Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - TERRAFORM GLOBAL, INC. | glbl_-x2016x10xkxxxexx32xx.htm |

| EX-31.2 - EXHIBIT 31.2 - TERRAFORM GLOBAL, INC. | glbl_-x2016x10xkxxxexxx31x.htm |

| EX-31.1 - EXHIBIT 31.1 - TERRAFORM GLOBAL, INC. | glbl_-x2016x10xkxxxexx31x1.htm |

| EX-21.1 - EXHIBIT 21.1 - TERRAFORM GLOBAL, INC. | glbl_-xexhibitxofxsubsidia.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________

FORM 10-K

______________________________________________________________

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year ended December 31, 2016

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-37528

______________________________________________________________

TerraForm Global, Inc.

(Exact name of registrant as specified in its charter)

______________________________________________________________

Delaware | 47-1919173 | |

(State or other jurisdiction of incorporation or organization) | (I. R. S. Employer Identification No.) | |

7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland | 20814 | |

(Address of principal executive offices) | (Zip Code) | |

(240)-762-7700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Exchange on Which Registered | |

Common Stock, Class A, par value $0.01 | Nasdaq Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

______________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. o Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in

Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | x | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Emerging growth company | x | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2016, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity of the registrant held by non-affiliates of the registrant (based upon the closing price of shares of Class A common stock of the registrant on the Nasdaq Global Select Market on such date) was approximately $368.0 million.

As of May 31, 2017, there were 112,952,170 shares of Class A common stock outstanding, 61,343,054 shares of Class B common stock outstanding, and no shares of Class B1 common stock outstanding.

TerraForm Global, Inc. and Subsidiaries

Table of Contents

Form 10-K

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

3

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Global, Inc. and its subsidiaries (together, the “Company”) expect or anticipate will occur in the future are forward-looking statements. They may include estimates of cash available for distribution to shareholders, earnings, revenues, capital expenditures, liquidity, capital structure, future growth, financing arrangements and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide the Company’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although the Company believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

Some of the important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are listed below and further disclosed under the section entitled Item 1A. Risk Factors:

• | risks related to the closing of the transactions contemplated by the merger agreement entered into with certain affiliates of Brookfield Asset Management Inc. (the “Brookfield Transaction”) and the consequences to the Company if the Brookfield Transaction is not consummated; |

• | risks related to our relationship with SunEdison, Inc. (“SunEdison”); |

• | risks related to the voluntary filing by SunEdison and certain of its domestic and international subsidiaries for protection under Chapter 11 of the U.S. Bankruptcy Code (the “SunEdison Bankruptcy”), including our transition away from reliance on SunEdison for management, corporate and accounting services, employees, critical systems and information technology infrastructure, and the operation, maintenance and asset management of our power plants, and the risk of recovery on our claims against SunEdison; |

• | risks related to the settlement agreement entered into among the Company, SunEdison and certain of their respective affiliates to resolve, among other things, the intercompany claims between the Company and SunEdison in the SunEdison Bankruptcy case; |

• | risks related to events of default and potential events of default arising under (i) the indenture governing our 9.75% Senior Notes due 2022 (the “Senior Notes”) and/or (ii) project level financings and other agreements related to the SunEdison Bankruptcy, our failure to complete corporate and/or project level audits, SunEdison’s failure to perform its obligations under project level agreements, and/or related adverse effects on our business and operations (including the delay in the filing of our periodic reports with the U.S. Securities and Exchange Commission (the “SEC”)) and other factors; |

• | the condition of the debt and equity capital markets and our ability to borrow additional funds and access the capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward; |

• | risks related to our failure to satisfy the requirements of Nasdaq, which could result in the delisting of our common stock; |

• | our ability to integrate the power plants we acquire from third parties or otherwise and realize the anticipated benefits from such acquisitions; |

• | our ability to distribute cash from our project companies to the United States; |

• | fluctuations in exchange rates of the currencies in which we generate our revenue and incur our expenses; |

• | our ability to complete our pending acquisition; |

• | the willingness and ability of the counterparties to our offtake agreements to fulfill their obligations under such agreements; |

• | price fluctuations and termination provisions related to our offtake agreements; |

• | our ability to successfully identify, evaluate and consummate acquisitions; |

• | risks related to conducting operations in emerging markets; |

• | government regulation, including compliance with regulatory and permit requirements and changes in market rules, rates, tariffs, environmental laws and policies affecting renewable energy; |

4

• | operating and financial restrictions placed on us and our subsidiaries related to agreements governing our indebtedness and other agreements of certain of our subsidiaries and project companies, including the indenture governing the Senior Notes; |

• | our ability to compete against traditional and renewable energy companies; |

• | hazards customary to the power production industry and power generation operations such as unusual weather conditions, catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, interconnection problems or other developments, environmental incidents, or electric transmission constraints and curtailment and the possibility that we may not have adequate insurance to cover losses as a result of such hazards; |

• | the variability of wind and solar resources, which may result in lower than expected output of our renewable energy facilities; |

• | our ability to expand into new business segments or new geographies; |

• | departure of some or all of the employees providing services to us, particularly executive officers, key employees or operation and maintenance (“O&M”) or asset management personnel; |

• | pending and future litigation; |

• | our ability to operate our business efficiently, to operate and maintain our information technology, technical, accounting and generation monitoring systems, to manage capital expenditures and costs tightly, to manage risks related to international operations, and to generate earnings and cash flows from our asset-based businesses in relation to our debt and other obligations, including in light of the SunEdison Bankruptcy and the ongoing process to establish separate information technology systems; and |

• | potential conflicts of interests due to the fact that certain of our directors and executive officers are also directors and executive officers of TerraForm Power, Inc. (together with its subsidiaries, "TerraForm Power"). |

The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties, which are described in this Annual Report on Form 10-K, as well as additional factors we may describe from time to time in other filings with the SEC. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

5

PART I

Item 1. Business.

Overview

TerraForm Global, Inc. and its subsidiaries (together, the "Company") is a globally diversified renewable energy company that owns long-term contracted solar and wind power plants. The Company's business objective is to own and operate a portfolio of renewable energy power plants and to pay cash dividends to our stockholders. The Company’s portfolio consists of solar and wind power plants located in Brazil, China, India, Malaysia, South Africa, Thailand and Uruguay with an aggregate net capacity (based on our share of economic ownership) of 919.0 MW as of May 31, 2017.

We were formed as a Delaware corporation under the name SunEdison Emerging Markets Growth and Yield, Inc. on September 12, 2014 as a wholly owned indirect subsidiary of SunEdison, Inc. The name of the Company was changed from SunEdison Emerging Markets Growth and Yield, Inc. to SunEdison Emerging Markets Yield, Inc. on September 26, 2014. The name change from SunEdison Emerging Markets Yield, Inc. to TerraForm Global, Inc., became effective on April 1, 2015. Following our initial public offering (“IPO”) on August 5, 2015, TerraForm Global, Inc. became a holding company and its sole asset is a 64.8% equity interest in TerraForm Global, LLC (“Global LLC”) as of May 31, 2017. TerraForm Global, Inc. is the managing member of Global LLC, and operates, controls and consolidates the business affairs of Global LLC. Unless otherwise indicated or otherwise required by the context, references to “we,” “our,” “us” or the “Company” refer to TerraForm Global, Inc. and its consolidated subsidiaries.

Our principal executive offices are located at 7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland 20814, and our telephone number is (240) 762-7700. Our website address is www.terraformglobal.com.

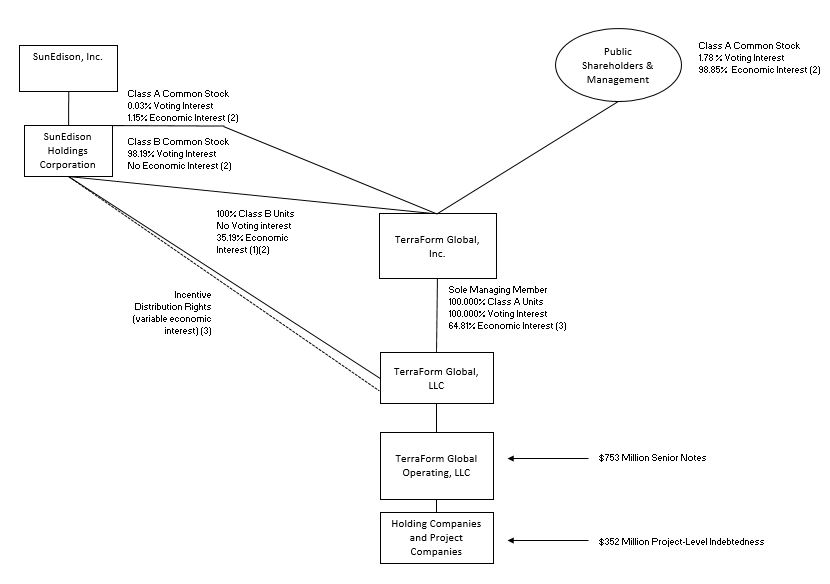

The diagram below is a summary depiction of our organizational structure as of May 31, 2017:

6

(1) Both SunEdison, Inc. and SunEdison Holdings Corporation are debtors in the SunEdison Bankruptcy. SunEdison’s economic interest is subject to certain limitations on distributions to holders of Class B units during the Subordination Period and the Distribution Forbearance Period (as described in Item 15. Note 19 - Related Parties).

(2) The economic interest of holders of Class A units, Class B units and, in turn, holders of shares of Class A common stock, is subject to the right of holders of the IDRs to receive a portion of distributions after certain distribution thresholds are met.

(3)IDRs represent a variable interest in distributions by Global LLC and therefore cannot be expressed as a fixed percentage interest. All of our IDRs are currently issued to SunEdison Holdings Corporation, which is a wholly owned subsidiary of SunEdison, Inc.

Our Business

Our primary business is to own and operate a portfolio of renewable energy power plants and to pay cash dividends to our stockholders.

We have acquired a portfolio of long-term contracted clean power plants from SunEdison and unaffiliated third parties that have proven technologies, creditworthy counterparties, low operating risks and stable cash flows. We have focused on the solar and wind energy segments because we believe they are currently the fastest growing segments of the clean power generation industry globally. Solar and wind assets are also attractive because there is no associated fuel cost risk, the technologies have become highly reliable and assets have an expected life which can exceed 30 years. From time to time, we may selectively choose to acquire renewable energy projects before they have reached commercial operation if we believe there is greater value to the Company’s stockholders by owning the asset prior to commercial operation and if we believe that any risks to achieving commercial operation have been sufficiently mitigated.

On April 21, 2016, SunEdison and certain of its domestic and international subsidiaries voluntarily filed for protection under Chapter 11 of the U.S. Bankruptcy Code (the “SunEdison Bankruptcy”). In anticipation of and in response to SunEdison’s financial and operating difficulties, which culminated in the SunEdison Bankruptcy, at the direction of the Board of Directors of the Company (the “Board”), the Company has undertaken, and continues to undertake, a number of strategic initiatives to mitigate the adverse impacts of the SunEdison Bankruptcy on the Company. Focusing on governance, operations and business performance initiatives deemed especially critical because SunEdison provided all personnel and services to the Company (other than those operational services provided by third parties), these initiatives have included, among other things, developing continuity plans, establishing stand-alone information technology, accounting and other critical systems and infrastructure, directly hiring employees, and developing the ability to provide (or engaging third parties to provide) O&M and asset management services for the Company's wind and solar power plants.

As part of this overall strategic review process, the Company also initiated a process for the exploration and evaluation of potential strategic alternatives, including potential transactions to secure a new sponsor or sell the Company. As discussed under Item 1. Business - Recent Developments - Entry into a Material Definitive Agreement with Brookfield Asset Management Inc. below, this process resulted in the announcement by the Company on March 6, 2017, that the Company had entered into an Agreement and Plan of Merger (the “Merger Agreement”) with affiliates of Brookfield Asset Management Inc. (“Brookfield”) pursuant to which a controlled subsidiary of Brookfield would acquire 100% of the outstanding equity interests in the Company (the “Brookfield Transaction”). If the Brookfield Transaction is consummated, each issued and outstanding share of our Class A common stock (with certain exceptions) will be converted into the right to receive the per share cash merger consideration, we will no longer have public stockholders and our Class A common stock will be delisted from the Nasdaq Global Select Market and deregistered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Except as otherwise noted, the disclosures in this Annual Report on Form 10-K for the fiscal year ended December 31, 2016 discuss our business and operations without considering the impact and consequences of the Brookfield Transaction and reflect the business strategy we expect to pursue in the event the Brookfield Transaction is not consummated.

7

We continue to focus on satisfying the conditions to the closing of the Brookfield Transaction under the Merger Agreement and executing our other near term plans and priorities, including:

• | focusing on the performance and efficiency of our existing portfolio of power plants; |

• | mitigating, to the extent possible, the adverse impacts resulting from the SunEdison Bankruptcy, including ensuring the continuity of operation, maintenance and asset management of our power plants; |

• | resolving our material pending litigation; |

• | working with our project level lenders to cure, or obtain waivers or forbearance of, defaults that have arisen under certain of our project level debt financings as a result of the SunEdison Bankruptcy; |

• | resolving the pending commitment to acquire three operating power plants from BioTherm (as defined below); and |

• | seeking to optimize our portfolio and capital structure by financing or refinancing certain power plants and/or exiting certain markets or selling certain assets if we believe the opportunity would improve stockholder value. |

If we are unable to successfully complete the Brookfield Transaction, it would be necessary for the Company to reevaluate its strategic alternatives. If such reevaluation does not result in the Company entering into an alternative transaction, we expect to pursue our long-term business, which is to own and operate our portfolio of renewable energy power plants, pursue growth opportunities and pay cash dividends to our stockholders.

Our Portfolio

Our portfolio consists of solar and wind power plants located in Brazil, China, India, Malaysia, South Africa, Thailand, and Uruguay with an aggregate net capacity (based on our share of economic ownership) of 919.0 MW as of May 31, 2017. These power plants generally have long-term Power Purchase Agreements (“PPAs”) with creditworthy counterparties. Our current portfolio has PPAs with a weighted average (based on net capacity according to share of economic ownership) remaining life of 17 years as of May 31, 2017. For the years ended December 31, 2016, 2015 and 2014, solar energy represented 55%, 75% and 100% of our consolidated operating revenues, net for the respective periods, and wind energy represented 45% and 25% of our consolidated operating revenues, net for the years ended December 31, 2016 and 2015, respectively.

Subject to market and other conditions, our long-term plan is to further expand and diversify our current portfolio by acquiring utility-scale and distributed assets located in our core markets and certain other jurisdictions, each of which we expect will also have a long-term PPA with a creditworthy counterparty. However, as discussed under Item 1. Business - Recent Developments - SunEdison Bankruptcy below, in connection with the Brookfield Transaction, we entered into a Settlement Agreement (as defined below) with SunEdison to resolve our outstanding intercompany claims and defenses in connection with the SunEdison Bankruptcy, and the Settlement Agreement has been approved by the bankruptcy court overseeing the SunEdison Bankruptcy. If the Settlement Agreement becomes effective, our existing rights to acquire certain projects from SunEdison will be terminated. Even if such rights are not terminated, as a result of the SunEdison Bankruptcy, we do not expect to acquire any additional projects from SunEdison. In addition, recent market conditions affecting companies in our sector generally have limited our ability to acquire and finance projects at attractive returns, so our ability to complete acquisitions on attractive terms or at all may be limited.

8

The following tables list the solar and wind power plants that comprise our portfolio as of May 31, 2017:

Power Plant Name | Country | Power Plant Type | Gross Nameplate Capacity (MW) (1) | Net Capacity based on share of Economic Ownership (MW)(2) | Net Capacity based on share of Equity Ownership (MW)(2) | # of Sites | Weighted Average Remaining Duration of PPA (Years)(3) |

Portfolio as of December 31, 2016 | |||||||

Salvador | Brazil | Wind | 203.2 | 203.2 | 203.2 | 9 | 16 |

Bahia | Brazil | Wind | 103.5 | 103.5 | 103.5 | 5 | 16 |

Honiton | China | Wind | 148.5 | 148.5 | 148.5 | 3 | 13 |

Dunhuang | China | Solar | 18.0 | 18.0 | 18.0 | 1 | 16 |

Hanumanhatti | India | Wind | 50.4 | 50.4 | 50.4 | 1 | 14 |

NSM Suryalabh | India | Solar | 39.0 | 39.0 | 39.0 | 1 | 23 |

Gadag | India | Wind | 31.2 | 31.2 | 31.2 | 1 | 12 |

NSM Sitara | India | Solar | 31.0 | 31.0 | 31.0 | 1 | 23 |

NSM L’Volta | India | Solar | 26.0 | 26.0 | 26.0 | 1 | 23 |

SE 25(4) | India | Solar | 25.0 | 25.0 | — | 1 | 20 |

NSM 24 | India | Solar | 24.0 | 24.0 | 24.0 | 1 | 21 |

Focal | India | Solar | 23.0 | 23.0 | 23.0 | 2 | 23 |

Bhakrani | India | Wind | 20.0 | 20.0 | 20.0 | 1 | 22 |

Millenium(4) | India | Solar | 9.3 | 9.3 | 6.9 | 1 | 20 |

Brakes | India | Solar | 7.7 | 7.7 | 5.4 | 1 | 13 |

Raj 5 | India | Solar | 5.0 | 5.0 | 5.0 | 1 | 20 |

ESP Urja | India | Solar | 5.0 | 5.0 | 5.0 | 1 | 20 |

Azure | India | Solar | 5.0 | 5.0 | 5.0 | 1 | 20 |

Silverstar Pavilion | Malaysia | Solar | 10.0 | 5.1 | 4.8 | 2 | 18 |

Fortune 11 | Malaysia | Solar | 5.1 | 4.8 | 2.4 | 1 | 18 |

Corporate Season | Malaysia | Solar | 4.0 | 2.5 | 1.9 | 1 | 18 |

Boshof | South Africa | Solar | 65.9 | 33.6 | 33.6 | 1 | 18 |

Witkop | South Africa | Solar | 32.9 | 16.8 | 16.8 | 1 | 17 |

Soutpan | South Africa | Solar | 31.0 | 15.8 | 15.8 | 1 | 17 |

NPS Star | Thailand | Solar | 18.0 | 17.8 | 8.7 | 3 | 24 |

WXA | Thailand | Solar | 17.8 | 17.8 | 8.7 | 3 | 24 |

PP Solar | Thailand | Solar | 3.6 | 3.6 | 3.6 | 3 | 28 |

Alto Cielo | Uruguay | Solar | 26.4 | 26.4 | 26.4 | 1 | 27 |

Total portfolio as of December 31, 2016 | 989.5 | 919.0 | 867.8 | 50 | 17 | ||

Subsequent Additions | |||||||

Add'l 26% equity in Millenium (4) | India | Solar | — | — | 2.4 | ||

100% equity in SE 25 (4) | India | Solar | — | — | 25.0 | ||

Total Subsequent Additions | — | — | 27.4 | — | — | ||

Total Portfolio as of May 31, 2017 | 989.5 | 919.0 | 895.2 | 50 | 17 | ||

(1) Nameplate capacity represents the maximum generating capacity at standard test conditions of a facility. Revenue in the financial statements is based on nameplate capacity with the exception of unconsolidated businesses.

(2) Net capacity represents the maximum generating capacity at standard test conditions of a power plant multiplied by either the Company’s percentage of economic ownership of that power plant after taking into account any redeemable preference shares and shareholder loans held by the Company or percentage of equity ownership of that power plant, as applicable.

(3) Calculated as of May 31, 2017. The number represents a weighted average (based on net capacity based on share of economic ownership) of remaining duration.

(4) The equity interests in Millenium and SE 25 that were not owned by the Company as of December 31, 2016 were transferred to the Company following the expiration of the equity lock up period in the applicable PPA in January and March 2017, respectively. In the case of SE 25, prior to the transfer of the equity interests to the Company, the Company received approximately 100% of the economic value of the power plant through the payment to the Company of interest and principal on bonds issued by the project company to the Company.

9

Recent Developments

Entry into a Definitive Merger Agreement with Brookfield Asset Management Inc.

On March 6, 2017, TerraForm Global, Inc. entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Orion US Holdings 1 L.P. (“Parent”), a Delaware limited partnership and an affiliate of Brookfield Asset Management Inc. (“Brookfield”), and BRE GLBL Holdings Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), providing for the merger of Merger Sub with and into TerraForm Global, Inc. (the “Merger”), with TerraForm Global, Inc. surviving as a wholly owned subsidiary of Parent.

The proposed Merger was approved by the Board, following the recommendation of the Corporate Governance and Conflicts Committee of the Board (the “Conflicts Committee”). Completion of the Merger is expected to occur, subject to satisfaction of closing conditions, in the second half of 2017.

As a result of the Merger, each share of Class A common stock of TerraForm Global, Inc., par value $0.01 per share (the “Class A Shares”), issued and outstanding immediately prior to the effective time of the Merger (other than Class A Shares that are (i) owned by TerraForm Global, Inc., Parent or any of their direct or indirect wholly owned subsidiaries and not held on behalf of third parties, (ii) owned by stockholders who have perfected and not withdrawn a demand for appraisal rights pursuant to Section 262 of the Delaware General Corporation Law or (iii) held by any direct or indirect wholly owned subsidiary of the Company that is taxable as a corporation (the foregoing clauses (i) - (iii), collectively, the “Excluded Shares”)), will be converted into the right to receive per share Merger consideration equal to $5.10 per Class A Share in cash, without interest.

Concurrently with the execution and delivery of the Merger Agreement, SunEdison and certain of its affiliates executed and delivered a voting and support agreement with Brookfield and TerraForm Global, Inc. (the “Voting and Support Agreement”) pursuant to which SunEdison agreed to vote or cause to be voted any shares of common stock of TerraForm Global, Inc. held by it or any of its controlled affiliates in favor of the Merger and to take certain other actions to support the consummation of the Merger and the other transactions contemplated by the Merger Agreement. The Voting and Support Agreement was approved by the bankruptcy court overseeing the SunEdison Bankruptcy on June 7, 2017.

The Merger Agreement includes a non-waivable condition to closing that the Merger Agreement and the transactions contemplated by the Merger Agreement be approved by holders of a majority of the outstanding Class A Shares, excluding all Class A Shares held by SunEdison or any of its affiliates (“SunEdison Class A Shares”) and Parent or any of its affiliates.

Closing of the Merger also is subject to certain other conditions, including the adoption of the Merger Agreement by the holders of a majority of the total voting power of the outstanding shares of common stock of TerraForm Global, Inc. entitled to vote on the Merger and receipt of certain regulatory approvals. The entry by the bankruptcy court overseeing the SunEdison Bankruptcy of orders authorizing and approving the entry by SunEdison (and, if applicable, SunEdison’s debtor affiliates) into the Settlement Agreement, the Voting and Support Agreement and any other agreement entered into in connection with the Merger or the other transactions contemplated by the Merger Agreement to which SunEdison or any other debtor will be a party (the “Bankruptcy Court Order”) is also a condition to the closing of the Merger. The bankruptcy court overseeing the SunEdison Bankruptcy entered the Bankruptcy Court Order on June 7, 2017 and this condition has been satisfied. In addition, Parent’s and Merger Sub’s obligations to consummate the Merger are subject to the requirement that certain litigation has been finally dismissed with prejudice or the settlement thereof has been submitted for court approval in a manner reasonably satisfactory to Parent pursuant to agreements or stipulations containing releases reasonably satisfactory to Parent, and all final approvals of courts or regulatory authorities required for the settlements and releases to become final, binding and enforceable; provided, however, that in no event will a settlement of certain claims made by Renova Energia, S.A. (“Renova”) include an aggregate payment by the Company of greater than $3,000,000 (net of any amounts funded directly or indirectly by insurance proceeds). In the event that this condition has not been satisfied when all other conditions to closing are satisfied (other than those that by their nature are satisfied or waived at closing), Parent and the Company have agreed to negotiate in good faith to adjust, or defer a portion of, the $5.10 in cash per Class A Share otherwise payable pursuant to the terms of the Merger Agreement so that this condition will be satisfied.

On May 26, 2017, TerraForm Global, Inc., TerraForm Global, LLC, TerraForm Global Brazil Holding B.V. and TERP GLBL Brasil I Participacoes Ltda. entered into a Settlement Agreement and Mutual Release (the “Renova Settlement Agreement”) with Renova. The Renova Settlement Agreement resolves all disputes among the Company and Renova that are the subject of an ongoing arbitration proceeding in the Center for Arbitration and Mediation of the Chamber of Commerce Brazil-Canada (the “Renova Arbitration”). Concurrently with the execution of the Renova Settlement Agreement, TerraForm Global, Inc. and Parent entered into a letter agreement (the “Renova Letter Agreement”), pursuant to which Parent has agreed that upon the later to occur of (i) the effective time as described in the Renova Settlement Agreement and (ii) the closing of the

10

share purchase contemplated by the PSA (as defined and described below), the condition to the obligations of Parent and Merger Sub to effect the Merger set forth in Section 7.2(c) (Litigation Settlement) of the Merger Agreement, solely with respect to Renova’s claims in the Renova Arbitration, has been satisfied and the aggregate payment made by the Company (net of any amounts funded directly or indirectly by insurance proceeds) under the Renova Settlement Agreement in connection with the settlement of Renova’s claims in the Renova Arbitration will be deemed to be zero. Also, concurrently with the execution of the Renova Settlement Agreement, Renova and Parent entered into a Purchase & Sale Agreement (the “PSA”) with respect to all of the shares of Class A common stock of TerraForm Global, Inc. owned by Renova (excluding the shares to be released from escrow to TerraForm Global, Inc. pursuant to the Renova Settlement Agreement). Pursuant to the terms of the PSA, Parent has agreed to purchase 19,535,004 shares of Class A common stock of TerraForm Global, Inc. from Renova for a purchase price in cash of $4.75 per share, or $92,791,269 in the aggregate. The consummation of the share purchase contemplated by the PSA is subject to customary conditions to closing and is conditioned upon the satisfaction of certain conditions set forth in the Renova Settlement Agreement described above, including the effectiveness of the mutual releases and release of the shares in escrow.

Each of the Company, Parent and Merger Sub has made customary representations and warranties in the Merger Agreement. The Company has also agreed to various agreements and covenants, including, among others, and subject to certain exceptions, to conduct its business in the ordinary course between execution of the Merger Agreement and closing of the Merger and not to engage in certain specified types of transactions during such period.

In addition, the Company is subject to a “no change of recommendation” restriction limiting its ability to change its recommendation in respect of the Merger except as permitted by the Merger Agreement and a “no shop” restriction on its ability to solicit alternative acquisition proposals from third parties and to provide information to, and engage in discussions with, third parties regarding alternative acquisition proposals.

The Merger Agreement contains specified termination rights, including the right for each of the Company and Parent to terminate the Merger Agreement if the Merger is not consummated by December 6, 2017 (subject to a three-month extension under certain circumstances at the discretion of either the Company or Parent). The Merger Agreement provides for other customary termination rights for both the Company and Parent (including, for Parent, if the Board changes its recommendation in respect of the Merger) as more particularly set forth in the Merger Agreement. The Company is required to pay Parent a termination fee equal to $30.0 million following termination of the Agreement in the following circumstances: (i) the requisite stockholder approval has not been obtained by the termination date, and an alternative acquisition proposal to acquire the Company has been made or announced, and within 12 months of the termination of the Merger Agreement, the Company enters into a definitive agreement or consummates any alternative acquisition (as defined in the Merger Agreement), in such case, net of any expense fee paid by the Company to Parent in connection with the Merger; (ii) if either party terminates the Merger Agreement because the Bankruptcy Court Order has not been entered by the bankruptcy court by the date provided for such approval in the Settlement Agreement, and within 12 months of the termination of the Merger Agreement, the Company enters into a definitive agreement or consummates any alternative acquisition (as defined in the Merger Agreement), in such case, net of any expense fee paid by the Company to Parent in connection with the Merger; (iii) if either party terminates the Merger Agreement because the requisite stockholder approval has not been obtained or because the Agreement has not been consummated by the termination date, and at the time of termination, the Board has changed its recommendation in respect of the Merger; or (iv) if Parent terminates the Merger Agreement because the Board has made and not withdrawn a change of recommendation in respect of the Merger and at the time of Parent’s termination the Company has not obtained the requisite stockholder approval of the Merger or the Bankruptcy Court Order has not been entered by the bankruptcy court. In addition, if the Merger Agreement is terminated, under certain circumstances, the Company has agreed to pay to Parent an $8.0 million expense reimbursement fee.

The representations, warranties and covenants of the Company contained in the Merger Agreement have been made solely for the benefit of Parent and Merger Sub. In addition, such representations, warranties and covenants (a) have been made only for purposes of the Merger Agreement, (b) have been qualified by confidential disclosures made to Parent and Merger Sub in connection with the Merger Agreement, (c) are subject to materiality qualifications contained in the Merger Agreement that may differ from what may be viewed as material by investors and (d) have been included in the Merger Agreement for the purpose of allocating risk among the contracting parties rather than establishing matters as facts. Accordingly, the Merger Agreement is incorporated by reference into this Annual Report on Form 10-K only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding the Company or its business. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may have changed after the date of the Merger Agreement and may continue to change in the future, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

11

Our entry into the Merger Agreement, and our exploration of strategic alternatives generally, involve certain risks and uncertainties, which may, among other things, disrupt our business or adversely impact our revenue, operating results and financial condition. A change of control of the Company without the consent of the lenders under our corporate level revolving credit facility (the "Revolver") would constitute an event of default under our Revolver and, pursuant to the indenture governing the Senior Notes, a change of control of the Company would require TerraForm Global Operating, LLC, a wholly-owned subsidiary of Global LLC (“Global Operating LLC”), to offer to repurchase its outstanding Senior Notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. Additionally, the occurrence of such changes may trigger change of control provisions in certain of our PPAs. There can be no assurance that we will be able to complete the Merger, and failure to complete the Merger may adversely impact our business. See “Risks Related to the Brookfield Transaction,” “Risks Related to a Failure to Complete the Brookfield Transaction,” “Risks Related to our Relationship with SunEdison and the SunEdison Bankruptcy” and “Risks Related to our Business” in Item 1A. Risk Factors for additional information.

The foregoing description of the Merger Agreement and the Voting and Support Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Merger Agreement and the Voting and Support Agreement, copies of which were included as Exhibit 2.1 and Exhibit 2.3, respectively, to our Current Report on Form 8-K filed with the SEC on March 7, 2017 and which are incorporated herein by reference. The foregoing description of the Renova Settlement Agreement and the Renova Letter Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Renova Settlement Agreement and the Renova Letter Agreement, copies of which were included as Exhibit 10.1 and Exhibit 10.2, respectively, to our Current Report on Form 8-K filed with the SEC on May 30, 2017 and which are incorporated herein by reference.

SunEdison Bankruptcy and Settlement Agreement with SunEdison

As discussed in “Business,” “Risk Factors” and this and other sections of this Annual Report on Form 10-K, including our audited consolidated financial statements and the notes thereto contained in this Annual Report on Form 10-K, the SunEdison Bankruptcy may have a material adverse effect on the Company. No assurance can be given on the outcome of the SunEdison Bankruptcy or its impact on the Company. Our Conflicts Committee is responsible for oversight and approval of the business and affairs of the Company relating to or involving SunEdison and any of its affiliates (other than the Company), including in connection with the SunEdison Bankruptcy. The matters described in this section entitled “SunEdison Bankruptcy and Settlement Agreement with SunEdison” and other matters that presented conflict of interest issues between the Company and SunEdison have been approved and authorized pursuant to this authority by those members of the Conflicts Committee in place at the time the applicable decision was made.

The Company is not a part of the SunEdison Bankruptcy and does not rely substantially on SunEdison for funding, liquidity, or operational or staffing support. The Company continues to participate actively in the SunEdison Bankruptcy proceedings, and the SunEdison Bankruptcy will continue to have a negative impact on the Company given our complex relationship with SunEdison.

During the SunEdison Bankruptcy, SunEdison has not performed substantially as obligated under its agreements with us, including under sponsorship arrangements consisting of the various corporate level agreements put in place at the time of the Company’s IPO (collectively, the “Sponsorship Arrangement”) and certain O&M and asset management arrangements. SunEdison’s failure to perform substantially as obligated under its agreements with us, including under the Sponsorship Arrangement, project level O&M and asset management agreements and other support agreements may have a material adverse effect on the Company. Despite these adverse effects, the Company operates its business without significant support from SunEdison pursuant to plans for transitioning away from reliance on SunEdison that we are in the process of implementing. These plans include, among other things, establishing stand-alone information technology, accounting and other critical systems and infrastructure, directly hiring our employees, and retaining third parties to provide O&M and asset management services for our power plants where we do not perform these services ourselves. In addition to the one-time costs of implementing a stand-alone organization, our business will be adversely affected to the extent we are unsuccessful in implementing the relevant plans or the resulting ongoing long-term costs are higher than the costs we expected to incur with SunEdison as a sponsor.

The project level financing agreements for our two remaining levered power plants in India and our three power plants in South Africa contain provisions that provide the lenders with the right to accelerate debt maturity due to the SunEdison Bankruptcy because SunEdison is an original sponsor of the project and/or a party to certain material project agreements, such as O&M and EPC related contracts. In addition, certain audited financial statements at the project level were delayed and may be delayed again in the future. Future delays would create defaults at the project level for our levered power plants. If not cured or waived, these defaults may restrict the ability of the project companies to make distributions to us and may provide the lenders with the right to accelerate debt maturity. However, neither our Revolver nor the indenture governing the Senior Notes includes an event of default provision triggered by the SunEdison Bankruptcy, and none of our power purchase agreements

12

includes a provision that would permit the offtake counterparty to terminate the agreement as a result of the SunEdison Bankruptcy. See Item 15. Note 10. - Project Level Debt for further detail regarding project level debt.

On September 25, 2016, the Company filed its initial proof of claim in the SunEdison Bankruptcy, and filed an amended proof of claim on October 7, 2016. As set forth in the proofs of claim, the Company believes it has unsecured claims against SunEdison that it estimates are in excess of $2.0 billion. These claims include, without limitation, claims for damages relating to breach of SunEdison's obligations under the Sponsorship Arrangement between the Company and SunEdison and other agreements; contribution and indemnification claims arising from litigation; claims relating to SunEdison’s breach of fiduciary, agency and other duties; and claims for interference with and the disruption of the business of the Company and its subsidiaries, including the loss of business opportunities, loss of business records, failure to provide timely audited financials, and the increased cost of financing and commercial arrangements. Many of these claims are contingent, unliquidated and/or disputed by SunEdison and other parties in interest in the SunEdison Bankruptcy, and the estimated amounts of these claims may change substantially as circumstances develop and damages are determined. In addition, recoveries on unsecured claims in the SunEdison Bankruptcy are expected to be significantly impaired.

In addition, the Company believes that it may have claims entitled to administrative priority against SunEdison, including, without limitation, claims with respect to certain expenses that the Company has incurred after the commencement of the SunEdison Bankruptcy; however, the Company expects SunEdison and other parties in interest in the SunEdison Bankruptcy to dispute both the amount of these claims and whether or not these claims are entitled to administrative priority over other claims against SunEdison.

On November 7, 2016, the unsecured creditors’ committee in the SunEdison Bankruptcy case filed a motion with the bankruptcy court seeking standing to assert against the Company, on behalf of SunEdison, avoidance claims arising from intercompany transactions between the Company and SunEdison. If the Settlement Agreement becomes effective, we expect this standing motion will be withdrawn. If the Settlement Agreement is terminated or if the standing motion is not withdrawn, the Company expects to vigorously contest this standing motion and, if standing is granted, the underlying avoidance claims.

On March 6, 2017, the Company entered into a settlement agreement with SunEdison in connection with the SunEdison Bankruptcy and the Merger Agreement (the “Settlement Agreement”). The Settlement Agreement was approved by the bankruptcy court overseeing the SunEdison Bankruptcy on June 7, 2017; however, its effectiveness is conditional on the completion of the Brookfield Transaction. The Settlement Agreement contains certain terms to resolve the complex legal relationship between the Company and SunEdison, including, among other things, an allocation of the total consideration paid in connection with the Brookfield Transaction and, with certain exceptions, the full mutual release of all claims between SunEdison and its affiliated debtors and non-debtors, on the one hand, and the Company and its subsidiaries, on the other hand. Under the settlement terms, following the exchange of all of its Class B shares in TerraForm Global, Inc. and the Class B units in Global LLC for Class A Shares, SunEdison will receive consideration equal to 25% of the total consideration paid to all of the Company's shareholders, reflecting the settlement of intercompany claims and cancellation of incentive distribution rights. The remaining 75% of the consideration will be distributed to existing Class A shareholders. In addition, upon the effectiveness of the Settlement Agreement, with certain limited exceptions, all agreements between the Company and its subsidiaries, on the one hand, and SunEdison and its subsidiaries, on the other hand, including the agreements comprising the Sponsorship Arrangement, would be terminated. There can be no assurance that the Settlement Agreement will become effective, and such failure may adversely impact our business. See “Risks Related to a Failure to Complete the Brookfield Transaction,” “Risks Related to our Relationship with SunEdison and the SunEdison Bankruptcy” and “Risks Related to our Business” in Item 1A. Risk Factors for additional information. The foregoing description of the Settlement Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Settlement Agreement, a copy of which was included as Exhibit 2.2 to our Current Report on Form 8-K filed with the SEC on March 7, 2017 and which is incorporated herein by reference.

Nasdaq Compliance

On March 31, 2016, we received a notification letter from a Director of Nasdaq Listing Qualifications. The notification letter stated that because the Company had not yet filed its Form 10-K for the year ended December 31, 2015, the Company was no longer in compliance with Nasdaq Listing Rule 5250(c)(1), which requires timely filing of periodic reports with the SEC.

On May 17, 2016, we received an additional notification letter from a Director of Nasdaq Listing Qualifications. The notification letter stated that because the Company had not yet filed its Form 10-Q for the quarter ended March 31, 2016, and because it remained delinquent in filing its Form 10-K for the year ended December 31, 2015, the Company was not in compliance with Nasdaq Listing Rule 5250(c)(1).

13

On May 27, 2016, in compliance with the deadline specified in the notification letters, the Company submitted a plan to Nasdaq as to how it planned to regain compliance with Nasdaq’s continued listing requirements.

On June 10, 2016, the Company received a letter from a Director of Nasdaq Listing Qualifications granting the Company an exception of 180 calendar days from the due date of the Form 10-K for the year ended December 31, 2015, or until September 26, 2016, to regain compliance with Nasdaq’s continued listing requirements.

On August 16, 2016, we received an additional notification letter from a Director of Nasdaq Listing Qualifications. The notification letter stated that because the Company had not yet filed its Form 10-Q for the quarter ended June 30, 2016, the Company was not in compliance with Nasdaq Listing Rule 5250(c)(1).

On September 9, 2016, the Company received a letter from Nasdaq stating that due to the Company’s ongoing non-compliance with Nasdaq’s listing requirements, the Company would be delisted from the Nasdaq Global Select Market at the opening of business on September 20, 2016 unless the Company requested a hearing on the determination by September 16, 2016. On September 9, 2016, the Company requested a hearing and also requested a stay of the delisting, pending the hearing. On September 15, 2016, we received a letter from Nasdaq granting our request to extend the stay of delisting until the hearings panel made a decision after the hearing scheduled for November 3, 2016. At the hearing on November 3, 2016, the Company requested from Nasdaq an extension until March 27, 2017 to regain compliance with Nasdaq’s continued listing requirements with respect to its delayed Form 10-K for the year ended December 31, 2015 and its delayed Forms 10-Q for the periods ended March 31 and June 30, 2016.

On November 15, 2016, the Company received a notification letter from a Hearings Advisor from the Nasdaq Office of General Counsel informing the Company that the hearings panel granted the Company’s request for an extension until March 27, 2017 with respect to its delayed Form 10-K for the year ended December 31, 2015 and its delayed Forms 10-Q for the first, second and third quarters of 2016.

In addition, on November 15, 2016, the Company received an additional notification letter from a Director of Nasdaq Listing Qualifications. The notification letter stated that because the Company has not yet filed its Form 10-Q for the quarter ended September 30, 2016, and because it remained delinquent in filing its Form 10-K for the year ended December 31, 2015 and its Forms 10-Q for the quarters ended March 31 and June 30, 2016 the Company was not in compliance with Nasdaq Listing Rule 5250(c)(1). Based on discussions with the hearings panel’s staff, the extension until March 27, 2017 granted by the hearings panel also covered the non-compliance by the Company with Nasdaq Listing Rule 5250(c)(1) caused by the failure of the Company to timely file its Form 10-Q for the quarter ended September 30, 2016.

The Company filed its Form 10-K for the year ended December 31, 2015 on December 21, 2016, its Form 10-Q for the period ended March 31, 2016 on December 23, 2016, its Form 10-Q for the period ended June 30, 2016 on January 31, 2017 and its Form 10-Q for the period ended September 30, 2016 on February 21, 2017. Therefore, as of February 21, 2017, the Company had filed all of its periodic reports with the SEC that were previously identified by Nasdaq as delinquent and the Company was current in its periodic filings with the SEC. On February 21, 2017, the Company requested an extension until June 30, 2017 to regain compliance with Nasdaq’s continued listing requirements with respect to its Form 10-K for the year ended December 31, 2016 and its Form 10-Q for the period ended March 31, 2017, which the Company expected to be delayed beyond applicable SEC deadlines.

On March 17, 2017, the Company received a notification letter from a Director of Nasdaq Listing Qualifications. The notification letter noted that the Company had regained compliance with Listing Rule 5250(c)(1) as of February 21, 2017. The notification letter also stated that because the Company had not yet filed its Form 10-K for the year ended December 31, 2016, the Company was no longer in compliance with Nasdaq Listing Rule 5250(c)(1).

On January 4, 2017, the Company received a notification letter from a Senior Director of Nasdaq Listing Qualification, which stated that the Company's failure to hold its annual meeting by December 31, 2016, as required by Nasdaq Listing Rule 5620(a) (the “Annual Meeting Rule”), serves as an additional basis for delisting the Company's securities and that the hearings panel would consider this matter in their decision regarding the Company's continued listing on the Nasdaq Global Select Market. On January 11, 2017, the Company submitted a response requesting an extension to hold an annual meeting and regain compliance with the Annual Meeting Rule.

On March 20, 2017, the Company received a notification letter from a Hearings Advisor from the Nasdaq Office of General Counsel informing the Company that the hearings panel granted the Company an extension until June 30, 2017 to regain compliance with Nasdaq’s continued listing requirements with respect to its Form 10-K for the year ended December 31, 2016, its Form 10-Q for the first quarter of 2017 and its delinquency in holding its annual meeting during the year ended December 31, 2016. The hearings panel reserved the right to reconsider the terms of the extension and the Nasdaq Listing and Hearing Review Council may determine to review the hearings panel’s decision.

14

On May 15, 2017, the Company received a notification letter from a Senior Director of Nasdaq Listing Qualifications stating that because the Company has not yet filed its Form 10-Q for the period ended March 31, 2017, this serves as an additional basis for delisting the Company’s securities from the Nasdaq Stock Market under Nasdaq Listing Rule 5250(c)(1).

The Company's annual meeting of stockholders for 2017 has been scheduled for June 29, 2017.

Board of Directors and Management Changes

On March 30, 2016, Mr. Brian Wuebbels resigned from his position as President and Chief Executive Officer of the Company and resigned from his position as a director on the Board. Following the resignation of Mr. Wuebbels, at the proposal of SunEdison, the Board elected Mr. Ilan Daskal, the Chief Financial Officer Designee and Executive Vice President of SunEdison, to be a member of the Board and fill the vacancy created by Mr. Wuebbels’ resignation.

In connection with Mr. Wuebbels' resignation, the Board delegated all of the powers, authority and duties vested in the President and Chief Executive Officer to the Chairman of the Board, Mr. Peter Blackmore. From March 30, 2016 until April 21, 2016, Mr. Blackmore served as the chairman of the Office of the Chairman. On April 21, 2016, the Board dissolved the Office of the Chairman and Mr. Blackmore was appointed as Interim Chief Executive Officer in addition to his role as Chairman of the Board. In connection with this appointment, Mr. Blackmore ceased to be a member of the Conflicts Committee. Mr. John F. Stark was appointed as the Chairman of the Conflicts Committee, and Mr. Dahya was designated as a member of the Conflicts Committee.

On May 25, 2016, at the proposal of SunEdison, the Board appointed Mr. David Ringhofer, an Assistant General Counsel of SunEdison, to be a member of the Board effective upon the resignation of Mr. Ahmad R. Chatila. Pursuant to an agreement entered into with SunEdison on May 26, 2016, the Company has undertaken to include Mr. Ringhofer as a nominee to the Board on the slate of directors to be elected at the next annual meeting of stockholders of the Company, unless Mr. Ringhofer resigns or is otherwise unable to serve as a director.

On May 26, 2016, Mr. Chatila resigned from his position as a director on the Board. The resignation was contingent upon, and effective immediately prior to, the appointment of Mr. Ringhofer as a member of the Board and did not alter Mr. Chatila’s prior approval of Mr. Ringhofer as a member of the Board as a director.

On June 24, 2016, Mr. Daskal resigned from his position as a director on the Board. The resignation was contingent upon, and effective immediately prior to, the appointment of Mr. Gregory Scallen, Head of Legal, Global EPC, Procurement and EHS of SunEdison, as an observer of the Board. The resignation did not alter Mr. Daskal’s prior approval by written consent to the appointment of Mr. Scallen to the Board as observer or director, as described below.

On June 24, 2016, at the proposal of SunEdison, the Board appointed Mr. Scallen as an observer of the Board, effective upon the resignation of Mr. Daskal and continuing until July 24, 2016, or until his earlier death, resignation or removal. The Board also approved Mr. Scallen to become a member of the Board on July 24, 2016.

On June 30, 2016, the Board appointed Mr. Thomas Studebaker as Chief Operating Officer of the Company and Mr. David Rawden as Interim Chief Accounting Officer, which appointments became effective on July 7, 2016.

On August 30, 2016, Mr. Ismael Guerrero Arias resigned as President, Head of Origination of the Company.

On August 30, 2016, Mr. Martin Truong resigned from his position as a director of the Board. The resignation was contingent upon, and effective immediately prior to, the appointment of Mr. David Springer, the Senior Vice President, EPC Global of SunEdison, to the Board as director. The resignation did not alter Mr. Truong’s prior approval by written consent to the appointment of Mr. Springer to the Board as a director, as described below.

On August 30, 2016, at the proposal of SunEdison, the Board executed a unanimous written consent that appointed Mr. Springer to the Board as a replacement director, effective immediately upon the resignation of Mr. Truong.

On October 13, 2016, the Board voted to increase the size of the Board to nine members and to elect Mr. Mark Lerdal and Mr. Frederick J. Boyle to be members of the Board effective immediately. On December 1, 2016, the Board appointed Messrs. Lerdal and Boyle to the Conflicts Committee of the Board, effectively immediately.

On December 1, 2016, the Board appointed Mr. Lerdal and Mr. Boyle to the Conflicts Committee, effective immediately. Additionally, on December 1, 2016, the members of the LLC Conflicts Committee (as defined below) appointed Mr. Boyle and Mr. Lerdal as additional members of the LLC Conflicts Committee.

15

On January 4, 2017, SunEdison Holdings Corporation, a wholly-owned subsidiary of SunEdison, Inc., exercised its right to designate Mr. David J. Mack to the Board effective immediately.

On January 10, 2017, the Board appointed Mr. Boyle to serve as a member of the Audit Committee of the Board. Following Mr. Boyle’s appointment, the Audit Committee consists of four members, Messrs. Hanif Dahya, Christopher Compton, Stark and Boyle.

On January 13, 2017, the Board appointed Mr. Mack to the Conflicts Committee, effective immediately upon the resignation of Messrs. Compton, Dahya and Stark from the Conflicts Committee. Messrs. Compton, Dahya and Stark resigned from the Conflicts Committee on January 13, 2017. As a result of these changes, the Conflicts Committee consists of three members, Messrs. Lerdal, Boyle and Mack. Mr. Boyle serves as the Chairman of the Conflicts Committee.

Additionally, on January 13, 2017, the members of the LLC Conflicts Committee appointed Mr. Mack to the LLC Conflicts Committee, effective immediately upon the resignation of Messrs. Compton, Dahya and Stark from the LLC Conflicts Committee. Messrs. Compton, Dahya and Stark resigned from the LLC Conflicts Committee on January 13, 2017. As a result of these changes, the LLC Conflicts Committee consists of three members, Messrs. Lerdal, Boyle and Mack.

On January 25, 2017, the Board voted to elect Mr. Alan B. Miller to be a member of the Board effective immediately.

Additionally, on January 25, 2017, Mr. David Springer resigned from his position as a director of the Board. The resignation was contingent upon, and effective immediately prior to, the election of Mr. Alan B. Miller as a director of the Board.

Creation of LLC Conflicts Committee

On June 1, 2016, TerraForm Global, Inc., acting in its capacity as the sole managing member of Global LLC, adopted a second amendment (the “LLC Agreement Amendment”) to the Fourth Amended and Restated Limited Liability Company Agreement of Global LLC, dated as of August 5, 2015 (as amended from time to time, the “Global LLC Agreement”). Pursuant to the LLC Agreement Amendment, until the first annual meeting of the Company’s stockholders held after December 31, 2016, the Company delegated to an independent conflicts committee (the “LLC Conflicts Committee”) the exclusive power to exercise all of its rights, powers and authority as the sole managing member of Global LLC to manage and control the business and affairs of Global LLC and its controlled affiliates relating to or involving SunEdison and any of its affiliates (other than the Company and its controlled affiliates) (as more specifically defined in the LLC Agreement Amendment, the “Conflicts Matters”).

The LLC Agreement Amendment was approved and authorized by the Company’s Conflicts Committee pursuant to the power and authority delegated to it by resolutions of the Board dated March 25, 2016 authorizing the Conflicts Committee, in anticipation of and in connection with a bankruptcy filing by SunEdison, to evaluate and act affirmatively with respect to matters involving or substantially relating to SunEdison, including actions to protect the Company’s contractual and other rights and otherwise to preserve the value of the Company and its assets. The decision to delegate authority to the Conflicts Committee with respect to these SunEdison related matters was taken by the Board in light of the obligation that material matters relating to SunEdison be approved by the Conflicts Committee. On June 1, 2016, the Board reaffirmed the power and authority delegated to the Conflicts Committee with respect to these SunEdison related matters by ratifying the adoption of the LLC Agreement Amendment.

The current members of the LLC Conflicts Committee are Messrs. Lerdal, Boyle and Mack. New members may be appointed (i) by a majority of LLC Conflicts Committee members then in office or (ii) by the Company (in its capacity as managing member of Global LLC) with the approval of the holders of a majority of the outstanding shares of Class A common stock of TerraForm Global, Inc., excluding any such shares held, directly or indirectly, by SunEdison or any of its affiliates (“Independent Shareholder Approval”).

Each member of the LLC Conflicts Committee must satisfy, in the determination of the LLC Conflicts Committee, the Nasdaq Global Select Market standards for “independent directors” and nominations committee members.

The delegation of exclusive power and authority to the LLC Conflicts Committee under the LLC Agreement Amendment may not be revoked and the members of the LLC Conflicts Committee may not be removed, other than by a written instrument signed by the Company, acting in its capacity as managing member of Global LLC, with either (i) the written consent of a majority of the LLC Conflicts Committee members then in office, or (ii) Independent Shareholder Approval.

16

Creation of Compensation Committee

For purposes of the applicable stock exchange rules, the Company is a “controlled company.” As a controlled company, the Company may rely upon certain exceptions, including with respect to establishing a compensation committee or nominating committee. While the Company remains able to rely upon such exceptions, on January 10, 2017, the Board created a Compensation Committee of the Board (the “Compensation Committee”).

The Compensation Committee is responsible for, among other matters: (i) reviewing and approving corporate goals and objectives relevant to the compensation of the Company’s Chief Executive Officer, (ii) determining, or recommending to the Board for determination, the Chief Executive Officer’s compensation level based on this evaluation, (iii) determining, or recommending to the Board for determination, the compensation of directors and all other executive officers, (iv) discharging the responsibility of the Board with respect to the Company’s incentive compensation plans and equity-based plans, (v) overseeing compliance with respect to compensation matters, (vi) reviewing and approving severance or similar termination payments to any current or former executive officer of the Company, and (vii) preparing an annual Compensation Committee Report, if required by applicable SEC rules.

The Compensation Committee consists of three members, Messrs. Lerdal, Mack and Stark. Mr. Lerdal has been designated as the Chairman of the Compensation Committee. The Board has adopted a written charter for the Compensation Committee, which is available on the Company’s corporate website, http://www.terraformglobal.com.

Dividends

On November 10, 2015, the Company declared a dividend for the third quarter of 2015 on the Company’s Class A common stock of $0.1704 per share, which was paid on December 15, 2015 to stockholders of record on December 1, 2015. This amount represents a quarterly dividend of $0.275 per share.

On February 29, 2016, the Company declared a dividend for the fourth quarter of 2015 on the Company’s Class A common stock of $0.275 per share. The dividend was paid on March 17, 2016 to stockholders of record as of March 10, 2016. The Company did not declare or pay a dividend for the first, second, third or fourth quarter of 2016. Prior to the execution of the Merger Agreement, as a result of the SunEdison Bankruptcy, the limitations on our ability to access the capital markets for our corporate debt and equity securities, and other risks that we face as detailed in this Annual Report on Form 10-K, we believed it was prudent to defer any decisions on paying dividends to our stockholders. Under the Merger Agreement, we are restricted from declaring or paying dividends prior to the consummation of the Brookfield Transaction.

Acquisitions

See Item 15. Note 4 - Acquisitions for information regarding the acquisitions completed by the Company, the Company’s pending acquisition, incomplete IPO project transfers and dropdowns, and terminated acquisitions.

Revolving Credit Facility and Senior Notes due 2022

Permanent Termination of Revolving Commitments under the Revolving Credit Facility

On March 31, 2017, Global Operating LLC permanently reduced to zero and terminated the revolving commitments under our Revolver and entered into a fifth amendment (the “Fifth Amendment”) to the Revolver. The Fifth Amendment provides that Global LLC will no longer be required to deliver to the administrative agent and the other lenders party to the Revolver its annual financial statements and accompanying audit reports, unaudited quarterly financial statements, annual compliance certificates, statements of reconciliation after changes in accounting principles, annual financial plans and reconciliations of non-recourse project indebtedness pursuant to the Revolver, and removes the requirement that Global LLC and its subsidiaries comply with certain financial ratios contained in the Revolver. The Fifth Amendment requires Global Operating LLC to provide the administrative agent under the Revolver with an annual collateral verification within 90 days after the end of each fiscal year.

On March 30, 2016, Global Operating LLC entered into a first amendment to the Revolver to amend certain financial covenants to extend the date on which the Company must deliver to the administrative agent and the other lenders party to the Revolver its financial statements and accompanying audit report with respect to the year ended December 31, 2015 (the “2015 Financials”) to April 30, 2016 and to provide for the engagement of a financial consultant to serve as advisor to the Revolver lenders. On April 29, 2016, Global Operating LLC entered into a second amendment to the Revolver, which further extended the due date for the delivery of the 2015 Financials to May 7, 2016.

17

However, on May 6, 2016, Global Operating LLC entered into a third amendment (the “Third Amendment”) to the Revolver. The Third Amendment reduced the aggregate amount of the revolving commitments to $350.0 million. Additionally, the Third Amendment extended the date by which the Company must deliver to the Administrative Agent and the other lenders party to the Revolver the 2015 Financials to the earlier of (a) the tenth business day prior to the date on which the failure to deliver the 2015 Financials would constitute an event of default under the indenture governing the Senior Notes and (b) March 30, 2017. The Third Amendment also extended the date by which the Company must deliver its unaudited quarterly financial statements with respect to the quarter ended March 31, 2016 to June 30, 2016 and with respect to the fiscal quarters ended June 30, 2016 and September 30, 2016 to the date that is 75 days after the end of each fiscal quarter. The Third Amendment also required the Company to undertake certain additional obligations, including (1) to provide the lenders with preliminary financial information for the quarter ended March 31, 2016, (2) to comply with Nasdaq requirements for submitting compliance plans for the Company’s delayed filings and (3) to request a waiver or amendment under the indenture governing the Senior Notes with respect to Global Operating LLC’s obligation to make available audited financial statements for fiscal year 2015. The Company has complied with all three requirements.

On September 13, 2016, Global Operating LLC entered into a fourth amendment (the "Fourth Amendment") to the Revolver pursuant to the requirements of the Third Amendment to increase the applicable margin used to determine the interest rate on loans under the Revolver under certain circumstances relating to a waiver or amendment under the Senior Notes.

As of December 31, 2016, the Company had issued a letter of credit for $0.4 million under the terms of the Revolver in support of the Alto Cielo acquisition. The letter of credit was terminated on March 23, 2017 in connection with the Fifth Amendment.

Senior Notes Due 2022

In December 2015, the Company’s Board approved a $40.0 million open market repurchase program for the Company’s Senior Notes. The repurchase program began in December 2015 and continued through January 2016. As of December 31, 2015, $8.6 million of the Senior Notes were repurchased for $6.8 million, and the Company paid $0.4 million of accrued interest and prepayment fees. As of December 31, 2015, $0.4 million was included in accounts payable on the consolidated balance sheet representing principal and interest due to an investment bank for repurchases completed in December 2015 but settled in January 2016. A gain on extinguishment of $6.3 million was recognized related to these repurchases and is included in loss on extinguishment of debt, net for the year ended December 31, 2016. In January 2016, the Company repurchased $41.0 million of the Senior Notes for $33.2 million and paid $1.9 million of interest and prepayment fees. In total, the Company repurchased $49.6 million of the Senior Notes for $40.0 million plus prepayment fees and interest of $2.3 million.

On May 11, 2016, Global Operating LLC received a letter on behalf of certain beneficial holders of the Senior Notes, which purported to constitute a notice of default with respect to the failure of Global Operating LLC to comply with its obligations under the indenture governing the Senior Notes to timely furnish the Company’s annual report for the year ended December 31, 2015. On May 13, 2016, Global Operating LLC sent a response to this letter, stating that the purported notice of default was untimely, and therefore ineffective, under the indenture.

On May 31, 2016, Global Operating LLC received a notice of default from the trustee under the indenture governing the Senior Notes with respect to the failure of Global Operating LLC to comply with its obligations under the indenture governing the Senior Notes to timely furnish the Company’s annual report for the year ended December 31, 2015.

Global Operating LLC received a notice of default, dated July 15, 2016, from the trustee under the indenture governing the Senior Notes with respect to the failure of Global Operating LLC to comply with its obligations under the indenture governing the Senior Notes to timely furnish the Company's Form 10-Q for the first quarter of 2016.

On September 2, 2016, the Company announced the successful completion of a consent solicitation to obtain waivers relating to certain reporting covenants under the indenture governing the Senior Notes and to effectuate certain amendments to the indenture governing the Senior Notes. Global Operating LLC received validly delivered and unrevoked consents from the holders of a majority in aggregate principal amount of the Senior Notes outstanding as of the record date. Global Operating LLC paid to each consenting holder a consent fee of $5.00 for each $1,000 principal amount of the Senior Notes held by such holder as to which Global Operating LLC received and accepted consents. Under the terms of the waivers, the deadline to comply with the reporting covenants in the indenture governing the Senior Notes relating to the filing of the Company’s Form 10-K for 2015 and Form 10-Q for the first quarter of 2016 was extended to December 6, 2016. Compliance with the reporting covenants in the indenture relating to the filing of the Company’s Form 10-Q for the second quarter of 2016 was also waived until December 6, 2016, with no event of default expected to occur with respect to the Form 10-Q for the second quarter of 2016 unless such Form 10-Q were not filed by early March 2017.

18