Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROYALE ENERGY FUNDS, INC | royaleenergy8k021517.htm |

Exhibit 99.1

A Growth-Oriented IndependentExploration & Production Company Investor Presentation February 2017

* Disclaimer Important Information for Investors and Security HoldersRoyale Energy Holdings, Inc. (“Royale Holdings”) has filed a draft registration statement (including a preliminary proxy statement/prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the final proxy statement/prospectus when it becomes available and other documents the issuer has filed with the SEC for more complete information about the merger transactions. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the draft preliminary proxy statement/prospectus and other documents filed with the SEC on Royale Energy, Inc.’s (“Royale”) website at www.royl.com (for documents filed by Royale and/or Royale Holdings., as applicable). Alternatively, the issuer will arrange to send you the prospectus if you request it by calling 619-383-6600. No Offer or SolicitationThis communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction. Participants in the Solicitation Royale and its executive officers and directors may be deemed to be participants in the solicitation of proxies from the shareholders of Royale in respect of the proposed transaction. Information regarding Royale’s directors and executive officers is available in its annual report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on March 15, 2016, and its proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on April 22, 2015. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

* Disclaimer (cont.) Important Additional Information Filed With The SECIn connection with the proposed transaction, Royale Holdings has filed with the SEC a draft registration statement on Form S-4 that includes a proxy statement that also constitutes a prospectus relating to the Royale Holdings Common Stock to be issued in connection with the proposed merger transactions. The draft preliminary proxy statement/prospectus includes important information about Royale, Matrix, the Matrix LPs and Matrix Operator. Royale also plans to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE FINAL REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ROYALE, MATRIX AND THE PROPOSED TRANSACTION.The information in this release is furnished by Royale in connection with the proposed acquisition by Royale Holdings of Royale and Matrix Oil Management Corporation and its affiliates, Matrix Oil Corporation, Matrix Investments, L.P., Matrix Las Cienegas Limited Partnership and Matrix Permian Investments, L.P. Forward Looking Statements In addition to historical information contained herein, this communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, subject to various risks and uncertainties that could cause the company’s actual results to differ materially from those in the “forward-looking” statements. While the company believes its forward looking statements are based upon reasonable assumptions, there are factors that are difficult to predict and that are influenced by economic and other conditions beyond the company’s control. Investors are directed to consider such risks and other uncertainties discussed in documents filed by the company with the Securities and Exchange Commission.

* Background to this Presentation Royale and Matrix have agreed to an amended and restated merger agreement, effective as of December 31, 2016The Form S-4 related to this merger was filed on February 14, 2017Currently under review by the Securities and Exchange Commission (“SEC”)The merger is subject to shareholder approval and 3rd party consents, including lendersAll numbers in this presentation refer to the companies on a pro forma basis and are subject to adjustment following the closing of the merger

* Acquisition & Organic Growth Opportunity Royale’s strategy is to continue acquiring accretive oil and gas assets at attractive valuations, while continuing to develop its existing asset baseRoyale is leveraging its combined team’s financing and operational experience in California and Texas to roll-up assets with substantial upside that have been overlooked or high-graded by larger peersHigher commodity prices and a more normalized acquisition market have improved prospects for supplementing organic growth with acquisitionsSuccessful acquisition of the Sansinena Field demonstrates Royale/Matrix’s capabilitiesSansinena, a high-graded asset acquired by Matrix from a large, public E&P, is a strategic acquisition due to its immediate proximity and similarity to Matrix’s West Whittier and Whittier Main Fields, which Matrix has operated since 2001More companies are showing Royale acquisition targets than ever before now that Royale has proven its ability to fund and close a deal

* All stock transaction where Matrix shareholders will receive 50% of Royale’s outstanding common stock post-mergerRoyale will assume Matrix’s secured debt of $12.4 millionMatrix will also be issued 3.5% Series B Convertible Preferred Stock with a liquidation value of $20.1 million to extinguish Matrix’s existing preferred interestsAttractive valuation metrics to current Royale shareholdersMatrix purchased for $3.56 per BOE of Proved Reserves1New core area – Sansinena FieldSansinena Field in Southern California has an estimated 13.3MMBOE of Proved Reserves with a PV-10 of $74.6MM as of December 31, 2016, based on SEC Pricing54 active producing, 44 re-works, and 88 PUD wells Step 1 in Growth Strategy – Matrix Acquisition Using Royale’s closing price immediately prior to the announcement of the Letter of Intent signed with Matrix

* Strategic Rationale The merger with Matrix immediately provides Royale with a long-lived, high-quality, operated asset base to develop over many years through its Direct Working Interest (“DWI”) program and improved access to capital markets Matrix brings a seasoned technical and operating team with substantial experience drilling and operating wells in both California and TexasThrough their significant equity position, Matrix’s team will be beneficially aligned for success with Royale’s shareholdersIncreases production and cash flow, along with lower operational and G&A costs per barrel producedGreatly diversifies Royale’s commodity mix and substantially increases Proved ReservesPositions Royale for Nasdaq compliance and up-listingGreatly improves access to debt and equity capital markets due to larger scaleLarger portfolio of exploitation and exploration opportunities that augments Royale’s existing portfolio of Sacramento Basin opportunities

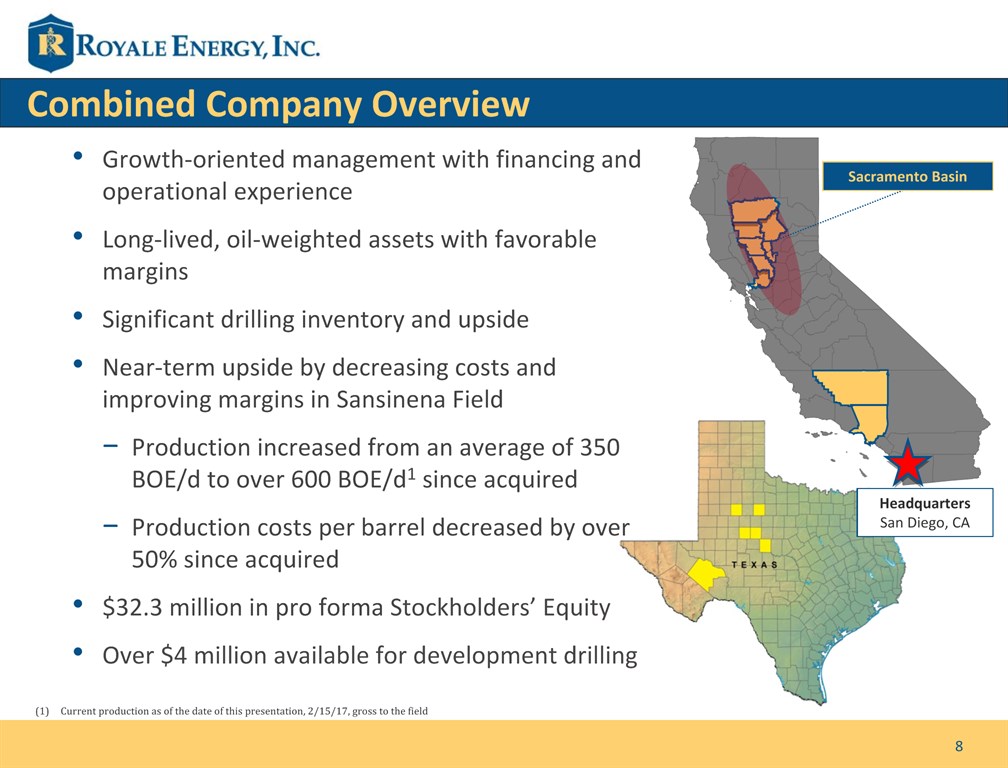

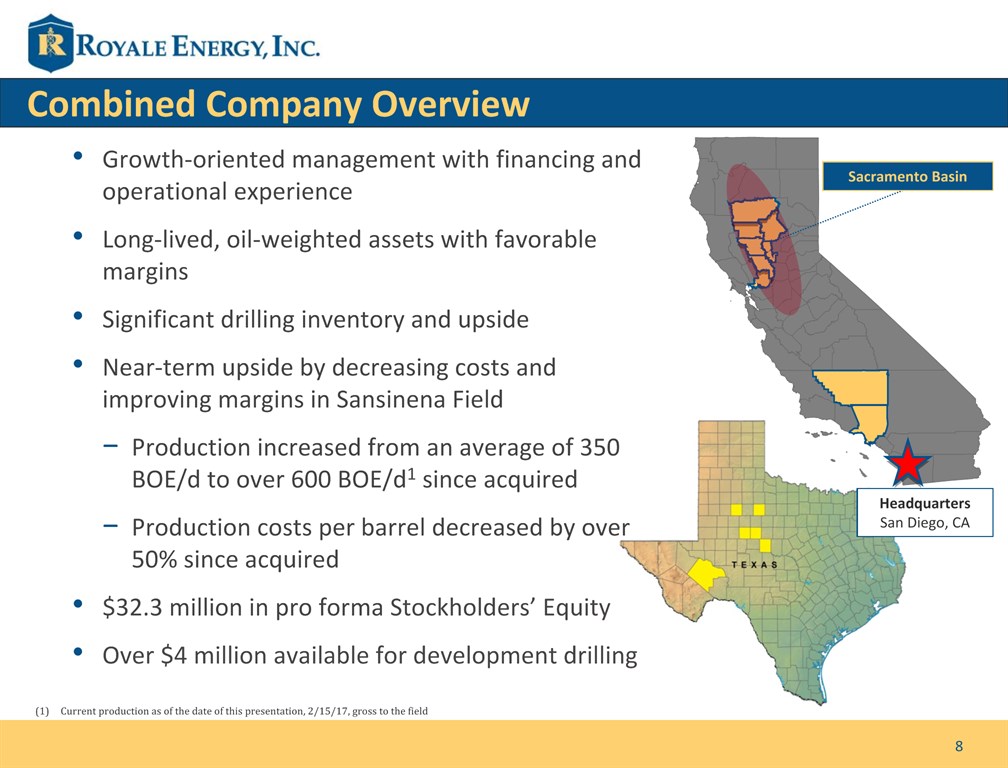

* Combined Company Overview Growth-oriented management with financing and operational experienceLong-lived, oil-weighted assets with favorable marginsSignificant drilling inventory and upside Near-term upside by decreasing costs and improving margins in Sansinena FieldProduction increased from an average of 350 BOE/d to over 600 BOE/d1 since acquired Production costs per barrel decreased by over 50% since acquired$32.3 million in pro forma Stockholders’ Equity Over $4 million available for development drilling Current production as of the date of this presentation, 2/15/17, gross to the field

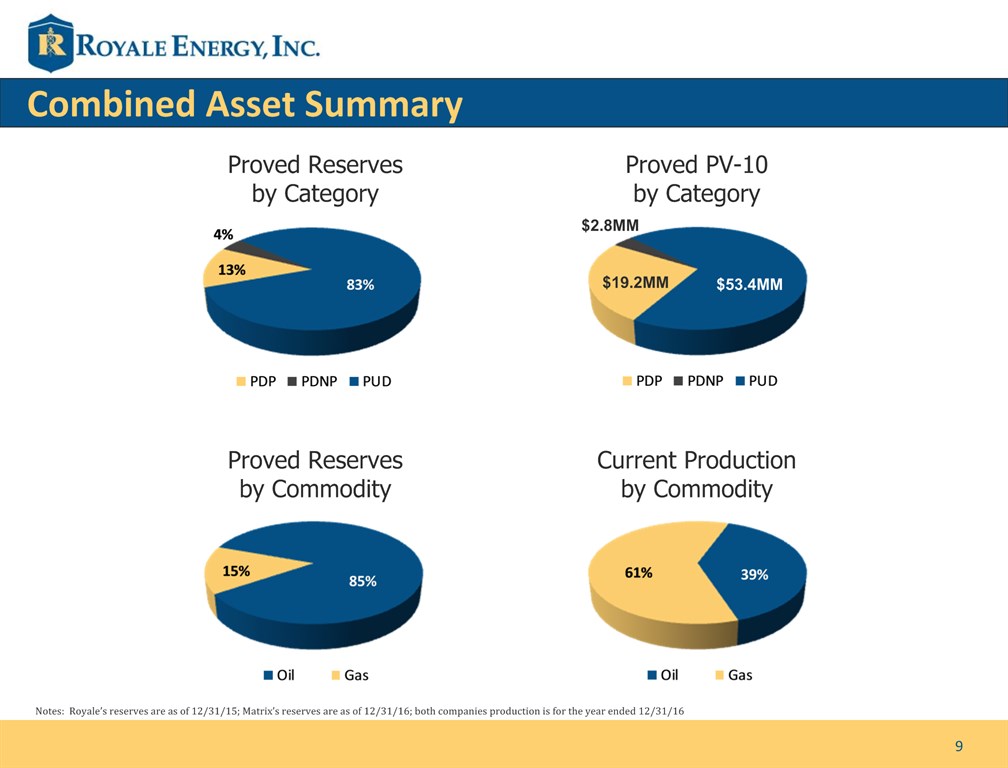

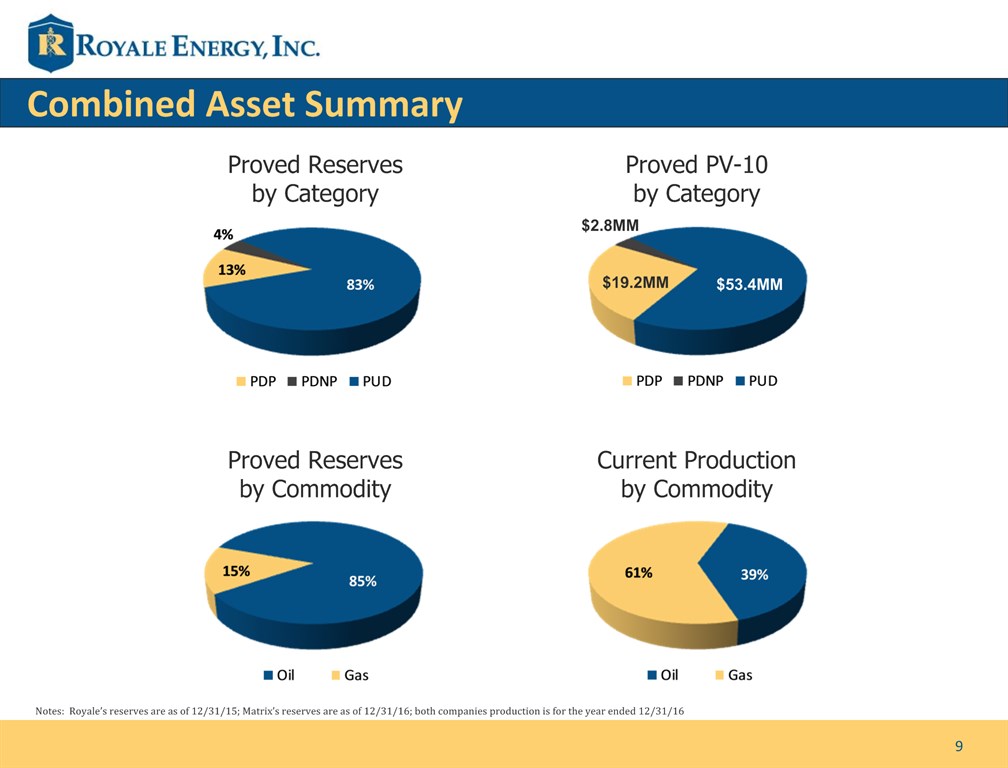

* Combined Asset Summary Proved Reservesby Category Proved PV-10by Category Proved Reservesby Commodity Current Productionby Commodity $2.8MM $19.2MM $53.4MM Notes: Royale’s reserves are as of 12/31/15; Matrix’s reserves are as of 12/31/16; both companies production is for the year ended 12/31/16

* Matrix’s Sansinena Field Matrix Sansinena Field Leases Matrix City of Whittier Leases Matrix West Whittier Leases Drilling/Production Sites are shown as yellow stars

* Since 1890 more than 500 wells have been drilled in this field. Previously Chevron and Standard Oil of California and Unocal.Abandoned by Chevron in 1992, at a time of low oil prices ($20/bbl), for real estate development. The field has produced 50 MMBOE to-date, estimated to be 10% OOIP.Much higher oil prices today ($50+/bbl) make this field very profitable once again. Whittier Fault Sempra Area Whittier Main Field Note: Colored outlines shown above are Matrix’s Leases Matrix’s Whittier Field

* Texas Overview Pecos Stonewall Garza Nolan Runnels Mitchell Location: Nolan, Runnels, Mitchell, Pecos, Garza, and Stonewall Counties, TexasCurrent Production: 470 BOE/d gross (47 BOE/d net)from 42 wells Acreage: 3,863 net acres (all HBP, non-operated)Opportunity to buyout partnersOperators: JVA Operating and Clayton Williams Primary Formations: Ellenburger, Devonian, Odom, Jennings, Capps, Penn, GardnerKey Development Areas: Rowena, Arledge and Boyd FieldsProspect Areas: Garza and Pecos County

* Other Assets – Real Estate Matrix obtained significant real estate assets with its Sansinena Field acquisitionThe prior operator invested millions of dollars in the surface infrastructure since 2007, which included replacing storage tanks, vessels holding pressure, vapor recovery systems, and natural gas processing equipment, significantly decreasing future maintenance CAPEX requirements After acquiring the underground mineral rights, the prior operator acquired 83 acres (in addition to 13 acres previously owned) in the city of La Habra HeightsThe land was appraised for $9.1MM in 2010.Under-utilized surface, including 6 acres adjacent to the field office, could be sold for residential real estate development.

* Management – Experienced Leadership in Energy and Finance Jonathan GregoryChief Executive Officer & Director Stephen M. HosmerChief Financial Officer Seasoned Energy and Finance Executive with more than 25 years of experienceServed as CEO and Vice Chairman since September 2015Chief Financial and Business Development Strategist of Americo Energy Resources, a privately held independent oil & gas company with principle operations in West Texas and the Texas Gulf Coast (2014)Chief Financial Officer of J&S Oil & Gas, a privately held E&P with operations in Louisiana and Texas (2012-2014)Executive Vice President with Texas Capital Bank (2005-2012); Senior Vice President with Guaranty Bank (2002-2004) Served as Co-President, Co-Chief Executive Officer and Chief Financial Officer for 7 years; has held leadership positions at Royale since 1991Directed Royale operations, drilled over 120 wells in Sacramento basin$140 million in drilling and development activitiesExecuted acquisition of 120 square miles of proprietary seismic data Raised $19 million in equity Donald H. HosmerBusiness Development Served as Co-President and Co-Chief Executive Officer for 7 years; has held leadership positions at Royale since 1991Responsible for Royale’s Direct Working Interest (DWI) ProgramResponsible for Royale’s marketing and investor/shareholder relationsSince 1994, raised over $150 million in gross proceeds through Royale’s Direct Working Interest (DWI) program Johnny JordanPresident, Chief Operating Officer & Director (Matrix Founder) More than 35 years of expertise in acquisitions, field economics and reserves analysis, reservoir and field operations Various supervisory roles with Exxon, Mack Energy, Enron Oil and Gas and Venoco CorporationsManaged acquisition evaluations in many of the oil and gas producing basins in the U.S. and has coordinated field development for various recovery mechanisms, including waterflood, tertiary flood, water drive oil and gas reservoirs, and pressure depletion fields with gas cap expansion or gravity drainageB.S., Chemical Engineering, University of Oklahoma

* Key Team Members – Successful Finders, Drillers and Operators Jeff KernsEngineer (Matrix Founder) Jay ScheevelChief Geologist Petroleum Engineer with 38 years of expertise in field operations, reservoir assessment, well design, and field accounting aspectsManaged capital budgets and performed reservoir surveillance for thermal recovery projects, waterfloods, depletion and gas drive reservoirsTeam member of Mobil Oil’s billion dollar, billion-barrel heavy oil development strategy for the San Joaquin Basin of California that has performed beyond expectationsB.S., Petroleum Engineering, Stanford University; registered professional engineer Founder of a multifaceted geological consulting company, Scheevel Geo Technologies (“SGT”)Provides geologic and geophysical support with the use of traditional tools and advanced modeling software, such as GoCad (from Paradigm) and other custom designed softwarePrior to forming SGT, worked for Chevron for 21 years as a geologistB.S. with distinction in Geology from the University of IllinoisM.S. in Geology from Texas A&M University, Center for Tectonophysics Michael McCaskeyGeologist (Matrix Founder) Performed exploration and development evaluations in many of the oil and gas producing basins in the US, Europe and AfricaWorked on over 250 well projects for Union Oil of California, Arco Exploration, Venoco and Matrix Oil Corporation in California, Texas, Rocky Mountain region, North Sea and West AfricaB.S. in Geology from Texas A&M UniversityM.S. in Geology from Texas A&M University Joe PaquetteVice President of Operations Over 30 years of experience, primarily in operations and process/facilities engineeringExpertise in conception, design, construction, and efficiency improvements of major oil and gas installationsPreviously a production engineer for Amoco Production Company in various locations in East Texas, the Gulf Coast, and West TexasWorked for Mobil Oil as a technical consultant providing project management and supervision on multiple oil and gas projects across the United States, including the San Joaquin Valley in CaliforniaB.S. in Civil Engineering from the University of Texas at Austin; member of American American Society of Civil Engineers, Society of Petroleum Engineers and American Petroleum Institute

* New Board Members – Governance Experience, Entrepreneurial Success Jonathan ClarksonDirector Gabriel L. EllisorDirector Served as Chief Financial Officer of Matrix Oil Corporation (2012-2016)Previously worked for Texas Capital Bank where he variously served as CEO and Chairman of the Houston Region Served in various management roles at Mission Resources Corp, Bargo Energy Company, and Ocean Energy CorpCurrently serves as non-executive chairman of Memorial Production Partners (NASDAQ: MEMP) and on the board of directors of Wildhorse Resource Development (NYSE: WRD)Also serves on the board of directors of Parker Drilling Company (NYSE: PKE) and on the advisory board of Rivington Capital Advisors Served as Chief Financial Officer of Three Rivers Operating Company I and II, both of which were private equity companies backed by Riverstone Holdings built as acquisition vehicles focused in the Permian Basin, sold for more than $2.25 billion combinedPreviously a principal at Rivington Capital Advisors, a boutique investment banking firm that specialized in raising private capital and providing M&A advisory services for the energy sectorWorked for First Interstate Bank, Wells Fargo, and BNP ParibasCurrently serves on the board of directors of Swift Energy (OTCQX: SWTF)B.B.A. with a major in Finance from Texas Christian University Rod EsonDirector Founder and Chief Executive Officer of Foothill Energy LLC, which owns and operates oil and gas properties in Texas and CaliforniaPreviously President and CEO of Venoco, which he co-founded in 1992 and was sold for $735 million in 2012Former chairman of the board of the California Independent Petroleum Association and has been a member of the Society of Petroleum Engineers and American Petroleum Institute for more than three decadesServes on the board of directors of Enhanced Oil RecoveriesB.S. in Mechanical Engineering from California State Polytechnic University

* Enhanced management team and board of directors provides leadership for significant growthOver $4 million is available for Sacramento Basin drilling and to jumpstart Sansinena “low hanging fruit” projects expected increase production and lowering operational expenses on a per barrel basisEvaluate additional acquisition targets, including buyout of existing working interest partners in California and TexasNASDAQ up-listing application at closingImproved Balance Sheet and larger asset base provide expanded financing optionalityUniquely positioned to attract joint venture development projects similar to Royale’s farm-out with CRC at Rio Vista Royale – Well-Positioned and Stronger than Ever

NASDAQ CM:ROYL A Growth-Oriented Independent Exploration & Production Company Phone: 619-383-6600Fax: 619-383-6699Investor Relations: 800-447-8505 CORPORATE ADDRESS1870 Cordel CtEl Cajon, CA 92020 Email Address: ir@royl.comWebsite: www.royl.com