Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ESSA Bancorp, Inc. | d356407d8k.htm |

ESSA Bancorp, Inc. 2017 Annual Meeting March 2, 2017 Bank Confidently. Exhibit 99.1

Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may”, “will”, “believe”, “expect”, “estimate”, “anticipate”, “continue”, or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those set forth in the “Risk Factors” section of our annual report on Form 10-K for the year ended September 30, 2016, and the following: those related to the economic environment, particularly in the market areas in which ESSA Bancorp, Inc. (the “Company”) operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated event.

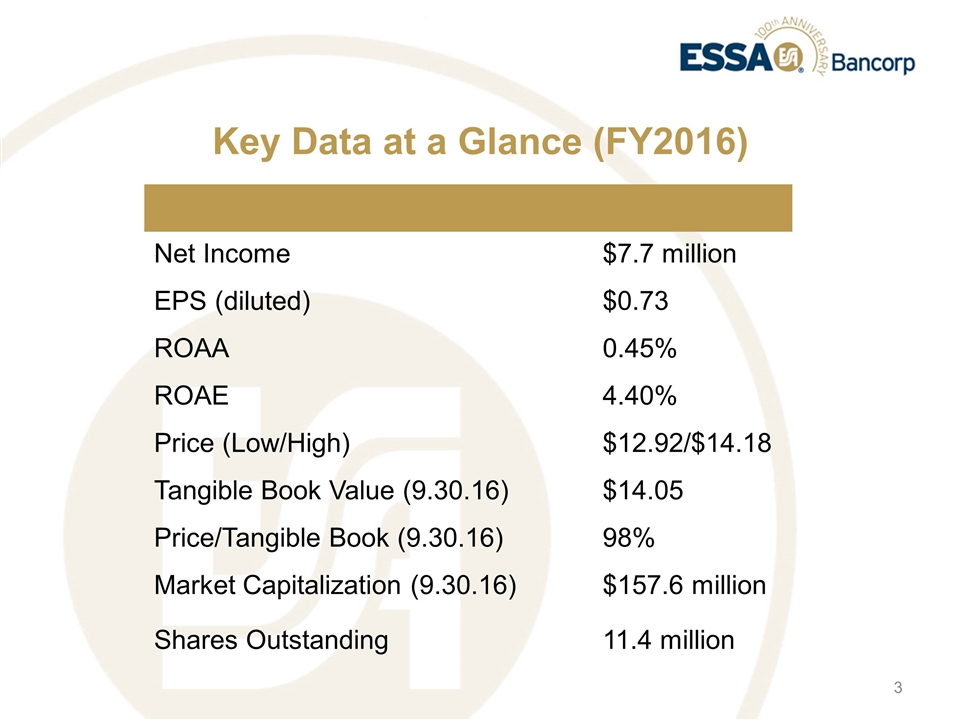

Key Data at a Glance (FY2016) Net Income $7.7 million EPS (diluted) $0.73 ROAA 0.45% ROAE 4.40% Price (Low/High) $12.92/$14.18 Tangible Book Value (9.30.16) $14.05 Price/Tangible Book (9.30.16) 98% Market Capitalization (9.30.16) $157.6 million Shares Outstanding 11.4 million

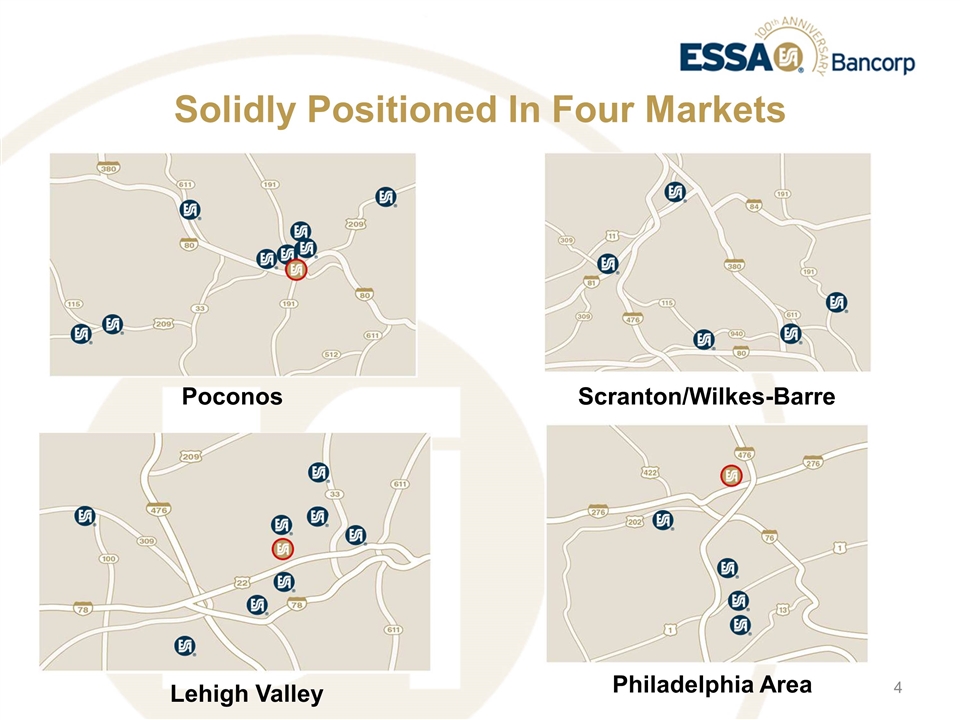

Solidly Positioned In Four Markets Scranton/Wilkes-Barre Poconos Lehigh Valley Philadelphia Area

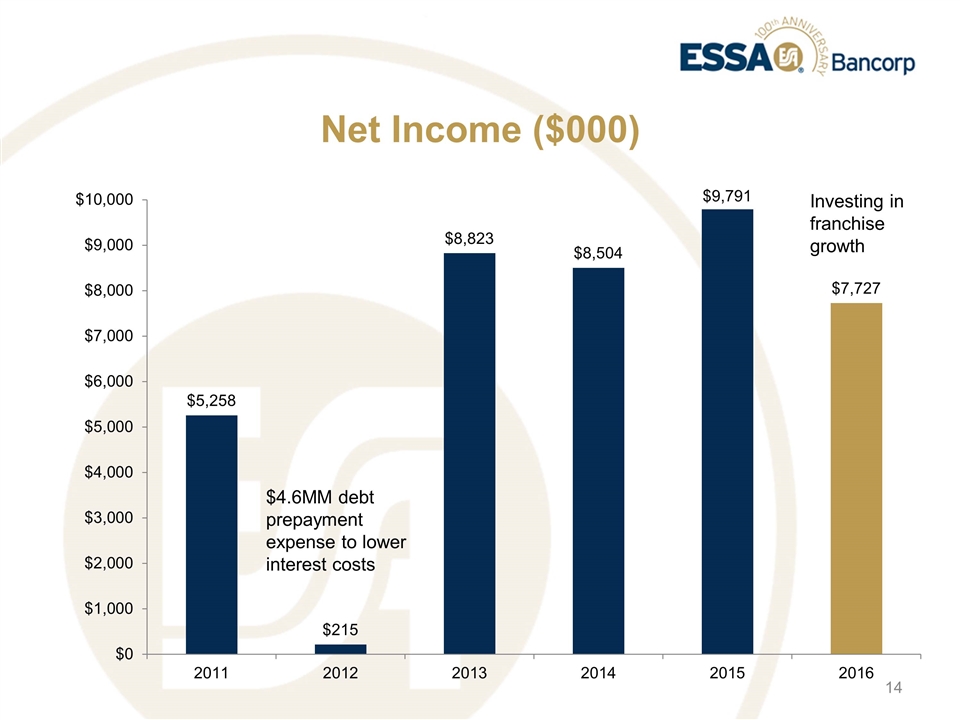

2016 Financials: Income Statement Total interest income increases 7.7% to $58.4 million on loan growth Net interest income in 2016 up $3.1 million (7.2%) vs. prior year, reflecting loan growth Net income of $7.7 million and EPS of $0.73 in per diluted share vs. net income of $9.8 million or $0.93 per diluted share in FY15 Prolonged and flattening yield curve impacting margins (recent Federal Reserve rate increase in December, 2016) Higher operating expenses from ENB acquisition, investment in business bankers Higher loan loss provision related to larger loan portfolio from acquisition of ENB

2016 Financials: Income Statement (Cont’d) Noninterest income rises, primarily reflecting increased service fees, trust and investment fees, and gains from managing investment portfolio Noninterest expense increases year-over-year Acquired facilities and equipment from ENB New team members from ENB acquisition New hires to expand lending and commercial banking teams Trimmed operating expenses by closing four branch locations

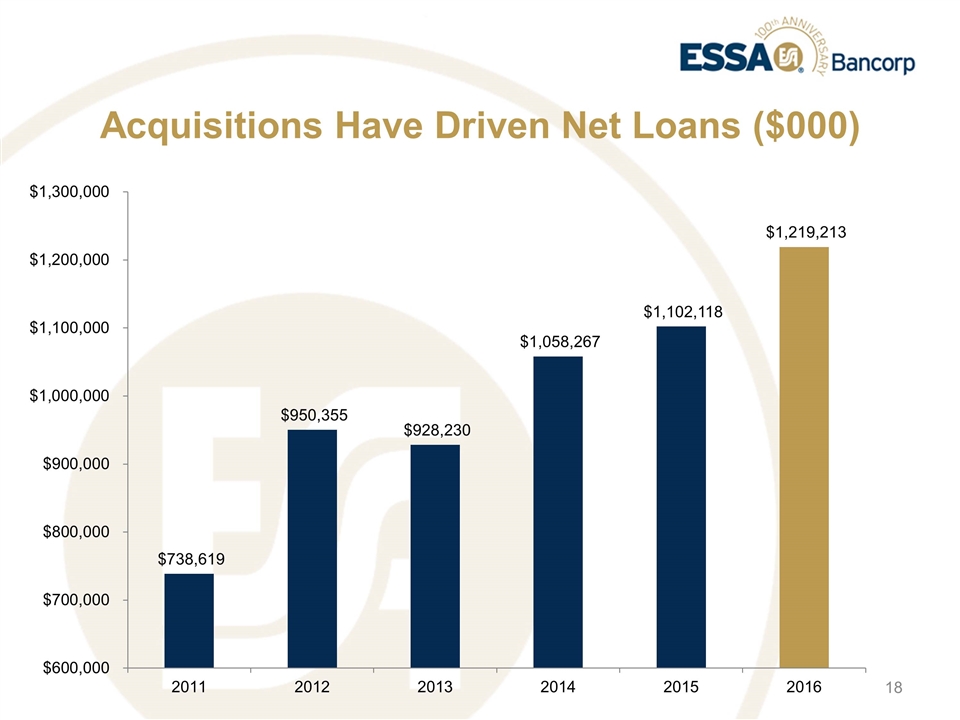

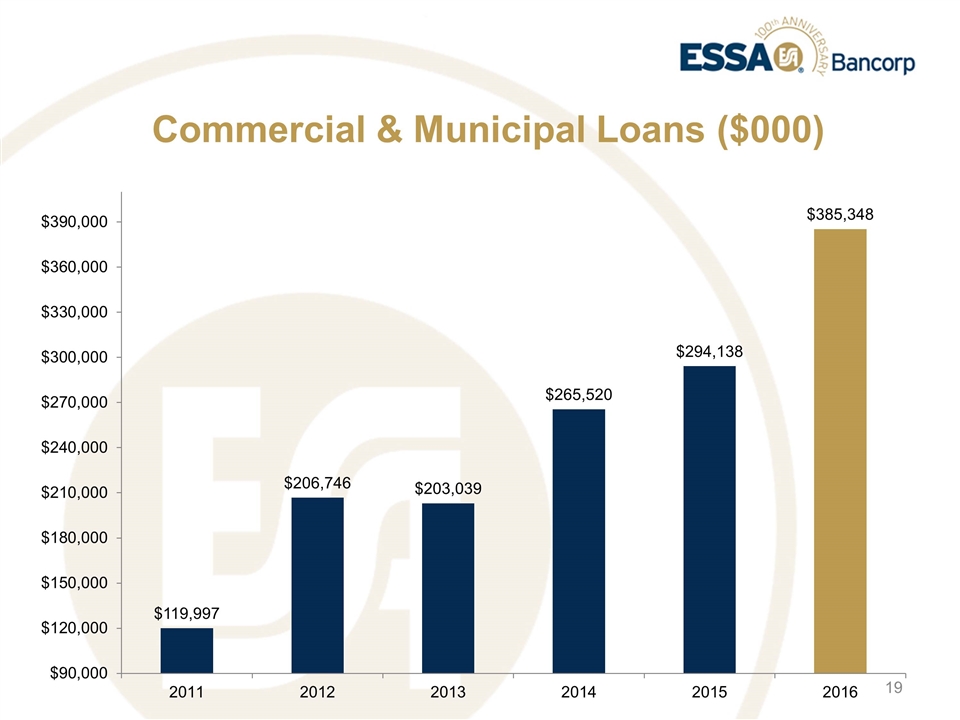

2016 Financials: Balance Sheet Record year for loan closings ($275 million) Record year for commercial loan closings ($102.5 million) Indirect auto lending up 19% year-over-year Loans acquired from ENB acquisition totaled $123.4 million

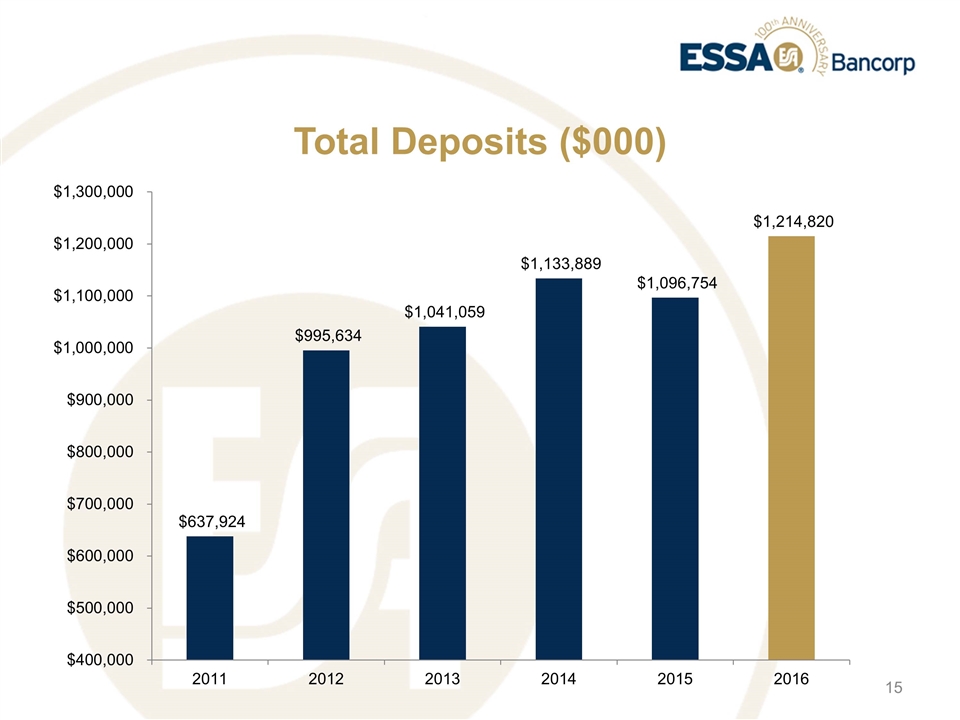

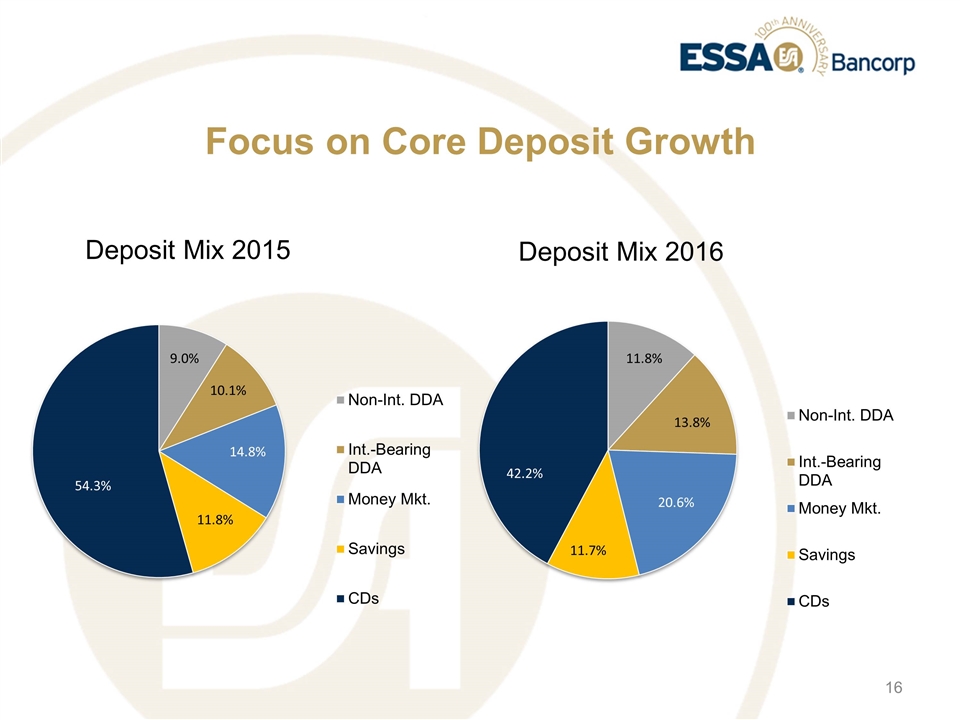

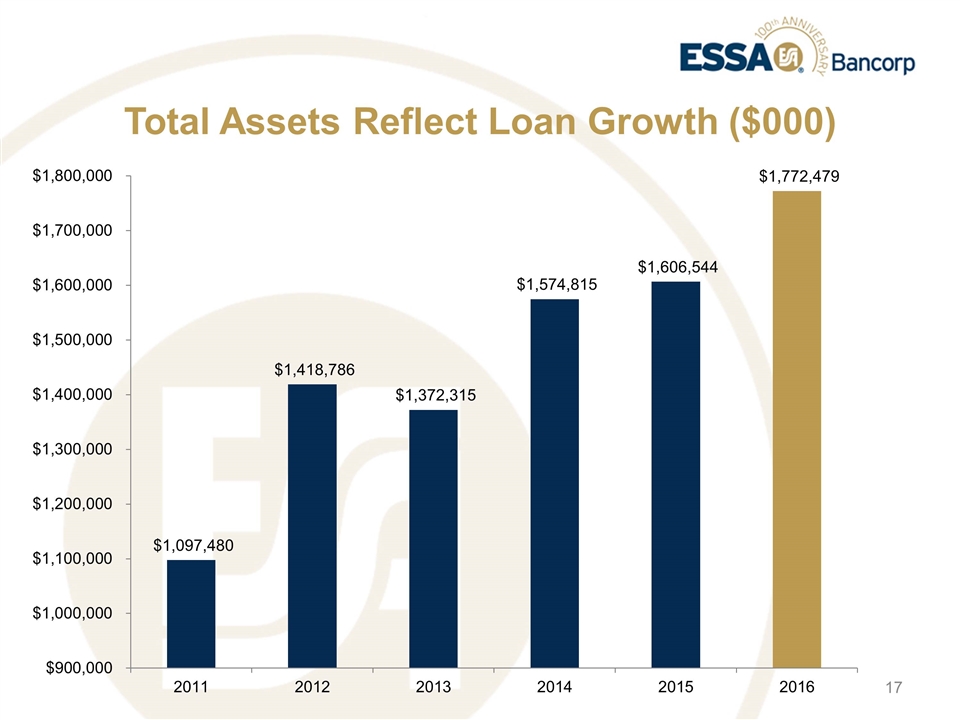

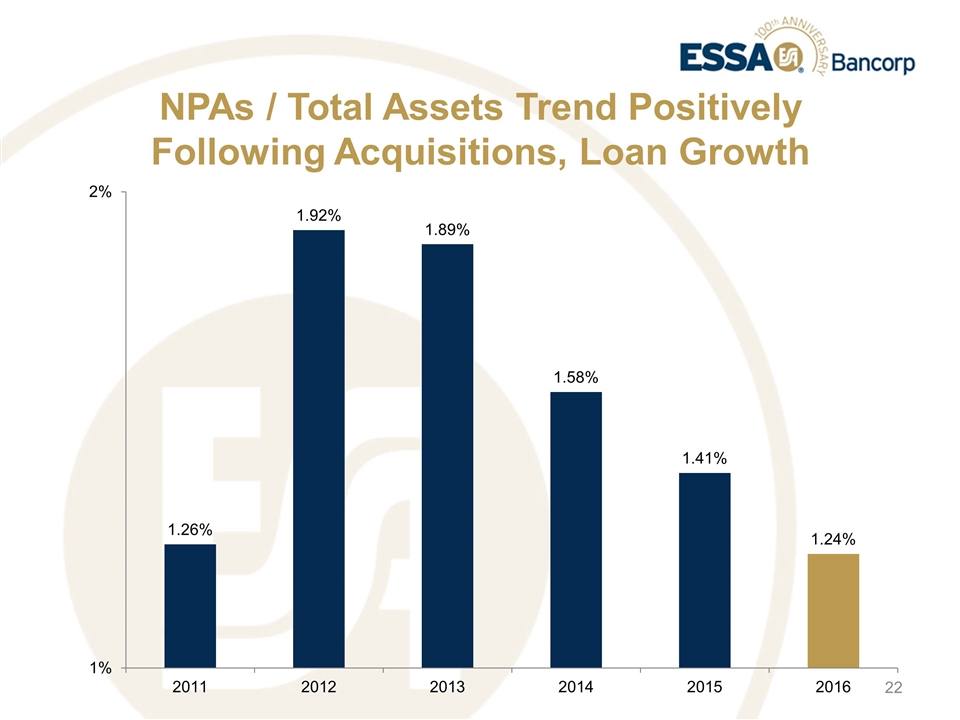

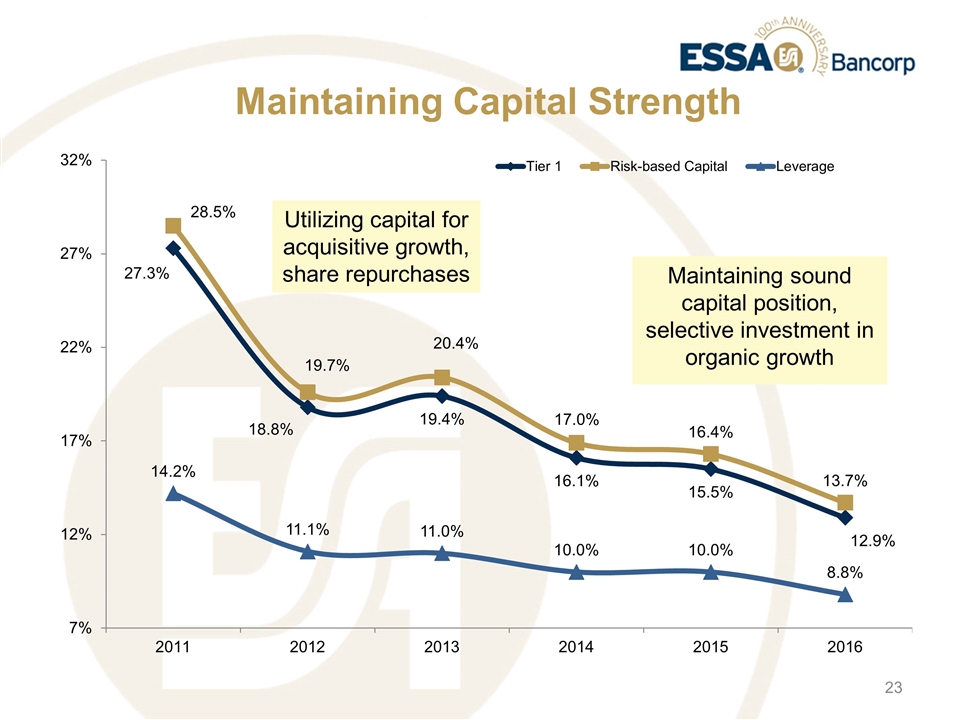

2016 Financials: Balance Sheet (Cont’d) Deposits increase 10.8% in 2016 vs. 2015 Core deposits (all Demand Deposit, Savings, and MMDA accounts) increase to 58% of portfolio from 46% a year earlier ENB acquisition contributes to deposit growth Leveraging commercial banking relationships contributed to growth of noninterest bearing demand deposit accounts Total assets rose to $1.77 billion Asset quality and capital measures remained strong

2016 Financials: Balance Sheet (Cont’d) Measures of shareholder value increased Total stockholders’ equity grew to $176.3 million Tangible book value up year-over-year (to $14.05) Dividend of $0.36 per share

Following The Strategic Growth Plan Closed, integrated ENB acquisition Focused on building commercial banking capabilities Significantly enhanced lending team, adding six experienced commercial bankers Stephen H. Patterson joined ESSA as the Company’s new Chief Lending Officer

Investment in Technology The following technologies were acquired to improve performance throughout our bank: Fiserv Business Online Banking – a brand new product Fiserv Online Bill Pay – enhancements include the ability to view all account transactions Mortgagebot – new paperless residential loan origination system Akcelerant – new paperless consumer loan origination system Personal Mobile App – without logging in, view your balance with the touch of a button Following the Strategic Growth Plan (Cont’d)

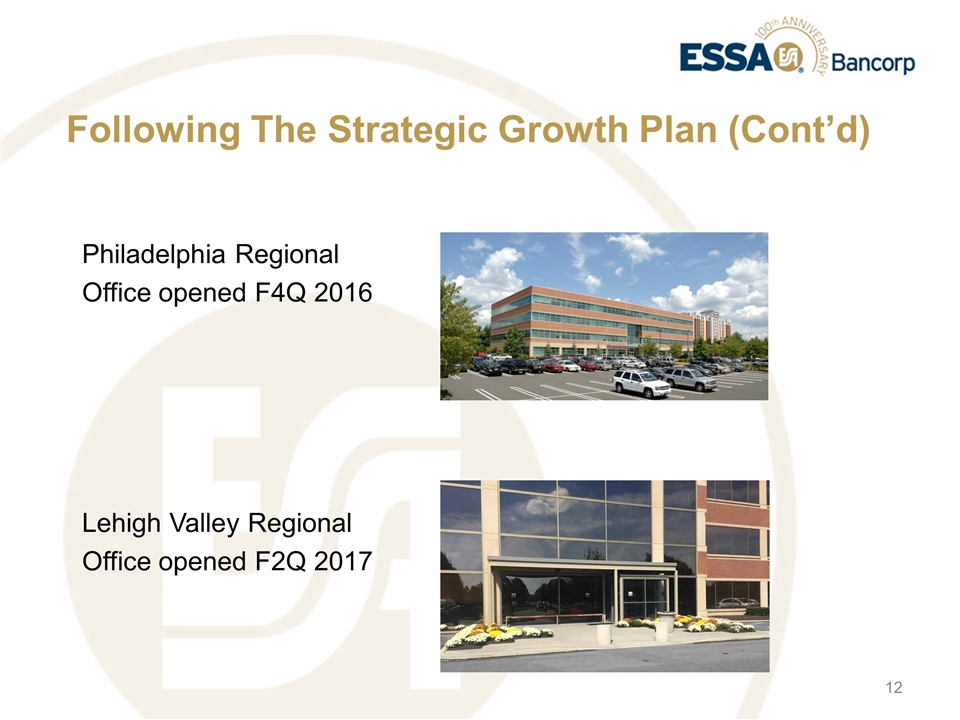

Following The Strategic Growth Plan (Cont’d) Philadelphia Regional Office opened F4Q 2016 Lehigh Valley Regional Office opened F2Q 2017

Growing ESSA Bancorp

Net Income ($000) $4.6MM debt prepayment expense to lower interest costs

Total Deposits ($000)

Focus on Core Deposit Growth

Total Assets Reflect Loan Growth ($000)

Acquisitions Have Driven Net Loans ($000)

Commercial & Municipal Loans ($000)

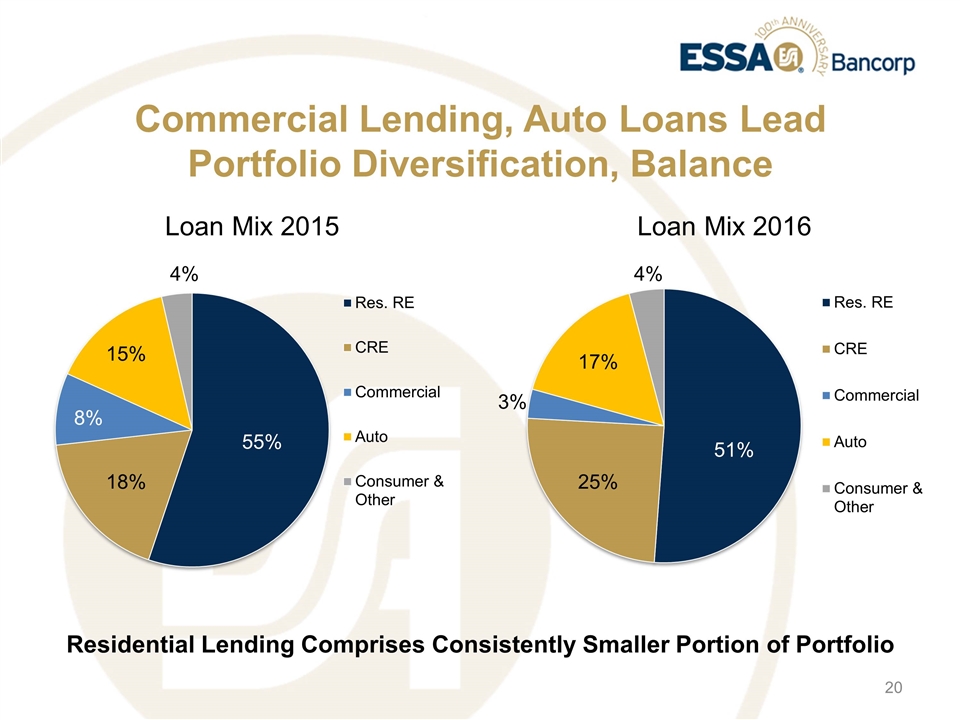

Commercial Lending, Auto Loans Lead Portfolio Diversification, Balance Residential Lending Comprises Consistently Smaller Portion of Portfolio 3% 4% 4% 8%

Quality, Strength, Shareholder Value

NPAs / Total Assets Trend Positively Following Acquisitions, Loan Growth

Maintaining Capital Strength Utilizing capital for acquisitive growth, share repurchases

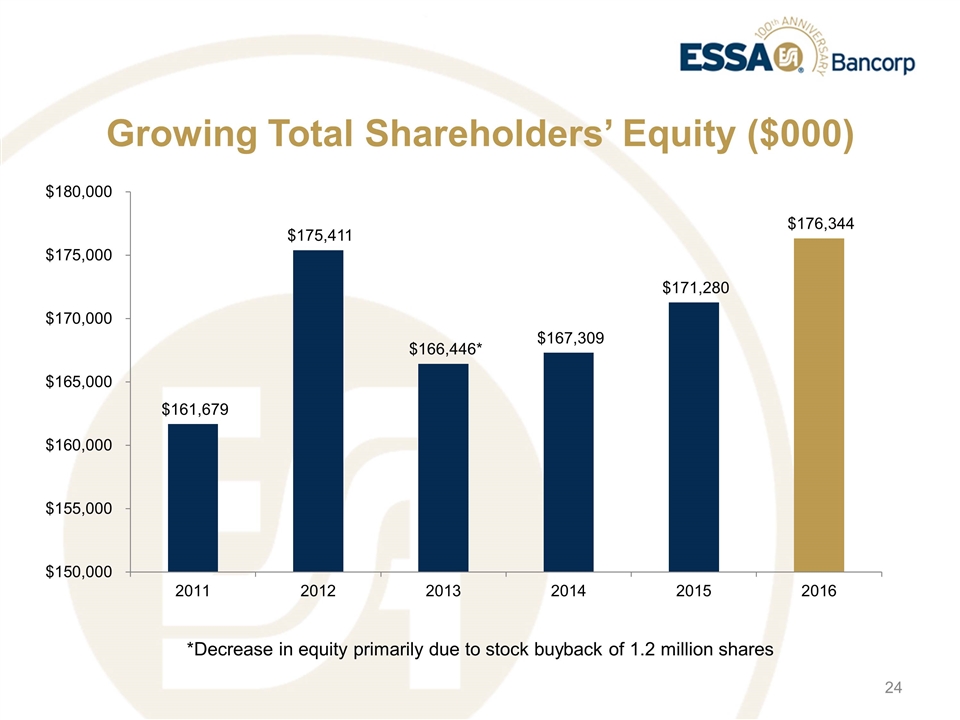

Growing Total Shareholders’ Equity ($000) *Decrease in equity primarily due to stock buyback of 1.2 million shares

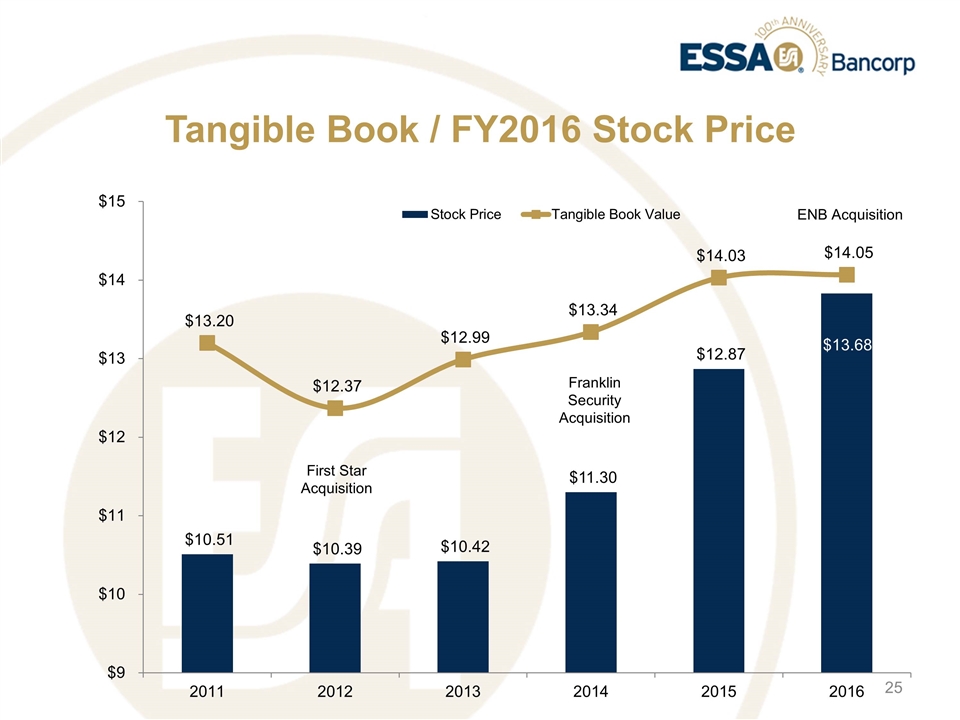

Tangible Book / FY2016 Stock Price

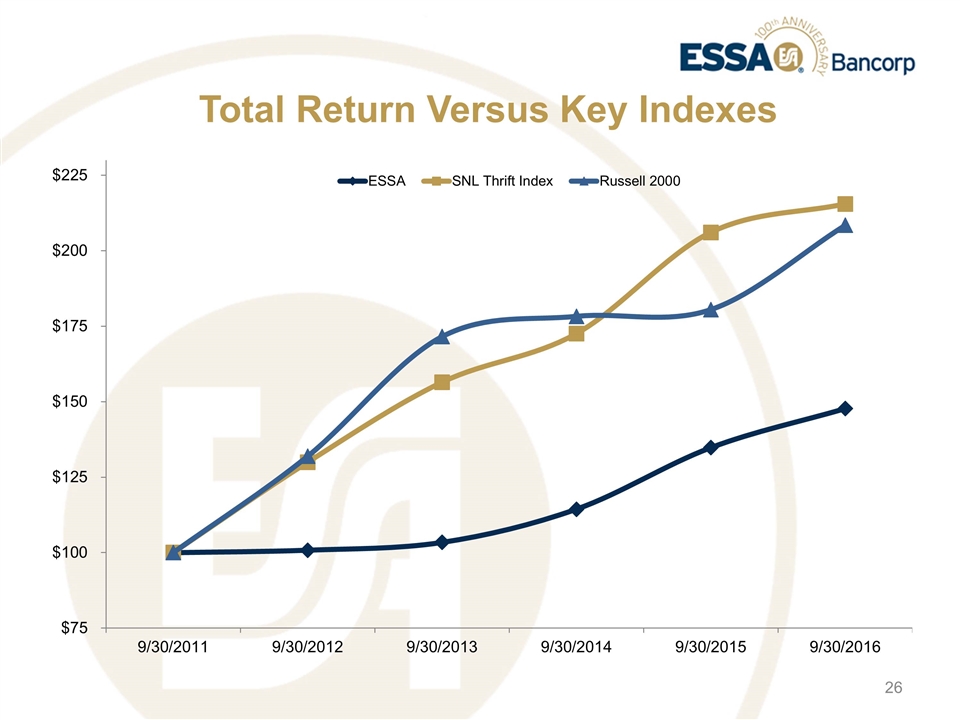

Total Return Versus Key Indexes

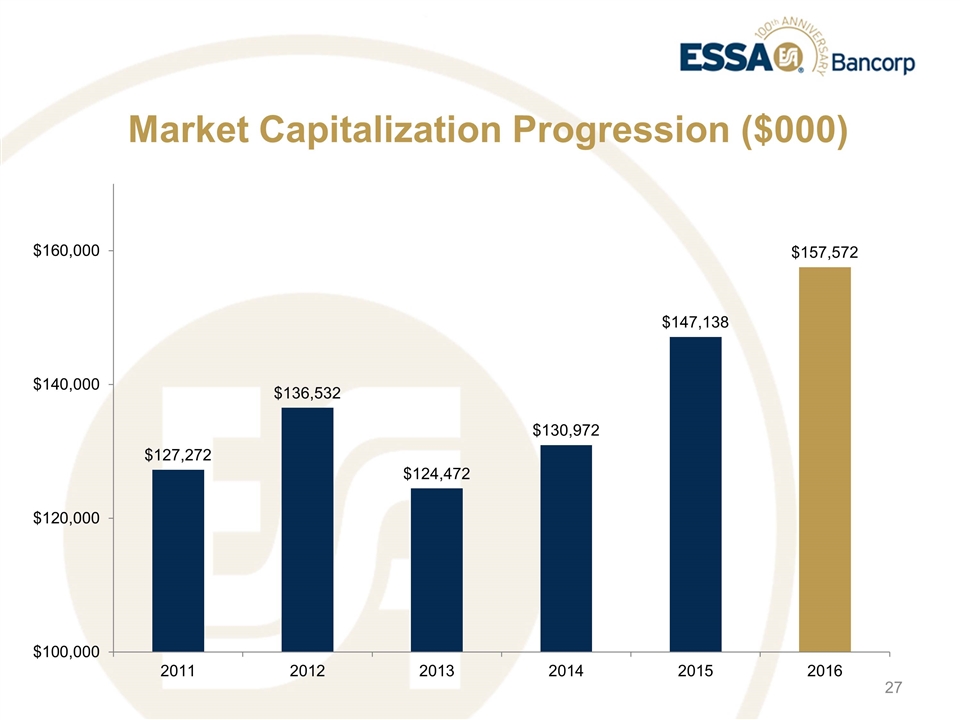

Market Capitalization Progression ($000)

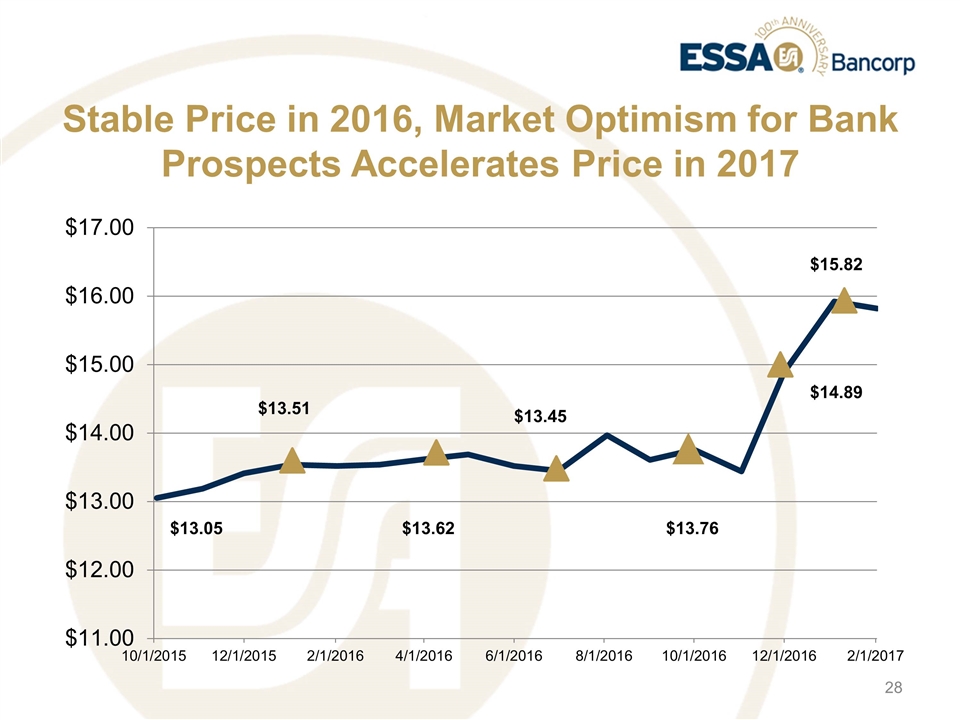

Stable Price in 2016, Market Optimism for Bank Prospects Accelerates Price in 2017

Outlook, Key Initiatives In FY2017 Accelerating organic loan growth Total loans increased by $4.8 million in 1Q17 Solid year-over-year growth in commercial real estate lending in 1Q 2017 Pursue continuing productivity from investments in ESSA team members, facilities, and capabilities Leverage and expand existing commercial banking relationships Optimize performance of all locations Potential for bank regulatory reform/economic growth Deliver value through operational growth, earnings, and dividends

Bank Confidently

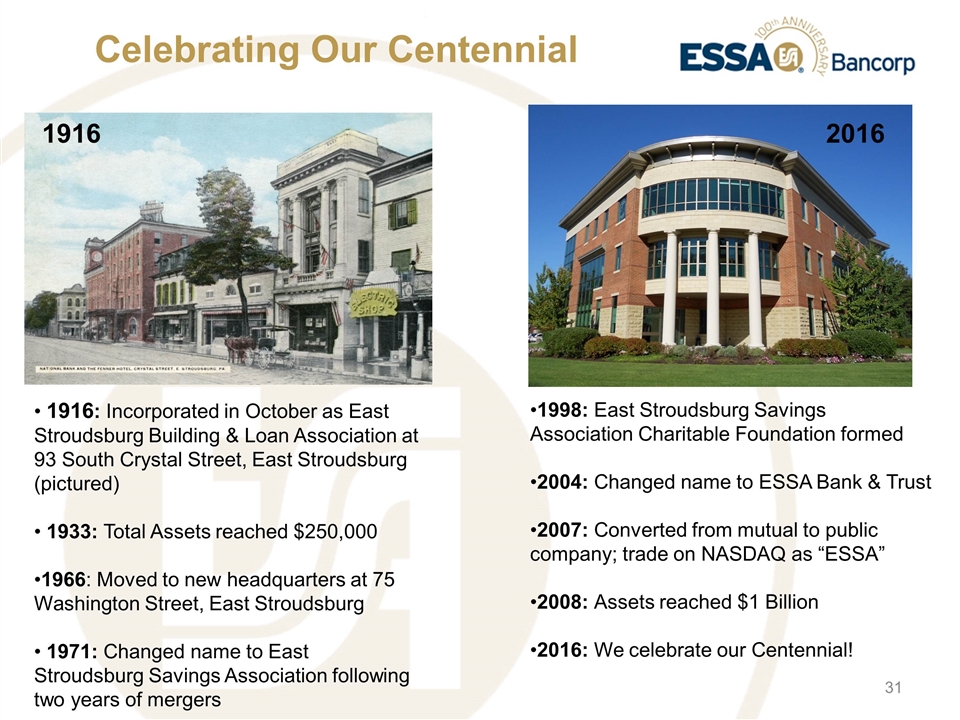

Celebrating Our Centennial 1916 2016 1916: Incorporated in October as East Stroudsburg Building & Loan Association at 93 South Crystal Street, East Stroudsburg (pictured) 1933: Total Assets reached $250,000 1966: Moved to new headquarters at 75 Washington Street, East Stroudsburg 1971: Changed name to East Stroudsburg Savings Association following two years of mergers 1998: East Stroudsburg Savings Association Charitable Foundation formed 2004: Changed name to ESSA Bank & Trust 2007: Converted from mutual to public company; trade on NASDAQ as “ESSA” 2008: Assets reached $1 Billion 2016: We celebrate our Centennial!

ESSA Bancorp, Inc. 2017 Annual Meeting March 2, 2017 Bank Confidently.