Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - INSIGHT ENTERPRISES INC | d850449dex321.htm |

| EX-21 - EX-21 - INSIGHT ENTERPRISES INC | d850449dex21.htm |

| EX-24.7 - EX-24.7 - INSIGHT ENTERPRISES INC | d850449dex247.htm |

| EX-23.1 - EX-23.1 - INSIGHT ENTERPRISES INC | d850449dex231.htm |

| EX-24.2 - EX-24.2 - INSIGHT ENTERPRISES INC | d850449dex242.htm |

| EX-24.6 - EX-24.6 - INSIGHT ENTERPRISES INC | d850449dex246.htm |

| EX-24.3 - EX-24.3 - INSIGHT ENTERPRISES INC | d850449dex243.htm |

| EX-24.1 - EX-24.1 - INSIGHT ENTERPRISES INC | d850449dex241.htm |

| EX-31.1 - EX-31.1 - INSIGHT ENTERPRISES INC | d850449dex311.htm |

| EX-31.2 - EX-31.2 - INSIGHT ENTERPRISES INC | d850449dex312.htm |

| EX-24.5 - EX-24.5 - INSIGHT ENTERPRISES INC | d850449dex245.htm |

| EX-24.4 - EX-24.4 - INSIGHT ENTERPRISES INC | d850449dex244.htm |

| EXCEL - IDEA: XBRL DOCUMENT - INSIGHT ENTERPRISES INC | Financial_Report.xls |

| EX-24.8 - EX-24.8 - INSIGHT ENTERPRISES INC | d850449dex248.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2014

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number: 0-25092

INSIGHT ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 86-0766246 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

6820 South Harl Avenue, Tempe, Arizona 85283

(Address of principal executive offices, Zip Code)

Registrant’s telephone number, including area code: (480) 333-3000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common stock, par value $0.01 | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

n/a

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based upon the closing price of the registrant’s common stock as reported on The Nasdaq Global Select Market on June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, was $1,246,650,771.

The number of shares outstanding of the registrant’s common stock on February 13, 2015 was 39,753,955.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to its 2015 Annual Meeting of Stockholders have been incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this Annual Report on Form 10-K.

Table of Contents

INSIGHT ENTERPRISES, INC.

ANNUAL REPORT ON FORM 10-K

Year Ended December 31, 2014

| Page | ||||||

| PART I | ||||||

| ITEM 1. |

2 | |||||

| ITEM 1A. |

9 | |||||

| ITEM 1B. |

13 | |||||

| ITEM 2. |

14 | |||||

| ITEM 3. |

14 | |||||

| ITEM 4. |

15 | |||||

| PART II | ||||||

| ITEM 5. |

15 | |||||

| ITEM 6. |

18 | |||||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||

| ITEM 7A. |

35 | |||||

| ITEM 8. |

36 | |||||

| ITEM 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

69 | ||||

| ITEM 9A. |

69 | |||||

| ITEM 9B. |

69 | |||||

| PART III | ||||||

| ITEM 10. |

69 | |||||

| ITEM 11. |

69 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

70 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

70 | ||||

| ITEM 14. |

70 | |||||

| PART IV | ||||||

| ITEM 15. |

70 | |||||

| 71 | ||||||

| 72 | ||||||

Table of Contents

INSIGHT ENTERPRISES, INC.

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K, including statements in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this report, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include: projections of matters that affect net sales, gross profit, operating expenses, earnings from operations, non-operating income and expenses, net earnings or cash flows, cash needs and the payment of accrued expenses and liabilities; the effect of changes being implemented by our largest software partner to elements of its channel incentive program, including the expected financial effect in 2015; the expected effects of seasonality on our business; that there will be further consolidation in the Information Technology (“IT”) industry; our business strategy and our strategic initiatives, including our efforts to grow our core business, develop and grow our global Cloud business and build scalable services business; the availability of competitive sources of products for our purchase and resale; industry pricing and consolidation trends; our intentions concerning the payment of dividends and retirement of treasury shares; our acquisition strategy; our ability to offset the effects of inflation and manage any increase in interest rates; projections of capital expenditures in 2015; the sufficiency of our capital resources and the availability of financing and our needs or plans relating thereto; the effect of new accounting principles or changes in accounting policies; the effect of indemnification obligations; projections about the outcome of ongoing tax audits; our positions and strategies with respect to ongoing and threatened litigation; our exposure to derivative counterparty concentration and non-performance risks; our ability to expand our client relationships; that pricing pressures in the IT industry will continue; the sufficiency of our facilities; our intention not to repatriate certain foreign undistributed earnings where management considers those earnings to be reinvested indefinitely and plans relating thereto; our plans to use cash flow from operations for working capital, to pay down debt, make capital expenditures, repurchase shares of our common stock, and fund acquisitions; our exposure to off-balance sheet arrangements; statements of belief; and statements of assumptions underlying any of the foregoing. Forward-looking statements are identified by such words as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “project,” “will,” “may” and variations of such words and similar expressions and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. There can be no assurances that results described in forward-looking statements will be achieved, and actual results could differ materially from those suggested by the forward-looking statements. Some of the important factors that could cause our actual results to differ materially from those projected in any forward-looking statements include, but are not limited to, the following:

| • | our reliance on partners for product availability and competitive products to sell as well as our competition with our partners; |

| • | our reliance on partners for marketing funds and purchasing incentives; |

| • | changes in the IT industry and/or rapid changes in technology; |

| • | actions of our competitors, including manufacturers and publishers of products we sell; |

| • | failure to comply with the terms and conditions of our commercial and public sector contracts; |

| • | disruptions in our IT systems and voice and data networks; |

| • | the security of our electronic and other confidential information; |

| • | general economic conditions; |

| • | our reliance on commercial delivery services; |

| • | our dependence on certain personnel; |

| • | the variability of our net sales and gross profit; |

| • | the risks associated with our international operations; |

| • | exposure to changes in, interpretations of, or enforcement trends related to tax rules and regulations; and |

| • | intellectual property infringement claims and challenges to our registered trademarks and trade names. |

Additionally, there may be other risks that are otherwise described from time to time in the reports that we file with the Securities and Exchange Commission. Any forward-looking statements in this report should be considered in light of various important factors, including the risks and uncertainties listed above, as well as others. We assume no obligation to update, and, except as may be required by law, do not intend to update, any forward-looking statements. We do not endorse any projections regarding future performance that may be made by third parties.

1

Table of Contents

INSIGHT ENTERPRISES, INC.

| Item 1. | Business |

General

Insight Enterprises, Inc. (“Insight” or the “Company”) is a leading worldwide technology provider of integrated solutions to business and government clients. Through our extensive hardware, software and services offerings and efficient supply chain combined with highly skilled technology specialists and engineers, we provide integrated information technology (“IT”) solutions to our clients’ most compelling problems, helping them run their businesses smarter. Our ability to assess, design, deploy and manage IT solutions creates meaningful connections with our clients, enabling them to better manage and secure their IT environments. We are a single source for our clients’ diverse IT needs, simplifying their businesses and helping them control their IT costs.

The Company is organized in the following three operating segments, which are primarily defined by their related geographies:

| Operating Segment* |

Geography |

% of 2014 Consolidated Net Sales |

||||

| North America |

United States and Canada |

67 | % | |||

| EMEA |

Europe, Middle East and Africa |

29 | % | |||

| APAC |

Asia-Pacific |

4 | % | |||

| * | Additional detailed segment and geographic information can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 and in Note 22 to the Consolidated Financial Statements in Part II, Item 8 of this report. |

Insight has locations in 22 countries, and we have the capabilities to serve clients in more than 200 countries and territories with software provisioning and related services, transacting business in 15 languages and 15 currencies. Our offerings in North America and select countries in EMEA include a suite of IT hardware, software and services solutions. Our offerings in the remainder of our EMEA segment and in APAC are almost entirely software and select software-related services. On a consolidated basis, hardware, software and services represented 52%, 43% and 5%, respectively, of our net sales in 2014 compared to 51%, 44% and 5%, respectively, in 2013.

We began operations in Arizona in 1988, incorporated in Delaware in 1991 and completed our initial public offering in 1995. Our corporate headquarters are located in Tempe, Arizona. We began operations in the U.S., expanded into Canada in 1997 and into the United Kingdom in 1998. In 2006, through our acquisition of Software Spectrum, Inc., we expanded deeper into global markets in EMEA and APAC. In 2008, through our acquisitions of Calence, LLC in North America and MINX Limited in the United Kingdom, we enhanced our global technical expertise around higher-end networking and communications technologies, as well as managed services and security. In 2011, we enhanced our professional services capabilities by acquiring Tempe, Arizona-based Ensynch, Incorporated (“Ensynch”). In 2012, we expanded our hardware capabilities into key markets in our existing European footprint by acquiring Inmac GmbH and Micro Warehouse BV (“Inmac”), a broad portfolio business-to-business hardware reseller based in Germany and the Netherlands. Through the evolution of our business and these acquisitions, we have successfully migrated from our reseller roots to become a comprehensive IT solutions provider.

Values

We have an established set of values that set the tone for our business and define who we are. Our core values are:

| • | We Exist to Win the Loyalty of Our Clients |

| • | We Respect Each Other |

| • | We Develop and Value Our Teammates |

| • | We Act with Integrity |

| • | We Strive for Operational Excellence in All We Do |

2

Table of Contents

INSIGHT ENTERPRISES, INC.

We believe that these values strengthen the overall Insight experience for our teammates, clients and partners (we refer to our employees as “teammates,” our customers as “clients” and our suppliers as “partners”). By living these values, we believe we are able to attract, develop and retain great talent and instill a winning culture.

Business Strategy

Our purpose is to make meaningful connections that help businesses run smarter. Our value is our ability to guide, advise, implement and manage IT solutions for our clients, and our strategy is to grow profitable market share by delivering relevant IT solutions to our clients on a scalable support and delivery platform. With the continual emergence of new technologies in the IT industry, we believe businesses continue to seek technology providers to supply value-added advice to help them identify and deploy complex IT solutions, rather than to just supply product selection, price and availability. We believe that Insight has a unique position in the market to gain profitable market share by providing enhanced value to our clients.

We believe that what differentiates Insight from our competitors is:

| • | Our scalable services and solution offering – we have well developed services capabilities, including over 1,200 skilled, certified consulting and service delivery professionals, focused on managed, technical and professional services. |

| • | Our software expertise – we understand complex licensing requirements and have the know-how to optimize our clients’ usage and compliance management through a portfolio of Software Asset Management (“SAM”) services. |

| • | Our global scale – we have the capabilities to serve clients in more than 200 countries and territories with software provisioning and related services. |

| • | Our E-Commerce capability – we have customizable client portals, primarily in North America that allow clients to streamline procurement and processes through a self-service online tool, drive standardization and optimize reconciliation. |

| • | Our one-stop shopping value proposition – we have a multi-partner approach and have partnerships with all of the leading product manufacturers, software publishers and distribution partners as well as emerging Cloud technology partners to service our global portfolio of commercial and public sector clients with the best integrated IT solutions with the products that make the most sense for their IT environments. |

| • | Our operational expertise and effectiveness – we offer a broad offering of hardware and software products with access to billions of dollars in virtual inventory and efficient supply chain execution as well as product fulfillment and logistics capabilities, management tools and technical expertise. |

Our long-term strategy represents a continuation and refinement of our 2014 growth initiatives and includes three components:

| • | Grow our core business and improve profitability; |

| • | Build scalable services business; and |

| • | Develop and grow our global Cloud business. |

Grow our core business and improve profitability. We believe that there is significant opportunity for profitable growth in our core business as a technology provider of integrated solutions to business and government clients. Our balanced portfolio of manufacturer and publisher brands, extensive E-commerce and logistics capabilities and differentiated service delivery capabilities allow us to tailor our offerings based on the size and complexity of our clients. In addition, our go-to-market model leverages both centralized and local market sales, technical and support resources to efficiently serve and advise our clients.

In each of our geographic operating segments, we are focused on driving our growth objectives by acquiring new clients within our pre-defined target client set, or as we call it, our TAM, and expanding our relationships with existing clients by increasing the types of products and services they buy from us. In North America, we are expanding our local market presence in select cities by investing in sales, technical and service delivery resources to drive growth with existing and new TAM clients, particularly in the large account client space, as well as to drive expansion in specific service/solution areas with key partners. We are also concentrating our efforts on growing our business with mid-sized and large clients in select vertical markets, including Federal government, K-12 education, healthcare and service provider, and have been investing in both local market and centralized sales resources to drive these efforts. In EMEA, we are focused on increasing our share in the mid-market and public sector by increasing software and select hardware sales across the business. We are also working to expand our services capabilities in the region and plan to leverage

3

Table of Contents

INSIGHT ENTERPRISES, INC.

strategic relationships with partners and service delivery vendors to bring additional software, Cloud and collaboration solutions to clients beginning in 2015. Our APAC operating segment, which is largely comprised of software sales, is engaged in growing our sales in the mid-market and public sector and on the development of specialized software services, particularly in the areas of software asset management and the Cloud.

We continue to place significant emphasis on profitability initiatives throughout the Company. We regularly perform client and partner profitability reviews and intend to expand our business relationships to drive an appropriate level of profitability. Additionally, we are continuing to implement specific action plans to remediate the negative effects on our gross profit of program changes implemented by our largest software partner.

Build scalable services business. We are engaged with top IT partners in designing, procuring, deploying, implementing and managing solutions that combine hardware, software and services to leverage technology to deliver business results. Our solutions can be provided through a variety of delivery mechanisms, including on-premise, remotely, or through a private, public or hybrid Cloud. The key areas of focus are:

| • | Integrated Collaboration – integrating the best of breed features across Cisco and Microsoft to improve employee productivity; |

| • | Omni-Channel Retail – designing, deploying and managing store architectures to enable customer loyalty and store profitability; |

| • | Hybrid Cloud – designing a public-private-hybrid Cloud roadmap, migrating workloads to a public Cloud and implementing a converged infrastructure platform to enable business agility; |

| • | Workforce Mobility – providing secure any time/place/device access to information and applications to enhance employee productivity; and |

| • | Strategic Outsourcing – outsourcing end-user support and network operations to improve return on IT investment. |

In North America, we have teams of technology specialists and architects who have expertise around applying technology to solve our clients’ business challenges in these focus areas. These teams drive best practices within our broader sales organization, support demand generation activities and provide oversight from pre-sales through service delivery. We believe that by concentrating on market relevant and differentiated solutions offerings, we can deliver more profitable, repeatable and scalable services solutions.

We also intend to take advantage of the trends impacting the technology market, with a specific emphasis on Cloud computing and mobility. We are committed to leveraging opportunities as manufacturers, publishers and service providers develop new technologies and as new channels for buying and supplying technology develop and gain market acceptance.

While Insight’s business was primarily built on hardware and software product sales, which are still the foundation of many of our client relationships, we believe our services capabilities differentiate Insight in the marketplace and enhance our profitability. Although our services capabilities are most mature in North America, we are investing to expand our capabilities in EMEA and APAC around software license optimization and management, Cloud assessment and migration and workplace collaboration. In addition, we are developing our capabilities and expanding our service partner network in the United Kingdom, the Netherlands, Germany, France and Canada to deliver select hardware-related services to clients in those markets.

Develop and grow our global Cloud business. Cloud computing represents an evolution in the IT world. Private, public and hybrid Cloud solutions provide flexible, reliable and affordable solutions for delivering critical IT functions, such as email, data security, data center hosting and more.

Our global Cloud strategy is a two-pronged approach:

| • | Expand our current Cloud portfolio to include Software as a Service (“SaaS”) and Infrastructure as a Service (“IaaS”) solutions in the areas of office collaboration, mobility, data protection and security and hybrid Cloud, continuing to build out our portfolio based on clients’ needs; and |

4

Table of Contents

INSIGHT ENTERPRISES, INC.

| • | Develop Cloud assessment and migration services to help clients determine which workloads should be transitioned from the traditional IT computing model to Cloud computing and provide managed Cloud services to assist clients in operating their Cloud environment. |

Offerings

Services Offerings. We currently offer a suite of consulting, technical and managed services in the U.S. and the United Kingdom via Insight teammates, augmented by service partners to fill gaps in our geographic coverage or capabilities. We also utilize partners to deliver these services in Canada and selected services in the rest of EMEA and APAC. We believe that developing the breadth and quality of these capabilities internally or through targeted acquisitions over time will be a key differentiator for us. We have, and intend to continue to develop, an array of technical expertise and service capabilities to help identify, acquire, implement and manage technology solutions to allow our clients to improve their business performance. We deliver these services through three service groups:

Consulting Services

| • | Assessment, design and implementation |

| • | Office productivity, networking, collaboration and data center practices |

Technical Services

| • | Multi-site deployment, outsourcing and maintenance |

| • | Support across a wide range of hardware and software partners from desktops to infrastructure |

Managed Services

| • | An extension of our client’s team to monitor, manage and resolve issues |

| • | Remote Network Operation Center (“RNOC”), integration labs, service desk and National Repair Center (“NRC”). |

Our consulting services help our clients preserve capital and increase the value from limited resources by delivering business-critical applications and programs from the Cloud. With low upfront costs and no need for in-house maintenance, “as-a-service” offerings are an effective alternative to potentially more capital-intensive, on-premise solutions. We partner with providers to deliver solutions around collaboration and messaging, managed security and data management, including Microsoft, Symantec, McAfee and IBM. We also help our clients successfully adopt “as-a-service” offerings by providing Cloud readiness, migration and management services.

Additionally, we help our clients standardize their software environments while reducing costs and limiting risk through optimal license use and compliance management. We offer clients a portfolio of Software Asset Management (“SAM”) services, including SAM consultations, assessment of ISO standard attainment, and license reconciliations. We help clients determine their license rights and utilization rates, reconcile the difference, and then proactively track, analyze, and manage their software portfolio from procurement to update to retirement.

Our technical services help clients deliver technology refresh across geographically dispersed locations, in some cases thousands of locations. In addition, we provide Service Level Agreement (“SLA”) based outsourcing of end user support, network operations and maintenance.

Managed Services include our RNOC, which provides 24x7 remote management of clients’ infrastructure, spanning network, server and storage. Our ISO certified labs deliver a range of services from imaging to configuration to remote testing of product in a client’s IT environment via secure Virtual Private Network (“VPN”) connections. The NRC offers repair, remarketing and overnight hot-swap services. We have a smaller RNOC in the United Kingdom.

Our service teams are made up of industry-, technical- and product-certified engineers, consultants, architects and specialists who are current on best practices and the latest developments in their respective practice areas and reference architectures.

We are a Cisco Gold Certified partner in the United States and the United Kingdom and have Master Certifications in unified communications and security in the United States. Our data center practice in the United States is a Hewlett-Packard (“HP”) Authorized Enterprise Provider and holds HP Storage Elite, HP Blade Elite and HP Services Elite partner status. We hold Microsoft Gold certifications in identity and security, portals and collaboration, virtualization,

5

Table of Contents

INSIGHT ENTERPRISES, INC.

server platform, systems management, software asset management and volume licensing and are a Microsoft Cloud Accelerator Partner. We also have been awarded premier partner status by a number of other partners, such as IBM, EMC and VMware.

Hardware Offerings. We offer our clients in North America and select countries in EMEA a comprehensive selection of IT hardware products. We offer products from hundreds of manufacturers, including such industry leaders as Cisco, HP, Lenovo, Dell, EMC, NetApp, Apple and IBM. Our scale and purchasing power, combined with our efficient, high-volume and cost effective direct sales and marketing model, allow us to offer competitive prices. We believe that offering choices from multiple partners enables us to better serve our clients by providing a variety of product solutions to address their specific business needs. These needs may be based on particular client preferences or other criteria, such as real-time best pricing and availability, or compatibility with existing technology.

The four hardware technology categories we have identified as key to our solutions selling focus are:

| • | Desktop, notebook and tablet |

| • | Networking |

| • | Server and power |

| • | Storage |

In addition to our distribution facilities, we have “direct-ship” programs with many of our partners, including manufacturers and distributors, allowing us to expand our product offerings without increasing inventory, handling costs or inventory risk exposure. As a result, we are able to provide a product offering with billions of dollars of products in virtual inventory. Convenience and product options among multiple brands are key competitive advantages against manufacturers’ direct selling programs, which are generally limited to their own brands and may not offer clients a complete or best-in-class solution across all product categories.

Software Offerings. Our clients acquire software applications from us in the form of licensing agreements with software publishers, boxed products, or through SaaS, whereby clients subscribe to software that is hosted either by the software publisher or a dedicated third-party hosting company. We offer products from hundreds of publishers, including such industry leaders as Microsoft, Adobe, VMware, Symantec, McAfee and Citrix, as well as newer entrants, such as Box and 8x8. Today, the majority of our clients obtain their software applications through licensing agreements, which we believe is a result of their ease of administration and cost-effectiveness. Licensing agreements, or right-to-copy agreements, allow a client to either purchase a license for each of its users in a single transaction or periodically report its software usage, paying a license fee based on the number of users.

As software publishers choose different models for implementing licensing agreements, businesses must evaluate the alternatives to ensure that they select the appropriate agreements and comply with the publishers’ licensing terms when purchasing and managing their software licenses. We provide assessment services to help our clients better understand their software needs, evaluate their existing software and provide options to optimize their assets.

The four software and licensing technology categories we have identified as key to our solutions selling focus are:

| • | Office productivity |

| • | Virtualization |

| • | Creativity |

| • | Data protection |

Our Information Technology Systems

We have committed significant resources to the IT systems we own and use to manage our business and believe that our success is dependent upon our ability to provide prompt and efficient service to our clients based on the accuracy, quality and utilization of the information generated by our IT systems. Because these systems affect our ability to manage our sales, client service, partner relationships and programs, distribution, inventories and accounting systems and our voice and data networks, we have built redundancy into certain systems, maintain system outage policies and procedures and have comprehensive data backup. We are focused on driving improvements in sales productivity through upgraded IT systems to support higher levels of client satisfaction and new client acquisition, as well as garnering efficiencies in our business.

6

Table of Contents

INSIGHT ENTERPRISES, INC.

We operate under a single, standardized IT system across North America and APAC and a separate, single IT system platform in all countries in our EMEA operations.

For a discussion of risks associated with our IT systems, see “Risk Factors – Disruptions in our IT systems and voice and data networks could affect our ability to service our clients and cause us to incur additional expenses,” in Part I, Item 1A of this report.

Competition

The IT hardware, software and services industry is very fragmented and highly competitive. We compete with a large number and wide variety of marketers and resellers of IT hardware, software and services, including:

| • | Direct marketers and resellers, such as CDW (North America), Systemax (Europe), Softchoice, Comparex, PC Connection, PCM, World Wide Technology, SHI, SoftwareONE, Computacenter, Specialist Computercenters, Bechtle and Cancom; |

| • | National and regional resellers, including value-added resellers, specialty retailers, aggregators, distributors, and to a lesser extent, national computer retailers, computer superstores, Internet-only computer providers, consumer electronics and office supply superstores and mass merchandisers; |

| • | Product manufacturers, such as Dell, HP, IBM and Lenovo; |

| • | Software publishers, such as IBM, Microsoft and Symantec; |

| • | Systems integrators, such as Compucom Systems, Inc.; |

| • | National and global service providers, such as IBM Global Services and HP Enterprise Services; and |

| • | E-tailers, such as Newegg, Buy.com and e-Buyer (United Kingdom). |

The competitive landscape in the industry is continually changing as various competitors expand their product and service offerings. In addition, emerging models such as Cloud computing are creating new competitors and opportunities in messaging, infrastructure, security, collaboration and other services offerings, and, as with other areas, we both resell and compete directly with many of these offerings.

For a discussion of risks associated with the actions of our competitors, see “Risk Factors – The IT hardware, software and services industry is intensely competitive, and actions of our competitors, including manufacturers and publishers of products we sell, can negatively affect our business,” in Part I, Item 1A of this report.

Partners

During 2014, we purchased products and software from approximately 3,600 partners. Approximately 63% (based on dollar volume) of these purchases were directly from manufacturers or software publishers, with the balance purchased through distributors. Purchases from Microsoft and Ingram Micro (a distributor) accounted for approximately 25% and 11%, respectively, of our aggregate purchases in 2014. No other partner accounted for more than 10% of purchases in 2014. Our top five partners as a group for 2014 were Microsoft, Ingram Micro, HP, Cisco and Tech Data (a distributor), and approximately 63% of our total purchases during 2014 came from this group of partners. Although brand names and individual products are important to our business, we believe that competitive sources of supply are available in substantially all of our product categories such that, with the exception of Microsoft, we are not dependent on any single partner for sourcing products.

During 2014, sales of Microsoft, HP and Cisco products accounted for approximately 31%, 14% and 10%, respectively, of our consolidated net sales. No other manufacturer’s products accounted for more than 10% of our consolidated net sales in 2014. Sales of product from our top five manufacturers/publishers as a group (Microsoft, HP, Cisco, Lenovo and Dell) accounted for approximately 67% of Insight’s consolidated net sales during 2014.

We obtain incentives from certain product manufacturers, software publishers and distribution partners based typically upon the volume of sales or purchases of their products and services. In other cases, such incentives may be in the form of participation in our partner programs, which may require specific services or activities with our clients, discounts, marketing funds, price protection or rebates. Manufacturers and publishers may also provide mailing lists, contacts or leads to us. We believe that these incentives (or partner funding) and other marketing assistance allow us to increase our marketing reach and strengthen our relationships with leading manufacturers and publishers. This funding is important to us, and any elimination or substantial reduction would increase our costs of goods sold or marketing expenses, resulting in a corresponding decrease in our earnings from operations.

7

Table of Contents

INSIGHT ENTERPRISES, INC.

We are focused on understanding our partners’ objectives and developing plans and programs to grow our mutual businesses. We measure partner satisfaction regularly and hold quarterly business reviews with our largest partners to review business results from the prior quarter, discuss plans for the future and obtain feedback. Additionally, we host annual partner conferences in North America, EMEA and APAC to articulate our plans for the upcoming year.

As we move into new service areas, we may become even more reliant on certain partner relationships. For a discussion of risks associated with our reliance on partners, see “Risk Factors – We rely on our partners for product availability and competitive products to sell, and we also compete with many of our partners” and “– We rely on our partners for marketing funds and purchasing incentives,” in Part I, Item 1A of this report.

Teammates

As of December 31, 2014, we employed 5,406 teammates, of whom 2,965 were engaged in management, support services and administration activities (including over 1,200 skilled, certified consulting and service delivery professionals), 2,324 were engaged in sales related activities, and 117 were engaged in distribution activities. Our teammates in the U.S. are not represented by a labor union, and our workforces in certain foreign countries, such as Germany, have worker representative committees or work councils with which we maintain strong relationships. We believe our relations with employees are good, and we have never experienced a labor related work stoppage.

For a discussion of risks associated with our dependence on certain personnel, including sales personnel, see “Risk Factors – We depend on certain personnel,” in Part I, Item 1A of this report.

Seasonality

We experience some seasonal trends in our sales of IT hardware, software and services. For example:

| • | software sales are typically seasonally higher in our second and fourth quarters, particularly the second quarter; |

| • | business clients, particularly larger enterprise businesses in the U.S., tend to spend more in our fourth quarter as they utilize their remaining capital budget authorizations, and less in the first quarter; |

| • | sales to the federal government in the U.S. are often stronger in our third quarter, while sales in the state and local government and education markets are stronger in our second quarter; and |

| • | sales to public sector clients in the United Kingdom are often stronger in our first quarter. |

These trends create overall seasonality in our consolidated results such that sales and profitability are expected to be higher in the second and fourth quarters of the year. For a discussion of risks associated with seasonality see “Risk Factors – Our net sales and gross profit have historically varied, making our future operating results less predictable,” in Part I, Item 1A of this report.

Backlog

The majority of our backlog historically has been and continues to be open cancelable purchase orders. We do not believe that backlog as of any particular date is predictive of future results.

Intellectual Property

We do not maintain a traditional research and development group, but we do develop and seek to protect a range of intellectual property, including trademarks, service marks, copyrights, domain name rights, trade dress, trade secrets and similar intellectual property, relying for such protection on applicable statutes and common law rights, trade-secret protection and confidentiality and license agreements, as applicable, with teammates, clients, partners and others to protect our intellectual property rights. Our principal trademark is a registered mark, and we also license certain of our proprietary intellectual property rights to third parties. We have registered a number of domain names, applied for registration of other marks in the U.S. and in select international jurisdictions, and, from time to time, filed patent applications. We believe our trademarks and service marks, in particular, have significant value, and we continue to invest in the promotion of our trademarks and service marks and in our protection of them.

8

Table of Contents

INSIGHT ENTERPRISES, INC.

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the reports of beneficial ownership filed pursuant to Section 16(a) of the Exchange Act are available free of charge on our web site at www.insight.com, as soon as reasonably practicable after we electronically file them with, or furnish them to, the Securities and Exchange Commission. The information contained on our web site is not included as a part of, or incorporated by reference into, this Annual Report on Form 10-K.

| Item 1A. | Risk Factors |

We rely on our partners for product availability and competitive products to sell, and we also compete with many of our partners. We acquire products for resale both directly from manufacturers and publishers and indirectly through distributors, and the loss of a significant partner relationship could cause a disruption in the availability of products to us. Many of our manufacturer and publisher partners are also our competitors, as many sell directly to business customers, particularly larger corporate customers. There can be no assurance that, as manufacturers and publishers continue to sell both through the reseller channel and directly to end users, they will not limit or curtail the availability of their product to resellers like us. In addition, the manner in which publishers distribute software is changing, and many publishers now offer their programs as Cloud, hosted or SaaS solutions. These changes in distribution may intensify competition and increase the volume of software made available directly to end users through these competitive programs. Any significant increase in such sales could have a material adverse effect on our business, financial condition and results of operations.

We rely on our partners for marketing funds and purchasing incentives. Certain manufacturers, publishers and distributors provide us with substantial incentives in the form of rebates, marketing funds, purchasing incentives, early payment discounts, referral fees and price protections (collectively, “partner funding”). Partner funding is used to offset, among other things, inventory costs, costs of goods sold, marketing costs and other operating expenses. Certain of these funds are based on our volume of sales or purchases, growth rate of net sales or purchases and marketing programs. If we do not meet the goals of these programs or if we are not in compliance with the terms of these programs, there could be a material negative effect on the amount of incentives offered or paid to us by manufacturers and publishers. We continue to experience adverse program changes, and we anticipate that in the future the incentives that many partners make available to us may either be reduced or that the requirements for earning the available amounts will change. If we are unable to react timely to any fundamental changes in the partner funding programs of publishers or manufacturers, including the elimination of, or significant reductions in, funding for some of the activities for which we have been compensated in the past, particularly related to incentive programs with our largest partners, Microsoft, HP and Cisco, the changes could have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that we will continue to receive such incentives.

Changes in the IT industry and/or rapid changes in technology may reduce demand for the IT hardware, software and services we sell or change who makes purchasing decisions for IT hardware, software and services. Our results of operations are influenced by a variety of factors, including the condition of the IT industry, shifts in demand for, or availability of, IT hardware, software, peripherals and services, and industry innovation and the introduction of new products. The IT industry is characterized by rapid technological change and the frequent introduction of new products and changing delivery channels and models, which can decrease demand for current products and services and can disrupt purchasing patterns. If we fail to react in a timely manner to such changes, we may experience lower sales and, with respect to hardware, we may have to record write-downs of obsolete inventory. In addition, in order to satisfy client demand, protect ourselves against product shortages, obtain greater purchasing discounts and react to changes in original equipment manufacturers’ terms and conditions, we may decide to carry inventory products that may have limited or no return privileges. There can be no assurance that we will be able to avoid losses related to inventory obsolescence on these products. Additionally, if purchasing power within our clients shifts from centralized procurement functions to business units or individual end users and we are unable to react timely to any such changes, these shifts in purchasing power could have a material adverse effect on our business, financial conditions and results of operations.

The Cloud and “as-a-service” models are disrupting the IT market and introducing new products, services and competitors to the market. In many cases, these new distribution models allow enterprises to obtain the benefits of commercially licensed, internally operated software with less complexity and lower initial set-up, operational and licensing costs, increasing competition for us. There can be no assurance that we will be able to adapt to, or compete effectively with, current or future distribution channels or competitors or that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations.

9

Table of Contents

INSIGHT ENTERPRISES, INC.

The IT hardware, software and services industry is intensely competitive, and actions of our competitors, including manufacturers and publishers of products we sell, can negatively affect our business. Competition in the industry is based on price, product availability, speed of delivery, credit availability, quality and breadth of product lines, and, increasingly, on the ability to provide services and tailor specific solutions to client needs. In addition to the manufacturers and publishers of products we sell, we compete with a large number and wide variety of providers and resellers of IT hardware, software and services. We believe our industry will see further consolidation as product resellers and direct marketers combine operations or acquire or merge with other resellers, service providers and direct marketers to increase efficiency, service capabilities and market share. Moreover, current and potential competitors have established or may establish cooperative relationships among themselves or with third parties to enhance their product and service offerings. Accordingly, it is possible that new competitors or alliances among competitors may emerge and acquire significant market share. Generally, pricing is very aggressive in the industry, and we expect pricing pressures to continue. There can be no assurance that we will be able to negotiate prices as favorable as those negotiated by our competitors or that we will be able to offset the effects of price reductions with an increase in the number of clients, higher net sales, cost reductions, greater sales of services, which are typically at higher gross margins, or otherwise. Price reductions by our competitors that we either cannot or choose not to match could result in an erosion of our market share and/or reduced sales or, to the extent we match such reductions, could result in reduced operating margins or inventory impairment charges, any of which could have a material adverse effect on our business, financial condition and results of operations.

Certain of our competitors in each of our operating segments have greater financial, technical, marketing and other resources than we do. In addition, some of these competitors may be able to respond more quickly to new or changing opportunities, technologies and client requirements. Many current and potential competitors also have greater name recognition and engage in more extensive promotional activities, offer more attractive terms to their customers and adopt more aggressive pricing policies than we do. Additionally, some of our competitors have higher margins and/or lower operating cost structures, allowing them to price more aggressively. There can be no assurance that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations.

The failure to comply with the terms and conditions of our commercial and public sector contracts could result in, among other things, damages, fines or other liabilities. Sales to commercial clients are based on stated contractual terms, the terms and conditions on our website or terms contained in purchase orders on a transaction by transaction basis. Sales to public sector clients are derived from sales to federal, state and local governmental departments and agencies, as well as to educational institutions, through open market sales and various contracts and programs. Noncompliance with contract terms, particularly to highly regulated public sector clients, or with government procurement regulations could result in fines or penalties against us or termination of contracts, and, in the public sector, could also result in civil, criminal, and administrative liability. With respect to our public sector clients, the government’s remedies may include suspension or debarment. In addition, almost all of our contracts have default provisions, and substantially all of our contracts in the public sector are terminable at any time for convenience of the contracting agency. The effect of any of these possible actions or the adoption of new or modified procurement regulations or practices could materially adversely affect our business, financial position and results of operations.

Disruptions in our IT systems and voice and data networks could affect our ability to service our clients and cause us to incur additional expenses. We believe that our success to date has been, and future results of operations will be, dependent in large part upon our ability to provide prompt and efficient service to our clients. Our ability to provide that level of service is largely dependent on the ease of use, accuracy, quality and utilization of our IT systems, which affects our ability to manage our sales, client service, distribution, inventories and accounting systems, and the reliability of our voice and data networks and managed services offerings. During 2013 and 2014, we completed a comprehensive integration and conversion of our IT systems. There can be no assurance that these integration and conversion projects will yield the anticipated efficiency benefits. If current technology is determined to have a shorter useful life or the value of the current system is impaired, we could incur additional depreciation expense and/or impairment charges. A substantial interruption in our IT systems or in our voice and data networks, however caused, could occur and could have a material adverse effect on our business, financial condition and results of operations.

10

Table of Contents

INSIGHT ENTERPRISES, INC.

Breaches in the security of our electronic and other confidential information could materially adversely affect our financial condition and results of operations. We are dependent upon automated information technology processes. Privacy, security, and compliance concerns have continued to increase as technology has evolved to facilitate commerce and as cross-border commerce increases. As part of our normal business activities, we collect and store certain confidential information, including information about teammates and information about partners and clients which may be entitled to protection under a number of regulatory regimes. In the course of normal and customary business practice, we may share some of this information with vendors who assist us with certain aspects of our business. Moreover, the success of our operations depends upon the secure transmission of confidential and personal data over public networks, including the use of cashless payments. Any failure on the part of us or our vendors to maintain the security of data we are required to protect, including via the penetration of our network security and the misappropriation of confidential and personal information, could result in business disruption, damage to our reputation, financial obligations to third parties, fines, penalties, regulatory proceedings and private litigation with potentially large costs, and also result in deterioration in our teammates’, partners’ and clients’ confidence in us and other competitive disadvantages, and thus could have a material adverse effect on our business, financial condition and results of operations. In 2014, we were subject to information security attacks with increasing frequency at year-end. Although we do not believe the attacks resulted in the misappropriation of sensitive data, we have been, and expect to continue to be, subject to electronic data attacks and threats.

General economic conditions, including unfavorable economic conditions in a particular region, business or industry sector, may lead our clients to delay or forgo investments in IT hardware, software and services. Weak economic conditions generally or any broad-based reduction in IT spending adversely affects our business, operating results and financial condition. A prolonged slowdown in the global economy or similar crisis, or in a particular region or business or industry sector, or tightening of credit markets, could cause our clients to have difficulty accessing capital and credit sources, delay contractual payments, or delay or forgo decisions to upgrade or add to their existing IT environments, license new software or purchase products or services (particularly with respect to discretionary spending for hardware, software and services). Such events could have a material adverse effect on our business, financial condition and results of operations.

Economic or industry downturns could result in longer payment cycles, increased collection costs and defaults in excess of our expectations. A significant deterioration in our ability to collect on accounts receivable could also impact the cost or availability of financing under our accounts receivable securitization program.

We rely on independent shipping companies for delivery of products and are subject to price increases or service interruptions from these carriers. We generally ship hardware products to our customers by FedEx, United Parcel Service and other commercial delivery services and invoice customers for delivery charges. If we are unable to pass on to our clients future increases in the cost of commercial delivery services, our profitability could be adversely affected. Additionally, strikes, inclement weather, natural disasters or other service interruptions by such shippers could adversely affect our ability to deliver products on a timely basis. Such events could have a material adverse effect on our business, financial condition and results of operations.

We depend on certain personnel. We rely on key management teammates to execute our strategy to grow profitable market share. The loss of one or more of these leaders, or a failure to attract and retain new executives, could have a material adverse effect on our business, financial condition and results of operations. We also believe that our future success will be largely dependent on our ability to attract and retain highly qualified management, sales, service and technical teammates, and we make significant investments in the training of our sales account executives and services engineers. If we are not able to retain such personnel or to train them quickly enough to meet changing market conditions, we could experience a drop in the overall quality and efficiency of our sales and services teammates, and that could have a material adverse effect on our business, financial condition and results of operations.

Our net sales and gross profit have historically varied, making our future operating results less predictable. Our operating results are highly dependent upon our level of gross profit as a percentage of net sales, which fluctuates due to numerous factors, including changes in prices from partners, changes in the amount and timing of partner funding, volumes of purchases, changes in client mix, management of our cash conversion cycle, the relative mix of products and services sold during the period, general competitive conditions, and strategic product and services pricing and purchasing actions. As a result of significant price competition, our gross margins are low, and we expect them to continue to be low in the future. Increased competition arising from industry consolidation and low demand for certain IT products and services may hinder our ability to maintain or improve our gross margins. These low gross margins magnify the impact

11

Table of Contents

INSIGHT ENTERPRISES, INC.

of variations in revenue and operating costs on our operating results. In addition, our expense levels are based, in part, on anticipated net sales and the anticipated amount and timing of partner funding, and a portion of our operating expenses is relatively fixed. Therefore, we may not be able to reduce spending quickly enough to compensate for any unexpected net sales shortfall, and we may not be able to reduce our operating expenses as a percentage of revenue to mitigate any further reductions in gross margins in the future. If we cannot proportionately decrease our cost structure, our business, financial condition and results of operations could suffer.

In addition, a reduction in the amount of credit granted to us by our partners could increase our need for and cost of working capital and have a material adverse effect on our business, financial condition and results of operations.

There are risks associated with our international operations that are different than the risks associated with our operations in the United States, and our exposure to the risks of a global market could hinder our ability to maintain and expand international operations. We have operation centers in Australia, Canada, France, Germany, the U.S., and the United Kingdom, as well as sales offices throughout EMEA and APAC. In the regions in which we do not currently have a physical presence, we serve our clients through strategic relationships. In implementing our international strategy, we may face barriers to entry and competition from local companies and other companies that already have established global businesses, as well as the risks generally associated with conducting business internationally. The success and profitability of international operations are subject to numerous risks and uncertainties, many of which are outside of our control, such as:

| • | political or economic instability; |

| • | changes in governmental regulation or taxation (foreign and domestic); |

| • | currency exchange fluctuations; |

| • | changes in import/export laws, regulations and customs and duties (foreign and domestic); |

| • | trade restrictions (foreign and domestic); |

| • | difficulties and costs of staffing and managing operations in certain foreign countries; |

| • | work stoppages or other changes in labor conditions; |

| • | taxes and other restrictions on repatriating foreign profits back to the U.S.; |

| • | extended payment terms; and |

| • | seasonal reductions in business activity in some parts of the world. |

In addition, changes in policies and/or laws of the U.S. or foreign governments resulting in, among other changes, higher taxation, tariffs or similar protectionist laws, currency conversion limitations or the nationalization of private enterprises could reduce the anticipated benefits of international operations and could have a material adverse effect on our business, financial condition and results of operations.

We have currency exposure arising from both sales and purchases denominated in foreign currencies, including intercompany transactions outside the U.S., and we currently conduct limited hedging activities. In addition, some currencies are subject to limitations on conversion into other currencies, which can limit the ability to otherwise react to rapid foreign currency devaluations. We cannot predict with precision the effect of future exchange-rate fluctuations, and significant rate fluctuations could have a material adverse effect on our business, financial condition and results of operations.

International operations also expose us to currency fluctuations as we translate the financial statements of our foreign operations to U.S. dollars.

Changes in, interpretations of, or enforcement trends related to, tax rules and regulations may adversely affect our effective income tax rates or operating margins and we may be required to pay additional tax assessments. We conduct business globally and file income tax returns in various U.S. and foreign tax jurisdictions. Our effective tax rate could be adversely affected by various factors, many of which are outside of our control, including:

| • | changes in pre-tax income in various jurisdictions in which we operate that have differing statutory tax rates; |

| • | higher corporate tax rates and the availability of deductions or credits in the U.S. and elsewhere; |

| • | changes in tax laws, regulations, and/or interpretations of such tax laws in multiple jurisdictions; |

| • | tax effects related to purchase accounting for acquisitions; and |

| • | resolutions of issues arising from tax examinations and any related interest or penalties. |

12

Table of Contents

INSIGHT ENTERPRISES, INC.

The determination of our worldwide provision for income taxes and other tax liabilities requires estimation, judgment and complex calculations in situations where the ultimate tax determination may not be certain. Our determination of tax liabilities is always subject to review or examination by tax authorities in various jurisdictions. Any adverse outcome of such review or examination could have a material adverse effect on our financial condition and results of operations

We may not be able to protect our intellectual property adequately, and we may be subject to intellectual property infringement claims. To protect our intellectual property, we rely on copyright, trademark and trade secret laws, unpatented proprietary know-how, and patents, as well as confidentiality, invention assignment, non-solicitation and non-competition agreements. There can be no assurance that these measures will afford us sufficient protection of our intellectual property, and it is possible that third parties may copy or otherwise obtain and use our proprietary information without authorization or otherwise infringe on our intellectual property rights. The disclosure of our trade secrets could impair our competitive position and could have a material adverse effect on our business, financial condition and results of operations.

In addition, our registered trademarks and trade names are subject to challenge by third parties. This may affect our ability to continue using those marks and names. Likewise, many businesses are actively investing in, developing and seeking protection for intellectual property in the areas of search, indexing, e-commerce and other Web-related technologies, as well as a variety of on-line business models and methods, all of which are in addition to traditional research and development efforts for IT products and application software, and non-practicing entities continue to invest in acquiring patent portfolios for the purpose of turning the portfolios into income-generating assets, whether through licensing campaigns or litigation. As a result, disputes regarding the ownership of and the right to use these technologies are likely to arise in the future, and, from time to time, parties do assert various infringement claims against us, either because of our practices or because we resell allegedly infringing hardware or software, in the form of cease-and-desist letters, licensing inquiries, lawsuits and other communications and demands. If there is a determination that we have infringed the proprietary rights of others, we could incur substantial monetary liability, be forced to stop selling infringing products or providing infringing services, be required to enter into costly royalty or licensing agreements, if available, or be prevented from using the rights, which could force us to change our business practices or hardware, software or services offerings in the future. Additionally, as we increase the types of services provided under the Insight brand, there is a greater likelihood that we will encounter challenges to our trade names, trademarks and service marks. We may not be able to use our principal mark without modification in all geographies for all of our offerings, and these challenges may come from either governmental agencies or other market participants. These types of claims could have a material adverse effect on our business, financial condition and results of operations.

| Item 1B. | Unresolved Staff Comments |

Not applicable.

13

Table of Contents

INSIGHT ENTERPRISES, INC.

| Item 2. | Properties |

Our principal executive offices are located in Tempe, Arizona. We believe that our facilities will be suitable and adequate for our present purposes, and we anticipate that we will be able to extend our existing leases on terms satisfactory to us or, if necessary, to locate substitute facilities on acceptable terms. At December 31, 2014, we owned or leased a total of approximately 1.3 million square feet of office and warehouse space, and, while approximately 70% of the square footage is in the United States, we own or lease office and warehouse facilities in 11 countries in EMEA and we lease office facilities in five countries in APAC.

Information about significant sales, distribution, services and administration facilities in use as of December 31, 2014 is summarized in the following table:

| Operating Segment |

Location |

Primary Activities |

Own or Lease | |||

| Headquarters/North America |

Tempe, Arizona, USA |

Executive Offices, Sales and Administration and Network Operations Center | Own | |||

| Tempe, Arizona, USA |

Client Support Center | Own | ||||

| Addison, Illinois, USA |

Sales and Administration | Lease | ||||

| Hanover Park, Illinois, USA |

Services, Distribution and Administration | Lease | ||||

| Plano, Texas, USA |

Sales and Administration | Lease | ||||

| Austin, Texas, USA |

Sales and Administration | Lease | ||||

| Liberty Lake, Washington, USA |

Sales and Administration | Lease | ||||

| Tampa, Florida, USA |

Sales and Administration | Lease | ||||

| Winnipeg, Manitoba, Canada |

Sales and Administration | Lease | ||||

| Montreal, Quebec, Canada |

Sales and Administration | Own | ||||

| Montreal, Quebec, Canada |

Distribution | Lease | ||||

| EMEA |

Sheffield, United Kingdom |

Sales and Administration | Own | |||

| Sheffield, United Kingdom |

Distribution | Lease | ||||

| Uxbridge, United Kingdom |

Sales and Administration | Lease | ||||

| Garching, Germany |

Sales and Administration | Lease | ||||

| Frankfurt, Germany |

Sales and Administration | Lease | ||||

| Frankfurt, Germany |

Distribution | Lease | ||||

| Vélizy, France |

Sales and Administration | Lease | ||||

| APAC |

Sydney, New South Wales, Australia |

Sales and Administration | Lease | |||

In addition to those listed above, we have leased sales offices in various cities across North America, EMEA and APAC. These properties are not included in the table above. Substantially all of our owned properties secure our senior revolving credit facility. A portion of the client support center that we own in Tempe, Arizona included in the table above is currently leased to Revana, formerly known as Direct Alliance Corporation, a discontinued operation that was sold to a third party in 2006. For additional information on operating leases, see Note 8 to the Consolidated Financial Statements in Part II, Item 8 of this report.

In November 2014, we relocated our sales and administrative operations that were housed in a property that we own in Bloomingdale, Illinois. The property is classified as a held for sale asset, which is included in other current assets in the accompanying consolidated balance sheet as of December 31, 2014. For additional information on held for sale assets, see Note 11 to the Consolidated Financial Statements in Part II, Item 8 of this report.

| Item 3. | Legal Proceedings |

For a discussion of legal proceedings, see “Legal Proceedings” in Note 18 to the Consolidated Financial Statements in Part II, Item 8 of this report, which is incorporated by reference herein.

14

Table of Contents

INSIGHT ENTERPRISES, INC.

| Item 4. | Mine Safety Disclosures |

Not applicable.

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

Our common stock trades under the symbol “NSIT” on The Nasdaq Global Select Market. The following table shows, for the calendar quarters indicated, the high and low sales prices per share for our common stock as reported on The Nasdaq Global Select Market.

| Common Stock | ||||||||

| High Price | Low Price | |||||||

| Year 2014 |

||||||||

| Fourth Quarter |

$ | 26.27 | $ | 21.99 | ||||

| Third Quarter |

31.49 | 22.34 | ||||||

| Second Quarter |

30.74 | 25.40 | ||||||

| First Quarter |

25.16 | 19.79 | ||||||

| Year 2013 |

||||||||

| Fourth Quarter |

$ | 25.02 | $ | 18.37 | ||||

| Third Quarter |

22.11 | 18.36 | ||||||

| Second Quarter |

20.47 | 16.51 | ||||||

| First Quarter |

21.25 | 18.48 | ||||||

As of February 13, 2015, we had 39,753,955 shares of common stock outstanding held by 71 stockholders of record. This figure does not include an estimate of the number of beneficial holders whose shares are held of record by brokerage firms and clearing agencies.

We have never paid a cash dividend on our common stock, and we currently do not intend to pay any cash dividends in the foreseeable future. Our senior revolving credit facility contains restrictions on the payment of cash dividends.

15

Table of Contents

INSIGHT ENTERPRISES, INC.

Issuer Purchases of Equity Securities

| Period |

(a) Total Number of Shares Purchased |

(b) Average Price Paid per Share |

(c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

(d) Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

||||||||||||

| October 1, 2014 through October 31, 2014 |

— | $ | — | — | $ | 37,574,000 | ||||||||||

| November 1, 2014 through November 30, 2014 |

439,130 | 23.57 | 439,130 | 27,224,000 | ||||||||||||

| December 1, 2014 through December 31, 2014 |

428,796 | 24.21 | 428,796 | 16,843,000 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total |

867,926 | $ | 23.89 | 867,926 | ||||||||||||

|

|

|

|

|

|||||||||||||

On October 30, 2013, we announced that our Board of Directors had authorized the repurchase of up to $50 million of our common stock, of which approximately $12,574,000 remained available for repurchases of our common stock at September 30, 2014. On October 29, 2014, we announced that our Board of Directors had authorized the repurchase of up to an additional $25 million of our common stock. On February 11, 2015, we announced that our Board of Directors had authorized the repurchase of an additional $75 million of our common stock. This authorization is excluded from the above table. Repurchases during the quarter ended December 31, 2014 are reflected in the table above. There is no stated expiration date for our current share repurchase plan. Any share repurchases may be made on the open market, through block trades, through 10b5-1 plans or otherwise. The amount of shares purchased and the timing of the purchases will be based on working capital requirements, general business conditions and other factors. We intend to retire the repurchased shares. All shares repurchased during the year ended December 31, 2014 have been retired.

16

Table of Contents

INSIGHT ENTERPRISES, INC.

Stock Price Performance Graph

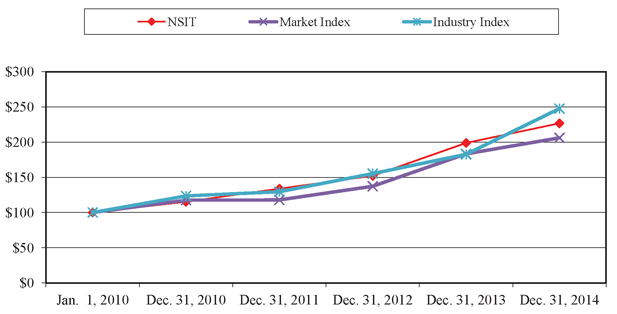

Set forth below is a graph comparing the percentage change in the cumulative total stockholder return on our common stock with the cumulative total return of the Nasdaq US Benchmark TR Index (Market Index) and the Nasdaq US Benchmark Computer Hardware TR Index (Industry Index) for the period starting January 1, 2010 and ending December 31, 2014. The graph assumes that $100 was invested on January 1, 2010 in our common stock and in each of the two Nasdaq indices, and that, as to such indices, dividends were reinvested. We have not, since our inception, paid any cash dividends on our common stock. Historical stock price performance shown on the graph is not necessarily indicative of future price performance.

| Jan. 1, 2010 |

Dec. 31, 2010 |

Dec. 31, 2011 |

Dec. 31, 2012 |

Dec. 31, 2013 |

Dec. 31, 2014 |

|||||||||||||||||||

| Insight Enterprises, Inc. Common Stock (NSIT) |

100.00 | 115.24 | 133.89 | 152.10 | 198.86 | 226.71 | ||||||||||||||||||

| Nasdaq US Benchmark TR Index (Market Index) |

100.00 | 117.55 | 117.91 | 137.29 | 183.26 | 206.09 | ||||||||||||||||||

| Nasdaq US Benchmark Computer Hardware TR Index (Industry Index) |

100.00 | 123.53 | 129.51 | 155.26 | 182.65 | 247.60 | ||||||||||||||||||

17

Table of Contents

INSIGHT ENTERPRISES, INC.

| Item 6. | Selected Financial Data |

The following selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements and the Notes thereto in Part II, Item 8 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this report. The selected consolidated financial data presented below under the captions “Consolidated Statements of Operations Data” and “Consolidated Balance Sheet Data” as of and for each of the years in the five-year period ended December 31, 2014 is derived from our audited consolidated financial statements. The consolidated financial statements as of December 31, 2014 and 2013, and for each of the years in the three-year period ended December 31, 2014, which have been audited by KPMG LLP, our independent registered public accounting firm, are included in Part II, Item 8 of this report.

| Years Ended December 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data (1) |

||||||||||||||||||||

| Net sales |

$ | 5,316,229 | $ | 5,144,347 | $ | 5,301,441 | $ | 5,287,228 | $ | 4,809,930 | ||||||||||

| Costs of goods sold |

4,603,826 | 4,445,460 | 4,581,765 | 4,578,071 | 4,163,833 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

712,403 | 698,887 | 719,676 | 709,157 | 646,097 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Selling and administrative expenses |

576,967 | 564,910 | 565,206 | 556,689 | 519,065 | |||||||||||||||

| Severance and restructuring expenses |

4,433 | 12,740 | 6,317 | 5,085 | 2,956 | |||||||||||||||

|

|

|