Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CrossAmerica Partners LP | exhibit991capl3q2016earnin.htm |

| 8-K - 8-K - CrossAmerica Partners LP | capl20163qform8-kearningsr.htm |

3Q 2016

Earnings Call

November 2016

Safe Harbor Statement

2

Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are

forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “estimates,” “target” and other similar expressions

identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such

forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or

forecasted, see CrossAmerica’s Forms 10-Q or Form 10-K filed with the Securities and Exchange Commission and available on

CrossAmerica’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove

to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during

this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no

obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information,

future events, or otherwise.

Important Additional Information

In connection with the proposed transaction, CST has filed a proxy statement and other relevant documents concerning the proposed

transaction with the SEC. The definitive proxy statement has been sent or given to CST stockholders and contains important

information about the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR

ENTIRETY THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS. Investors and security holders are be able to obtain a copy of the proxy statement as well as

other documents filed with the SEC free of charge at the SEC’s website at http://www.sec.gov. In addition, the proxy statement, the

SEC filings that are incorporated by reference in the proxy statement and the other documents filed with the SEC by CST may be

obtained free of charge from CST’s Investor Relations page on its corporate website at http://www.cstbrands.com.

Certain Information Concerning Participants

CST and its directors, executive officers, and certain other members of management and employees may be deemed to be

participants in the solicitation of proxies from CST stockholders in connection with the proposed transaction. Information about the

directors and executive officers of CST is set forth in CST’s Annual Report on Form 10-K for the year ended December 31, 2015 and

the proxy statement on Schedule 14A for CST’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 29, 2016.

Additional information regarding participants in the proxy solicitation may be obtained by reading the proxy statement regarding the

proposed transaction when it becomes available.

CrossAmerica Business Overview

Jeremy Bergeron, President

3

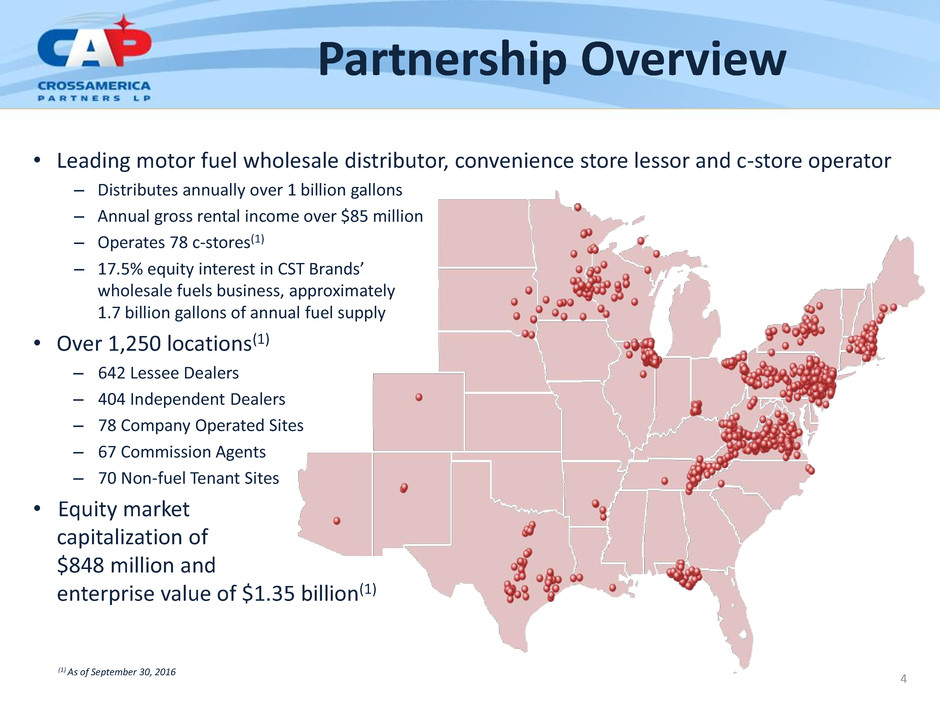

Partnership Overview

• Leading motor fuel wholesale distributor, convenience store lessor and c-store operator

– Distributes annually over 1 billion gallons

– Annual gross rental income over $85 million

– Operates 78 c-stores(1)

– 17.5% equity interest in CST Brands’

wholesale fuels business, approximately

1.7 billion gallons of annual fuel supply

• Over 1,250 locations(1)

– 642 Lessee Dealers

– 404 Independent Dealers

– 78 Company Operated Sites

– 67 Commission Agents

– 70 Non-fuel Tenant Sites

• Equity market

capitalization of

$848 million and

enterprise value of $1.35 billion(1)

(1) As of September 30, 2016

4

Continuing Accretive Growth

5

52 Lessee Dealers, 25 Indep.

Dealers, 3 Company Ops*

$41.8 Million Purchase

60 Million Gallons

Chicago Market

Marathon, Citgo, Phillips 66,

Mobil, BP, Shell

Sep 27, 2016 close date

Asset Purchase

Rationale

• 56 valuable fee sites in

Greater Chicago

• Located in proximity of

existing markets

• Expands branding

relationship with several

suppliers

* - Also includes 2 non-fuel locations

154 previous locations

82 acquired State Oil locations

CrossAmerica Upper Midwest Region

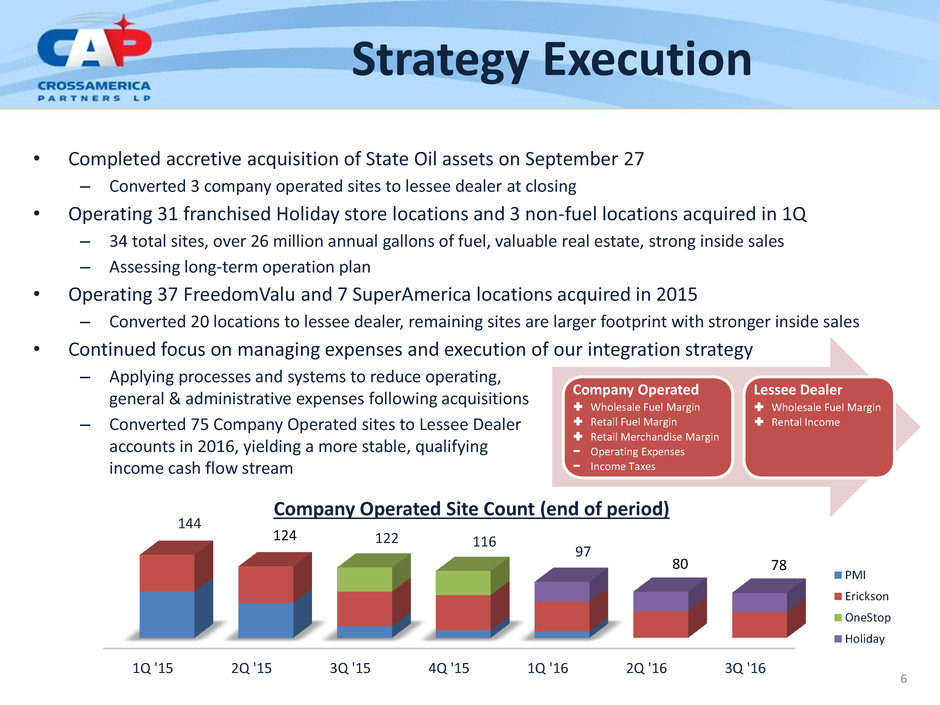

Strategy Execution

1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 2Q '16 3Q '16

144

122 116

97

124

80 78

Company Operated Site Count (end of period)

PMI

Erickson

OneStop

Holiday

Company Operated

Wholesale Fuel Margin

Retail Fuel Margin

Retail Merchandise Margin

− Operating Expenses

− Income Taxes

Lessee Dealer

Wholesale Fuel Margin

Rental Income

6

• Completed accretive acquisition of State Oil assets on September 27

– Converted 3 company operated sites to lessee dealer at closing

• Operating 31 franchised Holiday store locations and 3 non-fuel locations acquired in 1Q

– 34 total sites, over 26 million annual gallons of fuel, valuable real estate, strong inside sales

– Assessing long-term operation plan

• Operating 37 FreedomValu and 7 SuperAmerica locations acquired in 2015

– Converted 20 locations to lessee dealer, remaining sites are larger footprint with stronger inside sales

• Continued focus on managing expenses and execution of our integration strategy

– Applying processes and systems to reduce operating,

general & administrative expenses following acquisitions

– Converted 75 Company Operated sites to Lessee Dealer

accounts in 2016, yielding a more stable, qualifying

income cash flow stream

2010 2011 2012 2013 2014 2015 3Q16

516,200 530,500

605,162 637,845

906,200

1,051,357 1,025,523

Operating Results

Operating Results

(in thousands, except for per gallon and site count)

Three Months ended Sep 30,

2016 2015

%

Change

Total Motor Fuel Sites (period avg.) 1,115 1,094 2%

Total Volume of Gallons Distributed 267,121 284,089 (6%)

Wholesale Fuel Margin per Gallon $0.053 $0.061 (13%)

Rental & Other Gross Profit (Wholesale) $14,263 $12,621 13%

Company Operated Sites (period avg.) 76 157 (52%)

Volume of Company Op Gallons Distributed 20,651 42,107 (51%)

Company Op Fuel Margin per Gallon $0.082 $0.166 (51%)

General, Admin. & Operating Expenses $20,366 $28,813 (29%)

Gallons of Motor Fuel Distributed (in thousands)

2010 2011 2012 2013 2014 2015 3Q16

332 368

511 556 571

691

809

87

116

78

Number of Sites Owned & Leased (end of period)

Generating Rental Income Company Operated

TTM

2010 2011 2012 2013 2014 2015 3Q16

$18,961 $20,425 $21,222

$41,577 $43,258

$59,962

$78,236

Gross Rental Income (in thousands)

TTM

7

3Q 2016 Results

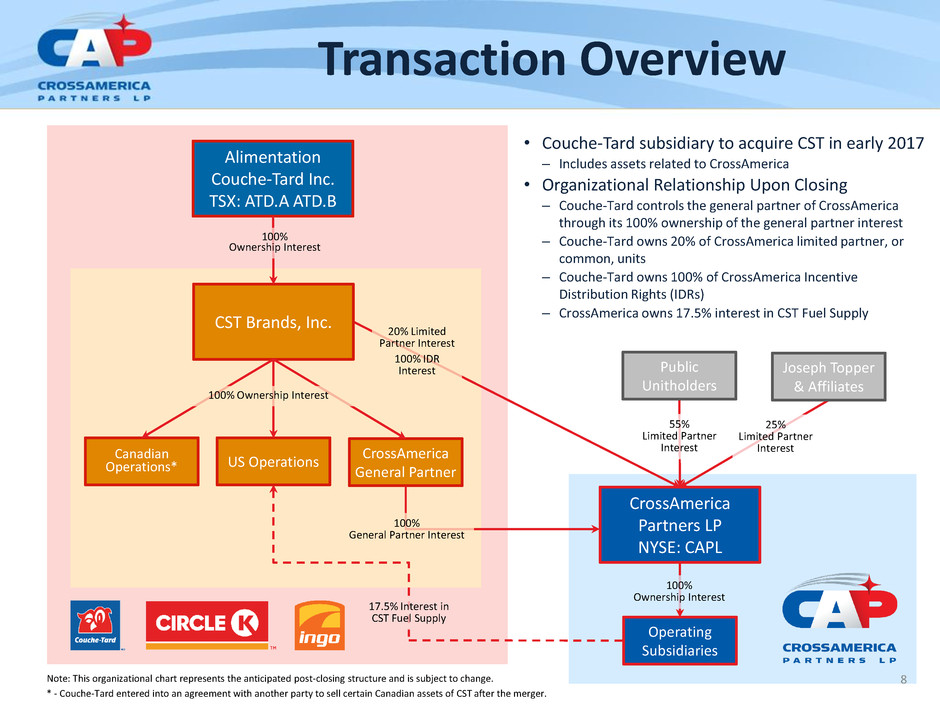

Transaction Overview

8

Operating

Subsidiaries

55%

Limited Partner

Interest

CrossAmerica

Partners LP

NYSE: CAPL

Public

Unitholders

Joseph Topper

& Affiliates

CST Brands, Inc.

Canadian

Operations* US Operations

CrossAmerica

General Partner

Alimentation

Couche-Tard Inc.

TSX: ATD.A ATD.B

25%

Limited Partner

Interest

100%

Ownership Interest

100% Ownership Interest

20% Limited

Partner Interest

100% IDR

Interest

100%

Ownership Interest

100%

General Partner Interest

* - Couche-Tard entered into an agreement with another party to sell certain Canadian assets of CST after the merger.

• Couche-Tard subsidiary to acquire CST in early 2017

– Includes assets related to CrossAmerica

• Organizational Relationship Upon Closing

– Couche-Tard controls the general partner of CrossAmerica

through its 100% ownership of the general partner interest

– Couche-Tard owns 20% of CrossAmerica limited partner, or

common, units

– Couche-Tard owns 100% of CrossAmerica Incentive

Distribution Rights (IDRs)

– CrossAmerica owns 17.5% interest in CST Fuel Supply

17.5% Interest in

CST Fuel Supply

Note: This organizational chart represents the anticipated post-closing structure and is subject to change.

Strategic Benefit to CAPL

• Provides continuity with a sponsor whose management culture is aligned with

CrossAmerica

– Disciplined operator with best practices in acquisitions and integration

– Strong and consistent financial performance throughout all economic cycles

– Heightened focus on growing free cash flow, with particular expertise in cost management

– Well capitalized with solid balance sheet

– Well positioned to lead further consolidation in fragmented industry

• Scale and global reach provides additional operational benefits

– Further strengthens relationship with many of our key suppliers

– Many turnkey branding and franchise programs that can

complement our dealer offerings

• Supports dealer health, which

impacts fuel volume growth and

additional rental income potential

• Wholesale operations with

complementary geographic reach

9

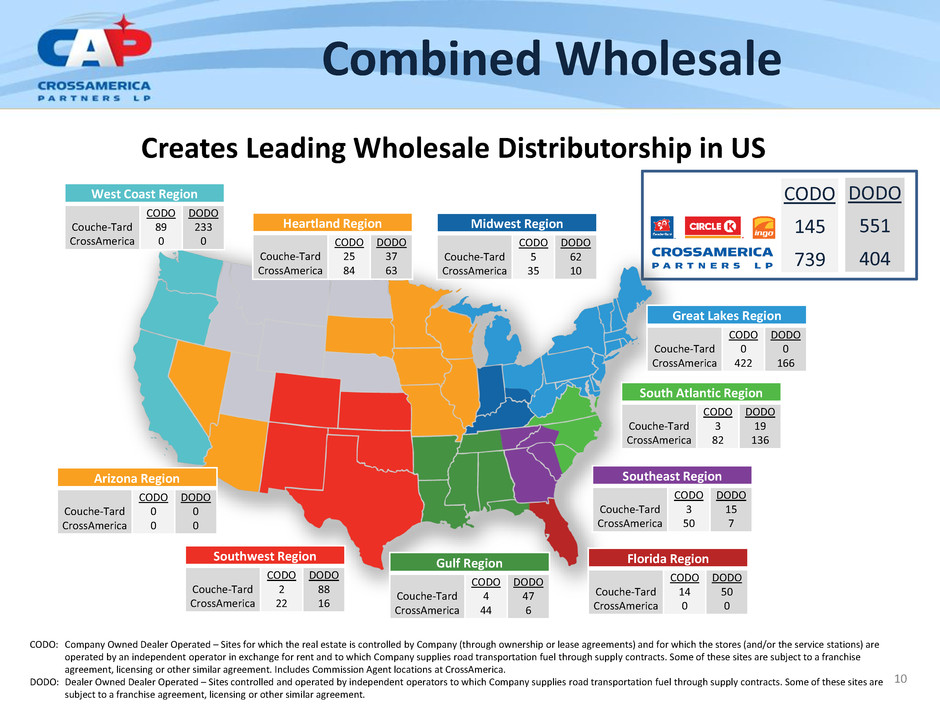

Combined Wholesale

10

West Coast Region

Couche-Tard

CrossAmerica

CODO

89

0

DODO

233

0

Arizona Region

Couche-Tard

CrossAmerica

CODO

0

0

DODO

0

0

Southwest Region

Couche-Tard

CrossAmerica

CODO

2

22

DODO

88

16

Gulf Region

Couche-Tard

CrossAmerica

CODO

4

44

DODO

47

6

Southeast Region

Couche-Tard

CrossAmerica

CODO

3

50

DODO

15

7

Florida Region

Couche-Tard

CrossAmerica

CODO

14

0

DODO

50

0

South Atlantic Region

Couche-Tard

CrossAmerica

CODO

3

82

DODO

19

136

Great Lakes Region

Couche-Tard

CrossAmerica

CODO

0

422

DODO

0

166

Midwest Region

Couche-Tard

CrossAmerica

CODO

5

35

DODO

62

10

Heartland Region

Couche-Tard

CrossAmerica

CODO

25

84

DODO

37

63

CODO: Company Owned Dealer Operated – Sites for which the real estate is controlled by Company (through ownership or lease agreements) and for which the stores (and/or the service stations) are

operated by an independent operator in exchange for rent and to which Company supplies road transportation fuel through supply contracts. Some of these sites are subject to a franchise

agreement, licensing or other similar agreement. Includes Commission Agent locations at CrossAmerica.

DODO: Dealer Owned Dealer Operated – Sites controlled and operated by independent operators to which Company supplies road transportation fuel through supply contracts. Some of these sites are

subject to a franchise agreement, licensing or other similar agreement.

Creates Leading Wholesale Distributorship in US

CODO

145

739

DODO

551

404

CrossAmerica Financial Overview

Steven Stellato, Chief Accounting Officer

11

3Q 2016 Results

12 (1) See the (i) reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF in the

appendix of this presentation.

KEY METRICS

Three Months ended Sep 30,

2016 2015 % Change

Gross Profit $39,138 $50,969 (23%)

Adjusted EBITDA(1) $27,086 $30,963 (13%)

Distributable Cash Flow(1) $21,254 $25,120 (15%)

Weighted Avg. Diluted Units 33,391 33,094 1%

Distribution Paid per LP Unit $0.6025 $0.5625 7%

Distribution Coverage 1.06x 1.35x (22%)

Financial Summary

(in thousands, except for per unit amounts)

3Q15 vs 3Q16 Adjusted EBITDA(1)

(in thousands)

$27,086

$30,963

$1,684 ($731) ($1,144)

($2,491)

($1,195)

Acquisitions &

Integration(2)

Impact of

Supplier

Terms

Discounts

Q3 2015

Adjusted

EBITDA(1)

Q3 2016

Adjusted

EBITDA(1)

Net, Misc.(3)

Retail Fuel

CPG Margin

(1) See the (i) reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF in the

appendix of this presentation.

(2) Acquisitions & Integration includes third party acquisitions conducted since 10/1/15 and integration activity on prior transactions

(3) Net, Misc. includes increased Incentive Distribution Right distributions and other miscellaneous items

13

3Q 2016 Results

Impact of

Dealer Tank

Wagon

Pricing

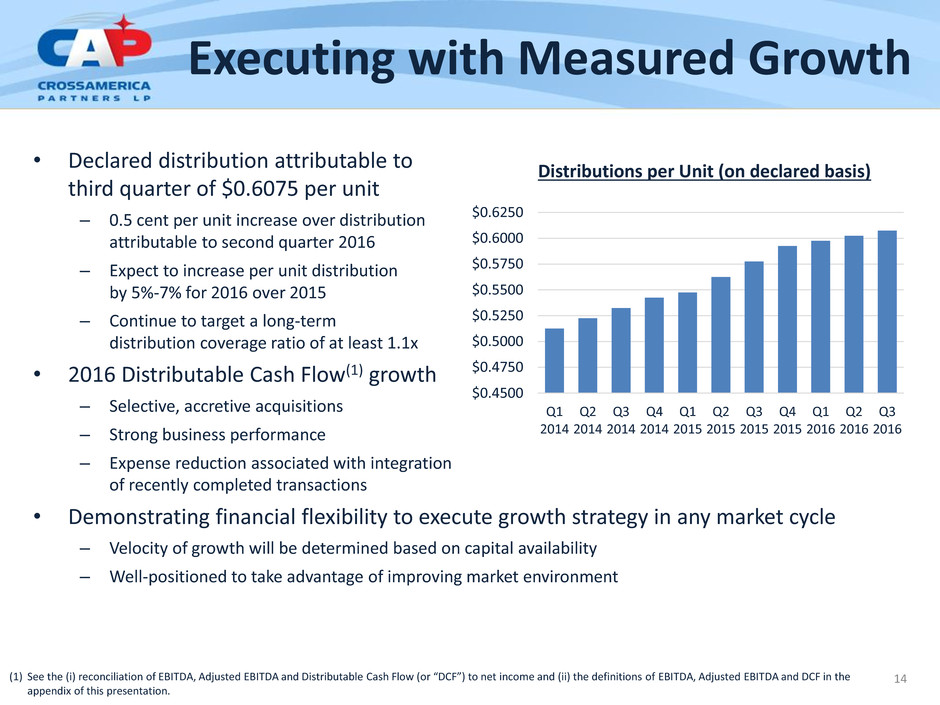

Executing with Measured Growth

• Declared distribution attributable to

third quarter of $0.6075 per unit

– 0.5 cent per unit increase over distribution

attributable to second quarter 2016

– Expect to increase per unit distribution

by 5%-7% for 2016 over 2015

– Continue to target a long-term

distribution coverage ratio of at least 1.1x

• 2016 Distributable Cash Flow(1) growth

– Selective, accretive acquisitions

– Strong business performance

– Expense reduction associated with integration

of recently completed transactions

• Demonstrating financial flexibility to execute growth strategy in any market cycle

– Velocity of growth will be determined based on capital availability

– Well-positioned to take advantage of improving market environment

14

$0.4500

$0.4750

$0.5000

$0.5250

$0.5500

$0.5750

$0.6000

$0.6250

Q1

2014

Q2

2014

Q3

2014

Q4

2014

Q1

2015

Q2

2015

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Q3

2016

Distributions per Unit (on declared basis)

(1) See the (i) reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF in the

appendix of this presentation.

Appendix

15

16

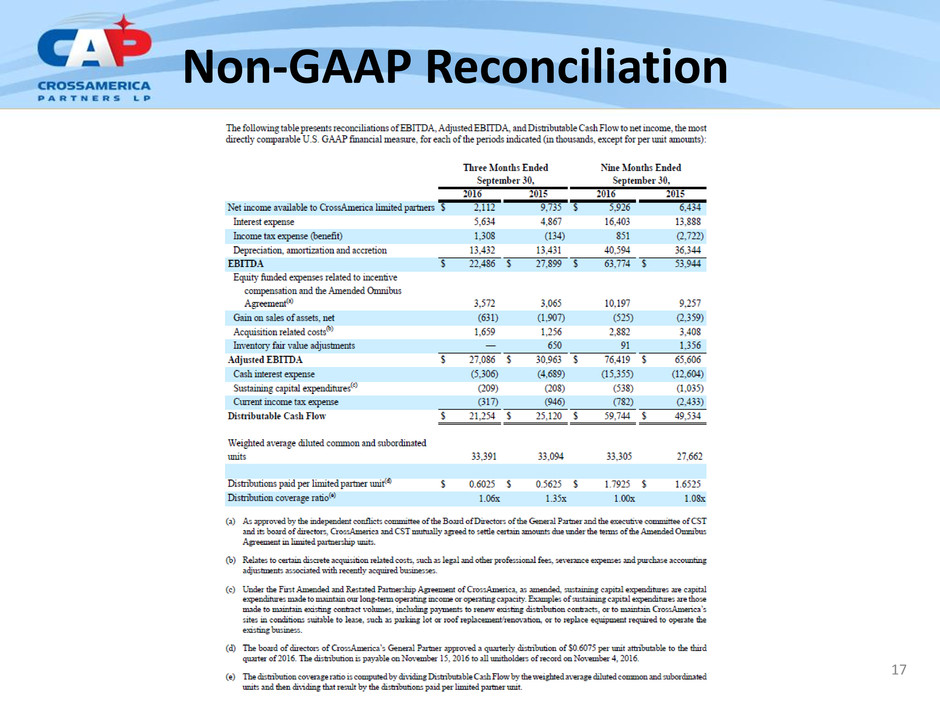

Non-GAAP Financial Measures

17

Non-GAAP Reconciliation