Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - SOUPMAN, INC. | exhibit32-1.htm |

| EX-31.1 - CERTIFICATION - SOUPMAN, INC. | exhibit31-1.htm |

| EX-14.1 - CODE OF ETHICS AND BUSINESS CONDUCT - SOUPMAN, INC. | exhibit14-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number: 005-85426

PASSPORT ARTS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 90-0529190 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

| 5147 Mountain Sights | |

| Montreal, Quebec, Canada | H3W 2Y1 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (514) 961-0140

Securities registered under Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined by Rule 405 of the Securities Act

Yes

[ ] No [X]

Indicate by check mark if the registrant is not required to file

reports pursuant to Rule 13 or Section 15(d) of the Act

Yes [

] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days.

Yes [X] No

[ ]

1

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate web site, if any, every

Interactive Data File required to be submitted and posted pursuant Rule 405 of

Regulation S-T (§220.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such

files.

Yes [ ] No [ ] Not

applicable.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

Yes [ ]

No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

$133,375 based on a price of $0.25 per share multiplied by 533,500 common shares held by non-affiliates. The common shares of our company have not traded to date. As a result, aggregate market value has been determined by the issue price per share of the last private placement of our company, whereby 18,500 common shares were issued at $0.25 per common share on April 23, 2009.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

3,893,600 common shares issued and outstanding as of October 25, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). Not applicable.

2

TABLE OF CONTENTS

3

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may”, “should”, “plan”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. References to common shares refer to common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, and “our” refer to Passport Arts Inc., a Nevada corporation, and/or its wholly-owned subsidiary, Passport Arts Inc., a Quebec corporation, as the context may require.

PART I

Item 1. Business.

Overview

We were incorporated in the state of Nevada on December 2, 2008. Our wholly-owned subsidiary, Passport Arts Inc., was incorporated in the province of Quebec, Canada on December 10, 2008.

We are in the business of selling artworks through the Internet. We procure artworks from emerging artists working primarily in the Caucasus and Central Asia for sales in developed art markets like the United States, the United Kingdom, Europe, and Canada and, in future expansion, developing art markets including Russia and China. Through our subsidiary, Passport Arts Inc., incorporated in the province of Quebec, Canada, we operate our primary sales vehicle, passportarts.com, and we showcase artworks in an online gallery located at that website. Artworks range in price from $300 to $10,000.

Our business is located in Montreal, Canada, but we intend to serve a clientele base worldwide through our current and future operating partners. We have established—and intend to continue to establish—relationships with art professionals in strategic regions around the world who can, through their expertise, source and nurture relationships with artists to develop our business. We depend on our Vice-president, Procurement, Hasmik Ginoyan, who is also Director of Exhibitions at the National Gallery of Armenia to use her extensive contacts throughout the Caucasus and Central Asia to establish relationships directly with artists or art professionals like herself who will source unique and undiscovered artists in their respective regions to showcase on PassportArts.com.

In order to be profitable, we need to grow and expand our product offering. Initially we had 150 artworks for sale. In mid-January 2010, we added another 50 artworks from four new artists. By the end of February 2010 we added another 48 pieces from five new artists to bring our total to 248 artworks. We still need to significantly increase that number in order to offer something for everyone. Also in January 2010, to increase interaction with consumers and induce sales, we introduced a new feature called “Best Offer”. This allows a consumer to make an offer on an artwork whereas the artist can accept the offer or make a counter offer within 72 hours. We are also negotiating with various suppliers to offer lower-cost products such as poster reproductions from the original art to supplement revenue. We will need to translate the site to other major languages like French, Spanish, Chinese and Russian in order to reach more potential buyers. To accommodate these future initiatives, our website must be able to handle the larger product offering and increased traffic.

4

As a result of our failure to generate substantial revenues from our current business, we are simultaneously seeking compatible or alternate business opportunities with established business entities for the merger of a target business with our company. In certain instances, a target business may wish to become a subsidiary of us or may wish to contribute assets to us rather than merge. We have not entered into any definitive agreements to enter into a business acquisition or opportunity to date and there can be no assurance that we will be able to enter into any definitive agreements. When any such agreement is reached, we intend to disclose such an agreement by filing a current report on Form 8-K with the Securities and Exchange Commission.

The search for new business opportunities, and any due diligence required in connection with such business opportunities, is expected to be undertaken by Asbed Palakian, our president and chief executive officer, who is not a professional business analyst. In seeking or analyzing prospective business opportunities, Mr. Palakian may utilize the services of outside consultants or advisors. Management does not have the capacity to conduct as extensive an investigation of a target business as might be undertaken by a venture capital fund or similar institution. As a result, management may elect to merge with a target business which has one or more undiscovered shortcomings and may, if given the choice to select among target businesses, fail to enter into an agreement with the most investment-worthy target business.

In implementing a structure for a particular business acquisition or opportunity, we may become a party to a merger, consolidation, reorganization, joint venture, or licensing agreement with another corporation or entity. We may also acquire stock or assets of an existing business. Upon the consummation of a transaction, it is likely that our present management will no longer be in control of our company. In addition, it is likely that our officer and director will, as part of the terms of the acquisition transaction, resign and be replaced by one or more new officers and directors.

We anticipate that any new acquisition or business opportunity by our company will require additional financing. There can be no assurance, however, that we will be able to acquire the financing necessary to enable us to pursue such an acquisition or opportunity. If our company requires additional financing and we are unable to acquire such funds, our business may fail.

Business Developments

Initially we are focusing procurement of artworks from the countries of the Caucasus: Armenia, Georgia, Nagorno-Karabakh, and the Black Sea region of Russia. Presently there are approximately 248 pieces of artworks available on passportarts.com. In the next three to five years, our goal is to offer over 1,000 paintings, photographs and sculptures on passportarts.com from over a dozen countries including Ukraine, Belarus, Kyrgyzstan, Kazakhstan, Moldova, Azerbaijan, Turkmenistan, Tajikistan, Chechnya and Uzbekistan.

For the initial phase beginning in July 2009, we had a soft launch of our website, passportarts.com. A soft launch signifies that although the site was up and running, we chose not to promote the site to the general public until all bugs in the website were worked out and any usability issues were resolved using a small group of testers comprised of friends and family. Building on that launch, we are seeking listings on various web directories and refining search engine optimization/meta tags to increase page ranking in organic searches.

In September 2009, we conducted a public relations campaign to over 400 art critics, art writers, and art magazines in the United States, Canada and Europe to raise our profile within the existing contemporary art community. We used the services of Arts Media Contact, an art press directory and contact service to distribute our press releases (www.artsmediacontacts.com). As well, we created journalistic content to promote our company and submitted them to several article syndication sites such as www.goarticles.com, www.articlesbase.com, www.articleblast.com and others. Syndication sites essentially offer free advertising space to marketers who provide them with content, much like an online advertorial.

5

In January 2011, resources allowing, we plan to direct our marketing efforts to specific ethnic communities in the United States and Canada. We plan to target these communities through a combination of low-cost public relations and email campaigns. We have already begun sending news releases to the churches, newspapers and community organizations of our ethnic target markets in the United States and Canada. We may use opt-in email list providers in the United States and Canada such as www.listservice.com which can provide email addresses of Armenian, Georgian and Russian ethnic consumers in the United States. For example, 128,248 promotional emails to ethic Armenian consumers in the United States can be sent for $1,500 per transmission. If our resources allow, we may purchase a highly targeted opt-in email list to proven art buyers in the United States through Marigold Technologies for the purpose of reaching our “discerning buyers” segment.

Since the launch of our website in July 2009, we have collected hundreds of email addresses from people around the world who have visited our site. In 2010, we plan to develop a monthly online newsletter as a mechanism to pull users back to passportarts.com.

In early 2011, resources allowing, we intend to begin paid search campaigns through Google AdWords to increase traffic to the site. We also intend to develop an affiliate program through Clickbank.com and their network of 100,000 affiliates to offer compensation to drive buyers to passportarts.com. Also in early 2011, we plan to launch French and Spanish parallel sites to passportarts.com. By the end of 2011, we plan to launch Russian and Chinese parallel sites to passportarts.com to better penetrate into these two growing art markets.

Seven Arts Ltd.

Currently, we have an online marketing and sales agreement with Seven Arts Ltd., a company incorporated in Armenia, which handles the logistics of procurement and shipment of artworks from the Caucasus and Central Asia. Seven Arts’ through its principal, Hasmik Ginoyan is well-known in the art circles of the region. They have organized extensive exhibitions to present and sell Caucasian artworks globally in regions including the Middle East, Australasia, North America and Europe. Seven Arts’ network of artist contacts is extensive throughout the Caucasus and Central Asia. In addition, Seven Arts Ltd. is the publisher of a leading art periodical in the Caucasus entitled “Armenian Art Magazine”, which is distributed world-wide and is published in Armenian, English and French.

We facilitate the sale of artwork to a buyer while Seven Arts fulfills the order by working with the artist to dispatch the artwork. We contain costs by having artwork shipped directly from artist to buyer without having to carry inventory. As a result, we do not have direct agreements with artists in these regions but transact with artists through Seven Arts. We hold the exclusive right for online sales for the artworks which artists supply through contract with Seven Arts. According to the terms of our online marketing and sales agreement, Seven Arts (and not our company) is liable for damage to or loss of artwork during transit to the buyer.

Pursuant to the online marketing and sales agreement that we entered into with Seven Arts, Seven Arts and our company agreed to agree upon the retail price for each piece of artworks to be sold via our website at the time that we agree to market and sell such artworks on our website. We retain the final word on the determination of the retail price and the decision to display the artwork. We are to earn an average profit of 25% of the retail price, and we are to forward the rest of the retail price plus applicable costs for shipping, taxes, tariffs, customs and levies received from a buyer to Seven Arts.

Recently we have also initiated discussions directly with artists who also live in the Caucasus and Central Asia region in the hope of entering into purchase agreements with them. Although we expect Seven Arts to remain the linchpin of our procurement efforts in the Caucasus and Central Asia, we foresee initiating and completing other such direct agreements with artists as the situation sees fit. Whomever the agreement is with, be it a third party or directly with the artist, we expect that our four basic tenets will always remain the same.

-

We will not pre-buy or carry any inventory;

-

We have final say on the price;

6

-

The artist or third party is responsible to package and deliver the artworks safely to the consumer; and

-

The artist or third party must abide by our 14-day unconditional guarantee.

Vasgen Degirmentas

Effective May 20, 2009, we entered into another online marketing and sales agreement with Vasgen Degirmentas, an Armenia artist. Pursuant to the online marketing and sales agreement, we agreed to use our commercially reasonable efforts to market, promote, and sell the prints of Mr. Degirmentas’s original photographs and to solicit orders via our website for the purchase of the prints of these photographs. Mr. Degirmentas will retain the copyright of these photographs. We agreed to pay $100 to Mr. Degirmentas for each print ordered, exclusive of all applicable sales, exercise taxes, and all shipping, and we agreed to set the retail price of each print on our website at our discretion.

Upon receiving a buyer’s order and payment, we agreed to promptly notify Mr. Degirmentas of what print has been purchased and Mr. Degirmentas agreed to arrange for the shipment of the print directly to the buyer.

Mr. Degirmentas agreed that all risk relating to the loss, destruction or damage of the purchased print will remain with him until the purchased print has arrived and been safely unloaded at the buyer’s specified address.

Mr. Degirmentas agreed that the title to the purchased print will pass from him to a buyer at the time when the purchased print is received by the buyer, and agreed to abide by our 14-day money-back guarantee.

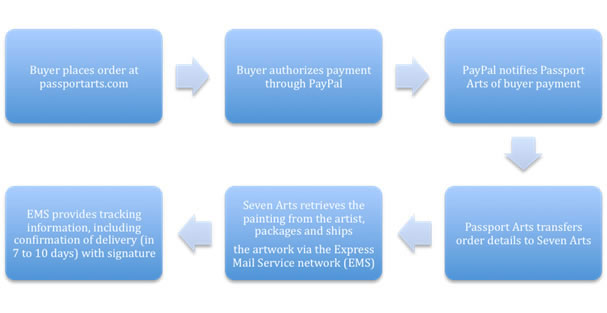

The sales model for a Passport Arts transaction is as follows:

Our Products

We showcase artworks in an online gallery located at passportarts.com, which was launched in July 2009. Initially we are focusing procurement of artworks from the countries of the Caucasus: Armenia, Georgia, Nagorno-Karabakh, and the Black Sea region of Russia. Presently there are approximately 248 pieces of artworks available at passportarts.com. Artworks range in price from $300 to $10,000. As a showcase for contemporary art, passportarts.com allows users to create their own personal galleries for viewing and engages art buyers in the acquisition process. From initial searching through artworks to carrying through to purchase, we believe that passportarts.com is accessible to expert and novice art buyers alike.

7

We offer art aficionados works they might otherwise never see. We believe that our on-the-ground network of artists combined with a user-friendly but tech-savvy online showcase make us different from our competition. The online gallery at passportarts.com provides an engaging experience for both experienced and beginner art collectors. We believe that the artworks exhibited on the site is difficult, if not impossible, to find elsewhere as artists of these regions live and work in small, often isolated areas. We believe that while these artists are rich in talent, few possess the kind of marketing resources to drive sales of their work outside the boundaries of their home countries. The lack of online connectivity to artists of the Caucasus and Central Asia provides us an opportunity to be first in the market of exhibiting their works outside the boundaries of their home countries.

Customer Service

We guarantee 100% buyer satisfaction through a 14-day unconditional return policy. If, for any reason, the customer is unhappy with his or her purchase, it can be returned for a full refund, provided that the work is returned to the country of origin in its original condition. The buyer is responsible for the cost of the return shipping but will not be charged any return or restocking fees by us. We believe that this level of customer service satisfaction is rare for any online art dealer and that it will be a point of marked differentiation from our competitors.

Target Markets

We have three target markets: shared-ethnicity buyers, affinity buyers, and discerning buyers:

-

Shared-ethnicity buyers are defined as expatriates of the same ethnic ancestry as an artist whose artwork is sold through us but who reside outside of that country, e.g. Armenian buyers living outside of Armenia who purchase Armenian artwork from us;

-

Affinity buyers are defined as former residents and visitors of an area where we procure artworks. Assuming a positive experience during their stay in that region, these art patrons could be expected to have a high affinity for the artworks from that country or region; and

-

Discerning buyers are defined as art buyers worldwide who seek high-quality, rare international artworks.

We believe that the global contemporary art market is still developing and pushing out into new territory in pace with the economic growth of domestic economies. As such, we plan to continue to expand our gallery of offerings and increase the diversity of ethnic artistry therein. Growth opportunities also include launching parallel multilingual websites to serve French, Spanish, Russian and Chinese markets. Future growth may also involve product extensions of art-related products, such as licensed apparel, reproduction art, greeting cards, Giclées and so on.

Competition

We compete in a market that is highly competitive and expect competition to intensify in the future. We currently or potentially compete with a variety of companies, both the traditional brick-and-mortar galleries and online art dealers. Many of our competitors have significantly greater financial, technical, and marketing resources. Those that have established a presence on the Internet have already begun to establish a customer base and their brand. Many of these companies have existed for a longer period, have greater financial resources, and have established marketing relationships with leading manufacturers, strategic partners, and advertisers, and have secured greater presence in distribution channels. We believe there are also numerous other smaller entrepreneurial companies that are focusing on developing websites to market and sell artworks on the Internet that will compete directly with our website.

However, we believe that we have a competitive advantage over our competitors in some areas, as described below.

Traditional Galleries in Countries Where Our Artists Reside

There are several brick-and-mortar galleries in the countries where we procure artworks at which buyers could purchase artworks from the artists contracted by Seven Arts. Shared-ethnicity buyers, the first priority target market, who are visiting the land of their ancestry, for example, could purchase artworks directly from a gallery. Similarly, affinity buyers may also be present in person to make a purchase.

8

It is possible that this can become an advantage to us as buyers can ‘touch and feel’ the art but may not be ready to buy. At a later date, once they have had time to think through what could be a significant financial investment, they can then purchase that artist’s artworks through passportarts.com from the comfort and security of their own home.

As an additional edge over traditional galleries, our business model allows for an average mark-up of 25% on artworks—which we believe is significantly lower than the traditional gallery mark-up of between 50 to 100%. This provides a price-point advantage to us. In addition, we believe that our artists’ prices are less expensive than comparable works by artists residing in the United States or Canada which may also vie for our buyers’ attention.

Online Art Dealers

Though there are numerous online art dealers and virtual galleries on the Internet, only a few have similar artworks as we do and would target a similar buyer. In general, we believe that these online galleries fail to impress and none take a buyer from arrival on-site to completed purchase as in our sales model. The two most likely contenders for competition are assessed below:

-

Roslin Gallery (www.roslin.com) - This is an unsophisticated website with an extensive inventory of Armenian art only. No prices are displayed nor can a buyer purchase online. Anyone wanting to know the price of particular work must send an inquiry by email and pay by cheque.

-

Russian Art Gallery (www.russianartgallery.com) - Although it is an extensive site with artworks from the Caucasus region, Russia and the Ukraine, similar to our website, it seems to serve largely as a lead generator and is not intended to complete the purchase online. For the majority of artworks, a buyer must inquire by contacting the company thus complicating the transaction and likely resulting in lower conversion rates of browsers to buyers.

It is possible one of these competitors could improve its online sales approach and imitate our approach. However, we utilize three key organizational strengths to create a competitive advantage: 1) our existing access to hard-to-reach artists; 2) savvy promotion and buyer engagement through passportarts.com; and 3) exceptional customer service guaranteeing 100% buyer satisfaction. While competitors may be able to imitate one of those three key strengths, we do not believe that it is likely that they will be able to imitate all three and capture the synergy that we can exploit through our business model.

Intellectual Property

We own the domain name passportarts.com. Asbed Palakian, our president and chief executive officer, purchased the domain name on our behalf for a period of two years at a cost of $23.74. The domain name is renewable at any time. The website is hosted by Google App Engine, free of charge.

We intend to register “Passport Arts” as a trademark in Canada. We have conducted initial searches on the registrability of “Passport Arts” as a trademark and found there to be no conflicting prior marks. As a result of these searches, we have determined that registration is feasible. We intend to file a trademark application for “Passport Arts” for the registration in Canada and expect that this trademark application will take 16 to 20 months from filing to registration.

We are not aware that our services or proprietary rights infringe the proprietary rights of third parties. However, from time to time, we may receive notices from third parties asserting that we have infringed their trademarks, copyrights or other intellectual property rights. In addition, we may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Any such claims could be time-consuming, result in costly litigation, cause service stoppages or lead us to enter into royalty or licensing agreements rather than disputing the merits of such claims. An adverse outcome in litigation or similar proceedings could subject us to significant liabilities to third parties, require expenditure of significant resources to develop non-infringing opportunities, require disputed rights to be licensed from others, or require us to cease the marketing or use of our website, any of which could have a material adverse effect on our business, operating results and financial condition.

9

Governmental Regulations

There are two aspects of our business which face significant governmental regulation or are likely to face such regulation: our sales offering via the Internet and laws and regulations regarding the sale of artworks in various countries.

Within the United States and Canada, the legal landscape for Internet privacy is new and rapidly evolving. Collectors and users of customer information over the Internet face potential liability for public disclosure of private information. Due to the increasing popularity and use of the Internet, it is likely that a growing number of laws and regulations will be adopted at the international, federal, state, local, and foreign levels relating to the Internet covering issues such as user privacy, pricing, content, copyrights, distribution, antitrust and characteristics and quality of services. Furthermore, if more stringent customer protection laws are imposed, additional burdens will be placed on those companies conducting business online. Moreover, the applicability to the Internet of existing laws in various jurisdictions governing issues such as property ownership, sales and other taxes, libel and personal privacy is uncertain and may take years to resolve. Any such new legislation or regulation, the application of laws and regulations from jurisdictions whose laws do not currently apply to our business or the application of existing laws and regulations to the Internet could harm our business.

We are also subject to certain laws and regulations regarding the sale of artworks in various countries, including import and export laws. Also sellers of retail art and collectibles are particularly susceptible to unscrupulous individuals selling forged or stolen goods. There are significant federal, state, foreign, and local penalties for merchants who sell forged or stolen goods, or goods that violate existing copyright interests. Although we intend to make an effort to insure that our supply of goods comes from reputable artists and sources, we may nevertheless be liable under these regulations for sales of such articles. Liability can include civil and criminal penalties, as well as forfeiture of the artworks without compensation. We may be able to insure against the costs of some, but not all of these regulations, but do not currently maintain such insurance. Liability under existing criminal or civil regulations for such sales could have a material, adverse impact on our business.

Employees

Our president, chief executive officer, secretary, treasurer, and one of our directors, Asbed Palakian, and our vice-president, procurement, Hasmik Ginoyan, are the only employees of our company. We contract with consultants, advisors and service providers as needed but, as a cost-containment measure, do not maintain administrative employees.

Item 1A Risk Factors

Risks Associated with Our Financial Condition

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

We incurred a net loss of $107,058 for the period from December 2, 2008 (date of inception) to August 31, 2010. On August 31, 2010, we had cash of $551. Because we are in the development stage and are yet to attain profitable operations, in their report on our financial statements for the year ended August 31, 2010, our independent auditors included an explanatory paragraph regarding the substantial doubt about our ability to continue as a going concern.

Our ability to continue as a going concern is depending upon our ability to generate future profitable operations and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. We have not generated significant revenues since our inception on December 2, 2008. Since we only recently commenced business operations, we will, in all likelihood, continue to incur operating expenses without significant revenues for the foreseeable future. We cannot assure that we will be able to generate enough interest in our artworks. If we cannot attract a significant customer base, we will not be able to generate any significant revenues or income. In addition, if we are unable to establish and generate significant revenues, or obtain adequate future financing, our business will fail and you may lose some or all of your investment in our commons stock.

10

We do not have sufficient cash on hand to satisfy all of our cash requirements for the next 12 months and we do not anticipate that we will generate sufficient funds from operations to satisfy all of our cash requirements for the next 12 months.

We anticipate that our cash on hand and the revenue that we anticipate generating going forward from our operations will not be sufficient to satisfy all of our cash requirements for the next twelve month period. Our primary source of funds has been loans from Asbed Palakian, our president, chief executive officer, secretary, treasurer, and one of our directors, and from the sale of our common stock. Mr. Palakian has not committed to provide additional financing to our company and we do not currently have any arrangement for financing from any other sources. For the short term, we intend to fund our operations and capital expenditures from limited cash flow and our cash on hand.

Management anticipates that our capital resources are insufficient to cover costs for the next 12 month period. As a result, we anticipate we will have to raise additional funds for the continued development of our business and the marketing of our products. Such additional funds may be raised through the sale of additional stock, stockholder and director advances and/or commercial borrowing. There can be no assurance that a financing will continue to be available if necessary to meet these continuing development costs or, if the financing is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us will result in a significant dilution in the equity interests of our stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may not be able to expand or continue our operations and developments and so may be forced to scale back or cease operations or discontinue our business and you could lose your entire investment.

Risks Associated with Our Business

Our limited operating history makes evaluation of our business difficult.

We were incorporated in the state of Nevada on December 2, 2008 and our wholly-owned subsidiary, Passport Arts Inc., was incorporated in the province of Quebec, Canada on December 10, 2008. Our limited operating history makes it difficult to evaluate our business and prospects. We have encountered, and expect to continue to encounter, many of the difficulties and uncertainties frequently encountered by early stage companies, including limited capital, insufficient customer base, and limited inventory resulting in delays in implementing effective marketing strategies, inability to gain customer acceptance of our products and inability to attract new artists to provide inventory for our business. We cannot be certain that we will successfully address these risks. If we are unable to address these risks, our business may not grow, our stock price may suffer and/or we may be unable to stay in business.

We currently depend on a limited number of third parties for procuring artworks, therefore, if they do not perform, we may not be able to complete orders effectively.

We rely on third parties to supply artworks and fulfil and ship orders. Currently, the sales of the artworks from Seven Arts Ltd. account for approximately 65% of our total sales, while the sales of the prints of Vasgen Degirmentas’s photographs account for approximately 35% of our total sales. If our existing relationship with Seven Arts or Vasgen Degirmentas deteriorates or is terminated in the future, and we are not successful in establishing a relationship with an alternative supplier at prices and products currently offered by Seven Arts or Vasgen Degirmentas, our results of operations could be adversely affected. In addition, a significant decline in the financial condition of Seven Arts or Vasgen Degirmentas, a material rise in their prices or a reduction in the number of products currently available from them could adversely affect our results of operations.

11

To generate the significant customer traffic, volume of purchases and repeat purchases that we believe are crucial to obtaining sufficient revenues, we must develop and maintain customer trust in the timing and accuracy of our product deliveries. If for any reason any of these providers fails to perform, we may not be able to service our customers and thereby may lose customers or damage our reputation. In addition, the success of our business requires that we establish relationships with art professionals in strategic regions around the world who can, through their expertise, source and nurture relationships with artists to develop our business. If we are unable to establish such relationships, we may be unable to procure artworks on terms acceptable to us, and our business may fail. Currently, our online marketing and sales agreements with Seven Arts and Mr. Degirmentas are the only relationships that we have established for procuring artworks.

Our executive officers devote only part time efforts to our business which may not be sufficient to successfully develop our business.

The amount of time which each of our executive officers devote to our business is limited. Asbed Palakian, our president, chief executive officer, secretary and treasurer, and Hasmik Ginoyan, our vice-president, procurement, currently devote approximately 40% and 30%, respectively, of their working time to our company. All of our executive officers have other business interests. While we expect them to increase the percentage of the working time they devote to our company if our operations increase, the amount of time which they devote to our business may not be sufficient to fully develop our business.

Our executive officers have potential conflict of interests with our company and we have no agreements with our executive officers as to how they allocate either their time to our company or how they handle corporate opportunities.

Potential conflicts of interest exist between our company and our executive officers including, among other things, time, effort, and corporate opportunity involved with participating in the business entities other than our company. Effective January 20, 2009, we entered into an online marketing and sales agreement with Seven Arts Ltd. Seven Arts is owned and controlled by Hasmik Ginoyan, our vice-president, procurement. On December 15, 2008, we entered into an office rental agreement with Lumisculpt Productions Inc., a company of which Asbed Palakian is the founder and principal. We have no agreements with our executive officers as to how they allocate either their time to our company or how they handle corporate opportunities. As a result, we may be unable to implement our plan and our business might ultimately fail.

Customers may not adopt the Internet as a way of buying artworks, which would prevent us from becoming profitable.

If we do not attract and retain a high volume of online customers to our website at a reasonable cost, our business will not succeed. We may not be able to convert a large number of customers from traditional shopping methods to online shopping for artworks and as a result may never achieve widespread customer acceptance of shopping for artworks online. Specifically, customers may not wish to change the way they purchase artworks and may feel it is necessary to view the actual artworks rather than pictures before purchasing them. In addition, customers may not be willing to make orders online due to perceived security issues or pricing that does not meet customer expectations. As a result we may never drive sufficient revenues from our operations in order to become a profitable enterprise.

We may not be able to compete effectively against other companies that have existed for a longer period and have greater financial resources.

We compete in a market that is highly competitive and expect competition to intensify in the future. We currently or potentially compete with a variety of companies, both the traditional brick-and-mortar galleries and online art dealers including auction sites such as eBay. Many of our competitors have significantly greater financial, technical, and marketing resources. Those that have established a presence on the Internet have already begun to establish a customer base and their brand. Many of these companies have existed for a longer period, have greater financial resources, and have established marketing relationships with leading manufacturers, strategic partners, and advertisers, and have secured greater presence in distribution channels. We believe there are also numerous other smaller entrepreneurial companies that are focusing on developing websites to market and sell artworks on the Internet that will compete directly with our website. We may not be able to compete successfully against these competitors. If we are unable to effectively compete in the art industry, our results would be negatively affected, we may be unable to implement our plan and our business might ultimately fail.

12

Any significant economic downturn or any future changes in consumer spending habits could have a material adverse effect on our financial condition and results of operations.

Demand for artworks is affected by the general economic conditions in the United States, Europe, and Canada. When economic conditions are favorable and discretionary income increases, purchases of non-essential items like artworks generally increase. When economic conditions are less favorable, sales of artworks are generally lower. In addition, we may experience more competitive pricing pressure during economic downturns. Therefore, any significant economic downturn or any future changes in consumer spending habits could have a material adverse effect on our financial condition and results of operations.

If the United States dollars gain significantly in value against the foreign currencies, our artworks could become prohibitively expensive for the customers outside the United States resulting in lower sales and revenues.

All transactions on our website are in United States dollars. Because our clientele is based around the world, the relationship between their currency and United States dollar is an influencing factor on our future sales. If the United States dollar gains significantly in value against the foreign currencies, then our artworks could become prohibitively expensive for the customers outside the United States resulting in lower sales and revenues. A significant increase in the value of the United States dollars relative to the value of the foreign currencies may force us to reduce our pricing in order to maintain our competitiveness. Such reduction in our pricing could reduce our profit margin, adversely affecting our results of operations and financial condition.

The inability to respond quickly to market changes could have a material adverse effect on our financial condition and results of operations.

The markets for our products are subject to changing customer tastes and the need to create and market new products. Demand for artworks is influenced by the popularity of certain themes, cultural and demographic trends, marketing and advertising expenditures and general economic conditions. Because these factors can change rapidly, customer demand also can shift quickly. The changes in customer tastes are likely to affect the markets for our products significantly because of our limited selection of artworks. Currently, we depend on only Seven Arts Ltd. or artists with whom Seven Arts contracts, or Vasgen Degirmentas for procuring artworks. Even if we introduce new products from other sources, the success of new product introductions depends on various factors, including product selection and quality, sales and marketing efforts, timely production and delivery and customer acceptance. We may not always be able to respond quickly and effectively to changes in customer taste and demand due to the amount of time and financial resources that may be required to bring new products to market. If we were to materially misjudge the market, certain of our artworks may remain unsold. The inability to respond quickly to market changes could have a material adverse effect on our financial condition and results of operations.

Because we do not have sufficient insurance to cover our business losses, we might have uninsured losses, increasing the possibility that you may lose your investment.

We may incur uninsured liabilities and losses as a result of the conduct of our business. We do not currently maintain any comprehensive liability or property insurance. Even if we obtain such insurance in the future, we may not carry sufficient insurance coverage to satisfy potential claims. We do not carry any business interruption insurance. Should uninsured losses occur, any purchasers of our common stock could lose their entire investment.

We may be subject to intellectual property rights claims in the future, which may be costly to defend, could require the payment of damages and could limit our ability to use certain intellectual properties in the future.

Our trademark and other intellectual property rights are important assets to us. Even though we intend to register “Passport Arts” as a trademark in Canada, we may not be able to register it as our trademark. Even if we register it as our trademark, the protections provided by such trademark may not be adequate to prevent our competitors from misappropriating our trademark. Large internet-based companies and media industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property rights claims increases. Our intellectual properties may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time consuming, expensive to litigate or settle and could divert management resources and attention. An adverse outcome in litigation or similar proceedings could subject us to significant liabilities to third parties, require expenditure of significant resources to develop non-infringing opportunities, require disputed rights to be licensed from others, or require us to cease the marketing or use of our website, any of which could have a material adverse effect on our business, operating results and financial condition.

13

We may have liabilities to affiliated or unaffiliated third parties incurred in the regular course of our business.

As we conduct business, we become subject to the risk of litigation from customers, employees, suppliers or other third parties. Although the majority of artists from whom we procure artworks do not have direct agreements with our company, the artists may be forced to sue us if they are unable to get restitution from Seven Arts Ltd.—for example if Seven Arts is in default of payment to the artists or makes any misrepresentation. Litigation could cause us to incur substantial expenses and, negative outcomes of any such litigation could add to our operating costs which would reduce the available cash from which we could fund our ongoing business operations and take management time away from running the business.

Our technical systems are vulnerable to interruption and damage that may be costly and time-consuming to resolve and may harm our business and reputation.

As an internet-based company conducting all sales through our website, a disaster could interrupt our services for an indeterminate length of time and severely damage our business, prospects, financial condition and results of operations. Our systems and operations are vulnerable to damage or interruption from fire, floods, network failure, hardware failure, software failure, power loss, telecommunication failures, break-ins, sabotage, computer viruses, denial of service attacks, penetration of our network by unauthorized computer users and “hackers” and other similar events, and other unanticipated problems.

Any of these occurrences could cause material interruptions or delays in our business, result in the loss of data or render us unable to provide services to our customers. In addition, if anyone can circumvent our security measures, he or she could destroy or misappropriate information or disrupt our operations. If we fail to address these issues in a timely manner, we may lose the confidence of our customers, and our revenue may decline and our business could suffer.

We rely on an outside firm to host our server, and a failure of service by this provider could adversely affect our business and reputation.

We rely upon a third party provider to host our main server. In the event that this provider experiences any interruption in operations or cease operations for any reason or if we are unable to agree on satisfactory terms for continued hosting relationships, we would be forced to enter into a relationship with other service providers or assume hosting responsibilities ourselves. If we are forced to switch hosting facilities, we may not be successful in finding an alternative service provider on acceptable terms or in hosting the computer server ourselves. We may also be limited in our remedies against this provider in the event of a failure of service. A failure or limitation of service or available capacity by this third party provider could adversely affect our business and reputation.

Due to the international nature of our business, political or economic changes in the countries in which we do our business could harm our future sales, expenses, operations and financial condition.

Initially we are focusing procurement of artworks from the countries of the Caucasus: Armenia, Georgia, Nagorno-Karabakh, and the Black Sea region of Russia. As in any emerging market, these countries are subject to greater risks than more developed markets, including in some cases significant legal, economic and political risks. Our future sales, costs, expenses could be adversely affected by various factors affecting our business in those countries, including:

14

-

changes in a country’s or region’s political or economic conditions;

-

changes in foreign currency exchange rates and inflation or deflation;

-

the closing of borders or other trade restrictions imposed by foreign countries relating the imports and exports of the artworks; and

-

potentially negative consequences from changes in regulatory requirements.

For example, if export taxes are suddenly increased in one of the countries we procure our artworks from making the price prohibitive or a decision was made by a government banning cultural treasures such as artworks to be exported from the country, this would negatively impact our business. We cannot predict what economic, political, legal or other changes may occur in those emerging markets, but such changes could adversely affect our ability to carry out our business in those countries. In addition, following the end of the Soviet Union, Georgia, Azerbaijan and Armenia became independent in 1991. The Caucasus region is subject to various territorial disputes since the collapse of the Soviet Union.

Risks Associated with Our Company

Our senior management has never managed a public company.

The individuals who now constitute our senior management have never had responsibility for managing a public company prior to managing our company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. There can be no assurance that our senior management will be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements. Further, this could impair our ability to comply with legal and regulatory requirements such as those imposed by the Sarbanes-Oxley Act of 2002. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

The loss of the services of our executive officers would disrupt our operations and interfere with our ability to compete.

We depend upon the continued contributions of our executive officers. We only have two employees, our president, chief executive officer, secretary, treasurer, and one of our directors, Asbed Palakian, and our vice-president, procurement, Hasmik Ginoyan. They handle all of the responsibilities in the area of corporate administration and business development. We do not carry key person life insurance on any of their lives and the loss of services of any of these individuals could disrupt our operations and interfere with our ability to compete with others.

All of our assets and all of our directors and officers are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers.

All of our assets are located outside the United States and we do not currently maintain a permanent place of business within the United States. In addition, all of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under United States federal and state securities laws against us or any of our directors or officers.

15

Because Asbed Palakian, our president, chief executive officer, secretary, treasurer, and one of our directors, controls a large percentage of our common stock, he has the ability to influence matters affecting our stockholders.

Asbed Palakian, our president, chief executive officer, secretary, treasurer, and one of our directors, beneficially owns 74.2% of the issued and outstanding shares of our common stock. As a result, he has the ability to influence matters affecting our stockholders, including the election of our directors, the acquisition or disposition of our assets, and the future issuance of our shares. Because he controls such shares, investors will find it difficult to replace our management if they disagree with the way our business is being operated. Because the influence by Mr. Palakian could result in management making decisions that are in his best interest and not in the best interest of the investors, you may lose some or all of the value of your investment in our common stock.

Risks Associated with Our Common Stock

There is no active trading market for our common stock and if a market for our common stock does not develop, our investors will be unable to sell their shares.

There is currently no active trading market for our common stock and such a market may not develop or be sustained. We cannot provide our investors with any assurance that our common stock will be traded on the OTC Bulletin Board or, if traded, that a public market will materialize. Further, the OTC Bulletin Board is not a listing service or exchange, but is instead a dealer quotation service for subscribing members. If a public market for our common stock does not develop, then investors may not be able to resell the shares of our common stock that they have purchased and may lose all of their investment.

Since our common stock has never been traded and, if a market ever develops for our common stock, the price of our common stock is likely to be highly volatile and may decline in the future. If this happens, investors may have difficulty selling their shares and may not be able to sell their shares at all.

If an active trading market for our common stock does develop, the market price of our common stock is likely to be highly volatile. The market price of our common stock may also fluctuate significantly in response to the following factors, most of which are beyond our control:

-

variations in our quarterly operating results;

-

changes in market valuations of similar companies;

-

announcements by us or our competitors of significant new products; and,

-

the loss of key management.

The equity markets have, on occasion, experienced significant price and volume fluctuations that have particularly affected the market prices for the shares of development stage companies and that have often been unrelated to the operating performance of these companies. Any such fluctuations may adversely affect the market price of our common stock, regardless of our actual operating performance. As a result, our stockholders may be unable to sell their shares, or may be forced to sell them at a loss.

Because we can issue additional shares of our common stock or preferred stock, purchasers of our common stock may experience dilution in their ownership of our company in the future.

We are authorized to issue up to 100,000,000 shares of common stock and 100,000,000 shares of preferred stock. As of October 25, 2010, there were 3,893,600 shares of our common stock issued and outstanding and no shares of our preferred stock issued and outstanding. Our board of directors has the authority to cause our company to issue additional shares of common stock or preferred stock without the consent of any of our stockholders. Consequently, our stockholders may experience dilution in their ownership of our company in the future.

16

We do not intend to pay any dividends on our common stock in the foreseeable future.

We do not currently anticipate declaring and paying dividends to our stockholders in the foreseeable future. It is our current intention to apply net earnings, if any, in the foreseeable future to increasing our working capital. We currently have no material revenues and a history of losses, so there can be no assurance that we will ever have sufficient earnings to declare and pay dividends to the holders of shares of our common stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of directors, which currently do not intend to pay any dividends on shares of our common stock for the foreseeable future.

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

The Financial Industry Regulatory Authority sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority, which we refer to as FINRA, has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our common stock and have an adverse effect on the market for shares of our common stock.

Item 1B. Unresolved Staff Comments.

Not applicable.

17

Item 2. Properties.

Principal Office

Our principal executive offices are located at 5147 Mountain Sights, Montreal, Quebec H3W 2Y1, Canada. We rent the 300 square foot offices from Lumisculpt Productions, Inc. at a monthly rent of CDN$1,000, including G.S.T. (General Sales Tax of 5%), together with all outstanding charges and disbursements, to pay interest of 2.0% per month on any invoiced charges, disbursements or service fees, including interest on interest charges which are outstanding for more than 30 days, and to pay any taxes or license fees assessed against us or that portion of the premises occupied by us as additional rent. The agreement is for a term of 12 months commencing on December 15, 2008 and thereafter on a month-to-month basis. The agreement may be terminated by Lumisculpt by giving one month’s clear written notice to us, or immediately for cause. The agreement may be terminated by us by giving two months clear written notice to Lumisculpt, following the six month term, provided, however, that all terms of the agreement have been complied with by us to Lumisculpt’s satisfaction. Lumisculpt Productions Inc. is a company of which Asbed Palakian is the founder and principal. Also Mr. Palakian owns and controls Lumisculpt. We believe our current premises are adequate for our current operations and we do not anticipate that we will require any additional premises in the foreseeable future.

Item 3. Legal Proceedings.

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

Item 4. (Removed and Reserved).

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our shares of common stock are quoted on the OTC Bulletin Board under the symbol “PPOR”. Our CUSIP number is 702848 102. There have been no trades of our shares of common stock reported on the OTC Bulletin Board.

Holders of our Common Stock

As of the date of this report the shareholders' list of our common shares showed 42 registered shareholders holding 3,893,600 shares; there are no shares held by broker-dealers. There are 3,893,600 shares outstanding.

Dividends

We have not declared any dividends since incorporation and do not anticipate that we will do so in the foreseeable future. Although there are no restrictions that limit the ability to pay dividends on our common shares, our intention is to retain future earnings for use in our operations and the expansion of our business.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans in place.

18

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

Since the beginning of the fourth quarter of our fiscal year ended August 31, 2010, we have not sold any equity securities that were not registered under the Securities Act of 1933 that were not previously reported in a quarterly report on Form 10-Q or in a current report on Form 8-K.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

Because we are in the development stage and are yet to attain profitable operations, in their report on our financial statements for the year ended August 31, 2010, our independent auditors included an explanatory paragraph regarding the substantial doubt about our ability to continue as a going concern.

The following discussion should be read in conjunction with our audited consolidated financial statements for the year ended August 31, 2010 and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this annual report, particularly in the section entitled “Risk Factors” beginning on page 10 of this annual report.

Our audited financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Overview

We were incorporated in the state of Nevada on December 2, 2008. Our wholly-owned subsidiary, Passport Arts Inc., was incorporated in the province of Quebec, Canada on December 10, 2008.

We are in the business of selling artworks through the Internet. We procure artworks from emerging artists working primarily in the Caucasus and Central Asia for sales in developed art markets like the United States, the United Kingdom, Europe, and Canada and, in future expansion, developing art markets including Russia and China. Through our subsidiary, Passport Arts Inc., incorporated in the province of Quebec, Canada, we operate our primary sales vehicle, passportarts.com, and we showcase artworks in an online gallery located at that website. Artworks range in price from $300 to $10,000.

Our business is located in Montreal, Canada, but we intend to serve a clientele base worldwide through our current and future operating partners. We have established—and intend to continue to establish—relationships with art professionals in strategic regions around the world who can, through their expertise, source and nurture relationships with artists to develop our business. We depend on our Vice-president, Procurement, Hasmik Ginoyan, who is also Director of Exhibitions at the National Gallery of Armenia to use her extensive contacts throughout the Caucasus and Central Asia to establish relationships directly with artists or art professional like herself who will source unique and undiscovered artists in their respective regions to showcase on PassportArts.com.

In order to be profitable, we need to grow and expand our product offering. Currently we have approximately 248 artworks for sale. We will need to significantly increase that number in order to offer something for everyone. As well, we will need to offer lower-cost products such as poster reproductions from the original art to supplement revenue. We will need to translate the site to other major languages like French, Spanish, Chinese and Russian in order to reach more potential buyers. To accommodate these future initiatives, our website must be able to handle the larger product offering and increased traffic.

19

As a result of our failure to generate substantial revenues from our current business, we are simultaneously seeking compatible or alternate business opportunities with established business entities for the merger of a target business with our company. In certain instances, a target business may wish to become a subsidiary of us or may wish to contribute assets to us rather than merge. We have not entered into any definitive agreements to enter into a business acquisition or opportunity to date and there can be no assurance that we will be able to enter into any definitive agreements. When any such agreement is reached, we intend to disclose such an agreement by filing a current report on Form 8-K with the Securities and Exchange Commission.

The search for new business opportunities, and any due diligence required in connection with such business opportunities, is expected to be undertaken by Asbed Palakian, our president and chief executive officer, who is not a professional business analyst. In seeking or analyzing prospective business opportunities, Mr. Palakian may utilize the services of outside consultants or advisors. Management does not have the capacity to conduct as extensive an investigation of a target business as might be undertaken by a venture capital fund or similar institution. As a result, management may elect to merge with a target business which has one or more undiscovered shortcomings and may, if given the choice to select among target businesses, fail to enter into an agreement with the most investment-worthy target business.

In implementing a structure for a particular business acquisition or opportunity, we may become a party to a merger, consolidation, reorganization, joint venture, or licensing agreement with another corporation or entity. We may also acquire stock or assets of an existing business. Upon the consummation of a transaction, it is likely that our present management will no longer be in control of our company. In addition, it is likely that our officer and director will, as part of the terms of the acquisition transaction, resign and be replaced by one or more new officers and directors.

We anticipate that any new acquisition or business opportunity by our company will require additional financing. There can be no assurance, however, that we will be able to acquire the financing necessary to enable us to pursue such an acquisition or opportunity. If our company requires additional financing and we are unable to acquire such funds, our business may fail.

Sources of Revenue

We generate revenue by selling artworks showcased in an online gallery located at our website, passportarts.com. Currently, the sales of the artworks from Seven Arts account for approximately 65% of our total sales, while the sales of the prints of Vasgen Degirmentas’s photographs account for approximately 35% of our total sales. While we anticipate selling more prints of Mr. Degirmentas’s photographs than the artworks from Seven Arts, we anticipate that we will generate more cash from selling the artworks from Seven Arts than from selling the prints of Mr. Degirmentas’s photographs because of the differences in retail price.

If our existing relationship with Seven Arts or Vasgen Degirmentas deteriorates or is terminated in the future, and we are not successful in establishing a relationship with an alternative supplier at prices and products currently offered by Seven Arts Ltd. or Vasgen Degirmentas, our results of operations could be adversely affected. In addition, a significant decline in the financial condition of Seven Arts Ltd. or Vasgen Degirmentas, a material rise in their prices or a reduction in the number of products currently available from them could adversely affect our results of operations. In order to reduce our reliance on Seven Arts or Vasgen Degirmentas, we need to identify greater sources of artwork to offer to our customers. It is not known whether we will be able to identify such sources.

In order to be successful, we need to attract and retain a high volume of online customers to our website at a reasonable cost. We may not be able to convert a large number of customers from traditional shopping methods to online shopping for artworks and as a result may never achieve widespread customer acceptance of shopping for artworks online. Specifically, customers may not wish to change the way they purchase artworks and may feel it is necessary to view the actual artworks rather than pictures before purchasing them. In addition, customers may not be willing to make orders online due to perceived security issues or pricing that does not meet customer expectations. As a result we may never drive sufficient revenues from our operations in order to become a profitable enterprise. In order to increase our customer base, we plan to increase our marketing efforts, but it is not known whether our efforts can lead to the increased customer base to make our company profitable.

20

Demand for artworks is affected by the general economic conditions in the United States and Canada. When economic conditions are favorable, management expects purchases of non-essential items like artworks to increase, and therefore expects our revenue to increase. When economic conditions are less favourable, management expects sales of artworks to be lower. Therefore, any significant economic downturn could have a material adverse effect on our financial condition and results of operations.

The fluctuations in United States dollar can have a favorable or unfavorable impact on our future net sales and revenues. All transactions on our website are in United States dollars. However, because our clientele is based around the world, the relationship between their currency and United States dollar is an influencing factor on our future sales.

Results of Operations

For the year ended August 31, 2010 and for the period from December 2, 2008 (Date of Inception) to August 31, 2009

The following table summarizes our operating results for the year ended August 31, 2010 and for the period from December 2, 2008 (Date of Inception) to August 31, 2009:

| From December 2, 2008 | ||||||

| (Date of Inception) to | ||||||

| August 31, 2010 | August 31, 2009 | |||||

| Revenue | $ | 10,141 | $ | 2,516 | ||

| Cost of Sales | $ | 4,766 | $ | 1,417 | ||

| Gross Margin | $ | 5,375 | $ | 1,099 | ||

| Expenses | $ | 76,321 | $ | 37,423 | ||

| Gain/Loss on Sale of Assets | $ | (212 | ) | $ | - | |

| Net Loss | $ | 70,734 | $ | 36,324 |

During the year ended August 31, 2010, we generated revenues of $10,141 with cost of sales of $4,766, resulting in gross maring of $5,375. We generated revenues primarily from the sale of artwork through our website. The cost of sales primarily consisted of the artwork itself.

During the period from December 2, 2008 (date of inception) to August 31, 2009, we generated revenues of $2,516 with cost of sales of $1,417, resulting in gross margin of $1,099. We generated revenues primarily from the sale of artwork through our website. The cost of sales primarily consisted of the artwork itself.