Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Versum Materials, Inc. | exhibit991pressreleasedate.htm |

| 8-K - 8-K - Versum Materials, Inc. | vsm8-kearnings10312016.htm |

VERSUM MATERIALS

EARNINGS CONFERENCE CALL:

Fourth Quarter & Full Fiscal Year 2016

December 1, 2016 – 11:00 A.M. Eastern

FORWARD-LOOKING STATEMENTS

This presentation contains certain statements regarding future actions, results and other matters which are “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “project,”

“estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,”

“guidance,” “outlook,” “effort,” “target” and similar expressions identify these forward-looking statements, which speak only as of the date the statements

were made. Forward-looking statements include, without limitation, statements about business strategies, operating plans, and outlook for Versum

Materials, our growth prospects, expectations as to future sales, operating income or Adjusted EBITDA, estimates regarding capital requirements and needs

for additional financing, estimates of expenses and cost reduction efforts, future revenues and profitability, our future operating results on a segment basis,

anticipated cash flows, estimates of the size of the market for our products, estimates of the success of other competing technologies that may become

available, and our future success as an independent public company. These forward-looking statements are based on management’s reasonable

expectations and assumptions as of the date of this presentation. Actual results and the outcomes of future events may differ materially from the those

expressed or implied in the forward-looking statements because of a number of risks and uncertainties, including, without limitation, weakening of global

or regional general economic and business conditions that could decrease the demand for our goods and services; our ability to continue technological

innovation to meet the evolving needs of our customers; future financial and operating performance of major customers; unanticipated contract

terminations or customer cancellations of sales; the impact of competitive products and pricing; unexpected changes in raw material supply and markets;

our failure to successfully develop and market new products and optimally manage product life cycles; our inability to protect and enforce intellectual

property rights; our failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions;

global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats,

such as acts of sabotage, terrorism or war, weather events and natural disaster; increased competition; changes in relationships with our significant

customers and suppliers; unanticipated business disruptions; our ability to predict, identify and interpret changes in consumer preferences and demand;

uncertainty regarding the availability of financing to us in the future and the terms of such financing; disruptions in our information technology networks

and systems; unexpected safety or manufacturing issues; costs and outcomes of litigation or regulatory investigations; the impact of management and

organizational changes; the success of productivity and operational improvement programs; the timing, impact, and other uncertainties of future

acquisitions or divestitures; the impact of changes in environmental, tax or other legislation and regulations in jurisdictions in which Versum Materials and

its affiliates operate; and uncertainties related to our ability to contain costs and realize the anticipated benefits of the completed spin-off from Air

Products. These and other important factors that could cause actual results or events to differ materially from those expressed in our forward-looking

statements are described in our filings with the U.S. Securities and Exchange Commission, including our Form 10 Registration Statement, as amended, and

our periodic filings. Versum Materials disclaims any obligation or undertaking to disseminate any updates or revisions to the outlook and any forward-

looking statements contained in this document to reflect any change in assumptions, beliefs or expectations, or any change in circumstances occurring after

the date of this presentation.

Non-GAAP Financial Measures

This presentation contains certain “Non-GAAP financial measures.” Please refer to the Appendix for definitions of the non-GAAP financial measures used

herein and for a reconciliation of those non-GAAP financial measures to their most comparable GAAP measures.

AGENDA

Business Review: Guillermo Novo, President & CEO

Financial Overview and Guidance: George Bitto, SVP & CFO

Summary: Guillermo Novo, President & CEO

3

Refer to Appendix for reconciliations between GAAP and non-GAAP measures.

VERSUM MATERIALS

INVESTMENT HIGHLIGHTS

Solid growth

High margins

Low capital intensity

Strong cash flow

4

BEST IN CLASS ELECTRONIC MATERIALS COMPANY

Leadership positions in a profitable and

complex semiconductor materials industry

Strong technology, commercial and

operations capabilities

Compelling growth platforms with

sustainable competitive advantage

Strong financial performance and cash flow

generation

Experienced management team with

proven track record

Global infrastructure

BUSINESS REVIEW

6

FISCAL YEAR 2016 IN REVIEW

VERSUM BUSINESS ACHIEVEMENTS

Transitioned Operating Structure to Business from Functional

Delivered Strong Financial Performance

Completed Successful Spin-off

Improved Safety Track Record

Expanded capacity and increased productivity

Initiated Stand-alone Restructuring Activities

Built Robust Innovation Pipeline

7

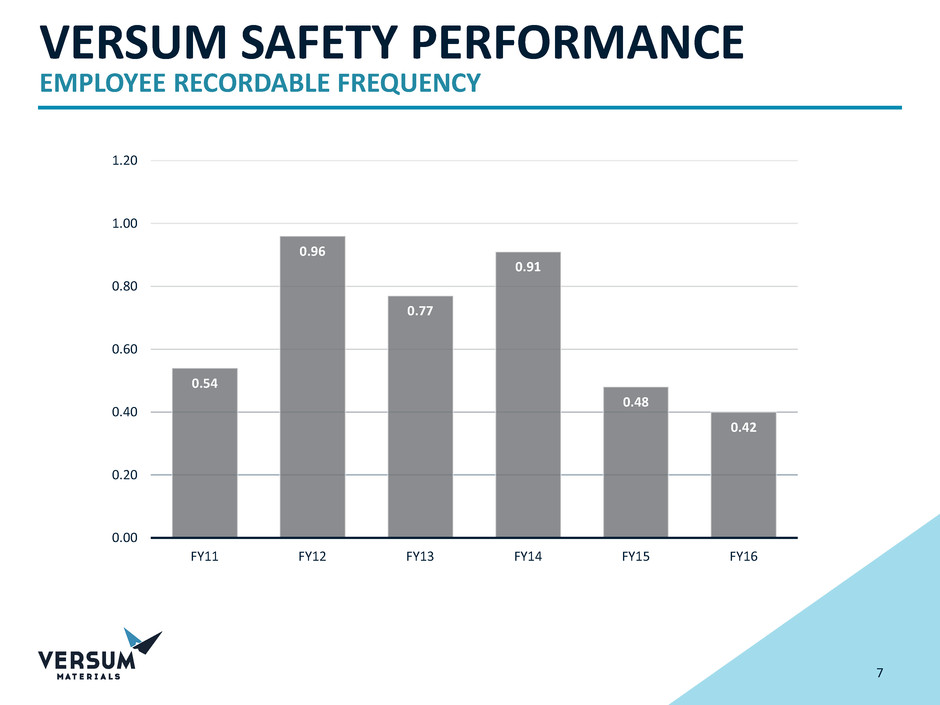

VERSUM SAFETY PERFORMANCE

EMPLOYEE RECORDABLE FREQUENCY

0.54

0.96

0.77

0.91

0.48

0.42

0.00

0.20

0.40

0.60

0.80

1.00

1.20

FY11 FY12 FY13 FY14 FY15 FY16

FINANCIAL HIGHLIGHTS

FOURTH QUARTER AND FISCAL FULL YEAR 2016 PERFORMANCE AND DRIVERS

(In millions, except percentages) FYQ416 FYQ415 % change

FY16 FY15 % change

Sales 248.4 232.4 7% 970.1 1,009.3 (4)%

Gross Margin 44% 40% 400 bps 44% 39% 500 bps

Operating Income 63.0 47.9 32% 278.9 222.0 26%

Net Income 45.2 43.2 5% 212.0 184.1 15%

Adjusted EBITDA 78.0 69.8 12% 326.9 301.5 8%

Adjusted EBITDA Margin 31% 30% 100 bps 34% 30% 400 bps

Fourth Quarter: Adjusted EBITDA margin of 31%, up 1%

Sales higher due to strong DS&S and AM volumes, offset by lower volumes

in certain PM products

Adjusted EBITDA up due to cost productivity, strong sales and favorable

price/mix

Fiscal Year: Adjusted EBITDA margin of 34%, up 4%

Sales down due to lower DS&S turnkey volumes, product line exits and

currency, partially offset by price/mix

Adjusted EBITDA up on favorable price/mix and cost improvements, offset

by lower volumes

8 AM: Advanced Materials; PM: Process Materials; DS&S: Delivery Systems & Services

NOTES: Based on carveout financials

Refer to Appendix for reconciliations between GAAP and non-GAAP measures.

9

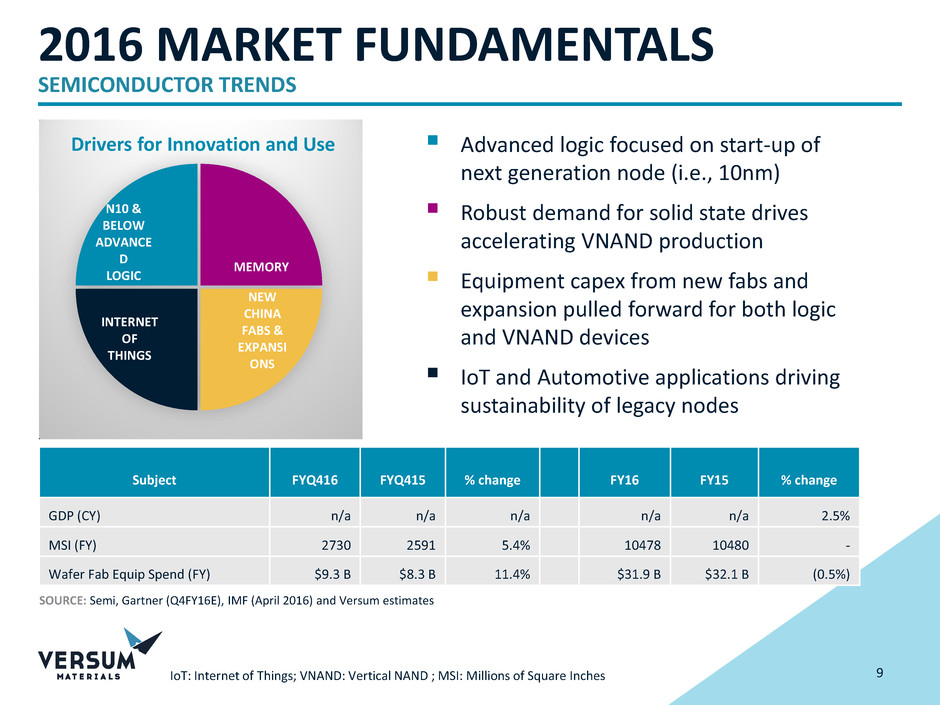

2016 MARKET FUNDAMENTALS

SEMICONDUCTOR TRENDS

Advanced logic focused on start-up of

next generation node (i.e., 10nm)

Robust demand for solid state drives

accelerating VNAND production

Equipment capex from new fabs and

expansion pulled forward for both logic

and VNAND devices

IoT and Automotive applications driving

sustainability of legacy nodes

NEW

CHINA

FABS &

EXPANSI

ONS

INTERNET

OF

THINGS

N10 &

BELOW

ADVANCE

D

LOGIC

MEMORY

Subject FYQ416 FYQ415 % change

FY16 FY15 % change

GDP (CY) n/a n/a n/a n/a n/a 2.5%

MSI (FY) 2730 2591 5.4% 10478 10480 -

Wafer Fab Equip Spend (FY) $9.3 B $8.3 B 11.4% $31.9 B $32.1 B (0.5%)

IoT: Internet of Things; VNAND: Vertical NAND ; MSI: Millions of Square Inches

SOURCE: Semi, Gartner (Q4FY16E), IMF (April 2016) and Versum estimates

Drivers for Innovation and Use

MATERIALS SEGMENT

FOURTH QUARTER AND FISCAL FULL YEAR 2016 PERFORMANCE AND DRIVERS

(In millions, except percentages) FYQ416 FYQ415 % change

FY16 FY15 % change

Sales 192.9 192.8 - % 756.7 743.4 2%

Operating Income 57.3 55.1 4% 252.3 213.7 18%

Adjusted EBITDA 69.1 67.6 2% 296.9 262.8 13%

Adjusted EBITDA Margin 35.8% 35.1% 70 bps 39.2% 35.4% 380 bps

In weaker industry demand environment, solid

performance driven largely by memory

AM strong volumes from legacy and new node

participation

PM lower volumes from exited businesses and lower

spot sales

Positive price/mix and Improved operational

productivity offsetting higher stand-up costs

10

NOTES: Based on carveout financials

Full Year Overview:

Refer to Appendix for reconciliations between GAAP and non-GAAP measures.

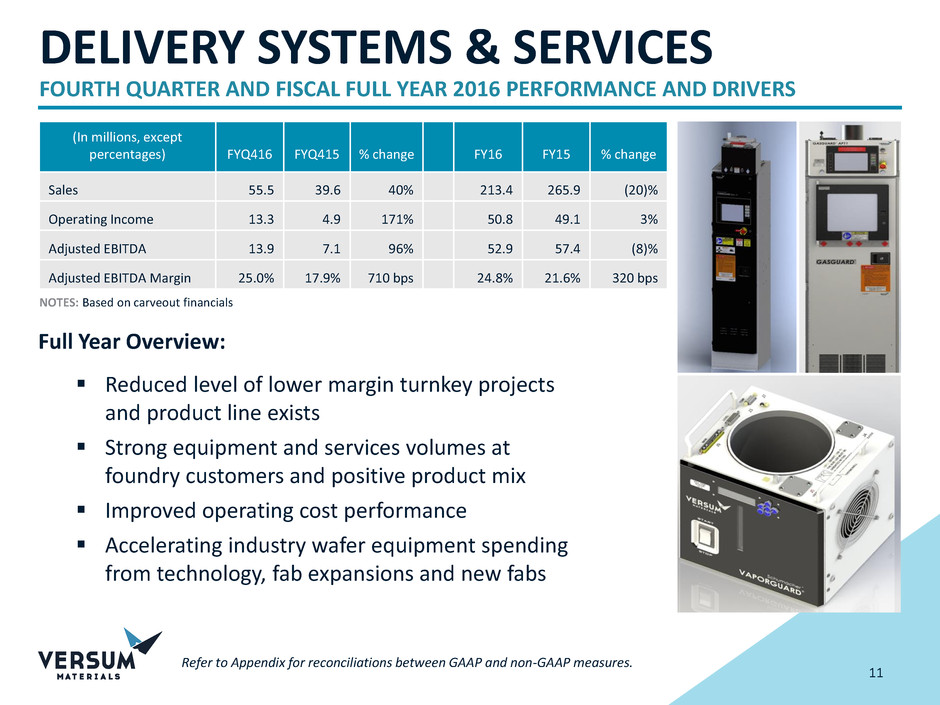

DELIVERY SYSTEMS & SERVICES

FOURTH QUARTER AND FISCAL FULL YEAR 2016 PERFORMANCE AND DRIVERS

(In millions, except

percentages) FYQ416 FYQ415 % change

FY16 FY15 % change

Sales 55.5 39.6 40% 213.4 265.9 (20)%

Operating Income 13.3 4.9 171% 50.8 49.1 3%

Adjusted EBITDA 13.9 7.1 96% 52.9 57.4 (8)%

Adjusted EBITDA Margin 25.0% 17.9% 710 bps 24.8% 21.6% 320 bps

11

NOTES: Based on carveout financials

Reduced level of lower margin turnkey projects

and product line exists

Strong equipment and services volumes at

foundry customers and positive product mix

Improved operating cost performance

Accelerating industry wafer equipment spending

from technology, fab expansions and new fabs

Full Year Overview:

Refer to Appendix for reconciliations between GAAP and non-GAAP measures.

FINANCIAL UPDATE

REPORTED INCOME STATEMENT

FOURTH QUARTER AND FISCAL FULL YEAR 2016

13

(In Millions) Q4 FY16 Q4 FY15 % change FY16 FY15 % change

Sales 248.4 232.4 7% 970.1 1,009.3 (4)%

Cost of Sales 138.7 139.7 (1)% 539.5 616.5 (12)%

Selling and administrative 33.2 26.6 25% 109.8 109.6 - %

Research and development 11.5 11.7 (2)% 43.9 40.7 8%

Operating Income 63.0 47.9 32% 278.9 222.0 26%

Separation, restructuring and cost reduction actions 2.5 7.1 (65)% 0.9 21.6 (96)%

Adjusted EBITDA 78.0 69.8 12% 326.9 301.5 8%

Net Income Attributable to Versum 45.2 43.2 5% 212.0 184.1 15%

NOTES: Based on carveout financials

Sales

Versum

Total

FYQ416

Versum

Total

FY16

Materials

FYQ416

Materials

FY16

Delivery Systems

and Services

FYQ416

Delivery Systems

and Services

FY16

Volume 7% (5)% -% -% 42% (19)%

Price/Mix -% 3% (1)% 3% —% —%

Currency -% (2)% 1% (1)% (2)% (1)%

Total Change 7% (4)% -% 2% (40)% (20)%

Major Factors Impacting Sales

Refer to Appendix for reconciliations between GAAP and non-GAAP measures.

ESTIMATED CASH FLOW NET DEBT TO ADJ EBITDA

(In millions, except debt multiple) FY2016

Debt

Term Loan 575

Senior Notes 425

Total Debt 1,000

Less Cash 106

Net Debt 894

2016 ADJ EBITDA 327

Net Debt/Adjusted EBITDA (x) 2.7x

(In millions) FY2016

Total Adjusted EBITDA $327

Working Capital (7)

Estimated Cash Taxes (54)

Cash Interest & Principal Repayment (49)

Less Working Capital, Cash Taxes and Interest $217

Capital Expenditures (36)

Cash Flow $181

CASH GENERATION AND LEVERAGE

FISCAL YEAR 2016 BASIS

14

NOTES: FY16 EBITDA and capital spending based on carve-out unaudited financials. Working capital is estimated change in accounts receivable,

inventory and accounts payables for FY16. Interest and principal repayment reflect forward estimates on $1B debt financing closed September 30,

2016. Estimated cash taxes based on 23% cash tax rate, which management believes will be consistent with current tax position on a stand-alone

basis.

Refer to Appendix for reconciliations between GAAP and non-GAAP measures.

CALENDAR YEAR % CHANGE

GLOBAL GDP 2.7% – 3.0%

GLOBAL MSI 2% – 6%

WAFER FAB EQUIPMENT 5% – 9%

SOURCE: Linx/Hilltop Economics, Gartner, Versum estimates

FINANCIAL OUTLOOK

NOTES: 2016 Actual reflects carveout financials and includes $3 million of Adjusted EBITDA for businesses remaining with APD. 2017 guidance includes

approximately $10 million of transition costs; Adj EBITDA excludes estimated one time restructuring costs of $20 - $25mm. 2017 D&A estimate of $50MM; cash

and book tax rate in range of 20 – 25%, capital spending includes $35-40 of stand-up capital

2017 FISCAL YEAR FINANCIAL OUTLOOK

15

MARKET DRIVERS:

Continued strong VNAND demand

Acceleration of advanced

logic devices

Logic and memory drive continued

new fab expansions

BUSINESS DRIVERS:

Volume growth from new products,

capacity expansions and increased

equipment sales

Continued cost optimization

Maintain margins

ASSUMPTIONS FOR GROWTH OUTLOOK

Reconciliation of net income to our 2017 outlook for adjusted EBITDA is not

provided. See Appendix for more information.

(In millions) FISCAL 2016 ACTUAL 2017 OUTLOOK

SALES $970 $990 – $1,050

ADJ EBITDA $327 $330 – $350

Capital Expenditures $36 $75 – $85

SUMMARY

17

SEMICONDUCTOR MARKET OUTLOOK

2017 TREND EXPECTATIONS

Advanced logic benefits as 10nm moves from

qualification into production

VNAND production accelerates as additional

flash manufacturers ramp

DRAM shows signs of recovery

Equipment capex remains robust as leading edge

logic, VNAND and China investments continue

IoT and automotive applications drive demand

for legacy nodes

5 Strongest End Markets

• Smartphones

• Servers

• PC (returns to growth)

• Solid State Drives

• IoT

VNAND: Vertical NAND; DRAM: Dynamic Random Access Memory; IoT: Internet of Things;

MCU: Micro Controller Units

Unit Shipments 2016E 2017E 2018E

Smartphones 6.2% 6.6% 5.3%

Servers 3.2% 4.1% 4.1%

PCs (8.2%) 1.8% 2.4%

Solid-State Drives 34% 25% 21%

IoT (MCU) 4.5% 5.0% 7.1%

NOTE: Gartner and Versum estimates; top 5 products shipments represent ~50% of

semi consumption

NEW

CHINA

FABS &

EXPANSI

ONS

INTERNE

T

OF

THINGS

N10 &

BELOW

ADVANC

ED

LOGIC

MEMOR

Y

Drivers for Innovation and Use

18

2017 PRIORITIES

DRIVING OPERATIONAL EXCELLENCE AND FINANCIAL EXECUTION AS A STAND-ALONE COMPANY

APD TSA: Air Products and Chemicals Transition Service Agreements; VSM: Versum

Stand-Alone Activities

Transition Fully to Stand-Alone

• Move from APD TSA to VSM

stand-alone managed cost

structure

• Robust Reporting and

Governance processes

• Investor Engagement

• Implement enterprise

resource planning (ERP)

system

Deliver on 2017 Fiscal Year

Financial Targets

Drive Innovation to capture

market share on next

generation nodes

Strengthen front line

commercial and technical

capabilities

Optimize Cash Flow generation

to fund value enhancing

organic and inorganic

investments

Complete debottlenecking

and capacity expansions in

Materials segment

Continue to optimize our

global supply network

Increase operating

productivity and yield

Expand our Quality and

Reliability capabilities

Productivity Growth

Customer Focus – Strengthened capabilities to collaborate and create value for customers

Accountability – Increased alignment of compensation to direct business level performance

Culture

VERSUM MATERIALS

INVESTMENT HIGHLIGHTS

Solid growth

High margins

Low capital intensity

Strong cash flow

19

BEST IN CLASS ELECTRONIC MATERIALS COMPANY

Leadership positions in a profitable and

complex semiconductor materials industry

Strong technology, commercial and

operations capabilities

Compelling growth platforms with

sustainable competitive advantage

Strong financial performance and cash flow

generation

Experienced management team with

proven track record

Global infrastructure

APPENDICES

21

REVENUES BY BUSINESS & REGION

FISCAL YEARS 2014 - 2016

Year Ended September 30,

2016 2015 2014

Sales to External Customers (by Origin) (In millions)

United States $ 349.4

$ 361.3

$ 330.3

Taiwan 230.8

236.3

228.0

South Korea 217.2

220.3

184.3

China 53.8

70.9

76.9

Europe 57.8

69.2

70.3

Asia, excluding China, Taiwan, and South Korea 61.1

51.3

52.7

Total $ 970.1

$ 1,009.3

$ 942.5

Geographic Information

Year Ended September 30,

2016 2015 2014

(In millions)

Materials

Process Materials $ 387.4

$ 387.3

$ 321.8

Advanced Materials 369.3

356.1

318.2

DS&S

Equipment and Installations 150.8

208.3

244.1

Site Services 62.6

57.6

58.4

Total $ 970.1

$ 1,009.3

$ 942.5

Sales by Product Group

22

CONSOLIDATED INCOME STATEMENT

Q1 – Q4 FISCAL YEAR 2016

For the Quarter Ended

December 31,

2015 March 31, 2016 June 30, 2016

September 30,

2016 Total

(In millions)

Sales $ 245.5 $ 233.5 $ 242.7 $ 248.4 $ 970.1

Cost of sales 132.4 132.5 135.9 138.7 539.5

Selling and administrative 23.6 25.7 27.3 33.2 109.8

Research and development 10.9 10.2 11.3 11.5 43.9

Business separation, restructuring and cost reduction

actions (0.9 ) (1.8 ) 1.1 2.5 0.9

Other income (expense), net 1.1 1.0 0.3 0.5 2.9

Operating Income 80.6 67.9 67.4 63.0 278.9

Equity affiliates’ income 0.2 — — — 0.2

Interest expense — — — 0.4 0.4

Income Before Taxes 80.8 67.9 67.4 62.6 278.7

Income tax provision 13.4 12.2 17.6 15.6 58.8

Net Income 67.4 55.7 49.8 47.0 219.9

Less: Net Income Attributable to Non-controlling

Interests 2.2 1.9 2.0 1.8 7.9

Net Income Attributable to Versum $ 65.2 $ 53.8 $ 47.8 $ 45.2 $ 212.0

23

CONSOLIDATED AND SEGMENT SALES MAJOR FACTORS

THREE MONTHS AND FULL FISCAL YEAR 2015 AND 2016

Three Months

Ended September

30, 2016

Year Ended

September 30, 2016

Sales

Underlying business

Volume 7 % (5 )%

Price/Mix — % 3 %

Currency — % (2 )%

Versum Materials Sales Change 7 % (4 )%

Three Months

Ended September

30, 2016

Year Ended

September 30, 2016

Sales

Underlying business

Volume — % — %

Price/Mix — % 3 %

Currency 1 % (1 )%

Materials Sales Change 1 % 2 %

Three Months

Ended September

30, 2016

Year Ended

September 30,

2016

Sales

Underlying business

Volume 42 % (19 )%

Price/Mix — % — %

Currency (2 )% (1 )%

DS&S Sales Change 40 % (20 )%

Versum Materials Total

Materials Segment

DS&S Segment

RECONCILIATIONS

Non-GAAP Financial Measures

This presentation includes “non-GAAP financial measures,” including Adjusted EBITDA, Segment Adjusted EBITDA, Adjusted EBITDA

margin, Segment Adjusted EBITDA margin, net debt and estimated cash flow. We define Adjusted EBITDA as net income excluding

certain disclosed items which we do not believe to be indicative of underlying business trends, including interest expense, income tax

provision, depreciation and amortization expense, non-controlling interests, and business separation, restructuring and cost reduction

actions. Versum Materials defines Segment Adjusted EBITDA as segment operating income excluding segment depreciation and

amortization expense, and equity affiliates’ income. Adjusted EBITDA margin and Segment Adjusted EBITDA margin are calculated by

dividing Adjusted EBITDA and Segment Adjusted EBITDA, respectively, by sales. In the Appendix to this presentation, Versum Materials

has provided reconciliations of net income to Adjusted EBITDA and of segment operating income (loss) to Segment Adjusted EBITDA,

in each case the most directly comparable GAAP financial measure. We encourage investors to read these reconciliations.

Our presentation of estimated cash flow is defined as Adjusted EBITDA, less capital expenditures, working capital, cash taxes and cash

Interest and principal repayment. Management believes that estimated cash flow is meaningful to investors because it is an indication

of the strength of the company and its ability to generate cash. However, a limitation of estimated cash flow is that it does not

represent the total increase or decrease in cash during the period. Estimated cash flow is not intended to be an alternative to cash

flows from operating activities as a measure of liquidity. In addition, the term “cash flow” does not have a standardized meaning.

Therefore, other companies may use the same or a similarly named measure but exclude different items or use different

computations, which may provide investors a comparable view of our performance in relation to other companies.

RECONCILIATIONS

Non-GAAP Financial Measures (continued)

The presentation of these non-GAAP financial measures is intended to enhance the usefulness of financial information by providing measures which

management uses internally to evaluate operating performance. We use these non-GAAP measures to assess our operating performance by excluding

certain disclosed items that we believe are not representative of our underlying business. We use Adjusted EBITDA to calculate performance-based cash

bonuses and determine whether certain performance-based options and restricted stock units vest (as such bonuses, options and restricted stock units

are tied to Adjusted EBITDA). We use Segment Adjusted EBITDA as the primary measure used by our chief operating decision maker to evaluate the

ongoing performance of our business segments. We believe non-GAAP financial measures provide investors with meaningful information to understand

our underlying operating results and to analyze financial and business trends. These non-GAAP financial measures should not be viewed in isolation, are

not a substitute for GAAP measures, and have limitations which include but are not limited to the following: (a) Adjusted EBITDA excludes expenses

related to business separation, restructuring and cost reduction actions which we do not consider to be representative of our underlying business

operations, however, these disclosed items represent costs to Versum; (b) Adjusted EBITDA is not intended to be a measure for management’s

discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements; (c) though

not business operating costs, interest expense and income tax provision represent ongoing costs of Versum; (d) depreciation, amortization, and

impairment charges represent the wear and tear or reduction in value of the plant, equipment, and intangible assets which permit us to manufacture

and market our products; and (e) other companies may define non-GAAP measures differently than we do, limiting their usefulness as comparative

measures. A reader may find any one or all of these items important in evaluating our performance. Management compensates for the limitations of

using non-GAAP financial measures by using them only to supplement our GAAP results and to provide a more complete understanding of the factors

and trends affecting our business. In evaluating these non-GAAP financial measures, the reader should be aware that we may incur expenses similar to

those eliminated in this presentation in the future.

A reconciliation of net income to Adjusted EBITDA as forecasted for 2017 is not provided. Versum Materials does not forecast net income as it cannot,

without unreasonable effort, estimate or predict with certainty various components of net income. These components include additional costs

associated with the separation from Air Products, further restructuring and other income or charges incurred in 2017 as well as the related tax impacts

of these items. Additionally, discrete tax items could drive variability in our forecasted effective tax rate. All of these components could significantly

impact net income. Further, in the future, other items with similar characteristics to those currently included in Adjusted EBITDA that have a similar

impact on comparability of periods, and which are not known at this time, may exist and impact Adjusted EBITDA.

REPORTED NET INCOME TO ADJUSTED EBITDA

FOURTH QUARTER AND FISCAL FULL YEAR

26

Three Months Ended September 30, Year Ended September 30,

2016 2015 % Change 2016 2015 % Change

(In millions, except percentages)

Net Income Attributable to Versum $ 45.2 $ 43.2 5 % $ 212.0 $ 184.1 15 %

Add: Interest expense 0.4 — 100 % 0.4 0.1 300 %

Add: Income tax provision 15.6 3.6 333 % 58.8 31.7 85 %

Add: Depreciation and amortization 12.5 14.5 (14) % 46.9 56.9 (18) %

Add: Non-controlling interests 1.8 1.4 29 % 7.9 7.1 11 %

Add: Business separation, restructuring and cost

reduction actions 2.5 7.1 (65) % 0.9 21.6 (96) %

Adjusted EBITDA $ 78.0 $ 69.8 12 % $ 326.9 $ 301.5 8 %

Net Income Margin 18.2 % 18.6 % 21.9 % 18.2 %

Adjusted EBITDA Margin 31.4 % 30.0 % 33.7 % 29.9 %

27

SALES BY SEGMENT

FISCAL QUARTERS FOR 2015 AND 2016

SEGMENT OPERATING INCOME TO ADJUSTED EBITDA

QUARTER AND FISCAL FULL YEAR

28

(A) Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by sales.

For the Quarter Ended For the Quarter Ended

December

31, 2015

March 31,

2016

June 30,

2016

September

30, 2016 Total

December

31, 2014

March 31,

2015

June 30,

2015

September

30, 2015 Total

(In millions, except percentages) (In millions, except percentages)

Materials

Operating income $ 68.5 $ 60.1 $ 66.4 $ 57.3 $ 252.3 $ 42.7 $ 53.0 $ 62.9 $ 55.1 $ 213.7

Add: Depreciation and amortization 10.9 10.5 11.2 11.8 44.4 13.4 11.3 11.2 12.2 48.1

Add: Equity affiliates’ income 0.2 — — — 0.2 0.4 0.3 — 0.3 1.0

Segment Adjusted EBITDA $ 79.6 $ 70.6 $ 77.6 $ 69.1 $ 296.9 $ 56.5 $ 64.6 $ 74.1 $ 67.6 $ 262.8

Segment Adjusted EBITDA margin(A) 42.2 % 38.9 % 40.1 % 35.8 % 39.2 % 32.2 % 36.1 % 37.7 % 35.1 % 35.4 %

Delivery Systems and Services

Operating income $ 15.9 $ 9.7 $ 11.9 $ 13.3 $ 50.8 $ 15.4 $ 14.7 $ 14.1 $ 4.9 $ 49.1

Add: Depreciation and amortization 0.5 0.5 0.5 0.6 2.1 1.8 2.1 2.2 2.2 8.3

Add: Equity affiliates’ income — — — — — — — — — —

Segment Adjusted EBITDA $ 16.4 $ 10.2 $ 12.4 $ 13.9 $ 52.9 $ 17.2 $ 16.8 $ 16.3 $ 7.1 $ 57.4

Segment Adjusted EBITDA margin(A) 28.9 % 19.6 % 25.2 % 25.0 % 24.8 % 21.6 % 21.0 % 24.4 % 17.9 % 21.6 %

Corporate

Operating loss $ (4.7 ) $ (3.7 ) $ (9.8 ) $ (5.1 ) $ (23.3 ) $ (4.4 ) $ (4.5 ) $ (5.3 ) $ (5.0 ) $ (19.2 )

Add: Depreciation and amortization 0.1 0.1 0.1 0.1 0.4 0.1 0.1 0.2 0.1 0.5

Add: Equity affiliates’ income — — — — — — — — — —

Segment Adjusted EBITDA $ (4.6 ) $ (3.6 ) $ (9.7 ) $ (5.0 ) $ (22.9 ) $ (4.3 ) $ (4.4 ) $ (5.1 ) $ (4.9 ) $ (18.7 )

Total Versum Adjusted EBITDA $ 91.4 $ 77.2 $ 80.3 $ 78.0 $ 326.9 $ 69.4 $ 77.0 $ 85.3 $ 69.8 $ 301.5