Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - INSIGHT ENTERPRISES INC | d194915dex992.htm |

| EX-99.1 - EX-99.1 - INSIGHT ENTERPRISES INC | d194915dex991.htm |

| EX-2.1 - EX-2.1 - INSIGHT ENTERPRISES INC | d194915dex21.htm |

| 8-K - 8-K - INSIGHT ENTERPRISES INC | d194915d8k.htm |

Insight to Acquire Datalink November 7, 2016 Exhibit 99.3

Important Information Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this communication may constitute “forward-looking statements.” Forward-looking statements can usually be identified by the use of words such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “opinion,” “plan,” “possible,” “potential,” “project,” “should,” “will” and other expressions which indicate future events or trends. These forward-looking statements are based upon certain expectations and assumptions and are subject to risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including the following: Datalink’s shareholders may not approve the transaction; conditions to the closing of the transaction, including receipt of required regulatory approvals, may not be satisfied; the transaction may involve unexpected costs, liabilities or delays; the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected time frames or at all and to successfully integrate Datalink’s operations into those of Insight; such integration may be more difficult, time consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the transaction; uncertainties surrounding the transaction; the outcome of any legal proceedings related to the transaction; Datalink and/or Insight may be adversely affected by other economic, business, and/or competitive factors; risks that the pending transaction disrupts current plans and operations; the retention of key employees of Datalink; other risks to consummation of the transaction, including circumstances that could give rise to the termination of the merger agreement and the risk that the transaction will not be consummated within the expected time period or at all; and the other risks described from time to time in Datalink’s and Insight’s reports filed with the Securities and Exchange Commission (the “SEC”) under the heading “Risk Factors,” including each company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, subsequent Quarterly Reports on Form 10-Q and in other of Datalink’s and Insight’s filings with the SEC. All forward-looking statements are qualified by, and should be considered in conjunction with, such cautionary statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which such statements were made. Except as required by applicable law, neither Insight nor Datalink undertakes any obligation to update forward-looking statements to reflect events or circumstances arising after such date. Additional Information and Where to Find It In connection with the transaction, Datalink intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Datalink will mail the definitive proxy statement and a proxy card to each shareholder entitled to vote at the special meeting relating to the transaction. Datalink shareholders are urged to carefully read these materials (and any amendments or supplements) and any other relevant documents that Datalink files with the SEC when they become available because they will contain important information. The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the transaction (when they become available), and any other documents filed by Datalink with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov), at Datalink’s investor website (http://www.datalink.com/Investor-Information), or by writing or calling Datalink at Datalink Corporation, 10050 Crosstown Circle, Suite 500, Eden Prairie, Minnesota 55344 or by (952) 944-3462. Participants in the Solicitation Datalink and its directors and executive officers, and Insight and its directors and officers, may be deemed to be participants in the solicitation of proxies from Datalink’s stockholders with respect to the transaction. Information about Datalink’s directors and executive officers and their ownership of Datalink’s common stock is set forth in Datalink’s proxy statement on Schedule 14A filed with the SEC on April 15, 2016. To the extent that holdings of Datalink’s securities have changed since the amounts printed in Datalink’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the identity of the participants in the proxy solicitation, and their direct or indirect interests in the transaction, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with SEC in connection with the transaction. Information about the directors and executive officers of Insight is set forth in the proxy statement for Insight’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 5, 2016.

Insight’s Acquisition of Datalink Insight to acquire Datalink (Nasdaq: “DTLK”) for $11.25 per share, implying an equity purchase price of approximately $258 million and enterprise value of $196 million (net of cash and debt acquired) Strengthens position as a market leading IT solutions provider with global scale and deep technical talent focused on delivering data center solutions to clients on premise or in the cloud To be financed through cash on hand and borrowings under existing credit facilities

Increases addressable market opportunity in high growth data center categories Enhances our go-to-market with solutions-led approach Expands our services capabilities, particularly in the data center and around next generation technologies Drives scale and growth by adding complementary capabilities, partner relationships and clients in key U.S. markets Leverages our best-in-class digital marketing engine to bring scalable solutions to the mid-market Consistency of culture, values and vision across the organizations Accretive to gross margins with increased services sales and higher growth, higher margin product categories Significant run-rate cost savings of approximately $20M expected within 2 years Expected to be accretive to Adjusted EPS in the first year Insight and Datalink: Strategic & Compelling Acquisition 4

Datalink Profile

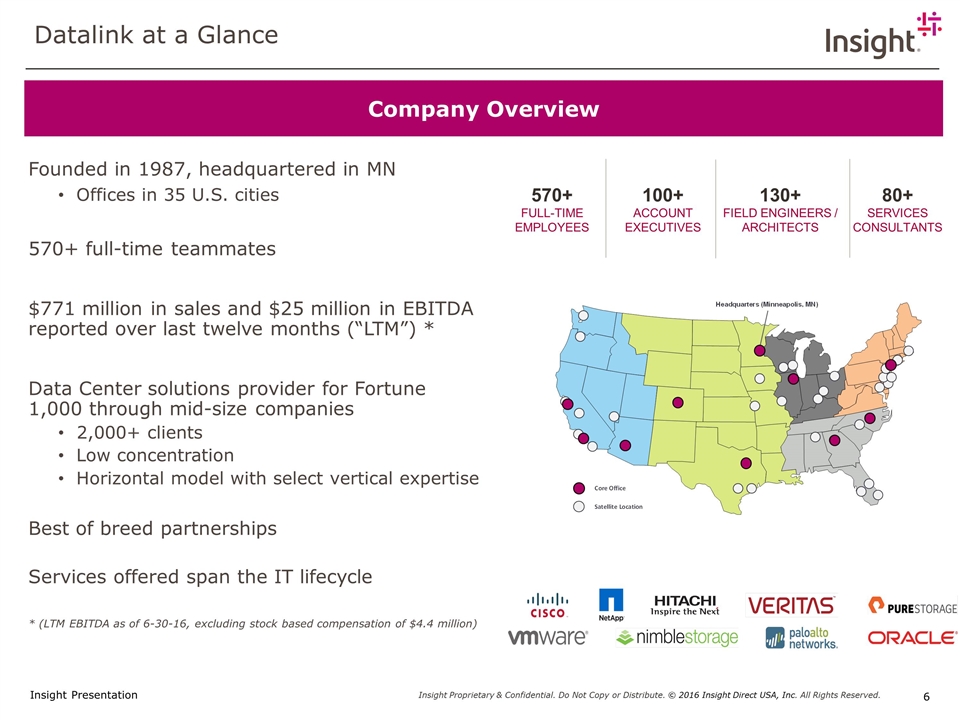

Datalink at a Glance Founded in 1987, headquartered in MN Offices in 35 U.S. cities 570+ full-time teammates $771 million in sales and $25 million in EBITDA reported over last twelve months (“LTM”) * Data Center solutions provider for Fortune 1,000 through mid-size companies 2,000+ clients Low concentration Horizontal model with select vertical expertise Best of breed partnerships Services offered span the IT lifecycle * (LTM EBITDA as of 6-30-16, excluding stock based compensation of $4.4 million) Company Overview 130+ Field Engineers / Architects 100+ Account Executives 80+ Services Consultants 570+ Full-Time Employees

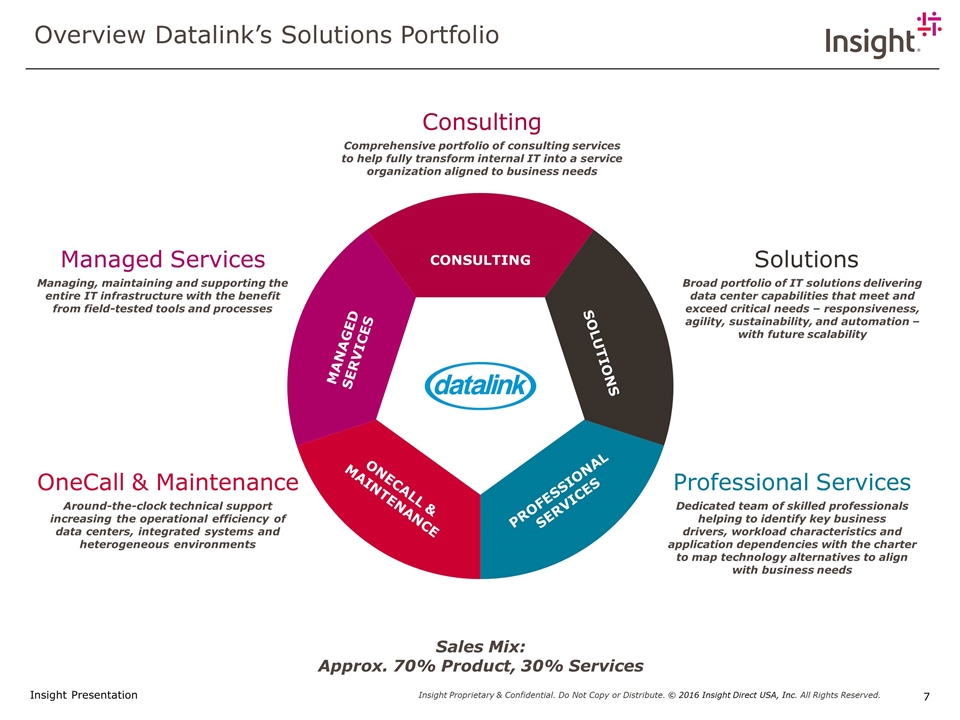

Overview Datalink’s Solutions Portfolio CONSULTING SOLUTIONS PROFESSIONAL SERVICES ONECALL & MAINTENANCE MANAGED SERVICES Consulting Comprehensive portfolio of consulting services to help fully transform internal IT into a service organization aligned to business needs Professional Services Dedicated team of skilled professionals helping to identify key business drivers, workload characteristics and application dependencies with the charter to map technology alternatives to align with business needs Solutions Broad portfolio of IT solutions delivering data center capabilities that meet and exceed critical needs – responsiveness, agility, sustainability, and automation – with future scalability OneCall & Maintenance Around-the-clock technical support increasing the operational efficiency of data centers, integrated systems and heterogeneous environments Managed Services Managing, maintaining and supporting the entire IT infrastructure with the benefit from field-tested tools and processes Sales Mix: Approx. 70% Product, 30% Services

Why Are We Excited About Datalink?

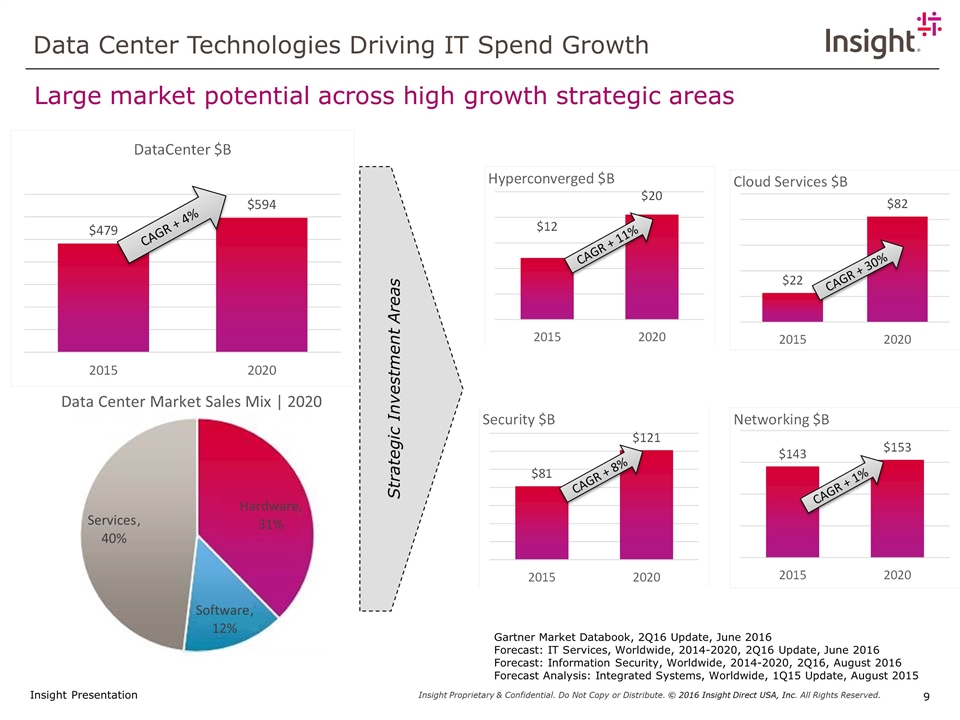

Data Center Technologies Driving IT Spend Growth Strategic Investment Areas Large market potential across high growth strategic areas Gartner Market Databook, 2Q16 Update, June 2016 Forecast: IT Services, Worldwide, 2014-2020, 2Q16 Update, June 2016 Forecast: Information Security, Worldwide, 2014-2020, 2Q16, August 2016 Forecast Analysis: Integrated Systems, Worldwide, 1Q15 Update, August 2015 Hardware, 31% Software , 12% Services , 40% Data Center Market Sales Mix | 2020

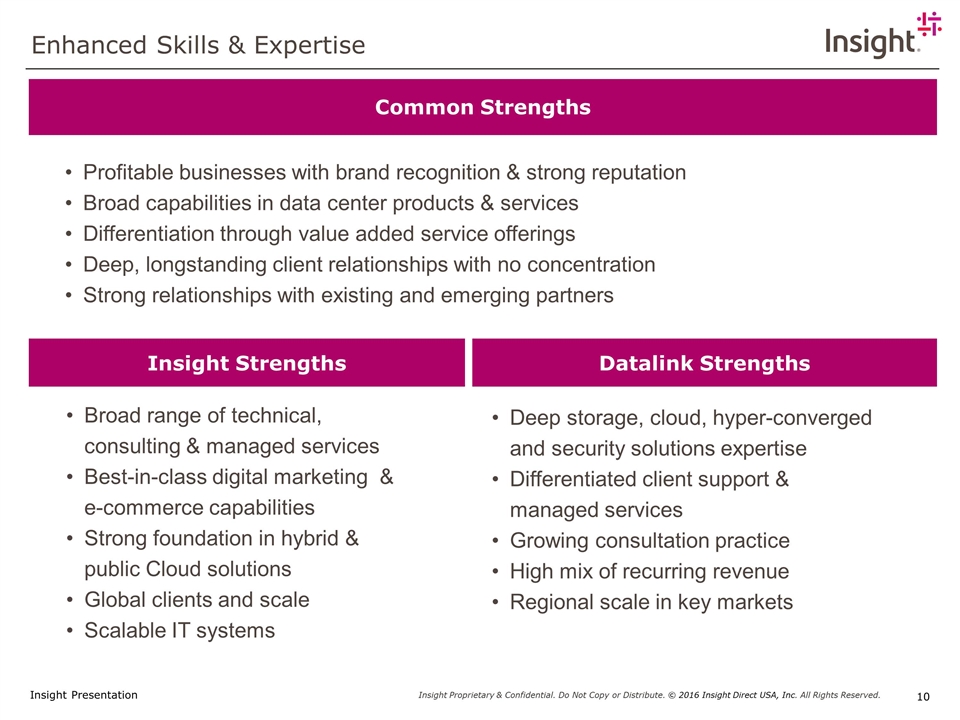

Enhanced Skills & Expertise Common Strengths Broad range of technical, consulting & managed services Best-in-class digital marketing & e-commerce capabilities Strong foundation in hybrid & public Cloud solutions Global clients and scale Scalable IT systems Insight Strengths Deep storage, cloud, hyper-converged and security solutions expertise Differentiated client support & managed services Growing consultation practice High mix of recurring revenue Regional scale in key markets Datalink Strengths Profitable businesses with brand recognition & strong reputation Broad capabilities in data center products & services Differentiation through value added service offerings Deep, longstanding client relationships with no concentration Strong relationships with existing and emerging partners

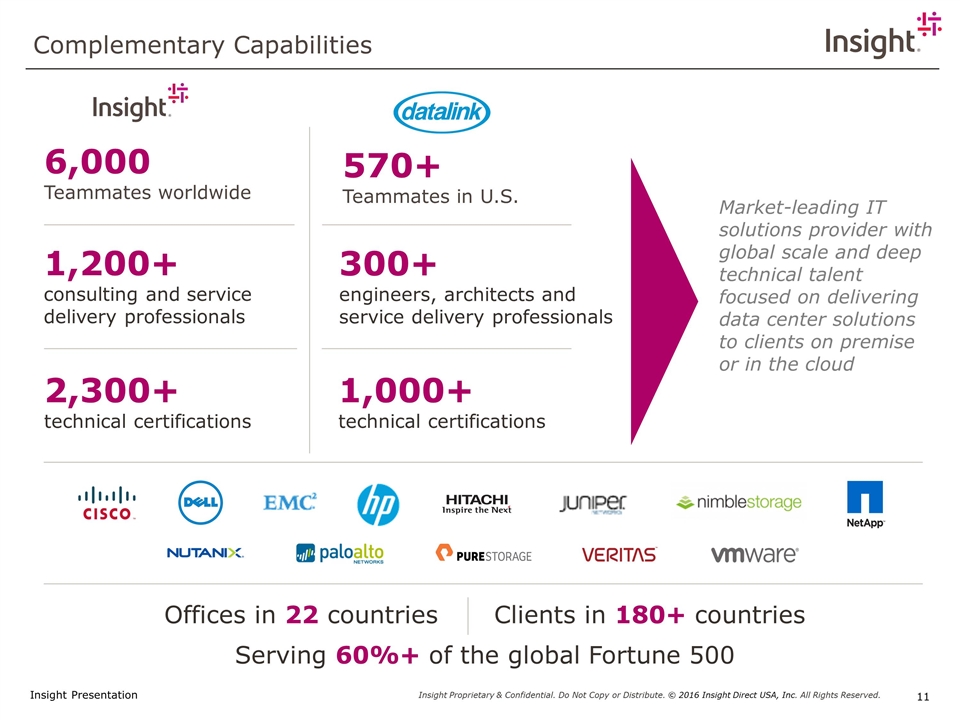

Complementary Capabilities 6,000 Teammates worldwide 2,300+ technical certifications 1,200+ consulting and service delivery professionals Offices in 22 countriesClients in 180+ countries Serving 60%+ of the global Fortune 500 570+ Teammates in U.S. 1,000+ technical certifications 300+ engineers, architects and service delivery professionals Market-leading IT solutions provider with global scale and deep technical talent focused on delivering data center solutions to clients on premise or in the cloud

Financial Overview

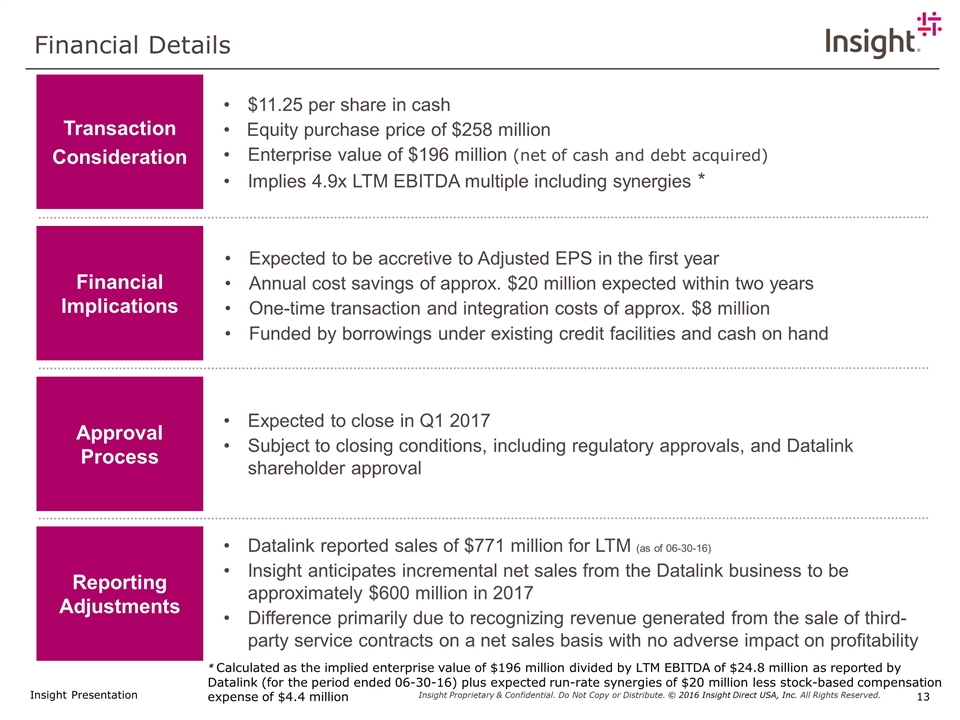

Financial Details $11.25 per share in cash Equity purchase price of $258 million Enterprise value of $196 million (net of cash and debt acquired) Implies 4.9x LTM EBITDA multiple including synergies * Expected to be accretive to Adjusted EPS in the first year Annual cost savings of approx. $20 million expected within two years One-time transaction and integration costs of approx. $8 million Funded by borrowings under existing credit facilities and cash on hand Transaction Consideration Approval Process Financial Implications Reporting Adjustments Datalink reported sales of $771 million for LTM (as of 06-30-16) Insight anticipates incremental net sales from the Datalink business to be approximately $600 million in 2017 Difference primarily due to recognizing revenue generated from the sale of third-party service contracts on a net sales basis with no adverse impact on profitability * Calculated as the implied enterprise value of $196 million divided by LTM EBITDA of $24.8 million as reported by Datalink (for the period ended 06-30-16) plus expected run-rate synergies of $20 million less stock-based compensation expense of $4.4 million Expected to close in Q1 2017 Subject to closing conditions, including regulatory approvals, and Datalink shareholder approval

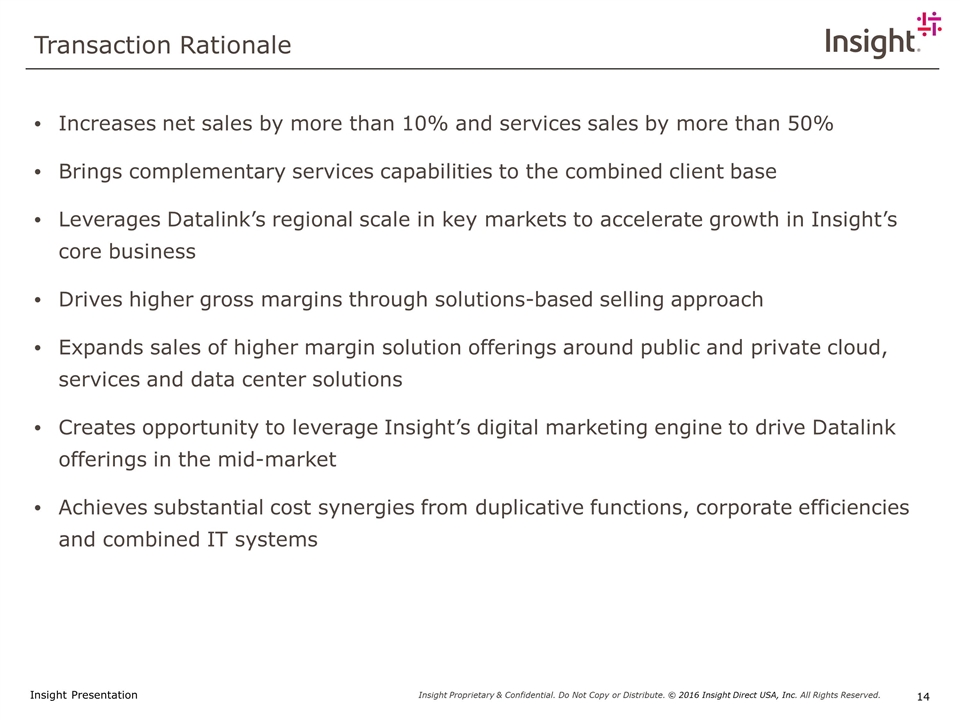

Transaction Rationale Increases net sales by more than 10% and services sales by more than 50% Brings complementary services capabilities to the combined client base Leverages Datalink’s regional scale in key markets to accelerate growth in Insight’s core business Drives higher gross margins through solutions-based selling approach Expands sales of higher margin solution offerings around public and private cloud, services and data center solutions Creates opportunity to leverage Insight’s digital marketing engine to drive Datalink offerings in the mid-market Achieves substantial cost synergies from duplicative functions, corporate efficiencies and combined IT systems

Thank you Questions