Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CenterState Bank Corp | csfl-ex991_6.htm |

| EX-2.1 - EX-2.1 - CenterState Bank Corp | csfl-ex21_7.htm |

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20161018.htm |

Acquisition of Platinum Bank Holding Company October 18, 2016 Exhibit 99.2

This presentation contains forward-looking statements, as defined by Federal Securities Laws, relating to present or future trends or factors affecting the operations, markets and products of CenterState Banks, Inc. (CSFL). These statements are provided to assist in the understanding of future financial performance. Any such statements are based on current expectations and involve a number of risks and uncertainties. For a discussion of factors that may cause such forward-looking statements to differ materially from actual results, please refer to CSFL’s most recent Form 10-Q and Form 10-K filed with the Securities Exchange Commission. CSFL undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation. Forward Looking Statement

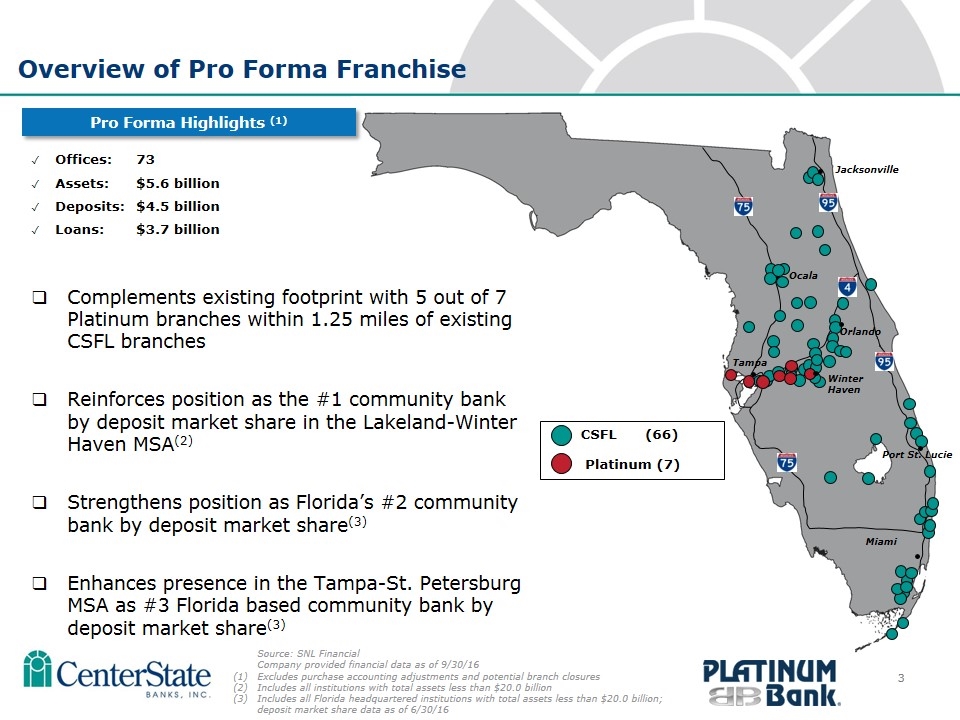

Offices: 73 Assets: $5.6 billion Deposits: $4.5 billion Loans: $3.7 billion CSFL (66) Platinum (7) Tampa Jacksonville Orlando Winter Haven Miami Port St. Lucie Overview of Pro Forma Franchise Source: SNL Financial Company provided financial data as of 9/30/16 Excludes purchase accounting adjustments and potential branch closures Includes all institutions with total assets less than $20.0 billion Includes all Florida headquartered institutions with total assets less than $20.0 billion; deposit market share data as of 6/30/16 Pro Forma Highlights (1) Complements existing footprint with 5 out of 7 Platinum branches within 1.25 miles of existing CSFL branches Reinforces position as the #1 community bank by deposit market share in the Lakeland-Winter Haven MSA(2) Strengthens position as Florida’s #2 community bank by deposit market share(3) Enhances presence in the Tampa-St. Petersburg MSA as #3 Florida based community bank by deposit market share(3) Ocala

Transaction Rationale Strategic Rationale Low Risk Profile Attractive Financial Returns Solidifies footprint in West Central Florida with significant overlap Consolidates a strong competitor Robust enhancement to community bank market share position (#1 in the Lakeland-Winter Haven MSA(1), #2 in Florida(2), and #3 in the Tampa-St. Petersburg MSA(2)) Low risk, mature franchise with history of strong performance and long term relationships Minimal tangible book value dilution, earned back within 2.5 years Mid single-digit EPS accretion with cost savings fully phased in Internal rate of return greater than 20% Enhances profitability / efficiency metrics Pro forma company “well-capitalized” and remains under CRE guidelines In-market transaction All key executives under contract CenterState is an experienced acquiror and integrator Talented and practiced credit review team Includes all institutions with total assets less than $20.0 billion Includes all Florida headquartered institutions with total assets less than $20.0 billion; deposit market share data as of 6/30/16

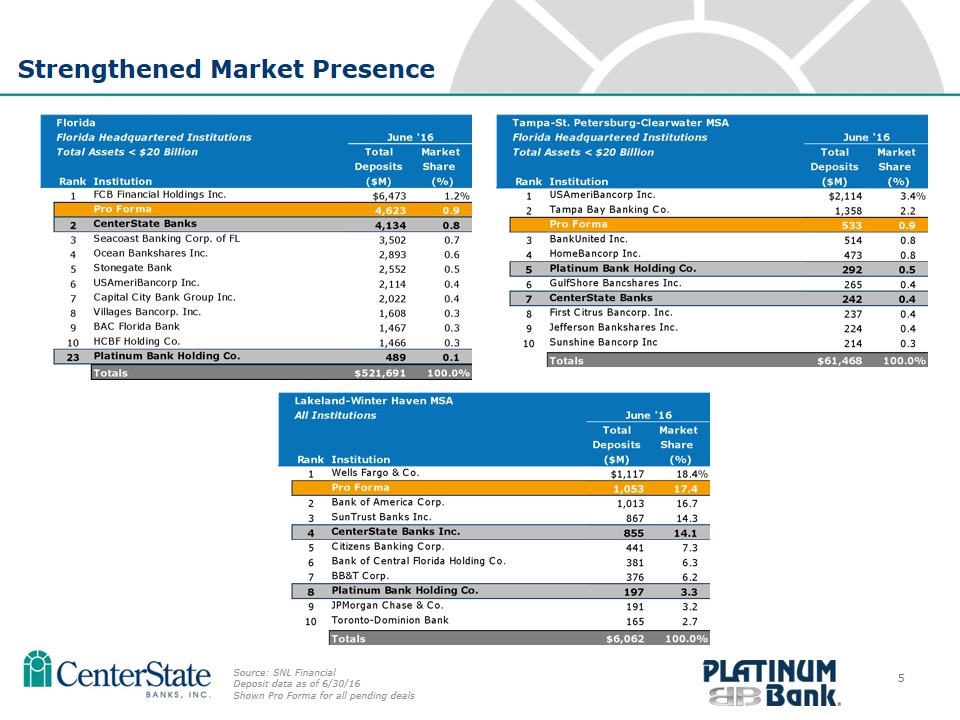

Strengthened Market Presence Source: SNL Financial Deposit data as of 6/30/16 Shown Pro Forma for all pending deals

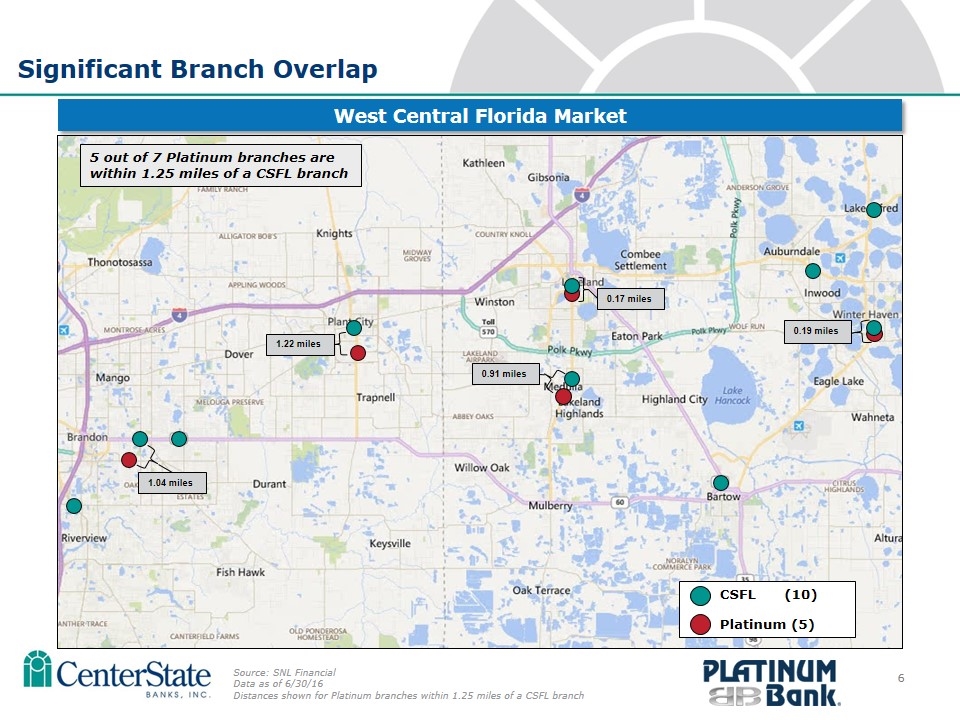

Significant Branch Overlap West Central Florida Market Source: SNL Financial Data as of 6/30/16 Distances shown for Platinum branches within 1.25 miles of a CSFL branch 0.17 miles 0.19 miles 1.04 miles 1.22 miles 5 out of 7 Platinum branches are within 1.25 miles of a CSFL branch CSFL (10) Platinum (5) 0.91 miles

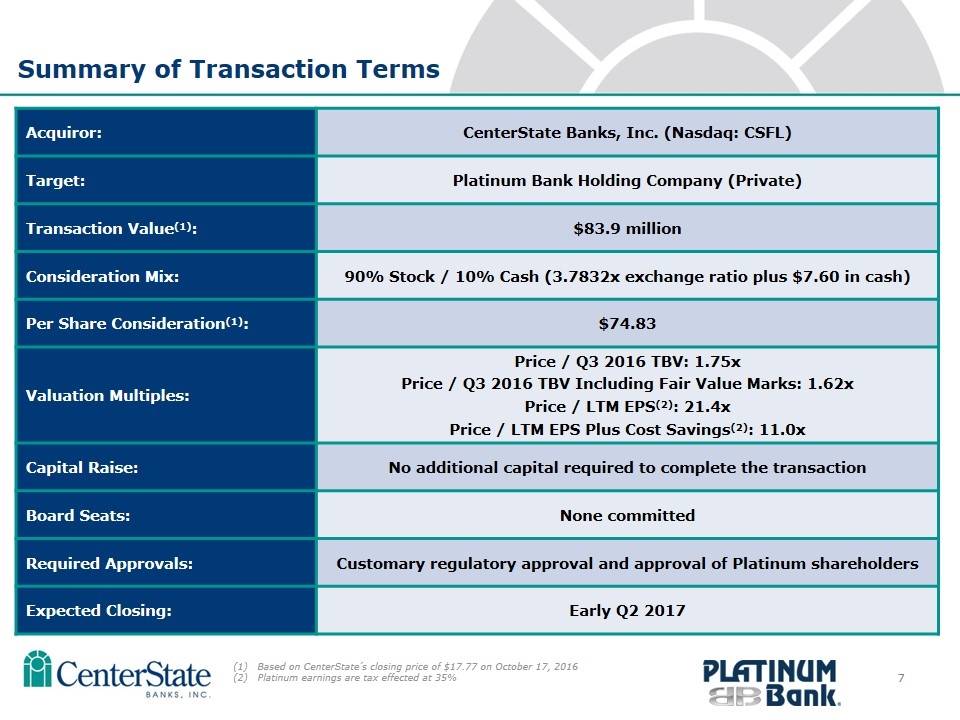

Summary of Transaction Terms Acquiror: CenterState Banks, Inc. (Nasdaq: CSFL) Target: Platinum Bank Holding Company (Private) Transaction Value(1): $83.9 million Consideration Mix: 90% Stock / 10% Cash (3.7832x exchange ratio plus $7.60 in cash) Per Share Consideration(1): $74.83 Valuation Multiples: Price / Q3 2016 TBV: 1.75x Price / Q3 2016 TBV Including Fair Value Marks: 1.62x Price / LTM EPS(2): 21.4x Price / LTM EPS Plus Cost Savings(2): 11.0x Capital Raise: No additional capital required to complete the transaction Board Seats: None committed Required Approvals: Customary regulatory approval and approval of Platinum shareholders Expected Closing: Early Q2 2017 Based on CenterState’s closing price of $17.77 on October 17, 2016 (2)Platinum earnings are tax effected at 35%

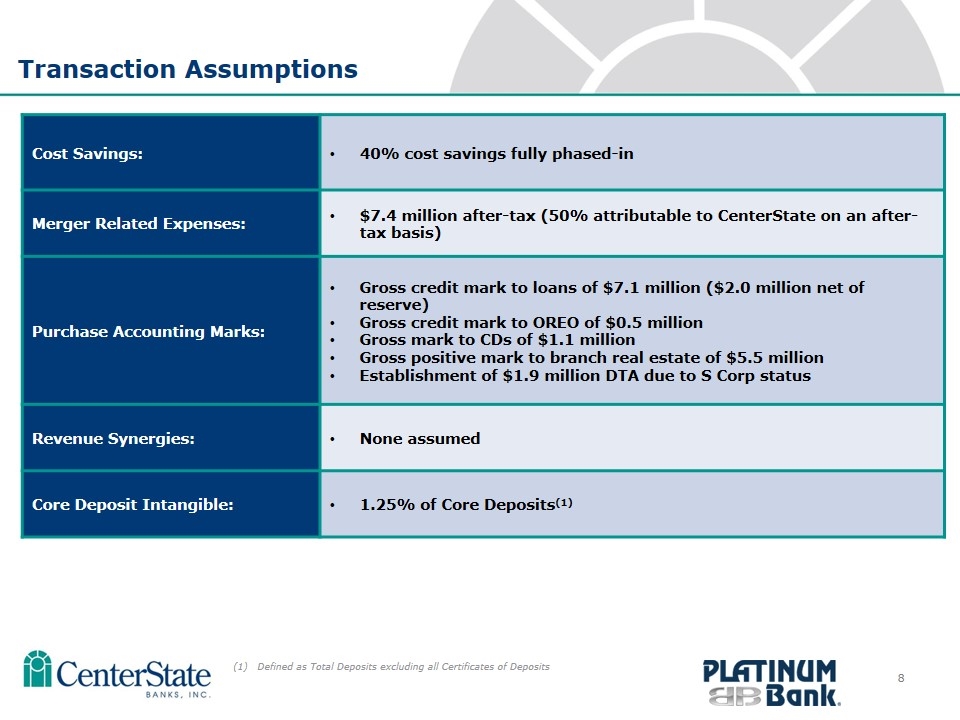

Transaction Assumptions Cost Savings: 40% cost savings fully phased-in Merger Related Expenses: $7.4 million after-tax (50% attributable to CenterState on an after-tax basis) Purchase Accounting Marks: Gross credit mark to loans of $7.1 million ($2.0 million net of reserve) Gross credit mark to OREO of $0.5 million Gross mark to CDs of $1.1 million Gross positive mark to branch real estate of $5.5 million Establishment of $1.9 million DTA due to S Corp status Revenue Synergies: None assumed Core Deposit Intangible: 1.25% of Core Deposits(1) Defined as Total Deposits excluding all Certificates of Deposits

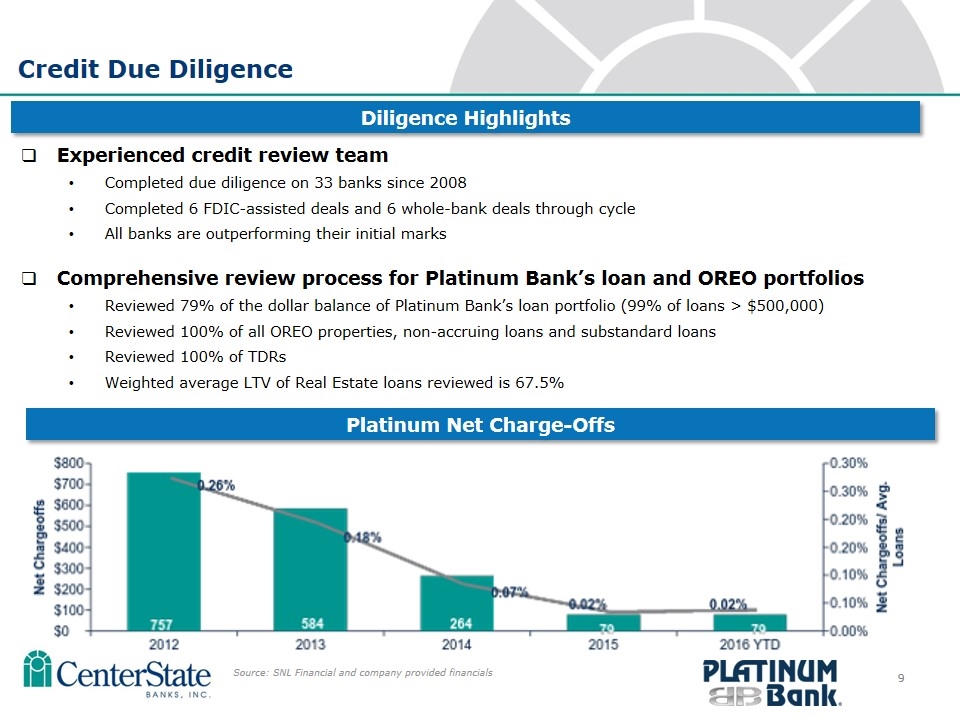

Credit Due Diligence Experienced credit review team Completed due diligence on 33 banks since 2008 Completed 6 FDIC-assisted deals and 6 whole-bank deals through cycle All banks are outperforming their initial marks Comprehensive review process for Platinum Bank’s loan and OREO portfolios Reviewed 79% of the dollar balance of Platinum Bank’s loan portfolio (99% of loans > $500,000) Reviewed 100% of all OREO properties, non-accruing loans and substandard loans Reviewed 100% of TDRs Weighted average LTV of Real Estate loans reviewed is 67.5% Diligence Highlights Platinum Net Charge-Offs Source: SNL Financial and company provided financials

Transaction Summary Complements our existing franchise Significant overlap in existing markets (5 out of 7 Platinum branches within 1.25-mile overlap) Enhances footprint in West Central Florida while allowing for further penetration into the Tampa-St. Petersburg MSA #1 community bank by deposit market share in Lakeland-Winter Haven MSA(1) #3 community bank by deposit market share in Tampa-St. Petersburg MSA(2) Financially beneficial to our shareholders with minimal risk Mid single-digit accretion with fully phased in cost savings and minimal tangible book value earnback period Internal rate of return in excess of 20%, a robust return on invested capital Accretive to profitability metrics Low risk, mature franchise with history of strong performance and long term relationships Includes all institutions with total assets less than $20.0 billion Includes all Florida headquartered institutions with total assets less than $20.0 billion; deposit market share data as of 6/30/16

Appendix

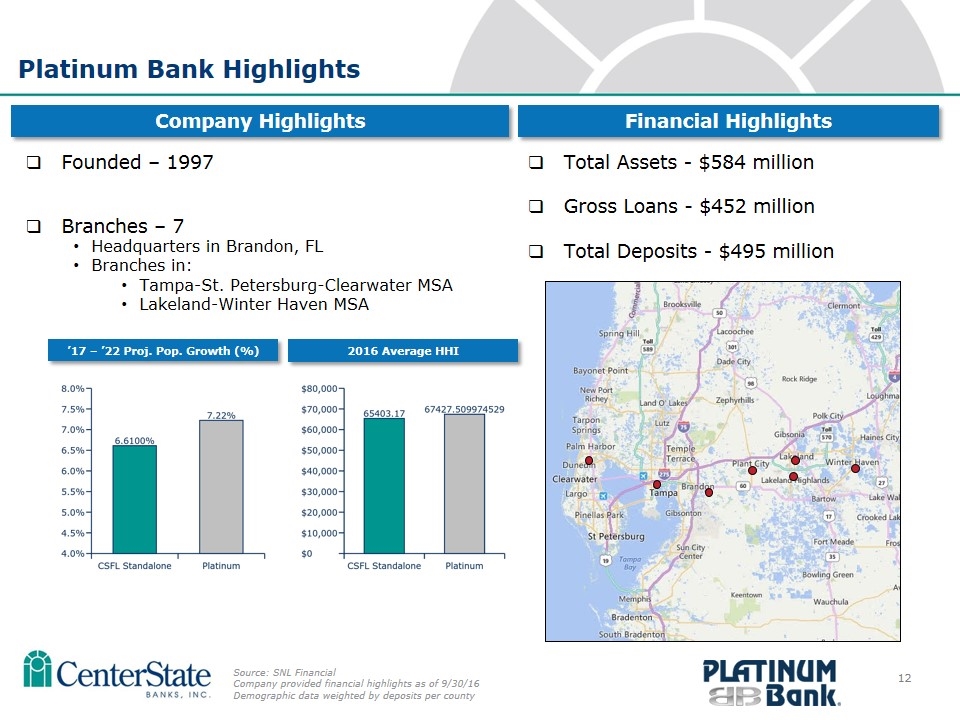

Platinum Bank Highlights Founded – 1997 Branches – 7 Headquarters in Brandon, FL Branches in: Tampa-St. Petersburg-Clearwater MSA Lakeland-Winter Haven MSA Company Highlights Total Assets - $584 million Gross Loans - $452 million Total Deposits - $495 million Financial Highlights Source: SNL Financial Company provided financial highlights as of 9/30/16 Demographic data weighted by deposits per county ’17 – ’22 Proj. Pop. Growth (%) 2016 Average HHI

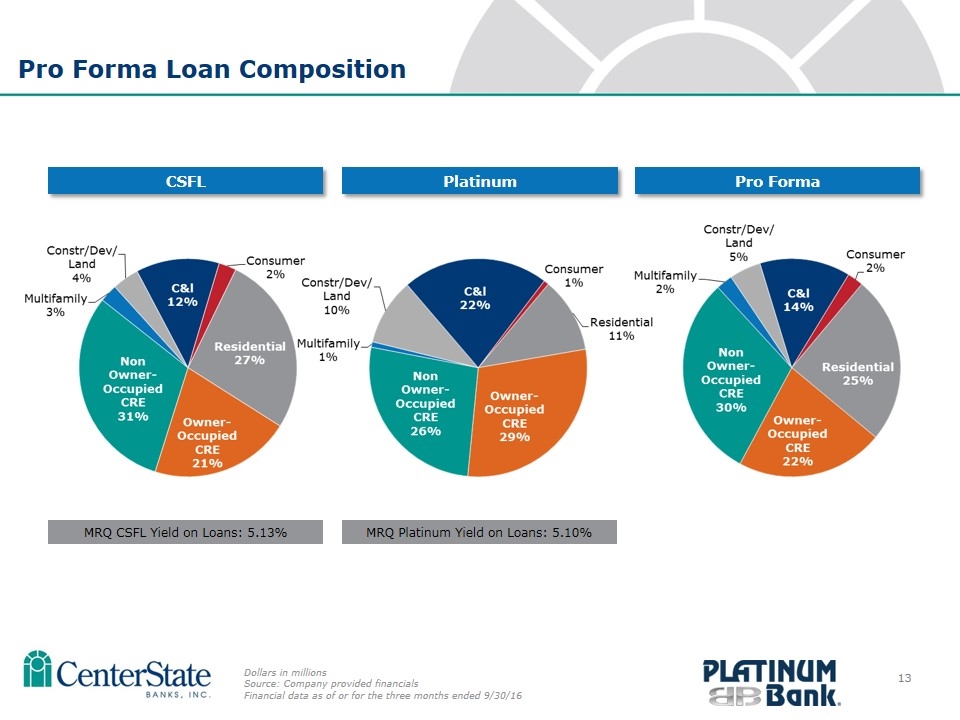

Pro Forma Loan Composition CSFL MRQ CSFL Yield on Loans: 5.13% Platinum MRQ Platinum Yield on Loans: 5.10% Pro Forma Dollars in millions Source: Company provided financials Financial data as of or for the three months ended 9/30/16

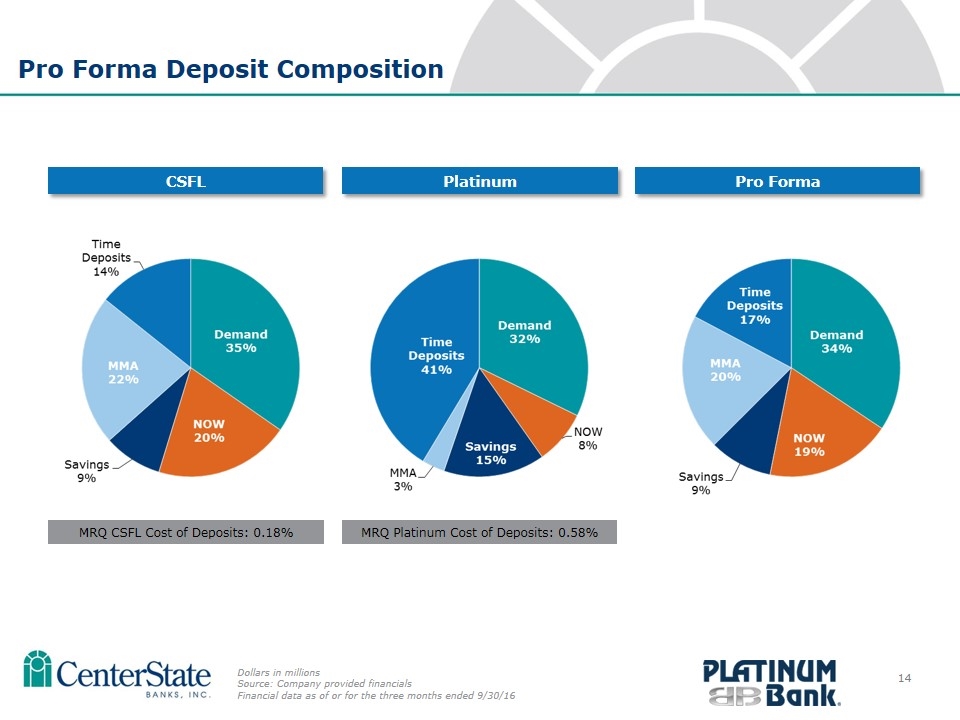

Pro Forma Deposit Composition MRQ CSFL Cost of Deposits: 0.18% MRQ Platinum Cost of Deposits: 0.58% CSFL Platinum Pro Forma Dollars in millions Source: Company provided financials Financial data as of or for the three months ended 9/30/16

Extraordinary Florida Markets The Tampa-St. Petersburg MSA is the 4th largest MSA by population size in the Southeastern United States Tampa is home to MacDill Air Force Base, the only military installation that hosts two, four-star Combatant Commands, the U.S. Central Command and U.S. Special Operations Command Port Tampa is the largest of Florida’s 14 ports by tonnage and land, and is in the top 25 busiest ports in the United States by tonnage Hillsborough, Pinellas, and Polk county all rank in the top 10 most populous counties in Florida Tampa International Airport is one of the largest airports in the United States. In 2015, over 9 million travelers passed through Tampa International The Tampa-St. Petersburg MSA has an unemployment rate that is lower than both the Florida and national rate High Quality Employment Base Sample of Top Employers in Platinum Bank Markets:

Investor Contacts Ernie Pinner Executive Chairman esp@centerstatebank.com John Corbett President & CEO jcorbett@centerstatebank.com Jennifer Idell Chief Financial Officer jidell@centerstatebank.com Steve Young Chief Operating Officer syoung@centerstatebank.com Phone Number 863-293-4710