Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KINGSWAY FINANCIAL SERVICES INC | a8-k11x30x16.htm |

KINGSWAY FINANCIAL SERVICES INC.

INVESTOR DAY PRESENTATION

NOVEMBER 30, 2016

Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are not historical facts, and involve

risks and uncertainties that could cause actual results to differ materially from those expected and projected.

Words such as “expects”, “believes”, “anticipates”, “intends”, “estimates”, “seeks” and variations and similar

words and expressions are intended to identify such forward-looking statements. Such forward-looking

statements relate to future events or future performance, but reflect Kingsway management’s current beliefs,

based on information currently available. A number of factors could cause actual events, performance or results

to differ materially from the events, performance and results discussed in the forward-looking statements. For

information identifying important factors that could cause actual results to differ materially from those

anticipated in the forward-looking statements, please refer to the section entitled “Risk Factors” in the

Company’s 2015 Annual Report on Form 10-K. Except as expressly required by applicable securities law, the

Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a

result of new information, future events or otherwise.

All dollar amounts set forth in this presentation are in U.S. dollars unless stated otherwise

2

Kingsway Representatives and Agenda

3

Kingsway Representatives

Larry G. Swets, Jr., President, CEO and Board Member

John T. Fitzgerald, Executive Vice President and Board

Member

William A. Hickey, Jr., Executive Vice President, CFO,

and COO

Hassan R. Baqar, Vice President - Finance

Terence M. Kavanagh – Chairman of the Board

Gregory P. Hannon – Chairman of the Audit

Committee

Steve Harrison – President of Mendota Insurance

Company

Agenda

(9:30 am – 12pm CT / lunch to follow)

Opening Remarks

Operating Businesses

Case Studies

Q&A

Future Focus

Kingsway Opening Remarks

4

Kingsway acquires Argo Management Group LLC ("Argo"), an asset management business, in April, and John T. ("JT") Fitzgerald,

the Managing Member of Argo, joins Kingsway as an Executive Vice President and Board member

Substantial issuer bid for Kobex Capital Corp. (renamed Itasca Capital Ltd.) is closed in June, resulting in 31.2% equity stake

CMC Industries, Inc. is acquired in July

1347 Capital closes previously announced SPAC transaction in July; becomes Limbach Holdings Inc.

Private placement raises $10.5 million in gross proceeds in November

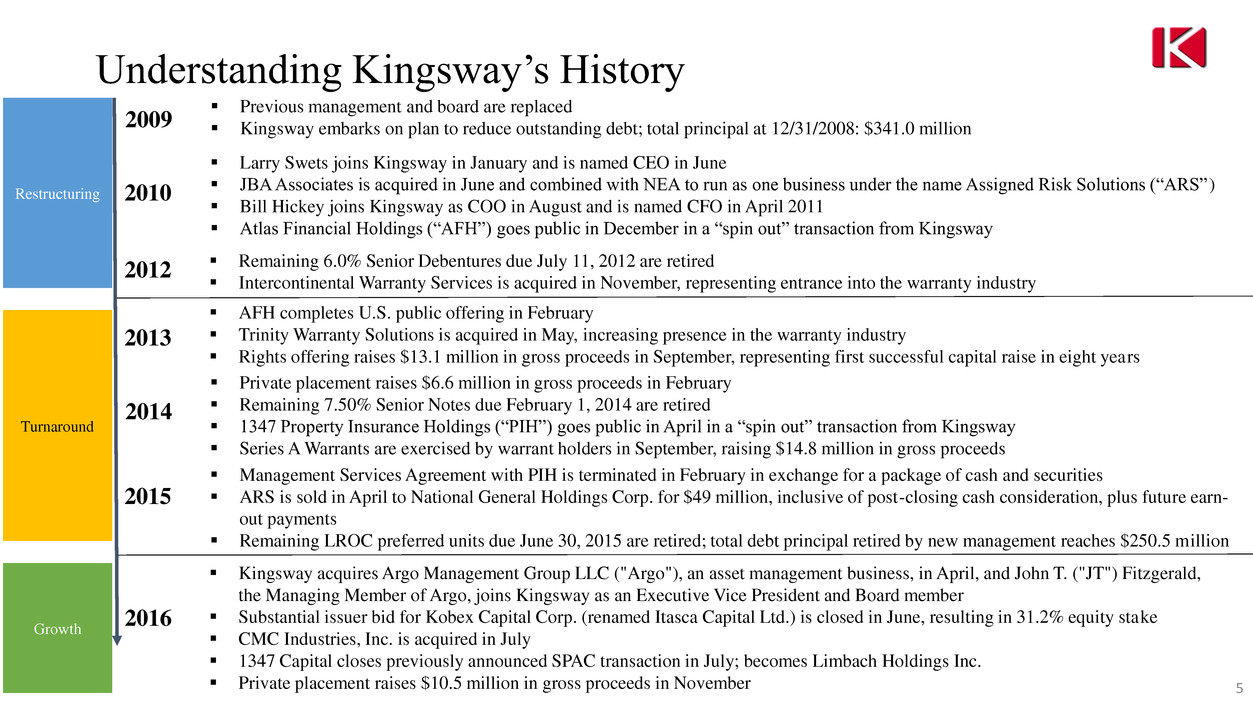

Understanding Kingsway’s History

5

AFH completes U.S. public offering in February

Trinity Warranty Solutions is acquired in May, increasing presence in the warranty industry

Rights offering raises $13.1 million in gross proceeds in September, representing first successful capital raise in eight years

Previous management and board are replaced

Kingsway embarks on plan to reduce outstanding debt; total principal at 12/31/2008: $341.0 million

Larry Swets joins Kingsway in January and is named CEO in June

JBA Associates is acquired in June and combined with NEA to run as one business under the name Assigned Risk Solutions (“ARS”)

Bill Hickey joins Kingsway as COO in August and is named CFO in April 2011

Atlas Financial Holdings (“AFH”) goes public in December in a “spin out” transaction from Kingsway

Private placement raises $6.6 million in gross proceeds in February

Remaining 7.50% Senior Notes due February 1, 2014 are retired

1347 Property Insurance Holdings (“PIH”) goes public in April in a “spin out” transaction from Kingsway

Series A Warrants are exercised by warrant holders in September, raising $14.8 million in gross proceeds

2009

2010

2013

Remaining 6.0% Senior Debentures due July 11, 2012 are retired

Intercontinental Warranty Services is acquired in November, representing entrance into the warranty industry

2012

2014

Management Services Agreement with PIH is terminated in February in exchange for a package of cash and securities

ARS is sold in April to National General Holdings Corp. for $49 million, inclusive of post-closing cash consideration, plus future earn-

out payments

Remaining LROC preferred units due June 30, 2015 are retired; total debt principal retired by new management reaches $250.5 million

2015

2016

Restructuring

Turnaround

Growth

6

Kingsway History – New Management

September 16,

2013

Kingsway

Announces Closing

of Rights Offering

March 31, 2014

Kingsway CEO

Believes the

Company Has

Turned the Corner

June 30, 2015

Kingsway Retires

Its KLROC Debt;

$250.5 Million of

Total Debt Retired

Under New

Management

November 17, 2016

Kingsway Announces

$10.5 Million

Common Stock

Private Placement

Restructuring Turnaround Growth

December 31, 2010

Atlas Completes

Initial IPO

Value Building Philosophy

7

Kingsway focuses on building long‐term value by

compounding capital with investments/acquisitions/financings

that offer asymmetric risk/reward potential with a margin of

safety supported by private market values using a merchant

banking approach

We aspire to compound our book value per share by 15 to 20%

annually over the long-term by operating Kingsway and its

subsidiaries for the benefit of its stakeholders

Utilization of insurance company investment portfolios and available net operating loss tax

attributes to compound and leverage investment results

Focus on understanding private market values, which better match long-term perspective

Consider upside and downside probabilities, with focus on investing when weighted

upside potential is multiples of the downside

Focus on a 15-30 year perspective when creating/building value, while recognizing

short- and near-term realities

How We Think About Building Value

8

A Long-term Perspective

Compounding Capital

Asymmetric Risk/Reward

Margin of Safety

Private Market Values

Compounding capital in the long term with investments/acquisitions/financings that offer

asymmetric risk/reward potential with a margin of safety supported by private market values

Looking for classic margin of safety as building value is not without its risks

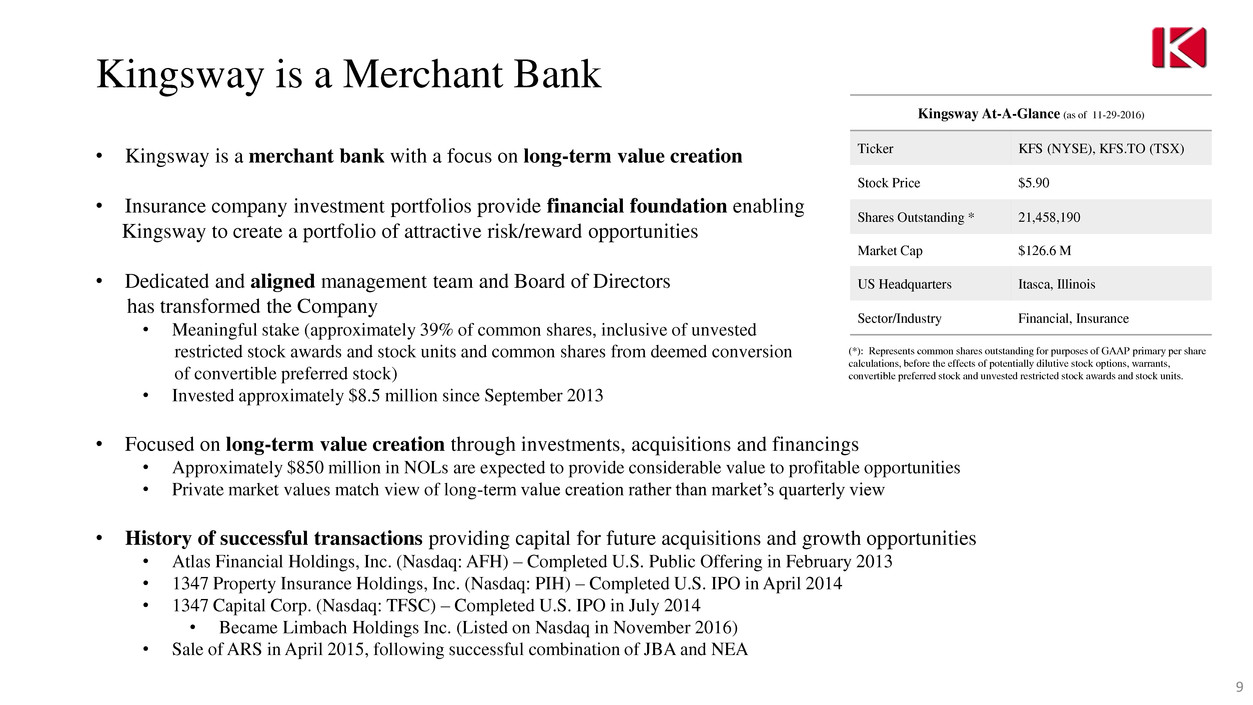

Kingsway is a Merchant Bank

9

• Kingsway is a merchant bank with a focus on long-term value creation

• Insurance company investment portfolios provide financial foundation enabling

Kingsway to create a portfolio of attractive risk/reward opportunities

• Dedicated and aligned management team and Board of Directors

has transformed the Company

• Meaningful stake (approximately 39% of common shares, inclusive of unvested

restricted stock awards and stock units and common shares from deemed conversion

of convertible preferred stock)

• Invested approximately $8.5 million since September 2013

• Focused on long-term value creation through investments, acquisitions and financings

• Approximately $850 million in NOLs are expected to provide considerable value to profitable opportunities

• Private market values match view of long-term value creation rather than market’s quarterly view

• History of successful transactions providing capital for future acquisitions and growth opportunities

• Atlas Financial Holdings, Inc. (Nasdaq: AFH) – Completed U.S. Public Offering in February 2013

• 1347 Property Insurance Holdings, Inc. (Nasdaq: PIH) – Completed U.S. IPO in April 2014

• 1347 Capital Corp. (Nasdaq: TFSC) – Completed U.S. IPO in July 2014

• Became Limbach Holdings Inc. (Listed on Nasdaq in November 2016)

• Sale of ARS in April 2015, following successful combination of JBA and NEA

Kingsway At-A-Glance (as of 11-29-2016)

Ticker KFS (NYSE), KFS.TO (TSX)

Stock Price $5.90

Shares Outstanding * 21,458,190

Market Cap $126.6 M

US Headquarters Itasca, Illinois

Sector/Industry Financial, Insurance

(*): Represents common shares outstanding for purposes of GAAP primary per share

calculations, before the effects of potentially dilutive stock options, warrants,

convertible preferred stock and unvested restricted stock awards and stock units.

How We Are Organized

• Home office focus on merchant banking activities

• Merchant bank makes capital allocation and buy/sell decisions

– Passive Investments

– Owned Businesses

– Business decisions are made at operating business unit level

– Our operating businesses are decentralized and run by the presidents except for performance evaluation,

succession planning, accounting, and capital allocation, which are done by or with Kingsway

– Share ownership and aligned incentives are encouraged across the group

10

Kingsway Operating Businesses

11

John T. Fitzgerald

12

Executive Vice President and Board Member

• Joined Kingsway as Executive Vice President in April 2016 following Kingsway’s acquisition of Argo

Management Group, a private equity investment partnership focused on search-fund investments

• JT has oversight of Kingsway’s operating business units as well as manages the investment activity of Argo

Management Group

• Received a Bachelor of Science degree in Finance from DePaul University with highest honor, Beta Gamma

Sigma

• MBA graduate of the Kellogg School of Management, Northwestern University, with concentrations in

Finance, Accounting and Management Strategy

• Additionally serves on the board of directors of Atlas Financial Holdings Inc. (NASDAQ: AFH), and Itasca

Capital, LTD (TSXV: ICL)

IWS Acquisition Corporation (“IWS”)

• Kingsway acquired in November 2012 in a highly structured transaction for total

consideration consisting of cash, future contingent payments and common equity in

a newly formed entity

• Providing after-market vehicle protection services since 1991

• IWS distributes and markets its products in 23 states

13

Trinity Warranty Solutions (“TWS”)

• Kingsway acquired in May 2013

• Provides warranty products and maintenance support to consumers and businesses

in the heating, ventilation, air-conditioning (HVAC), standby generator,

commercial LED lighting and refrigeration industries

Why We Like the Warranty Industry

Desired Attributes Extended Service Contract Industry

Large Industry The service contract industry is huge and growing in the U.S. A market worth

over $40 billion this year

Growing The US Extended Warranty Market has been growing strongly since

2009. VSC sales have grown at a compound annual rate of 13.5% since 2009.

(Colonnade Advisors Market Commentary)

Fragmented industry with several small players

Industry Concentration is low -- IBISWorld estimates that the top companies in

the industry account for 32.5% of industry revenue, with the largest operator,

The Warranty Group, accounting for about 16%.

Profitable The VSC administration market is very profitable with a Colonnade Advisors

2015 Market Commentary suggesting industry EBITDA margins of 20%.

Larger companies have operational/competitive

advantages

Larger consolidated companies have competitive advantages in:

Underwriting (data and analytics)

Reinsurance relationships (access to A paper)

Marketing/Brand awareness

Claims handling (Technology and expertise)

Product Development and Pricing (data, reinsurance, brand, channels,

technology)

Regulatory environment Because they are supported by reimbursement insurance, these companies

require less capital to grow than traditional P&C insurance companies

14

2016 Improvement Priorities

1. Get Trinity to positive Operating Profit by year-end while focusing resources on growing the higher margin

ESA (Warranty) component of the business and improving margins on Facilities Management (TNA)

2. Improve IWS Operating Margins and profit by focusing on reduction in operating expenses, growing VSA

sales in credit union channel, and investing trust reserves

3. Develop Business Development/M&A process to facilitate consolidation strategy

4. Complete bolt-on or market entering Warranty acquisition by year-end

15

Trinity Performance

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

Operating Expenses

2015

2016

16 See reconciliation table at the end of this presentation.

17

42,000

42,500

43,000

43,500

44,000

44,500

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

In-force Contracts

2015 2016

IWS Performance

Segment operating (loss) income is a non-U.S. GAAP measure. Refer to the section entitled "Non-U.S. GAAP Financial Measures" in Management's Discussion and Analysis section of the Company's

Annual Report on Form 10-K for the year ended December 31, 2015 for a detailed description of this non-U.S. GAAP measure. Refer to the Segmented Information footnote in the Company's Quarterly

Report on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016, and the Company's Annual Report on Form 10-K for the year ended December 31, 2015, for a

reconciliation of segment operating (loss) income to income (loss) from continuing operations before income tax expense for the periods presented above.

* Q2 2016 segment operating income has been adjusted to include an addback of $941k related to extraordinary expenses recorded at IWS related to severance and an agreement executed with the former

owners of IWS.

Insurance Services Segment Operating Income (Loss)

18

$(186)

$(102)

$(185)

$(155) $(156)

[VALUE]*

$558

$-

$(300)

$(200)

$(100)

$-

$100

$200

$300

$400

$500

$600

2015

2016

Q1 Q3 Q2 Q4

Business Development

Focus on a proprietary, direct outreach (non-intermediated) process to acquire solid businesses at private company

values

Sam Duprey joined Kingsway in the spring of 2016 as a Principal focused on business development. Sam brings many

years of experience across all facets of a transaction and management of a company from sourcing investment

opportunities through working collaboratively with management teams and board members post-transaction to build and

grow businesses.

Prior to joining Kingsway, Sam worked at Deloitte Consulting helping management teams achieve their goals, and at

private equity firm Growth Equity Capital Partners in deal sourcing and investment evaluation. Sam was also previously

the Controller of a consumer products company.

Mr. Duprey is an MBA Graduate of the University of Chicago Booth School of Business and holds a BA from Yale

University.

• Develop a database of potential targets

• Direct outreach via email, letter-writing and phone introductions

• Utilize industry veterans to make warm introductions

• Limited reliance on brokers/bankers

19

20

Management Background

Steve Harrison – President of Mendota Insurance. Steve has over 42 years of experience in the insurance

industry. Mr. Harrison has been the President of Mendota Insurance Company since June of 2016.

Steve was previously over the Personal Lines for Qeo Insurance from 2015 to 2016, and was the Senior Vice

President for Allstar Financial Group from 2012 to 2015.

Mr. Harrison was the President and co-founder of USAuto Insurance Company, Inc. in 1995, which merged and

went public in 2004 as First Acceptance Corporation (FAC). He expanded the company to be licensed in 25

states and writing in 12 states by the time he left in 2012.

Prior to that, Mr. Harrison was the President and co-founder of Direct Insurance Company in 1991. He was the

President of Harrison Brothers Insurance Agency, Inc., writing all lines of insurance from 1974 to 1995.

Mr. Harrison received his Bachelor of Science in Business degree from the University of Tennessee, majoring in

insurance. He is a Chartered Life Underwriter (CLU) and is licensed in property and casualty, life and health,

and surplus lines. He was the recipient of the 2007 Ernst & Young Entrepreneur of the Year Award.

21

Non-standard Automobile (“NSA”) market: definition

• Drivers with certain risk factors that make it difficult or impossible for them to obtain

insurance in a standard or preferred market

• Drivers with credit problems

• New or young drivers

• Drivers with multiple losses or moving violations

• Drivers who want only minimum limits coverage

• Drivers with an unusual driver’s license status (foreign driver’s license)

22

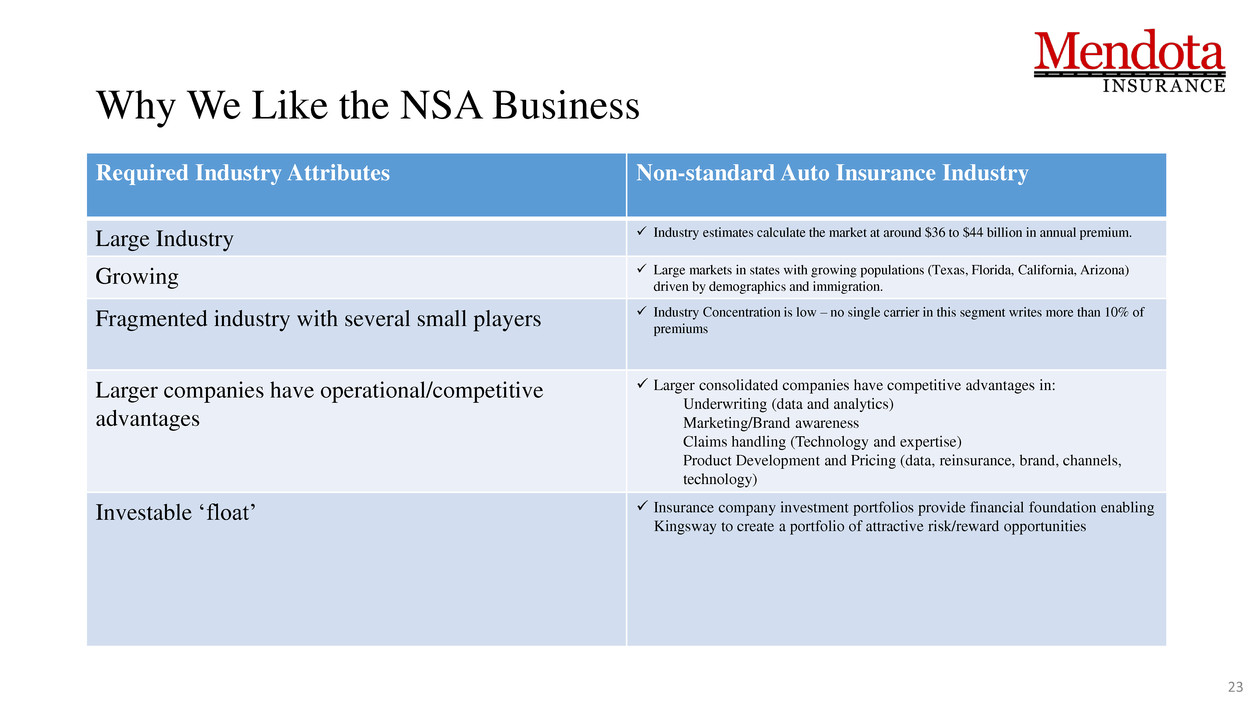

Why We Like the NSA Business

Required Industry Attributes

Non-standard Auto Insurance Industry

Large Industry Industry estimates calculate the market at around $36 to $44 billion in annual premium.

Growing Large markets in states with growing populations (Texas, Florida, California, Arizona)

driven by demographics and immigration.

Fragmented industry with several small players

Industry Concentration is low – no single carrier in this segment writes more than 10% of

premiums

Larger companies have operational/competitive

advantages

Larger consolidated companies have competitive advantages in:

Underwriting (data and analytics)

Marketing/Brand awareness

Claims handling (Technology and expertise)

Product Development and Pricing (data, reinsurance, brand, channels,

technology)

Investable ‘float’ Insurance company investment portfolios provide financial foundation enabling

Kingsway to create a portfolio of attractive risk/reward opportunities

23

Repositioned the business

24

Previous NSA View

Kingsway wrote total NSA premium of $350 million in 33 states at its “peak”

Established goals based solely on growth targets

Today’s NSA Guiding Principles

Focused solely on writing profitable premiums – not volume or market share – which means sometimes the

best strategy is to retreat!

In first nine months of 2016, Kingsway reported NSA net premiums earned of $94.2 million

Actively writing new business in 8 states

25

$27,859,368

$18,658,167

$13,765,101

$11,363,770

$10,262,221

$8,568,375

$4,878,834

$3,769,054

$1,368,871

$758,467 $450,730

$0

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

$30,000,000

FL TX IL NV CA CO AZ MS AR VA Other

Withdrawing from MS, AR, VA and Other States

Gross Premium Written (“GPW”) / State Allocation

GPW by State for the Nine Month Period ended September 30, 2016

26

Steve Harrison

President, TN

Scott Walker

Vice President, Claims-

TN

Robert Schreiber

Sr. Manager, Material

Damage - TN

William Evans

Manager, Material

Damage-TN

Walter Dix

Vice President, Claims-

TN

Julie Roettger

Assistant Vice

President, Human

Resources-MN

Richard Slater

Sr. Vice President and

Chief Operating

Officer-IL

Patrick Pribyl

Assistant Vice

President, Software

Development-MN

Sandra Pappas

Vice President Finance-

IL

New hires in 2016

New Organizational Chart

2017 Improvement Priorities

27

Process reorganization and software implementation

Claims reorganization

Streamline workflows

Outsource first notice of loss function

Outsource of Subrogation

Loss severity reduction

Reconfigure sales model (expense reduction)

Additional rate taking in a hard market

Bad debt reduction

Policy fee income

Kingsway Case

Studies of

Merchant

Banking Execution

28

Case Study: Sale of Assigned Risk Solutions

• Assigned Risk Solutions (“ARS”) was created from the combination of Northeast Alliance Insurance Agency

(“NEA”), a legacy Kingsway business, and JBA Associates (“JBA”), a competitor acquired by Kingsway in

June 2010

• ARS partnered in 2011 with Berkshire Hathaway’s National Liability & Fire Insurance Company

• ARS underwent a strategic review process in 2014, leading to a more acute understanding of the risks of the

business and a determination that it was better suited for an owner with a much larger base to diversify and

assume the underwriting risk

• Given that we no longer believed the business delivered to Kingsway the asymmetric reward potential in

relation to this risk, we made the decision to exit the business

• The business was subsequently sold to National General Holdings Corp. for $49 million, inclusive of post-

closing cash consideration, plus future earn-out payments

• The disposition of ARS nearly five years after the acquisition of JBA enabled us to convert $31.8 million of

goodwill and intangible assets, including $20.0 million of intangible assets related to NEA, into cash that can

now be redeployed

• Kingsway’s cumulative cash investment in the ARS business beginning with the acquisition of JBA was $16.3

million

• Kingsway’s total consideration generated has been $54.2 million, comprised of $46.0 million of net proceeds

from the sale of ARS, including receipt of the first of three earn-out payments, plus cumulative cash dividends

of $8.2 million paid by ARS to Kingsway from the time of the JBA acquisition through the sale of ARS

29

First acquisition under new

Kingsway management

Exited at the right moment to

provide a strong return for

Kingsway and enable ARS to

grow under new ownership

Case Study: Atlas Financial Holdings

• Atlas Financial Holdings, Inc. (“Atlas” or “AFH”) started as a combination of former Kingsway

units American Country Insurance Company and American Service Insurance Company, Inc.

• Commercial auto insurance in the U.S.

• Niche markets of taxi/limo/para-transit

• Atlas went public in Canada utilizing a reverse merger with a CPC structure completed in December

2010

• Atlas completed a successful U.S. public offering in February 2013 and trades on the Nasdaq stock

exchange under the symbol AFH

Atlas price per common share is $17.05 as of 11/29/2016 compared to the pricing of its U.S. public

offering of $5.85 per common share

30

Prime example of identifying

talented managers and an

attractive loss ratio business to structure a

transaction to solve a problem

30

Case Study: 1347 Property Insurance Holdings

• 1347 Property Insurance Holdings, Inc. (“PIH”) is comprised primarily of Maison Insurance Company (“Maison”), a de novo

homeowners insurance start-up by Kingsway

• PIH completed an IPO effective March 31, 2014 at which time Kingsway entered into a management services agreement (“MSA”)

with PIH; Kingsway and PIH subsequently terminated the MSA agreement in February 2015 with Kingsway receiving a package of

cash and securities

• Kingsway’s cumulative cash investment in Maison and PIH through the IPO and subsequent open-market purchases of PIH common

stock was $9.3 million

Kingsway’s return has been $12.8 million, comprised of (i) cash of $0.3 million received under the MSA; (ii) cash preferred stock

dividends of $0.2 million; (iii) cash and market value of securities of $5.6 million received upon the termination of the MSA; and (iv)

$6.7 million of market value of PIH common stock owned; in addition, Kingsway is entitled to receive up to an aggregate of 475,000

shares of PIH common stock under Performance Share Grant Agreements upon the achievement of PIH common stock prices ranging

from $10 to $18 per share; at this time, Kingsway has assigned a fair value of zero to these performance shares

31

Attractive loss ratio business to structure a transaction

intended to generate asymmetric opportunity

for value creation

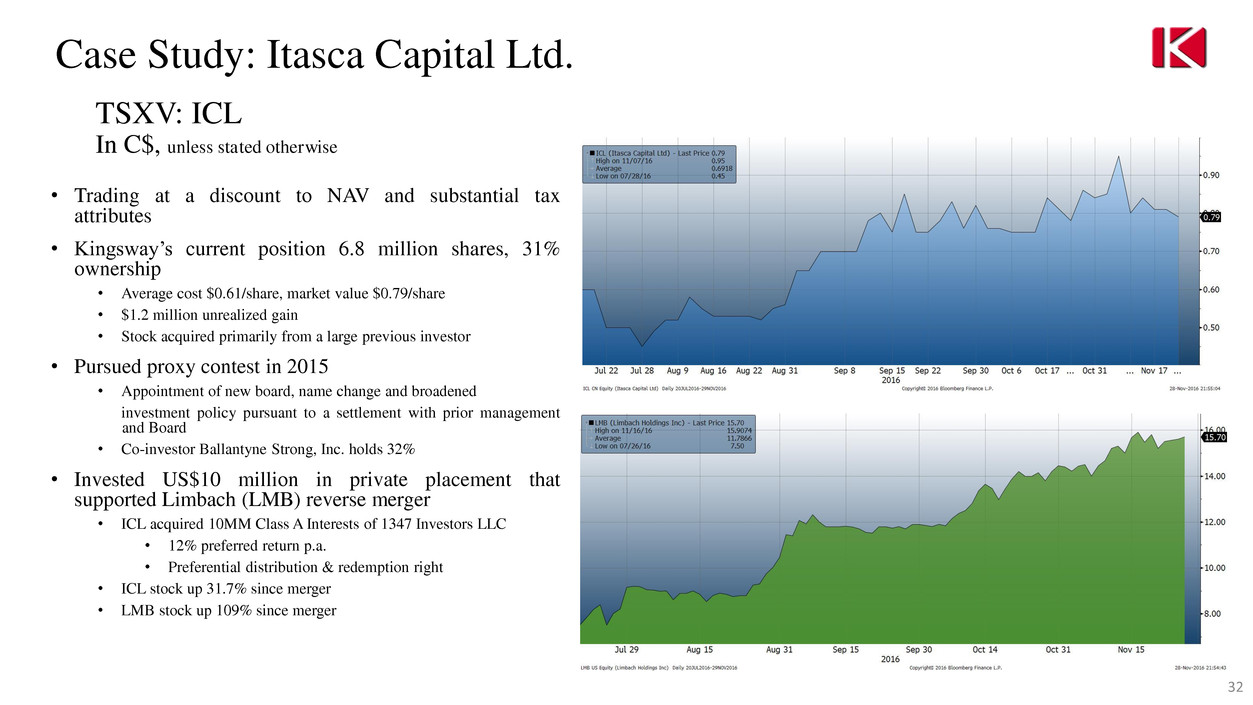

TSXV: ICL

In C$, unless stated otherwise

Case Study: Itasca Capital Ltd.

• Trading at a discount to NAV and substantial tax

attributes

• Kingsway’s current position 6.8 million shares, 31%

ownership

• Average cost $0.61/share, market value $0.79/share

• $1.2 million unrealized gain

• Stock acquired primarily from a large previous investor

• Pursued proxy contest in 2015

• Appointment of new board, name change and broadened

investment policy pursuant to a settlement with prior management

and Board

• Co-investor Ballantyne Strong, Inc. holds 32%

• Invested US$10 million in private placement that

supported Limbach (LMB) reverse merger

• ICL acquired 10MM Class A Interests of 1347 Investors LLC

• 12% preferred return p.a.

• Preferential distribution & redemption right

• ICL stock up 31.7% since merger

• LMB stock up 109% since merger

32

Case Study: Purchase of Oilfield Assets

1347 Energy Holdings, LLC

• Capitalized on dislocation created by low oil price environment

• Acquired mineral leases and oilfield assets of a producing oilfield at a deep discount to intrinsic value

• 1347 Energy Holdings, LLC recently acquired the mineral rights to the South Gillock Unit (“SGU”)and State Kohlfeldt

Unit (“SKU”) on Galveston Bay southeast of Houston

• Proved recoverable reserves of 4.6mm barrels in the SGU. SKU reserves and newly acquired leases at all depths will add to

the opportunity

• 1347 Energy has entered into a Management Agreement with Promise Energy Operations to manage the assets. Promise

has significant experience operating oil and gas assets and will also aid in identifying opportunities to strategically grow the

reserve base via acquisition during the current market dislocation

• PV10 Proved Reserves of >$50mmm based on an Independent Reserve Report performed by Gustavson Associates in

December 2015

• Gas Cap of estimated 32+bln Cubic Feet which represents a significant potential incremental asset

• Kingsway structured the transaction, contributed transaction expenses of $300K and provided $740K towards a surety bond

in addition to investing $1.4 million in the senior collateralized debt yielding 14% with significant equity upside

33

Market dislocation created opportunity for unique upside potential

33

Case Study: 1347 Capital Corp.

(now known as Limbach Holdings Inc.)

34

• 1347 Capital Corp. spent significant time in insurance related search, but

was unable to find a reasonable risk/reward willing to consummate a

transaction

• Given the limited time remaining, the team evaluated targets that had a

predisposition to being public and/or reverse merger

• Limbach had previously explored a reverse merger with a SPAC

• Entry multiple was at significant discount to comps, diligence suggested

significant growth in backlog with high quality clients

• Kingsway’s cumulative cash investment in 1347 Capital Corp. from the

time the SPAC first went public through the closing of the merger with

Limbach was $1.8 million

• The fair value of Kingsway’s investment in 1347 Investors LLC based

upon the fair value of the Limbach securities owned by 1347 Investors

LLC is approximately $11.0 million as of October 31, 2016

The promote available in the 1347 Capital Corp.

structure provided unique opportunity to develop

an asymmetric risk/reward for investors that were

unable to take an institutional sized position due to

liquidity restraints

Case Study: CMC

35

• Acquired 81% of CMC Industries the sole asset of which is

BNSF rail yard in Dayton, TX

• Specific attributes of CMC include deferred tax liability and

phantom income

• Credit tenant NNN lease with approximately $11.9 million

in annualized lease payments

• Kingsway receives priority cash flow (after debt/principal

repayment) for the tax liability incurred by CMC

• If the lease were to continue to its scheduled termination in

2034, it is expected CMC would generate approximately

$100 million of taxable income, resulting in approximately

$34 million due to Kingsway

Q&A

36

Future Focus

37

Growth Strategy

• Enhance existing operations

• Pursue potential bolt-on acquisitions to build out warranty business

• Pursue additional triple-net lease real estate acquisitions with similar characteristics to CMC

• Develop a strategic approach to leveraging our managerial skills over a larger capital base

38

Key Takeaways

• Kingsway provides an opportunity to invest in a diverse pool of insurance assets and insurance-

related businesses led by experienced leadership team with a history of success

• Through our merchant bank platform, we have the opportunity to capitalize on changing markets

through a variety of funding and investing vehicles

• Kingsway plans to leverage its relationships and assets to opportunistically seek new sources of

revenue and earnings in order to return value to shareholders

39

Compounding

Capital Long-Term

Pursuing

Asymmetric Risk /

Reward

Opportunities

Aligned

Management

Structure

Contact Us

INVESTOR RELATIONS

Hassan Baqar

Kingsway Financial Services Inc.

1.847.700.8064

hbaqar@kingswayfinancial.com

Adam Prior

The Equity Group

1.212.836.9606

aprior@equityny.com

40

KINGSWAY FINANCIAL SERVICES INC.

INVESTOR DAY

NOVEMBER, 30 2016

Trinity EBITDA Reconciliation to Insurance Services Segment Operating (Loss) Income

41

2015 January February March Q1 2015 April May June Q2 2015 July August September Q3 2015 October November December Q4 2015 YTD 2015

Trinity EBITDA per Investor Day slide (1) $ (131,690) $ (146,335) $ (179,573) $ (457,598) $ (117,412) $ (160,904) $ (179,188) $ (457,504) $ (100,901) $ (126,415) $ (116,401) $ (343,716) $ (31,656) $ (10,907) $ (37,997) $ (80,560) $ (1,339,378)

Add: Trinity interest, depreciation and amortization $ (588) $ (1,247) $ (918) $ (2,753) $ (966) $ (966) $ (1,292) $ (3,224) $ (1,292) $ (1,292) $ (1,292) $ (3,876) $ (1,363) $ (1,363) $ (6,180) $ (8,906) $ (18,759)

Add: IWS operating income (loss) $ 52,454 $ 75,720 $ 146,547 $ 274,721 $ 106,379 $ 240,333 $ 12,198 $ 358,910 $ (62,167) $ 97,959 $ 126,595 $ 162,386 $ (115,961) $ 182,261 $ (132,443) $ (66,143) $ 729,875

Insurance Services segment operating (loss) income (2) $ (79,824) $ (71,862) $ (33,944) $ (185,630) $ (11,999) $ 78,463 $ (168,282) $ (101,818) $ (164,360) $ (29,748) $ 8,902 $ (185,206) $ (148,980) $ 169,991 $ (176,619) $ (155,609) $ (628,262)

2016 January February March Q1 2016 April May June Q2 2016 July August September Q3 2016

Trinity EBITDA per Investor Day slide (1) $ (97,618) $ (88,029) $ (69,878) $ (255,525) $ (59,154) $ (39,556) $ 14,465 $ (84,245) $ 31,872 $ 38,622 $ 57,011 $ 127,505

Add: Trinity interest, depreciation and amortization $ (1,363) $ (1,363) $ (1,363) $ (4,089) $ (1,364) $ (1,363) $ (1,364) $ (4,091) $ (1,264) $ (1,264) $ (1,264) $ (3,792)

Add: IWS operating income (loss) $ 189,319 $ (142,398) $ 56,598 $ 103,519 $ 51,131 $ 107,897 $ (850,246) $ (691,218) $ (27,111) $ 240,281 $ 220,941 $ 434,110

Insurance Services segment operating (loss) income (2) $ 90,338 $ (231,790) $ (14,643) $ (156,094) $ (9,387) $ 66,978 $ (837,145) $ (779,553) $ 3,497 $ 277,639 $ 276,688 $ 557,823

(1) EBITDA is a non-U.S. GAAP measure. Management uses EBITDA as a way of gauging how much cash is being generated by or used in the business.

(2) Segment operating (loss) income is a non-U.S. GAAP measure. Refer to the section entitled "Non-U.S. GAAP Financial Measures" in Management's Discussion and Analysis section of the Company's Annual Report on Form 10-K for the year ended December 31, 2015 for a detailed

description of this non-U.S. GAAP measure. Refer to the Segmented Information footnote in the Company's Quarterly Report on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016, and the Company's Annual Report on Form 10-K for the year

ended December 31, 2015, for a reconciliation of segment operating (loss) income to income (loss) from continuing operations before income tax expense for the periods presented above.