Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20170209.htm |

4th Quarter 2016 Investor Presentation Exhibit 99.1

This presentation contains forward-looking statements, as defined by Federal Securities Laws, relating to present or future trends or factors affecting the operations, markets and products of CenterState Banks, Inc. (CSFL). These statements are provided to assist in the understanding of future financial performance. Any such statements are based on current expectations and involve a number of risks and uncertainties. For a discussion of factors that may cause such forward-looking statements to differ materially from actual results, please refer to CSFL’s most recent Form 10-Q and Form 10-K filed with the Securities and Exchange Commission. CSFL undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation. Forward Looking Statement

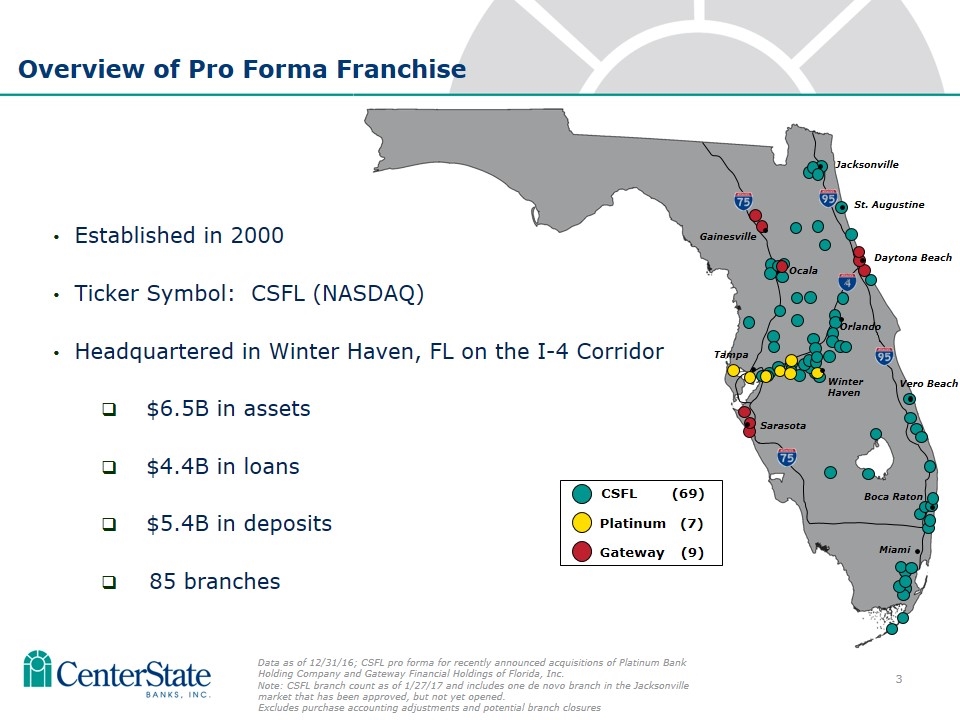

Tampa Jacksonville Orlando Winter Haven Miami Overview of Pro Forma Franchise Ocala Gainesville Sarasota Daytona Beach CSFL (69) Platinum (7) Gateway (9) St. Augustine Vero Beach Boca Raton Established in 2000 Ticker Symbol: CSFL (NASDAQ) Headquartered in Winter Haven, FL on the I-4 Corridor $6.5B in assets $4.4B in loans $5.4B in deposits 85 branches Data as of 12/31/16; CSFL pro forma for recently announced acquisitions of Platinum Bank Holding Company and Gateway Financial Holdings of Florida, Inc. Note: CSFL branch count as of 1/27/17 and includes one de novo branch in the Jacksonville market that has been approved, but not yet opened. Excludes purchase accounting adjustments and potential branch closures

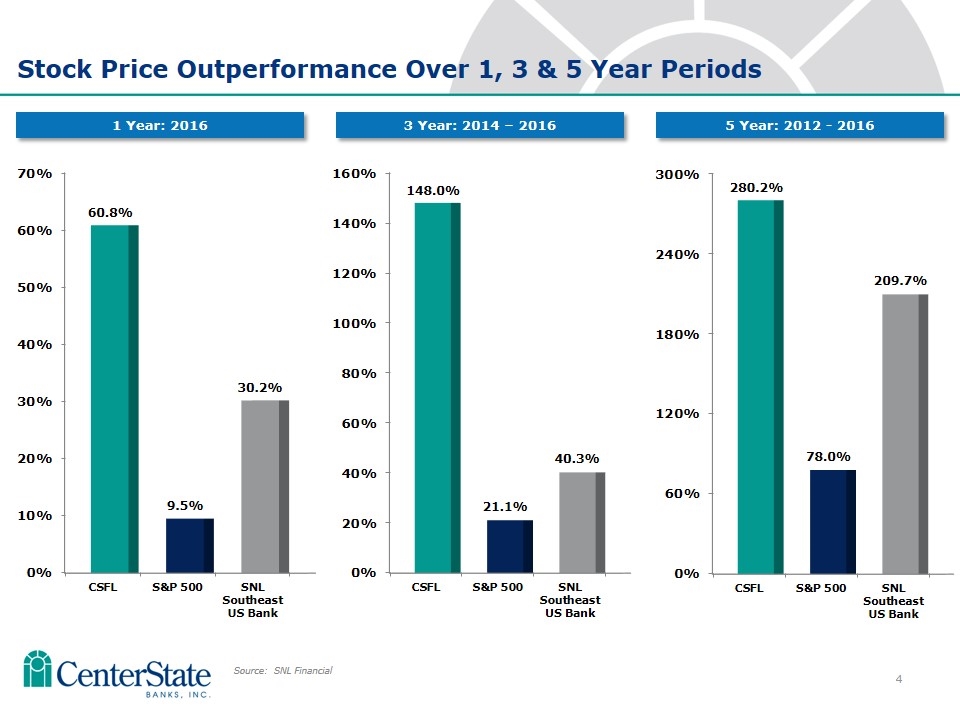

Stock Price Outperformance Over 1, 3 & 5 Year Periods Source: SNL Financial 1 Year: 2016 3 Year: 2014 – 2016 5 Year: 2012 - 2016

Current Focus 1. Improve earning asset mix with a target loan to deposit ratio of 85% Recruiting commercial lending teams 2. Invest in non-interest income lines of business Mortgage SBA ARC interest rate swap product 3. M&A Core competency after 14 announced acquisitions since 20091 Ample opportunities (1)Pro forma for recently announced acquisitions of Platinum Bank Holding Company and Gateway Financial Holdings of Florida, Inc.

Banking the Sunshine State

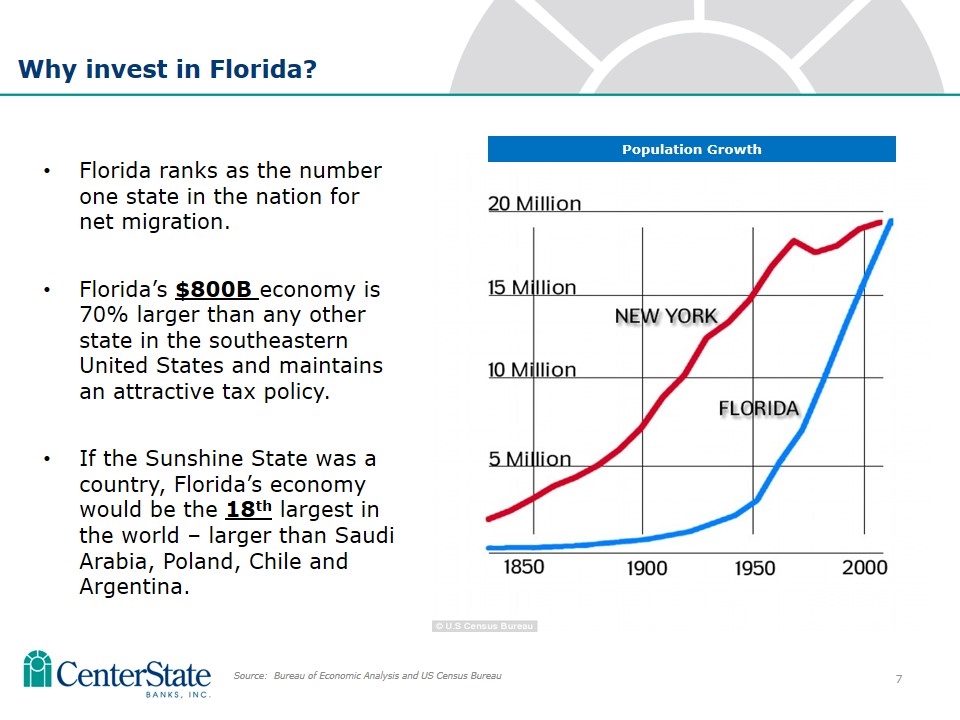

Florida ranks as the number one state in the nation for net migration. Florida’s $800B economy is 70% larger than any other state in the southeastern United States and maintains an attractive tax policy. If the Sunshine State was a country, Florida’s economy would be the 18th largest in the world – larger than Saudi Arabia, Poland, Chile and Argentina. Why invest in Florida? Source: Bureau of Economic Analysis and US Census Bureau Population Growth

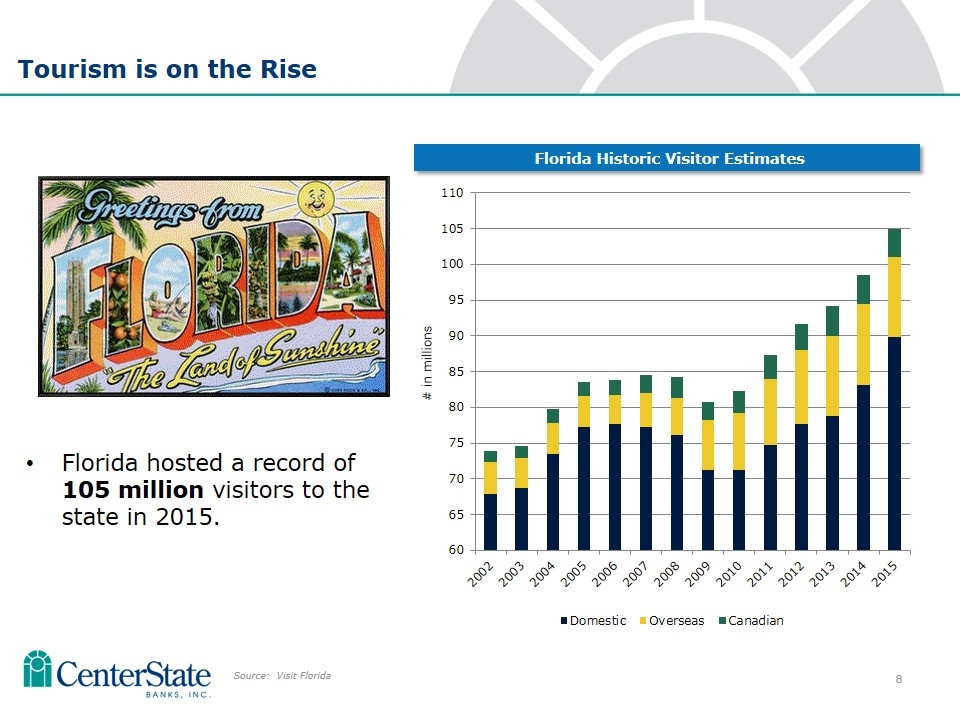

Florida hosted a record of 105 million visitors to the state in 2015. Tourism is on the Rise Source: Visit Florida Florida Historic Visitor Estimates

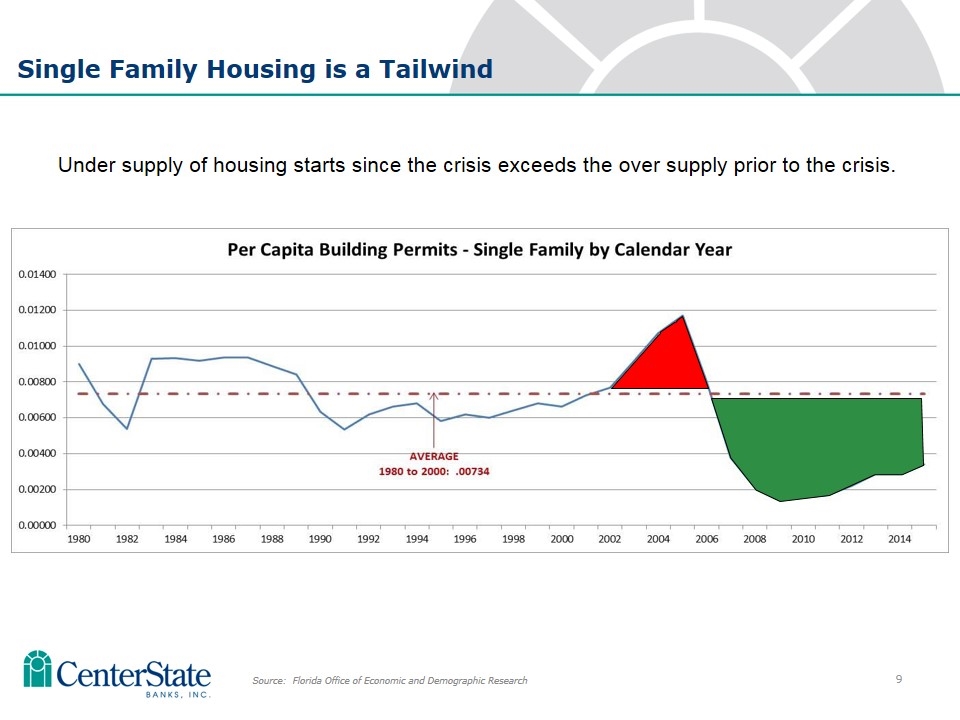

Single Family Housing is a Tailwind Under supply of housing starts since the crisis exceeds the over supply prior to the crisis. Source: Florida Office of Economic and Demographic Research Over supply Under supply

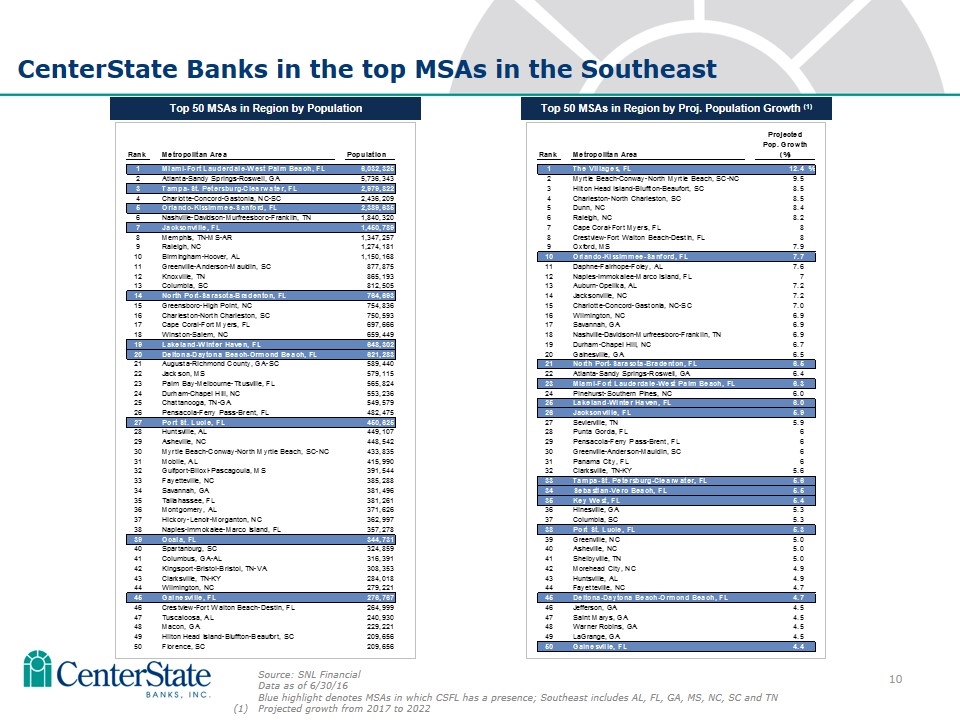

Source: SNL Financial Data as of 6/30/16 Blue highlight denotes MSAs in which CSFL has a presence; Southeast includes AL, FL, GA, MS, NC, SC and TN (1)Projected growth from 2017 to 2022 CenterState Banks in the top MSAs in the Southeast Top 50 MSAs in Region by Population Top 50 MSAs in Region by Proj. Population Growth (1)

Capital Management

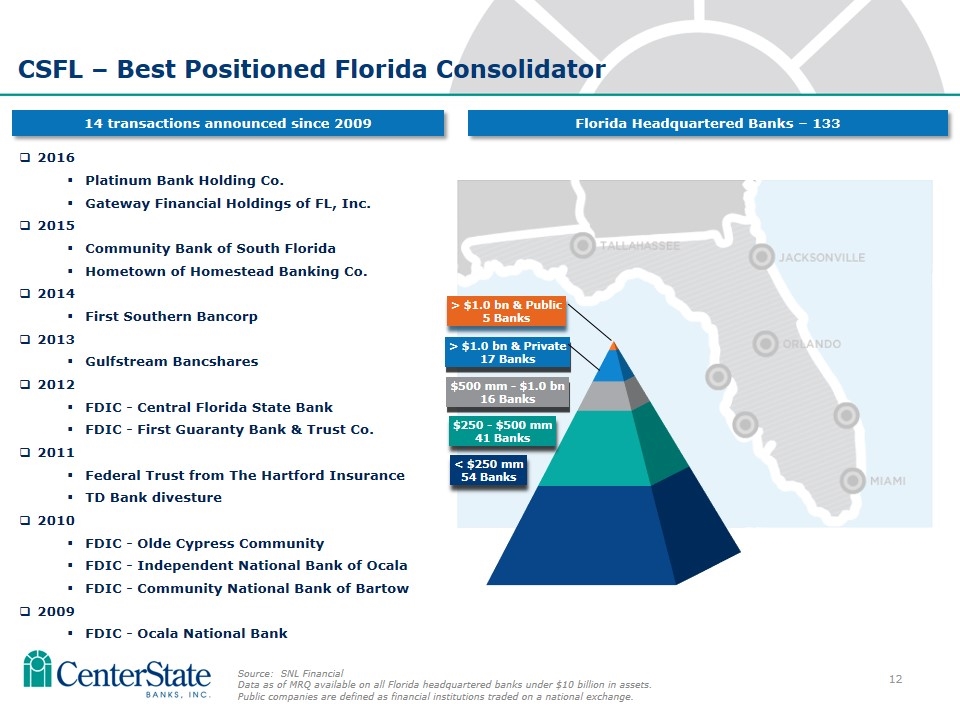

18 CSFL – Best Positioned Florida Consolidator Source: SNL Financial Data as of MRQ available on all Florida headquartered banks under $10 billion in assets. Public companies are defined as financial institutions traded on a national exchange. 2016 Platinum Bank Holding Co. Gateway Financial Holdings of FL, Inc. 2015 Community Bank of South Florida Hometown of Homestead Banking Co. 2014 First Southern Bancorp 2013 Gulfstream Bancshares 2012 FDIC - Central Florida State Bank FDIC - First Guaranty Bank & Trust Co. 2011 Federal Trust from The Hartford Insurance TD Bank divesture 2010 FDIC - Olde Cypress Community FDIC - Independent National Bank of Ocala FDIC - Community National Bank of Bartow 2009 FDIC - Ocala National Bank 14 transactions announced since 2009 Florida Headquartered Banks – 133

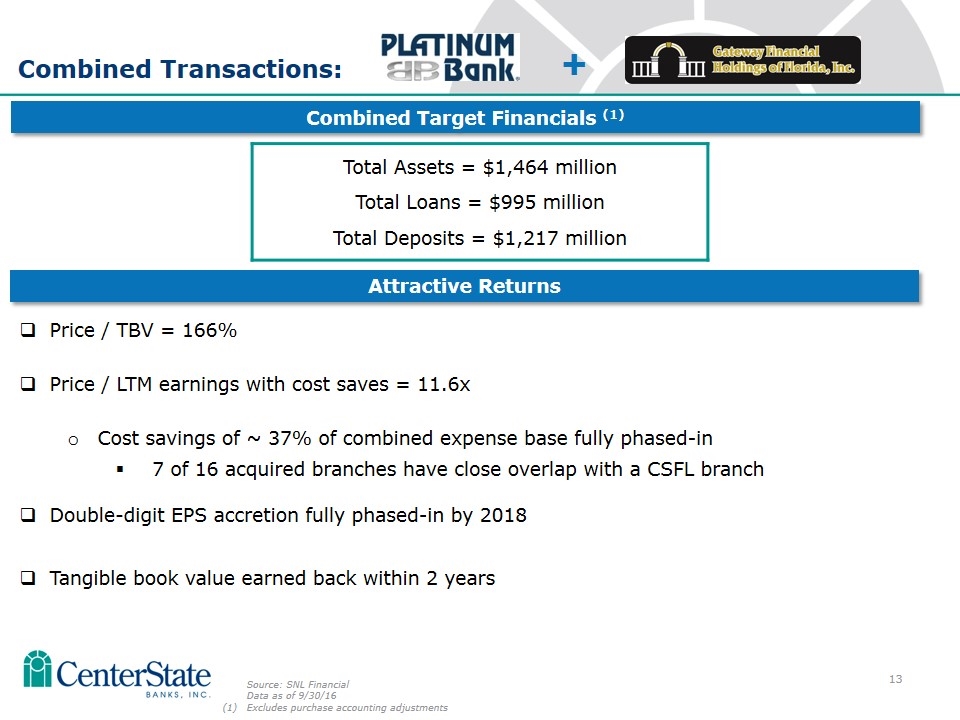

Combined Transactions: Total Assets = $1,464 million Total Loans = $995 million Total Deposits = $1,217 million Combined Target Financials (1) + Attractive Returns Price / TBV = 166% Price / LTM earnings with cost saves = 11.6x Cost savings of ~ 37% of combined expense base fully phased-in 7 of 16 acquired branches have close overlap with a CSFL branch Double-digit EPS accretion fully phased-in by 2018 Tangible book value earned back within 2 years Source: SNL Financial Data as of 9/30/16 Excludes purchase accounting adjustments

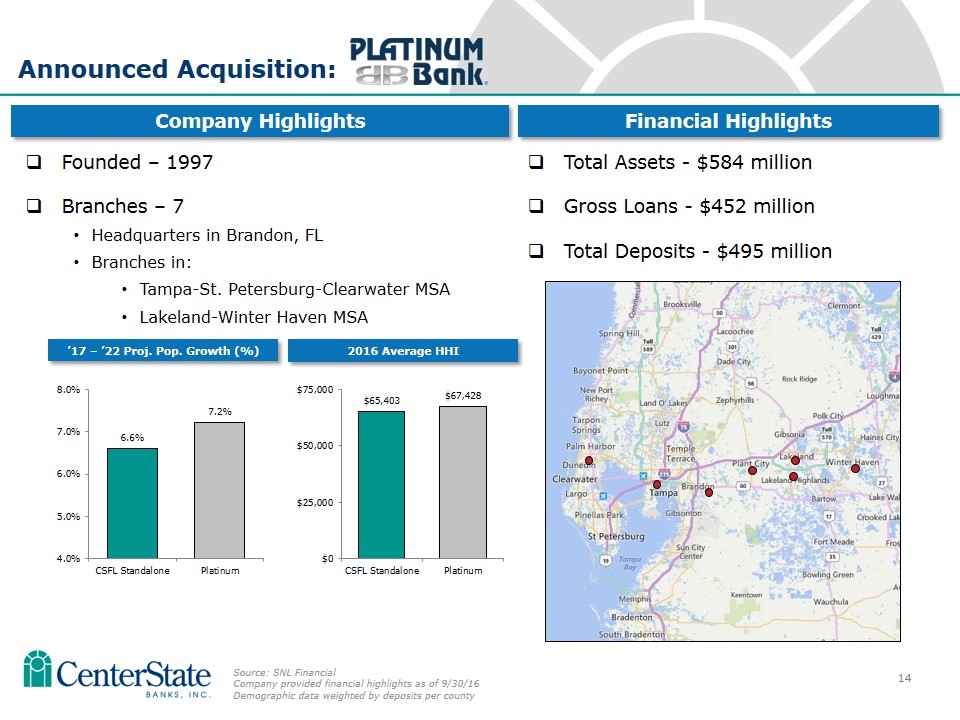

Founded – 1997 Branches – 7 Headquarters in Brandon, FL Branches in: Tampa-St. Petersburg-Clearwater MSA Lakeland-Winter Haven MSA Company Highlights Total Assets - $584 million Gross Loans - $452 million Total Deposits - $495 million Financial Highlights Source: SNL Financial Company provided financial highlights as of 9/30/16 Demographic data weighted by deposits per county ’17 – ’22 Proj. Pop. Growth (%) 2016 Average HHI Announced Acquisition:

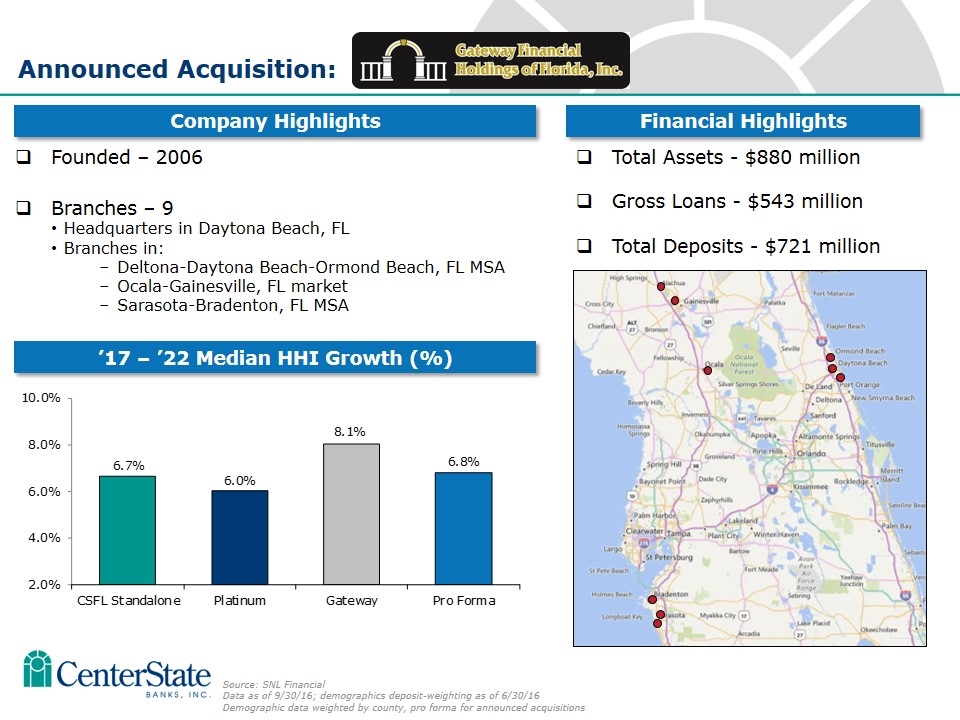

Founded – 2006 Branches – 9 Headquarters in Daytona Beach, FL Branches in: Deltona-Daytona Beach-Ormond Beach, FL MSA Ocala-Gainesville, FL market Sarasota-Bradenton, FL MSA Company Highlights Total Assets - $880 million Gross Loans - $543 million Total Deposits - $721 million Financial Highlights Source: SNL Financial Data as of 9/30/16; demographics deposit-weighting as of 6/30/16 Demographic data weighted by county, pro forma for announced acquisitions ’17 – ’22 Median HHI Growth (%) Announced Acquisition:

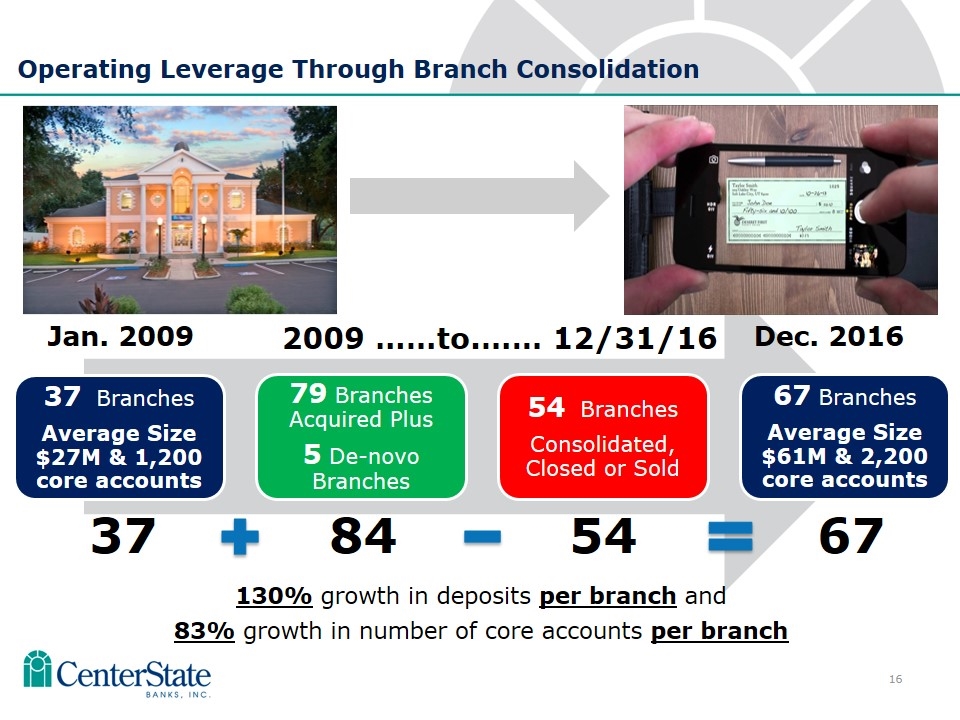

Operating Leverage Through Branch Consolidation 130% growth in deposits per branch and 83% growth in number of core accounts per branch 37 84 54 67 Jan. 2009 2009 ……to.…… 12/31/16 Dec. 2016 37 Branches Average Size $27M & 1,200 core accounts 79 Branches Acquired Plus 5 De-novo Branches 54 Branches Consolidated, Closed or Sold 67 Branches Average Size $61M & 2,200 core accounts

Operating Performance

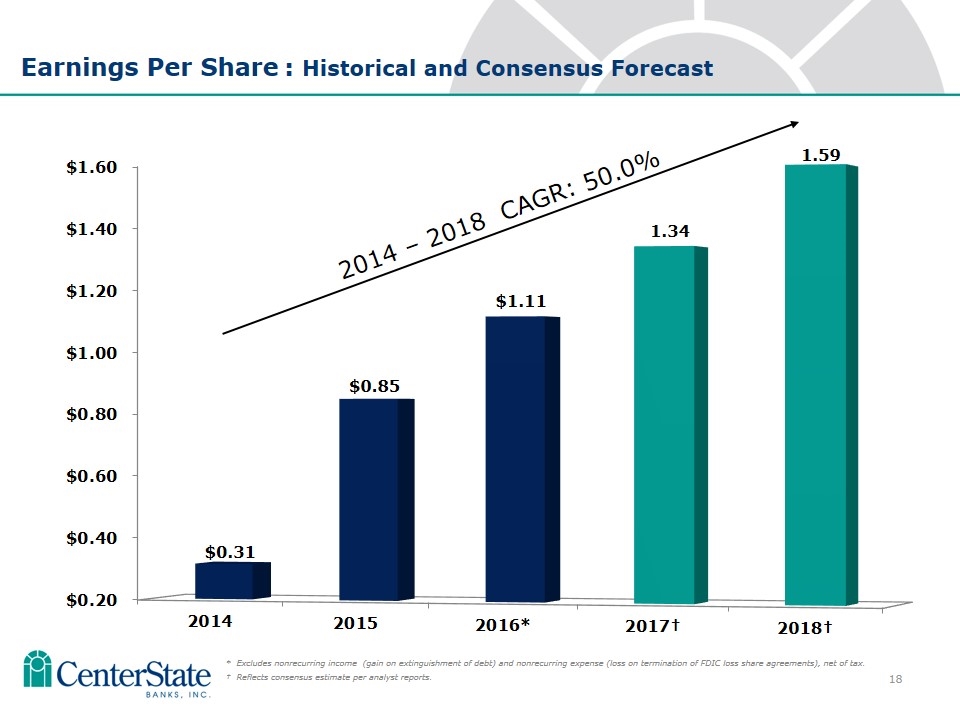

Earnings Per Share : Historical and Consensus Forecast 2014 – 2018 CAGR: 50.0% * Excludes nonrecurring income (gain on extinguishment of debt) and nonrecurring expense (loss on termination of FDIC loss share agreements), net of tax. † Reflects consensus estimate per analyst reports.

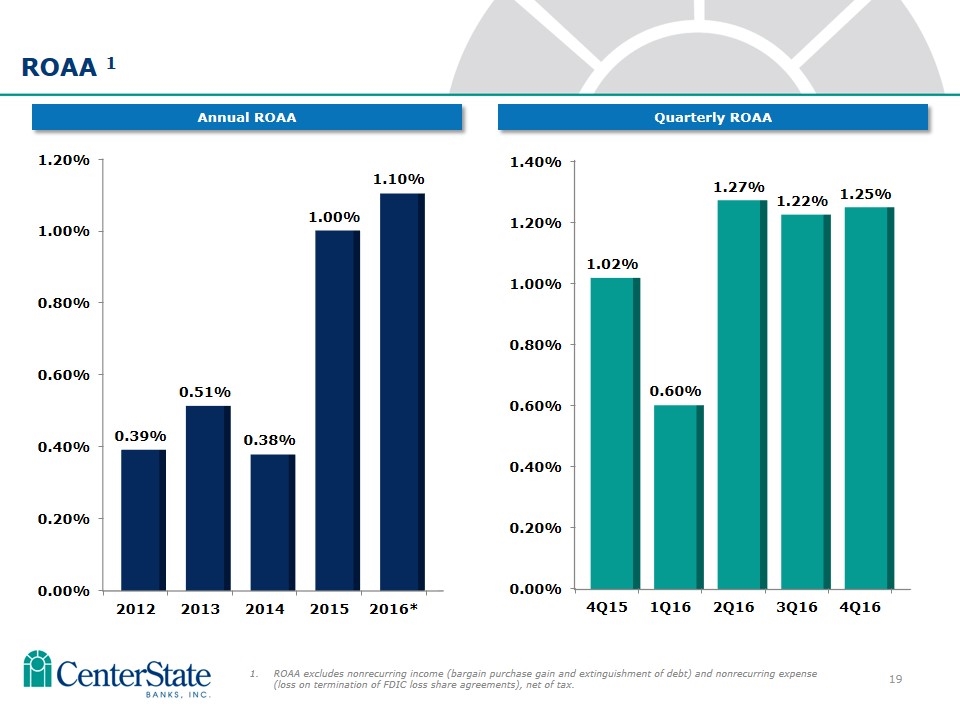

ROAA 1 ROAA excludes nonrecurring income (bargain purchase gain and extinguishment of debt) and nonrecurring expense (loss on termination of FDIC loss share agreements), net of tax. Quarterly ROAA Annual ROAA

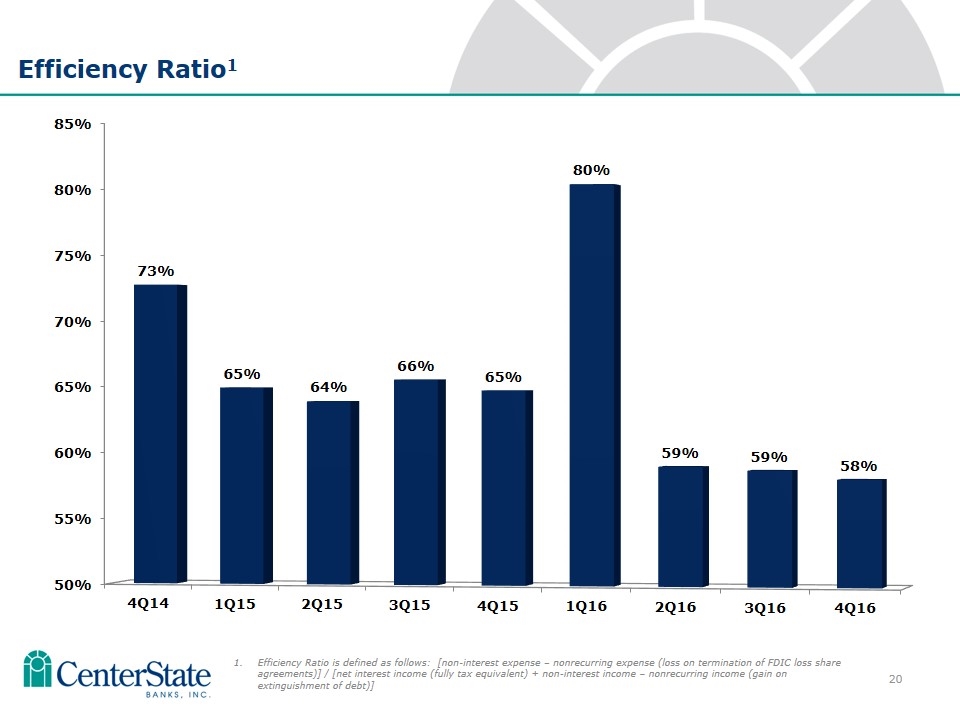

10 Efficiency Ratio1 Efficiency Ratio is defined as follows: [non-interest expense – nonrecurring expense (loss on termination of FDIC loss share agreements)] / [net interest income (fully tax equivalent) + non-interest income – nonrecurring income (gain on extinguishment of debt)]

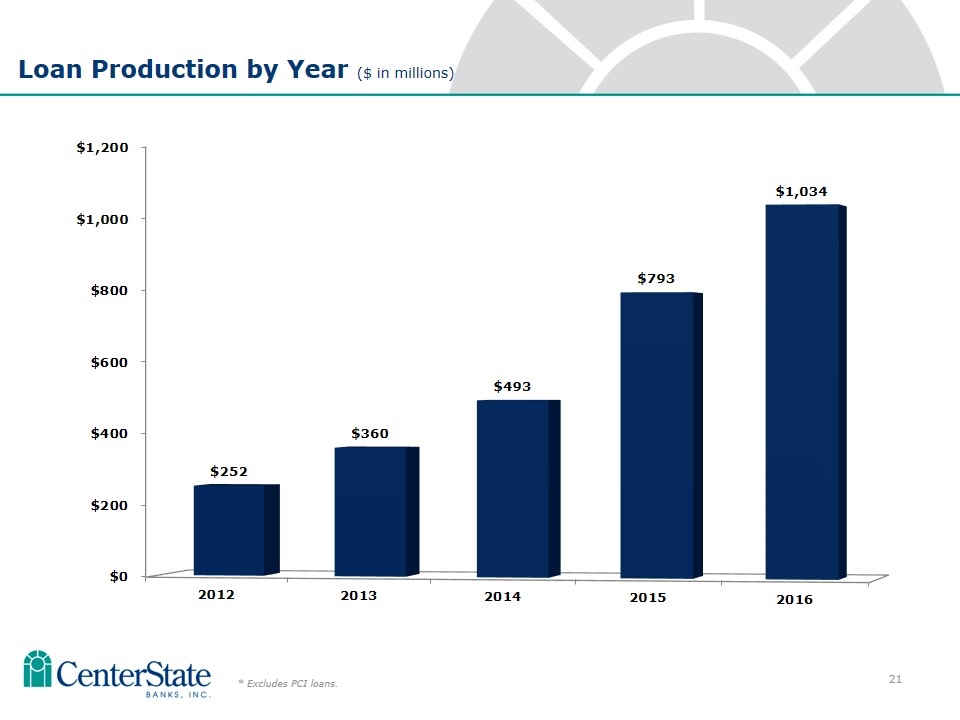

Loan Production by Year ($ in millions) * Excludes PCI loans.

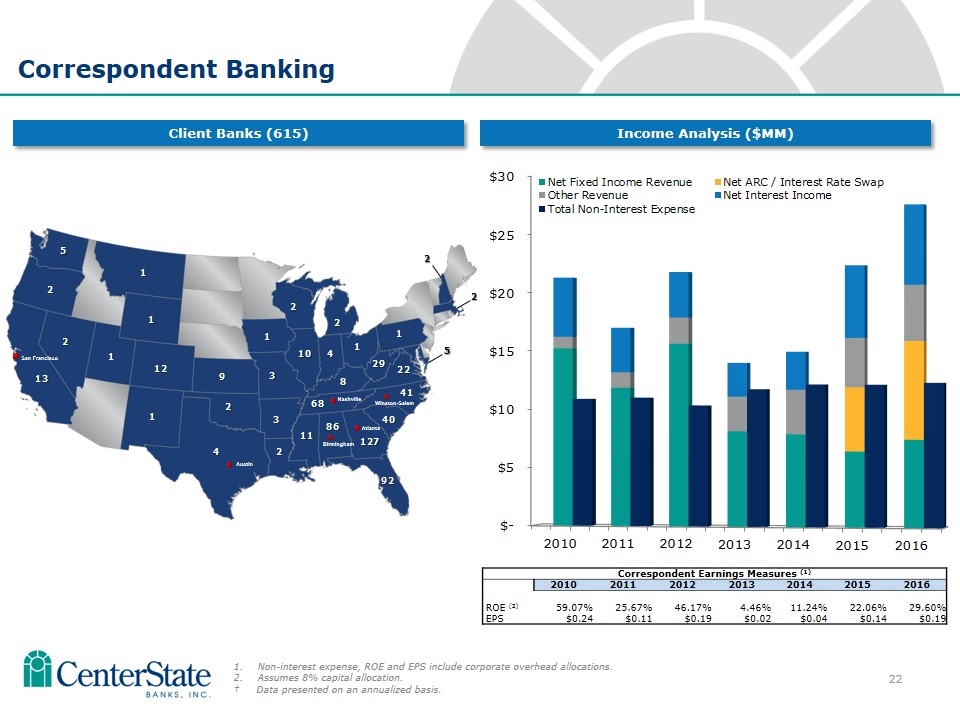

Non-interest expense, ROE and EPS include corporate overhead allocations. Assumes 8% capital allocation. † Data presented on an annualized basis. Correspondent Banking Client Banks (615) Income Analysis ($MM) Correspondent Earnings Measures (1) 2010 2011 2012 2013 2014 2015 2016 ROE (2) 59.07% 25.67% 46.17% 4.46% 11.24% 22.06% 29.60% EPS $0.24 $0.11 $0.19 $0.02 $0.04 $0.14 $0.19 Birmingham Atlanta 92 4 3 2 11 68 40 41 8 22 29 Nashville Winston-Salem 10 3 2 4 1 9 1 2 1 2 12 1 1 1 1 2 13 2 5 2 2 5 San Francisco Austin 127 86

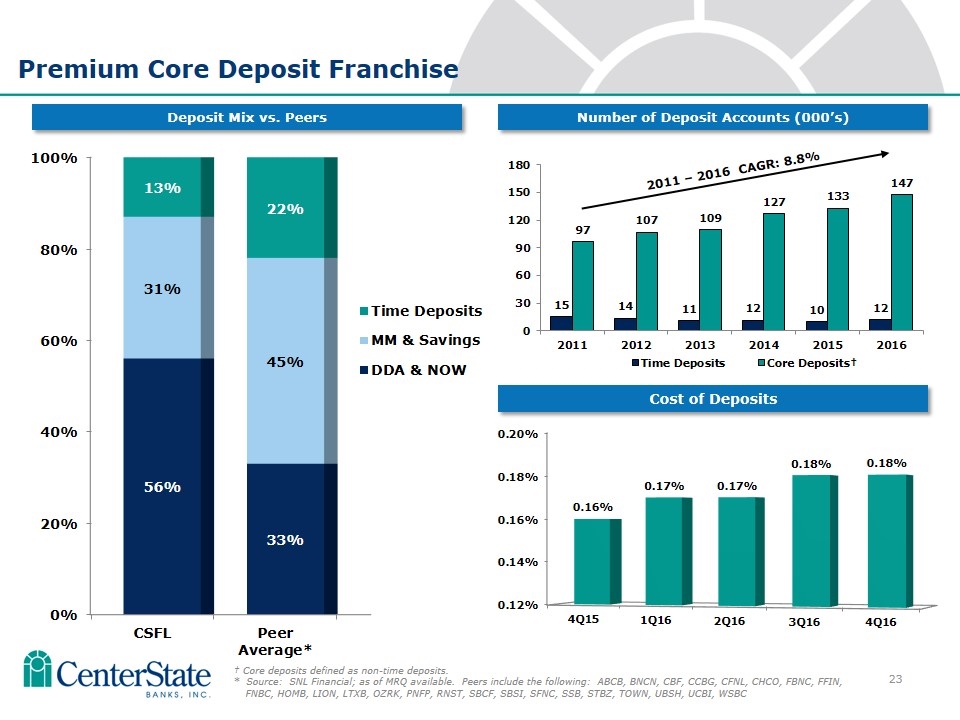

Premium Core Deposit Franchise Cost of Deposits 2011 – 2016 CAGR: 8.8% Number of Deposit Accounts (000’s) Deposit Mix vs. Peers † Core deposits defined as non-time deposits. * Source: SNL Financial; as of MRQ available. Peers include the following: ABCB, BNCN, CBF, CCBG, CFNL, CHCO, FBNC, FFIN, FNBC, HOMB, LION, LTXB, OZRK, PNFP, RNST, SBCF, SBSI, SFNC, SSB, STBZ, TOWN, UBSH, UCBI, WSBC

Investment Thesis Based on strong operating results, CSFL shares outperformed the banking index over a 1, 3 & 5 year horizon. Florida is an economic powerhouse and leads the nation in net migration. With $6.5 billion in pro-forma assets, CSFL ranks as the 2nd largest community bank headquartered in Florida. Investments are currently underway to accelerate organic growth and build shareholder value.

Supplemental

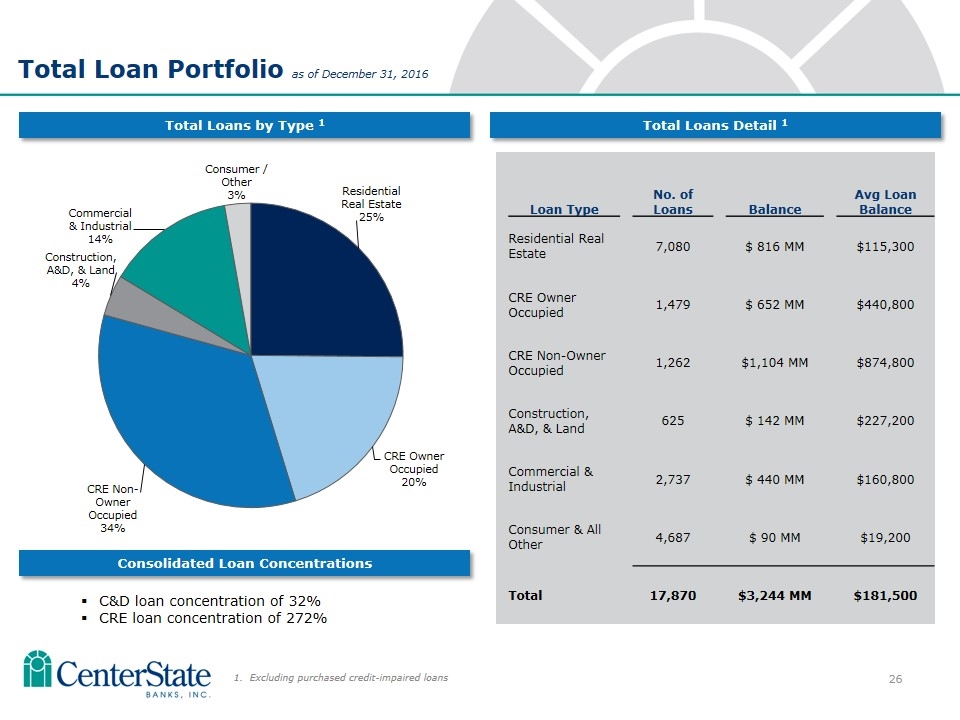

Total Loans by Type 1 Total Loans Detail 1 Loan Type No. of Loans Balance Avg Loan Balance Residential Real Estate 7,080 $ 816 MM $115,300 CRE Owner Occupied 1,479 $ 652 MM $440,800 CRE Non-Owner Occupied 1,262 $1,104 MM $874,800 Construction, A&D, & Land 625 $ 142 MM $227,200 Commercial & Industrial 2,737 $ 440 MM $160,800 Consumer & All Other 4,687 $ 90 MM $19,200 Total 17,870 $3,244 MM $181,500 Total Loan Portfolio as of December 31, 2016 1. Excluding purchased credit-impaired loans C&D loan concentration of 32% CRE loan concentration of 272% Consolidated Loan Concentrations

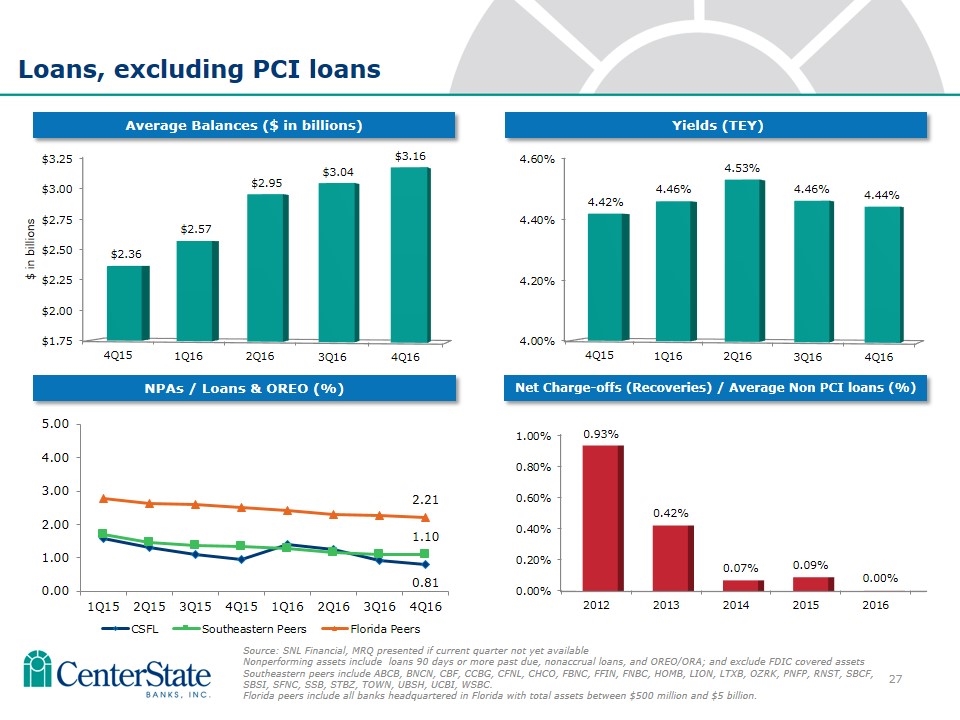

Loans, excluding PCI loans Yields (TEY) Average Balances ($ in billions) Source: SNL Financial, MRQ presented if current quarter not yet available Nonperforming assets include loans 90 days or more past due, nonaccrual loans, and OREO/ORA; and exclude FDIC covered assets Southeastern peers include ABCB, BNCN, CBF, CCBG, CFNL, CHCO, FBNC, FFIN, FNBC, HOMB, LION, LTXB, OZRK, PNFP, RNST, SBCF, SBSI, SFNC, SSB, STBZ, TOWN, UBSH, UCBI, WSBC. Florida peers include all banks headquartered in Florida with total assets between $500 million and $5 billion. NPAs / Loans & OREO (%) Net Charge-offs (Recoveries) / Average Non PCI loans (%)

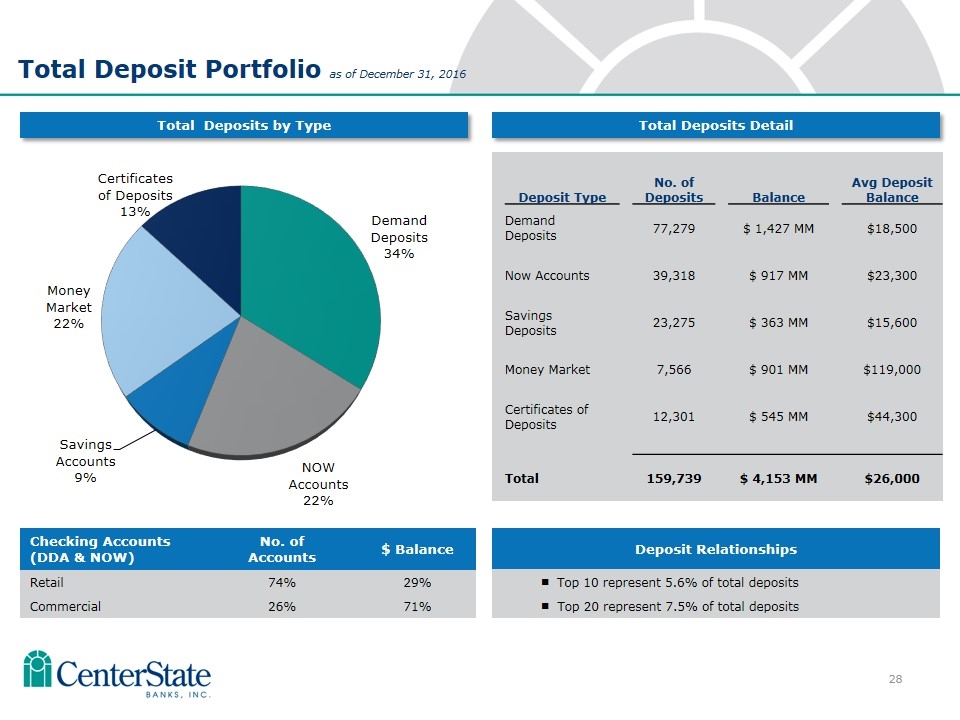

Deposit Relationships n Top 10 represent 5.6% of total deposits n Top 20 represent 7.5% of total deposits Total Deposits by Type Total Deposits Detail 23 Total Deposit Portfolio as of December 31, 2016 Deposit Type No. of Deposits Balance Avg Deposit Balance Demand Deposits 77,279 $ 1,427 MM $18,500 Now Accounts 39,318 $ 917 MM $23,300 Savings Deposits 23,275 $ 363 MM $15,600 Money Market 7,566 $ 901 MM $119,000 Certificates of Deposits 12,301 $ 545 MM $44,300 Total 159,739 $ 4,153 MM $26,000 Checking Accounts (DDA & NOW) No. of Accounts $ Balance Retail 74% 29% Commercial 26% 71%

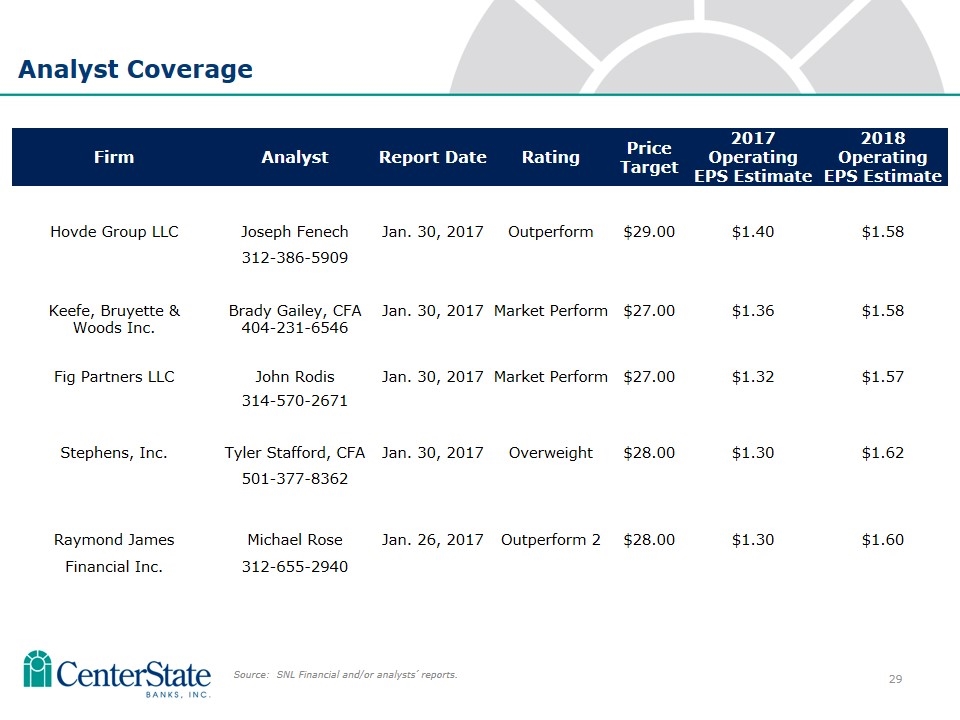

Analyst Coverage Source: SNL Financial and/or analysts’ reports. Firm Analyst Report Date Rating Price Target 2017 Operating EPS Estimate 2018 Operating EPS Estimate Hovde Group LLC Joseph Fenech Jan. 30, 2017 Outperform $29.00 $1.40 $1.58 312-386-5909 Keefe, Bruyette & Brady Gailey, CFA Jan. 30, 2017 Market Perform $27.00 $1.36 $1.58 Woods Inc. 404-231-6546 Fig Partners LLC John Rodis Jan. 30, 2017 Market Perform $27.00 $1.32 $1.57 314-570-2671 Stephens, Inc. Tyler Stafford, CFA Jan. 30, 2017 Overweight $28.00 $1.30 $1.62 501-377-8362 Raymond James Michael Rose Jan. 26, 2017 Outperform 2 $28.00 $1.30 $1.60 Financial Inc. 312-655-2940

Investor Contacts Ernie Pinner John Corbett Executive Chairman President & Chief Executive Officer esp@centerstatebank.com jcorbett@centerstatebank.com Steve Young Jennifer Idell Chief Operating Officer Chief Financial Officer syoung@centerstatebank.com jidell@centerstatebank.com