Attached files

| file | filename |

|---|---|

| EX-10.9.3 - EX-10.9.3 - JANUS CAPITAL GROUP INC | a2227369zex-10_93.htm |

| EX-10.17 - EX-10.17 - JANUS CAPITAL GROUP INC | a2227369zex-10_17.htm |

| EX-10.13.8 - EX-10.13.8 - JANUS CAPITAL GROUP INC | a2227369zex-10_138.htm |

| EX-32.2 - EX-32.2 - JANUS CAPITAL GROUP INC | a2227369zex-32_2.htm |

| EX-31.1 - EX-31.1 - JANUS CAPITAL GROUP INC | a2227369zex-31_1.htm |

| EX-23.1 - EX-23.1 - JANUS CAPITAL GROUP INC | a2227369zex-23_1.htm |

| EX-31.2 - EX-31.2 - JANUS CAPITAL GROUP INC | a2227369zex-31_2.htm |

| EX-32.1 - EX-32.1 - JANUS CAPITAL GROUP INC | a2227369zex-32_1.htm |

| EX-21.1 - EX-21.1 - JANUS CAPITAL GROUP INC | a2227369zex-21_1.htm |

| EX-10.19 - EX-10.19 - JANUS CAPITAL GROUP INC | a2227369zex-10_19.htm |

| EX-12.1 - EX-12.1 - JANUS CAPITAL GROUP INC | a2227369zex-12_1.htm |

| EX-10.9.2 - EX-10.9.2 - JANUS CAPITAL GROUP INC | a2227369zex-10_92.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15253

Janus Capital Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

43-1804048 (I.R.S. Employer Identification No.) |

|

151 Detroit Street, Denver, Colorado (Address of principal executive offices) |

80206 (Zip Code) |

(303) 333-3863

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|---|---|---|

| Common Stock, $0.01 Per Share Par Value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2015, the aggregate market value of common equity held by non-affiliates was $3,198,997,199. As of February 19, 2016, there were 185,897,108 shares of the Company's common stock, $0.01 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into Part of the Form 10-K as indicated:

Document

|

Part of Form 10-K into Which Incorporated | |

| Company's Definitive Proxy Statement for the 2016 Annual Meeting of Stockholders | Part III |

JANUS CAPITAL GROUP INC.

2015 FORM 10-K ANNUAL REPORT

1

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 21E of the Securities Exchange Act of 1934 ("Exchange Act") and Section 27A of the Securities Act of 1933. In addition, Janus Capital Group Inc. and its subsidiaries (collectively, "JCG" or the "Company") may make other written and oral communications from time to time (including, without limitation, in the Company's 2015 Annual Report to Stockholders) that contain such statements. Forward-looking statements include statements as to industry trends, future expectations of the Company and other matters that do not relate strictly to historical facts and are based on certain assumptions by management. These statements are often identified by the use of words such as "may," "will," "expect," "believe," "anticipate," "intend," "could," "should," "estimate" or "continue," and similar expressions or variations. These statements are based on the beliefs and assumptions of Company management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in Part I, Item 1A, Risk Factors, and elsewhere in this report and other documents filed or furnished by JCG from time to time with the Securities and Exchange Commission ("SEC"). JCG cautions readers to carefully consider such factors. Furthermore, such forward-looking statements speak only as of the date on which such statements are made. Except to the extent required under applicable securities law and stock exchange rules, the Company undertakes no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events.

JCG provides investment management, administration, distribution and related services to financial advisors, individuals and institutional clients through mutual funds, separate accounts, other pooled investment vehicles, exchange-traded products ("ETPs") and subadvised relationships (collectively referred to as "investment products") in both domestic and international markets. Over the last several years, JCG has expanded its business to become a more diversified manager with increased investment product offerings and distribution capabilities. JCG provides investment management competencies across a range of disciplines, including fundamental U.S. and global equities (growth and value), mathematical equities, fixed income and alternatives, through its subsidiaries, Janus Capital Management LLC ("Janus"), INTECH Investment Management LLC ("INTECH") and Perkins Investment Management LLC ("Perkins"). These subsidiaries specialize in specific investment styles, and each has its own unique and independent perspective. JCG's investment products are distributed through three primary channels: intermediary, institutional and self-directed. Each distribution channel focuses on specific investor groups and the unique requirements of each group. As of December 31, 2015, JCG's complex wide assets totaled $192.3 billion for mutual fund shareholders, clients and institutions around the globe.

JCG's complex-wide assets include all assets under management and ETPs. ETPs are not included in assets under management as the Company is not the named advisor or subadvisor to ETPs. Assets under management primarily consist of domestic and international equity and fixed income securities. Accordingly, fluctuations in domestic and international financial markets, relative investment performance, sales and redemptions of investment products, and changes in the composition of assets under management are all factors that have a direct effect on JCG's operating results.

2

Revenues are generally based upon a percentage of the market value of assets under management and are calculated as a percentage of the daily average asset balance in accordance with contractual agreements. Certain investment products are also subject to performance fees, which vary based on a product's relative performance as compared to a benchmark index and the level of assets subject to such fees.

Although JCG manages and distributes a wide range of investment products and services, the Company's management directs JCG's operations as one business, the investment management business, and thus operates in one business segment.

Subsidiaries

Janus

Janus has managed primarily growth equity portfolios since 1969 with the introduction of the Janus Fund. Janus has leveraged its research-driven investment philosophy and culture to other areas of the markets, including fundamental fixed income, global macro fixed income, diversified alternatives and ETPs. Independent thinking and fundamental research are at the core of Janus' investment culture across its investment product teams. Janus believes its depth of research, willingness to make concentrated investments when Janus believes it has a research edge and commitment to delivering strong long-term results for its investors differentiate Janus from its competitors.

At December 31, 2015, Janus managed $87.4 billion of long-term equity assets, $37.2 billion of fixed income assets and $1.3 billion of money market assets, or approximately 67% of total Company assets under management.

INTECH

INTECH has managed institutional portfolios since 1987, establishing one of the industry's longest continuous performance records of mathematical equity investment strategies. INTECH's unique investment process is based on a mathematical theorem that seeks to add value for clients by capitalizing on the volatility in stock price movements. INTECH's goal is to achieve long-term returns that outperform a specified benchmark index while controlling risks and trading costs. At December 31, 2015, INTECH managed $47.6 billion, or approximately 25% of total Company assets under management.

Perkins

Perkins has managed value-disciplined investment products since 1980, focusing on building diversified portfolios of what it believes to be high-quality, undervalued stocks with favorable reward characteristics. With its fundamental research and careful consideration for downside risk, Perkins has established a reputation as a leading value manager. Perkins offers value equity investment products across a range of U.S. asset classes and global equity. At December 31, 2015, Perkins managed $8.4 billion, or approximately 4% of total Company assets under management.

Acquisitions

Kapstream

On July 1, 2015, JCG announced and closed the acquisition of a controlling 51% voting interest in Kapstream Capital Pty Limited ("Kapstream"), a global macro fixed income asset manager located in Australia. The acquisition serves to further expand JCG's fixed income capabilities and build out its global macro fixed income team. Kapstream is part of the Company's global macro fixed income team and remains a separate, autonomous and distinct capability from the fundamental fixed income

3

team. At December 31, 2015, Kapstream managed $7.2 billion, or approximately 4% of total Company assets under management.

VelocityShares

On December 1, 2014, JCG announced the closing of its acquisition of VS Holdings, Inc. ("VelocityShares"). VelocityShares is a sponsor of unique ETPs that are institutionally focused and offers sophisticated volatility management solutions. VelocityShares has recently launched a second business around innovative and intelligent exchange-traded funds ("ETFs") for diversified investment portfolios, currently focused on volatility-hedged equities and equal-risk weighted solutions. These ETF strategies, along with future product innovation, offer significant potential synergies between VelocityShares and JCG. VelocityShares-branded products had $3.2 billion in assets as of December 31, 2015. The majority of these assets represent tactical trading products serving short-term investors and traders in the form of exchange-traded notes ("ETNs"). ETNs are not included in assets under management.

Distribution Channels

JCG distributes its products through three channels: intermediary, institutional and self-directed. Each channel is discussed below.

Intermediary Channel

The intermediary channel serves U.S. financial advisors, variable insurance trusts, retirement platforms and ETFs. International mutual funds are also part of the intermediary channel and are offered through Janus Capital Funds Plc, a Dublin-domiciled mutual fund trust. Significant investments have been made to grow the Company's presence in the financial advisor subchannel, including increasing the number of external and internal wholesalers, enhancing the Company's technology platform and recruiting highly seasoned client relationship managers. At December 31, 2015, assets in the intermediary channel totaled $70.8 billion, or 37% of total complex-wide assets.

Institutional Channel

The institutional channel serves U.S. corporations, endowments, foundations, Taft-Hartley funds, public fund clients and non-U.S. separate accounts, and focuses on distribution direct to the plan sponsor and through consultants. Although the current asset base in this channel is weighted heavily toward INTECH's mathematical products, the Company has steadily increased its fixed income penetration, growing fixed income assets to $13.8 billion (including international institutional fixed income assets), an increase of approximately 85% compared to December 31, 2014. At December 31, 2015, assets in the institutional channel totaled $66.5 billion, or 34% of total complex-wide assets.

Self-Directed Channel

This channel serves existing individual investors who invest in JCG products through a mutual fund supermarket or directly with JCG. ETNs associated with VelocityShares are also part of the self-directed channel. At December 31, 2015, assets in the self-directed channel totaled $55.0 billion, or 29% of total complex-wide assets.

The investment management industry is relatively mature and saturated with competitors that provide services similar to JCG. As such, JCG encounters significant competition in all areas of its business. JCG competes with other investment managers, mutual fund advisers, brokerage and

4

investment banking firms, insurance companies, hedge funds, venture capitalists, banks and other financial institutions, many of which are larger, have proprietary access to certain distribution channels, have a broader range of product choices and investment capabilities, and have greater capital resources. Additionally, the marketplace for investment products is rapidly changing, investors are becoming more sophisticated, the demand for and access to investment advice and information is becoming more widespread, passive investment strategies are becoming more prevalent, and more investors are demanding investment vehicles that are customized to their individual requirements.

JCG believes its ability to successfully compete in the investment management industry significantly depends upon its ability to achieve consistently strong investment performance, provide exceptional client service and strategic partnerships, and develop and innovate products that will best serve its clients.

The investment management industry is subject to extensive federal, state and international laws and regulations intended to benefit and protect the shareholders of investment products such as those managed by JCG's subsidiaries and advisory clients of JCG's subsidiaries. The costs of complying with such laws and regulations have significantly increased and may continue to contribute significantly to the costs of doing business as a global investment adviser. These laws and regulations generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of businesses and to impose sanctions for failure to comply with laws and regulations. Possible consequences for failure to comply include, but are not limited to, voiding of investment advisory and subadvisory agreements, the suspension of individual employees (particularly investment management and sales personnel), limitations on engaging in certain lines of business for specified periods of time, revocation of registrations, disgorgement of profits, and imposition of censures and fines. Further, failure to comply with such laws and regulations may provide the basis for civil litigation that may also result in significant costs and reputational harm to JCG.

U.S. Regulation

JCG and certain of its U.S. subsidiaries are subject to laws and regulations from a number of government agencies and regulatory bodies, including, but not limited to, the SEC, the U.S. Department of Labor ("DOL"), the Financial Industry Regulatory Authority ("FINRA") and the Commodity Futures Trading Commission ("CFTC").

Investment Advisers Act of 1940

Certain subsidiaries of JCG are registered investment advisers under the Investment Advisers Act of 1940, as amended (the "Investment Advisers Act") and, as such, are regulated by the SEC. The Investment Advisers Act requires registered investment advisers to comply with numerous and pervasive obligations, including, among others, recordkeeping requirements, operational procedures, registration and reporting requirements, and disclosure obligations. Certain subsidiaries of JCG are also registered with regulatory authorities in various countries and states, and thus are subject to the oversight and regulation by such countries' and states' regulatory agencies.

Investment Company Act of 1940

Certain of JCG's subsidiaries act as the adviser or subadviser to mutual funds, which are registered with the SEC pursuant to the Investment Company Act of 1940, as amended (the "1940 Act"). Certain of JCG's subsidiaries also serve as adviser or subadviser to investment products that are not

5

required to be registered under the 1940 Act. As an adviser or subadviser to a registered investment company, these subsidiaries must comply with the requirements of the 1940 Act and related regulations, including, among others, requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure and governance. In addition, the adviser or subadviser to a registered investment company generally has obligations with respect to the qualification of the registered investment company under the Internal Revenue Code of 1986, as amended (the "Code").

Broker-Dealer Regulations

JCG's limited purpose broker-dealer subsidiary, Janus Distributors LLC ("JD"), is registered with the SEC under the Exchange Act and is a member of FINRA, the securities industry's domestic self-regulatory organization. JD is the general distributor and agent for the sale and distribution of shares of domestic mutual funds that are directly advised or serviced by certain of JCG's subsidiaries. The SEC imposes various requirements on JD's operations, including disclosure, recordkeeping and accounting. FINRA has established conduct rules for all securities transactions among broker-dealers and private investors, trading rules for the over-the-counter markets and operational rules for its member firms. The SEC and FINRA also impose net capital requirements on registered broker-dealers.

JD is also subject to regulation under state law. The federal securities laws prohibit states from imposing substantive requirements on broker-dealers that exceed those under federal law. This does not preclude the states from imposing registration requirements on broker-dealers that operate within their jurisdiction or from sanctioning broker-dealers and their employees for engaging in misconduct.

ERISA

Certain JCG subsidiaries are also subject to the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), and related regulations to the extent they are considered "fiduciaries" under ERISA with respect to some of their clients. ERISA-related provisions of the Code and regulations issued by the DOL impose duties on persons who are fiduciaries under ERISA and prohibit some transactions involving the assets of each ERISA plan that is a client of a JCG subsidiary as well as some transactions by the fiduciaries (and several other related parties) to such plans.

CFTC

The CFTC has regulations that require Janus to register as a Commodity Pool Operator ("CPO") and become a member of the National Futures Association ("NFA") in connection with the operation of certain of the Company's products. The regulations generally impose certain registration, reporting and disclosure requirements on CPOs and products that utilize futures, swaps and other derivatives that are subject to CFTC regulation. The CFTC or NFA may institute proceedings to enforce applicable rules and regulations, and violations may result in fines, censure or the termination of CPO registration and NFA membership.

Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") was signed into law in July 2010. The Dodd-Frank Act established enhanced regulatory requirements for non-bank financial institutions designated as "systemically important" by the Financial Stability Oversight Council ("FSOC"). Subsequently, in April 2012, the FSOC issued a final rule and interpretive guidance related to the process by which it will designate non-bank financial companies as systemically important financial institutions ("SIFI"). Certain non-bank financial companies have since been designated as SIFIs and additional non-bank financial companies, including large asset

6

management companies, may be designated as SIFIs in the future. If JCG were designated a SIFI, it would be subject to enhanced prudential measures, which could include capital and liquidity requirements, leverage limits, enhanced public disclosures and risk management requirements, annual stress testing by the Federal Reserve, credit exposure and concentration limits, and supervisory and other requirements. These heightened regulatory requirements could adversely affect the Company's business and operations. JCG is not a designated SIFI.

International Regulation

JCG increased its product offerings and international business activities over the past several years, resulting in increased exposure to international regulation. JCG's international subsidiaries are subject to the laws and regulations of non-U.S. jurisdictions and non-U.S. regulatory agencies and bodies, including the following:

- •

- Australian Securities and Investments Commission

- •

- Authorité des Marchés Financiers of France

- •

- Canadian Provincial Securities Commissions

- •

- Central Bank of Ireland

- •

- Commissione Nazionale per le Societa e la Borsa of Italy

- •

- Dubai Financial Services Authority

- •

- Federal Financial Supervisory Authority of Germany

- •

- Financial Conduct Authority in the United Kingdom

- •

- Financial Market Supervisory Authority of Switzerland

- •

- Financial Services Agency of Japan

- •

- Financial Supervisory Commission of Taiwan

- •

- Financial Supervisory Service and the Financial Services Commission of Korea

- •

- Monetary Authority of Singapore

- •

- Netherlands Authority for the Financial Markets

- •

- Securities and Futures Commission of Hong Kong

These regulatory agencies have broad supervisory and disciplinary powers, including, among others, the power to temporarily or permanently revoke the authorization to conduct regulated business, suspend registered employees, and censure and fine both regulated businesses and their registered employees. As JCG expands its international presence, the costs and risks associated with doing business in other countries will increase.

Many of the non-U.S. securities exchanges and regulatory authorities have imposed rules (and others may impose rules) relating to capital requirements applicable to JCG's foreign subsidiaries. These rules, which specify minimum capital requirements, are designed to measure general financial integrity and liquidity, and require that a minimum amount of assets be kept in relatively liquid form.

As of December 31, 2015, JCG had 1,272 full-time employees. None of these employees are represented by a labor union.

7

Copies of JCG's filings with the SEC can be obtained from the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information can be obtained about the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

JCG makes available free of charge its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments thereto as soon as reasonably practical after such filing has been made with the SEC. Reports may be obtained through the Investor Relations section of JCG's website (http://ir.janus.com) or by contacting JCG at (888) 834-2536. The contents of JCG's website are not incorporated herein for any purpose.

JCG's Officer Code of Ethics for Chief Executive Officer and Senior Financial Officers (including its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer) (the "Officer Code"); Corporate Code of Business Conduct for all employees; corporate governance guidelines; and the charters of key committees of the Board of Directors (including the Audit, Compensation, and Nominating and Corporate Governance committees) are available on the Investor Relations section of JCG's website (http://ir.janus.com), and printed copies are available to any shareholder upon request by calling JCG at (888) 834-2536. Any future amendments to or waivers of the Officer Code will be posted to the Investor Relations section of JCG's website.

ADDITIONAL FINANCIAL INFORMATION

See additional financial information about geographical areas in Part II, Item 8, Financial Statements and Supplementary Data, Note 19 — Geographic Information, of this Annual Report on Form 10-K.

JCG faces numerous risks, uncertainties and other factors that are substantial and inherent to its business, including market, operational, legal and regulatory risks. The following are significant factors that could affect JCG's business.

JCG's revenues and profits are primarily dependent on the value, composition and relative investment performance of its investment products.

Any decrease in the value, relative investment performance or amount of assets under management will cause a decline in revenues and operating results. Assets under management may decline for various reasons, many of which are not under JCG's control.

Factors that could cause assets under management and revenues to decline include the following:

- •

- Declines in equity markets. JCG's assets under

management are concentrated in the U.S. equity markets and, to a lesser extent, in the international equity markets. As such, declines in the financial markets as a whole or the market segments in

which JCG's investment products are concentrated will cause assets under management to decrease.

- •

- Declines in fixed income markets. In the case of fixed

income investment products, which invest in high-quality short-term instruments as well as other fixed income securities of varying quality and duration, the value of the assets may decline as a

result of changes in interest rates, available liquidity in the markets in which a security trades, an issuer's actual or perceived creditworthiness, or an issuer's ability to meet its obligations.

- •

- Redemptions and other withdrawals. Investors may reduce their investments in specific JCG investment products or in the markets in which JCG's investment products are concentrated in

8

response to adverse market conditions, inconsistent investment performance, the pursuit of other investment opportunities (including passive investment strategies) or other factors.

- •

- Operations in international markets. The investment

products managed by JCG may have significant investments in international markets that are subject to risk of loss from political or diplomatic developments, government policies, civil unrest,

currency fluctuations and changes in legislation related to foreign ownership. International markets, particularly emerging markets and frontier markets, which are often smaller and may not have the

liquidity of established markets, may lack established regulations and may experience significantly more volatility than established markets.

- •

- Relative investment performance. JCG's investment products are often judged on their performance as compared to benchmark indices or peer groups, or on an absolute return basis. Any period of underperformance of investment products may result in the loss of existing assets and affect JCG's ability to attract new assets. In addition, approximately 34% of the Company's assets under management at December 31, 2015, are subject to performance fees. Performance fees are based on each product's investment performance as compared to an established benchmark index over a specified period of time. If investment products subject to performance fees underperform their respective benchmark index for a defined period, JCG's revenues and thus results of operations may be adversely affected. In addition, performance fees subject JCG's revenues to increased volatility.

JCG's results are dependent on its ability to attract and retain key personnel.

The investment management business is highly dependent on the ability to attract, retain and motivate highly skilled and often highly specialized technical, executive, sales and investment management personnel. The market for qualified investment and sales professionals is extremely competitive and is increasingly characterized by the frequent movement of portfolio managers, analysts and salespersons among different firms. Any changes to management structure, shifts in corporate culture, changes to corporate governance authority, or adjustments or reductions to compensation could affect JCG's ability to retain key personnel and could result in legal claims. If JCG is unable to retain key personnel, it could adversely affect JCG's assets under management, results of operations and financial condition.

JCG is dependent upon third-party distribution channels to access clients and potential clients.

JCG's ability to market and distribute its investment products is significantly dependent on access to the client base of insurance companies, defined contribution plan administrators, securities firms, broker-dealers, financial advisors, banks and other distribution channels. These companies generally offer their clients various investment products in addition to, and in competition with, JCG. Further, the separate account business uses referrals from financial planners, investment advisers and other professionals. JCG cannot be certain that it will continue to have access to these third-party distribution channels or have an opportunity to offer some or all of its investment products through these channels. In addition, JCG's existing relationships with third-party distributors and access to new distributors could be adversely affected by recent consolidation within the financial services industry. Consolidation may result in increased distribution costs, a reduction in the number of third parties distributing JCG's investment products or increased competition to access third-party distribution channels. The inability to access clients through third-party distribution channels could adversely affect JCG's business prospects, assets under management, results of operations and financial condition.

9

INTECH's investment process is highly dependent on key employees and proprietary software.

INTECH's investment process is based on complex and proprietary mathematical models that seek to outperform various indices by capitalizing on the volatility in stock price movements while controlling trading costs and overall risk relative to the index. The maintenance of such models for current products and the development of new products are highly dependent on certain key INTECH employees. If INTECH is unable to retain key personnel or properly transition key personnel responsibilities to others, or if the mathematical investment strategies fail to produce the intended results, INTECH may not be able to maintain its historical level of investment performance, which could adversely affect JCG's assets under management, results of operations and financial condition.

Changes in the value of seeded investment products could affect JCG's nonoperating income or earnings and could increase the volatility of its earnings.

JCG periodically adds new investment strategies to its investment product offerings by providing the initial cash investment or "seeding" to facilitate the launch of the product. JCG may also provide substantial supplemental capital to an existing investment product in order to accelerate the growth of a strategy and attract outside investment in the product. A decline in the valuation of these seeded investments could increase the volatility of JCG's earnings and result in a decline in earnings and financial condition.

JCG's international operations are subject to foreign risks, including political, regulatory, economic and currency risks.

JCG operates offices and advises clients outside of the U.S., and is thereby subject to risks inherent in doing business internationally. These risks may include changes in applicable laws and regulatory requirements; difficulties in staffing and managing foreign operations; difficulties in collecting investment management fees receivable; different, and in some cases less stringent, legal, regulatory and accounting regimes; political instability; fluctuations in currency exchange rates; expatriation controls; expropriation risks; and potential adverse tax consequences. These or other risks related to JCG's international operations could adversely affect the Company's assets under management, results of operations and financial condition.

The regulatory environment in which JCG operates has changed and may continue to change.

JCG may be adversely affected as a result of new or revised legislation or regulations, or by changes in the interpretation or enforcement of existing laws and regulations. The Company has increased its product offerings and international business activities over the past several years, resulting in increased exposure to international regulation. The costs and burdens of compliance with these and other new reporting and operational requirements and regulations have increased significantly and may continue to increase the cost of operating mutual funds and other investment products, which could adversely affect JCG's assets under management, results of operations and financial condition. (See Part I, Item 1, Business — Regulation, of this Annual Report on Form 10-K.)

10

Any damage to JCG's reputation could harm its business and lead to a loss of assets under management, revenues and net income.

JCG's reputation is critical to the success of its business. Any damage to the Company's reputation could impede its ability to attract and retain clients and key personnel, and could adversely affect JCG's assets under management, results of operations and financial condition.

JCG's business may be vulnerable to failures or breaches in support systems and client service functions, and may be subject to cyberattacks.

The ability to consistently and reliably obtain securities pricing information, process client transactions and provide reports and other client services to the shareholders of funds and other investment products managed by JCG is essential to JCG's operations. Any delays, errors or inaccuracies in obtaining pricing information, processing client transactions or providing reports, and any other inadequacies in other client service functions could discourage clients, result in financial loss and potentially give rise to regulatory action and claims against JCG. Any failures of the Company's systems could adversely affect JCG's results of operations and financial condition, assets under management, and ability to maintain confidential information relating to its clients and business operations.

JCG's client service capabilities as well as JCG's ability to obtain prompt and accurate securities pricing information and to process client transactions and reports are significantly dependent on communication and information systems and services provided by third-party vendors. Also, JCG's established disaster recovery plans could suffer failures or interruptions due to various natural or man-made causes, and backup procedures and capabilities may not be adequate to avoid extended interruptions. Furthermore, JCG places significant reliance on its automated systems, thereby increasing the related risks if such systems were to fail. A failure of third-party systems or services, disaster recovery plans or automated systems could adversely affect JCG's assets under management, results of operations and financial condition.

JCG maintains confidential information relating to its clients and business operations. Authorized persons could inadvertently or intentionally release confidential or proprietary information. JCG's systems could be infiltrated by unauthorized users or damaged by computer viruses or other malicious software code as a result of cyberattacks by computer programmers or hackers. While JCG has established business continuity plans and risk management systems designed to prevent or reduce the severity of any such improprieties or cyberattacks, there are inherent limitations in such plans and systems including the possibility that certain risks have not been identified. JCG also cannot directly control any cybersecurity plans and systems put in place by third-party service providers. Unauthorized or inadvertent disclosure of confidential or proprietary information or cyberattacks could be detrimental to JCG's reputation and lead to legal claims, negative publicity, regulatory action, increased costs or loss of revenue, among other things, all of which could adversely affect JCG's assets under management, results of operations and financial condition.

JCG's business is dependent on investment management agreements that are subject to termination, non-renewal or reductions in fees.

JCG derives revenue from investment management agreements with mutual funds and other investment products. With respect to investment management agreements with mutual funds, these agreements may be terminated by either party with notice, or terminated in the event of an "assignment" (as defined in the 1940 Act), and must be approved and renewed annually by the independent members of each fund's board of directors or trustees or its shareowners, as required by law. In addition, the board of directors or trustees of certain funds generally may terminate these investment management agreements upon written notice for any reason and without penalty. The

11

termination of or failure to renew one or more of these agreements or the reduction of the fee rates applicable to such agreements could have a material adverse effect on JCG's assets under management, results of operations and financial condition.

JCG's financial results could be adversely affected by the financial stability of other financial institutions.

JCG routinely executes transactions with various counterparties in the financial services industry. Historical market volatility highlights the interconnection of the global markets and demonstrates how the deteriorating financial condition of one institution may materially and adversely affect the performance of other institutions. JCG may be exposed to operational, credit or other risks in the event that a counterparty with whom the Company transacts defaults on its obligations or if there are other unrelated systemic failures in the markets.

JCG's indebtedness could adversely affect its financial condition and results of operations.

JCG's indebtedness could limit its ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt servicing requirements or other purposes. Debt servicing requirements increase JCG's vulnerability to adverse economic, market and industry conditions; limit JCG's flexibility in planning for or reacting to changes in business operations or to the asset management industry overall; and place JCG at a disadvantage in relation to competitors that have lower debt levels. Any or all of the above events and factors could adversely affect JCG's assets under management, results of operations and financial condition.

JCG is periodically involved in various legal proceedings and regulatory matters and may be involved in such proceedings in the future.

JCG and its employees are periodically involved in various legal proceedings and regulatory matters. These matters could adversely affect JCG's assets under management, results of operations and financial condition. Additionally, JCG and its employees have received and may receive in the future requests for information in connection with certain investigations or proceedings from various governmental and regulatory authorities. These investigations or proceedings may result in increased costs or reputational harm to the Company, which may lower sales and increase redemptions.

JCG operates in a highly competitive environment and its current fee structure may be reduced.

The investment management business is highly competitive and has relatively low barriers to entry. JCG's current fee structure may be subject to downward pressure due to these factors. Moreover, in recent years there has been a trend toward lower fees in the investment management industry. Fee reductions on existing or future new business as well as changes in regulations pertaining to its fee structure could adversely affect JCG's results of operations and financial condition. Additionally, JCG competes with investment management companies on the basis of investment performance, fees, diversity of products, distribution capability, reputation and the ability to develop new investment products to meet the changing needs of investors. Failure to adequately compete could adversely affect JCG's assets under management, results of operations and financial condition.

Acquisitions expose JCG to risks inherent in acquiring a company.

JCG has and may acquire or invest in businesses that the Company believes will add value to its business and generate positive net returns. These acquisitions and investments may not be effective, and could result in decreased earnings and harm to the Company's competitive position in the investment management industry.

12

Any strategic transaction can involve a number of risks, such as additional demands on JCG's existing employees and unanticipated problems regarding integration of products, technologies and new employees. As a result, the Company may not be able to realize all of the benefits that it hoped to achieve from such transactions. In addition, entering new jurisdictions or managing new products involves numerous risks such as adhering to new regulations, foreign currency exposure and the integration of new products into JCG's existing operations. JCG may be required to spend additional time or money on integration which could decrease its earnings and prevent the Company from focusing on the development and expansion of its existing business and services.

JCG has significant goodwill and intangible assets that are subject to impairment.

Goodwill and intangible assets totaled $2.0 billion at December 31, 2015. The value of these assets may not be realized for a variety of reasons, including, but not limited to, significant redemptions, loss of clients, damage to brand name and unfavorable economic conditions. JCG has recorded goodwill and intangible asset impairments in the past and could incur similar charges in the future. JCG reviews the carrying value of goodwill and intangible assets not subject to amortization on an annual basis, or more frequently if indications exist suggesting that the fair value of its intangible assets may be below their carrying value. JCG evaluates the value of intangible assets subject to amortization whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Should such reviews indicate impairment, a reduction of the carrying value of the intangible asset could occur, resulting in a charge that may, in turn, adversely affect JCG's assets under management, results of operations and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

JCG's headquarters are located in Denver, Colorado. JCG leases office space from non-affiliated companies for administrative, investment and client servicing operations in the following locations:

Domestic properties

- •

- Boston, Massachusetts

- •

- Chicago, Illinois

- •

- Darien, Connecticut

- •

- Denver, Glendale and Aurora, Colorado

- •

- Newport Beach, California

- •

- Princeton, New Jersey

- •

- San Francisco, California

- •

- West Palm Beach, Florida

International properties

- •

- Dubai

- •

- Frankfurt

- •

- Hong Kong

13

- •

- London

- •

- Melbourne

- •

- Milan

- •

- Paris

- •

- Singapore

- •

- Sydney

- •

- Taipei

- •

- The Hague

- •

- Tokyo

- •

- Zurich

In the opinion of management, the space and equipment owned or leased by the Company are adequate for existing operating needs.

The information set forth in response to Item 103 of Regulation S-K under "Legal Proceedings" is incorporated by reference from Part II, Item 8, Financial Statements and Supplementary Data, Note 16 — Commitments and Contingencies, of this Annual Report on Form 10-K.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

14

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

JCG Common Stock

JCG's common stock is traded on the New York Stock Exchange ("NYSE") (symbol: JNS). The following table presents the high and low sale prices as reported on the NYSE composite tape for each completed quarter in 2015 and 2014.

| |

2015 | 2014 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Quarter

|

High | Low | High | Low | |||||||||

First |

$ | 18.59 | $ | 15.56 | $ | 12.99 | $ | 10.32 | |||||

Second |

$ | 18.75 | $ | 16.66 | $ | 12.91 | $ | 10.40 | |||||

Third |

$ | 17.29 | $ | 13.29 | $ | 15.89 | $ | 11.08 | |||||

Fourth |

$ | 16.01 | $ | 13.37 | $ | 16.47 | $ | 13.40 | |||||

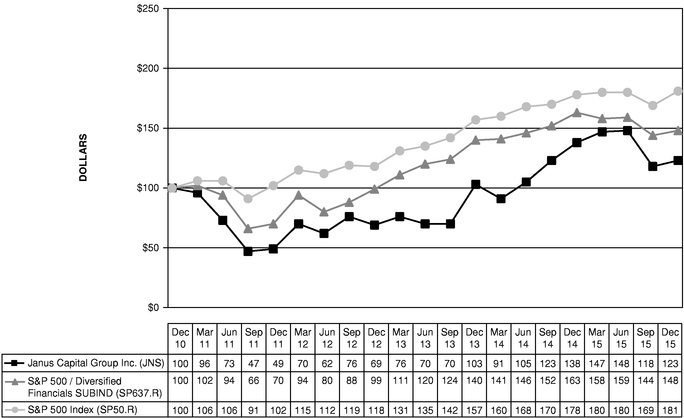

The following graph illustrates the cumulative total shareholder return (rounded to the nearest whole dollar) of JCG's common stock over the five-year period ending December 31, 2015, the last trading day of 2015, and compares it to the cumulative total return on the Standard and Poor's ("S&P") 500 Index and the S&P Diversified Financials Index. The comparison assumes a $100 investment on December 31, 2010, in JCG's common stock and in each of the foregoing indices and assumes reinvestment of dividends, if any. This table is not intended to forecast future performance of JCG's common stock.

On December 31, 2015, there were approximately 2,187 holders of record of JCG's common stock.

15

Dividends

The payment of cash dividends is within the discretion of JCG's Board of Directors and depends on many factors, including, but not limited to, JCG's results of operations, financial condition, capital requirements, restrictions imposed by financing arrangements, general business conditions and legal requirements. Dividends are subject to quarterly declaration by JCG's Board of Directors.

On April 16, 2015, JCG's Board of Directors approved an increase of $0.01 per share, or 13%, in the Company's regular quarterly dividend. The approved quarterly rate of $0.09 per share represents an expected annualized dividend rate of $0.36 per share of common stock.

On January 19, 2016, JCG's Board of Directors declared a regular quarterly cash dividend of $0.09 per share, which will be paid on February 25, 2016, to stockholders of record at the close of business on February 12, 2016.

The following cash dividends were declared and paid during 2015:

Dividend per share

|

Date declared | Date paid | ||

|---|---|---|---|---|

| $ 0.08 | January 15 | February 27 | ||

| $ 0.09 | April 16 | May 22 | ||

| $ 0.09 | July 16 | August 21 | ||

| $ 0.09 | October 15 | November 20 |

JCG declared and paid three $0.08 per share dividends and one $0.07 per share dividend in 2014. JCG declared and paid three $0.07 per share dividends in 2013.

Common Stock Repurchases

JCG's Board of Directors authorized a $500 million share repurchase program in July 2008. During the year ended December 31, 2015, JCG repurchased 4,500,938 shares of its common stock at an average price of $15.58 per share and a total cost of $70.2 million as part of the share repurchase program. The share repurchase program is conducted within the parameters of Rule 10b5-1 under the Exchange Act. Any future repurchases of common stock will depend on prevailing market conditions, the Company's liquidity requirements, contractual and legal restrictions, and other factors.

JCG also repurchased 295,850 shares of common stock from The Dai-ichi Life Insurance Company ("Dai-ichi Life") on January 27, 2015, for a total cost of $4.6 million in order for Dai-ichi Life to comply with the ownership limit obligations under the investment agreement between JCG and Dai-ichi Life. At December 31, 2015, Dai-ichi Life owned approximately 20% of the outstanding common shares of the Company.

In addition to the share repurchase program, during the year ended December 31, 2015, JCG withheld 1,002,805 shares from employees as part of a share withholding program to satisfy the employees' minimum statutory income tax liabilities attributable to the vesting of restricted stock. The shares withheld had a value of $17.0 million and were deposited into treasury shares.

16

The following table presents total 2015 JCG common stock repurchases by month as part of the share repurchase programs:

Period

|

Total number of shares purchased |

Average price paid per share |

Total number of shares purchased as part of publicly announced programs |

Approximate dollar value of shares that may yet be purchased under the programs (end of month) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

January |

| 595,575 | $ | 16.29 | | 594,050 | $ | 378 million | |||||

February |

791,172 | 17.41 | — | $ | 378 million | ||||||||

March |

| — | | — | | — | $ | 378 million | |||||

April |

40,653 | 17.85 | 27,565 | $ | 377 million | ||||||||

May |

| 280,905 | | 17.81 | | 280,905 | $ | 372 million | |||||

June |

307,434 | 17.89 | 307,434 | $ | 367 million | ||||||||

July |

| 382,791 | | 16.80 | | 328,422 | $ | 361 million | |||||

August |

585,492 | 15.49 | 585,492 | $ | 352 million | ||||||||

September |

| 731,234 | | 14.37 | | 731,234 | $ | 342 million | |||||

October |

745,775 | 14.80 | 744,045 | $ | 331 million | ||||||||

November |

| 636,728 | | 15.71 | | 636,728 | $ | 321 million | |||||

December |

701,834 | 14.28 | 560,913 | $ | 313 million | ||||||||

| | | | | | | | | | | | | | |

Total |

| 5,799,593 | $ | 15.82 | | 4,796,788 | | ||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

17

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data below was derived from the Company's audited consolidated financial statements and should be read in conjunction with Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this Annual Report on Form 10-K and Part II, Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

| |

Year ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

| |

(dollars in millions, except per share data and operating data) |

|||||||||||||||

Income statement: |

| | | | | |||||||||||

Revenues |

$ | 1,076.2 | $ | 953.2 | $ | 873.9 | $ | 850.0 | $ | 981.9 | ||||||

Operating expenses |

| 753.9 | | 663.5 | | 634.8 | | 635.5 | | 670.1 | ||||||

| | | | | | | | | | | | | | | | | |

Operating income |

322.3 | 289.7 | 239.1 | 214.5 | 311.8 | |||||||||||

Interest expense |

| (27.7 | ) | | (33.1 | ) | | (41.1 | ) | | (45.0 | ) | | (51.0 | ) | |

Investment gains (losses), net |

(8.2 | ) | (1.9 | ) | 6.5 | 11.1 | (21.9 | ) | ||||||||

Other income, net |

| 3.2 | | 3.0 | | 4.5 | | 3.2 | | 3.8 | ||||||

Loss on early extinguishment of debt |

(36.3 | ) | — | (13.5 | ) | (7.2 | ) | (9.9 | ) | |||||||

Income tax provision |

| (94.0 | ) | | (102.3 | ) | | (73.3 | ) | | (64.7 | ) | | (79.4 | ) | |

| | | | | | | | | | | | | | | | | |

Net income |

159.3 | 155.4 | 122.2 | 111.9 | 153.4 | |||||||||||

Noncontrolling interests |

| (3.5 | ) | | (1.0 | ) | | (7.5 | ) | | (9.6 | ) | | (10.5 | ) | |

| | | | | | | | | | | | | | | | | |

Net income attributable to JCG |

$ | 155.8 | $ | 154.4 | $ | 114.7 | $ | 102.3 | $ | 142.9 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Earnings per share attributable to JCG common shareholders: (1) |

| | | | | |||||||||||

Diluted |

$ | 0.80 | $ | 0.81 | $ | 0.62 | $ | 0.55 | $ | 0.78 | ||||||

Weighted-average diluted common shares outstanding |

|

186.8 |

|

184.9 |

|

185.9 |

|

185.1 |

|

184.2 |

||||||

Dividends declared and paid per share |

$ |

0.35 |

$ |

0.31 |

$ |

0.21 |

$ |

0.29 |

$ |

0.15 |

||||||

Balance sheet (as of December 31): |

|

|

|

|

|

|||||||||||

Total assets |

$ | 2,871.5 | $ | 2,793.2 | $ | 2,747.3 | $ | 2,660.4 | $ | 2,644.0 | ||||||

Long-term debt (including current portion) |

$ | 406.1 | $ | 450.5 | $ | 544.6 | $ | 545.1 | $ | 595.2 | ||||||

Other non-current liabilities |

$ | 545.1 | $ | 519.6 | $ | 480.1 | $ | 477.8 | $ | 465.5 | ||||||

Redeemable noncontrolling interests |

$ | 21.8 | $ | 5.4 | $ | 7.3 | $ | 42.9 | $ | 85.4 | ||||||

Cash flow: |

||||||||||||||||

Cash flows provided by operating activities |

$ | 274.4 | $ | 218.4 | $ | 224.1 | $ | 208.9 | $ | 224.6 | ||||||

Operating data (in billions): |

||||||||||||||||

Ending assets under management (2) |

$ | 189.1 | $ | 183.1 | $ | 173.9 | $ | 156.8 | $ | 148.2 | ||||||

Average assets under management (2) |

$ | 190.6 | $ | 175.8 | $ | 165.4 | $ | 156.3 | $ | 162.3 | ||||||

Long-term net flows (2) (3) |

$ | (2.6 | ) | $ | (4.9 | ) | $ | (19.7 | ) | $ | (12.0 | ) | $ | (12.2 | ) | |

- (1)

- Each

component of earnings per share presented has been individually rounded.

- (2)

- Does

not include VelocityShares assets at December 31, 2015 and 2014, as VelocityShares is not the named advisor or subadvisor to its branded

products.

- (3)

- Long-term net flows represent total Company net sales and redemptions, excluding money market and VelocityShares assets. Money market flows have been excluded due to the short-term nature of such investments while VelocityShares assets are excluded as VelocityShares is not the named advisor or subadvisor to its branded products.

18

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

JCG finished 2015 with assets under management of $189.1 billion, an increase of 3.3% from the end of 2014, as a result of the acquisition of Kapstream and market appreciation partially offset by long-term net outflows. The acquisition of Kapstream contributed $7.1 billion to assets under management. Long-term net outflows improved from $4.9 billion in 2014 to $2.6 billion in 2015 driven by higher sales in JCG's fundamental equity strategies partially offset by higher net redemptions in mathematical equity strategies and lower net sales in JCG's fixed income strategies.

Total revenue for JCG in 2015 of $1,076.2 million increased $123.0 million from 2014, primarily as a result of higher average assets under management and lower negative mutual fund performance fees.

The Company remains focused on operating efficiently by managing operating expenses in relation to total revenue. JCG realized operating margins of 29.9% and 30.4% for 2015 and 2014, respectively.

Net income attributable to JCG common shareholders for 2015 totaled $155.8 million, or $0.80 per diluted share, compared with $154.4 million, or $0.81 per diluted share, for 2014. Net income attributable to JCG common shareholders in 2015 was impacted by a $36.3 million loss on the redemption of its 6.700% Senior Notes due 2017 ("2017 Senior Notes").

JCG continued to execute on its strategy of Intelligent Diversification in 2015. A summary of accomplishments include the following:

- •

- Focus on performance in the fundamental equity franchise — As of

December 31, 2015, 84%, 70% and 62% of fundamental equity mutual fund assets were in the top two Morningstar quartiles on a 1-, 3- and 5-year basis, respectively, compared to 66%, 81% and 48% a

year ago.

- •

- Focus on performance and grow the fixed income franchise — In 2015,

JCG acquired a controlling 51% voting interest in Kapstream, a global macro fixed income asset manager located in Australia. The acquisition serves to further expand JCG's fixed income capabilities

and build out its global macro fixed income team.

Performance in the fundamental fixed income franchise has improved in 2015. As of December 31, 2015, 82%, 100% and 82% of fixed income mutual fund assets were in the top two Morningstar quartiles on a 1-, 3-, and 5-year basis, respectively, compared to 2%, 85% and 80% a year ago.

- •

- Expand non-U.S. distribution capabilities and product offerings — The non-U.S. business had full-year 2015 net flows of $6.6 billion, a 20% organic

growth rate, representing the strongest year of non-U.S. net flows in the firm's

history. JCG's strategic alliance with Dai-ichi Life continues to assist with the Company's ongoing growth in Japan.

- •

- Develop solutions-based products — During 2015, JCG launched the

Adaptive Global Allocation strategy which aims to provide investors total returns by dynamically allocating assets across a portfolio of global equity and fixed income investments.

JCG's acquisition of VelocityShares in 2014 positions the firm to deliver rules-based and actively managed products within the rapidly growing ETF universe, enhancing the customized solutions JCG can provide to its clients and enabling the Company to work with the growing segment of financial advisors and institutions focused on these instruments. The Company filed an initial registration statement with the SEC for the Janus Small Cap Growth Alpha and Janus Small-Mid Cap Growth Alpha ETFs with an anticipated launch date in the first quarter of 2016.

19

- •

- Strengthen the Consolidated Balance Sheets — In July 2015, JCG issued $300.0 million of 4.875% Senior Notes due 2025 ("2025 Senior Notes"). Using the proceeds of the 2025 Senior Notes and cash on hand, JCG fully redeemed the outstanding 2017 Senior Notes. The redemption of the 2017 Senior Notes and issuance of the 2025 Senior Notes strengthened the Company's balance sheet by reducing the carrying amount of debt on the Consolidated Balance Sheets by $44.4 million in 2015 and extending the maturity of the notes to 2025.

Investment Performance of Assets Under Management

Investment products are generally evaluated based on their investment performance relative to other investment products with similar disciplines and strategies or benchmark indices.

The following table is a summary of investment performance as of December 31, 2015:

| |

Percentage of mutual fund assets outperforming majority of Morningstar peers (1) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

1-Year | 3-Year | 5-Year | |||||||

Complex-wide mutual fund assets |

| 84 | % | | 74 | % | | 65 | % | |

Fundamental equity mutual fund assets |

84 | % | 70 | % | 62 | % | ||||

Fixed income mutual fund assets |

| 82 | % | | 100 | % | | 82 | % | |

| |

Percentage of relative return strategies outperforming respective benchmarks (2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

1-Year | 3-Year | 5-Year | |||||||

Mathematical equity strategies |

| 74 | % | | 53 | % | | 67 | % | |

| |

Percentage of complex-wide mutual funds with 4- or 5-star Overall Morningstar RatingTM |

|

|---|---|---|

Complex-wide mutual funds |

55% |

- (1)

- References

Morningstar relative performance on an asset-weighted, total return basis.

- (2)

- References performance of relative return strategies, net of fees.

Assets Under Management and ETPs

Total Company assets under management increased $6.0 billion, or 3.3%, from 2014 as a result of market appreciation of $1.5 billion and the July 1, 2015, acquisition of Kapstream, which contributed $7.1 billion in fixed income assets. These items were partially offset by long-term net outflows of $2.6 billion. Long-term net flows represent total Company net sales and redemptions, excluding money market assets. Money market net sales and redemptions were nil in 2015.

Fundamental equity net outflows were $1.5 billion in 2015 compared with $7.6 billion in 2014. The decrease in net outflows was primarily driven by improved investment performance and an increase in sales while redemptions remained relatively flat in 2015.

Positive net flows for fixed income continued in 2015 with net inflows of $3.3 billion compared to $4.4 billion in 2014. The year-over-year change in net inflows was driven by increased redemptions partially offset by increased sales.

Mathematical equity net outflows were $4.4 billion in 2015 compared with $1.7 billion in 2014. The increase in net outflows was primarily driven by an increase in redemptions and flat sales in 2015.

ETP assets contributed $3.2 billion to complex-wide assets, an increase of $0.8 billion from 2014 due to net sales of $3.3 billion partially offset by market depreciation of $2.5 billion.

20

In December 2015, JCG announced that Gibson Smith, the Company's Fundamental Fixed Income Chief Investment Officer will leave JCG on March 31, 2016. While JCG's other fixed income investment, research, trading and risk management teams remain intact, the Company believes that Mr. Smith's departure could have an impact on assets under management, results of operations and financial condition.

Market volatility in January 2016 has led to a decline in JCG's assets under management from December 31, 2015, which will negatively impact the Company's results of operations and financial condition.

The following table presents the components of JCG's assets under management for the years ended December 31, 2015, 2014 and 2013 (in billions):

| |

Year ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | |||||||

Beginning of year assets |

$ | 183.1 | $ | 173.9 | $ | 156.8 | ||||

Long-term sales (1) |

||||||||||

Fundamental equity |

| 24.9 | | 18.6 | | 17.2 | ||||

Fixed income |

16.2 | 13.7 | 12.6 | |||||||

Mathematical equity |

| 6.6 | | 6.6 | | 5.2 | ||||

Long-term redemptions (1) |

||||||||||

Fundamental equity |

| (26.4 | ) | | (26.2 | ) | | (33.1 | ) | |

Fixed income |

(12.9 | ) | (9.3 | ) | (11.7 | ) | ||||

Mathematical equity |

| (11.0 | ) | | (8.3 | ) | | (9.9 | ) | |

| | | | | | | | | | | |

Long-term net flows (1) |

||||||||||

Fundamental equity |

| (1.5 | ) | | (7.6 | ) | | (15.9 | ) | |

Fixed income |

3.3 | 4.4 | 0.9 | |||||||

Mathematical equity |

| (4.4 | ) | | (1.7 | ) | | (4.7 | ) | |

| | | | | | | | | | | |

Total long-term net flows |

(2.6 | ) | (4.9 | ) | (19.7 | ) | ||||

Net money market flows |

| — | | (0.1 | ) | | (0.1 | ) | ||

Acquisition |

7.1 | — | — | |||||||

Market/fund performance |

| 1.5 | | 14.2 | | 36.9 | ||||

| | | | | | | | | | | |

End of year assets (2) |

$ | 189.1 | $ | 183.1 | $ | 173.9 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Excludes

money market flows. Sales and redemptions of money market funds are presented net on a separate line due to the short-term nature of the

investments.

- (2)

- Excludes VelocityShares assets of $3.2 billion and $2.4 billion as of December 31, 2015 and 2014, respectively, as VelocityShares is not the named advisor or subadvisor to its branded products.

| |

Year ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | |||||||

Average assets under management: (1) |

| | | |||||||

Fundamental equity |

$ | 99.5 | $ | 94.0 | $ | 93.0 | ||||

Fixed income |

| 39.5 | | 31.3 | | 27.7 | ||||

Mathematical equity |

50.3 | 49.1 | 43.3 | |||||||

Money market |

| 1.3 | | 1.4 | | 1.4 | ||||

| | | | | | | | | | | |

Total |

$ | 190.6 | $ | 175.8 | $ | 165.4 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Does not include VelocityShares assets at December 31, 2015 and 2014, as VelocityShares is not the named advisor or subadvisor to its branded products.

21

Assets and Flows by Investment Discipline

JCG, through its subsidiaries, offers investment products based on a diversified set of investment disciplines. Janus offers growth and core equity, global and international equity as well as balanced, fixed income, ETPs and retail money market investment products. INTECH offers mathematical-based investment products, and Perkins offers value-disciplined investment products. Assets and flows by investment discipline are as follows (in billions):

| |

Growth / Core (1) |

Global / International |

Mathematical Equity |

Fixed Income (1) |

Value | Total Company (Excluding Money Market and ETPs) |

ETPs (2) | Money Market |

Total Company |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

December 31, 2015 |

$ | 64.9 | $ | 22.5 | $ | 47.6 | $ | 44.4 | $ | 8.4 | $ | 187.8 | $ | 3.2 | $ | 1.3 | $ | 192.3 | ||||||||||

Sales |

13.8 | 9.3 | 6.6 | 16.2 | 1.8 | 47.7 | 12.6 | 0.7 | 61.0 | |||||||||||||||||||

Redemptions |

| (14.2 | ) | | (7.0 | ) | | (11.0 | ) | | (12.9 | ) | | (5.2 | ) | | (50.3 | ) | | (9.3 | ) | | (0.7 | ) | | (60.3 | ) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales (redemptions) |

(0.4 | ) | 2.3 | (4.4 | ) | 3.3 | (3.4 | ) | (2.6 | ) | 3.3 | — | 0.7 | |||||||||||||||

Market/fund performance |

| 1.4 | | (0.1 | ) | | 1.0 | | (0.4 | ) | | (0.4 | ) | | 1.5 | | (2.5 | ) | | — | | (1.0 | ) | |||||

Acquisitions (3) |

— | — | — | 7.1 | — | 7.1 | — | — | 7.1 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2014 |

$ | 63.9 | $ | 20.3 | $ | 51.0 | $ | 34.4 | $ | 12.2 | $ | 181.8 | $ | 2.4 | $ | 1.3 | $ | 185.5 | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sales |

10.6 | 5.5 | 6.6 | 13.7 | 2.5 | 38.9 | 1.1 | 0.6 | 40.6 | |||||||||||||||||||

Redemptions |

| (13.7 | ) | | (5.2 | ) | | (8.3 | ) | | (9.3 | ) | | (7.3 | ) | | (43.8 | ) | | (0.4 | ) | | (0.7 | ) | | (44.9 | ) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales (redemptions) |

(3.1 | ) | 0.3 | (1.7 | ) | 4.4 | (4.8 | ) | (4.9 | ) | 0.7 | (0.1 | ) | (4.3 | ) | |||||||||||||

Market/fund performance |

| 6.2 | | 0.7 | | 5.1 | | 1.1 | | 1.1 | | 14.2 | | (0.6 | ) | | — | | 13.6 | |||||||||

Acquisitions (2) |

— | — | — | — | — | — | 2.3 | — | 2.3 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2013 |

$ | 60.8 | $ | 19.3 | $ | 47.6 | $ | 28.9 | $ | 15.9 | $ | 172.5 | $ | — | $ | 1.4 | $ | 173.9 | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sales |

10.5 | 3.3 | 5.2 | 12.6 | 3.4 | 35.0 | — | 0.6 | 35.6 | |||||||||||||||||||

Redemptions |

| (19.2 | ) | | (5.6 | ) | | (9.9 | ) | | (11.7 | ) | | (8.3 | ) | | (54.7 | ) | | — | | (0.7 | ) | | (55.4 | ) | ||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales (redemptions) |

(8.7 | ) | (2.3 | ) | (4.7 | ) | 0.9 | (4.9 | ) | (19.7 | ) | — | (0.1 | ) | (19.8 | ) | ||||||||||||

Market/fund performance |

| 15.7 | | 3.7 | | 12.1 | | 1.6 | | 3.8 | | 36.9 | | — | | — | | 36.9 | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2012 |

$ | 53.8 | $ | 17.9 | $ | 40.2 | $ | 26.4 | $ | 17.0 | $ | 155.3 | $ | — | $ | 1.5 | $ | 156.8 | ||||||||||

Notes:

- (1)

- Growth/Core

and Fixed Income disciplines reflect an even split of the Janus Balanced fund between the two categories.

- (2)

- VelocityShares

was acquired in the fourth quarter 2014; prior to that JCG did not offer ETPs.

- (3)

- Kapstream was acquired on July 1, 2015.

Valuation of Assets Under Management

The fair value of assets under management is derived from the cash and investment securities underlying JCG's investment products. Investment security values are determined using unadjusted or adjusted quoted market prices and independent third-party price quotes in active markets. The fair value of the vast majority of the equity securities underlying JCG's investment products is derived from readily available and reliable market price quotations while the fair value of a majority of the fixed income securities is derived from evaluated pricing from independent third-party providers. JCG uses adjusted market prices to value certain international equity securities in its domestic and non-domestic mutual funds to adjust for stale pricing that may occur between the close of certain foreign exchanges and the NYSE. Security prices are adjusted based upon historical impacts for similar post-close activity. For fixed income securities with maturities of 60 days or less, the amortized cost method is used to determine the value. Securities for which market prices are not readily available or are considered unreliable are internally valued using appropriate methodologies for each security type or by engaging third-party specialists.

The pricing policies for mutual funds advised by JCG's subsidiaries (the "Funds") are established by the Funds' Independent Board of Trustees and are designed to test and validate fair value

22

measurements. Responsibility for pricing securities held within separate and subadvised accounts may be delegated by the separate or subadvised clients to JCG or another party. JCG validates pricing received from third-party providers by comparing pricing between primary and secondary vendors. Any discrepancies are identified and resolved.

JCG performs a number of procedures to validate the pricing received from third-party providers. For actively traded equity securities, prices are received daily from both a primary and secondary vendor. For fixed income securities, prices are received daily from a primary vendor and weekly from a secondary vendor. Prices from the primary and secondary vendors are compared to identify any discrepancies. In the event of a discrepancy, a price challenge may be issued to both vendors. Securities with significant price changes require additional research, which may include a review of all news pertaining to the issue and issuer and any corporate actions. All fixed income prices are reviewed by JCG's fixed income trading desk to incorporate market activity information available to JCG's traders. In the event the traders have received price indications from market makers for a particular issue, this information is transmitted to the pricing vendors.

All pricing vendors are subject to an annual on-site due diligence review that includes a detailed discussion about the methodologies used, particularly for evaluated prices, and any changes to the methodologies.

JCG is generally not the pricing agent for securities held within separate and subadvised accounts. However, JCG does perform a daily reconciliation between the pricing performed by the pricing agent and the pricing applied based on JCG's procedures. Any pricing discrepancies are resolved with the client designated pricing agent.

Revenues

Revenues are generally based upon a percentage of the market value of assets under management and are calculated as a percentage of the daily average asset balance in accordance with contractual agreements. Certain mutual funds and separate accounts are also subject to performance fees, which vary based on a product's relative performance as compared to an established benchmark index over a specified period of time and the level of assets subject to such fees. Assets under management primarily consist of domestic and international equity and debt securities. Accordingly, fluctuations in domestic and international financial markets, relative investment performance, sales and redemptions of investment products, and changes in the composition of assets under management are all factors that have a direct effect on JCG's operating

23

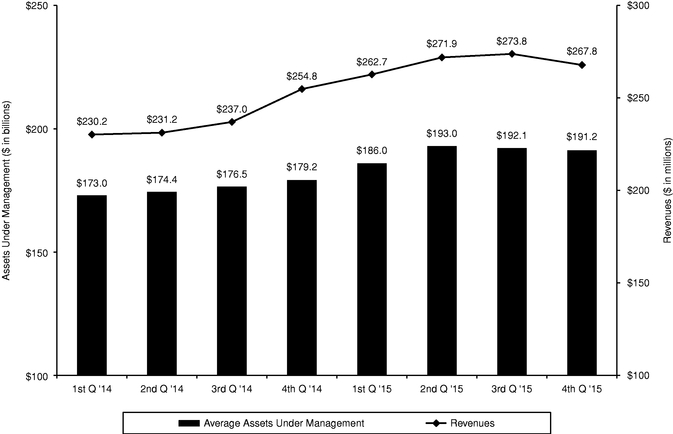

results. The following graph depicts the direct relationship between average assets under management and revenues:

Revenues

| |

Year ended December 31, | |

|

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 vs. 2014 |

2014 vs. 2013 |

||||||||||||||

| |

2015 | 2014 | 2013 | |||||||||||||

Revenues (in millions): |

| | | | | |||||||||||

Investment management fees |

$ | 913.7 | $ | 849.1 | $ | 813.0 | 7.6 | % | 4.4 | % | ||||||

Performance fees |

| (9.8 | ) | | (48.0 | ) | | (82.2 | ) | | 79.6 | % | | 41.6 | % | |

Shareowner servicing fees and other |

172.3 | 152.1 | 143.1 | 13.3 | % | 6.3 | % | |||||||||

| | | | | | | | | | | | | | | | | |

Total revenues |

$ | 1,076.2 | $ | 953.2 | $ | 873.9 | | 12.9 | % | | 9.1 | % | ||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Investment Management Fees

Investment management fees increased $64.6 million from 2014 to 2015 primarily due to an 8.4% increase in average assets under management driven by market appreciation, the addition of $7.1 billion in assets under management related to the Kapstream acquisition, and a reduction in long-term net outflows.

Investment management fees increased $36.1 million from 2013 to 2014 primarily as a result of a 6.3% increase in average assets under management driven by market appreciation in addition to a reduction in long-term net outflows. Revenue increased at a lower rate than average assets primarily due to a product mix shift toward lower yielding products and channels.

24

Performance Fees

Performance fee revenue is derived from certain mutual funds and separate accounts. Performance fee revenue consisted of the following for the years ended December 31, 2015, 2014 and 2013 (in millions):

| |

December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |