Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - JANUS CAPITAL GROUP INC | a2230904zex-32_2.htm |

| EX-32.1 - EX-32.1 - JANUS CAPITAL GROUP INC | a2230904zex-32_1.htm |

| EX-31.2 - EX-31.2 - JANUS CAPITAL GROUP INC | a2230904zex-31_2.htm |

| EX-31.1 - EX-31.1 - JANUS CAPITAL GROUP INC | a2230904zex-31_1.htm |

| EX-23.1 - EX-23.1 - JANUS CAPITAL GROUP INC | a2230904zex-23_1.htm |

| EX-21.1 - EX-21.1 - JANUS CAPITAL GROUP INC | a2230904zex-21_1.htm |

| EX-12.1 - EX-12.1 - JANUS CAPITAL GROUP INC | a2230904zex-12_1.htm |

| EX-10.17 - EX-10.17 - JANUS CAPITAL GROUP INC | a2230904zex-10_17.htm |

| EX-10.13.9 - EX-10.13.9 - JANUS CAPITAL GROUP INC | a2230904zex-10_139.htm |

| EX-10.12.2 - EX-10.12.2 - JANUS CAPITAL GROUP INC | a2230904zex-10_122.htm |

| EX-10.11.1 - EX-10.11.1 - JANUS CAPITAL GROUP INC | a2230904zex-10_111.htm |

| EX-10.9.6 - EX-10.9.6 - JANUS CAPITAL GROUP INC | a2230904zex-10_96.htm |

| EX-10.9.5 - EX-10.9.5 - JANUS CAPITAL GROUP INC | a2230904zex-10_95.htm |

| EX-10.9.4 - EX-10.9.4 - JANUS CAPITAL GROUP INC | a2230904zex-10_94.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15253

Janus Capital Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

43-1804048 (I.R.S. Employer Identification No.) |

|

151 Detroit Street, Denver, Colorado (Address of principal executive offices) |

80206 (Zip Code) |

(303) 333-3863

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|---|---|---|

| Common Stock, $ 0.01 Per Share Par Value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2016, the aggregate market value of common equity held by non-affiliates was $2,595,834,364. As of February 10, 2017, there were 184,300,141 shares of the Company's common stock, $0.01 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report is incorporated by reference to the registrant's definitive proxy statement for the 2017 Annual Meeting of Stockholders or will be provided in an amendment filed on Form 10-K/A.

JANUS CAPITAL GROUP INC.

2016 FORM 10-K ANNUAL REPORT

1

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, as amended, Section 21E of the Securities Exchange Act of 1934 ("Exchange Act"), as amended, and Section 27A of the Securities Act of 1933, as amended. In addition, Janus Capital Group Inc. and its subsidiaries (collectively, "JCG" or the "Company") may make other written and oral communications from time to time (including, without limitation, in the Company's 2016 Annual Report to Stockholders) that contain such statements. Forward-looking statements include statements as to industry trends, future expectations of the Company and other matters that do not relate strictly to historical facts and are based on certain assumptions by management. These statements are often identified by the use of words such as "may," "will," "expects," "believes," "anticipates," "intends," "could," "should," "plans," "projects," "estimates," "continue," "seeks," "targets" or "outlook," and similar words, expressions and variations. These statements are based on the beliefs and assumptions of Company management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in Part I, Item 1A, Risk Factors, and elsewhere in this report and other documents filed or furnished by JCG from time to time with the Securities and Exchange Commission ("SEC"). JCG cautions readers to carefully consider such factors. Furthermore, such forward-looking statements speak only as of the date on which such statements are made. The Company does not assume any duty and does not undertake to update forward-looking statements, to report events or to report the occurrence of unanticipated events, whether as a result of new information, future developments or otherwise, should circumstances change, nor does the Company intend to do so, except as otherwise required by securities and other applicable laws and regulations.

JCG provides investment management, administration, distribution and related services to financial advisors, individuals and institutional clients through mutual funds, separate accounts, other pooled investment vehicles, exchange-traded products ("ETPs") and subadvised relationships (collectively referred to as "investment products") in both domestic and international markets. JCG provides investment management competencies across a range of disciplines, including fundamental U.S. and global equities (growth and value), mathematical equities, fixed income and alternatives, through its subsidiaries, Janus Capital Management LLC ("Janus"), INTECH Investment Management LLC ("INTECH") and Perkins Investment Management LLC ("Perkins"). These subsidiaries specialize in specific investment styles, and each has its own unique and independent perspective. JCG's investment products are distributed through three primary channels: intermediary, institutional and self-directed. Each distribution channel focuses on specific investor groups and the unique requirements of each group. As of December 31, 2016, JCG's complex-wide assets totaled $196.8 billion for mutual fund shareholders, clients and institutions around the globe.

JCG's complex-wide assets include all assets under management and exchange traded notes ("ETNs"). ETNs are not included in assets under management as the Company is not the named adviser or subadviser to ETNs. Assets under management primarily consist of domestic and international equity and fixed income securities. Accordingly, fluctuations in domestic and international financial markets, relative investment performance, sales and redemptions of investment products, and changes in the composition of assets under management are all factors that have a direct effect on JCG's operating results.

2

Operating revenues are generally based upon a percentage of the market value of assets under management and are calculated as a percentage of the daily average asset balance in accordance with contractual agreements. Certain investment products are also subject to performance fees, which vary based on a product's relative performance as compared to a benchmark index and the level of assets subject to such fees.

Although JCG manages and distributes a wide range of investment products and services, the Company's management directs JCG's operations as one business, the investment management business, and thus operates in one business segment.

Merger Agreement

On October 3, 2016, JCG and Henderson Group plc ("Henderson") entered into an Agreement and Plan of Merger (the "Merger Agreement") relating to the business combination of JCG and Henderson. The merger was unanimously approved by the board of directors of both JCG and Henderson. The combined company will be named Janus Henderson Group plc ("Janus Henderson") and will apply for admission to trade on the New York Stock Exchange ("NYSE") as its primary listing, while retaining Henderson's existing listing on the Australian Securities Exchange ("ASX"). Janus Henderson intends to comply with all applicable U.S. and Australian security reporting requirements. The merger will be effected via a share exchange with each share of JCG common stock converted into the right to receive 4.7190 newly issued shares of Henderson. Henderson and JCG shareholders are expected to own approximately 57% and 43%, respectively, of Janus Henderson ordinary shares upon closing.

The closing of the merger is subject to, among other things, (a) the approval of the shareholders of JCG of the merger; (b) the approval of the shareholders of Henderson of (i) the merger, (ii) the name change of Henderson, (iii) the amended and restated memorandum and articles of association of Henderson, (iv) the delisting of Henderson ordinary shares from the London Stock Exchange and (v) the payment of a dividend in respect to the second half of the 2016 fiscal year; (c) the receipt of the required regulatory approvals, including the approval of the Financial Industry Regulatory Authority, Inc. ("FINRA") and the United Kingdom ("U.K.") Financial Conduct Authority; (d) the approval by the board of trustees and shareholders for JCG-advised U.S. mutual funds of new investment advisory agreements with JCG to take effect at the closing of the merger representing at least 67.5% of the assets under management of those funds as of September 30, 2016; (e) the effectiveness of the registration statement relating to the issuance of Henderson ordinary shares in connection with the merger and absence of any stop order or proceedings by the SEC; (f) approval for listing on the NYSE of the Henderson ordinary shares; and (g) the absence of governmental restraints or prohibitions preventing the consummation of the merger. The obligation of each of JCG and Henderson to consummate the merger is also conditioned on, among other things, the truth and correctness of the representations and warranties made by the other party as of the closing date (subject to certain "materiality" and "material adverse effect" qualifiers). Subject to the satisfaction or, if applicable, waiver of these conditions, the merger is expected to close on or about May 30, 2017.

JCG incurred $13.3 million of merger-related expenses in 2016. The merger expenses are included in (a) general, administrative and occupancy and (b) marketing and advertising on JCG's Consolidated Statements of Comprehensive Income.

Subsidiaries

Janus

Janus has managed primarily growth equity portfolios since 1969 with the introduction of the Janus Fund. Janus has leveraged its research-driven investment philosophy and culture to other areas of

3

the markets, including fundamental fixed income, global macro fixed income, diversified alternatives and ETPs. Independent thinking and fundamental research are at the core of Janus' investment culture across its investment product teams. Janus believes its depth of research, willingness to make concentrated investments when Janus believes it has a research edge and commitment to delivering strong long-term results for its investors differentiate Janus from its competitors.

At December 31, 2016, Janus managed $89.7 billion of long-term equity assets, $40.0 billion of fixed income assets and $1.1 billion of money market assets, or approximately 67% of total Company assets under management.

INTECH

INTECH has managed institutional portfolios since 1987, establishing one of the industry's longest continuous performance records of mathematical equity investment strategies. INTECH's unique investment process is based on a mathematical theorem that seeks to add value for clients by capitalizing on the volatility in stock price movements. INTECH's goal is to achieve long-term returns that outperform a specified benchmark index while controlling risks and trading costs. At December 31, 2016, INTECH managed $46.7 billion, or approximately 24% of total Company assets under management.

Perkins

Perkins has managed value-disciplined investment products since 1980, focusing on building diversified portfolios of what it believes to be high-quality, undervalued stocks with favorable reward characteristics. With its fundamental research and careful consideration for downside risk, Perkins has established a reputation as a leading value manager. Perkins offers value equity investment products across a range of U.S. asset classes and global equities. At December 31, 2016, Perkins managed $9.8 billion, or approximately 5% of total Company assets under management.

Kapstream

Kapstream Capital Pty Limited ("Kapstream") has managed global macro fixed income products since 2006 with the introduction of the Kapstream Absolute Return Income Fund. In July 2015, JCG closed the acquisition of a controlling 51% voting interest in Kapstream. Kapstream is part of the Company's global macro fixed income team and remains a separate, autonomous and distinct capability from the fundamental fixed income team. At December 31, 2016, Kapstream managed $7.2 billion, or approximately 4% of total Company assets under management.

On January 31, 2017, JCG acquired the remaining 49% voting interest in Kapstream. The noncontrolling interests were held by the founders of Kapstream, who are current JCG employees. The transaction included initial upfront cash consideration of $42.5 million and contingent consideration payable in the form of mutual fund share awards ("MFSAs"). Payment of the MFSAs is contingent on all Kapstream products and certain Janus products reaching defined revenue targets on the first, second and third anniversaries of January 31, 2017. The MFSAs will be payable in three equal installments of $14.2 million on the anniversary dates and are indexed to the performance of the Kapstream Absolute Return Income Fund. Upon vesting, the holders of MFSAs receive the value of the awards adjusted for gains or losses attributable to the mutual fund to which the awards were indexed, subject to tax withholding.

VelocityShares

VS Holdings, Inc. ("VelocityShares") has been providing sophisticated investors with unique solutions for portfolio and trading risk management since 2009. VelocityShares is a sponsor of unique ETPs that are institutionally focused and offer sophisticated volatility management solutions.

4

The majority of ETPs represents tactical trading products serving short-term investors and traders in the form of ETNs. JCG acquired VelocityShares in December 2014. VelocityShares-branded ETNs had $2.3 billion in complex-wide assets as of December 31, 2016. ETNs are not included in assets under management.

Distribution Channels

JCG distributes its products through three channels: intermediary, institutional and self-directed. Each channel is discussed below.

Intermediary Channel

The intermediary channel distributes mutual funds and exchange-traded funds ("ETFs") through financial intermediaries including banks, broker-dealers, financial advisors, variable insurance trusts and retirement platforms. International mutual funds are also part of the intermediary channel and are offered through Janus Capital Funds plc, a Dublin-domiciled mutual fund trust. Significant investments have been made to grow the Company's presence in the financial advisor subchannel, including increasing the number of external and internal wholesalers, enhancing the Company's technology platform and recruiting highly seasoned client relationship managers. At December 31, 2016, assets in the intermediary channel totaled $76.5 billion, or 39% of total complex-wide assets.

Institutional Channel

The institutional channel serves corporations, endowments, foundations, Taft-Hartley funds, public fund clients and sovereign entities, with distribution direct to the plan sponsor and through consultants. Although the current asset base in this channel is weighted heavily toward INTECH's mathematical products, the Company has steadily increased its fixed income penetration, growing fixed income assets to $14.9 billion (including international institutional fixed income assets), an increase of approximately 8% compared to December 31, 2015. At December 31, 2016, assets in the institutional channel totaled $67.4 billion, or 34% of total complex-wide assets.

Self-Directed Channel

The self-directed channel serves existing individual investors who invest in JCG products through a mutual fund supermarket or directly with JCG. ETNs associated with VelocityShares are also part of the self-directed channel. At December 31, 2016, assets in the self-directed channel totaled $52.9 billion, or 27% of total complex-wide assets.

The investment management industry is relatively mature and saturated with competitors that provide services similar to JCG. As such, JCG encounters significant competition in all areas of its business. JCG competes with other investment managers, mutual fund advisers, brokerage and investment banking firms, insurance companies, hedge funds, venture capitalists, banks and other financial institutions, many of which are larger, have proprietary access to certain distribution channels, have a broader range of product choices and investment capabilities, and have greater capital resources. Additionally, the marketplace for investment products is rapidly changing, investors are becoming more sophisticated, the demand for and access to investment advice and information is becoming more widespread, passive investment strategies are becoming more prevalent, and more investors are demanding investment vehicles that are customized to their individual requirements.

JCG believes its ability to successfully compete in the investment management industry significantly depends upon its ability to achieve consistently strong investment performance, provide exceptional

5

client service and strategic partnerships, and develop and innovate products that will best serve its clients.

The investment management industry is subject to extensive federal, state and international laws and regulations intended to benefit and protect the shareholders of investment products such as those managed by JCG's subsidiaries and advisory clients of JCG's subsidiaries. The costs of complying with such laws and regulations have significantly increased and may continue to contribute significantly to the costs of doing business as a global investment adviser. These laws and regulations generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of businesses and to impose sanctions for failure to comply with laws and regulations. Possible consequences for failure to comply include, but are not limited to, voiding of investment advisory and subadvisory agreements, the suspension of individual employees (particularly investment management and sales personnel), limitations on engaging in certain lines of business for specified periods of time, revocation of registrations, disgorgement of profits, and imposition of censures and fines. Further, failure to comply with such laws and regulations may provide the basis for civil litigation that may also result in significant costs and reputational harm to JCG.

U.S. Regulation

JCG and certain of its U.S. subsidiaries are subject to laws and regulations from a number of government agencies and regulatory bodies, including, but not limited to, the SEC, the U.S. Department of Labor ("DOL"), FINRA and the U.S. Commodity Futures Trading Commission ("CFTC").

Investment Advisers Act of 1940

Certain subsidiaries of JCG are registered investment advisers under the Investment Advisers Act of 1940, as amended (the "Investment Advisers Act") and, as such, are regulated by the SEC. The Investment Advisers Act requires registered investment advisers to comply with numerous and pervasive obligations, including, among others, recordkeeping requirements, operational procedures, registration and reporting requirements, and disclosure obligations. Certain subsidiaries of JCG are also registered with regulatory authorities in various countries and states, and thus are subject to the oversight and regulation by such countries' and states' regulatory agencies.

Investment Company Act of 1940

Certain of JCG's subsidiaries act as the adviser or subadviser to mutual funds and ETFs, which are registered with the SEC pursuant to the Investment Company Act of 1940, as amended (the "1940 Act"). Certain of JCG's subsidiaries also serve as adviser or subadviser to investment products that are not required to be registered under the 1940 Act. As an adviser or subadviser to a registered investment company, these subsidiaries must comply with the requirements of the 1940 Act and related regulations, including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure and governance. In addition, the adviser or subadviser to a registered investment company generally has obligations with respect to the qualification of the registered investment company under the Internal Revenue Code of 1986, as amended (the "Code").

6

Broker-Dealer Regulations

JCG's limited purpose broker-dealer subsidiary, Janus Distributors LLC ("JD"), is registered with the SEC under the Exchange Act and is a member of FINRA, the securities industry's domestic self-regulatory organization. JD is the general distributor and agent for the sale and distribution of shares of domestic mutual funds that are directly advised or serviced by certain of JCG's subsidiaries, as well as the distribution of certain commingled funds and ETPs. The SEC imposes various requirements on JD's operations, including disclosure, recordkeeping and accounting. FINRA has established conduct rules for all securities transactions among broker-dealers and private investors, trading rules for the over-the-counter markets and operational rules for its member firms. The SEC and FINRA also impose net capital requirements on registered broker-dealers.

JD is subject to regulation under state law. The federal securities laws prohibit states from imposing substantive requirements on broker-dealers that exceed those under federal law. This does not preclude the states from imposing registration requirements on broker-dealers that operate within their jurisdiction or from sanctioning broker-dealers and their employees for engaging in misconduct.

ERISA

Certain JCG subsidiaries are also subject to the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), and related regulations to the extent they are considered "fiduciaries" under ERISA with respect to some of their clients. ERISA-related provisions of the Code and regulations issued by the DOL impose duties on persons who are fiduciaries under ERISA and prohibit some transactions involving the assets of each ERISA plan that is a client of a JCG subsidiary as well as some transactions by the fiduciaries (and several other related parties) to such plans.

CFTC

The CFTC has regulations that require Janus to register as a commodity pool operator ("CPO") and become a member of the National Futures Association ("NFA") in connection with the operation of certain of the Company's products. The regulations generally impose certain registration, reporting and disclosure requirements on CPOs and products that utilize futures, swaps and other derivatives that are subject to CFTC regulation. The CFTC or NFA may institute proceedings to enforce applicable rules and regulations, and violations may result in fines, censure or the termination of CPO registration and NFA membership.

Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") was signed into law in July 2010. The Dodd-Frank Act established enhanced regulatory requirements for non-bank financial institutions designated as "systemically important" by the Financial Stability Oversight Council ("FSOC"). Subsequently, in April 2012, the FSOC issued a final rule and interpretive guidance related to the process by which it will designate non-bank financial companies as systemically important financial institutions ("SIFI"). Certain non-bank financial companies have since been designated as SIFIs, and additional non-bank financial companies, including large asset management companies, may be designated as SIFIs in the future. If JCG were designated a SIFI, it would be subject to enhanced prudential measures, which could include capital and liquidity requirements, leverage limits, enhanced public disclosures and risk management requirements, annual stress testing by the Federal Reserve, credit exposure and concentration limits, and supervisory and other requirements. These heightened regulatory requirements could adversely affect the Company's business and operations. JCG is not a designated SIFI.

7

International Regulation

JCG's product offerings and international business activities expose the Company to international regulation. The Company's international subsidiaries are subject to the laws and regulations of non-U.S. jurisdictions and non-U.S. regulatory agencies and bodies, including the following:

- •

- Australian Securities and Investments Commission

- •

- Authorité des Marchés Financiers of France

- •

- Canadian Provincial Securities Commissions

- •

- Central Bank of Ireland

- •

- Commissione Nazionale per le Societa e la Borsa of Italy

- •

- Dubai Financial Services Authority

- •

- Federal Financial Supervisory Authority of Germany

- •

- Financial Conduct Authority in the United Kingdom

- •

- Financial Market Supervisory Authority of Switzerland

- •

- Financial Services Agency of Japan

- •

- Financial Supervisory Commission of Taiwan

- •

- Financial Supervisory Service and the Financial Services Commission of Korea

- •

- Monetary Authority of Singapore

- •

- Netherlands Authority for the Financial Markets

- •

- Securities and Futures Commission of Hong Kong

These regulatory agencies have broad supervisory and disciplinary powers, including, among others, the power to temporarily or permanently revoke the authorization to conduct regulated business, suspend registered employees, and censure and fine both regulated businesses and their registered employees.

Many of the non-U.S. securities exchanges and regulatory authorities have imposed rules (and others may impose rules) relating to capital requirements applicable to JCG's foreign subsidiaries. These rules, which specify minimum capital requirements, are designed to measure general financial integrity and liquidity, and require that a minimum amount of assets be kept in relatively liquid form.

As of December 31, 2016, JCG had 1,277 full-time employees. None of these employees are represented by a labor union.

Copies of JCG's filings with the SEC can be obtained from the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information can be obtained about the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

8

JCG makes available free of charge its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments thereto as soon as reasonably practical after such filing has been made with the SEC. Reports may be obtained through the Investor Relations section of JCG's website (http://ir.janus.com) or by contacting JCG at (888) 834-2536. The contents of JCG's website are not incorporated herein for any purpose.

JCG's Officer Code of Ethics for Chief Executive Officer and Senior Financial Officers (including its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer) (the "Officer Code"); Corporate Code of Business Conduct for all employees; corporate governance guidelines; and the charters of key committees of the Board of Directors (including the Audit, Compensation, and Nominating and Corporate Governance committees) are available on the Investor Relations section of JCG's website (http://ir.janus.com), and printed copies are available to any shareholder upon request by calling JCG at (888) 834-2536. Any future amendments to or waivers of the Officer Code will be posted to the Investor Relations section of JCG's website.

ADDITIONAL FINANCIAL INFORMATION

See additional financial information about geographical areas in Part II, Item 8, Financial Statements and Supplementary Data, Note 21 — Geographic Information.

JCG faces numerous risks, uncertainties and other factors that are substantial and inherent to its business, including risks related to the merger with Henderson, market and investment performance risks, operational and technology risks, and legal and regulatory risks. The following are significant factors that could affect JCG's business.

Risks related to the merger with Henderson

The Merger Agreement may be terminated in accordance with its terms and the merger may not be completed.

The closing of the merger is subject to the satisfaction or waiver of a number of conditions. Those conditions include: (a) the approval of the shareholders of JCG of the merger; (b) the approval of the shareholders of Henderson of (i) the merger, (ii) the name change of Henderson, (iii) the amended and restated memorandum and articles of association of Henderson, (iv) the delisting of Henderson ordinary shares from the London Stock Exchange and (v) the payment of a dividend in respect to the second half of the 2016 fiscal year; (c) the receipt of the required regulatory approvals, including the approval of FINRA and the U.K. Financial Conduct Authority; (d) the approval by the board of trustees and shareholders for JCG-advised U.S. mutual funds of new investment advisory agreements with JCG to take effect at the closing of the merger representing at least 67.5% of the assets under management of those funds as of September 30, 2016; (e) the effectiveness of the registration statement relating to the issuance of Henderson ordinary shares in connection with the merger and absence of any stop order or proceedings by the SEC; (f) approval for listing on the NYSE of the Henderson ordinary shares; and (g) the absence of governmental restraints or prohibitions preventing the consummation of the merger. The obligation of each of JCG and Henderson to consummate the merger is also conditioned on, among other things, the truth and correctness of the representations and warranties made by the other party as of the closing date (subject to certain "materiality" and "material adverse effect" qualifiers). These conditions to the closing may not be fulfilled and, accordingly, the merger may not be completed.

If the merger is not completed by September 30, 2017, either JCG or Henderson may choose not to proceed with the merger. In addition, the parties can mutually decide to terminate the Merger Agreement at any time prior to consummation of the merger, before or after the required JCG and

9

Henderson shareholder approvals. In addition, JCG or Henderson may elect to terminate the Merger Agreement in certain other circumstances.

If the Merger Agreement is terminated, JCG may incur substantial fees in connection with termination of the Merger Agreement and will not recognize the anticipated benefits of the merger.

Termination of the Merger Agreement could negatively impact JCG.

If the Merger Agreement is terminated and the merger is not consummated, JCG may be adversely affected. JCG may be adversely impacted by the failure to pursue other beneficial opportunities during the pendency of the merger, by the failure to obtain the anticipated benefits of completing the merger, by payment of certain costs relating to the merger, and by the focus of its management on the merger for an extended period of time rather than on normal business operations or opportunities or by the loss of certain senior managers as a consequence of the merger not completing. The market price of JCG common stock might decline as a result of any such failures to the extent that the current market price reflects a market assumption that the merger will be completed. Any of these factors, among others, could have a material impact on the business, prospects, financial condition and results of operations of JCG.

In addition, if the Merger Agreement is terminated under certain circumstances, JCG may be required to pay Henderson a termination fee of $34,000,000 in cash or to pay Henderson's expenses in the amount of up to $10,000,000 in cash, depending on the circumstances surrounding the termination (and in each case subject to certain adjustments that may be required in respect of applicable taxes).

JCG may also be negatively impacted if JCG becomes subject to litigation related to entering into or failing to consummate the merger, including direct actions by JCG stockholders against the directors and/or officers of JCG for breaches of fiduciary duty and derivative actions brought by JCG stockholders in the name of JCG.

JCG will be subject to business uncertainties while the merger is pending.

Uncertainty about the closing or effect of the merger may affect the relationship between JCG and its customers, including through reduced net flows during the pendency of the merger. This uncertainty may also affect the relationship between JCG and its business counterparties. Any such impact may have an adverse effect on JCG. These uncertainties may cause parties that deal with JCG to seek to change existing business relationships with it and to delay or defer decisions concerning JCG. Changes to existing business relationships, including termination or modification, could negatively affect JCG's assets under management, revenue, earnings and cash flow, as well as the market price of JCG's common stock.

JCG may face challenges in attracting and retaining key personnel during the pendency of the merger.

JCG is dependent on the experience and industry knowledge of its officers, key management personnel and other key employees to operate and execute its business plans. Such dependency is heightened as a result of the Merger Agreement. Current and prospective employees of JCG may experience uncertainty about their role within the combined company during and following the merger, which may have an adverse effect on the ability of JCG to attract or retain key management personnel and other key employees. If key employees depart because of issues related to the uncertainty and difficulty of integration or a desire not to remain with JCG, JCG could be negatively impacted. Accordingly, no assurance can be given that JCG will be able to attract or retain key management personnel and other key employees of JCG to the same extent that JCG has previously been able to attract or retain its employees. Adverse effects arising from the pendency of

10

the merger could be exacerbated by any delays in consummation of the merger or termination of the Merger Agreement.

JCG will be subject to certain contractual restrictions while the merger is pending.

The Merger Agreement restricts JCG from making certain acquisitions and divestitures, entering into certain contracts, incurring certain indebtedness and expenditures, repurchasing or issuing securities outside of existing equity awards, and taking other specified actions without the consent of Henderson until the earlier of the closing of the merger or the termination of the Merger Agreement. These restrictions may prevent JCG from pursuing attractive business opportunities that may arise prior to the closing of the merger and could have the effect of delaying or preventing other strategic transactions. Adverse effects arising from the pendency of the merger could be exacerbated by any delays in consummation of the merger or termination of the Merger Agreement.

Third parties may terminate or alter existing contracts or relationships with JCG.

JCG has contracts with customers, vendors, distributors, affiliates, landlords, licensors, and other business partners which may require JCG to obtain consent from these other parties in connection with the merger. If these consents cannot be obtained, the counterparties to these contracts and other third parties with which JCG currently has relationships may have the ability to terminate, reduce the scope of or otherwise materially adversely alter their relationships with JCG in anticipation of the merger. The pursuit of such rights may result in JCG suffering a loss of potential future revenue or incurring liabilities in connection with a breach of such agreements and losing rights that are material to its business. Such disruptions could also result from a delay in the closing of the merger.

JCG will incur significant transaction costs in connection with the merger.

JCG has incurred and expects to incur significant non-recurring costs associated with the merger. These costs and expenses include financial advisory, legal, accounting, consulting and other advisory fees and expenses, reorganization and restructuring costs, severance/employee benefit related expenses, public company filing fees and other regulatory expenses, printing expenses and other related charges. Some of these costs are payable by JCG regardless of whether the merger is completed.

The Merger Agreement contains provisions that may discourage other companies from trying to enter into a strategic transaction with JCG for greater consideration.

Notwithstanding that such provisions are to be disregarded in respect of both parties to the extent that the U.K. Panel on Takeovers and Mergers determines that they are prohibited by Rule 21.2 of the City Code, certain provisions of the Merger Agreement may discourage third parties from submitting business combination proposals to JCG during the pendency of the Merger Agreement that might have otherwise resulted in greater value to JCG stockholders than the merger. These provisions include a general prohibition on JCG, its controlled affiliates, directors, officer employees and representatives, from soliciting, initiating or knowingly encouraging, or, subject to certain exceptions, entering into discussions with any third party regarding any alternative transactions, subject to limited exceptions. In addition, Dai-ichi Life Holdings Inc. ("Dai-ichi Life"), JCG's largest shareholder, has committed to vote its shares of JCG's common stock in favor of the merger. This may discourage a third-party from pursuing a strategic transaction with JCG.

If, in certain permitted circumstances, the JCG board (i) withdraws, qualifies or modifies, or proposes publicly to withdraw, qualify or modify, or fails to make, in each case in any manner adverse to Henderson, its approval or recommendation of the merger or (ii) approves or recommends, or

11

proposes publicly to approve or recommend, any alternative transaction, JCG will still be required to submit the merger to a vote of its stockholders at the special meeting unless the Merger Agreement is earlier terminated by the other party in accordance with its terms.

The Merger Agreement provides that, upon termination of the Merger Agreement under specified circumstances, including (i) a change in the recommendation of the Board of Directors of JCG, (ii) a failure to obtain the requisite approvals of the stockholders of JCG, (iii) a material breach by JCG or (iv) because the merger is not consummated by the September 30, 2017 (the "Outside Date"), and in the cases set forth in clauses (ii), (iii) and (iv) above, at a time when there was an offer or proposal for an alternative transaction with respect to JCG and JCG enters into or consummates an alternative transaction, in the case of clause (ii) or (iii), within 12 months following such date of termination or in the case of clause (iv), within 12 months from the Outside Date, JCG will pay to the other party a termination fee equal to $34,000,000 in cash.

In addition, the Merger Agreement provides that if JCG or Henderson terminates the Merger Agreement because of a failure of the stockholders of JCG to approve the merger at the JCG stockholder meeting, JCG will reimburse Henderson for its actual out-of-pocket fees and expenses up to an aggregate amount equal to $10,000,000 in cash.

If the Merger Agreement is terminated and JCG determines to seek another strategic transaction, JCG may not be able to negotiate a transaction on terms comparable to, or more favorable than, the terms of the Merger Agreement.

Market and investment performance risks

JCG's revenues and profits are primarily dependent on the value, composition and relative investment performance of its investment products.

Any decrease in the value, relative investment performance or amount of assets under management will cause a decline in revenues and operating results. Assets under management may decline for various reasons, many of which are not under JCG's control.

Factors that could cause assets under management and revenues to decline include the following:

- •

- Declines in equity markets. JCG's assets under management are concentrated

in the U.S. equity markets and, to a lesser extent, in the international equity markets. As such, declines in the financial markets as a whole or the market segments in which JCG's investment products

are concentrated will cause assets under management to decrease.

- •

- Declines in fixed income markets. In the case of fixed income investment

products, which invest in high-quality short-term instruments as well as other fixed income securities of varying quality and duration, the value of the assets may decline as a result of changes in

interest rates, available liquidity in the markets in which a security trades, an issuer's actual or perceived creditworthiness, or an issuer's ability to meet its obligations.

- •

- Redemptions and other withdrawals. Investors may reduce their investments

in specific JCG investment products or in the markets in which JCG's investment products are concentrated in response to adverse market conditions, inconsistent investment performance, the pursuit of

other investment opportunities (including passive investment strategies) or other factors.

- •

- Operations in international markets. The investment products managed by JCG may have significant investments in international markets that are subject to risk of loss from political or diplomatic developments, government policies, civil unrest, currency fluctuations and changes in legislation related to foreign ownership. International markets, particularly emerging markets and frontier markets, which are often smaller and may not have the liquidity of established markets,

12

may lack established regulations and may experience significantly more volatility than established markets.

- •

- Relative investment performance. JCG's investment products are often judged on their performance as compared to benchmark indices or peer groups, or on an absolute return basis. Any period of underperformance of investment products may result in the loss of existing assets and affect JCG's ability to attract new assets. In addition, approximately 34% of the Company's assets under management at December 31, 2016, are subject to performance fees. Performance fees are based on each product's investment performance as compared to an established benchmark index over a specified period of time. If investment products subject to performance fees underperform their respective benchmark index for a defined period, JCG's revenues and thus results of operations may be adversely affected. In addition, performance fees subject JCG's revenues to increased volatility.

Changes in the value of seeded investment products could affect JCG's non-operating income or earnings and could increase the volatility of its earnings.

JCG periodically adds new investment strategies to its investment product offerings by providing the initial cash investment or "seeding" to facilitate the launch of the product. JCG may also provide substantial supplemental capital to an existing investment product in order to accelerate the growth of a strategy and attract outside investment in the product. A decline in the valuation of these seeded investments could increase the volatility of JCG's earnings and result in a decline in earnings and financial condition.

JCG's financial results could be adversely affected by the financial stability of other financial institutions.

JCG routinely executes transactions with various counterparties in the financial services industry. Historical market volatility highlights the interconnection of the global markets and demonstrates how the deteriorating financial condition of one institution may materially and adversely affect the performance of other institutions. JCG may be exposed to operational, credit or other risks in the event that a counterparty with whom the Company transacts defaults on its obligations or if there are other unrelated systemic failures in the markets.

JCG has significant goodwill and intangible assets that are subject to impairment.

Goodwill and intangible assets totaled $1.9 billion at December 31, 2016. The value of these assets may not be realized for a variety of reasons, including, but not limited to, significant redemptions, loss of clients, damage to brand name and unfavorable economic conditions. JCG has recorded goodwill and intangible asset impairments in the past and could incur similar charges in the future. JCG reviews the carrying value of goodwill and intangible assets not subject to amortization on an annual basis, or more frequently if indications exist, suggesting that the fair value of its intangible assets may be below their carrying value. JCG evaluates the value of intangible assets subject to amortization whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Should such reviews indicate impairment, a reduction of the carrying value of goodwill or intangible assets could occur, resulting in a charge that may, in turn, adversely affect JCG's assets under management, results of operations and financial condition.

13

Operational and technology risks

JCG's business may be vulnerable to failures or breaches in support systems and client services functions, and may be subject to cyberattacks.

The ability to consistently and reliably obtain securities pricing information, process client transactions and provide reports and other client services to the shareholders of funds and other investment products managed by JCG is essential to JCG's operations. Any delays, errors or inaccuracies in obtaining pricing information, processing client transactions or providing reports, and any other inadequacies in other client services functions could discourage clients, result in financial loss and potentially give rise to regulatory action and claims against JCG. Any failures of the Company's systems could adversely affect JCG's results of operations and financial condition, assets under management, and ability to maintain confidential information relating to its clients and business operations.

JCG's client services capabilities as well as JCG's ability to obtain prompt and accurate securities pricing information and to process client transactions and reports are significantly dependent on communication and information systems and services provided by third-party vendors. Also, JCG's established disaster recovery plans could suffer failures or interruptions due to various natural or man-made causes, and backup procedures and capabilities may not be adequate to avoid extended interruptions. Furthermore, JCG places significant reliance on its automated systems, thereby increasing the related risks if such systems were to fail. A failure of third-party systems or services, disaster recovery plans or automated systems could adversely affect JCG's assets under management, results of operations and financial condition.

JCG maintains confidential information relating to its clients and business operations. Authorized persons could inadvertently or intentionally release confidential or proprietary information. JCG's systems could be infiltrated by unauthorized users or damaged by computer viruses or other malicious software code as a result of cyberattacks by computer programmers and hackers. While JCG has established business continuity plans and risk management systems designed to prevent or reduce the severity of any such improprieties or cyberattacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified. JCG also cannot directly control any cybersecurity plans and systems put in place by third-party service providers. Unauthorized or inadvertent disclosure of confidential or proprietary information, or cyberattacks could be detrimental to JCG's reputation and lead to legal claims, negative publicity, regulatory action, increased costs or loss of revenue, among other things, all of which could adversely affect JCG's assets under management, results of operations and financial condition.

JCG operates in a highly competitive environment and its current fee structure may be reduced.

The investment management business is highly competitive and has relatively low barriers to entry. JCG's current fee structure may be subject to downward pressure due to these factors. Moreover, in recent years there has been a trend toward lower fees in the investment management industry. Fee reductions on existing or future new business as well as changes in regulations pertaining to its fee structure could adversely affect JCG's results of operations and financial condition. Additionally, JCG competes with investment management companies on the basis of investment performance, fees, diversity of products, distribution capability, reputation and the ability to develop new investment products to meet the changing needs of investors. Failure to adequately compete could adversely affect JCG's assets under management, results of operations and financial condition.

14

JCG's results are dependent on its ability to attract and retain key personnel.

The investment management business is highly dependent on the ability to attract, retain and motivate highly skilled and often highly specialized technical, executive, sales and investment management personnel. The market for qualified investment and sales professionals is extremely competitive and is increasingly characterized by the frequent movement of portfolio managers, analysts and salespersons among different firms. Any changes to management structure, shifts in corporate culture, changes to corporate governance authority, or adjustments or reductions to compensation could affect JCG's ability to retain key personnel and could result in legal claims. If JCG is unable to retain key personnel, it could adversely affect JCG's assets under management, results of operations and financial condition.

INTECH's investment process is highly dependent on key employees and proprietary software.

INTECH's investment process is based on complex and proprietary mathematical models that seek to outperform various indices by capitalizing on the volatility in stock price movements while controlling trading costs and overall risk relative to the index. The maintenance of such models for current products and the development of new products are highly dependent on certain key INTECH employees. If INTECH is unable to retain key personnel or properly transition key personnel responsibilities to others, or if the mathematical investment strategies fail to produce the intended results, INTECH may not be able to maintain its historical level of investment performance, which could adversely affect JCG's assets under management, results of operations and financial condition.

JCG's international operations are subject to foreign risks, including political, regulatory, economic and currency risks.

JCG operates offices and advises clients outside of the U.S. and is thereby subject to risks inherent in doing business internationally. These risks may include changes in applicable laws and regulatory requirements; difficulties in staffing and managing foreign operations; difficulties in collecting investment management fees receivable; different, and in some cases less stringent, legal, regulatory and accounting regimes; political instability; fluctuations in currency exchange rates; expatriation controls; expropriation risks; and potential adverse tax consequences. These or other risks related to JCG's international operations could adversely affect the Company's assets under management, results of operations and financial condition.

JCG's business is dependent on investment management agreements that are subject to termination, non-renewal or reductions in fees.

JCG derives revenue from investment management agreements with mutual funds and other investment products. With respect to investment management agreements with mutual funds, these agreements may be terminated by either party with notice, or terminated in the event of an "assignment" (as defined in the 1940 Act), and must be approved and renewed annually by the independent members of each fund's board of directors, its trustees, or its shareowners, as required by law. In addition, the board of directors or trustees of certain funds generally may terminate these investment management agreements upon written notice for any reason and without penalty. The termination of or failure to renew one or more of these agreements or the reduction of the fee rates applicable to such agreements could have a material adverse effect on JCG's assets under management, results of operations and financial condition.

15

JCG's indebtedness could adversely affect its financial condition and results of operations.

JCG's indebtedness could limit its ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt servicing requirements or other purposes. Debt servicing requirements increase JCG's vulnerability to adverse economic, market and industry conditions, and limit JCG's flexibility in planning for or reacting to changes in business operations or to the asset management industry. Any or all of the above events and factors could adversely affect JCG's assets under management, results of operations and financial condition.

Acquisitions expose JCG to risks inherent in acquiring a company.

JCG has and may acquire or invest in businesses that the Company believes will add value to its business and generate positive net returns. These acquisitions and investments may not be effective and could result in decreased earnings and harm to the Company's competitive position in the investment management industry.

Any strategic transaction can involve a number of risks, such as additional demands on JCG's existing employees and unanticipated problems regarding integration of products, technologies and new employees. As a result, the Company may not be able to realize all of the benefits that it hoped to achieve from such transactions. In addition, entering new jurisdictions or managing new products involves numerous risks such as adhering to new regulations, foreign currency exposure and the integration of new products into JCG's existing operations. JCG may be required to spend additional time or money on integration, which could decrease its earnings and prevent the Company from focusing on the development and expansion of its existing business and services.

As discussed above in Risks related to the merger with Henderson, the Merger Agreement restricts JCG from making certain acquisitions without the consent of Henderson.

Any damage to JCG's reputation could harm its business and lead to a loss of assets under management, revenues and net income.

JCG's reputation is critical to the success of its business. Any damage to the Company's reputation could impede its ability to attract and retain clients and key personnel, and could adversely affect JCG's assets under management, results of operations and financial condition.

JCG is dependent upon third-party distribution channels to access clients and potential clients.

JCG's ability to market and distribute its investment products is significantly dependent on access to the client base of insurance companies, defined contribution plan administrators, securities firms, broker-dealers, financial advisors, banks and other distribution channels. These companies generally offer their clients various investment products in addition to, and in competition with, JCG. Further, the separate account business uses referrals from financial planners, investment advisers and other professionals. JCG cannot be certain that it will continue to have access to these third-party distribution channels or have an opportunity to offer some or all of its investment products through these channels. In addition, JCG's existing relationships with third-party distributors and access to new distributors could be adversely affected by recent consolidation within the financial services industry. Consolidation may result in increased distribution costs, a reduction in the number of third parties distributing JCG's investment products or increased competition to access third-party distribution channels. The inability to access clients through third-party distribution channels could adversely affect JCG's business prospects, assets under management, results of operations and financial condition.

16

JCG may be unable to develop new products, and the development of new products may expose JCG to additional costs or operational risks.

JCG's success is partially dependent on its ability to develop, launch, market and manage new investment products. New investment products require an initial cash investment, innovation, time and the appropriate resources as well as ongoing support. The initial cash investment or "seeding" utilizes capital and liquidity that would otherwise be available for other corporate purposes. JCG may also be required to provide additional support to seeded investment products after the initial cash investment. Numerous risks and uncertainties are associated with all stages of the seeded investment product life cycle, including shifting client or market preferences, the introduction of competing products and compliance with regulatory requirements. A failure to successfully manage these risks or to innovate and introduce new seeded investment products may adversely affect JCG's business prospects, assets under management, results of operations and financial condition.

JCG is periodically involved in various legal proceedings and regulatory matters and may be involved in such proceedings in the future.

JCG and its employees are periodically involved in various legal proceedings and regulatory matters. These matters could adversely affect JCG's assets under management, results of operations and financial condition. Additionally, JCG and its employees have received and may receive in the future requests for information in connection with certain investigations or proceedings from various governmental and regulatory authorities. These investigations or proceedings may result in increased costs or reputational harm to the Company, which may adversely affect JCG's business prospects, assets under management, results of operations and financial condition.

The regulatory environment in which JCG operates has changed and may continue to change.

JCG may be adversely affected as a result of new or revised legislation or regulations, or by changes in the interpretation or enforcement of existing laws and regulations. The Company has increased its product offerings and international business activities over the past several years, resulting in increased exposure to international regulation. The costs and burdens of compliance with these and other new reporting and operational requirements and regulations have increased significantly and may continue to increase the cost of operating mutual funds and other investment products, which could adversely affect JCG's assets under management, results of operations and financial condition. (See Part I, Item 1, Business — Regulation)

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

JCG's headquarters are located in Denver, Colorado. JCG leases office space from non-affiliated companies for administrative, investment and client servicing operations in the following locations:

Domestic properties

- •

- Boston, Massachusetts

- •

- Chicago, Illinois

- •

- Darien, Connecticut

17

- •

- Denver, Glendale and Aurora, Colorado

- •

- Newport Beach, California

- •

- Princeton, New Jersey

- •

- San Francisco, California

- •

- West Palm Beach, Florida

International properties

- •

- Dubai

- •

- Frankfurt

- •

- Hong Kong

- •

- London

- •

- Melbourne

- •

- Milan

- •

- Paris

- •

- Singapore

- •

- Sydney

- •

- Taipei

- •

- The Hague

- •

- Tokyo

- •

- Zurich

In the opinion of management, the space and equipment owned or leased by the Company are adequate for existing operating needs.

The information set forth in response to Item 103 of Regulation S-K under "Legal Proceedings" is incorporated by reference from Part II, Item 8, Financial Statements and Supplementary Data, Note 18 — Commitments and Contingencies.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

18

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

JCG Common Stock

JCG's common stock is traded on the NYSE (symbol: JNS). The following table presents the high and low sale prices as reported on the NYSE composite tape for each completed quarter in 2016 and 2015.

| |

2016 | 2015 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Quarter

|

High | Low | High | Low | |||||||||

First |

$ | 14.69 | $ | 11.47 | $ | 18.59 | $ | 15.56 | |||||

Second |

$ | 15.71 | $ | 13.14 | $ | 18.75 | $ | 16.66 | |||||

Third |

$ | 15.10 | $ | 13.63 | $ | 17.29 | $ | 13.29 | |||||

Fourth |

$ | 15.70 | $ | 12.36 | $ | 16.01 | $ | 13.37 | |||||

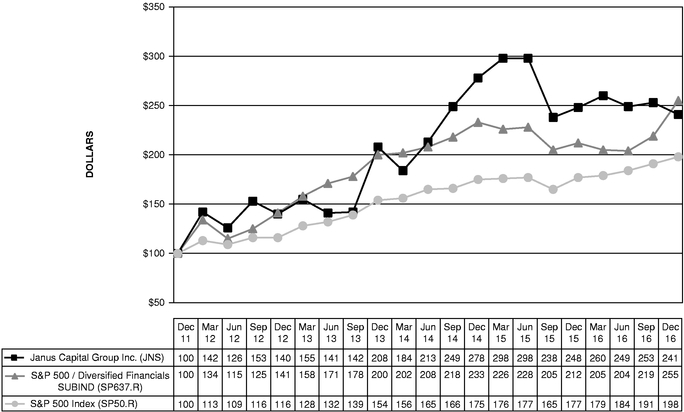

The following graph illustrates the cumulative total shareholder return (rounded to the nearest whole dollar) of JCG's common stock over the five-year period ending December 31, 2016, the last trading day of 2016, and compares it to the cumulative total return on the Standard and Poor's ("S&P") 500 Index and the S&P Diversified Financials Index. The comparison assumes a $100 investment on December 31, 2011, in JCG's common stock and in each of the foregoing indices and assumes reinvestment of dividends, if any. This data is not intended to forecast future performance of JCG's common stock.

On December 31, 2016, there were approximately 2,114 holders of record of JCG's common stock.

19

Dividends

The payment of cash dividends is within the discretion of JCG's Board of Directors and depends on many factors, including, but not limited to, JCG's results of operations, financial condition, capital requirements, restrictions imposed by financing arrangements, general business conditions and legal requirements. Dividends are subject to quarterly declaration by JCG's Board of Directors.

On April 21, 2016, JCG's Board of Directors approved an increase of $0.02 per share, or 22%, in the Company's regular quarterly dividend. The approved quarterly rate of $0.11 per share represents an expected annualized dividend rate of $0.44 per share of common stock.

The Merger Agreement requires JCG to operate its business in the ordinary course and, subject to certain exceptions, may prevent JCG from taking certain actions without the approval of Henderson, including, but not limited to, dividend payments. However, under the terms of the Merger Agreement, subject to the approval of the JCG Board of Directors, JCG is permitted to pay a cash dividend in respect to the fourth quarter of 2016.

On January 19, 2017, JCG's Board of Directors declared a regular quarterly cash dividend of $0.11 per share in respect to the fourth quarter 2016. The quarterly dividend will be paid on February 17, 2017, to shareholders of record at the close of business on February 6, 2017.

Subsequent to the Merger Agreement, JCG and Henderson agreed to separately pay regular quarterly cash dividends in respect to the first quarter 2017 during the second quarter 2017, subject to respective board approvals.

The following cash dividends were declared and paid during 2016:

Dividend per share |

Date declared |

Dividends paid (in millions) |

Date paid | |||

|---|---|---|---|---|---|---|

| $ 0.09 | January 19 | $ 16.7 | February 25 | |||

| $ 0.11 | April 21 | $ 20.3 | May 20 | |||

| $ 0.11 | July 21 | $ 20.1 | August 19 | |||

| $ 0.11 | October 20 | $ 20.1 | November 18 |

JCG declared and paid three $0.09 per share dividends and one $0.08 per share dividend in 2015. JCG declared and paid three $0.08 per share dividends and one $0.07 per share dividend in 2014.

Common Stock Repurchases

JCG's Board of Directors authorized a $500 million share repurchase program in July 2008. During the year ended December 31, 2016, JCG repurchased 3,772,389 shares of its common stock at an average price of $13.95 per share and a total cost of $52.6 million as part of the share repurchase program. The share repurchase program is conducted within the parameters of Rule 10b5-1 under the Exchange Act. After the Merger Agreement, JCG ceased share repurchases and does not intend on utilizing the share repurchase program while the merger progresses toward the expected close date on or about May 30, 2017.

JCG also repurchased 406,659 shares of common stock from Dai-ichi Life on August 1, 2016, for a total cost of $5.9 million in order for Dai-ichi Life to comply with the ownership limit obligations under the investment agreement between JCG and Dai-ichi Life. At December 31, 2016, Dai-ichi Life owned approximately 20% of the outstanding common shares of the Company.

In addition to the share repurchase program, during the year ended December 31, 2016, JCG withheld 1,085,600 shares from employees as part of a share withholding program to satisfy the employees' minimum statutory income tax liabilities attributable to the vesting of restricted stock. The withheld shares had a value of $13.6 million and were deposited into treasury shares.

20

The following table presents total 2016 JCG common stock repurchases by month as part of the share repurchase programs:

Period

|

Total number of shares purchased |

Average price paid per share |

Total number of shares purchased as part of publicly announced programs |

Approximate dollar value of shares that may yet be purchased under the programs (end of month) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

January |

| 2,046 | $ | 13.53 | | — | $ | 313 million | |||||

February |

1,754,714 | 12.29 | 817,725 | $ | 303 million | ||||||||

March |

| 786,024 | | 14.01 | | 786,024 | $ | 292 million | |||||

April |

549,462 | 14.75 | 542,005 | $ | 284 million | ||||||||

May |

| 542,518 | | 14.51 | | 542,518 | $ | 276 million | |||||

June |

567,800 | 14.53 | 567,800 | $ | 268 million | ||||||||

July |

| 531,678 | | 14.52 | | 516,317 | $ | 260 million | |||||

August |

407,079 | 14.50 | 406,659 | $ | 254 million | ||||||||

September |

| — | | 0.00 | | — | $ | 254 million | |||||

October |

1,719 | 16.06 | — | $ | 254 million | ||||||||

November |

| — | | 0.00 | | — | $ | 254 million | |||||

December |

121,608 | 13.41 | — | $ | 254 million | ||||||||

| | | | | | | | | | | | | | |

Total |

| 5,264,648 | $ | 13.70 | | 4,179,048 | | ||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

21

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data below was derived from the Company's consolidated financial statements and should be read in conjunction with Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Part II, Item 8, Financial Statements and Supplementary Data.

| |

Year ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||

| |

(dollars in millions, except per share data and where noted) |

|||||||||||||||

Income statement data: |

| | | | | |||||||||||

Operating revenues |

$ | 1,010.7 | $ | 1,076.2 | $ | 953.2 | $ | 873.9 | $ | 850.0 | ||||||

Operating income |

$ | 261.6 | $ | 322.3 | $ | 289.7 | $ | 239.1 | $ | 214.5 | ||||||

Adjusted operating income (1) |

$ | 274.9 | $ | 322.3 | $ | 289.7 | $ | 239.1 | $ | 214.5 | ||||||

Operating margin |

| 25.9 | % | | 29.9 | % | | 30.4 | % | | 27.4 | % | | 25.2 | % | |

Adjusted operating margin (1) |

27.2 | % | 29.9 | % | 30.4 | % | 27.4 | % | 25.2 | % | ||||||

Net income attributable to JCG |

$ | 146.1 | $ | 155.8 | $ | 154.4 | $ | 114.7 | $ | 102.3 | ||||||

Adjusted net income attributable to JCG (1) |

$ | 156.6 | $ | 178.6 | $ | 154.4 | $ | 114.7 | $ | 102.3 | ||||||

Per share data: |

|

|

|

|

|

|||||||||||

Basic earnings per share |

$ | 0.79 | $ | 0.84 | $ | 0.82 | $ | 0.62 | $ | 0.56 | ||||||

Diluted earnings per share |

$ | 0.78 | $ | 0.80 | $ | 0.81 | $ | 0.62 | $ | 0.55 | ||||||

Adjusted diluted earnings per share (1) |

$ | 0.83 | $ | 0.92 | $ | 0.81 | $ | 0.62 | $ | 0.55 | ||||||

Dividends declared and paid |

$ | 0.42 | $ | 0.35 | $ | 0.31 | $ | 0.21 | $ | 0.29 | ||||||

Balance sheet data: |

||||||||||||||||

Total assets |

$ | 2,949.9 | $ | 2,871.5 | $ | 2,790.5 | $ | 2,743.5 | $ | 2,657.5 | ||||||

Long-term debt (including current portion) |

$ |

406.3 |

$ |

406.1 |

$ |

447.8 |

$ |

540.8 |

$ |

542.2 |

||||||

Deferred income taxes, net |

$ | 502.8 | $ | 498.9 | $ | 478.4 | $ | 447.7 | $ | 436.0 | ||||||

Other non-current liabilities |

$ | 46.7 | $ | 46.2 | $ | 41.2 | $ | 32.4 | $ | 41.8 | ||||||

Redeemable noncontrolling interests |

$ |

43.1 |

$ |

21.8 |

$ |

5.4 |

$ |

7.3 |

$ |

42.9 |

||||||

Other data: |

||||||||||||||||

Cash flows provided by operating activities |

$ | 262.2 | $ | 274.4 | $ | 218.4 | $ | 224.1 | $ | 208.9 | ||||||

Assets under management (in billions): |

||||||||||||||||

Ending AUM (2) |

$ | 194.5 | $ | 189.1 | $ | 183.1 | $ | 173.9 | $ | 156.8 | ||||||

Average AUM (2) |

$ | 189.3 | $ | 190.6 | $ | 175.8 | $ | 165.4 | $ | 156.3 | ||||||

Long-term net flows (2) (3) |

$ | (3.0 | ) | $ | (2.6 | ) | $ | (4.9 | ) | $ | (19.7 | ) | $ | (12.0 | ) | |

- (1)

- Item

represents a non-GAAP financial measure. See Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of

Operations — Non-GAAP Financial Measures, for the definition of these measures and the related reconciliation reference.

- (2)

- Does

not include VelocityShares ETNs. VelocityShares was acquired in 2014; prior to that JCG did not offer ETNs.

- (3)

- Long-term net flows represent total Company net sales and redemptions, excluding money market and ETNs.

22

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

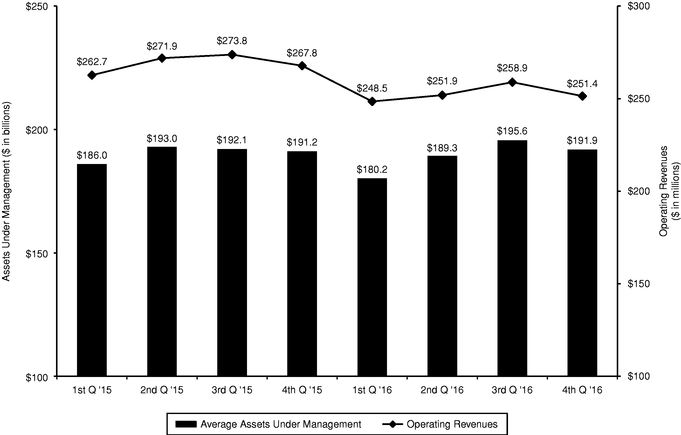

JCG finished 2016 with assets under management of $194.5 billion, an increase of 2.9% from the end of 2015, as a result of market appreciation partially offset by long-term net outflows. Long-term net flows deteriorated in 2016 driven by net redemptions in mathematical equity strategies of $3.4 billion, net redemptions in JCG's fundamental equity strategies of $0.9 billion, partially offset by net sales in fixed income strategies of $1.3 billion.

Total operating revenue for JCG in 2016 of $1,010.7 million decreased $65.5 million from 2015 as a result of decreased investment management fees in 2016 due to lower average assets under management and a product mix shift to lower yielding products. Increased negative mutual fund performance fees in 2016 also contributed to the year-over-year decrease in total operating revenue.

JCG realized operating margins of 25.9% and 29.9% for 2016 and 2015, respectively. Merger-related expenses of $13.3 million in the second half of 2016 had a negative impact on operating margin for 2016. Operating margin, adjusted for merger-related expenses, for the year ended December 31, 2016, was 27.2%. See Non-GAAP Financial Measures discussion.

Net income attributable to JCG for 2016 totaled $146.1 million, or $0.78 per diluted share, compared with $155.8 million, or $0.80 per diluted share, for 2015. Net income attributable to JCG, adjusted for merger-related costs, for the year ended December 31, 2016, totaled $156.6 million, or $0.83 per diluted share on an adjusted basis. Net income attributable to JCG, adjusted for the loss on early extinguishment of debt, for the year ended December 31, 2015, totaled $178.6 million, or $0.92 per diluted share on an adjusted basis. See Non-GAAP Financial Measures discussion.

JCG continued to execute on a number of strategic priorities in 2016. A summary of accomplishments include the following:

- •

- Announced business combination of JCG and Henderson — The merger of the two

firms is transformative, accelerating the Company's strategic efforts around growth, diversification and globalization.

- •

- The merger will create a combined company with highly complementary businesses that have a larger geographic footprint, compatible cultures and

a shared focus on delivering excellent investment performance and service to clients.

- •

- The combined company would accelerate both JCG's and Henderson's objectives to achieve growth, diversification and globalization, creating a

more global active investment manager with enhanced scale and market position.

- •

- The merger is expected to combine the talent pools of both organizations to build a strong global team with enhanced capabilities to innovate

on behalf of clients and to create a leading independent active asset manager with a globally relevant brand, footprint, investment proposition and client service capability.

- •

- The combined company is expected to have an expanded client-facing team that will permit it to deepen client relationships and increase growth

opportunities across a wider range of investment products and geographies.

- •

- The combined company will have a more diversified revenue mix across products, geographies and clients giving it a greater ability to maintain revenue levels and profitability across market cycles than JCG on a standalone basis.

23

- •

- Gaining market share in the U.S. intermediary channel — JCG's investments in

the U.S. intermediary business are translating into market share gains. In 2016, this channel had $2.8 billion of net inflows, an approximate 5% annual organic growth rate, which compared

favorably on a relative basis to meaningful outflows across the U.S. active mutual fund industry.

- •