Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Versum Materials, Inc. | d252377dex992.htm |

| 8-K - FORM 8-K - Versum Materials, Inc. | d252377d8k.htm |

Table of Contents

Exhibit 99.1

| Air Products and Chemicals, Inc. 7201 Hamilton Boulevard, Allentown, PA 18195-1501 T 610-481-4911 F 610-481-5900 www.airproducts.com |

|

Dear Air Products Shareholders:

The Air Products team has consistently executed our strategic Five-Point Plan toward our goal: being the safest and most profitable industrial gas company in the world, providing excellent service to customers.

As part of that strategic Plan, the Board of Directors approved the intention to separate and spin-off the Electronic Materials Division of Air Products as Versum Materials, Inc. (“Versum”). This separation provides current shareholders ownership in two leading and focused companies, each positioned to capitalize on distinct opportunities for growth and profitability.

I am pleased to report that on September 9, 2016, the Board approved the completion of the spin-off of Versum. Versum will be a separate public company beginning October 1, 2016, moving toward its goal of being the partner of choice for the semiconductor industry, providing innovative products and expertise for next generation chips used in consumer products. Versum common stock is expected to begin trading on the New York Stock Exchange (NYSE) on October 3, 2016 under the ticker symbol “VSM.”

Meanwhile, the dedicated team at Air Products is forging ahead, continuing to prove that they have the determination and the capability to deliver outstanding results and move our company forward to be the best in the industry. We see great opportunities ahead to win key projects and invest in our core industrial gases business so that we grow Air Products in the years to come.

You do not need to take any action to receive the applicable number of shares of Versum common stock (and, if applicable, cash in lieu of any fractional shares). Immediately following the spin-off you will own shares of Air Products and Versum Materials.

I invite you to read the enclosed information statement, which describes the spin-off in detail and provides other important business and financial information.

Thank you for your continued support of Air Products and your future support of Versum Materials.

Very truly yours,

Seifi Ghasemi

Chairman, President and Chief Executive Officer of Air Products

and Chairman of Versum Materials

Table of Contents

| Versum Materials 8555 South River Parkway Tempe, AZ 85284 T: 602-282-1000 |

|

Dear Future Versum Materials, Inc. Shareholder,

On behalf of Versum Materials, Inc., it is our pleasure to welcome you as a shareholder.

As an independent company, Versum’s goal is to be the supplier of choice for specialty materials and equipment to the semiconductor industry and drive performance to create shareholder value. Our company will focus on innovation to complement our diversified portfolio of critical, technology-driven and high-purity products and solutions. This focus will help enable the semiconductor industry to make the next generation chips fueling mobility, connectivity and big data required for the Internet of Things.

Over the past few years, we have strengthened our innovation pipeline, restructured our operations and realigned our businesses to be closer to our customers. All of these initiatives have improved our performance and enabled us to better collaborate with and serve our customers. We believe that Versum Materials is well positioned to further innovate, drive growth and deliver shareholder value.

Beginning on October 3, 2016, shares of Versum Materials stock will trade on the NYSE under the symbol “VSM.” Our team is excited about our future as an independent company. I encourage you to learn more about us and our strategy by reading the attached information statement.

Thank you for your support. We look forward to having you as a fellow shareholder.

Sincerely,

Guillermo Novo

President and Chief Executive Officer

Versum Materials, Inc.

Table of Contents

Exhibit 99.1

INFORMATION STATEMENT

Versum Materials, Inc.

Common Stock, Par Value $1.00 Per Share

This information statement is being furnished to the holders of common stock of Air Products and Chemicals, Inc. (“Air Products”) in connection with the distribution by Air Products to its stockholders of all of the outstanding shares of common stock of Versum Materials, Inc. (“Versum” or “We”). Versum is a wholly owned subsidiary of Air Products that was formed to hold and operate Air Products’ Electronic Materials business, a global business that provides innovative solutions for specific customer applications based upon expertise in specialty materials. The Electronic Materials business employs applications technology to provide solutions to the semiconductor industry through chemical synthesis, analytical technology, process engineering, and surface science. To implement the distribution, Air Products will distribute the shares of Versum common stock on a pro rata basis to Air Products’ stockholders in a manner that is intended to be tax-free for United States federal income tax purposes, except for any cash received in lieu of fractional shares. The distribution is subject to certain conditions, as described in this information statement. You should consult your own tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local and non-U.S. tax laws.

For every common share of Air Products held of record by you as of the close of business on September 21, 2016, the record date for the distribution, you will receive one-half of a share of Versum common stock. You will receive cash in lieu of any fractional shares of Versum common stock that you would have received after application of the above ratio. As discussed under “The Separation and Distribution—Trading Between the Record Date and the Distribution Date,” if you sell your Air Products common stock in the “regular-way” market after the record date and before the separation, you also will be selling your right to receive shares of Versum common stock in connection with the separation. We expect the shares of Versum common stock to be distributed by Air Products to you on October 1, 2016. We refer to the date of the distribution of Versum common stock as the “distribution date.” Immediately after the distribution becomes effective, Versum will be an independent, publicly traded company.

No vote of Air Products’ stockholders is required to effect the distribution. Therefore, you are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing common shares of Air Products or take any other action to receive your shares of Versum common stock.

Versum was organized as a Delaware limited liability company on November 17, 2015. Versum was converted from a limited liability company to a Delaware corporation on September 8, 2016. Air Products currently owns all of the outstanding equity of Versum. Accordingly, there is no current trading market for Versum common stock, although we expect that a limited market, commonly known as a “when-issued” trading market, will develop on or shortly before the record date for the distribution. We expect “regular-way” trading of Versum common stock to begin on the first trading day following the distribution date. Versum intends to apply to have its common stock authorized for listing on the New York Stock Exchange, Inc. under the symbol “VSM”.

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 20.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

References in this information statement to specific codes, legislation or other statutory enactments are to be deemed as references to those codes, legislation or other statutory enactments, as amended from time to time.

The date of this information statement is September 14, 2016.

This information statement was first made available to Air Products stockholders on or about September 16, 2016.

Table of Contents

| Page |

||||

| 1 | ||||

| 12 | ||||

| 20 | ||||

| 39 | ||||

| 40 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 56 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

58 | |||

| 85 | ||||

| 100 | ||||

| 107 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

152 | |||

| 154 | ||||

| 159 | ||||

| 162 | ||||

| 165 | ||||

| 170 | ||||

| F-1 | ||||

Table of Contents

The following is a summary of material information discussed in this information statement. This summary may not contain all the details concerning the separation or other information that may be important to you. To better understand the separation and distribution and Versum’s business and financial position, you should carefully review this entire information statement.

In this information statement, unless the context otherwise requires:

| • | “Versum,” “we,” “our,” “us” and “the company” refer to Versum Materials, Inc. and its consolidated subsidiaries, after giving effect to the separation and distribution; |

| • | “Air Products” refers to Air Products and Chemicals, Inc. and its consolidated subsidiaries, other than, for all periods following the separation and distribution, Versum. |

| • | References to the “separation” refer to the internal reorganization described under “The Separation and Distribution” that includes the series of internal transactions resulting in the allocation, transfer and assignment to Versum of the assets, liabilities and operations of Air Products’ Electronic Materials business and the creation, as a result of the distribution, of a separate, publicly traded company, Versum Materials, Inc., which holds the Electronic Materials business. |

| • | References in this information statement to the “distribution” refer to the distribution by Air Products to its stockholders as of the record date of 100% of the outstanding shares of Versum, as further described herein. |

Versum was organized as a Delaware limited liability company on November 17, 2015. Versum was converted from a limited liability company to a Delaware corporation on September 8, 2016.

This information statement describes the businesses to be transferred to Versum by Air Products in the separation as if the transferred businesses were our businesses for all historical periods described. References in this information statement to historical assets, liabilities, products, businesses or activities of our business are generally intended to refer to the historical assets, liabilities, products, businesses or activities of the transferred business as conducted as part of Air Products and its subsidiaries prior to the separation.

You should not assume that the information contained in this information statement is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations.

Air Products

Air Products is a Delaware corporation originally founded in 1940, which serves energy, electronics, chemicals, metals, and manufacturing customers globally with a unique portfolio of products, services, and solutions that include atmospheric gases, process and specialty gases, electronic and performance materials, equipment and services. Air Products is the world’s largest supplier of hydrogen and has built leading positions in growth markets such as helium, refinery hydrogen, semiconductor materials, natural gas liquefaction, and advanced coatings and adhesives. As of September 30, 2015, Air Products had approximately 19,700 employees and operations in more than 50 countries worldwide.

Our Company

Versum is a global business that provides innovative solutions for specific customer applications based on our expertise in materials for semiconductors. The business employs applications technology to provide solutions to the

1

Table of Contents

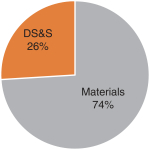

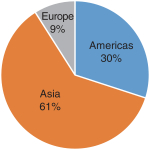

semiconductor industry through chemical synthesis, analytical technology, process engineering, and surface science. Versum consists of two primary operating segments, Materials and Delivery Systems and Services (“DS&S”), under which we will manage our operations and assess performance, and a Corporate segment. Fundamental to both primary operating segments are strong customer relationships and collaborative development, technology leadership, unique product positioning and a strong global infrastructure with flexible manufacturing capabilities in the U.S. and Asia.

We are a leading global producer of critical materials, including high purity process materials, cleaners and etchants, slurries, organosilanes and organometallics, and equipment which we sell to the semiconductor and display industries. Through our global network, we position our research, manufacturing and technical support close to our customer facilities, enabling supply chain optimization and rapid response to product and service needs. Many of our products have undergone rigorous product performance and quality reviews by our customers to be qualified for use in their products or manufacturing processes. Once these qualification processes are completed and our products are designated by our customers for use in their processes or products, it is often time consuming and costly for our customers to change suppliers. Our products perform critical tasks in customers’ products or manufacturing processes, yet typically represent a very small portion of the cost of the end product. Over the last 20 plus years, we have developed strong customer relationships with the majority of the industry-leading Integrated Device Manufacturers (“IDM’s”), Foundries and Original Equipment Manufacturers (“OEM’s”) through joint product development and providing on-site service and technical personnel at these customers’ facilities.

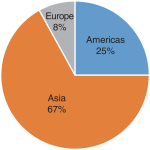

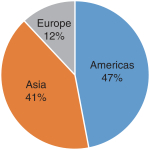

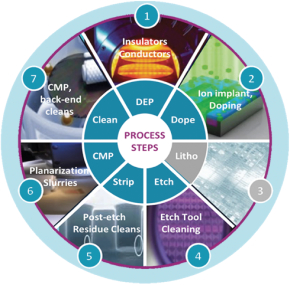

Our business primarily serves the semiconductor industry, deriving over 80% of its sales in recent years from that industry in both the memory and logic segments. The semiconductor industry is characterized by large scale global players and, while we serve a variety of customers from smaller technology firms to OEM’s to multinational semiconductor companies, the majority of our sales are concentrated to large global players. The semiconductor industry is global in scope with nearly all major semiconductor manufacturers having operations in multiple countries. The semiconductor materials industry is estimated at $45 billion in annual sales and is part of a maturing $450 billion value chain with more stable growth behavior. We participate in the specialty gases materials and equipment space which has estimated annual sales of $5.5 billion, targeting six of the seven critical process steps in semiconductor manufacturing.

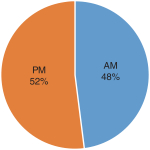

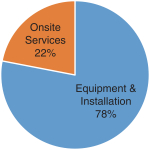

We operate our business in two primary operating segments, Materials and DS&S. In our Materials segment we provide leading edge specialty materials for the high-growth electronics industry, focusing on the semiconductor and flat-panel display markets. Our products include specialty chemicals and materials utilized in the latest generation of semiconductors as well as high-purity specialty gases used in the semiconductor manufacturing process. In our DS&S segment, we design, manufacture, install, operate, and maintain state-of-the-art chemical and gas delivery and distribution systems enabling the safe and cost efficient use of specialty gases and chemicals delivered directly to our customers’ manufacturing tools and provide other on-site services. In addition to our two primary operating segments, our Corporate segment includes certain administrative costs associated with operating a public company, foreign exchange gains and losses, and other income and expense that cannot be directly associated with operating segments. Assets in the Corporate segment include cash and deferred tax assets.

Competitive Strengths

Innovative Product Development. Versum has established leadership positions in niche markets with performance-critical products tailored to meet specific customer needs based upon its research and development capabilities. Our products deliver differentiated performance to our customers’ products, enhancing their productivity, quality, and characteristics; yet they constitute a small portion of end-product cost. Our research and development efforts enable us to formulate specific solutions for our customers’ needs in focused applications.

Longstanding Relationships with Key Industry Leaders. As a trusted supplier to our customers, Versum works closely with many of its customers to create specialty solutions. Versum has maintained long-term

2

Table of Contents

relationships, often spanning decades, with a base of blue chip customers by providing innovative solutions to our customers’ problems. Due to the specialized nature of our products, manufacturing complexity, qualification and purity requirements in customers’ manufacturing process, high customer qualification change costs, and extensive proprietary chemistry, we believe our supply position with our customers is strong.

Technology Leadership. We believe our extensive expertise in the field of high-value electronic materials is and will be a key competitive strength. Our customers regularly seek to introduce new generations of semiconductors and require technological improvement to complete their innovation cycle. We develop and manufacture complex formulated products and advanced deposition materials to high quality and purity standards that enable our customers to create the next generation of semiconductors. We believe our ability to develop new products to meet these needs positions us for further differentiation and growth.

Positioned To Take Advantage of Secular Growth Trends. Our business has strong opportunities for growth into the future due to macro trends related to mobility, connectivity and big data. We believe growth will be further enhanced by the following secular trends:

| • | Continued proliferation of the use of semiconductors in equipment and consumer goods |

These macro trends of mobility, connectivity and big data have moved the semiconductor industry from a computer dominated space to a market much more correlated with demand for consumer products such as tablets, cell phones, automobiles, appliances and other electronics. This change has resulted in increased semiconductor demand, less variability in the level of semiconductor wafer production and a tighter correlation between the volume of silicon wafers produced and global gross domestic product. We believe our business will benefit from the increasing use of semiconductors, which significantly drives demand for our products.

| • | Increased importance of materials in driving future operating improvements in semiconductor design |

The semiconductor industry requires development of new materials to meet the increased demand for device density and performance and more capable and energy efficient chips. We believe we are well-positioned to capitalize on these innovation based opportunities, given our proprietary technologies, research and development capabilities and strong relationships with leading innovators in both logic and memory market space.

| • | Continued expansion of emerging market economies |

As growth continues in emerging markets, it drives expansion in both the industrial and consumer sectors of these economies, resulting in increased consumption of goods that contain semiconductors, such as tablets, cell phones, automobiles, appliances and other electronics.

Strategically Located Global Manufacturing Footprint and Infrastructure. Versum has a global, well- established infrastructure with fourteen strategically located manufacturing and six research and development facilities in the United States and Asia. We maintain production facilities in the United States and Asia, and strong technical sales capabilities near our customers. This critical mass in the markets we serve, combined with our global supply chain efficiency, enables us to provide key solutions in a timely manner to support our customers’ needs.

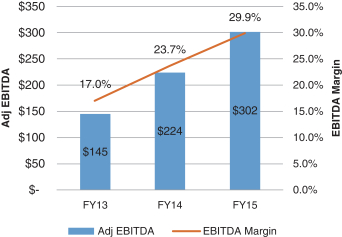

Strong Financial Performance and Cash Flow Generation. Versum has a strong financial profile with an operating margin of 22.0% and Adjusted EBITDA margin of 29.9% for the fiscal year ended September 30, 2015. We expect to incur indebtedness of $1.0 billion in connection with the spin-off. These strong margins will enable the business to service its debt obligations and generate significant cash flow. For an explanation of Adjusted EBITDA and EBITDA margin and reconciliation to accounting principles generally accepted in the United States of America (“GAAP”), see “Management’s Discussion and Analysis of Financial Condition and

3

Table of Contents

Results of Operations—Reconciliation of Non-GAAP Financial Measures—Adjusted EBITDA and EBITDA Margin.” Net income attributable to Versum for the period was $184 million in 2015. The combination of strong operating margins and low capital intensity results in substantial cash flow generation.

Experienced Management Team. We have a strong management team which combines individuals with long standing industry experience and leadership in both the materials industry and the semiconductor industry with key outside hires who bring a diverse perspective to the business from various other companies. Guillermo Novo, our Chief Executive Officer, has 30 years of materials industry operating and executive experience at Air Products, Rohm and Haas Company and Dow Chemical Company, and is supported by a leadership team that has extensive industry and international experience and a proven operating and safety track record.

Business Strategies

Drive Operational Excellence and Asset Efficiency. Driving operational excellence, including a commitment to safety, environmental stewardship and supply chain reliability, is critical to the success of our business. Over the last three years, Versum has significantly improved operational performance. We have refocused our business, invested in research and development capabilities, exited unprofitable product lines, increased productivity and improved our cost structure. We intend to continue to implement various initiatives to improve the efficiency, effectiveness and reliability of our operations.

Maintain Strong Customer Focus. A key element of our success has been our ability to establish long standing working relationships with many of our customers. Our understanding of our customers’ needs and our ability to develop innovative product solutions in a timely manner, together with our supply reliability, high quality products and analytical capabilities, have been critical in developing these long-term relationships. We will continue to leverage our technical sales teams and research and development capabilities to facilitate this ongoing collaboration with customers and foster new product development and product scale up.

Leverage our Leadership to Drive Growth. We have invested on average approximately 4.0% of sales in research and development over each of the last three years and expect to continue a similar level of spending to deliver innovative solutions for our customers. We expect our leadership position to drive growth in the markets we compete in. We believe our focus on maintaining an in-depth knowledge of the key chemistries underlying our product portfolio, such as formulated products and advanced deposition materials, and a detailed understanding of our customers’ applications, together with continuing to invest in innovation-driven product development, will enable us to capitalize on secular growth trends. In addition, we believe there are significant opportunities for us to invest capital in strategic acquisitions to strengthen our businesses and market positions and expand our technology platform.

Focus on Cash Flow Generation. Versum has a successful track record of delivering strong financial results. Given the low capital intensity of our business, this results in significant cash flow generation. Strong future cash flow should enable us to fund organic and inorganic growth opportunities, return capital to shareholders or reduce leverage. We intend to continue to drive cash flow improvement by optimizing our cost structure through productivity actions and cost savings initiatives.

4

Table of Contents

Risks Associated with Our Business

An investment in Versum common stock is subject to a number of risks. The following list of risk factors is not exhaustive. Please read the information in “Risk Factors” for a more thorough description of these and other risks.

| • | Economic conditions or product supply versus demand imbalance in certain markets in which we do business may decrease the demand for our goods and services and adversely impact our financial condition, results of operations and cash flows. |

| • | We are exposed to risks associated with a concentrated customer base. |

| • | If we are not able to continue technological innovation and successful introduction of new products, our financial condition, results of operations and cash flows could be adversely affected. |

| • | Our available cash and access to additional capital may be limited by our substantial leverage and debt service obligations. |

| • | If our intellectual property is compromised or copied by competitors, if our competitors were to develop similar or superior intellectual property or technology, or if our intellectual property or technology violate third-party rights, our financial condition, results of operations and cash flows could be negatively affected. |

| • | We may need additional capital in the future and may not be able to obtain it on favorable terms. |

| • | The agreements governing our indebtedness may restrict our current and future operations, particularly our ability to respond to changes or to take certain actions. |

| • | Our international operations may be adversely impacted by political or economic instability, nationalization, the United Kingdom exit from the European Union, or expropriation of property, or underdeveloped property rights and legal systems. |

| • | Hazards associated with chemical manufacturing could disrupt our operations or the operations of our suppliers or customers, having a negative impact on our financial condition, results of operations and cash flows. |

| • | Our financial condition, results of operations and cash flows could be adversely affected by regulation to which our raw materials, products and facilities are subject. |

| • | Interruption in ordinary sources of supply or an inability to recover increases in raw material costs from customers could adversely impact our financial condition, results of operations and cash flows. |

| • | If any of our sole source or limited source suppliers, or suppliers who were required to satisfy our customers’ rigorous qualification requirements, were unable to deliver to us in a timely manner, our financial condition, results of operations and cash flows could be adversely affected. |

| • | Costs and expenses resulting from compliance with environmental, health and safety regulations may negatively impact our financial condition, results of operations and cash flows. |

| • | We are subject to extensive government regulation in jurisdictions around the globe. Any changes in regulations addressing, among other things, environmental compliance, import/export restrictions, product use restrictions, and taxes, may negatively impact our financial condition, results of operations and cash flows. |

| • | The security of our information technology systems could be compromised, which could adversely affect our financial condition, results of operations and cash flows. |

| • | Our reported results could be adversely affected by currency exchange rates and currency devaluation could impair our competitiveness. |

5

Table of Contents

| • | The end markets in which we compete are highly competitive. Our inability to compete effectively could adversely impact our financial condition, results of operations and cash flows |

| • | Our financial condition, results of operations and cash flows may be affected by various legal and regulatory proceedings, including those involving antitrust, tax, environmental, or other matters. |

| • | We may not be able to complete acquisitions, or successfully integrate acquisitions, we may undertake in the future. |

| • | Relocation of our headquarters and other key activities could disrupt our operations. |

The Separation and Distribution

On September 16, 2015, the Air Products board of directors announced its intention to separate Air Products’ Materials Technologies business (which consisted of the Performance Materials and Electronic Materials businesses) into a newly formed company and to distribute the common stock of that company, Versum, to stockholders of Air Products on a pro-rata basis. On May 6, 2016, Air Products announced that it had reached a definitive agreement to sell a part of the Materials Technologies business, the Performance Materials business, to Evonik Industries, A.G. Air Products also announced its intention to proceed with the separation and distribution of the Electronic Materials business. The distribution is intended to be generally tax-free for U.S. federal income tax purposes, except for any cash received in lieu of fractional shares.

In furtherance of this plan, on September 9, 2016, Air Products’ board of directors approved the distribution of all of the issued and outstanding shares of Versum common stock on the basis of one-half share of Versum common stock for each share of Air Products common stock issued and outstanding on September 21, 2016, the record date for the distribution. As a result of the distribution, Versum and Air Products will become two independent, publicly traded companies.

On October 1, 2016, the distribution date, each Air Products stockholder will receive one-half of a share of Versum common stock for each share of Air Products common stock held at the close of business on the record date, as described above. You will receive cash in lieu of any fractional shares of Versum common stock that you would have received as a result of the application of the distribution ratio. You will not be required to make any payment, surrender or exchange your Air Products common stock or take any other action to receive your shares of Versum common stock in the distribution.

Air Products decided to sell the Performance Materials business because it represented the best overall value proposition for Air Products shareholders based on the attractive purchase price offered for the business. The sale of the Performance Materials business is expected to allow Air Products to realize the value of that business at a price that represents a significant premium compared to recent precedent specialty chemical transactions. The sale is expected to produce significant net proceeds for Air Products, enable Air Products to generate more cash than the spin-off of the combined businesses, and eliminate Air Products’ shareholders’ exposure to potential future market and business risk related to the Performance Materials business.

Air Products determined to continue with the spin-off of the Electronic Materials business as a standalone business in order to allow the management of both the Industrial Gases and Electronic Materials businesses to focus on their specific businesses, including by adopting capital structures and resource allocation policies that reflect the financial and strategic characteristics of the business; to eliminate competition between the businesses for capital; to permit each business to offer stock based incentive compensation more closely aligned with its performance; to facilitate Versum’s access to debt and equity financing to execute its business plans and pursue acquisitions; and to allow the investment community to better understand and evaluate the distinct characteristics of each business and the respective industries of the businesses.

6

Table of Contents

Although the spin-off of the Electronic Materials business alone will create a smaller publicly traded company compared to the spin-off of the two businesses together, there are significant benefits to spinning off Electronic Materials alone. The spin-off will create a focused, pure semiconductor materials business with a distinct business model, strategy, capital requirements and growth profile; and investors often prefer to invest in companies with a single line of business. In addition, recently the profitability and performance of the Electronic Materials business has been superior to the Performance Materials business, which should enhance the financial profile of the spun off company.

Internal Reorganization

We are currently a wholly owned subsidiary of Air Products. In connection with the separation, Air Products will transfer to us employees, operations, assets and liabilities associated with Air Products’ Electronic Materials business and certain other current and former businesses and activities of Air Products.

Prior to the distribution, Air Products will undertake a series of internal reorganization transactions to facilitate the transfers of entities and the related assets and liabilities described above from Air Products to Versum. To the extent that any transfer of entities, employees, operations or assets or assumption of liabilities contemplated in connection with the separation and distribution has not been consummated on or prior to the distribution date, the parties will cooperate with each other to effect such transfers or assumptions in the manner set forth below under “Certain Relationships and Related Person Transactions—Our Relationship with Air Products Following the Separation—The Separation Agreement.”

References in this information statement to the “contribution” refer to the transfer to Versum of the entities and related employees, operations, assets and liabilities of Air Products’ Electronic Materials business and certain other current and former businesses and activities of Air Products together with the conversion of Versum from a limited liability company to a Delaware corporation.

Conditions to the Distribution

The distribution is subject to a number of conditions, including, among others:

| • | The United States Securities and Exchange Commission (the “SEC”) having declared effective the registration statement on Form 10, of which this information statement forms a part; no stop order relating to the registration statement being in effect, nor any proceeding seeking such stop order being pending, and the information statement having been distributed to Air Products’ stockholders; |

| • | Versum’s common stock having been approved and accepted for listing by the New York Stock Exchange (the “NYSE”), subject to official notice of distribution; |

| • | Receipt by Air Products of an opinion of tax counsel confirming that the contribution and distribution generally should be tax-free to Air Products and its stockholders for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (the “Code”); |

| • | Receipt of an opinion from an independent appraisal firm by the board of directors of Air Products confirming the solvency of each of Air Products and Versum after the distribution that is in form and substance acceptable to Air Products in its sole discretion; |

| • | No order, injunction, or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, distribution or any of the related transactions being in effect; |

| • | The internal reorganization of Air Products’ and Versum’s businesses prior to the contribution and distribution having been completed to the satisfaction of the board of directors of Air Products; |

| • | The approval by the board of directors of Air Products of the distribution and all related transactions (and such approval not having been withdrawn); |

7

Table of Contents

| • | Air Products’ election of our post-distribution board of directors, as described in this information statement, immediately prior to the distribution date; |

| • | Our having entered into certain agreements in connection with the separation and distribution and certain financing arrangements prior to or concurrent with the separation; |

| • | The distribution in-kind of the unsecured senior notes to Air Products and the making of a $550 million cash distribution from Versum to Air Products prior to the distribution, and the determination by Air Products in its sole discretion that following the separation it shall have no further liability or obligation whatsoever under any financing arrangements that Versum will be entering into in connection with the separation; |

| • | Receipt by Versum of all permits, registrations and consents required under the securities or blue sky laws of states or other political subdivisions of the United States or of foreign jurisdictions in connection with the distribution; and |

| • | No events or developments shall have occurred or exist that, in the sole and absolute judgment of the board of directors of Air Products, make it inadvisable to effect the distribution or would result in the distribution and related transactions not being in the best interest of Air Products and its stockholders. |

We cannot assure you that any or all of the conditions will be satisfied or waived. Until the distribution has occurred, Air Products has the right to terminate the distribution, even if all the conditions have been satisfied, if the board of directors of Air Products determines that the distribution is not in the best interest of Air Products and its stockholders or that market conditions or other circumstances are such that the separation of Versum and Air Products is no longer advisable at that time. For more information, see “The Separation and Distribution—Conditions to the Distribution.”

Our Post-Separation Relationship with Air Products

We will enter into a Separation Agreement with Air Products (“the Separation Agreement”), which will contain the principles governing the internal reorganization discussed above and specify the terms of the distribution. In connection with the separation and distribution, we will enter into various other agreements to effect the separation and distribution and provide a framework for our relationship with Air Products after the separation and distribution. These other agreements will include a Transition Services Agreement, a Tax Matters Agreement, an Employee Matters Agreement, Intellectual Property License Agreement, and certain leases and utility, supply and toll manufacturing contracts. These agreements will provide for the allocation between us and Air Products of Air Products’ and our assets, employees, liabilities and obligations (including investments, property, employee benefits, and tax-related assets and liabilities) attributable to periods prior to, at and after our separation from Air Products, and will govern certain relationships between us and Air Products after the separation and distribution. Following the distribution, Seifollah Ghasemi, who currently serves, and following the distribution will continue to serve, as Chairman, President and Chief Executive Officer of Air Products, will also serve as a director of Versum and our non-executive Chairman of the board of directors. For more information regarding the Separation Agreement and other transaction agreements, see “Risk Factors—Risks Related to the Separation” and “Certain Relationships and Related Person Transactions—Our Relationship with Air Products Following the Separation.”

Reasons for the Separation

We currently are a wholly owned subsidiary of Air Products that was formed to hold Air Products’ Electronic Materials business. In connection with the separation, Air Products will transfer to us employees, operations, assets and liabilities associated with Air Products’ Electronic Materials business and certain other current and former businesses and activities of Air Products. The separation of Versum from Air Products and the distribution of Versum’s common stock are intended to provide equity investments in two separate companies that will be able to focus on each of their respective businesses. The Air Products board of directors

8

Table of Contents

believes that separating the Versum business from the remainder of the Air Products businesses is in the best interests of Air Products and its stockholders for a number of reasons, including that:

| • | The separation will allow management of each company to focus on the opportunities and challenges specific to that company’s business, including the adoption of capital structures and resource allocation policies that reflect the financial and strategic characteristics of each business; |

| • | The separation will permit each company to offer stock-based incentive compensation to its employees and executives that is more closely aligned with the performance of that company’s business; |

| • | The separation will facilitate obtaining debt and equity financing necessary to execute Versum’s business plans and ability to pursue tailored acquisition strategies; |

| • | The separation will facilitate acquisitions by Versum by improving the attractiveness of its capital stock as an acquisition currency; |

| • | The separation will allow the investment community to better understand and evaluate the distinct characteristics of each company’s business and the respective industries of the businesses; and |

| • | The separation will improve capital investment flexibility and free both businesses from capital competition. |

The Air Products board of directors also considered a number of potentially negative factors in evaluating the separation, including that:

| • | As a current part of Air Products, Versum takes advantage of Air Products’ size and purchasing power in procuring certain goods and services. After the separation and distribution, as a separate, independent entity, Versum may be unable to obtain these goods, services and technologies at prices or on terms as favorable as those Air Products obtained prior to the separation. |

| • | Versum also is expected to incur costs for certain functions previously performed by Air Products, including information technology, accounting, tax, finance, legal, insurance, human resources, compliance and other administrative activities, that may be higher than the amounts reflected in Versum’s combined financial statements, which may impact our financial performance, results of operations and cash flow; |

| • | The actions required to separate Versum’s and Air Products’ respective businesses could disrupt our operations; |

| • | Certain costs and liabilities that were less significant to Air Products as a whole will be more significant for Versum as a standalone company; |

| • | We will incur costs in the transition to being a standalone public company, which include accounting, tax, legal and other professional services costs, recruiting and relocation costs associated with hiring or reassigning our personnel, costs related to establishing a new brand identity in the marketplace and costs to separate from Air Products’ information systems; |

| • | We may not achieve the anticipated benefits of the separation for a variety of reasons, including, among others: (i) the separation will require significant amounts of management’s time and effort, which may divert management’s attention from operating and growing our business; (ii) following the separation, we may be more susceptible to market fluctuations and other adverse events than if we were still part of Air Products; and (iii) following the separation, our business will be significantly less diversified than Air Products’ business prior to the separation; and |

| • | To preserve the tax-free treatment of the contribution, the distribution and certain related transactions to Air Products for U.S. federal income tax purposes, under the Tax Matters Agreement that we will enter into with Air Products, we will be restricted from taking actions that may cause the contribution, |

9

Table of Contents

| the distribution and certain related transactions to be taxable to Air Products for U.S. federal income tax purposes. These restrictions may limit our ability to pursue certain strategic transactions or other transactions that we believe to be in the best interests of our stockholders or that might increase the value of our business. |

The Air Products board of directors concluded that the potential benefits of the separation outweighed these negative factors. For more information, see “The Separation and Distribution—Reasons for the Separation” and “Risk Factors.”

Description of Indebtedness

We intend to enter into certain senior secured credit facilities, which we expect will be comprised of (i) a senior secured first lien term loan B facility in an aggregate principal amount of $575 million (the “Term Facility”, and the loans thereunder, the “Term Loans”) and (ii) a senior secured first lien revolving credit facility in an aggregate principal amount of $200 million (the “Revolving Facility” and, together with the Term Facility, the “Senior Credit Facilities”). We intend to use the proceeds of the Term Facility to fund, in part, the distribution to Air Products for its contribution of assets to us in connection with the separation. The Revolving Facility will be used to provide funds for our ongoing working capital requirements after the separation and for general corporate purposes. A portion of the Revolving Facility is expected to be available in certain agreed upon currencies other than US dollars and the Revolving Facility is expected to have a sublimit for swingline loans in US dollars and issuances of letters of credit in US dollars and other certain agreed upon currencies.

Prior to the separation and distribution, we anticipate that we will distribute in-kind to Air Products unsecured senior notes with a term of eight years in a total aggregate principal amount of up to approximately $425 million, which will be partial consideration for the contribution of assets to us by Air Products in connection with the separation. Versum will not receive any cash proceeds from the issuance of these notes. We expect that Air Products will exchange these notes for its outstanding debt.

As a result of these transactions, at or shortly prior to the time of the distribution, we expect to incur approximately $1.0 billion of new third-party indebtedness, $975 million of which will be distributed, in cash or in-kind, to Air Products in partial consideration for the contribution of assets to us in connection with the separation.

For more information, see “Financing Arrangements.”

Separation Payments and Costs

We will make a cash distribution of approximately $550 million to Air Products prior to the distribution, primarily funded by third party indebtedness that we will have incurred. For more information, see “Financing Arrangements”. The completion of the cash distribution will be a condition to the consummation of the separation under the Separation Agreement. Air Products has informed Versum that Air Products expects to incur and pay one-time costs associated with the separation, including legal and advisory costs, in the range of $40 to $50 million. Additionally, in connection with the separation and distribution, Versum expects to incur and pay non-recurring transaction, transition, financing and other expenses, including legal and advisory costs, of approximately $20 to $25 million prior to or shortly after the distribution. For more information, see “Risk Factors—Risks Related to the Separation” and “Certain Relationships and Related Person Transactions—Our Relationship with Air Products Following the Separation.”

Indemnification Obligations to Air Products

In connection with our separation we will assume, and indemnify Air Products for certain liabilities, including for certain tax matters. Most of our indemnification obligations to Air Products will be uncapped and

10

Table of Contents

may include, among other items, associated defense costs, settlement amounts and judgments. Payments pursuant to these indemnities may be significant and could negatively impact our business. Each of these risks could negatively affect our financial condition, results of operations and cash flows. For more information, see Note 12, “Commitments and Contingencies” to the Annual Combined Financial Statements, “Certain Relationships and Related Person Transactions—Our Relationship with Air Products Following the Separation—The Separation Agreement” and “Risk Factors—Risks Related to the Separation.”

Regulatory Approval

Versum must complete the necessary registration under U.S. federal securities laws of Versum common stock, as well as the applicable NYSE listing requirements for such shares.

Based on current information, there are no material governmental or regulatory filings or approvals that are expected to prevent or delay the separation and distribution.

No Appraisal Rights

Air Products’ stockholders will not have any appraisal rights in connection with the distribution.

Dividend Policy

The payment and amount of any future dividends will be subject to the sole discretion of our post-distribution, independent board of directors and will depend upon many factors, including our financial condition and prospects, our capital requirements and access to capital markets, covenants associated with certain of our debt obligations, legal requirements and other factors that our board of directors may deem relevant. There can be no assurance that we will pay a dividend in the future.

Transfer Agent

Following the separation and distribution, Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”) will serve as transfer agent and registrar for our common stock.

Stock Exchange Listing

Currently, there is no public trading market for Versum’s common stock. Versum intends to apply to list its common stock on the NYSE under the symbol “VSM”.

Corporate Information

Versum was organized in the state of Delaware on November 17, 2015 as Versum Materials, LLC., Versum was converted from a limited liability company to a Delaware corporation on September 8, 2016. The address of Versum’s principal executive offices is 7201 Hamilton Boulevard, Allentown, Pennsylvania 18195. Versum’s telephone number is (610) 481-7499.

11

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| What is Versum and how is Air Products separating Versum’s business and distributing its stock? |

Versum is currently a wholly owned subsidiary of Air Products. In connection with the separation, Air Products will transfer to Versum employees, operations, assets and liabilities associated with Air Products’ Electronic Materials business and certain other current and former businesses and activities of Air Products. The distribution will be effected by means of a distribution of Versum common stock on a pro rata basis to Air Products’ stockholders. Following the separation, Versum will be a separate company from Air Products, and Air Products will not retain any ownership interest in Versum. |

| Why am I receiving this document? |

Air Products is delivering this document to you because you are a holder of Air Products common stock. If you are a holder of Air Products common stock as of the close of business on September 21, 2016, the record date for the distribution, you are entitled to receive one-half of a share of our common stock for every share of Air Products common stock that you hold at the close of business on such date. This document will help you understand how the separation will affect your investment in Air Products and your investment in Versum after the separation. |

| What are the reasons for the separation? |

The Air Products board of directors determined that the separation of the Versum business from the Air Products business would be in the best interests of Air Products and its stockholders and approved the separation. A wide variety of factors were considered by Air Products’ board of directors in evaluating the separation. Among other things, Air Products’ board of directors considered the following potential benefits of the separation: |

| • | The separation will allow management of each company to focus on the opportunities and challenges specific to that company’s business, including the adoption of capital structures and resource allocation policies that reflect the financial and strategic characteristics of each business; |

| • | The separation will permit each company to offer stock-based incentive compensation to its employees and executives that is more closely aligned with the performance of that company’s business; |

| • | The separation will facilitate obtaining debt and equity financing necessary to execute Versum’s business plans and ability to pursue tailored acquisition strategies; |

| • | The separation will facilitate acquisitions by Versum by improving the attractiveness of its capital stock as an acquisition currency; |

| • | The separation will allow the investment community to better understand and evaluate the distinct characteristics of each company’s business and the respective industries of the businesses; and |

12

Table of Contents

| • | The separation will improve capital investment flexibility and free both businesses from capital competition. |

| Air Products’ board of directors also considered a number of potentially negative factors in evaluating the separation, including risks relating to the creation of a new public company, possible increased administrative costs and one-time separation costs, but concluded that the potential benefits of the separation outweighed these factors. For more information, see “The Separation and Distribution—Reasons for the Separation” and “Risk Factors.” |

| What do stockholders need to do to |

Nothing. You are not required to take any action to receive your Versum shares, although you are urged to read this entire document carefully. No stockholder approval of the distribution is required or sought. Therefore, you are not being asked for a proxy to vote on the separation or the distribution. You will not be required to pay anything for the shares of Versum common stock or to surrender any shares of Air Products common stock to participate in the distribution. Please do not send in your Air Products stock certificates. |

| What is the record date for the distribution? |

Air Products will determine record ownership as of the close of business on September 21, 2016, which we refer to as the “record date.” |

| Will the number of Air Products shares I own change as a result of the distribution? |

No, the number of shares of Air Products common stock you own will not change as a result of the distribution. |

| What will I receive in the distribution? |

If you hold Air Products common stock as of the record date, on the distribution date you will receive one-half of a share of our common stock for every share of Air Products common stock that you hold at the close of business on the record date. You will receive only whole shares of our common stock in the distribution. For more information, see “The Separation and Distribution.” |

| How will fractional shares be treated in the distribution? |

You will not receive any fractional shares of Versum common stock in connection with the distribution. Instead, the distribution agent will aggregate all fractional shares into whole shares and sell the whole shares in the open market at prevailing market prices on behalf of stockholders entitled to receive a fractional share. The distribution agent will then distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to these holders (net of any required withholding for taxes applicable to each holder). You will not be entitled to any interest on the amount of payment made to you in lieu of fractional shares. |

| How many shares of Versum common stock will be distributed? |

The actual number of shares of Versum common stock that Air Products will distribute will depend on the number of shares of Air Products common stock outstanding on the record date. The shares of our common stock that Air Products distributes will constitute all of the issued and outstanding shares of our common stock immediately prior to the distribution. For more information on the shares being distributed, see “Description of Our Capital Stock.” |

13

Table of Contents

| When will the distribution occur? |

It is expected that the distribution will be effected on October 1, 2016, which we refer to as the “distribution date.” On or shortly after the distribution date, the whole shares of Versum common stock will be credited in book-entry accounts for stockholders entitled to receive the shares in the distribution. We expect the distribution agent, acting on behalf of Air Products, to take about two weeks after the distribution date to fully distribute to Air Products stockholders any cash in lieu of the fractional shares they are entitled to receive. For more information on how to access your book-entry account or your bank, brokerage or other account holding the Versum common stock you receive in the distribution, see “How will Air Products distribute shares of Versum common stock?” |

| What are the conditions to the distribution? |

The distribution is subject to a number of conditions, including, among others: |

| • | The SEC having declared effective the registration statement on Form 10, of which this information statement forms a part; no stop order relating to the registration statement being in effect, nor any proceeding seeking such stop order being pending, and the information statement having been distributed to Air Products’ stockholders; |

| • | Versum’s common stock having been approved and accepted for listing by the NYSE, subject to official notice of distribution; |

| • | Receipt by Air Products of an opinion of tax counsel confirming that the contribution and distribution generally should be tax-free to Air Products and its stockholders for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code; |

| • | Receipt of an opinion from an independent appraisal firm by the board of directors of Air Products confirming the solvency of each of Air Products and Versum after the distribution that is in form and substance acceptable to Air Products in its sole discretion; |

| • | No order, injunction, or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, distribution or any of the related transactions being in effect; |

| • | The internal reorganization of the Air Products and Versum businesses prior to the contribution and distribution having been completed to the satisfaction of the board of directors of Air Products; |

| • | The approval by the board of directors of Air Products of the distribution and all related transactions (and such approval not having been withdrawn); |

| • | Air Products’ election of our post-distribution board of directors, as described in this information statement, immediately prior to the distribution date; |

14

Table of Contents

| • | Our having entered into certain agreements in connection with the separation and distribution and certain financing arrangements prior to or concurrent with the separation; |

| • | The distribution in-kind of the unsecured senior notes to Air Products and the making of a $550 million cash distribution from Versum to Air Products prior to the distribution, and the determination by Air Products in its sole discretion that following the separation it shall have no further liability or obligation whatsoever under any financing arrangements that Versum will be entering into in connection with the separation; |

| • | Receipt by Versum of all permits, registrations and consents required under the securities or blue sky laws of states or other political subdivisions of the United States or of foreign jurisdictions in connection with the distribution; and |

| • | No events or developments shall have occurred or exist that, in the sole and absolute judgment of the board of directors of Air Products, make it inadvisable to effect the distribution or would result in the distribution and related transactions not being in the best interest of Air Products or its stockholders. |

| We cannot assure you that any or all of the conditions will be satisfied or waived. For more information, see “The Separation and Distribution—Conditions to the Distribution.” |

| Can Air Products decide to cancel the distribution even if all the conditions have been satisfied? |

Yes. Until the distribution has occurred, Air Products has the right to terminate the distribution, even if all the conditions have been satisfied. Air Products has informed us that, to the extent the board of directors of Air Products determines to waive, or take any action to amend or modify, any condition in a manner that is material or abandon the distribution, Air Products will issue a press release publicly announcing such decision. |

| If I sell my Air Products shares prior to the distribution, will I still be entitled to receive shares of Versum in the distribution? |

If you hold shares of Air Products common stock on the record date and decide to sell them on or before the distribution date, you may choose to sell your Air Products common stock with or without your entitlement to Versum common stock. Beginning on or shortly before the record date and continuing up to and through the distribution, it is expected that there will be two markets in Air Products common stock: a “regular-way” market and an “ex-distribution” market. Shares of Air Products common stock that trade in the “regular-way” market will trade with an entitlement to shares of Versum common stock distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without an entitlement to shares of Versum common stock distributed pursuant to the distribution. |

| You should discuss these alternatives with your bank, broker or other nominee. For more information, see “The Separation and Distribution—Trading Between the Record Date and the Distribution Date.” |

| How will Air Products distribute shares of Versum common stock? |

Registered stockholders: If you are a registered stockholder (meaning you hold physical Air Products stock certificates or you own your shares of Air Products common stock directly through an account |

15

Table of Contents

| with Air Products’ transfer agent), Broadridge, the distribution agent, will credit the whole shares of Versum common stock you receive in the distribution to your book-entry account on or shortly after the distribution date. About two weeks after the distribution date, the distribution agent will mail you a book-entry account statement that reflects the number of whole shares of Versum common stock you own, along with a check for any cash in lieu of fractional shares you are entitled to receive. You will be able to access information regarding your book-entry account holding the Versum shares at Broadridge using the same credentials that you use to access your Air Products account. You may also contact Broadridge at (720) 414-6875 (U.S. and Canada) or 1-844-730-9019 (all other locations). |

| “Street name” or beneficial stockholders: If you own your shares of Air Products common stock beneficially through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with the whole shares of Versum common stock you receive in the distribution on or shortly after the distribution date. Please contact your bank, broker or other nominee for further information about your account. |

| We will not issue any physical stock certificates to any stockholders, even if requested. For more information, see “The Separation and Distribution—When and How You Will Receive the Distribution.” |

| What are the U.S. federal income tax consequences of the distribution? |

Assuming that the contribution and distribution qualify as a transaction that is tax-free to Air Products and its stockholders for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code, Air Products stockholders will not be required, for U.S. federal income tax purposes, to recognize any gain or loss (except with respect to any cash received in lieu of fractional shares) or to include any amount in their income upon the receipt of shares of Versum’s common stock pursuant to the distribution. |

| For more information regarding the potential U.S. federal income tax consequences of the contribution and distribution, see “U.S. Federal Income Tax Consequences.” You should consult your tax advisor as to the particular tax consequences of the contribution and distribution to you. |

| How will I determine my tax basis in my shares of Air Products common stock and the Versum shares I receive in the distribution? |

Assuming that the distribution qualifies as tax-free to Air Products’ stockholders for U.S. federal income tax purposes, except for cash received in lieu of fractional shares, your aggregate tax basis in the common stock that you hold in Air Products and the new Versum common stock received in the distribution (including any fractional share interest in Versum common stock for which cash is received) will equal the aggregate basis in the Air Products common stock held by you immediately before the distribution, allocated between your Air Products common stock and the Versum common stock (including any fractional share interest in Versum common stock for which cash is received) you receive in the distribution in proportion to the relative fair market value of each on the distribution date. |

16

Table of Contents

| Air Products will provide its stockholders with information to enable them to compute their tax basis in both Air Products and Versum shares. This information will be posted on Air Products’ website, www.airproducts.com, promptly following the distribution date. You should consult your tax advisor about the particular consequences of the contribution and distribution to you, including the application of the tax basis allocation rules and the application of state, local and non-U.S. tax laws. |

| Will the distribution affect the trading price of my Air Products shares? |

Yes. As a result of the distribution, Air Products expects the trading price of Air Products common stock immediately following the distribution to be lower than the “regular-way” trading price of such shares immediately prior to the distribution because the trading price will no longer reflect the value of the Versum business. Air Products believes that, following the separation, assuming the same market conditions and the realization of the expected benefits of the separation, Air Products common stock and Versum common stock over time should have a higher combined aggregate market value compared to what the market value of Air Products’ common stock would be if the separation did not occur. There can be no assurance, however, that such a higher aggregate market value will be achieved. This means, for example, that the combined trading prices of one share of Air Products common stock and one-half of a share of Versum common stock after the distribution may be equal to, greater than or less than the trading price of one share of Air Products common stock before the distribution. |

| When will I be able to trade my Versum shares? |

Currently, there is no public market for our common stock. Versum intends to apply to list its common stock on the NYSE under the symbol “VSM”. |

| Versum anticipates that trading in shares of its common stock will begin on a “when-issued” basis on or shortly before the record date and will continue up to and through the distribution date and that “regular-way” trading in Versum’s common stock will begin on the first trading day following the completion of the separation. If trading begins on a “when-issued” basis, you may purchase or sell Versum’s common stock up to and through the distribution date, but your transaction will not settle until after the distribution date. Versum cannot predict the trading prices for its common stock before, on or after the distribution date. |

| Will my Air Products shares continue to trade after the distribution? |

Yes. Air Products common stock will continue to trade on the NYSE under the symbol “APD” after the distribution. |

| Do I have appraisal rights in connection with the distribution? |

No. Holders of Air Products stock are not entitled to appraisal rights in connection with the distribution. |

| What will be the relationship between Air Products and Versum following the separation? |

Versum will enter into a Separation Agreement with Air Products to effect the separation and to provide a framework for Versum’s relationship with Air Products after the separation and distribution and will also enter into certain other agreements, such as a Transition |

17

Table of Contents

| Services Agreement, a Tax Matters Agreement, an Employee Matters Agreement, an Intellectual Property License Agreement and certain manufacturing, service, leasing and supply agreements and patent assignments. These agreements will provide for the terms of the allocation between Versum and Air Products of Air Products’ and our assets, employees, liabilities and obligations (including investments, property, employee benefits, and tax-related assets and liabilities) attributable to periods prior to, at and after Versum’s separation from Air Products and will govern the relationship between Versum and Air Products subsequent to the completion of the separation and distribution. For more information regarding the Separation Agreement and other transaction agreements, see “Risk Factors—Risks Related to the Separation” and “Certain Relationships and Related Person Transactions—Our Relationship with Air Products Following the Separation.” |

| What will happen to Air Products equity compensation awards in connection with the distribution? |

Air Products equity compensation awards granted under Air Products’ Long-Term Incentive Plan will generally be adjusted in connection with the distribution to maintain their economic value before and after the distribution. The number and exercise price (if any) of Air Products stock options, restricted stock units and performance shares held by Air Products employees following the distribution will be adjusted to maintain the economic value of such awards. Air Products stock options, restricted stock units and performance shares held by Versum employees following the distribution will generally be converted into new Versum equity compensation awards, with the number and exercise price (if any) of such awards adjusted to maintain the economic value of such awards, but will otherwise remain subject to the same vesting and other terms and conditions applicable to the corresponding Air Products equity compensation awards prior to the distribution. Holders of Air Products restricted stock will receive one-half of a fully vested share of Versum common stock for every share of Air Products restricted stock held at the time of the distribution, as if such holder held fully vested Air Products common stock on the record date. Air Products directors who hold Air Products deferred stock units under the Deferred Compensation Program for Directors will be credited with one half of a Versum deferred stock unit for each Air Products deferred stock unit. For more information regarding the treatment of Air Products equity compensation awards in connection with the distribution, see the section entitled “Treatment of Outstanding Equity Awards at the Time of Separation.” |

| What are Versum’s financing arrangements? |

At or shortly prior to the time of the distribution, we expect to incur approximately $1.0 billion of new third-party indebtedness, $975 million of which will be distributed, in cash or in-kind, to Air Products in partial consideration for the contribution of assets to us in connection with the separation. For more information, see “Financing Arrangements.” |

| Does Versum intend to pay cash dividends? |

The payment and amount of any future dividends will be subject to the sole discretion of our post-distribution, independent board of directors and will depend upon many factors, including our financial |

18

Table of Contents

| condition and prospects, our capital requirements and access to capital markets, covenants associated with certain of our debt obligations, legal requirements and other factors that our board of directors may deem relevant, and there can be no assurance that we will pay a dividend. |

| Are there risks associated with owning |

Yes. Our business faces both general and specific risks and uncertainties. Our business also faces risks relating to the separation. Following the separation, we will also face risks associated with being an independent, publicly traded company. You should read carefully the information set forth in “Risk Factors.” |

| Who is the distribution agent, transfer |

Following the separation and distribution, Broadridge will serve as transfer agent and registrar for our common stock. |

| Broadridge has two additional roles in the distribution: |

| • | Broadridge currently serves and will continue to serve as Air Products’ transfer agent and registrar. |

| • | In addition, Broadridge will serve as the distribution agent in the distribution and will assist Air Products in the distribution of our common stock to Air Products’ stockholders. |

| Where can I get more information? |

If you have any questions relating to the mechanics of the distribution, you should contact Broadridge at: |

| (720) 414-6875 (U.S. & Canada) or 1-844-730-9019 (outside U.S. & Canada) |

| Before the separation and distribution, if you have any questions relating to the separation and distribution, you should contact Air Products at: |

| (610) 481-7461 (for Institutional Holders) |

| (610) 481-8657 (for Individual Holders) |

| Individual Holders: After the separation and distribution, if you have any questions relating to Versum, you should contact us at: |

| Investor Relations: (610) 481-7499 |

| Individual Holders: After the separation and distribution, if you have any questions relating to Air Products, you should contact them at: |

| Air Products Shareholder Relations: (610) 481-8657 |

| Institutional Holders: After the separation and distribution, if you have any questions relating to Versum, you should contact us at: |

| Investor Relations: (610) 481-7499 |

| Institutional Holders: After the separation and distribution, if you have any questions relating to Air Products, you should contact them at: |

| Air Products Investor Relations: (610) 481-7461 |

19

Table of Contents

You should carefully consider the following risks and other information in this information statement in evaluating us and our common stock. The risk factors generally have been separated into three groups: risks related to our business, risks related to the separation and risks related to our common stock.

Any of the following risks could materially and adversely affect our financial condition, results of operations or cash flows. Our operations could be affected by various risks, many of which are beyond our control. Based on current information, we believe that the following list identifies the most significant risk factors that could affect our financial condition, results of operations or cash flows. There may be additional risks and uncertainties that adversely affect our financial condition, results of operations or cash flows in the future that are not presently known, are not currently believed to be material, or are not identified below because they are common to all businesses. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. For more information, see “Cautionary Statement Concerning Forward-Looking Statements.”

Risks Related to Our Business

Overall Economic and Supply/Demand Conditions—Economic conditions or product supply versus demand imbalance in the semiconductor industry or certain geographic markets in which we do business may decrease the demand for our goods and services and adversely impact our financial condition, results of operations and cash flows.