Attached files

| file | filename |

|---|---|

| 8-K - 8-K FOR PERIOD ENDED OCTOBER 3, 2016 - WINNEBAGO INDUSTRIES INC | wgo8koct2016release.htm |

| EX-99.3 - EXH 99.3 FACT SHEET - WINNEBAGO INDUSTRIES INC | exh993factsheet.htm |

| EX-99.1 - EXH 99.1 PRESS RELEASE - WINNEBAGO INDUSTRIES INC | exh991oct2016release.htm |

0

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

A c q u i s i t i o n o f G r a n d D e s i g n

R e c r e a t i o n a l V e h i c l e s

O c t o b e r 3 , 2 0 1 6

1

1

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Forward Looking Statements

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Investors are cautioned that forward-looking statements are inherently uncertain. A number of factors could

cause actual results to differ materially from these statements, including, but not limited to increases in interest rates,

availability of credit, low consumer confidence, availability of labor, significant increase in repurchase obligations,

inadequate liquidity or capital resources, availability and price of fuel, a slowdown in the economy, increased material and

component costs, availability of chassis and other key component parts, sales order cancellations, slower than anticipated

sales of new or existing products, new product introductions by competitors, the effect of global tensions, integration of

operations relating to mergers and acquisitions activities, any unexpected expenses related to ERP, risks relating to the

consummation of our acquisition of Grand Design including, the possibility that the closing conditions to the contemplated

transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a

necessary regulatory approval; delay in closing the transaction or the possibility of non-consummation of the transaction;

the potential for regulatory authorities to require divestitures in connection with the proposed transaction, the failure to

consummate the debt transactions contemplated by the transaction with Grand Design, the possibility that we might have

to pay a $35 million termination fee to Grand Design or additional damages for failing to close the transaction; the

occurrence of any event that could give rise to termination of the agreement; the risk that shareholder litigation in

connection with the contemplated transaction may affect the timing or occurrence of the contemplated transaction or result

in significant costs of defense, indemnification and liability; risks inherent in the achievement of cost synergies and the

timing thereof; risks related to the disruption of the transaction to Winnebago and Grand Design and its management; the

effect of announcement of the transaction on Grand Design’s ability to retain and hire key personnel and maintain

relationships with customers, suppliers and other third parties, risks related to integration of the two companies and other

factors. Additional information concerning certain risks and uncertainties that could cause actual results to differ materially

from that projected or suggested is contained in the Company's filings with the Securities and Exchange Commission

(SEC) over the last 12 months, copies of which are available from the SEC or from the Company upon request. The

Company disclaims any obligation or undertaking to disseminate any updates or revisions to any forward looking

statements contained in this presentation or to reflect any changes in the Company's expectations after the date of this

presentation or any change in events, conditions or circumstances on which any statement is based, except as required by

law.

3

2

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Accelerates Winnebago’s expansion in the attractive towables segment

Provides greater scale and a more balanced portfolio across motorized and

towable RVs

Combines the industry’s fastest growing brand with the most well-known brand,

strengthening Winnebago’s position across the RV industry

Broadens and enhances dealer network, with limited current overlap

Expands Winnebago’s expertise and depth of talent through addition of Grand

Design’s world-class leadership team

Common focus on quality, value and service creates ideal cultural fit

Immediately accretive to growth, margins and EPS(1)

Compelling Strategic Acquisition

Driving Growth and Long-Term Value for Shareholders

(1) Accretion includes non-cash amortization of acquired intangible assets, but excludes

transaction costs and identified synergies

3

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Grand Design Overview

Grand Design is a rapidly growing manufacturer of premium towable fifth-wheel and travel trailers

Strategic

Focus

Long-term value

Customer focus

Owner involvement

Experienced workforce

Superior service

Class-leading warranty

Experienced

Leadership

(Co-Founders Have

80 Years of

Combined Industry

Expertise)

Don Clark: CEO & Co-

Founder

Ron and Bill Fenech: Co-

Founders

Cam Boyer: CFO

Gerald McCarthy: VP,

Service Operations

Nate Goldenberg: GM,

Momentum and Solitude

Micah Staley: GM,

Reflection and Imagine

Source: Company data and RVIA.

* 2016 financial data as of LTM from August of 2016

Net Sales $428M

2016 Financial Overview*

EBITDA ~$60M

2.5%

7.0%

8.5%

9.1%

2013 2014 2015 2016

YTD

Towable Fifth Wheel

Market Share

EBITDA Margin 14%

$85

$238

$336

$428

2013 2014 2015 2016*

Revenue

(in millions)

TOP TIER

4

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Attractive, Premium Towable Product Portfolio

10

Product

Category

Fifth Wheel Toy Hauler

Luxury Extended Stay

Fifth Wheel

Mid-Profile Fifth Wheel Upscale Travel Trailer Lightweight Travel Trailer

Brands

Models

Year of

introduction

2013 2013 2013 2014 2015

Luxury

Interior

Superior

Consumer

Value

Extraordinary living and

extreme play

A Brand new Era in

Extended Stay

A celebration of Luxury,

value and Towability

Towing light without

compromise

Significantly Increases Winnebago’s Portfolio of Towable RVs

5

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

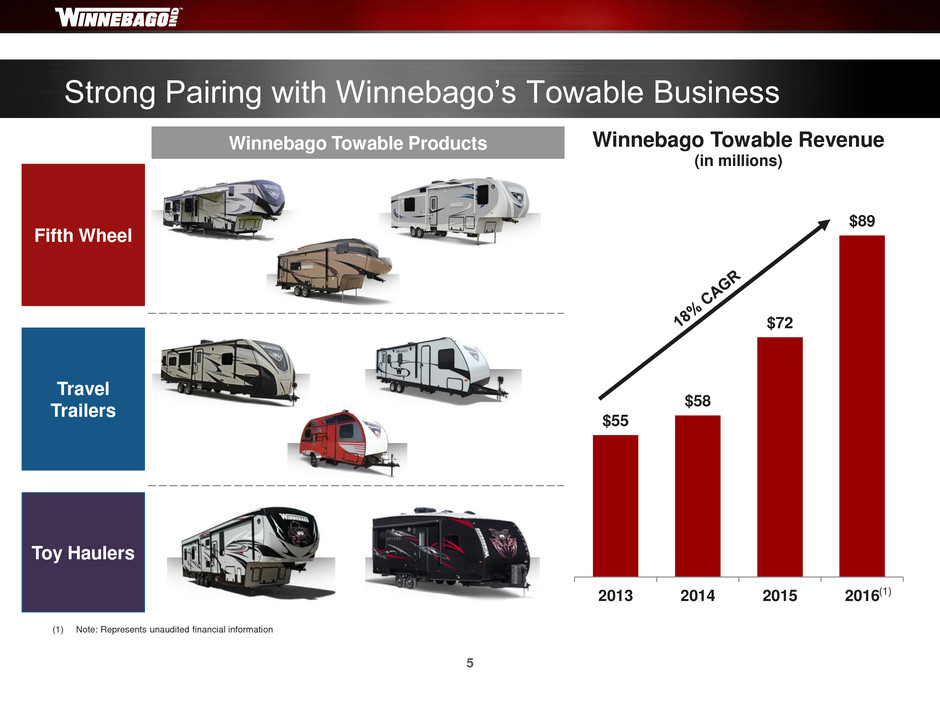

Strong Pairing with Winnebago’s Towable Business

$55

$58

$72

$89

2013 2014 2015 2016

Winnebago Towable Revenue

(in millions)

Fifth Wheel

Travel

Trailers

Toy Haulers

(1) Note: Represents unaudited financial information

(1)

Winnebago Towable Products

6

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Grand Design’s Business Model

9

Product

Strategy

Dealer

Strategy

Quality and

Service

Strategy

One brand per market segment and no “cloning” of models

Cross-functional R&D led by GMs and Product Managers–constant market

feedback loop

One dealer per market representing all products

Strict adherence to MSRP advertising

Does not partner with internet-based dealers

Equalized pricing for all dealers

Rigorous ~200 point pre-delivery inspection (“PDI”) process

Organization-wide focus on quality and customer service

Dedicated training and support provided to territory dealers

Central administration of all supplier warranties with immediately available service

professionals

Winnebago’s Primary Focus is Retaining Grand Design’s Promise to

Prioritize Dealer and Customer Satisfaction

7

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Towable RV Market is Large and Growing

217

228

258

283

313

327

2010 2011 2012 2013 2014 2015

Towable Unit Shipments to

Retailers

(in thousands)

Source: RVIA 2015 Industry Profile

$7.4

$4.8

RV Industry

(in billions)

Towables Motorized

8

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Balanced Portfolio Across Motorized and Towable RVs

9

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Snapshot of Combined Company

Greater

Scale

(Revenue $mm)

Balanced

Revenue

Base

Enhanced

Margins

(EBITDA Margin)

$975

$1,403 $428

7.4%

14.0%

9.4%

91%

9%

100%

63%

37%

Motorized

Towables

Source: Company data and filings. Note: Winnebago and Grand Design LTM 08/16. EBITDA margin excludes the impact of synergies.

10

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Transaction Overview

Consideration

Total consideration of $500 million, including tax assets valued at over $75 million

$395 million cash

$105 million in new Winnebago shares issued to the sellers (4.6 million shares)

Implied multiple of 7.1x LTM EBITDA after adjusting for value of tax assets

Grand Design shareholders will own approximately 14.5% of Winnebago shares outstanding

Financial Impact

Broader revenue opportunities, increased scale mitigates risk across the economic cycle

Immediately accretive to Winnebago’s growth, margins and EPS(1)

Anticipated annual run-rate cost synergies of $7 million, phased in over three years

Identified opportunities in purchasing and elimination of redundant processes

Additional upside potential from sharing of manufacturing best practices

Enhanced cash flow generation

Leverage

Profile

Expected debt to EBITDA ratio of approximately 2.5x following transaction(2)

Prioritize delevering the business immediately following the acquisition

Expected to de-lever to under 1.5x Debt/EBITDA by the end of Fiscal 2018

Closing

Expected to close by the end of Winnebago’s first quarter of 2017, subject to regulatory approvals

and other customary closing conditions

Organizational

Structure

Grand Design will operate as a standalone unit within Winnebago

Grand Design management team will remain in place and continue to operate out of Middlebury, IN

Grand Design CEO, Don Clark will report directly to Winnebago CEO Mike Happe

(1) Accretion includes non-cash amortization of acquired intangible assets, but excludes transaction costs and identified synergies

(2) Represents unaudited financial estimate; EBITDA inclusive of $7mm of annual run rate synergies

11

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Pro Forma Balance Sheet Financing

$500 million in total consideration

Includes tax assets valued at over $75 million

Financing structure

– Equity to sellers $105 million

– Draw on new ABL facility $53 million

– Term loan $300 million

– Cash on hand $60 million(1)

J.P. Morgan has provided committed

financing

Pro forma debt-to-EBITDA ratio of

2.5x(2)

Equity issued to sellers preserves balance sheet

flexibility

Over $75 million in liquidity at close

$26 million of remaining cash on hand

Over $50 million undrawn capacity on new ABL

facility

Strong combined cash flow supports

rapid delevering

1.5x debt-to-EBITDA target by the end of fiscal

2018

Financing and Liquidity

(1) Includes $18 million in expenses related to the transaction

(2) Note: Represents unaudited financial estimate; EBITDA inclusive of $7mm of annual run rate synergies

12

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

Advancing Our Strategic Priorities

Create Connected Customer Advocacy

Elevate Excellence in Operations

Expand to New Markets

Streamline and Strengthen the Core

Revitalize and Leverage Iconic Brands

Build a Performance Culture

13

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

59

14

Color palette

Object titles

86, 86, 86

155, 17, 17

22, 87, 136

64, 49, 82

79, 98, 40

152, 72, 7

149, 149, 149

220, 220, 220

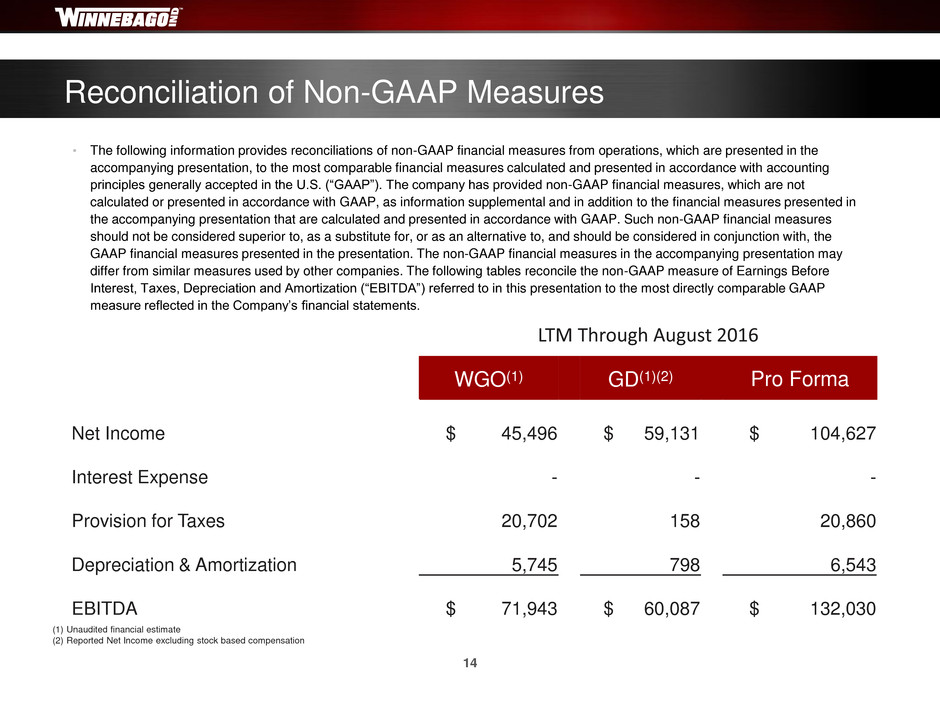

• The following information provides reconciliations of non-GAAP financial measures from operations, which are presented in the

accompanying presentation, to the most comparable financial measures calculated and presented in accordance with accounting

principles generally accepted in the U.S. (“GAAP”). The company has provided non-GAAP financial measures, which are not

calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in

the accompanying presentation that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures

should not be considered superior to, as a substitute for, or as an alternative to, and should be considered in conjunction with, the

GAAP financial measures presented in the presentation. The non-GAAP financial measures in the accompanying presentation may

differ from similar measures used by other companies. The following tables reconcile the non-GAAP measure of Earnings Before

Interest, Taxes, Depreciation and Amortization (“EBITDA”) referred to in this presentation to the most directly comparable GAAP

measure reflected in the Company’s financial statements.

Reconciliation of Non-GAAP Measures

(1) Unaudited financial estimate

(2) Reported Net Income excluding stock based compensation

LTM Through August 2016

WGO(1) GD(1)(2) Pro Forma

Net Income $ 45,496 $ 59,131 $ 104,627

Interest Expense - - -

Provision for Taxes 20,702 158 20,860

Depreciation & Amortization 5,745 798 6,543

EBITDA $ 71,943 $ 60,087 $ 132,030