Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Cheniere Energy Partners LP Holdings, LLC | exhibit991cqp2016form10-k.htm |

| EX-32.2 - EXHIBIT 32.2 - Cheniere Energy Partners LP Holdings, LLC | exhibit322cqh2016form10-k.htm |

| EX-32.1 - EXHIBIT 32.1 - Cheniere Energy Partners LP Holdings, LLC | exhibit321cqh2016form10-k.htm |

| EX-31.2 - EXHIBIT 31.2 - Cheniere Energy Partners LP Holdings, LLC | exhibit312cqh2016form10-k.htm |

| EX-31.1 - EXHIBIT 31.1 - Cheniere Energy Partners LP Holdings, LLC | exhibit311cqh2016form10-k.htm |

| EX-21.1 - EXHIBIT 21.1 - Cheniere Energy Partners LP Holdings, LLC | exhibit211cqh2016form10-k.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 001-36234

Cheniere Energy Partners LP Holdings, LLC

(Exact name of registrant as specified in its charter)

Delaware | 36-4767730 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900 Houston, Texas | 77002 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 375-5000

Securities registered pursuant to Section 12(b) of the Act:

Common Shares | NYSE MKT |

(Title of Class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

(Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common shares held by non-affiliates of the registrant was approximately $0.9 billion as of June 30, 2016.

As of February 17, 2017, the registrant had 231,700,000 common shares outstanding.

Documents incorporated by reference: None

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

TABLE OF CONTENTS

i

DEFINITIONS

As commonly used in the liquefied natural gas industry, to the extent applicable and as used in this annual report, the terms listed below have the following meanings:

Common Industry and Other Terms

EPC | engineering, procurement and construction | |

GAAP | generally accepted accounting principles in the United States | |

LNG | liquefied natural gas, a product of natural that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state | |

SEC | Securities and Exchange Commission | |

Train | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG | |

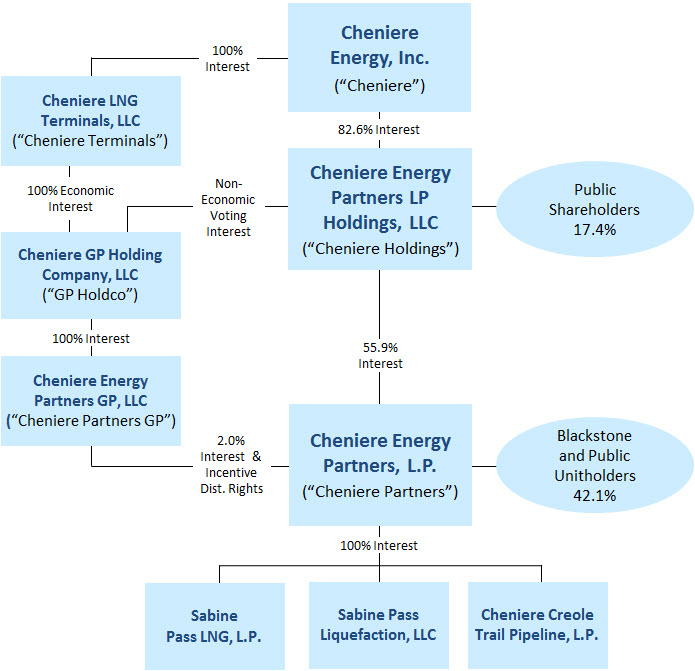

Abbreviated Organizational Structure

The following diagram depicts our abbreviated organizational structure as of December 31, 2016, including our ownership of certain subsidiaries, and the references to these entities used in this annual report:

Unless the context requires otherwise, references to “Cheniere Holdings,” the “Company,” “we,” “us” and “our” are intended to refer to Cheniere Energy Partners LP Holdings, LLC.

References to “Blackstone Group” refer to The Blackstone Group, L.P. References to “Blackstone CQP Holdco” refer to Blackstone CQP Holdco LP. References to “Blackstone” refer to Blackstone Group and Blackstone CQP Holdco.

ii

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements.” All statements, other than statements of historical facts, included herein or incorporated herein by reference are “forward-looking statements.” Because substantially all of our assets consist of our interest in the limited partner interests of Cheniere Partners, many of these statements primarily relate to Cheniere Partners’ business. Included among “forward-looking statements” are, among other things:

• | statements regarding our ability to pay dividends to our shareholders; |

• | statements regarding Cheniere Partners’ ability to pay distributions to its unitholders; |

• | statements regarding our anticipated tax rates and operating expenses; |

• | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

• | statements regarding any financing transactions or arrangements, or ability to enter into such transactions; |

• | statements relating to the construction of Cheniere Partners’ Trains, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; |

• | statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas liquefaction or storage capacities that are, or may become, subject to contracts; |

• | statements regarding counterparties to Cheniere Partners’ commercial contracts, construction contracts and other contracts; |

• | statements regarding Cheniere Partners’ planned development and construction of additional Trains, including the financing of such Trains; |

• | statements that Cheniere Partners’ Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

• | statements regarding our or Cheniere Partners’ business strategy, strengths, business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change; |

• | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; |

• | statements regarding Cheniere Partners’ anticipated LNG and natural gas marketing activities; and |

• | any other statements that relate to non-historical or future information. |

All of these types of statements, other than statements of historical fact, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our and Cheniere Partners’ expectations, which reflect estimates and assumptions made by management of the respective entities. These estimates and assumptions reflect our and Cheniere Partners’ best judgment based on currently known market conditions and other factors. Although we and Cheniere Partners believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this annual report and in the other reports and other information that we file with the SEC. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

iii

PART I

ITEM 1. | BUSINESS |

General

We are a publicly traded Delaware limited liability company formed by Cheniere in 2013 to hold its limited partner interests in Cheniere Partners, a publicly traded limited partnership. Our only business consists of owning and holding Cheniere Partners’ limited partner common units, Class B units (“Class B units”) and subordinated units (collectively, the “Cheniere Partners units”), along with cash or other property that we receive as distributions in respect of such units, and, accordingly, our operating results and financial condition are dependent on the performance of Cheniere Partners. Therefore, Cheniere Partners’ Annual Report on Form 10-K for the year ended December 31, 2016, has been included in this filing as Exhibit 99.1 and incorporated herein by reference (the “Cheniere Partners Annual Report”).

Cheniere Partners is developing, constructing and operating natural gas liquefaction facilities at the Sabine Pass LNG terminal located in Cameron Parish, Louisiana, on the Sabine-Neches Waterway less than four miles from the Gulf Coast adjacent to the existing regasification facilities through its wholly owned subsidiary, SPL. The liquefaction of natural gas into LNG allows it to be shipped economically from areas of the world where natural gas is abundant and inexpensive to produce to other areas where natural gas demand and infrastructure exist to economically justify the use of LNG. Cheniere Partners owns and operates the LNG regasification facilities at the Sabine Pass LNG terminal through its wholly owned subsidiary, SPLNG. Cheniere Partners also owns a 94-mile pipeline that interconnects the Sabine Pass LNG terminal with a number of large interstate pipelines through its wholly owned subsidiary, CTPL.

When Cheniere Partners makes cash distributions to us with respect to the Cheniere Partners units, we will pay dividends to our shareholders consisting of the cash that we receive from Cheniere Partners, less income taxes and reserves established by our Board of Directors (our “Board”). Cheniere Partners has paid the initial quarterly distribution amount of $0.425 per common unit, or $1.70 per common unit on an annualized basis, for each fiscal quarter since its initial public offering in March 2007. Cheniere Partners has not made any cash distributions in respect of the subordinated units with respect to the quarters ended on or after June 30, 2010.

We have elected to be treated as a corporation for U.S. federal income tax purposes. As a result, an owner of our shares will not report any of our items of income, gain, loss and deduction on its U.S. federal income tax return, nor will an owner of our shares receive a Schedule K-1. Our shareholders also are not subject to state income tax filings in the various states in which Cheniere Partners conducts operations as a result of owning our shares. Like dividends paid by a corporation, dividends received by our shareholders are reported on a Form 1099-DIV and subject to U.S. federal income tax, as well as any applicable state or local income tax.

As of December 31, 2016, we owned a 55.9% limited partner interest in Cheniere Partners and Cheniere owned, indirectly through GP Holdco, the general partner of Cheniere Partners and the incentive distribution rights in Cheniere Partners. In addition, we owned a non-economic voting interest in GP Holdco that allows us to control GP Holdco and the appointment of four of the eleven members to the board of directors of the general partner of Cheniere Partners to oversee the operations of Cheniere Partners. Cheniere owns the sole share entitled to vote in the election of our directors (the “Director Voting Share”). If Cheniere relinquishes the Director Voting Share, which it may do in its sole discretion, or ceases to own greater than 25% of our outstanding shares (a “Cheniere Separation Event”), our non-economic voting interest in GP Holdco would be extinguished and we would cease to control GP Holdco.

1

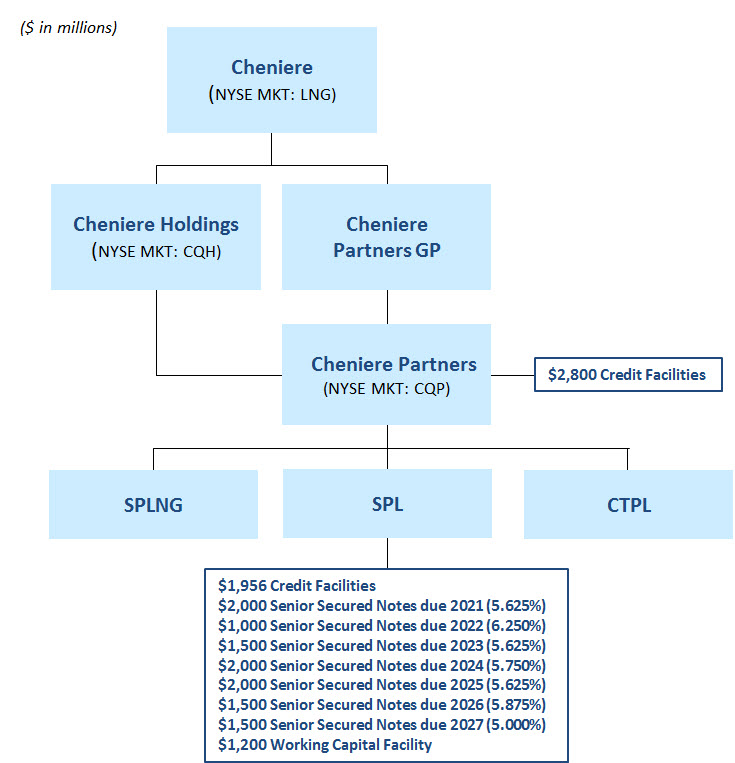

The following diagram depicts our abbreviated capital structure as of December 31, 2016:

Our Business Purpose

Our primary business purpose is to:

• | own and hold the Cheniere Partners units; |

• | pay dividends on our shares from the distributions that we receive from Cheniere Partners, less income taxes and any reserves established by our Board to pay our company expenses and amounts due under our services agreement (the “Services Agreement”) with a wholly owned subsidiary of Cheniere to service and reduce indebtedness that we may incur and for company purposes, in each case as permitted by our limited liability company agreement (“LLC Agreement”); |

• | simplify tax reporting requirements for investors by issuing a Form 1099-DIV with respect to the dividends received on our shares rather than a Schedule K-1 that would be received as a unitholder of Cheniere Partners; and |

• | designate members of the board of directors of Cheniere Partners GP to oversee the operations of Cheniere Partners. |

2

Our Business

Our business consists of owning the following Cheniere Partners units, along with cash or other property that we receive as distributions in respect of such units:

Common Units

We own 11,963,488 common units, which are entitled to quarterly cash distributions from Cheniere Partners. To the extent that Cheniere Partners is unable to pay the initial quarterly distribution in the future, arrearages in the amount of the initial quarterly distribution (or the difference between the initial quarterly distribution and the amount of the distribution actually paid to common unitholders) may accrue with respect to the common units.

Subordinated Units

We own 135,383,831 subordinated units. The subordinated units are not entitled to receive distributions until all common units have received at least the initial quarterly distribution, including any arrearages that may accrue. Cheniere Partners has not made any cash distributions in respect of the subordinated units with respect to the quarters ended on or after June 30, 2010. The subordination period will extend until the first business day following the distribution of available cash to partners in respect of any quarter that each of the following occurs:

• | distributions of available cash from operating surplus on each of the outstanding common units (assuming conversion of the Class B units), subordinated units and any other outstanding units that are senior or equal in right of distribution to the subordinated units equaled or exceeded the sum of the initial quarterly distributions on all of the outstanding common units (assuming conversion of the Class B units), subordinated units, general partner units and any other outstanding units that are senior or equal in right of distribution to the subordinated units for each of the three consecutive, non-overlapping four-quarter periods immediately preceding that date; |

• | the “adjusted operating surplus” (as defined in the Third Amended and Restated Agreement of Limited Partnership of Cheniere Partners, dated as of August 9, 2012 (the “Partnership Agreement”)) generated during each of the three consecutive, non-overlapping four-quarter periods immediately preceding that date equaled or exceeded the sum of the initial quarterly distributions on all of the outstanding common units (assuming conversion of the Class B units), subordinated units, general partner units and any other outstanding units that are senior or equal in right of distribution to the subordinated units during those periods on a fully diluted basis; and |

• | there are no arrearages in payment of the initial quarterly distribution on the common units. |

Expiration of the Subordination Period

When the subordination period expires, each outstanding subordinated unit will convert into one common unit and will then participate pro rata with the other common units in distributions of available cash. In addition, if the Cheniere Partners’ unitholders remove its general partner other than for cause and units held by the general partner and its affiliates are not voted in favor of such removal:

• | the subordination period will end and each subordinated unit will immediately convert into one common unit; |

• | any existing arrearages in payment of the initial quarterly distribution on the common units will be extinguished; and |

• | the general partner will have the right to convert its general partner units and its incentive distribution rights into common units or to receive cash in exchange for those interests. |

Early Conversion of Subordinated Units

The subordination period will automatically terminate and all of the subordinated units will convert into common units on a one-for-one basis on the first business day following the distribution of available cash to partners in respect of any quarter that each of the following occurs:

• | in connection with distributions of available cash from operating surplus, the amount of such distributions constituting “contracted adjusted operating surplus” (as defined in the Partnership Agreement) on each outstanding common unit (assuming conversion of the Class B units), subordinated unit and any other outstanding unit that is senior or equal in |

3

right of distribution to the subordinated units equaled or exceeded $0.638 (150% of the initial quarterly distribution) for each quarter in the four-quarter period immediately preceding that date;

• | the contracted adjusted operating surplus generated during each quarter in the four-quarter period immediately preceding that date equaled or exceeded the sum of a distribution of $0.638 (150% of the initial quarterly distribution) on all of the outstanding common units (assuming conversion of the Class B units), subordinated units, general partner units, any other units that are senior or equal in right of distribution to the subordinated units, and any other equity securities that are junior to the subordinated units that the board of directors of Cheniere Partners GP deems to be appropriate for the calculation, after consultation with management of Cheniere Partners GP, on a fully diluted basis; and |

• | there are no arrearages in payment of the initial quarterly distribution on the common units. |

Class B Units

We own 45,333,334 Class B units. The Class B units are not entitled to receive cash distributions except in the event of a liquidation of Cheniere Partners, a merger, consolidation or other combination of Cheniere Partners with another person or the sale of all or substantially all of the assets of Cheniere Partners. The Class B units are subject to conversion, mandatorily or at the option of the holders of the Class B units under specified circumstances, into a number of common units based on the then-applicable conversion value of the Class B units. On a quarterly basis beginning on the initial purchase date of the Class B units, the conversion value of the Class B units increases at a compounded rate of 3.5% per quarter subject to additional upward adjustment for certain equity and debt financings. As of December 31, 2016, the accreted conversion ratio of the Class B units owned by us and Blackstone CQP Holdco was 1.86 and 1.83, respectively. The Class B units will mandatorily convert into common units on the first business day following the record date of our first distribution after the substantial completion date of Cheniere Partners’ Train 3, but in any case no earlier than the first business day following the record date of our distribution with respect to the quarter ended June 30, 2017. If the Class B units are not mandatorily converted by July 2019, the holders of the Class B units have the option to convert the Class B units into common units at that time.

The following table (in thousands) illustrates the number of common units into which the Class B units held by us and Blackstone CQP Holdco would convert at the dates specified below and our and Blackstone CQP Holdco’s percentage ownership of then outstanding Cheniere Partners units, assuming that none of the outstanding Class B units are optionally converted prior to the dates set forth in the table and that no additional limited partner interests are issued by Cheniere Partners prior to such dates:

December 31, 2017 | December 31, 2018 | July 9, 2019 | |||

Cheniere Holdings: | |||||

Number of Common Units | 96,792 | 111,060 | 118,959 | ||

Percentage Ownership | 47.9% | 46.5% | 45.9% | ||

Blackstone CQP Holdco: | |||||

Number of Common Units | 209,782 | 240,640 | 257,683 | ||

Percentage Ownership (1) | 41.2% | 43.3% | 44.4% | ||

(1) | This percentage ownership is based solely upon the conversion of Class B units and does not include any common units that may be deemed to be beneficially owned by Blackstone Group, an affiliate of Blackstone CQP Holdco. Based on information from a Schedule 13D/A filed by Blackstone Group and related parties with the SEC on January 15, 2016, Blackstone Group may be deemed to beneficially own 3,758,003 common units. |

Employees

We have no employees and rely on Cheniere, via the Services Agreement, to manage all aspects of the conduct of our business. As of January 31, 2017, Cheniere and its subsidiaries had 911 full-time employees.

Available Information

Our common shares have been publicly traded since December 2013 and are traded on the NYSE MKT under the symbol “CQH.” Our principal executive offices are located at 700 Milam Street, Suite 1900, Houston, Texas 77002, and our telephone number is (713) 375-5000. Our internet address is www.cheniere.com. We provide public access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the SEC. Cheniere Partners also provides public

4

access to its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practicable after the materials are electronically filed with, or furnished to, the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our reports and those of Cheniere Partners may be accessed free of charge through our internet website. We make our website content available for informational purposes only. The website should not be relied upon for investment purposes and is not incorporated by reference into this Form 10-K.

We will also make available to any shareholder, without charge, copies of our annual report on Form 10-K as filed with the SEC. For copies of this, or any other filing, please contact: Cheniere Energy Partners LP Holdings, LLC, Investor Relations Department, 700 Milam Street, Suite 1900, Houston, Texas 77002 or call (713) 375-5000. In addition, the public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site (www.sec.gov) that contains reports and other information regarding issuers, like us, that file electronically with the SEC.

ITEM 1A. | RISK FACTORS |

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates or expectations contained in our forward-looking statements. In addition, the risk factors described in the Cheniere Partners Annual Report could affect the financial performance of Cheniere Partners, and consequently us, or could cause Cheniere Partners’ actual results to differ materially from estimates or expectations contained in Cheniere Partners’ forward-looking statements. We and Cheniere Partners may encounter risks in addition to those described. Additional risks and uncertainties not currently known to us or Cheniere Partners, or that we or Cheniere Partners currently deem to be immaterial, may also impair or adversely affect the business, contracts, financial condition, operating results, cash flows, liquidity and prospects of Cheniere Partners or us. Please also read the “Risk Factors” within the Cheniere Partners Annual Report.

The risk factors in this report are grouped into the following categories:

• | Risks Relating to the Ownership of Our Shares; and |

• | Tax Risks. |

Risks Relating to the Ownership of Our Shares

Our only cash-generating assets are our limited partner interests in Cheniere Partners, and our cash flow is therefore completely dependent upon the ability of Cheniere Partners to make cash distributions to its unitholders. Cheniere Partners may not be successful in its efforts to maintain or increase its cash available for distribution on its units.

Our only cash-generating assets are our limited partner interests in Cheniere Partners. Our cash flows are therefore completely dependent upon the ability of Cheniere Partners to make distributions to its unitholders. Cheniere Partners may not be successful in its efforts to maintain or increase its cash available for distribution on its units. The amount of cash that Cheniere Partners can distribute each quarter to its unitholders principally depends upon the items discussed in the Cheniere Partners Annual Report under Item 1.A “Risk Factors—Risks Relating to Our Cash Distributions.” Because of these factors, Cheniere Partners may not have sufficient available cash each quarter to continue to pay quarterly distributions in respect of the common units at its most recently paid amount of $0.425 per unit or any other amount, and Cheniere Partners may not have sufficient available cash each quarter to make any distributions in respect of the subordinated units. In addition, if Cheniere Partners does not continue to pay quarterly distributions, we will not be able to continue to pay dividends to our shareholders. Consistent with the terms of our Partnership Agreement, Cheniere Partners distributes to its partners all of its available cash each quarter. To the extent Cheniere Partners does not have sufficient cash reserves or is unable to finance growth externally, its cash distribution policy will significantly impair its ability to grow. Furthermore, to the extent Cheniere Partners issues additional units in connection with any acquisitions or expansion capital projects, the payment of distributions on those additional units may increase the risk that Cheniere Partners will be unable to maintain or increase its per unit distribution level, which in turn may lower the amount of cash that we have available to pay dividends on our outstanding shares.

If we issue additional shares or incur debt, the amount of cash that we have available to pay dividends on our outstanding shares could be reduced.

5

The amount of cash that we have available to pay dividends on our shares will be reduced by, among other things, income taxes and reserves established by our Board.

Our LLC Agreement requires us to pay dividends on our shares equal to the amount of cash distributions received from Cheniere Partners in respect of the Cheniere Partners units, less income taxes and any reserves established by our Board. Given that our only cash-generating assets are limited partner interests in Cheniere Partners, and we currently have no independent operations separate from those of Cheniere Partners, we may not have enough cash to meet our needs if our general and administrative expenses increase or if Cheniere Partners’ cash needs increase, resulting in a reduction in Cheniere Partners’ distributions.

Furthermore, under the Services Agreement, we pay administrative fees to an affiliate of Cheniere and reimburse it for expenses incurred on our behalf. We may also incur administrative and other expenses directly to operate our company. The payment of fees and the reimbursement of expenses to Cheniere, as well as the incurrence of expenses, reduces our ability to pay cash dividends to our shareholders. We expect the total costs payable under the Services Agreement, together with any third-party costs we pay directly, to be approximately $2.5 million per year. If a Cheniere Separation Event takes place, our directors and officers who are also directors or officers of Cheniere would resign. However, the Services Agreement would not automatically terminate. At such time, we expect that we will have increased costs related to hiring new officers and financial or business consultants.

If we cease to control GP Holdco, we may be deemed an “investment company,” which could impose restrictions on us.

We rely on an exemption from being regulated as an investment company under the Investment Company Act of 1940, as amended (“the Investment Company Act”) available to companies engaged in a non-investment company business through a controlled subsidiary. However, if we cease to control GP Holdco for any reason, we may be deemed to be an “investment company” within the meaning of the Investment Company Act. If Cheniere’s ownership is reduced to less than 25% of our outstanding shares or if Cheniere otherwise relinquishes the Director Voting Share, which it may do in its sole discretion, our non-economic voting interest in GP Holdco will be extinguished. Our non-economic voting interest in GP Holdco allows us to control GP Holdco and indirectly to appoint four of the eleven directors to the board of directors of Cheniere Partners GP. If, for any reason, our non-economic voting interest in GP Holdco is extinguished, we may be subject to regulation as an investment company under the Investment Company Act. As an investment company, we would be subject to restrictions under the Investment Company Act that could be material to our operations and financial flexibility or require changes to our operations, including the following:

• | Cheniere Partners could be deemed an affiliated person with respect to us, and holders of more than 5% of our shares would also be affiliated persons of Cheniere Partners, and sales of securities or other property between us and any affiliated person could be prohibited; |

• | we may be required to modify our Consolidated Financial Statements to reflect a change from the equity method of accounting to the fair value method of accounting, which might result in a change to the way we value our assets; |

• | we would be restricted from having more than one class of senior debt securities and one class of senior equity securities, such as indebtedness or preferred stock, and we could only issue such senior securities if certain coverage tests are met relative to payments to be made to holders of senior securities, including asset coverage of 300% for debt securities and asset coverage of 200% for preferred stock; |

• | we would be subject to compliance review and record-keeping requirements that would add to our operating expenses and increase the amount of cash we would have to reserve from the distributions we receive from Cheniere Partners to enable us to pay such expenses; |

• | there may be restrictions on the extent to which certain types of investors could invest in our shares, such as registered investment companies, Section 3(c)(1) funds and Section 3(c)(7) funds (traditionally hedge funds and private equity funds); |

• | we would be restricted from selling our shares in subsequent offerings for less than the net asset value of our underlying assets; and |

• | we would be subject to stricter corporate governance requirements, including the requirement that at least 40% of our directors qualify as “independent.” |

In addition to the factors listed above, we believe that we would not be a company with the characteristics that are typically associated with investment companies that the SEC is accustomed to regulating under the Investment Company Act. Therefore,

6

the SEC might seek to impose additional operational restrictions on us that could have a material adverse effect on our operating results.

Upon a Cheniere Separation Event, we may lose the ability to disclose developments about Cheniere Partners’ business and operating results to our shareholders in a timely manner.

Upon a Cheniere Separation Event, we would no longer have access to information about developments regarding Cheniere Partners’ business and operating results (other than information that Cheniere Partners reports to the public). We would consequently be unable to provide information concerning Cheniere Partners’ business to our shareholders simultaneously with announcements by Cheniere Partners in our annual, quarterly and current reports or in any future offering documents relating to our securities. Any delay in our ability to announce information regarding Cheniere Partners’ business and operating results could have an adverse effect on the market price of our shares.

Cheniere owns a majority of our outstanding shares and the Director Voting Share and therefore is able to amend our LLC Agreement and elect and remove members of our Board without the vote of the holders of any other shares.

Cheniere owns 82.6% of our outstanding shares, as well as the Director Voting Share. By holding the Director Voting Share and more than 50% of our outstanding shares, Cheniere has the ability to control us, including amending our LLC Agreement, without the vote of a holder of any other shares. Furthermore, under Delaware law, Cheniere is able to take certain actions by written consent of the majority of the outstanding shares without calling a meeting of our shareholders. In addition, as the owner of the Director Voting Share, Cheniere has the sole ability to elect our directors until a Cheniere Separation Event. While Cheniere continues to beneficially own a majority of our outstanding shares and the Director Voting Share, shareholders that are not affiliated with Cheniere have limited voting rights on matters affecting our business, which could affect the price at which our shares trade.

If Cheniere transfers its interest in GP Holdco to a non-affiliate, it will lose its ability to appoint the members of our Board.

Cheniere owns the Director Voting Share, the sole share entitled to vote in the election of our directors. In the event Cheniere transfers its interest in GP Holdco to a non-affiliate, it will also be required to transfer the Director Voting Share. Any such change in the ownership of the Director Voting Share could have an adverse impact on the market price of our shares and our financial results.

Our LLC Agreement prohibits us from selling Cheniere Partners units that we own, and we are restricted from selling the Cheniere Partners units that we own by applicable securities laws.

Our LLC Agreement prohibits us from selling, pledging or otherwise transferring any of the common units, subordinated units or Class B units that we own, or the common units into which the subordinated units and Class B units convert. Unlike a business that can sell its assets in order to generate cash or increase liquidity, we would be unable to do so without an amendment of our LLC Agreement. Although Cheniere, through its ownership of a majority of our shares, is able to amend our LLC Agreement, the Cheniere Partners units we hold constitute restricted securities under the Securities Act of 1933, as amended (the “Securities Act”). Absent an amendment to our LLC Agreement and an effective registration statement covering the sale of the Cheniere Partners units, we are unable to generate cash through sales of the Cheniere Partners units we hold, which could affect our liquidity. In addition, until a Cheniere Separation Event, we need Cheniere’s consent to sell any of the Cheniere Partners units that we hold.

Our LLC Agreement does not prohibit us from purchasing additional Cheniere Partners units, although we have no current intention to do so. However, if we did acquire additional Cheniere Partners units, we would be unable to sell any such additional Cheniere Partners units without an effective registration statement covering the sale of those Cheniere Partners units or an exemption from the registration requirements. If we choose to sell Cheniere Partners units pursuant to the exemption from registration provided by Rule 144 under the Securities Act, our sales of such Cheniere Partners units would be subject to volume limitations, regardless of whether we continue to be an “affiliate” of Cheniere Partners (as such term is defined under the Securities Act). However, if we are unable to sell Cheniere Partners units that we acquire on the open market, our liquidity and cash flows could be adversely affected.

7

We are restricted from acquiring additional Cheniere Partners units with the proceeds of indebtedness, if that indebtedness is secured by Cheniere Partners units that we own, to the extent those secured Cheniere Partners units would constitute margin securities.

If we acquire additional Cheniere Partners units with the proceeds of indebtedness, and we secure that indebtedness with the Cheniere Partners units that we own, we will be restricted from securing the Cheniere Partners units to the extent they would be considered “margin securities” under Regulation T of the Board of Governors of the Federal Reserve System, which generally restricts us from taking on secured debt with an aggregate principal amount of greater than 40% of the value of the Cheniere Partners units securing the debt.

The market price of our shares has fluctuated significantly in the past and is likely to fluctuate in the future. The value of our shares may be difficult for investors to accurately assess.

The market price of our shares has historically experienced and may continue to experience volatility. For example, between January 1, 2016 and December 31, 2016, the market price of our shares ranged between $12.04 and $23.05. Such fluctuations may continue as a result of a variety of factors, some of which are beyond our control, including:

• | the trading price of Cheniere Partners units; |

• | the level of Cheniere Partners’ quarterly distributions (including whether Cheniere Partners is paying distributions on the subordinated units) and our quarterly dividends; |

• | domestic and worldwide supply of and demand for natural gas and fluctuations in the price of natural gas; |

• | Cheniere Partners’ quarterly or annual earnings or those of other companies in its industry; |

• | the loss of a large customer by Cheniere Partners; |

• | announcements by Cheniere Partners or its competitors of significant contracts or acquisitions; |

• | changes in accounting standards, policies, guidance, interpretations or principles; |

• | general conditions in the industries in which Cheniere Partners operates; |

• | general economic conditions; |

• | the impact of Investment Company Act regulations on our business; |

• | future sales of our shares; and |

• | other factors described in these “Risk Factors” and the “Risk Factors” in the Cheniere Partners Annual Report. |

In addition, a number of factors may make it difficult for investors to accurately assess the value of our shares and may adversely impact the market price of our shares. These factors include, but are not limited to, the following:

• | we are a limited liability company structured as a non-operating holding company that owns, and our only business consists of owning, Cheniere Partners units; |

• | our financial condition and operating results are dependent entirely upon the performance of Cheniere Partners, and we do not expect to have any revenues or cash flow other than from distributions that we receive in respect of the Cheniere Partners units; |

• | due to the illiquid nature of the subordinated and Class B units that we own, it is difficult to value our assets; |

• | we account for our ownership of the Cheniere Partners units in our Consolidated Financial Statements using the equity method of accounting, which shows historical cost, but items of income and expense related to the Cheniere Partners units are not necessarily reported and our Consolidated Financial Statements may not accurately reflect the value of Cheniere Partners’ assets and operations as they relate to the value of our ownership in Cheniere Partners; and |

• | we have elected to be treated as a corporation for federal income tax purposes. |

If investors are unable to adequately value our shares due to these and other factors, the market price of our shares may not accurately reflect the underlying value of our shares, which could result in a loss of some or all of your investment in us.

8

Our share price may be substantially different than the market price of the Cheniere Partners units that we own.

We do not expect the price of our shares to be linked to the market price of the Cheniere Partners units for the following reasons:

• | our shares are not issued on a one to one ratio with the number of Cheniere Partners units that we hold; |

• | the aggregate amount of dividends on our shares may be lower than the aggregate amount of distributions we receive because the cash we have to pay dividends may be reduced by income taxes and reserves established by our Board; |

• | our assets include the subordinated units, which do not currently receive cash distributions, and the Class B units, neither of which is admitted for trading on a national securities exchange nor has a liquid trading market; and |

• | the other risks described in these Risk Factors. |

Upon Cheniere Partners being involved in a cash merger, going private, or selling all or substantially all of its assets (a “Termination Transaction”), the aggregate net proceeds that our shareholders receive from us may, as a result of our corporate income tax liabilities from the transaction and other factors, be substantially lower than the aggregate net proceeds received by us from Cheniere Partners. As a result of these considerations, our shares may trade at a substantial discount to the market price of the Cheniere Partners units, and the trading price of our shares may not be linked to the trading price of the Cheniere Partners units.

We may issue additional shares without shareholder approval, which would dilute your indirect ownership interest in Cheniere Partners.

Our LLC Agreement does not limit the number of additional shares that we may issue at any time without the approval of our shareholders. The issuance by us of additional shares or other equity securities of equal or senior rank will have the following effects:

• | our existing shareholders’ proportionate ownership interest will decrease; |

• | the amount of cash available for dividends on each share may decrease; |

• | the relative voting strength of each previously outstanding share may be diminished; and |

• | the market price of our shares may decline. |

Cheniere Partners may issue additional units without our or your approval, which would dilute our direct and your indirect ownership interest in Cheniere Partners. The issuance by Cheniere Partners of additional units or other equity securities of equal or senior rank to the units that we hold will have the following effects:

• | our proportionate ownership interest in Cheniere Partners will decrease; |

• | the amount of cash available for distribution on each Cheniere Partner unit may decrease, resulting in a decrease in the amount of cash available to pay dividends to you; |

• | the relative voting strength of each previously outstanding unit, including the Cheniere Partners units that we hold, will be diminished; and |

• | the market price of the Cheniere Partners units may decline, resulting in a decline in the market price of our shares. |

We are a “controlled company” within the meaning of the NYSE MKT rules and rely on exemptions from various corporate governance requirements.

Our shares are traded on the NYSE MKT. A company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company is a “controlled company” within the meaning of the NYSE MKT rules. A “controlled company” may elect not to comply with various corporate governance requirements of the NYSE MKT, including the requirement that a majority of its board of directors consist of independent directors, the requirement that its nominating and governance committee consist of all independent directors and the requirement that its compensation committee consist of all independent directors.

9

We are a “controlled company” because Cheniere owns a majority of our outstanding shares and the Director Voting Share. Because we rely on certain of the “controlled company” exemptions and do not have a compensation committee or a nominating and corporate governance committee, owners of our common shares may not have the same corporate governance advantages afforded to stockholders of companies that are subject to all of the corporate governance requirements of the NYSE MKT.

In addition, the rules of the NYSE MKT require us to obtain the affirmative vote from holders of at least a majority of our outstanding shares in order to issue, in a private offering, greater than 20% of our outstanding shares for less than the greater of book and market value of our shares. However, until such time as Cheniere ceases to own a majority of our outstanding shares, we would be able to make such an offering with the written consent of Cheniere and without the vote of any other of our shareholders.

Our Consolidated Financial Statements do not currently, and may not in the future, reflect the value of our assets in a manner familiar to investors.

Cheniere Partners has not been profitable, and because we use the equity method of accounting, as of December 31, 2016, we reflect our investment in Cheniere Partners as having no value. Because Cheniere Partners does not expect to be profitable in the near future, our Consolidated Balance Sheet is likely to continue to reflect our assets as having no value for some period after Cheniere Partners does become profitable. It may therefore be difficult for investors to easily assess our business and operating results, which could adversely affect the trading price of our shares.

Tax Risks

As a member of the Cheniere consolidated group, we will not have complete control over our tax decisions and there could be conflicts of interest.

For so long as Cheniere continues to own at least 80% of the total voting power and value of our shares, we and our U.S. subsidiaries will be included in Cheniere’s consolidated group for U.S. federal income tax purposes. In addition, we or one or more of our U.S. subsidiaries may be included in the combined, consolidated or unitary tax returns of Cheniere or one or more of its subsidiaries for U.S. state or local income tax purposes. On December 18, 2013, we entered into a tax sharing agreement (the “Tax Sharing Agreement”) with Cheniere that provides that for each period in which we or any of our subsidiaries are consolidated or combined with Cheniere for purposes of any tax return, Cheniere will prepare a pro forma tax return for us as if we filed our own consolidated, combined or unitary return, except that such pro forma tax return will generally include current income, deductions, credits and losses from us and a deemed net operating loss (“NOL”) carryforward amount. The current deemed NOL carryforward amount is the amount of our gross deferred tax liability for financial reporting purposes immediately prior to the initial public offering of our common shares (the “IPO”) increased by any losses or credits that we recognized based on the pro forma tax returns and decreased by any amount we previously utilized on the pro forma tax returns, but in no event will the deemed NOL carryforward amount exceed Cheniere’s available consolidated NOL carryforward. We will be required to reimburse Cheniere for any taxes shown on the pro forma tax returns. In addition, by virtue of Cheniere’s controlling ownership and the Tax Sharing Agreement, Cheniere effectively controls all of our U.S. tax decisions in connection with any consolidated, combined or unitary income tax returns in which we (or any of our subsidiaries) are included. The Tax Sharing Agreement provides that Cheniere will have the responsibility and discretion to prepare and file all consolidated, combined or unitary income tax returns on our behalf (including the making of any tax elections), to respond to and conduct all tax proceedings (including tax audits) relating to such tax returns and to determine the reimbursement amounts in connection with any pro forma tax returns. This arrangement may result in conflicts of interest between Cheniere and us. For example, under the Tax Sharing Agreement, Cheniere will be able to choose to contest, compromise or settle any adjustment or deficiency proposed by the relevant taxing authority in a manner that may be beneficial to Cheniere and detrimental to us.

As a member of the Cheniere consolidated group, we will be liable for the tax obligation of the Cheniere consolidated group to the extent any member fails to make any U.S. federal income tax payment.

Notwithstanding the Tax Sharing Agreement, U.S. federal law provides that each member of a consolidated group is liable for the group’s entire tax obligation. Thus, to the extent Cheniere or other members of Cheniere’s consolidated group fail to make any U.S. federal income tax payments required by law, we could be liable for the shortfall. Similar principles may apply for foreign, state or local income tax purposes where we file combined, consolidated or unitary returns with Cheniere or its subsidiaries for foreign, state or local income tax purposes.

10

If there is a determination that any of the restructuring transactions entered into prior to and in connection with our initial public offering are taxable for U.S. federal income tax purposes and we cease to be a member of the Cheniere consolidated group for U.S. federal income tax purposes, then Cheniere could incur significant income tax liabilities. We could be liable for the tax obligation of the Cheniere consolidated group to the extent any group member fails to make any U.S. federal income tax payment.

Prior to and in connection with our initial public offering, we and other members of the Cheniere consolidated group for U.S. federal income tax purposes participated in a series of restructuring transactions intended to qualify as tax-free for U.S. federal income tax purposes. No ruling from the U.S. Internal Revenue Service was requested in connection with such restructuring transactions.

Under the Internal Revenue Code, we will cease to be a member of the Cheniere consolidated group for U.S. federal income tax purposes (a deconsolidation) if at any time Cheniere owns less than 80% of the vote or 80% of the value of our outstanding shares, whether by issuance of additional shares by us or by Cheniere’s sale or other disposition of our shares.

If any of the restructuring transactions is determined to be taxable for U.S. federal income tax purposes for any reason, following a deconsolidation, Cheniere could incur significant income tax liabilities. In addition, as a member of the Cheniere consolidated group at the time of the restructuring transactions, we could be liable for Cheniere’s U.S. federal income tax liabilities related to the restructuring transactions to the extent Cheniere and other members of the Cheniere consolidated group fail to make any U.S. federal income tax payment.

The ability to use NOL carryforwards and certain other U.S. federal income tax attributes may be limited.

For so long as we are included in Cheniere’s consolidated group for U.S. federal income tax purposes, our taxable income or loss will be included in Cheniere’s consolidated federal income tax return. Cheniere has experienced ownership changes for purposes of Section 382 of the Internal Revenue Code that will subject a significant amount of its consolidated NOL carryforwards to annual utilization limitations for U.S. federal income tax purposes. Although we do not expect it to, the utilization limitations may affect the timing of when these federal NOL carryforwards may be utilized. Subsequent trading activity in Cheniere shares or further changes in the ownership of Cheniere stock may cause additional ownership changes, which may ultimately affect the ability to fully utilize Cheniere’s federal NOL carryforwards.

Upon a Termination Transaction, we may incur substantial corporate income tax liabilities in which case the aggregate amount we have to distribute may be substantially lower than the aggregate net proceeds we receive in respect of the Cheniere Partners units we own.

Upon a liquidation of Cheniere Partners, unitholders will receive distributions in accordance with the positive balance in their respective capital accounts in their units.

We are classified as a corporation for U.S. federal income tax purposes and, in most states in which Cheniere Partners does business, for state income tax purposes. Upon a Termination Transaction, we will be required to liquidate and distribute the net after-tax proceeds of the transaction to you. We may incur substantial corporate income tax liabilities upon a Termination Transaction. The tax liability we incur will depend in part upon the amount by which the value of the Cheniere Partners units that we own exceeds our tax basis in the units. We expect our tax basis in our common units to decrease over time as we receive distributions that exceed the net income allocated to us by Cheniere Partners with respect to those units. As a result, we may incur substantial income tax liabilities upon such a transaction even if Cheniere Partners units decrease in value after we purchase them. The amount of cash or other property available for distribution to you upon our liquidation will be reduced by the amount of any such income taxes paid by us.

As a result of these factors, upon a Termination Transaction, the aggregate amount we have to distribute may be substantially lower than the aggregate net proceeds received by us in respect of the Cheniere Partners units.

11

If Cheniere Partners were subject to a material amount of entity-level income taxes or similar taxes, whether as a result of being treated as a corporation for U.S. federal income tax purposes or otherwise, its cash available for distribution would be reduced substantially.

The anticipated benefit of an investment in Cheniere Partners units depends largely on the assumption that Cheniere Partners will not be subject to a material amount of entity-level income taxes or similar taxes.

Cheniere Partners may be subject to material entity-level U.S. federal income tax and state income taxes if it is treated as a corporation, rather than as a partnership, for U.S. federal income tax purposes. Because the common units are publicly traded, Section 7704 of the Internal Revenue Code requires that Cheniere Partners derive at least 90% of its gross income each year from the transportation, storage, processing and marketing of crude oil, natural gas and products thereof, or from certain other specified activities, in order to be treated as a partnership for U.S. federal income tax purposes. We believe that Cheniere Partners has satisfied this “qualifying income” requirement and will continue to do so in the future, so we believe Cheniere Partners is and will be treated as a partnership for U.S. federal income tax purposes. Failing to meet the qualifying income requirement or a change in current law could cause Cheniere Partners to be treated as a corporation for U.S. federal income tax purposes or otherwise subject Cheniere Partners to material entity-level taxes. From time to time, the U.S. President and members of the U.S. Congress propose and consider substantive changes to the existing federal income tax laws that would affect certain publicly traded partnerships. Further, final Treasury regulations under Section 7704(d)(1)(E) of the Code recently published in the Federal Register interpret the scope of qualifying income requirements for publicly traded partnerships by providing industry-specific guidance. We are unable to predict whether any changes or other proposals will ultimately be enacted. Any modification to the U.S. federal income tax laws and interpretations thereof may or may not be applied retroactively and could make it more difficult or impossible to meet the requirements for partnership status, affect or cause Cheniere Partners to change its business activities, change the character or treatment of portions of Cheniere Partners’ income and adversely affect our investment in Cheniere Partners units.

If Cheniere Partners were treated as a corporation for federal income tax purposes, it would pay federal income tax on its taxable income at the corporate tax rate, which is currently a maximum of 35%, and would likely pay state and local income taxes at varying rates. Distributions from Cheniere Partners would generally be taxed again as corporate dividends, and no income, gains, losses or deductions would flow through to Cheniere Partners unitholders. Because a tax would be imposed upon Cheniere Partners as a corporation, the cash available for distribution to its unitholders would be substantially reduced. Therefore, treatment of Cheniere Partners as a corporation would result in a material reduction in the anticipated cash flow and after-tax return to Cheniere Partners unitholders, likely causing a substantial reduction in the value of Cheniere Partners common units we own and the value of our shares.

The Partnership Agreement provides that if a law is enacted or existing law is modified or interpreted in a manner that subjects it to taxation as a corporation or otherwise subjects it to entity-level taxation for federal income tax purposes, then the initial quarterly distribution amount and the target distribution amounts will be adjusted to reflect the impact of that law on Cheniere Partners.

If Cheniere Partners were subjected to a material amount of additional entity-level taxation by individual states, it would reduce the cash available for distribution to Cheniere Partners’ unitholders.

Changes in current state law may subject Cheniere Partners to additional entity-level taxation by individual states. Because of widespread state budget deficits and other reasons, several states have been evaluating ways to subject partnerships to entity-level taxation through the imposition of state income, franchise and other forms of taxation. Imposition of any such taxes may substantially reduce the cash available for distribution to Cheniere Partners’ unitholders and, therefore, negatively impact the value of an investment in our shares. The Partnership Agreement provides that if a law is enacted or existing law is modified or interpreted in a manner that subjects it to additional amounts of entity-level taxation for state or local income tax purposes, the initial quarterly distribution amount and the target distribution amounts may be adjusted to reflect the impact of that law on Cheniere Partners.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

12

ITEM 2. | PROPERTIES |

We have no properties. Our assets consist of a small amount of working capital, the Cheniere Partners limited partner interests that we own and the non-economic voting interest in GP Holdco that we hold. See Item 1. Business for additional information.

ITEM 3. | LEGAL PROCEEDINGS |

We may in the future be involved as a party to various legal proceedings, which are incidental to the ordinary course of business. We regularly analyze current information and, as necessary, provide accruals for probable liabilities on the eventual disposition of these matters. In the opinion of management, as of December 31, 2016, there were no pending legal matters that would reasonably be expected to have a material impact on our consolidated operating results, financial position or cash flows.

ITEM 4. | MINE SAFETY DISCLOSURE |

None.

13

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common shares are listed on the NYSE MKT under the symbol “CQH” and began trading in December 2013, after the pricing of our IPO. The table below presents the high and low sales prices per common share, as reported by the NYSE MKT, and cash dividends to common shareholders for each quarter during 2016 and 2015.

High | Low | Cash Dividends Per Common Share | ||||||||||

2016 | ||||||||||||

First Quarter | $ | 18.41 | $ | 12.04 | $ | 0.020 | ||||||

Second Quarter | 21.33 | 16.94 | 0.020 | |||||||||

Third Quarter | 22.84 | 18.73 | 0.020 | |||||||||

Fourth Quarter | 23.05 | 19.00 | 0.020 | |||||||||

2015 | ||||||||||||

First Quarter | $ | 24.77 | $ | 20.50 | $ | 0.020 | ||||||

Second Quarter | 25.99 | 23.13 | 0.020 | |||||||||

Third Quarter | 23.85 | 17.71 | 0.020 | |||||||||

Fourth Quarter | 21.21 | 14.91 | 0.020 | |||||||||

As of February 17, 2017, there were approximately 3 shareholders of record.

Dividends

After we receive a distribution on the Cheniere Partners units, we will pay dividends on our shares of the cash that we receive as distributions in respect of the Cheniere Partners units, less income taxes and any reserves established by our Board to pay company expenses and amounts due under the Services Agreement, to service and reduce indebtedness that we may incur and for company purposes, in each case as permitted by our LLC Agreement. Pursuant to the Services Agreement, we have agreed to pay an administrative fee to reimburse Cheniere for the costs and expenses incurred on our behalf. If distributions are made on the Cheniere Partners units that we own other than in cash, we may, but are not required to, pay a dividend on our shares in substantially the same form. However, if Cheniere Partners makes a distribution on Cheniere Partners units in the form of additional Cheniere Partners units, we will be required to hold any units we receive as a distribution on the Cheniere Partners units.

Because we have elected to be treated as a corporation for U.S. federal income tax purposes, we are obligated to pay U.S. federal income tax on the net income allocated to us by Cheniere Partners with respect to the Cheniere Partners units that we own, and we may be subject to a 20% alternative minimum tax on our alternative minimum taxable income to the extent that the alternative minimum tax exceeds our regular income tax. We are also classified as a corporation in most states in which Cheniere Partners does business for state income tax purposes and will be subject to state income tax at rates that vary from state to state on the net income allocated to us by Cheniere Partners with respect to the Cheniere Partners units that we own.

The reserves for income taxes payable by us will account for the U.S. federal income taxes, any alternative minimum taxes and the state income taxes described in the preceding paragraph.

14

ITEM 6. | SELECTED FINANCIAL DATA |

Selected financial data set forth below (in thousands, except per share data) are derived from our audited Consolidated Financial Statements for the period indicated. The financial data should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and our Consolidated Financial Statements and the accompanying notes thereto included elsewhere in this report.

Year Ended December 31, | Period from July 29, 2013 (Date of Inception) Through December 31, 2013 | ||||||||||||||

2016 | 2015 | 2014 | |||||||||||||

Consolidated Statement of Income data: | |||||||||||||||

Equity income from investment in Cheniere Partners | $ | 20,338 | $ | 20,338 | $ | 20,338 | $ | — | |||||||

Net income (loss) | 17,798 | 18,173 | 18,141 | (54 | ) | ||||||||||

Net income per common share, basic and diluted | $ | 0.08 | $ | 0.08 | $ | 0.08 | $ | 0.00 | |||||||

Weighted average shares outstanding | 231,700 | 231,700 | 231,700 | 231,700 | |||||||||||

Consolidated Balance Sheet data: | |||||||||||||||

Total assets | $ | 423 | $ | 1,195 | $ | 1,553 | $ | 353 | |||||||

Selected financial data of Cheniere Partners is found in Part II, Item 6. “Selected Financial Data” of the Cheniere Partners Annual Report, which is included in this filing as Exhibit 99.1 and incorporated herein by reference as our consolidated operating results, financial position and cash flows are dependent on the operating results, financial position and cash flows of Cheniere Partners.

15

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Introduction

The following discussion and analysis presents management’s view of our business, financial condition and overall performance and should be read in conjunction with our Consolidated Financial Statements and the accompanying notes in “Financial Statements and Supplementary Data.” This information is intended to provide investors with an understanding of our past performance, current financial condition and outlook for the future. Our discussion and analysis includes the following subjects:

• | Our Business |

• | Overview of Significant Events |

• | Our Relationship with Cheniere Partners |

• | Liquidity and Capital Resources |

• | Results of Operations |

• | Off-Balance Sheet Arrangements |

• | Summary of Critical Accounting Estimates |

• | Recent Accounting Standards |

Our Business

We are a limited liability company that has elected to be treated as a corporation for U.S. federal income tax purposes. Our primary business purpose is to:

• | own and hold Cheniere Partners’ limited partner common units, Class B units (“Class B units”) and subordinated units (collectively, the “Cheniere Partners units”); |

• | pay dividends on our shares from the distributions that we receive from Cheniere Partners, less income taxes and any reserves established by our Board of Directors (our “Board”) to pay our company expenses and amounts due under our services agreement (the “Services Agreement”) with a wholly owned subsidiary of Cheniere, to service and reduce indebtedness that we may incur and for company purposes, in each case as permitted by our limited liability company agreement (“LLC Agreement”); |

• | simplify tax reporting requirements for investors by issuing a Form 1099-DIV with respect to the dividends received on our shares rather than a Schedule K-1 that would be received as a unitholder of Cheniere Partners; and |

• | designate members of the board of directors of Cheniere Partners GP to oversee the operations of Cheniere Partners. |

Our business consists of owning the following Cheniere Partners units, along with cash or other property that we receive as distributions in respect of such units:

Common Units

We own 11,963,488 common units, which are entitled to quarterly cash distributions from Cheniere Partners. To the extent that Cheniere Partners is unable to pay the initial quarterly distribution in the future, arrearages in the amount of the initial quarterly distribution (or the difference between the initial quarterly distribution and the amount of the distribution actually paid to common unitholders) may accrue with respect to the common units.

Subordinated Units

We own 135,383,831 subordinated units. The subordinated units are not entitled to receive distributions until all common units have received at least the initial quarterly distribution, including any arrearages that may accrue. The subordinated units will convert on a one-for-one basis into common units at the expiration of the subordination period as described in the Third Amended

16

and Restated Agreement of Limited Partnership of Cheniere Partners, dated as of August 9, 2012. Cheniere Partners has not made any cash distributions in respect of the subordinated units with respect to the quarters ended on or after June 30, 2010.

Class B Units

We own 45,333,334 Class B units. The Class B units are not entitled to receive cash distributions except in the event of a liquidation of Cheniere Partners, a merger, consolidation or other combination of Cheniere Partners with another person or the sale of all or substantially all of the assets of Cheniere Partners. The Class B units are subject to conversion, mandatorily or at the option of the holders of the Class B units under specified circumstances, into a number of common units based on the then-applicable conversion value of the Class B units. On a quarterly basis beginning on the initial purchase date of the Class B units, the conversion value of the Class B units increases at a compounded rate of 3.5% per quarter subject to additional upward adjustment for certain equity and debt financings. As of December 31, 2016, the accreted conversion ratio of the Class B units owned by us and Blackstone CQP Holdco was 1.86 and 1.83, respectively. The Class B units will mandatorily convert into common units on the first business day following the record date of our first distribution after the substantial completion date of Cheniere Partners’ Train 3, but in any case no earlier than the first business day following the record date of our distribution with respect to the quarter ended June 30, 2017. If the Class B units are not mandatorily converted by July 2019, the holders of the Class B units have the option to convert the Class B units into common units at that time.

The following table (in thousands) illustrates the number of common units into which the Class B units held by us and Blackstone CQP Holdco would convert at the dates specified below and our and Blackstone CQP Holdco’s percentage ownership of then outstanding Cheniere Partners units, assuming that none of the outstanding Class B units are optionally converted prior to the dates set forth in the table and that no additional limited partner interests are issued by Cheniere Partners prior to such dates:

December 31, 2017 | December 31, 2018 | July 9, 2019 | |||

Cheniere Holdings: | |||||

Number of Common Units | 96,792 | 111,060 | 118,959 | ||

Percentage Ownership | 47.9% | 46.5% | 45.9% | ||

Blackstone CQP Holdco: | |||||

Number of Common Units | 209,782 | 240,640 | 257,683 | ||

Percentage Ownership (1) | 41.2% | 43.3% | 44.4% | ||

(1) | This percentage ownership is based solely upon the conversion of Class B units and does not include any common units that may be deemed to be beneficially owned by Blackstone Group, an affiliate of Blackstone CQP Holdco. Based on information from a Schedule 13D/A filed by Blackstone Group and related parties with the SEC on January 15, 2016, Blackstone Group may be deemed to beneficially own 3,758,003 common units. |

Overview of Significant Events

Our significant accomplishments since January 1, 2016 and through the filing date of this Form 10-K include the following:

• | In May 2016, the Board appointed Jack A. Fusco as our Chairman of the Board and President and Chief Executive Officer. Mr. Fusco replaced our former Chairman of the Board and Interim Chief Executive Officer and President, Neal A. Shear. |

• | In September 2016, the Board appointed Anatol Feygin and Doug Shanda as members of the Board. |

• | In December 2016, Cheniere terminated negotiations with the conflicts committee of our Board regarding Cheniere’s previously announced non-binding proposal to acquire all of our publicly held shares not already owned by Cheniere in a stock for stock exchange transaction. Subsequent to the termination of negotiations, Cheniere has acquired a total of 5,785,161 shares of our common shares through individually negotiated transactions with our shareholders. |

Our Relationship with Cheniere Partners

We own approximately 55.9% of the outstanding Cheniere Partners units. As a result of our non-economic voting interest in GP Holdco, which holds a 100% interest in Cheniere Partners GP, we control GP Holdco and indirectly control the appointment of four of the eleven members of the board of directors of Cheniere Partners GP to oversee the operations of Cheniere Partners. Cheniere owns the sole share entitled to vote in the election of our directors (the “Director Voting Share”). If Cheniere relinquishes the Director Voting Share, which it may do in its sole discretion, or ceases to own greater than 25% of our outstanding shares, our

17

non-economic voting interest in GP Holdco would be extinguished and we would cease to control GP Holdco. Because our only assets are limited partner interests in Cheniere Partners and we are therefore dependent on the operating results and financial condition of Cheniere Partners, we believe that the discussion and analysis of Cheniere Partners’ financial condition and operating results is important to our shareholders. Therefore, Cheniere Partners’ annual report on Form 10-K for the fiscal year ended December 31, 2016 has been included in this filing as Exhibit 99.1 and incorporated herein by reference (the “Cheniere Partners Annual Report”).

Liquidity and Capital Resources

As of December 31, 2016, we had cash and cash equivalents of $0.2 million. Our capital structure consists only of common shares, of which 191.4 million shares are owned by Cheniere and 40.3 million shares are owned by the public, and one Director Voting Share which is held by Cheniere. We are authorized to issue an unlimited number of additional common shares. Additional classes or series of securities may be created with the approval of our Board, provided that any such additional class or series must be approved by a vote of holders of a majority of our outstanding shares. Our shareholders will not have preemptive or preferential rights to acquire additional common shares or other classes of our securities.

Cheniere provides certain general and administrative services pursuant to the Services Agreement. We pay a fixed fee of $1.0 million per year (payable quarterly in installments of $250,000 per quarter, in arrears), subject to adjustment for inflation, for certain general and administrative services, including the services of our directors and officers who are also directors and executive officers of Cheniere. In addition, we pay directly for, or reimburse Cheniere for, certain third-party general and administrative expenses incurred. Cheniere also provides us with cash management services, including treasury services with respect to the payment of dividends and allocation of reserves for taxes. Under the Services Agreement, we recorded general and administrative expense—affiliate of $1.0 million during each of the years ended December 31, 2016, 2015 and 2014.

We believe that the cash distributions we will receive on the Cheniere Partners units will be sufficient to fund fees and expenses due under the Services Agreement and our working capital requirements for the next twelve months.

Dividends

Our LLC Agreement requires us to pay dividends on our shares equal to the amount of cash that we receive as distributions in respect of the Cheniere Partners units that we own, less income taxes and reserves established by our Board. See Note 8—Distributions Received and Dividends Paid of our Notes to Consolidated Financial Statements for a summary of dividends paid by us during the years ended December 31, 2016 and 2015.

Sources and Uses of Cash

The following table (in thousands) summarizes the sources and uses of our cash and cash equivalents for the years ended December 31, 2016, 2015 and 2014. Additional discussion of these items follows the table.

Year Ended December 31, | |||||||||||

2016 | 2015 | 2014 | |||||||||

Operating cash flows | |||||||||||

Net cash used in operating activities | $ | (2,500 | ) | $ | (2,165 | ) | $ | (2,147 | ) | ||