as a senior executive and board member of Pacific Life, corporate oversight experience as a member of several boards of directors and committees, and general executive management experience as a senior executive and

board member of Pacific Life. Company • Director of the Company since December 2007 • Chairman of the Board of Directors since April 27, 2012 Other current experience • Director of Mercury General Corporation since October 2015 (a publicly traded insurance company) • Director of Genesis Healthcare, Inc. since 2006 (the successor company resulting from the combination of Skilled Healthcare Group, Inc., to which Mr. Schafer was a director, and Genesis Healthcare, LLC) (a nursing and assisted living facilities company) • Director of GeoOptics LLC (a weather satellite manufacturer) Previous experience • Director of the Michigan State University Foundation (a non-profit fundraising corporation) from 2004 to 2014 • Board of Directors for Scottish Re Group from 2006 to 2007 • Vice Chairman of Pacific Life Insurance Company from April 2005 until his retirement in December 2005 • Member of Pacific Life Insurance Company's board of directors and President of Pacific Life from 1995 to 2005 • Executive Vice President and Chief Financial Officer of Pacific Life from 1991 to 1995 • Non-executive Chairman of Beckman Coulter, Inc. (a biomedical testing products developer and manufacturer) from 2009 to 2011 |

8

| Director | Skills and Qualifications | |

| Richard M. Weil, 53 |

In determining that Mr. Weil should serve as a director of the Company, the Board of Directors believes that the CEO of the Company should be a member of the Board of Directors and identified Mr. Weil's extensive business and legal

experience in the investment management industry; his general executive management experience as a senior executive officer at PIMCO; and as a lawyer at Simpson Thacher & Bartlett LLP. The Board of Directors also considered his

extensive experience in the development and oversight of global company operations. Company • Chief Executive Officer and a director of the Company since February 2010 • Member of the Company's executive committee since February 2010 • Member of the Board of Directors of the Company's subsidiaries, INTECH Investment Management LLC ("INTECH") and Perkins Investment Management LLC ("Perkins") Previous experience • Global head of Pacific Investment Management Company LLC ("PIMCO") Advisory (an investment management firm) from February 2009 until joining Janus in February 2010 • Member of the board of trustees for the PIMCO funds from February 2009 to February 2010 • PIMCO's Chief Operating Officer from 2000 to 2009, during which time he: • led the development of PIMCO's global business; • founded PIMCO's German operations; • was responsible for PIMCO's operations, technology, fund administration, finance, human resources, legal, compliance, and distribution functions; • managed PIMCO's non-U.S. offices; and • served on PIMCO's executive committee • General counsel for PIMCO Advisors LP from January 1999 to August 2000 • Bankers Trust Global Asset Management from 1994 to 1995 in their hedge fund business • Attorney with the law firm Simpson Thacher & Bartlett LLP in New York from September 1989 to 1994 • Member of Security Industry and Financial Markets Association's ("SIFMA") board of directors and chaired the SIFMA asset management industry group until 2010 |

9

| Director | Skills and Qualifications | |

| Billie I. Williamson, 64 |

In determining that Ms. Williamson should serve as a director of the Company, the Board of Directors identified Ms. Williamson's significant expertise in financial reporting and audit process. The Board also considered her understanding of

technology control implementation and protocols for businesses dealing in foreign countries as a Senior Global Client Serving Partner at Ernst & Young L.L.P. and her corporate oversight, financial reporting, and controls experience as a

member of several boards of directors and audit and financial committees. Ms. Williamson is a Certified Public Accountant. Company • Director of the Company since March 2015 Other current experience • Director and member of Audit Committee of Pentair plc (an industrial machinery company) since 2014 • Director and Chairman of the Audit Committee of Energy Future Holdings Corporation (the largest private utility in Texas) since February 2013 • Director and Chairman of the Audit Committee, and member of the Executive Committee of CSRA, Inc. (a software and technology company serving the public government sector) since November 2015 • Co-Chairman of the Dallas Chapter of Women Corporate Directors • Director of the North Texas Chapter of the National Association of Corporate Directors ("NACD") and a NACD Leadership Fellow • Director on the boards of several non-profit organizations Previous experience • Director and member of Audit and Nominating Corporate Governance Committees of Exelis Inc. (a global aerospace, defense, information and services company) from January 2012 until completion of the sale of the Company in May 2015 • Senior Global Client Serving Partner at Ernst & Young L.L.P. from 1998 until retirement in December 2011, and served on the Americas Executive Board of Ernst & Young L.L.P. • Lead Independent Director and member of Audit, Compensation, and Transaction Committees of Annie's Inc. from March 2012 until completion of the sale of the company in October 2014 • Senior Vice President, Finance and Corporate Controller at Marriott International, Inc. from 1996 to 1998 • Chief Financial Officer of AMX Corporation from 1993 to 1996 |

10

| Director | Skills and Qualifications | |

| Tatsusaburo Yamamoto, 52 |

In determining that Mr. Yamamoto should serve as a director of the Company, the Board of Directors identified Mr. Yamamoto's extensive experience in the financial services industry outside of the U.S. and his roles in management in the

investment planning, asset management and international business management departments of The Dai-ichi Life Insurance Company, Limited ("Dai-ichi Life"), Executive Officer and Chief of Asset Management Business Unit of Dai-ichi Life Holdings,

Inc. and Managing Director of Dai-ichi Life (Asia Pacific). The Board of Directors also considered his experience and familiarity with the Company's management team. Company • Director of the Company since July 2015 • Mr. Yamamoto was appointed director on July 24, 2015, after being designated by Dai-ichi Life as its representative for appointment to the Company's Board. This right was granted to Dai-ichi Life as a result of the Investment and Strategic Cooperation Agreement (the "Strategic Agreement") between Dai-ichi Life and the Company. In accordance with the Strategic Agreement, Dai-ichi Life was granted the right to designate a representative for appointment to the Company's Board after it acquired at least 15% of the issued and outstanding shares of the Company's stock, with such right continuing as long as Dai-ichi Life maintains ownership of at least 15% of the issued and outstanding shares of the Company's common stock or until the right is otherwise terminated in accordance with the terms of the Strategic Agreement. Before his appointment to the Board, the Nominating Committee met with Mr. Yamamoto, reviewed his background and business experience, and determined that Mr. Yamamoto possessed the membership criteria for non-employee directors as set forth in the Governance Guidelines. Other current experience • Joined Dai-ichi Life in 1988 supporting numerous key areas related to investment planning, asset management, and international business management • Executive Officer and Chief of Asset Management Business Unit of Dai-ichi Life Holdings, Inc. since October 2016; Executive Officer and General Manager, Investment Planning Department of Dai-ichi Life since 2015; General Manager, Investment Planning Department of Dai-ichi Life since 2014; Managing Director of Dai-ichi Life (Asia Pacific) from 2011 to 2014 |

11

Executive Officers

All executive officers are elected annually by the Board of Directors and serve at the discretion of the Board. The executive officers shown below and Richard M. Weil are considered our "named executive officers" ("NEOs") for purposes of this Amendment. Ages shown below are as of February 24, 2017.

Richard M. Weil's biographical information is included under "Directors" on page 9.

Bruce L. Koepfgen, 64 — Mr. Koepfgen joined Janus in May 2011 as Executive Vice President. In July 2011, Mr. Koepfgen was named CFO of Janus, and in August 2013, he was named President of Janus. He also serves as President and Chief Executive Officer of the Janus Investment Fund and Janus Aspen Series Trusts (appointed in July 2014), and the recently established Detroit Street Trust and Clayton Street Trust (appointed to both in February 2016). Mr. Koepfgen is a member of the Janus executive committee, INTECH's board of directors, and Perkins's board of managers, and works with senior leaders to advance the interests of Janus's clients, shareholders, and employees. Prior to joining Janus, Mr. Koepfgen was Co-CEO of Allianz Global Investors Management Partners and CEO of Oppenheimer Capital from 2003 to 2009. From August 2010 through October 2011, Mr. Koepfgen was a director of the Mortgage Guaranty Insurance Corporation, and was a director of Thermo Fisher Scientific from May 2005 through September 2008. Mr. Koepfgen was previously a managing director of Salomon Brothers Inc. where he held various positions from 1976 to 1999, and he was president and principal of Koepfgen Company LLC, a management consulting organization, from 1999 to 2003.

Enrique Chang, 54 — Mr. Chang has served as President, Head of Investments of Janus since April 2016. Mr. Chang has more than 28 years of financial industry experience. Upon joining Janus in September 2013, Mr. Chang was Chief Investment Officer, Equities and Asset Allocation. Mr. Chang has also served as a Portfolio Manager on the Janus Global Allocation strategies since 2015 and as a member of the Janus executive committee since 2013. From 2006 to 2013, Mr. Chang held various positions at American Century Investments, headquartered in Kansas City, MO, including serving as chief investment officer and executive vice president from 2007 to 2013, as well as a corporate board of director of American Century Investments from 2007 to 2013. Mr. Chang served as president and chief investment officer for Munder Capital Management from 2004 to 2006. Prior to that, he held a number of senior investment management positions at Vantage Global Advisor (from 1997 to 2000), J&W Seligman and Co. (1997) and General Reinsurance Corporation (from 1993 to 1997).

Jennifer McPeek, 47 — Ms. McPeek is Executive Vice President and Chief Financial Officer of Janus. Ms. McPeek was appointed CFO of Janus in August 2013 and was appointed as Executive Vice President in January 2014. Prior to taking over as CFO, Ms. McPeek was Senior Vice President of Corporate Finance and Treasurer overseeing the Financial Planning, Investor Relations, Treasury, and Corporate Development functions. In Ms. McPeek's current role, she serves as a member of the Janus executive committee and oversees Janus's finance, corporate accounting, and tax departments. Prior to joining Janus in 2009, Ms. McPeek was senior vice president of strategic planning at ING Investment Management — Americas Region from 2005 to 2009. Ms. McPeek was previously an Associate Principal at McKinsey and Company in their corporate strategy and finance practice from 1995 to 2001, and previously worked in the investment banking industry for Bank of Boston and Goldman, Sachs & Company from 1991 to 1995. Ms. McPeek holds the Chartered Financial Analyst designation.

Augustus Cheh, 49 — Mr. Cheh joined Janus in March 2011 as President of Janus International (a division of Janus), and oversees Janus's non-U.S. businesses in Europe, Asia Pacific, and Latin America. Mr. Cheh is also Executive Vice President of Janus Capital Management LLC and a member of the Janus executive committee. Prior to joining Janus, Mr. Cheh was at AllianceBernstein

12

from 2003 to 2011. He was serving as CEO of Asia ex-Japan when he left in 2011, with oversight responsibility for the institutional, retail, and Bernstein sell-side businesses for the Asia region. Mr. Cheh was the global director of investments at PricewaterhouseCoopers from 2000 to 2003. From 1994 to 2000, Mr. Cheh was at J.P. Morgan Investment Management where he started as a senior quantitative research analyst. Later on, he was a trader of U.S. government and money market securities, and subsequently, he was a fixed income portfolio manager where he managed short-duration and intermediate-duration strategies and other fixed income portfolios. He was also portfolio manager of the JP Morgan U.S. Short Duration Bond Fund. Before joining J.P. Morgan Investment Management, Mr. Cheh was a management and actuarial consultant at Towers Perrin from 1991 to 1994.

Officer Code of Ethics

Our Officer Code of Ethics for the CEO and Senior Financial Officers (including our CEO, Chief Financial Officer ("CFO"), and Chief Accounting Officer) (the "Officer Code") is available on our website at ir.janus.com in the "Governance Documents" section and is reviewed by the Nominating Committee. Any amendments to or waivers of the Officer Code will be disclosed on our website at ir.janus.com in the "Governance Documents" section.

Audit Committee

The members of the Audit Committee are Jeffrey J. Diermeier, Deborah R. Gatzek, Arnold A. Pinkston and Billie I. Williamson, each of whom is independent under the standards established by the Board and the NYSE. Mr. Diermeier is Chairman of the Audit Committee.

Audit Committee Financial Expert

The Board has determined that each member of the Audit Committee meets the accounting or related financial management expertise requirements of the NYSE and that Mses. Gatzek and Williamson and Messrs. Diermeier and Pinkston qualify as "audit committee financial experts" under applicable SEC regulations. No member of the Audit Committee serves on an audit committee of more than two public companies in addition to Janus.

Item 11. Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis ("CD&A") provides shareholders with a detailed description of the Company's executive compensation philosophy, programs, and process, explains the compensation decisions the Compensation Committee (defined as the "Committee" for purposes of this CD&A) has made under those programs, and describes the factors considered in making those decisions.

Executive Summary

The Committee believes that shareholders' interests are best served when executive compensation is tied to Company performance. Our compensation programs are designed to:

- •

- Align the interests of Janus executives, shareholder and clients;

- •

- Help attract and retain top-performing executives; and

- •

- Reward executives for achieving investment, financial and strategic objectives, while mitigating risk-taking that may be harmful to Janus, its shareholders and clients.

13

Further, the Committee believes that executives should be appropriately rewarded for successfully executing the Company's long-term strategy, which is based on a three-prong approach that focuses on investment performance, financial performance and strategic results. (See page 19 for a more detailed discussion of the Company's long-term strategy.)

Company Results

Investment

The Committee and management recognized that the Company's largest Janus equity and fixed income strategies, as well as INTECH, underperformed in 2016. In Janus's fundamental equity platform, as of December 31, 2016, only 46%, 81% and 73% of mutual fund assets were performing in the top half of their Morningstar categories on a one-, three- and five-year basis, compared to 84%, 70%, and 62% at the end of 2015. Only 11%, 16% and 84% of fixed income mutual fund assets were performing in the top half of their Morningstar categories as of December 31, 2016 on a one-, three- and five-year basis, compared to 82%, 100%, and 82% at the end of 2015. And 0%, 6% and 15% of INTECH strategies were outperforming their benchmarks (net of fees) on a one-, three- and five-year basis as of December 31, 2016, compared to 74%, 53%, and 67% at the end of 2015.

Financial

Total revenue in 2016 declined approximately 6% compared to 2015, and adjusted operating income dropped by approximately 15% compared to 2015. In addition, the underperformance of the Company's largest fundamental equity and mathematical equity strategies led to a decline in performance fees, $(37) million in 2016 compared to $(10) million in 2015. Despite a decline in revenue and operating income, the Company maintained a strong balance sheet during the year and generated $262 million of cash flow from operations. Additionally, over the course of 2016, the Company returned $149 million to shareholders in the form of share repurchases and regular dividends, which was equivalent to 57% of annual cash flow from operations. For a reconciliation of adjusted operating income with generally accepted accounting principles, please see page 33 of our Original Filing.

Strategy

On October 3, 2016, the Company announced a proposed merger with Henderson Group plc. The merger of the two firms is expected to:

- •

- expand the client-facing teams and our distribution presence across major client segments around the world.

- •

- create a firm with a more diverse, more scalable product offering with increased depth and breadth of investment teams, supporting more

consistent outcomes for clients across a broader range of investment strategies. In addition, the complementary investment expertise creates enhanced coverage of active investment strategies across

markets — in both traditional and alternative strategies.

- •

- result in a company with a more diversified revenue mix, stronger scale and meaningful operational synergies, which will lead to increased

stability and profitability for our shareholders and allow the new firm to continue to grow and invest in new opportunities throughout market cycles.

- •

- create an environment with increased opportunity for our employees.

During 2016, the Company posted its 8th consecutive year of organic growth in the fixed income business and the 6th consecutive year of organic growth for the non-U.S. business. Additionally, the

14

U.S. Intermediary channel had $2.8 billion of net flows during the year, a 5% organic growth rate, which compared favorably on a relative basis to meaningful outflows across the U.S. active mutual fund industry.

2016 Executive Compensation

The Committee continued to utilize the scorecard approach used in prior years to drive decisions around CEO compensation and maintain the proper alignment with Company performance. Despite achieving an 86% shareholder approval for our executive compensation program again in 2016, the Committee continues to evaluate the structure of the CEO's and other NEO's compensation, particularly the elements of their variable compensation to ensure the compensation program meets the objectives set out above and aligns the interests of Janus executives, shareholders and clients. The Committee, aided by Aon Hewitt and McLagan Partners, Inc. (collectively, the "Compensation Consultants"), did not make any modifications to the structure of the executive compensation program for 2016.

Based on the results described above and in more detail throughout this CD&A, the Committee rated the CEO down for investment results, neutral for financial results, and up for strategic results, and accordingly set the CEO's total compensation for 2016 at $7.69 million, which is 124% of target and an 8% decline from 2015 total compensation. Please see page 16 for more detail regarding the Committee's decisions about CEO pay.

Analysis of Pay for Performance

This section describes (i) how the CEO's 2016 compensation is tied to the Company's performance and (ii) the process by which the Committee determined the CEO's 2016 compensation.

Tying CEO Compensation to Company Performance

The Committee believes that executives should be appropriately rewarded for successfully executing the Company's long-term business strategy, while optimizing current year operating results. The current business strategy focused on investment performance, client service, financial strength, and Intelligent Diversification continues to meet the evolving needs of the Company's clients. The Committee believes that executive compensation decisions, and in particular, the CEO compensation decisions, should give reasonable weight to the achievement of strategic business goals designed to generate long-term results for clients and shareholders. To do otherwise would undermine motivation of key executive talent during a critical time in the Company's evolution.

2016 CEO Compensation Structure

The CEO's compensation structure is based upon the same factors used by the Company to evaluate its business. This structure aligns CEO compensation with factors that the Committee believes drive long-term value for shareholders and clients. As illustrated in the table below and consistent with the process implemented for prior years, the Committee utilized a scorecard for 2016 in which 30% of the CEO's variable compensation was based on delivering investment excellence for clients, 30% was based on driving financial results for shareholders, and the final 40% was

15

based on executing the strategy, including various Intelligent Diversification initiatives, which should generate better long-term results for clients and shareholders.

Weighting

|

Objectives | Performance Factors | ||

|---|---|---|---|---|

| 30% | Deliver investment excellence for clients | • 1-, 3- and 5-year investment performance |

||

| 30% | Drive financial results for shareholders | • Total company net flows • Operating income and margin growth • Maintain a strong balance sheet and continue returning capital to shareholders |

||

| 40% | Drive strategic results for long-term success for clients and shareholders | • Deliver on client promises • Execute Intelligent Diversification initiatives • Ensure operational excellence |

For 2016, 60% of the CEO's variable compensation was dependent upon delivering investment excellence for clients and driving financial results for shareholders. This weighting balances client and shareholder expectations and aligns most of the CEO's variable compensation with results that drive value for each of these important stakeholders. The Committee determined it was appropriate to tie the remaining 40% of variable compensation to the execution of the Company's overall business strategy, including our ongoing commitment to client service, delivering operational excellence, and executing the various Intelligent Diversification initiatives focused on diversifying product offerings, distribution capabilities, and geographic presence.

Compensation Committee Decisions about CEO Pay

Setting Total Variable Compensation Target

The Committee established a total variable compensation target for Mr. Weil's 2016 compensation. In its analysis, the Committee reviewed the median variable compensation for the Company's Public Company Peer Group as provided by its Compensation Consultants. The Committee also considered the Company's revenue and total AUM as compared to the revenue and total AUM of the companies in the Public Company Peer Group, as well as relative performance against these peers. In addition, the Committee considered the complexity of the Company's business as compared to the companies in the Public Company Peer Group. The market data provided by the Committee's Compensation Consultants indicates a median CEO variable compensation amount for the Company's Public Company Peer Group of approximately $8.4 million. For the aforementioned reasons, the Committee adjusted this amount downwards by approximately one-third and set the CEO's variable compensation target at $5.6 million. See "Compensation Decision-Making Process — Peer Groups" on page 26 for more detail.

Evaluating CEO and Business Performance

Having established the total variable compensation target amount for Mr. Weil, the Committee completed a rigorous assessment of Mr. Weil's performance relative to specific 2016 investment, financial, and strategic objectives mentioned in the table above and described in more detail below. As previously mentioned, the Committee assigned a weighting to each of the three categories of objectives to identify for shareholders how their relative importance relates to the Company's overall success, and, therefore, to shareholder value. The Committee then rated Mr. Weil's performance against each of these factors to determine an overall performance rating.

16

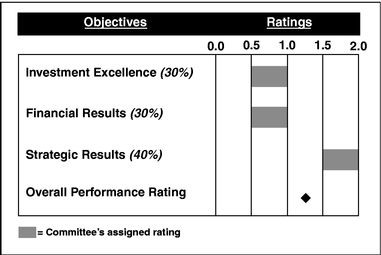

The Committee's evaluation of the CEO's performance involved: (i) completing an assessment of the CEO's overall performance versus each objective; (ii) using the following table to identify a ratings range for each set of objectives; and (iii) determining an overall performance ratings range in consideration of actual performance and the assigned weights.

Rating

|

Ranges of the Committee's Evaluation of Performance | |

|---|---|---|

| 0.0 to 0.5 |

Significant decline in absolute performance year-over-year Bottom quartile performance relative to the applicable peer group or Morningstar ratings |

|

| 0.6 to 1.0 | Slight decline to flat in absolute performance year-over-year Slightly below median performance relative to the applicable peer group or Morningstar ratings |

|

| 1.1 to 1.5 |

Slight to moderate increase in absolute performance year-over-year Slightly above median performance relative to the applicable peer group or Morningstar ratings |

|

| 1.6 to 2.0 | Significant increase in absolute performance year-over-year First or high second quartile performance relative to the applicable peer group or Morningstar ratings |

The Committee's determination of a ratings range for each of the weighted objectives was determined by reviewing:

- •

- The Company's year-over-year absolute results for each measure;

- •

- The Company's relative performance for each measure compared with the Company's Public Company Peer Group (excluding Ameriprise

Financial, Inc. and Waddell & Reed Financial, Inc., which have a business mix that differs from Janus's and therefore are less relevant for comparison purposes); and

- •

- Primarily with respect to the strategic results objectives, other factors that the Committee deemed important in evaluating the CEO's performance, including progress in executing the Company's multi-year strategic initiatives, financial market conditions, and the impact of performance fees on the Company's revenues.

Below are the highlights of the results from each area of evaluation (Investment Excellence, Financial Results, and Strategic Results) that the Committee took into account when determining the CEO's compensation for 2016.

Investment Excellence

Weight

|

Objective | Performance Factors | ||

|---|---|---|---|---|

30% |

Deliver investment excellence for clients | • 1-, 3- and 5-year investment performance |

Fundamental Equity: As of December 31, 2016, 46%, 81%, and 73% of mutual fund assets were performing in the top half of their Morningstar categories on a one-, three-, and five-year basis, respectively, compared to 84%, 70%, and 62% of mutual fund assets at the end of 2015.

Fixed Income: As of December 31, 2016, 11%, 16%, and 84% of mutual fund assets were performing in the top half of their Morningstar categories on a one-, three-, and five-year basis, respectively, compared to 82%, 100%, and 82% of mutual fund assets at the end of 2015.

Mathematical Equity: As of December 31, 2016, 0%, 6%, and 15% of relative return strategies were outperforming their benchmarks, net of fees, on a one-, three-, and five-year basis, compared to 74%, 53%, and 67% of relative return strategies at the end of 2015.

17

The Committee's Evaluation of Investment Excellence: Based on (i) significant declines in the short-term investment performance of the Company's fundamental equity and fixed income strategies; (ii) balanced by solid long-term investment performance for both the fundamental equity and fixed income strategies; and (iii) below benchmark performance of the mathematical equity strategies, the Committee assigned a rating of 0.6 to 1.0 to the objective of "Investment Excellence" in 2016. This represents a decline from the prior year rating of 1.1 to 1.5.

Financial Results

Weight

|

Objective | Performance Factors | ||

|---|---|---|---|---|

| 30% | Drive financial results for shareholders | • Total company net flows • Operating income and margin growth • Maintain a strong balance sheet and continue returning capital to shareholders |

The Company's 2016 business performance and financial results were largely driven by a $66 million decline in revenue compared to the prior year. The year-over-year decline was driven by an increase in negative performance fees, as a result of underperformance in the Janus Equity and INTECH strategies, as well as lower management fees. 2016 business performance and financial results are as follows:

- •

- Total Company Net Flows: Total

company long-term net flows in 2016 of $(3.0) billion compared to $(2.6) billion in 2015, and $(4.9) billion in 2014. The Company is encouraged with net inflows of $1.3 billion in the Fixed

Income strategies during the year following the leadership change that took place for this business at the end of the first quarter of 2016.

- •

- Operating Income and

Margin: Operating income of $262 million in 2016 was down 19% compared to 2015, resulting in an operating margin of 26% for 2016 compared

to 30% in 2015.

- •

- Adjusted Operating Income and

Margin: 2016 operating income adjusted for merger-related costs of $275 million was down 15% compared to 2015, resulting in an operating

margin of 27% for 2016 compared to 30% in 2015. See page 33 of the Original Filing for detail on Non-GAAP adjustments.

- •

- Balance Sheet and Returning Cash to

Shareholders: The Company maintained a strong balance sheet during the year and generated $262 million of cash flow from operations.

Additionally, over the course of 2016, the Company returned $149 million to shareholders in the form of share repurchases and regular dividends, which was equivalent to 57% of annual cash flow

from operations.

- •

- Total Shareholder Return: Total one-year shareholder return through December 31, 2016 was (3)% compared to 2% for the Company's Public Company Peer Group and 12% for the S&P 500.

The Committee's Evaluation of Financial Results: Based on the slight decline in total company net flows year-over-year, the decline in operating margins largely due to a drop in performance fee revenues, the Company's strong balance sheet, and the continued return of capital to shareholders, the Committee assigned a rating of 0.6 to 1.0 to the objective of "Financial Results" in 2016. This represents a decline from the prior year rating of 1.1 to 1.5 to this objective.

18

Strategic Results

Weight

|

Objective | Performance Factors | ||

|---|---|---|---|---|

| 40% | Drive strategic results for long-term success for clients and shareholders | • Deliver on client promises • Execute Intelligent Diversification initiatives • Ensure operational excellence |

The Company's multi-year strategic plan focuses on investment performance, client service, financial strength, and Intelligent Diversification. Intelligent Diversification includes several growth initiatives, including growing the fixed income business by maximizing the opportunities for the fundamental and global macro strategies, expanding our non-U.S. distribution capabilities, strengthening our U.S. Intermediary distribution capabilities, and further advancing our diversification through organic and potentially inorganic research, development, and investment. The strategic results section of the scorecard focuses on the progress achieved in executing the Intelligent Diversification initiatives and on other key strategic priorities during the year.

- •

- Announced Merger of Equals: The

Company announced a transformational merger of equals with Henderson Group plc in 2016. This merger represents a significant opportunity for clients, shareholders and employees of the Company.

- •

- Grow the Fixed Income

Business: Following a change in leadership in early 2016, the Fixed Income business had $1.3 billion of net flows, an organic growth rate

of 3%, marking the 8th consecutive year of organic growth for this business. Encouragingly, growth during the year came from both Retail and Institutional clients in both the U.S.

and non-U.S. markets.

- •

- Expand Non-U.S. Distribution

Capabilities: Non-U.S. distribution finished 2016 with $2.7 billion in net flows, an organic growth rate of 6%, representing the

6th consecutive year of organic growth for this business, and the company's strategic relationship with Dai-ichi Life continues to assist with ongoing growth in Japan.

- •

- Strengthen U.S. Intermediary Distribution: The U.S. Intermediary channel had $2.8 billion of net flows, a 5% organic growth rate, which compared favorably on a relative basis to meaningful outflows across the U.S. active mutual fund industry. Additionally, during the year, the company expanded its wholesaling team to continue capitalizing on momentum in the channel

The Committee's Evaluation of Strategic Results: Based on the transformational merger with Henderson Group plc, the significant achievements executing the Intelligent Diversification initiatives and the progress on numerous key strategic priorities during 2016, including asset retention in the fixed income business, and demonstrated strength of the U.S. and non-U.S. distribution teams, the Committee assigned a rating of 1.6 to 2.0 to the objective of "Strategic Results" in 2016. This represents an increase from the prior year rating of 1.1 to 1.5.

Overall Performance Rating

Based on the investment performance, financial results, and the progress executing the Company's strategic initiatives described above, the Committee established the cumulative "Overall Performance Rating" rating at 1.1 to 1.5 for 2016, which is consistent with the rating the Committee established in 2015.

19

Summary of the Committee's

Evaluation of CEO Compensation:

Actual Total Compensation

The CEO's actual total compensation for 2016 was $7.69 million, consisting of a base salary of $0.575 million and total variable compensation of $7.11 million. The CEO's variable compensation represented approximately 93% of his total direct compensation in 2016. The 8% year-over-year decline in CEO total compensation is aligned with the Company's absolute and relative performance and remains situated under the median total compensation amount when compared to the Company's Public Company Peer Group.

Base Salary: Since joining Janus in 2010, Mr. Weil's base salary has only been adjusted once, from $500,000 to $575,000 at the beginning of 2015. The Committee continues to believe that Mr. Weil should be compensated almost exclusively through variable compensation and determined not to issue an increase in Mr. Weil's base salary for 2017.

Actual Total Variable Compensation: The CEO's actual total variable compensation award was determined by multiplying the $5.6 million target total variable compensation amount by the Committee-determined Overall Performance Rating. Total variable compensation was awarded 50% as a cash bonus and 50% in LTI awards. The value of the CEO's LTI awards were granted as follows:

- •

- 50% in the form of a restricted stock award that will vest in four equal and consecutive annual installments, with the first installment

vesting one year after the date of grant; and

- •

- 50% in the form of a performance share unit ("PSU") award that may or may not vest, in whole or in part, three years after the date of grant, at the end of the performance period. The PSUs have a one-year holding period following vesting, and dividends are not paid on unvested PSUs. See page 36 for additional details regarding Mr. Weil's PSU award for 2016.

PSU Award Vesting: Mr. Weil's 2013 PSU award vested at 54.33% of target in 2017, for a total of 53,110 stock units. The vesting provision for this award of 97,747 units was 3-year cumulative operating margin from 2014 through 2016, adjusted for merger-related costs in 2016 (totaling $13.3 million). Cumulative margin for this period was 29.2%, versus a target of 31.0%, and a vesting range between 27% and 35%.

20

Other NEO Compensation

This section describes how each of the other NEO's compensation is tied to performance for 2016. When determining the amount of compensation paid to the other NEOs, as described below, the Committee considered, among other factors, the following:

- •

- The Committee's evaluation of each of the other NEOs, and the CEO's evaluation of other NEOs performance;

- •

- Alignment between individual compensation and the objectives of the Company's compensation programs, which are aligned with Company profits;

- •

- Individual performance and contributions to investment, financial, and strategic goals, such as those listed in the

"Analysis of Pay for Performance" section beginning on page 15;

- •

- Alignment of pay to performance (i.e., median pay for median

performance);

- •

- Market compensation levels and structures for similarly situated executives that reflect the scope and characteristics of Janus operations and

each of the other NEOs' individual responsibilities;

- •

- The results of recent say-on-pay votes and related discussions with shareholders;

- •

- Individual expertise, skills, knowledge, and tenure in position; and

- •

- The continued evolution of the Company's compensation programs and the related recommendations of the Committee's Compensation Consultants.

Ultimately, it is the Committee's judgment of these factors, along with competitive data, that form the basis for determining the other NEOs' compensation.

Other NEO Compensation Decisions

Base Salary

Base salary represents a small proportion of our other NEOs' compensation (11% in 2016) and salary increases are rare, as the Committee believes the other NEOs should receive a significant portion of their compensation as variable compensation as it better correlates to Company performance. The Committee determined that no salary increases were warranted for any NEO for 2017.

Variable Compensation

The Committee emphasizes variable compensation as the primary element of the other NEOs' compensation program, illustrated by the fact that 89% of the other NEOs' total direct compensation was variable compensation and not guaranteed, including 37% in the form of LTI awards.

Tying Other NEO Compensation to Performance

Variable compensation awards paid to the other NEOs are based upon their contributions toward Company-wide investment performance, financial results, and strategic priorities, as well as their performance compared to individual objectives. These awards are determined following an assessment of each of the other NEOs:

- •

- Contribution toward Company performance against the scorecard objectives:

- •

- deliver investment excellence for clients,

- •

- drive financial results for shareholders, and

21

- •

- drive strategic results for long-term success.

- •

- Performance compared to individual objectives which reflect the unique responsibilities and opportunities of each role.

Based upon each of the other NEOs' individual performance and contributions to the Company's objectives, 2016 variable compensation awards for the NEOs are in alignment with Company results. Compared to 2015, variable compensation awards for NEOs (excluding Mr. Chang, who was not a NEO in 2015) were all down 12%.

The compensation described above differs from the amounts shown in the "Summary Compensation Table" on page 31 because the above compensation shows variable compensation associated with 2015 performance that was determined and paid to the other NEOs in 2016.

While there is no specific weighting, nor is there a requirement that individual contributions be measured across scorecard objectives, each of the other NEOs made meaningful contributions toward the following Company objectives described in the scorecard approach used to assess the CEO's performance, which were considered by the Committee in establishing variable compensation awards for 2016:

- •

- Mr. Koepfgen partnered with distribution leadership in U.S. Intermediary to continue to upgrade talent and drive positive

results. The business saw $2.8 billion of net flows in 2016 (a 5% organic growth rate), despite industry headwinds in active retail.

- •

- Mr. Koepfgen led both the U.S. Intermediary and U.S. Institutional businesses through Gibson Smith's departure as CIO,

Fixed Income. Firm-wide asset retention in Fixed Income products was strong, with overall net flows totaling $1.3 billion despite the leadership change.

- •

- Overall growth in U.S. Institutional remains slower than internal expectations.

- •

- Mr. Koepfgen oversaw a reorganization of Janus' Product and Marketing department, which now has expanded capabilities in

thought leadership, Janus Labs, and digital marketing.

- •

- Mr. Koepfgen was among those instrumental to the discussions around and eventual announcement of the merger of equals with Henderson Group plc, and has been leading the integration efforts since the announcement on October 3, 2016.

Bruce L. Koepfgen, President

- •

- Mr. Chang assumed the role of President, Head of Investments on April 1, 2016, and now oversees all Equity,

Fundamental Fixed Income, and Asset Allocation Investments professionals. Before then, he had been CIO, Equity and Asset Allocation since his hire in September, 2013.

- •

- Mr. Chang's tenure as head of all Equity products now exceeds 3 years, and during that time risk-adjusted returns in

Equity strategies have been strong overall on a 3-year performance basis, with 81% of Fundamental Equity AUM in the top half of their Morningstar categories as of December 31, 2016.

- •

- Short-term Investment performance fell short of expectations in 2016, with only 46% of Fundamental Equity and 11% of Fixed Income products in the top half of their Morningstar categories as of December 31, 2016.

Enrique Chang, President, Head of Investments

22

- •

- Mr. Chang fostered a smooth transition for the Fundamental Fixed Income team after Gibson Smith's departure as CIO, Fixed

Income. He also led an effort during 2016 to create Investment Policy Statements for all Fixed Income products.

- •

- Mr. Chang was a key partner in broad firm strategy discussions, including those around the planned merger of equals with Henderson Group plc.

- •

- Ms. McPeek was integral to many of the processes leading up to the announced merger of equals with Henderson

Group plc, including financial due diligence, financial forecasting/synergy estimation, strategic communication with Janus' Board of Directors, and new role/responsibility design for new

Executive Committee.

- •

- Since the merger announcement, Ms. McPeek has assumed additional responsibilities, including oversight of the

Operations & Technology departments, which will be under her purview once the merger is complete.

- •

- Ms. McPeek continues to oversee the Company's cost management and budgeting processes. 2016 financial results declined from

2015, as Operating Income (adjusted for deal-related expenses) fell 15%. Adjusted operating margin also fell from 29.9% in 2015 to 27.2% in 2016.

- •

- During 2016, Ms. McPeek also led the structuring, due diligence, and successful completion of investment in LongTail Alpha.

- •

- Since Ms. McPeek became CFO in 2013, the Company has executed a robust share repurchase program, maintained a strong balance sheet, and has been instrumental in driving increases in the quarterly dividend each year. In 2016, the Company generated $262 million of cash flow from operations and returned $149 million to shareholders in the form of dividends and share repurchases, which is a payout ratio of 57%.

Jennifer J. McPeek, Executive Vice President and CFO

- •

- Mr. Cheh has led the Non-US business since he joined the Company in 2011. Beginning in 2012, net flows have been positive

in each year, and AUM has more than tripled, hitting high watermarks for six consecutive years at a compound annual growth rate (CAGR) of 28%.

- •

- In 2016, International organic growth was $2.7 billion, representing a 6% growth rate. As of December 31, 2016, the

Non-US business constituted 24% of the firm's total AUM, as compared with 8%* when he joined Janus in March 2011.

- •

- Mr. Cheh was among those instrumental in retaining the majority of Fixed Income AUM with International clients after Gibson

Smith's departure as CIO, Fixed Income.

- •

- Mr. Cheh worked to improve Key Performance Indicator transparency and channel-level reporting for the International

business during 2016, leading to more precise analysis and measurement of business results.

- •

- Mr. Cheh expanded relationships with large global distributors and key clients during 2016, positioning the business for future success.

Augustus Cheh, President of Janus International

- *

- Number is adjusted from previously 2011 AUM numbers to exclude assets in Canada in order to be consistent with how Janus currently calculates Non-US AUM.

23

Elements of Executive Compensation

In addition to compensation amounts that are competitive and appropriate, the Committee intends for the compensation program to be internally fair and equitable relative to roles, responsibilities, and relationships among NEOs. Accordingly, the Committee also considers other factors in the process of determining compensation levels for each NEO, other than the CEO, including those factors described elsewhere in this CD&A.

Compensation Program Objectives

The Committee believes that Janus provides pay for performance programs that are externally competitive and internally equitable (similar pay opportunities for similar roles and responsibilities), and that support the following compensation program objectives:

- •

- Alignment: Align the interests of executives with those of both

shareholders and clients.

- •

- Pay for Performance: Reward performance against investment, financial, and

strategic (non-financial) results over the short- and long-term.

- •

- Competitive Pay: Attract, retain and motivate top performing executives by

offering competitive total compensation opportunities.

- •

- Risk Management: Mitigate and control excessive risk-taking that could harm the Company's business, its shareholders, or its clients.

Principal Components of the Janus Pay for Performance Approach

Base Salary

Janus pays base salaries to attract talented executives and to provide a fixed amount of cash compensation. Base salaries for the NEOs are individually determined by the Committee, in consultation with the Compensation Consultants, and reflect the NEOs level of responsibility, expertise, skills, knowledge, and experience. The Committee determines the base salary amounts for the upcoming fiscal year each December.

Variable Compensation

Other than for the CEO, President, and CFO, variable compensation for all Janus employees is generally paid out of a pool of funds equal to a percentage of consolidated operating income before the deduction of incentive compensation ("pre-incentive operating income"). The overall pools from which variable compensation awards are granted are a function of the Company's performance in any given year. Based on underperformance in the Company's largest Janus equity and fixed income strategies, as well as INTECH, and declines in both revenue and operating income in 2016, there was a notable decrease in the Company's variable compensation pools in 2016.

Variable compensation is awarded in the form of cash and LTI awards (consisting of a mix of PSUs, restricted stock, and mutual fund unit ("MFUs") awards in 2016). Half of the CEO's compensation is in the form of LTI awards, and the other NEOs receive a significant portion of their variable compensation in the form of LTI awards.

Why Variable Compensation Is Divided Between Cash and LTI

Variable compensation awards to NEOs are typically granted as a combination of cash and equity (in the form of LTI awards), with equity comprising a significant portion of the total variable compensation award. By awarding a portion of the total variable compensation award as cash, the Committee is able to provide appropriate short-term incentives for the NEOs, which is an important

24

retention element of our overall compensation philosophy. Awarding a significant portion of the total variable compensation award as equity serves two fundamental compensation objectives: (i) LTI awards reinforce a longer-term focus that balances the short-term nature of the cash award; and (ii) when used in conjunction with the stock ownership guidelines, LTI awards ensure the NEOs acquire and maintain a meaningful stock position in the Company, which creates a strong alignment between the interests of the NEOs and the long-term interests of Janus shareholders. Stock ownership levels for each NEO are reviewed annually by the Committee and evaluated against the minimum stock ownership guidelines as described under "Ownership Guidelines" on page 28. As of February 24, 2017, Mr. Weil's equity ownership exceeded 20 times his base salary.

As set forth in the "Summary Compensation Table" on page 31, the Company issued the following types of long-term incentives for NEOs in 2016:

Title

|

Type of Awards | Vesting Schedule | ||

|---|---|---|---|---|

CEO |

50% Restricted Stock | 4-year ratable time-based vesting (i.e., 25% each year) | ||

|

50% Performance Share Units | 3-year cliff performance-based vesting, based on 3-year relative TSR | ||

President |

85% Restricted Stock | 4-year ratable time-based vesting (i.e., 25% each year) | ||

|

15% Mutual Fund Unit Awards | 4-year ratable time-based vesting (i.e., 25% each year) | ||

President, Head of Investments |

56% Restricted Stock | 4-year ratable time-based vesting (i.e., 25% each year) | ||

|

44% Mutual Fund Unit Awards | 4-year ratable time-based vesting (i.e., 25% each year) | ||

Other NEOs |

100% Restricted Stock | 4-year ratable time-based vesting (i.e., 25% each year) |

Why the Committee Grants Long-Term Incentive Awards

The Committee grants LTI awards to our CEO and the other NEOs in the form of restricted stock awards ("RSA"s), PSUs and MFUs. LTI grants account for a significant portion of NEO compensation to provide alignment between executive compensation and the interests of our shareholders and fundholders. RSAs are the most common form of awards for the other NEOs. In 2016, the CEO received half of his LTI in the form of PSUs which vest based upon three-year relative total share return (defined below), and the President and President, Head of Investments received a portion of their respective LTI in the form of MFUs, which is appropriate given their respective roles in the Company. The Committee evaluates and determines the appropriate forms and mix of LTI awards on a periodic basis, including consideration of the market data provided by the Compensation Consultants. In keeping with its goal of providing market competitive compensation to the Company's executives, the Committee determined that RSAs would be the primary form of LTI award granted to the other NEOs in 2016.

Compensation Decision-Making Process

The Committee determines the levels and type of compensation paid to the NEOs. The Committee also considers the scope of each NEOs responsibilities, skills, and talents, demonstrated leadership capabilities, compensation relative to similarly situated peers, and Company and individual performance on an absolute and relative basis. External factors, such as market compensation levels, unforeseen issues that arise during the year that may lead to a change or reprioritization of

25

pre-established goals or objectives, and Compensation Consultant recommendations, are also taken into consideration.

Risk Considerations

The Committee, in consultation with the Board and management, reviews the material terms of the Company's compensation policies and programs for all employees, and identifies compensation-related risks that are reasonably likely to have a material adverse impact on Janus, as well as features of the Company's compensation programs that could encourage excessive risk-taking. The Compensation Committee reports regularly to the Board.

Peer Groups

Janus competes for top executive talent with a broad and diverse range of public and privately owned asset management firms, including firms that, from a size and complexity perspective, are smaller, larger, or similar to Janus. Recognizing this wide range of competitors and acknowledging the complexity associated with pay and performance comparisons, the Committee:

- •

- Reviews compensation practices using two primary comparator groups recommended by McLagan: (i) a Custom Peer Group of 17 companies that

are considered most comparable to Janus relative to size, complexity and operating structure; and (ii) a Public Company Peer Group consisting of 12 companies that broadens the survey sample and

allows shareholders to obtain important comparative information independently;

- •

- Considers the Company's size as compared to the companies in the Custom and Public Company Peer Groups based on revenue and AUM, evaluates

relative performance against both peer groups, and acknowledges the Company's current strategic efforts to transition to a more globally diverse organization; and

- •

- Does not benchmark specific elements of compensation for any of the NEOs and it does not establish target percentiles for the other NEOs when determining individual compensation decisions in comparison to the Company's peers.

Janus's Custom Peer Group

Our Custom Peer Group includes 17 companies that are most similar to Janus relative to size, business complexity, and operating structure. This group includes companies that are publicly owned, like Janus, as well as privately owned companies and asset management subsidiaries of larger companies. In 2016, the Committee reviewed the composition of the Custom Peer Group and determined that no changes were necessary.

In determining the reasonableness of the 17-company Custom Peer Group, the Committee acknowledges that: (i) no single competitor company is exactly like Janus; (ii) Janus competes with a broad range of companies for executive talent; and (iii) the Custom Peer Group provides data from publicly traded asset management companies in addition to the confidential data from private companies, which provides the Committee with a more complete view of the competitive landscape.

The Committee believes that the Custom Peer Group for 2016 provides a reasonable frame of reference for evaluating executive pay levels and practices given a combination of factors, including the competitors' size, geographic scope, operating structure, product breadth, operating complexity,

26

channel coverage, ownership, history, and performance. The Custom Peer Group consists of the following firms:

Janus's Custom Peer Group

|

|

|

|---|---|---|

| Affiliated Managers Group | Neuberger Berman Group | |

AllianceBernstein Holding L.P. |

Nuveen Investments |

|

American Century Investments |

Old Mutual Asset Management |

|

Delaware Investments |

Oppenheimer Funds, Inc. |

|

Eaton Vance Management |

Putnam Investments |

|

Jennison Associates, LLC |

T. Rowe Price Associates, Inc. (1) |

|

Lazard Asset Management LLC |

Waddell & Reed, Inc. |

|

MFS Investment Management |

Western Asset Management Co. |

|

Morgan Stanley Investment Management |

- (1)

- Considered in the pay analysis for all other NEOs. This company was not included in the CEO pay analysis due to the incumbent's significant equity holdings which may or may not have had a distortive impact on that CEO's compensation.

Janus's Public Company Peer Group

Our Public Company Peer Group takes into consideration companies with similar business models and represents peers with which the Company may compete for talent, but it also includes companies that are, in some cases, substantially larger than Janus on a revenue and/or AUM basis. The Public Company Peer Group provides shareholders the opportunity to make independent comparisons of the Company's relative pay and performance. The Committee believes that public asset management companies that compete with Janus for business and talent provide better pay and performance comparisons than do companies that are only similar to Janus based on the amount of revenues or assets. There are a smaller number of publicly traded global asset management companies that are similar to Janus when the following factors are taken into consideration: size, geographic scope, operating structure, product breadth, operating complexity, distribution coverage, ownership, history, and performance. The Committee acknowledges that the Public Company Peer Group includes companies that are larger than Janus, and for that and other reasons as described on page 16 under the section titled "Analysis of Pay for Performance — Compensation Committee Decisions about CEO Pay — Setting Total Variable Compensation Target," decided to adjust the CEO's 2016 variable compensation target downward by approximately one-third compared with median total variable pay data from this peer group. The Committee reviewed the composition of the Public Company Peer Group in 2016 and determined that no changes were necessary.

27

The Public Company Peer Group consists of the following firms:

Janus's Public Company Peer Group

|

|

|

|---|---|---|

| Affiliated Managers Group, Inc. | Franklin Resources, Inc. | |

AllianceBernstein Holding L.P. |

Invesco Ltd. |

|

Ameriprise Financial, Inc. |

Legg Mason, Inc. |

|

Cohen & Steers, Inc. |

Old Mutual Asset Management |

|

Eaton Vance Corp. |

T. Rowe Price Group, Inc. |

|

Federated Investors, Inc. |

Waddell & Reed Financial, Inc. |

Role of Compensation Consultants

In making compensation decisions, the Committee relies in part on advice from the Compensation Consultants who provide an objective perspective, comprehensive comparative data on the financial services industry, pay for performance approaches, and general best practices, which enhance the quality of the Committee's decisions.

Role of Executive Officers

Management assists the Committee by providing information and recommendations on Janus's various compensation programs. At the beginning of each year, the CEO, in conjunction with Janus's Human Resources department and other key leaders within Janus, recommends to the Board and the Committee the investment, financial, and strategic objectives for the Company. During the year, management provides the Board and the Committee with periodic progress reports. At the end of each year, management presents the Committee with its evaluation of the Company's performance against those objectives. The CEO then evaluates the individual performance of each member of the senior management team and recommends levels of compensation (other than his own) to the Committee for review and approval.

Shareholder Outreach and Review of Compensation Practices

At the 2016 annual meeting of shareholders, approximately 86% of the votes cast were in favor of the advisory vote to approve executive compensation, which was in line with the 2015 approval rate of approximately 86% and 2014 approval rate of approximately 90%. The Company actively considers the results of the advisory vote to approve executive compensation each year and engages regularly with its shareholders throughout the year, which provides shareholders with an opportunity to raise issues. The Committee will continue to look for appropriate opportunities in which to engage shareholders prior to material changes to the Company's executive compensation structure.

Additional Compensation Practices and Policies

Ownership Guidelines

The Compensation Committee determines the minimum stock ownership guidelines for the CEO, the other NEOs, and all members of the Company's Executive Committee. Ensuring that executive officers own a meaningful number of shares in the Company more closely aligns their economic interests with our shareholders.

- •

- The CEO is required to hold Janus equity or mutual fund holdings equal to at least 20 times his annual base salary. The CEO currently holds shares worth substantially more than the required 20 times his annual base salary.

28

- •

- All other members of the Executive Committee are required to hold Janus equity or mutual fund holdings equal to at least four times his or her annual salary within seven years of becoming subject to the ownership requirement.

As of February 24, 2017, all NEOs and Executive Committee members are either meeting the guidelines, or on track to fulfill guidelines by the required deadline.

Severance Guidelines