Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TERRAFORM GLOBAL, INC. | glbl8-kbondholderproposala.htm |

1

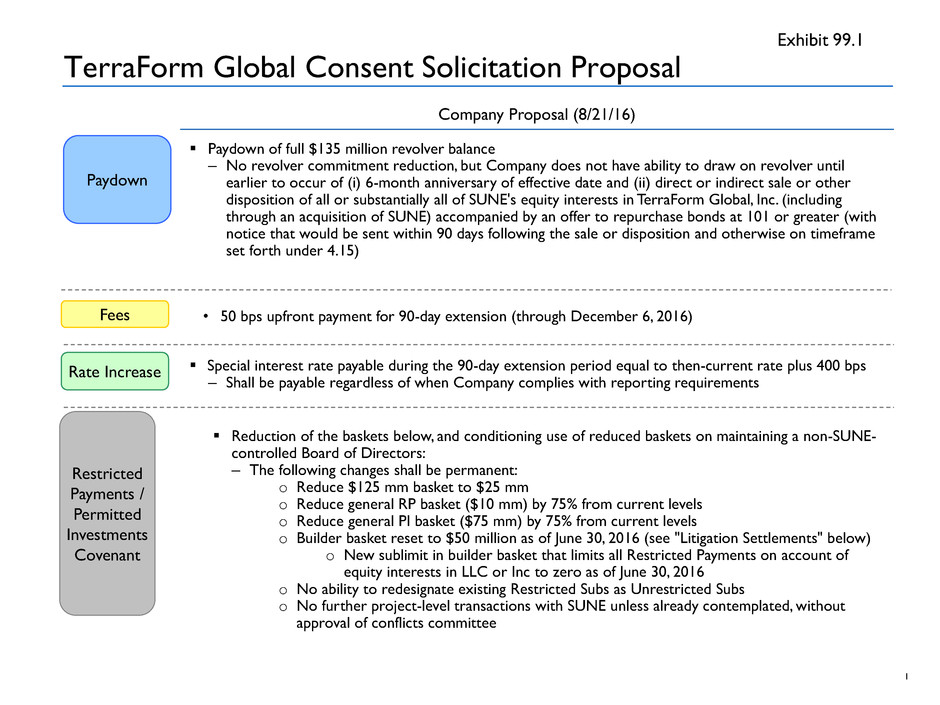

TerraForm Global Consent Solicitation Proposal

Company Proposal (8/21/16)

Paydown

Fees

Rate Increase

�ƒPaydown of full $135 million revolver balance

– No revolver commitment reduction, but Company does not have ability to draw on revolver until

earlier to occur of (i) 6-month anniversary of effective date and (ii) direct or indirect sale or other

disposition of all or substantially all of SUNE's equity interests in TerraForm Global, Inc. (including

through an acquisition of SUNE) accompanied by an offer to repurchase bonds at 101 or greater (with

notice that would be sent within 90 days following the sale or disposition and otherwise on timeframe

set forth under 4.15)

�ƒSpecial interest rate payable during the 90-day extension period equal to then-current rate plus 400 bps

– Shall be payable regardless of when Company complies with reporting requirements

• 50 bps upfront payment for 90-day extension (through December 6, 2016)

Restricted

Payments /

Permitted

Investments

Covenant

�ƒReduction of the baskets below, and conditioning use of reduced baskets on maintaining a non-SUNE-

controlled Board of Directors:

– The following changes shall be permanent:

o Reduce $125 mm basket to $25 mm

o Reduce general RP basket ($10 mm) by 75% from current levels

o Reduce general PI basket ($75 mm) by 75% from current levels

o Builder basket reset to $50 million as of June 30, 2016 (see "Litigation Settlements" below)

o New sublimit in builder basket that limits all Restricted Payments on account of

equity interests in LLC or Inc to zero as of June 30, 2016

o No ability to redesignate existing Restricted Subs as Unrestricted Subs

o No further project-level transactions with SUNE unless already contemplated, without

approval of conflicts committee

Exhibit 99.1

2

TerraForm Global Consent Solicitation Proposal (Cont’d)

Company Proposal (8/21/16)

Debt / Lien

Covenant

�ƒReduction of the baskets below, and conditioning use of reduced baskets on maintaining a non-SUNE-

controlled Board of Directors:

– Increase ratio needed to incur ratio debt from FCCR 2.0x to 3.0x

– Reduce general debt basket ($125 mm) by 75% from current levels

– Reduce general lien basket ($50 mm) by 75% from current levels

– Delete debt baskets for A/R factoring, guarantees of Unrestricted Sub debt ($50 mm)

– Reduce Credit Facility basket to $350 mm

– The following changes shall only be in effect until a direct or indirect sale or other disposition of all or

substantially all of SUNE's equity interests in TerraForm Global, Inc. (including through an acquisition of

SUNE) accompanied by an offer to repurchase bonds at 101 or greater (with notice that would be sent

within 90 days following the sale or disposition and otherwise on timeframe set forth under 4.15)

o Builder basket changes:

• Increase FCCR from 1.75x to 2.25x

• Limit builder basket growth (for all purposes) to 70% Cumulative CAFD, with a cap of $15

mn for Q3 2016 and cap of $21 mn for subsequent quarters

o Limit PI baskets under clauses (2), (6) (solely as it relates to whole plant acquisitions) and (12)

to those currently existing

�ƒFor the avoidance of doubt, Company shall retain the right to tender for bonds in any amount and for

whatever price it chooses

Restricted

Payments /

Permitted

Investments

Covenant

(Con’t)

Exhibit 99.1

3

TerraForm Global Consent Solicitation Proposal (Cont’d)

Company Proposal (8/21/16)

Other Terms

�ƒCompliance with reporting covenants is tolled if the Company publicly announces a board-approved

binding M&A transaction with an offer to repurchase bonds at 101 or greater; provided that such tolling

shall cease in the event that such M&A transaction and offer have not been consummated within 6 months

of such announcement.

– If the M&A transaction has been consummated within 6 months of such announcement, (a) historical

compliance with reporting covenant will be waived and (b) the Company will be required to comply

with the reporting covenants on a going-forward basis, beginning for quarterly reports with the first full

quarter that is at least three months after consummation of such M&A transaction and for annual

reports with the first full fiscal year after consummation of such M&A transaction

�ƒCancellation of treasury notes

�ƒDelete 4.18 (covenant fall away)

�ƒAdvisors will receive all reporting provided to Revolver advisors on a consistent timetable. This includes:

– Financial statements for Q2 and Q3 2016 by 75 days after fiscal quarter

– Comparison to respective fiscal quarter for prior year

– Financial Officer Certification

– Explanation of differences between info relating to Parent and its Subs (other than Holdings and its Subs)

vs. Holdings and its Subs on a stand-alone basis

– Updated org chart

– Cooperate with Evercore to prepare updates to forecasts of project level CAFD for FY 2016

�ƒIn addition:

– Provide Evercore with monthly Holdco cash balances

– Updates on audit process

– Updates on defaults and waivers for project-level debt

Advisor

Info

Exhibit 99.1

4

TerraForm Global Consent Solicitation Proposal (Cont’d)

Company Proposal (8/21/16)

Litigation

Claim

Settlements

The Parent, the Issuer and the Restricted Subsidiaries may settle any litigation claim (or may provide an

affiliate, including TerraForm Global Inc. with consideration to settle a litigation claim) without restriction

unless the aggregate cash payments by the Parent, the Issuer and the Restricted Subsidiaries in connection

with such settlement excluding (A) payment of professional fees and expenses, (B) payments reimbursed or

to be reimbursed by insurance or (C) payments with respect to which reimbursement has actually been

received from any third party ("Net Settlement Payments"), exceed $5 million.

Until the public announcement of a board-approved, binding M&A transaction with an offer to repurchase

the bonds at price of 101 or greater, settlement of any litigation claim by the Parent, the Issuer or a

Restricted Subsidiary (or the provision of consideration by such parties to an affiliate to settle a litigation

claim) involving Net Settlement Payments in excess of $5 million cash shall require (A) approval of the Board

of Directors of Inc. or the Conflicts Committee of Inc. or LLC, as applicable and (B) for settlements on

account of a Junior Claim, application of the amount of Net Settlement Payments in excess of $5 million cash

to reduce the builders basket.

"Junior Claim" means (a) a claim against the Issuer or any Guarantor of the bonds that would be

subordinated to such Issuer's or Guarantor's obligation to pay the bonds under 11 USC 510 in a hypothetical

chapter 11 case where such Issuer or Guarantor were a debtor and (b) any claim against TerraForm Global,

Inc. (other than related to tax claims) for which the Parent, Issuer or a Restricted Subsidiary are not directly

or indirectly liable.

Exhibit 99.1