Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - APARTMENT INVESTMENT & MANAGEMENT CO | q42016er-ssxex991.htm |

| 8-K - 8-K - APARTMENT INVESTMENT & MANAGEMENT CO | a8-kq42016earningsrelease.htm |

1

2017 OUTLOOK & 2018 FORECAST

FEBRUARY 2017

2

INTRODUCTION

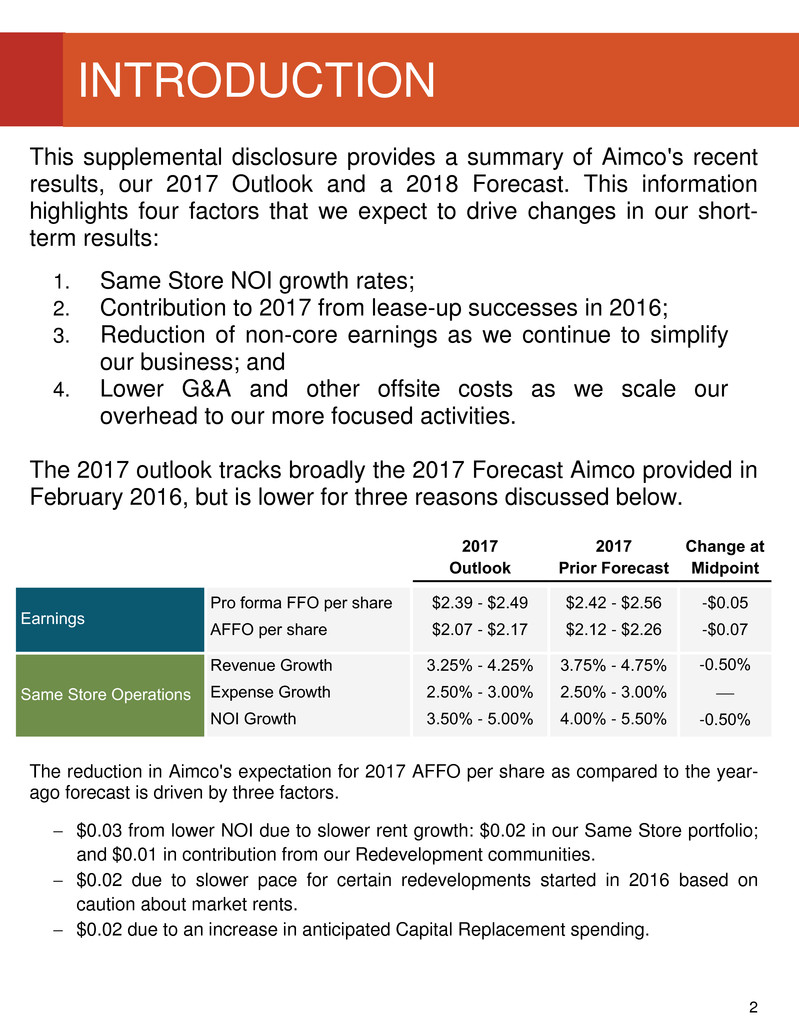

This supplemental disclosure provides a summary of Aimco's recent

results, our 2017 Outlook and a 2018 Forecast. This information

highlights four factors that we expect to drive changes in our short-

term results:

1. Same Store NOI growth rates;

2. Contribution to 2017 from lease-up successes in 2016;

3. Reduction of non-core earnings as we continue to simplify

our business; and

4. Lower G&A and other offsite costs as we scale our

overhead to our more focused activities.

The 2017 outlook tracks broadly the 2017 Forecast Aimco provided in

February 2016, but is lower for three reasons discussed below.

2017

Outlook

2017

Prior Forecast

Change at

Midpoint

Earnings

Pro forma FFO per share

AFFO per share

$2.39 - $2.49

$2.07 - $2.17

$2.42 - $2.56

$2.12 - $2.26

-$0.05

-$0.07

Same Store Operations

Revenue Growth

Expense Growth

NOI Growth

3.25% - 4.25%

2.50% - 3.00%

3.50% - 5.00%

3.75% - 4.75%

2.50% - 3.00%

4.00% - 5.50%

-0.50%

-0.50%

The reduction in Aimco's expectation for 2017 AFFO per share as compared to the year-

ago forecast is driven by three factors.

$0.03 from lower NOI due to slower rent growth: $0.02 in our Same Store portfolio;

and $0.01 in contribution from our Redevelopment communities.

$0.02 due to slower pace for certain redevelopments started in 2016 based on

caution about market rents.

$0.02 due to an increase in anticipated Capital Replacement spending.

3

TABLE OF CONTENTS

Page

2016 Highlights 4

Strategic Areas of Focus 5

Property Operations 6

Redevelopment & Development 8

Portfolio Management 9

Balance Sheet Management 10

Summary Expectations for 2017 & 2018 11

4

2016 HIGHLIGHTS

* Economic Income represents the annual change in NAV per share plus cash dividends per share. The annual change

in NAV per share is computed based on Aimco's 3Q 2016 NAV.

Economic Income: $7 per share*

15% Return on Net Asset Value (NAV)

NAV per share up 12% to $52 Cash dividends per share up 12% to $1.32

Same Store NOI

6.2%

Redevelopments &

Lease-Ups:

value creation of

$270M from

stabilization of

redevelopments and

lease-up activities

Portfolio Quality

increasing; average

revenue per

apartment home

8% to $1,978

Leverage 0.1x;

$1.6B

unencumbered

pool; largely

unused $600M line

of credit

AFFO per share

5% to $1.97

Recognized as a "Top Place to Work" for the fourth year in a row

5

STRATEGIC AREAS OF FOCUS

EXCELLENCE IN

PROPERTY OPERATIONS

MAINTAIN A SAFE, FLEXIBLE BALANCE SHEET

WITH ABUNDANT LIQUIDITY

ADD VALUE THROUGH REDEVELOPMENT AND

LIMITED DEVELOPMENT

OPERATE A SIMPLE BUSINESS AND

FOSTER A PERFORMANCE CULTURE

UPGRADE PORTFOLIO THROUGH DISCIPLINED

PORTFOLIO MANAGEMENT

6

PROPERTY OPERATIONS

STRATEGIC OBJECTIVE: Produce above-average operating results through focus on

customer satisfaction, resident retention and superior cost control.

LOOKING BACK: Aimco NOI 17% over the past three years

LOOKING FORWARD: Aimco expects Same Store NOI growth above trend due to solid

consumer demand for apartments and our continued focus on cost control.

Our 2017 Outlook projects lower revenue growth than in our prior forecast, which forecast included

assumptions about market rent growth based on the weighted average of submarket growth rates

projected by REIS and AXIOMetrics at the time. Aimco's current outlook for 2017 rent growth is based

on the earn-in of Aimco's 2016 leasing activities and our projections for 2017 weighted average rent

increases.

Our 2018 forecast assumes:

Renewal rents increase at 4.5% and New Lease rents increase at 3.0%, the weighted average

of submarket growth rates projected by REIS and AXIOMetrics.

Operating expenses increase at a market-weighted inflation rate as projected by Moody's

Economy.com, reduced by 15 basis points due to Aimco operating efficiency and innovation

initiatives.

4.5%

2.3%

5.5%

4.5%

2.1%

5.6%

4.7%

1.4%

6.2%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

Revenue Expense NOI

Same Store Growth Rates

2014 2015 2016

3.75%

2.75%

4.25%

Low 3.75%

Low 2.50%

Low 4.00%

High 4.75%

High 3.00%

High 5.50%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

Revenue Expense NOI

Projected Same Store Growth Rates

2017 Outlook 2017 Prior Forecast

3.75%

2.75%

4.25%

Low 3.25%

Low 2.50%

Low 3.50%

High 4.25%

High 3.00%

High 5.00%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

Revenue Expense NOI

Project d Same Store Growth Rates

2017 Outlook 2018 Forecast

7

PROPERTY OPERATIONS

Lease-Up Communities - During 2016, Aimco completed the lease-up of Vivo, located in

Cambridge, MA, ahead of plan and significantly outperformed our expectations for the

lease-up of One Canal, located in Boston, MA, and Indigo located in Redwood City, CA.

% Apt. Homes Occupied

Year-End 2016

Stabilized

Occupancy Stabilized NOI

Total Apt.

Homes

2016

Outlook

2016

Actual

2016

Outlook

2017

Outlook

2016

Outlook

2017

Outlook

ONE CANAL,

BOSTON

310 65% 86% 3Q 2017 1Q 2017 4Q 2018 2Q 2018

INDIGO,

BAY AREA

463 40% 77% 3Q 2017 2Q 2017 4Q 2018 3Q 2018

With the accelerated leasing pace and rental rate achievement consistent with

underwriting, the projected contribution to 2017 NOI from these lease-up communities is

$0.13 per share, $0.01 per share greater than we had forecast one year ago.

8

REDEVELOPMENT & DEVELOPMENT

STRATEGIC OBJECTIVES: Add value by repositioning communities in special locations

with expected higher rates of revenue growth and some protection against competitive

new supply. Invest selectively through development in desirable locations where accretive

redevelopment or acquisition opportunities are not readily available.

LOOKING BACK: During the last three years, Aimco completed seven redevelopments

located in high-quality locations in: the Bay Area; La Jolla, CA; west Los Angeles;

downtown Seattle; and suburban Chicago, all of which had reached NOI stabilization as

of December 31, 2016. In total, these redevelopments added value of $298M, an amount

equal to 40% of Aimco's investment.

NOI

Stabilized

Properties

PROJECT SCOPE

Redevelopment projects 7

Net investment $750M

Apartment homes redeveloped 1,349

VALUE CREATION

Redevelopment value creation ($M) (1) $298M

As a % of investment (2) 40%

(1) Based on stabilized GAV as computed by Aimco as of the quarter of NOI stabilization.

(2) During 2008, Aimco recognized impairment losses on two of its redevelopment properties totaling approximately $91M. These impairments are

included in the net investment amount in this table.

LOOKING FORWARD: Aimco expects over the next two years to invest $200M - $450M

in redevelopment and development and to create value equal to 25% to 35% of its

investment. Aimco redevelopment and development activities during 2017 are focused on:

Completion of the six multi-phase redevelopments under construction at year-

end 2016;

Subject to favorable economic conditions, potentially starting additional

redevelopments including the fourth and final tower at Park Towne Place and

three to five new projects; and

Continuing to plan 2018 starts to backfill our redevelopment pipeline.

9

PORTFOLIO MANAGEMENT

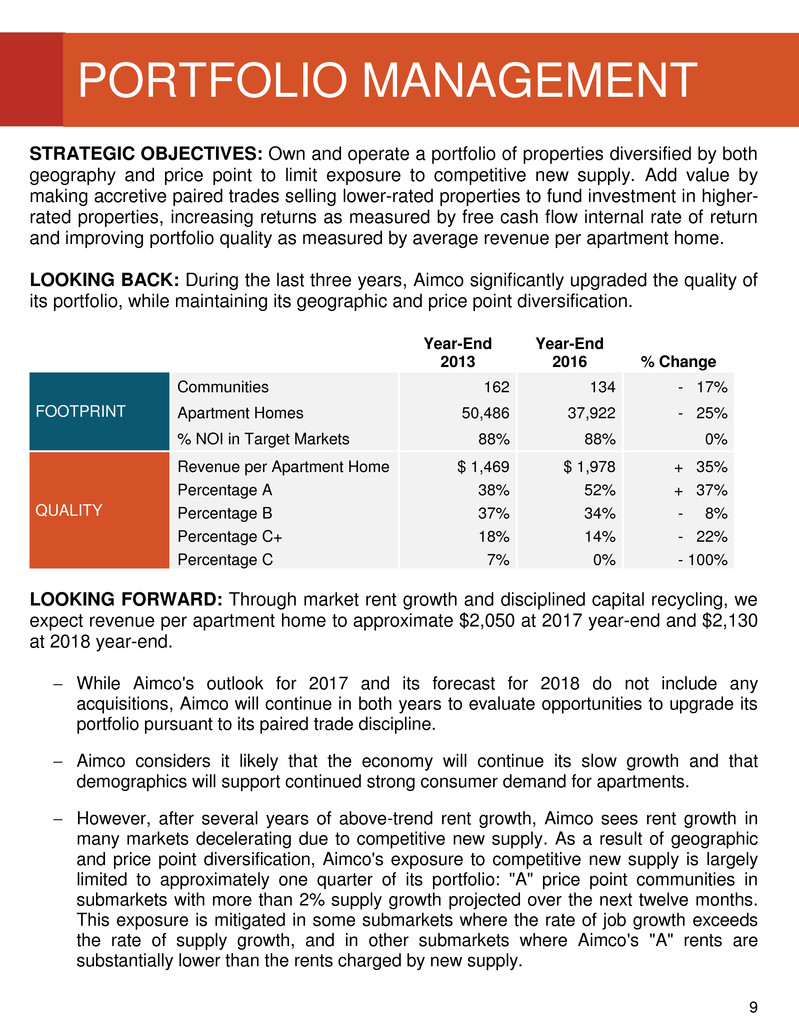

STRATEGIC OBJECTIVES: Own and operate a portfolio of properties diversified by both

geography and price point to limit exposure to competitive new supply. Add value by

making accretive paired trades selling lower-rated properties to fund investment in higher-

rated properties, increasing returns as measured by free cash flow internal rate of return

and improving portfolio quality as measured by average revenue per apartment home.

LOOKING BACK: During the last three years, Aimco significantly upgraded the quality of

its portfolio, while maintaining its geographic and price point diversification.

Year-End

2013

Year-End

2016 % Change

FOOTPRINT

Communities

Apartment Homes

% NOI in Target Markets

162

50,486

88%

134

37,922

88%

- 17%

- 25%

0%

QUALITY

Revenue per Apartment Home

Percentage A

Percentage B

Percentage C+

Percentage C

$ 1,469

38%

37%

18%

7%

$ 1,978

52%

34%

14%

0%

+ 35%

+ 37%

- 8%

- 22%

- 100%

LOOKING FORWARD: Through market rent growth and disciplined capital recycling, we

expect revenue per apartment home to approximate $2,050 at 2017 year-end and $2,130

at 2018 year-end.

While Aimco's outlook for 2017 and its forecast for 2018 do not include any

acquisitions, Aimco will continue in both years to evaluate opportunities to upgrade its

portfolio pursuant to its paired trade discipline.

Aimco considers it likely that the economy will continue its slow growth and that

demographics will support continued strong consumer demand for apartments.

However, after several years of above-trend rent growth, Aimco sees rent growth in

many markets decelerating due to competitive new supply. As a result of geographic

and price point diversification, Aimco's exposure to competitive new supply is largely

limited to approximately one quarter of its portfolio: "A" price point communities in

submarkets with more than 2% supply growth projected over the next twelve months.

This exposure is mitigated in some submarkets where the rate of job growth exceeds

the rate of supply growth, and in other submarkets where Aimco's "A" rents are

substantially lower than the rents charged by new supply.

10

BALANCE SHEET MANAGEMENT

STRATEGIC OBJECTIVE: Maintain a safe, flexible balance sheet with abundant liquidity,

rated "investment grade" by both S&P and Fitch, with the capacity to take advantage of

opportunities created by a future real estate down-cycle.

LOOKING BACK: During the last three years, Aimco has reduced leverage and added

financial flexibility by creating an unencumbered pool of assets.

Year-End

2013

Year-End

2016

%

Change

DEBT TO EBITDA 7.1x 6.3x - 11%

DEBT AND PREFERRED EQUITY TO EBITDA 7.3x 6.7x - 8%

VALUE OF UNENCUMBERED ASSETS $0.4B $1.6B +300%

LOOKING FORWARD: We expect the quantum of leverage to remain fairly constant. We

expect our leverage ratios will improve due to NOI growth in our Same Store portfolio and

the earn-in from stabilization of redevelopments and lease-up communities.

Year-End

2016

Year-End

2018

Forecast

%

Change

DEBT TO EBITDA 6.3x ~ 5.8x - 8%

DEBT AND PREFERRED EQUITY TO EBITDA 6.7x ~ 6.2x - 7%

VALUE OF UNENCUMBERED ASSETS $1.6B $1.9B + 19%

Exposure to interest rates - Aimco has limited near-term exposure to changes in interest

rates due to the long duration and fixed rates of its leverage. A 100 basis point change in

the 10-year treasury rate leading to an equal change in Aimco borrowing rates would

change, plus or minus, forecasted 2017 and 2018 AFFO per share by $0.01 and $0.04,

respectively.

Exposure to capital markets - Aimco's operating, investing and financing activities have

limited exposure to capital markets.

Aimco's business plans for 2017 and 2018 are fully funded by (i) continuing

operations, (ii) refinancing $416M of maturing property debt over the next two years

at LTVs lower than 50%, and (iii) selling $385M - $465M in properties over the next

two years.

Aimco's business plans do not contemplate equity issuance.

11

SUMMARY EXPECTATIONS

2017 Outlook and 2018 Forecast

The information in this "2017 Outlook and 2018 Forecast" document contains forward-looking statements

within the meaning of the federal securities laws, which statements are based on management's

judgment as of this date. This information includes certain risks and uncertainties and will be affected by

a variety of factors, some of which are beyond Aimco's control. Additional information regarding risks and

uncertainties that may affect future results may be found on page 14 herein. Please see pages 6 to 8 of

Aimco's Fourth Quarter 2016 Earnings Release for additional information regarding Aimco's 2017

Outlook.

Our 2017 Outlook and 2018 Forecast reflect continuation of the strategy we have executed over the last

several years. This strategy focuses on excellence in property operations; value creation through

redevelopment and occasional development; portfolio management based on a disciplined approach to

capital recycling and simplification of the business; a safe, flexible balance sheet with abundant liquidity;

and a simple business model executed by a performance-oriented and collaborative team.

Consistent execution of that strategy has produced:

Improved operating results;

An improved portfolio;

A simpler business with higher quality earnings;

Safer leverage;

Reduced offsite costs; and

Increased AFFO per share, cash dividends per share and NAV per share.

Our outlook for 2017 and forecast for 2018 reflect continued progress on each of these fronts.

12

SUMMARY EXPECTATIONS

($ Amounts represent Aimco Share)

2016

ACTUAL

2017

OUTLOOK

2018

FORECAST

Net Income $2.67 $0.38 - $0.48 $0.48 - $0.62

Pro forma FFO per share $2.32 $2.39 - $2.49 $2.50 - $2.64

AFFO per share $1.97 $2.07 - $2.17 $2.17 - $2.31

Select Components of FFO

Conventional Same Store Operating Measures

Revenue change compared to prior year 4.7% 3.25% - 4.25% 3.25% - 4.25%

Expense change compared to prior year 1.4% 2.50% - 3.00% 2.50% - 3.00%

NOI change compared to prior year 6.2% 3.50% - 5.00% 3.50% - 5.00%

Non-Core Earnings

Amortization of deferred tax credit income

(1)

$18M $11M $6M

Non-recurring investment management revenues

(2)

$5M $0M $0M

Historic Tax Credit benefits

(3)

$14M $4M - $5M $0 - $4M

Other tax benefits, net $12M $15M - $17M $10M - $12M

Total Non-Core Earnings $49M $30M - $33M $16M - $22M

Offsite Costs

Property management expenses $25M $23M $22M - $23M

General and administrative expenses $45M $43M $42M - $43M

Investment management expenses $4M $4M $4M

Total Offsite Costs $74M $70M $68M - $70M

Capital Investments

Redevelopment and development $183M $100M - $200M $100M - $250M

Property upgrades $75M $70M - $90M $70M - $90M

Transactions

Property dispositions $529M $160M - $190M $225M - $275M

Property acquisitions

(4)

$320M $0M $0M

Portfolio Quality

Fourth quarter Conventional Property average revenue per apartment home $1,978 ~$2,050 ~$2,130

Balance Sheet

Debt to Trailing-Twelve-Month EBITDA 6.3x ~6.1x ~5.8x

Debt and Preferred Equity to Trailing-Twelve-Month EBITDA 6.7x ~6.5x ~6.2x

Value of unencumbered properties

(5)

~$1.6B ~$1.9B ~$1.9B

Note: Financial information included in Aimco's 2017 Outlook and 2018 Forecast has been prepared based on Generally

Accepted Accounting Principles in effect as of 2017. Such information does not incorporate the effect of Aimco's anticipated

2018 adoption of revenue recognition and lease accounting pronouncements. Aimco is currently evaluating the effect of the

adoption of these standards, but does not expect there to be a material effect to AFFO.

13

SUMMARY EXPECTATIONS

Notes:

(1) Amortization of deferred tax credit income includes: current period recognition of cash received in

prior periods required by GAAP to be deferred at the time of receipt and recognized in future

periods; and approximately $5M per year of income received in cash in the current period. As our

Low Income Housing Tax Credit arrangements expire, and we ultimately exit the business,

recognition of tax credit income will continue to decline.

(2) Non-recurring investment management revenues represent fees earned by Aimco in connection

with certain financing and disposition activities, which fees are paid to Aimco in cash. Over the last

many years, we have simplified our business and eliminated substantially all of the real estate

partnership arrangements that gave rise to these non-recurring fees.

(3) Historic Tax Credit benefits are realized in connection with our redevelopment of officially

designated historic apartment communities. As those redevelopments are completed, such

benefits are no longer available.

(4) While Aimco's outlook for 2017 and forecast for 2018 do not include any acquisitions, Aimco will

continue in both years to evaluate opportunities to upgrade its portfolio pursuant to its paired trade

discipline.

(5) Represents Aimco's estimate of the value of unencumbered properties at period-end, assuming

constant capitalization rates.

Glossary & Reconciliations of Non-GAAP Financial and Operating Measures

Financial and operating measures discussed in this document include certain financial measures used by

Aimco management, some of which are measures not defined under accounting principles generally

accepted in the United States, or GAAP. These measures are defined in the Glossary and

Reconciliations of Non-GAAP Financial and Operating Measures included in Aimco's Fourth Quarter

2016 Earnings Release dated February 2, 2017. Where appropriate, the non-GAAP financial measures

for Aimco's 2016 results and 2017 Outlook included within this document have been reconciled to the

most comparable GAAP measures within Aimco's Fourth Quarter 2016 Earnings Release referenced

above. For additional information regarding Aimco's NAV and the valuation methodology used to

estimate NAV, please refer to Aimco's Net Asset Value Presentation as of September 30, 2016,

published on November 15, 2016 and can be found on Aimco's website.

14

FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the federal securities laws,

including, without limitation, statements regarding projected results and specifically forecasts of first full year

2017 and 2018 results, including but not limited to: Pro forma FFO and selected components thereof; AFFO;

Aimco redevelopment and development investments, timelines and Net Operating Income contribution;

expectations regarding sales of Aimco apartment communities and the use of proceeds thereof; and Aimco

liquidity and leverage metrics.

These forward-looking statements are based on management's judgment as of this date, which is subject to

risks and uncertainties. Risks and uncertainties include, but are not limited to: Aimco's ability to maintain

current or meet projected occupancy, rental rate and property operating results; the effect of acquisitions,

dispositions, redevelopments and developments; Aimco's ability to meet budgeted costs and timelines, and

achieve budgeted rental rates related to Aimco redevelopments and developments; and Aimco's ability to

comply with debt covenants, including financial coverage ratios.

Actual results may differ materially from those described in these forward-looking statements and, in addition,

will be affected by a variety of risks and factors, some of which are beyond Aimco's control, including, without

limitation:

• Real estate and operating risks, including fluctuations in real estate values and the general

economic climate in the markets in which Aimco operates and competition for residents in

such markets; national and local economic conditions, including the pace of job growth and the

level of unemployment; the amount, location and quality of competitive new housing supply;

the timing of acquisitions, dispositions, redevelopments and developments; and changes in

operating costs, including energy costs;

• Financing risks, including the availability and cost of capital markets' financing; the risk that

cash flows from operations may be insufficient to meet required payments of principal and

interest; and the risk that earnings may not be sufficient to maintain compliance with debt

covenants;

• Insurance risks, including the cost of insurance, and natural disasters and severe weather

such as hurricanes; and

• Legal and regulatory risks, including costs associated with prosecuting or defending claims

and any adverse outcomes; the terms of governmental regulations that affect Aimco and

interpretations of those regulations; and possible environmental liabilities, including costs,

fines or penalties that may be incurred due to necessary remediation of contamination of

apartment communities presently or previously owned by Aimco.

• In addition, Aimco's current and continuing qualification as a real estate investment trust

involves the application of highly technical and complex provisions of the Internal Revenue

Code and depends on Aimco's ability to meet the various requirements imposed by the

Internal Revenue Code, through actual operating results, distribution levels and diversity of

stock ownership.

Readers should carefully review Aimco's financial statements and the notes thereto, as well as the section

entitled "Risk Factors" in Item 1A of Aimco's Annual Report on Form 10-K for the year ended December 31,

2015, and the other documents Aimco files from time to time with the Securities and Exchange Commission.

These forward-looking statements reflect management's judgment as of this date, and Aimco assumes no

obligation to revise or update them to reflect future events or circumstances. This press release does not

constitute an offer of securities for sale.