Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AVADEL PHARMACEUTICALS PLC | ex991earningsrelease.htm |

| 8-K - 8-K - AVADEL PHARMACEUTICALS PLC | a8-kpressrelease.htm |

November 7, 2016 Third Quarter 2016 Earnings Conference Call 1

Third Quarter 2016 Earnings

Conference Call

November 7, 2016 Third Quarter 2016 Earnings Conference Call 2

Forward Looking Statements

This presentation may include "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of

1995. All statements herein that are not clearly historical in nature are forward-looking, and the words "anticipate," "assume,"

"believe," "expect," "estimate," "plan," "will," "may," and the negative of these and similar expressions generally identify forward-

looking statements. All forward-looking statements involve risks, uncertainties and contingencies, many of which are beyond

Flamel's control and could cause actual results to differ materially from the results contemplated in such forward-looking

statements. These risks, uncertainties and contingencies include the risks relating to: our dependence on a small number of

products and customers for the majority of our revenues; the possibility that our Bloxiverz® and Vazculep® products, which are not

patent protected, could face substantial competition resulting in a loss of market share or forcing us to reduce the prices we charge

for those products; the possibility that we could fail to successfully complete the research and development for the two pipeline

products we are evaluating for potential application to the FDA pursuant to our "unapproved-to-approved" strategy, or that

competitors could complete the development of such products and apply for FDA approval of such products before us; our

dependence on the performance of third parties in partnerships or strategic alliances for the commercialization of some of our

products; the possibility that our products may not reach the commercial market or gain market acceptance; our need to invest

substantial sums in research and development in order to remain competitive; our dependence on certain single providers for

development of several of our drug delivery platforms and products; our dependence on a limited number of suppliers to

manufacture our products and to deliver certain raw materials used in our products; the possibility that our competitors may

develop and market technologies or products that are more effective or safer than ours, or obtain regulatory approval and market

such technologies or products before we do; the challenges in protecting the intellectual property underlying our drug delivery

platforms and other products; our dependence on key personnel to execute our business plan; the amount of additional costs we

will incur to comply with U.S. securities laws as a result of our ceasing to qualify as a foreign private issuer; and the other risks,

uncertainties and contingencies described in the Company's filings with the U.S. Securities and Exchange Commission, including our

annual report on Form 10-K for the year ended December 31, 2015, all of which filings are also available on the Company's

website. Flamel undertakes no obligation to update its forward-looking statements as a result of new information, future events or

otherwise, except as required by law.

November 7, 2016 Third Quarter 2016 Earnings Conference Call 3

Call Outline

Phase III Trial Initiation – REST-ON

Sodium Oxybate Patent Landscape

Base Business Overview

Akovaz™

Bloxiverz®

Vazculep®

Business Development Status

Cross-Border Merger & Name Change

Overview of Income Statement

Revenue

Expenses

Tax

Non-GAAP Results

Revenue by Business Segment

Guidance

November 7, 2016 Third Quarter 2016 Earnings Conference Call 4

REST-ON Phase III Trial

Initiation of Phase III Pivotal Trial (REST-ON) announced (Sept 26th)

Special Protocol Assessment process completed (Oct 6th)

Sites in Canada and Germany have started screening and enrollment

Expect to dose first patient before year end

First U.S. site expected to initiate patient enrollment January 2017

Goal to complete patient enrollment by 4Q 2017

November 7, 2016 Third Quarter 2016 Earnings Conference Call 5

Sodium Oxybate IP Landscape

JAZZ – 6 of 7 REMS patents overturned by PTAB

Settled with Wockhardt & Ranbaxy for 2026 generic entry

Yet to settle with other filers – including first to file, Roxane (Hikma)

‘306 patent for concomitant dosing of sodium oxybate and valproate /

divalproex sodium still in place (exp. 2033)

‘306 patent to be evaluated again during trial with Roxane

Label requirements for NDA filers are not the same as for ANDAs, even

through 505(b)(2)

Flamel will have unique REMS & strong patent strategy for ‘306

November 7, 2016 Third Quarter 2016 Earnings Conference Call 6

Base Business

• Akovaz launched Aug

2016

• $5.6 million in revenues

3Q 2016

• On target to exit 2016 with

20-30% market share

• Averaged 40% neostigmine

market during 3Q 2016

• $15.6 million in revenues 3Q

2016

• Smaller overall market volume

and increased competition

resulted in lower revenues –

anticipate stable market Q4

• Share remained stable in 3Q

2016

• $9.3 million in revenues 3Q

2016

• Expect market to remain

stable going forward

Akovaz™ Bloxiverz® Vazculep®

November 7, 2016 Third Quarter 2016 Earnings Conference Call 7

Business Development

4th Unapproved Marketed Drug identified – awaiting

feedback from FDA on potential clinical work

Looking to grow inorganically – searching for accretive

commercial stage products to fold into FSC

Actively seeking licensing deal for Trigger Lock™

Actively seeking licensing or sale of Medusa™

November 7, 2016 Third Quarter 2016 Earnings Conference Call 8

Coming soon…

Avadel Pharmaceuticals plc (NASDAQ: AVDL)

“AdVAnced DELivery”

Cross-border merger from France to Ireland effective January

1, 2017

No changes to capital structure or share count

COMPANY WILL CONTINUE TO OPERATE AS FLAMEL TECHNOLOGIES SA

UNTIL JANUARY 1, 2017

November 7, 2016 Third Quarter 2016 Earnings Conference Call 9

GAAP Financial Results

(in $000s)

Q3 2016 Q2 2016 Q3 2015

Q3 2016

vs.

Q2 2016

Q3 2016

vs.

Q3 2015

Revenue 32,087$ 38,858$ 47,313$ (6,771)$ (15,226)$

Cost of products and services sold 2,844 3,907 2,087 (1,063) 757

Research and development expenses 8,143 7,604 7,221 539 922

Selling, general and admin expenses 12,740 11,290 4,568 1,450 8,172

Intangible asset amortization 3,702 3,702 3,141 - 561

Fair value adjustments of contingent consideration 20,848 23,898 44,782 (3,050) (23,934)

Operating Expenses 48,277 50,401 61,799 (2,124) (13,522)

Operating income (loss) (16,190) (11,543) (14,486) (4,647) (1,704)

Interest & Other Expense (net) (2,656) (966) (6,287) (1,690) 3,631

Income (loss) before income taxes (18,846) (12,509) (20,773) (6,337) 1,927

Income tax provision 3,451 7,449 7,302 (3,998) (3,851)

Net loss (22,297)$ (19,958)$ (28,075)$ (2,339)$ 5,778$

Diluted loss per share (0.54)$ (0.48)$ (0.69)$ (0.06)$ 0.15$

Difference - Inc./(Dec.)

November 7, 2016 Third Quarter 2016 Earnings Conference Call 10

Non-GAAP Financial Results

(in $000s)

Q3 2016 Q2 2016 Q3 2015

Q3 2016

vs.

Q2 2016

Q3 2016

vs.

Q3 2015

Revenue 32,087$ 38,858$ 47,313$ (6,771)$ (15,226)$

Cost of products and services sold 2,844 3,145 2,087 (301) 757

Research and development expenses 8,143 7,604 7,221 539 922

Selling, general and admin expenses 12,740 11,290 4,568 1,450 8,172

Intangible asset amortization - - - - -

Fair value adjustments of contingent consideration 5,884 6,992 9,027 (1,108) (3,143)

Operating Expenses 29,611 29,031 22,903 580 6,708

Operating income (loss) 2,476 9,827 24,410 (7,351) (21,934)

Interest & Other Expense (net) (559) (814) (1,014) 255 455

Income (loss) before income taxes 1,917 9,013 23,397 (7,096) (21,480)

Income tax provision 5,416 9,998 10,255 (4,581) (4,839)

Net loss (3,499)$ (985)$ 13,142$ (2,515)$ (16,641)$

Diluted loss per share (0.08)$ (0.02)$ 0.32$ (0.06)$ (0.40)$

Difference - Inc./(Dec.)

*Reconciliations from GAAP to Non-GAAP can be found in the appendix

November 7, 2016 Third Quarter 2016 Earnings Conference Call 11

(in $000s)

Q3 2016 Q2 2016 Q3 2015

Q3 2016

vs.

Q2 2016

Q3 2016

vs.

Q3 2015

Bloxiverz 15,591$ 25,620$ 41,243$ (10,029)$ (25,652)$

Vazculep 9,340 10,421 5,605 (1,081) 3,735

Akovaz 5,568 - - 5,568 5,568

Other 841 2,124 465 (1,283) 376

Total product sales and services 31,340$ 38,165$ 47,313$ (6,825)$ (15,973)$

License and research revenue 747$ 693$ -$ 54$ 747$

Total revenues 32,087$ 38,858$ 47,313$ (6,771)$ (15,226)$

Difference - Inc./(Dec.)

Product Sales

November 7, 2016 Third Quarter 2016 Earnings Conference Call 12

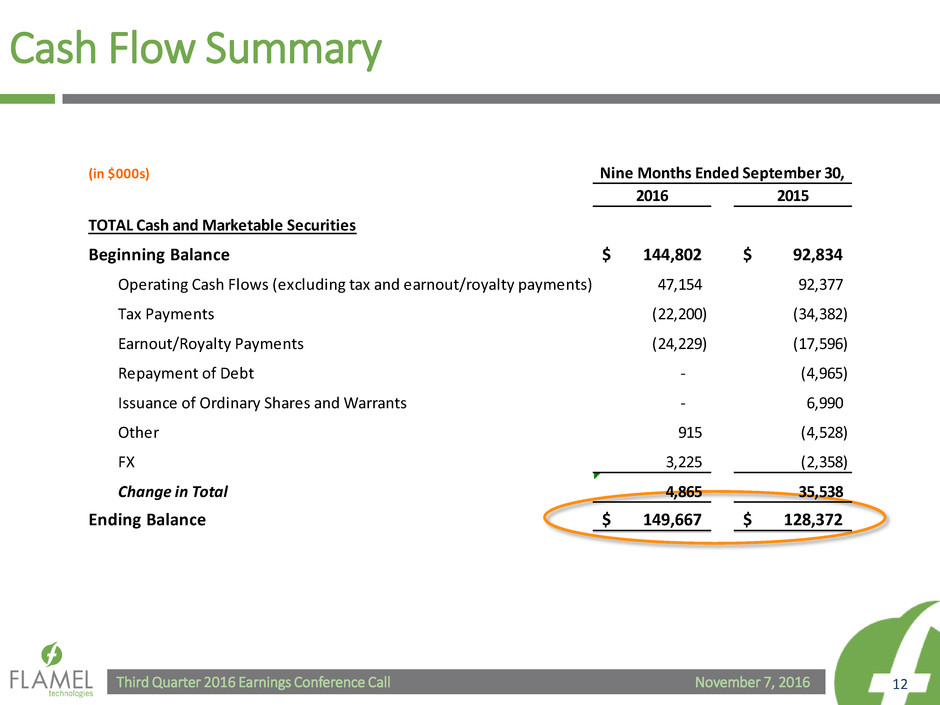

Cash Flow Summary

(in $000s)

2016 2015

TOTAL Cash and Marketable Securities

Beginning Balance 144,802$ 92,834$

Operating Cash Flows (excluding tax and earnout/royalty payments) 47,154 92,377

Tax Payments (22,200) (34,382)

Earnout/Royalty Payments (24,229) (17,596)

Repayment of Debt - (4,965)

Issuance of Ordinary Shares and Warrants - 6,990

Other 915 (4,528)

FX 3,225 (2,358)

Change in Total 4,865 35,538

Ending Balance 149,667$ 128,372$

Nine Months Ended September 30,

November 7, 2016 Third Quarter 2016 Earnings Conference Call 13

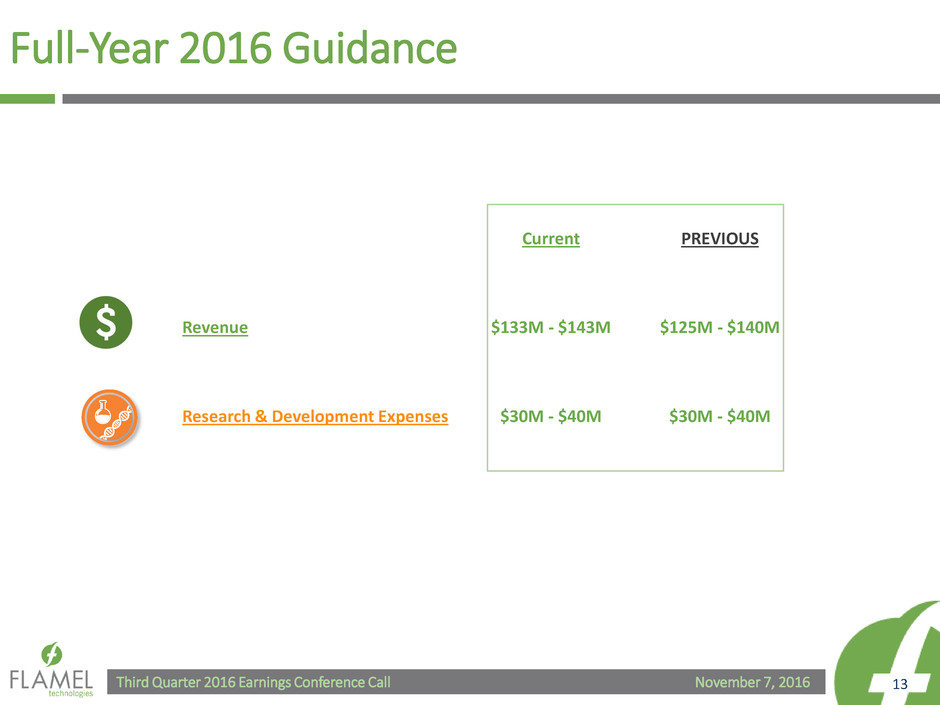

Full-Year 2016 Guidance

Current PREVIOUS

Revenue $133M - $143M $125M - $140M

Research & Development Expenses $30M - $40M $30M - $40M

November 7, 2016 Third Quarter 2016 Earnings Conference Call 14

Question & Answer

November 7, 2016 Third Quarter 2016 Earnings Conference Call 15

Appendix

November 7, 2016 Third Quarter 2016 Earnings Conference Call 16

GAAP to Non-GAAP Reconciliations

Three Months Ended September 30, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 31,340$ -$ -$ -$ -$ -$ 31,340$

License and research revenue 747 - - - - - 747

Total revenue 32,087 - - - - - 32,087

Cost of products and services sold 2,844 - - - - - 2,844

Research and development expenses 8,143 - - - - - 8,143

Selling, general and administrative expenses 12,740 - - - - - 12,740

Intangible asset amortization 3,702 (3,702) - - - (3,702) -

Changes in fair value of related party contingent

consideration 20,848 - - (20,848) 5,884 (14,964) 5,884

Total operating expenses 48,277 (3,702) - (20,848) 5,884 (18,666) 29,611

Operating income (loss) (16,190) 3,702 - 20,848 (5,884) 18,666 2,476

Investment Income 490 - - - - - 490

Interest Expense (264) - - - - - (264)

Other Expense - changes in fair value of related party

payable (1,828) - - 1,828 (785) 1,043 (785)

Foreign exchange gain (loss) (1,054) - 1,054 - - 1,054 -

Income (loss) before income taxes (18,846) 3,702 1,054 22,676 (6,669) 20,763 1,917

I come tax provision 3,451 1,329 - 1,021 (385) 1,965 5,416

Income Tax Rate (18%) 36% - 5% 6% 9% 283%

Net Loss (22,297)$ 2,373$ 1,054$ 21,655$ (6,284)$ 18,798$ (3,499)$

Net loss per share - Diluted (0.54)$ 0.06$ 0.03$ 0.52$ (0.15)$ 0.46$ (0.08)$

Weighted average number of shares outstanding - Diluted 41,241 41,241 41,241 41,241 41,241 41,241 41,241

Adjustments

Exclude

November 7, 2016 Third Quarter 2016 Earnings Conference Call 17

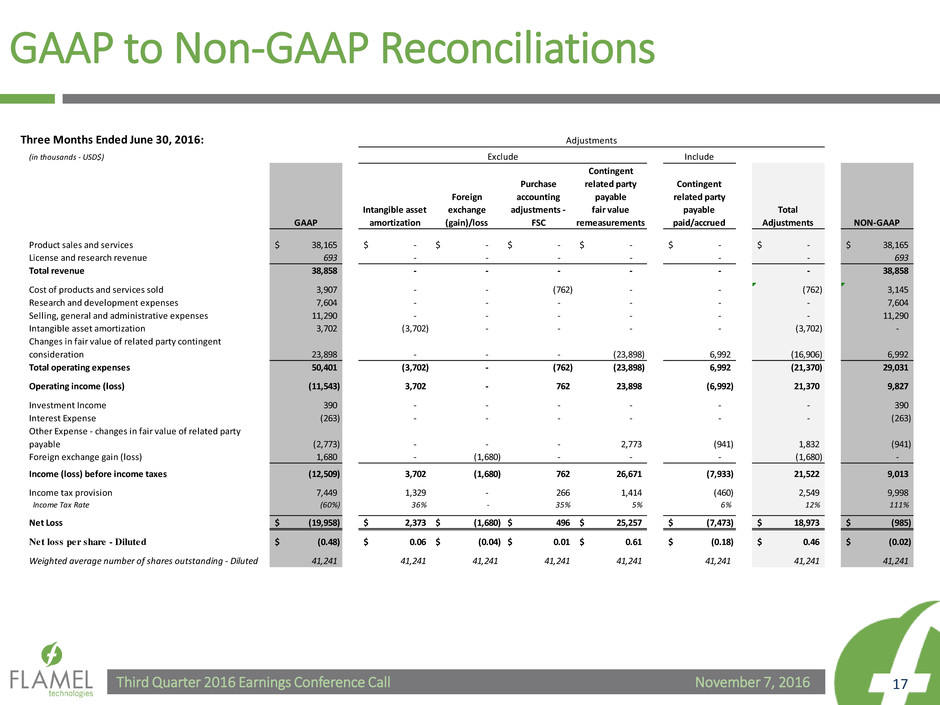

GAAP to Non-GAAP Reconciliations

Three Months Ended June 30, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 38,165$ -$ -$ -$ -$ -$ -$ 38,165$

License and research revenue 693 - - - - - - 693

Total revenue 38,858 - - - - - - 38,858

Cost of products and services sold 3,907 - - (762) - - (762) 3,145

Research and development expenses 7,604 - - - - - - 7,604

Selling, general and administrative expenses 11,290 - - - - - - 11,290

Intangible asset amortization 3,702 (3,702) - - - - (3,702) -

Changes in fair value of related party contingent

consideration 23,898 - - - (23,898) 6,992 (16,906) 6,992

Total operating expenses 50,401 (3,702) - (762) (23,898) 6,992 (21,370) 29,031

Operating income (loss) (11,543) 3,702 - 762 23,898 (6,992) 21,370 9,827

Investment Income 390 - - - - - - 390

Interest Expense (263) - - - - - - (263)

Other Expense - changes in fair value of related party

payable (2,773) - - - 2,773 (941) 1,832 (941)

Foreign exchange gain (loss) 1,680 - (1,680) - - - (1,680) -

Income (loss) before income taxes (12,509) 3,702 (1,680) 762 26,671 (7,933) 21,522 9,013

I come tax provision 7,449 1,329 - 266 1,414 (460) 2,549 9,998

Income Tax Rate (60%) 36% - 35% 5% 6% 12% 111%

Net Loss (19,958)$ 2,373$ (1,680)$ 496$ 25,257$ (7,473)$ 18,973$ (985)$

Net loss per share - Diluted (0.48)$ 0.06$ (0.04)$ 0.01$ 0.61$ (0.18)$ 0.46$ (0.02)$

Weighted average number of shares outstanding - Diluted 41,241 41,241 41,241 41,241 41,241 41,241 41,241 41,241

Adjustments

Exclude

November 7, 2016 Third Quarter 2016 Earnings Conference Call 18

GAAP to Non-GAAP Reconciliations

Three Months Ended September 30, 2015:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 47,313$ -$ -$ -$ -$ -$ 47,313$

License and research revenue - - - - - - -

Total revenue 47,313 - - - - - 47,313

Cost of products and services sold 2,087 - - - - - 2,087

Research and development expenses 7,221 - - - - - 7,221

Selling, general and administrative expenses 4,568 - - - - - 4,568

Intangible asset amortization 3,141 (3,141) - - - (3,141) -

Changes in fair value of related party contingent

consideration 44,782 - - (44,782) 9,027 (35,755) 9,027

Total operating expenses 61,799 (3,141) - (44,782) 9,027 (38,896) 22,903

Operating income (loss) (14,486) 3,141 - 44,782 (9,027) 38,896 24,410

Investment Income 197 - - - - - 197

Interest Expense - - - - - - -

Other Expense - changes in fair value of related party

payable (6,644) - - 6,644 (1,211) 5,433 (1,211)

Foreign exchange gain (loss) 160 - (160) - - (160) -

Income (loss) before income taxes (20,773) 3,141 (160) 51,426 (10,237) 44,170 23,397

I come tax provision 7,302 1,099 (48) 2,325 (424) 2,953 10,255

Income Tax Rate (35%) 35% 30% 5% 4% 7% 44%

Net Loss (28,075)$ 2,042$ (112)$ 49,101$ (9,814)$ 41,217$ 13,142$

Net loss per share - Diluted (0.69)$ 0.05$ -$ 1.20$ (0.24)$ 1.01$ 0.32$

Weighted average number of shares outstanding - Diluted 40,625 40,625 40,625 40,625 40,625 40,625 40,625

Adjustments

Exclude