Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - SAUL CENTERS, INC. | bfs-12312016xexhibit32.htm |

| EX-31 - EXHIBIT 31 - SAUL CENTERS, INC. | bfs-12312016xexhibit31.htm |

| EX-23 - EXHIBIT 23 - SAUL CENTERS, INC. | bfs-12312016xexhibit23.htm |

| EX-21 - EXHIBIT 21 - SAUL CENTERS, INC. | bfs-12312016xexhibit21.htm |

| 10-K - 10-K - SAUL CENTERS, INC. | bfs-12312016x10k.htm |

Exhibit 99

B. F. SAUL REAL ESTATE

B. F. SAUL REAL ESTATE

Investment Trust

7501 WISCONSIN AVENUE, SUITE 1500E, BETHESDA, MARYLAND 20814

(301) 986-6000

December 8, 2016

Saul Holdings Limited Partnership

7501 Wisconsin Avenue, Suite 1500E

Bethesda, Maryland 20814

Attn: Scott V. Schneider, Senior Vice President and Chief Financial Officer

RE: Shared Third Party Pre-Development Costs for Twinbrook area properties

Mr. Schneider:

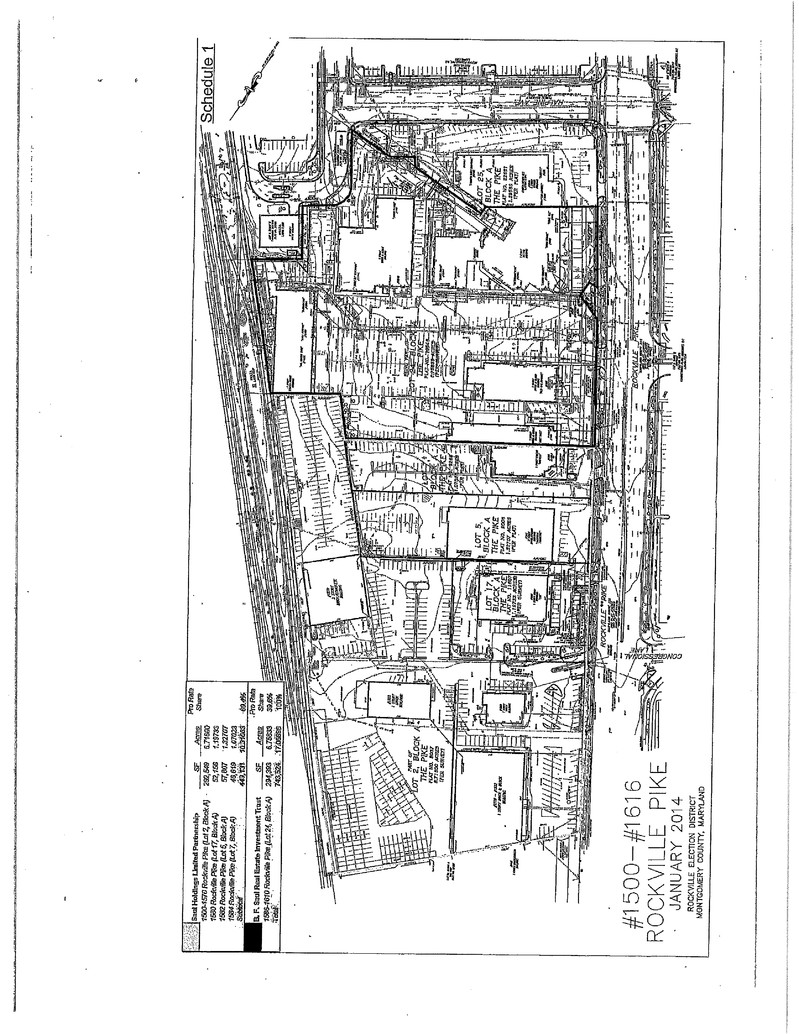

As you know, on February 19, 2014, the B.F. Saul Real Estate Investment Trust (the “Trust”) purchased approximately 6.75 acres of land at 1592 Rockville Pike, Rockville, Maryland (the “Trust Twinbrook Property”). The Trust understands that Saul Holdings Limited Partnership (“Holdings”) owns, through subsidiaries, properties (the “Holdings Twinbrook Property”) nearby and adjacent to the Trust Twinbrook Property, as more fully described on Schedule 1 to this letter. Further, the Trust understands that Holdings has engaged third party consultants, including but not limited to architects, civil engineers, and land use counsel to assist Holdings in planning a future development of the Holdings Twinbrook Property and has incurred and will incur costs, expenses and fees in connection with a future development (such services and costs, the “Pre-Development Services and Costs”).

In 2014, the Trust and Holdings concluded that it will be more efficient for the Trust and Holdings to share Pre-Development Services and Costs for their respective Twinbrook Properties. To that end, they entered into a letter agreement dated October 16, 2014 (the “Original Letter Agreement”) and an amendment dated November 6, 2015 (the “First Amendment”). The Trust and Holdings have agreed to replace the Original Letter Agreement and the First Amendment to address certain practical issues identified during the pre-development, but to retain the material terms of the Original Letter Agreement and First Amendment. Specifically:

1) | Holdings will inform the third party consultants that the Trust Twinbrook Property will be included in the scope of the Pre-Development Services and Costs. Holdings will manage the consultants providing such services, and provide the Trust with regular notice of developments and advance notice of any progress meetings. The Trust may send a representative to attend progress meetings and participate fully in discussions. |

2) | Holdings and the Trust will share Pre-Development Services and Costs, with such shares to be determined by dividing the acreage of each respective Twinbrook Property by the acreage of the Trust Twinbrook Property and Holdings Twinbrook Property combined, as set forth on Schedule 1. The Trust and Holdings agree that the division of the Pre-Development Services and Costs will be recalculated to include additional land parcels that either the Trust or Holdings |

may acquire in the future, with the pro rata share of each party to be adjusted retroactively to reallocate all costs and expenses incurred since October 16, 2014.

3) | Neither the Trust nor Holdings will advance funds to the other for Pre-Development Services and Costs. |

4) | The terms of this agreement shall extend through December 31, 2017, and renew automatically thereafter for a twelve-month term, unless either party provides written notice of termination 60 days in advance of the end of the term. |

5) | Prior to the end of any term, the Trust and Holdings will approve a budget for Pre-Development Services and Costs for the next term, and may include changing the allocation method set forth in paragraph 2 if the Trust and Holdings agree that a different allocation method would be more appropriate. |

Please indicate your agreement and acceptance of the terms of this letter by signing where indicated below and returning one executed copy of this letter to me. Upon execution by both parties, this agreement will be effective.

Sincerely yours,

/s/ Patrick T. Connors

Patrick T. Connors

Vice President

AGREED AND APPROVED:

Saul Holdings Limited Partnership

By: Saul Centers, Inc., General Partner

By: /s/ Scott V. Schneider

Name: Scott V. Schneider, Senior Vice President

and Chief Financial Officer