Attached files

| file | filename |

|---|---|

| EX-99.5 - EX-99.5 - STONE ENERGY CORP | d290934dex995.htm |

| EX-99.4 - EX-99.4 - STONE ENERGY CORP | d290934dex994.htm |

| EX-99.3 - EX-99.3 - STONE ENERGY CORP | d290934dex993.htm |

| EX-99.2 - EX-99.2 - STONE ENERGY CORP | d290934dex992.htm |

| 8-K - FORM 8-K - STONE ENERGY CORP | d290934d8k.htm |

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

| ----------------------------------------------------------- |

x | |||||

| In re: |

: | Chapter 11 | ||||

| : | ||||||

| STONE ENERGY CORPORATION, et al., |

: | Case No. 16- ( ) | ||||

| : | ||||||

| Debtors.1 |

: | Joint Administration Requested | ||||

| ----------------------------------------------------------- |

x |

PROPOSED DISCLOSURE STATEMENT FOR JOINT PREPACKAGED PLAN OF

REORGANIZATION OF STONE ENERGY CORPORATION AND ITS DEBTOR

AFFILIATES UNDER CHAPTER 11 OF THE BANKRUPTCY CODE

| LATHAM & WATKINS LLP Michael E. Dillard 811 Main Street, Suite 3700 Houston, TX 77002 Telephone: (713) 546-7414 Facsimile (713) 546-5401 |

LATHAM & WATKINS LLP David S. Heller Josef S. Athanas Caroline A. Reckler Matthew L. Warren 330 North Wabash Avenue, Suite 2800 Chicago, Illinois 60611 Telephone: (312) 876-7700 Facsimile (312) 993-9767 |

Dated: November 17, 2016

| 1 | The Debtors in these Chapter 11 Cases, along with the last four digits of each Debtor’s federal tax identification number, are: Stone Energy Corporation (5413); Stone Energy Holding, L.L.C. (3151); and Stone Energy Offshore, L.L.C. (8062). The above-captioned Debtors’ mailing address is 625 E. Kaliste Saloom Road, Lafayette, Louisiana 70508. |

THIS SOLICITATION OF VOTES (THE “SOLICITATION”) IS BEING CONDUCTED TO OBTAIN SUFFICIENT ACCEPTANCES OF THE PLAN (AS DEFINED HEREIN) BEFORE THE FILING OF VOLUNTARY REORGANIZATION CASES UNDER CHAPTER 11 OF TITLE 11 OF THE UNITED STATES CODE (THE “BANKRUPTCY CODE”). BECAUSE THE CHAPTER 11 CASES HAVE NOT YET BEEN COMMENCED, THIS DISCLOSURE STATEMENT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT AS CONTAINING ADEQUATE INFORMATION WITHIN THE MEANING OF SECTION 1125(a) OF THE BANKRUPTCY CODE. FOLLOWING THE COMMENCEMENT OF THE CHAPTER 11 CASES, THE DEBTORS EXPECT TO PROMPTLY SEEK ORDERS OF THE BANKRUPTCY COURT (I) APPROVING THIS DISCLOSURE STATEMENT AS CONTAINING ADEQUATE INFORMATION, (II) APPROVING THE SOLICITATION OF VOTES AS BEING IN COMPLIANCE WITH SECTIONS 1125 AND 1126(b) OF THE BANKRUPTCY CODE, AND (III) CONFIRMING THE PLAN.

DISCLOSURE STATEMENT, DATED NOVEMBER 17, 2016

Solicitation of Votes on the

Prepackaged Plan of Reorganization of

STONE ENERGY CORPORATION AND ITS DEBTOR AFFILIATES

from the holders of outstanding

PREPETITION BANKS CLAIMS

PREPETITION NOTES CLAIMS

| THE VOTING DEADLINE TO ACCEPT OR REJECT THE PLAN IS 5:00 P.M., CENTRAL TIME, ON DECEMBER 16, 2016, UNLESS EXTENDED BY THE DEBTORS AND THE CONSENTING NOTEHOLDERS (AS DEFINED HEREIN). THE RECORD DATE FOR DETERMINING WHICH HOLDERS OF CLAIMS OR INTERESTS MAY VOTE ON THE PLAN IS NOVEMBER 9, 2016 (THE “VOTING RECORD DATE”).

|

| RECOMMENDATION BY THE DEBTORS | ||||

| The Board of Directors of Stone Energy Corporation (“Stone”) and the board of directors, managers, members, or partners, as applicable, of each of its affiliated Debtors (as of the date hereof) have unanimously approved the transactions contemplated by the Solicitation and the Plan and recommend that all creditors whose votes are being solicited submit ballots to accept the Plan. Holders of approximately 85.4% in outstanding principal amount of the Prepetition Notes Claims (as defined herein) have already agreed to vote in favor of the Plan.

|

HOLDERS OF CLAIMS OR INTERESTS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND SHOULD CONSULT WITH THEIR OWN ADVISORS BEFORE VOTING ON THE PLAN.

THE ISSUANCE OF AND THE DISTRIBUTION UNDER THE PLAN OF (I) NEW COMMON STOCK TO HOLDERS OF ALLOWED PREPETITION NOTES CLAIMS AND ALLOWED STONE EQUITY INTERESTS (AS DEFINED HEREIN), (II) NEW SECURED NOTES TO HOLDERS OF ALLOWED PREPETITION NOTES CLAIMS, AND (III) NEW WARRANTS TO HOLDERS OF ALLOWED STONE EQUITY INTERESTS AND THE NEW COMMON STOCK ISSUABLE UPON EXERCISE THEREOF SHALL BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND ANY OTHER APPLICABLE SECURITIES LAWS PURSUANT TO SECTION 1145 OF THE BANKRUPTCY CODE.

THE SOLICITATION OF VOTES ON THE PLAN WITH RESPECT TO PREPETITION NOTES CLAIMS IS BEING MADE PURSUANT TO SECTION 4(a)(2) AND REGULATION D OF THE SECURITIES ACT AND ONLY WITH RESPECT TO HOLDERS OF SUCH CLAIMS THAT ARE ELIGIBLE HOLDERS OF PREPETITION NOTES CLAIMS (I.E., ACCREDITED INVESTORS AS DEFINED IN RULE 501 OF THE SECURITIES ACT); PROVIDED, HOWEVER, THAT ALL HOLDERS OF ALLOWED PREPETITION NOTES CLAIMS WILL BE ENTITLED TO RECEIVE DISTRIBUTIONS UNDER THE PLAN.

THE NEW COMMON STOCK AND NEW WARRANTS TO BE ISSUED ON THE EFFECTIVE DATE HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING STATEMENTS INCORPORATED BY REFERENCE, PROJECTED FINANCIAL INFORMATION, AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED HEREIN.

FURTHER, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

HOLDERS OF ALLOWED OTHER SECURED CLAIMS AND ALLOWED GENERAL UNSECURED CLAIMS WILL NOT BE IMPAIRED BY THE PLAN AND, AS A RESULT, THE RIGHT OF SUCH HOLDERS TO RECEIVE PAYMENT IN FULL ON ACCOUNT OF EXISTING OBLIGATIONS OR INTERESTS IS NOT ALTERED BY THE PLAN. DURING THE CHAPTER 11 CASES, THE DEBTORS INTEND TO OPERATE THEIR BUSINESSES IN THE ORDINARY COURSE AND WILL SEEK AUTHORIZATION FROM THE BANKRUPTCY COURT TO MAKE PAYMENT IN FULL ON A TIMELY BASIS TO ALL TRADE CREDITORS, CUSTOMERS, AND EMPLOYEES OF ALL AMOUNTS DUE PRIOR TO AND DURING THE CHAPTER 11 CASES.

NO INDEPENDENT AUDITOR OR ACCOUNTANT HAS REVIEWED OR APPROVED THE FINANCIAL PROJECTIONS OR THE LIQUIDATION ANALYSIS HEREIN.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY WITH THE SUMMARIES IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE.

ALL EXHIBITS TO THE DISCLOSURE STATEMENT ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL HEREIN.

TABLE OF CONTENTS

| I. |

INTRODUCTION | 1 | ||||||

| II. |

OVERVIEW OF THE DEBTORS’ OPERATIONS | 11 | ||||||

| A. | The Debtors’ Business | 11 | ||||||

| B. | The Debtors’ Organizational Structure | 12 | ||||||

| C. | Directors and Officers | 12 | ||||||

| D. | Regulation of the Debtors’ Business | 17 | ||||||

| E. | The Debtors’ Capital Structure | 18 | ||||||

| III. |

KEY EVENTS LEADING TO THE COMMENCEMENT OF CHAPTER 11 CASES | 21 | ||||||

| A. | Collapse in Oil Prices | 21 | ||||||

| B. | 2016 Restructuring Transactions | 22 | ||||||

| C. | Prepetition Negotiations with the Consenting Noteholders and the Restructuring Support Agreement | 22 | ||||||

| D. | Purchase and Sale Agreement with Tug Hill | 25 | ||||||

| IV. |

ANTICIPATED EVENTS DURING THE CHAPTER 11 CASES | 27 | ||||||

| A. | Commencement of Chapter 11 Cases and First Day Motions | 27 | ||||||

| B. | Other Procedural Motions and Retention of Professionals | 30 | ||||||

| C. | Timetable for the Chapter 11 Cases | 30 | ||||||

| V. |

PENDING LITIGATION | 30 | ||||||

| VI. |

SUMMARY OF THE PLAN | 32 | ||||||

| A. | Administrative Claims and Priority Claims | 32 | ||||||

| B. | Classification of Claims and Interests | 33 | ||||||

| C. | Treatment of Claims and Interests | 35 | ||||||

| D. | Means for Implementation of the Plan | 37 | ||||||

| E. | Treatment of Executory Contracts and Unexpired Leases | 42 | ||||||

| F. | Provisions Governing Distributions | 44 | ||||||

| G. | Procedures for Resolving Contingent, Unliquidated and Disputed Claims and Disputed Equity Interests | 48 | ||||||

| H. | Conditions Precedent to Confirmation of the Plan and the Effective Date | 50 | ||||||

| I. | Settlement, Release, Injunction and Related Provisions | 52 | ||||||

| J. | Binding Nature of Plan | 55 | ||||||

| K. | Retention of Jurisdiction. | 55 | ||||||

| L. | Modification, Revocation or Withdrawal of the Plan | 57 | ||||||

| M. | Miscellaneous Provisions | 58 | ||||||

| VII. |

DESCRIPTION OF THE NEW SECURED NOTES | 61 | ||||||

| VIII. |

FINANCIAL INFORMATION AND PROJECTIONS | 62 | ||||||

| IX. |

VALUATION ANALYSIS | 63 | ||||||

| X. |

TRANSFER RESTRICTIONS AND CONSEQUENCES UNDER FEDERAL SECURITIES LAWS | 63 | ||||||

| XI. |

CERTAIN TAX CONSEQUENCES OF THE PLAN | 64 | ||||||

| A. | Introduction | 64 | ||||||

| B. | Federal Income Tax Consequences to the Debtors | 65 | ||||||

| C. | Federal Income Tax Consequences to Holders of Certain Claims and Interests | 68 | ||||||

| XII. |

CERTAIN RISK FACTORS TO BE CONSIDERED | 85 | ||||||

| A. |

Certain Bankruptcy Law Considerations | 85 | ||||||

| B. |

Additional Factors Affecting the Value of the Reorganized Debtors | 86 | ||||||

| C. |

Risks Relating to the Debtors’ Business and Financial Condition | 87 | ||||||

| D. |

Factors Relating to Securities To Be Issued Under the Plan, Generally | 110 | ||||||

| E. |

Risks Related to an Investment in the New Common Stock | 111 | ||||||

| F. |

Additional Factors | 111 | ||||||

| XIII. |

VOTING PROCEDURES AND REQUIREMENTS | 112 | ||||||

| A. |

Parties Entitled To Vote | 112 | ||||||

| B. |

Voting Deadline | 113 | ||||||

| C. |

Voting Procedures | 114 | ||||||

| D. |

Waivers of Defects, Irregularities, etc. | 117 | ||||||

| XIV. |

CONFIRMATION OF THE PLAN | 118 | ||||||

| A. |

Confirmation Hearing | 118 | ||||||

| B. |

Requirements for Confirmation of the Plan | 118 | ||||||

| XV. |

ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN | 124 | ||||||

| A. |

Alternative Plan of Reorganization | 124 | ||||||

| B. |

Sale of All or Substantially All Assets Under Section 363 of the Bankruptcy Code | 124 | ||||||

| C. |

Liquidation Under Chapter 7 or Applicable Non-Bankruptcy Law | 125 | ||||||

| XVI. |

CONCLUSION AND RECOMMENDATION | 126 | ||||||

ii

EXHIBITS

| Exhibit A |

Plan | |

| Exhibit B |

Restructuring Support Agreement | |

| Exhibit C |

Organizational Structure Chart | |

| Exhibit D |

Liquidation Analysis | |

| Exhibit E |

Projections | |

| Exhibit F |

Valuation Analysis |

iii

I.

INTRODUCTION

The Debtors submit this Disclosure Statement in connection with the Solicitation of votes on the Joint Prepackaged Plan of Reorganization of Stone Energy Corporation and Its Debtor Affiliates Under Chapter 11 of the Bankruptcy Code, dated November 17, 2016 (the “Plan,” attached hereto as Exhibit A). The Debtors under the Plan are Stone Energy Corporation (“Stone”), Stone Energy Holdings, L.L.C., and Stone Energy Offshore, L.L.C. (collectively, the “Debtors,” and the Debtors other than Stone, the “Debtor Affiliates”). Capitalized terms used in this Disclosure Statement, but not otherwise defined herein, have the meanings ascribed to such terms in the Plan. To the extent any inconsistencies exist between this Disclosure Statement and the Plan, the Plan governs.

The Debtors are commencing this Solicitation after extensive discussions over the past several months with certain of their key creditor constituencies. As a result of these negotiations, the Debtors entered into that certain Restructuring Support Agreement, dated as of October 20, 2016, as amended on November 4, 2016, November 9, 2016, and November 15, 2016 (the “Restructuring Support Agreement”), with certain creditors holding (i) the Debtors’ 7.5% Senior Notes due 2022 (the “Consenting Senior Noteholders”) and (ii) the Debtors’ 1.75% Senior Unsecured Convertible Notes due 2017 (the “Consenting Convertible Noteholders” and, together with the Consenting Senior Noteholders, the “Consenting Noteholders”). The Consenting Noteholders hold, in the aggregate, approximately 85.4% of the aggregate outstanding amount of the Prepetition Notes Claims. A copy of the Restructuring Support Agreement is attached hereto as Exhibit B. Under the terms of the Restructuring Support Agreement, the Consenting Noteholders agreed to a deleveraging transaction that would restructure the existing debt obligations of the Debtors in chapter 11 proceedings through the Plan (the “Restructuring”).

The Restructuring proposed by the Debtors will provide substantial benefits to the Debtors and all of their stakeholders, including, without limitation, the following:

| • | The Restructuring will leave the Debtors’ business intact and substantially de-levered, providing for the permanent reduction of at least a net $850 million of debt and a net $46 million of annual cash interest expense as a result of the extinguishment of the $775 million Senior Notes (as defined below) and $300 million Convertible Notes (as defined below) offset by the issuance of $225 million of New Secured Notes upon the completion of the Restructuring. This deleveraging will enhance the Debtors’ long-term growth prospects and competitive position and allow the Debtors to emerge from their chapter 11 cases (the “Chapter 11 Cases”) as reorganized entities better positioned to withstand depressed oil and natural gas prices. |

| • | In addition, the Restructuring will allow the Debtors’ management team to focus on operational performance and value creation. A significantly improved balance sheet will enable the Reorganized Debtors to pursue value-creating development and exploration associated with the Pompano platform rig and exploration prospects. Furthermore, by enhancing their capital structure, the Debtors will have the ability to accelerate drilling activity if prices recover. |

| • | Moreover, the Restructuring proposed under the Plan provides recoveries to all of the Debtors’ stakeholders. As set forth below, the Plan provides for a recovery to each class of Claims and Interests (for those Holders who do not affirmatively elect to opt out of the releases provided under the Plan) in the form of cash, notes, stock, warrants, or a combination thereof. Distributions of equity in the Reorganized Debtors will allow certain stakeholders to participate in potential future upside in the Reorganized Debtors. The proposed Restructuring has the additional benefit of ensuring that management remains highly committed to the future of the Reorganized Debtors. |

Executing the Restructuring in a timely manner, however, is of critical importance. The pre-packaged bankruptcy process contemplated under the Plan preserves value for all stakeholders while minimizing restructuring costs and delays. Management’s focus can then turn from balance sheet management towards operational performance and value creation. Failure to timely consummate the Plan, however, will likely result in many creditors and interest holders of the Debtors receiving little or no value on account of their Claims or Interests. The Debtors anticipate commencing the Chapter 11 Cases no later than December 9, 2016, and emerging from the chapter 11 process approximately 90 days thereafter. A discussion of key dates and deadlines is set forth below.

| THE DEBTORS AND THE CONSENTING NOTEHOLDERS (COLLECTIVELY, THE “PLAN SUPPORT PARTIES”) SUPPORT CONFIRMATION OF THE PLAN AND URGE ALL HOLDERS OF CLAIMS ENTITLED TO VOTE ON THE PLAN TO VOTE TO ACCEPT THE PLAN. THE PLAN SUPPORT PARTIES BELIEVE THAT THE PLAN PROVIDES THE HIGHEST AND BEST RECOVERY FOR ALL CREDITORS AND INTEREST HOLDERS.

|

There are two creditor groups whose acceptances of the Plan are being solicited:

| 1. | Holders of Prepetition Banks Claims (Class 2); and |

| 2. | Holders of Prepetition Notes Claims (Class 3). |

Below is a short summary of the treatment of the various groups of creditors and interest holders under the Plan. Greater detail on such treatment is provided later in this Disclosure Statement.

Other Secured Claims (Class 1): The legal, equitable and contractual rights of the Holders of Other Secured Claims will not be altered by the Plan, and therefore Class 1 is Unimpaired. Holders of Class 1 Other Secured Claims are presumed to have accepted the Plan, and therefore Holders of such Other Secured Claims are not entitled to vote to accept or reject the Plan. Except to the extent a Holder of an Allowed Other Secured Claim has been paid by the Debtors prior to the Effective Date or the Holder of an Allowed Other Secured Claim, the Required Consenting Noteholders, and the Debtors agree to less favorable treatment of such Claim, each Holder of an Allowed Other Secured Claim (including any Claim for postpetition interest accrued until the Effective Date at the non-default rate provided in the applicable contract or, if there is no contract, then at the Federal Judgment Rate, to the extent permissible under Bankruptcy Code section 506(a)) shall receive, in full and final satisfaction, settlement, release and discharge of, and in exchange for, such Allowed Other Secured Claim, in the discretion of the Debtors (subject to the consent of the Required Consenting Noteholders), one of the following alternative treatments:

| (i) | payment of the Allowed Class 1 Claim in full in Cash on the later of the Distribution Date or as soon as practicable after a particular Claim becomes Allowed; |

| (ii) | delivery to the Holder of the Allowed Class 1 Claim of the collateral securing such Allowed Class 1 Claim; |

2

| (iii) | such other treatment as may be agreed to by the applicable Debtor, the Required Consenting Noteholders, and the Holder; or |

| (iv) | the Holder shall retain its Lien on such property and such Allowed Class 1 Claim shall be Reinstated pursuant to section 1124(2) of the Bankruptcy Code. |

Prepetition Banks Claims (Class 2): Class 2 is Impaired. Class 2, the Holders of Prepetition Banks Claims, is entitled to vote to accept or reject the Plan. If Class 2 votes in favor of the Plan, (a) the Consenting Banks shall receive on account of the Prepetition Banks Claims held by such Consenting Banks, including obligations relating to issued but undrawn letters of credit under the Prepetition Credit Agreement, (i) their respective Pro Rata share of commitments, and obligations owing to such Holders with respect to outstanding loans, under the Amended Credit Agreement and (ii) their respective Pro Rata share of Prepetition Banks Cash as a partial repayment of such outstanding loans subject to re-borrowing pursuant to the terms of the Amended Credit Agreement and (b) the Holders of Prepetition Banks Claims other than the Consenting Banks shall receive their respective Pro Rata share of the obligations owing to such Holders with respect to the New Senior Secured Term Loans, provided that the obligations owing to such Holders of Prepetition Banks Claims with respect to issued but undrawn letters of credit under the Prepetition Credit Agreement shall remain outstanding and be cash collateralized in an amount equal to 102% of the face amount thereof. If Class 2 votes against the Plan, the Holders of Prepetition Banks Claims, including any Consenting Banks, shall each receive their respective Pro Rata share of the obligations owing to such Holders with respect to the New Senior Secured Term Loans, provided that the issued but undrawn letters of credit under the Prepetition Credit Agreement shall remain outstanding and be cash collateralized in an amount equal to 102% of the face amount thereof.

Prepetition Notes Claims (Class 3): Class 3 is Impaired. Holders of Class 3 Prepetition Notes Claims are entitled to vote to accept or reject the Plan. Holders of Prepetition Notes Claims shall receive their respective Pro Rata share of (i) the Prepetition Notes Cash, (ii) 85% of the net cash proceeds received by the Debtors from the Appalachia Sale in excess of $350 million, if any, (iii) the New Secured Notes, and (iv) the number of shares of New Common Stock constituting ninety-five (95%) of the shares of New Common Stock to be issued and outstanding pursuant to the Plan on the Effective Date, prior to dilution for the Management Equity Incentive Program and the New Warrants.

IN THE EVENT THE PLAN IS REJECTED BY THE HOLDERS OF PREPETITION BANKS CLAIMS, THE DEBTORS INTEND TO SEEK TO CONFIRM THE PLAN UNDER SECTION 1129(B) OF THE BANKRUPTCY CODE WHICH MAY INVOLVE MATERIAL LITIGATION WITH THE HOLDERS OF PREPETITION BANKS CLAIMS. SUCH LITIGATION MAY RESULT IN THE TREATMENT OF THE PREPETITION BANKS CLAIMS MATERIALLY DIFFERING FROM THAT SET FORTH IN THE PLAN AS A RESULT OF THE ORDER OF THE BANKRUPTCY COURT OR SETTLEMENT REACHED WITH THE HOLDERS OF PREPETITION BANKS CLAIMS. THE RESTRUCTURING SUPPORT AGREEMENT REQUIRES THAT THE TREATMENT OF THE PREPETITION BANKS CLAIMS BE ACCEPTABLE TO THE REQUIRED CONSENTING NOTEHOLDERS UNDER THE RESTRUCTURING SUPPORT AGREEMENT. EACH HOLDER OF PREPETITION NOTES CLAIMS MAY EXECUTE A JOINDER TO THE RESTRUCTURING SUPPORT AGREEMENT AND, THEREBY, BECOME A CONSENTING NOTEHOLDER THEREUNDER. EACH HOLDER OF PREPETITION NOTES CLAIMS THAT VOTES TO ACCEPT THE PLAN EXPRESSLY AGREES AND ACKNOWLEDGES THAT (A) THE ULTIMATE TREATMENT OF THE PREPETITION BANKS CLAIMS MAY DIFFER MATERIALLY FROM THAT SET FORTH HEREIN AND IN THE PLAN AS A RESULT OF THE ORDER OF THE BANKRUPTCY COURT OR SETTLEMENT REACHED WITH THE HOLDERS OF PREPETITION BANKS CLAIMS ACCEPTABLE TO THE REQUIRED CONSENTING NOTEHOLDERS IN ACCORDANCE WITH THE TERMS OF THE RESTRUCTURING SUPPORT AGREEMENT AND

3

(B) FURTHER SOLICITATION OR RE-SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN BY THE PREPETITION NOTES CLAIMS SHALL NOT BE REQUIRED WITH RESPECT TO ANY MODIFICATION OR ALTERATION OF THE TREATMENT OF THE PREPETITION BANKS CLAIMS THAT IS ACCEPTABLE TO THE DEBTORS AND THE REQUIRED CONSENTING NOTEHOLDERS IN ACCORDANCE WITH THE TERMS OF THE RESTRUCTURING SUPPORT AGREEMENT.

General Unsecured Claims (Class 4): Class 4 is Unimpaired. Holders of Class 4 General Unsecured Claims are presumed to have accepted the Plan, and therefore Holders of such General Unsecured Claims are not entitled to vote to accept or reject the Plan. Except to the extent that a Holder of a General Unsecured Claim agrees to less favorable treatment, in full and final satisfaction, settlement, release and discharge of and in exchange for each General Unsecured Claim, on or as soon as practicable after the Effective Date or when such obligation becomes due in the ordinary course of business in accordance with applicable law or the terms of any agreement that governs such General Unsecured Claim, whichever is later, each Holder of a General Unsecured Claim shall be paid in full in Cash, or otherwise receive such treatment as to render such Holder Unimpaired; provided, however, that no Holder of a General Unsecured Claim shall receive any distribution for any Claim which has previously been satisfied pursuant to a Final Order of the Bankruptcy Court.

Stone Equity Interests (Class 5): Class 5 is Impaired. Holders of Class 5 Stone Equity Interests are presumed to have rejected the Plan, and therefore Holders of such Stone Equity Interests are not entitled to vote to accept or reject the Plan. On the Effective Date, all Class 5 Equity Interests shall be canceled and shall be of no further force and effect, whether surrendered for cancellation or otherwise. On or as soon as practicable after the Effective Date, each Holder of Old Common Stock, or other Stone Equity Interests that were exercised or exchanged for Old Common Stock in accordance with their terms prior to the Voting Record Date, that did not submit a valid Release Opt-Out by the Release Opt-Out Deadline shall receive its Pro Rata share of the number of shares of the New Common Stock constituting five percent (5%) of the shares of New Common Stock to be issued and outstanding pursuant to the Plan on the Effective Date, prior to dilution for the Management Equity Incentive Program and the New Warrants and its Pro Rata share of the New Warrants in satisfaction of its Class 5 Equity Interests. Each Holder of Stone Equity Interests that submits a valid Release Opt-Out by the Release Opt-Out Deadline shall receive no distribution on account of such Stone Equity Interests held by such Holder, and all shares of New Common Stock and New Warrants that would have been otherwise distributed to such Holders of Stone Equity Interests shall be distributed, Pro Rata, to those Holders of Stone Equity Interests that did not submit a valid Release Opt-Out.

THE PLAN PROVIDES THAT HOLDERS OF IMPAIRED CLAIMS WHO VOTE IN FAVOR OF THE PLAN, WHO DO NOT SUBMIT A BALLOT TO ACCEPT OR REJECT THE PLAN, OR WHO REJECT THE PLAN BUT DO NOT OPT OUT OF THE RELEASE PROVISIONS OF THE PLAN ARE DEEMED TO HAVE CONSENTED TO THE RELEASES THEREIN. THE PLAN ALSO PROVIDES THAT HOLDERS OF IMPAIRED INTERESTS THAT DO NOT OPT OUT OF THE RELEASE PROVISIONS OF THE PLAN ARE DEEMED TO HAVE CONSENTED TO THE RELEASES THEREIN.

WHO IS ENTITLED TO VOTE: Under the Bankruptcy Code, only Holders of Claims in “impaired” Classes are entitled to vote on the Plan. Under section 1124 of the Bankruptcy Code, a class of claims or interests is deemed to be “impaired” under the Plan unless (i) the Plan leaves unaltered the legal, equitable, and contractual rights to which such claim or interest entitles the holder thereof or (ii) notwithstanding any legal right to an accelerated payment of such claim or interest, the Plan, among other things, cures all existing defaults (other than defaults resulting from the occurrence of events of bankruptcy) and reinstates the maturity of such claim or interest as it existed before the default.

4

The following table summarizes, assuming an Effective Date of March 9, 2017, (i) the treatment of Claims and Interests under the Plan, (ii) which Classes are impaired by the Plan, (iii) which Classes are entitled to vote on the Plan, and (iv) the estimated recoveries for holders of Claims and Interests. The table is qualified in its entirety by reference to the full text of the Plan. For a more detailed summary of the terms and provisions of the Plan, see Section VI—Summary of the Plan below. A detailed discussion of the analysis underlying the estimated recoveries, including the assumptions underlying such analysis, is set forth in the Valuation Analysis in Section XI.

5

| Class |

Claim or Interest |

Treatment |

Impaired or |

Entitlement to Vote on the |

Approx. | |||||

| 1 | Other Secured Claims | The legal, equitable and contractual rights of the Holders of Other Secured Claims will not be altered by the Plan. Except to the extent a Holder of an Allowed Other Secured Claim has been paid by the Debtors prior to the Effective Date or the Holder of an Allowed Other Secured Claim, the Required Consenting Noteholders, and the Debtors agree to less favorable treatment of such Claim, each Holder of an Allowed Other Secured Claim (including any Claim for postpetition interest accrued until the Effective Date at the non-default rate provided in the applicable contract or, if there is no contract, then at the Federal Judgment Rate, to the extent permissible under Bankruptcy Code section 506(a)) shall receive, in full and final satisfaction, settlement, release and discharge of, and in exchange for, such Allowed Other Secured Claim, in the discretion of the Debtors (subject to the consent of the Required Consenting Noteholders), one of the following alternative treatments:

(i) payment of the Allowed Class 1 Claim in full in Cash on the later of the Distribution Date or as soon as practicable after a particular Claim becomes Allowed;

(ii) delivery to the Holder of the Allowed Class 1 Claim of the collateral securing such Allowed Class 1 Claim; |

Unimpaired | No (Presumed to accept) | 100% |

| 2 | The ranges set forth under Approximate Percentage Recovery are based on the range of reorganized equity value of the Debtors as described in the Valuation Analysis. |

6

| Class |

Claim or Interest |

Treatment |

Impaired or |

Entitlement to Vote on the |

Approx. | |||||

| (iii) such other treatment as may be agreed to by the applicable Debtor, the Required Consenting Noteholders, and the Holder; or

(iv) the Holder shall retain its Lien on such property and such Allowed Class 1 Claim shall be Reinstated pursuant to section 1124(2) of the Bankruptcy Code. |

||||||||||

| 2 | Prepetition Banks Claims | If Class 2 votes in favor of the Plan, (a) the Consenting Banks shall receive on account of the Prepetition Banks Claims held by such Consenting Banks, including obligations relating to issued but undrawn letters of credit under the Prepetition Credit Agreement, (i) their respective Pro Rata share of commitments, and obligations owing to such Holders with respect to outstanding loans, under the Amended Credit Agreement and (ii) their respective Pro Rata share of Prepetition Banks Cash as a partial repayment of such outstanding loans subject to re-borrowing pursuant to the terms of the Amended Credit Agreement and (b) the Holders of Prepetition Banks Claims other than the Consenting Banks shall receive their respective Pro Rata share of the obligations owing to such Holders with respect to the New Senior Secured Term Loans, provided that the obligations owing to such Holders of Prepetition Banks Claims with respect to issued but undrawn letters of credit under the Prepetition Credit Agreement shall remain outstanding and be cash collateralized in an amount equal to 102% of the face amount thereof. If Class 2 votes against | Impaired | Yes | 100% | |||||

7

| Class |

Claim or Interest |

Treatment |

Impaired or |

Entitlement to Vote on the |

Approx. | |||||

| the Plan, the Holders of Prepetition Banks Claims, including any Consenting Banks, shall each receive their respective Pro Rata share of the obligations owing to such Holders with respect to the New Senior Secured Term Loans, provided that the issued but undrawn letters of credit under the Prepetition Credit Agreement shall remain outstanding and be cash collateralized in an amount equal to 102% of the face amount thereof. | ||||||||||

| 3 | Prepetition Notes Claims | Holders of Prepetition Notes Claims shall receive their respective Pro Rata share of (i) the Prepetition Notes Cash, (ii) 85% of the net cash proceeds received by the Debtors from the Appalachia Sale in excess of $350 million, if any, (iii) the New Secured Notes, and (iv) the number of shares of New Common Stock constituting ninety-five (95%) of the shares of New Common Stock to be issued and outstanding pursuant to the Plan on the Effective Date, prior to dilution for the Management Equity Incentive Program and the New Warrants. | Impaired | Yes | 36% to 49% | |||||

| 4 | General Unsecured Claims | Except to the extent that a Holder of a General Unsecured Claim agrees to less favorable treatment, in full and final satisfaction, settlement, release and discharge of and in exchange for each General Unsecured Claim, on or as soon as practicable after the Effective Date or when such obligation becomes due in the ordinary course of business in accordance with applicable law or the terms of any agreement that | Unimpaired | No (Presumed to accept) |

100% | |||||

8

| Class |

Claim or Interest |

Treatment |

Impaired or |

Entitlement Vote on the |

Approx. | |||||

| governs such General Unsecured Claim, whichever is later, each Holder of a General Unsecured Claim shall be paid in full in Cash, or otherwise receive such treatment as to render such Holder Unimpaired; provided, however, that no Holder of a General Unsecured Claim shall receive any distribution for any Claim which has previously been satisfied pursuant to a Final Order of the Bankruptcy Court. | ||||||||||

| 5 | Stone Equity Interests | On the Effective Date, all Class 5 Equity Interests shall be canceled and shall be of no further force and effect, whether surrendered for cancellation or otherwise. On or as soon as practicable after the Effective Date, each Holder of Old Common Stock, or other Stone Equity Interests that were exercised or exchanged for Old Common Stock in accordance with their terms prior to the Voting Record Date, that did not submit a valid Release Opt-Out by the Release Opt-Out Deadline shall receive its Pro Rata share of the number of shares of the New Common Stock constituting five percent (5%) of the shares of New Common Stock to be issued and outstanding pursuant to the Plan on the Effective Date, prior to dilution for the Management Equity Incentive Program and the New Warrants and its Pro Rata share of the New Warrants in satisfaction of its Class 5 Equity Interests. Each Holder of Stone Equity Interests that submits a valid Release Opt-Out by the Release Opt-Out Deadline shall receive no distribution on account of such Stone Equity Interests | Impaired | No (Presumed to reject) | N/A | |||||

9

| Class |

Claim or |

Treatment |

Impaired or |

Entitlement |

Approx. | |||||

| held by such Holder, and all shares of New Common Stock and New Warrants that would have been otherwise distributed to such Holders of Stone Equity Interests shall be distributed, Pro Rata, to those Holders of Stone Equity Interests that did not submit a valid Release Opt-Out. |

WHERE TO FIND ADDITIONAL INFORMATION: Stone currently files quarterly and annual reports with, and furnishes other information to, the SEC. Copies of any document filed with the SEC may be obtained by visiting the SEC website at http://www.sec.gov and performing a search under the “Company Filings” link. Each of the following filings is incorporated as if fully set forth herein and is a part of this Disclosure Statement. Reports filed with the SEC on or after the date of this Disclosure Statement are also incorporated by reference herein.

| • | Annual Report filed on Form 10-K for the fiscal year ended December 31, 2015; |

| • | Quarterly Reports filed on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016, and September 30, 2016; |

| • | Current Reports on Form 8-K filed on March 11, 2016, March 24, 2016, April 14, 2016, April 20, 2016, May 5, 2016, May 16, 2016, May 19, 2016, May 20, 2016, June 1, 2016, June 3, 2016, June 13, 2016, June 14, 2016 (two filings), June 29, 2016, July 25, 2016, August 2, 2016, August 23, 2016, October 21, 2016, November 7, 2016, November 10, 2016, November 15, 2016, and November 16, 2016; and |

| • | Description of Stone’s capital stock contained in its registration statement on Form 8-A filed on June 11, 1993. |

PLEASE TAKE NOTE OF THE FOLLOWING KEY DATES AND DEADLINES FOR THE CHAPTER 11 CASES AS SET FORTH IN THE RESTRUCTURING SUPPORT AGREEMENT:3

| Deadline to commence Solicitation: |

November 17, 2016 | |

| Deadline to vote to accept or reject the Plan: |

5:00 p.m. (Prevailing Central Time) on December 16, 2016 | |

| Deadline to commence the Chapter 11 Cases: |

11:59 p.m. (Prevailing Central Time) on December 9, 2016 | |

| Deadline for entry of order(s) approving the Disclosure Statement and confirming the Plan: |

Seventy-five (75) calendar days after the Petition Date | |

| Deadline for the Effective Date of the Plan: |

Fifteen (15) calendar days after entry of the order confirming the Plan | |

| 3 | The foregoing dates and deadlines may be modified or amended with the written consent of the Required Consenting Noteholders in accordance with the Restructuring Support Agreement. |

10

II.

OVERVIEW OF THE DEBTORS’ OPERATIONS

| A. | The Debtors’ Business |

The Debtors are an independent oil and natural gas company engaged in the acquisition, exploration, exploitation, development and operation of oil and gas properties. The Debtors have been operating in the Gulf of Mexico (the “GOM”) Basin since 1993 and have established a technical and operational expertise in this area. The Debtors have leveraged their experience in the GOM conventional shelf and expanded their reserve base into the more prolific basins of the GOM deep water, Gulf Coast deep gas and the Marcellus and Utica shales in Appalachia. As of December 31, 2015, the Debtors’ estimated proved oil and natural gas reserves were approximately 57 million barrels of oil equivalent (MMBoe) or 342 billion cubic feet equivalent (Bcfe). During 2015, approximately 95 MMBoe or 570 Bcfe of the Debtors’ estimated proved reserves were revised downward as a result of lower oil, natural gas and natural gas liquids prices.

As of December 31, 2015, the Debtors held leasehold interests in approximately 60,000 net (83,000 gross) acres in the GOM conventional shelf, where the water depths range from 0 to 1,000 feet; approximately 363,000 net (600,000 gross) acres in the GOM deep water, where the water depths range from 1,000 to 9,000 feet; and approximately 11,000 net (37,000 gross) acres in the deep gas, where the water depths range from 15,000 to 25,000 feet. As of December 31, 2015, the Debtors had completed 35 net (36 gross) wells in the GOM conventional shelf; 47 net (54 gross) wells in the GOM deep water; and 1 net (5 gross) well(s) in the GOM deep gas. Since 2006, the Debtors have secured numerous oil and gas leasehold interests in the Appalachian basin in Pennsylvania and West Virginia. As of December 31, 2015, the Debtors held leasehold interests in approximately 89,000 net (104,000 gross) mineral acres and had completed 95 net (136 gross) wells (collectively, the “Appalachia Properties”).

For the fiscal year ended December 31, 2015, the Debtors’ total operating revenues were approximately $545 million, compared to $796 million for the fiscal year ended December 31, 2014, representing an approximate 32% decrease in operating revenues year over year. The decrease in operating revenues was driven by the decline in the prices of crude oil and natural gas in 2015. For the six months ended June 30, 2016, the Debtors’ total operating revenues were approximately $170 million, compared to approximately $302 million for the six months ended June 30, 2015, representing an approximate 44% decrease in operating revenues year over year. The year-over-year decrease was driven by the decline in the realized prices of crude oil and natural gas in the second half of 2015 and the temporary shut-in of the Mary field in Appalachia from September 1, 2015 until June 2016.

For the nine months ended September 30, 2016, the Debtors’ total operating revenues were approximately $264 million, compared to approximately $434 million for the nine months ended September 30, 2015. The decrease in total revenue for the nine months ended September 30, 2016 was primarily due to a 23% decrease in production volumes and a 20% decrease in average realized prices on an equivalent basis from the comparable period in 2015.

On October 20, 2016, the Debtors entered into a purchase and sale agreement with TH Exploration III, LLC, an affiliate of Tug Hill, Inc. See Section III.D hereof Key Events Leading to the Commencement of Chapter 11 Cases – Purchase and Sale Agreement with Tug Hill.

11

| B. | The Debtors’ Organizational Structure. |

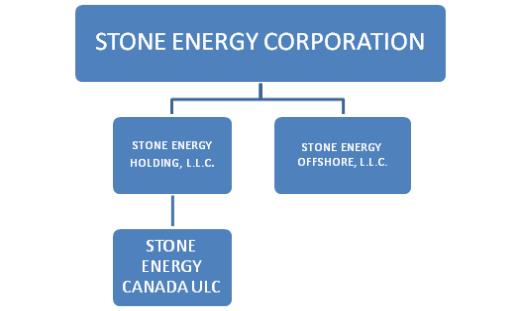

Stone is the ultimate corporate parent, the issuer of publicly traded common stock, and the issuer of certain senior unsecured notes and senior unsecured convertible notes, all as further described herein. Stone’s direct and indirect subsidiaries include all of the Debtor Affiliates as well as the non-operating, non-Debtor Stone Energy Canada ULC. A chart illustrating the Debtors’ organizational structure, as of the date hereof, is attached hereto as Exhibit C.

| C. | Directors and Officers |

The following table sets forth the names of the members of Stone’s current board of directors:

| Name |

Director Since | Position | ||

| David H. Welch |

2004 | Chairman of the Board, President and Chief Executive Officer | ||

| Richard A. Pattarozzi |

2000 | Director | ||

| Kay G. Priestly |

2006 | Director | ||

| Donald E. Powell |

2008 | Director | ||

| Robert S. Murley |

2011 | Director | ||

| B.J. Duplantis |

1993 | Director | ||

| George R. Christmas. |

2003 | Director | ||

| Peter D. Kinnear |

2008 | Director | ||

| Phyllis M. Taylor |

2012 | Director | ||

| David T. Lawrence |

2013 | Director |

David H. Welch has served as the President and Chief Executive Officer of Stone since April 2004 and has served as Chairman of the Board since May 2012. Prior to joining the Debtors in 2004, he worked for BP Amoco or its predecessors for 26 years, where his final role was Senior Vice President, BP America Inc. Mr. Welch has an engineering degree from Louisiana State University and a doctoral degree in engineering and economics from Tulane University. He has completed the Harvard Business School advanced management program and executive development programs at Stanford Business School and at Cambridge University. Mr. Welch serves as a director of Iberia Bank (member of the compensation committee and Chairman of the enterprise risk committee). Mr. Welch has served as Chairman of the Offshore Energy Center, Chairman of the Greater Lafayette Chamber of Commerce and 2011 Chairman of the United Way in Acadiana. He currently serves as an executive director of the National Ocean Industries Association, a trustee of The Nature Conservancy of Louisiana, a director of the Offshore Energy Center, a director of Louisiana Association of Business and Industry, a director of the Upper Lafayette Economic Development Foundation and on the Lafayette Central Park board.

Richard A. Pattarozzi served as Vice President of Shell Oil Company from March 1999 until his retirement in January 2000, having worked for Shell Oil Company for over 33 years, from 1966 to 2000, in the United States, both onshore and in the Gulf of Mexico. He also served as President and Chief Executive Officer for both Shell Deepwater Development, Inc. and Shell Deepwater Production, Inc. from 1995 until 1999, and previously was appointed General Manager of Shell’s Deepwater Production Division in April 1991 and General Manager of Shell’s Deepwater Exploration and Production Division in October 1991. Mr. Pattarozzi graduated from the University of Illinois with a civil engineering degree. Mr. Pattarozzi presently serves on the board of directors of FMC Technologies, Inc. (member of the compensation committee and chair of the nominating and governance committee) and Tidewater Inc. (“Tidewater”) (as independent Chairman of the Board and a member of the compensation and nominating and governance committees), both of which are public companies. Mr. Pattarozzi previously served on the boards of Superior Energy Services, Inc. and Global Industries, Ltd., which merged with Technip in

12

December 2011. Mr. Pattarozzi also serves on the board of trustees of the U.S. Army War College Foundation and is a past Trustee of the National World War II Museum, Inc. and past Chairman of the Offshore Energy Center and also of the United Way in New Orleans, Louisiana.

Kay G. Priestly was formerly the Chief Executive Officer and a director of Turquoise Hill Resources Ltd., an international mining company focused on copper, gold and coal in the Asia Pacific region, retiring therefrom as of December 31, 2014. From 2008 until her appointment as CEO of Turquoise Hill in 2012, she was Chief Financial Officer of Rio Tinto Copper (a division of the Rio Tinto Group – Rio Tinto plc and Rio Tinto Limited). From 2006 to 2008, she was Vice President, Finance and Chief Financial Officer of Rio Tinto’s Kennecott Utah Copper operations. Ms. Priestly served as Vice President, Risk Management and General Auditor for Entergy Corporation, an integrated energy company engaged primarily in electric power production and retail distribution operations, from 2004 to 2006. Ms. Priestly previously spent over 24 years with global professional services firm Arthur Andersen, where she provided tax, consulting and mergers & acquisitions services to global companies across many industries, including energy, mining, manufacturing and services. While at Andersen, she was a member of the global energy team, served as managing partner of the New Orleans office from 1997 to 2000, and was a member of Andersen’s global executive team from 2001 to 2002 where she had overall responsibility for the firm’s human resources strategy. Ms. Priestly also serves on the board of directors for New Gold, Inc. (chair of the audit committee) and for FMC Technologies, Inc. (member of the audit committee). She formerly served as Chairman of the board of directors of SouthGobi Resources Ltd., from September 2012 through December 2014, retiring therefrom as of December 31, 2014, and formerly served as a director of Palabora Mining Company Limited from January 2009 through May 2010.

Donald E. Powell served as the Federal Coordinator of Gulf Coast Rebuilding from November 2005 until March 2008, and he received the Presidential Citizens Medal in 2008 from President George W. Bush. Mr. Powell was the 18th Chairman of the Federal Deposit Insurance Corporation, where he served from August 2001 until November 2005. Mr. Powell previously served as President and Chief Executive Officer of the First National Bank of Amarillo, where he started his banking career in 1971. Mr. Powell graduated from West Texas State University with a bachelor of science degree in economics and is a graduate of The Southwestern Graduate School of Banking at Southern Methodist University. Mr. Powell presently serves on the board of directors of T.D. Williamson, a privately held company. Mr. Powell previously served as a director of QR Energy, LP (member of the audit and compensation committees and chairman of the conflicts committee prior to resigning in connection with the acquisition of QR Energy, LP by Breitburn Energy Partners LP in November 2014) and as a director of Bank of America Corporation and Merrill Lynch International (United Kingdom) (retiring in May 2013 from both). He also has served on the boards of several non-public, civic and charitable organizations, including as Chairman of the Board of Regents of the Texas A&M University System, Advisory Board Member of the George Bush School of Government and Public Service and Chairman of the Amarillo Chamber of Commerce, the City of Amarillo Housing Board and the High Plains Baptist Hospital and Harrington Regional Medical Center in Amarillo, Texas.

Robert S. Murley is a Senior Advisor to Credit Suisse, LLC, having been employed by Credit Suisse and its predecessors from 1975 to April 2012. In 2005, he was appointed Chairman of Investment Banking in the Americas, serving in that position until April 2012. Prior to that time, Mr. Murley headed the Global Industrial and Services Group within the Investment Banking Division, as well as the Chicago investment banking office. He was named a Managing Director in 1984 and appointed a Vice Chairman in 1998. Mr. Murley received a bachelor of arts degree from Princeton University, a MBA from the UCLA Anderson School of Management and a master of science degree in International Economics from the London School of Economics. Mr. Murley has been a director of Apollo Education Group since June 2011 (chair of the audit, finance and special litigation committees, and member of the nominating and governance committee), a director of Health Insurance Innovations since November 2013 and a director of Brown

13

Advisory since January 2016. He also serves as a Trustee of Princeton University, is Chairman of the Board of the Educational Testing Service in Princeton, New Jersey, is Vice Chairman of the Board of the Ann & Robert Lurie Children’s Hospital of Chicago, is Chairman of the Board of Overseers of the UCLA Anderson School of Management and is a Trustee of the Museum of Science & Industry in Chicago, Illinois.

B.J. Duplantis is a senior partner with the law firm of Gordon, Arata, McCollam, Duplantis & Eagan, having joined the firm in 1982, with a practice focused on the oil and gas industry. Prior to joining the law firm, Mr. Duplantis served in the legal department of The Superior Oil Company from 1979 to 1982 and previously was employed by Shell Oil Company, where he served in various engineering and management capacities over 10 years in Louisiana, Texas, California and New York, and also as a member of its legal department from 1971 to 1978. Mr. Duplantis graduated from Louisiana State University with a bachelor of science degree in petroleum chemical engineering and from Loyola University with a Juris Doctor degree. In addition to his several professional affiliations, Mr. Duplantis has served on the Louisiana State Office of Conservation Intrastate Pipelines Ad Hoc Committee, the Louisiana State Office of Conservation Committee on Revision of Rules of Procedure, and the Advisory Committee for the Louisiana State Commissioner’s Office of Conservation, and is a former board member of Holy Cross College, New Orleans, Louisiana.

George R. Christmas retired in 2011 as President and Chief Executive Officer of the Marine Corps Heritage Foundation, which directly supports the historical programs of the Marine Corps, preserves the history, traditions and culture of the Marine Corps, and educates Americans in its virtues. Retired Lt. Gen. Christmas graduated from the University of Pennsylvania with a bachelor of arts degree and then from Shippensburg University with a master of public administration degree. He served in the U.S. Marine Corps from 1962 to 1996, originally commissioned as a second lieutenant and rising to Brigadier General in 1988, Major General in 1991, and Lieutenant General in 1993 as Commanding General, I Marine Expeditionary Force, Camp Pendleton, California. Lt. General Christmas’s personal decorations and medals include the Navy Cross, Defense Distinguished Service Medal, Navy Distinguished Service Medal, Defense Superior Service Medal, Purple Heart, Meritorious Service Medal and three gold stars in lieu of consecutive awards, the Army Commendation Medal, and the Vietnamese Cross of Gallantry with palm. He previously served as a consultant or advisor to various entities, including Wexford Group International, Northrup Gruman Space & Mission Systems Corporation, Marine Corps Heritage Foundation, RAND Corporation and HARRIS Corporation. Retired Lt. General Christmas presently serves as an advisor to the Marine Corps Heritage Foundation; as Member, Advisory Board, to the Florence & Robert A. Rosen Family Wellness Center for Law Enforcement and Military; as Chairman, Board of Directors, for Center House Association; as Marine Corps Senior Advisor for the Department of Defense Commemoration of the 50th Anniversary of the Vietnam War; as Witness to the War Advisory Board; as Member of the Stafford County Virginia Armed Services Memorial Commission; and as Trustee of the Stafford Hospital Foundation.

Peter D. Kinnear held numerous management, operations and marketing roles with FMC Technologies, Inc. and FMC Corporation, both leading providers of technology services to the energy industry, starting in 1971 and retiring from FMC Technologies, Inc. in 2011. Mr. Kinnear served as Chief Executive Officer from March 2007 through February 2011 of FMC Technologies, Inc., and previously as President from March 2006 through April 2010, and Chief Operating Officer from March 2006 through March 2007. Mr. Kinnear received a bachelor’s degree in chemical engineering from Vanderbilt University and an MBA from the University of Chicago. Mr. Kinnear presently serves on the board of directors of Superior Energy Services, Inc. (member of the audit and corporate governance committees). In addition to serving as trustee or director of various non-public entities, including The Petroleum Equipment Suppliers Association, the Business Council, and Spindletop International, Mr. Kinnear previously served on the board of directors of Tronox Incorporated from November 2005 to December 2010, and as FMC Technologies, Inc.’s Chairman of the Board from October 2008 through October 2011.

14

Phyllis M. Taylor is the Chairman and Chief Executive Officer of Taylor Energy Company LLC. Ms. Taylor is a graduate of Tulane University School of Law in New Orleans, and she served as a law clerk for the Supreme Court of Louisiana and subsequently served as in-house counsel for private energy companies. Ms. Taylor also serves as Chairman and President of the Patrick F. Taylor Foundation and on the Iberia Bank Advisory Board. Ms. Taylor is involved in numerous civic activities, including serving on the New Orleans Business Council, the Catholic Leadership Institute National Advisory Board and the Tulane University Board of Trustees.

David T. Lawrence has extensive global experience across the upstream energy business. He currently is Chairman and CEO of Lawrence Energy Group LLC. He served as Executive Vice President Exploration and Commercial for Shell Upstream Americas and Functional Head of Global Exploration for Shell worldwide from June 2009 until retiring from this position in April 2013. His responsibilities included exploration, acquisitions, divestments, new business development, LNG, Gas to Liquids and wind energy in the Americas. Prior roles included Executive Vice President Global Exploration and Executive Vice President Investor Relations for Royal Dutch Shell based in The Hague and London, respectively, and Vice President Exploration and Development for Shell Exploration and Production Company in the United States. In his 29 years with Shell, Mr. Lawrence conducted business in more than 40 countries around the globe. Mr. Lawrence currently serves as a Trustee Associate of the American Association of Petroleum Geologists Foundation, and he has served on the National Ocean Industry Association as Membership Chair and as a past commissioner on the Aspen Institute Commission on Arctic Climate Change. He was a member of the American Petroleum Institute Upstream Committee, where he helped lead efforts to establish the Center for Offshore Safety and was the Chairman of the European Association of Geologists and Engineers (EAGE) Annual Meeting in Amsterdam in 2008. Mr. Lawrence is the author of numerous technical and business articles, is a recipient of the Meritorious Service Award from the American Petroleum Institute, and received the Wallace Pratt Memorial Award for best paper in the American Association of Petroleum Geologists bulletin. Mr. Lawrence received his Ph.D. in Geology and Geophysics from Yale University in 1984 and his B.A. in Geology from Lawrence University in 1977.

Stone’s current senior management team is comprised of the following individuals:

| Name |

Position | |

| David H. Welch |

Chairman of the Board, President and Chief Executive Officer | |

| Kenneth H. Beer |

Executive Vice President and Chief Financial Officer | |

| Lisa S. Jaubert |

Senior Vice President, General Counsel and Secretary | |

| E.J. Louviere |

Senior Vice President – Land | |

| John J. Leonard |

Senior Vice President – Exploration and Business Development | |

| Florence M. Ziegler |

Senior Vice President – Human Resources, Communications & Administration | |

| Richard L. Toothman, Jr. |

Senior Vice President – Appalachia | |

| Keith Seilhan |

Senior Vice President – Gulf of Mexico | |

| Thomas L. Messonnier |

Vice President – Planning, Marketing & Midstream |

Please see above for Mr. Welch’s biographical information.

Kenneth H. Beer was named Executive Vice President and Chief Financial Officer in January 2011. Previously, he served as Senior Vice President and Chief Financial Officer since August 2005. Prior to joining Stone, he served as a director of research and a senior energy analyst at the investment banking firm of Johnson Rice & Company. Prior to joining Johnson Rice & Company in 1992, he was an energy analyst and investment banker at Howard Weil Incorporated.

15

Lisa S. Jaubert was named Senior Vice President, General Counsel and Secretary in May 2013. She previously served as Assistant General Counsel since joining Stone in July 2012. Prior to joining Stone, she worked as Counsel with Latham & Watkins, LLP where she was a specialist in M&A, finance and other energy related transactions. Ms. Jaubert also served over five years as Assistant General Counsel and Assistant Corporate Secretary for Mariner Energy, was a founding shareholder of Schully Roberts Slattery Jaubert & Marino PLC, served as an outsourced general counsel for many smaller E&P companies and was partner or associate in two other law firms with national energy practices.

E. J. Louviere was named Senior Vice President—Land in April 2004. Previously, he served as Vice President—Land since June 1995. He has been employed by Stone since its inception in 1993.

John J. Leonard was promoted to Senior Vice President—Exploration and Business Development effective January 28, 2015, after being named Vice President—Exploration in January 2014. He previously served as General Manager of Deepwater Development from February 2013 through January 2014, Director of Reservoir Engineering from January 2012 through February 2013, Asset Manager Conventional Shelf from July 2011 through January 2012, Asset Manager GOM Shelf East from January 2010 through July 2011, Eastern GOM Asset Manager from January 2007 through January 2010, Chief Reservoir Engineer from February 2006 through January 2007, and also Reservoir Engineer from August 2005 through February 2006. Prior to joining Stone in August 2005, he was employed by Object Reservoir as a Project Manager and Service Engineer, by Expro Americas as an Engineering Manager, and by Pro Tech as an Engineering Manager.

Florence M. Ziegler was named Senior Vice President—Human Resources, Communications and Administration in February 2014 and Vice President—Human Resources, Communications and Administration in September 2005. She has been employed by Stone since its inception in 1993 and served as the Director of Human Resources from 1997 to 2004.

Richard L. Toothman, Jr. was named Senior Vice President—Appalachia in February 2013 and Vice President—Appalachia in May 2010. Prior to joining Stone in May 2010, he was employed by CNX Gas Company in Bluefield, Virginia since August 2005 where he held two executive positions, VP Engineering and Technical Services and VP International Business. He also worked for Consol Energy and Conoco in prior years.

Keith A. Seilhan was promoted to Senior Vice President—Gulf of Mexico effective January 28, 2015, after being named Vice President—Deep Water in February 2013. He previously served as Deep Water Projects Manager since joining Stone in July 2012. Prior to joining Stone, Mr. Seilhan filled various senior leadership roles for Amoco and BP over his 21 year career with them. In his final year with BP, he filled the role as BP’s Incident Commander on the Deepwater Horizon Incident in 2010, and thereafter worked as an Emergency Response Consultant with The Response Group for 11/2 years. While with Amoco and BP, he served, among other roles, as an Asset Manager and an Operations Manager for Deep Water assets, Operations Director for Gulf of Mexico and the Organizational Capability Manager. On April 17, 2014, pursuant to a settlement between the SEC and Mr. Seilhan, which settlement was approved by the Court, the SEC filed a complaint in the U.S. District Court for the Eastern District of Louisiana alleging that Mr. Seilhan sold securities while in possession of material nonpublic information and in breach of duties owed to BP and its shareholders, in violation of Section 17(a) of the Securities Act of 1933, as amended (the “Securities Act”), Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder. Without admitting or denying the allegations, Mr. Seilhan consented to the entry of a final judgment permanently enjoining him from future violations of Section

16

17(a) of the Securities Act, Section 10(b) of the Exchange Act and Rule 10b-5 thereunder. Mr. Seilhan also agreed to disgorgement in the amount of $105,409, plus $13,300 of prejudgment interest, and to pay a civil penalty of $105,409. The SEC’s inquiry related to activities prior to Mr. Seilhan’s employment with Stone and was not directed at, and does not concern, Stone or any other member of Stone’s management or any member of its Board.

Thomas L. Messonnier was named Vice President—Planning, Marketing & Midstream in May 2015. He has over 30 years of industry experience and joined Stone in June 2004. He has served Stone in several capacities, including as Director of Strategic Planning, Business Development and Reserves, GOM Exploitation Manager, and Reservoir Engineering Manager.

The composition of the board of directors of each Reorganized Debtor will be disclosed prior to the entry of the order confirming the Plan in accordance with section 1129(a)(5) of the Bankruptcy Code.

| D. | Regulation of the Debtors’ Business |

The Debtors’ operations are conducted in the United States and the Gulf of Mexico and are subject to the local, state and federal laws, regulations, and treaties in the jurisdictions in which they operate. The laws, regulations, and treaties that impact the Debtors’ operations include those relating to the operation of drilling units, environmental protection, and health and safety, and restrictions on oil and natural gas exploration and development.

The Debtors’ operations on federal oil and gas leases in the Gulf of Mexico Shelf are subject to regulation by the Bureau of Ocean Energy Management (“BOEM”), the Bureau of Safety and Environmental Enforcement (“BSEE”) and the Office of Natural Resources Revenue (“ONRR”), requiring compliance with BOEM, BSEE and ONRR regulations and with applicable federal and state law, including the Outer Continental Shelf Lands Act. These laws and regulations are subject to change, and many new requirements were imposed by BSEE, BOEM and ONRR after and since the April 2010 Deepwater Horizon incident. For offshore operations, lessees, including the Debtors, must obtain BOEM and BSEE approval for exploration, development and production plans prior to the commencement of such operations. In addition to permits required from other agencies such as the United States Environmental Protection Agency (“EPA”), lessees, including the Debtors, must obtain a permit from BSEE prior to commencing drilling and comply with regulations governing, among other things, engineering and construction specifications for production facilities, safety procedures, plugging and abandonment of wells on the outer continental shelf, and removal of infrastructure facilities. The ONRR is responsible for management of all revenues associated with both federal offshore and onshore mineral leases, including royalty and revenue collection, distribution, auditing and compliance, investigation and enforcement, and asset management.

The Debtors’ onshore operations are subject to regulation by the EPA and state and local environmental agencies and/or oil and gas commissions. Similar to offshore laws and regulations, laws and regulations affecting onshore operations are subject to change, and many new requirements have been imposed by the EPA and state and local governments since approximately 2010, which coincides with the increase of onshore oil and natural gas production. For certain onshore operations, operators, including the Debtors, must obtain air and/or water discharge permits from the EPA and/or state agencies prior to commencing construction or drilling operations. Operators, including the Debtors, also must comply with regulations governing, among other things, engineering and construction specifications for production facilities, setback requirements, remediation of contaminated properties, safety procedures, plugging and abandonment of wells, and removal of infrastructure facilities.

17

| E. | The Debtors’ Capital Structure |

| 1. | Equity Ownership |

Stone is a public company and files annual reports with, and furnishes other information to, the SEC. The common stock of Stone is currently traded on the New York Stock Exchange (the “NYSE”) under the symbol “SGY.” However, as a result of the commencement of the Chapter 11 Cases, Stone may receive a notice from the NYSE informing it that Stone’s common stock will be de-listed from the exchange. If Stone receives such a notice, it is anticipated that Stone’s common stock will nevertheless be eligible to be traded as over the counter securities on the OTC Bulletin Board. As of the date hereof, 30,000,000 shares of Stone’s $0.01 par value common stock had been authorized with 5,690,253 shares of common stock issued and outstanding.

| 2. | Prepetition Indebtedness |

The following description is for informational purposes only and is qualified in its entirety by reference to the documents setting forth the specific terms of such obligations and their respective related agreements.

As of the date hereof, the Debtors had outstanding funded debt obligations in the aggregate amount of approximately $1.44 billion, which amount consists of (i) approximately $354 million in secured borrowings under the Debtors’ Prepetition Credit Agreement (as defined below), (ii) approximately $11.5 million in secured borrowings under Stone’s Building Loan (as defined below), (iii) approximately $775 million in principal amount of Senior Notes (as defined below), and (iv) approximately $300 million in principal amount of Convertible Notes (as defined below).

| (a) | Prepetition Credit Agreement |

Stone, as borrower, and Stone Energy Offshore, L.L.C., as guarantor (the “Guarantor Subsidiary”), are parties to that certain Fourth Amended and Restated Credit Agreement, dated as of June 24, 2014, with the lenders and issuing banks party thereto from time to time (the “Prepetition Banks”), Bank of America, N.A., as administrative agent (the “Prepetition Administrative Agent”), and certain other parties thereto (as amended, modified, or supplemented from time to time, the “Prepetition Credit Agreement”). The Prepetition Credit Agreement provides the Debtors with a reserve-based revolving credit facility and other commitments in an aggregate principal amount of up to $900 million. The Prepetition Credit Agreement matures July 1, 2019.

The borrowing base under the Prepetition Credit Agreement is re-determined semi-annually, typically in May and November, taking into consideration the estimated asset values of Stone’s oil and gas properties and those of the Guarantor Subsidiary, in accordance with the Prepetition Banks’ customary practices for oil and gas credit facilities. In addition, Stone and the Prepetition Banks each have discretion at any time, but not more than two additional times in any calendar year, to have the borrowing base re-determined.

On June 14, 2016, Stone, the Guarantor Subsidiary, and the Prepetition Banks entered into that certain Amendment No. 3 to the Prepetition Credit Agreement (the “Third Amendment to Credit Agreement”) to (i) increase the borrowing base to $360.0 million from $300.0 million, (ii) provide a moratorium on re-determination of the borrowing base until January 15, 2017, other than an automatic reduction upon the sale of certain of the Debtors’ properties, (iii) permit second lien indebtedness to refinance the Senior Notes and the Convertible Notes, (iv) revise the maximum consolidated funded leverage ratios, (v) require minimum liquidity of at least $125.0 million until January 15, 2017, (vi) impose limitations on capital expenditures, (vii) grant the Prepetition Banks a perfected security interest in all deposit accounts, and (viii) provide for anti-hoarding cash provisions for amounts in excess of $50.0 million to apply after December 10, 2016.

18

As of the date hereof, the aggregate principal amount outstanding under the Prepetition Credit Agreement is approximately $341.5 million in unpaid principal and approximately $12.5 million of outstanding letters of credit, plus any applicable interest, fees, and other expenses.

All amounts outstanding under the Prepetition Credit Agreement are secured by a first-lien security interest in certain of the Debtors’ existing and future assets, and the obligations under the Prepetition Credit Agreement are guaranteed by the Guarantor Subsidiary. The Prepetition Banks do not have a security interest in all of the Debtors’ assets. For example, as of December 31, 2015, the Prepetition Banks’ minimum collateral coverage of mortgaged properties was eighty percent (80%) of the Debtors’ Mortgaged Property Value,4 which was increased in the Third Amendment to Credit Agreement to eighty-six percent (86%). As a result, a portion of the Debtors’ proved reserves may be unencumbered as well as significant reserve assets currently excluded from the Debtors’ Mortgaged Property Value. The Debtors’ unencumbered real property is scattered throughout the GOM, Louisiana, West Virginia and Pennsylvania and includes reserves, undeveloped acreage, mineral rights, and real estate. In addition, the Prepetition Credit Agreement does not grant a security interest in certain Excluded Assets.5 The Prepetition Credit Agreement does, however, require that the Debtors grant a perfected security interest on their cash (i.e., control agreements with the Debtors’ depositary banks are required). Accordingly, as of the date hereof, the Debtors do not have any unencumbered cash.

| 4 | “Mortgaged Property Value” means, as of any date of its determination, the aggregate present value of the future net income with respect to the Mortgaged Properties as set forth in the applicable engineering report, discounted at the stated per annum rate utilized in such report; provided, however, that the Mortgaged Property Value does not include any Oil and Gas Properties acquired by any Credit Party after the recordation of the Mortgages in the real property records of the jurisdiction where such Oil and Gas Properties are located unless an amendment or supplement to such Mortgages sufficiently describing such after-acquired Oil and Gas Properties has been recorded in such real property records. All defined terms in the aforementioned definition shall have the meanings ascribed to them in the Prepetition Credit Agreement. |

| 5 | “Excluded Assets” means any of the following property or assets of any Debtor: (i) Excluded Equity Interests; (ii) motor vehicles or other assets subject to certificates of title; (iii) commercial tort claims where the amount of the damages claimed by the applicable Debtor is less than $5,000,000; (iv) any lease, license, contract, property right or agreement (or any of its rights or interests thereunder) if and to the extent that the grant of the security interest shall, after giving effect to Sections 9-406, 9-407, 9-408 or 9-409 of the UCC (or any successor provision or provisions) or any other applicable law, constitute or result in (A) the abandonment, invalidation or unenforceability of any material right, title or interest of the applicable Debtor therein or (B) a breach or termination pursuant to the terms of, or a default under, any such lease license, contract, property rights or agreement; provided, however, that the security interest shall attach immediately at any such time as the restriction resulting in abandonment, invalidation or unenforceability or breach or termination shall be removed or become invalid or any condition thereto (including any consent) shall be satisfied; (v) once paid, any amounts constituting the payment of a dividend or the repurchase or redemption of the shares of the Borrower’s common stock, in each case to the extent such dividend, repurchase or redemption is permitted under Section 6.5 of the Credit Agreement; (vi) Realty Collateral (as such term is defined in the Mortgages); and (vii) assets subject to a Lien securing Capital Leases or purchase money debt obligations, in each case permitted under Section 6.1(c) and 6.2(c) of the Credit Agreement, if the contract or other agreement in which such Lien is granted prohibits the creation of any other Lien on such assets (other than to the extent that any such prohibition would be rendered ineffective pursuant to the UCC or any other applicable Legal Requirement), provided that such asset (x) will be excluded from the Collateral only to the extent and for so long as the consequences specified in this clause (vii) will result and (y) will cease to be excluded from the Collateral and will become subject to the Lien granted hereunder, immediately and automatically, at such time as such consequences will no longer result. All defined terms in the aforementioned definition shall have the meanings ascribed to them in the Prepetition Credit Agreement. |

19

| (b) | 4.20% Building Loan |

On November 20, 2015, Stone entered into a 4.20% term loan (the “Building Loan”), maturing on December 20, 2030. Stone received $11.8 million in cash, net of debt issuance costs related to the Building Loan. The proceeds are being used for general corporate purposes. The Building Loan bears interest at a rate of 4.20% per annum and is to be repaid in 180 equal monthly installments commencing on December 20, 2015. The Building Loan is collateralized by the Debtors’ two Lafayette, Louisiana office buildings. As of the date hereof, a total of approximately $11.5 million was outstanding under the Building Loan.

| (c) | The Senior Notes |

On November 8, 2012, Stone completed an offering of $300.0 million in aggregate principal amount of 7.5% Senior Unsecured Notes due 2022 (the “Senior Notes”). The first $300.0 million of Senior Notes were issued under the Second Supplemental Indenture, dated as of November 8, 2012, to the Indenture, dated as of January 26, 2010 (the “Senior Notes Indenture”), among Stone, Stone Energy Offshore, L.L.C., as the Guarantor Subsidiary, and The Bank of New York Mellon Trust Company, N.A., as trustee. On November 27, 2013, Stone issued an additional $475.0 million in aggregate principal amount of the Senior Notes. The Senior Notes will be due on November 15, 2022.

The Senior Notes bear interest at a rate of 7.5% per annum with interest payable semiannually on May 15 and November 15. The Senior Notes are senior unsecured obligations of Stone and are effectively subordinate to all of Stone’s secured debt, including secured debt under the Prepetition Credit Agreement and the Building Loan, and rank equally in right of payment with all of Stone’s other senior indebtedness. The Senior Notes are guaranteed on a senior unsecured basis by the Guarantor Subsidiary.

As of the date hereof, the aggregate principal amount outstanding under the Senior Notes is approximately $775 million, plus any applicable interest, fees, and other expenses.

| (d) | The Convertible Notes |