Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SCHULMAN A INC | shlm-201611168k.htm |

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 1

Re: SHLM

A. Schulman Investor Day

November 16, 2016

Exhibit 99.1

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 2

A number of the matters discussed in this document that are not historical or current facts deal with potential future circumstances and developments and August constitute

"forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do

not relate strictly to historic or current facts and relate to future events and expectations. Forward-looking statements contain such words as "anticipate,” "estimate," "expect,"

"project," "intend," "plan," "believe," and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. Forward-

looking statements are based on management's current expectations and include known and unknown risks, uncertainties and other factors, many of which management is

unable to predict or control, that August cause actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking

statements. Important factors that could cause actual results to differ materially from those suggested by these forward-looking statements, and that could adversely affect the

Company's future financial performance, include, but are not limited to, the following:

– worldwide and regional economic, business and political conditions, including continuing economic uncertainties in some or al l of the Company's major product

markets or countries where the Company has operations;

– the effectiveness of the Company's efforts to improve operating margins through sales growth, price increases, productivity gains, and improved purchasing

techniques;

– competitive factors, including intense price competition;

– fluctuations in the value of currencies in areas where the Company operates;

– volatility of prices and availability of the supply of energy and raw materials that are critical to the manufacture of the Company's products, particularly plastic resins

derived from oil and natural gas;

– changes in customer demand and requirements;

– effectiveness of the Company to achieve the level of cost savings, productivity improvements, growth and other benefits anticipated from acquisitions, joint ventures

and restructuring initiatives;

– escalation in the cost of providing employee health care;

– uncertainties regarding the resolution of pending and future litigation and other claims;

– the performance of the global automotive market as well as other markets served;

– further adverse changes in economic or industry conditions, including global supply and demand conditions and prices for products;

– operating problems with our information systems as a result of system security failures such as viruses, cyber-attacks or other causes;

– our current debt position could adversely affect our financial health and prevent us from fulfilling our financial obligations;

– integration of acquisitions, including most recently Citadel, with our existing business, including the risk that the integration will be more costly or more time consuming

and complex or simply less effective than anticipated;

– our ability to achieve the anticipated synergies, cost savings and other benefits from the Citadel acquisition;

– substantial time devoted by management to the integration of the Citadel acquisition; and

– failure of counterparties to perform under the terms and conditions of contractual arrangements, including suppliers, customers, buyers and sellers of a business and

other third parties with which the Company contracts.

The risks and uncertainties identified above are not the only risks the Company faces. Additional risk factors that could affect the Company's performance are set forth in the

Company's Annual Report on Form 10-K for the fiscal year ended August 31, 2016. In addition, risks and uncertainties not presently known to the Company or that it believes

to be immaterial also may adversely affect the Company. Should any known or unknown risks or uncertainties develop into actual events, or underlying assumptions prove

inaccurate, these developments could have material adverse effects on the Company's business, financial condition and results of operations.

Cautionary Note on Forward-Looking Statements

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 3

This presentation includes certain financial information determined by methods other than in accordance with

accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include

segment gross profit, SG&A expenses excluding certain items, segment operating income, operating income before

certain items, net income excluding certain items, net income per diluted share excluding certain items and adjusted

EBITDA, as discussed further in the Reconciliation of GAAP and Non-GAAP Financial Measures below. These non-

GAAP financial measures are considered relevant to aid analysis and understanding of the Company’s results and

business trends. However, non-GAAP measures are not in accordance with, nor are they a substitute for, GAAP

measures, and tables included in this release reconcile each non-GAAP financial measure with the most directly

comparable GAAP financial measure. The most directly comparable GAAP financial measures for these purposes are

gross profit, SG&A expenses, operating income, net income and net income per diluted share. The Company's non-

GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial

measures, and should be read only in conjunction with the Company's consolidated financial statements prepared in

accordance with GAAP.

While the Company believes that these non-GAAP financial measures provide useful supplemental information to

investors, there are very significant limitations associated with their use. These non-GAAP financial measures are not

prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly

comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method

of calculation. The Company compensates for these limitations by using these non-GAAP financial measures as

supplements to GAAP financial measures and by reviewing the reconciliations of the non-GAAP financial measures to

their most comparable GAAP financial measures.

Use of Non-GAAP Financial Measures

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 4

2016 Investor Day Agenda

Opening Remarks – 3:00 p.m.

Ms. Jennifer Beeman, Vice President, Corporate Communications & Investor Relations

A. Schulman Overview

Mr. Joseph Gingo, Chairman, President and Chief Executive Officer

Global Operational Update

Mr. Gary Miller, Executive Vice President and Chief Operating Officer

Financial Strategy & Results

Mr. John Richardson, Executive Vice President and Chief Financial Officer

Panel Discussion – 4:00 p.m. (moderated by Jennifer Beeman)

Mr. Frank Roederer, Senior Vice President & General Manager, U.S. & Canada and Engineered Composites

Mr. Heinrich Lingnau, Senior Vice President & General Manager, Europe, Middle East & Africa

Mr. Gustavo Perez, Senior Vice President & General Manager, Latin America

Mr. Derek Bristow, Senior Vice President & General Manager, Asia-Pacific

Cocktail Reception – 5:00 p.m. – 6:30 p.m.

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 5

Joe Gingo

Chairman, President and Chief Executive Officer

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 6

A. Schulman Business Overview

A. Schulman, Inc. is an international supplier of high-performance and engineered

plastic compounds, engineered composites, color concentrates and size reduction

services, used in a variety of consumer, packaging, industrial and automotive

applications

BUSINESS MODEL

Engineered Plastics

Specialty Powders &

Engineered Composites

Masterbatch Solutions

Custom Performance Colors

Polymer Polymer Additives

Fiber & Reinforcements Finished

Compound

SIGNIFICANT TRANSFORMATION SINCE 2008 WITH A FOCUS ON SPECIALTY MATERIALS SOLUTIONS

Resin

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 7

Current Product Families

7

Masterbatch

Solutions

28%

Black and

white

masterbatches

Additives and

processing

aids

Engineered

Composites

8%

Highly filled

thermoset

compounds,

with glass

and/or carbon

fibers

Engineered

Plastics

36%

Thermoplastic

compounds

and resins for

injection

molding and

durable goods

Specialty

Powders

10%

Thermoplastic

powders for

rotomolding

Specialty

powders and

size reduction

services

Distribution

Services

11%

Distribution of

producer

grade

polymers and

specialties

Custom

Performance

Colors

7%

Customized

color

masterbatches

Standard color

masterbatches

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 8

Key Markets

Custom Services

Packaging Mobility

Electronics and

Electrical

Agriculture

Personal Care

and Hygiene

Sports, Leisure

and Home

Building and

Construction

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 9

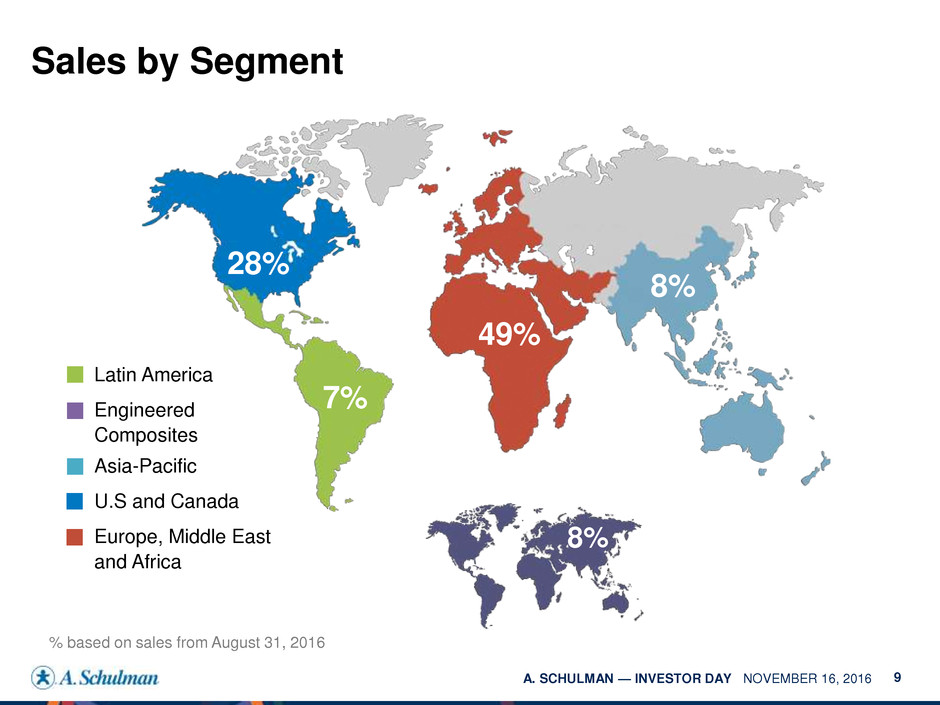

Sales by Segment

% based on sales from August 31, 2016

Latin America

Engineered

Composites

Asia-Pacific

U.S and Canada

Europe, Middle East

and Africa

28%

7%

49%

8%

8%

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 10

SHLM Performance 2009 to 2016 – Market Cap

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 11

Significant Boost to

Scale And Scope

Creates Critical

Geographic Balance

Cross-Selling

Opportunities

• Expands scale in Engineered Plastics business

• Adds scope with a new growth platform in Engineered

Composites

• Significantly enhances A. Schulman’s Engineered

Plastics presence in North America

• Global Engineered Composites platform with

substantial presence in high-growth markets such as

Mexico and China, among others

• Overlap in customers, products and channels

sets the stage for revenue synergies

Strategic Rationale For Acquiring Citadel

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 12

Lucent Issue

• Discrepancies between lab data & certifications provided to customers

and UL by two Lucent plants

• $12 million of total Lucent costs incurred in FY16

• Operationally remediated

Impairment

• $401.7 million non-cash impairment charge in 4Q

• Largely due to Lucent fraud and lower outlook for oil field services

Intangibles Impairment

• Intangible impairment reduced amortization expense in 4Q

by $1.2 million, or $0.03 per share

• Will reduce amortization expense in FY17 by $4.8 million

or $0.12 cents per share

Citadel Wrap Up

COMPANY BELIEVES SELLERS ARE RESPONSIBLE FOR DAMAGES AND HAVE FILED A LAWSUIT

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 13

Reset: Citadel

Continue to integrate Citadel’s

Engineered Plastics

• Evansville consolidation continues

Continue to grow Engineered

Composites globally

• Major investment in Germany will

provide entire range of glass & carbon

fiber sheet molding compounds

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 14

Fiscal 2014 Fiscal 2016

Metric Actuals Actuals

Sales $2.4B $2.5B

Adjusted EBITDA $147.8M $228.9M

EPS $2.36 $2.08

ROIC 12.2% 11.3%

Leverage 1.6x 3.98x

Performance 2014 vs. 2016

(1) Metrics are on a non-GAAP basis

(2) Trailing Twelve Month (TTM) Non-GAAP Operating Income After Tax (30% Tax Rate Assumed) Divided by 12 Month Average Invested Capital Defined as

Current Assets Minus Cash, Less Current Liabilities, Minus Current Portion of Long Term Debt.

(2)

(1)

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 15

• Reset: business portfolio and strategic execution

• Reexamine: market intelligence and go-to-market strategy

• Refocus: customer engagement

• Restructure: streamline costs and manufacturing footprint

• Results: deliver historical performance

Regaining Momentum

DONE WITH A HEALTHY SENSE OF URGENCY

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 16

Reset: Management Changes at A. Schulman

Gary Miller - Chief Operating Officer

Frank Roederer - Senior Vice President, General Manager of U.S. and

Canada in addition to General Manager of Engineered Composites

John Richardson - Executive Vice President – Chief Financial Officer

WE WILL FOCUS, SIMPLIFY AND EXECUTE WITH A SENSE OF URGENCY

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 17

Review of A. Schulman

GOAL WAS TO VERIFY OUR MARKET INTELLIGENCE, CONDUCT DEEP ASSESSMENT OF

UNDERLYING ASSUMPTIONS AND DEFINE PATH FORWARD – NOT SELL THE COMPANY

Over the last several months, A. Schulman partnered with Citi for a comprehensive

review of the Company’s 2017 budget and long-range plan

Citi’s

Approach

Work

Performed

• Reviewed existing budget and long-range plan

• Refined views on global market trends

• Assessed sources of growth and profitability for achievability

• Met with 30 segment and business unit leaders to discuss and test

assumptions

• Assisted A. Schulman management in development of new budget /

long-range plan

• Assisted A. Schulman management in presentation of proposed budget

and long-range plan to A. Schulman’s Board

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 18

Build on What’s Right

Build on our Process and Product Technology

• Strong global brand with long customer

relationships

Focus on Cash Generation

• Strong growth in Free Cash Flow and EBITDA

Pricing Discipline

• Implemented product pricing tools

to drive improvements

Successfully Gain Market Share in Growth Regions

• LATAM and APAC

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 19

Focus Over Next Two Years

Reinvest in the Business

• New operations in Turkey & China

• Capacity expansions in APAC, LATAM & EC

Strengthen Sales

• Hiring of Chief Commercial Officer

• Adding sales and replacement of non-performing sales people

• Product technology will report to CEO

Simplify Management Structure

• Create streamlined Product Families to gain regional control

• Eliminate redundant positions

Restructure

• Continue to optimize manufacturing footprint

• Continue to consolidate back office operations

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 20

Fiscal 2017 Fiscal 2018 Fiscal 2019 Fiscal 2020 Fiscal 2021

• Reset year

• Deliver on

expectations

• Continue business plan

implementation

• Capture benefits of 2017

initiatives

• Regain growth momentum

• Continued growth under a new

management team

Excellent internal candidates for

CFO & COO

Consider internal & external

candidates for CEO

A. Schulman Outlook

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 21

Gary Miller

Executive Vice President & Chief Operating Officer

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 22

Reexamined: Global Operations

Reexamined our businesses and

functions

• Nothing off limits

• Citi assisted in the evaluation

• “Go to Market” strategy

ALL DONE WITH A HEALTHY SENSE OF URGENCY

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 23

Reexamined: Business Unit Sales Process

Hampered service and delivery

Obstructs “Strategic Global Account” coordination

New application development slow to launch

No differentiation in growth regions

BUSINESS UNIT STRUCTURE TOO COMPLEX

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 24

Reexamination: Two Major Initiatives

Simplify management

structure/processes of our

businesses and functions

Refocus and reinvigorate

sales processes

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 25

Product Families Simplified

25

Masterbatch

Solutions

28%

Engineered

Composites

8%

Engineered

Plastics

36%

Specialty

Powders

10%

Distribution

Services

11%

Custom

Performance

Colors

7%

Current

Performance Materials

47%

Custom Concentrates

and Services

45%

Engineered Composites

8%

Restructured

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 26

New Product Families Are Market Aligned

PROVIDING INNOVATIVE SOLUTIONS TO EXACTLY MEET

CUSTOMER APPLICATION REQUIREMENTS

Performance Materials Custom Concentrates

and Services

Engineered

Composites

Packaging X

Building and Construction X X X

Agriculture X X X

Personal Care & Hygiene X

Electronics & Electrical X X

Mobility X X

Custom Services X X

Sports, Leisure & Home X X X

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 27

Refocus on Sales

Accuracy / Insight Value Pricing

Drive Organic

Growth

• Improved sales

forecasting

• “Weekly Outlook”

• Foster robust customer

discussions

TARGET DATE

Fiscal 2017 Fiscal 2017 – Fiscal 2018

Key Focus

• Reinforce pricing authority

• Utilize accurate pricing data

• Enforce appropriate pricing

• Innovation

• Focus on strategic accounts

• Have right “feet on the

street” with addition of 10%

sales resources

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 28

Refocus on Sales (continued)

Reinvigorating Innovation Process

• Restructuring global innovation pipeline

• Led by CEO

Restructuring Global Strategic Account Process

• Allows efficient cross-selling

• Leverages our global footprint

Strengthen Sales

• Hiring of Chief Commercial Officer

• Upgrade Sales capability – add resources,

upgrade talent

SIGNIFICANT CHANGES TO DRIVE ORGANIC GROWTH FUNDED BY A PORTION

OF RESTRUCTURING SAVINGS

* Registered Trademarks of Companies

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 29

Refocus: Initiatives and Savings

Simplification of management

structure/processes and Sales Refocus

• Total annual pre-tax savings approximately

$5 to $6 million with partial year savings in

FY17, and full anticipated annual savings

in FY18

• Portion of these savings will be reinvested

into additional sales resources

Pursuing rationalization of 3-4

manufacturing facilities by the end of fiscal

2017

• Total annual savings potentially $3.5 million

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 30

The Path Forward

REDEFINING THE BUSINESS & THE WAY THE CUSTOMER VIEWS US RATHER

THAN THE WAY WE VIEW THE CUSTOMER

Major initiatives

• Simplify management structure/processes

• Reinvigorate sales processes

• Pursuing asset optimization

Desired outcomes

• Pivot sales organization to customer-

centric

• Nimble & agile

• Focus on Quality, Service and Delivery

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 31

John Richardson

Executive Vice President & Chief Financial Officer

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 32

Metric(1)

Fiscal 2017

Estimates

CAGR

Fiscal 2019

Estimates

Sales $2.5 - $2.6 billion 3.8% - 3.9% $2.7 - $2.8 billion

Adjusted EBITDA $225 - $230 million 6.5% - 8.3% $255 - $270 million

EPS $2.08 - $2.18 16.0% - 17.3% $2.80 - $3.00

ROIC(2) 11% - 12.5% 16.6% - 16.8% 15% - 17%

Leverage 3.5x – 3.8x (11.1%) - (15.5%) 2.5x – 3.0x

SHLM 2019 Targets

(1) Metrics are on a non-GAAP basis

(2) Trailing Twelve Month (TTM) Non-GAAP Operating Income After Tax (30% Tax Rate Assumed) Divided by 12 Month Average Invested Capital Defined as

Current Assets Minus Cash, Less Current Liabilities, Minus Current Portion of Long Term Debt.

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 33

GDP Driven

Growth from

Developed

Markets

GDP Driven

Growth from

Emerging

Markets

Restructuring

Expansion

and

Leveraging

Technology

Balanced Long-Term Growth Profile

$225 -

$230 MM

$255 -

$270 MM

2017E EBITDA 2019E EBITDA

* Metrics are on a non-GAAP basis

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 34

Cash Utilization Philosophy

A. Schulman will invest in growth, focus on paying down debt to achieve leverage

target & return capital to shareholders

Reinvest

Return Capital

to

Shareholders

• New operations in Turkey and China

• Capacity expansions in APAC and LATAM

• Sales resources

ACHIEVING OUR NET LEVERAGE TARGET WILL PROVIDE A. SCHULMAN

WITH FURTHER STRATEGIC FLEXIBILITY

• Maintain and protect current common / convertible

stock dividends

Debt Pay

down • In addition to mandatory debt pay down, intense focus on

deleveraging balance sheet

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 35

Appendix

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 36

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 37

Explanation of Adjustments

1 - Asset impairments are related to goodwill and intangible assets, and also include information technology assets, in the Company's USCAN, EC and EMEA segments. Refer to Note 4 and Note

19 of the 2016 Annual Report on Form 10-K for further discussion.

2 - Accelerated depreciation is related to restructuring plans in the Company's USCAN, LATAM and EMEA segments. Refer to Note 14 of the 2016 Annual Report on Form 10-K for further

discussion.

3 - Costs related to acquisitions and integrations primarily include third party professional, legal, IT and other expenses associated with successful and unsuccessful full or partial acquisition and

divestiture/dissolution transactions, as well as certain employee-related expenses such as travel, bonuses and post-acquisition severance separate from a formal restructuring plan.

4 - Restructuring and related costs include items such as employee severance charges, lease termination charges, curtailment gains/losses, other employee termination costs, and professional fees

related to the reorganization of the Company’s legal entity structure and facility operations. Refer to Note 16 of the 2016 Annual Report on Form 10-K for further discussion.

5 - Lucent costs primarily represent legal and investigation costs related to resolving the Lucent matter, product manufacturing costs for reworking existing Lucent inventory, obsolete Lucent inventory

reserve costs, and dedicated internal personnel costs that would have otherwise been focused on normal operations.

6 - Accelerated amortization of deferred financing costs related to the €108.6 million prepayment of the Euro Term Loan B.

7 - CEO transition costs in 2016 represent charges for deferred compensation granted to Bernard Rzepka. Costs in 2015 represent a charge for the modification and accelerated vesting upon

retirement of the outstanding equity compensation awards granted to Joseph M. Gingo in 2013 and 2014.

8 - Tax (benefits) charges represent the Company's adjustment of reported tax expense to non-GAAP tax based on the overall estimated annual non-GAAP effective tax rates.

9 - Inventory step-up costs represent the amortization of adjustments to fair value of inventory acquired for acquisition purchase accounting.

10 – Primarily relates to bridge financing fees and the write-off of deferred debt costs of $18.8 million and $1.5 million, respectively. Refer to note 5 of the 2016 Annual Report on Form 10-K for

further discussion.

11 – Represents a pre-tax net gain of $1.3 million on the early extinguishment of debt.

.

A. SCHULMAN — INVESTOR DAY NOVEMBER 16, 2016 38

Explanation of Adjustments

(1) - Other includes Foreign currency transaction (gains) losses, Other (income) expense, net, and Gain on early extinguishment of debt.

(2) - For details on Non-GAAP adjustments, refer to "Reconciliation of GAAP and Non-GAAP Financial Measures", items (1), (3) - (11) and Loss (income) from

discontinued operations. Amounts are included in Operating Income (Loss) and Loss (income) from discontinued operations. Accelerated depreciation on the

"Reconciliation of GAAP and Non-GAAP Financial Measures" has been excluded as it is already included in Depreciation and Amortization above.