Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UCP, Inc. | ucp8-kq32016coverresults.htm |

| EX-99.1 - EXHIBIT 99.1 - UCP, Inc. | ucpq32016pressrelease.htm |

3Q16 Earnings Presentation

October 31, 2016

U

Forward-Looking Statements

We make forward-looking statements in this presentation that are subject to risks, uncertainties and assumptions. All statements other

than statements of historical fact included in this presentation are forward-looking statements. You can identify forward-looking

statements by the fact that they do not relate strictly to historical facts. These statements may include words such as “may,” “might,”

“will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” “project,” “goal,” “intend” or “continue,” the

negative of these terms and other comparable terminology. These forward-looking statements may include projections of our future

financial or operating performance, our anticipated growth strategies, anticipated trends in our business and other future events or

circumstances. These statements are based on our current expectations and projections about future events and may prove to be

inaccurate.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events.

Forward-looking statements depend on assumptions, data or methods which may prove to be incorrect or imprecise and may prove to be

inaccurate. We do not guarantee that the transactions and events described in any forward-looking statements will happen as described

(or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from

those set forth or contemplated in the forward-looking statements: economic changes, either nationally or in the markets in which we

operate, including declines in employment, volatility of mortgage interest rates, declines in consumer sentiment and an increase in

inflation; downturns in the homebuilding industry, either nationally or in the markets in which we operate; continued volatility and

uncertainty in the credit markets and broader financial markets; the operating performance of our business; changes in our business and

investment strategy; availability of land to acquire and our ability to acquire land on favorable terms or at all; availability, terms and

deployment of capital; disruptions in the availability of mortgage financing or increases in the number of foreclosures in our markets;

shortages of or increased prices for labor, land or raw materials used in housing construction; delays or restrictions in land development

or home construction, or reduced consumer demand resulting from adverse weather and geological conditions or other events outside

our control; the cost and availability of insurance and surety bonds; changes in, or the failure or inability to comply with, governmental

laws and regulations; the timing of receipt of regulatory approvals and the opening of communities; the degree and nature of our

competition; our leverage and debt service obligations; our future operating expenses, which may increase disproportionately to our

revenue; our ability to achieve operational efficiencies with future revenue growth; our relationship, and actual and potential conflicts of

interest, with PICO, which owns a majority economic interest in UCP, LLC; and availability of, and our ability to retain, qualified

personnel. For a further discussion of these and other factors, see the “Risk Factors” disclosed in our Annual Report on Form 10-K for

the year ended December 31, 2015, which is filed with the Securities and Exchange Commission. In light of these risks and

uncertainties, the forward-looking statements discussed in this presentation might not occur.

You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation. While

forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance, and our actual results could

differ materially from those expressed in any forward-looking statement. We disclaim any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or

other changes, except as required by law.

2

U

• SG&A % Revenue -380 bps to

10.1%

• HB Gross Margin of 18.5% and

Adj. HB Gross Margin1 of 21.0%

• Another Quarter of consecutive

profitability

• $1.0 million of stock2 repurchased

• Maintaining a conservative

balance sheet

Momentum31

Discipline32Transformation3

• Homebuilding Revenue +28%

• Net New Home Orders +14%

• Backlog Units +34%

(1) Adjusted homebuilding gross margin is a non-GAAP financial measure. The most directly comparable GAAP financial measure is homebuilding gross margin. A discussion of adjusted

homebuilding gross margin is included in the Appendix hereto, as well as a reconciliation between homebuilding gross margin and adjusted homebuilding gross margin.

(2) The timing and amount of any repurchases will be at UCP’s discretion and will be subject to prevailing market conditions and other considerations, including UCP’s liquidity, the terms of

its debt instruments, planned land investment and development spending, acquisition and other investment opportunities and ongoing capital requirements.

(3) 3Q16 Compared to 3Q15

3

Continued Progress on Objectives

U

+28

%

Momentum: Homebuilding Revenue

Homebuilding Revenue Homes Delivered Average Selling Price

Mix of Homes Delivered by Region Homes Delivered

4

3Q15 3Q16

ASP ($000)

$348

$451

3Q15 3Q16

Homes Delivered

202 199

West

78%

Southeast

22%

+30%

3Q15 3Q16

Homebuilding Revenue ($MM)

$70.3

$89.8

U

3Q15 3Q16

288

387

Momentum: Markets, New Orders & Backlog

UCP Homebuilding Markets

Net New Home OrdersBacklog Dollar Basis ($000's)

5

Southeast

Southern

California

Central

Valley

Pacific

Northwest

Note: ‘Land inventory’ denotes owned & controlled lots as of September 30, 2016.

Homes in Backlog

SF Bay Area

3Q15 3Q16

216 247

+34%

+14%

3Q15 3Q16

$120,834

$157,176

+30%

U

Discipline: Gross Margin

6

HighlightsHomebuilding Gross Margin

▪ 3Q16 adjusted homebuilding

gross margin1 trending in line with

full year expectations

▪ Maintaining sales prices in order

to manage demand, given supply

constraints

▪ Balancing pre-sales and spec

sales

▪ Actively managing land and home

construction costs

▪ Incentives decreased to 1.6%

from 2.4% of HB Revenue

▪ Exiting the Bakersfield, California

market

(1) Adjusted homebuilding gross margin is a non-GAAP financial measure. The most directly comparable GAAP financial measure is homebuilding gross margin. A discussion of adjusted

homebuilding gross margin is included in the Appendix hereto, as well as a reconciliation between homebuilding gross margin and adjusted homebuilding gross margin.

Adj. Homebuilding Gross Margin1

3Q15 3Q16

18.9%

18.5%

+(40) bps

3Q15 3Q16

21.1% 21.0%

+(10) bps

U

3Q15 3Q16

6.4%

5.2%

Discipline: SG&A Improvement

7

Sales & Marketing as % of Total

Revenue

G&A as % of Total Revenue Highlights

▪ 3Q16 SG&A as a percent of total

revenue decreased 380 bps to

10.1%

▪ 3Q16 G&A improved 120 basis

points excluding $2.4 million

reduction in contingent

consideration

▪ Disciplined control of overhead

expenses continues to enhance

performance

▪ More efficient cost base to

leverage rising revenue and

deliveries

3Q15 3Q16

7.5%

4.9%

-260 bps

-120 bps

U

West

69%

Southeast

31%

Transformation: Inventory Management & Earnings

Land Inventory by Region

Completed HomesHomes under Construction

8

Note: ‘Land inventory’ denotes owned & controlled lots as of September 30, 2016.

UCP, Inc. Diluted Earnings (Loss) Per Share

3,798 Lots

1,686 Lots

Under contract

for sale

276

65.6%

Model homes

9

2.1%

Unsold homes

136

32.3%

Under contract

for sale

43

31.2%

Model homes

60

43.5%

Unsold homes

35

25.4%

3Q

2015

3Q

2016

YTD

2015

YTD

2016

$0.20 $0.16

$(0.11)

$0.26

U

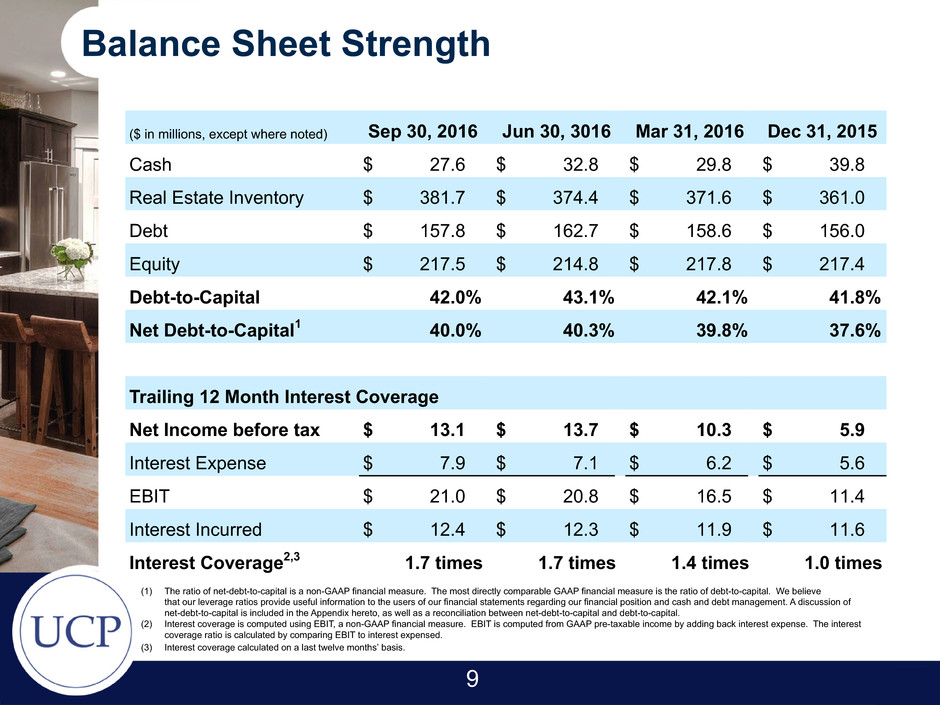

Balance Sheet Strength

9

(1) The ratio of net-debt-to-capital is a non-GAAP financial measure. The most directly comparable GAAP financial measure is the ratio of debt-to-capital. We believe

that our leverage ratios provide useful information to the users of our financial statements regarding our financial position and cash and debt management. A discussion of

net-debt-to-capital is included in the Appendix hereto, as well as a reconciliation between net-debt-to-capital and debt-to-capital.

(2) Interest coverage is computed using EBIT, a non-GAAP financial measure. EBIT is computed from GAAP pre-taxable income by adding back interest expense. The interest

coverage ratio is calculated by comparing EBIT to interest expensed.

(3) Interest coverage calculated on a last twelve months’ basis.

($ in millions, except where noted) Sep 30, 2016 Jun 30, 3016 Mar 31, 2016 Dec 31, 2015

Cash $ 27.6 $ 32.8 $ 29.8 $ 39.8

Real Estate Inventory $ 381.7 $ 374.4 $ 371.6 $ 361.0

Debt $ 157.8 $ 162.7 $ 158.6 $ 156.0

Equity $ 217.5 $ 214.8 $ 217.8 $ 217.4

Debt-to-Capital 42.0% 43.1% 42.1% 41.8%

Net Debt-to-Capital1 40.0% 40.3% 39.8% 37.6%

Trailing 12 Month Interest Coverage

Net Income before tax $ 13.1 $ 13.7 $ 10.3 $ 5.9

Interest Expense $ 7.9 $ 7.1 $ 6.2 $ 5.6

EBIT $ 21.0 $ 20.8 $ 16.5 $ 11.4

Interest Incurred $ 12.4 $ 12.3 $ 11.9 $ 11.6

Interest Coverage2,3 1.7 times 1.7 times 1.4 times 1.0 times

U

2014 2015 2016E

$155

$253

$325

Building on Strong Track Record of Growth

10

▪ Growing home deliveries and

revenue to expected record

highs in 2016

▪ Scalable corporate

infrastructure in place to

support growth and ROE

▪ Strong backlog to support

growth

▪ Expect higher homebuilding

revenue in 4Q16 compared to

4Q15

+45% CAG

R

~

Homebuilding Revenue ($MM)

U

Financial Summary

11

(1) Adjusted homebuilding gross margin is a non-GAAP financial measure. The most directly comparable GAAP financial measure is homebuilding gross margin. A discussion of adjusted

homebuilding gross margin is included in the Appendix hereto, as well as a reconciliation between homebuilding gross margin and adjusted homebuilding gross margin.

Three Months Ended September 30, Nine Months Ended September 30,

($ in millions, except where noted) 2016 2015 2016 2015

Net Orders 247 216 701 676

Homebuilding Deliveries 199 202 563 478

ASP (000s) $ 451 $ 348 $ 425 $ 342

Revenue

Homebuilding $ 89.8 $ 70.3 $ 239.5 $ 163.7

Land development $ 3.9 $ 1.1 $ 5.3 $ 3.2

Other $ — $ 2.3 $ — $ 5.1

Total revenue $ 93.7 $ 73.7 $ 244.8 $ 171.9

% Growth 27.1% 42.4%

Homebuilding Gross Margin 18.5% 18.9% 18.1% 17.7%

Homebuilding Adjusted Gross Margin ¹ 21.0% 21.1% 20.6% 19.7%

Operating Expense

Sales and marketing $ 4.9 $ 4.7 $ 13.6 $ 13.2

General and administrative $ 4.6 $ 5.5 $ 19.1 $ 19.3

Goodwill impairment $ 4.2 $ — $ 4.2 $ —

Total operating expense $ 13.7 $ 10.2 $ 36.9 $ 32.6

Other income, net $ 0.2 $ 0.0 $ 0.3 $ 0.2

Net income (loss) before income taxes $ 3.3 $ 3.8 $ 5.5 $ (1.8)

Provision for income taxes $ (0.1) $ — $ (0.3) $ —

Net income (loss) $ 3.1 $ 3.8 $ 5.2 $ (1.8)

Totals may not add due to rounding

U

Appendix – Gross Margin and Adj. Gross Margin Reconciliation

12

(1) Adjusted homebuilding gross margin percentage is a non-GAAP financial measure. The most directly comparable GAAP financial measure is homebuilding gross margin. Adjusted

gross margin is defined as gross margin plus capitalized interest, impairment and abandonment charges. We use adjusted gross margin information as a supplemental measure when

evaluating our operating performance. We believe this information is meaningful, because it isolates the impact that leverage and non-cash impairment and abandonment charges have

on gross margin. However, because adjusted gross margin information excludes interest expense and impairment and abandonment charges, all of which have real economic effects

and could materially impact our results, the utility of adjusted gross margin information as a measure of our operating performance is limited. In addition, other companies may not

calculate adjusted gross margin information in the same manner that we do. Accordingly, adjusted gross margin information should be considered only as a supplement to gross margin

information as a measure of our performance. The table above provides a reconciliation of adjusted gross margin numbers to the most comparable GAAP financial measure.

Three Months Ended September 30,

2016 % 2015 %

($ in thousands)

Consolidated Gross Margin & Adjusted Gross Margin

Revenue $ 93,740 100.0% $ 73,672 100.0%

Cost of Sales 77,010 82.2% 59,680 81.0%

Gross Margin 16,730 17.8% 13,992 19.0%

Add: interest in cost of sales 2,214 2.4% 1,443 2.0%

Add: impairment and abandonment charges 223 0.2% 144 0.2%

Adjusted Gross Margin(1) $ 19,167 20.4% $ 15,579 21.1%

Consolidated Gross margin percentage 17.8% 19.0%

Consolidated Adjusted gross margin percentage(1) 20.4% 21.1%

Homebuilding Gross Margin & Adjusted Gross Margin

Homebuilding revenue $ 89,840 100.0% $ 70,284 100.0%

Cost of home sales 73,176 81.5% 57,006 81.1%

Homebuilding gross margin 16,664 18.5% 13,278 18.9%

Add: interest in cost of home sales 1,990 2.2% 1,443 2.1%

Add: impairment and abandonment charges 192 0.2% 119 0.2%

Adjusted homebuilding gross margin(1) $ 18,846 21.0% $ 14,840 21.1%

Homebuilding gross margin percentage 18.5% 18.9%

Adjusted homebuilding gross margin percentage(1) 21.0% 21.1%

U

Appendix – Ratio of Net Debt to Capital

13

(1) The ratio of net debt-to-capital is a non-GAAP financial measure. The most directly comparable GAAP financial measure is the ratio of debt-to-capital. We believe that our leverage ratios

provide useful information to the users of our financial statements regarding our financial position and cash and debt management. The ratio of net debt-to-capital is computed as the quotient

obtained by dividing net debt (which is debt less unrestricted cash and cash equivalents) by the sum of net debt plus stockholders’ and member's equity. We believe the ratio of net debt-to-

capital is a relevant financial measure for investors to understand the leverage employed in our operations and as an indicator of our ability to obtain financing. We reconcile this non-GAAP

financial measure to the ratio of debt-to-capital in the table above. In addition, other issuers or issuers in other industries may not calculate net debt-to-capital ratio in the same manner that

we do. Accordingly, the net debt-to-capital ratio should be considered only as a supplement to the ratio of debt-to-capital information as a measure of our financial leverage.

As of September 30, 2016 As of December 31, 2015

Debt $ 157,785 $ 155,966

Equity 217,472 217,408

Total capital $ 375,257 $ 373,374

Ratio of debt-to-capital 42.0% 41.8%

Debt $ 157,785 $ 155,966

Net cash and cash equivalents $ 28,486 $ 40,729

Less: restricted cash and minimum liquidity requirement 15,900 15,900

Unrestricted cash and cash equivalents $ 12,586 $ 24,829

Net debt $ 145,199 $ 131,137

Equity 217,472 217,408

Total adjusted capital $ 362,671 $ 348,545

Ratio of net debt-to-capital (1) 40.0% 37.6%

U

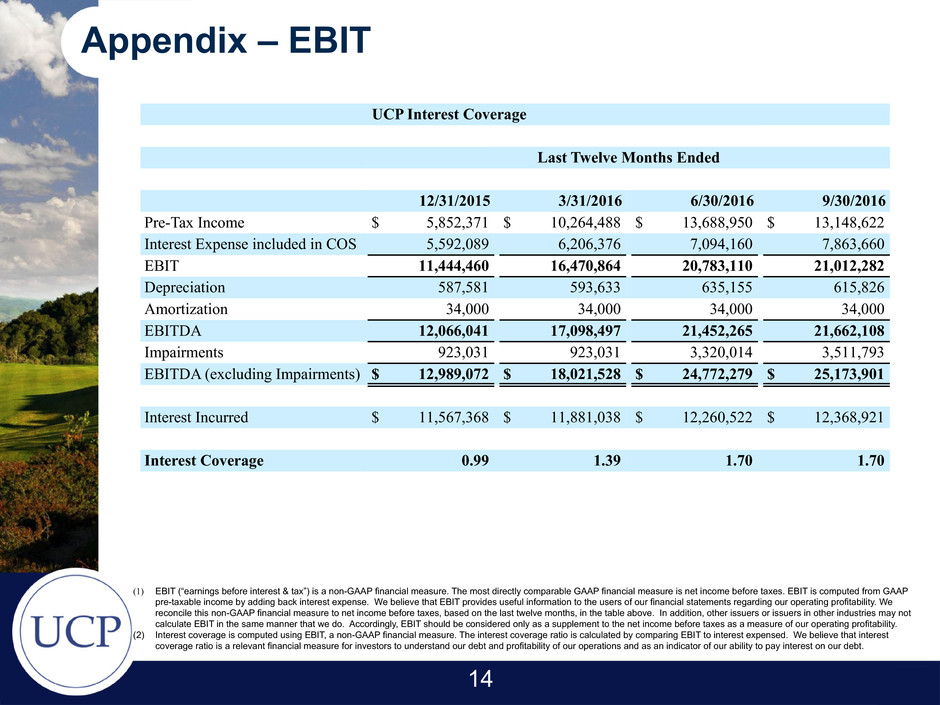

Appendix – EBIT

14

(1) EBIT (“earnings before interest & tax”) is a non-GAAP financial measure. The most directly comparable GAAP financial measure is net income before taxes. EBIT is computed from GAAP

pre-taxable income by adding back interest expense. We believe that EBIT provides useful information to the users of our financial statements regarding our operating profitability. We

reconcile this non-GAAP financial measure to net income before taxes, based on the last twelve months, in the table above. In addition, other issuers or issuers in other industries may not

calculate EBIT in the same manner that we do. Accordingly, EBIT should be considered only as a supplement to the net income before taxes as a measure of our operating profitability.

(2) Interest coverage is computed using EBIT, a non-GAAP financial measure. The interest coverage ratio is calculated by comparing EBIT to interest expensed. We believe that interest

coverage ratio is a relevant financial measure for investors to understand our debt and profitability of our operations and as an indicator of our ability to pay interest on our debt.

UCP Interest Coverage

Last Twelve Months Ended

12/31/2015 3/31/2016 6/30/2016 9/30/2016

Pre-Tax Income $ 5,852,371 $ 10,264,488 $ 13,688,950 $ 13,148,622

Interest Expense included in COS 5,592,089 6,206,376 7,094,160 7,863,660

EBIT 11,444,460 16,470,864 20,783,110 21,012,282

Depreciation 587,581 593,633 635,155 615,826

Amortization 34,000 34,000 34,000 34,000

EBITDA 12,066,041 17,098,497 21,452,265 21,662,108

Impairments 923,031 923,031 3,320,014 3,511,793

EBITDA (excluding Impairments) $ 12,989,072 $ 18,021,528 $ 24,772,279 $ 25,173,901

Interest Incurred $ 11,567,368 $ 11,881,038 $ 12,260,522 $ 12,368,921

Interest Coverage 0.99 1.39 1.70 1.70