Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | scusa8-k9x30x16earningsfin.htm |

| EX-99.1 - EXHIBIT 99.1 - Santander Consumer USA Holdings Inc. | exhibit991september302016.htm |

11.09.2016

SANTANDER CONSUMER USA HOLDINGS INC.

Third Quarter 2016

2IMPORTANT INFORMATION

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our

expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking.

These statements are often, but not always, made through the use of words or phrases such as anticipates, believes, can, could, may, predicts, potential, should,

will, estimates, plans, projects, continuing, ongoing, expects, intends, and similar words or phrases. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties that are subject to

change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled Risk Factors

and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the U.S. Securities and Exchange Commission (SEC).

Among the factors that could cause the forward-looking statements in this press release and/or our financial performance to differ materially from that suggested

by the forward-looking statements are (a) the inherent limitations in internal controls over financial reporting; (b) our ability to remediate any material weaknesses

in internal controls over financial reporting completely and in a timely manner; (c) continually changing federal, state, and local laws and regulations could

materially adversely affect our business; (d) adverse economic conditions in the United States and worldwide may negatively impact our results; (e) our business

could suffer if our access to funding is reduced; (f) significant risks we face implementing our growth strategy, some of which are outside our control; (g)

unexpected costs and delays in connection with exiting our personal lending business; (h) our agreement with Fiat Chrysler Automobiles US LLC may not result in

currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (i) our business could

suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (j) our financial condition, liquidity, and results of operations

depend on the credit performance of our loans; (k) loss of our key management or other personnel, or an inability to attract such management and personnel; (l)

certain regulations, including but not limited to oversight by the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the

European Central Bank, and the Federal Reserve, whose oversight and regulation may limit certain of our activities, including the timing and amount of dividends

and other limitations on our business; and (m) future changes in our relationship with Banco Santander that could adversely affect our operations. If one or more

of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially

from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking

information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should

not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the

impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained

in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any

forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable

to us are expressly qualified by these cautionary statements.

33Q16 HIGHLIGHTS

» Net income of $214 million, or $0.59 per diluted common share

» One-time tax benefit of $0.03 per diluted common share

» Net interest income of $1.2 billion

» ROA of 2.2% and ROE of 17.1%

» Total auto originations of $5.2 billion, down 31% vs. prior year third quarter

» Underwriting standards remain disciplined in a competitive environment impacting short term market share

» Lease originations of $1.3 billion, down 17% vs. prior year third quarter

» QoQ nonprime originations up 13%

» Expense ratio of 2.2%, as SC continues to leverage scale to manage expenses

» Continued strength of ABS platforms evidenced by the upgrade of 90 ABS tranches by Moody’s, S&P and Fitch across multiple

platforms during the quarter, positively impacting more than $7 billion in securities

» Retail installment contract (RIC) net charge-off ratio of 8.7%; up 50 bps year-over-year driven by slower portfolio growth, fewer

bankruptcy sales and lower recovery rates

» CET1 ratio of 13.1%, demonstrating SC’s ability to generate earnings and capital

» During 2Q16 SC executed a subservicing agreement with its Puerto Rico entity, Santander Consumer International (“SCI”), to

service the performing portion of SC’s loan and lease portfolio

» Call center operations to begin by the end of 2016, adding geographic and time-zone diversification as well as proximity

to existing SC servicing vendors facilitating improved oversight

SC continues to be a leader in the auto finance industry, and consistently demonstrates strength in its operational capabilities.

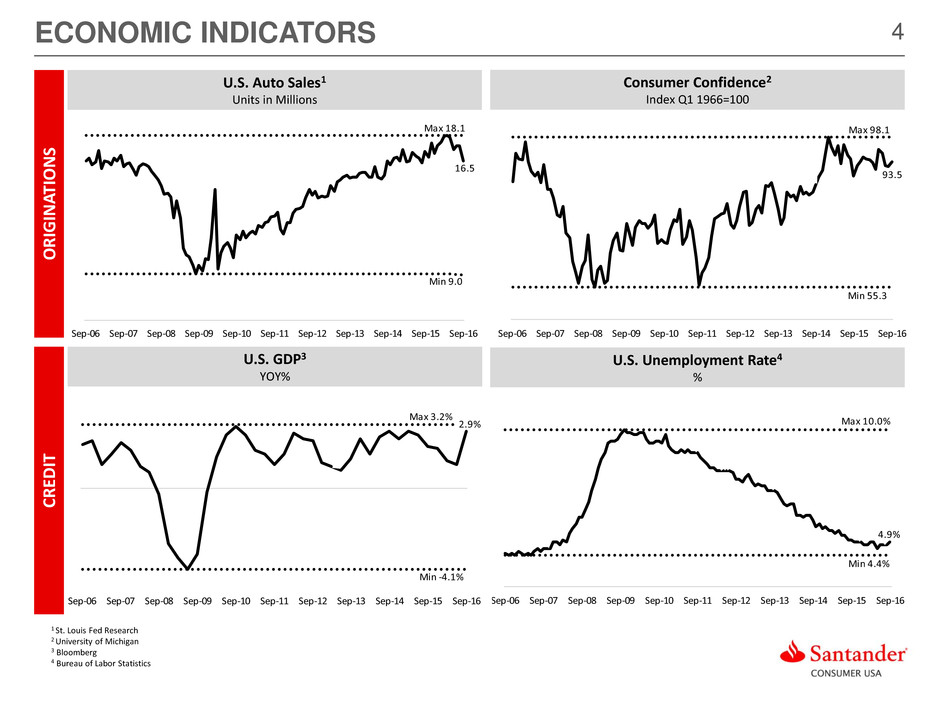

4ECONOMIC INDICATORS

U.S. Auto Sales1

Units in Millions

1 St. Louis Fed Research

2 University of Michigan

3 Bloomberg

4 Bureau of Labor Statistics

Consumer Confidence2

Index Q1 1966=100

U.S. GDP3

YOY%

U.S. Unemployment Rate4

%

OR

IGIN

A

TI

O

N

S

CRE

D

IT

16.5

Max 18.1

Min 9.0

Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16

93.5

Max 98.1

Min 55.3

Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-1 Sep-12 S - 3 Sep-14 Sep-15 Sep-16

2.9%

Max 3.2%

Min -4.1%

Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16

4.9%

Max 10.0%

Min 4.4%

Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16

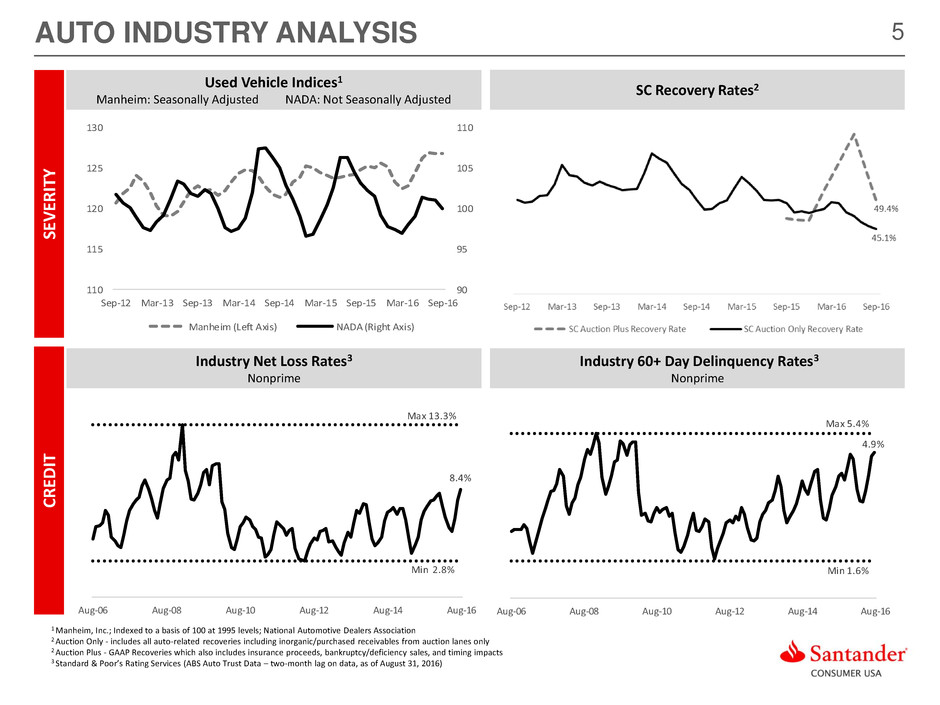

5

4.9%

Max 5.4%

Min 1.6%

Aug-06 Aug-08 Aug-10 Aug-12 Aug-14 Aug-16

AUTO INDUSTRY ANALYSIS

Used Vehicle Indices1

Manheim: Seasonally Adjusted NADA: Not Seasonally Adjusted

1 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels; National Automotive Dealers Association

2 Auction Only - includes all auto-related recoveries including inorganic/purchased receivables from auction lanes only

2 Auction Plus - GAAP Recoveries which also includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts

3 Standard & Poor’s Rating Services (ABS Auto Trust Data – two-month lag on data, as of August 31, 2016)

SC Recovery Rates2

Industry Net Loss Rates3

Nonprime

Industry 60+ Day Delinquency Rates3

Nonprime

SE

V

ER

IT

Y

CRE

D

IT

8.4%

Max 13.3%

Min 2.8%

Aug-06 Aug-08 Aug-10 Aug-12 Aug-14 Aug-16

90

95

100

105

110

110

115

120

125

130

Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 Sep-16

Manheim (Left Axis) NADA (Right Axis)

6

VEHICLE FINANCE

LEVERAGING TECHNOLOGY IS INTEGRAL TO THE FOUR PILLARS OF OUR FOCUSED BUSINESS MODEL

FOCUSED BUSINESS MODEL

DISCIPLINED APPROACH TO MARKET

SIMPLE, PERSONAL, FAIR APPROACH WITH

CUSTOMERS, EMPLOYEES AND ALL CONSTITUENCIES

SERVICED FOR OTHERS

FUNDING AND LIQUIDITY CULTURE OF COMPLIANCE

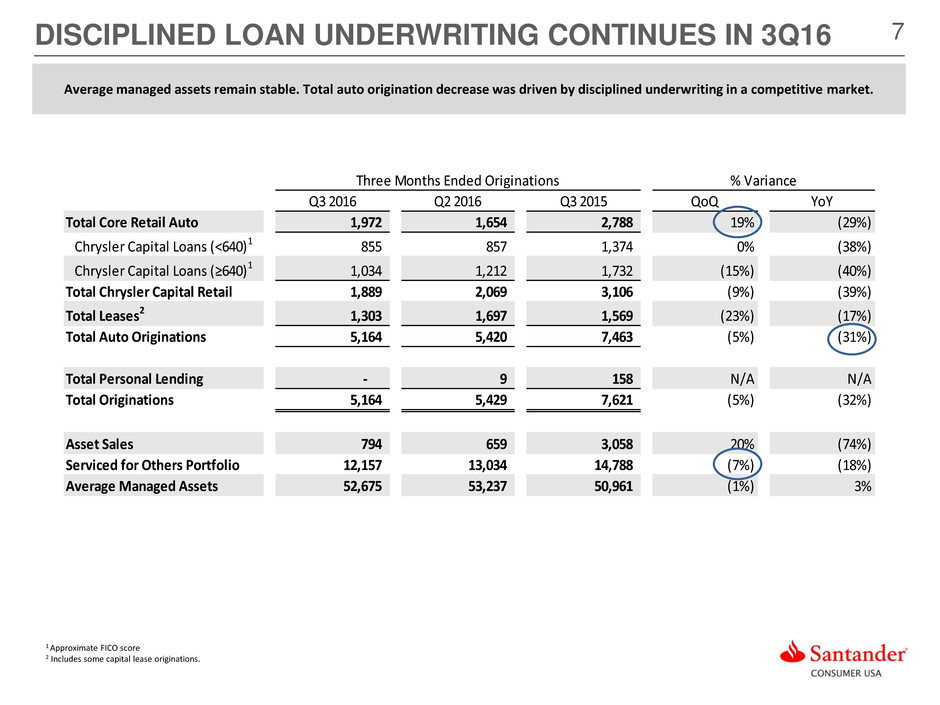

7DISCIPLINED LOAN UNDERWRITING CONTINUES IN 3Q16

1 Approximate FICO score

2 Includes some capital lease originations.

Average managed assets remain stable. Total auto origination decrease was driven by disciplined underwriting in a competitive market.

Q3 2016 Q2 2016 Q3 2015 QoQ YoY

Total Core Retail Auto 1,972 1,654 2,788 19% (29%)

Chrysler Capital Loans (<640)1 855 857 1,374 0% (38%)

Chrysler Capital Loans (≥640)1 1,034 1,212 1,732 (15%) (40%)

Total Chrysler Capital Retail 1,889 2,069 3,106 (9%) (39%)

Total Leases2 1,303 1,697 1,569 (23%) (17%)

Total Auto Originations 5,164 5,420 7,463 (5%) (31%)

Total Personal Lending - 9 158 N/A N/A

Total Originations 5,164 5,429 7,621 (5%) (32%)

Asset Sales 794 659 3,058 20% (74%)

Serviced for Others Portfolio 12,157 13,034 14,788 (7%) (18%)

Average Managed Assets 52,675 53,237 50,961 (1%) 3%

Three Months Ended Originations % Variance

8

3% 4% 4% 3% 2%

15% 12% 14% 13% 12%

14%

12%

15%

12% 13%

22%

20%

22%

20% 23%

12%

12%

13%

13%

14%

33%

39%

32%

40%

35%

3Q15 4Q15 1Q16 2Q16 3Q16

Originations by Credit (RIC only)

($ in millions)

>640

600-639

540-599

<540

No FICO

Commercial

$4,929 $5,162$5,894 $3,723 $3,861

RECENT ORIGINATIONS EXHIBIT HIGHER CREDIT QUALITY

1 Loans to commercial borrowers; no FICO score obtained

1

% of RIC originations <600 FICO have declined YoY

Consistent with disciplined pricing strategy and track

record of leveraging performance and data into new

originations

YoY increase in loans >600 FICO driven by Fiat Chrysler

(“FCA”) relationship

Stable mix of new and used vehicle originations YoY

Average loan balances for new/used originations down YoY

Average loan balance

in dollars

$22,165 $23,721 $21,745 $21,929 $21,482

55% 61% 51% 57% 56%

45% 39% 49% 43% 44%

3Q15 4Q15 1Q16 2Q16 3Q16

New/Used Originations

($ in millions)

Used

New

$5,894 $3,861$5,162$4,929 $3,723

49%45%

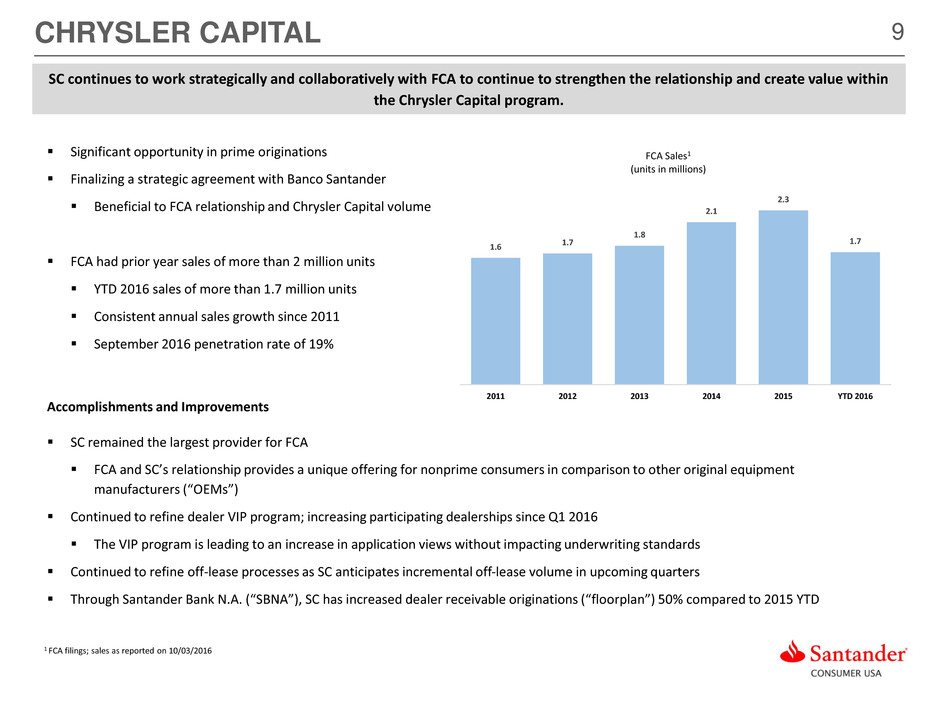

9

Significant opportunity in prime originations

Finalizing a strategic agreement with Banco Santander

Beneficial to FCA relationship and Chrysler Capital volume

FCA had prior year sales of more than 2 million units

YTD 2016 sales of more than 1.7 million units

Consistent annual sales growth since 2011

September 2016 penetration rate of 19%

Accomplishments and Improvements

SC remained the largest provider for FCA

FCA and SC’s relationship provides a unique offering for nonprime consumers in comparison to other original equipment

manufacturers (“OEMs”)

Continued to refine dealer VIP program; increasing participating dealerships since Q1 2016

The VIP program is leading to an increase in application views without impacting underwriting standards

Continued to refine off-lease processes as SC anticipates incremental off-lease volume in upcoming quarters

Through Santander Bank N.A. (“SBNA”), SC has increased dealer receivable originations (“floorplan”) 50% compared to 2015 YTD

CHRYSLER CAPITAL

1 FCA filings; sales as reported on 10/03/2016

SC continues to work strategically and collaboratively with FCA to continue to strengthen the relationship and create value within

the Chrysler Capital program.

1.6 1.7

1.8

2.1

2.3

1.7

2011 2012 2013 2014 2015 YTD 2016

FCA Sales1

(units in millions)

10

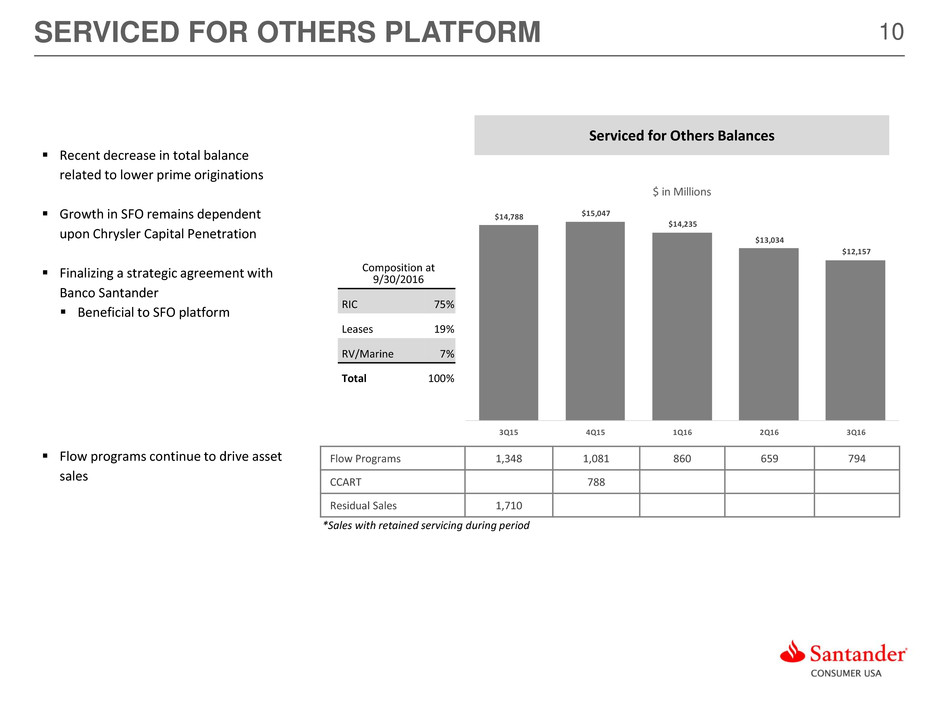

$14,788 $15,047

$14,235

$13,034

$12,157

3Q15 4Q15 1Q16 2Q16 3Q16

$ in Millions

Flow Programs 1,348 1,081 860 659 794

CCART 788

Residual Sales 1,710

Recent decrease in total balance

related to lower prime originations

Growth in SFO remains dependent

upon Chrysler Capital Penetration

Finalizing a strategic agreement with

Banco Santander

Beneficial to SFO platform

SERVICED FOR OTHERS PLATFORM

Composition at

9/30/2016

RIC 75%

Leases 19%

RV/Marine 7%

Total 100%

Serviced for Others Balances

Flow programs continue to drive asset

sales

*Sales with retained servicing during period

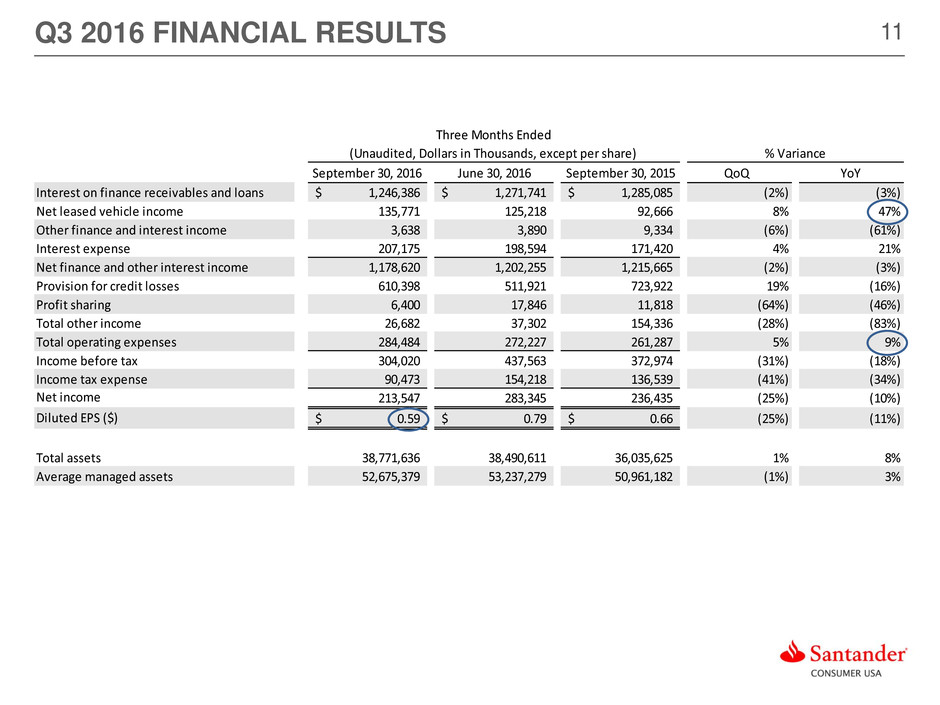

11Q3 2016 FINANCIAL RESULTS

September 30, 2016 June 30, 2016 September 30, 2015 QoQ YoY

Interest on finance receivables and loans 1,246,386$ 1,271,741$ 1,285,085$ (2%) (3%)

Net leased vehicle income 135,771 125,218 92,666 8% 47%

Other finance and interest income 3,638 3,890 9,334 (6%) (61%)

Interest expense 207,175 198,594 171,420 4% 21%

Net finance and other interest income 1,178,620 1,202,255 1,215,665 (2%) (3%)

Provision for credit losses 610,398 511,921 723,922 19% (16%)

Profit sharing 6,400 17,846 11,818 (64%) (46%)

Total other income 26,682 37,302 154,336 (28%) (83%)

Total operating expenses 284,484 272,227 261,287 5% 9%

Income before tax 304,020 437,563 372,974 (31%) (18%)

Income tax expense 90,473 154,218 136,539 (41%) (34%)

Net income 213,547 283,345 236,435 (25%) (10%)

Diluted EPS ($) 0.59$ 0.79$ 0.66$ (25%) (11%)

Total assets 38,771,636 38,490,611 36,035,625 1% 8%

Average managed assets 52,675,379 53,237,279 50,961,182 (1%) 3%

Three Months Ended

(Unaudited, Dollars in Thousands, except per share) % Variance

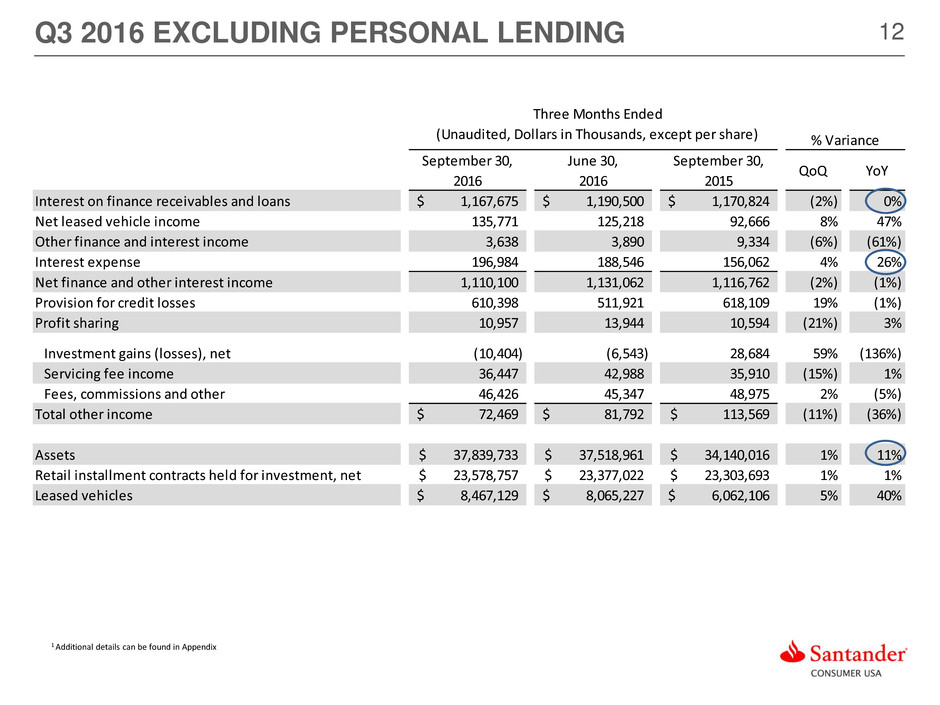

12

September 30,

2016

June 30,

2016

September 30,

2015

QoQ YoY

Interest on finance receivables and loans 1,167,675$ 1,190,500$ 1,170,824$ (2%) 0%

Net leased vehicle income 135,771 125,218 92,666 8% 47%

Other finance and interest income 3,638 3,890 9,334 (6%) (61%)

Interest expense 196,984 188,546 156,062 4% 26%

Net finance and other interest income 1,110,100 1,131,062 1,116,762 (2%) (1%)

Provision for credit losses 610,398 511,921 618,109 19% (1%)

Profit sharing 10,957 13,944 10,594 (21%) 3%

Investment gains (losses), net (10,404) (6,543) 28,684 59% (136%)

Servicing fee income 36,447 42,988 35,910 (15%) 1%

Fees, commissions and other 46,426 45,347 48,975 2% (5%)

Total other income 72,469$ 81,792$ 113,569$ (11%) (36%)

Assets 37,839,733$ 37,518,961$ 34,140,016$ 1% 11%

Retail installment contracts held for investment, net 23,578,757$ 23,377,022$ 23,303,693$ 1% 1%

Leased vehicles 8,467,129$ 8,065,227$ 6,062,106$ 5% 40%

Three Months Ended

(Unaudited, Dollars in Thousands, except per share) % Variance

Q3 2016 EXCLUDING PERSONAL LENDING

1 Additional details can be found in Appendix

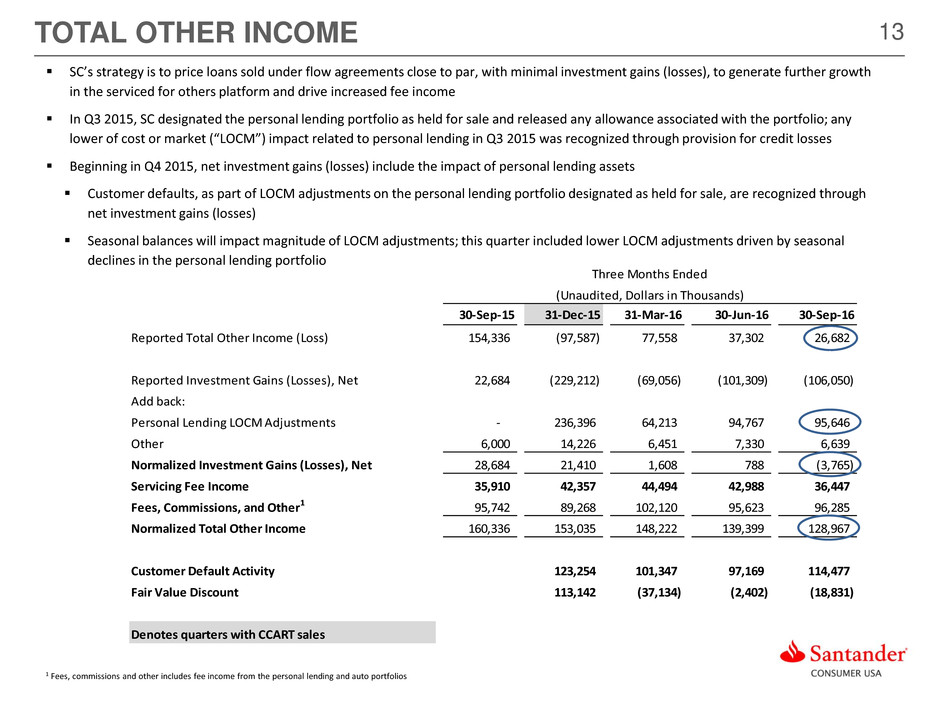

13

30-Sep-15 31-Dec-15 31-Mar-16 30-Jun-16 30-Sep-16

Reported Total Other Income (Loss) 154,336 (97,587) 77,558 37,302 26,682

Reported Investment Gains (Losses), Net 22,684 (229,212) (69,056) (101,309) (106,050)

Add back:

Personal Lending LOCM Adjustments - 236,396 64,213 94,767 95,646

Other 6,000 14,226 6,451 7,330 6,639

Normalized Investment Gains (Losses), Net 28,684 21,410 1,608 788 (3,765)

Servicing Fee Income 35,910 42,357 44,494 42,988 36,447

Fees, Commissions, and Other1 95,742 89,268 102,120 95,623 96,285

Normalized Total Other Income 160,336 153,035 148,222 139,399 128,967

Customer Default Activity 123,254 101,347 97,169 114,477

Fair Value Discount 113,142 (37,134) (2,402) (18,831)

Denotes quarters with CCART sales

Three Months Ended

(Unaudited, Dollars in Thousands)

TOTAL OTHER INCOME

SC’s strategy is to price loans sold under flow agreements close to par, with minimal investment gains (losses), to generate further growth

in the serviced for others platform and drive increased fee income

In Q3 2015, SC designated the personal lending portfolio as held for sale and released any allowance associated with the portfolio; any

lower of cost or market (“LOCM”) impact related to personal lending in Q3 2015 was recognized through provision for credit losses

Beginning in Q4 2015, net investment gains (losses) include the impact of personal lending assets

Customer defaults, as part of LOCM adjustments on the personal lending portfolio designated as held for sale, are recognized through

net investment gains (losses)

Seasonal balances will impact magnitude of LOCM adjustments; this quarter included lower LOCM adjustments driven by seasonal

declines in the personal lending portfolio

1 Fees, commissions and other includes fee income from the personal lending and auto portfolios

14

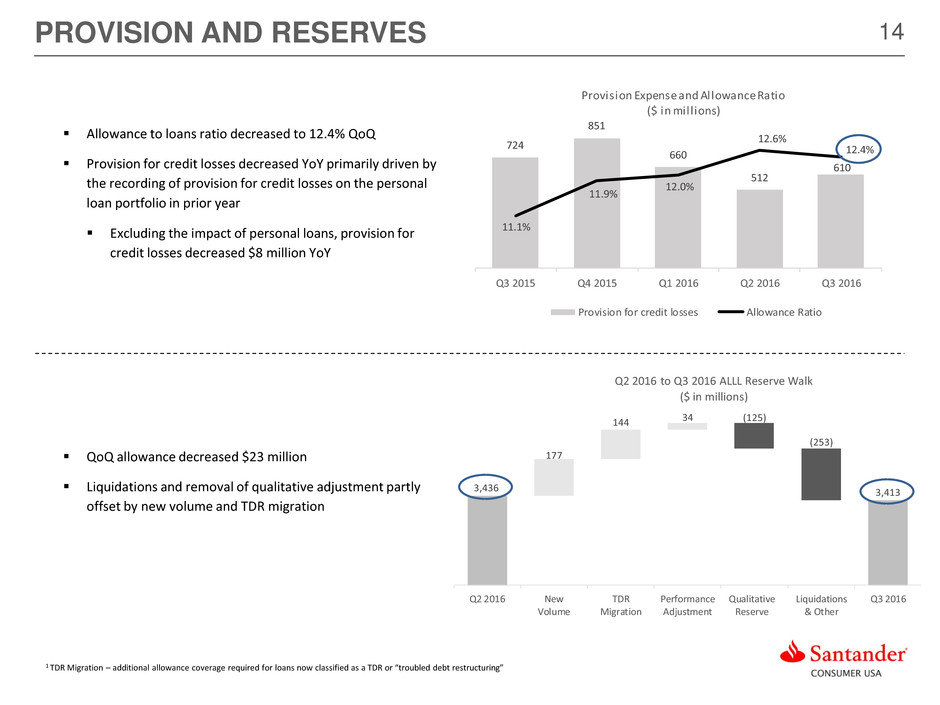

3,436

177

144 34 (125)

(253)

3,413

3000

3100

3200

3300

3400

3500

3600

3700

3800

3900

Q2 2016 New

Volume

TDR

Migration

Performance

Adjustment

Qualitative

Reserve

Liquidations

& Other

Q3 2016

Q2 2016 to Q3 2016 ALLL Reserve Walk

($ in millions)

724

851

660

512

610

11.1%

11.9%

12.0%

12.6%

12.4%

10.0%

10.5%

11.0%

11.5%

12.0%

12.5%

13.0%

0

100

200

300

400

500

600

700

800

900

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Provision Expense and Allowance Ratio

($ in mill ions)

Provision for credit losses Allowance Ratio

PROVISION AND RESERVES

Allowance to loans ratio decreased to 12.4% QoQ

Provision for credit losses decreased YoY primarily driven by

the recording of provision for credit losses on the personal

loan portfolio in prior year

Excluding the impact of personal loans, provision for

credit losses decreased $8 million YoY

QoQ allowance decreased $23 million

Liquidations and removal of qualitative adjustment partly

offset by new volume and TDR migration

1 TDR Migration – additional allowance coverage required for loans now classified as a TDR or “troubled debt restructuring”

15

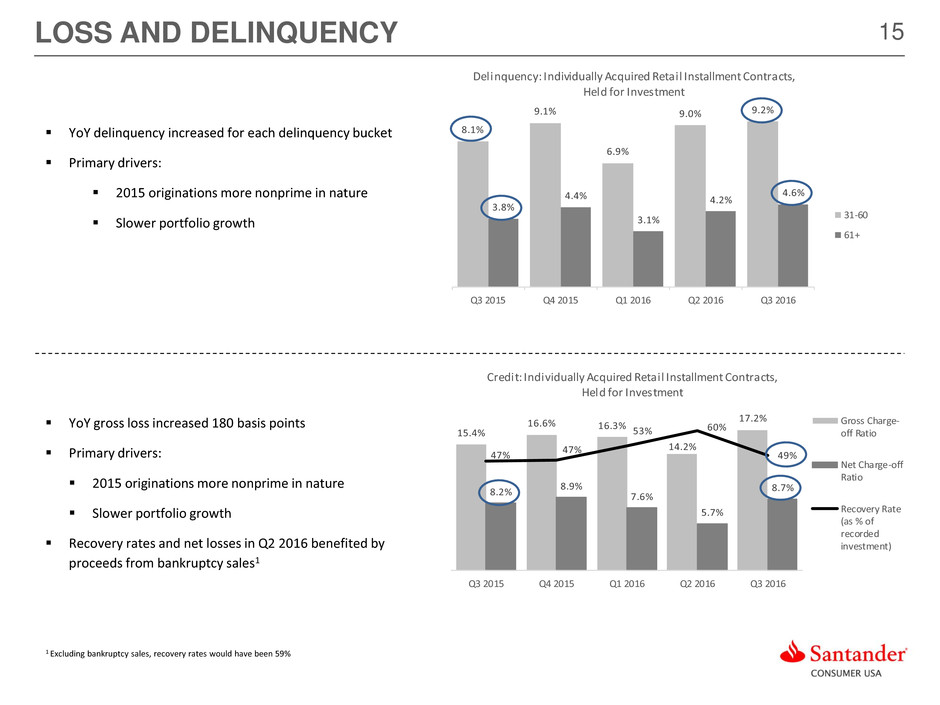

15.4%

16.6% 16.3%

14.2%

17.2%

8.2%

8.9%

7.6%

5.7%

8.7%

47%

47%

53% 60%

49%

0%

10%

20%

30%

40%

50%

60%

70%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Credit: Individually Acquired Retail Installment Contracts,

Held for Investment

Gross Charge-

off Ratio

Net Charge-off

Ratio

Recovery Rate

(as % of

recorded

investment)

LOSS AND DELINQUENCY

YoY delinquency increased for each delinquency bucket

Primary drivers:

2015 originations more nonprime in nature

Slower portfolio growth

YoY gross loss increased 180 basis points

Primary drivers:

2015 originations more nonprime in nature

Slower portfolio growth

Recovery rates and net losses in Q2 2016 benefited by

proceeds from bankruptcy sales1

1 Excluding bankruptcy sales, recovery rates would have been 59%

8.1%

9.1%

6.9%

9.0% 9.2%

3.8%

4.4%

3.1%

4.2%

4.6%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Delinquency: Individually Acquired Retail Installment Contracts,

Held for Investment

31-60

61+

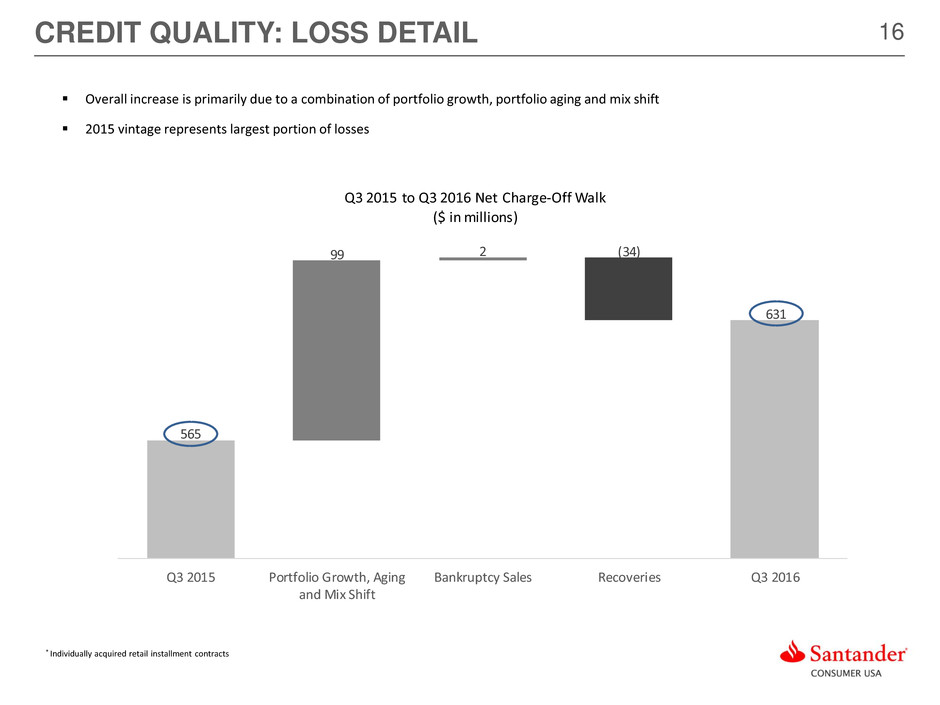

16CREDIT QUALITY: LOSS DETAIL

Overall increase is primarily due to a combination of portfolio growth, portfolio aging and mix shift

2015 vintage represents largest portion of losses

* Individually acquired retail installment contracts

565

631

99 2 (34)

Q3 2015 Portfolio Growth, Aging

and Mix Shift

Bankruptcy Sales Recoveries Q3 2016

Q3 2015 to Q3 2016 Net Charge-Off Walk

($ in millions)

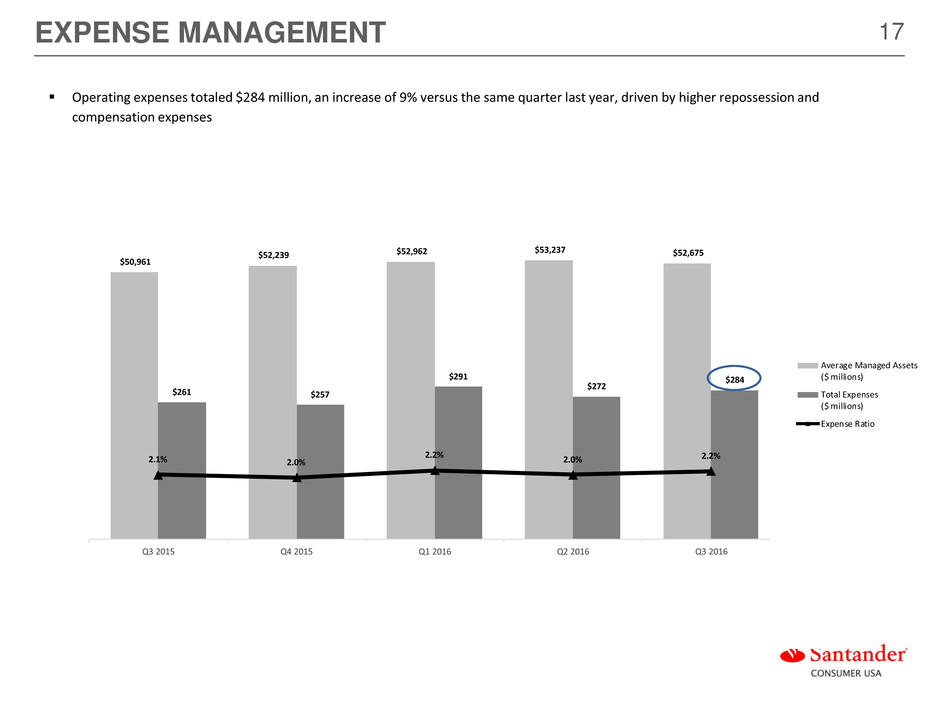

17

$50,961

$52,239 $52,962

$53,237 $52,675

$261 $257

$291

$272

$284

2.1% 2.0%

2.2% 2.0% 2.2%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

$2

$10,002

$20,002

$30,002

$40,002

$50,002

$60,002

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Average Managed Assets

($ millions)

Total Expenses

($ millions)

Expense Ratio

EXPENSE MANAGEMENT

Operating expenses totaled $284 million, an increase of 9% versus the same quarter last year, driven by higher repossession and

compensation expenses

18

7.0 8.3

3.8 2.5

Q2 2016 Q3 2016

Unused Used

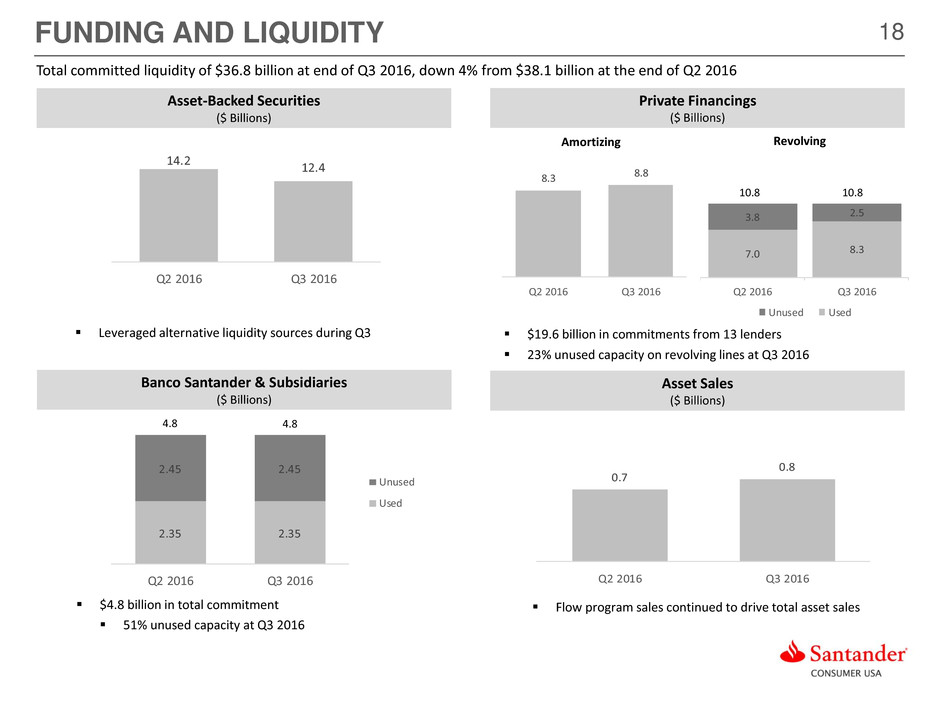

FUNDING AND LIQUIDITY

Total committed liquidity of $36.8 billion at end of Q3 2016, down 4% from $38.1 billion at the end of Q2 2016

Asset-Backed Securities

($ Billions)

Private Financings

($ Billions)

Banco Santander & Subsidiaries

($ Billions)

Asset Sales

($ Billions)

Leveraged alternative liquidity sources during Q3

$4.8 billion in total commitment

51% unused capacity at Q3 2016

Flow program sales continued to drive total asset sales

Amortizing Revolving

10.8

$19.6 billion in commitments from 13 lenders

23% unused capacity on revolving lines at Q3 2016

10.8

14.2

12.4

Q2 2016 Q3 2016

8.3 8.8

Q2 2016 Q3 2016

0.7

0.8

Q2 2016 Q3 2016

2.35 2.35

2.45 2.45

Q2 2016 Q3 2016

Unused

Used

4.8 4.8

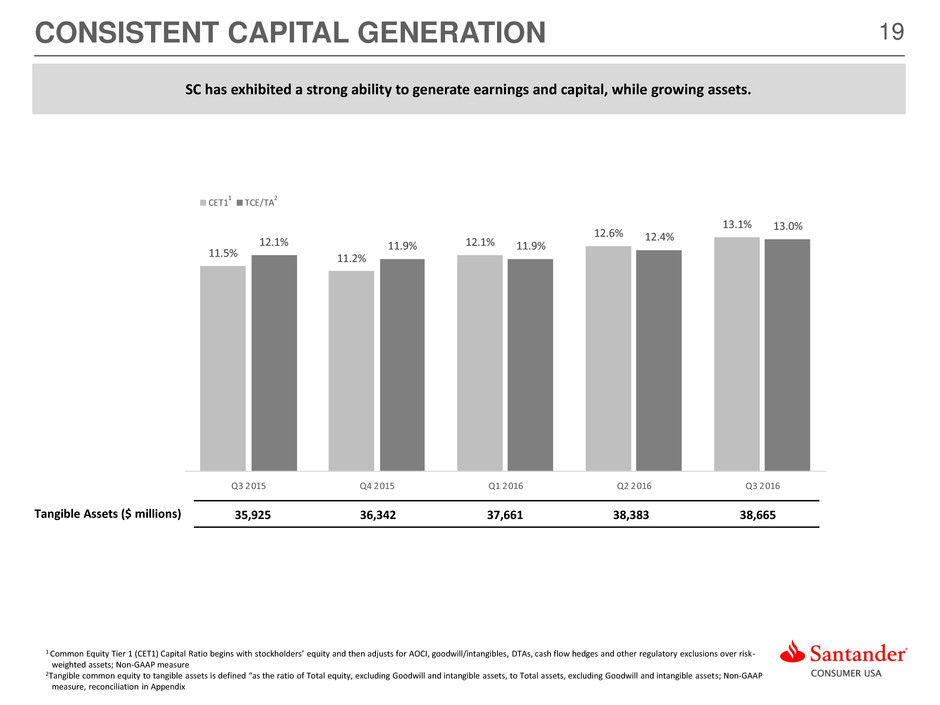

19CONSISTENT CAPITAL GENERATION

1 Common Equity Tier 1 (CET1) Capital Ratio begins with stockholders’ equity and then adjusts for AOCI, goodwill/intangibles, DTAs, cash flow hedges and other regulatory exclusions over risk-

weighted assets; Non-GAAP measure

2Tangible common equity to tangible assets is defined “as the ratio of Total equity, excluding Goodwill and intangible assets, to Total assets, excluding Goodwill and intangible assets; Non-GAAP

measure, reconciliation in Appendix

1 2

SC has exhibited a strong ability to generate earnings and capital, while growing assets.

Tangible Assets ($ millions) 35,925 36,342 37,661 38,383 38,665

11.5% 11.2%

12.1%

12.6%

13.1%

12.1% 11.9% 11.9%

12.4%

13.0%

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

CET1 TCE/TA

APPENDIX

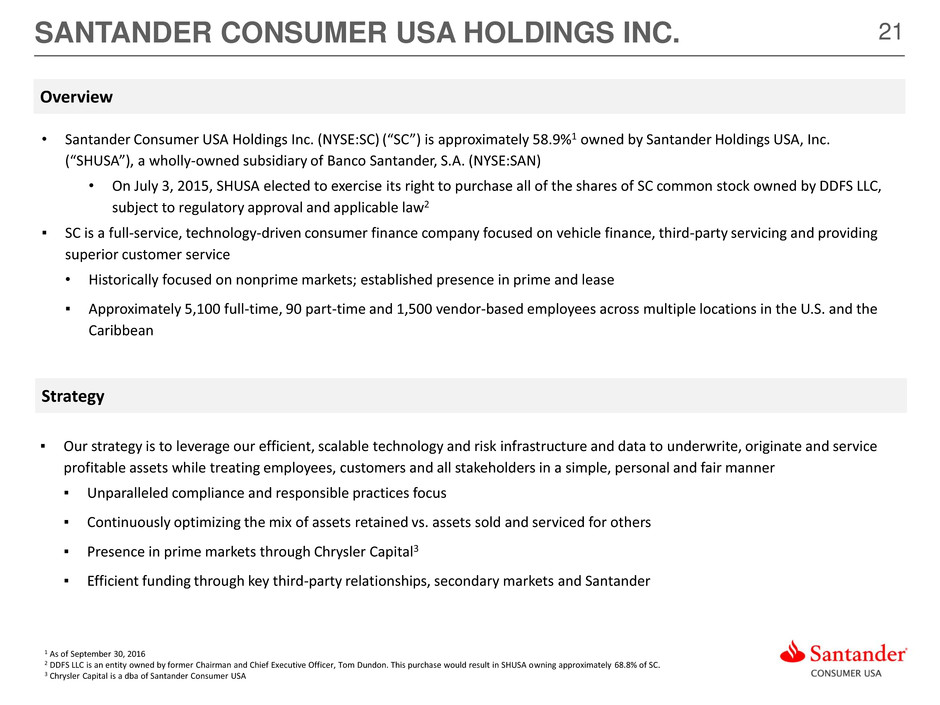

21SANTANDER CONSUMER USA HOLDINGS INC.

1 As of September 30, 2016

2 DDFS LLC is an entity owned by former Chairman and Chief Executive Officer, Tom Dundon. This purchase would result in SHUSA owning approximately 68.8% of SC.

3 Chrysler Capital is a dba of Santander Consumer USA

• Santander Consumer USA Holdings Inc. (NYSE:SC) (“SC”) is approximately 58.9%1 owned by Santander Holdings USA, Inc.

(“SHUSA”), a wholly-owned subsidiary of Banco Santander, S.A. (NYSE:SAN)

• On July 3, 2015, SHUSA elected to exercise its right to purchase all of the shares of SC common stock owned by DDFS LLC,

subject to regulatory approval and applicable law2

▪ SC is a full-service, technology-driven consumer finance company focused on vehicle finance, third-party servicing and providing

superior customer service

• Historically focused on nonprime markets; established presence in prime and lease

▪ Approximately 5,100 full-time, 90 part-time and 1,500 vendor-based employees across multiple locations in the U.S. and the

Caribbean

▪ Our strategy is to leverage our efficient, scalable technology and risk infrastructure and data to underwrite, originate and service

profitable assets while treating employees, customers and all stakeholders in a simple, personal and fair manner

▪ Unparalleled compliance and responsible practices focus

▪ Continuously optimizing the mix of assets retained vs. assets sold and serviced for others

▪ Presence in prime markets through Chrysler Capital3

▪ Efficient funding through key third-party relationships, secondary markets and Santander

Overview

Strategy

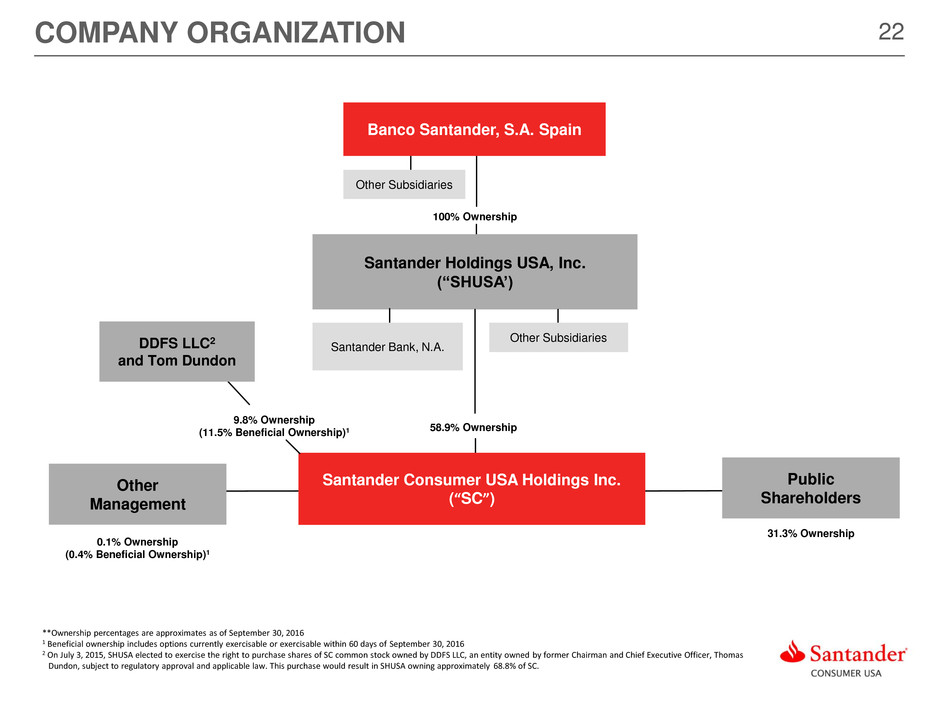

22COMPANY ORGANIZATION

Other Subsidiaries

100% Ownership

Santander Holdings USA, Inc.

(“SHUSA’)

58.9% Ownership

Santander Consumer USA Holdings Inc.

(“SC”)

Santander Bank, N.A.

Other Subsidiaries

9.8% Ownership

(11.5% Beneficial Ownership)1

DDFS LLC2

and Tom Dundon

0.1% Ownership

(0.4% Beneficial Ownership)1

31.3% Ownership

Other

Management

Public

Shareholders

Banco Santander, S.A. Spain

**Ownership percentages are approximates as of September 30, 2016

1 Beneficial ownership includes options currently exercisable or exercisable within 60 days of September 30, 2016

2 On July 3, 2015, SHUSA elected to exercise the right to purchase shares of SC common stock owned by DDFS LLC, an entity owned by former Chairman and Chief Executive Officer, Thomas

Dundon, subject to regulatory approval and applicable law. This purchase would result in SHUSA owning approximately 68.8% of SC.

23HELD FOR INVESTMENT CREDIT TRENDS

Retail Installment Contracts1

1Held for investment; excludes assets held for sale

3.9

% 12.

2%

23.

8%

30.

4%

17.

1%

12.

6%

4.0

% 12.

2%

23.

4%

30.

9%

17.

3%

12.

2%

4.2

% 12

.6%

23.

2%

31.

0%

17.

1%

11.

9%

2.6

% 1

2.6

%

22.

9%

31.

2%

17.

4%

13.

3%

3.3

% 12

.4%

22.

2%

31.

1%

17.

2%

13.

8%

Commercial Unknown <540 540-599 600-639 >=640

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

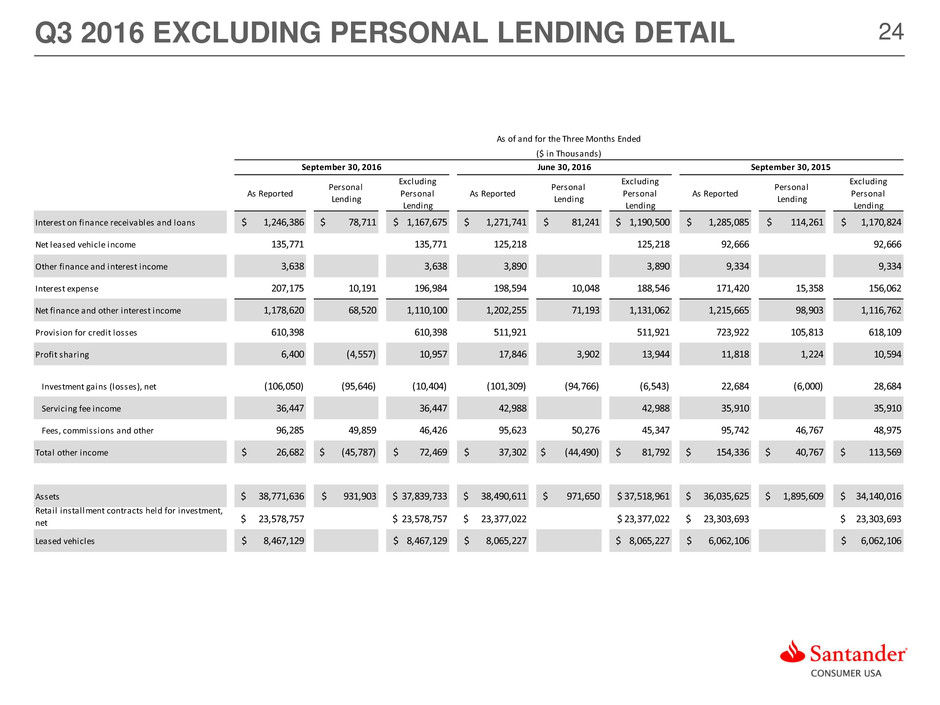

24Q3 2016 EXCLUDING PERSONAL LENDING DETAIL

As Reported

Personal

Lending

Excluding

Personal

Lending

As Reported

Personal

Lending

Excluding

Personal

Lending

As Reported

Personal

Lending

Excluding

Personal

Lending

Interest on finance receivables and loans $ 1,246,386 $ 78,711 $ 1,167,675 $ 1,271,741 $ 81,241 $ 1,190,500 $ 1,285,085 $ 114,261 $ 1,170,824

Net leased vehicle income 135,771 135,771 125,218 125,218 92,666 92,666

Other finance and interest income 3,638 3,638 3,890 3,890 9,334 9,334

Interest expense 207,175 10,191 196,984 198,594 10,048 188,546 171,420 15,358 156,062

Net finance and other interest income 1,178,620 68,520 1,110,100 1,202,255 71,193 1,131,062 1,215,665 98,903 1,116,762

Provision for credit losses 610,398 610,398 511,921 511,921 723,922 105,813 618,109

Profit sharing 6,400 (4,557) 10,957 17,846 3,902 13,944 11,818 1,224 10,594

Investment gains (losses), net (106,050) (95,646) (10,404) (101,309) (94,766) (6,543) 22,684 (6,000) 28,684

Servicing fee income 36,447 36,447 42,988 42,988 35,910 35,910

Fees, commissions and other 96,285 49,859 46,426 95,623 50,276 45,347 95,742 46,767 48,975

Total other income $ 26,682 $ (45,787) $ 72,469 $ 37,302 $ (44,490) $ 81,792 $ 154,336 $ 40,767 $ 113,569

Assets $ 38,771,636 $ 931,903 $ 37,839,733 $ 38,490,611 $ 971,650 $ 37,518,961 $ 36,035,625 $ 1,895,609 $ 34,140,016

Retail installment contracts held for investment,

net $ 23,578,757 $ 23,578,757 $ 23,377,022 $ 23,377,022 $ 23,303,693 $ 23,303,693

Leased vehicles $ 8,467,129 $ 8,467,129 $ 8,065,227 $ 8,065,227 $ 6,062,106 $ 6,062,106

As of and for the Three Months Ended

($ in Thousands)

September 30, 2016 June 30, 2016 September 30, 2015

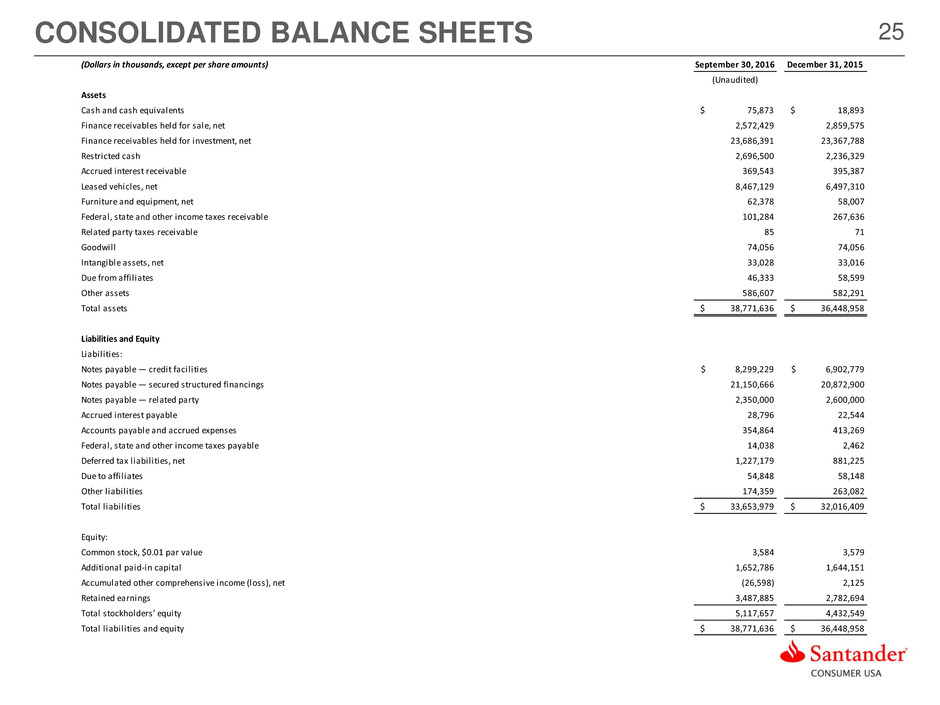

25CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share amounts) September 30, 2016 December 31, 2015

(Unaudited)

Assets

Cash and cash equivalents $ 75,873 $ 18,893

Finance receivables held for sale, net 2,572,429 2,859,575

Finance receivables held for investment, net 23,686,391 23,367,788

Restricted cash 2,696,500 2,236,329

Accrued interest receivable 369,543 395,387

Leased vehicles, net 8,467,129 6,497,310

Furniture and equipment, net 62,378 58,007

Federal, state and other income taxes receivable 101,284 267,636

Related party taxes receivable 85 71

Goodwill 74,056 74,056

Intangible assets, net 33,028 33,016

Due from affil iates 46,333 58,599

Other assets 586,607 582,291

Total assets $ 38,771,636 $ 36,448,958

Liabilities and Equity

Liabilities:

Notes payable — credit facil ities $ 8,299,229 $ 6,902,779

Notes payable — secured structured financings 21,150,666 20,872,900

Notes payable — related party 2,350,000 2,600,000

Accrued interest payable 28,796 22,544

Accounts payable and accrued expenses 354,864 413,269

Federal, state and other income taxes payable 14,038 2,462

Deferred tax liabilities, net 1,227,179 881,225

Due to affil iates 54,848 58,148

Other l iabilities 174,359 263,082

Total l iabilities $ 33,653,979 $ 32,016,409

Equity:

Common stock, $0.01 par value 3,584 3,579

Additional paid-in capital 1,652,786 1,644,151

Accumulated other comprehensive income (loss), net (26,598) 2,125

Retained earnings 3,487,885 2,782,694

Total stockholders’ equity 5,117,657 4,432,549

Total l iabilities and equity $ 38,771,636 $ 36,448,958

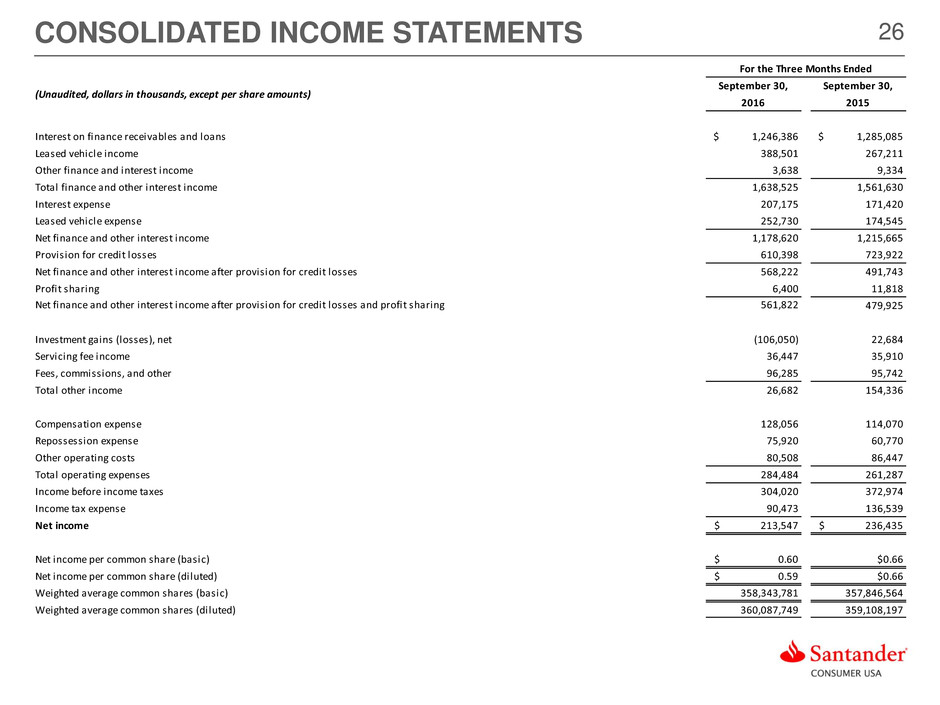

26CONSOLIDATED INCOME STATEMENTS

September 30, September 30,

2016 2015

Interest on finance receivables and loans $ 1,246,386 $ 1,285,085

Leased vehicle income 388,501 267,211

Other finance and interest income 3,638 9,334

Total finance and other interest income 1,638,525 1,561,630

Interest expense 207,175 171,420

Leased vehicle expense 252,730 174,545

Net finance and other interest income 1,178,620 1,215,665

Provision for credit losses 610,398 723,922

Net finance and other interest income after provision for credit losses 568,222 491,743

Profit sharing 6,400 11,818

Net finance and other interest income after provision for credit losses and profit sharing 561,822 479,925

Investment gains (losses), net (106,050) 22,684

Servicing fee income 36,447 35,910

Fees, commissions, and other 96,285 95,742

Total other income 26,682 154,336

Compensation expense 128,056 114,070

Repossession expense 75,920 60,770

Other operating costs 80,508 86,447

Total operating expenses 284,484 261,287

Income before income taxes 304,020 372,974

Income tax expense 90,473 136,539

Net income $ 213,547 $ 236,435

Net income per common share (basic) $ 0.60 $0.66

Net income per common share (diluted) $ 0.59 $0.66

Weighted average common shares (basic) 358,343,781 357,846,564

Weighted average common shares (diluted) 360,087,749 359,108,197

For the Three Months Ended

(Unaudited, dollars in thousands, except per share amounts)

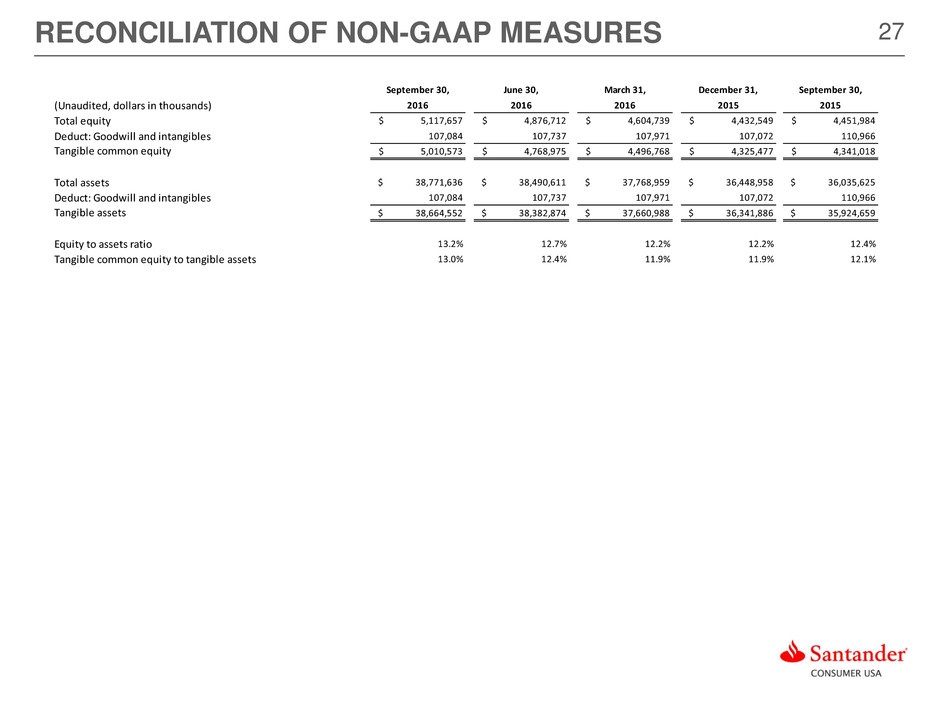

27RECONCILIATION OF NON-GAAP MEASURES

September 30, June 30, March 31, December 31, September 30,

2016 2016 2016 2015 2015

Total equity $ 5,117,657 $ 4,876,712 $ 4,604,739 $ 4,432,549 $ 4,451,984

Deduct: Goodwill and intangibles 107,084 107,737 107,971 107,072 110,966

Tangible common equity $ 5,010,573 $ 4,768,975 $ 4,496,768 $ 4,325,477 $ 4,341,018

Total assets $ 38,771,636 $ 38,490,611 $ 37,768,959 $ 36,448,958 $ 36,035,625

Deduct: Goodwill and intangibles 107,084 107,737 107,971 107,072 110,966

Tangible assets $ 38,664,552 $ 38,382,874 $ 37,660,988 $ 36,341,886 $ 35,924,659

Equity to assets ratio 13.2% 12.7% 12.2% 12.2% 12.4%

Tangible common equity to tangible assets 13.0% 12.4% 11.9% 11.9% 12.1%

(Unaudited, dollars in thousands)