Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20161201.htm |

3rd Quarter 2016 Investor Presentation Exhibit 99.1

This presentation contains forward-looking statements, as defined by Federal Securities Laws, relating to present or future trends or factors affecting the operations, markets and products of CenterState Banks, Inc. (CSFL). These statements are provided to assist in the understanding of future financial performance. Any such statements are based on current expectations and involve a number of risks and uncertainties. For a discussion of factors that may cause such forward-looking statements to differ materially from actual results, please refer to CSFL’s most recent Form 10-Q and Form 10-K filed with the Securities and Exchange Commission. CSFL undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation. Forward Looking Statement

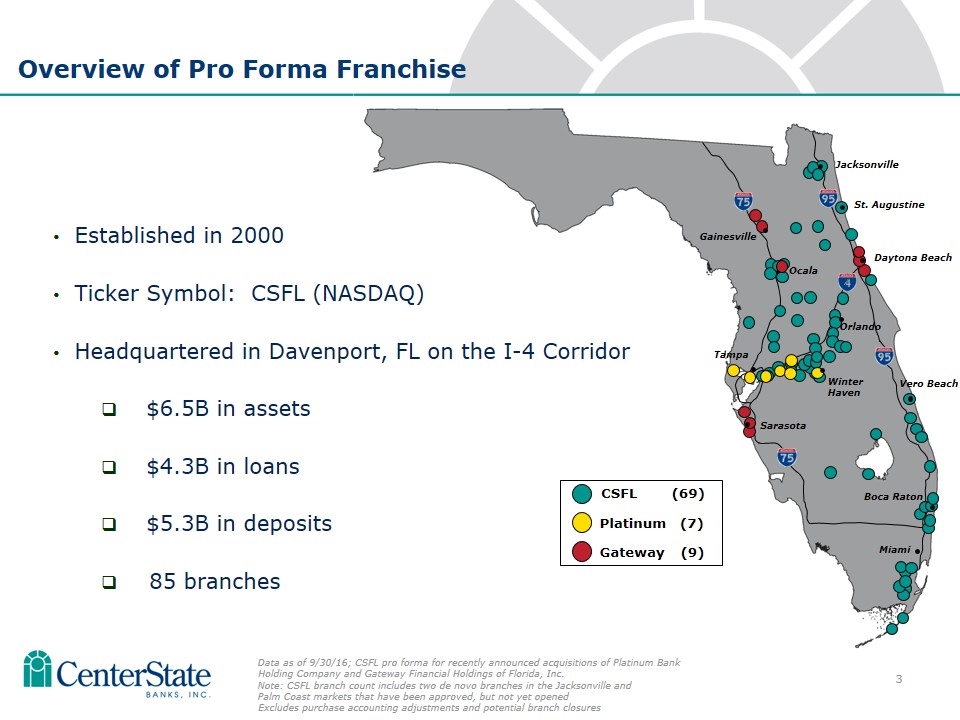

Tampa Jacksonville Orlando Winter Haven Miami Overview of Pro Forma Franchise Ocala Gainesville Sarasota Daytona Beach CSFL (69) Platinum (7) Gateway (9) St. Augustine Vero Beach Boca Raton Established in 2000 Ticker Symbol: CSFL (NASDAQ) Headquartered in Davenport, FL on the I-4 Corridor $6.5B in assets $4.3B in loans $5.3B in deposits 85 branches Data as of 9/30/16; CSFL pro forma for recently announced acquisitions of Platinum Bank Holding Company and Gateway Financial Holdings of Florida, Inc. Note: CSFL branch count includes two de novo branches in the Jacksonville and Palm Coast markets that have been approved, but not yet opened Excludes purchase accounting adjustments and potential branch closures

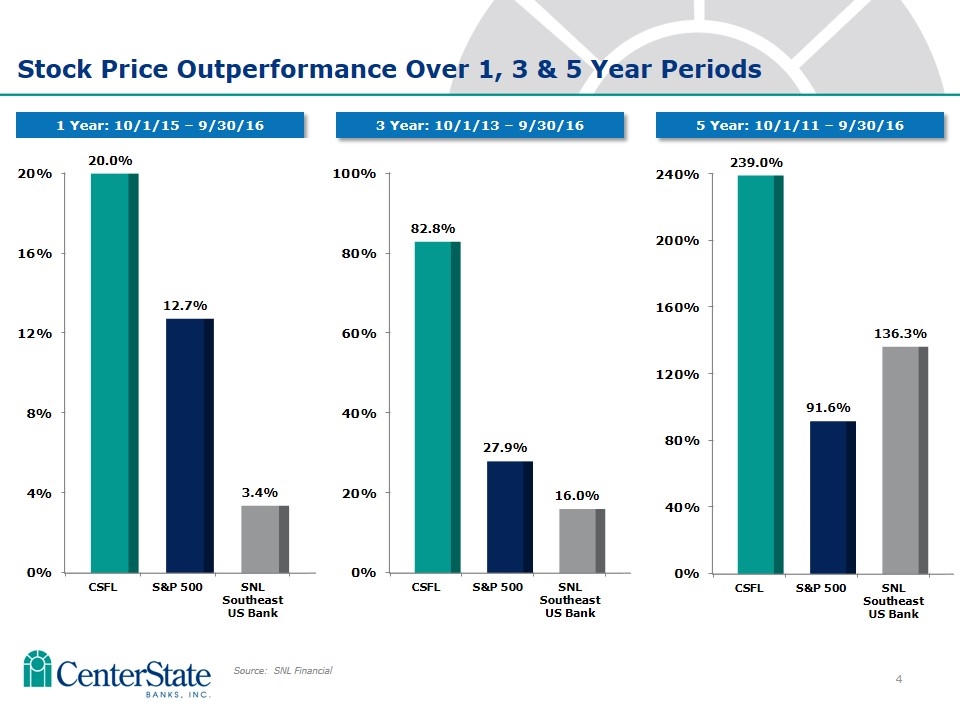

Stock Price Outperformance Over 1, 3 & 5 Year Periods 1 Year: 10/1/15 – 9/30/16 3 Year: 10/1/13 – 9/30/16 Source: SNL Financial 5 Year: 10/1/11 – 9/30/16

Current Focus 1. Improve earning asset mix from a 81% loan to deposit ratio to 85% Recruiting commercial lending teams 2. Invest in non-interest income lines of business Mortgage SBA ARC interest rate swap product Deposit service charges 3. M&A No longer necessary to achieve scale Core competency after 14 announced acquisitions since 20091 Ample opportunities (1)Pro forma for recently announced acquisitions of Platinum Bank Holding Company and Gateway Financial Holdings of Florida, Inc.

Banking the Sunshine State

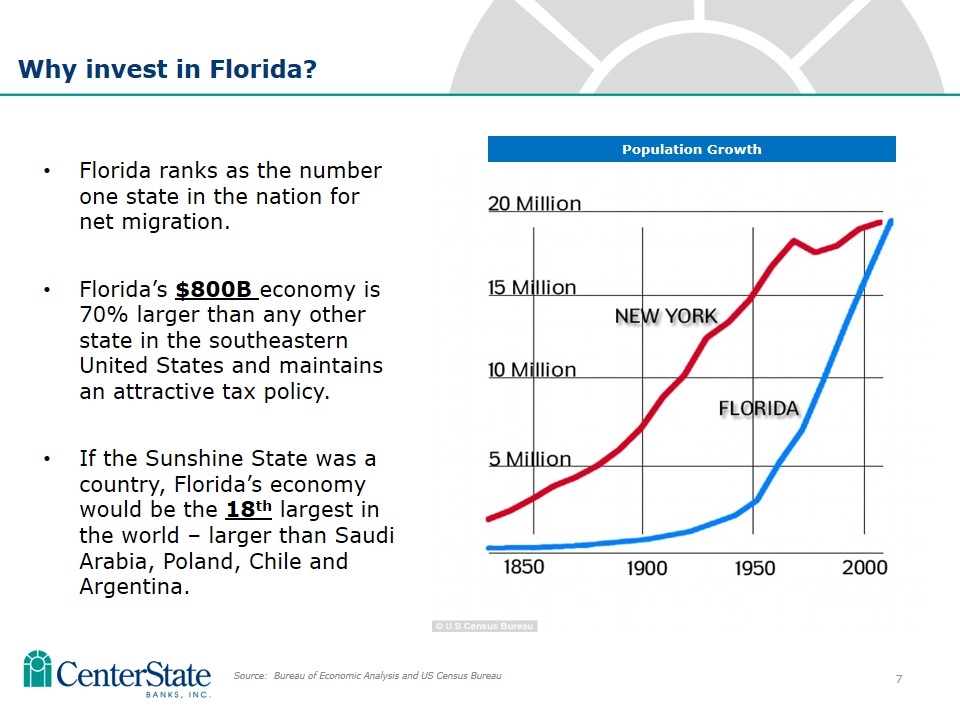

Florida ranks as the number one state in the nation for net migration. Florida’s $800B economy is 70% larger than any other state in the southeastern United States and maintains an attractive tax policy. If the Sunshine State was a country, Florida’s economy would be the 18th largest in the world – larger than Saudi Arabia, Poland, Chile and Argentina. Why invest in Florida? Source: Bureau of Economic Analysis and US Census Bureau Population Growth

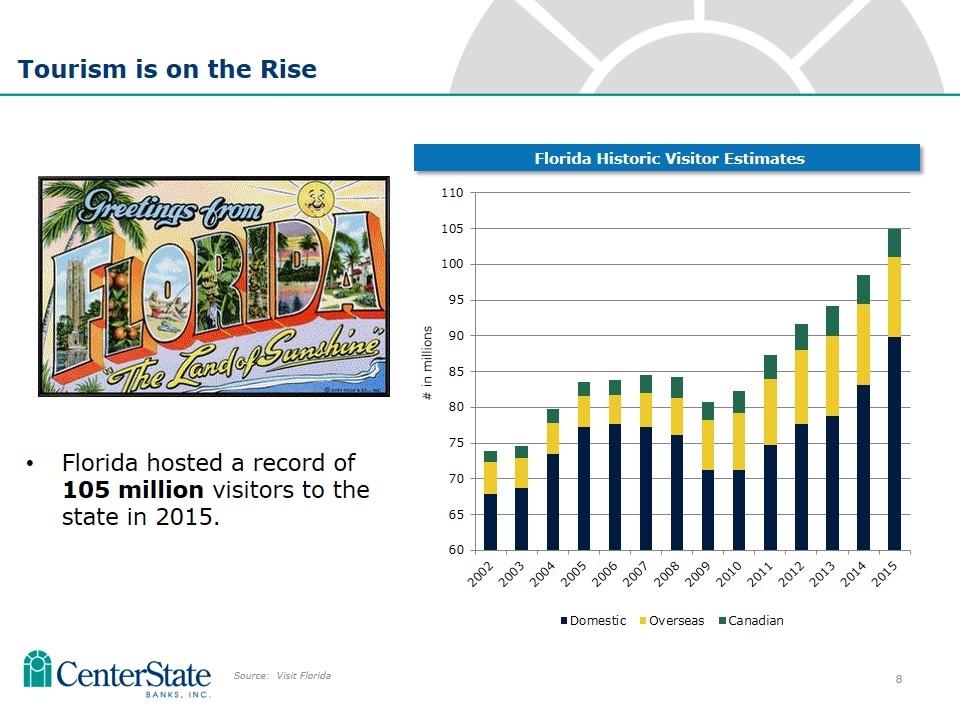

Florida hosted a record of 105 million visitors to the state in 2015. Tourism is on the Rise Source: Visit Florida Florida Historic Visitor Estimates

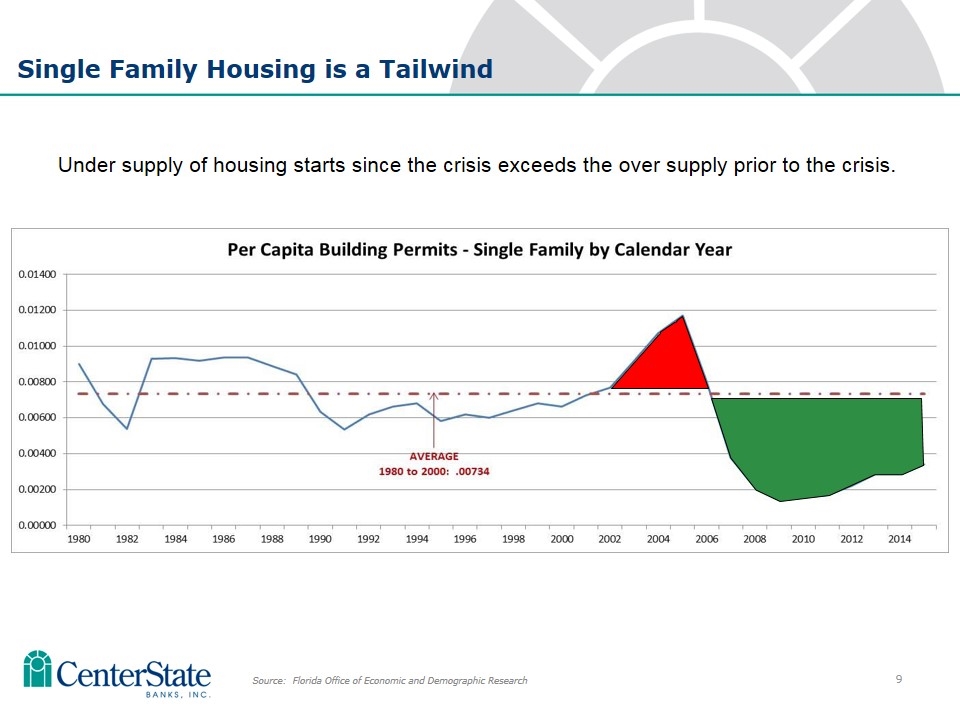

Single Family Housing is a Tailwind Under supply of housing starts since the crisis exceeds the over supply prior to the crisis. Source: Florida Office of Economic and Demographic Research Over supply Under supply

Capital Management

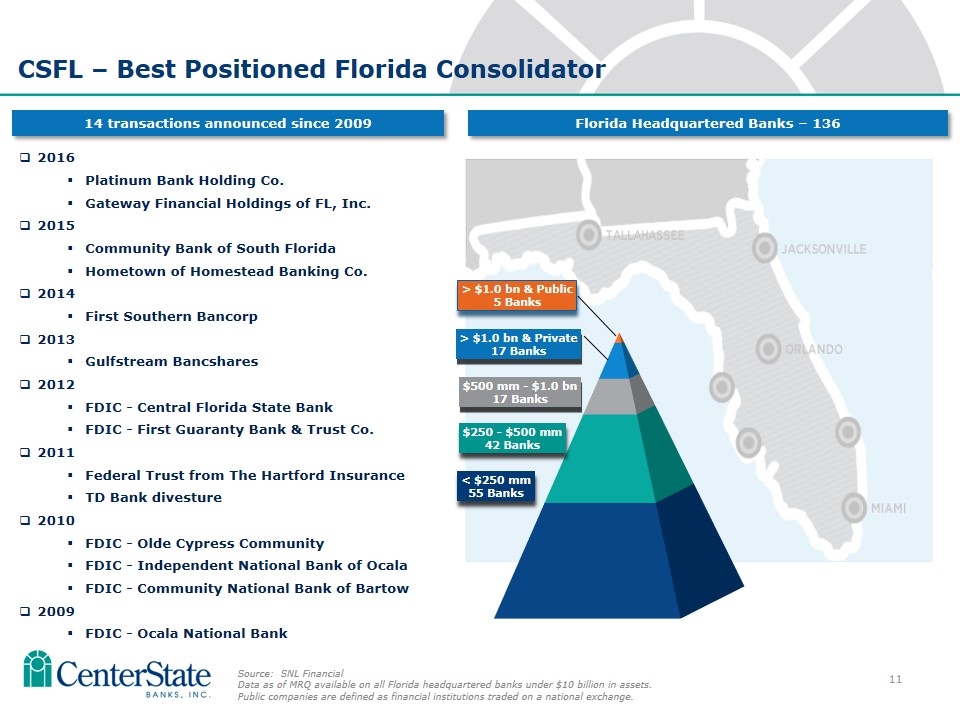

18 CSFL – Best Positioned Florida Consolidator Source: SNL Financial Data as of MRQ available on all Florida headquartered banks under $10 billion in assets. Public companies are defined as financial institutions traded on a national exchange. 2016 Platinum Bank Holding Co. Gateway Financial Holdings of FL, Inc. 2015 Community Bank of South Florida Hometown of Homestead Banking Co. 2014 First Southern Bancorp 2013 Gulfstream Bancshares 2012 FDIC - Central Florida State Bank FDIC - First Guaranty Bank & Trust Co. 2011 Federal Trust from The Hartford Insurance TD Bank divesture 2010 FDIC - Olde Cypress Community FDIC - Independent National Bank of Ocala FDIC - Community National Bank of Bartow 2009 FDIC - Ocala National Bank 14 transactions announced since 2009 Florida Headquartered Banks – 136

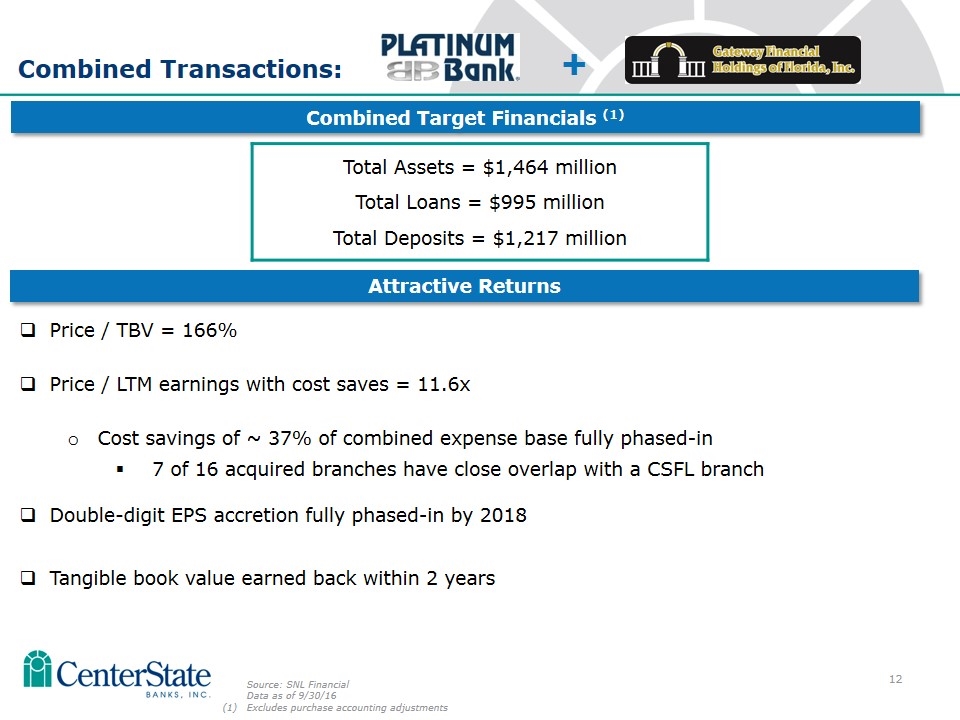

Combined Transactions: Total Assets = $1,464 million Total Loans = $995 million Total Deposits = $1,217 million Combined Target Financials (1) + Attractive Returns Price / TBV = 166% Price / LTM earnings with cost saves = 11.6x Cost savings of ~ 37% of combined expense base fully phased-in 7 of 16 acquired branches have close overlap with a CSFL branch Double-digit EPS accretion fully phased-in by 2018 Tangible book value earned back within 2 years Source: SNL Financial Data as of 9/30/16 Excludes purchase accounting adjustments

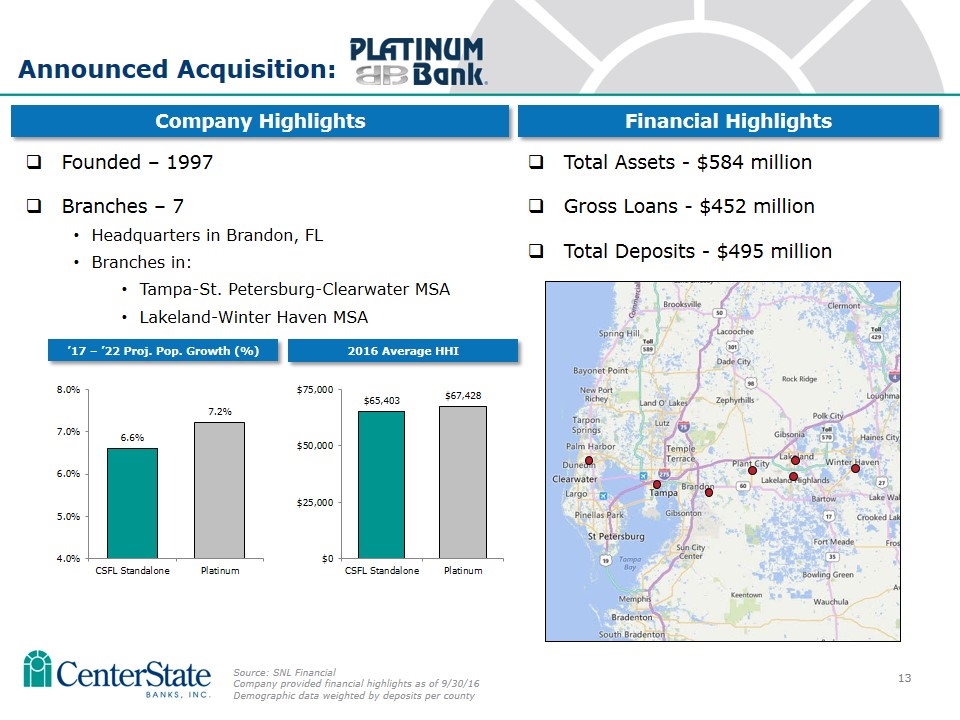

Founded – 1997 Branches – 7 Headquarters in Brandon, FL Branches in: Tampa-St. Petersburg-Clearwater MSA Lakeland-Winter Haven MSA Company Highlights Total Assets - $584 million Gross Loans - $452 million Total Deposits - $495 million Financial Highlights Source: SNL Financial Company provided financial highlights as of 9/30/16 Demographic data weighted by deposits per county ’17 – ’22 Proj. Pop. Growth (%) 2016 Average HHI Announced Acquisition:

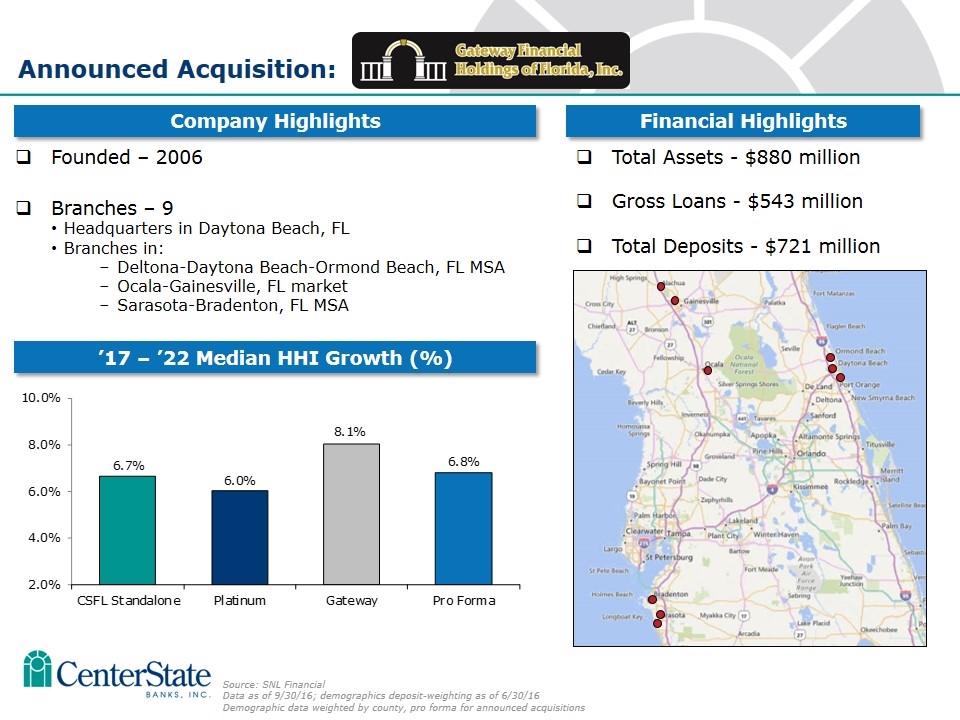

Founded – 2006 Branches – 9 Headquarters in Daytona Beach, FL Branches in: Deltona-Daytona Beach-Ormond Beach, FL MSA Ocala-Gainesville, FL market Sarasota-Bradenton, FL MSA Company Highlights Total Assets - $880 million Gross Loans - $543 million Total Deposits - $721 million Financial Highlights Source: SNL Financial Data as of 9/30/16; demographics deposit-weighting as of 6/30/16 Demographic data weighted by county, pro forma for announced acquisitions ’17 – ’22 Median HHI Growth (%) Announced Acquisition:

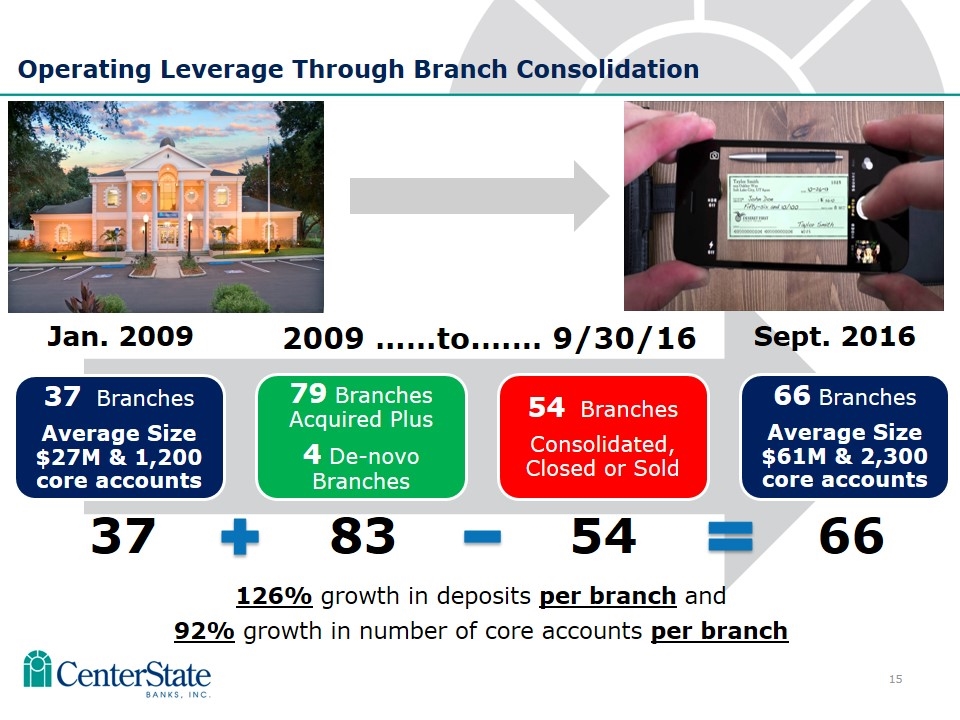

Operating Leverage Through Branch Consolidation 126% growth in deposits per branch and 92% growth in number of core accounts per branch 37 83 54 66 Jan. 2009 2009 ……to.…… 9/30/16 Sept. 2016 37 Branches Average Size $27M & 1,200 core accounts 79 Branches Acquired Plus 4 De-novo Branches 54 Branches Consolidated, Closed or Sold 66 Branches Average Size $61M & 2,300 core accounts

Operating Performance

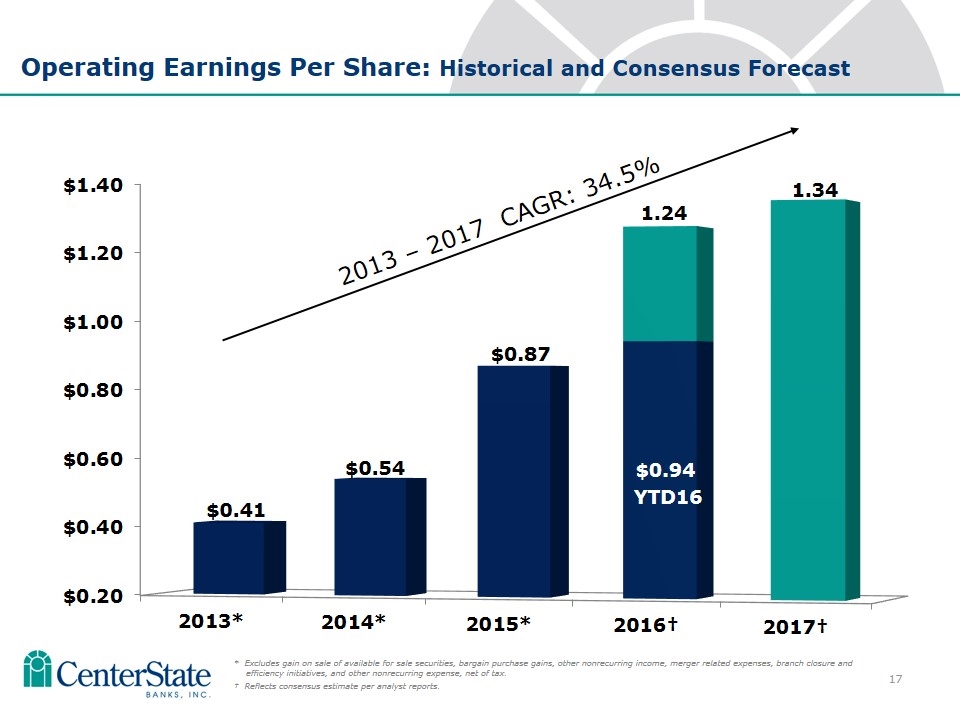

Operating Earnings Per Share: Historical and Consensus Forecast * Excludes gain on sale of available for sale securities, bargain purchase gains, other nonrecurring income, merger related expenses, branch closure and efficiency initiatives, and other nonrecurring expense, net of tax. † Reflects consensus estimate per analyst reports. 1.24 2013 – 2017 CAGR: 34.5% YTD16

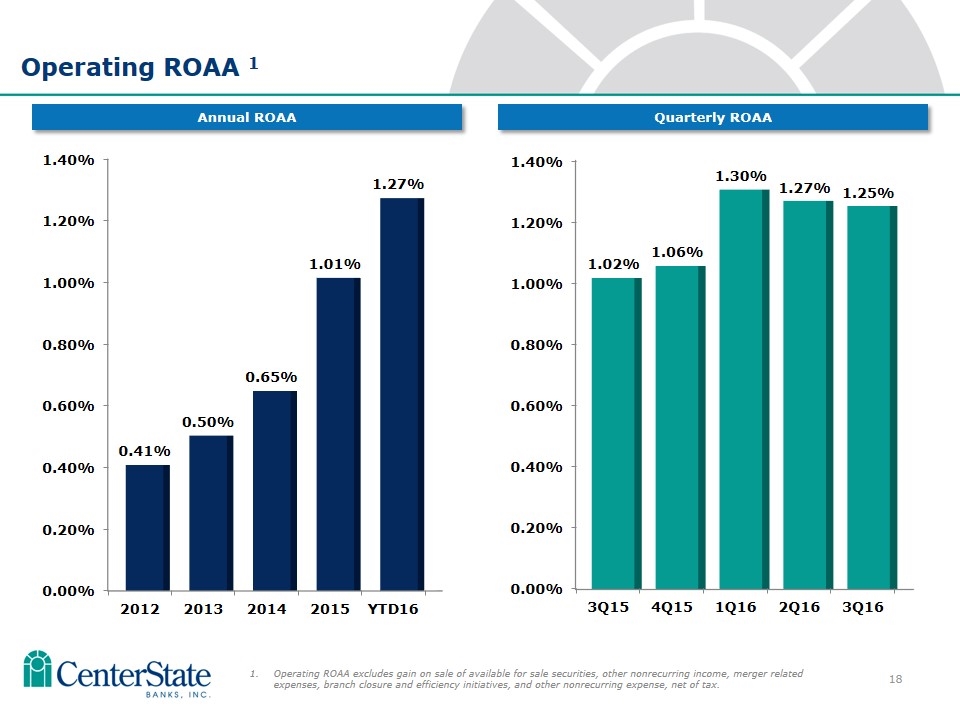

Operating ROAA 1 Operating ROAA excludes gain on sale of available for sale securities, other nonrecurring income, merger related expenses, branch closure and efficiency initiatives, and other nonrecurring expense, net of tax. Quarterly ROAA Annual ROAA

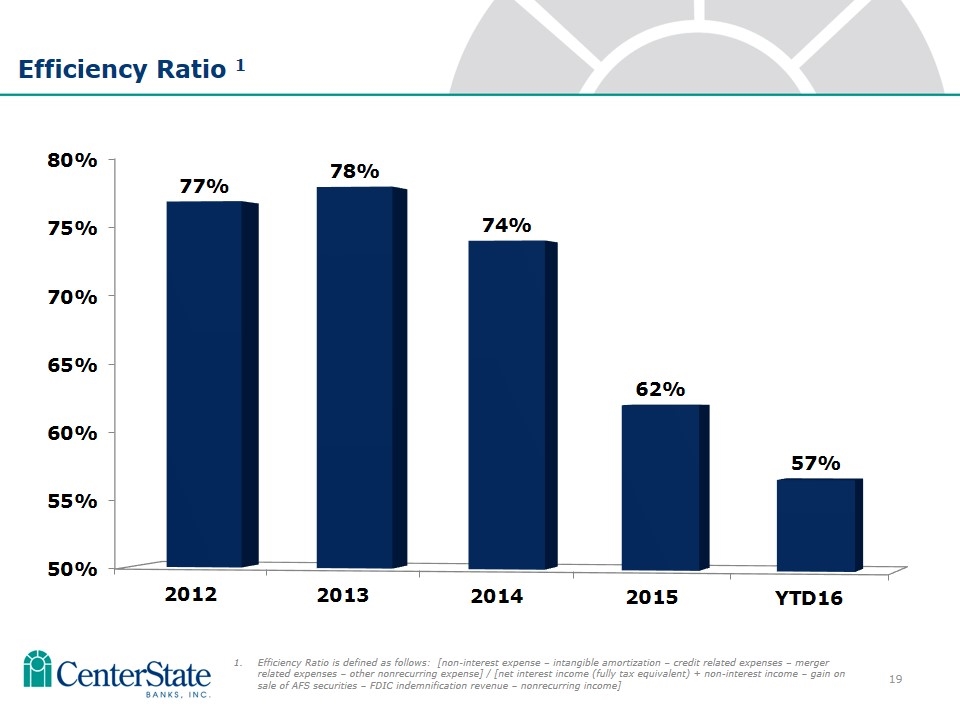

10 Efficiency Ratio 1 Efficiency Ratio is defined as follows: [non-interest expense – intangible amortization – credit related expenses – merger related expenses – other nonrecurring expense] / [net interest income (fully tax equivalent) + non-interest income – gain on sale of AFS securities – FDIC indemnification revenue – nonrecurring income]

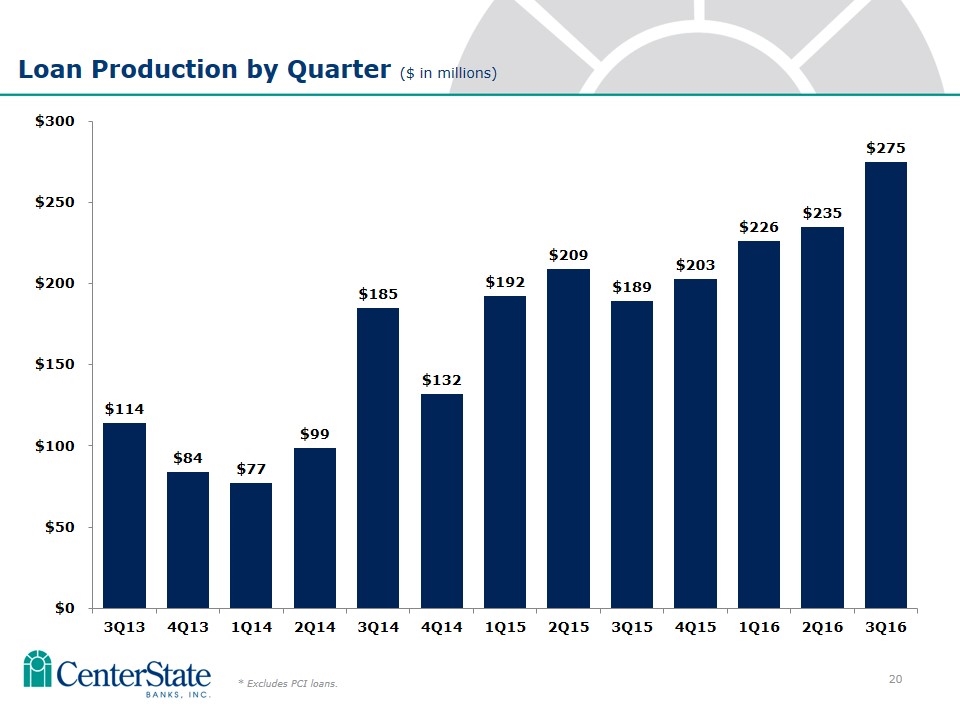

Loan Production by Quarter ($ in millions) * Excludes PCI loans.

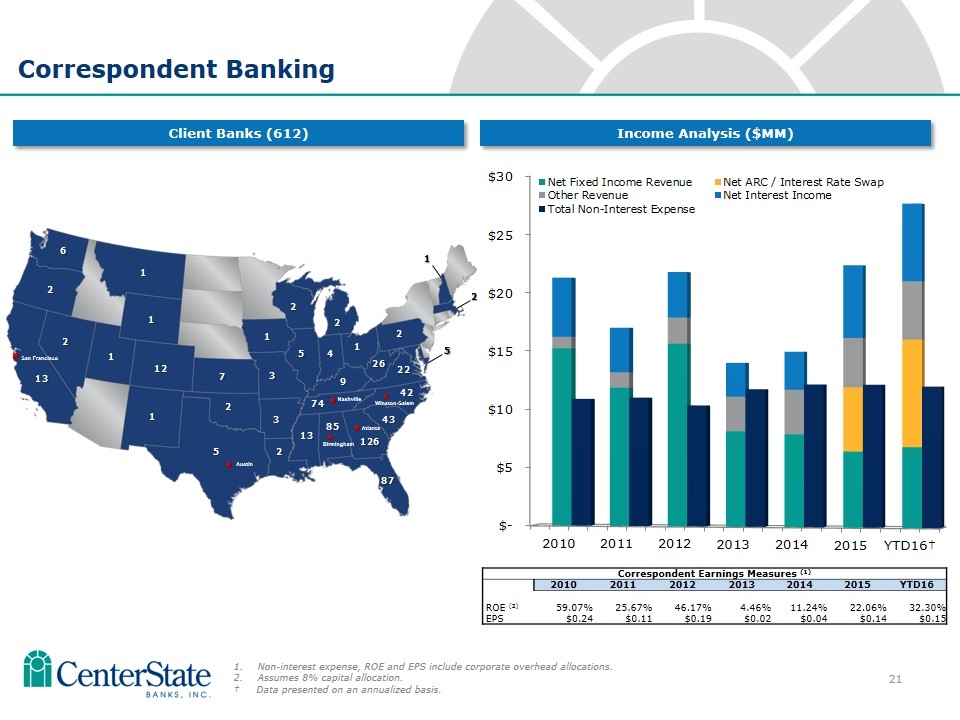

Non-interest expense, ROE and EPS include corporate overhead allocations. Assumes 8% capital allocation. † Data presented on an annualized basis. Correspondent Banking Client Banks (612) Income Analysis ($MM) Correspondent Earnings Measures (1) 2010 2011 2012 2013 2014 2015 YTD16 ROE (2) 59.07% 25.67% 46.17% 4.46% 11.24% 22.06% 32.30% EPS $0.24 $0.11 $0.19 $0.02 $0.04 $0.14 $0.15 Birmingham Atlanta 87 5 3 2 13 74 43 42 9 22 26 Nashville Winston-Salem 5 3 2 4 1 7 1 2 2 2 12 1 1 1 1 2 13 2 6 2 1 5 San Francisco Austin 126 85

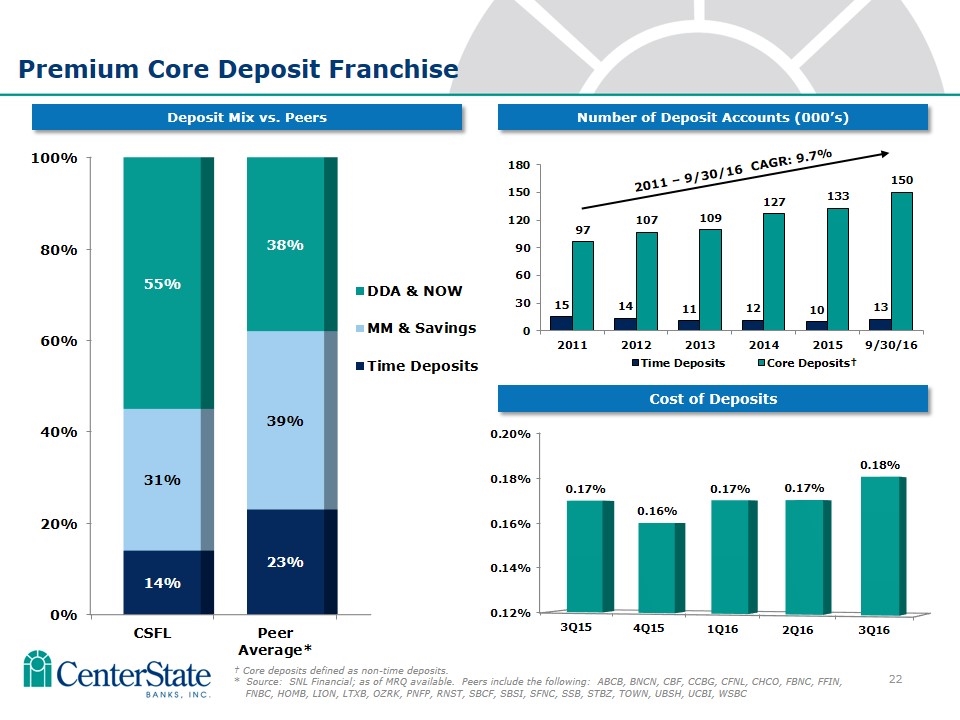

Premium Core Deposit Franchise Cost of Deposits 2011 – 9/30/16 CAGR: 9.7% Number of Deposit Accounts (000’s) Deposit Mix vs. Peers † Core deposits defined as non-time deposits. * Source: SNL Financial; as of MRQ available. Peers include the following: ABCB, BNCN, CBF, CCBG, CFNL, CHCO, FBNC, FFIN, FNBC, HOMB, LION, LTXB, OZRK, PNFP, RNST, SBCF, SBSI, SFNC, SSB, STBZ, TOWN, UBSH, UCBI, WSBC

Investment Thesis Based on strong operating results, CSFL shares outperformed the banking index over a 1, 3 & 5 year horizon. Florida is an economic powerhouse and leads the nation in net migration. With $6.5 billion in pro-forma assets, CSFL ranks as the 2nd largest community bank headquartered in Florida. Investments are currently underway to accelerate organic growth and build shareholder value.

Supplemental

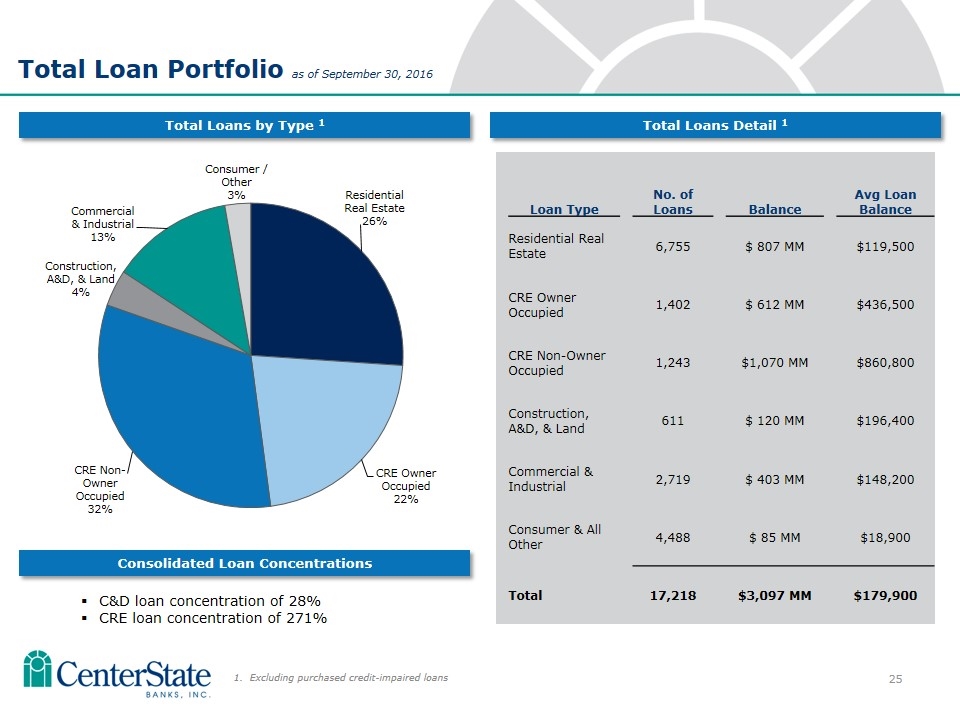

Total Loans by Type 1 Total Loans Detail 1 Loan Type No. of Loans Balance Avg Loan Balance Residential Real Estate 6,755 $ 807 MM $119,500 CRE Owner Occupied 1,402 $ 612 MM $436,500 CRE Non-Owner Occupied 1,243 $1,070 MM $860,800 Construction, A&D, & Land 611 $ 120 MM $196,400 Commercial & Industrial 2,719 $ 403 MM $148,200 Consumer & All Other 4,488 $ 85 MM $18,900 Total 17,218 $3,097 MM $179,900 Total Loan Portfolio as of September 30, 2016 1. Excluding purchased credit-impaired loans C&D loan concentration of 28% CRE loan concentration of 271% Consolidated Loan Concentrations

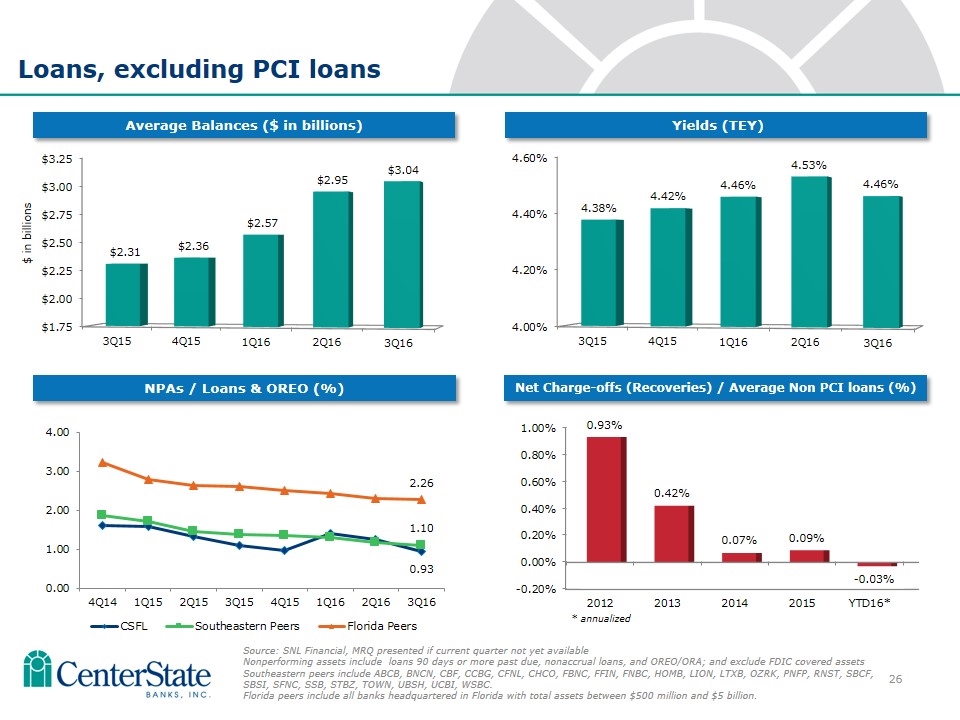

Loans, excluding PCI loans Yields (TEY) Average Balances ($ in billions) Source: SNL Financial, MRQ presented if current quarter not yet available Nonperforming assets include loans 90 days or more past due, nonaccrual loans, and OREO/ORA; and exclude FDIC covered assets Southeastern peers include ABCB, BNCN, CBF, CCBG, CFNL, CHCO, FBNC, FFIN, FNBC, HOMB, LION, LTXB, OZRK, PNFP, RNST, SBCF, SBSI, SFNC, SSB, STBZ, TOWN, UBSH, UCBI, WSBC. Florida peers include all banks headquartered in Florida with total assets between $500 million and $5 billion. NPAs / Loans & OREO (%) Net Charge-offs (Recoveries) / Average Non PCI loans (%) * annualized

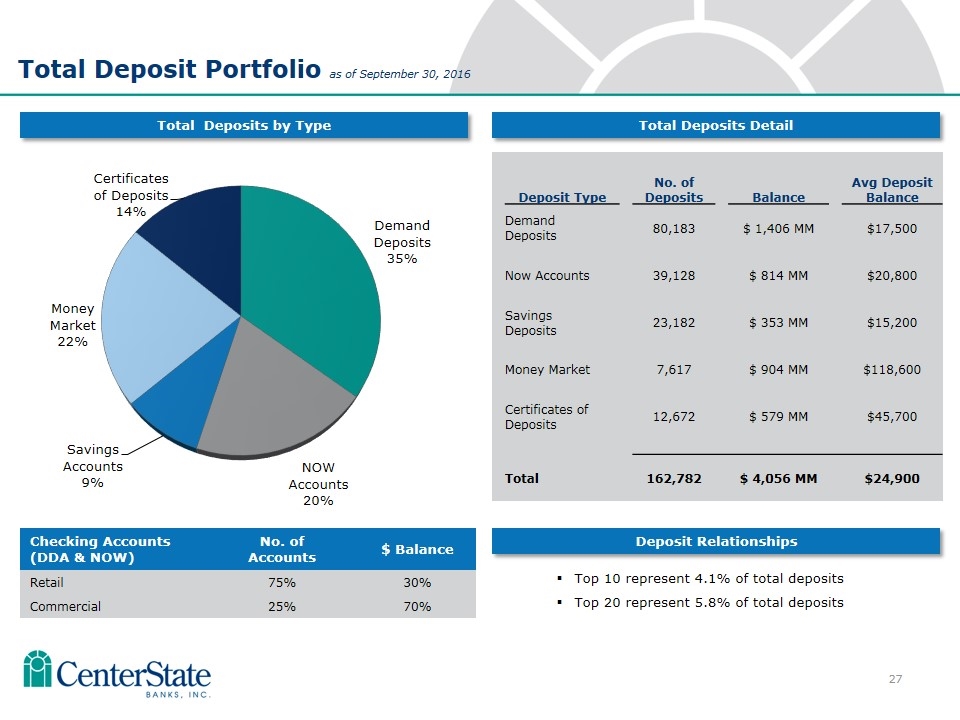

Total Deposits by Type Total Deposits Detail 23 Total Deposit Portfolio as of September 30, 2016 Deposit Type No. of Deposits Balance Avg Deposit Balance Demand Deposits 80,183 $ 1,406 MM $17,500 Now Accounts 39,128 $ 814 MM $20,800 Savings Deposits 23,182 $ 353 MM $15,200 Money Market 7,617 $ 904 MM $118,600 Certificates of Deposits 12,672 $ 579 MM $45,700 Total 162,782 $ 4,056 MM $24,900 Checking Accounts (DDA & NOW) No. of Accounts $ Balance Retail 75% 30% Commercial 25% 70% Top 10 represent 4.1% of total deposits Top 20 represent 5.8% of total deposits Deposit Relationships

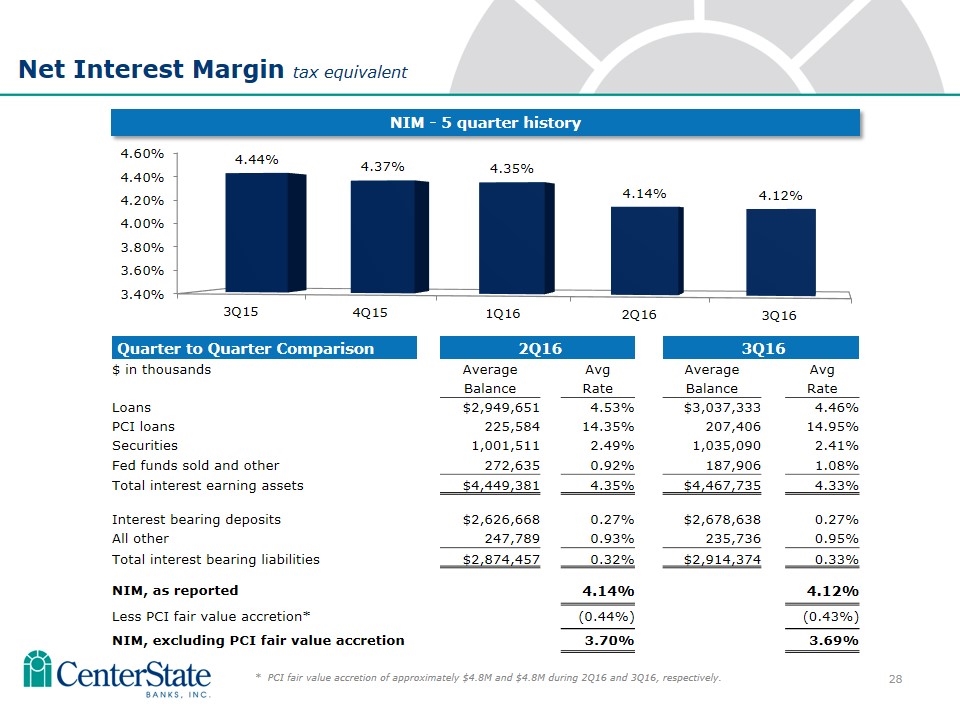

Net Interest Margin tax equivalent Quarter to Quarter Comparison 2Q16 3Q16 $ in thousands Average Avg Average Avg Balance Rate Balance Rate Loans $2,949,651 4.53% $3,037,333 4.46% PCI loans 225,584 14.35% 207,406 14.95% Securities 1,001,511 2.49% 1,035,090 2.41% Fed funds sold and other 272,635 0.92% 187,906 1.08% Total interest earning assets $4,449,381 4.35% $4,467,735 4.33% Interest bearing deposits $2,626,668 0.27% $2,678,638 0.27% All other 247,789 0.93% 235,736 0.95% Total interest bearing liabilities $2,874,457 0.32% $2,914,374 0.33% NIM, as reported 4.14% 4.12% Less PCI fair value accretion* (0.44%) (0.43%) NIM, excluding PCI fair value accretion 3.70% 3.69% NIM - 5 quarter history * PCI fair value accretion of approximately $4.8M and $4.8M during 2Q16 and 3Q16, respectively.

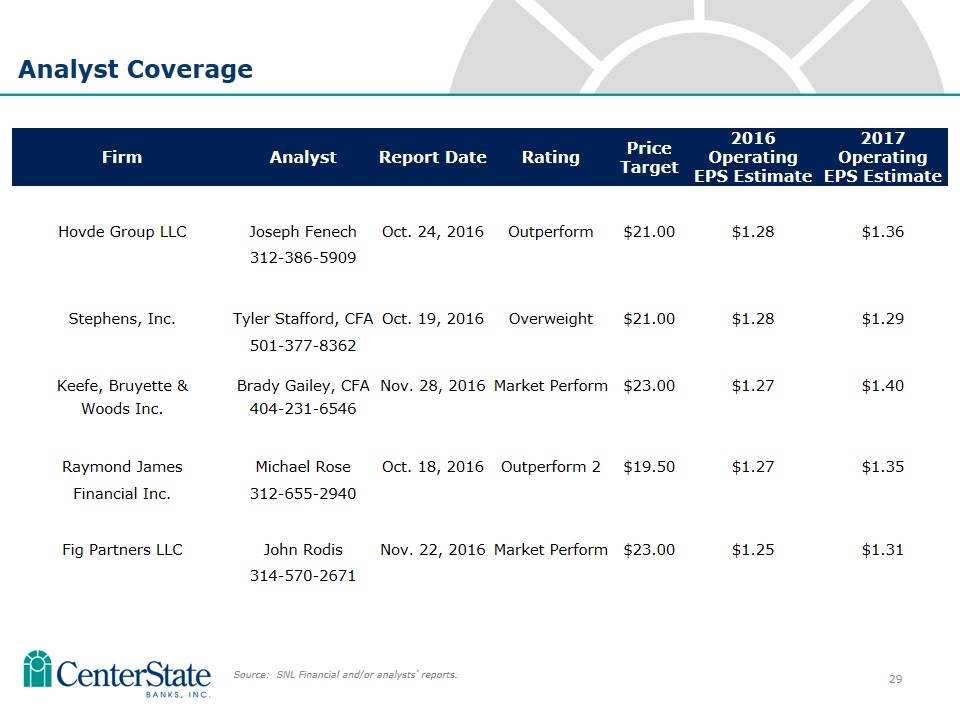

Analyst Coverage Source: SNL Financial and/or analysts’ reports. Firm Analyst Report Date Rating Price Target 2016 Operating EPS Estimate 2017 Operating EPS Estimate Hovde Group LLC Joseph Fenech Oct. 24, 2016 Outperform $21.00 $1.28 $1.36 312-386-5909 Stephens, Inc. Tyler Stafford, CFA Oct. 19, 2016 Overweight $21.00 $1.28 $1.29 501-377-8362 Keefe, Bruyette & Brady Gailey, CFA Nov. 28, 2016 Market Perform $23.00 $1.27 $1.40 Woods Inc. 404-231-6546 Raymond James Michael Rose Oct. 18, 2016 Outperform 2 $19.50 $1.27 $1.35 Financial Inc. 312-655-2940 Fig Partners LLC John Rodis Nov. 22, 2016 Market Perform $23.00 $1.25 $1.31 314-570-2671

Investor Contacts Ernie Pinner John Corbett Executive Chairman President & Chief Executive Officer esp@centerstatebank.com jcorbett@centerstatebank.com Steve Young Jennifer Idell Chief Operating Officer Chief Financial Officer syoung@centerstatebank.com jidell@centerstatebank.com