Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVADEL PHARMACEUTICALS PLC | flamelform8-kjefferiespres.htm |

November 2016 1

November 2016 2

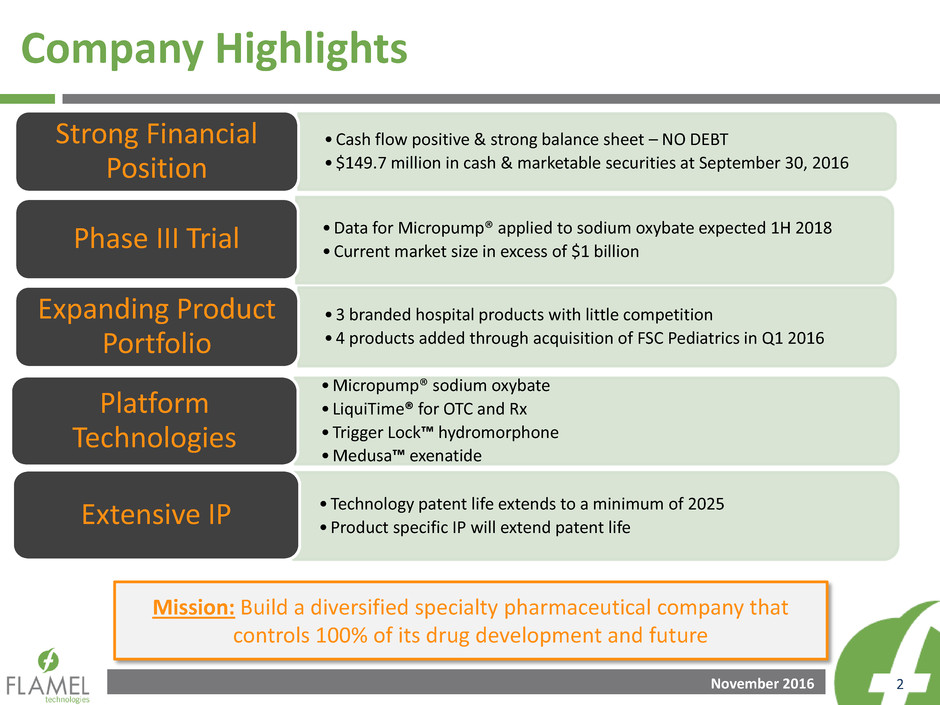

Company Highlights

Mission: Build a diversified specialty pharmaceutical company that

controls 100% of its drug development and future

•Cash flow positive & strong balance sheet – NO DEBT

•$149.7 million in cash & marketable securities at September 30, 2016

Strong Financial

Position

•Data for Micropump® applied to sodium oxybate expected 1H 2018

•Current market size in excess of $1 billion Phase III Trial

•3 branded hospital products with little competition

•4 products added through acquisition of FSC Pediatrics in Q1 2016

Expanding Product

Portfolio

•Micropump® sodium oxybate

• LiquiTime® for OTC and Rx

•Trigger Lock™ hydromorphone

•Medusa™ exenatide

Platform

Technologies

•Technology patent life extends to a minimum of 2025

•Product specific IP will extend patent life Extensive IP

November 2016 3

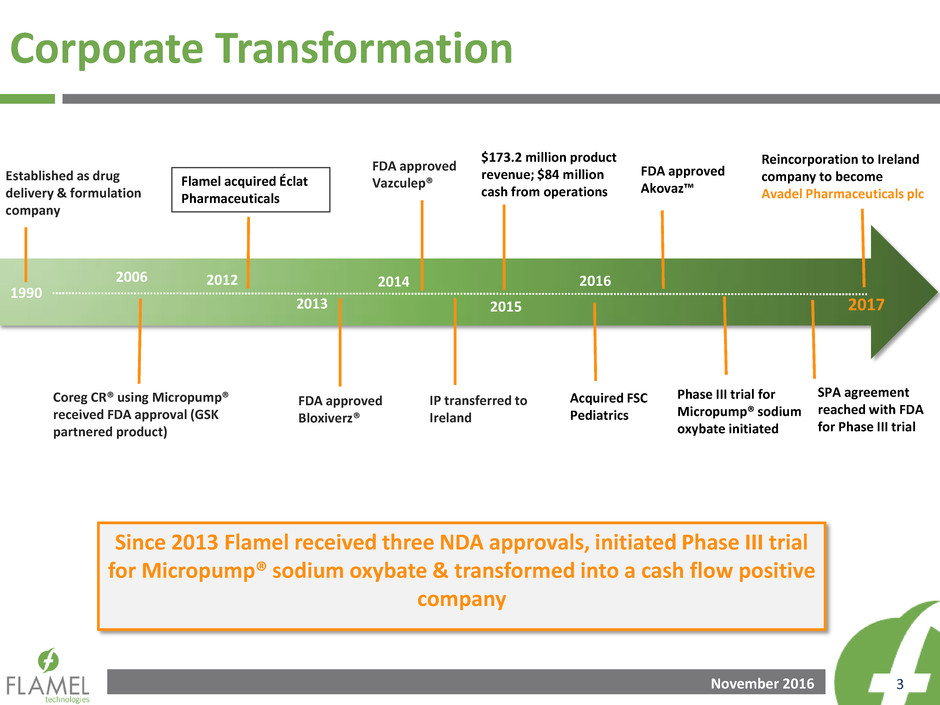

Corporate Transformation

Established as drug

delivery & formulation

company

1990

2006

Coreg CR® using Micropump®

received FDA approval (GSK

partnered product)

2012

Flamel acquired Éclat

Pharmaceuticals

2013

FDA approved

Bloxiverz®

2014

FDA approved

Vazculep®

IP transferred to

Ireland

2015

$173.2 million product

revenue; $84 million

cash from operations

2016

Acquired FSC

Pediatrics

SPA agreement

reached with FDA

for Phase III trial

Since 2013 Flamel received three NDA approvals, initiated Phase III trial

for Micropump® sodium oxybate & transformed into a cash flow positive

company

FDA approved

Akovaz™

Phase III trial for

Micropump® sodium

oxybate initiated

2017

Reincorporation to Ireland

company to become

Avadel Pharmaceuticals plc

November 2016 4

Becoming Avadel Pharmaceuticals plc

1990

Avadel Pharmaceuticals plc (NASDAQ: AVDL)

“AdVAnced DELivery”

Cross-border merger from France to Ireland effective January

1, 2017

No changes to capital structure or share count

November 2016 5

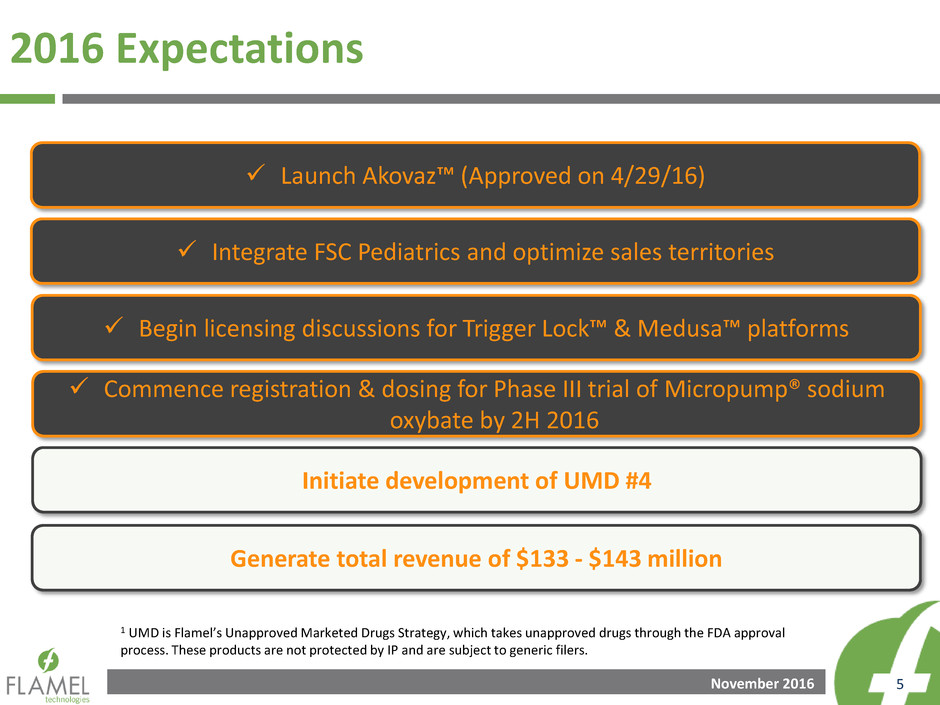

2016 Expectations

1 UMD is Flamel’s Unapproved Marketed Drugs Strategy, which takes unapproved drugs through the FDA approval

process. These products are not protected by IP and are subject to generic filers.

Generate total revenue of $133 - $143 million

Initiate development of UMD #4

Commence registration & dosing for Phase III trial of Micropump® sodium

oxybate by 2H 2016

Begin licensing discussions for Trigger Lock™ & Medusa™ platforms

Integrate FSC Pediatrics and optimize sales territories

Launch Akovaz™ (Approved on 4/29/16)

November 2016 6

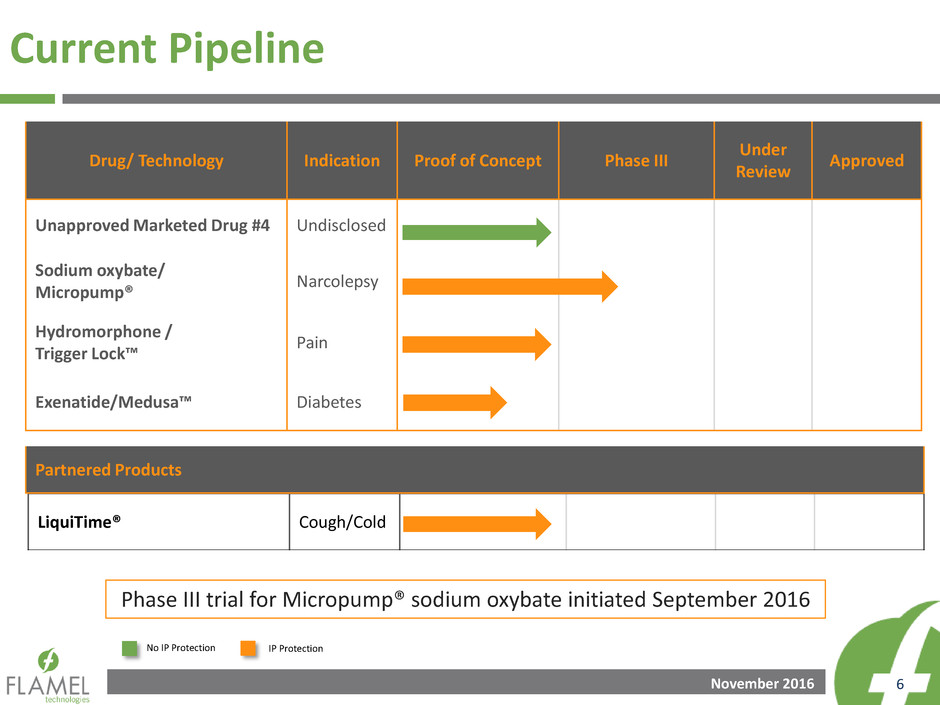

LiquiTime® Cough/Cold

Drug/ Technology Indication Proof of Concept Phase III

Under

Review

Approved

Unapproved Marketed Drug #4 Undisclosed

Sodium oxybate/

Micropump®

Narcolepsy

Hydromorphone /

Trigger Lock™

Pain

Exenatide/Medusa™ Diabetes

Current Pipeline

Partnered Products

Phase III trial for Micropump® sodium oxybate initiated September 2016

No IP Protection IP Protection

November 2016 7

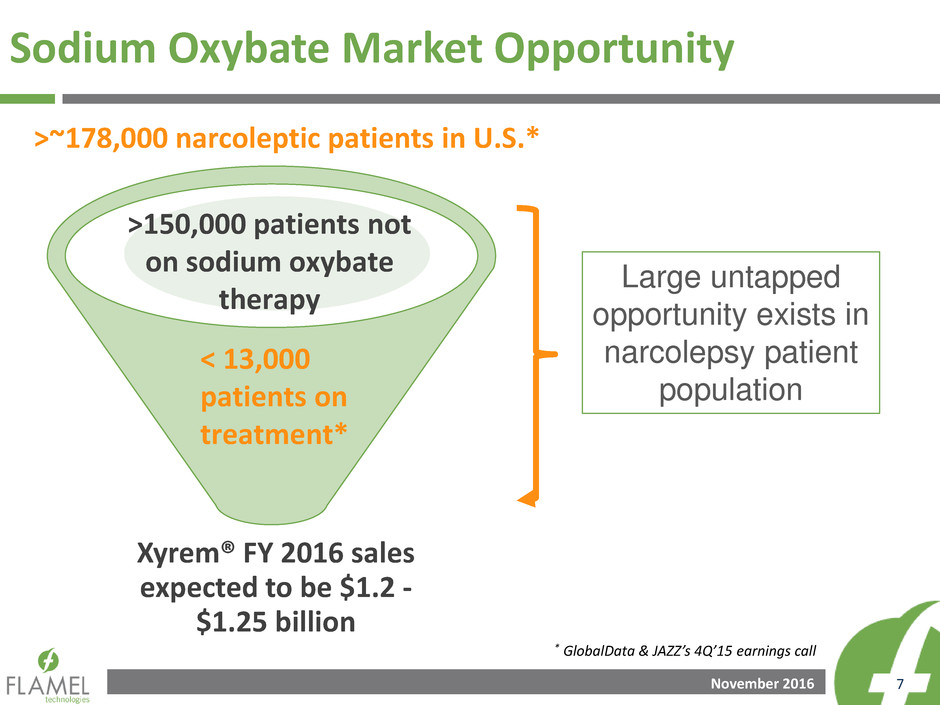

Xyrem® FY 2016 sales

expected to be $1.2 -

$1.25 billion

Sodium Oxybate Market Opportunity

* GlobalData & JAZZ’s 4Q’15 earnings call

>~178,000 narcoleptic patients in U.S.*

< 13,000

patients on

treatment*

Large untapped

opportunity exists in

narcolepsy patient

population

>150,000 patients not

on sodium oxybate

therapy

November 2016 8

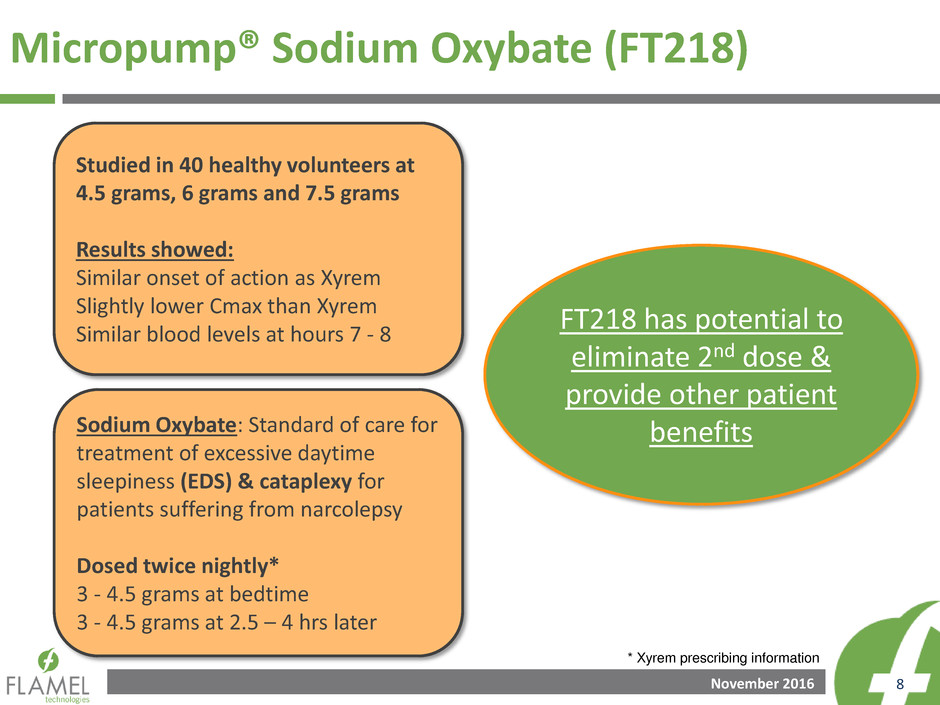

Micropump® Sodium Oxybate (FT218)

* Xyrem prescribing information

Studied in 40 healthy volunteers at

4.5 grams, 6 grams and 7.5 grams

Results showed:

Similar onset of action as Xyrem

Slightly lower Cmax than Xyrem

Similar blood levels at hours 7 - 8

Sodium Oxybate: Standard of care for

treatment of excessive daytime

sleepiness (EDS) & cataplexy for

patients suffering from narcolepsy

Dosed twice nightly*

3 - 4.5 grams at bedtime

3 - 4.5 grams at 2.5 – 4 hrs later

FT218 has potential to

eliminate 2nd dose &

provide other patient

benefits

November 2016 9

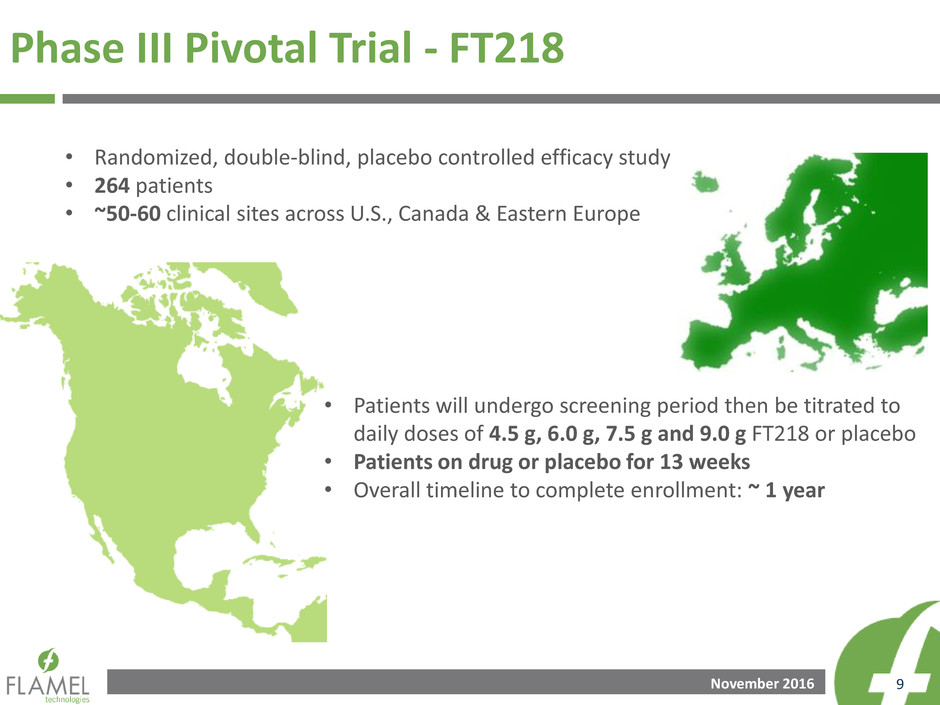

Phase III Pivotal Trial - FT218

• Randomized, double-blind, placebo controlled efficacy study

• 264 patients

• ~50-60 clinical sites across U.S., Canada & Eastern Europe

• Patients will undergo screening period then be titrated to

daily doses of 4.5 g, 6.0 g, 7.5 g and 9.0 g FT218 or placebo

• Patients on drug or placebo for 13 weeks

• Overall timeline to complete enrollment: ~ 1 year

November 2016 10

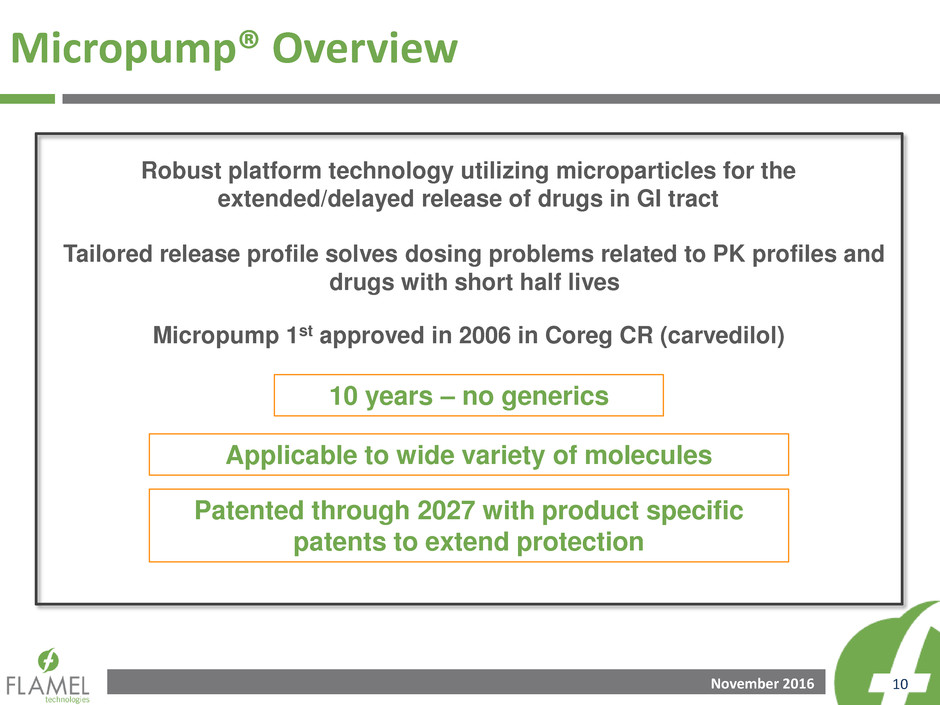

Micropump® Overview

Robust platform technology utilizing microparticles for the

extended/delayed release of drugs in GI tract

Micropump 1st approved in 2006 in Coreg CR (carvedilol)

10 years – no generics

Tailored release profile solves dosing problems related to PK profiles and

drugs with short half lives

Applicable to wide variety of molecules

Patented through 2027 with product specific

patents to extend protection

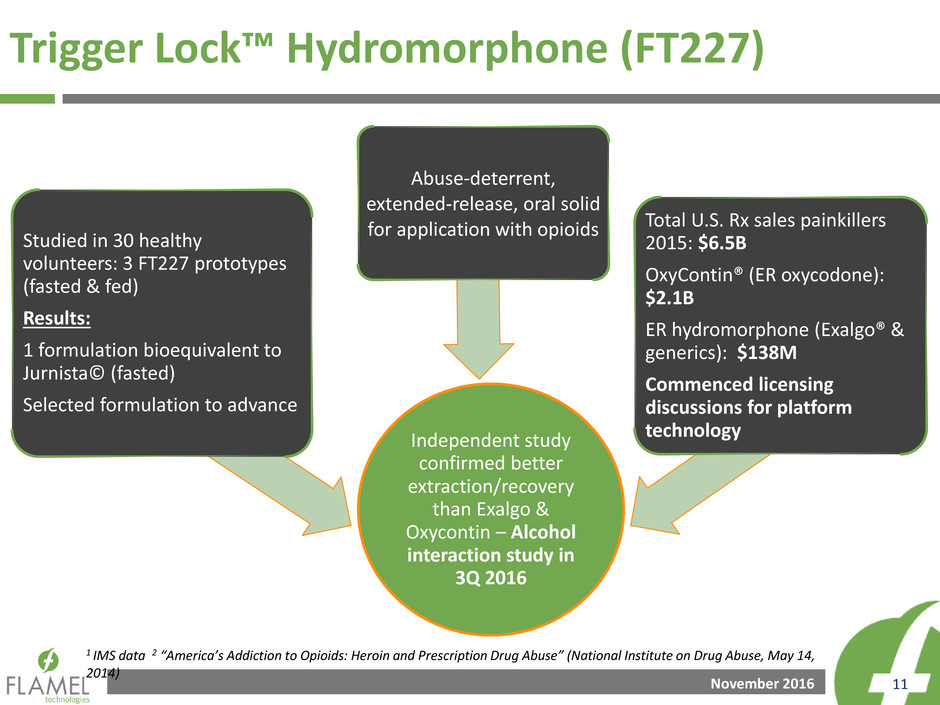

November 2016 11

Independent study

confirmed better

extraction/recovery

than Exalgo &

Oxycontin – Alcohol

interaction study in

3Q 2016

Studied in 30 healthy

volunteers: 3 FT227 prototypes

(fasted & fed)

Results:

1 formulation bioequivalent to

Jurnista© (fasted)

Selected formulation to advance

Abuse-deterrent,

extended-release, oral solid

for application with opioids Total U.S. Rx sales painkillers

2015: $6.5B

OxyContin® (ER oxycodone):

$2.1B

ER hydromorphone (Exalgo® &

generics): $138M

Commenced licensing

discussions for platform

technology

Trigger Lock™ Hydromorphone (FT227)

1 IMS data 2 “America’s Addiction to Opioids: Heroin and Prescription Drug Abuse” (National Institute on Drug Abuse, May 14,

2014)

November 2016 12

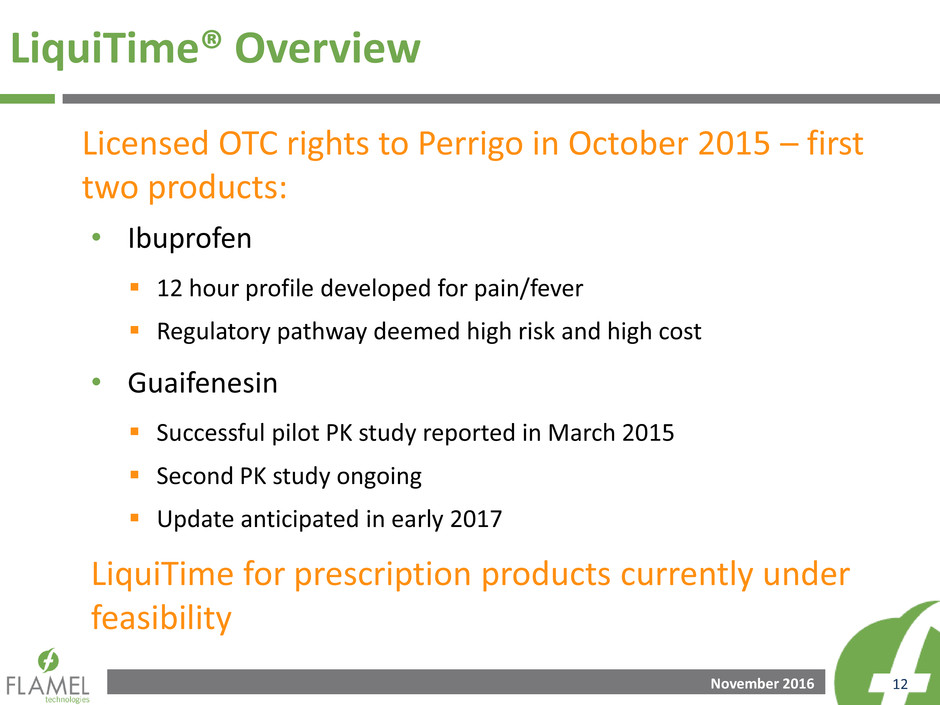

LiquiTime® Overview

• Ibuprofen

12 hour profile developed for pain/fever

Regulatory pathway deemed high risk and high cost

• Guaifenesin

Successful pilot PK study reported in March 2015

Second PK study ongoing

Update anticipated in early 2017

LiquiTime for prescription products currently under

feasibility

Licensed OTC rights to Perrigo in October 2015 – first

two products:

November 2016 13

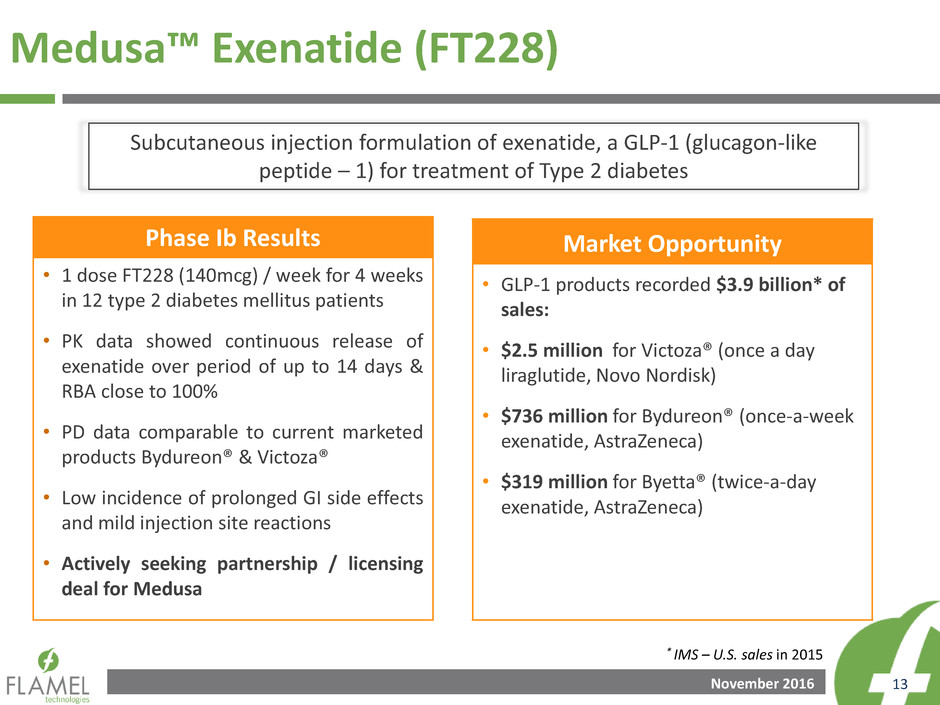

Phase Ib Results

• 1 dose FT228 (140mcg) / week for 4 weeks

in 12 type 2 diabetes mellitus patients

• PK data showed continuous release of

exenatide over period of up to 14 days &

RBA close to 100%

• PD data comparable to current marketed

products Bydureon® & Victoza®

• Low incidence of prolonged GI side effects

and mild injection site reactions

• Actively seeking partnership / licensing

deal for Medusa

Market Opportunity

• GLP-1 products recorded $3.9 billion* of

sales:

• $2.5 million for Victoza® (once a day

liraglutide, Novo Nordisk)

• $736 million for Bydureon® (once-a-week

exenatide, AstraZeneca)

• $319 million for Byetta® (twice-a-day

exenatide, AstraZeneca)

Medusa™ Exenatide (FT228)

* IMS – U.S. sales in 2015

Subcutaneous injection formulation of exenatide, a GLP-1 (glucagon-like

peptide – 1) for treatment of Type 2 diabetes

November 2016 14

Marketed Products

November 2016 15

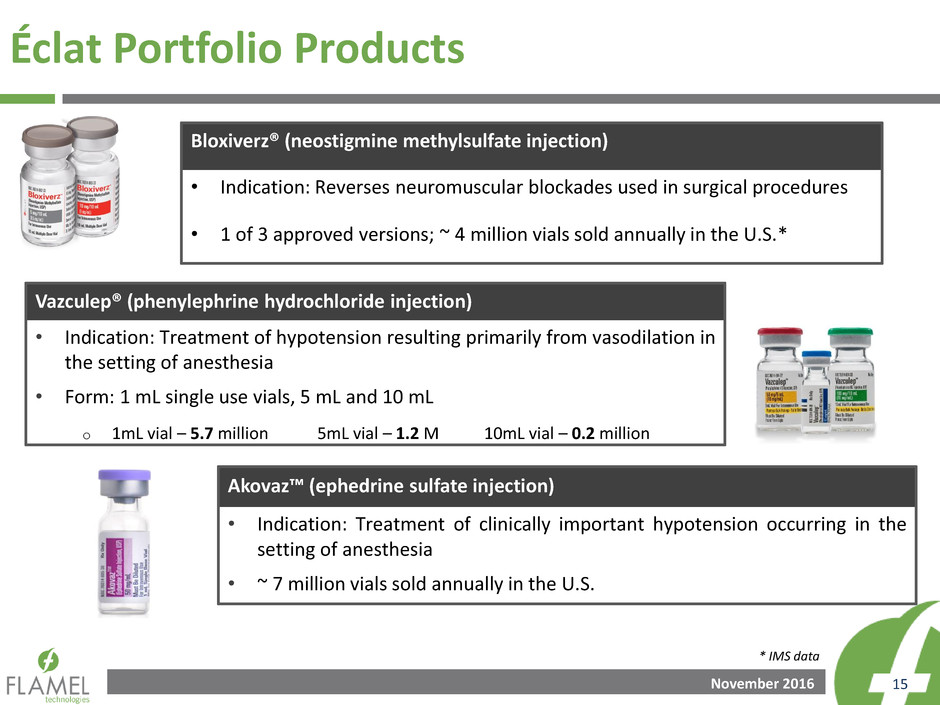

Éclat Portfolio Products

* IMS data

Bloxiverz® (neostigmine methylsulfate injection)

• Indication: Reverses neuromuscular blockades used in surgical procedures

• 1 of 3 approved versions; ~ 4 million vials sold annually in the U.S.*

Vazculep® (phenylephrine hydrochloride injection)

• Indication: Treatment of hypotension resulting primarily from vasodilation in

the setting of anesthesia

• Form: 1 mL single use vials, 5 mL and 10 mL

o 1mL vial – 5.7 million 5mL vial – 1.2 M 10mL vial – 0.2 million

Akovaz™ (ephedrine sulfate injection)

• Indication: Treatment of clinically important hypotension occurring in the

setting of anesthesia

• ~ 7 million vials sold annually in the U.S.

November 2016 16

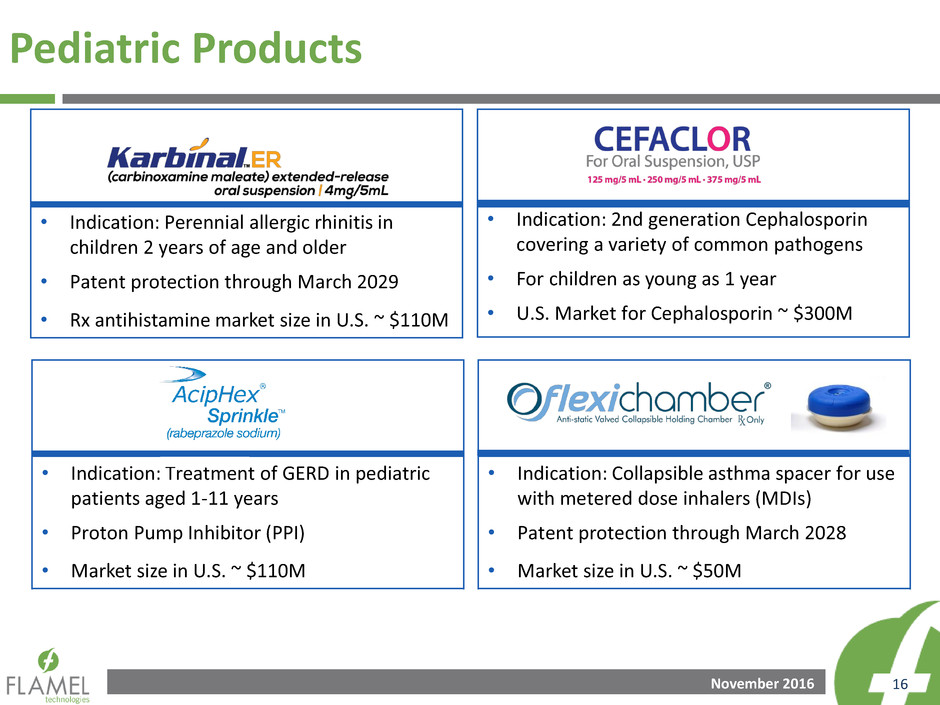

Pediatric Products

• Indication: Perennial allergic rhinitis in

children 2 years of age and older

• Patent protection through March 2029

• Rx antihistamine market size in U.S. ~ $110M

• Indication: 2nd generation Cephalosporin

covering a variety of common pathogens

• For children as young as 1 year

• U.S. Market for Cephalosporin ~ $300M

• Indication: Treatment of GERD in pediatric

patients aged 1-11 years

• Proton Pump Inhibitor (PPI)

• Market size in U.S. ~ $110M

• Indication: Collapsible asthma spacer for use

with metered dose inhalers (MDIs)

• Patent protection through March 2028

• Market size in U.S. ~ $50M

November 2016 17

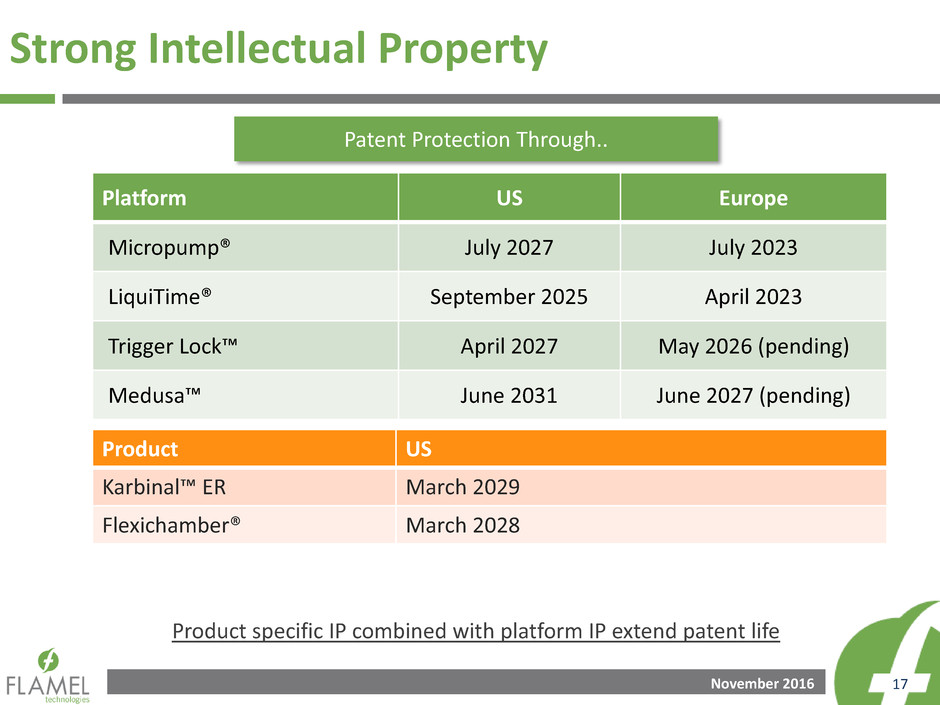

Strong Intellectual Property

Platform US Europe

Micropump® July 2027 July 2023

LiquiTime® September 2025 April 2023

Trigger Lock™ April 2027 May 2026 (pending)

Medusa™ June 2031 June 2027 (pending)

Product US

Karbinal™ ER March 2029

Flexichamber® March 2028

Patent Protection Through..

Product specific IP combined with platform IP extend patent life

November 2016 18

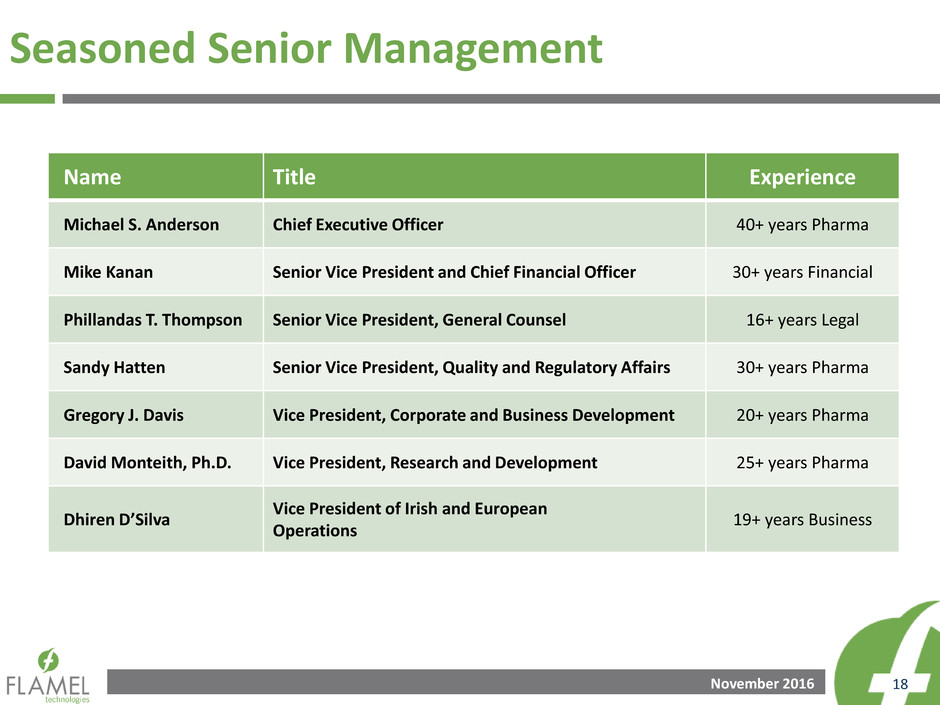

Seasoned Senior Management

Name Title Experience

Michael S. Anderson Chief Executive Officer 40+ years Pharma

Mike Kanan Senior Vice President and Chief Financial Officer 30+ years Financial

Phillandas T. Thompson Senior Vice President, General Counsel 16+ years Legal

Sandy Hatten Senior Vice President, Quality and Regulatory Affairs 30+ years Pharma

Gregory J. Davis Vice President, Corporate and Business Development 20+ years Pharma

David Monteith, Ph.D. Vice President, Research and Development 25+ years Pharma

Dhiren D’Silva

Vice President of Irish and European

Operations

19+ years Business

November 2016 19

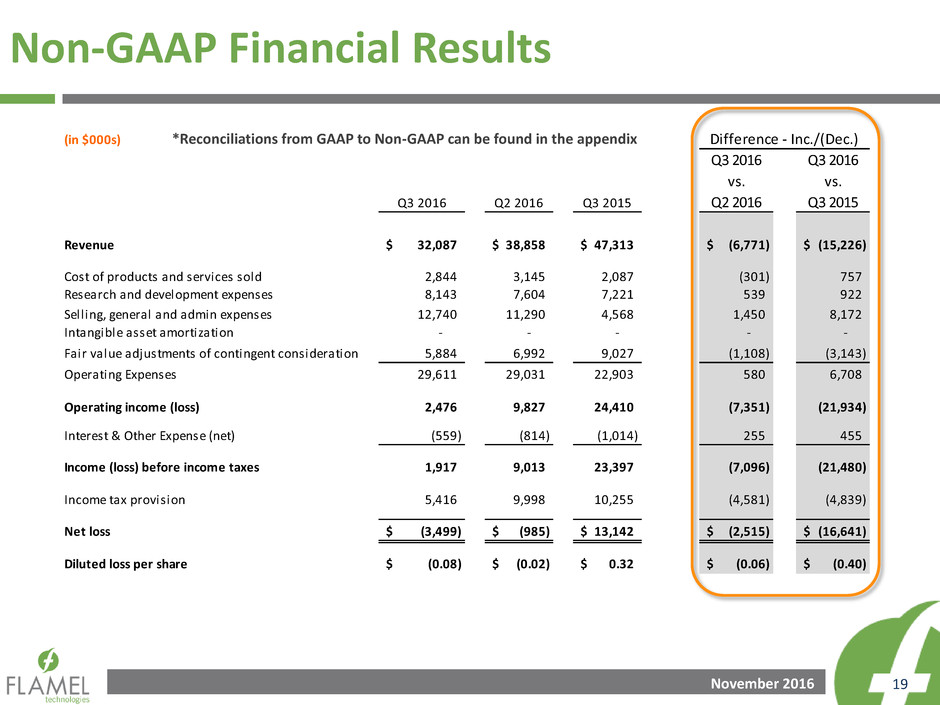

Non-GAAP Financial Results

*Reconciliations from GAAP to Non-GAAP can be found in the appendix

(in $000s)

Q3 2016 Q2 2016 Q3 2015

Q3 2016

vs.

Q2 2016

Q3 2016

vs.

Q3 2015

Revenue 32,087$ 38,858$ 47,313$ (6,771)$ (15,226)$

Cost of products and services sold 2,844 3,145 2,087 (301) 757

Research and development expenses 8,143 7,604 7,221 539 922

Selling, general and admin expenses 12,740 11,290 4,568 1,450 8,172

Intangible asset amortization - - - - -

Fair value adjustments of contingent consideration 5,884 6,992 9,027 (1,108) (3,143)

Operating Expenses 29,611 29,031 22,903 580 6,708

Operating income (loss) 2,476 9,827 24,410 (7,351) (21,934)

Interest & Other Expense (net) (559) (814) (1,014) 255 455

Income (loss) before income taxes 1,917 9,013 23,397 (7,096) (21,480)

Income tax provision 5,416 9,998 10,255 (4,581) (4,839)

Net loss (3,499)$ (985)$ 13,142$ (2,515)$ (16,641)$

Diluted loss per share (0.08)$ (0.02)$ 0.32$ (0.06)$ (0.40)$

Difference - Inc./(Dec.)

November 2016 20

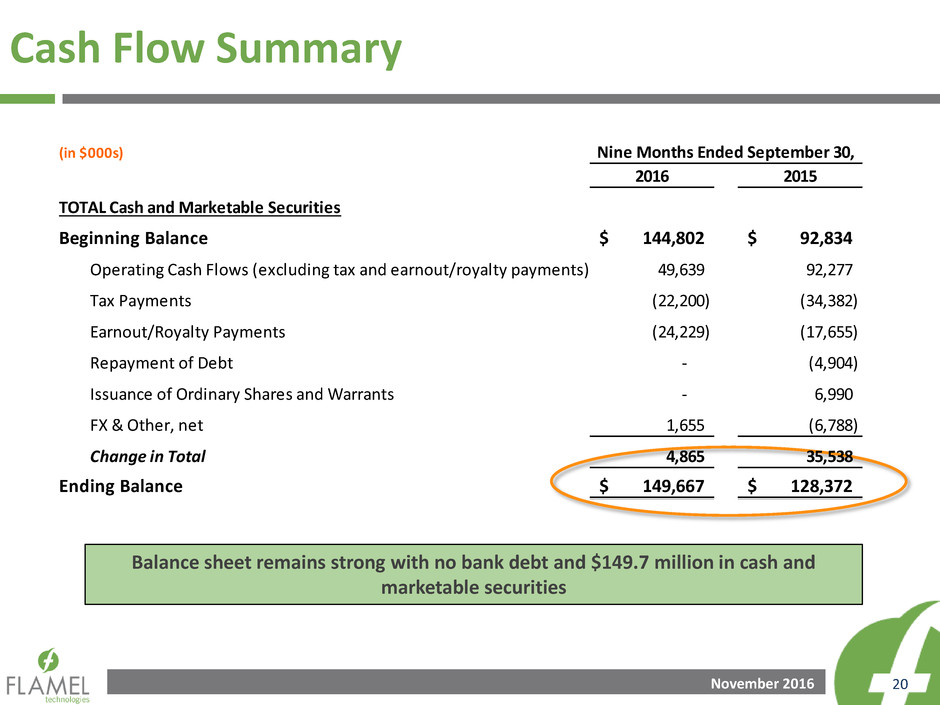

Cash Flow Summary

Balance sheet remains strong with no bank debt and $149.7 million in cash and

marketable securities

(in $000s)

2016 2015

TOTAL Cash and Marketable Securities

Beginning Balance 144,802$ 92,834$

Operating Cash Flows (excluding tax and earnout/royalty payments) 49,639 92,277

Tax Payments (22,200) (34,382)

Earnout/Royalty Payments (24,229) (17,655)

Repayment of Debt - (4,904)

Issuance of Ordinary Shares and Warrants - 6,990

FX & Other, net 1,655 (6,788)

Change in Total 4,865 35,538

Ending Balance 149,667$ 128,372$

Nine Months Ended September 30,

November 2016 21

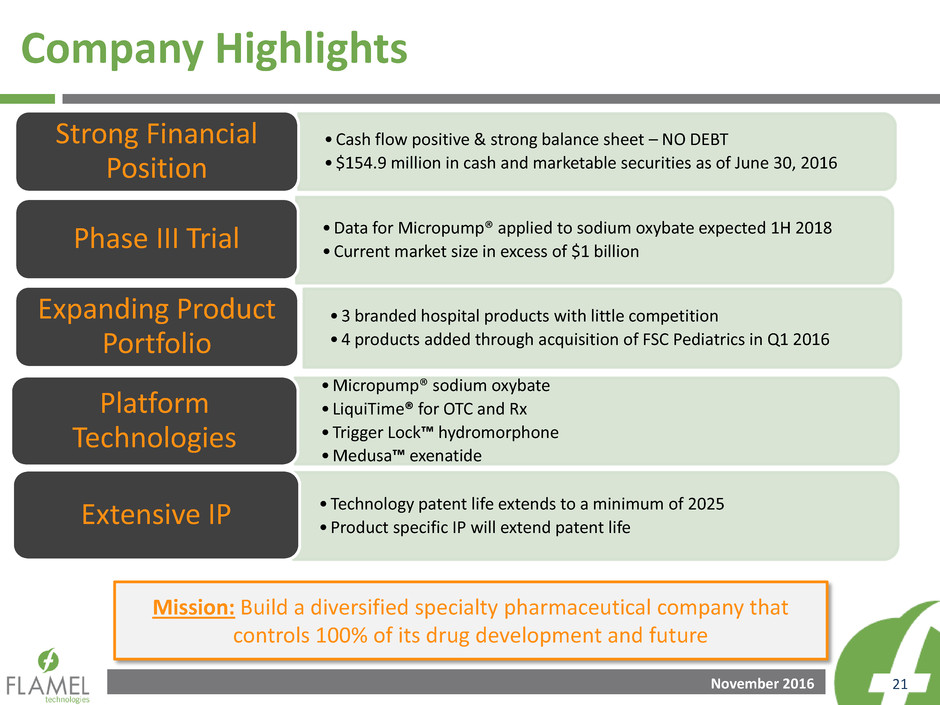

Company Highlights

Mission: Build a diversified specialty pharmaceutical company that

controls 100% of its drug development and future

•Cash flow positive & strong balance sheet – NO DEBT

•$154.9 million in cash and marketable securities as of June 30, 2016

Strong Financial

Position

•Data for Micropump® applied to sodium oxybate expected 1H 2018

•Current market size in excess of $1 billion Phase III Trial

•3 branded hospital products with little competition

•4 products added through acquisition of FSC Pediatrics in Q1 2016

Expanding Product

Portfolio

•Micropump® sodium oxybate

• LiquiTime® for OTC and Rx

•Trigger Lock™ hydromorphone

•Medusa™ exenatide

Platform

Technologies

•Technology patent life extends to a minimum of 2025

•Product specific IP will extend patent life Extensive IP

November 2016 22

Appendix

November 2016 23

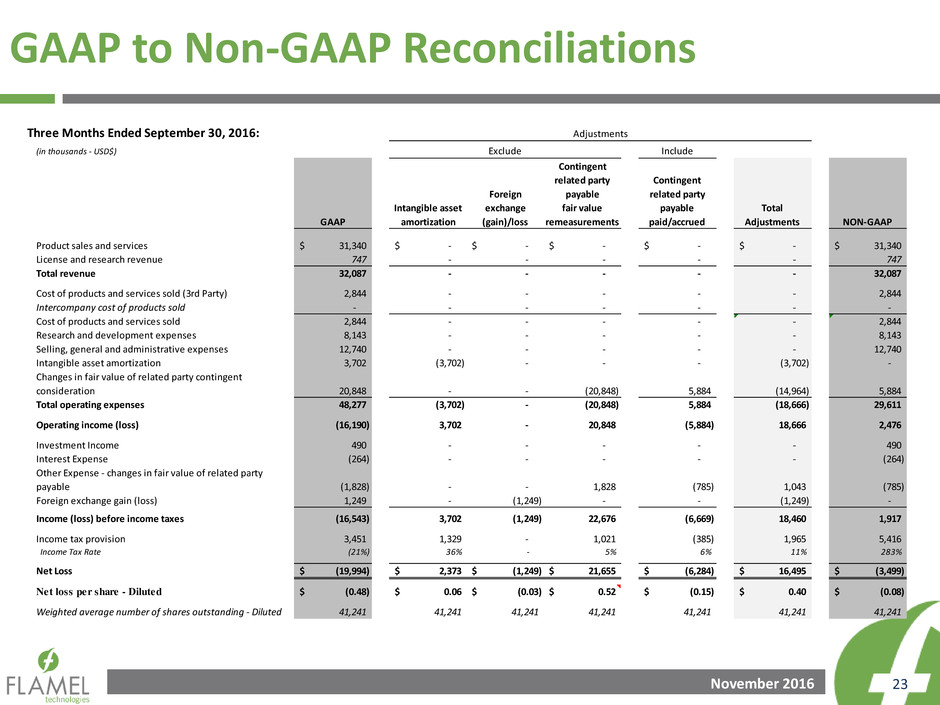

GAAP to Non-GAAP Reconciliations

Three Months Ended September 30, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 31,340$ -$ -$ -$ -$ -$ 31,340$

License and research revenue 747 - - - - - 747

Total revenue 32,087 - - - - - 32,087

Cost of products and services sold (3rd Party) 2,844 - - - - - 2,844

Intercompany cost of products sold - - - - - - -

Cost of products and services sold 2,844 - - - - - 2,844

Research and development expenses 8,143 - - - - - 8,143

Selling, general and administrative expenses 12,740 - - - - - 12,740

Intangible asset amortization 3,702 (3,702) - - - (3,702) -

Changes in fair value of related party contingent

consideration 20,848 - - (20,848) 5,884 (14,964) 5,884

Total operating expenses 48,277 (3,702) - (20,848) 5,884 (18,666) 29,611

Operating income (loss) (16,190) 3,702 - 20,848 (5,884) 18,666 2,476

Investment Income 490 - - - - - 490

Interest Expense (264) - - - - - (264)

Other Expense - changes in fair value of related party

payable (1,828) - - 1,828 (785) 1,043 (785)

Foreign exchange gain (loss) 1,249 - (1,249) - - (1,249) -

Income (loss) before income taxes (16,543) 3,702 (1,249) 22,676 (6,669) 18,460 1,917

I come tax provision 3,451 1,329 - 1,021 (385) 1,965 5,416

Income Tax Rate (21%) 36% - 5% 6% 11% 283%

Net Loss (19,994)$ 2,373$ (1,249)$ 21,655$ (6,284)$ 16,495$ (3,499)$

Net loss per share - Diluted (0.48)$ 0.06$ (0.03)$ 0.52$ (0.15)$ 0.40$ (0.08)$

Weighted average number of shares outstanding - Diluted 41,241 41,241 41,241 41,241 41,241 41,241 41,241

Adjustments

Exclude

November 2016 24

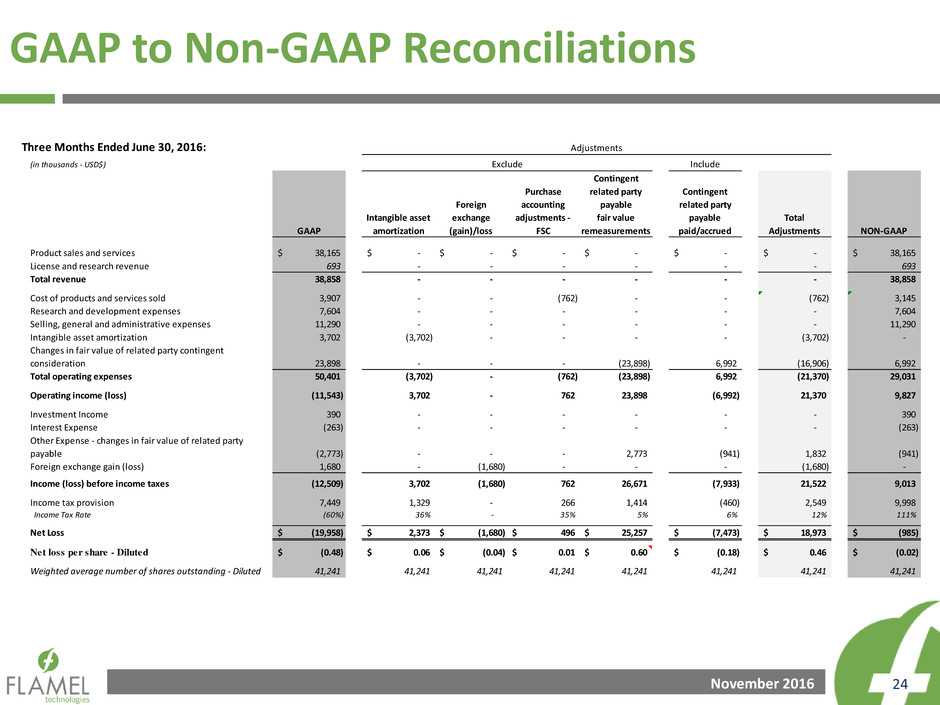

GAAP to Non-GAAP Reconciliations

Three Months Ended June 30, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 38,165$ -$ -$ -$ -$ -$ -$ 38,165$

License and research revenue 693 - - - - - - 693

Total revenue 38,858 - - - - - - 38,858

Cost of products and services sold 3,907 - - (762) - - (762) 3,145

Research and development expenses 7,604 - - - - - - 7,604

Selling, general and administrative expenses 11,290 - - - - - - 11,290

Intangible asset amortization 3,702 (3,702) - - - - (3,702) -

Changes in fair value of related party contingent

consideration 23,898 - - - (23,898) 6,992 (16,906) 6,992

Total operating expenses 50,401 (3,702) - (762) (23,898) 6,992 (21,370) 29,031

Operating income (loss) (11,543) 3,702 - 762 23,898 (6,992) 21,370 9,827

Investment Income 390 - - - - - - 390

Interest Expense (263) - - - - - - (263)

Other Expense - changes in fair value of related party

payable (2,773) - - - 2,773 (941) 1,832 (941)

Foreign exchange gain (loss) 1,680 - (1,680) - - - (1,680) -

Income (loss) before income taxes (12,509) 3,702 (1,680) 762 26,671 (7,933) 21,522 9,013

I come tax provision 7,449 1,329 - 266 1,414 (460) 2,549 9,998

Income Tax Rate (60%) 36% - 35% 5% 6% 12% 111%

Net Loss (19,958)$ 2,373$ (1,680)$ 496$ 25,257$ (7,473)$ 18,973$ (985)$

Net loss per share - Diluted (0.48)$ 0.06$ (0.04)$ 0.01$ 0.60$ (0.18)$ 0.46$ (0.02)$

Weighted average number of shares outstanding - Diluted 41,241 41,241 41,241 41,241 41,241 41,241 41,241 41,241

Adjustments

Exclude

November 2016 25

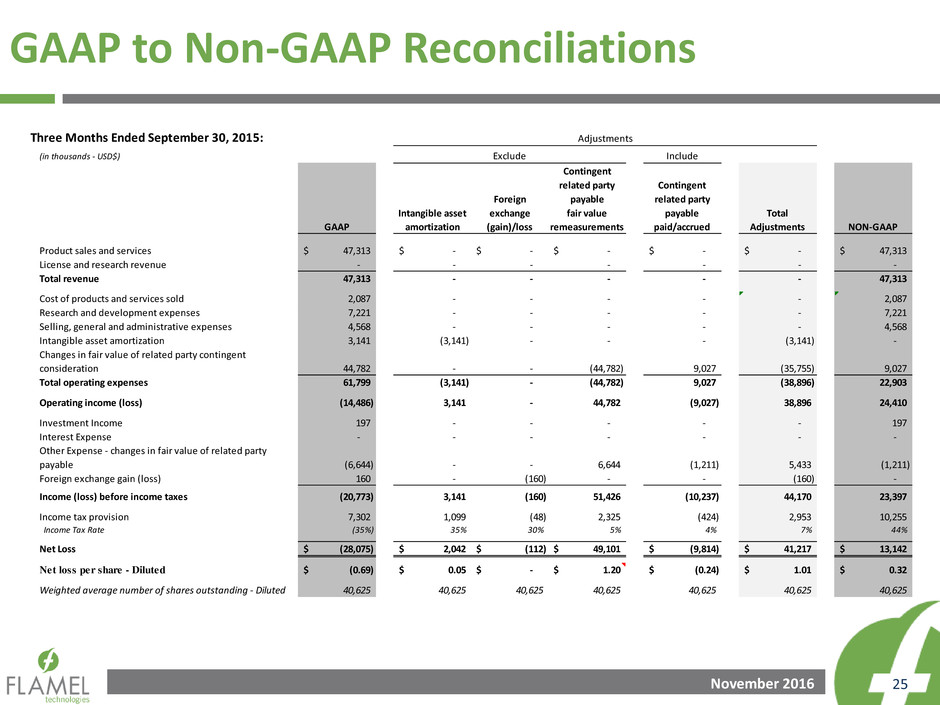

GAAP to Non-GAAP Reconciliations

Three Months Ended September 30, 2015:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 47,313$ -$ -$ -$ -$ -$ 47,313$

License and research revenue - - - - - - -

Total revenue 47,313 - - - - - 47,313

Cost of products and services sold 2,087 - - - - - 2,087

Research and development expenses 7,221 - - - - - 7,221

Selling, general and administrative expenses 4,568 - - - - - 4,568

Intangible asset amortization 3,141 (3,141) - - - (3,141) -

Changes in fair value of related party contingent

consideration 44,782 - - (44,782) 9,027 (35,755) 9,027

Total operating expenses 61,799 (3,141) - (44,782) 9,027 (38,896) 22,903

Operating income (loss) (14,486) 3,141 - 44,782 (9,027) 38,896 24,410

Investment Income 197 - - - - - 197

Interest Expense - - - - - - -

Other Expense - changes in fair value of related party

payable (6,644) - - 6,644 (1,211) 5,433 (1,211)

Foreign exchange gain (loss) 160 - (160) - - (160) -

Income (loss) before income taxes (20,773) 3,141 (160) 51,426 (10,237) 44,170 23,397

I come tax provision 7,302 1,099 (48) 2,325 (424) 2,953 10,255

Income Tax Rate (35%) 35% 30% 5% 4% 7% 44%

Net Loss (28,075)$ 2,042$ (112)$ 49,101$ (9,814)$ 41,217$ 13,142$

Net loss per share - Diluted (0.69)$ 0.05$ -$ 1.20$ (0.24)$ 1.01$ 0.32$

Weighted average number of shares outstanding - Diluted 40,625 40,625 40,625 40,625 40,625 40,625 40,625

Adjustments

Exclude

November 2016 26

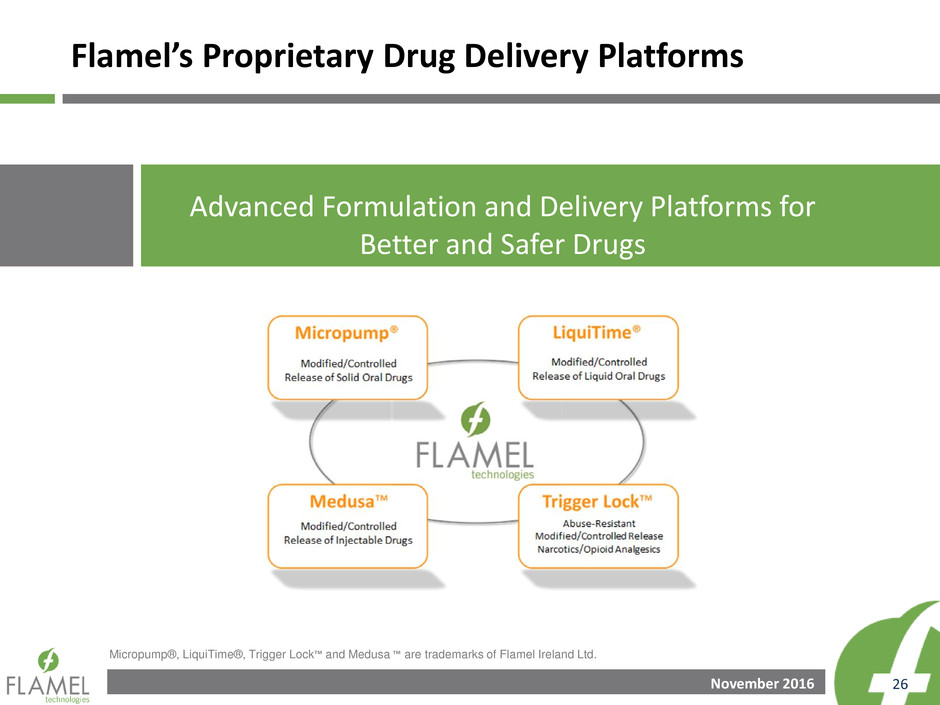

Advanced Formulation and Delivery Platforms for

Better and Safer Drugs

Micropump®, LiquiTime®, Trigger Lock™ and Medusa ™ are trademarks of Flamel Ireland Ltd.

Flamel’s Proprietary Drug Delivery Platforms

November 2016 27

Micropump®

Drug Delivery Platform

Modified/Controlled Release

of Solid Oral Drugs

November 2016 28

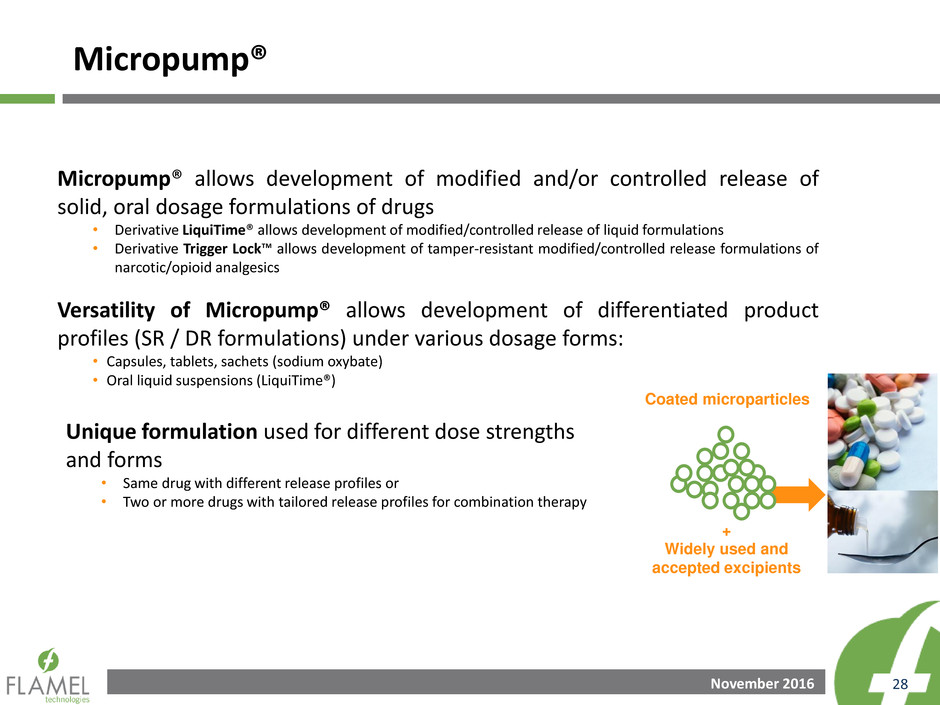

Micropump®

Micropump® allows development of modified and/or controlled release of

solid, oral dosage formulations of drugs

• Derivative LiquiTime® allows development of modified/controlled release of liquid formulations

• Derivative Trigger Lock™ allows development of tamper-resistant modified/controlled release formulations of

narcotic/opioid analgesics

Versatility of Micropump® allows development of differentiated product

profiles (SR / DR formulations) under various dosage forms:

• Capsules, tablets, sachets (sodium oxybate)

• Oral liquid suspensions (LiquiTime®)

+

Widely used and

accepted excipients

Coated microparticles

Unique formulation used for different dose strengths

and forms

• Same drug with different release profiles or

• Two or more drugs with tailored release profiles for combination therapy

November 2016 29

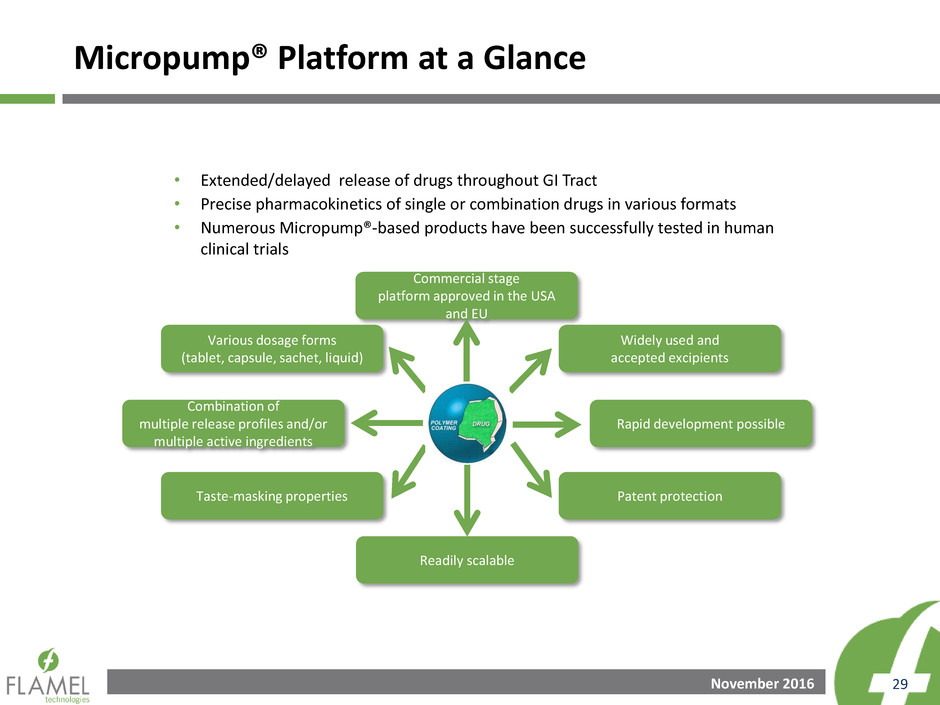

Micropump® Platform at a Glance

• Extended/delayed release of drugs throughout GI Tract

• Precise pharmacokinetics of single or combination drugs in various formats

• Numerous Micropump®-based products have been successfully tested in human

clinical trials

Various dosage forms

(tablet, capsule, sachet, liquid)

Commercial stage

platform approved in the USA

and EU

Widely used and

accepted excipients

Rapid development possible

Combination of

multiple release profiles and/or

multiple active ingredients

Taste-masking properties

Readily scalable

Patent protection

November 2016 30

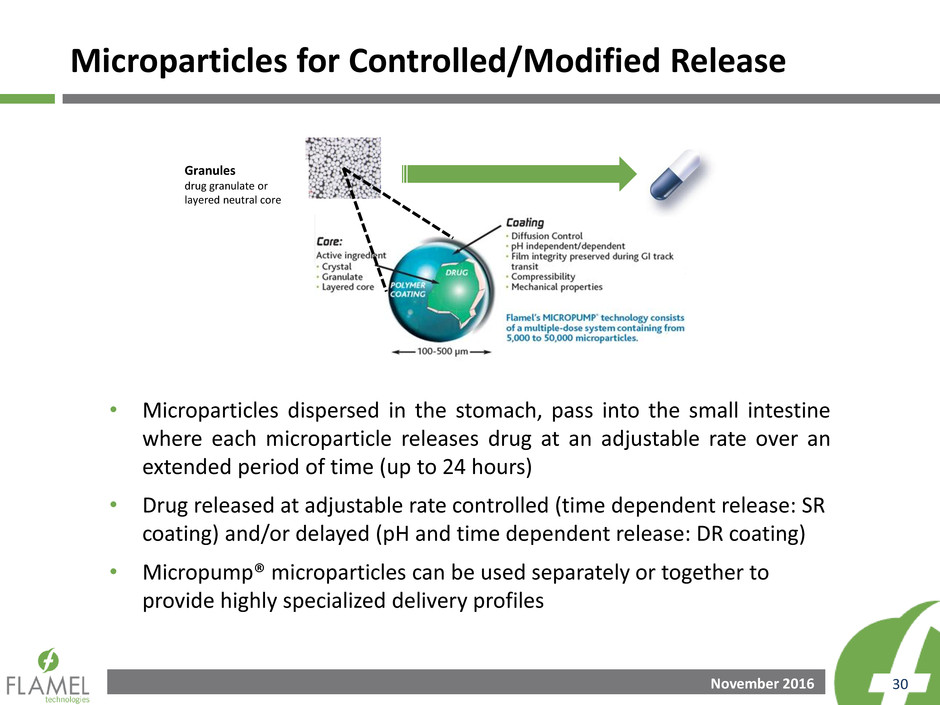

• Microparticles dispersed in the stomach, pass into the small intestine

where each microparticle releases drug at an adjustable rate over an

extended period of time (up to 24 hours)

• Drug released at adjustable rate controlled (time dependent release: SR

coating) and/or delayed (pH and time dependent release: DR coating)

• Micropump® microparticles can be used separately or together to

provide highly specialized delivery profiles

Microparticles for Controlled/Modified Release

Granules

drug granulate or

layered neutral core

November 2016 31

LiquiTime®

Drug Delivery Platform

Modified/Controlled Release

of Liquid Oral Drugs

November 2016 32

LiquiTime®

• Allows development of modified/controlled release liquid formulations for

patients having issues swallowing tablets/capsules

• Not limited to working solely with ionic drugs as with resin-complex based

technologies

• Readily scalable to commercial quantities

• Easy to swallow, good mouth feel, taste masked - dose flexibility while

maintaining accuracy and safety

Pediatric1

• US population younger than 18 years old =

76 million in 2019

• 75% of households with children under 12

purchased an OTC pain reliever over the past 12

months

• Sales of OTC pediatric product in the US

= $1.6 B in 2013 ($1.9 B estimated in 2018)

Geriatric

• 810 million people > 60 years in 2012

2 billion expected in 20502

• In 2010 approximately 45-50% of the

prescriptions were written for people aged 60

and above and one in three patients took at least

5 drugs or more on a daily basis in the United

States3

Applicable to:

1 “OTC Pediatrics – US” (March 2014, Mintel) 2 World

Health Organization

3 “Geriatric Medicine Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013 – 2019”

(Transparency Market Research)

November 2016 33

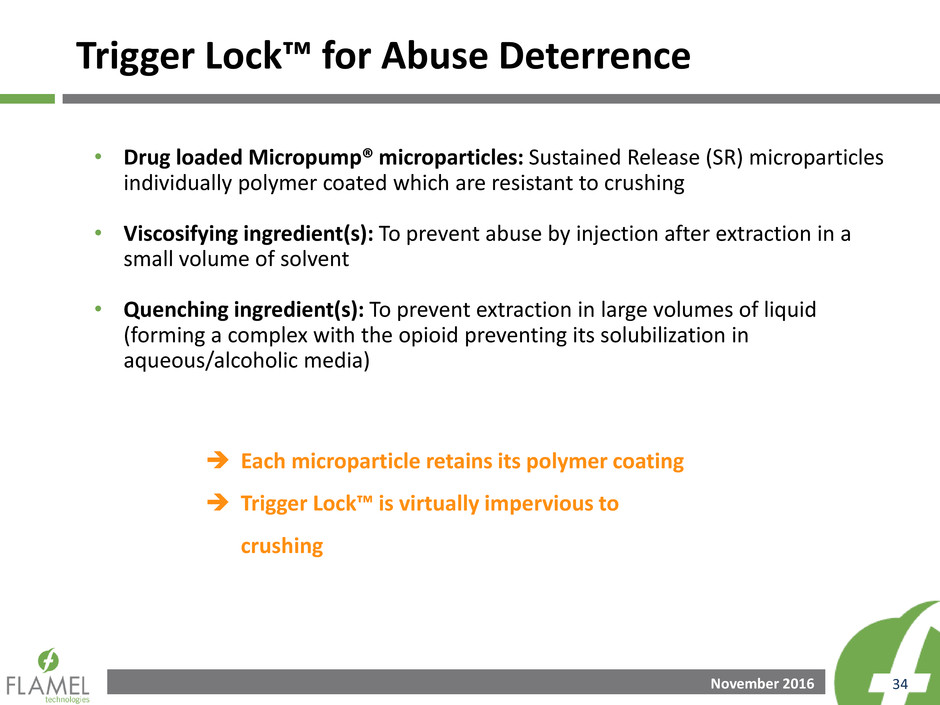

Trigger Lock™

Platform

Abuse Deterrent Extended Release

of Opioids

November 2016 34

• Drug loaded Micropump® microparticles: Sustained Release (SR) microparticles

individually polymer coated which are resistant to crushing

• Viscosifying ingredient(s): To prevent abuse by injection after extraction in a

small volume of solvent

• Quenching ingredient(s): To prevent extraction in large volumes of liquid

(forming a complex with the opioid preventing its solubilization in

aqueous/alcoholic media)

Trigger Lock™ for Abuse Deterrence

Each microparticle retains its polymer coating

Trigger Lock™ is virtually impervious to

crushing

November 2016 35

Medusa™

Drug Delivery Platform

Modified/Controlled Release

of Injectable Drugs

November 2016 36

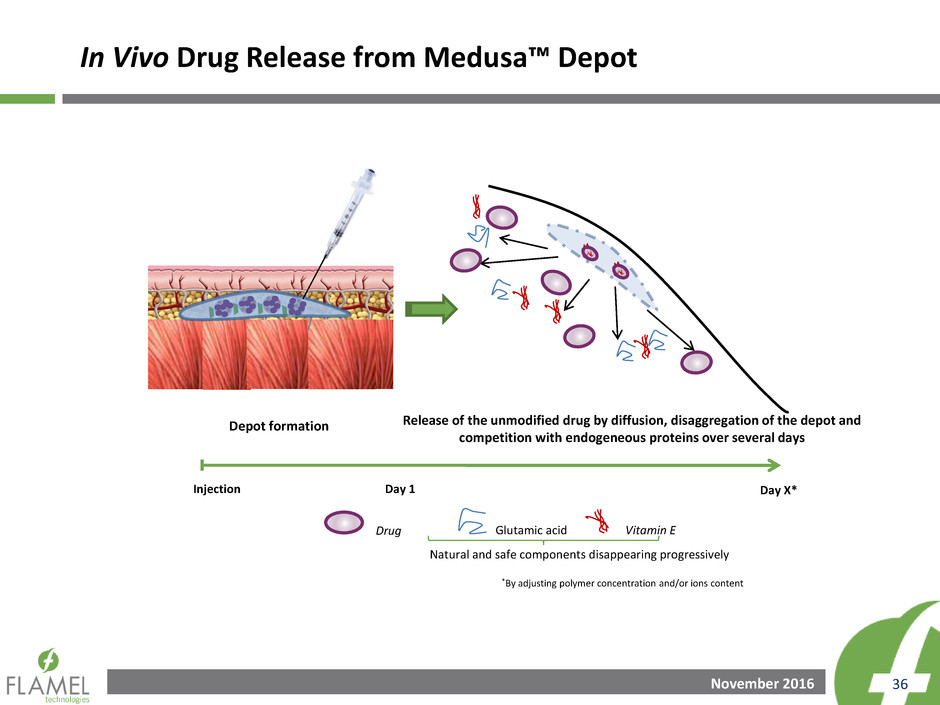

In Vivo Drug Release from Medusa™ Depot

Release of the unmodified drug by diffusion, disaggregation of the depot and

competition with endogeneous proteins over several days

Depot formation

Drug Vitamin E Glutamic acid

Day 1 Injection Day X*

Natural and safe components disappearing progressively

*By adjusting polymer concentration and/or ions content