Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Impax Laboratories, LLC | ipxl-3x1x2017xex991.htm |

| 8-K - 8-K - Impax Laboratories, LLC | ipxl-3x1x2017x8k.htm |

1

Fourth Quarter and

Full Year 2016 Results

March 1, 2017

2

Impax Cautionary Statement Regarding

Forward Looking Statements

"Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995:

To the extent any statements made in this presentation contain information that is not historical; these statements are forward-looking in nature

and express the beliefs and expectations of management. Such statements are based on current expectations and involve a number of known

and unknown risks and uncertainties that could cause the Company’s future results, performance, or achievements to differ significantly from

the results, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but

are not limited to, fluctuations in the Company’s operating results and financial condition, the volatility of the market price of the Company’s

common stock, the Company’s ability to successfully develop and commercialize pharmaceutical products in a timely manner, the impact of

competition, the effect of any manufacturing or quality control problems, the Company’s ability to manage its growth, risks related to

acquisitions of or investments in technologies, products or businesses, risks relating to goodwill and intangibles, the reduction or loss of

business with any significant customer, the substantial portion of the Company’s total revenues derived from sales of a limited number of

products, the impact of consolidation of the Company’s customer base, the Company’s ability to sustain profitability and positive cash flows, the

impact of any valuation allowance on the Company’s deferred tax assets, the restrictions imposed by the Company’s credit facility and

indenture, the Company’s level of indebtedness and liabilities and the potential impact on cash flow available for operations, the availability of

additional funds in the future, any delays or unanticipated expenses in connection with the operation of the Company’s manufacturing facilities,

the effect of foreign economic, political, legal and other risks on the Company’s operations abroad, the uncertainty of patent litigation and other

legal proceedings, the increased government scrutiny on the Company’s agreements to settle patent litigations, product development risks and

the difficulty of predicting FDA filings and approvals, consumer acceptance and demand for new pharmaceutical products, the impact of market

perceptions of the Company and the safety and quality of the Company’s products, the Company’s determinations to discontinue the

manufacture and distribution of certain products, the Company’s ability to achieve returns on its investments in research and development

activities, changes to FDA approval requirements, the Company’s ability to successfully conduct clinical trials, the Company’s reliance on third

parties to conduct clinical trials and testing, the Company’s lack of a license partner for commercialization of Numient® (IPX066) outside of the

United States, impact of illegal distribution and sale by third parties of counterfeits or stolen products, the availability of raw materials and

impact of interruptions in the Company’s supply chain, the Company’s policies regarding returns, rebates, allowances and chargebacks, the use

of controlled substances in the Company’s products, the effect of current economic conditions on the Company’s industry, business, results of

operations and financial condition, disruptions or failures in the Company’s information technology systems and network infrastructure caused

by third party breaches or other events, the Company’s reliance on alliance and collaboration agreements, the Company’s reliance on licenses

to proprietary technologies, the Company’s dependence on certain employees, the Company’s ability to comply with legal and regulatory

requirements governing the healthcare industry, the regulatory environment, the effect of certain provisions in the Company’s government

contracts, the Company’s ability to protect its intellectual property, exposure to product liability claims, changes in tax regulations, uncertainties

involved in the preparation of the Company’s financial statements, the Company’s ability to maintain an effective system of internal control over

financial reporting, the effect of terrorist attacks on the Company’s business, the location of the Company’s manufacturing and research and

development facilities near earthquake fault lines, expansion of social media platforms and other risks described in the Company’s periodic

reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as to the date on which they are made,

and the Company undertakes no obligation to update publicly or revise any forward-looking statement, regardless of whether new information

becomes available, future developments occur or otherwise.

Trademarks referenced herein are the property of their respective owners.

©2017 Impax Laboratories, Inc. All Rights Reserved.

3

Agenda

Business Update

Kevin Buchi – Interim President & Chief Executive Officer

Financial Review

Bryan Reasons – Senior Vice President, Chief Financial Officer

Additional Participants for Q&A Session

Doug Boothe – President Impax Generics

Michael Nestor – President Impax Specialty Pharma

4

Business Update

Kevin Buchi

Interim President & Chief Executive Officer

5

Increased rate of ANDA approvals by FDA

Consolidation of payers and customers

Aggressive competition and pricing activities; impacted our 2016 results

Generic division pricing declined ~22%

Excluding diclofenac sodium gel and metaxalone; pricing declined ~12%

Generic Industry Challenges…

Summary of 2016

$0

$50

$100

$150

$200

$250

1Q 2Q 3Q 4Q

2016 Quarterly Revenue

Generic Specialty Pharma

…Resulted in Significant Sales Volatility

$226

$173

$228

$198

$711

$606

$150

$218

$0

$200

$400

$600

$800

$1,000

2015 2016

Annual Revenue

Generic Specialty Pharma

$861 $824

($ millions)

Note: The sum of the individual amounts may not equal due to rounding.

6

Expanded production/supply

Enhanced greater awareness

The “Go To Choice”

Significantly expanded preferred drug list status

CVS agreement

2016 revenue of $92MM; up 139% over 2015

Generics Business Highlights

IMS NPA Weekly Feb. 17, 2017

0%

5%

10%

15%

20%

25%

30%

Epinephrine Auto-Injector

Share Growth

Jan. 1, 2016 – Feb. 17, 2017

4

26%

0%

10%

20%

30%

40%

50%

60%

70%

Oxymorphone ER

Share Growth

Jan. 1, 2016 – Feb. 17, 2017

7.5 & 15 mg 5, 10, 20, 30 & 40 mg

34%

46%

Sole generic player

Captured share of exiting generic player

2016 revenue of $73MM; up 23% over 2015

48%

58%

Despite Industry challenges, several products in the generic

portfolio delivered strong growth

7

Redefined clinical messaging related to formulation

Simplified dose conversion guidance for general neurologists

Launched myRytary Patient Support Program www.myrytary.com

74% revenue growth and 114% script growth in 2016 (a)

Delivering Solid Growth Across Specialty Portfolio

Emphasis on second position promotion

Increased non-personal promotion

Solid growth from general neurologists, headache

specialists and pediatricians

9% revenue growth and 8% script growth in 2016

0%

1%

2%

3%

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17

CD

L

D

S

h

a

re

T

R

x

Monthly TRx and Share of National CD-LD TRx

Rytary TRx CD-LD Share

(a) Rytary was launched in Feb. 2015.

(b) Acquired in the Tower Holdings Acquisition in March 2015.

Source: IMS NPA Monthly Jan. 2017

Emverm launched late 1Q 2016

Focusing on Albenza to Emverm conversion

Increased non-personal promotion of Emverm

Albenza: 43% revenue growth in 2016 (b)

8

Investing to Expand Pipeline Opportunities

Source of sales data: IMS NSP Dec 2016; *U.S. Brand/Generic market sales; Pipeline data as of Feb 24, 2017

Generic R&D

16

14

7

6

Pending at FDA

$14B

Under Development

$10B

Solid Oral Dose Alternative Dose

23

20

# of Potential

Products

FTF or FTM

8 17

Specialty Pharma R&D

Portfolio of 43 Products

Current U.S. Brand/Generic Market of $24B

IPX-203 Carbidopa-Levodopa

Ongoing Phase 2b study

Multiple dose study in patients with

advanced Parkinson’s disease

Interim results by end of first half 2017

Held meeting with FDA in Feb. 2017 to

discuss Phase 3 development plan

Pipeline provides solid platform for growth

9

Leveraging Our Strengths and Focusing

on Opportunities for Growth

Continue focus on sustainable quality and compliance programs

Select the right products for internal and partnership development

Develop, file and launch on time and capitalize on market opportunities

Ensure effective and compliant marketing and sales execution of generic

and specialty products

Leveraging

Our Strengths

Improve cost of goods sold and supply chain flexibility

Reduce expenses by identifying additional efficiency opportunities

Increase productivity from internal R&D programs

Diversify via select partnering and business development activities in

both brand and generic businesses

Focusing on

Opportunities

to Drive

Growth

Over last couple years, took steps to reduce costs and improve

efficiencies, which we expect to produce estimated annual savings

between $40MM and $50MM by 2018

Undertook thorough review of product portfolio and cost structure, which

will provide incremental operational opportunities

Operating

Efficiently

10

Financial Review

Bryan Reasons

Senior Vice President, Chief Financial Officer

11

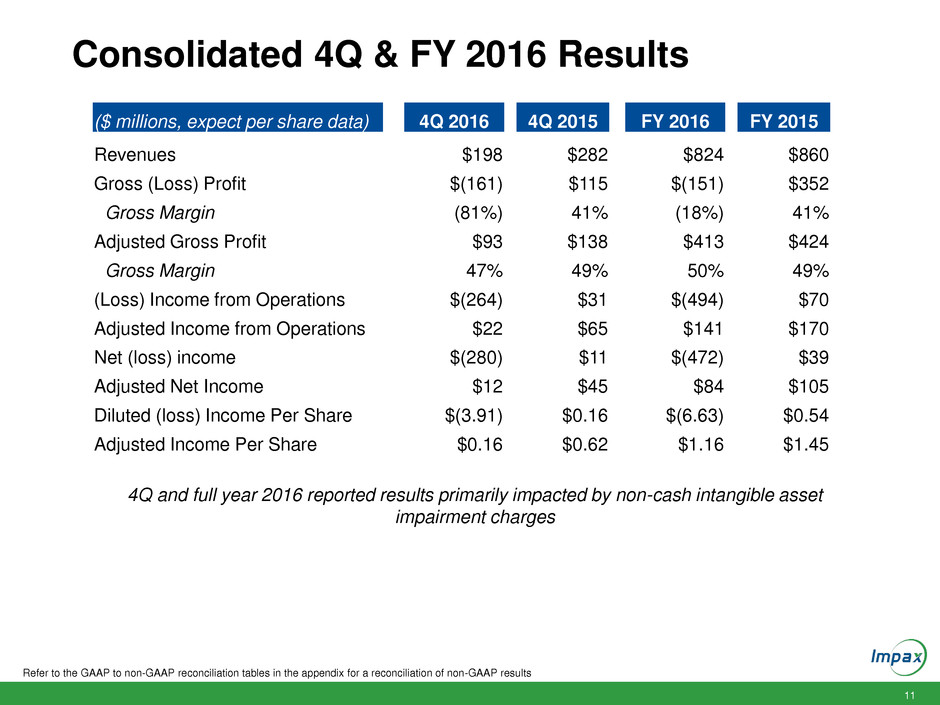

Consolidated 4Q & FY 2016 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

($ millions, expect per share data) 4Q 2016 4Q 2015 FY 2016 FY 2015

Revenues $198 $282 $824 $860

Gross (Loss) Profit $(161) $115 $(151) $352

Gross Margin (81%) 41% (18%) 41%

Adjusted Gross Profit $93 $138 $413 $424

Gross Margin 47% 49% 50% 49%

(Loss) Income from Operations $(264) $31 $(494) $70

Adjusted Income from Operations $22 $65 $141 $170

Net (loss) income $(280) $11 $(472) $39

Adjusted Net Income $12 $45 $84 $105

Diluted (loss) Income Per Share $(3.91) $0.16 $(6.63) $0.54

Adjusted Income Per Share $0.16 $0.62 $1.16 $1.45

4Q and full year 2016 reported results primarily impacted by non-cash intangible asset

impairment charges

12

$ millions 4Q 2016 FY 2016

Tower Holdings Acquisition

Currently marketed portfolio $175 $177

In-process R&D $20 $46

Other --- $8

Teva Transaction

Currently marketed portfolio $54 $302

In-process R&D $4 $7

Other

Currently marketed portfolio $1 $1

Total non-cash impairment $254 $542

Note: The sum of the individual amounts may not equal due to rounding.

Non-Cash Intangible Asset Impairment Charges

13

Generic Division 4Q & FY 2016 Results

($ millions) 4Q 2016 4Q 2015 FY 2016 FY 2015

Revenues $139 $227 $606 $711

Gross (Loss) Profit $(176) $76 $(275) $261

Gross Margin (127%) 34% (45%) 37%

Adjusted Gross Profit $46 $92 $238 $303

Gross Margin 33% 41% 39% 43%

(Loss) Income from Operations $(212) $42 $(386) $169

Adjusted Income from Operations $22 $58 $157 $211

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

4Q and full year 2016 reported results primarily impacted by non-cash intangible asset

impairment charges

14

Specialty Pharma Division 4Q & FY 2016 Results

($ millions) 4Q 2016 4Q 2015 FY 2016 FY 2015

Revenues $59 $55 $218 $150

Gross Profit $15 $38 $124 $92

Gross Margin 26% 70% 57% 61%

Adjusted Gross Profit $47 $46 $174 $121

Gross Margin 79% 84% 80% 81%

(Loss) Income from Operations $(17) $19 $12 $19

Adjusted Income from Operations $26 $27 $87 $49

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

4Q and full year 2016 reported results primarily impacted by non-cash intangible asset

impairment charges

15

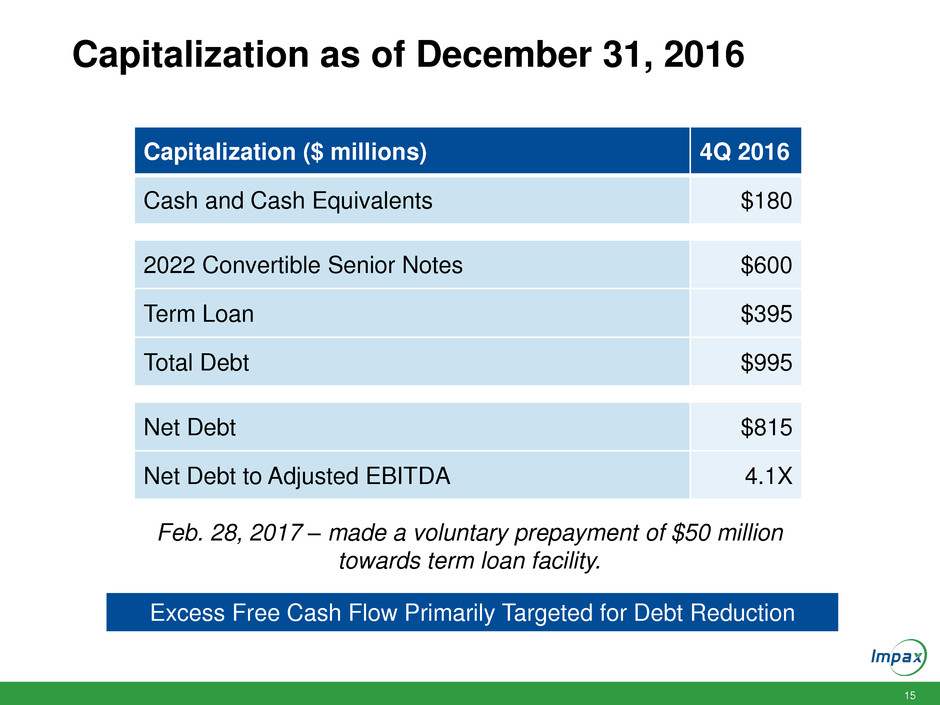

Capitalization as of December 31, 2016

Capitalization ($ millions) 4Q 2016

Cash and Cash Equivalents $180

2022 Convertible Senior Notes $600

Term Loan $395

Total Debt $995

Net Debt $815

Net Debt to Adjusted EBITDA 4.1X

Excess Free Cash Flow Primarily Targeted for Debt Reduction

Feb. 28, 2017 – made a voluntary prepayment of $50 million

towards term loan facility.

16

The Company’s full year 2017 estimates are based on management’s current expectations,

including with respect to prescription trends, pricing levels, inventory levels, and the anticipated

timing of future product launches and events. The following statements are forward-looking, and

actual results could differ materially depending on market conditions and the factors set forth

above under our “Safe Harbor” statement.

2017 Outlook

17

2017 Assumptions

Generic Division

Aggressive competition and pricing activities expected to continue

Pricing erosion in the high single to low double digit range

Minimal contribution from approved/tentatively approved products expected to launch throughout 2017

Generic Vytorin® (tentatively approved), patent expires late April

Not expecting approval of generics Renvela® and/or Welchol® until late 2017 – at the earliest

May be delayed until 2018

Total revenues, excluding products not yet approved, expected to decline year over year

Specialty Pharma Division

Continued Rytary® and Zomig® nasal spray growth

Possible generic competition on Albenza®

Partially offset by launch of our own authorized generic

Focusing on Albenza® to Emverm® conversion

The Company’s full year 2017 estimates are based on management’s current expectations, including with respect to prescription trends, pricing levels, inventory levels, and

the anticipated timing of future product launches and events. These statements are forward-looking, and actual results could differ materially depending on market conditions

and the factors set forth under our “Safe Harbor” statement above.

18

2017 Financial Guidance Summary

Guidance

Adjusted Gross Margin as a % of Revenues 47% to 49%

R&D & Patent Litigation Expense $90MM to $95MM

Selling, General & Administrative Expense $190MM to $195MM

Adjusted Interest Expense $30MM

Tax Rate 34% to 35%

Capital Expenditures $25MM to $30MM

The Company’s full year 2017 estimates are based on management’s current expectations, including with respect to prescription trends, pricing levels, inventory levels, and

the anticipated timing of future product launches and events. These statements are forward-looking, and actual results could differ materially depending on market conditions

and the factors set forth under our “Safe Harbor” statement above.

Aggressively pursuing additional efficiency opportunities to

free up resources to invest in growth initiatives and reduce

long-term debt

19

Q&A

20

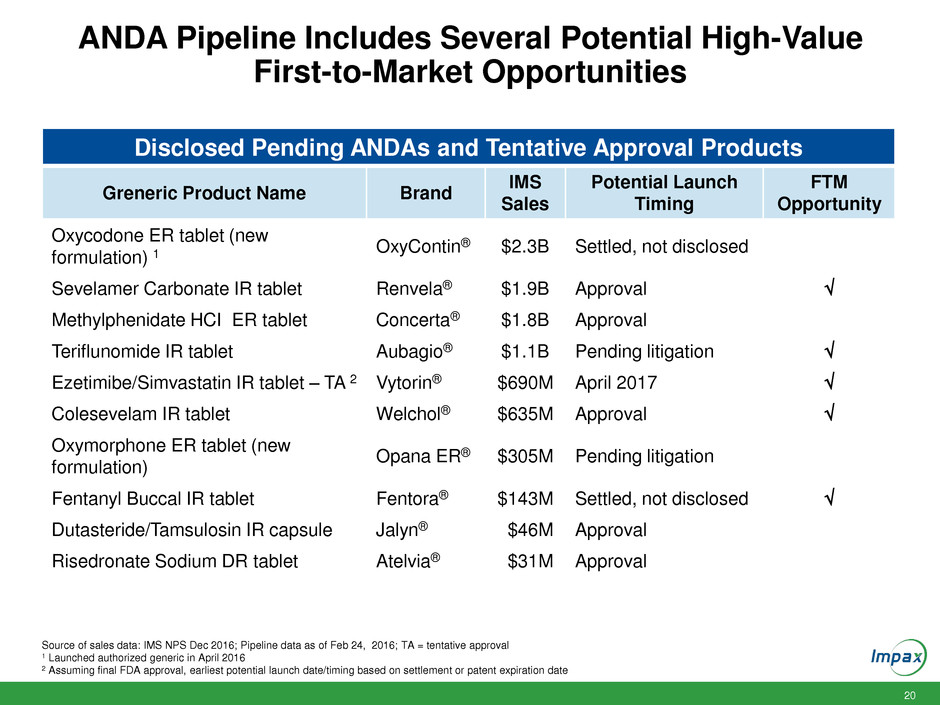

ANDA Pipeline Includes Several Potential High-Value

First-to-Market Opportunities

Source of sales data: IMS NPS Dec 2016; Pipeline data as of Feb 24, 2016; TA = tentative approval

1 Launched authorized generic in April 2016

2 Assuming final FDA approval, earliest potential launch date/timing based on settlement or patent expiration date

Disclosed Pending ANDAs and Tentative Approval Products

Greneric Product Name Brand

IMS

Sales

Potential Launch

Timing

FTM

Opportunity

Oxycodone ER tablet (new

formulation) 1

OxyContin® $2.3B Settled, not disclosed

Sevelamer Carbonate IR tablet Renvela® $1.9B Approval

Methylphenidate HCI ER tablet Concerta® $1.8B Approval

Teriflunomide IR tablet Aubagio® $1.1B Pending litigation

Ezetimibe/Simvastatin IR tablet – TA 2 Vytorin® $690M April 2017

Colesevelam IR tablet Welchol® $635M Approval

Oxymorphone ER tablet (new

formulation)

Opana ER® $305M Pending litigation

Fentanyl Buccal IR tablet Fentora® $143M Settled, not disclosed

Dutasteride/Tamsulosin IR capsule Jalyn® $46M Approval

Risedronate Sodium DR tablet Atelvia® $31M Approval

21

GAAP to Adjusted Results Reconciliation

The following table reconciles total Company reported cost of revenues and (Loss) income from operations to adjusted cost of

revenues, adjusted gross profit, adjusted gross margin and adjusted income from operations.

(Unaudited, amounts in thousands)

Refer to the Fourth Quarter 2016 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

Three months ended Year Ended

December 31, December 31,

2016 2015 2016 2015

Cost of revenues $ 129,047 $ 160,019 $ 486,899 $ 500,762

Cost of revenues impairment charges 230,625 7,303 488,632 7,303

Adjusted to deduct:

Amortization 16,886 12,970 56,490 40,186

Intangible asset impairment charges 230,625 7,303 488,632 7,303

Restructuring and severance charges 6,414 1,136 18,708 6,387

Lease termination for office consolidation - - 53 -

Hayward facility remediation costs - 1,973 - 11,364

Fair value of inventory step-up - (9) - 6,458

Adjusted cost of revenues $ 105,747 $ 143,949 $ 411,648 $ 436,367

Adjusted gross profit (a) $ 92,675 $ 138,143 $ 412,781 $ 424,102

Adjusted gross margin (a) 46.7% 49.0% 50.1% 49.3%

GAAP (loss) income from operations $ (263,906) $ 30,804 $ (494,182) $ 69,568

Adjusted to deduct:

Amortization 16,886 12,970 56,490 40,186

Intangible asset impairment charges 230,625 7,303 488,632 7,303

Restructuring and severance charges 11,705 2,946 24,071 10,768

In-process research and development impairment charges 23,248 6,360 52,965 6,360

Business development expenses 251 2,363 4,540 17,334

Turing legal expenses 2,111 - 7,554 -

Lease termination for office consolidation - - 144 -

Hayward facility remediation costs - 1,973 - 11,364

Fair value of inventory step-up - (9) - 6,458

Other 600 - 1,522 750

Adjusted income from operations $ 21,520 $ 64,710 $ 141,736 $ 170,091

22

GAAP to Adjusted Net Income Reconciliation

The following table reconciles reported net (loss) income to adjusted net income.

(Unaudited, amounts in thousands, except per share and per share data)

Refer to the Fourth Quarter 2016 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal

due to rounding.

Three months ended Year Ended

December 31, December 31,

2016 2015 2016 2015

Net (loss) income $(279,585) $ 11,427 $(472,031) $ 38,997

Adjusted to add (deduct):

Amortization 16,886 12,970 56,490 40,186

Non-cash interest expense 6,241 5,204 22,846 11,230

Business development expenses 251 2,363 4,540 17,334

Intangible asset impairment charges 253,873 13,664 541,597 13,664

Reserve for Turing receivable (7,731) - 40,312 -

Turing legal expenses 2,111 - 7,554 -

Restructuring and severance charges 11,705 2,947 23,896 10,768

Fixed asset impairment charges 1,644 - 1,644 -

Lease termination for office consolidation - - 144 -

Gain on sale of asset - - - (45,574)

Loss on extinguishment of debt - - - 16,903

Net change in fair value of derivatives - 9,000 - 13,000

Hayward facility remediation costs - 1,973 - 11,364

Fair value of inventory step-up - (9) - 6,458

Ticking Fees - - - 2,317

Other 1,118 520 2,040 1,270

Income tax effect 5,136 (15,540) (145,368) (33,399)

Adjusted net income $ 11,649 $ 44,519 $ 83,664 $ 104,518

Adjusted net income per diluted share $ 0.16 $ 0.62 $ 1.16 $ 1.45

Net (loss) income per diluted share $ (3.91) $ 0.16 $ (6.63) $ 0.54

23

Generic Division GAAP to Adjusted

Results Reconciliation

The following tables reconcile the Impax Generics Division reported cost of revenues and (Loss) income from operations to adjusted cost

of revenues, adjusted gross profit, adjusted gross margin and adjusted operating income.

(Unaudited, amounts in thousands)

Refer to the Fourth Quarter 2016 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

Three Months Ended Year Ended

December 31, December 31,

2016 2015 2016 2015

Cost of revenues $ 109,380 $ 143,146 $ 417,316 $ 442,742

Cost of revenues impairment charges 206,312 7,303 464,319 7,303

Adjusted to deduct:

Amortization 9,470 5,155 30,599 15,692

Intangible asset impairment charges 206,312 7,303 464,319 7,303

Restructuring and severance charges 6,414 1,136 18,708 6,387

Lease termination for office consolidation - - 53 -

Hayward facility remediation costs - 1,973 - 11,364

Fair value of inventory step-up - (9) - 1,083

Adjusted cost of revenues $ 93,496 $ 134,891 $ 367,956 $ 408,216

Adjusted gross profit (a) $ 45,730 $ 91,955 $ 238,364 $ 302,716

Adjusted gross margin (a) 32.8% 40.5% 39.3% 42.6%

GAAP (loss) income from operations $ (212,088) $ 42,256 $ (386,397) $ 169,466

Adjusted to add (deduct):

Amortization 9,470 5,155 30,599 15,692

Intangible asset impairment charges 217,587 7,303 492,084 7,303

Restructuring and severance charges 6,414 472 18,708 5,723

Payments for licensing agreements 600 - 1,522 -

Lease termination for office consolidation - - 144 -

Hayward facility remediation costs - 1,973 - 11,364

Fair value of inventory step-up - (9) - 1,083

Hayward technical operations and R&D restructuring - 664 - 664

Tower Acquisition severance - - - -

Adjusted income from operations $ 21,983 $ 57,814 $ 156,660 $ 211,295

24

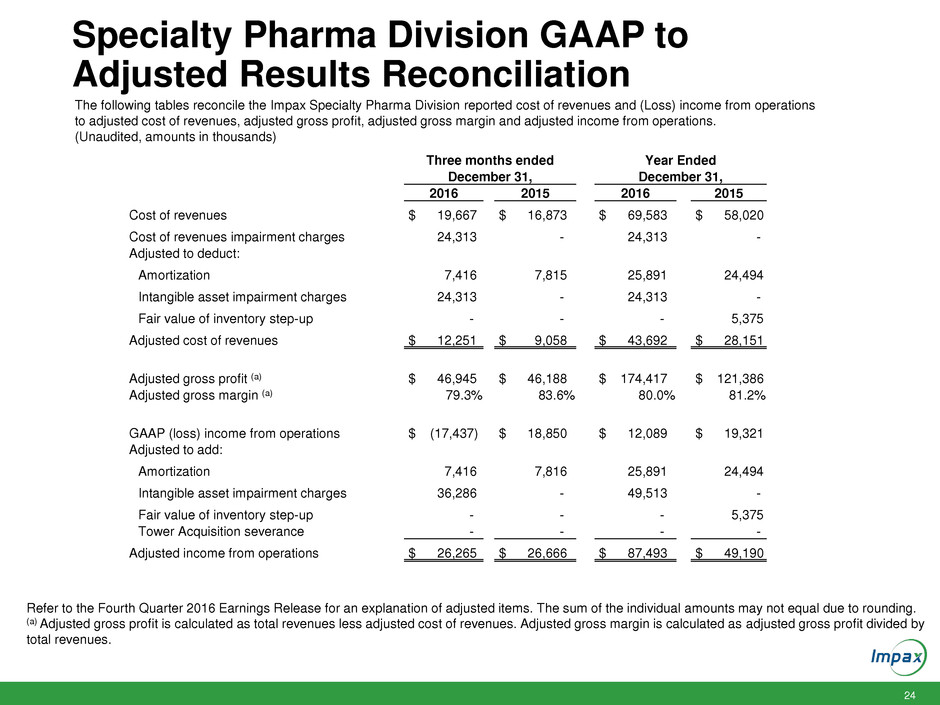

Specialty Pharma Division GAAP to

Adjusted Results Reconciliation

The following tables reconcile the Impax Specialty Pharma Division reported cost of revenues and (Loss) income from operations

to adjusted cost of revenues, adjusted gross profit, adjusted gross margin and adjusted income from operations.

(Unaudited, amounts in thousands)

Refer to the Fourth Quarter 2016 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

Three months ended Year Ended

December 31, December 31,

2016 2015 2016 2015

Cost of revenues $ 19,667 $ 16,873 $ 69,583 $ 58,020

Cost of revenues impairment charges 24,313 - 24,313 -

Adjusted to deduct:

Amortization 7,416 7,815 25,891 24,494

Intangible asset impairment charges 24,313 - 24,313 -

Fair value of inventory step-up - - - 5,375

Adjusted cost of revenues $ 12,251 $ 9,058 $ 43,692 $ 28,151

Adjusted gross profit (a) $ 46,945 $ 46,188 $ 174,417 $ 121,386

Adjusted gross margin (a) 79.3% 83.6% 80.0% 81.2%

GAAP (loss) income from operations $ (17,437) $ 18,850 $ 12,089 $ 19,321

Adjusted to add:

Amortization 7,416 7,816 25,891 24,494

Intangible asset impairment charges 36,286 - 49,513 -

Fair value of inventory step-up - - - 5,375

Tower Acquisition severance - - - -

Adjusted income from operations $ 26,265 $ 26,666 $ 87,493 $ 49,190