Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVADEL PHARMACEUTICALS PLC | form8-kcover_presentation.htm |

Avadel Pharmaceuticals plc

January 2017

Corporate Presentation

2January 2017

Safe Harbor

This presentation may include "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements herein that are not clearly historical in nature are forward-looking, and the words

"anticipate," "assume," "believe," "expect," "estimate," "plan," "will," "may," and the negative of these and similar

expressions generally identify forward-looking statements. All forward-looking statements involve risks, uncertainties

and contingencies, many of which are beyond Flamel's control and could cause actual results to differ materially from

the results contemplated in such forward-looking statements. These risks, uncertainties and contingencies include the

risks relating to: our dependence on a small number of products and customers for the majority of our revenues; the

possibility that our Bloxiverz®, Vazculep® and Akovaz™ products, which are not patent protected, could face substantial

competition resulting in a loss of market share or forcing us to reduce the prices we charge for those products; the

possibility that we could fail to successfully complete the research and development for the pipeline product we are

evaluating for potential application to the FDA pursuant to our "unapproved-to-approved" strategy, or that competitors

could complete the development of such product and apply for FDA approval of such product before us; our

dependence on the performance of third parties in partnerships or strategic alliances for the commercialization of some

of our products; the possibility that our products may not reach the commercial market or gain market acceptance; our

need to invest substantial sums in research and development in order to remain competitive; our dependence on

certain single providers for development of several of our drug delivery platforms and products; our dependence on a

limited number of suppliers to manufacture our products and to deliver certain raw materials used in our products; the

possibility that our competitors may develop and market technologies or products that are more effective or safer than

ours, or obtain regulatory approval and market such technologies or products before we do; the challenges in

protecting the intellectual property underlying our drug delivery platforms and other products; our dependence on key

personnel to execute our business plan; the amount of additional costs we will incur to comply with U.S. securities laws

as a result of our ceasing to qualify as a foreign private issuer; and the other risks, uncertainties and contingencies

described in the Company's filings with the U.S. Securities and Exchange Commission, including our annual report on

Form 10-K for the year ended December 31, 2015, all of which filings are also available on the Company's website.

Flamel undertakes no obligation to update its forward-looking statements as a result of new information, future events

or otherwise, except as required by law.

3January 2017

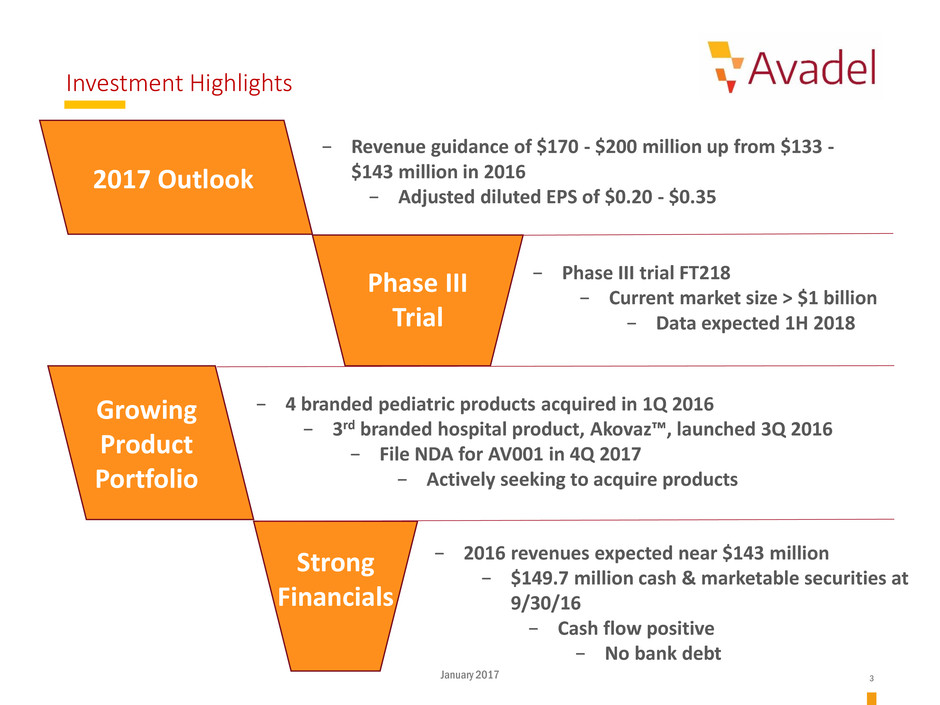

Investment Highlights

Phase III

Trial

Growing

Product

Portfolio

2017 Outlook

− 2016 revenues expected near $143 million

− $149.7 million cash & marketable securities at

9/30/16

− Cash flow positive

− No bank debt

− Phase III trial FT218

− Current market size > $1 billion

− Data expected 1H 2018

− 4 branded pediatric products acquired in 1Q 2016

− 3rd branded hospital product, Akovaz™, launched 3Q 2016

− File NDA for AV001 in 4Q 2017

− Actively seeking to acquire products

− Revenue guidance of $170 - $200 million up from $133 -

$143 million in 2016

− Adjusted diluted EPS of $0.20 - $0.35

Strong

Financials

4January 2017

Corporate Transformation

− Established in 1990 to

provide life cycle solutions

to large pharma using its

polymer-based drug

delivery technology

− Coreg CR® using

Micropump® received FDA

approval (GSK partnered

product)

− Acquired Éclat

Pharmaceuticals and

transitions to specialty

pharma model

− FDA approval for

Boxiverz®

− FDA approval for

Vazculep®

− Moved IP to Irish

subsidiary

− FDA approval for

Akovaz™

− Acquired FSC Pediatrics

− Phase III Trial for FT218

initiated

− Reincorporated in

Ireland

− Avadel established

5January 2017

Management Team

Michael Anderson

Chief Executive Officer

• Appointed CEO in 2012

• Former CEO of Éclat

Pharmaceuticals

• Former President & CEO of

generics business at KV

Pharmaceutical Company

• Former President & CEO of

Ther-Rx

Michael Kanan

SVP, Chief Financial Officer

• Appointed in 2015

• Former VP, Finance,

Corporate Controller & Chief

Accounting Officer at Sigma

Aldrich

• Various finance leadership

roles Meritor

Gregory Divis

EVP, Chief Commercial Officer

• Appointed CCO in January

2017

• Former President & CEO of

Lumara Health

• VP, Business Development

& Lifecycle Management at

Sanofi-Aventis

• VP & General Manager, UK

and Ireland, for Schering-

Plough

Phil Thompson

SVP, General Counsel

• Appointed in 2013

• VP, Legal Affairs at West-

Ward Pharmaceutical Corp

• VP, General Counsel for

Paddock Laboratories

• VP, Strategic Business

Transactions & Assistant

General Counsel at KV

Pharmaceutical Co.

Sandy Hatten

SVP, Quality & Regulatory

• Appointed in 2015

• Former SVP, Quality &

Regulatory Compliance at

Mallinckrodt plc

• VP, Quality Assurance at KV

Pharmaceutical Co

• Director, Quality Assurance

at Perrigo

Dhiren D’Silva

SVP, Irish & European Operations

• Appointed in 2015

• Former Sr. Director of

International Business Operations

at NPS Pharmaceuticals, Inc.

• Served as Director of Business

Development for Product

Ventures Group at Catalent

Pharma

David Monteith

VP, Research & Development

• Appointed in 2014

• Former AVP, Pharmaceutical

Development for Emerging

Markets at Merck & Co

• Worked at Schering-Plough

in various positions from Ass.

Director, Pharmaceutical

Development to Sr. Director,

Product Value Enhancement

Gregg Davis

VP, Business Development

• Appointed in 2015

• Previously co-founder & CBO

of Flag Therapeutics, Inc.

• Former VP, Corporate

Development of Patheon

• Former Director, Worldwide

Business Development at

GlaxoSmithKline.

6January 2017

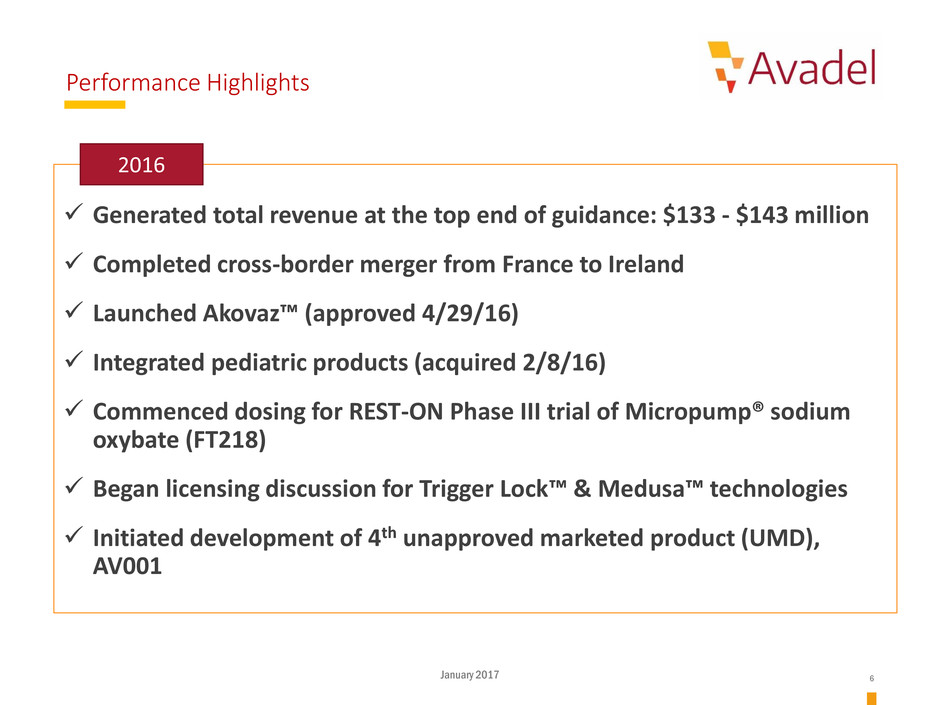

Performance Highlights

Generated total revenue at the top end of guidance: $133 - $143 million

Completed cross-border merger from France to Ireland

Launched Akovaz™ (approved 4/29/16)

Integrated pediatric products (acquired 2/8/16)

Commenced dosing for REST-ON Phase III trial of Micropump® sodium

oxybate (FT218)

Began licensing discussion for Trigger Lock™ & Medusa™ technologies

Initiated development of 4th unapproved marketed product (UMD),

AV001

2016

7January 2017

Pipeline

Completed feasibility and PK studies for both Medusa™ exenatide and Trigger Lock™

hydromorphone, and actively seeking to out license or divest these platforms*

(AV001)

* Please see our appendix for more details on these technologies

OTC

8January 2017

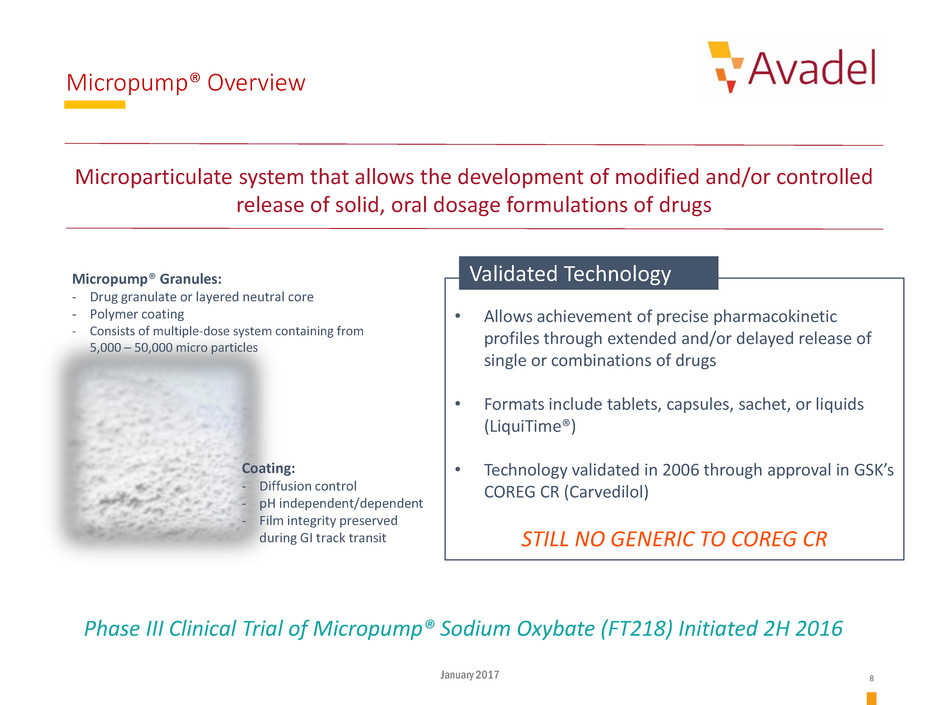

Micropump® Overview

Micropump® Granules:

- Drug granulate or layered neutral core

- Polymer coating

- Consists of multiple-dose system containing from

5,000 – 50,000 micro particles

Coating:

- Diffusion control

- pH independent/dependent

- Film integrity preserved --

during GI track transit

• Allows achievement of precise pharmacokinetic

profiles through extended and/or delayed release of

single or combinations of drugs

• Formats include tablets, capsules, sachet, or liquids

(LiquiTime®)

• Technology validated in 2006 through approval in GSK’s

COREG CR (Carvedilol)

STILL NO GENERIC TO COREG CR

Microparticulate system that allows the development of modified and/or controlled

release of solid, oral dosage formulations of drugs

Validated Technology

Phase III Clinical Trial of Micropump® Sodium Oxybate (FT218) Initiated 2H 2016

9January 2017

LiquiTime® Overview

• Intended for development of modified/controlled release liquid

formulations for patients having issues swallowing

tablets/capsules

• Not limited to working solely with ionic drugs as with resin-

complex based technologies

• Easy-to-swallow, good mouthfeel, taste-masked and dosing

flexibility

Potential Advantages

Out licensed rights to Perrigo for OTC cough / cold products, and internally conducting

feasibility assessment on a number of Rx products

10January 2017

Narcolepsy Overview

A sleep disorder, involving irregular patterns in Rapid Eye Movement (REM) sleep and

significant disruptions of the normal sleep/wake cycle

- Only 25% of people

with narcolepsy have

been diagnosed and are

receiving treatment*

- Sodium oxybate (Xyrem®)

dosed 2x / night – totaling 9g -

only drug indicated for BOTH

EDS and Cataplexy***

- Xyrem® expected to

generate between $1.1 -

$1.125 billion in revenue in

2016**

~

- ~12,800 of diagnosed

patients treated with sodium

oxybate**

*Narcolepsy Network foundation http://narcolepsynetwork.org/about-narcolepsy/

**Jazz Pharmaceuticals plc 3Q2016 Earnings Conference Call

*** Xyrem prescribing information

- Estimated ~ 200,000

Americans suffer from

Narcolepsy*

- Prevalent symptoms

include Excessive

Daytime Sleepiness

(EDS) and Cataplexy*

11January 2017

FT218: Potential for Improved Treatment

FT218: Once-nightly formulation of sodium oxybate utilizing Avadel’s proprietary

extended-release Micropump® micro/nano particle technology for oral suspension

Studied in 40 healthy volunteers:

Comparable AUC as Xyrem® on dose-

for-dose basis

Similar onset of action to Xyrem®

Similar blood levels at hrs 7-8

Slightly lower C-max

FT218 potential to provide:

• One single dose at bedtime

• Possible reduction of sleep

disruption

• Potential for additional benefits,

including improved safety

Goal: Provide 7-8 hours of restful sleep and effective relief of EDS and Cataplexy with a

single dose of medication

12January 2017

Double-Blind, Randomized, Placebo-Controlled, Study to Assess

Safety and Efficacy of Once Nightly Sodium Oxybate (FT218) for

the Treatment of Excessive Daytime Sleepiness (EDS) and

Cataplexy in Patients with Narcolepsy

REST-ON Phase III

Clinical Trial

13January 2017

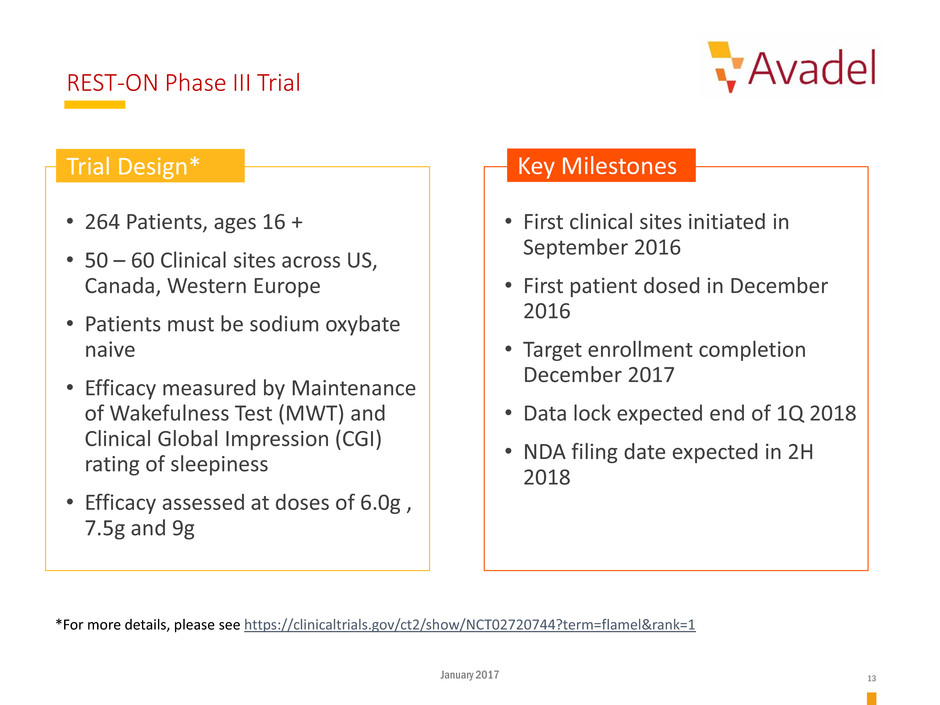

REST-ON Phase III Trial

• 264 Patients, ages 16 +

• 50 – 60 Clinical sites across US,

Canada, Western Europe

• Patients must be sodium oxybate

naive

• Efficacy measured by Maintenance

of Wakefulness Test (MWT) and

Clinical Global Impression (CGI)

rating of sleepiness

• Efficacy assessed at doses of 6.0g ,

7.5g and 9g

• First clinical sites initiated in

September 2016

• First patient dosed in December

2016

• Target enrollment completion

December 2017

• Data lock expected end of 1Q 2018

• NDA filing date expected in 2H

2018

Trial Design* Key Milestones

*For more details, please see https://clinicaltrials.gov/ct2/show/NCT02720744?term=flamel&rank=1

14January 2017

Current Product Portfolio

Hospital Products Pediatric Products

15January 2017

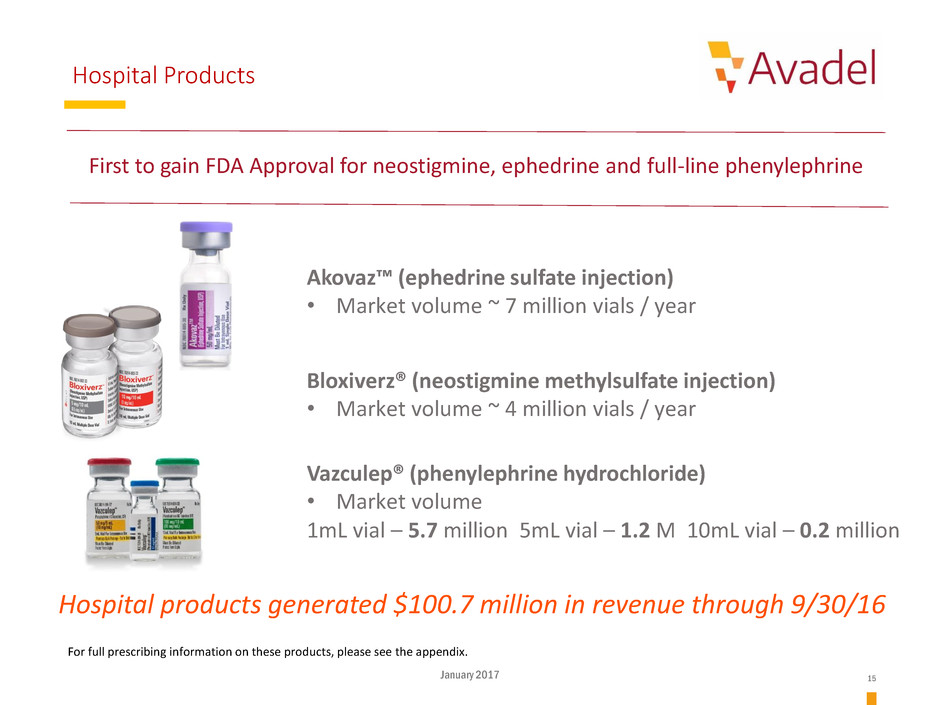

Hospital Products

Akovaz™ (ephedrine sulfate injection)

• Market volume ~ 7 million vials / year

Bloxiverz® (neostigmine methylsulfate injection)

• Market volume ~ 4 million vials / year

Vazculep® (phenylephrine hydrochloride)

• Market volume

1mL vial – 5.7 million 5mL vial – 1.2 M 10mL vial – 0.2 million

Hospital products generated $100.7 million in revenue through 9/30/16

First to gain FDA Approval for neostigmine, ephedrine and full-line phenylephrine

For full prescribing information on these products, please see the appendix.

16January 2017

Pediatrics

• Acquired 3 commercial stage pediatric-focused

products (February 2016)

• Flexichamber® launch planned for the end of 1Q

2017

• Actively seeking to acquire additional products to fold

into sales force

For full prescribing information on these products, please see the appendix.

17January 2017

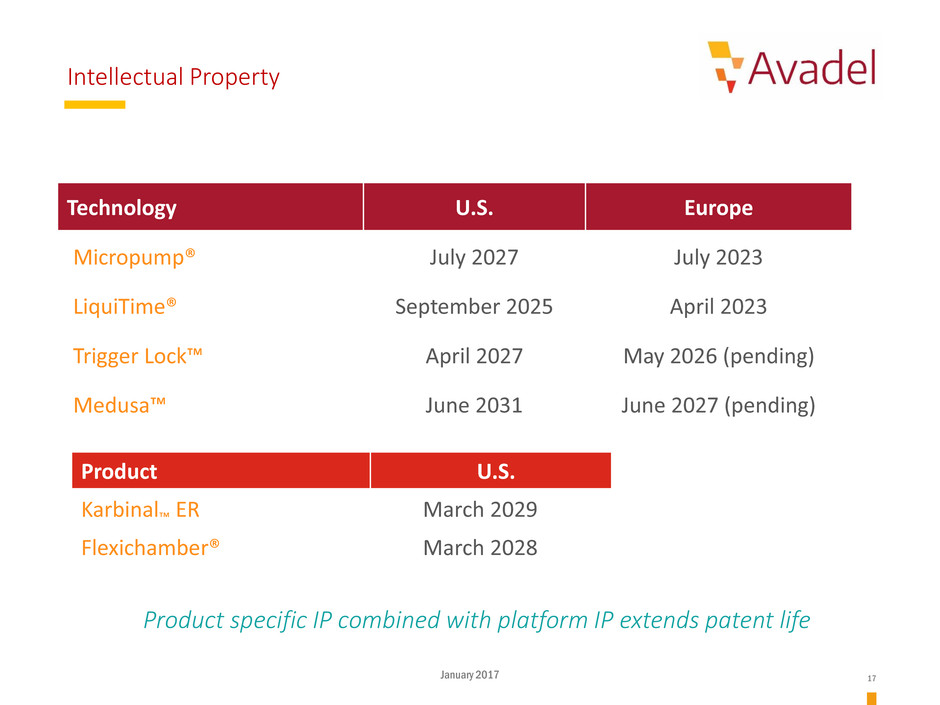

Intellectual Property

Technology U.S. Europe

Micropump® July 2027 July 2023

LiquiTime® September 2025 April 2023

Trigger Lock™ April 2027 May 2026 (pending)

Medusa™ June 2031 June 2027 (pending)

Product U.S.

Karbinal™ ER March 2029

Flexichamber® March 2028

Product specific IP combined with platform IP extends patent life

18January 2017

Non GAAP Financial Results

*Reconciliations from GAAP to Non-GAAP can be found in the appendix

2016 2015

Total revenue 107,161 128,441 (21,280)

-

Cost of products and services sold (3rd Party) 9,132 8,473 659

Intercompany cost of products sold - - -

Cost of products and services sold 9,132 8,473 659

Research and development expenses 21,135 20,447 688

Selling, general and administrative expenses 33,491 14,904 18,587

Intangible asset amortization - - -

Changes in fair value of related party contingent consideration 19,321 23,923 (4,602)

Loss on early repayment of related party acquisition-related note - - -

Total operating expenses 83,079 67,747 15,332

-

Operating income (loss) 24,082 60,694 (36,612)

-

Interest & Other Expense (net) (2,240) (2,120) -

Income (loss) before income taxes 21,842 58,574 (36,732)

-

Income tax provision 24,485 27,604 (3,119)

-

Net Loss (2,643)$ 30,971$ (33,613)$

0

Net loss per share - Diluted (0.06)$ 0.77$ (0.83)$

Difference

Year/Year

Nine months ended September 30,

(in $000s)

19January 2017

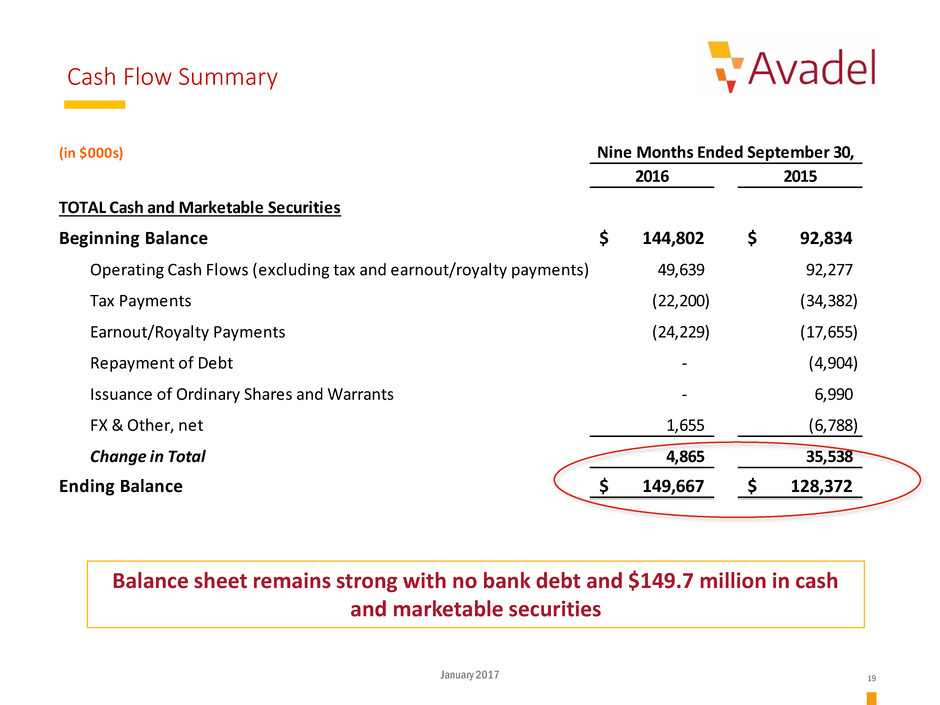

Cash Flow Summary

(in $000s)

2016 2015

TOTAL Cash and Marketable Securities

Beginning Balance 144,802$ 92,834$

Operating Cash Flows (excluding tax and earnout/royalty payments) 49,639 92,277

Tax Payments (22,200) (34,382)

Earnout/Royalty Payments (24,229) (17,655)

Repayment of Debt - (4,904)

Issuance of Ordinary Shares and Warrants - 6,990

FX & Other, net 1,655 (6,788)

Change in Total 4,865 35,538

Ending Balance 149,667$ 128,372$

Nine Months Ended September 30,

Balance sheet remains strong with no bank debt and $149.7 million in cash

and marketable securities

20January 2017

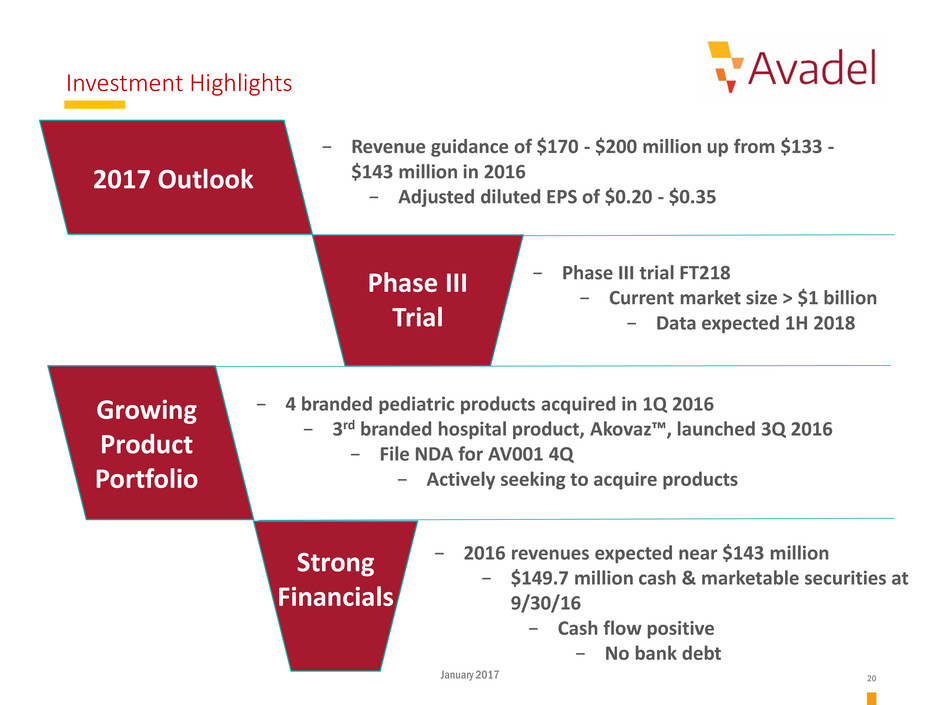

Investment Highlights

Phase III

Trial

Growing

Product

Portfolio

2017 Outlook

− 2016 revenues expected near $143 million

− $149.7 million cash & marketable securities at

9/30/16

− Cash flow positive

− No bank debt

− Phase III trial FT218

− Current market size > $1 billion

− Data expected 1H 2018

− 4 branded pediatric products acquired in 1Q 2016

− 3rd branded hospital product, Akovaz™, launched 3Q 2016

− File NDA for AV001 4Q

− Actively seeking to acquire products

− Revenue guidance of $170 - $200 million up from $133 -

$143 million in 2016

− Adjusted diluted EPS of $0.20 - $0.35

Strong

Financials

January 2017 21

Appendix

22January 2017

GAAP to Non-GAAP Adjustments

Nine Months Ended September 30, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent related

party payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 104,858$ -$ -$ -$ -$ -$ -$ 104,858$

License and research revenue 2,303 - - - - - - 2,303

Total revenue 107,161 - - - - - - 107,161

Cost of products and services sold (3rd Party) 10,657 - - (1,525) - - (1,525) 9,132

Intercompany cost of products sold - - - - - - - -

Cost of products and services sold 10,657 - - (1,525) - - (1,525) 9,132

Research and development expenses 21,135 - - - - - - 21,135

Selling, general and administrative expenses 33,491 - - - - - - 33,491

Intangible asset amortization 10,918 (10,918) - - - - (10,918) -

Changes in fair value of related party contingent consideration 52,989 - - - (52,989) 19,321 (33,668) 19,321

Total operating expenses 129,190 (10,918) - (1,525) (52,989) 19,321 (46,111) 83,079

Operating income (loss) (22,029) 10,918 - 1,525 52,989 (19,321) 46,111 24,082

Investment Income 1,080 - - - - - - 1,080

Interest Expense (702) - - - - - - (702)

Other Expense - changes in fair value of related party payable (6,135) - - - 6,135 (2,618) 3,517 (2,618)

Foreign exchange gain (loss) (12) - 12 - - - 12 -

Income (loss) before income taxes (27,798) 10,918 12 1,525 59,124 (21,939) 49,640 21,842

Income tax provision 18,212 3,920 - 533 2,986 (1,165) 6,273 24,485

Income Tax Rate (66%) 36% - 35% 5% 5% 13% 112%

Net Loss (46,010)$ 6,998$ 12$ 992$ 56,138$ (20,774)$ 43,367$ (2,643)$

Net loss per share - Diluted (1.12)$ 0.17$ -$ 0.02$ 1.36$ (0.50)$ 1.05$ (0.06)$

Adjustments

Exclude

Nine months ended September 30, 2016

23January 2017

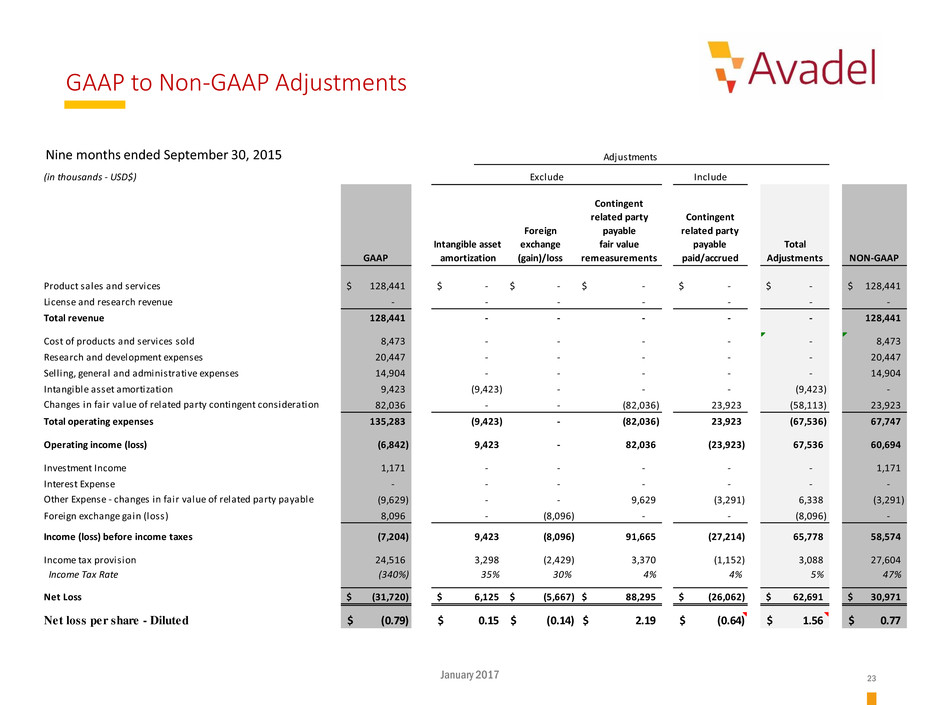

Nine Months Ended September 30, 2015:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 128,441$ -$ -$ -$ -$ -$ 128,441$

License and research revenue - - - - - - -

Total revenue 128,441 - - - - - 128,441

Cost of products and services sold 8,473 - - - - - 8,473

Research and development expenses 20,447 - - - - - 20,447

Selling, general and administrative expenses 14,904 - - - - - 14,904

Intangible asset amortization 9,423 (9,423) - - - (9,423) -

Changes in fair value of related party contingent consideration 82,036 - - (82,036) 23,923 (58,113) 23,923

Total operating expenses 135,283 (9,423) - (82,036) 23,923 (67,536) 67,747

Operating income (loss) (6,842) 9,423 - 82,036 (23,923) 67,536 60,694

Investment Income 1,171 - - - - - 1,171

Interest Expense - - - - - - -

Other Expense - changes in fair value of related party payable (9,629) - - 9,629 (3,291) 6,338 (3,291)

Foreign exchange gain (loss) 8,096 - (8,096) - - (8,096) -

Income (loss) before income taxes (7,204) 9,423 (8,096) 91,665 (27,214) 65,778 58,574

Income tax provision 24,516 3,298 (2,429) 3,370 (1,152) 3,088 27,604

Income Tax Rate (340%) 35% 30% 4% 4% 5% 47%

Net Loss (31,720)$ 6,125$ (5,667)$ 88,295$ (26,062)$ 62,691$ 30,971$

Net loss per share - Diluted (0.79)$ 0.15$ (0.14)$ 2.19$ (0.64)$ 1.56$ 0.77$

Adjustments

Exclude

Nine months ended September 30, 2015

GAAP to Non-GAAP Adjustments

24January 2017

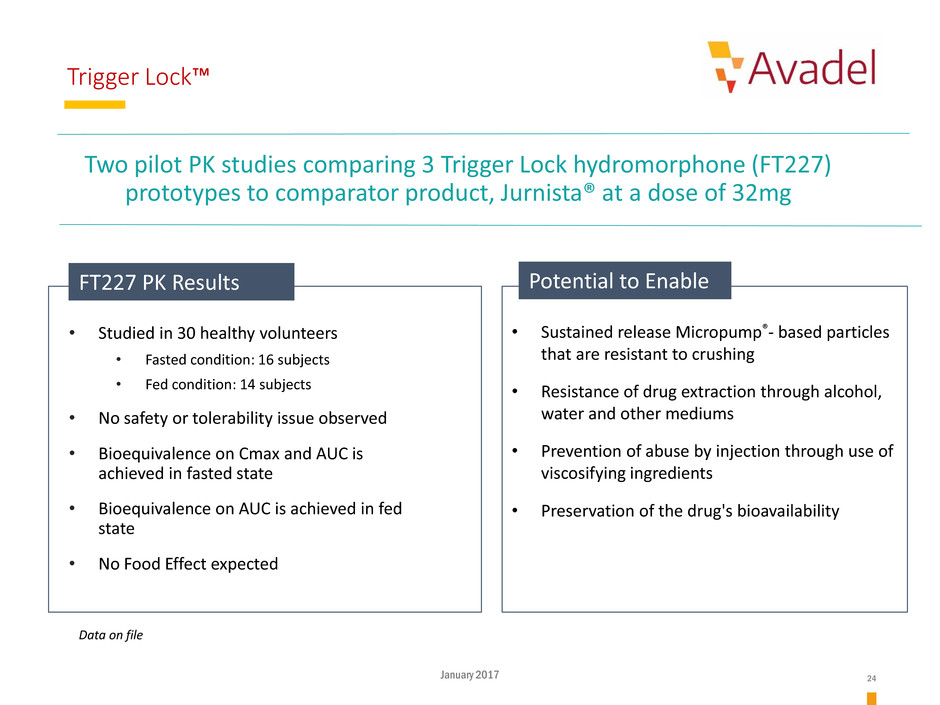

Trigger Lock™

• Sustained release Micropump®- based particles

that are resistant to crushing

• Resistance of drug extraction through alcohol,

water and other mediums

• Prevention of abuse by injection through use of

viscosifying ingredients

• Preservation of the drug's bioavailability

Potential to Enable

Data on file

FT227 PK Results

• Studied in 30 healthy volunteers

• Fasted condition: 16 subjects

• Fed condition: 14 subjects

• No safety or tolerability issue observed

• Bioequivalence on Cmax and AUC is

achieved in fasted state

• Bioequivalence on AUC is achieved in fed

state

• No Food Effect expected

Two pilot PK studies comparing 3 Trigger Lock hydromorphone (FT227)

prototypes to comparator product, Jurnista® at a dose of 32mg

25January 2017

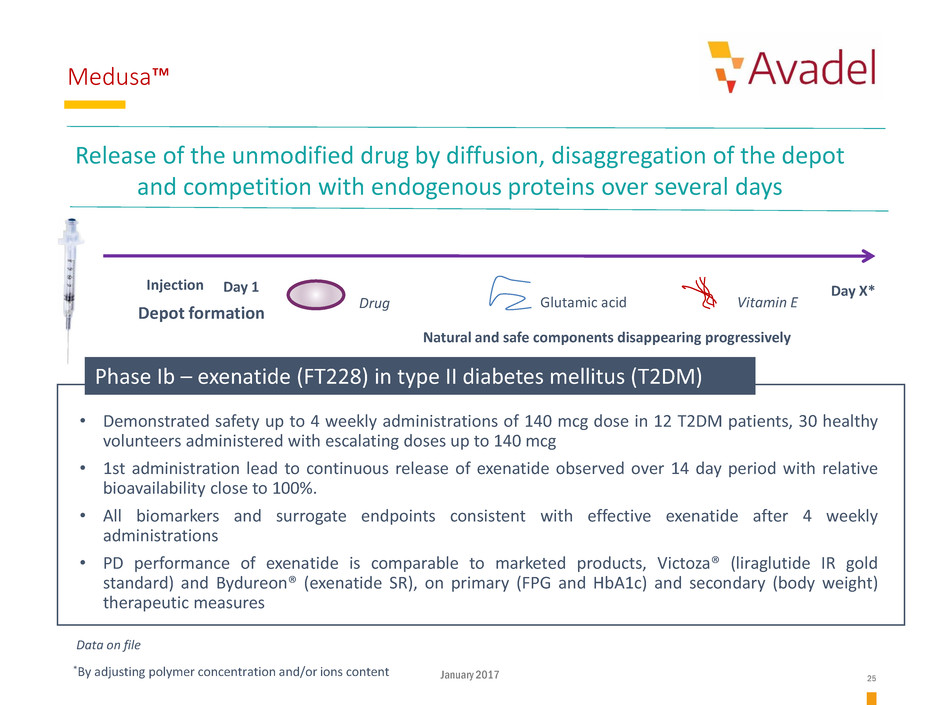

Medusa™

Release of the unmodified drug by diffusion, disaggregation of the depot

and competition with endogenous proteins over several days

Depot formation

Drug Vitamin EGlutamic acid

Day 1Injection Day X*

Natural and safe components disappearing progressively

*By adjusting polymer concentration and/or ions content

• Demonstrated safety up to 4 weekly administrations of 140 mcg dose in 12 T2DM patients, 30 healthy

volunteers administered with escalating doses up to 140 mcg

• 1st administration lead to continuous release of exenatide observed over 14 day period with relative

bioavailability close to 100%.

• All biomarkers and surrogate endpoints consistent with effective exenatide after 4 weekly

administrations

• PD performance of exenatide is comparable to marketed products, Victoza® (liraglutide IR gold

standard) and Bydureon® (exenatide SR), on primary (FPG and HbA1c) and secondary (body weight)

therapeutic measures

Phase Ib – exenatide (FT228) in type II diabetes mellitus (T2DM)

Data on file

26January 2017

Product & Safety Information

Please click below or visit our websites for full prescribing and safety

information for our marketed products

Bloxiverz®

www.bloxiverz.com

Vazculep®

www.vazculep.com

Akovaz™

www.akovaz.com

Karbinal™ ER

www.karbinaler.com

Aciphex® Sprinkle™

http://www.aciphexsprinkle.com

Cefaclor

http://cefaclororal.com

Flexichamber®

http://flexichamber.com