Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File No. 333-175483

China Xuefeng Environmental Engineering Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

99-0364975

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

229 Tongda Avenue

Economic and Technological Development Zone,

Suqian, Jiangsu Province, P.R. China 223800

(Address of principal executive offices) (Zip Code)

|

|

+86 (527) 8437-0508

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

|

Securities registered under Section 12(b) of the Exchange Act:

|

|

|

|

|

|

Title of each class:

|

Name of each exchange on which registered:

|

|

None

|

None

|

|

|

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

|

None

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☒

|

|

|

|

|

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

|

(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $216,164,672.

As of August 30, 2016, the registrant had 55,200,000 shares of common stock, par value $0.001 per share, issued and outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

|

PART I

|

Page

|

|

|

|

|

|

|

Item 1.

|

Business

|

1 |

|

|

|

|

|

Item 1A.

|

Risk Factors

|

10 |

|

|

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

21 |

|

|

|

|

|

Item 2.

|

Properties

|

21 |

|

|

|

|

|

Item 3.

|

Legal Proceedings

|

22 |

|

|

|

|

|

Item 4.

|

Mine Safety Disclosures

|

22 |

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

22 |

|

|

|

|

|

Item 6.

|

Selected Financial Data

|

23 |

|

|

|

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

23 |

|

|

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

33 |

|

|

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

33 |

|

|

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants On Accounting and Financial Disclosure

|

68 |

|

|

|

|

|

Item 9A.

|

Controls and Procedures

|

68 |

|

|

|

|

|

Item 9B.

|

Other Information

|

68 |

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

69 |

|

|

|

|

|

Item 11.

|

Executive Compensation

|

72 |

|

|

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

73 |

|

|

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

74 |

|

|

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

74 |

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

75 |

|

|

|

|

|

SIGNATURES

|

77 | |

CERTAIN USAGE OF TERMS

PART I

Item 1. Business

Except as otherwise indicated by the context, references in this report to "we," "us," "our," "our Company," or "the Company" are to the combined business of China Xuefeng Environmental Engineering Inc.

Overview

We are in the business of providing services to optimize garbage-recycling processes. We utilize our patented technology of "comprehensive and harmless garbage-processing equipment," to upgrade software systems and reconstruct hardware for our clients, and therefore expand the sorting scope and capacity of our clients' garbage recycling equipment. We conduct our operations through our controlled consolidated affiliate Jiangsu Xuefeng Environmental Protection Science and Technology Co., Ltd. ("Jiangsu Xuefeng"). Jiangsu Xuefeng was incorporated under the laws of the People's Republic of China ("PRC") on December 14, 2007.

Our Corporate History and Background

We were incorporated in the state of Nevada on March 30, 2011. We were initially formed to engage in the business of clothing distribution. Since our inception and until the acquisition of Inclusion Business Limited (BVI), we were a development stage company without significant assets or any revenue.

Acquisition of Inclusion

On November 27, 2012, we completed a reverse acquisition transaction through a share exchange with Inclusion Business Limited (BVI) ("Inclusion") and its stockholders (the "Inclusion Stockholders"), whereby we acquired 100% of the issued and outstanding capital stock of Inclusion and in exchange we issued 7,895,000 shares of our common stock (pre-Forward Split), or 76.65% of our issued and outstanding capital stock as of and immediately after the consummation of the reverse acquisition, to the Inclusion Stockholders. As a result of the reverse acquisition, Inclusion became our wholly-owned subsidiary and the former Inclusion Stockholders became our controlling stockholders. The share exchange transaction has been treated as a reverse acquisition, with Inclusion as the acquirer and the Company as the acquired party for accounting purposes.

Prior to the closing of the reverse acquisition, the Company's prior shareholder, Mr. Zhenxing Liu, surrendered 7,895,000 shares of the common stock of the Company. Mr. Zhenxing Liu did not receive any consideration from the Company for accounting purposes. However, Mr. Zhenxing Liu may be deemed to have received consideration from the increase in the value of 250,000 shares held by Mr. Zhenxing Liu as a result of the reverse acquisition. Mr. Zhenxing Liu purchased 8,145,000 shares at approximately $0.007 per share at the time when the Company was considered a shell and kept 250,000 shares after the surrender. On November 30, 2012, at the closing of the reverse acquisition, the stockholder's equity increased to $5,194,728. Accordingly, the value of the 250,000 shares held by Mr. Zhenxing Liu appreciated to approximately $124,673. Other than such appreciation in the value of his shares, Mr. Zhenxing Liu did not receive any other consideration in connection with the reverse acquisition.

As a result of our acquisition of Inclusion, we now own all of the issued and outstanding capital stock of Lotus International Holdings Limited ("Lotus"), which in turn owns all of the issued and outstanding capital stock of Baichuang Information Consulting (Shenzhen) Co. Ltd ("Baichuang Consulting"). In addition, we effectively and substantially control Jiangsu Xuefeng through a series of captive agreements with Baichuang Consulting.

Subsequent to the closing of the Exchange Agreement, we conduct our operations through our controlled consolidated affiliate Jiangsu Xuefeng. Jiangsu Xuefeng is primarily engaged in providing improvement and upgrading services of garbage recycling processing technology and equipment.

Name Change and Forward Split

On November 27, 2012, the Company filed a certificate of amendment to its articles of incorporation to change its name from "NYC Moda Inc" to "China Xuefeng Environmental Engineering Inc" and to effect a 4-for-1 forward stock split of its outstanding shares of common stock. The name change went effective on December 14, 2012 and the forward split went effective on December 17, 2012, upon the approval of Financial Industry Regulatory Authority, Inc. (FINRA). Upon the effectiveness of the forward split, the number of outstanding shares of the Company's common stock increased from 10,300,000 to 41,200,000 shares, and the number of authorized shares of common stock remained 75,000,000 shares. The effect of the forward split was applied retroactively to the Company's consolidated financial statements for the periods presented.

1

Contractual Arrangements with our Controlled Consolidated Affiliate and its Shareholders

On October 17, 2012, prior to the reverse acquisition transaction, Baichuang Consulting and Jiangsu Xuefeng and its shareholders Li Yuan and Yi Yuan entered into a series of agreements known as variable interest agreements (the "VIE Agreements") pursuant to which Jiangsu Xuefeng became Baichuang Consulting's contractually controlled affiliate. The VIE Agreements included:

|

(1)

|

an Exclusive Technical Service and Business Consulting Agreement between Baichuang Consulting and Jiangsu Xuefeng pursuant to which Baichuang Consulting is to provide technical support and consulting services to Jiangsu Xuefeng in exchange for (i) 95% of the total annual net profit of Jiangsu Xuefeng plus (ii) RMB100,000 per month (approximately U.S.$16,000).

|

|

|

|

|

(2)

|

a Call Option Agreement among Li Yuan and Yi Yuan (together referred to as "Jiangsu Xuefeng Shareholders"), and Baichuang Consulting under which the Jiangsu Xuefeng Shareholders have granted to Baichuang Consulting the irrevocable right and option to acquire all of the equity interests in Jiangsu Xuefeng to the extent permitted by PRC law. If PRC law limits the percentage of Jiangsu Xuefeng that Baichuang Consulting may purchase at any time, then Baichuang Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00 ($0.16) or any lower price permitted by PRC law. The Jiangsu Xuefeng Shareholders agreed to refrain from taking certain actions which might harm the value of Jiangsu Xuefeng or Baichuang Consulting's option;

|

|

|

|

|

(3)

|

a Proxy Agreement by Li Yuan and Yi Yuan pursuant to which they each authorize Baichuang Consulting to designate someone to exercise all of their shareholder decision rights with respect to Jiangsu Xuefeng; and

|

|

|

|

|

(4)

|

a Share Pledge Agreement among Li Yuan and Yi Yuan, Jiangsu Xuefeng, and Baichuang Consulting under which the Jiangsu Xuefeng Shareholders agree to pledge all of their equity in Jiangsu Xuefeng to Baichuang Consulting to guarantee Jiangsu Xuefeng's and its shareholders' performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement.

|

The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See "Risk Factors - Risks Relating to the VIE Agreements."

The foregoing description of the terms of the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement, the Proxy Agreement and the Share Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 10.1, 10.2, 10.3 and 10.4 to this report, respectively, which are incorporated by reference herein.

See "Related Party Transactions" for further information on our contractual arrangements with these parties.

2

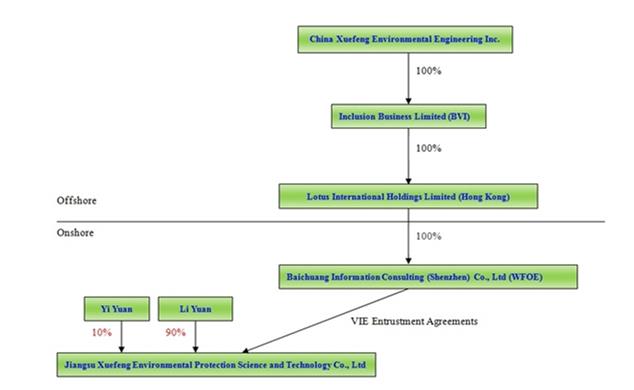

After the exchange, our current organizational structure after giving effect to the name change is as follows:

Inclusion was established in the British Virgin Islands on August 9, 2012. Lotus was established in Hong Kong on May 2, 2012 to serve as an intermediate holding company with authorized shares of 10,000 at HK$1.00 per share. Baichuang Consulting was established by Lotus as a wholly foreign owned enterprise (the "WFOE") in the PRC on September 5, 2012. Jiangsu Xuefeng, our operating consolidated affiliate, was established in the PRC on December 14, 2007. The local government of the PRC issued a certificate of approval of the foreign ownership of Baichuang Consulting by Lotus, a Hong Kong entity on September 5, 2012.

Recent Acquisition of Linyi Xuefeng

On August 2016, the Company entered into an agreement to acquire 100% interest of Linyi County Xuefeng Renewable Resources Utilization Technology Co., Ltd ("Linyi Xuefeng"), a privately-held company owned by our CEO and Chairman of the Board, Yuan Li. Pursuant to the transfer agreement, the specific transfer price is based upon the net asset amount in Linyi Xuefeng's audit report as of May 31, 2016. The Company will pay thirty percent of the transfer price with cash and seventy percent of the transfer price by issuing additional shares for the acquisition. From the date of the execution of the agreement through the period when Mr. Li Yuan and the Company complete all obligations of performing the agreement, Mr. Li Yuan shall not transfer any assets of Linyi Xuefeng under any circumstances.

Upon acquisition, Linyi Xuefeng will become a wholly-owned subsidiary of the Company. The acquisition will be accounted for as a business combination.

Our Services

As the urbanization in China progresses, the amount of household garbage increases. The processing capability of current garbage processing equipment in China cannot typically satisfy the increasing demands. We expand the garbage sorting scope and capacity of our clients' garbage processing equipment, by installing the various systems that embody the patented technology of "comprehensive and harmless garbage-processing equipment" into the client's garbage processing equipment and reconstructing their hardware, to provide upgrades and improvement to their equipment.

3

The patented technology of "harmless and comprehensive garbage processing equipment" helps to achieve high and stable garbage processing capacity, which uses a Distribution Control System (DCS) to realize mechanical automation for the comprehensive garbage treatment. The core technology is to organically integrate the anaerobic digestion and aerobic fermentation garbage process, degrade and transform the organic matter of domestic waste, effectively sort out the garbage and recycle all kinds of materials, to eventually realize the true waste resource utilization and harmless utilization, with its resource utilization and harmless utilization rate approaching 100%. The resource recovery products, biogas, can not only be used for meeting the needs of the plant itself, but also for outer supply, which greatly improves the efficiency of garbage processing of customer's equipment, decreases production cost, and increases the recovery return of garbage processing.

The comprehensive and harmless garbage processing equipment is comprised of a waste digestion pretreatment system, methane gas power generation system, sorting processing system, bricklaying building system, leachate treatment system, DCS (distribution control system), XFET-5 ecological and water-saving toilets and excrement comprehensive processing system and various material collection systems. The equipment technology is designed and manufactured based on the complicated situation of the household garbage in China. According to the features of various garbage, the equipment utilizes the wind-force, gravity, magnetic, shape, etc. to process the garbage by the combined way of machine selecting, winnowing, magnetic separation, automatic cutting, smashing and other technological processes. The equipment has large processing capacity and can run all day. The stand-alone equipment can process 500 tons to 1000 tons of garbage per day. It can sort and process complicated municipal solid waste, leaving no pollution and no residue, reaching the"3 without" standard of no waste gas, no waste water and no waste residue.

After we complete the internal system upgrade and hardware equipment improvement of the garbage equipment, we deliver the upgraded equipment to the customers. The customers will conduct inspection and performance testing to the upgraded equipment no more than one month pursuant to the contract to inspect whether the internal control system and the hardware structure can operate steadily and achieve the garbage process features. The inspection includes the following: whether the quality of the equipment and accessories after improvement can match the patented technology and process various kinds of garbage, whether the various garbage systems can process automatically, and whether the daily garbage processing capacity reaches the standard of the contract. If during the performance testing period, all the performance index can fulfill the requirements of the contract are achieved, it would be deemed that we have fully executed the agreement.

Prior to the first service agreement in April 2012, we did not conduct any business activities except for the preparation of the business and the development of the clients, etc. When we complete the upgrading service for the client, we go through the acceptance check and commissioning of the company in accordance with the contract, to make sure that the service provided met the requirements of the clients. After that, we are not subject to any additional service. The revenue we generated belongs to the service class income, with the main cost being the salaries of the staff and the leasing fees for the patent, whereas the hardware and software equipment, as well as the material used in the upgrading are the responsibility of the clients.

Until August 31, 2012, the main revenue of Jiangsu Xuefeng was generated from providing improvement and upgrading services to garbage recycling processing plants. On August 5, 2012, Jiangsu Xuefeng entered into a license agreement with Li Yuan, one of its stockholders for the use of a patent on garbage recycling processing technology, a Utility Model Patent of Comprehensive and Harmless Garbage Processing Equipment, issued by the State Intellectual Property Office (SIPO) on July 7, 2010 and valid for ten years (Patent Number: ZL 2009 2 0232893.7). The patent is owned by our Chief Executive Officer, Mr. Li Yuan. Although the license commenced on September 1, 2012 and expired in August 2017, Mr. Li Yuan has agreed to allow the company continue to use the patent under the same terms and conditions. Jiangsu Xuefeng expanded its business model from the sole service of providing upgrading to waste processing plants to also providing patent licensing based on its newly acquired use right of the patent technology. We use the patent technology to help the clients to upgrade their internal system or reconstruct the hardware equipment we have, the Company has of the garbage processing equipment so that the equipment performance could reach the standard of our patent technology. After the upgrade and reconstruction, the patent technology will continue to be used in their equipment and we allow the clients to continue using the patent technology in their equipment for patent licensing revenue. License agreements will be offered to clients for a limited period of three to five years, within which period, the client shall pay patent royalties yearly to Jiangsu Xuefeng for their use of the equipment containing the patent technology.

4

Therefore, under the new business model, Jiangsu Xuefeng generates its revenues from two sources: improvement and upgrading services of garbage processing equipment and patent licensing for the use of the upgraded technology.

For the year ended May 31, 2016, sales from improvement and upgrading services and patent licensing were $2,907,422 and $4,079,769, respectively. For the year ended May 31, 2015, sales from improvement and upgrading services and patent licensing were $3,481,780 and $3,514,320, respectively. For the year ended May 31, 2014, sales from improvement and upgrading services and patent licensing were $1,464,300 and $3,245,865, respectively.

Products and Facilities

We provide equipment improvement and upgrading service and license the patented technology to our customers. We also sell or lease garbage-processing units equipped with our patented technology.

We mainly incorporate and install the patented technology into garbage processing equipment's internal control and operation systems to achieve the requested processing capacity. During the internal system upgrading process, if any hardware equipment, such as the machine parts, is required to be reconstructed, the customers are responsible for the hardware purchase while we provide guided and assisted installation.

In addition, as our customers continue to use the equipment embodying the patented technology, they pay us a fee for the use of the patented technology.

We hope to construct our own garbage processing plant to process various environmental wastes.

Customers

None of the customers individually accounted for more than 10% of the Company's revenue during the year ended May 31, 2016 and 2015, respectively.

The following table sets forth our major customers for the year ended May 31, 2014:

|

Customers

|

Sales

(US Dollar)

|

% of

Total

Revenue

|

||||||

|

|

||||||||

|

Gaoyou Zhujia Household Garbage Process Co., Ltd

|

$

|

732,150

|

15.54

|

%

|

||||

|

Tianjin Yongtai Household Garbage Process Co., Ltd

|

$

|

707,745

|

15.03

|

%

|

||||

|

Linxiang Municipal Garbage Process Co., Ltd

|

$

|

634,530

|

13.47

|

%

|

||||

Our Industry

In the description below we rely on certain information and statistics regarding our industry and the economy in China from the reports published by National Bureau of Statistics of China and the PRC Ministry of Environmental Protection. We have no reason to believe that the information and statistics we cite are not accurate.

The Chinese industry of garbage processing is highly fragmented and in a very early-stage of development. Benefiting from a series of encouraging and supportive policies on garbage processing formulated by the Chinese government, the urban garbage processing industry has been in rapid development. The current market is primarily dominated by small regional companies, like Jiangsu Xuefeng, which account for approximately 90% of all environmental protection enterprises in China.

The volume of solid waste generated by industrial companies directly correlates to the industrial rate of utilization of natural resources and is expected to grow by over 10% per year according to the National Bureau of Statistics of China. In addition, according to estimates from the PRC Ministry of Environmental Protection, the production of industrial waste was approximately 3.25 billion tons in 2013, excluding approximately 31.57 million tons of hazardous industrial waste.

5

According to the Opinions on Further the Municipal Solid Waste Processing Service issued by the Chinese government, the harmless garbage processing rate will reach over 80% by 2015. This anticipated increase creates a strong incentive for companies to improve their garbage processing capability. Thus, the Chinese garbage processing industry has significant potential for growth both in areas of equipment marketing and equipment upgrading and improvement.

Nationwide Innocuous Disposal Facilities MSW Facilities Construction Planning (2011-2015) ("Planning"), recently passed by the Chinese government, has gone into the implementation phase. In accordance with the Planning, the aggregate investment in the items of the Planning will reach RMB 260Billion Yuan (approximately US $41 billion).

According to the Environmental Protection Equipment "Twelfth Five-Year" Development Planning, the yearly growth rate of the environmental protection industry gross output during the Twelfth Five-Year period is 20% and will reach 500 billion yuan (approximately US $79 billion) by 2015.

Thus, recently issued policies reducing the cost of Jiangsu Xuefeng operations, and anticipated future industrial policies of the Chinese government show the Chinese government's encouragement and support for the long term development of the environmental waste processing industry, setting the stage for a larger market place for the environmental protection equipment upgrading and improvement business.

Competition

Competitive Advantages

The industry for environmental protection equipment upgrading and improvement in China, being in its early stage, creates a great amount of business opportunities. We believe that, with our services and products that are supported by the patented technology and gradually gaining its market acceptance, we are well positioned to take advantage of the opportunities presented in this industry.

Competitive Disadvantages

While we saw gross profit margins of 43%, 95% and 92% for the years of 2016, 2015 and 2014, respectively, we are uncertain that our high gross profit margins are sustainable if we have to commit to substantive research and development activities when the Chinese government adopts higher standards for environmental protection technologies and when the cost of our services become substantially higher.

Our Growth Strategy

As industrial development continues its rapid increase in growth, the demand for the Company service should also increase rapidly. The Company hopes to seize the opportunity to use industrial growth of both large and medium-size enterprises, establishing cooperative relationships with high-quality customers by fully using its advantages in waste processing technology providing customers with improved environmental solutions and larger scale processing capability.

The Company will further develop the equipment upgrading business. Jiangsu Xuefeng will make the best use of its patented technology of comprehensive and harmless garbage processing equipment to carry on the improvement and upgrading service for Chinese clients. In addition, patent license agreements will be offered to clients for a limited period of three to five years, within which period, the client shall pay patent royalties yearly to Jiangsu Xuefeng for their use of the equipment containing the patent technology thus providing the Company with an additional source of revenue.

The Company hopes to establish an equipment manufacturing and sales center. While continuing to provide equipment upgrading services, Jiangsu Xuefeng intends to establish a garbage processing equipment manufacturing and sales center to meet the anticipated market needs for Chinese garbage processing equipment, gradually branching further into the Chinese garbage processing equipment market and improving the Company's revenue.

The Company plans to also undertake technical cooperation with key domestic and foreign R&D institutions and industry partners. Keeping abreast of domestic and foreign technical developments, the Company plans to make use of international and domestic newly advanced technology in comprehensive garbage processing with high daily processing capacity. The Company plans to constantly expand marketing channels and increase its market shares.

6

Markets, Sales and Distribution

Currently, our marketing and sales efforts largely rely on word of mouth among our existing clients.

Intellectual Property

The Company acquired the license of the patent technology of comprehensive and harmless garbage processing equipment" that passed the ISO9001:2008 International Quality Management System Certification through the Patent Licensing Service Agreement signed with our Chairman, Chief Executive Officer and a shareholder, Li Yuan. The Licensing Agreement commenced on September 1, 2012 with a monthly payment to Li Yuan of approximately $12,600 (RMB 80,000). Although the Licensing Agreement expired in July 2017. Mr. Li Yuan has agreed to continue licensing our company the use of the patent under the same terms and conditions. Provision 42 of the Patent Law of the People's Republic Of China (as amended in 2008) provides that "the time limit of patent for invention is twenty years, the time limit of patent of utility models and design patent is ten years, both of which are calculated from the date of application". Company has received Utility Model Patent Certificate and Certificate of Patent for Invention, from the State Intellectual Property Office of the People's Republic of China. Patent right of comprehensive disposal equipment for waste processing was terminated on July, 2009 due to the expiration of the protection period. We no longer enjoy the exclusive patent right to that technology. However, because patent for our waste sorting treatment technology was granted in July 2009 and its time limit is 20 years, we could license the use of the patent to other company until July 2029.

Comprehensive and Harmless Garbage Processing Equipment is a Utility Model Patent issued by the State Intellectual Property Office (SIPO) on July 7, 2010 and valid for ten years (Patent Number: ZL 2009 2 0232893.7). It is owned by with our Chairman. This patented technology is for the treatment of complex municipal solid waste including sorting and classification, leaving almost no pollution and no residue.

Regulation

Because our operating affiliate Jiangsu Xuefeng is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

Environmental Law

Jiangsu Xuefeng is subject to China's national Environmental Protection Law, which was enacted on December 26, 1989, as well as a number of other national and local laws and regulations governing landfills, air, water, and noise pollution and establishing pollutant discharge standards for wastewater.

On July 1, 2004, the PRC central government adopted the Measures for the Administration of Permit for Operation of Dangerous Wastes (the "Measures"). The Measures are intended to strengthen supervision and administration of activities relating to the collection, storage and disposal of dangerous wastes, and preventing dangerous wastes from polluting the environment.

Both the PRC Ministry of Environment Protection and local bureaus of environmental protection, license and regulate companies engaged in waste disposal and treatment in China. The requirements for licensing have become more stringent, with applicants having to demonstrate a sufficient operating history and a number of professional technicians, as well as comply with national and local environmental standards. The licensing process is also very time consuming and requires lengthy lead times.

7

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for our operations in the PRC.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People's Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On March 16, 2007, the National People's Congress of China passed the Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. The EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

Under the EIT Law, companies designated as High- and New-Technology Enterprises may enjoy a reduced national EIT rate of 15%. The Administrative Measures for Assessment of High-New Tech Enterprises and Catalogue of High/New Tech Domains Strongly Supported by the State (2008), jointly issued by the Ministry of Science and Technology and the Ministry of Finance and State Administration of Taxation set forth general guidelines regarding criteria as well as application procedures for qualification as a High- and New-Tech Enterprise under the EIT Law.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with "de facto management bodies" within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term "de facto management bodies" as "an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise." If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization's global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see "Risk Factors – Risks Related to Our Business – Under the EIT Law, we may be classified as a 'resident enterprise' of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders."

Our future effective income tax rate depends on various factors, such as tax legislation, the geographic composition of our pre-tax income and non-tax deductible expenses incurred. Our management carefully monitors these legal developments and will timely adjust our effective income tax rate when necessary.

8

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to a general reserve until the cumulative amount of such reserve reaches 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

The EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises' shareholder has a tax treaty with China that provides for a different withholding arrangement. Baichuang Consulting is considered a FIE and is directly held by our subsidiary in Hong Kong, Lotus. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Lotus by Baichuang Consulting, but this treatment will depend on our status as a non-resident enterprise.

PRC M&A Rule, Circular 75 and Circular 638

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, referred to as the "New M&A Rules", which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore "special purpose vehicles," that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges. Based on our understanding of current Chinese Laws and pursuant to a legal opinion issued by Jilin Changchun Law Firm dated October 17, 2012, (i) Baichuang Consulting was incorporated by a foreign investor and therefore has no Chinese shareholders; (ii) the share exchange between Inclusion and the Company, is between two offshore companies and is not deemed as a transaction to acquire equity or assets of a "Chinese domestic company" as defined under the New M&A Rules and (ii) no provision in the New M&A Rules clearly classifies the contractual arrangements between Baichuang Consulting and Jiangsu Xuefeng as a type of transaction falling within the New M&A Rules.

The SAFE issued a public notice in October 2005, or the Circular 75, requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equity of Chinese companies, referred to in the Circular 75 as special purpose vehicles, or SPVs. Chinese residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

Pursuant to the Circular 698, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly via disposing of the equity interests of an overseas holding company, which we refer to as an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an abusive arrangement in order to avoid Chinese tax, they will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

9

Insurance

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face losses from the interruption of our business as summarized under "Risk Factors – Risks Related to Our Business – We do not carry business interruption insurance so we could incur unrecoverable losses if our business is interrupted."

Our Employees

As of August 30, 2016, we had a total of 32 employees. The Company employs a highly qualified team of technically trained personnel. Among the Company's employees, 11 employees have environmental assessment engineering degrees and 10 employees have ecological and environmental protection planning qualifications. This team provides support for clients.

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

Our failure to effectively compete in the waste processing market may have a material adverse effect on our growth prospects and our ability to generate revenue.

We currently compete primarily on the basis of our ability to secure contracts with waste processing companies, and local government entities in the Jiangsu Province, China and surrounding areas for the updating of waste processing equipment. The Company is embarking on an area of growth in licensing the use of our licensed patented technology used in these updates and plans to establish our own waste processing centers. There can be no assurance that we will be able to complete such expansion without losses or that our competitors will not develop at a faster rate and offer more favorable arrangements to our current and future customers. We expect that we will be required to continue to invest in research and development and building our waste treatment and disposal infrastructure.

Our competitors include both domestic companies and international companies operating in the waste processing industry in China. Some of these competitors have significantly greater financial and marketing resources and name recognition than that of our Company at this point. As the Chinese government continues to support and encourage the development of the environmentally sound waste processing industry, more domestic and international competitors may enter the market. We believe that the Chinese market for our services is subject to intense regional competition, with a relatively limited number of large competitors. While the Company effectively competes in our current focus of updating waste processing equipment for centers in our primary regional market of Jiangsu Province and surrounding areas, our reach outside this primary market and beyond our current focus has yet to be tested and we will necessarily face new competitors in the other geographic markets into which we plan to expand. If the Chinese government continues to emphasize the spending on environmental protection and continues to allocate funds to our industry, the number of our competitors throughout China, both domestic and foreign companies, will likely increase, so we cannot assure you that we will be able to compete successfully against any new or existing competitors, or against any new technologies our competitors may develop or implement. All of these competitive factors could have a material adverse effect on our revenues, profitability and growth prospects.

10

The waste processing industry is highly regulated and our business depends on governmental permits and certifications to operate our business, the loss of any of which would have a material adverse impact on our business.

Only those companies that have been granted operating licenses issued by the PRC central and local governments are permitted to engage in the industrial waste treatment and disposal business in China. Our company is currently fully licensed to carry out our core business of updating and improving waste processing equipment, however, creation of our own waste processing center in the future will require new licenses for which we will apply. The central and local governments of the PRC impose strict requirements on companies regarding the technology which must be employed and the qualifications and training of management employees which must be maintained. While we possess the necessary permits and certifications to operate our business, our regulatory approvals authorizing our operations and activities are subject to periodic review, reassessment and renewal by Chinese authorities. Standards of compliance necessary to pass such reviews change from time to time and differ from jurisdiction to jurisdiction, leading to a degree of uncertainty. If our licenses and permits are revoked, substantially modified or not renewed or if additional permits, business licenses or approvals that may become necessary in connection with our business are not granted or are delayed, we may suffer adverse consequences. As a result, the termination or suspension of our licenses to operate would have a material adverse impact on our revenue and business.

If we fail to introduce new products or services or our existing products and services do not meet the requirements of our customers, we may not gain or may lose market share.

Our continued growth is dependent upon our ability to generate increased revenue from our existing customers, obtain new customers and raise capital from outside sources. While our current technology is at the forefront of industry developments, in order to maintain that advantage we will need to continue to pursue innovative solutions to meet our customers' needs. We believe that in order to continue to capture additional market share and generate additional revenue, we will have to raise more capital to fund the construction and installation of new facilities and to obtain additional equipment to collect, process and dispose of industrial waste and recycle waste for our existing and future customers. We anticipate that such funding will be provided through a variety of sources including bank loans, equity financing and net cash flow generated from operations.

In the future we may be unable to obtain the necessary financing for our capital requirements on a timely basis or on acceptable terms, which may prevent or delay the planned expansion of our service offerings. Our failure to provide new products or services may prevent us from retaining customers or gaining new customers, which may adversely affect our financial position, competitive position, growth and profitability. Our ability to obtain acceptable financing at any time may depend on a number of factors, including, our financial condition and results of operations; the condition of the PRC economy, the industrial waste treatment industry in the PRC, and conditions in relevant financial markets in the United States, PRC and elsewhere in the world.

The rapid expansion of our business could strain our resources and adversely affect our ability to effectively control and manage our growth.

If our business and markets grow and develop as planned, it will be necessary for us to finance and manage expansion in an efficient manner. We may face challenges in managing our waste processing equipment updating business over an expanded geographical area as well as managing expanded service offerings, including, among other things, waste processing services and patent licensing. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect our operations and cause administrative inefficiencies.

Waste processing operations can be hazardous and may subject us to civil liabilities as a result of hazards posed by such operations.

Waste processing operations are subject to potential hazards incident to the gathering, processing and storage of industrial hazardous waste such as explosions, product spills, leaks, emissions and fires. These hazards can cause personal injury and loss of life, severe damage to and destruction of property and equipment, and pollution or other environmental damage, and may result in the curtailment or suspension of operations at the affected facility. Consequently, we may face civil liabilities in the ordinary course of our business as we update the equipment which performs this process at clients' waste processing plants and as we branch into our own waste processing business. As the environmental protection industry in China is developing, there is no comprehensive insurance available to cover environmental liabilities. Although we have not faced any civil liabilities in the ordinary course of our waste processing equipment updating operations, there is no assurance that we will not face such liabilities in the future. If such liabilities occur in the future, they may have a material adverse effect on our results of operations, financial condition and business prospects.

11

Our success depends on our management team and other key personnel, the loss of any of whom could disrupt our business operations and have a material adverse effect on our financial condition, operating results and growth prospects.

Our success to date has been largely due to the contributions of our current management team, especially Chairman Li Yuan. The continued success of our business is very much dependent on the experience of the members of our management team and the goodwill that they have developed in the industry to date. As a result, our continued success is dependent, to a large extent, on our ability to retain the services of our management team and key personnel. The loss of the services of any of our management team or key personnel due to resignation, retirement, illness or otherwise without suitable replacement or the inability to attract and retain qualified personnel would have a material adverse effect on our operations and may reduce our profitability and the return on your investment. We do not currently maintain key man insurance covering our key personnel.

If we fail to adequately protect or enforce our intellectual property rights, we may be exposed to intellectual property infringement and the value of our intellectual property rights could diminish.

If we need to initiate litigation or administrative proceedings to enforce or protect our intellectual property rights, such actions may be costly and may divert management attention as well as expend other resources which could otherwise have been devoted to our business. An adverse determination in any such litigation could impair our intellectual property rights and may harm our business, prospects and reputation. In addition, historically, implementation of PRC intellectual property-related laws has been lacking, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries, which increases the risk that we may not be able to adequately protect our intellectual property. Given the relative unpredictability of China's legal system and potential difficulties enforcing a court judgment in China, there is no guarantee that we would be able to halt any unauthorized use of our intellectual property through litigation which may cause us to lose our competitive advantage and adversely affect our business and profitability.

We may face claims for infringement of third-party intellectual property rights.

We may face claims from third parties with respect to the infringement of any intellectual property rights owned by such third parties. There is no assurance that third parties will not assert claims to our processes, technologies and systems. In such an event, we may need to acquire licenses to, or to contest the validity of, issued or pending patents or claims of third parties. There can be no assurance that any license acquired under such patents would be made available to us on acceptable terms, if at all, or that we would prevail in any such contest. In addition, we would incur substantial costs and spend substantial amounts of time in defending ourselves in or contesting suits brought against us for alleged infringement of another party's patent rights. As such, our operations and business may be adversely affected by such civil actions. We rely on trade secrets, technology and know-how. There can be no assurance that other parties may not obtain knowledge of our trade secrets and processes, technology and systems. Should these events occur, our business would be affected and our profitability affected.

A significant portion of our revenue is dependent on our improvement and upgrading business. As our improvement and upgrading business has become dependent on only a limited few customers, such dependency may have a material adverse effect on our business, operating results and financial condition.

Our improvement and upgrading business greatly relies on our ability to maintain and continue to develop our customer base. Our improvement and upgrading business generated revenue from four customers for the fiscal year ended May 31, 2016. Should any of our current customers cease to require the use of our service, and if we are unable to grow our customer base on a timely basis, our operations, revenue and profitability could be materially and adversely affected.

12

BOT (Build-Operate-Transfer) projects that we may be awarded could be adversely affected by cost overruns, project delays and/or incorrect estimation of project costs.

The Company is establishing its own waste processing centers as an extension of its current business. However, any future BOT projects we may be awarded will require us to incur high up-front expenditures. Therefore, it is important that we manage such projects efficiently in terms of time, procurement of materials and allocation of resources. If our initial cost estimates are incorrect or delays occur in a project resulting in cost overruns, the profitability of that project could be adversely affected. Cost overruns due to additional rectification work and delays in completion of projects or delivery of waste to our new processing centers would adversely affect our profitability. We may also face potential liability from legal suits brought against us by our government customers for causing loss due to any delay in completing a project. In addition, we may also face potential liability from legal suits brought against us by our customers who have suffered loss due to such mismanagement or mistakes. This would also adversely affect our profitability and financial position.

Substantially all of our business operations are concentrated in Jiangsu and surrounding areas, and expose us to regional economic or market declines.

Substantially all of our revenues are generated from Jiangsu, China. Our current customer base is comprised of companies located in Jiangsu and surrounding areas. As a result, any adverse economic developments in Jiangsu could affect regional waste generation rates and demand for waste processing services which we plan to provide in the future or waste processing equipment upgrades which we currently provide to waste processing centers in Jiangsu. In addition, adverse market developments caused by increased waste disposal capacity from our competitors in this region could adversely affect waste disposal pricing. While one of our main growth strategies is to expand into other geographic markets in China, the occurrence of any adverse economic developments in Jiangsu and surrounding areas could have a material adverse effect on our business, financial condition and growth prospects.

We are subject to risks relating to expanding into other geographic markets in China outside of our principal market of Jiangsu.

To take advantage of industrialization outside of Jiangsu and to expand our service offerings to other geographic markets, we plan to establish centers for waste processing both within Jiangsu and expanding into other areas of the country. We intend to build and operate waste treatment facilities gradually.

Expansion into new geographic markets will require us to comply with rules and regulations of the applicable local government, and to address certain business issues particular to each market depending on the development and demand of customers within that market. As a result, there may be a significant period of time before any facility that we construct develops a consistent revenue stream. Accordingly, any delays or interruptions in implementing our expansion strategy or our business operations outside of Jiangsu may have a material adverse effect on our growth prospects, profitability and financial condition.

Relaxed enforcement of PRC environmental laws and governmental approvals and non-compliance by new and existing customers could have an adverse effect on our business, financial condition and growth prospects.

Companies operating in the waste treatment and disposal industry are subject to China's national Environmental Protection Law as well as a number of other national and local laws and regulations governing air, water, noise pollution and establishing pollutant discharge standards. In addition, such companies are subject to stringent licensing and certification requirements imposed by the PRC Ministry of Environmental Protection and the provincial environmental bureaus, which has created high barriers to entry for potential market participants. However, the urbanization and industrialization from China's rapid economic growth has created an increased need for waste treatment services from solid waste disposal to sewage and sludge treatment. In order to help meet the demand for such services, the central government may not strictly enforce the compliance with environmental laws and relax certain conditions to gaining governmental licensing and approvals. If such an event were to occur, there would be more competitors to our business operations and customers may turn to less expensive competitors for their waste disposal needs, which in turn, would have an adverse effect on our business, financial condition and grow prospects.

13

Fluctuations in exchange rates could adversely affect our business and the value of our securities

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and the RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People's Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market. In August 2015, the PRC Government devalued its currency by approximately 3%.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Under the EIT Law, we may be classified as a 'resident enterprise' of China

Under the New Income Tax Law, enterprises established outside the PRC whose "de facto management bodies" are located in the PRC are considered "resident enterprises" and their global income will generally be subject to the uniform 25% enterprise income tax rate. On December 6, 2007, the PRC State Council promulgated the Implementation Regulations on the New Income Tax Law (the "Implementation Regulations"), which define "de facto management bodies" as bodies that have material and overall management control over the business, personnel, accounts and properties of an enterprise. In addition, a recent circular issued by the State Administration of Taxation on April 22, 2009 provides that a foreign enterprise controlled by a PRC company or a PRC company group will be classified as a "resident enterprise" with its "de facto management bodies" located within the PRC if the following requirements are satisfied:

|

(i)

|

the senior management and core management departments in charge of its daily operations function mainly in the PRC;

|

|

|

|

|

(ii)

|

its financial and human resources decisions are subject to determination or approval by persons or bodies in the PRC;

|

|

|

|

|

(iii)

|

its major assets, accounting books, company seals, and minutes and files of its board and shareholders' meetings are located or kept in the PRC; and

|

|

|

|

|

(iv)

|

more than half of the enterprise's directors or senior management with voting rights reside in the PRC.

|

Because the EIT Law, its implementing rules and the recent circular are relatively new, no official interpretation or application of this new "resident enterprise" classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

14

If the PRC tax authorities determine that we are a "resident enterprise" for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us from our PRC subsidiary would qualify as "tax-exempt income," we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new "resident enterprise" classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

We do not carry business interruption insurance so we could incur unrecoverable losses if our business is interrupted

We are subject to risk inherent to our business, including equipment failure, theft, natural disasters, industrial accidents, labor disturbances, business interruptions, property damage, product liability, personal injury and death. We do not carry any business interruption insurance or third-party liability insurance or other insurance to cover risks associated with our business. As a result, if we suffer losses, damages or liabilities, including those caused by natural disasters or other events beyond our control and we are unable to make a claim against a third party, we will be required to bear all such losses from our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

We will incur increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We will be subject to the reporting and other requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and the Dodd-Frank Wall Street Reform and Protection Act. These rules and regulations will require, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition and establish and maintain effective disclosure and financial controls and corporate governance practices. We expect these rules and regulations to substantially increase our legal and financial compliance costs and to make some activities more time-consuming and costly. Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives.

We qualify as an "emerging growth company" under the jobs act of 2012

We are an "emerging growth company," as defined in the JOBS Act, and, for as long as we continue to be an "emerging growth company," we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to "emerging growth companies," including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use the extended transition period provided above and therefore our financial statements may not be comparable to companies that comply with public company effective dates.

Because of the exemptions from various reporting requirements provided to us as an "emerging growth company," we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our reports are not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

15

Risks Related to Doing Business in the PRC

We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

The PRC's economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the central government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, we cannot assure you that this will be the case. A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, we cannot assure you that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social environment.

Introduction of new laws or changes to existing laws by the PRC government may adversely affect our business.

The PRC legal system is a codified legal system made up of written laws, regulations, circulars, administrative directives and internal guidelines. Unlike common law jurisdictions like the U.S., decided cases (which may be taken as reference) do not form part of the legal structure of the PRC and thus have no binding effect on subsequent cases with similar issues and fact patterns. Furthermore, in line with its transformation from a centrally-planned economy to a more free market-oriented economy, the PRC government is still in the process of developing a comprehensive set of laws and regulations. As the legal system in the PRC is still evolving, laws and regulations or the interpretation of the same may be subject to further changes. For example, the PRC government may impose restrictions on the amount of service fees that may be payable by municipal governments to wastewater and sludge treatment service providers. Also, the PRC central and municipal governments may impose more stringent environmental regulations which would affect our ability to comply with, or our costs to comply with, such regulations. Such changes, if implemented, may adversely affect our business operations and may reduce our profitability.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material adverse effect on our business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. We are required to comply with PRC laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our operations, financial condition, and business prospects.

16

A slowdown or other adverse developments in the PRC economy or other major economies all over the world may have a material adverse effect on our customers' demand for our services and our business. A slowdown in the economic growth in the PRC has recently occurred.