Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - R1 RCM INC. | a4q16earningprfinal120pm.htm |

| 8-K - 8-K - R1 RCM INC. | a3-1x178xk.htm |

Q4 and Full Year 2016 Results Conference Call

March 1, 2017

Exhibit 99.2

2

Safe Harbor Statement and Non-GAAP Financial Measures

This presentation contains forward-looking statements, including statements regarding future growth, plans and performance. All forward-

looking statements contained in this presentation involve risks and uncertainties. The Company’s actual results and outcomes could differ

materially from those anticipated in these forward-looking statements as a result of various factors, including the factors set forth under the

heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 1, 2017. The

words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “vision,” “would,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words. The Company has based these forward-looking statements on its current expectations and projections about future events. Although

the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to

be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize,

or should underlying assumptions, projections, or expectations prove incorrect, actual results, performance, financial condition, or events may

vary materially and adversely from those anticipated, estimated, or expected.

All forward-looking statements included in this presentation are expressly qualified in their entirety by these cautionary statements. The

Company cautions readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to

recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ

materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described

above, as well as others that the Company may consider immaterial or does not anticipate at this time. Although the Company believes that

the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations may prove

correct. The Company’s expectations reflected in its forward-looking statements can be affected by inaccurate assumptions it might make or

by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not

exclusive, and further information concerning the Company and its business, including factors that potentially could materially affect its

financial results or condition or relationships with customers and potential customers, may emerge from time to time. The Company assumes

no, and it specifically disclaims any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in

factors or assumptions affecting such forward-looking statements. The Company advises investors, however, to consult any further disclosures

it makes on related subjects in our periodic reports that it files with or furnishes to the SEC.

This presentation includes the following non-GAAP financial measures : Gross Cash Generated and Net Cash Generated from Customer

Contracting Activities (on a historical basis), and Adjusted EBITDA (on a projected basis). Please refer to the Appendix located at the end of this

presentation for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measure.

3

2016 Highlights

Financial Results

Significant bottom-line improvement in 2H’16 versus 1H’16

Company re-launch

Rebranded company in January 2017

On track for relisting in 1H’17

Renewal and expansion of Ascension agreement

Started onboarding first tranche in mid-2016

Deployment office set up as a strategic capability

Intermountain Healthcare renewal

Second-largest R1 customer – improved visibility to forecast

PAS Improvement

Gained market share in addition to organic growth

Cost structure alignment

Annualized cost savings of approximately $16 million

4

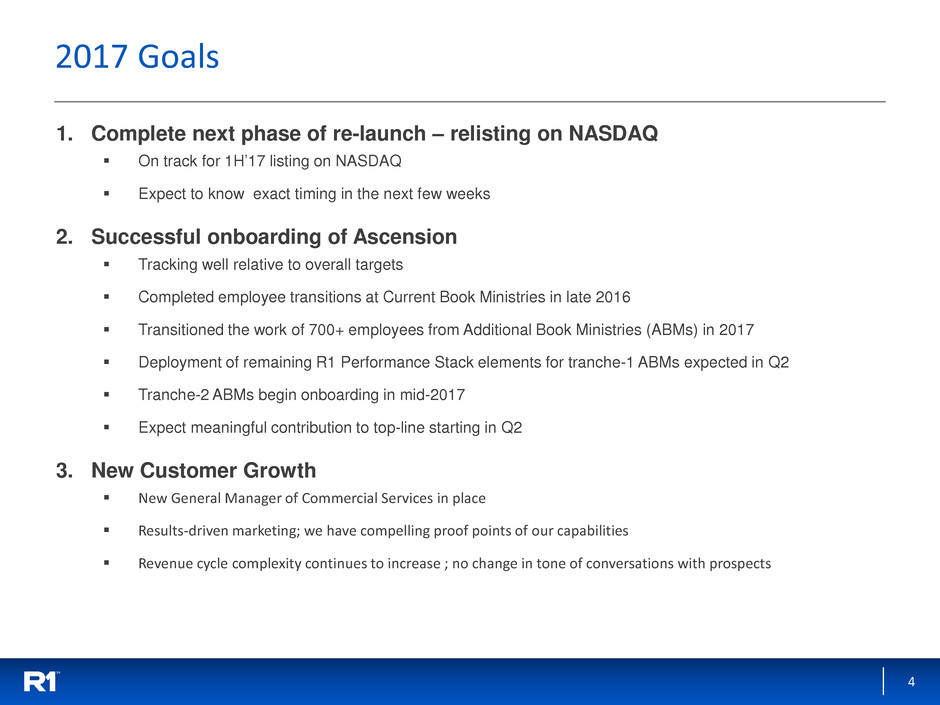

2017 Goals

1. Complete next phase of re-launch – relisting on NASDAQ

On track for 1H’17 listing on NASDAQ

Expect to know exact timing in the next few weeks

2. Successful onboarding of Ascension

Tracking well relative to overall targets

Completed employee transitions at Current Book Ministries in late 2016

Transitioned the work of 700+ employees from Additional Book Ministries (ABMs) in 2017

Deployment of remaining R1 Performance Stack elements for tranche-1 ABMs expected in Q2

Tranche-2 ABMs begin onboarding in mid-2017

Expect meaningful contribution to top-line starting in Q2

3. New Customer Growth

New General Manager of Commercial Services in place

Results-driven marketing; we have compelling proof points of our capabilities

Revenue cycle complexity continues to increase ; no change in tone of conversations with prospects

5

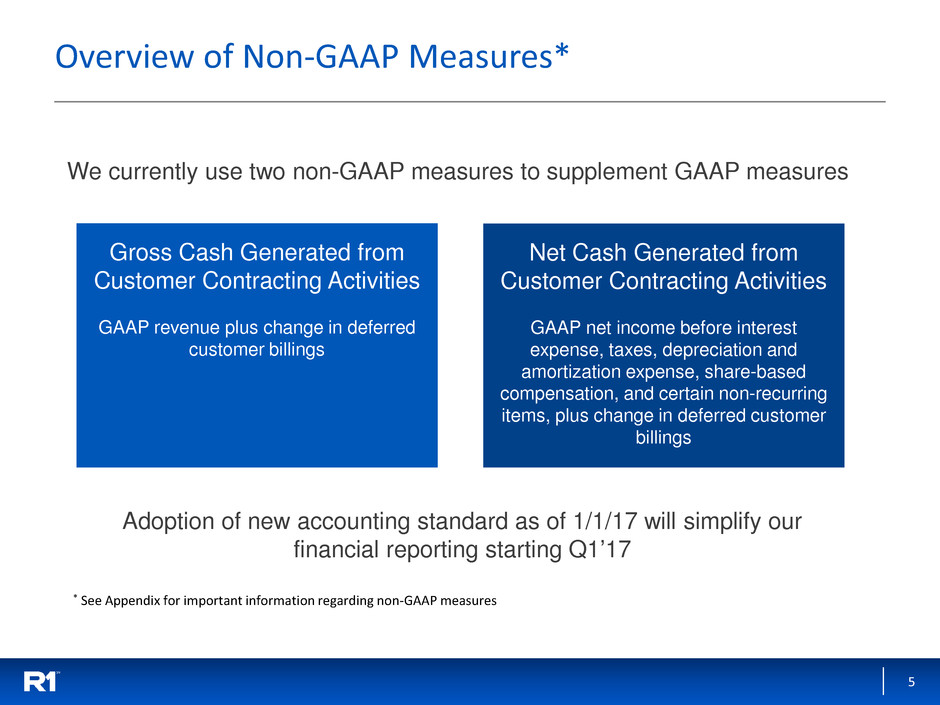

Overview of Non-GAAP Measures*

We currently use two non-GAAP measures to supplement GAAP measures

Gross Cash Generated from

Customer Contracting Activities

GAAP revenue plus change in deferred

customer billings

Net Cash Generated from

Customer Contracting Activities

GAAP net income before interest

expense, taxes, depreciation and

amortization expense, share-based

compensation, and certain non-recurring

items, plus change in deferred customer

billings

* See Appendix for important information regarding non-GAAP measures

Adoption of new accounting standard as of 1/1/17 will simplify our

financial reporting starting Q1’17

6

Q4’16 non-GAAP Results – Q/Q and Y/Y Comparison

($ in millions) 4Q’16 3Q’16 4Q’15 Key change driver(s)

Gross Cash

Generated

$69.8 $59.7 $72.7

• Ascension CBM employees

onboarded in Q4

• Customer attrition y/y

• PAS growth q/q and y/y

Cost of Services $58.1 $43.6 $35.5

• Onboarding of Ascension CBM

employees to R1

SG&A $12.1 $12.6 $10.2

• June 2016 restructuring, offset in

part by re-launch expenses

• Lower incentive compensation in

4Q’15

Net Cash Generated ($0.4) $3.6 $27.0 • Combination of above reasons

7

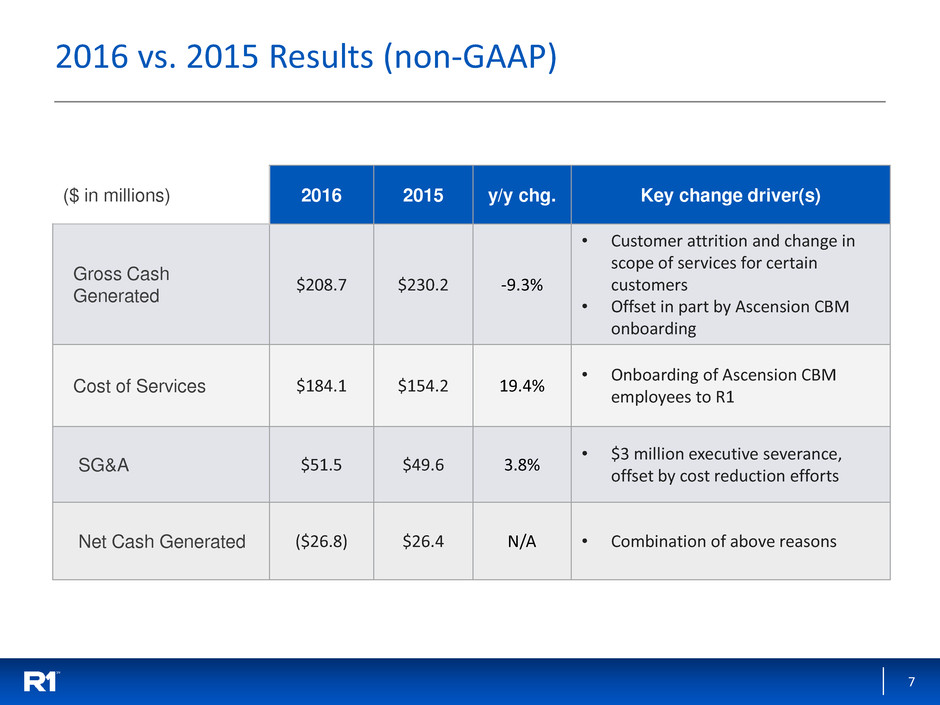

2016 vs. 2015 Results (non-GAAP)

($ in millions) 2016 2015 y/y chg. Key change driver(s)

Gross Cash

Generated

$208.7 $230.2 -9.3%

• Customer attrition and change in

scope of services for certain

customers

• Offset in part by Ascension CBM

onboarding

Cost of Services $184.1 $154.2 19.4%

• Onboarding of Ascension CBM

employees to R1

SG&A $51.5 $49.6 3.8%

• $3 million executive severance,

offset by cost reduction efforts

Net Cash Generated ($26.8) $26.4 N/A • Combination of above reasons

8

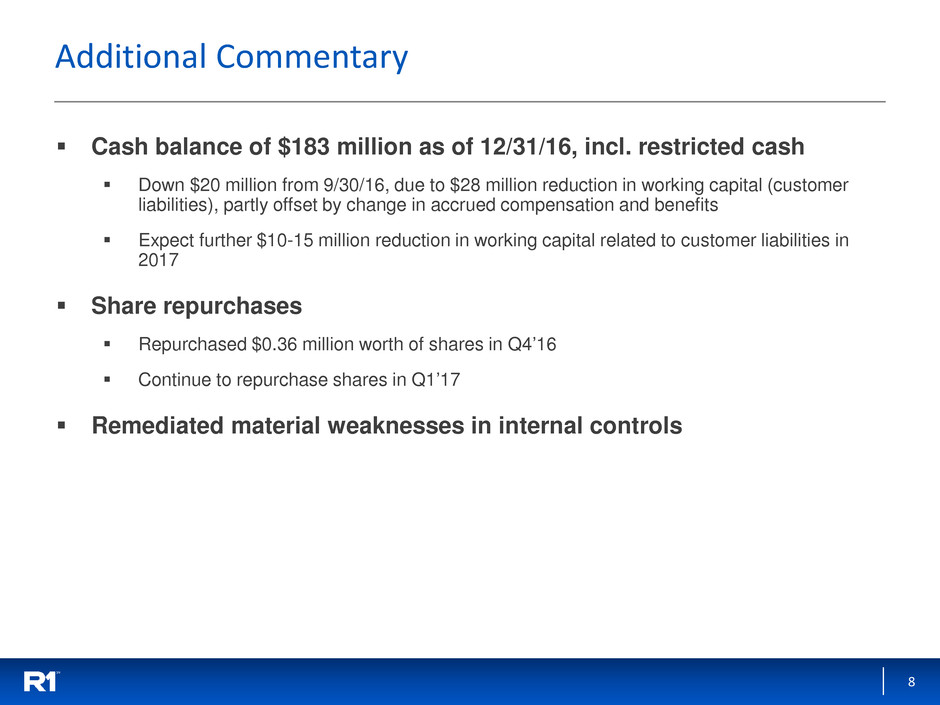

Additional Commentary

Cash balance of $183 million as of 12/31/16, incl. restricted cash

Down $20 million from 9/30/16, due to $28 million reduction in working capital (customer

liabilities), partly offset by change in accrued compensation and benefits

Expect further $10-15 million reduction in working capital related to customer liabilities in

2017

Share repurchases

Repurchased $0.36 million worth of shares in Q4’16

Continue to repurchase shares in Q1’17

Remediated material weaknesses in internal controls

9

2017 Guidance

($ in millions) 2017

Revenue $400 - $425

GAAP Operating Income ($25) – ($30)

Adjusted EBITDA* $0 - $5

* Adjusted EBITDA is calculated as GAAP operating income plus depreciation and

amortization expense, share-based compensation expense, and severance and other costs.

10

2020 Outlook

($ in millions) 2020

Revenue $700 - $900

GAAP Operating Income $75 - $105

Adjusted EBITDA* $105 - $135

* Adjusted EBITDA is calculated as GAAP operating income plus depreciation and

amortization expense, share-based compensation expense, and severance and other costs.

11

Appendix

12

Use of Non-GAAP Financial Measures

In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational

decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, which

are included in this presentation on a projected basis. These include Gross Cash Generated from Customer Contracting Activities, Net Cash

Generated from Customer Contracting Activities, and adjusted EBITDA. Our Board and management team use these non-GAAP measures as

(i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations;

and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for

incentive compensation plans for employees.

Gross Cash Generated from Customer Contracting Activities is defined as GAAP net services revenue, plus the change in deferred customer

billings. Accordingly, Gross Cash Generated from Customer Contracting Activities is the sum of (i) invoiced or accrued net operating fees, (ii)

cash collections on incentive fees and (iii) other services fees. Net Cash Generated from Customer Contracting Activities reflects non-GAAP

adjusted EBITDA and the change in deferred customer billings. The Company anticipates that it will no longer report Gross Cash Generated

from Customer Contracting Activities and Net Cash Generated from Customer Contracting Activities once it adopts the new revenue

recognition accounting standard in 2017.

Adjusted EBITDA is defined as net income before net interest income (expense), income tax provision, depreciation and amortization

expense, share-based compensation, transaction-related expenses, reorganization-related expenses and certain other items. The use of

adjusted EBITDA to measure operating and financial performance is limited by our revenue recognition criteria, pursuant to which GAAP

net services revenue is recognized at the end of a contract or other contractual agreement event. Adjusted EBITDA does not adequately

match corresponding cash flows from customer contracting activities. As a result, the Company uses Gross and Net Cash Generated from

Customer Contracting Activities to better compare cash flows to operating performance.

Deferred customer billings include the portion of both (i) invoiced or accrued net operating fees and (ii) cash collections of incentive fees, in

each case, that have not met our revenue recognition criteria. Deferred customer billings are included in the detail of our customer

liabilities balance in the consolidated balance sheet available in the Company’s Annual Report on Form 10-K for the year ended December

31, 2016.

These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information prepared in

accordance with GAAP.

13

Reconciliation of GAAP net services revenue to non-GAAP Gross Cash

Generated from Customer Contracting Activities

* fav. - Favorable

unfav. – Unfavorable

$ in thousands

Three Months Ended

December 31,

2016 vs. 2015 Change

Year Ended

December 31,

2016 vs. 2015 Change

2016

2015

Amount %

2016

2015

Amount %

Consolidated Statement of Operations Data:

RCM services: net operating fees $68,589

$46,832

$21,757 46.5%

$368,848

$66,234

$302,614 456.9%

RCM services: incentive fees 24,780

11,289

13,491 119.5%

191,317

20,311

171,006 841.9%

RCM services: other 8,030

6,790

1,240 18.3%

16,322

16,381

(59) -0.4%

Other services fees 4,758

3,430

1,328 38.7%

16,070

14,313

1,757 12.3%

Total net services revenue 106,157

68,341

37,816 55.3%

592,557

117,239

475,318 405.4%

Change in deferred customer billings (318,059)

4,337

(322,396) unfav.

(383,864)

112,938

(496,802) unfav.

Gross cash generated from customer

contracting activities

$69,835

$72,678

($284,580) -391.6%

$208,693

$230,177

($21,484) -9.3%

Components of Gross Cash Generated from Customer Contracting Activities:

RCM services: net operating fee $55,713

$34,424

$21,289 61.8%

$150,527

$123,185

$27,342 22.2%

RCM services: incentive fee 5,309

20,155

(14,846) -73.7%

29,112

67,656

(38,544) -57.0%

RCM services: other 4,056

14,669

(10,613) -72.3%

12,985

25,023

(12,038) -48.1%

Total RCM services fees 65,078

69,248

(4,170) -6.0%

192,624

215,864

(23,240) -10.8%

Other services fees 4,757

3,430

1,327 38.7%

16,069

14,313

1,756 12.3%

Gross cash generated from customer

contracting activities

$69,835

$72,678

($2,843) -3.9%

$208,693

$230,177

($21,484) -9.3%

14

Reconciliation of GAAP net income (loss) to non-GAAP Net Cash Generated

from Customer Contracting Activities

* fav. - Favorable

unfav. – Unfavorable

$ in thousands

Three Months Ended

December 31,

2016 vs. 2015 Change

Year Ended

December 31,

2016 vs. 2015 Change

2016

2015

Amount %

2016

2015

Amount %

Net income (loss) $13,126

$5,447

$7,679 141.0%

$177,071

($84,256)

$261,327 -310.2%

Net interest income (110)

(84)

(26) 31.0%

(297)

(231)

(66) 28.6%

Income tax provision (benefit) 14,493

5,555

8,938 160.9%

121,127

(51,557)

172,684 -334.9%

Depreciation and amortization expense 2,893

1,906

987 51.8%

10,198

8,462

1,736 20.5%

Share-based compensation expense 4,659

6,353

(1,694) -26.7%

28,102

31,671

(3,569) -11.3%

Other 829

3,493

(2,664) -76.3%

20,822

9,343

11,479 122.9%

Adjusted EBITDA 35,890

22,670

13,220 58.3%

357,023

(86,568)

443,591 -512.4%

Change in deferred customer billings (36,322)

4,337

(40,659) unfav.

(383,864)

112,938

(496,802) unfav.

Net cash generated from customer contracting

activities

($432)

$27,007

($27,439) unfav.

($26,841) $26,370

($53,211) unfav.

15

Share-Based Compensation and D&A Expense included within Operating Expenses

Three Months Ended

December 31,

Year Ended

December 31,

2016

2015

2016

2015

Cost of services $1,333

$1,452

$6,137

$7,208

Selling, general and administrative $3,326

4,901

21,965

24,463

Other $0

—

1,828

—

Total share-based compensation expense $4,659

$6,353

$29,930

$31,671

Three Months Ended

December 31,

Year Ended

December 31,

2016

2015

2016

2015

Cost of services $2,620

$1,737

$9,492

$7,536

Selling, general and administrative $273

169

706

926

Total depreciation and amortization $2,893

$1,906

$10,198

$8,462

Share-Based Compensation Expense Allocation Details

Depreciation and Amortization Expense Allocation Details

$ in thousands

$ in thousands

16

Condensed Consolidated non-GAAP Financial Information

Three Months Ended December 31,

Year Ended December 31,

2016

2015

2016

2015

GAAP net services revenue $106,157

$68,341

$592,557

$117,239

Increase/(decrease) in deferred customer billings (36,322)

4,337

(383,864)

112,938

Gross cash generated from customer contracting activities 69,835

72,678

208,693

230,177

Operating Expenses1:

Cost of services 58,126

35,504

184,068

154,233

Selling, general and administrative 12,141

10,167

51,466

49,574

Sub-total 70,267

45,671

235,534

203,807

Net cash generated from customer contracting activities ($432)

$27,007

($26,841)

$26,370

Net cash generated margin -0.6%

37.2%

-12.9%

11.5%

$ in thousands

1Excludes share-based compensation, depreciation and amortization, and other costs

17

Reconciliation GAAP Operating Income Guidance to non-GAAP Adjusted EBITDA Guidance

$ in millions

2017 2020

GAAP Operating Income Guidance ($25) - ($30) $75 - $105

Plus:

Depreciation and amortization expense ~$13 $10- $15

Share-based compensation expense ~$13 $10- $15

Severance and other costs ~$5 ~$5

Adjusted EBITDA guidance $0 - $5 $105 - $135