Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CrossAmerica Partners LP | exhibit991capl4q2016earnin.htm |

| 8-K - 8-K - CrossAmerica Partners LP | capl20164qform8-kearningsr.htm |

February 2017

4Q and Full Year 2016

Earnings Call

1

4Q and Full Year 2016 Earnings Call February 2017

Safe Harbor Statement

Statements contained in this presentation that state the Partnership’s or

management’s expectations or predictions of the future are forward-looking

statements. The words “believe,” “expect,” “should,” “intends,” “estimates,”

“target” and other similar expressions identify forward-looking statements. It

is important to note that actual results could differ materially from those

projected in such forward-looking statements. For more information

concerning factors that could cause actual results to differ from those

expressed or forecasted, see CrossAmerica’s Forms 10-Q or Form 10-K filed

with the Securities and Exchange Commission and available on

CrossAmerica’s website at www.crossamericapartners.com. If any of these

factors materialize, or if our underlying assumptions prove to be incorrect,

actual results may vary significantly from what we projected. Any forward-

looking statement you see or hear during this presentation reflects our

current views as of the date of this presentation with respect to future

events. We assume no obligation to publicly update or revise these forward-

looking statements for any reason, whether as a result of new information,

future events, or otherwise.

2

CrossAmerica Business Overview

Jeremy Bergeron, President

3

4Q and Full Year 2016 Earnings Call February 2017

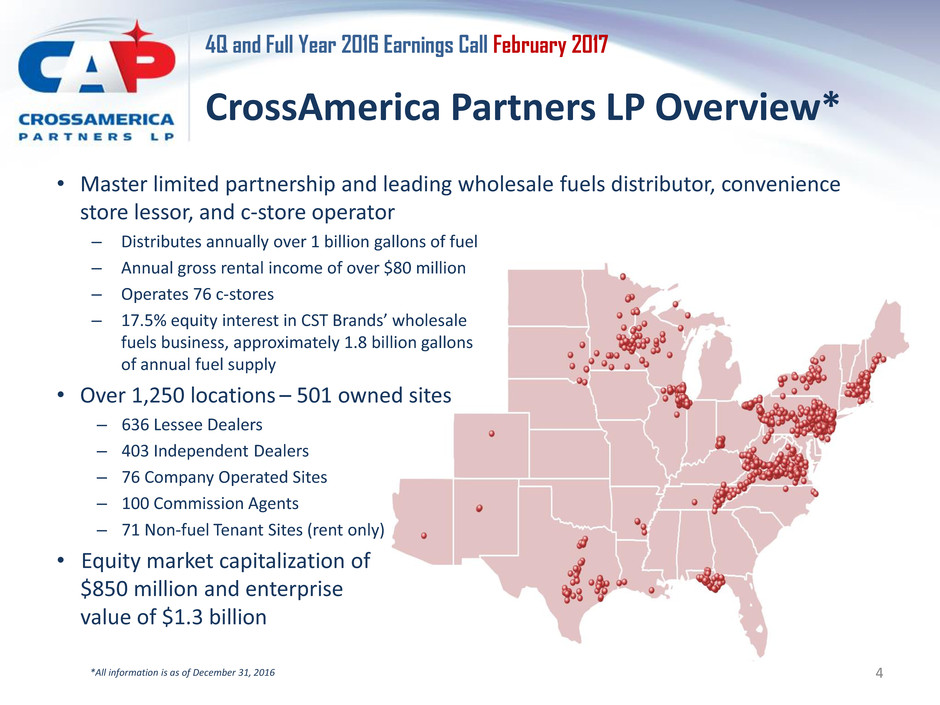

CrossAmerica Partners LP Overview*

• Master limited partnership and leading wholesale fuels distributor, convenience

store lessor, and c-store operator

– Distributes annually over 1 billion gallons of fuel

– Annual gross rental income of over $80 million

– Operates 76 c-stores

– 17.5% equity interest in CST Brands’ wholesale

fuels business, approximately 1.8 billion gallons

of annual fuel supply

• Over 1,250 locations – 501 owned sites

– 636 Lessee Dealers

– 403 Independent Dealers

– 76 Company Operated Sites

– 100 Commission Agents

– 71 Non-fuel Tenant Sites (rent only)

• Equity market capitalization of

$850 million and enterprise

value of $1.3 billion

*All information is as of December 31, 2016 4

4Q and Full Year 2016 Earnings Call February 2017

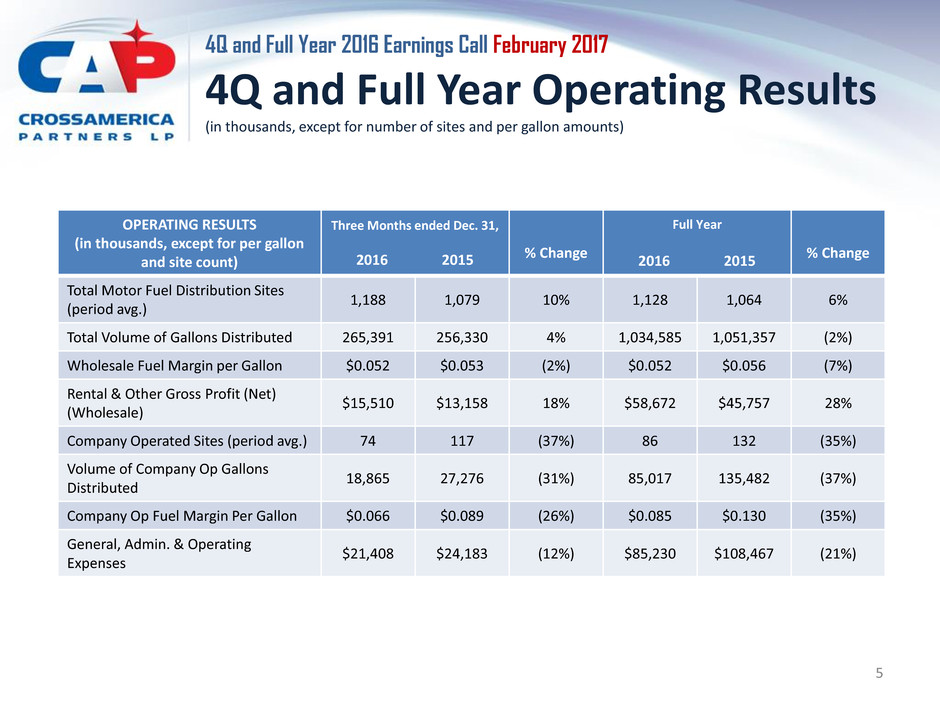

4Q and Full Year Operating Results

(in thousands, except for number of sites and per gallon amounts)

OPERATING RESULTS

(in thousands, except for per gallon

and site count)

Three Months ended Dec. 31,

2016 2015

% Change

Full Year

2016 2015

% Change

Total Motor Fuel Distribution Sites

(period avg.)

1,188 1,079 10% 1,128 1,064 6%

Total Volume of Gallons Distributed 265,391 256,330 4% 1,034,585 1,051,357 (2%)

Wholesale Fuel Margin per Gallon $0.052 $0.053 (2%) $0.052 $0.056 (7%)

Rental & Other Gross Profit (Net)

(Wholesale)

$15,510 $13,158 18% $58,672 $45,757 28%

Company Operated Sites (period avg.) 74 117 (37%) 86 132 (35%)

Volume of Company Op Gallons

Distributed

18,865 27,276 (31%) 85,017 135,482 (37%)

Company Op Fuel Margin Per Gallon $0.066 $0.089 (26%) $0.085 $0.130 (35%)

General, Admin. & Operating

Expenses

$21,408 $24,183 (12%) $85,230 $108,467 (21%)

5

4Q and Full Year 2016 Earnings Call February 2017

Portfolio Optimization

• Continued focus on managing expenses and execution of our integration strategy

– Divested of low-margin, high-expense commercial fuels business acquired with PMI

acquisition

• Divestiture was cash flow positive despite 80 million gallon reduction of wholesale fuel supply

– Continue to apply our processes and systems to reduce operating and general &

administrative expenses following acquisitions

– Converted 77 Company Operated

sites to Lessee Dealer accounts in

2016, yielding a more stable, qualifying

income cash flow stream

Company Operated

Wholesale Fuel Margin

Retail Fuel Margin

Retail Merchandise Margin

− Operating Expenses

− Income Taxes

Lessee Dealer

Wholesale Fuel Margin

Rental Income

6

144

124 121 116

97

80 78 76

1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 2Q '16 3Q '16 4Q '16

Company Operated Site Count

(end of period)

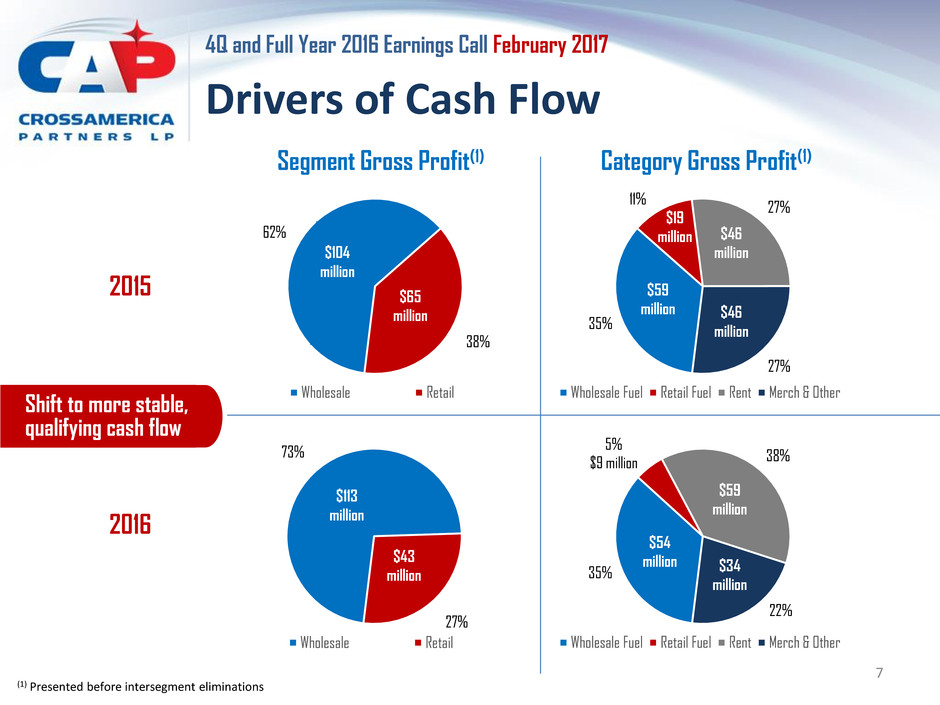

4Q and Full Year 2016 Earnings Call February 2017

Drivers of Cash Flow

Segment Gross Profit(1) Category Gross Profit(1)

(1) Presented before intersegment eliminations

7

2016

73%

27%

Wholesale Retail

$113

million

$43

million 35%

5%

$9 million 38%

22%

Wholesale Fuel Retail Fuel Rent Merch & Other

$59

million

$34

million

$54

million

2015

62%

38%

Wholesale Retail

$104

million

$65

million 35%

11%

27%

27%

Wholesale Fuel Retail Fuel Rent Merch & Other

$46

million

$46

million

$59

million

$19

million

Shift to more stable,

qualifying cash flow

4Q and Full Year 2016 Earnings Call February 2017

2016 Highlights

• Acquisitions

– 31 stores acquired from S/S/G Corp (Franchised Holiday Stores), approx. 26 million annual fuel gallons

– 55 lessee dealer and 25 independent dealer accounts acquired from State Oil, approx. 60 million annual

gallons

• Portfolio Optimization

– Closed on a $25 million sale-leaseback transaction (17 properties in the Chicago market)

– Continued dealerization process with 77 sites dealerized in 2016

• Expense Reduction

– Reduced expenses (operating and G&A) 21% from 2015 to 2016

• Capital Strength

– Leverage, as defined under our credit facility, was 4.2 times as of 12/31/16

– Amended credit facility to provide additional borrowing flexibility and sale-leaseback optionality

• Sustained Distribution Growth

– Grew annual distributions 6.1% in 2016 compared to 2015

– 11 consecutive quarters of distribution growth

• Couche-Tard/Circle K proposed merger with CST Brands

– Announced in August 2016

– Potential strategic benefit to CrossAmerica

– Expected closing in 2nd Quarter 2017

8

CrossAmerica Financial Overview

Steven Stellato, Chief Accounting Officer

9

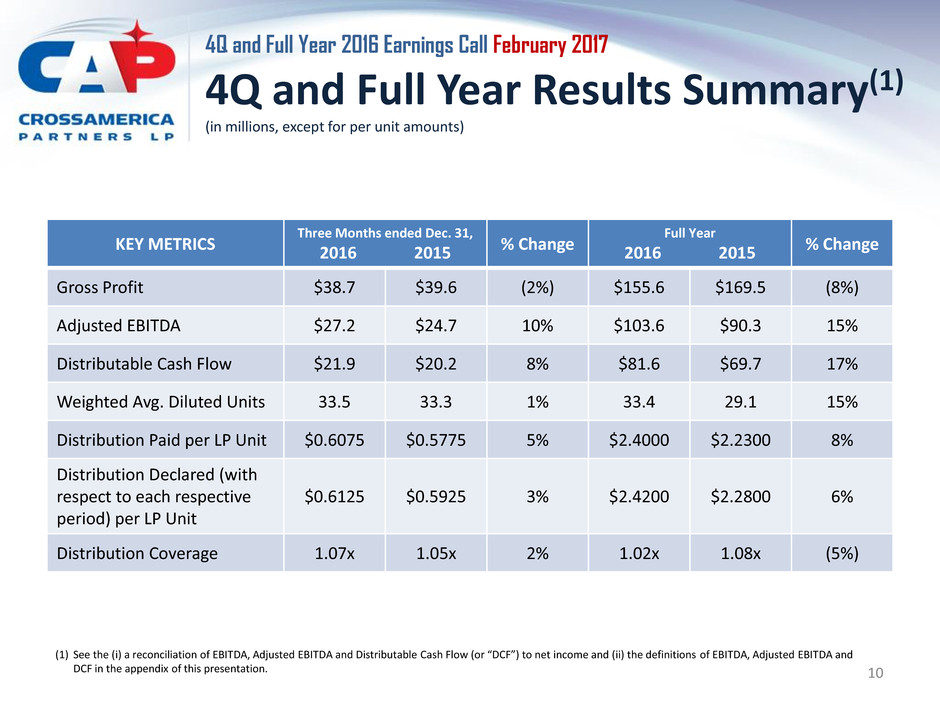

4Q and Full Year 2016 Earnings Call February 2017

4Q and Full Year Results Summary(1)

(in millions, except for per unit amounts)

KEY METRICS

Three Months ended Dec. 31,

2016 2015 % Change

Full Year

2016 2015 % Change

Gross Profit $38.7 $39.6 (2%) $155.6 $169.5 (8%)

Adjusted EBITDA $27.2 $24.7 10% $103.6 $90.3 15%

Distributable Cash Flow $21.9 $20.2 8% $81.6 $69.7 17%

Weighted Avg. Diluted Units 33.5 33.3 1% 33.4 29.1 15%

Distribution Paid per LP Unit $0.6075 $0.5775 5% $2.4000 $2.2300 8%

Distribution Declared (with

respect to each respective

period) per LP Unit

$0.6125 $0.5925 3% $2.4200 $2.2800 6%

Distribution Coverage 1.07x 1.05x 2% 1.02x 1.08x (5%)

10

(1) See the (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and

DCF in the appendix of this presentation.

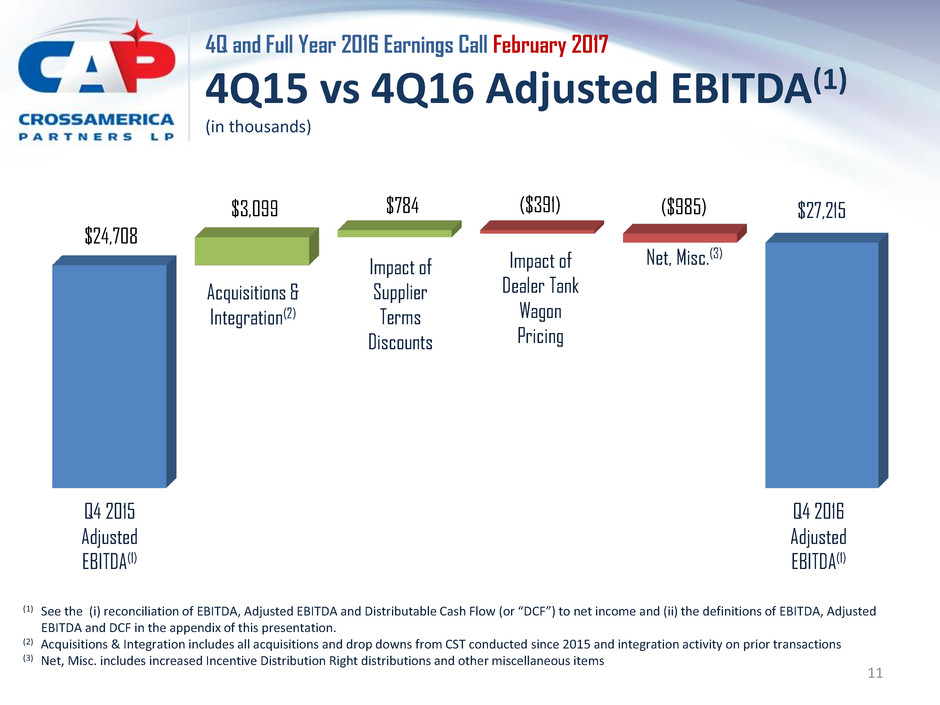

4Q and Full Year 2016 Earnings Call February 2017

4Q15 vs 4Q16 Adjusted EBITDA(1)

(in thousands)

11

$27,215

$24,708

$3,099 $784 ($391) ($985)

(1) See the (i) reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted

EBITDA and DCF in the appendix of this presentation.

(2) Acquisitions & Integration includes all acquisitions and drop downs from CST conducted since 2015 and integration activity on prior transactions

(3) Net, Misc. includes increased Incentive Distribution Right distributions and other miscellaneous items

Q4 2015

Adjusted

EBITDA(1)

Acquisitions &

Integration(2)

Impact of

Supplier

Terms

Discounts

Impact of

Dealer Tank

Wagon

Pricing

Net, Misc.(3)

Q4 2016

Adjusted

EBITDA(1)

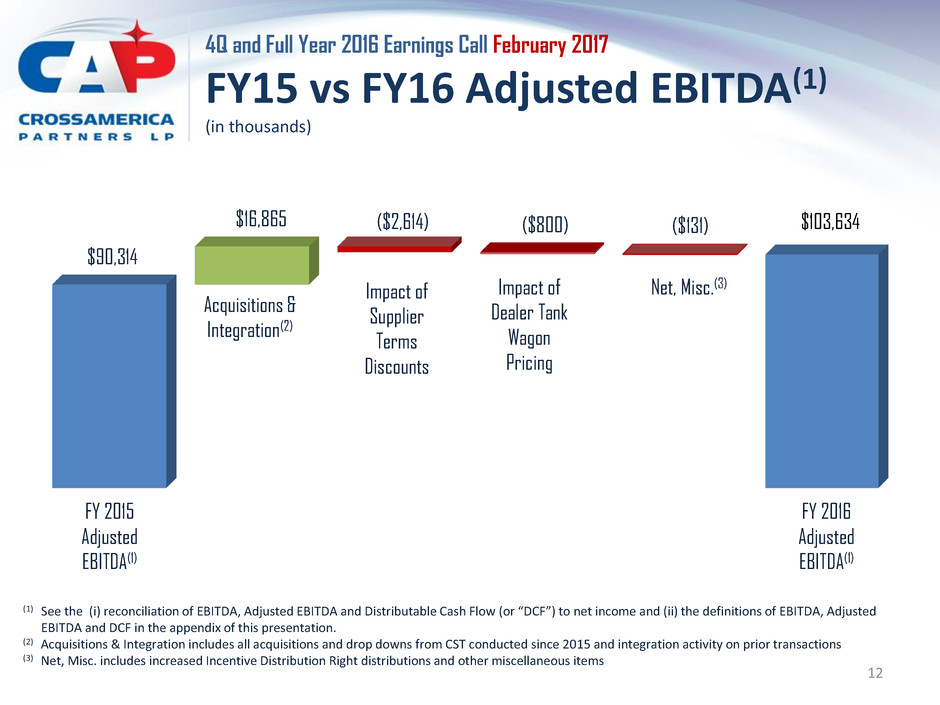

4Q and Full Year 2016 Earnings Call February 2017

FY15 vs FY16 Adjusted EBITDA(1)

(in thousands)

12

$90,314

$16,865 ($2,614) ($800) ($131)

(1) See the (i) reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted

EBITDA and DCF in the appendix of this presentation.

(2) Acquisitions & Integration includes all acquisitions and drop downs from CST conducted since 2015 and integration activity on prior transactions

(3) Net, Misc. includes increased Incentive Distribution Right distributions and other miscellaneous items

Acquisitions &

Integration(2)

Impact of

Supplier

Terms

Discounts

Impact of

Dealer Tank

Wagon

Pricing

Net, Misc.(3)

FY 2015

Adjusted

EBITDA(1)

FY 2016

Adjusted

EBITDA(1)

$103,634

4Q and Full Year 2016 Earnings Call February 2017

Executing with Measured Growth

• Declared distribution attributable to

fourth quarter of $0.6125 per unit

– 0.5 cent per unit increase over

distributions attributable to

third quarter 2016

– Increased annual per unit distribution

by 6.1% for 2016 over 2015

– Continue to target a long-term

distribution coverage ratio of at

least 1.1x, while continuing to grow distributions

• Further strengthened balance sheet with recent sale-leaseback transaction and

amendments to credit facility

– Ended 2016 with leverage ratio of 4.2x, as defined under our credit facility

• Continue to demonstrate financial flexibility to execute growth strategy in any

market cycle

• Pending acquisition of our GP by a U.S. subsidiary of Alimentation Couche-Tard

presents even more opportunity for growth

$0.5125

$0.5225

$0.5325

$0.5425 $0.5475

$0.5625

$0.5775

$0.5925 $0.5975

$0.6025 $0.6075

$0.6125

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16

Distributions per Unit (on declared basis)

13

Appendix

4Q and Full Year 2016 Earnings Call

14

4Q and Full Year 2016 Earnings Call February 2017

Non-GAAP Financial Measures

15

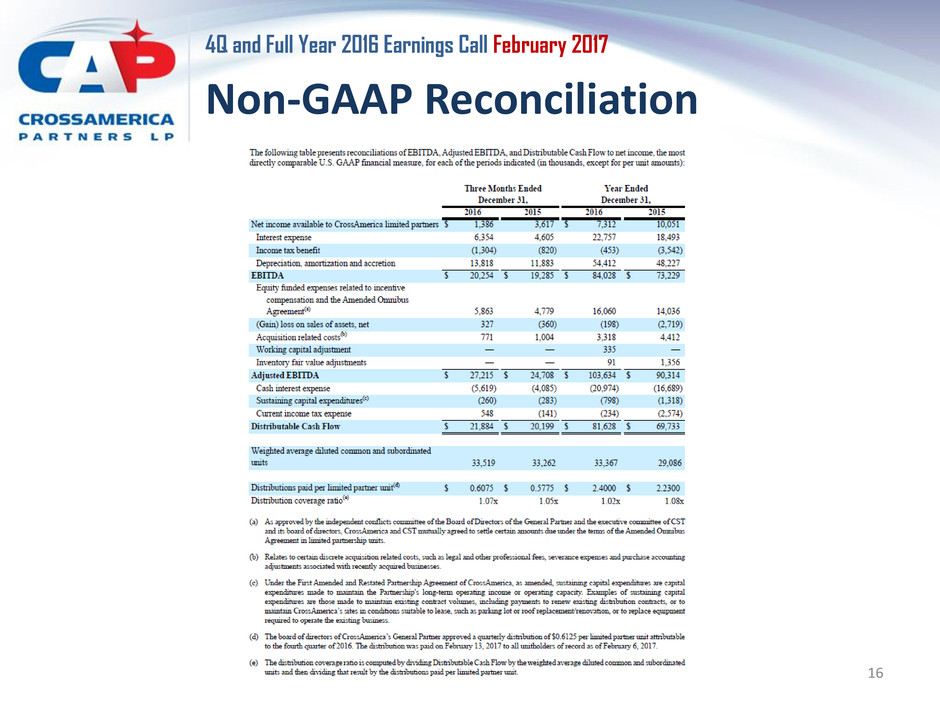

4Q and Full Year 2016 Earnings Call February 2017

Non-GAAP Reconciliation

16