Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SOUPMAN, INC. | soup_8k.htm |

EXHIBIT 99.1

1 Soupman Inc. Ticker Symbol: “SOUP” November 2016

Safe Harbor Statement 2 This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The forward-looking statements are based on current expectations, estimates and projections made by management. The Company intends for the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements. Words such as "anticipates", "expects", "intends", "plans", "believes", "seeks", "estimates" or variations of such words are intended to identify such forward-looking statements. The forward-looking statements contained in this presentation include, statements regarding our expected growth and business strategy. All forward-looking statements in this press release are made as of the date of this press release, and the Company assumes no obligation to update these forward-looking statements other than as required by law. The forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those set forth or implied by any forward-looking statements such as our ability to position the Company for future growth , and the risk factors discussed in the Business and Management's Discussion and Analysis sections in our Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K. Copies of these filings are available www.originalsoupman.com.

3 The Original Store at 55th Street & 8th Ave. NYC

Proven, Experienced Leadership Team Key managers are respected industry figures:Jamieson Karson - CEO and Chairman of the Board of Directors Former Chairman and CEO, Steve Madden Ltd, 2001-2008 Accomplishments include: Expanding footprint into global retail and wholesale marketsTwice awarded “Footwear Company of the Year” while CEO Karson named to 2009 HVS list of Top 10 retail CEOs in America Built Steve Madden market cap to $1 billionBob Bertrand - President & CFO - Over 23 years of experience as a public company CFO - Barinco and Industrial AcousticsAl Yeganeh - Creator of all the Soupman soups - Recognized as foremost soup chef in the world - Opened the 55 Street store in 1984 - Inspiration for Seinfeld soup episodeBarbara Axelson - VP of Tetra Pack Soup Sales - Former Campbell’s Sales Executive Premium Soup 8yrs. 4

5 OUR STRATEGY Expand Tetra Pak grocery channel by (i) increasing sales velocity in existing accounts through targeted marking (ii) adding new accounts and increasing existing footprint, (iii) adding new soup varieties to expand our SKU count (iv) adding new products such as bone broths and gravies2. Increase our Tetra Pak distribution at Costco to more regions, add more SKUs and include a bulk hot soup program for Costco3. Add Convenience Store and business delivery channel such as Circle K, 7 Eleven, Quick Chek and WaWa with our Heat-n-Eat program4. Increase our bulk hot soup business to national restaurant chains like Subway and food service providers like Sodexo 5. Acquisitions of other iconic NYC or authentic brands that we can plug into our distribution at grocery and restaurant

Retail Distribution is Expanding Nationwide with Leading Retailers Currently Available At: Total storeCount as of11/1/16 : 6500

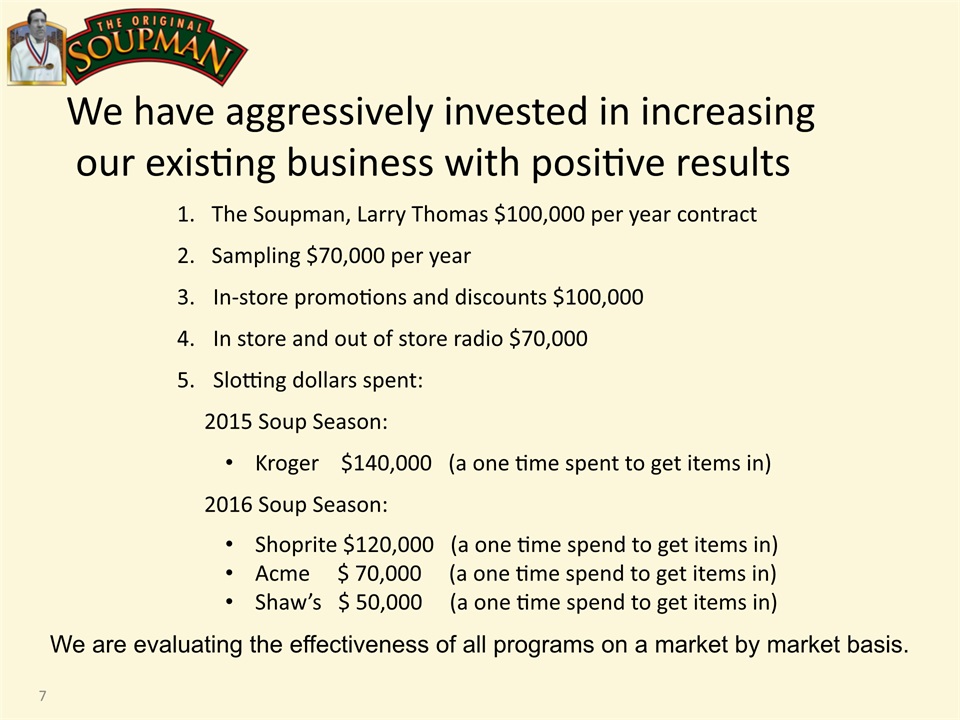

7 We have aggressively invested in increasing our existing business with positive results 1. The Soupman, Larry Thomas $100,000 per year contract2. Sampling $70,000 per yearIn-store promotions and discounts $100,000In store and out of store radio $70,000Slotting dollars spent: 2015 Soup Season:Kroger $140,000 (a one time spent to get items in) 2016 Soup Season:Shoprite $120,000 (a one time spend to get items in)Acme $ 70,000 (a one time spend to get items in)Shaw’s $ 50,000 (a one time spend to get items in) We are evaluating the effectiveness of all programs on a market by market basis.

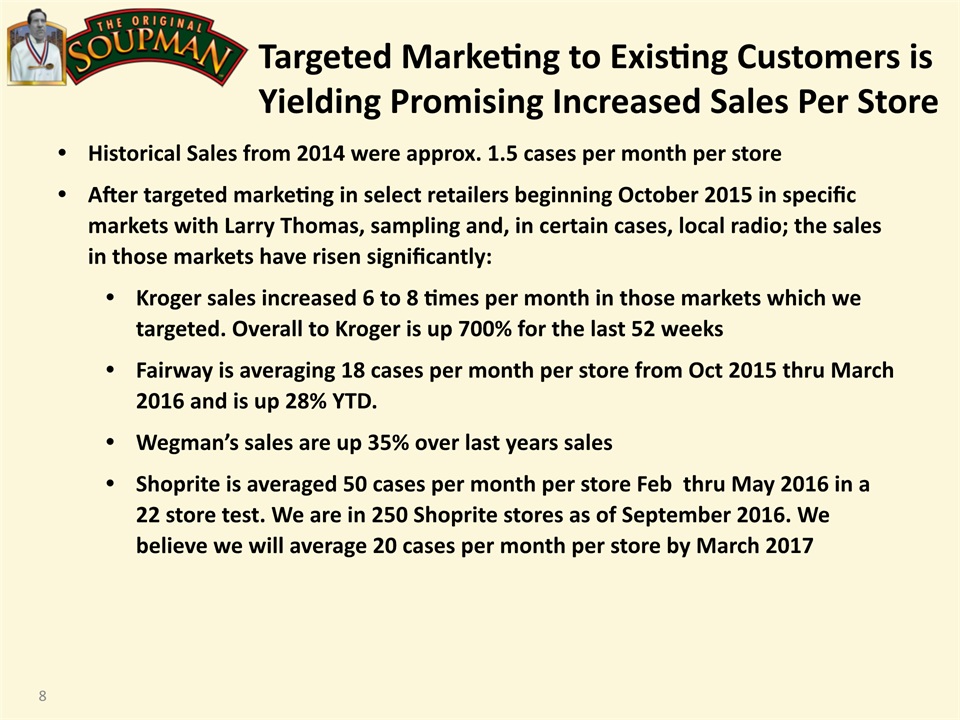

8 Targeted Marketing to Existing Customers is Yielding Promising Increased Sales Per Store Historical Sales from 2014 were approx. 1.5 cases per month per storeAfter targeted marketing in select retailers beginning October 2015 in specific markets with Larry Thomas, sampling and, in certain cases, local radio; the sales in those markets have risen significantly:Kroger sales increased 6 to 8 times per month in those markets which we targeted. Overall to Kroger is up 700% for the last 52 weeks Fairway is averaging 18 cases per month per store from Oct 2015 thru March 2016 and is up 28% YTD. Wegman’s sales are up 35% over last years salesShoprite is averaged 50 cases per month per store Feb thru May 2016 in a 22 store test. We are in 250 Shoprite stores as of September 2016. We believe we will average 20 cases per month per store by March 2017

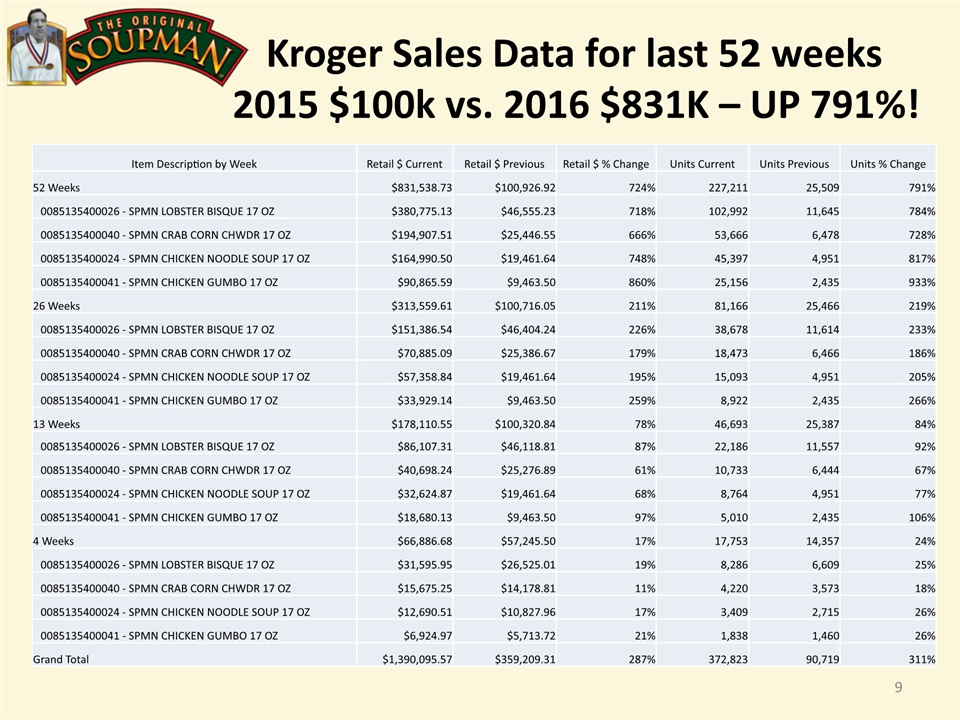

Kroger Sales Data for last 52 weeks2015 $100k vs. 2016 $831K – UP 791%! 9 Item Description by Week Retail $ Current Retail $ Previous Retail $ % Change Units Current Units Previous Units % Change 52 Weeks $831,538.73 $100,926.92 724% 227,211 25,509 791% 0085135400026 - SPMN LOBSTER BISQUE 17 OZ $380,775.13 $46,555.23 718% 102,992 11,645 784% 0085135400040 - SPMN CRAB CORN CHWDR 17 OZ $194,907.51 $25,446.55 666% 53,666 6,478 728% 0085135400024 - SPMN CHICKEN NOODLE SOUP 17 OZ $164,990.50 $19,461.64 748% 45,397 4,951 817% 0085135400041 - SPMN CHICKEN GUMBO 17 OZ $90,865.59 $9,463.50 860% 25,156 2,435 933% 26 Weeks $313,559.61 $100,716.05 211% 81,166 25,466 219% 0085135400026 - SPMN LOBSTER BISQUE 17 OZ $151,386.54 $46,404.24 226% 38,678 11,614 233% 0085135400040 - SPMN CRAB CORN CHWDR 17 OZ $70,885.09 $25,386.67 179% 18,473 6,466 186% 0085135400024 - SPMN CHICKEN NOODLE SOUP 17 OZ $57,358.84 $19,461.64 195% 15,093 4,951 205% 0085135400041 - SPMN CHICKEN GUMBO 17 OZ $33,929.14 $9,463.50 259% 8,922 2,435 266% 13 Weeks $178,110.55 $100,320.84 78% 46,693 25,387 84% 0085135400026 - SPMN LOBSTER BISQUE 17 OZ $86,107.31 $46,118.81 87% 22,186 11,557 92% 0085135400040 - SPMN CRAB CORN CHWDR 17 OZ $40,698.24 $25,276.89 61% 10,733 6,444 67% 0085135400024 - SPMN CHICKEN NOODLE SOUP 17 OZ $32,624.87 $19,461.64 68% 8,764 4,951 77% 0085135400041 - SPMN CHICKEN GUMBO 17 OZ $18,680.13 $9,463.50 97% 5,010 2,435 106% 4 Weeks $66,886.68 $57,245.50 17% 17,753 14,357 24% 0085135400026 - SPMN LOBSTER BISQUE 17 OZ $31,595.95 $26,525.01 19% 8,286 6,609 25% 0085135400040 - SPMN CRAB CORN CHWDR 17 OZ $15,675.25 $14,178.81 11% 4,220 3,573 18% 0085135400024 - SPMN CHICKEN NOODLE SOUP 17 OZ $12,690.51 $10,827.96 17% 3,409 2,715 26% 0085135400041 - SPMN CHICKEN GUMBO 17 OZ $6,924.97 $5,713.72 21% 1,838 1,460 26% Grand Total $1,390,095.57 $359,209.31 287% 372,823 90,719 311%

10 Chicken Gumbo in Costco Midwest:Ohio, Michigan, Indiana, Kentucky, Missouri Crab & Corn Chowder in Costco Northwest:Oregon and Washington 27% Gross Margin at this volume First order $242,500 Shipped Nov 1 2016 25% Gross margins at this small volumeFirst order $142,500 Shipping Dec 4 2016

11 HEAT -N- EAT PROGRAMConvenience Store and Business Delivery Program 2017 Initiative starting now:POSITIONED NEXT TO MICROWAVE ON COUNTER SINGLE SERVE PORTION FOR LUNCH OR DINNER10 OZ. PORTION IN TETRA CARTONNO WASTE OR LABOR FOR BUSINESS2 YEAR SHELF LIFE WITH NO PRESERVATIVESSIMPLE AND CONVENIENT MEALOPEN SOUP CARTONPOUR INTO SOUPMAN CUPMICROWAVE 1 ½ MINUTES ENJOY A HEALTHY MEAL!IMPROVED MARGIN OF 40% PLUS FOR SOUPMAN We are partnering with Food Concepts Inc. http://www.foodconcepts.com to build the fixtures and open new accounts.After NACS show, Vintner Distributors on the West Coast has committed to testing in 160 stores and we met with Circle K http://www.circlek.com one of FCI’s largest customers with over 7,000 stores

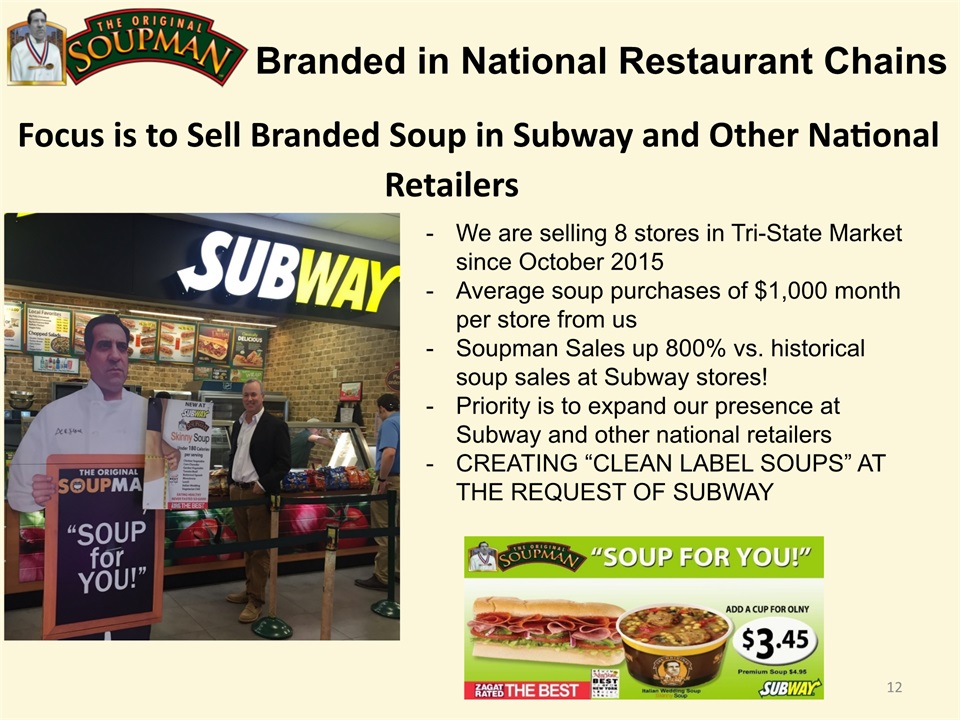

12 Focus is to Sell Branded Soup in Subway and Other National Retailers Branded in National Restaurant Chains We are selling 8 stores in Tri-State Market since October 2015 Average soup purchases of $1,000 month per store from usSoupman Sales up 800% vs. historical soup sales at Subway stores!Priority is to expand our presence at Subway and other national retailersCREATING “CLEAN LABEL SOUPS” AT THE REQUEST OF SUBWAY

13 Soup Marketing Tour 2016

14 ACCRETIVE ACQUISITIONS We are an iconic NYC brand selling across multiple distribution channels including retail storesTargeting acquisitions other iconic NYC brands or Accretive Growth brands with multi-channel distribution and a variance between the size of their business and the strength of their brand The acquisitions should have the potential to reach $100 million in sales through restaurants/stores, products at grocery/clubs stores and onlineUtilize our existing distribution in 6500 stores to sell its productsSales growth is our focus for the next 36 months