Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Primo Water Corp /CN/ | d352088dex994.htm |

| EX-99.3 - EX-99.3 - Primo Water Corp /CN/ | d352088dex993.htm |

| EX-99.2 - EX-99.2 - Primo Water Corp /CN/ | d352088dex992.htm |

| EX-99.1 - EX-99.1 - Primo Water Corp /CN/ | d352088dex991.htm |

| 8-K - 8-K - Primo Water Corp /CN/ | d352088d8k.htm |

Exhibit 99.5

Please refer to the “Forward-Looking Statements” in the accompanying Current Report on Form 8-K.

|

|

$650 million Senior Notes due 2025 Investor Presentation March 2017

|

|

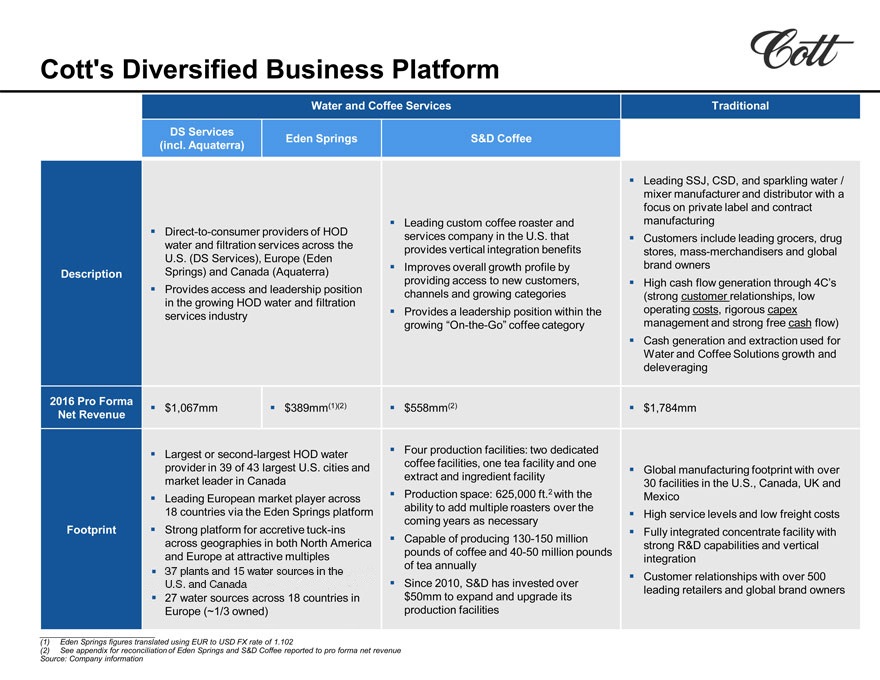

Diversified Business PlatformWater and Coffee ServicesTraditionalDS ServicesEden SpringsS&D Coffee(incl. Aquaterra) Leading SSJ, CSD, and sparkling water /mixer manufacturer and distributor with afocus on private label and contract Leading custom coffee roaster andmanufacturing Direct-to-consumer providers of HODservices company in the U.S. that Customers include leading grocers, drugwater and filtration services across theprovides vertical integration benefitsstores, mass-merchandisers and globalU.S. (DS Services), Europe (EdenDescriptionSprings) and Canada (Aquaterra) Improves overall growth profile bybrand ownersproviding access to new customers, High cash flow generation through 4C s Provides access and leadership positionchannels and growing categories(strong customer relationships, lowin the growing HOD water and filtrationservices industry Provides a leadership position within theoperating costs, rigorous capexgrowing On-the-Go coffee categorymanagement and strong free cash flow) Cash generation and extraction used forWater and Coffee Solutions growth anddeleveraging2016 Pro Forma $1,067mm $389mm(1)(2) $558mm(2) $1,784mmNet Revenue Largest or second-largest HOD water Four production facilities: two dedicatedprovider in 39 of 43 largest U.S. cities andcoffee facilities, one tea facility and one Global manufacturing footprint with overmarket leader in Canadaextract and ingredient facility30 facilities in the U.S., Canada, UK and Leading European market player across Production space: 625,000 ft.2 with theMexico18 countries via the Eden Springs platformability to add multiple roasters over the High service levels and low freight costscoming years as necessaryFootprint Strong platform for accretive tuck-ins Fully integrated concentrate facility withacross geographies in both North America Capable of producing 130-150 millionstrong R&D capabilities and verticaland Europe at attractive multiplespounds of coffee and 40-50 million poundsintegrationof tea annually 37 plants and 15 water sources in the U.S. and Canada Customer relationships with over 500 Since 2010, S&D has invested over 27 water sources across 18 countries in$50mm to expand and upgrade itsleading retailers and global brand ownersEurope (~1/3 owned)production facilities(1)Eden Springs figures translated using EUR to USD FX rate of 1.102(2)See appendix for reconciliation of Eden Springs and S&D Coffee reported to pro forma net revenue Source: Company information

|

|

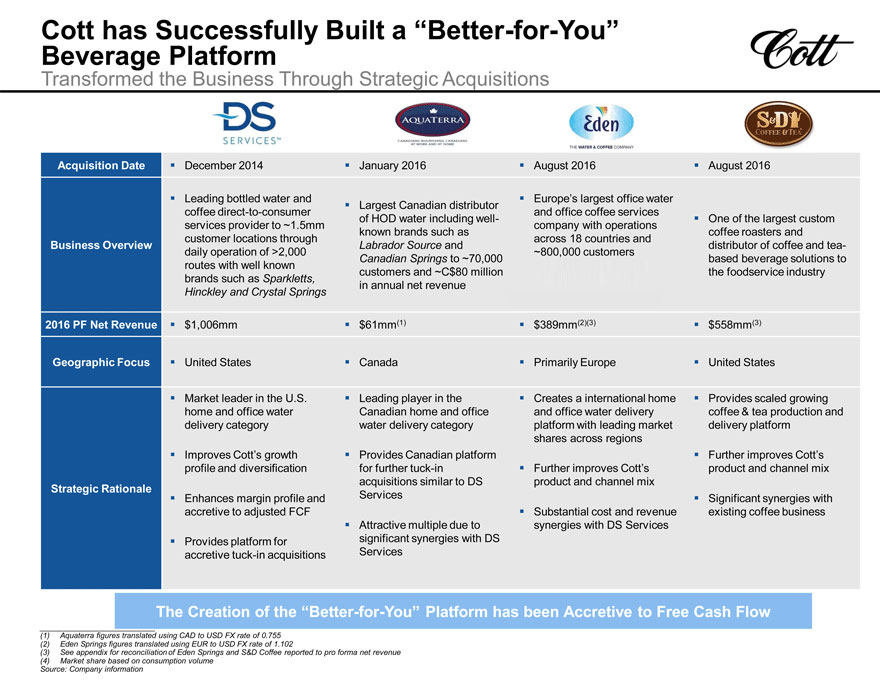

Cott has Successfully Built a “Better-for-You” Beverage Platform Transformed the Business Through Strategic Acquisitions Acquisition Date December 2014 January 2016 August 2016 August 2016 Leading bottled water and Europe’s largest office water Largest Canadian distributor coffee direct-to-consumer and office coffee services of HOD water including well- One of the largest custom services provider to ~1.5mm company known brands such as coffee roasters and customer locations through Business Overview Labrador Source and distributor of coffee and tea- daily operation of >2,000 Canadian Springs to ~70,000 based beverage solutions to routes with well known with operations customers and ~C$80 million the foodservice industry brands such as Sparkletts, across 18 countries and in annual net revenue Hinckley and Crystal Springs ~800,000 customers 2016 PF Net Revenue $1,006mm $61mm(1) $389mm(2)(3) $558mm(3) Geographic Focus United States Canada Primarily Europe United States Market leader in the U.S. Leading player in the Creates a international home Provides scaled growing home and office water Canadian home and office and office water delivery coffee & tea production and delivery category water delivery category platform with leading market delivery platform shares across regions Improves Cott’s growth Provides Canadian platform Further improves Cott’s profile and diversification for further tuck-in Further improves Cott’s product and channel mix acquisitions similar to DS product and channel mix Strategic Rationale Enhances margin profile and Services Significant synergies with accretive to adjusted FCF Substantial cost and revenue existing coffee business Attractive multiple due to synergies with DS Services Provides platform for significant synergies with DS accretive tuck-in acquisitions Services The Creation of the “Better-for-You” Platform has been Accretive to Free Cash Flow(1) Aquaterra figures translated using CAD to USD FX rate of 0.755 (2) Eden Springs figures translated using EUR to USD FX rate of 1.102 (3) See appendix for reconciliation of Eden Springs and S&D Coffee reported to pro forma net revenue (4) Market share based on consumption volume Source: Company information

|

|

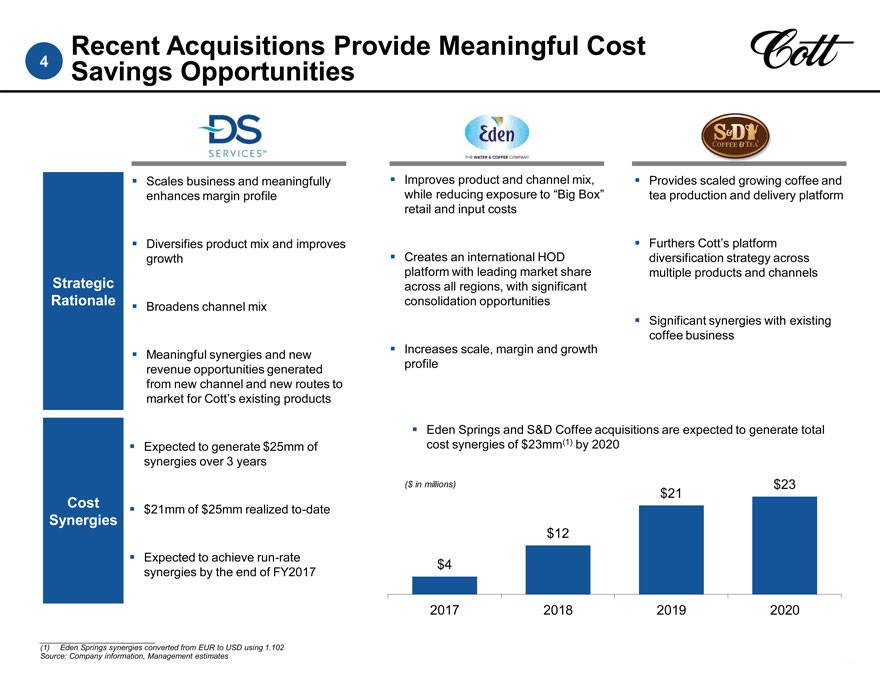

Recent Acquisitions Provide Meaningful Cost4Savings Opportunities Scales business and meaningfully Improves product and channel mix, Provides scaled growing coffee andenhances margin profilewhile reducing exposure to “Big Box“tea production and delivery platformretail and input costs Diversifies product mix and improves Furthers Cott’s platformgrowth Creates an international HODdiversification strategy acrossplatform with leading market sharemultiple products and channelsStrategicacross all regions, with significantRationale Broadens channel mixconsolidation opportunities Significant synergies with existingcoffee business Meaningful synergies and new Increases scale, margin and growthrevenue opportunities generatedprofilefrom new channel and new routes tomarket for Cott’s existing products Eden Springs and S&D Coffee acquisitions are expected to generate total Expected to generate $25mm ofcost synergies of $23mm(1) by 2020synergies over 3 years($ in millions)$23$21Cost $21mm of $25mm realized to-dateSynergies$12 Expected to achieve run-rate$4synergies by the end of FY20172017201820192020(1) Eden Springs synergies converted from EUR to USD using 1.102Source: Company information, Management estimates

|

|

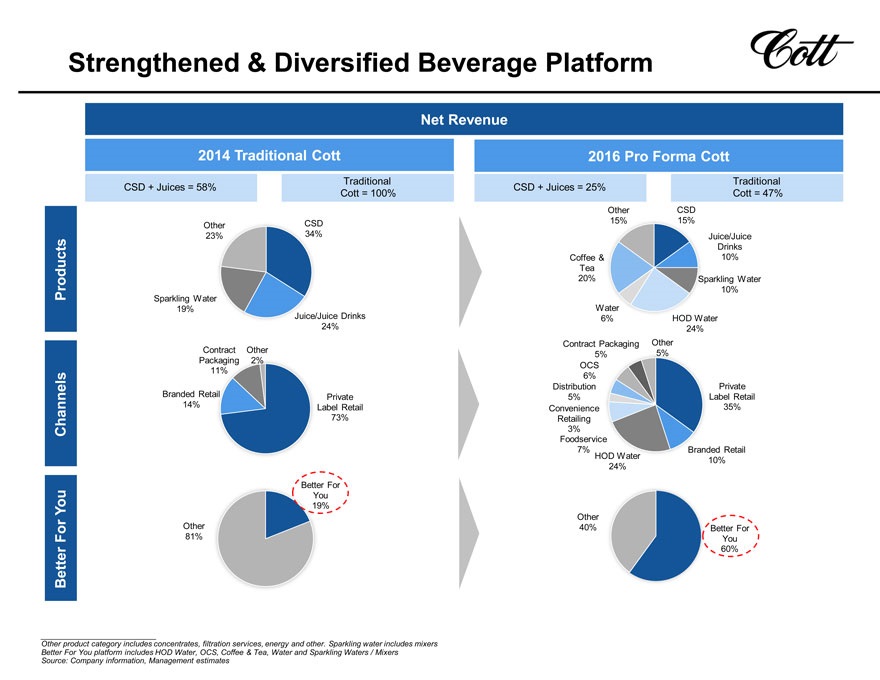

Strengthened & Diversified Beverage PlatformNet Revenue2014 Traditional Cott2016 Pro Forma CottTraditionalTraditionalCSD + Juices = 58%CSD + Juices = 25%Cott = 100%Cott = 47%OtherCSDOtherCSD15%15%23%34%Juice/JuiceDrinksCoffee &10%Tea20%Sparkling WaterProducts10%Sparkling Water19%WaterJuice/Juice Drinks6%HOD Water24%24%Contract PackagingOtherContract Other5%5%Packaging2%OCS11%6%DistributionPrivateBranded RetailPrivate5%Label Retail14%Label RetailConvenience35%73%RetailingChannels3%Foodservice7%Branded RetailHOD Water10%24%Better ForYouYou19%OtherOther40%Better ForFor81%You60%BetterOther product category includes concentrates, filtration services, energy and other. Sparkling water includes mixersBetter For You platform includes HOD Water, OCS, Coffee & Tea, Water and Sparkling Waters / Mixers Source: Company information, Management estimates

|

|

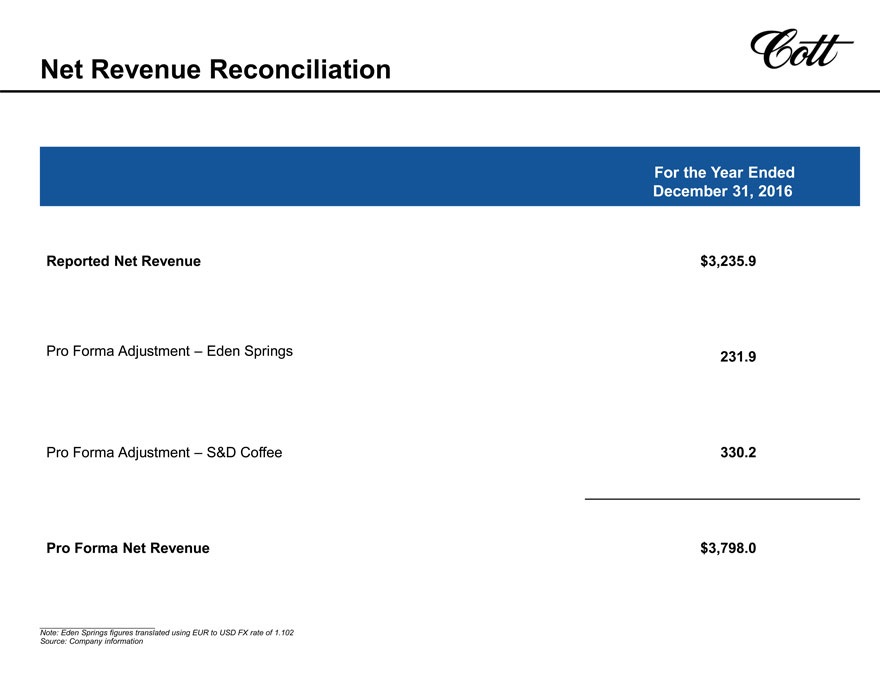

Net RevenueReconciliationFor the Year EndedDecember 31, 2016Reported Net Revenue$3,235.9Pro Forma Adjustment–Eden Springs231.9Pro Forma Adjustment–S&D Coffee330.2Pro Forma Net Revenue$3,798.0Note: Eden Springs figures translated using EUR to USD FX rate of 1.102Source: Company information

|

|

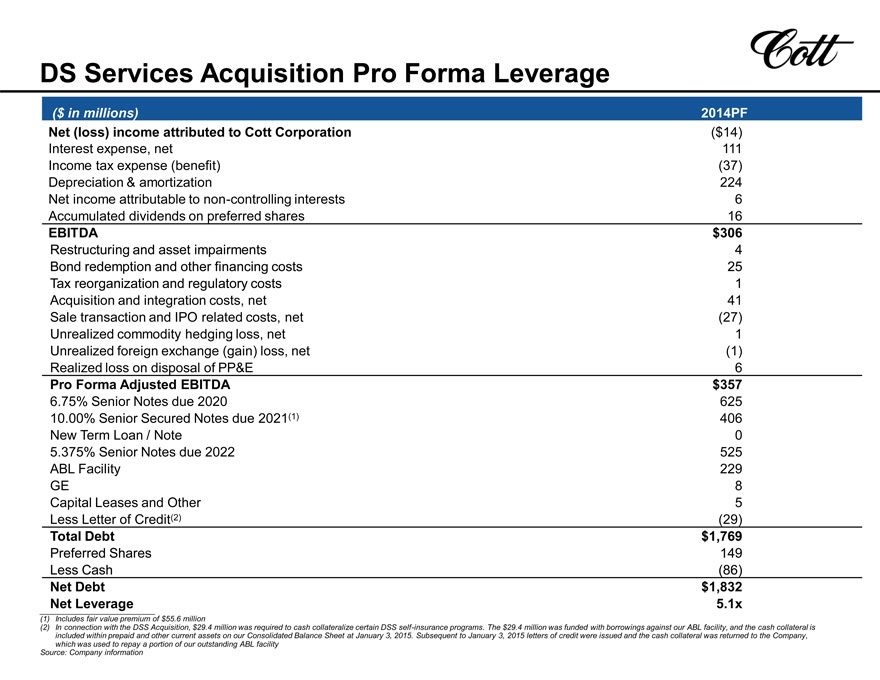

DS Services Acquisition Pro Forma Leverage ($ in millions) 2014PF Net (loss) income attributed to Cott Corporation($14) Interest expense, net 111 Income tax expense (benefit)(37) Depreciation & amortization 224 Net income attributable to non-controlling interests 6 Accumulated dividends on preferred shares 16 EBITDA $306 Restructuring and asset impairments 4 Bond redemption and other financing costs 25 Tax reorganization and regulatory costs 1 Acquisition and integration costs, net 41 Sale transaction and IPO related costs, net(27) Unrealized commodity hedging loss, net 1 Unrealized foreign exchange (gain) loss, net(1) Realized loss on disposal of PP&E 6 Pro Forma Adjusted EBITDA $357 6.75% Senior Notes due 2020 625 10.00% Senior Secured Notes due 2021(1) 406 New Term Loan / Note 0 5.375% Senior Notes due 2022 525 ABL Facility 229 GE 8 Capital Leases and Other 5 Less Letter of Credit(2)(29) Total Debt $1,769 Preferred Shares 149 Less Cash(86) Net Debt $1,832 Net Leverage 5.1x (1) Includes fair value premium of $55.6 million (2) In connection with the DSS Acquisition, $29.4 million was required to cash collateralize certain DSS self-insurance programs. The $29.4 million was funded with borrowings against our ABL facility, and the cash collateral is included within prepaid and other current assets on our Consolidated Balance Sheet at January 3, 2015. Subsequent to January 3, 2015 letters of credit were issued and the cash collateral was returned to the Company, which was used to repay a portion of our outstanding ABL facility Source: Company information