Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BAY BANKS OF VIRGINIA INC | d268464dex991.htm |

| 8-K - FORM 8-K - BAY BANKS OF VIRGINIA INC | d268464d8k.htm |

Merger of Equals Overview and Investment Highlights November 3, 2016 Exhibit 99.2

This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended. These include statements as to the benefits of the merger, including future financial and operating results, cost savings, enhanced revenues and the accretion/dilution to reported earnings that may be realized from the merger as well as other statements of expectations regarding the merger and any other statements regarding future results or expectations. Each of Bay Banks and Virginia BanCorp intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of each of Bay Banks and Virginia BanCorp are generally identified by the use of words such as "believe," "expect," "intend," "anticipate," "estimate," or "project" or similar expressions. These forward-looking statements are subject to assumptions that are subject to change. The companies' respective ability to predict results, or the actual effect of future plans or strategies, is inherently uncertain. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ from those indicated or implied in the forward-looking statements and such differences may be material. Factors that could cause results and outcomes to differ materially include, among others, the ability to obtain required regulatory and shareholder approvals and meet other closing conditions to the transaction; the ability to complete the merger as expected and within the expected timeframe; disruptions to customer and employee relationships and business operations caused by the merger; the ability to implement integration plans associated with the transaction, which integration may be more difficult, time-consuming or costly than expected; the ability to achieve the cost savings and synergies contemplated by the merger within the expected timeframe, or at all; changes in local and national economies, or market conditions; changes in interest rates; regulations and accounting principles; changes in policies or guidelines; loan demand and asset quality, including real estate values and collateral values; deposit flow; the impact of competition from traditional or new sources; and the other factors detailed in Bay Banks’s publicly filed documents, including its Annual Report on Form 10-K for the year ended December 31, 2015. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Bay Banks and Virginia BanCorp do not undertake any obligation to update any forward-looking statement, whether written or oral, to reflect circumstances or events that occur after the date the forward-looking statements are made. Forward-Looking Statements

ADDITIONAL INFORMATION ABOUT THE COMPANIES AND THIS TRANSACTION This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed merger, Bay Banks will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 with respect to the offering of Bay Banks common stock as the merger consideration under the Securities Act of 1933, as amended, which will include a joint proxy statement of Bay Banks and Virginia BanCorp and a prospectus of Bay Banks. A definitive joint proxy statement/prospectus will be sent to the shareholders of each company seeking the required shareholder approvals. Investors and security holders are urged to read the registration statement and joint proxy statement/prospectus and other relevant documents when they become available because they will contain important information about the merger. You will be able to obtain a free copy of the joint proxy statement/prospectus, as well as other filings containing information about Bay Banks and Virginia BanCorp, at the SEC’s website (http://www.sec.gov). When available, you will also be are able to obtain these documents, free of charge, by accessing Virginia BanCorp’s website (www.vacommbank.com) or by requesting them in writing from C. Frank Scott, III, Virginia BanCorp Inc., 1965 Wakefield Street, Petersburg, Virginia 23805, or by telephone at (804) 732-2350; or by accessing Bay Banks’s website (www.bankoflancaster.com) or by requesting them in writing from Randal R. Greene, Bay Banks of Virginia, Inc., 100 South Main Street, Kilmarnock, Virginia 22482, or by telephone at (804) 435-1171. Bay Banks, Virginia BanCorp and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Bay Banks and Virginia BanCorp in connection with the merger. Information about the directors and executive officers of Bay Banks and their ownership of Bay Banks common stock is set forth in the definitive proxy statement for Bay Banks’s 2016 annual meeting of shareholders, as previously filed with the SEC on April 8, 2016. Information about the directors and executive officers of Virginia BanCorp and their ownership of Virginia BanCorp common stock may be obtained by reading the joint proxy statement/prospectus regarding the merger when it becomes available. Additional information regarding the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus regarding the merger when it becomes available. Forward-Looking Statements

Structure: Name: Headquarters: Consideration: Board Representation: Management: Closing: Bay Banks and Virginia BanCorp will combine in a merger of equals The Holding Company will be called Bay Banks of Virginia The Bank will be called Virginia Commonwealth Bank Richmond, Virginia 100% stock 1.178 shares of Bay Banks stock for each share of Virginia BanCorp stock Bay Banks shareholders will own 51% of the shares and Virginia BanCorp shareholders will own 49% Holding company Board will be equally represented by each Company Bank Board will consist of all members of each banks’ current Board C. Frank Scott will be Chairman of the Board of the Holding Company and President of the Bank Randal R. Greene will be Vice Chairman, President and CEO of the Holding Company, and Vice Chairman and CEO of the Bank Richard A. Farmar III will be Chairman of the Board of the Bank Other management positions will be mutually determined 2nd quarter 2017 Transaction Highlights

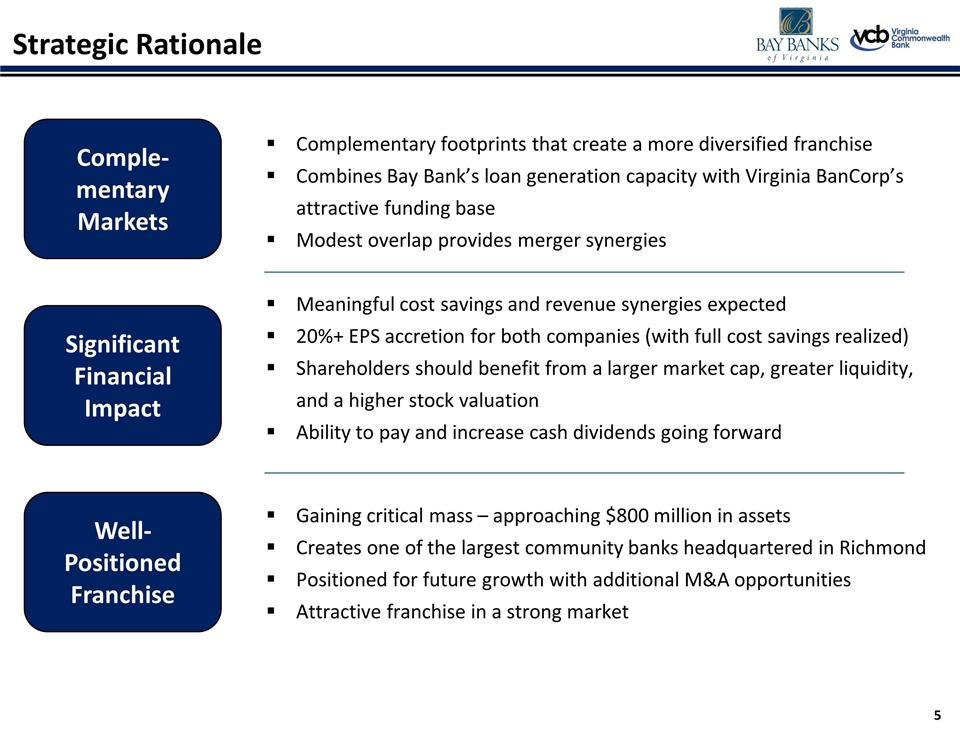

Complementary footprints that create a more diversified franchise Combines Bay Bank’s loan generation capacity with Virginia BanCorp’s attractive funding base Modest overlap provides merger synergies Meaningful cost savings and revenue synergies expected 20%+ EPS accretion for both companies (with full cost savings realized) Shareholders should benefit from a larger market cap, greater liquidity, and a higher stock valuation Ability to pay and increase cash dividends going forward Gaining critical mass – approaching $800 million in assets Creates one of the largest community banks headquartered in Richmond Positioned for future growth with additional M&A opportunities Attractive franchise in a strong market Comple- mentary Markets Significant Financial Impact Well-Positioned Franchise Strategic Rationale

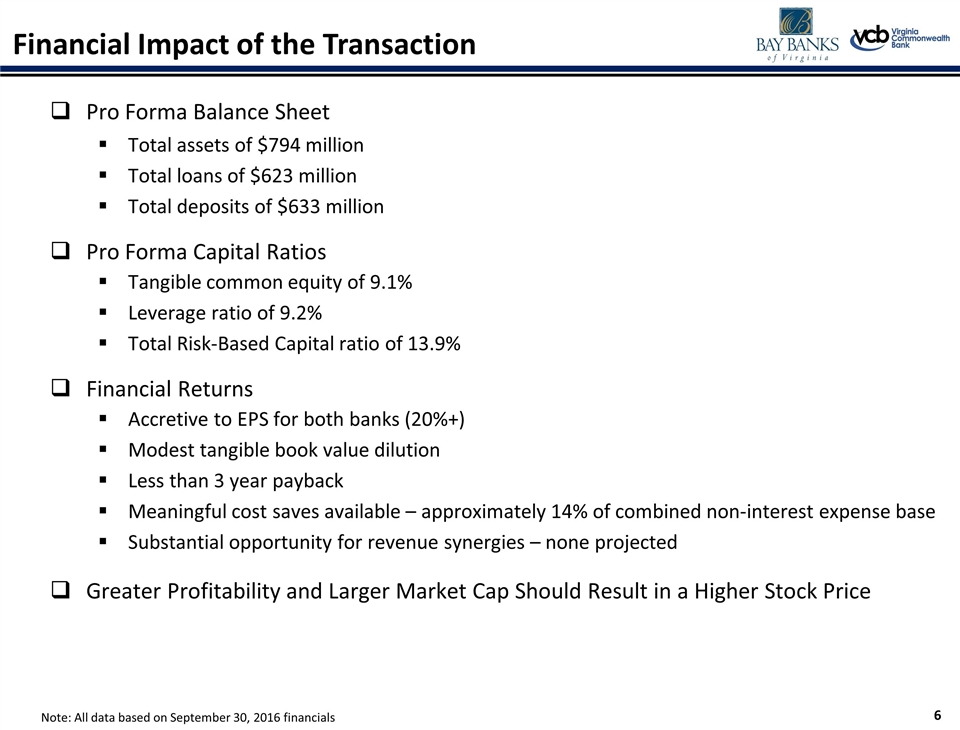

Pro Forma Balance Sheet Total assets of $794 million Total loans of $623 million Total deposits of $633 million Pro Forma Capital Ratios Tangible common equity of 9.1% Leverage ratio of 9.2% Total Risk-Based Capital ratio of 13.9% Financial Returns Accretive to EPS for both banks (20%+) Modest tangible book value dilution Less than 3 year payback Meaningful cost saves available – approximately 14% of combined non-interest expense base Substantial opportunity for revenue synergies – none projected Greater Profitability and Larger Market Cap Should Result in a Higher Stock Price Financial Impact of the Transaction Note: All data based on September 30, 2016 financials

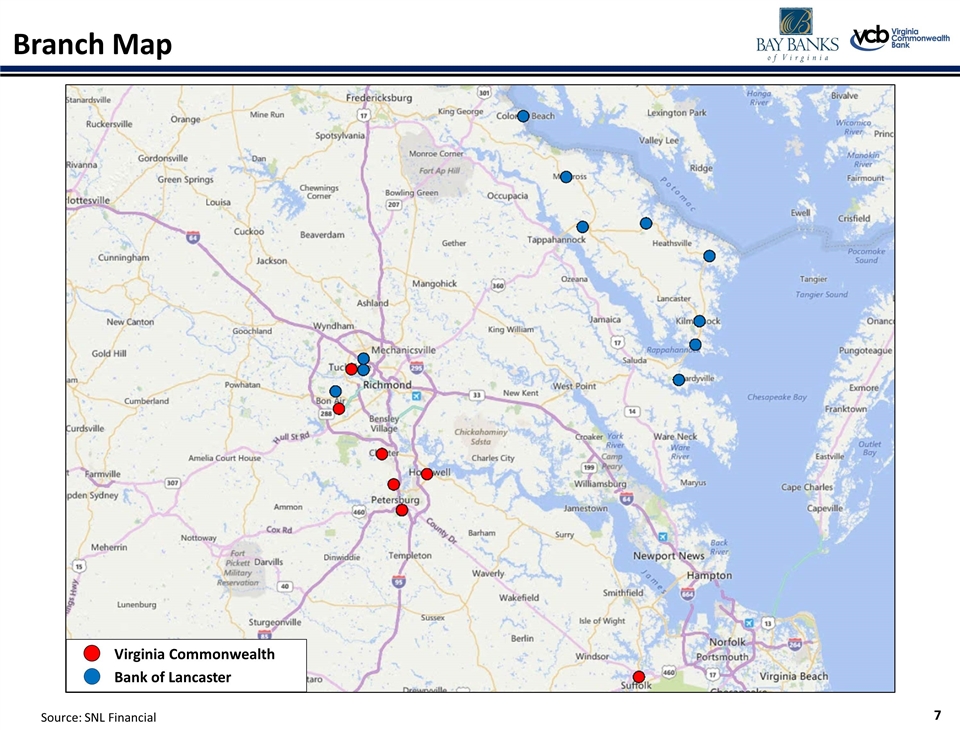

Branch Map Virginia Commonwealth Bank of Lancaster Source: SNL Financial

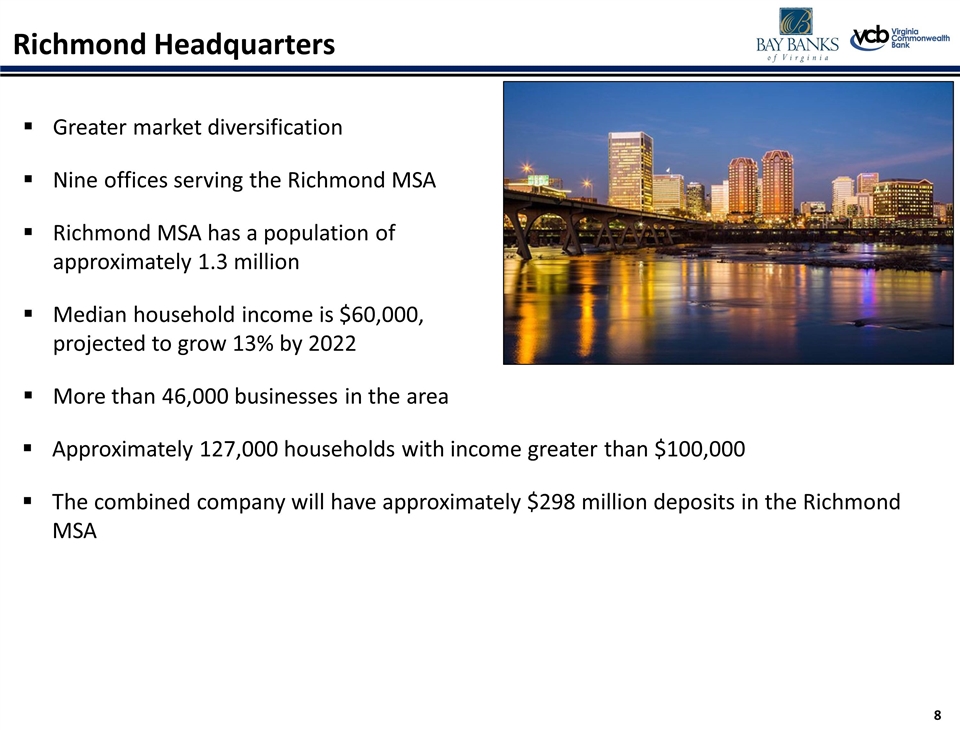

Approximately 127,000 households with income greater than $100,000 The combined company will have approximately $298 million deposits in the Richmond MSA Richmond Headquarters Greater market diversification Nine offices serving the Richmond MSA Richmond MSA has a population of approximately 1.3 million Median household income is $60,000, projected to grow 13% by 2022 More than 46,000 businesses in the area

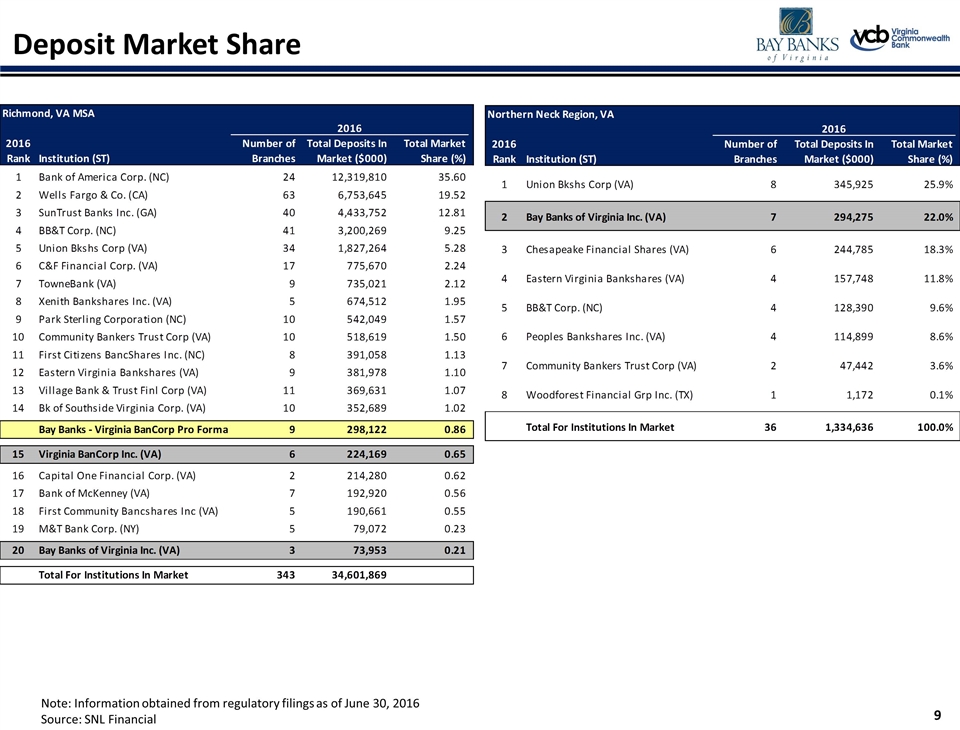

Deposit Market Share Note: Information obtained from regulatory filings as of June 30, 2016 Source: SNL Financial

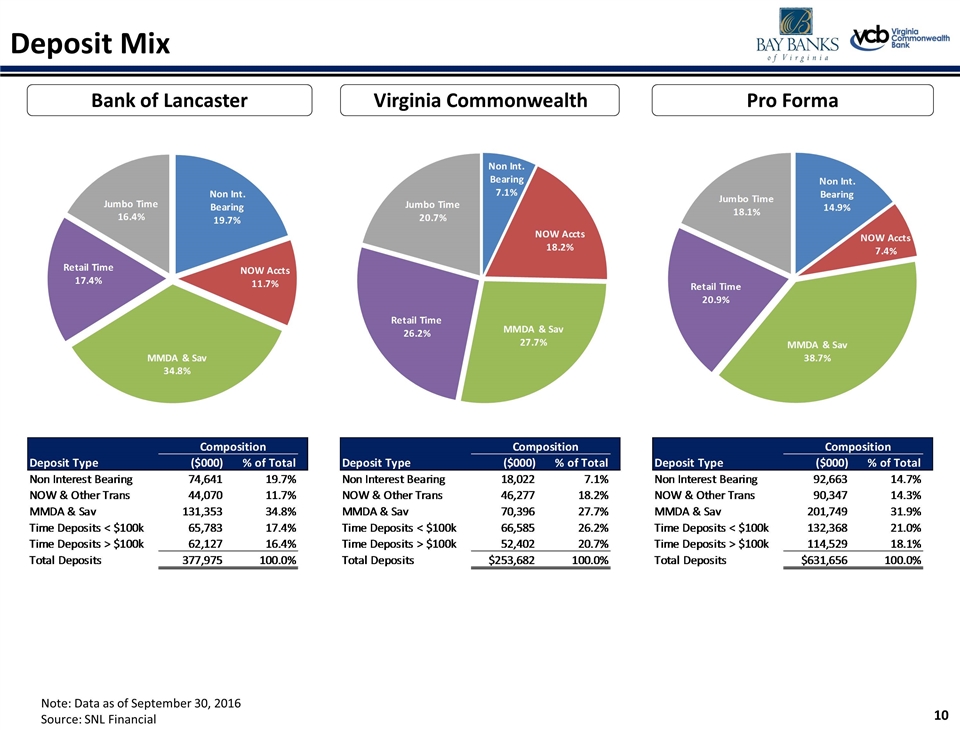

Deposit Mix Bank of Lancaster Pro Forma Virginia Commonwealth Note: Data as of September 30, 2016 Source: SNL Financial

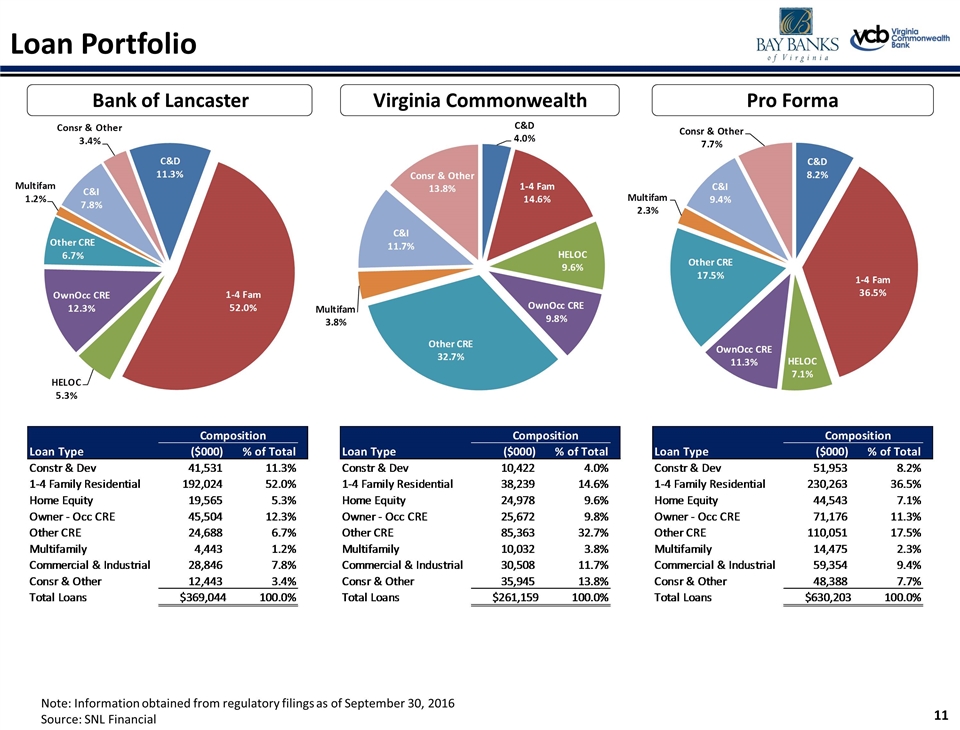

Loan Portfolio Bank of Lancaster Pro Forma Virginia Commonwealth Note: Information obtained from regulatory filings as of September 30, 2016 Source: SNL Financial