Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number 333-175483

China Xuefeng Environmental Engineering Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

99-0364975

|

|

State or other jurisdiction of incorporation or organization

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

229 Tongda Avenue

Economic and Technological Development Zone

Suqian, Jiangsu Province

People's Republic of China

|

223800

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: +86-527-84370508

Securities registered pursuant to Section 12(b) of the Exchange Act: None.

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☑

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

☐

|

Smaller reporting company

|

☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $216,164,672.

As of August 30, 2016, the registrant had 55,200,000 shares of common stock, par value $0.001 per share, issued and outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

|

|

|

Page

|

|

|

PART I

|

|

|

|

|

|

|

Item 1.

|

Business

|

3 |

|

Part II

|

||

|

Item 9A.

|

Controls and Procedures

|

14 |

|

|

|

|

|

|

PART IV

|

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

15 |

|

Signatures

|

16 | |

1

EXPLANATORY NOTE

China Xuefeng Environmental Engineering Inc. (the "Company") is filing this Amendment No. 1 (the "Amendment No. 1") to its Annual Report on Form 10-K for the fiscal year ended May 31, 2016, filed on August 30, 2016 (the "Original 10-K"). Company is filing this Amendment No. 1 to provide i) information regarding Company's customers that account for 10% or more of total revenue in the "Business" section and ii) additional information regarding management's control and procedures over financial.

In accordance with applicable SEC rules and as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, this amendment includes new certifications from our Principal Executive Officer and Principal Financial Officer dated as of the date of filing of this amendment.

No changes have been made to the Original 10-K other than to Item 1 and 9A and to the four certification exhibits. This amendment speaks as of the date of the Original 10-K, does not reflect events that may have occurred after the date of the Original 10-K and does not modify or update in any way the disclosures made in the Original 10-K, except as required to reflect the revisions discussed above. This amendment should be read in conjunction with the Original 10-K and with our filings with the SEC filed subsequent to the filing of the Original 10-K.

2

PART I

Except as otherwise indicated by the context, references in this report to "we," "us," "our," "our Company," or "the Company" are to the combined business of China Xuefeng Environmental Engineering Inc.

Overview

We are in the business of providing services to optimize garbage-recycling processes. We utilize our patented technology of "comprehensive and harmless garbage-processing equipment," to upgrade software systems and reconstruct hardware for our clients, and therefore expand the sorting scope and capacity of our clients' garbage recycling equipment. We conduct our operations through our controlled consolidated affiliate Jiangsu Xuefeng Environmental Protection Science and Technology Co., Ltd. ("Jiangsu Xuefeng"). Jiangsu Xuefeng was incorporated under the laws of the People's Republic of China ("PRC") on December 14, 2007.

Our Corporate History and Background

We were incorporated in the state of Nevada on March 30, 2011. We were initially formed to engage in the business of clothing distribution. Since our inception and until the acquisition of Inclusion Business Limited (BVI), we were a development stage company without significant assets or any revenue.

Acquisition of Inclusion

On November 27, 2012, we completed a reverse acquisition transaction through a share exchange with Inclusion Business Limited (BVI) ("Inclusion") and its stockholders (the "Inclusion Stockholders"), whereby we acquired 100% of the issued and outstanding capital stock of Inclusion and in exchange we issued 7,895,000 shares of our common stock (pre-Forward Split), or 76.65% of our issued and outstanding capital stock as of and immediately after the consummation of the reverse acquisition, to the Inclusion Stockholders. As a result of the reverse acquisition, Inclusion became our wholly-owned subsidiary and the former Inclusion Stockholders became our controlling stockholders. The share exchange transaction has been treated as a reverse acquisition, with Inclusion as the acquirer and the Company as the acquired party for accounting purposes.

Prior to the closing of the reverse acquisition, the Company's prior shareholder, Mr. Zhenxing Liu, surrendered 7,895,000 shares of the common stock of the Company. Mr. Zhenxing Liu did not receive any consideration from the Company for accounting purposes. However, Mr. Zhenxing Liu may be deemed to have received consideration from the increase in the value of 250,000 shares held by Mr. Zhenxing Liu as a result of the reverse acquisition. Mr. Zhenxing Liu purchased 8,145,000 shares at approximately $0.007 per share at the time when the Company was considered a shell and kept 250,000 shares after the surrender. On November 30, 2012, at the closing of the reverse acquisition, the stockholder's equity increased to $5,194,728. Accordingly, the value of the 250,000 shares held by Mr. Zhenxing Liu appreciated to approximately $124,673. Other than such appreciation in the value of his shares, Mr. Zhenxing Liu did not receive any other consideration in connection with the reverse acquisition.

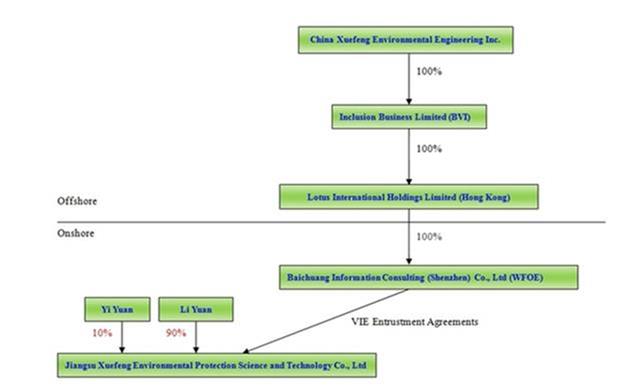

As a result of our acquisition of Inclusion, we now own all of the issued and outstanding capital stock of Lotus International Holdings Limited ("Lotus"), which in turn owns all of the issued and outstanding capital stock of Baichuang Information Consulting (Shenzhen) Co. Ltd ("Baichuang Consulting"). In addition, we effectively and substantially control Jiangsu Xuefeng through a series of captive agreements with Baichuang Consulting.

Subsequent to the closing of the Exchange Agreement, we conduct our operations through our controlled consolidated affiliate Jiangsu Xuefeng. Jiangsu Xuefeng is primarily engaged in providing improvement and upgrading services of garbage recycling processing technology and equipment.

Name Change and Forward Split

On November 27, 2012, the Company filed a certificate of amendment to its articles of incorporation to change its name from "NYC Moda Inc" to "China Xuefeng Environmental Engineering Inc" and to effect a 4-for-1 forward stock split of its outstanding shares of common stock. The name change went effective on December 14, 2012 and the forward split went effective on December 17, 2012, upon the approval of Financial Industry Regulatory Authority, Inc. (FINRA). Upon the effectiveness of the forward split, the number of outstanding shares of the Company's common stock increased from 10,300,000 to 41,200,000 shares, and the number of authorized shares of common stock remained 75,000,000 shares. The effect of the forward split was applied retroactively to the Company's consolidated financial statements for the periods presented.

3

Contractual Arrangements with our Controlled Consolidated Affiliate and its Shareholders

On October 17, 2012, prior to the reverse acquisition transaction, Baichuang Consulting and Jiangsu Xuefeng and its shareholders Li Yuan and Yi Yuan entered into a series of agreements known as variable interest agreements (the "VIE Agreements") pursuant to which Jiangsu Xuefeng became Baichuang Consulting's contractually controlled affiliate. The VIE Agreements included:

|

(1)

|

an Exclusive Technical Service and Business Consulting Agreement between Baichuang Consulting and Jiangsu Xuefeng pursuant to which Baichuang Consulting is to provide technical support and consulting services to Jiangsu Xuefeng in exchange for (i) 95% of the total annual net profit of Jiangsu Xuefeng plus (ii) RMB100,000 per month (approximately U.S.$16,000).

|

|

|

|

|

(2)

|

a Call Option Agreement among Li Yuan and Yi Yuan (together referred to as "Jiangsu Xuefeng Shareholders"), and Baichuang Consulting under which the Jiangsu Xuefeng Shareholders have granted to Baichuang Consulting the irrevocable right and option to acquire all of the equity interests in Jiangsu Xuefeng to the extent permitted by PRC law. If PRC law limits the percentage of Jiangsu Xuefeng that Baichuang Consulting may purchase at any time, then Baichuang Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00 ($0.16) or any lower price permitted by PRC law. The Jiangsu Xuefeng Shareholders agreed to refrain from taking certain actions which might harm the value of Jiangsu Xuefeng or Baichuang Consulting's option;

|

|

|

|

|

(3)

|

a Proxy Agreement by Li Yuan and Yi Yuan pursuant to which they each authorize Baichuang Consulting to designate someone to exercise all of their shareholder decision rights with respect to Jiangsu Xuefeng; and

|

|

|

|

|

(4)

|

a Share Pledge Agreement among Li Yuan and Yi Yuan, Jiangsu Xuefeng, and Baichuang Consulting under which the Jiangsu Xuefeng Shareholders agree to pledge all of their equity in Jiangsu Xuefeng to Baichuang Consulting to guarantee Jiangsu Xuefeng's and its shareholders' performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement.

|

The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See "Risk Factors - Risks Relating to the VIE Agreements."

The foregoing description of the terms of the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement, the Proxy Agreement and the Share Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 10.1, 10.2, 10.3 and 10.4 to this report, respectively, which are incorporated by reference herein.

See "Related Party Transactions" for further information on our contractual arrangements with these parties.

4

After the exchange, our current organizational structure after giving effect to the name change is as follows:

Inclusion was established in the British Virgin Islands on August 9, 2012. Lotus was established in Hong Kong on May 2, 2012 to serve as an intermediate holding company with authorized shares of 10,000 at HK$1.00 per share. Baichuang Consulting was established by Lotus as a wholly foreign owned enterprise (the "WFOE") in the PRC on September 5, 2012. Jiangsu Xuefeng, our operating consolidated affiliate, was established in the PRC on December 14, 2007. The local government of the PRC issued a certificate of approval of the foreign ownership of Baichuang Consulting by Lotus, a Hong Kong entity on September 5, 2012.

Recent Acquisition of Linyi Xuefeng

On August 2016, the Company entered into an agreement to acquire 100% interest of Linyi County Xuefeng Renewable Resources Utilization Technology Co., Ltd ("Linyi Xuefeng"), a privately-held company owned by our CEO and Chairman of the Board, Yuan Li. Pursuant to the transfer agreement, the specific transfer price is based upon the net asset amount in Linyi Xuefeng's audit report as of May 31, 2016. The Company will pay thirty percent of the transfer price with cash and seventy percent of the transfer price by issuing additional shares for the acquisition. From the date of the execution of the agreement through the period when Mr. Li Yuan and the Company complete all obligations of performing the agreement, Mr. Li Yuan shall not transfer any assets of Linyi Xuefeng under any circumstances.

Our Services

As the urbanization in China progresses, the amount of household garbage increases. The processing capability of current garbage processing equipment in China cannot typically satisfy the increasing demands. We expand the garbage sorting scope and capacity of our clients' garbage processing equipment, by installing the various systems that embody the patented technology of "comprehensive and harmless garbage-processing equipment" into the client's garbage processing equipment and reconstructing their hardware, to provide upgrades and improvement to their equipment.

5

The patented technology of "harmless and comprehensive garbage processing equipment" helps to achieve high and stable garbage processing capacity, which uses a Distribution Control System (DCS) to realize mechanical automation for the comprehensive garbage treatment. The core technology is to organically integrate the anaerobic digestion and aerobic fermentation garbage process, degrade and transform the organic matter of domestic waste, effectively sort out the garbage and recycle all kinds of materials, to eventually realize the true waste resource utilization and harmless utilization, with its resource utilization and harmless utilization rate approaching 100%. The resource recovery products, biogas, can not only be used for meeting the needs of the plant itself, but also for outer supply, which greatly improves the efficiency of garbage processing of customer's equipment, decreases production cost, and increases the recovery return of garbage processing.

The comprehensive and harmless garbage processing equipment is comprised of a waste digestion pretreatment system, methane gas power generation system, sorting processing system, bricklaying building system, leachate treatment system, DCS (distribution control system), XFET-5 ecological and water-saving toilets and excrement comprehensive processing system and various material collection systems. The equipment technology is designed and manufactured based on the complicated situation of the household garbage in China. According to the features of various garbage, the equipment utilizes the wind-force, gravity, magnetic, shape, etc. to process the garbage by the combined way of machine selecting, winnowing, magnetic separation, automatic cutting, smashing and other technological processes. The equipment has large processing capacity and can run all day. The stand-alone equipment can process 500 tons to 1000 tons of garbage per day. It can sort and process complicated municipal solid waste, leaving no pollution and no residue, reaching the"3 without" standard of no waste gas, no waste water and no waste residue.

After we complete the internal system upgrade and hardware equipment improvement of the garbage equipment, we deliver the upgraded equipment to the customers. The customers will conduct inspection and performance testing to the upgraded equipment no more than one month pursuant to the contract to inspect whether the internal control system and the hardware structure can operate steadily and achieve the garbage process features. The inspection includes the following: whether the quality of the equipment and accessories after improvement can match the patented technology and process various kinds of garbage, whether the various garbage systems can process automatically, and whether the daily garbage processing capacity reaches the standard of the contract. If during the performance testing period, all the performance index can fulfill the requirements of the contract are achieved, it would be deemed that we have fully executed the agreement.

Prior to the first service agreement in April 2012, we did not conduct any business activities except for the preparation of the business and the development of the clients, etc. When we complete the upgrading service for the client, we go through the acceptance check and commissioning of the company in accordance with the contract, to make sure that the service provided met the requirements of the clients. After that, we are not subject to any additional service. The revenue we generated belongs to the service class income, with the main cost being the salaries of the staff and the leasing fees for the patent, whereas the hardware and software equipment, as well as the material used in the upgrading are the responsibility of the clients.

Until August 31, 2012, the main revenue of Jiangsu Xuefeng was generated from providing improvement and upgrading services to garbage recycling processing plants. On August 5, 2012, Jiangsu Xuefeng entered into a license agreement with Li Yuan, one of its stockholders for the use of a patent on garbage recycling processing technology, a Utility Model Patent of Comprehensive and Harmless Garbage Processing Equipment, issued by the State Intellectual Property Office (SIPO) on July 7, 2010 and valid for ten years (Patent Number: ZL 2009 2 0232893.7). The patent is owned by our Chief Executive Officer, Mr. Li Yuan. Although the license commenced on September 1, 2012 and expired in August 2017, Mr. Li Yuan has agreed to allow the company continue to use the patent under the same terms and conditions. Jiangsu Xuefeng expanded its business model from the sole service of providing upgrading to waste processing plants to also providing patent licensing based on its newly acquired use right of the patent technology. We use the patent technology to help the clients to upgrade their internal system or reconstruct the hardware equipment we have, the Company has of the garbage processing equipment so that the equipment performance could reach the standard of our patent technology. After the upgrade and reconstruction, the patent technology will continue to be used in their equipment and we allow the clients to continue using the patent technology in their equipment for patent licensing revenue. License agreements will be offered to clients for a limited period of three to five years, within which period, the client shall pay patent royalties yearly to Jiangsu Xuefeng for their use of the equipment containing the patent technology.

6

Therefore, under the new business model, Jiangsu Xuefeng generates its revenues from two sources: improvement and upgrading services of garbage processing equipment and patent licensing for the use of the upgraded technology.

For the year ended May 31, 2016, sales from improvement and upgrading services and patent licensing were $2,907,422 and $4,079,769, respectively. For the year ended May 31, 2015, sales from improvement and upgrading services and patent licensing were $3,481,780 and $3,514,320, respectively. For the year ended May 31, 2014, sales from improvement and upgrading services and patent licensing were $1,464,300 and $3,245,865, respectively.

Products and Facilities

We provide equipment improvement and upgrading service and license the patented technology to our customers. We also sell or lease garbage-processing units equipped with our patented technology.

We mainly incorporate and install the patented technology into garbage processing equipment's internal control and operation systems to achieve the requested processing capacity. During the internal system upgrading process, if any hardware equipment, such as the machine parts, is required to be reconstructed, the customers are responsible for the hardware purchase while we provide guided and assisted installation.

In addition, as our customers continue to use the equipment embodying the patented technology, they pay us a fee for the use of the patented technology.

We hope to construct our own garbage processing plant to process various environmental wastes.

Customers

7

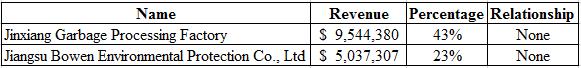

The following table sets forth customers individually accounted for more than 10% of our company's revenue for the year ended May 31, 2014:

|

Name

|

Revenue

|

Percentage

|

Relationship | |||||

|

|

||||||||

|

Gaoyou Zhujia Household Garbage Process Co., Ltd

|

$

|

732,150

|

16

|

%

|

None | |||

|

Tianjin Yongtai Household Garbage Process Co., Ltd

|

$

|

707,745

|

15

|

%

|

None | |||

|

Linxiang Municipal Garbage Process Co., Ltd

|

$

|

634,530

|

13

|

%

|

None | |||

Our Industry

In the description below we rely on certain information and statistics regarding our industry and the economy in China from the reports published by National Bureau of Statistics of China and the PRC Ministry of Environmental Protection. We have no reason to believe that the information and statistics we cite are not accurate.

The Chinese industry of garbage processing is highly fragmented and in a very early-stage of development. Benefiting from a series of encouraging and supportive policies on garbage processing formulated by the Chinese government, the urban garbage processing industry has been in rapid development. The current market is primarily dominated by small regional companies, like Jiangsu Xuefeng, which account for approximately 90% of all environmental protection enterprises in China.

The volume of solid waste generated by industrial companies directly correlates to the industrial rate of utilization of natural resources and is expected to grow by over 10% per year according to the National Bureau of Statistics of China. In addition, according to estimates from the PRC Ministry of Environmental Protection, the production of industrial waste was approximately 3.25 billion tons in 2013, excluding approximately 31.57 million tons of hazardous industrial waste.

8

According to the Opinions on Further the Municipal Solid Waste Processing Service issued by the Chinese government, the harmless garbage processing rate will reach over 80% by 2015. This anticipated increase creates a strong incentive for companies to improve their garbage processing capability. Thus, the Chinese garbage processing industry has significant potential for growth both in areas of equipment marketing and equipment upgrading and improvement.

Nationwide Innocuous Disposal Facilities MSW Facilities Construction Planning (2011-2015) ("Planning"), recently passed by the Chinese government, has gone into the implementation phase. In accordance with the Planning, the aggregate investment in the items of the Planning will reach RMB 260Billion Yuan (approximately US $41 billion).

According to the Environmental Protection Equipment "Twelfth Five-Year" Development Planning, the yearly growth rate of the environmental protection industry gross output during the Twelfth Five-Year period is 20% and will reach 500 billion yuan (approximately US $79 billion) by 2015.

Thus, recently issued policies reducing the cost of Jiangsu Xuefeng operations, and anticipated future industrial policies of the Chinese government show the Chinese government's encouragement and support for the long term development of the environmental waste processing industry, setting the stage for a larger market place for the environmental protection equipment upgrading and improvement business.

9

Competition

Competitive Advantages

The industry for environmental protection equipment upgrading and improvement in China, being in its early stage, creates a great amount of business opportunities. We believe that, with our services and products that are supported by the patented technology and gradually gaining its market acceptance, we are well positioned to take advantage of the opportunities presented in this industry.

Competitive Disadvantages

While we saw gross profit margins of 43%, 95% and 92% for the years of 2016, 2015 and 2014, respectively, we are uncertain that our high gross profit margins are sustainable if we have to commit to substantive research and development activities when the Chinese government adopts higher standards for environmental protection technologies and when the cost of our services become substantially higher.

Our Growth Strategy

As industrial development continues its rapid increase in growth, the demand for the Company service should also increase rapidly. The Company hopes to seize the opportunity to use industrial growth of both large and medium-size enterprises, establishing cooperative relationships with high-quality customers by fully using its advantages in waste processing technology providing customers with improved environmental solutions and larger scale processing capability.

The Company will further develop the equipment upgrading business. Jiangsu Xuefeng will make the best use of its patented technology of comprehensive and harmless garbage processing equipment to carry on the improvement and upgrading service for Chinese clients. In addition, patent license agreements will be offered to clients for a limited period of three to five years, within which period, the client shall pay patent royalties yearly to Jiangsu Xuefeng for their use of the equipment containing the patent technology thus providing the Company with an additional source of revenue.

The Company hopes to establish an equipment manufacturing and sales center. While continuing to provide equipment upgrading services, Jiangsu Xuefeng intends to establish a garbage processing equipment manufacturing and sales center to meet the anticipated market needs for Chinese garbage processing equipment, gradually branching further into the Chinese garbage processing equipment market and improving the Company's revenue.

The Company plans to also undertake technical cooperation with key domestic and foreign R&D institutions and industry partners. Keeping abreast of domestic and foreign technical developments, the Company plans to make use of international and domestic newly advanced technology in comprehensive garbage processing with high daily processing capacity. The Company plans to constantly expand marketing channels and increase its market shares.

10

Markets, Sales and Distribution

Currently, our marketing and sales efforts largely rely on word of mouth among our existing clients.

Intellectual Property

The Company acquired the license of the patent technology of comprehensive and harmless garbage processing equipment" that passed the ISO9001:2008 International Quality Management System Certification through the Patent Licensing Service Agreement signed with our Chairman, Chief Executive Officer and a shareholder, Li Yuan. The Licensing Agreement commenced on September 1, 2012 with a monthly payment to Li Yuan of approximately $12,600 (RMB 80,000). Although the Licensing Agreement expired in July 2017. Mr. Li Yuan has agreed to continue licensing our company the use of the patent under the same terms and conditions. Provision 42 of the Patent Law of the People's Republic Of China (as amended in 2008) provides that "the time limit of patent for invention is twenty years, the time limit of patent of utility models and design patent is ten years, both of which are calculated from the date of application". Company has received Utility Model Patent Certificate and Certificate of Patent for Invention, from the State Intellectual Property Office of the People's Republic of China. Patent right of comprehensive disposal equipment for waste processing was terminated on July, 2009 due to the expiration of the protection period. We no longer enjoy the exclusive patent right to that technology. However, because patent for our waste sorting treatment technology was granted in July 2009 and its time limit is 20 years, we could license the use of the patent to other company until July 2029.

Comprehensive and Harmless Garbage Processing Equipment is a Utility Model Patent issued by the State Intellectual Property Office (SIPO) on July 7, 2010 and valid for ten years (Patent Number: ZL 2009 2 0232893.7). It is owned by with our Chairman. This patented technology is for the treatment of complex municipal solid waste including sorting and classification, leaving almost no pollution and no residue.

Regulation

Because our operating affiliate Jiangsu Xuefeng is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

Environmental Law

Jiangsu Xuefeng is subject to China's national Environmental Protection Law, which was enacted on December 26, 1989, as well as a number of other national and local laws and regulations governing landfills, air, water, and noise pollution and establishing pollutant discharge standards for wastewater.

On July 1, 2004, the PRC central government adopted the Measures for the Administration of Permit for Operation of Dangerous Wastes (the "Measures"). The Measures are intended to strengthen supervision and administration of activities relating to the collection, storage and disposal of dangerous wastes, and preventing dangerous wastes from polluting the environment.

Both the PRC Ministry of Environment Protection and local bureaus of environmental protection, license and regulate companies engaged in waste disposal and treatment in China. The requirements for licensing have become more stringent, with applicants having to demonstrate a sufficient operating history and a number of professional technicians, as well as comply with national and local environmental standards. The licensing process is also very time consuming and requires lengthy lead times.

11

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for our operations in the PRC.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People's Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On March 16, 2007, the National People's Congress of China passed the Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. The EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

Under the EIT Law, companies designated as High- and New-Technology Enterprises may enjoy a reduced national EIT rate of 15%. The Administrative Measures for Assessment of High-New Tech Enterprises and Catalogue of High/New Tech Domains Strongly Supported by the State (2008), jointly issued by the Ministry of Science and Technology and the Ministry of Finance and State Administration of Taxation set forth general guidelines regarding criteria as well as application procedures for qualification as a High- and New-Tech Enterprise under the EIT Law.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with "de facto management bodies" within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term "de facto management bodies" as "an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise." If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization's global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see "Risk Factors – Risks Related to Our Business – Under the EIT Law, we may be classified as a 'resident enterprise' of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders."

Our future effective income tax rate depends on various factors, such as tax legislation, the geographic composition of our pre-tax income and non-tax deductible expenses incurred. Our management carefully monitors these legal developments and will timely adjust our effective income tax rate when necessary.

12

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to a general reserve until the cumulative amount of such reserve reaches 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

The EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises' shareholder has a tax treaty with China that provides for a different withholding arrangement. Baichuang Consulting is considered a FIE and is directly held by our subsidiary in Hong Kong, Lotus. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Lotus by Baichuang Consulting, but this treatment will depend on our status as a non-resident enterprise.

PRC M&A Rule, Circular 75 and Circular 638

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, referred to as the "New M&A Rules", which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore "special purpose vehicles," that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges. Based on our understanding of current Chinese Laws and pursuant to a legal opinion issued by Jilin Changchun Law Firm dated October 17, 2012, (i) Baichuang Consulting was incorporated by a foreign investor and therefore has no Chinese shareholders; (ii) the share exchange between Inclusion and the Company, is between two offshore companies and is not deemed as a transaction to acquire equity or assets of a "Chinese domestic company" as defined under the New M&A Rules and (ii) no provision in the New M&A Rules clearly classifies the contractual arrangements between Baichuang Consulting and Jiangsu Xuefeng as a type of transaction falling within the New M&A Rules.

The SAFE issued a public notice in October 2005, or the Circular 75, requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equity of Chinese companies, referred to in the Circular 75 as special purpose vehicles, or SPVs. Chinese residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

Pursuant to the Circular 698, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly via disposing of the equity interests of an overseas holding company, which we refer to as an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an abusive arrangement in order to avoid Chinese tax, they will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

13

Insurance

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face losses from the interruption of our business as summarized under "Risk Factors – Risks Related to Our Business – We do not carry business interruption insurance so we could incur unrecoverable losses if our business is interrupted."

Our Employees

As of August 30, 2016, we had a total of 32 employees. The Company employs a highly qualified team of technically trained personnel. Among the Company's employees, 11 employees have environmental assessment engineering degrees and 10 employees have ecological and environmental protection planning qualifications. This team provides support for clients.

Item 9A. Control and Procedures.

(a) Evaluation of Disclosure Controls and Procedures

Pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 ("Exchange Act"), the Company carried out an evaluation, with the participation of the Company's management, including the Company's Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO"), of the effectiveness of the Company's disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, the Company's CEO and CFO concluded that the Company's disclosure controls and procedures were not effective to ensure that information required to be disclosed by the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to the Company's management, including the Company's CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

(b) Management's Annual Report on Internal Control over Financial Reporting

Management, including our CEO and CFO, is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a – 15(f). Management conducted an assessment as of May 31, 2016 of the effectiveness of our internal control over financial reporting based on the framework in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO"). Based on that evaluation, the CEO and CFO concluded that, as of May 31, 2016, the Company had a material weakness with respect to its internal controls over financial reporting because it did not have a sufficient number of personnel to provide for adequate segregation of duties and independent review and approval of specific transactions. In addition, the Company lacked a sufficient number of personnel with an appropriate level of knowledge and experience of generally accepted accounting principles in the United States of America (U.S. GAAP).

14

Our management has identified the following steps to address the above material weakness:

(1) We have been working with a financial accountant to assist us in preparing our financial statements in accordance with US GAAP standards and SEC rules and regulations.

(2) We intend to hire, as needed, key accounting personnel with technical accounting expertise and reorganize the finance department to ensure that accounting personnel with adequate experience, skills and knowledge relating to complex, non-routine transactions are directly involved in the review and accounting evaluation of our complex, non-routine transactions.

Neither this Amendment No. 1 nor the Original 10-K includes an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management's report in this Amendment No. 1 or the Original 10-K.

(c) Changes in Internal Controls

There have been no changes in the Company's internal control over financial reporting during the latest fiscal quarter or year that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.

PART IV

(a) Exhibits

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

31.1*

|

|

Certifications of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

31.2*

|

|

Certifications of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

32.1+

|

|

Certification Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

32.2+

|

|

Certification Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

*

|

Filed herewith

|

|

+

|

In accordance with the SEC Release 33-8238, deemed being furnished and not filed.

|

15

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC.

|

|

|

|

|

|

|

Dated: November 14, 2016

|

By:

|

/s/ Li Yuan

|

|

|

|

Li Yuan

|

|

|

|

Chief Executive Officer

(Principal Executive Officer) |

|

|

|

|

|

Dated: November 14, 2016

|

By:

|

/s/ Kuanfu Fan

|

|

|

|

Kuanfu Fan

|

|

|

|

Chief Financial Officer

(Principal Accounting Officer) |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Name

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Li Yuan

|

|

Chief Executive Officer and

|

|

November 14, 2016

|

|

Li Yuan

|

|

Chairman of the Board of Directors

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Kuanfu Fan

|

|

Chief Financial Officer

|

|

November 14, 2016

|

|

Kuanfu Fan

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Yi Yuan

|

|

Director

|

|

November 14, 2016

|

|

Yi Yuan

|

|

|

||

|

|

|

|

|

|

|

/s/ Xiaojun Zhuang

|

|

Director

|

|

November 14, 2016

|

|

Xiaojun Zhuang

|

|

|

16