Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TERRAFORM GLOBAL, INC. | glbl8-kinvestorupdatejan92.htm |

Investor Update and Results for 4Q 2015 / 1Q 2016

January 9, 2017

2

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations,

projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,”

“plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other

comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Global expects or anticipates will occur in the future

are forward-looking statements. They may include financial metrics such as estimates of expected adjusted EBITDA, cash available for distribution (CAFD), earnings, revenues,

capital expenditures, liquidity, capital structure, future growth, financing arrangement and other financial performance items (including future dividends per share), descriptions of

management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements are based

on TerraForm Global’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Global

believes its respective expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and

actual results may vary materially.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking

statements. Factors that might cause such differences include, but are not limited to, risks related to the SunEdison bankruptcy, including our transition away from reliance on

SunEdison for management, corporate and accounting services, employees, critical systems and information technology infrastructure, and the operation, maintenance and asset

management of our renewable energy facilities; risks related to events of default and potential events of default arising under our revolving credit facility, the indenture governing

our senior notes, and/or project-level financing; risks related to failure to satisfy the requirements of Nasdaq, which could result in the delisting of our common stock; risks related

to our exploration and potential execution of strategic alternatives; pending and future litigation; our ability to integrate the projects we acquire from third parties or otherwise

realize the anticipated benefits from such acquisitions; the willingness and ability of counterparties to fulfill their obligations under offtake agreements; price fluctuations,

termination provisions and buyout provisions in offtake agreements; our ability to successfully identify, evaluate, and consummate acquisitions; government regulation, including

compliance with regulatory and permit requirements and changes in market rules, rates, tariffs, environmental laws and policies affecting renewable energy; operating and

financial restrictions under agreements governing indebtedness; the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital

markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward; our ability to compete against traditional and

renewable energy companies; potential conflicts of interests or distraction due to the fact that most of our directors and executive officers are also directors and executive officers

of TerraForm Power, Inc.; and hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages; and our

ability to manage our capital expenditures, economic, social and political risks and uncertainties inherent in international operations, including operations in emerging markets and

the impact of foreign exchange rate fluctuations, the imposition of currency controls and restrictions on repatriation of earnings and cash, protectionist and other adverse public

policies, including local content requirements, import/export tariffs, increased regulations or capital investment requirements, conflicting international business practices that may

conflict with other customs or legal requirements to which we are subject, inability to obtain, maintain or enforce intellectual property rights, and being subject to the jurisdiction of

courts other than those of the United States, including uncertainty of judicial processes and difficulty enforcing contractual agreements or judgments in foreign legal systems or

incurring additional costs to do so. Many of these factors are beyond TerraForm Global’s control.

TerraForm Global disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new

information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those

contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in TerraForm Global’s

Form 10-K for the fiscal year ended December 31, 2015, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange

Commission. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all

potential risks or uncertainties.

3

This presentation provides certain financial and operating metrics of TerraForm Global, Inc. (“TerraForm

Global” or the “Company”) as of or for the fiscal year and quarter ended December 31, 2015 and the quarter

ended March 31, 2016 and estimates for certain financial and operating metrics of TerraForm Global for 2016.

Please review these results together with the risk factors detailed in our annual report on Form 10-K for the

fiscal year ended December 31, 2015 filed with the SEC.

The financial information for full year 2016 is preliminary and unaudited and includes estimates which are

inherently uncertain. This financial information may change materially as a result of the completion of the

audit for fiscal year 2016 and review procedures for 2Q 2016 and 3Q 2016. Our estimates are based on

various assumptions and are subject to various risks which could cause actual results to differ materially. The

information presented on the following slides does not represent a complete picture of the financial position,

results of operation or cash flows of TerraForm Global, is not a replacement for full financial statements

prepared in accordance with U.S. GAAP and should not be viewed as indicative of future results, which may

differ materially.

The Company’s last quarterly report was its Form 10-Q for the period ended March 31, 2016. The Company

has not filed its Forms 10-Q for the periods ended June 30, 2016 or September 30, 2016. You should also

refer to our Form 10-K for the fiscal year 2015 and the other filings we have made with the SEC.

Importance of Our Risk Factors

TerraForm Global Focused on Key Areas of Execution

2016 was a year of transition and immense change

We are successfully navigating challenges and preparing for 2017 as a

well-functioning, independent company

Our fleet continues to perform well

Solid progress on moving to a stand-alone entity, expansion of board from

7 to 10 members, including 5 independents

Repaid revolver; ~$583M1 Holdco unrestricted cash available for

deployment

10-K for 2015 and 10-Q for 1Q 2016 filed; planning to file 10-Qs for 2Q and

3Q 2016 by Nasdaq deadline of March 2017

Collaborative strategic review process underway with aim of maximizing

value for all shareholders

4

(1) Preliminary unaudited Holdco cash at bank accounts owned by TerraForm Global, Inc., TerraForm Global, LLC and TerraForm Global Operating, LLC as of September 30, 2016.

5

Results: 4Q 2015 and 1Q 2016

Agenda

1

2

GLBL: High-Quality, Diversified Renewable Power Fleet

Estimates: 20163

6

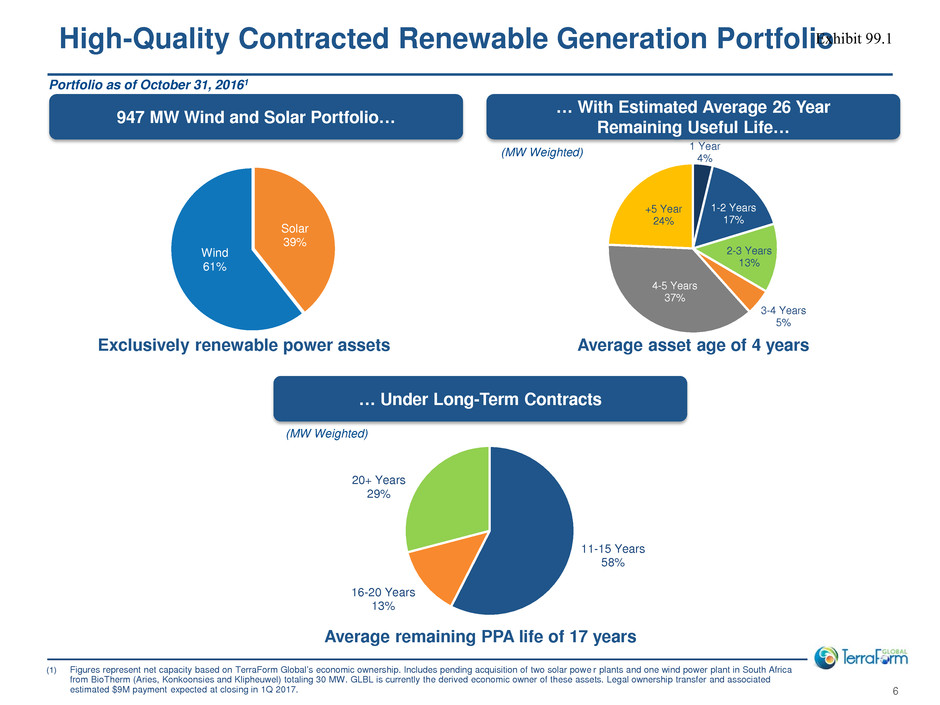

947 MW Wind and Solar Portfolio…

Exclusively renewable power assets

Portfolio as of October 31, 20161

… With Estimated Average 26 Year

Remaining Useful Life…

Average asset age of 4 years

… Under Long-Term Contracts

Average remaining PPA life of 17 years

(MW Weighted)

(MW Weighted)

High-Quality Contracted Renewable Generation Portfolio

1 Year

4%

1-2 Years

17%

2-3 Years

13%

3-4 Years

5%

4-5 Years

37%

+5 Year

24%

11-15 Years

58%

16-20 Years

13%

20+ Years

29%

(1) Figures represent net capacity based on TerraForm Global’s economic ownership. Includes pending acquisition of two solar powe r plants and one wind power plant in South Africa

from BioTherm (Aries, Konkoonsies and Klipheuwel) totaling 30 MW. GLBL is currently the derived economic owner of these assets. Legal ownership transfer and associated

estimated $9M payment expected at closing in 1Q 2017.

Solar

39%

Wind

61%

7

Uruguay

26 MW

26 MW

Brazil

307 MW

307 MW

India

299 MW

101 MW

198 MW

China

167 MW

149 MW

18 MW

Thailand

39 MW

39 MW

Malaysia

12 MW

12 MW

South Africa1

97 MW

18 MW

79 MW

(1) Portfolio as of October 31, 2016. Figures represent net capacity based on TerraForm Global’s economic ownership. Includes pen ding acquisition of two solar power plants and one

wind power plant in South Africa from BioTherm (Aries, Konkoonsies and Klipheuwel) totaling 30 MW. GLBL is currently the derived economic owner of these assets. Legal ownership

transfer and associated estimated $9M payment expected at closing in 1Q 2017.

Total: 947 MW

Wind: 575 MW

Solar: 372 MW

Brazil

32%

India

32%

China

18%

South

Africa

10%

Thailand

4%

Uruguay

3%

Malaysia

1%

Geographic Mix

High-Quality, Contracted Fleet of 947 MW Spread Across Seven Countries

Fleet Geography1

Large, Diversified Portfolio in Attractive Markets

8

4Q 2015 Results

Commentary

Added 177 MW in 4Q 2015

– 102 MW of wind plants in India from

FERSA acquisition1

– 75 MW increase due primarily to

additional economic ownership for solar

plants in India

Strong operational performance, in-line

with management expectations

Net loss of ($254M) negatively impacted

by ($231M) provision for losses related

to 425 MW India dropdown in 4Q 2015

Metrics 4Q 2015

Net MW Owned (Period End) 854

MWh (000s) 558

Capacity Factor 31%

Revenue, net ($M) 1 $51

Net Income / (Loss) ($M) ($254)

Non-GAAP Metrics 4Q 2015

Adj. Revenue ($M)1 $52

Adj. Revenue / MWh $93

Adj. EBITDA ($M)1 $40

Adj. EBITDA margin 77%

CAFD ($M) $38

1. The FERSA transaction was accounted for as an equity method investment and therefore was unconsolidated for GAAP accounting p urposes as of

December 31, 2015. Revenue and adjusted EBITDA for 4Q 2015 excludes the impact of this transaction.

9

1Q 2016 Results

Commentary

Increased fleet size by 36 MW

with the transfer of 2 solar

projects in Thailand in

February 2016

1Q 2016 operating results

below management

expectations due to unusually

low wind in Brazil, ~$5M

impact to revenue

Adjusted EBITDA margin

declined vs. 4Q 2015 due to

low wind resource in Brazil

and the loss of some G&A

support from SunEdison

Metrics 1Q 2016 4Q 2015 % change QoQ

Net MW Owned (Period End) 890 854 4%

MWh (000s) 506 558 (10%)

Capacity Factor 25% 31% (660) bps

Revenue, net ($M) 1 $48 $51 (6%)

Net Income / (Loss) ($M) ($6) ($254) 97%

Non-GAAP Metrics 1Q 2016 4Q 2015 % change QoQ

Adj. Revenue ($M)1 $48 $52 (8%)

Adj. Revenue / MWh 95 93 2%

Adj. EBITDA ($M)1 $34 $40 (17%)

Adj. EBITDA margin 70% 77% (660) bps

CAFD ($M) $44 $38 15%

1. The FERSA transaction was accounted for as an equity method investment and therefore was unconsolidated for GAAP accounting p urposes as of

December 31, 2015. Revenue and adjusted EBITDA excludes the impact of this transaction.

10

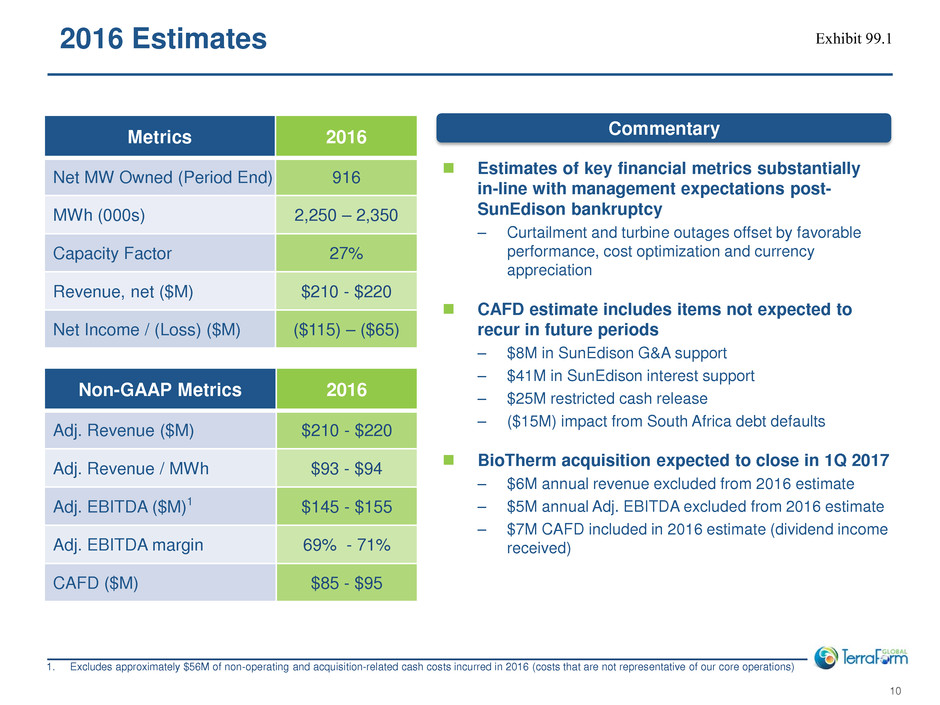

2016 Estimates

Commentary

Estimates of key financial metrics substantially

in-line with management expectations post-

SunEdison bankruptcy

– Curtailment and turbine outages offset by favorable

performance, cost optimization and currency

appreciation

CAFD estimate includes items not expected to

recur in future periods

– $8M in SunEdison G&A support

– $41M in SunEdison interest support

– $25M restricted cash release

– ($15M) impact from South Africa debt defaults

BioTherm acquisition expected to close in 1Q 2017

– $6M annual revenue excluded from 2016 estimate

– $5M annual Adj. EBITDA excluded from 2016 estimate

– $7M CAFD included in 2016 estimate (dividend income

received)

Metrics 2016

Net MW Owned (Period End) 916

MWh (000s) 2,250 – 2,350

Capacity Factor 27%

Revenue, net ($M) $210 - $220

Net Income / (Loss) ($M) ($115) – ($65)

Non-GAAP Metrics 2016

Adj. Revenue ($M) $210 - $220

Adj. Revenue / MWh $93 - $94

Adj. EBITDA ($M)1 $145 - $155

Adj. EBITDA margin 69% - 71%

CAFD ($M) $85 - $95

1. Excludes approximately $56M of non-operating and acquisition-related cash costs incurred in 2016 (costs that are not representative of our core operations)

11

$210

$145

$57

$85

$50

$22 $8

$35

$80

$8

$41

$15

$35

$220

$155

$95

Adj. Revenue Cost of

Operations

G&A (Corp.

Operating)

SUNE G&A

Support

Adj.

EBITDA

Project Debt

Interest

Payments

Holdco Debt

Interest

Payments

Project Debt

Principal

Payments

SUNE Interest

Support

S. Africa

Default

Impact

Other CAFD

$ in millions, non-GAAP metrics, unless otherwise noted

Figures may not foot due to rounding

Estimates of key metrics substantially in-line with management expectations post-SUNE bankruptcy

Other of $35M includes:

– $25M restricted cash release

– $10M economic interest

– $9M India viability gap funding receipt

– $2M net interest income

– Partially offset by ($6M) FX settlement losses and ($5M) maintenance capex/other

2016 Adjusted Revenue to CAFD Estimates

Note: The figures provided are projections for year-end 2016 and are based on various assumptions and estimates regarding the Company’s future operations and performance. These assumptions and estimates may not prove to be correct and actual results could differ

materially due to various factors, many of which are not within the control of the Company. In addition, estimated results for year-end 2016 should not be viewed as indicative of the Company’s expectations for future periods. Please see “Importance of Risk Factors” and

“Forward-Looking Statements”.

1. Excludes approximately $56M of non -operating and acquisition-related cash costs incurred in 2016 (costs that are not representative of our core operations)

2. We do not anticipate that we will receive further support for interest or G&A from SunEdison in 2017 or beyond

$150M

Midpoint

Adj. EBITDA1

$215M

Midpoint

Adj. Revenue

$90M

Midpoint

CAFD

2 21

12

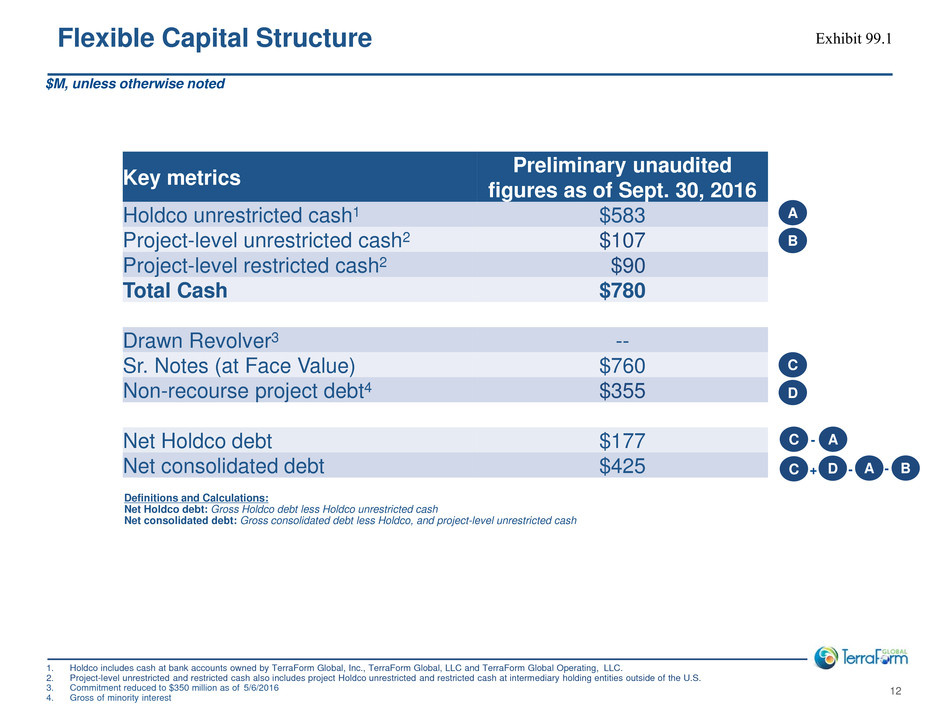

Key metrics Preliminary unaudited figures as of Sept. 30, 2016

Holdco unrestricted cash1 $583

Project-level unrestricted cash2 $107

Project-level restricted cash2 $90

Total Cash $780

Drawn Revolver3 --

Sr. Notes (at Face Value) $760

Non-recourse project debt4 $355

Net Holdco debt $177

Net consolidated debt $425

Flexible Capital Structure

$M, unless otherwise noted

Definitions and Calculations:

Net Holdco debt: Gross Holdco debt less Holdco unrestricted cash

Net consolidated debt: Gross consolidated debt less Holdco, and project-level unrestricted cash

1. Holdco includes cash at bank accounts owned by TerraForm Global, Inc., TerraForm Global, LLC and TerraForm Global Operating, LLC.

2. Project-level unrestricted and restricted cash also includes project Holdco unrestricted and restricted cash at intermediary holding entities outside of the U.S.

3. Commitment reduced to $350 million as of 5/6/2016

4. Gross of minority interest

A

B

C

D

C A-

C + B- -D A

Appendix

13

14

Definitions: Adjusted Revenue, Adjusted EBITDA and Cash Available

for Distribution

Reconciliation of Operating Revenues, Net to Adjusted Revenue

We define adjusted revenue as operating revenues, net, adjusted for non-cash items including unrealized gain/loss on derivatives, amortization

of favorable and unfavorable rate revenue contracts, net and other non-cash revenue items. We believe adjusted revenue is useful to investors

in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of

financial performance. Adjusted revenue is a non-GAAP measure used by our management for internal planning purposes, including for certain

aspects of our consolidated operating budget.

Reconciliation of Net Income (Loss) to Adjusted EBITDA

We believe Adjusted EBITDA is useful to investors in evaluating our operating performance because securities analysts and other interested

parties use such calculations as a measure of financial performance and debt service capabilities. In addition, Adjusted EBITDA is used by our

management for internal planning purposes, including for certain aspects of our consolidated operating budget.

We define adjusted EBITDA as net income (loss) plus depreciation, accretion and amortization, non-cash affiliate general and administrative

costs, acquisition related expenses, interest expense, gains (losses) on interest rate swaps, foreign currency gains (losses), income tax (benefit)

expense and stock compensation expense, and certain other non-cash charges, unusual or non-recurring items and other items that we believe

are not representative of our core business or future operating performance. Our definitions and calculations of these items may not necessarily

be the same as those used by other companies. Adjusted EBITDA is not a measure of liquidity or profitability and should not be considered as

an alternative to net income, operating income, net cash provided by operating activities or any other measure determined in accordance with

U.S. GAAP.

Reconciliation of Adjusted EBITDA to Cash Available for Distribution “CAFD”

CAFD is not a measure of liquidity or profitability and should not be considered as an alternative to net income, operating income, net cash

provided by operating activities or any other measure determined in accordance with U.S. GAAP

We define CAFD as adjusted EBITDA of Global LLC as adjusted for certain cash flow items that we associate with our operations. Cash

available for distribution represents adjusted EBITDA (i) minus deposits into (or plus withdrawals from) restricted cash accounts required by

project financing arrangements to the extent they decrease (or increase) cash provided by operating activities, (ii) minus cash distributions paid

to non-controlling interests in our renewable energy facilities, if any, (iii) minus scheduled project-level and other debt service payments and

repayments in accordance with the related borrowing arrangements, to the extent they are paid from operating cash flows during a period, (iv)

minus non-expansionary capital expenditures, if any, to the extent they are paid from operating cash flows during a period, (v) plus or minus

operating items as necessary to present the cash flows we deem representative of our core business operations, with the approval of the audit

committee.

Reg G: Reconciliation of Net Operating Revenue to Adjusted Revenue,

Net Income / (Loss) to Adjusted EBITDA and Adjusted EBITDA to CAFD

$M, unless otherwise noted

15

Reconciliation Revenue to Adjusted Revenue 4Q 2015 Actual 1Q 2016 Actual FY 2016 Estimate Mid-Point

Operating revenue, net 51 48 214

Amortization of favorable and unfavorable rate revenue contracts, net (a) 1 0 1

Adjusted revenue 52 48 215

Adjustments to reconcile net income to adjusted EBITDA and cash available for distribution 4Q 2015 Actual 1Q 2016 Actual FY 2016 Estimate Mid-Point

Net income (254) (6) (90)

Add/(Subtract):

Interest expense, net 23 34 123

Income tax expense (benefit) 4 1 3

Depreciation, accretion and amortization expense 16 15 60

General and administrative expense - affiliate (b) 6 5 54

Non-cash stock-based compensation 2 1 4

Acquisition, formation and related cost (c) 11 10 10

Provision for contingent loss on deposit for acquisitions (d) 231 - -

Loss (gain) on foreign currency exchange, net (e) 7 (12) -

Loss (gain) on extinguishment of debt, net 1 (6) (6)

Other net loss (income) (4) (7) (9)

Other non operating expenses (f) (3) - -

Adjusted EBITDA 40 34 150

Add/(Subtract):

Interest payment (7) (56) (115)

Scheduled project level and other debt service and repayments (1) (3) (8)

Cash distributions to non-controlling interests (4) - (1)

Non-expansionary capital expenditures (1) (0) (5)

Change in restricted cash (g) (10) 11 10

Settlement gain/(loss) on foreign currency exchange related to operations 3 1 (6)

SunEdison interest support - 41 41

India viability gap funding receipt - 8 9

BioTherm dividend receipt - 4 7

Economic interest (h) 17 4 4

Other (including interest income received) 2 1 5

Cash available for distribution 38 44 90

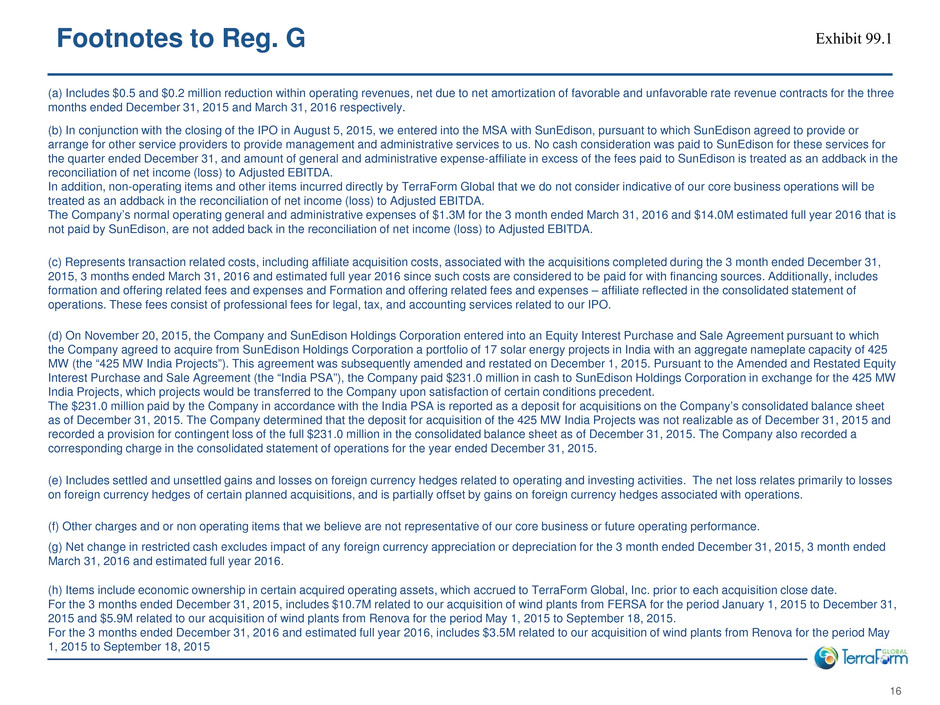

(a) Includes $0.5 and $0.2 million reduction within operating revenues, net due to net amortization of favorable and unfavorable rate revenue contracts for the three

months ended December 31, 2015 and March 31, 2016 respectively.

(b) In conjunction with the closing of the IPO in August 5, 2015, we entered into the MSA with SunEdison, pursuant to which SunEdison agreed to provide or

arrange for other service providers to provide management and administrative services to us. No cash consideration was paid to SunEdison for these services for

the quarter ended December 31, and amount of general and administrative expense-affiliate in excess of the fees paid to SunEdison is treated as an addback in the

reconciliation of net income (loss) to Adjusted EBITDA.

In addition, non-operating items and other items incurred directly by TerraForm Global that we do not consider indicative of our core business operations will be

treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA.

The Company’s normal operating general and administrative expenses of $1.3M for the 3 month ended March 31, 2016 and $14.0M estimated full year 2016 that is

not paid by SunEdison, are not added back in the reconciliation of net income (loss) to Adjusted EBITDA.

(c) Represents transaction related costs, including affiliate acquisition costs, associated with the acquisitions completed during the 3 month ended December 31,

2015, 3 months ended March 31, 2016 and estimated full year 2016 since such costs are considered to be paid for with financing sources. Additionally, includes

formation and offering related fees and expenses and Formation and offering related fees and expenses – affiliate reflected in the consolidated statement of

operations. These fees consist of professional fees for legal, tax, and accounting services related to our IPO.

(d) On November 20, 2015, the Company and SunEdison Holdings Corporation entered into an Equity Interest Purchase and Sale Agreement pursuant to which

the Company agreed to acquire from SunEdison Holdings Corporation a portfolio of 17 solar energy projects in India with an aggregate nameplate capacity of 425

MW (the “425 MW India Projects”). This agreement was subsequently amended and restated on December 1, 2015. Pursuant to the Amended and Restated Equity

Interest Purchase and Sale Agreement (the “India PSA”), the Company paid $231.0 million in cash to SunEdison Holdings Corporation in exchange for the 425 MW

India Projects, which projects would be transferred to the Company upon satisfaction of certain conditions precedent.

The $231.0 million paid by the Company in accordance with the India PSA is reported as a deposit for acquisitions on the Company’s consolidated balance sheet

as of December 31, 2015. The Company determined that the deposit for acquisition of the 425 MW India Projects was not realizable as of December 31, 2015 and

recorded a provision for contingent loss of the full $231.0 million in the consolidated balance sheet as of December 31, 2015. The Company also recorded a

corresponding charge in the consolidated statement of operations for the year ended December 31, 2015.

(e) Includes settled and unsettled gains and losses on foreign currency hedges related to operating and investing activities. The net loss relates primarily to losses

on foreign currency hedges of certain planned acquisitions, and is partially offset by gains on foreign currency hedges associated with operations.

(f) Other charges and or non operating items that we believe are not representative of our core business or future operating performance.

(g) Net change in restricted cash excludes impact of any foreign currency appreciation or depreciation for the 3 month ended December 31, 2015, 3 month ended

March 31, 2016 and estimated full year 2016.

(h) Items include economic ownership in certain acquired operating assets, which accrued to TerraForm Global, Inc. prior to each acquisition close date.

For the 3 months ended December 31, 2015, includes $10.7M related to our acquisition of wind plants from FERSA for the period January 1, 2015 to December 31,

2015 and $5.9M related to our acquisition of wind plants from Renova for the period May 1, 2015 to September 18, 2015.

For the 3 months ended December 31, 2016 and estimated full year 2016, includes $3.5M related to our acquisition of wind plants from Renova for the period May

1, 2015 to September 18, 2015

Footnotes to Reg. G

16

17