Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Option Care Health, Inc. | v454965_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Option Care Health, Inc. | v454965_ex99-2.htm |

Exhibit 99.1

© 2012 BioScrip Inc. All rights reserved. Bank Meeting Proposed Amendment to Credit Agreement

© 2012 BioScrip Inc. All rights reserved. 2 Disclaimer The information contained herein has not been independently verified . The Company and its respective affiliates and representatives expressly disclaim any and all liability based, in whole or in part, on such information, errors therein, or omission therefrom . None of the Company or its respective affiliates or representatives makes any representation or warranty, expressed or implied, as to the completeness or accuracy of the information contained herein or any other written or oral communication transmitted or made available to any recipient . In addition, any projections and forward - looking statements provided herein with respect to the anticipated future performance of the Company reflect various assumptions concerning the future performance of the Company and are subject to significant business, economic, and competitive uncertainties and contingencies, including those discussed in the Company’s most recent Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q . Accordingly, there can be no assurance that such projections and forward - looking statements will be realized . The actual results may vary from the anticipated results and such variations may be material . Neither the Company nor any other person assumes responsibility for the accuracy and completeness of these forward - looking statements . This document should not be relied upon to form the basis of any investment decision or any decision regarding the Company . Recipients should not construe the contents of this document or any enclosures or related documents as legal or investment advice . Recipients should make an independent assessment of the merits of pursuing a transaction and should consult such recipient’s own professional advisors . This document shall not be deemed an indication of the condition (financial or otherwise) of the Company, nor shall it constitute an indication that there has been no change in the business or affairs of the Company since the date hereof . None of the Company or its respective affiliates or representatives undertakes any obligation to update any of the information contained herein . This document contains an estimate of projected adjusted EBITDA. Projected adjusted EBITDA as used in this presentation is consistent with the Company’s definition of adjusted EBITDA as presented in its annual reports filed on Form 10 - K and quarterly reports filed on Form 10 - Q. The Company is not able to provide a reconciliation of projected adjusted EBITDA to expected results due to the unknown effect, timing and potential significance of gains or losses on disposition and restructuring, acquisition, integration and other similar expenses.

© 2012 BioScrip Inc. All rights reserved. 3 Agenda ▪ Industry & Company Overview ▪ Amendment Request ▪ Mid Quarter Update: Q4 - 2016 ▪ Legislative Update: Cures Act ▪ Amendment Terms Overview

© 2012 BioScrip Inc. All rights reserved. 4 Industry & Company Overview

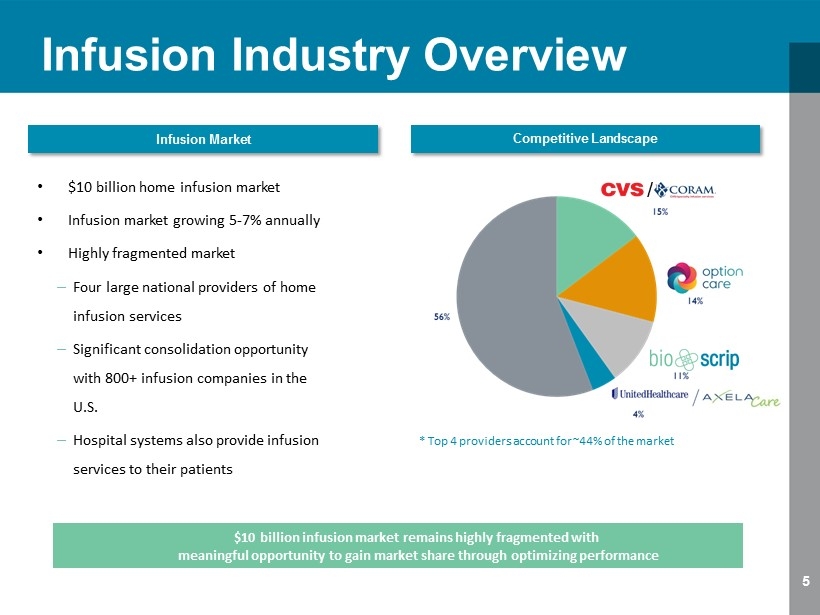

© 2012 BioScrip Inc. All rights reserved. Infusion Industry Overview 5 • $10 billion home infusion market • Infusion market growing 5 - 7% annually • Highly fragmented market – Four large national providers of home infusion services – Significant consolidation opportunity with 800+ infusion companies in the U.S. – Hospital systems also provide infusion services to their patients Infusion Market Competitive Landscape * Top 4 providers account for ~44% of the market $10 billion i nfusion m arket r emains highly fragmented with meaningful o pportunity to gain market share through optimizing performance /

© 2012 BioScrip Inc. All rights reserved. Bioscrip National Footprint 6 Nationwide Capabilities with Licensure to Dispense in All 50 States 58 Infusion Pharmacy Locations and 60+ Ambulatory Infusion Centers 100 Million Lives Under Contract 250+ Field Sales R esources Team of Regional Directors of Strategic Initiatives

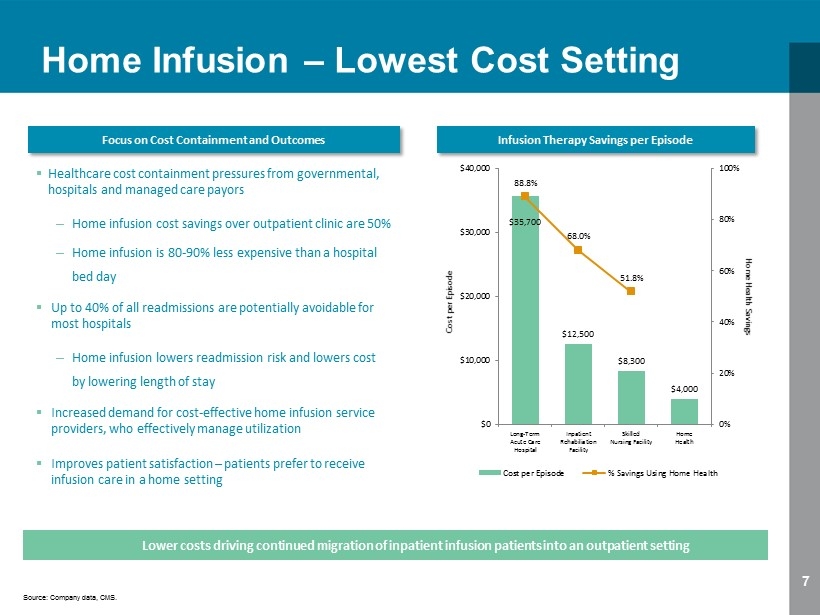

© 2012 BioScrip Inc. All rights reserved. Home Infusion – Lowest Cost Setting 7 Focus on Cost Containment and Outcomes Infusion Therapy Savings per Episode ▪ Healthcare cost containment pressures from governmental, hospitals and managed care payors – Home infusion cost savings over outpatient clinic are 50% – Home infusion is 80 - 90% less expensive than a hospital bed day ▪ Up to 40% of all readmissions are potentially avoidable for most hospitals – Home infusion lowers readmission risk and lowers cost by lowering length of stay ▪ Increased demand for cost - effective home infusion service providers, who effectively manage utilization ▪ Improves patient satisfaction – patients prefer to receive infusion care in a home setting Lower costs driving continued migration of inpatient infusion patients into an outpatient setting $35,700 $12,500 $8,300 $4,000 88.8% 68.0% 51.8% 0% 20% 40% 60% 80% 100% $0 $10,000 $20,000 $30,000 $40,000 Long-Term Acute Care Hospital Inpatient Rehabiliation Facility Skilled Nursing Facility Home Health Home Health Savings Cost per Episode Cost per Episode % Savings Using Home Health Source: Company data, CMS.

© 2012 BioScrip Inc. All rights reserved. 8 Amendment Request

© 2012 BioScrip Inc. All rights reserved. 9 Amendment Request ▪ New CEO, Dan Greenleaf, implementing turnaround plan which is already having a positive impact on the Company’s cash flows ▪ The Company is in the beginning stages of an 18 to 24 month turn around ▪ Amendment provides near - term liquidity and working capital for the Company ▪ Improved cash flows in Q2 - 2017 and beyond will allow for covering future Bond semi - annual interest payments as well as covering required debt amortization payments and all working capital and capex needs ▪ Q1 - 2017 is projected as the lowest liquidity point for company over the next eight quarters ▪ The Bond semi - annual interest payment due in Feb 2017 of $8.9mm is the primary reason for the low Q1 - 2017 liquidity

© 2012 BioScrip Inc. All rights reserved. 10 Mid Quarter Update

© 2012 BioScrip Inc. All rights reserved. 11 Mid Quarter Update: Q4 - 2016 ▪ October and November operating performance has been very solid and is expected to produce Q4 results at the high end of our fourth quarter guidance previously provided: – Q4 Revenues between $232mm and $239mm – Q4 adjusted EBITDA between $6mm and $8mm ▪ In terms of sales growth, we have experienced core growth at a pace better than we anticipated – YoY Core revenues are now growing, an improvement from the erosion noted in Q3 - 2017 – Core Revenue Mix Nov QTD is 70% up 500bps from 65% Core Mix at end of Q3 - 2016

© 2012 BioScrip Inc. All rights reserved. 12 Performance Update ▪ Synergies: By 12/31/16 we anticipate completion of all necessary actions to realize $17.0 million of synergies during the 2017 fiscal year ▪ In addition to the $17m in synergies we will realize in 2017, we also are on pace to fully realize between $8.0mm and $10.0mm in additional annualized cost cuts. ▪ O ur synergies and cost cut realization includes streamlining of operational and corporate workflows, as well as a workforce reduction (110 employees over the last 60 days)

© 2012 BioScrip Inc. All rights reserved. 13 Legislative Update

© 2012 BioScrip Inc. All rights reserved. 14 Legislative Update: Cures Act ▪ Cures Act was passed by Congress (Dec 2016) ▪ Cures impact on the Infusion industry is a significant reduction in Medicare reimbursement effective January 1, 2017 on specified drugs from AWP minus pricing down to ASP plus pricing ▪ The Company estimates that the Cures Act as written will result in reimbursement reductions impacting therapies representing approximately 3% to 4% of total current revenues ▪ Previously , the higher Medicare drug reimbursement for these therapies essentially subsidized the lack of reimbursement for nursing visits and pharmacy services / medical supplies – both of which were and continue to be “missing” under Medicare reimbursement regulations

© 2012 BioScrip Inc. All rights reserved. 15 Amendment Overview

© 2012 BioScrip Inc. All rights reserved. 16 Amendment Overview ▪ Remove the $15.0MM block on the Revolving Credit Facility in exchange for allowing a $35.0MM First - Out Revolver which will partially repay the existing $75.0MM parri Revolver and reduce its commitment to $40.0MM ▪ The First - Out Revolver will have scheduled commitment reduction in 3Q17, 4Q17 and 1Q18, resulting in a $20.0MM Commitment by the end of this period ▪ Amend the leverage covenant for the next 7 quarters ▪ The negative covenants in the Existing Credit Agreement shall be amended to reduce or remove certain baskets ▪ Maturity of the loan will remain unchanged ▪ Require the Company to hire and pay for a Financial Advisor FTI ▪ Add a minimum unadjusted EBITDA Covenant for the Revolving Lenders ▪ Pay a 25 bps fee for Consenting Term Loan Lenders

© 2012 BioScrip Inc. All rights reserved. 17 Capitalization Table (dollars in millions) SOURCES: USES: $35.0 mm First Out Revolver 0.5$ Fees & Expenses 0.5$ (dollars in millions) Interest LIBOR Unused Pro Forma Capitalization Amount Leverage* Rate Floor Maturity Fee Cash 2.8$ Debt: $35.0mm First Out Revolver 20.0 0.7x L + 5.25% na 7/31/2018 0.50% Revolving Credit Facility 40.0 1.3x L + 5.25% na 7/31/2018 0.50% 1st Lien Term Loan 213.4 7.0x L + 5.25% 1.25% 7/31/2018 na Capital Leases 0.7 nm Total First Lien Debt 274.1 9.0x Senior Secured Notes 196.5 6.5x 8.88% 2/28/2021 Total Debt 470.6$ 15.5x Equity: Common Equity 131.8$ Equity / Total Capitalization 21.9% * Leverage based on LTM adjusted ebitda "as reported" in BIOS press releases

© 2012 BioScrip Inc. All rights reserved. 18 Amendment Contact Info ▪ Legal documentation for the Amendment will be posted to Syndtrack in the next few business days ▪ The Company is requesting Consent by Tuesday, December 20 th by 4:00pm EST ▪ Consenting Lenders should email executed pdf copies of the signature page for each legal entity in the transaction to Christopher Boies of King & Spalding at cboies@kslaw.com Contact info ▪ Business Contact: Juan DeJesus - Caballero, juan.dejesus - caballero@suntrust.com – 407 - 237 - 4507 ▪ Legal Contact: Christopher Boies , cboies@kslaw.com – 212 - 556 - 2327