Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | kra1027168-k.htm |

October 27, 2016

Kraton Corporation

Third Quarter 2016

Earnings Presentation

Kraton Third Quarter 2016 Earnings Call 1

Disclaimers

Forward Looking Statements

Some of the statements in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. This presentation includes forward-looking statements that reflect our plans, beliefs, expectations, and current views with respect to, among

other things, future events and financial performance. Forward-looking statements are often characterized by the use of words such as “outlook,”

“believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans”, “on track” “on trend”, or “anticipates,” or by discussions of strategy,

plans or intentions, including all matters described on the slide titled “2016 Modeling Assumptions” including, but not limited to, expectations for

revenue, adjusted EBITDA, depreciation and amortization, non-cash compensation expense, interest expense, tax provision, capital expenditures,

spread between FIFO and ECRC, net debt, anticipated synergies and cost reset savings.

All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and

unknown risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed in forward-looking

statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item

1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other

filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: the integration of Arizona Chemical (now,

AZ Chem Holdings LP); Kraton's ability to repay its indebtedness; Kraton's reliance on third parties for the provision of significant operating and other

services; conditions in the global economy and capital markets; fluctuations in raw material costs; limitations in the availability of raw materials;

competition in Kraton's end-use markets; and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to

place undue reliance on our forward-looking statements. Forward-looking statements speak only as of the date they are made, and we assume no

obligation to update such information in light of new information or future events.

Pro Forma Financial Information

The unaudited pro forma information presented herein is for information purposes only and is not necessarily indicative of the operating results that

would have occurred had the Arizona Chemical Acquisition been consummated at the beginning of the period, nor is it necessarily indicative of future

operating results. The unaudited pro forma amounts above have been calculated after applying Kraton's accounting policies and adjusting the Arizona

Chemical results to reflect (1) the additional depreciation and amortization that would have been charged assuming the fair value adjustments to

property, plant, and equipment and intangible assets had been applied from January 1, 2015; (2) the elimination of historical interest expense for

Arizona Chemical as this debt was paid off by the previous owners; (3) the additional interest expense resulting from the debt issued to fund the Arizona

Chemical Acquisition; (4) the elimination of transaction-related costs; and (5) an adjustment to tax-effect the aforementioned unaudited pro forma

adjustments using an estimated aggregate statutory income tax rate of the jurisdiction to which that above adjustments relate. The unaudited pro

forma amounts do not include any potential synergies, cost savings or other expected benefits of the Arizona Chemical Acquisition

Kraton Third Quarter 2016 Earnings Call 2

GAAP Disclaimer

This presentation includes the use of both GAAP and non-GAAP financial measures. The non-GAAP financial measures are EBITDA, Adjusted EBITDA,

Adjusted Gross Profit and Adjusted Net Income attributable to Kraton (or earnings per share). Tables included in this presentation and our earnings

release reconcile each of these non-GAAP financial measures with the most directly comparable GAAP financial measure. For additional information

on the impact of the spread between the FIFO basis of accounting and estimated current replacement cost (“ECRC”), see Management’s Discussion and

Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

We consider these non-GAAP financial measures to be important supplemental measures of our performance and believe they are frequently used by

investors, securities analysts and other interested parties in the evaluation of our performance including period-to-period comparisons and/or that of

other companies in our industry. Further, management uses these measures to evaluate operating performance, and our incentive compensation plan

bases incentive compensation payments on our Adjusted EBITDA performance, along with other factors. These non-GAAP financial measures have

limitations as analytical tools and in some cases can vary substantially from other measures of our performance. You should not consider them in

isolation, or as a substitute for analysis of our results under GAAP in the United States. For EBITDA, which represents net income before interest, taxes,

depreciation and amortization, these limitations include: EBITDA does not reflect the significant interest expense on our debt; EBITDA does not reflect

the significant depreciation and amortization expense associated with our long-lived assets; and EBITDA included herein should not be used for purposes

of assessing compliance or non-compliance with financial covenants under our debt agreements. The calculation of EBITDA in our debt agreements

includes adjustments, such as extraordinary, non-recurring or one-time charges, pro forma cost savings, certain non-cash items, turnaround costs, and

other items included in the definition of EBITDA in our debt agreements. Other companies in our industry may calculate EBITDA differently than we

do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We

prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance,

including the spread between FIFO and ECRC, but you should be aware that in the future we may incur expenses similar to the adjustments in this

presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or

non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and

other performance measures, including net income calculated in accordance with U.S. GAAP; and Adjusted EBITDA may, and often will, vary significantly

from EBITDA calculations under the terms of our debt agreements and should not be used for assessing compliance or non-compliance with financial

covenants under our debt agreements. Because of these and other limitations, EBITDA and Adjusted EBITDA should not be considered as a measure of

discretionary cash available to us to invest in the growth of our business. As a measure of our performance, Adjusted Gross Profit is limited because it

often will vary substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Finally, we prepare

Adjusted Net Income attributable to Kraton by eliminating from net income the impact of a number of items we do not consider indicative of our on-

going performance, including the spread between FIFO and ECRC. Our presentation of non-GAAP financial measures and the adjustments made therein

should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items, and in the future we may incur

expenses or charges similar to the adjustments made in the presentation of our non-GAAP financial measures.

Disclaimers

Kraton Third Quarter 2016 Earnings Call 3

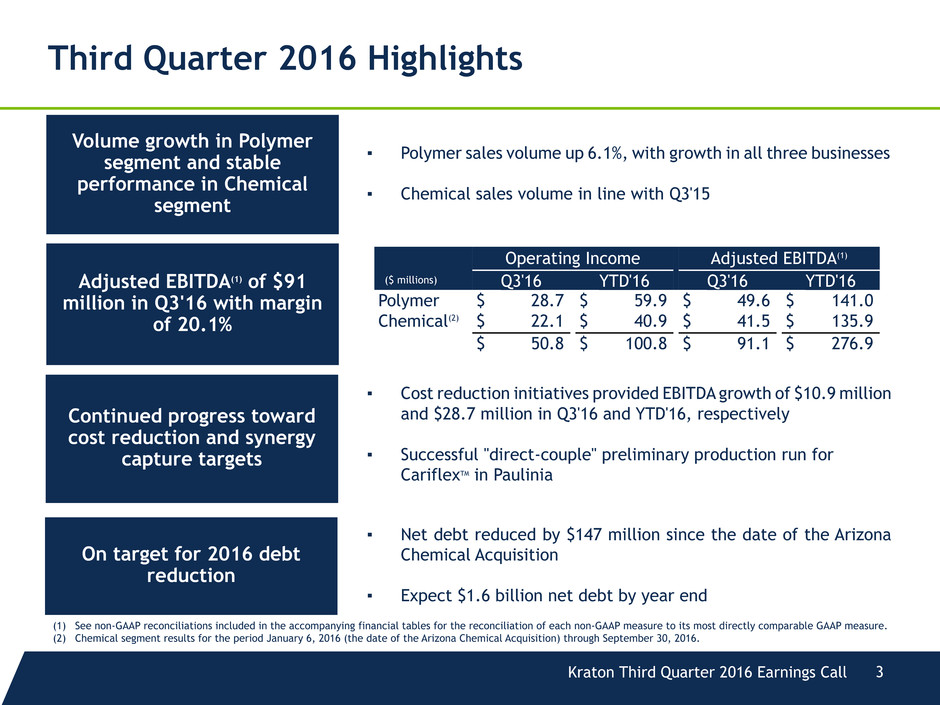

Third Quarter 2016 Highlights

Adjusted EBITDA(1) of $91

million in Q3'16 with margin

of 20.1%

Continued progress toward

cost reduction and synergy

capture targets

▪ Cost reduction initiatives provided EBITDA growth of $10.9 million

and $28.7 million in Q3'16 and YTD'16, respectively

▪ Successful "direct-couple" preliminary production run for

CariflexTM in Paulinia

On target for 2016 debt

reduction

▪ Net debt reduced by $147 million since the date of the Arizona

Chemical Acquisition

▪ Expect $1.6 billion net debt by year end

Volume growth in Polymer

segment and stable

performance in Chemical

segment

▪ Polymer sales volume up 6.1%, with growth in all three businesses

▪ Chemical sales volume in line with Q3'15

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Chemical segment results for the period January 6, 2016 (the date of the Arizona Chemical Acquisition) through September 30, 2016.

Operating Income Adjusted EBITDA(1)

($ millions) Q3'16 YTD'16 Q3'16 YTD'16

Polymer $ 28.7 $ 59.9 $ 49.6 $ 141.0

Chemical(2) $ 22.1 $ 40.9 $ 41.5 $ 135.9

$ 50.8 $ 100.8 $ 91.1 $ 276.9

Kraton Third Quarter 2016 Earnings Call 4

Polymer Segment Update

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

▪ Lower average selling prices reflecting lower raw material costs

▪ Price pressure for certain SIS adhesive grades resulting from global over capacity of SIS

▪ Strong volume growth in Cariflex benefiting from conversion to powder-free surgical gloves

▪ Strong paving demand

▪ For the TTM period ended September 30, 2016, 60% of the portfolio was comprised of differentiated grades, compared

to 57% in the TTM period ended September 30, 2015

▪ Sales Volumes (compared to 2015):

▪ Cariflex - up 29.4% in Q3 and up 23.7% YTD

▪ Specialty Polymers - up 10.2% in Q3 and up 7.2% YTD

▪ Performance Products – up 3.2% in Q3 and up 7.5% YTD

($ millions) Q3'16 Q3'15 Change YTD'16 YTD'15 Change

Volume (kT) 85.9 81.0 5.0 250.9 231.6 19.3

Revenues:

Cariflex $ 45.3 $ 34.0 $ 11.3 $ 126.5 $ 102.1 $ 24.4

Specialty polymers 89.1 86.8 2.3 256.2 263.1 (6.9)

Performance products 138.5 148.0 (9.5) 403.2 420.9 (17.7)

Other 0.1 0.2 (0.1) 0.2 0.3 (0.1)

Total $ 273.0 $ 269.0 $ 4.0 $ 786.1 $ 786.3 $ (0.2)

Operating income $ 28.7 $ 17.2 $ 11.6 $ 59.9 $ 14.1 $ 45.8

Adjusted EBITDA(1) $ 49.6 $ 42.4 $ 7.2 $ 141.0 $ 116.8 $ 24.3

Adjusted EBITDA as % of revenue 18.2% 15.8% 240 bps 17.9% 14.9% 309 bps

Note: May not foot due to rounding.

Kraton Third Quarter 2016 Earnings Call 5

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Chemical segment results for the period January 6, 2016 (the date of the Arizona Chemical Acquisition) through September 30, 2016.

(3) The 2015 amounts have been derived from the Arizona Chemical historical operating results and are being included for comparative purposes only.

Chemical Segment Update

▪ Competition with low-cost C5 hydrocarbon alternatives impacting pricing in adhesives

▪ In Chemical Intermediates, long TOFA market and inter-material influences result in price pressure for TOFA and TOR

▪ Sales Volumes (compared to 2015):

▪ Adhesives - up 2.4% in Q3 and down 3.0% YTD

▪ Roads & Construction - down 3.4% in Q3 and up 4.7% YTD

▪ Tires - flat in Q3 and YTD

▪ Chemical Intermediates - down 1.3% in Q3 and down 2.8% YTD

($ millions) Q3'16 Q3'15(3) Change YTD'16(2) YTD'15(3) Change

Volume (kT) 104.3 104.8 (0.5) 308.0 315.4 (7.4)

Revenues:

Adhesives $ 60.8 $ 65.8 $ (5.0) $ 186.9 $ 205.3 $ (18.3)

Roads & construction 13.8 16.1 (2.4) 40.8 41.9 (1.0)

Tires 10.4 11.1 (0.7) 30.2 32.1 (1.8)

Chemical intermediates 96.2 114.5 (18.3) 284.6 341.8 (57.2)

Total $ 181.2 $ 207.5 $ (26.3) $ 542.6 $ 621.0 $ (78.4)

Operating income $ 22.1 $ 40.9

Adjusted EBITDA(1) $ 41.5 $ 135.9

Adjusted EBITDA as % of revenue 22.9% 25.0%

Note: May not foot due to rounding.

Kraton Third Quarter 2016 Earnings Call 6

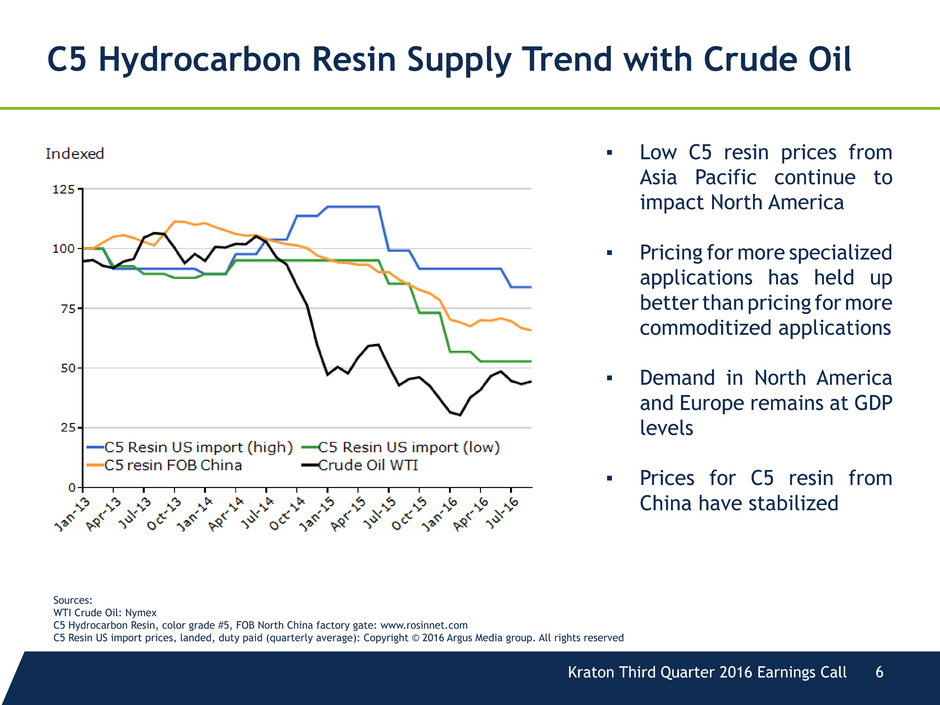

C5 Hydrocarbon Resin Supply Trend with Crude Oil

▪ Low C5 resin prices from

Asia Pacific continue to

impact North America

▪ Pricing for more specialized

applications has held up

better than pricing for more

commoditized applications

▪ Demand in North America

and Europe remains at GDP

levels

▪ Prices for C5 resin from

China have stabilized

Sources:

WTI Crude Oil: Nymex

C5 Hydrocarbon Resin, color grade #5, FOB North China factory gate: www.rosinnet.com

C5 Resin US import prices, landed, duty paid (quarterly average): Copyright © 2016 Argus Media group. All rights reserved

Kraton Third Quarter 2016 Earnings Call 7

Third Quarter 2016 Operating Results

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

Revenue:

▪ Excluding the increase from the Chemical segment acquired January 6, 2016, revenue increased by $23.2 million due to higher Polymer

segment sales volume offset by lower average selling prices

▪ Changes in currency exchange rates positively impacted revenue by $3.8 million

Integration synergies and cost reduction initiatives provided incremental benefit (pre-tax) of $10.9 million in Q3'16 compared to Q3'15

Polymer segment:

▪ Adjusted gross profit(1) of $848 per ton in Q3'16, up $125 sequentially

▪ Improvement in Adjusted EBITDA(1) of 16.9% in Q3'16 reflects the 6.1% increase in sales volumes and lower costs, which mitigated lower

unit margins

Chemical segment:

▪ Adjusted gross profit(1) of $577 per ton in Q3'16, was sequentially lower by $69 per ton due to the macro factors influencing the

segment, product mix, and higher costs

Q3'16 Q3'16 Q3'16 Q3'15 Q3'15

($ millions) Polymer Chemical Consolidated Polymer Consolidated

Revenue $ 273.0 $ 181.2 $ 454.1 $ 269.0 $ 269.0

Gross profit $ 77.0 $ 58.2 $ 135.3 $ 67.8 $ 67.8

Operating income $ 28.7 $ 22.1 $ 50.8 $ 17.2 $ 17.2

Net income attributable to Kraton $ 15.6 $ 8.4

Earnings Per Diluted Share $ 0.49 $ 0.27

Adjusted gross profit(1) $ 72.9 $ 60.1 $ 133.0 $ 68.8 $ 68.8

Adjusted EBITDA(1) $ 49.6 $ 41.5 $ 91.1 $ 42.4 $ 42.4

Adjusted EBITDA as a % of revenue(1) 18.2% 22.9% 20.1% 15.8% 15.8%

Adjusted Earnings Per Diluted Share(1) $ 0.63 $ 0.48

Kraton Third Quarter 2016 Earnings Call 8

Year-to-Date 2016 Operating Results(1)

(1) Chemical segment results for the the period January 6, 2016 (the date of the Arizona Chemical Acquisition) through September 30, 2016.

(2) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

YTD'16 YTD'16 YTD'16 YTD'15 YTD'15

($ millions) Polymer Chemical(1) Consolidated Polymer Consolidated

Revenue $ 786.1 $ 542.6 $ 1,328.7 $ 786.3 $ 786.3

Gross profit $ 209.8 $ 151.2 $ 361.0 $ 161.8 $ 161.8

Operating income $ 59.9 $ 40.9 $ 100.8 $ 14.1 $ 14.1

Net income (loss) attributable to Kraton $ 111.0 $ (6.6)

Earnings (loss) per diluted share $ 3.56 $ (0.21)

Adjusted gross profit(2) $ 216.8 $ 189.7 $ 406.5 $ 202.0 $ 202.0

Adjusted EBITDA(2) $ 141.0 $ 135.9 $ 276.9 $ 116.8 $ 116.8

Adjusted EBITDA as % of revenue(2) 17.9% 25.0% 20.8% 14.9% 14.9%

Adjusted earnings per diluted share(2) $ 2.07 $ 1.26

Revenue:

▪ Excluding the increase from the Chemical segment acquired January 6, 2016, revenue increased by $74.4 million due to higher Polymer

segment sales volume offset by lower average selling prices

▪ Changes in currency exchange rates positively impacted revenue by $2.0 million

Integration synergies and cost reduction initiatives provided incremental benefit (pre-tax) of $28.7 million compared to 2015

Polymer segment:

▪ Adjusted gross profit(2) of $864 per ton in 2016 is comparable to $872 per ton in 2015

▪ Improvement in Adjusted EBITDA(2) of 20.8% in 2016 reflects 8.3% increase in sales volumes and lower costs, which mitigated lower unit

margins

Chemical segment:

▪ Adjusted gross profit(2) of $616 per ton in 2016

Kraton Third Quarter 2016 Earnings Call 9

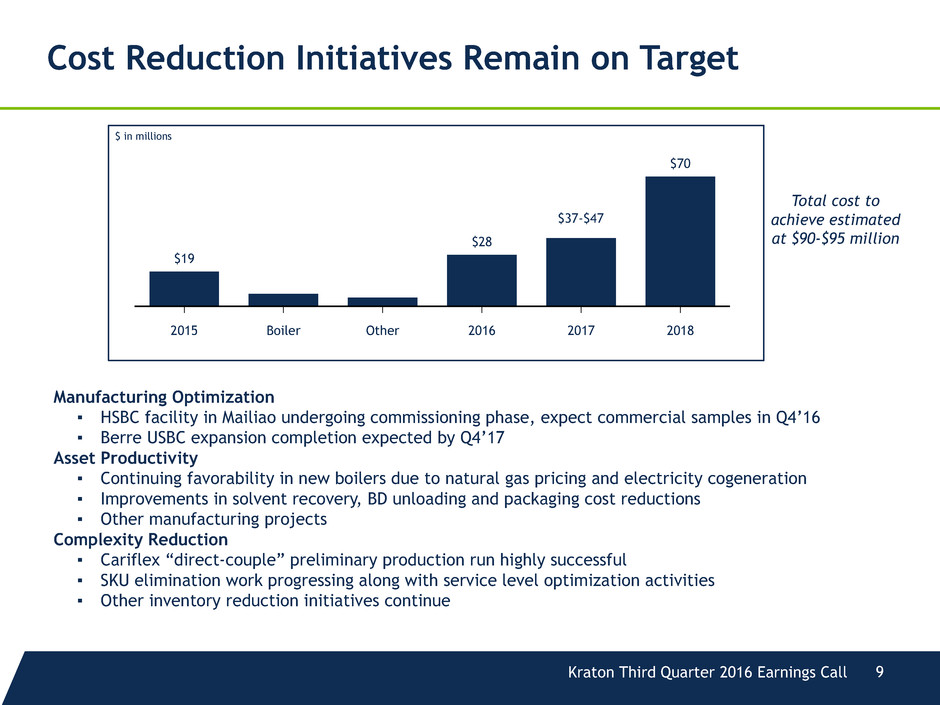

Cost Reduction Initiatives Remain on Target

Manufacturing Optimization

▪ HSBC facility in Mailiao undergoing commissioning phase, expect commercial samples in Q4’16

▪ Berre USBC expansion completion expected by Q4’17

Asset Productivity

▪ Continuing favorability in new boilers due to natural gas pricing and electricity cogeneration

▪ Improvements in solvent recovery, BD unloading and packaging cost reductions

▪ Other manufacturing projects

Complexity Reduction

▪ Cariflex “direct-couple” preliminary production run highly successful

▪ SKU elimination work progressing along with service level optimization activities

▪ Other inventory reduction initiatives continue

Total cost to

achieve estimated

at $90-$95 million

$ in millions

2015 Boiler Other 2016 2017 2018

$19

$28

$70

$37-$47

Kraton Third Quarter 2016 Earnings Call 10

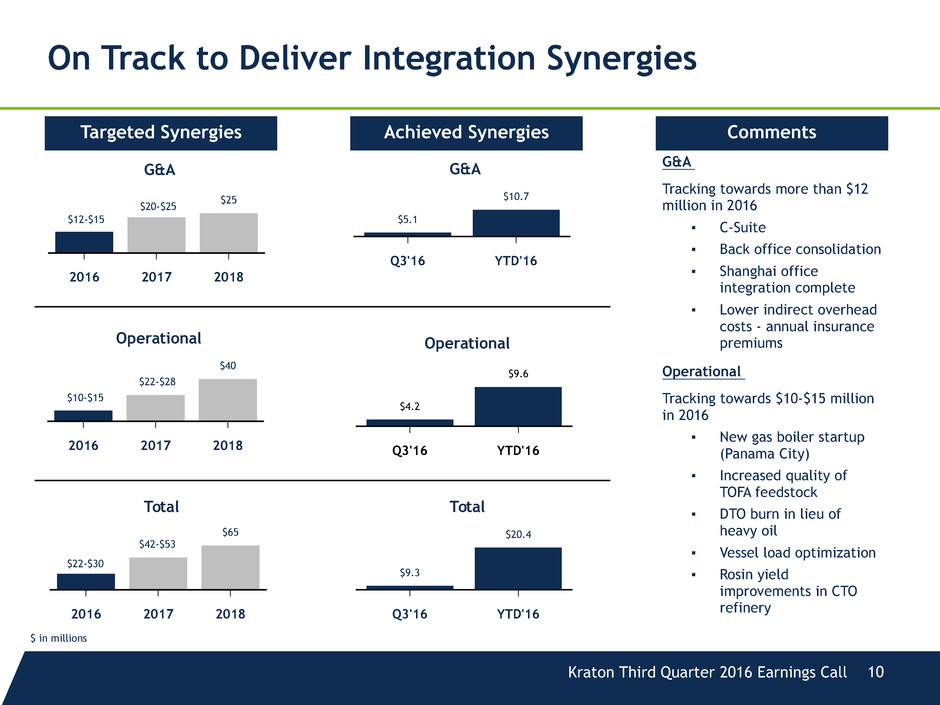

On Track to Deliver Integration Synergies

G&A

Tracking towards more than $12

million in 2016

▪ C-Suite

▪ Back office consolidation

▪ Shanghai office

integration complete

▪ Lower indirect overhead

costs - annual insurance

premiums

Operational

Tracking towards $10-$15 million

in 2016

▪ New gas boiler startup

(Panama City)

▪ Increased quality of

TOFA feedstock

▪ DTO burn in lieu of

heavy oil

▪ Vessel load optimization

▪ Rosin yield

improvements in CTO

refinery

10_85 11_85

$ in millions

Targeted Synergies Achieved Synergies Comments

G&A

2016 2017 2018

$25$20-$25

$12-$15

G&A

Q3'16 YTD'16

$5.1

$10.7

Operational

2016 2017 2018

$40

Operational

Q3'16 YTD'16

$4.2

$9.6

$10-$15

$22-$28

Total

Q3'16 YTD'16

$9.3

$20.4

Total

2016 2017 2018

$65

$42-$53

$22-$30

Kraton Third Quarter 2016 Earnings Call 11

Capital Structure

▪ Kraton net debt reduced by $146.5 million since closing of Arizona Chemical Acquisition

▪ Leverage reduced to 4.6 turns as of TTM September 30, 2016 compared to 5.2 turns upon closing the Arizona

Chemical Acquisition

($ millions) ABL

Term

Loan

10.50%

Notes

Capital

Lease

6.75%

Notes

KRA

Cash

KRA

Net Debt

JV

Debt(1)

JV

Cash(1)

Consol.

Net Debt

December 31, 2015 $ — $ — $ — $ 1.6 $ 350.0 $ 60.7 $ 290.9 $ 76.9 $ 9.3 $ 358.5

Arizona Chemical

Acquisition 37.1 1,350.0 440.0 — (350.0) 36.7 1,440.4 — — 1,440.4

Pro forma for Arizona

Chemical Acquisition 37.1 1,350.0 440.0 1.6 — 97.4 1,731.3 76.9 9.3 1,798.9

Sale of compounding assets — (72.0) — — — — (72.0) — — (72.0)

Adjustments to business

acquisition/divestiture — — — — — 5.9 (5.9) — — (5.9)

Other changes $ (37.1) $ — $ — $ (0.1) $ — $ 31.5 $ (68.7) $ 29.2 $ (0.5) $ (39.0)

Total changes $ (37.1) $ (72.0) $ — $ (0.1) $ — $ 37.4 $ (146.5) $ 29.2 $ (0.5) $ (116.9)

September 30, 2016 $ — $1,278.0 $ 440.0 $ 1.5 $ — $ 134.8 $1,584.8 $ 106.1 $ 8.8 $1,682.0

(1) Represents the 50% investment in a joint venture, Kraton Formosa Polymers Corporation (KFPC), located in Mailiao, Taiwan, which we consolidate.

Note: May not foot due to rounding.

Kraton Third Quarter 2016 Earnings Call 12

2016 Modeling Assumptions(1)

($ in millions)

Revenue $1,750

Adjusted EBITDA(2)

Includes an expectation in Q4 in the low $80 million range approximately $360

Non-cash compensation expense $10

Depreciation & amortization $125 - $130

Interest expense

Includes estimated amortization of DFC and accretion of OID totaling approximately $14.0 million $135 - $140

Effective tax rate excluding release of valuation allowance in Q1'16 10% – 15%

Capex

Excludes KFPC capex of approximately $40 million

Excludes capitalized interest of $5 million

$85 - $95

Estimated fourth quarter 2016 positive spread between FIFO and ECRC approximately $5

Estimated net debt at December 31, 2016

Excludes estimated KFPC net debt of approximately $130 million $1,600

(1) Management's estimates. These estimates are forward-looking statements and speak only as of October 27, 2016. Management assumes no obligation to update or confirm

these estimates in light of new information or future events.

(2) We have not reconciled Adjusted EBITDA guidance to net income (loss) because we do not provide guidance for net income (loss) or for items that we do not consider indicative

of our on-going performance, including, but not limited to, transaction and acquisition costs and costs associated with dispositions, business exits, and production downtime,

as certain of these items are out of our control and/or cannot be reasonably predicted. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the

corresponding GAAP measures is not available without unreasonable effort.

Note: Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS.

Appendix

Kraton Third Quarter 2016 Earnings Call 14

Polymer – Revenue by Geography and Product Group

TTM September 30, 2016

CARIFLEX PERFORMANCE PRODUCTSSPECIALTY POLYMERS

Revenue by Geog

raph

y

Revenue by Product Grou

p

Asia Pacific

93%

EMEA

6%

Americas

1%

Asia Pacific

30%

EMEA

25%

Americas

45%

Asia Pacific

9%

EMEA

46%

Americas

45%

Medical

94%

Industrial

5%

Other

1%

Other

28%

Industrial

10%

Polymod

13%

Lubricant

Additives

14%

Medical

9%

Cable

Gels

7%

Personal Care

7%

Adhsv &

Coatings

6%

Consumer

6%

Paving

30%

Personal

Care

20%

Roofing

19%

Pkg & Indust

Adhsv

14%

Other

10%

Industrial

7%

Kraton Third Quarter 2016 Earnings Call 15

Chemical – Revenue by Geography

TTM September 30, 2016

ADHESIVES TIRES

ROADS & CONSTRUCTION CHEMICAL INTERMEDIATES

Americas

57%

EMEA

34%

Asia Pacific

9%

Americas

33%

EMEA

38%

Asia Pacific

29%

Americas

51%

EMEA

48%

Asia Pacific

1%

Americas

48%

EMEA

39%

Asia Pacific

13%

Kraton Third Quarter 2016 Earnings Call 16

Reconciliation of Gross Profit to Adjusted Gross

Profit – Q3 2016

Three Months Ended September 30, 2016

Three Months Ended

September 30, 2015

Polymer Chemical Total Total

(In thousands)

Gross profit $ 77,008 $ 58,248 $ 135,256 $ 67,810

Add (deduct):

Restructuring and other charges (a) 743 8 751 61

Effect of purchase price accounting on inventory

valuation

— — — —

Production downtime (b) — — — (146)

Non-cash compensation expense 128 — 128 122

Spread between FIFO and ECRC (5,001) 1,879 (3,122) 926

Adjusted gross profit (non-GAAP) $ 72,878 $ 60,135 $ 133,013 $ 68,773

Sales volume (kilotons) 85.9 104.3 190.2 81.0

Adjusted gross profit per ton $ 848 $ 577 $ 699 $ 850

a) Severance expense and other restructuring related charges.

b) In 2015, the reduction in costs is due to additional insurance recovery related to the Belpre, Ohio, production downtime.

Kraton Third Quarter 2016 Earnings Call 17

Reconciliation of Gross Profit to Adjusted Gross

Profit – YTD 2016

Nine Months Ended September 30, 2016

Nine Months Ended

September 30, 2015

Polymer Chemical Total Total

(In thousands)

Gross profit $ 209,774 $ 151,197 $ 360,971 $ 161,807

Add (deduct):

Restructuring and other charges (a) 785 8 793 142

Effect of purchase price accounting on inventory

valuation (b)

— 24,719 24,719 —

Production downtime (c) — — — (474)

Non-cash compensation expense 436 — 436 396

Spread between FIFO and ECRC 5,807 13,788 19,595 40,144

Adjusted gross profit (non-GAAP) $ 216,802 $ 189,712 $ 406,514 $ 202,015

Sales volume (kilotons) 250.9 308.0 558.9 231.6

Adjusted gross profit per ton $ 864 $ 616 $ 727 $ 872

a) Severance expenses and other restructuring related charges.

b) Higher costs of goods sold for our Chemical segment related to the fair value adjustment in purchase accounting for their inventory.

c) In 2015, the reduction in costs is due to additional insurance recovery related to the Belpre, Ohio, production downtime.

Kraton Third Quarter 2016 Earnings Call 18

Reconciliation of Net Income to Operating Income to

Non-GAAP Financial Measures – Q3 2016

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are primarily recorded in selling, general,

and administrative expenses.

b) In 2015, the reduction in costs is due to additional insurance recovery related to the Belpre, Ohio, production downtime, which is primarily recorded in cost of goods sold.

c) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general, and administrative expenses.

d) For the three months ended September 30, 2016 and 2015, respectively, $1.9 million and $1.7 million is recorded in selling, general and administrative expenses, $0.1 million

and $0.2 million is recorded in research and development expenses, and $0.1 million and $0.1 million is recorded in cost of goods sold.

Three Months Ended September 30, 2016

Three Months Ended

September 30, 2015

Polymer Chemical Total Total

(In thousands)

Net income attributable to Kraton $ 15,560 $ 8,446

Net loss attributable to noncontrolling interest (717) (427)

Consolidated net income 14,843 8,019

Add (deduct):

Income tax benefit 2,198 3,076

Interest expense, net 33,870 6,151

Earnings of unconsolidated joint venture (94) (95)

Operating income $ 28,728 $ 22,089 50,817 17,151

Add:

Depreciation and amortization 14,977 17,000 31,977 16,145

Earnings of unconsolidated joint venture 94 — 94 95

EBITDA 43,799 39,089 82,888 33,391

Add (deduct):

Transaction, acquisition related costs, restructuring, and other costs (a) 7,216 530 7,746 5,501

Production downtime (b) — — — (134)

KFPC startup costs (c) 1,421 — 1,421 677

Non-cash compensation expense (d) 2,141 — 2,141 2,032

Spread between FIFO and ECRC (5,001) 1,879 (3,122) 926

Adjusted EBITDA $ 49,576 $ 41,498 $ 91,074 $ 42,393

Kraton Third Quarter 2016 Earnings Call 19

Reconciliation of Net Income (Loss) to Operating

Income to Non-GAAP Financial Measures – YTD 2016

Nine Months Ended September 30, 2016

Nine Months Ended

September 30, 2015

Polymer Chemical Total Total

(In thousands)

Net income (loss) attributable to Kraton $ 111,048 $ (6,574)

Net loss attributable to noncontrolling interest (1,792) (1,141)

Consolidated net income (loss) 109,256 (7,715)

Add (deduct):

Income tax benefit (expense) (83,024) 4,135

Interest expense, net 101,450 17,975

Earnings of unconsolidated joint venture (274) (273)

Loss on extinguishment of debt 13,423 —

Disposition and exit of business activities (40,001) —

Operating income $ 59,936 $ 40,894 100,830 14,122

Add (deduct):

Depreciation and amortization 45,199 48,714 93,913 46,852

Disposition and exit of business activities 40,001 — 40,001 —

Loss on extinguishment of debt (13,423) — (13,423) —

Earnings of unconsolidated joint venture 274 — 274 273

EBITDA 131,987 89,608 221,595 61,247

Add (deduct):

Transaction, acquisition related costs, restructuring, and other costs (a) 19,255 7,773 27,028 7,297

Disposition and exit of business activities (40,001) — (40,001) —

Loss on extinguishment of debt 13,423 — 13,423 —

Effect of purchase price accounting on inventory valuation — 24,719 24,719 —

Production downtime (b) — — — (343)

KFPC startup costs (c) 3,280 — 3,280 1,827

Non-cash compensation expense (d) 7,272 — 7,272 6,601

Spread between FIFO and ECRC 5,807 13,788 19,595 40,144

Adjusted EBITDA $ 141,023 $ 135,888 $ 276,911 $ 116,773

a) Charges related to the evaluation of acquisition transactions , severance expenses, and other restructuring related charges, which are primarily recorded in selling, general, and

administrative expenses.

b) In 2015, the reduction in costs is due to additional insurance recovery related to the Belpre, Ohio, production downtime, which is primarily recorded in cost of goods sold.

c) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general, and administrative expenses.

d) For the nine months ended September 30, 2016 and 2015, respectively, $6.3 million and $5.7 million is recorded in selling, general and administrative expenses, $0.6 million and

$0.5 million is recorded in research and development expenses, and $0.4 million and $0.4 million is recorded in cost of goods sold.

Kraton Third Quarter 2016 Earnings Call 20

Reconciliation of EPS to Adjusted EPS

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges which are primarily recorded in selling, general,

and administrative expenses.

b) In 2015, the reduction in costs is due to additional insurance recovery related to the Belpre, Ohio, production downtime, which is primarily recorded in cost of goods sold.

c) Higher costs of goods sold for our Chemical segment related to the fair value adjustment in purchase accounting for their inventory.

d) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general, and administrative expenses.

e) Reduction of income tax valuation allowance related to the assessment of our ability to utilize net operating losses in future periods.

Three Months Ended September 30, Nine Months Ended September 30,

2016 2015 2016 2015

Earnings (Loss) Per Diluted Share $ 0.49 $ 0.27 $ 3.56 $ (0.21)

Transaction, acquisition related costs, restructuring, and other

costs (a)

0.20 0.18 0.72 0.23

Disposition and exit of business activities — — (0.82) —

Loss on extinguishment of debt — — 0.28 —

Production downtime (b) — (0.01) — (0.01)

Effect of purchase price accounting on inventory valuation (c) — — 0.63 —

KFPC startup costs (d) 0.02 0.01 0.04 0.02

Valuation Allowance (e) — — (2.77) —

Spread between FIFO and ECRC (0.08) 0.03 0.43 1.23

Adjusted Earnings Per Diluted Share (non-GAAP) $ 0.63 $ 0.48 $ 2.07 $ 1.26