Attached files

| file | filename |

|---|---|

| 8-K - CATCHMARK INVESTOR PRESENTATION MARCH 2017 - CatchMark Timber Trust, Inc. | a8-kcatchmarkinvestorprese.htm |

1

CatchMark Timber Trust

N Y S E : C T T

M a y 2 0 1 6

C A T C H M A R K (NYSE: CTT)

F O U R T H Q U A R T E R 2 0 1 6

F O R WA R D - L O O K I N G S TAT E M E N T S

COMPANY UPDATE | FOURTH QUARTER 2016 2

This presentation contains certain forward-looking statements within the meaning of the safe harbor from civil liability provided for such

statements by the Private Securities Litigation Reform Act of 1995 (as set forth in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended) that are subject to risks and uncertainties. Such forward-looking

statements can generally be identified by use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate,"

"estimate," "believe," "continue," or other similar words. These forward-looking statements are based on certain assumptions, discuss future

expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information.

The Company's ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although the

Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, the

Company's actual results and performance could differ materially from those set forth in, or implied by, the forward-looking statements. You

should be aware that there are various factors that could cause actual results to differ materially from any forward-looking statements made

in this presentation. Factors that could cause or contribute to such differences include, but are not limited to, (i) we may not generate the

harvest volumes or the harvest mix from our timberlands that we currently anticipate; (ii) the demand for our timber may not increase at the

rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our

timberlands are located; (iii) the cyclical nature of the real estate market generally, including fluctuations in demand and valuations, may

adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties; (iv) housing starts and timber

prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (v) the supply of

timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (vi) we may be unsuccessful

in winning bids for timberland that are sold through an auction process; (vii) we may not be able to access external sources of capital at

attractive rates or at all; (viii) potential increases in interest rates could have a negative impact on our business; (ix) our share repurchase

program may not be successful in improving shareholder value over the long-term; (x) our cash dividends are not guaranteed and may

fluctuate; and (xi) the factors described in Item 1A. of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, under

the heading “Risk Factors” and our other filings with Securities and Exchange Commission. You are cautioned not to place undue reliance

on any of these forward-looking statements, which reflect the Company's views only as of this date. Furthermore, except as required by law,

the Company is under no duty to, and does not intend to, update any of our forward-looking statements after this date, whether as a result of

new information, future events or otherwise.

3

CatchMark Overview

CatchMark is a public company that strives to deliver

superior risk-adjusted returns for all stakeholders

through disciplined acquisitions, sustainable harvests,

and well-timed sales.

COMPANY UPDATE | FOURTH QUARTER 2016 4

A B O U T C AT C H M A R K

Key Facts

• Publicly-traded REIT (NYSE:CTT)

• 499,600 acres of commercial timberlands

– 467,500 fee acres

– 32,100 leased acres

• Approximately 20.3 million tons of merchantable

timber

• Well-diversified species and product mix

– 74% pine / 26% hardwood by acreage

– 51% pulpwood / 49% sawtimber by volume

• Sustainable Forestry Initiative-certified

5

Counties with Ownership and Leasehold Interests (As of 12/31/2016)

All data as of 12/31/2016

COMPANY UPDATE | FOURTH QUARTER 2016

Total Lease Fee

Alabama 82,300 5,600 76,700

Florida 2,000 -- 2,000

Georgia 280,100 26,500 253,600

Louisiana 21,300 -- 21,300

North Carolina 1,600 -- 1,600

South Carolina 76,400 -- 76,400

Tennessee 300 -- 300

Texas 35,600 -- 35,600

TOTAL 499,600 32,100 467,500

E X P E R I E N C E D M A N A G E M E N T T E A M

6

CatchMark’s seasoned leadership provides significant industry experience and capability to help

realize company objectives and growth plan.

Jerry Barag, President and CEO (31 years of industry experience)

• Managing Director and Founder TimberStar Advisors and TimberStar

• Chief Investment Officer at Lend Lease Real Estate Investments

• Executive Vice President, Equitable Real Estate

Brian Davis, Chief Financial Officer (26 years)

• Senior Vice President and Chief Financial Officer of Wells Timberland

• Various executive finance roles with SunTrust Bank and CoBank, delivering

capital market solutions – advisory, capital raising, and financial risk

management to public and private companies.

John Rasor, Chief Operating Officer (46 years)

• Managing Director and Founder TimberStar Advisors and TimberStar

• Executive Vice President of Georgia Pacific, responsible for timber and

timberlands, building product businesses, and wood and fiber procurement for

wood products, pulp and paper

CEO Barag and COO

Rasor have worked

together since 2004,

completing $1.4 billion in

timberland acquisitions

and $1.9 billion

dispositions prior to

joining CatchMark. These

transactions generated

investor returns of 2.0x

equity and 1.4x total

capital in the first and only

timberland securitization

(TimberStar).

COMPANY UPDATE | FOURTH QUARTER 2016

CATCHMARK ’ S I NVESTMENT DR I VERS

• Deliver recurring dividends from sustainable harvests

on prime timberlands and opportunistic land sales,

taking advantage of the current housing recovery

• Acquire highly-productive and well-located

timberlands in high demand fiber basket markets

through disciplined capital allocations

• Grow stable and predictable cash flows and enhance

NAV through active forest management and

concerted environmental stewardship

COMPANY UPDATE | FOURTH QUARTER 2016 7

CatchMark drives superior risk-adjusted performance through a focus on higher quality assets in

select mill markets and seeks to:

INVESTMENT DRIVERS

1. Prime Timberland Assets

2. High Demand Markets

3. Active Forest Management

4. Environmental Stewardship

Q U A L I T Y E A R N I N G S F R O M L O W E R - R I S K O P E R AT I O N S M O D E L

COMPANY UPDATE | FOURTH QUARTER 2016 8

CatchMark’s business model focuses on harvest operations of owned and leased timberlands to

secure durable earnings and does not include more volatile land development and manufacturing.

Timber

Operations

Land Sales

(<2% of fee acres)

Land Sales

(>2% of fee acres)

Commercial/

Residential Land

Development Manufacturing

CTT 70%1 30%1, 2 --- --- ---

WY

PCH

RYN

Risk Lower Higher

1. Based on % of Adjusted EBITDA. Adjusted EBITDA is a non-GAAP measure. See Appendix for our reconciliation from net income (losses) to Adjusted EBITDA.

2. Average for 2014 – 2016. See Appendix for reconciliation.

K E Y T E N E T S O F O P E R AT I O N A L S T R AT E G Y

Allows greater control of supply chain

process and deeper relationships with

customer base.

COMPANY UPDATE | FOURTH QUARTER 2016 9

CatchMark strategically manages harvest plans, operating in prime mill markets for sawtimber

and pulpwood, to serve customers and optimize yields within sustainable parameters.

Provides stable demand with well

capitalized counter-parties.

Improves cash flow per acre.

DELIVERED WOOD SALES FIBER SUPPLY AGREEMENTS BALANCED HARVEST MIX

64% of 2016 total

timber sales volume

27% of 2016 total

annual harvest volume

50/50 sawlog/pulpwood

volume mix target1

1. See page 15 for CTT historical and projected harvest mix.

S U S TA I N A B L E H A R V E S T P R O D U C T I O N D R I V E S C A S H F L O W A N D VA L U E

10 COMPANY UPDATE | FOURTH QUARTER 2016

1. 4Q 2016 TimberMart-South: Southwide averages. This pricing does not necessarily reflect the pricing realized by CatchMark.

2. Management estimates based on U.S. South stumpage prices published by TimberMart-South from 1981-2016.

3. Leasing/Ancillary Revenue estimated to be approximately $10 per acre on average.

4. Forest Management/Taxes estimated to be approximately $16 per acre on average.

Harvest Assumptions

% Pine (tons) 87.5%

% Hardwood (tons) 12.5%

Sustainable harvest production growth can yield significantly increased cash flow, particularly

when factoring in a price recovery.

Illustrative per Acre Example:

3.50 Tons per Acre 5.00 Tons per Acre

Pricing Pricing Product Tons / Revenue Revenue Tons / Revenue Revenue

Product Category 12/31/20161 (Trendline)2 Mix Acre (Current) (Trendline) Acre (Current) (Trendline)

Pine Pulpwood $9.60 $10.00 50.0% 1.52 $14.70 $15.31 2.19 $21.03 $21.90

Pine CNS $16.92 $21.00 25.0% 0.77 12.95 16.08 1.09 18.44 22.89

Pine Sawtimber $24.13 $35.00 25.0% 0.77 18.48 26.80 1.09 26.30 38.15

Subtotal Pine 100.0% 3.06 $46.13 $58.19 4.37 $65.77 $82.94

Hardwood Pulpwood $8.53 $10.00 66.7% 0.29 $2.49 $2.92 0.42 $3.58 $4.20

Hardwood Sawtimber $32.68 $29.00 33.3% 0.15 4.76 4.22 0.21 6.86 6.09

Subtotal Hardwood 100.0% 0.44 $7.25 $7.14 0.63 $10.44 $10.29

Total Revenues 3.50 $53.38 $65.33 5.00 $76.21 $93.23

(+) Leasing / Ancillary Revenue3 10.00 10.00 10.00 10.00

(–) Forest Management / Taxes4 (16.00) (16.00) (16.00) (16.00)

Adjusted per Acre Revenue $47.38 $59.33 $70.21 $87.23

% Δ versus 3.5 Tons per Acre @ Current Pricing 25.00% 48.00% 84.00%

11

Acquisitions and Sales Strategy

E X PA N D E D A N D I M P R O V E D T I M B E R L A N D A S S E T S

COMPANY UPDATE | FOURTH QUARTER 2016 12

Since its listing on the NYSE in late 2013, CatchMark has significantly expanded and improved

the quality of its timberland assets and enhanced productivity through sustainable forest

management practices.

Higher Quality and Productivity2

As of 12/31/2016.

1. Compared to fee timberland acres as of 12/31/2013

2. As of 1/1 of the given year.

• 22 acquisitions: $455 million

• Fee acreage acquired: 238,200 (96% increase)1

• Merchantable inventory added: 10.3 million tons

– 75% pine plantation by acreage

– 52% sawtimber by tons

– Acquisitions averaged stocking of 42 tons

per acre

35%

40%

45%

50%

30

35

40

45

2013 2014 2015 2016 2017

Merchantable Timber (tons/acre) Sawtimber %Ton/Acre Sawtimber %

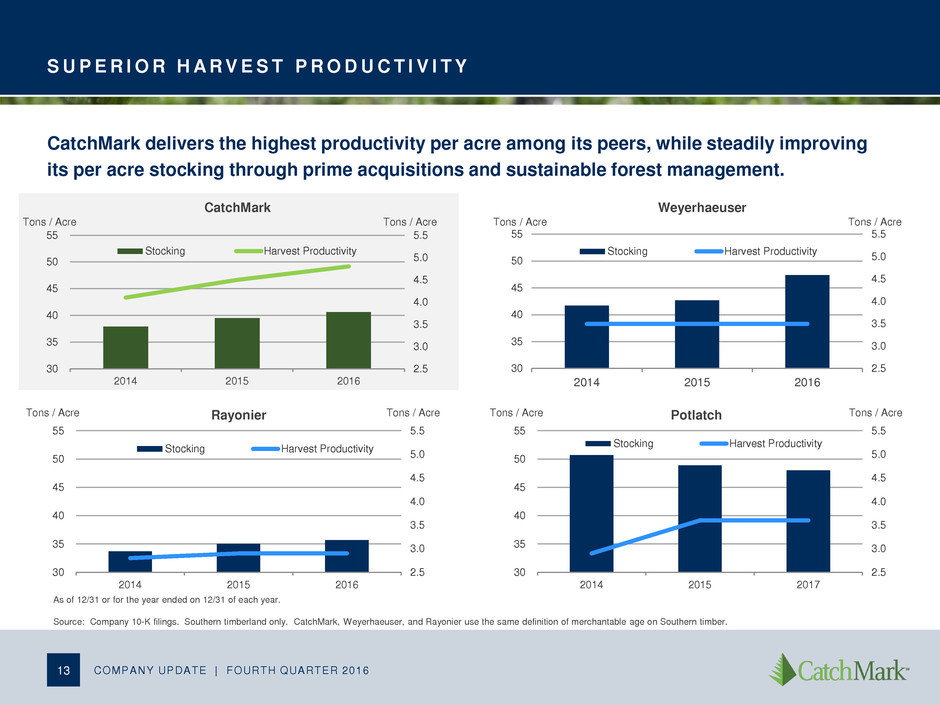

S U P E R I O R H A R V E S T P R O D U C T I V I T Y

COMPANY UPDATE | FOURTH QUARTER 2016 13

As of 12/31 or for the year ended on 12/31 of each year.

Source: Company 10-K filings. Southern timberland only. CatchMark, Weyerhaeuser, and Rayonier use the same definition of merchantable age on Southern timber.

CatchMark delivers the highest productivity per acre among its peers, while steadily improving

its per acre stocking through prime acquisitions and sustainable forest management.

CatchMark

30

35

40

45

50

55

2014 2015 2016

2.5

3.0

3.5

4.0

4.5

5.0

5.5

Stocking Harvest Productivity

Tons / Acre Tons / Acre

Weyerhaeuser

30

35

40

45

50

55

2014 2015 2016

2.5

3.0

3.5

4.0

4.5

5.0

5.5

Stocking Harvest Productivity

Tons / Acre Tons / Acre

Rayonier

30

35

40

45

50

55

2014 2015 2016

2.5

3.0

3.5

4.0

4.5

5.0

5.5

Stocking Harvest Productivity

Tons / Acre Tons / Acre Potlatch Tons / Acre Tons / Acre

30

35

40

45

50

55

2014 2015 2017

2.5

3.0

3.5

4.0

4.5

5.0

5.5

Stocking Harvest Productivity

A C Q U I S I T I O N S D R I V E I N C R E A S E D S U S TA I N A B L E H A R V E S T P R O D U C T I O N

14

3.4

3.1

2.4

3.1

0.0

1.0

2.0

3.0

4.0

5.0

6.0

1. Represents comparable publicly-traded timber company 10-year (2007-2016) historical average

Drivers of Cash Yield:

─ Sustainable harvest: 80% - 90%

─ Recreational leases: 5% - 10%

─ Land sales: 5% - 10%

+40% versus

Comparable

Company

Historical

Average

Comparable Company Data

(10-year Historical Average)1

CTT Acquisitions

(10-year Projected Average)

WY RYN DEL Weighted

Average

Waycross/

Panola

Oglethorpe/

Satilla

Weighted

Average of 4

Transactions

CTT

Pro Forma

CatchMark’s recent acquisitions exhibit strong productivity characteristics, which enhance

overall portfolio yields.

Harvest Volume per Acre (tons)

COMPANY UPDATE | FOURTH QUARTER 2016

Beauregard CTT @

12/2013

Carolinas

Midlands

III

3.9

5.0 - 5.5

4.3 - 4.7

4.2 - 4.7

4.8 - 5.8

4.7-5.1

4.4 - 4.6

R E P O S I T I O N I N G S T R AT E G Y E N H A N C E S F U T U R E VA L U E

COMPANY UPDATE | FOURTH QUARTER 2016 15

CatchMark’s evolving harvest mix to an increased share of sawtimber highlights the improved

quality of the company’s assets and enhanced prospects for future revenue growth.

Pulpwood

70%

Sawtimber

30%

2011 - 2013

Pulpwood

62%

Sawtimber

38%

2014 – 2016

Average Harvest Mix

Pulpwood

50%

Sawtimber

50%

2017 – 2021

(Near-Term Target)

Targeted Areas

Targeted states

R O B U S T A N D AT T R A C T I V E A C Q U I S I T I O N P I P E L I N E

• Key Metrics/Criteria:

– Local market dynamics (supply/demand

balance)

– Sustainable productivity (tons/acre/year)

– Merchantable inventory/mix (tons/acre)

– Target cash yield (near-term/long-term)

• Current Geographic Focus:

– Southern Pine Belt where best relative value

exists

– Continue to evaluate Pacific Northwest

opportunities

CatchMark seeks well-stocked, high-quality timberlands with near-term income potential to increase

its harvest volumes and cash flow as well as characteristics to sustain long-term growth.

16 COMPANY UPDATE | FOURTH QUARTER 2016

$0.7

$1.6

$2.0

$3.3

$2.8

$6.3

$8.3

$9.3

$5.2

$2.1

$1.4

$1.9

$7.3

$5.1

$2.3

$2.6

$3.62

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Ca

ro

lin

a

s

M

idl

a

n

d

s

I

II

1

$35 billion

75%+ TIMOs

U N I Q U E T I M I N G F O R A C C E S S T O Q U A L I T Y O P P O R T U N I T I E S

17

1. Vintage of CTT major acquisitions.

2. Approximately 60% of the total 2016 transactions came from the 2003 – 2008 transaction pool.

Source: Forest Economic Advisors, ERA Forest Products Research, RISI, Management Estimates

Historical Timberland Transaction Volume ($ in billions)

Timberland transaction volume totaled more than $35 billion between 2003 and 2008, the majority of

which was acquired by TIMOs and likely will be re-traded over the next five years.

COMPANY UPDATE | FOURTH QUARTER 2016

W

a

yc

ro

ss/

P

a

n

o

la

–

5

0

%

1

B

e

a

u

re

g

a

rd

/O

g

le

th

o

rp

e

1

L A N D S A L E S T R AT E G Y S U P P L E M E N T S P O R T F O L I O R E T U R N S

Disposition Strategy

• Higher and better use “HBU” opportunities

• Non-core operating assets

– Sub-optimal inventory stocking

– Heavy to hardwood mix

– Poor productivity

• Lower execution risk by targeting 1% - 2%

of fee acreage annually

COMPANY UPDATE | FOURTH QUARTER 2016 18

0.5%

1.0%

1.5%

2.0%

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

2013 2014 2015 2016

Land Sales $ % Fee Acres

CatchMark undertakes selective land sales to take advantage of “HBU” opportunities, divest

sub-optimal assets and augment overall portfolio returns.

Land Sale Revenue and % Fee Acres

Thousands

19

CatchMark’s Markets

H O U S I N G S TA R T S A N D S AW T I M B E R P R I C I N G

20 COMPANY UPDATE | FOURTH QUARTER 2016

1. Sawtimber prices represent TimberMart-South published south-wide average adjusted by Producer Price Index for All Commodities published by Federal Reserve Bank of St. Louis .

2. Source: Federal Reserve Bank of St. Louis, New Privately Owned Housing Units Started, Thousands of Units, Quarterly, Seasonally Adjusted Annual Rate.

0

10

20

30

40

50

60

70

Housing Start Activity Level (‘000)2

# of Data Points (right axis) Average Trendline

# of Quarters within

Housing Start

Activity Level

TMS South-wide

Sawtimber (2016 $/Ton)1

Avg +/- 1 Standard Deviation

• The average pine sawtimber

price (2016 $) when housing

starts are between 1.4-1.8

million Seasonally Adjusted

Annual Rates is $44.20/Ton.

• Over the past 40 years,

the US economy has

maintained that level of

housing starts four out of

the last ten quarters.

Quarterly Southern Pine Sawtimber Price by Housing Start Activity Level

1976 - Present

20

10

0

Housing starts will drive increase in sawtimber pricing.

M A C R O D E M A N D D R I V E R – H O U S I N G S TA R T S

21 COMPANY UPDATE | FOURTH QUARTER 2016

0.0

0.5

1.0

1.5

2.0

2.5

00 02 04 06 08 10 12 14 16 18 20

Historical and Projected U.S. Housing Starts

S

tart

s

i

n

m

ill

io

n

s

30

40

50

60

70

80

00 02 04 06 08 10 12 14 16 18 20

Projected North America Lumber Consumption

B

B

F

Source: Forest Economic Advisors January 2017, U.S. Census Bureau

0.0

0.5

1.0

1.5

2.0

2.5

00 01 02 04 05 06 07 08 09 10 11 12 13 14 15 16

Single Family and Multifamily Starts

Single Family Multifamily

CatchMark anticipates to capitalize on

increasing housing starts which should lead to

higher lumber consumption and better

sawtimber pricing.

S

tart

s

i

n

m

ill

io

n

s

C AT C H M A R K P O S I T I O N S I N O U T P E R F O R M I N G M A R K E T S

22 COMPANY UPDATE | FOURTH QUARTER 2016

1. Excludes chip-n-saw. Price represents simple average prices as reported by TimberMart-South.

Sources: TimberMart-South Sawtimber Prices

(US$ per ton)

$20

$30

$40

$50

2000 2002 2004 2006 2008 2010 2012 2014 2016

CatchMark markets consistently deliver better sawtimber pricing than other markets in the

U.S. South.

$3.53

difference

Non CTT Sawtimber Markets

CTT Sawtimber Markets

Average Sawtimber

Price Differentials

Price Time

High $7.50 Q4 2005

Low $1.14 Q2 2010

Average $4.47 Average 2000-2016

O T H E R M A C R O D E M A N D D R I V E R S

COMPANY UPDATE | FOURTH QUARTER 2016 23

1. Ministry of Forests, Lands and Natural Resource Operations, British Columbia – Current projection results, 2016; Bloomberg, “Beetle Bug Spurs

Canadians on U.S. Lumber Mill Buying Spree”, June 23, 2015.

Commercial Construction Demand

• 55% of British Columbia pine volume

may be killed by 2020, increasing timber

demand in other regions, particularly U.S.

South.

• New “Mass Timber” designs significantly

expand demand for lumber in

commercial and multifamily construction.

• New and expanded wood bioenergy

facilities in CatchMark operating regions

serve increased wood pellet demand from

Europe as a result of environmental

policies.

Wood Bioenergy Use Mountain Pine Beetle Scourge

Timber demand increases in CatchMark regions from commercial construction and bioenergy

uses while beetle infestation in British Columbia constrains overall North American supply.

M I C R O M A R K E T S M A K E A D I F F E R E N C E

24

CatchMark targets markets with favorable current and long-term supply/demand fundamentals.

COMPANY UPDATE | FOURTH QUARTER 2016

Source: Forisk, January 2017.

Source: Forisk, September 2016.

Operates in four distinct markets—

Mid-Atlantic, Coastal, South Central,

and Southwest—with diverse mills, well

capitalized customers, and strong

productivity.

• 142 pulpwood mills

• 288 pine grade mills

• Estimated annual total consumption: 73

million tons of pine products

• Outlook: Expect consumption to grow

20%-30% over next ten years.

CatchMark Acreage by Region (12/31/16)

─ Mid-Atlantic 78,500

─ Coastal 42,000

─ South Central 322,200

─ Southwest 56,900

Total 499,600

O P E R AT I N G I N M A R K E T S W I T H S T R O N G P R O D U C T I V I T Y A N D C U S T O M E R S

COMPANY UPDATE | FOURTH QUARTER 2016 25

CatchMark markets outperform TimberMart-South averages.

$15

$17

$19

$21

$23

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Pine Pulpwood Prices

$8

$10

$12

$14

$16

$18

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Pine Chip-n-Saw Prices

$24

$26

$28

$30

$32

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Pine Sawtimber Prices

• Timber prices driven by local supply and

demand.

• Prices can vary greatly from market to market.

TimberMart-South Published Prices:

M I D - AT L A N T I C – 7 8 , 5 0 0 A C R E S

26 COMPANY UPDATE | FOURTH QUARTER 2016

NC

SC

# of Mills

Consumption

(millions tons)

Pulpwood 53 10.6

Pine grade 109 7.7

Total 162 18.3

ANNUAL CONSUMPTION

Source: Forisk, September 2016. As of 6/30/2016.

0

5

10

15

20

25

Q315 - Q216 2025 Base 2025 High

Million

Tons

Pulpwood Pine Grade

Forecast Scenarios Current

DEMAND

Market Overview

• Deep and diversified mills

• Ability to capture export pricing

• Tight supply produces greater price movement as housing demand

improves

C O A S TA L – 4 2 , 0 0 0 A C R E S

27 COMPANY UPDATE | FOURTH QUARTER 2016

NC

SC

# of Mills

Consumption

(millions tons)

Pulpwood 52 12.4

Pine grade 87 8.0

Total 139 20.4

ANNUAL CONSUMPTION

Source: Forisk, September 2016. As of 6/30/2016.

0

5

10

15

20

25

30

Q315 - Q216 2025 Base 2025 High

Pulpwood Pine Grade

Forecast Scenarios Current

DEMAND

Market Overview

• Deep and diversified mill market

• Top tier pine pulpwood market

• Ability to capture export pricing

Million

Tons

S O U T H C E N T R A L – 3 2 2 , 2 0 0 A C R E S

28 COMPANY UPDATE | FOURTH QUARTER 2016

NC

SC

# of Mills

Consumption

(millions tons)

Pulpwood 52 7.0

Pine grade 94 6.1

Total 146 13.1

ANNUAL CONSUMPTION

Source: Forisk, September 2016. As of 6/30/2016.

0

2

4

6

8

10

12

14

16

18

Q315 - Q216 2025 Base 2025 High

Pulpwood Pine Grade

Forecast Scenarios Current

DEMAND

Market Overview

• Well capitalized mills

• Exposure to high value pulp/paper end-use products

• CatchMark has significant market presence

Million

Tons

S O U T H W E S T – 5 6 , 9 0 0 A C R E S

29 COMPANY UPDATE | FOURTH QUARTER 2016

NC

SC

# of Mills

Consumption

(millions tons)

Pulpwood 34 11.7

Pine grade 82 9.3

Total 116 21.0

ANNUAL CONSUMPTION

Source: Forisk, September 2016. As of 6/30/2016.

0

5

10

15

20

25

30

Q315 - Q216 2025 Base 2025 High

Pulpwood Pine Grade

Million

Tons Forecast Scenarios Current

DEMAND

Market Overview

• Low volatility

• Steady price/demand growth

• Strong upside in pricing driven by consumption growth

30

Capital Position

S O L I D C A P I TA L P O S I T I O N

COMPANY UPDATE | FOURTH QUARTER 2016 31

Credit Metrics

Fixed charge coverage ratio1 5.2x

Net Debt2/Adjusted EBITDA 8.7x

Net Debt2/Enterprise value3 42%

Debt/Timberland Value4 34.8%

Weighted average cost of debt5 2.19%

A sound credit profile and access to capital provide a clear path for funding future CatchMark

growth opportunities.

1. Calculated using trailing twelve month Adjusted EBITDA divided by cash paid for interest as of 12/31/2016.

2. Net debt equals outstanding borrowings net of cash on hand.

3. Enterprise value is based on equity market capitalization as of 12/31/2016 plus net debt.

4. Timberland value per bank appraisal.

5. After consideration of effects of interest rate swaps and patronage refund.

All data as of or for the year ended 12/31/2016.

Current

Fixed

25%

Current

Floating

75%

Intended

Additional

Fixed

25%

Interest Rate Mix

Credit Facilities

Capacity Outstanding Available Maturity

Term Loan $100 M $100 M 12/2024

Multi-Draw Term Loan $365 M $226 M $139 M 12/2021

Revolver Line of Credit $35 M $35 M 12/2019

Total Credit Facilities $500 M $326 M $174 M

$139.3 M

$35.0 M

$9.1 M

-

20

40

60

80

100

120

140

160

180

200

Acquisition facility RLOC CashMillions

Liquidity

$183.4M

H I G H E S T D I V I D E N D Y I E L D I N S E C T O R W I T H S U P E R I O R

R I S K - A D J U S T E D C O V E R A G E

• CatchMark’s dividend distributions consistently have been covered by cash available for distributions2 since its IPO.

• Dividends from timber REITs generally receive capital gains treatment.

• 100% of CatchMark’s dividends were treated as return of capital for 2016, largely due to non-cash depletion expense

deduction.

• Sustainable harvest volumes from acquisitions and/or lasting product price appreciations support dividend growth.

32 COMPANY UPDATE | FOURTH QUARTER 2016

2016 Tax Treatment CTT RYN2 PCH WY

Dividend Yield (before tax)1 4.8% 3.8% 3.6% 4.1%

% Return of Capital 100% 0% 0% 0%

% Capital Gain 0% 100% 100% 100%

% Ordinary Income 0% 0% 0% 0%

Dividend Yield (after tax)1 4.8% 3.0% 2.9% 3.3%

1. Calculated with close price on 12/30/2016.

2. Cash Available for Distributions (CAD) is a non-GAAP measure. See Appendix for our reconciliation to CAD.

CatchMark registered the highest dividend yield among timber REITs. Coupled with tax advantages,

the dividend yields outpaced the company’s peers by over 45%.

CAD2 Payout Ratio 2014 2015 2016

CTT 73% 74% 74%

RYN 276% 106% 85%

WY 66% 105% 275%

PCH 58% 132% 63%

Share Price

C A P I TA L A L L O C AT I O N S

33 COMPANY UPDATE | FOURTH QUARTER 2016

0

25

50

75

100

125

150

175

200

225

250

275

2014 2015 2016

Acquisitions Dividends Share Repurchases CAPEX

Millions

Allocation of Capital

94%

6%

73%

19%

6% 3%

2% 2%

84%

12%

Opportunistic Repurchase Program

Shares

Repurchased

CatchMark prudently allocates capital to fund growth through acquisitions, provide sustainable

dividends to deliver current income, opportunistically repurchase shares at attractive prices, and

provide for reinvestment needs to sustain portfolio value.

0

5000

10000

15000

20000

25000

30000

35000

40000

45000

50000

$8.00

$8.50

$9.00

$9.50

$10.00

$10.50

$11.00

$11.50

$12.00

$12.50

$13.00

Close Price Shares repurchased

S U M M A R Y

CatchMark’s focus on quality—timberland assets, operational excellence, and sustainable

earnings—helps the company grow cash flow, dividends and shareholder value.

S t r a t e g y

• Expand holdings of prime,

well-stocked timberlands;

manage for durable earnings

and increase value through

sustainable environmental

practices; grow cash flow

and increase dividends per

share.

P e r f o r m a n c e

• Increased total revenues by

18% compared to full-year

2015

• Increased Adjusted EBITDA by

13% compared to for full-year

2015

• Increased total harvest

volumes by 21%

• Increased gross timber sales

by 23%

• Increased quarterly dividend by

6%, compared to 2015

O p p o r t u n i t y

• Invest in a company well-

positioned to take advantage of

the improving housing market

with an experienced and

proven management team

implementing a clear strategy,

buoyed by a strong balance

sheet.

34 COMPANY UPDATE | FOURTH QUARTER 2016

35

Appendix

S U S TA I N A B L E F O R E S T R Y I N I T I AT I V E C E R T I F I C AT I O N

CatchMark SFI Implementation Program

• Forest management planning

• Forest health and productivity

• Protection and maintenance of water resources

• Conservation and biological diversity

• Management of visual quality and recreational benefits

• Protection of special sites

• Efficient use of fiber resources

• Recognize and respect indigenous people’s rights

• Legal and regulatory compliance

• Forestry research, science, and technology

• Training and education

• Community involvement and landowner outreach

• Public land management responsibilities

• Communications and public reporting

• Management review

36 COMPANY UPDATE | FOURTH QUARTER 2016

* SFI Re-certification Audit (2015) and Surveillance Audit (2016)

“CatchMark has developed a program that continues to meet the requirements of the SFIS 2015-2019

Forest Management Edition” *

M A J O R T R A N S A C T I O N S S I N C E 2 0 1 3 L I S T I N G O N N Y S E

37 COMPANY UPDATE | FOURTH QUARTER 2016

Over the past three years CatchMark has acquired approximately 246,500 acres1 of high quality

timberlands in the U.S. South “Timber Basket” totaling $455 million.

Carolinas Midlands III

• $101 million

• South Carolina

• 51,700 acres

• 250,000-300,000 tons of

annual harvest volume

(4.8 – 5.8 tons/acre/year)

• 2.0 million tons of

merchantable timber

(39 tons/acre)

Beauregard

• $38 million

• Louisiana

• 21,300 acres

• 90,000-100,000 tons of annual

harvest volume

(4.2 – 4.7 tons/acre/year)

• 840,000 tons of merchantable

timber (39 tons/acre)

Oglethorpe/Satilla

River

• $111 million

• Georgia and Florida

• 55,600 acres

• 240,000-260,000 tons of annual

harvest volume

(4.3 – 4.7 tons/acre/year)

• 2.5 million tons of merchantable

timber (44 tons/acre)

Waycross/Panola

• $74 million

• Texas and Georgia

• 36,300 acres

• 180,000-200,000 tons of annual

harvest volume

(5.0 – 5.5 tons/acre/year)

• 1.2 million tons of merchantable

timber (33 tons/acre)

Total Acres Owned and Leased: 499,600 (12/31/16)

Major transactions include:

1. Including 8,300 acres of leasehold interest acquired in November 2016.

A D J U S T E D E B I T D A

COMPANY UPDATE | FOURTH QUARTER 2016 38

Earnings from Continuing Operations before Interest, Taxes, Depletion, and Amortization (“EBITDA”) is a non-GAAP measure of operating

performance. EBITDA is defined by the SEC; however, we have excluded certain other expenses due to their non-cash nature, and we refer

to this measure as Adjusted EBITDA. As such, our Adjusted EBITDA may not be comparable to similarly titled measures reported by other

companies and should not be viewed as an alternative to net income or cash from operations as measurements of our operating

performance. Due to the significant amount of timber assets subject to depletion and the significant amount of financing subject to interest

and amortization expense, management considers Adjusted EBITDA to be an important measure of our financial condition and

performance. Our credit agreements contain a minimum debt service coverage ratio based, in part, on Adjusted EBITDA since this measure

is representative of adjusted income available for interest payments.

R E C O N C I L I AT I O N O F N E T I N C O M E ( L O S S ) T O A D J U S T E D E B I T D A

COMPANY UPDATE | FOURTH QUARTER 2016 39

1. For the purpose of the above reconciliation, amortization includes amortization of deferred financing costs, amortization of intangible lease assets, and amortization of

mainline road costs, which are included in either interest expense, land rent expense, or other operating expenses in the accompanying consolidated statements of

operations.

(in thousands) 2014 2015 2016

Net Income (loss) $660 $(8,387) $(11,070)

Add:

Depletion 14,788 27,091 28,897

Basis of timberland sold 5,072 8,886 9,728

Amortization1 836 765 1,093

Stock-based compensation expense 418 889 1,724

Interest expense1 1,897 2,924 5,753

Casualty loss - - 361

Adjusted EBITDA $23,671 $32,168 $36,486

A D J U S T E D E B I T D A B Y S O U R C E S

COMPANY UPDATE | FOURTH QUARTER 2016 40

(in thousands) 2014 2015 2016

Timber sales 40,635 52,837 65,035

Other revenue 3,026 4,440 4,305

(-) Contract logging and hauling costs (17,322) (19,911) (25,918)

(-) Forestry management expenses (3,567) (4,495) (6,092)

(-) Land rent expense (831) (736) (625)

(-) Other operating expenses (2,942) (4,295) (5,017)

(+) Other1 174 288 814

Harvest EBITDA 19,173 28,128 32,502

Timberland sales 10,650 11,845 12,515

(-) Cost of timberland sales (5,558) (9,747) (10,405)

(+) Basis of timberland sold 5,072 8,886 9,728

Real Estate EBITDA 10,164 10,984 11,838

Total Operating EBITDA 29,337 39,112 44,340

(-) General and administrative expense (6,185) (7,667) (9,309)

(+) Stock-based compensation 342 718 1,411

(+) Interest Income 177 6 44

Non-allocated / Corporate EBITDA (5,666) (6,943) (7,854)

Adjusted EBITDA 23,671 32,169 36,486

1. Other includes non-cash items: amortization, stock-based compensation, and casualty loss

Sources: Company 10-K

C A D R E C O N C I L I AT I O N A N D D I V I D E N D P AY O U T R AT I O C A L C U L AT I O N

COMPANY UPDATE | FOURTH QUARTER 2016 41

Sources: Company filings.

(Dollars in millions)

CATCHMARK (CTT) 2014 2015 2016

Dividends Paid $15.3 $19.6 $20.4

Cash provided by operating activities, as reported $19.8 $28.5 $30.8

(-) Capital Expenditures (excluding timberland acquisitions) (0.9) (2.7) (3.2)

+/(-) Working capital changes 1.9 0.8 (0.1)

CAD $20.8 $26.6 $27.5

Payout Ratio 73% 74% 74%

C A D R E C O N C I L I AT I O N A N D D I V I D E N D P AY O U T R AT I O C A L C U L AT I O N

COMPANY UPDATE | FOURTH QUARTER 2016 42

1. Weyerhaeuser's 2014 and 2015 numbers were calculate from its Form 10-K filed in 2015.

2. For 2014, Other includes $21.4M adjustment for large dispositions and $102.4M adjustment for cash flows from discontinued operations, as reported in Rayonier’s 2016 Form 10K.

Sources: Company filings

(Dollars in millions)

WEYERHAEUSER (WY) 20141 20151 2016

Dividends Paid $563 $619 $932

Cash provided by operating activities, as reported $1,088 $1,064 $735

(-) Capital Expenditures (excluding timberland acquisitions) (395) (483) (510)

+/(-) Working capital changes 160 10 (129)

(+) Incomes taxes paid for discontinued operations - - 243

CAD $853 $591 $339

Payout Ratio 66% 105% 275%

RAYONIER (RYN) 2014 2015 2016

Dividends Paid $257.5 $124.9 $122.8

Cash provided by operating activities, as reported $320.4 $177.2 $203.8

(-) Capital Expenditures (excluding timberland acquisitions) (63.7) (57.3) (58.7)

(-) Working capital changes (39.5) (2.5) (0.8)

(-) Other2 (123.8) - -

CAD $93.4 $117.4 $144.2

Payout Ratio 276% 106% 85%

POTLATCH (PCH) 2014 2015 2016

Dividends Paid $57.8 $61.0 $60.8

Cash provided by operating activities, as reported $131.4 $74.0 $102.1

(-) Capital Expenditures (excluding timberland acquisitions) (24.2) (32.7) (19.3)

+/(-) Working capital changes (7.2) 4.8 13.8

CAD $100.0 $46.1 $96.6

Payout Ratio 58% 132% 63%