Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarter ended: August 31, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ___________ to____________

Commission File Number: 000-53741

CHINA XUEFENG ENVIORNMENTAL ENGINEERING INC.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

99-0364975

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer I.D. No.)

|

The Beijing-Hangzhou Grand Canal Service Center

229 Tongda Avenue

Economic and Technological Development Zone,

Suqian, Jiangsu Province, P.R. China 223800

(Address of principal executive offices and zip Code)+86 (527) 8437-0508

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☑

|

|

|

|

|

|

|

|

Non-accelerated filer

|

☐

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ☒

As of October 17, 2016, there were 63,020,871 outstanding shares of common stock of the registrant, par value $0.001 per share.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC.

FORM 10-Q

TABLE OF CONTENTS

|

PART I – FINANCIAL INFORMATION

|

|

|

|

Page

|

|

Item 1. Financial Statements.

|

1 |

|

|

|

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

34 |

|

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

|

41 |

|

|

|

|

Item 4. Controls and Procedures.

|

42 |

|

|

|

|

PART II – OTHER INFORMATION

|

|

|

|

|

|

Item 1. Legal Proceedings.

|

43 |

|

|

|

|

Item 1A. Risk Factors.

|

43 |

|

|

|

|

Item 2 Unregistered Sales of Equity Securities and Use of Proceeds.

|

43 |

|

|

|

|

Item 3 Defaults Upon Senior Securities.

|

43 |

|

|

|

|

Item 4. Mine Safety Disclosures.

|

43 |

|

|

|

|

Item 5. Other Information.

|

44 |

|

|

|

|

Item 6. Exhibits.

|

44 |

|

|

|

|

Signatures

|

45 |

ITEM 1. FINANCIAL STATEMENTS.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (IN U.S. $) (UNAUDITED)

|

August 31,

|

May 31,

|

|||||||

|

ASSETS

|

2016

|

2016

|

||||||

|

Current assets:

|

||||||||

| Cash |

$

|

7,670,907

|

$

|

5,912,106

|

||||

|

Accounts receivable

|

4,166,689

|

4,173,156

|

||||||

|

Prepaid VAT

|

3,581,274

|

3,735,575

|

||||||

|

Prepaid expenses

|

500,347

|

88,477

|

||||||

|

Total current assets

|

15,919,217

|

13,909,314

|

||||||

|

Noncurrent assets:

|

||||||||

|

Fixed assets, net

|

40,706,868

|

41,603,297

|

||||||

|

Prepaid Lease

|

5,797,156

|

5,913,880

|

||||||

|

Accounts receivable-non-current

|

4,760,339

|

5,907,361

|

||||||

|

Deferred income tax assets

|

300,187

|

280,184

|

||||||

|

Total noncurrent assets

|

51,564,550

|

53,704,722

|

||||||

|

Total Assets

|

$

|

67,483,767

|

67,614,036

|

|||||

See accompanying notes to the consolidated financial statements.

1

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (IN U.S. $) (UNAUDITED)

|

August 31,

|

May 31,

|

|||||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

2016

|

2016

|

||||||

|

Current liabilities:

|

||||||||

| Accounts payable |

$

|

690,399

|

$

|

1,247,399

|

||||

| Deferred revenues |

3,058,646

|

2,967,016

|

||||||

|

Taxes payable

|

750,814

|

810,428

|

||||||

|

Loan from stockholder

|

8,696,914

|

8,781,471

|

||||||

|

Accrued liabilities

|

148,116

|

165,097

|

||||||

|

Total current liabilities

|

13,344,889

|

13,971,411

|

||||||

|

Security deposits payable

|

2,754,278

|

2,794,868

|

||||||

|

TOTAL LIABILITIES

|

16,099,167

|

16,766,279

|

||||||

|

Stockholders' equity:

|

||||||||

|

Common stock, $0.001 par value per share, 75,000,000 shares authorized; 63,020,871 shares issued and outstanding

|

63,021

|

63,021

|

||||||

|

Additional paid-in capital

|

33,518,248

|

33,518,248

|

||||||

|

Statutory reserve fund

|

1,956,240

|

1,843,520

|

||||||

|

Retained earnings

|

17,352,579

|

16,234,031

|

||||||

|

Other comprehensive income

|

(2,574,371

|

) |

(1,838,853

|

) | ||||

|

Stockholders' equity before noncontrolling interests

|

50,315,717

|

49,819,967

|

||||||

|

Noncontrolling interest

|

1,068,883

|

1,027,790

|

||||||

|

Total stockholders' equity

|

51,384,600

|

50,847,757

|

||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$

|

67,483,767

|

$

|

67,614,036

|

||||

See accompanying notes to the consolidated financial statements.

2

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

|

Three Months Ended

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

Revenue:

|

||||||||

| Sales |

$

|

1,536,109

|

$

|

10,865,073

|

||||

|

Lease income

|

592,099

|

-

|

||||||

|

Total revenue

|

2,128,208

|

10,865,073

|

||||||

|

Cost of goods sold:

|

||||||||

|

Cost of sales

|

139,786

|

8,103,499

|

||||||

|

Depreciation expense - leased equipment

|

286,323

|

-

|

||||||

|

Total cost of goods sold

|

426,109

|

8,103,499

|

||||||

|

Gross profit

|

1,702,099

|

2,761,574

|

||||||

|

Operating expenses:

|

||||||||

|

Selling and marketing

|

151,438

|

252,257

|

||||||

|

General and administrative

|

261,854

|

287,207

|

||||||

|

Total operating expenses

|

413,292

|

539,464

|

||||||

See accompanying notes to the consolidated financial statements.

3

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

|

Three Months Ended,

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

Income from operations

|

1,288,807

|

2,222,110

|

||||||

|

Interest income

|

135,165

|

21,865

|

||||||

|

Government subsidy

|

225,899

|

241,970

|

||||||

|

Income before provision for income taxes

|

1,649,871

|

2,485,945

|

||||||

|

Provision for income taxes

|

362,243

|

566,744

|

||||||

|

Net income

|

1,287,628

|

1,919,201

|

||||||

|

Noncontrolling interest

|

(56,360

|

) |

(87,987

|

) | ||||

|

Net income attributable to common stockholders

|

$

|

1,231,268

|

$

|

1,831,214

|

||||

|

Earnings per common share, basic and diluted

|

$

|

0.02

|

$

|

0.03

|

||||

|

Weighted average shares outstanding, basic and diluted

|

63,020,871

|

63,020,871

|

||||||

|

Comprehensive Income:

|

||||||||

|

Net Income

|

$

|

1,287,628

|

$

|

1,919,201

|

||||

|

Foreign currency translation adjustment

|

(750,785

|

) |

(1,154,335

|

) | ||||

|

Comprehensive income

|

536,843

|

764,866

|

||||||

|

Comprehensive income attributable to noncontrolling interests

|

(41,093

|

) |

(50,662

|

) | ||||

|

Net Comprehensive income attributable to common stockholders

|

$

|

495,750

|

$

|

714,204

|

||||

See accompanying notes to the consolidated financial statements.

4

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 (IN U.S. $) (UNAUDITED)

|

Common

Stock

|

Additional

Paid-in

Capital

|

Retained

Earnings

|

Noncontrolling

Interests

|

Statutory

Reserve

Fund

|

Other

Comprehensive

Income

|

Total

|

||||||||||||||||||||||

|

Balance, May 31, 2016

|

$

|

63,021

|

$

|

33,518,248

|

$

|

16,234,031

|

$

|

1,027,790

|

$

|

1,843,520

|

$

|

(1,838,853

|

)

|

$

|

50,847,757

|

|||||||||||||

|

Net income

|

-

|

-

|

1,231,268

|

56,360

|

-

|

-

|

1,287,628

|

|||||||||||||||||||||

|

Appropriation to statutory reserve

|

-

|

-

|

(112,720

|

)

|

-

|

112,720

|

-

|

-

|

||||||||||||||||||||

|

Foreign currencytranslation adjustment

|

-

|

-

|

-

|

(15,267

|

)

|

-

|

(735,518

|

)

|

(750,785

|

)

|

||||||||||||||||||

|

Balance, August 31, 2016

|

$

|

63,021

|

$

|

33,518,248

|

$

|

17,352,579

|

$

|

1,068,883

|

$

|

1,956,240

|

$

|

(2,574,371

|

)

|

$

|

51,384,600

|

|||||||||||||

See accompanying notes to the consolidated financial statements.

5

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

|

For The Three Month Ended

|

||||||||

|

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

Cash flows from operating activities:

|

$

|

1,287,628

|

$

|

1,919,201

|

||||

|

Net income

|

||||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation

|

311,417

|

7,373

|

||||||

|

Amortization for the land lease

|

31,024

|

33,230

|

||||||

|

Increase in deferred income tax assets

|

(24,219

|

) |

(30,974

|

) | ||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Decrease (increase) in accounts receivable

|

968,029

|

(10,050,668

|

) | |||||

|

Decrease in prepaid VAT

|

100,657

|

-

|

||||||

|

(Increase) decrease in prepaid expenses

|

(415,653

|

) |

43,437

|

|||||

|

(Increase) in advance to supplier

|

-

|

(2,625,840

|

) | |||||

|

(Decrease) increase in accounts payable and accrued liabilities

|

(473,197

|

) |

543,921

|

|||||

|

Increase in deferred revenue

|

135,544

|

209,399

|

||||||

|

(Decrease) increase in taxes payable

|

(48,136

|

) |

231,334

|

|||||

|

Net cash provided by (used in) operating activities

|

1,873,094

|

(9,719,587

|

) | |||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of fixed assets

|

(17,423

|

) |

(9,741,051

|

) | ||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from shareholder

|

-

|

12,259,848

|

||||||

|

Effect of exchange rate changes on cash

|

(96,870

|

) |

(1,142,809

|

) | ||||

|

Net increase (decrease) in cash

|

1,758,801

|

(8,343,599

|

) | |||||

|

Cash, beginning

|

5,912,106

|

26,493,540

|

||||||

|

Cash, end

|

$

|

7,670,907

|

$

|

18,149,941

|

||||

See accompanying notes to the consolidated financial statements.

6

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

|

For The Three Month Ended

|

||||||||

|

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

Supplemental disclosure of cash flow information

|

||||||||

|

Cash paid during the period for:

|

||||||||

|

Interest

|

$

|

-

|

$

|

627

|

||||

|

Income taxes

|

$ |

436,072

|

$ |

689,855

|

||||

|

Supplemental disclosure of non-cash activities

|

||||||||

|

Property, equipment, construction in process transferred from prepayment

|

$

|

-

|

$

|

834,302

|

||||

|

Property, equipment, construction in process accrued

|

$

|

-

|

$

|

(11,615

|

)

|

|||

|

Payment of accrued liabilities by shareholder

|

$

|

39,000

|

$ | |||||

See accompanying notes to the consolidated financial statements.

7

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 1. ORGANIZATION

China Xuefeng Environmental Engineering Inc. (the "Company"), formerly known as NYC Moda Inc., was incorporated under the laws of the State of Nevada on March 30, 2011. Since its inception until the closing of the Exchange Agreement, the Company was a development-stage company.

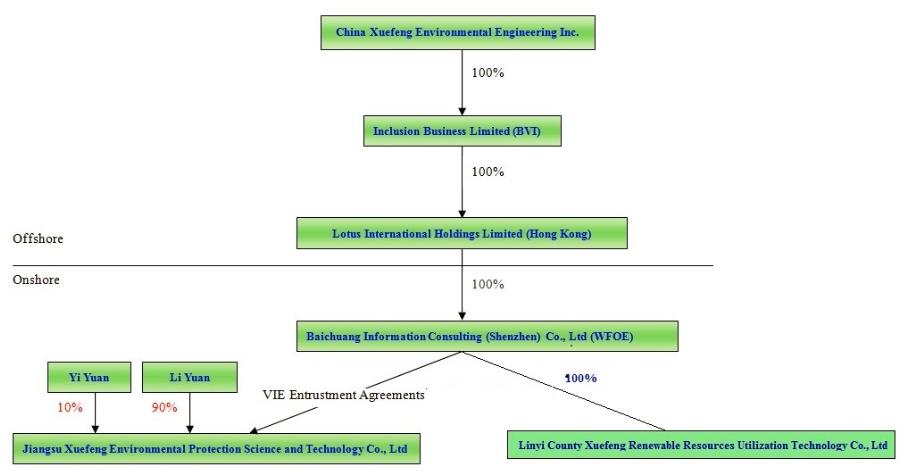

On November 27, 2012, the Company completed a reverse acquisition transaction through a share exchange with the stockholders of Inclusion Business Limited ("Inclusion"), whereby the Company acquired 100% of the outstanding shares of Inclusion in exchange for 7,895,000 shares of its common stock, representing 76.65% of the issued and outstanding shares of common stock. As a result of the reverse acquisition, Inclusion became the Company's wholly-owned subsidiary and the former Inclusion Stockholders became our controlling stockholders. The share exchange transaction was treated as a reverse acquisition, with Inclusion as the acquirer and the Company as the acquired party for accounting purposes.

In November, 2012, the Company filed a certificate of amendment to its articles of incorporation to change its name from "NYC Moda, Inc." to "China Xuefeng Environmental Engineering Inc." (the "Name Change") and to initiate a 4-for-1 forward stock split (the "Forward Split") of its outstanding shares of common stock. The Name Change and the Forward Split were effective in December, 2012. Upon the effectiveness of the Forward Split, the number of outstanding shares of the Company's common stock increased from 10,300,000 to 41,200,000 shares. In March, 2013, the Company sold 14,000,000 shares of common stock to 12 unrelated individuals in a private offering, generating $7,000,000 in net proceeds.

As a result of the transaction with Inclusion, the Company owns all of the issued and outstanding common stock of Lotus International Holdings Limited ("Lotus"), a wholly-owned subsidiary of Inclusion, which in turn owns all of the issued and outstanding capital stock of Baichuang Information Consulting (Shenzhen) Co. Ltd ("Baichuang Consulting"). In addition, the Company effectively and substantially controls Jiangsu Xuefeng Environmental Protection Science and Technology Co., Ltd. ("Jiangsu Xuefeng") through a series of captive agreements with Baichuang Consulting.

The Company conducts its operations through its controlled consolidated variable interest entity ("VIE"), Jiangsu Xuefeng. Jiangsu Xuefeng, incorporated under the laws of the People's Republic of China ("PRC") in December, 2007, is primarily engaged in the sale, lease and installation of garbage recycling equipment and provides improvement and upgrading services of garbage recycling processing technology and equipment.

In October 2012, Baichuang Consulting (the "WFOE"), a wholly-owned subsidiary of Lotus, entered into a series of contractual arrangements (the "VIE Agreements"). The VIE Agreements include (i) an Exclusive Technical Service and Business Consulting Agreement; (ii) a Proxy Agreement, (iii) Share Pledge Agreement and, (iv) Call Option Agreement with the stockholders of Jiangsu Xuefeng.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 1. ORGANIZATION (CONTINUED)

Exclusive Technical Service and Business Consulting Agreement: Pursuant to the Exclusive Technical Service and Business Consulting Agreement, the WFOE provides technical support, consulting, training, marketing and operational consulting services to Jiangsu Xuefeng. In consideration for such services, Jiangsu Xuefeng has agreed to pay an annual service fee to the WFOE of 95% of Jiangsu Xuefeng's annual net income and an additional payment of approximately US$15,910 (RMB 100,000) each month. The Agreement has an unlimited term and only can be terminated upon written notice agreed to by both parties.

Proxy Agreement: Pursuant to the Proxy Agreement, the stockholders of Jiangsu Xuefeng agreed to irrevocably entrust the WFOE to designate a qualified person acceptable under PRC law and foreign investment policies, all of the equity interests in Jiangsu Xuefeng held by the stockholders of Jiangsu Xuefeng. The Agreement has an unlimited term and only can be terminated upon written notice agreed to by both parties.

Call Option Agreement: Pursuant to the Call Option agreement, the WFOE has an exclusive option to purchase, or to designate a purchaser, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in Jiangsu Xuefeng held by each of the stockholders. To the extent permitted by PRC laws, the purchase price for the entire equity interest is approximately US$0.16 (RMB1.00) or the minimum amount required by PRC law or government practice. This Agreement remains effective until all the call options under the Agreement have been exercised by Baichuang Consulting or its designated entities or natural persons.

Share Pledge Agreement: Pursuant to the Share Pledge agreement, each of the stockholders pledged their shares in Jiangsu Xuefeng to the WFOE, to secure their obligations under the Exclusive Technical Service and Business Consulting Agreement. In addition, the stockholders of Jiangsu Xuefeng agreed not to transfer, sell, pledge, dispose of or create any encumbrance on their interests in Jiangsu Xuefeng that would affect the WFOE's interests. This Agreement remains effective until the obligations under the Exclusive Technical Service and Business Consulting Agreement, Call Option Agreement and Proxy Agreement have been fulfilled or terminated.

On August 4, 2016, Baichuang Information Consulting Co., Ltd ("Baichuang Information") entered into an agreement with Mr. Li Yuan, the sole shareholder of Linyi County Xuefeng Renewable Resources Utilization Technology Co., Ltd ("Linyi Xuefeng"), to purchase his 100% ownership of Linyi Xuefeng. Mr. Li Yuan is the Chief Executive Officer and main shareholder of the Company. The purchase price is to be determined by the audited net assets of the Company as of May 31, 2016, ("payment anticipated to be RMB10,000,000 ($1,500,000 US) in cash and the balance to be paid in common shares of China Xuefeng at 75% of the closing price of the last trading day of stock delivery"). In any event, the payment method of specific amount and securities shall be separately accounted for and discussed after the audit report is issued.

On October 7, 2016, a supplementary agreement was entered between both parties to finalize the purchase based upon the audited net asset value of $ 23,462,612 on May 31, 2016. The supplementary agreement indicated that the transfer price is $3 per share consisting entirely of stock of the Company. Accordingly, 7,820,871 shares were issued to Mr. Li Yuan.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 1. ORGANIZATION (CONTINUED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF ACCOUNTING AND PRESENTATION

The unaudited interim consolidated financial statements of the Company as of August 31, 2016 and for the three months ended August 31, 2016 and 2015, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the SEC which apply to interim financial statements. Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. In the opinion of management, such information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The interim consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company's Form 10-K filed with the SEC. The results of operations for the three months ended August 31, 2016 are not necessarily indicative of the results to be expected for future three months or for the year ending May 31, 2017.

The acquisition of Linyi Xuefeng was treated as a combination of entities under common as Mr. Li Yuan was the chief executive officer and major shareholder of both companies. An acquisition of an entity under common control is treated similar to a "pooling of interest." Accordingly, the financial statements of the Company include the historical balances of Linyi Xuefeng as if the acquisition occurred on the first day of the earliest period presented.

All consolidated financial statements and notes to the consolidated financial statements are presented in United States dollars ("US Dollar" or "US$" or "$").

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

VARIABLE INTEREST ENTITY

Pursuant to Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 810, "Consolidation" ("ASC 810"), the Company is required to include in its consolidated financial statements, the financial statements of its variable interest entities ("VIEs"). ASC 810 requires a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE's residual returns. VIEs are those entities in which a company, through contractual arrangements, bears the risk of, and enjoys the rewards normally associated with ownership of the entity, and therefore the company is the primary beneficiary of the entity.

Under ASC 810, a reporting entity has a controlling financial interest in a VIE, and must consolidate that VIE, if the reporting entity has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE's economic performance; and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE. The reporting entity's determination of whether it has this power is not affected by the existence of kick-out rights or participating rights, unless a single enterprise, including its related parties and de facto agents, have the unilateral ability to exercise those rights. Jiangsu Xuefeng's actual stockholders do not hold any kick-out rights that affect the consolidation determination.

Through the VIE agreements disclosed in Note 1, the Company is deemed the primary beneficiary of Jiangsu Xuefeng. Accordingly, the results of Jiangsu Xuefeng have been included in the accompanying consolidated financial statements. Jiangsu Xuefeng has no assets that are collateral for or restricted solely to settle their obligations. The creditors of Jiangsu Xuefeng do not have recourse to the Company's general credit.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

VARIABLE INTEREST ENTITY (CONTINUED)

The following financial statement amounts and balances of Jiangsu Xuefeng have been included in the accompanying consolidated financial statements.

|

ASSETS

|

August 31,

2016

|

May 31,

2016

|

||||||

|

(Unaudited)

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$

|

6,538,804

|

$

|

5,587,133

|

||||

|

Account receivable

|

4,165,891

|

4,172,406

|

||||||

|

Prepaid VAT

|

2,153,313

|

2,286,570

|

||||||

|

Prepaid expenses

|

497,566

|

87,492

|

||||||

|

Total current assets

|

13,355,574

|

12,133,601

|

||||||

|

Fixed assets, net

|

16,542,498

|

17,070,774

|

||||||

|

Account receivable-noncurrent

|

4,760,339

|

5,907,361

|

||||||

|

TOTAL ASSETS

|

$

|

34,658,411

|

$

|

35,111,736

|

||||

|

LIABILITIES

|

||||||||

|

Current liabilities:

|

||||||||

|

Due to China Xuefeng Environmental Engineering, Inc. (1)

|

$

|

6,513,058

|

$

|

6,609,043

|

||||

|

Payable to WFOE (2)

|

15,700,755

|

13,958,489

|

||||||

|

Accounts payable

|

254,471

|

774,665

|

||||||

|

Deferred revenue

|

2,385,045

|

2,967,016

|

||||||

|

Taxes payable

|

565,832

|

635,027

|

||||||

|

Loan from stockholder

|

272,866

|

276,888

|

||||||

|

Accrued liabilities

|

41,235

|

42,746

|

||||||

|

Total current liabilities

|

25,733,262

|

25,263,874

|

||||||

|

Deposit payable-noncurrent

|

2,754,278

|

2,794,868

|

||||||

|

TOTAL LIABILITIES

|

$

|

28,487,540

|

$

|

28,058,742

|

||||

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

VARIABLE INTEREST ENTITY (CONTINUED)

|

(1)

|

Due to China Xuefeng Environmental Engineering, Inc. is for the proceeds from the sale of common stock which proceeds were received by Jiangsu Xuefeng for 14,000,000 common shares issued by China Xuefeng Environmental Engineering, Inc. on March 19, 2013 at $0.50 each (approximately US$7,000,000).

|

|

(2)

|

Payable to WFOE represents outstanding amounts due to Baichuang Information Consulting (Shenzhen) Co. Ltd. under the Exclusive Technical Service and Business Consulting Agreement for consulting services provided to Jiangsu Xuefeng in exchange for 95% of Jiangsu Xuefeng's net income and additional monthly payments of RMB 100,000 (approximately US$15,630). During the three months ended August 31, 2016 and 2015, Jiangsu Xuefeng did not make any payment to the WOFE.

|

|

For The Three Months Ended

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Revenue

|

$

|

2,128,208

|

$

|

10,865,073

|

||||

|

Net income (3)

|

$

|

1,127,203

|

$

|

1,759,742

|

||||

|

(3)

|

Under the Exclusive Technical Service and Business Consulting Agreement, 95% of the net income is to be remitted to the WFOE, which is not reflected above.

|

|

For The Three Months Ended

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Net cash provided by (used in) operating activities

|

$

|

1,056,516

|

$

|

(9,650,785

|

)

|

|||

|

Net cash (used in) investing activities

|

(17,423

|

)

|

(178,100

|

)

|

||||

|

Effect of exchange rate changes on cash

|

(87,422

|

)

|

(740,497

|

)

|

||||

|

Net increase (decrease) in cash

|

$

|

951,671

|

$

|

(10,569,382

|

)

|

|||

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

VARIABLE INTEREST ENTITY (CONTINUED)

The Company believes that Baichuang Consulting's contractual agreements with Jiangsu Xuefeng are in compliance with PRC law and are legally enforceable. The stockholders of Jiangsu Xuefeng are also the senior management of the Company and therefore the Company believes that they have no current interest in seeking to act contrary to the contractual arrangements. However, Jiangsu Xuefeng and its stockholders may fail to take certain actions required for the Company's business or to follow the Company's instructions despite their contractual obligations to do so. Furthermore, if Jiangsu Xuefeng or its stockholders do not act in the best interests of the Company under the contractual arrangements and any dispute relating to these contractual arrangements remains unresolved, the Company will have to enforce its rights under these contractual arrangements through PRC law and courts and therefore will be subject to uncertainties in the PRC legal system. All of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. As a result, uncertainties in the PRC legal system could limit the Company's ability to enforce these contractual arrangements, which may make it difficult to exert effective control over Jiangsu Xuefeng, and its ability to conduct the Company's business may be adversely affected.

ACQUISITION OF LINYI XUEFENG

The following financial statement amounts and balances of Linyi Xuefeng have been included in the accompanying consolidated financial statements.

|

August 31,

|

May 31,

|

|||||||

|

2016

|

2016

|

|||||||

|

(Unaudited)

|

||||||||

|

TOTAL ASSETS

|

$

|

32,642,934

|

$

|

32,316,617

|

||||

|

TOTAL LIABILITIES

|

$ |

9,368,758

|

$ |

8,854,005

|

||||

|

For The Three Months Ended

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

TOTAL OPERATING EXPENSES

|

$

|

97,035

|

$

|

124,240

|

||||

|

TOTAL OTHER INCOME

|

$ |

226,058

|

$ |

242,315

|

||||

|

NET INCOME

|

$ |

153,242

|

$ |

149,049

|

||||

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

USE OF ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

FOREIGN CURRENCY TRANSLATION

Almost all Company assets are located in the PRC. The functional currency for the majority of the Company's operations is the Renminbi ("RMB"). The Company uses the United States dollar ("US Dollar" or "US$" or "$") for financial reporting purposes. The financial statements of the Company have been translated into US dollars in accordance with FASB ASC 830, "Foreign Currency Matters."

All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. Statements of income amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company's financial statements are recorded as other comprehensive income (loss).

The exchange rates used to translate amounts in RMB into US dollars for the purposes of preparing the financial statements are as follows:

|

August 31,

2016

|

May 31,

2016

|

August 31,

2015

|

||||||||||

|

Balance sheet items, except for stockholders' equity, as of year end

|

0.1497

|

0.1519

|

N/A

|

|

||||||||

|

Amounts included in the statements of income, statements of changes in stockholders' equity and statements of cash flows

|

0.1506

|

N/A

|

|

0.1613

|

||||||||

For the three months ended August 31, 2016 and 2015, foreign currency translation adjustments of $(750,785) and $(1,154,335), respectively, have been reported as other comprehensive income. Other comprehensive income of the Company consists entirely of foreign currency translation adjustments. Pursuant to ASC 740-30-25-17, "Exceptions to Comprehensive Recognition of Deferred Income Taxes," the Company does not recognize deferred U.S. taxes related to the undistributed earnings of its foreign subsidiaries and, accordingly, recognizes no income tax expense or benefit from foreign currency translation adjustments.

15

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

FOREIGN CURRENCY TRANSLATION (CONTINUED)

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US dollars at that rate or any other rate.

The value of the RMB against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC's political and economic conditions. Any significant revaluation of the RMB may materially affect the Company's financial condition in terms of US dollar reporting.

REVENUE RECOGNITION

Revenues are primarily derived from selling and leasing garbage processing equipment, providing garbage recycling processing system technology support, renovation and upgrade services and patent licensing to customers. The Company's revenue recognition policies comply with FASB ASC 605 "Revenue Recognition." In general, the Company recognizes revenue when there is persuasive evidence of an arrangement, the fee is fixed or determinable, the products or services have been delivered or performed and collectability of the resulting receivable is reasonably assured.

Improvement and upgrading service is a one-time service provided to upgrade customer's existing equipment before they opt to license and use our patented technology. The fee for the service would be paid within thirty (30) days upon execution of the contract.

Inspection would be conducted by the customers according to industry standards within three days upon completion of the improvement and upgrading service. Performance testing would then be conducted on the upgraded equipment, which typically can be done within a month. A final inspection assessment report would be provided to the customers within five days upon completion of the testing and Customers would provide the Company with a signed acceptance form if they are satisfied. The Company will recognize the revenue for the improvement and upgrading service once the performance testing is passed and the final evaluation report is provided by the customer.

Patent licensing is limited to five (5) years with payments due annually in advance and recognized as revenue monthly. We are responsible to provide repairing service when necessary, but customers would bear any out of pocket expense relating to the repairing service.

We believe that lease receivables have four potential risks: operation risk, credit risk, accident risk and natural disasters risk.

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

First, there is no guarantee that the licensee of our patent will have sufficient capital resources to perform the licensing agreement and pay the licensing fee on time or at all. The length of the agreement is up to five (5) years and therefore the Company may not able to collect fees for the entire agreement. Second, there is a potential credit risk for which the licensee may unilaterally terminate the agreement and thus affect the payout of the licensing agreement. Third, accident involving the equipment caused by employees of the licensee may have material adverse effect on the operation of the licensee. This unforeseeable risk could impact the licensee's ability to perform throughout the length of the agreement. Lastly, unforeseeable natural disasters could have a material adverse effect on the production and operation of the Company's licensees. If their operation is impacted by events such as fire, flood or earthquakes, they may need to cease their operation and therefore may be unable to perform their obligations under the agreement.

Linyi Xuefeng's income relates solely to government for city pollution garbage processing system constructions. Government subsidy are recognized as earned when grant expenses are incurred up to the maximum amount allowed for each grant award.

Sales-Type Leases

The Company entered into three sales-type lease arrangements during the three months ended August 31, 2015, with two customers for financing of their purchase of garbage processing equipment. The arrangements with the customers have a fixed term of three years. Revenue from the sale of the equipment is recognized at the inception of the lease. The payments have been present valued with an annual interest rate of 5.25%. In connection with these arrangements, the Company recognized revenue of $14,300,324 for the year ended May 31, 2016. Future minimum collections for the year ending May 31 are as follows:

| Year Ending | ||||

| May 31, | Amount | |||

|

2017

|

$

|

3,102,134

|

||

|

2018

|

4,329,537

|

|||

|

2019

|

1,492,458

|

|||

|

$

|

8,924,129

|

|||

17

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Operating Leases

The Company entered into three operating lease arrangements with two customers for garbage processing equipment on April 25, 2016, December 28, 2015 and November 6, 2015, respectively. The arrangement with the customer has a fixed term of five years with three monthly payments of $180,719, $361,438 and $150,599, respectively. Revenue from the leasing of the equipment is recognized monthly. In addition, the lease required a security deposit on $718,507, $1,437,014 and $598,756, respectively. At the end of the five years lease term, it will be determined whether the lease will be extended, leased to a new customer or returned to the Company. Future minimum payments for the years ending May 31 are as follows:

|

Year Ending

|

|||||

|

May 31,

|

Amount

|

||||

|

2017

|

$

|

2,078,266

|

|||

|

2018

|

2,771,022

|

||||

|

2019

|

2,771,022

|

||||

|

2020

|

2,771,022

|

||||

|

2021

|

1,756,988

|

||||

|

$

|

12,148,320

|

||||

Multiple-Element Arrangements

In October 2009, the FASB issued Accounting Standards Update ("ASU") No. 2009-13, "Multiple Deliverable Revenue Arrangements." ASU No. 2009-13 amended the guidance on arrangements with multiple deliverables under ASC 605-25, "Revenue Recognition—Multiple-Element Arrangements." To qualify as a separate unit of accounting under ASC 605-25, the delivered item must have value to the customer on a standalone basis. The significant deliverables under the Company's multiple-element arrangements are improvement and upgrade services and patent licensing.

18

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Multiple-Element Arrangements (Continued)

Improvement and Upgrade Service

The improvement and upgrade service is a one-time service. By the end of improvement and upgrading services, there is persuasive evidence of an arrangement exists since company has a signed contract with a customer; delivery has occurred and a customer has completed inspection and accepted the improvement and upgrading services then delivered; the fee is fixed and become due within 30 days upon the signing of the contract; and collectability is probable. An inspection is conducted by the customer according to industry standards within three days of the completion of the improvement and upgrade. An acceptance form is provided by the customer if the inspection is satisfactory. Performance testing is conducted on the upgraded equipment within one month. A final evaluation report is provided within five days of the completion of the performance testing. The fee for improvement and upgrade services is fixed and becomes due within 30 days, upon the signing of the contract. The fees for the improvement and upgrading services are not subject to refund, forfeiture or any other concession if patent licensing is not completed.

The Company has met the agreed upon specifications and has not been required to make any refunds for its services. No warranty is provided by the Company.

The customer is responsible for repair services when necessary. The out of pocket expenses for the repair services will be charged separately to the customer by the Company.

Patent Licensing

Patent licensing is limited to 5 years with payments due annually in advance. The patent technology of "harmless and comprehensive garbage processing equipment" provided by the Company to its customers has high garbage processing capacity and stable operation capacity. It is the first modern system equipment in China to use DCS (Distributed Control System) centralized control, by which mechanical automation will be realized for the comprehensive treatment of life garbage. Its core technology is to organically integrate the anaerobic digestion and aerobic fermentation garbage process, degrade and transform the organic matter of domestic waste, effectively sort out the garbage and recycle all kinds of materials, to eventually realize the true waste resource utilization and harmless utilization, with a utilization rate approaching 100%. The resource recovery products, biogas, not only can be used for meeting the needs of the plant itself, but also can be sold as a separate product, which greatly improves the efficiency of garbage processing of the customer's equipment, decreases production cost, and increases the recovery return of garbage processing.

19

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Multiple-Element Arrangements (Continued)

Patent Licensing (continued)

The Company's customer who pays for an upgrade and improvement fee is not required to enter into a licensing agreement to continue to use the patented technology. If the customer does not require the garbage processing equipment to reach the level of the patented technology which can process 500 tons to 1,000 tons of garbage per day, then the customer does not need to enter into the patent licensing agreement.

Multiple Elements

The Company determined that its improvement and upgrade services are individually a separate unit of accounting. In determining whether the improvement and upgrade services has standalone value, the Company considered factors including the availability of similar services from other vendors, its fee structure based on inclusion and exclusion of the service, and its marketing and delivery of the services. The Company uses the vendor-specific objective evidence to determine the selling price for its improvement and upgrade services when sold in multiple-element arrangements. Although not yet being sold separately, the price established by the management has the relevant authority.

The Company also determined that the patent licensing has standalone value because the patent can be licensed separately. The Company uses the vendor-specific objective evidence to determine the price for patent licensing when sold in multiple-element arrangements. Although not yet being licensed separately, the price established by the management has the relevant authority. The Company establishes the price of upgrading and improvement service and the price of patent licensing is determined based on the following method:

Since equipment improvement and upgrade service and patent leasing service are derived from the Company's patented technology, which the Company has the exclusive right to while others must obtain licensing rights to use the technology, the Company have a strong bargaining power in the market to undertake the promotion of its brand and corporate image. Furthermore, the Company uses a profit cost pricing method to determine the price of its product. The Company calculates the price by adding its target profit, or a 90% gross profit margin, to the base product cost to derive the final sale price of its services.

The Company allocates the arrangement consideration based on their relative selling prices. Revenues for the improvement and upgrade services are recognized when completed, the performance testing is passed and the final evaluation report is provided by the customer, which generally is within 30 days, assuming all other revenue recognition criteria are met. Revenues for patent licensing are recognized monthly over the licensing period.

20

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

REVENUE RECOGNITION (CONTINUED)

Multiple-Element Arrangements (Continued)

Multiple Elements (continued)

The Company believes the effect of changes in the selling price for improvement and upgrade services and patent licensing will not have significant effect on the allocation of the arrangement.

FAIR VALUE OF FINANCIAL INSTRUMENTS

FASB ASC 820, "Fair Value Measurement," defines fair value as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity.

Level 1 Inputs – Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access.

Level 2 Inputs – Inputs other than the quoted prices in active markets that are observable either directly or indirectly.

Level 3 Inputs – Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements.

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. As of August 31, 2016 and May 31, 2016, none of the Company's assets and liabilities were required to be reported at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash, accounts receivable, prepaid VAT, accounts payable and accrued expenses, and deferred revenue approximate their fair values due to the short term nature of these financial instruments. There were no changes in methods or assumptions during the periods presented.

CASH AND CASH EQUIVALENTS

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents.

21

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

FIXED ASSETS

Fixed assets are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire the asset, and any expenditures that substantially increase the asset's value or extends the useful life of an existing asset. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend the original useful life or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred. The estimated useful lives for fixed asset categories are as follows:

|

Computers and equipment

|

3 years

|

|

Motor vehicles

|

4 years

|

|

Furniture and fixtures

|

5 years

|

|

Investment in leased property

|

15 years

|

|

Machinery

|

10 years

|

|

Building and improvement

|

20 years

|

IMPAIRMENT OF LONG-LIVED ASSETS

The Company applies FASB ASC 360, "Property, Plant and Equipment," which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to those assets. No impairment of long-lived assets was recognized for the periods presented.

DEFERRED REVENUE

Deferred revenue is advance payments received for patent licensing fees and received from government for city pollution garbage processing system constructions. These payments received, but not yet earned, are recognized as deferred revenue in the consolidated balance sheets.

22

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

INCOME TAXES

The Company accounts for income taxes in accordance with FASB ASC 740, "Income Taxes" ("ASC 740"), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. At August 31, 2016 and May 31, 2016, the differences relate entirely to revenue deferred for financial statement purposes. During the year ended May 31, 2015, as permitted by the PRC tax law, the Company began recognizing revenue from patent licensing fees for income tax purposes, based on when it is earned rather than when it is collected, consistent with the financial statement recognition. As a result, there are no differences between the basis of assets and liabilities for financial statements and income tax purposes for deferred revenue and, as a result, deferred income taxes are no longer required to be recognized. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized.

ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with tax positions. As of August 31, 2016 and May 31, 2016, the Company does not have a liability for any unrecognized tax benefits.

The income tax laws of various jurisdictions in which the Company, its subsidiaries and the VIE operate are summarized as follows:

United States

The Company is subject to United States tax at graduated rates from 15% to 34%. No provision for income taxes in the United States has been made as the Company had no U.S. taxable income for the three months ended August 31, 2016 and 2015.

PRC

Jiangsu Xuefeng and Baichuang Consulting are subject to an Enterprise Income Tax at 25% and file their own tax returns. Consolidated tax returns are not permitted in China.

BVI

Inclusion is incorporated in the BVI and is governed by their income tax laws. According to current BVI income tax law, the applicable income tax rate for the Company is 0%.

23

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

INCOME TAXES (CONTINUED)

Hong Kong

Lotus is incorporated in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non-Hong Kong source income.

ADVERTISING COSTS

Advertising costs are charged to operations when incurred. For the three months ended August 31, 2016 and 2015, advertising expense was $90,359 and $183,076, respectively.

STATUTORY RESERVE FUND

Pursuant to corporate law in the PRC, the Company is required to transfer 10% of its net income, as determined under PRC accounting rules and regulations, to a statutory reserve fund until such reserve balance reaches 50% of the Company's registered capital. The statutory reserve fund is non-distributable other than during liquidation and can be used to fund previous years' losses, if any, and may be utilized for business expansion or used to increase registered capital, provided that the remaining reserve balance after such use is not less than 25% of the registered capital. For the three months ended August 31, 2016 and 2015, a statutory reserve of $112,720 and $194,220, respectively, was required to be allocated to the Company.

VALUE ADDED TAX ("VAT")

All China-based enterprises are subject to a VAT imposed by the PRC government on their domestic product sales. The output VAT is charged to customers who purchase goods from the Company and the input VAT is paid when the Company purchases goods from its vendors. Input VAT rates are 17% for the purchasing activities conducted by the Company. Output VAT rate is 17% for all products. The input VAT can be offset against the output VAT. The VAT payable will be presented on the balance sheets when input VAT is less than the output VAT. Recoverable balance will be presented on the balance sheets when input VAT is larger than the output VAT.

NOTE 3. RECENTLY ISSUED ACCOUNTING STANDARDS

In April 2016, the FASB issued Accounting Standards Update No. 2016-12, Revenue from Contracts with Customers. In May 2014, the FASB issued ASU No. 2014-09, "Revenue from Contracts with Customers (Topic 606).'' This guidance supersedes current guidance on revenue recognition in Topic 605, "Revenue Recognition.'' In addition, there are disclosure requirements related to the nature, amount, timing, and uncertainty of revenue recognition. In August 2015, the FASB issued ASU No.2015-14 to defer the effective date of ASU No. 2014-09 for all entities by one year. For public business entities that follow U.S. GAAP, the deferral results in the new revenue standard are being effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017, with early adoption permitted for interim and annual periods beginning after December 15, 2016. The Company is currently evaluating the impact of adopting this standard on its consolidated financial statements.

24

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 3. RECENTLY ISSUED ACCOUNTING STANDARDS (CONTINUED)

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases. The new standard establishes a right-of-use ("ROU") model that requires a lessee to record an ROU asset and a lease liability on the balance sheet for all leases with terms longer than twelve months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. This accounting standard update is not expected to have a material impact on the Company's consolidated financial statements.

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The updated guidance enhances the reporting model for financial instruments, which includes amendments to address aspects of recognition, measurement, presentation and disclosure. The update to the standard is effective for the Company beginning June 1, 2018. The Company is currently evaluating the effect the guidance will have on the consolidated financial statements.

In August 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date. The amendment is effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2017. Earlier application is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The Company is evaluating the impact of this standard on its consolidated financial statements.

In March 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") ASU 2015-03 – Interest – Imputation of Interest (Subtopic 835-30). This ASU addressed the simplification of debt issuance costs presentation by presenting debt issuance costs in the balance sheet as a direct deduction from the carrying amount of debt liability, consistent with debt discounts or premiums. For public business entities, the amendments in this Update are effective for financial statements issued for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. This accounting standard update is not expected to have a material impact on the Company's consolidated financial statements.

25

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 3. RECENTLY ISSUED ACCOUNTING STANDARDS (CONTINUED)

In January 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") ASU 2015-01 – Income Statement – Extraordinary and Unusual Items (Subtopic 225-20). This ASU addressed the simplification of income statement presentation by eliminating the concept of extraordinary items. The objective of the Simplification Initiative is to identify, evaluate, and improve areas of generally accepted accounting principles (GAAP) for which cost and complexity can be reduced while maintaining or improving the usefulness of the information provided to the users of financial statements. The amendments in this update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. A reporting entity may apply the amendments prospectively. A reporting entity also may apply the amendments retrospectively to all prior periods presented in the financial statements. Early adoption is permitted provided that the guidance is applied from the beginning of the fiscal year of adoption. This accounting standard update did not have a material impact on the Company's consolidated financial statements.

NOTE 4. FIXED ASSETS

Fixed assets are summarized as follows:

|

August 31,

|

May 31,

|

|||||||

|

2016

|

2016

|

|||||||

|

(Unaudited)

|

||||||||

|

Computers and equipment

|

$ |

81,193

|

$ |

64,818

|

||||

|

Vehicles

|

86,707

|

87,984

|

||||||

|

Investment in leased property

|

17,172,179

|

17,425,249

|

||||||

|

Production facilities

|

8,391,757

|

8,515,428

|

||||||

|

Furniture and fixtures

|

18,177

|

18,445

|

||||||

|

Building and improvement

|

15,792,189

|

16,024,922

|

||||||

|

41,542,202

|

42,136,846

|

|||||||

|

Less: accumulated depreciation

|

(835,334

|

) |

(533,549

|

) | ||||

|

$

|

40,706,868

|

$

|

41,603,297

|

|||||

For the three months ended August 31, 2016 and 2015, depreciation expense was $311,417 and $7,373 respectively.

26

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 5. INCOME TAXES

|

For the Three Months Ended

August 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Current

|

$

|

386,462

|

$

|

597,718

|

||||

|

Deferred

|

(24,219

|

)

|

(30,974

|

)

|

||||

|

Total

|

$

|

362,243

|

$

|

566,744

|

||||

As of August 31, 2016, the Company had unused operating loss carry-forwards of approximately $1,200,000 expiring in various years through 2022.

The expected tax rate for income in the PRC is 25%. The following table reconciles the effective income tax rates with the statutory rates for the three months ended August 31:

|

2016

|

2015

|

|||||||

|

Statutory rate

|

25

|

%

|

25

|

%

|

||||

|

Government subsidy

|

3

|

%

|

2

|

%

|

||||

|

Effective income tax rate

|

22

|

%

|

23

|

%

|

||||

The recognized government subsidy by Linyi Xuefeng was tax exempt per notice form the PRC tax authorities and accordingly there is no tax provision to be recognized.

The Company is required to file income tax returns in both the PRC and the United States. PRC tax filings for the tax year ended December 31, 2015 and 2014 were examined by the PRC tax authorities in May 2016 and 2015, respectively. The tax filings were accepted and no adjustments were proposed by the PRC tax authorities.

The Company did not file its U.S. federal income tax returns, including, without limitation, information returns on Internal Revenue Service ("IRS") Form 5471, "Information Return of U.S. Persons with Respect to Certain Foreign Corporations" for the fiscal years ended May 31, 2016, May 31, 2015, and May 31, 2014, which is a short year income tax return required to be filed as a result of the change in fiscal year. Failure to furnish any income tax returns and information returns with respect to any foreign business entity required, within the time prescribed by the IRS, subjects the Company to certain civil penalties. Management is of the opinion that penalties, if any, that may be assessed would not be material to the consolidated financial statements.

27

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 5. INCOME TAXES (CONTINUED)

In addition, because the Company did not generate any income in the United States or otherwise have any U.S. taxable income, the Company does not believe that it has any U.S. Federal income tax liabilities with respect to any transactions that the Company or any of its subsidiaries may have engaged in through May 31, 2016. However, there can be no assurance that the IRS will agree with this position, and therefore the Company ultimately could be liable for U.S. Federal income taxes, interest and penalties. The tax years ended May 31, 2016, 2015 and 2014 remain open to examination by the IRS.

NOTE 6. RELATED PARTY TRANSACTIONS

On August 5, 2012, the Company entered into an agreement to lease the patent rights on garbage recycling processing technology from Li Yuan, one of the Company's stockholders. Under the current terms, the Company is required to pay a fee of $12,048 (RMB 80,000) each month for five years from September 2012 to August 2017. The related prepaid patent leasing fees of $47,900 and $85,061 are included in prepaid expenses on the consolidated balance sheets as of August 31, 2016 and May 31, 2016, respectively.

The remaining payments for the patent rights are as follows:

|

Year Ending

|

||||

|

May 31,

|

Amount

|

|||

|

2017

|

$

|

108,432

|

||

|

2018

|

36,144

|

|||

|

$

|

144,576

|

|||

The Company obtained a demand loan from Li Yuan, a stockholder which is non-interest bearing. The total loan of approximately $519,000 represents $440,000 of expenses paid by the stockholder and payments of approximately $79,000 representing the registered capital and operating expenses of Baichuang Information Consulting (Shenzhen) Co., Ltd. The balance is reflected as loan from stockholder as of August 31, 2016 and May 31, 2016.

On June 25, 2013, Linyi Xuefeng and the shareholder, Mr. Li Yuan, entered into a loan agreement pursuant to which Mr. Li Yuan provides a loan facility to the Linyi Xuefeng, which are non-interest bearing and expiring on June 30, 2017. The maximum amount of the loan is RMB 200,000,000 (US $32,389,400). Any borrowings in excess of this amount may be negotiated between the parties. On December 17, 2015, a resolution of the board was signed by Mr. Li Yuan, who is the sole shareholder of Linyi Xuefeng, surrendered a loan to the Linyi Xuefeng of RMB 140,000,000 (USD $21,813,260) and treated as a capital contribution to the Linyi Xuefeng. The loans outstanding were $8,180,354 and $8,300,910 as of August 31, 2016 and May 31, 2016, respectively.

28

CHINA XUEFENG ENVIRONMENTAL ENGINEERING INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED AUGUST 31, 2016 AND 2015

(IN U.S. $) (UNAUDITED)

NOTE 6. RELATED PARTY TRANSACTIONS (CONTINUED)