Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Jones Lang LaSalle Income Property Trust, Inc. | q2investorletter.htm |

Quarterly Update

Q2 2016

1

OFFERING

JLL Income Property Trust (JLLIPT) is an institutionally

managed, non-listed real estate investment trust (REIT). The

offering is perpetual and its net asset value (NAV) is calculated

and posted daily. An investment in JLLIPT gives investors

access to a diversified portfolio of core commercial real estate

investments.

Real estate investments, such as JLLIPT, have the potential to

address a portion of an investor’s income needs, may enhance

the overall performance of their broader investment portfolio,

and may offer the potential for appreciation over a longer-term

time horizon.

This sales and advertising literature is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the prospectus. This literature must be read

in conjunction with the prospectus in order to fully understand all of the implications and risks of the offering of securities to which the prospectus relates. A copy

of the prospectus must be made available to you in connection with any offering. No offering is made except by a prospectus filed with the Department of Law of the State

of New York. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of

our common stock, determined if the prospectus is truthful or complete, or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

INVESTMENT OBJECTIVES

Generate attractive income for distribution to stockholders

Preserve and protect invested capital

Achieve NAV appreciation over time

Enable the use of real estate as a component of portfolio

diversification

There can be no guarantee that these objectives will be achieved.

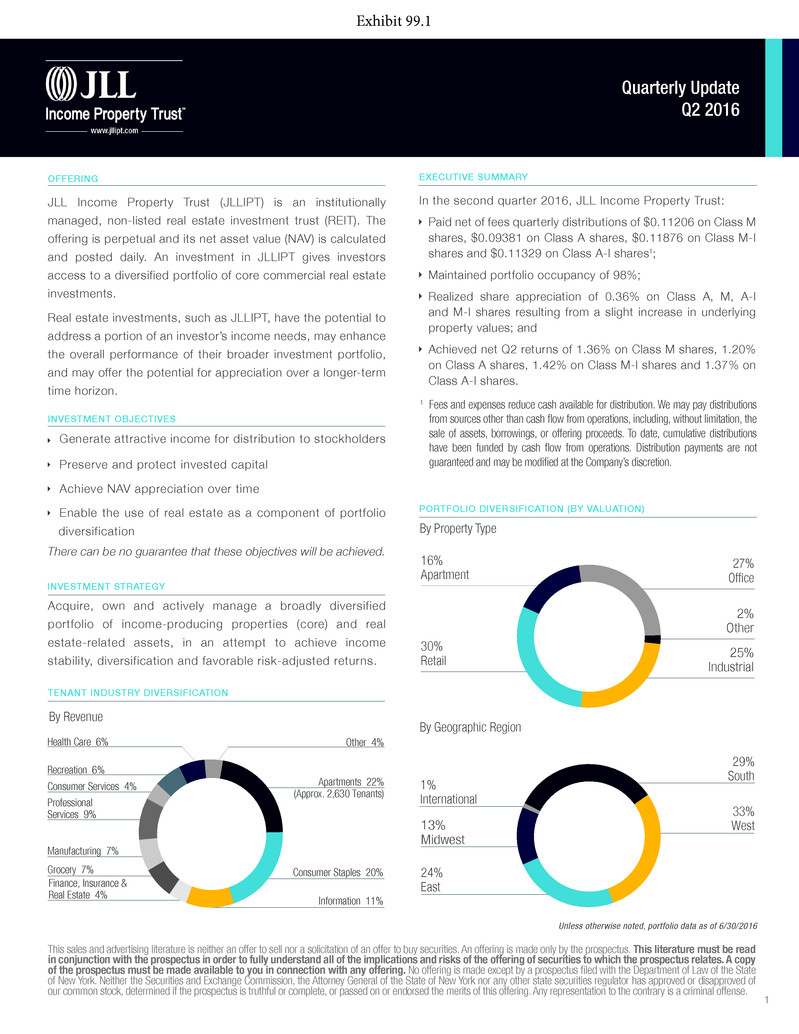

TENANT INDUSTRY DIVERSIFICATION

Unless otherwise noted, portfolio data as of 6/30/2016

EXECUTIVE SUMMARY

In the second quarter 2016, JLL Income Property Trust:

Paid net of fees quarterly distributions of $0.11206 on Class M

shares, $0.09381 on Class A shares, $0.11876 on Class M-I

shares and $0.11329 on Class A-I shares1;

Maintained portfolio occupancy of 98%;

Realized share appreciation of 0.36% on Class A, M, A-I

and M-I shares resulting from a slight increase in underlying

property values; and

Achieved net Q2 returns of 1.36% on Class M shares, 1.20%

on Class A shares, 1.42% on Class M-I shares and 1.37% on

Class A-I shares.

By Geographic Region

PORTFOLIO DIVERSIFICATION (BY VALUATION)

By Property Type

By Revenue

Acquire, own and actively manage a broadly diversified

portfolio of income-producing properties (core) and real

estate-related assets, in an attempt to achieve income

stability, diversification and favorable risk-adjusted returns.

INVESTMENT STRATEGY

Professional

Services 9%

Consumer Staples 20%

Information 11%

Manufacturing 7%

Other 4%Health Care 6%

Finance, Insurance &

Real Estate 4%

Grocery 7%

Apartments 22%

(Approx. 2,630 Tenants)

Recreation 6%

Consumer Services 4%

16%

Apartment

25%

Industrial

2%

Other

27%

Office

30%

Retail

13%

Midwest

33%

West

24%

East

1%

International

29%

South

1 Fees and expenses reduce cash available for distribution. We may pay distributions

from sources other than cash flow from operations, including, without limitation, the

sale of assets, borrowings, or offering proceeds. To date, cumulative distributions

have been funded by cash flow from operations. Distribution payments are not

guaranteed and may be modified at the Company’s discretion.

Exhibit 99.1

2

Quarterly Update | June 30, 2016

FEATURED PROPERTIES

VALENCIA INDUSTRIAL PORTFOLIO

Location Valencia (Los Angeles), CA

Type Industrial

Square Feet 492,000 (5 buildings)

Date Acquired June 2016

Occupancy 100%

Five-building, 100% leased industrial portfolio located in an infill location in Greater

Los Angeles, the largest industrial market in the U.S. with roughly 1.6 billion square

feet, an overall market vacancy rate of less than 2%, and near double-digit projected

annual rent growth for the next three years.

PIONEER TOWER

Location Portland, OR

Type Office

Square Feet 296,000

Date Acquired June 2016

Occupancy 95%

17-story, 95% leased, Class A office building in the heart of Portland’s central

business district, located at the intersection of Portland’s burgeoning technology

triangle that is home to Google, Salesforce, eBay, Airbnb and TripWire. Property

boasts direct access to worldclass Pioneer Place shopping and its Transit Mall.

LANE PARKE APARTMENTS

JLLIPT PORTFOLIO MANAGEMENT TEAM

C. Allan Swaringen

President & CEO

27 Years Real Estate Experience

17 Years with LaSalle Investment Management

Brian Kuzniar

Portfolio Manager

19 Years Real Estate Experience

8 Years with LaSalle Investment Management

Location Mountain Brook (Birmingham), AL

Type Apartment

Number of Units 276

Date Acquired May 2016

Occupancy 97%

Newly constructed apartments with luxury amenities located in Mountain Brook, a

suburb of Birmingham with a zip code rated among the top 5% most wealthy in the

United States. The area boasts upscale demographics, a high median home purchase

price of $470,000, and No. 1 rated schools in Alabama.

RETURNS SUMMARY1

DISTRIBUTION SUMMARY3

NAV

LASALLE INVESTMENT MANAGEMENT (ADVISOR)

LaSalle Investment Management (LaSalle), JLL Income Property Trust’s

Advisor and the investment management division of JLL, has been one

of the world’s leading global real estate investment managers for more

than 30 years. LaSalle only invests in real estate, bringing a unique focus

and depth of experience to the sector. The firm specializes in providing

comprehensive, multidisciplinary real estate investment services to

a broad range of institutional and individual investors from across the

globe. With nearly 700 employees in 17 countries worldwide, LaSalle

manages approximately $59.1 billion of assets (as of June 30, 2016) on

behalf of clients invested across all major property types. As a registered

investment advisor that has managed real estate assets for institutional

clients since 1980, the firm is among the largest managers of institutional

capital invested in real estate and real estate-related assets.

JLL (SPONSOR)

With over 58,100 professionals operating in more than 230 corporate

offices across 80 countries, and a portfolio of approximately 3.4 billion

square feet worldwide, JLL is a highly regarded global real estate

services company and the sponsor of JLL Income Property Trust.

3

This information is distributed by LaSalle Investment Management Distributors, LLC

(member FINRA/SIPC), an affiliate of Jones Lang LaSalle Incorporated and LaSalle

Investment Management, Inc. LaSalle Investment Management Distributors is the dealer

manager for this offering. The Company is advised by LaSalle Investment Management,

Inc. (“LaSalle”). For details, talk with your investment advisor or visit www.jllipt.com today.

1 Past performance is no guarantee of future results. All returns shown in the table are net of Company expenses and advisory fees and assume reinvestment of distributions. Net

returns shown are net of applicable share class specific fees. Class A and A-I shares are available for brokerage accounts, subject to suitability requirements. Class M and M-I shares

are available through fee-based programs, wrap accounts, registered investment advisors, and other institutional and fiduciary accounts, subject to suitability requirements. See Notes

section on back page for share class specific fees.

2 Class M and A shares went effective with the SEC on October 1, 2012 at an initial offering price of $10.00 per share. The inception date for Class M-I and A-I shares was July 1, 2014.

3 Fees and expenses reduce cash available for distribution. We may pay distributions from sources other than cash flow from operations, including, without limitation, the sale of assets,

borrowings, or offering proceeds. To date, cumulative distributions have been funded by cash flow from operations. Distribution payments are not guaranteed and may be modified at

the Company’s discretion.

4 NAV is reported based on the fair value of assets less liabilities. The returns have been prepared using unaudited data and valuations of the underlying investments in the Company’s

portfolio, which are done by our independent valuation advisor. Valuations based upon unaudited or estimated reports from the underlying investments may be subject to later

adjustments or revisions. The returns are net of all advisory fees (e.g. the fixed and performance advisory fee) and Company expenses (e.g. administration, organization, legal and

accounting fees, and transaction expenses) and include capital gains and other earnings. Current performance may be higher or lower than the performance quoted herein. The

investment return and principal value of an investment will fluctuate so that an investment may be worth more or less than its original cost. No representation or warranty is made as

to the efficacy of any particular strategy or the actual returns that may be achieved. Our daily NAV can be found on our website at www.jllipt.com and our toll-free line, 855.652.0277.

5 Total assets at fair value are reported at pro-rata share for properties with joint ownership.

6 Average remaining lease term excludes our apartment properties as these leases are generally one year in term.

Unless otherwise noted, portfolio data as of 6/30/2016

333 West Wacker Drive, Chicago, IL 60606

www.jllipt.com - 855.823.5521

PORTFOLIO SUMMARY

Total Assets (at fair value)5 $1.9 billion

Net Asset Value (NAV) $1.2 billion

Company Leverage Ratio 37%

Number of Properties 62

Total Commercial Square Feet,

Apartment Units and Parking Stalls

10.5 million sq. ft.,

1,587 units & 706 stalls

Geographic Diversification 16 States and Canada

Portfolio Occupancy 98%

Average Remaining Lease Term6 6.4 years

Investment Strategy Diversified - Core

Inception Date2 October 1, 2012

Tax Reporting 1099-DIV

Minimum Initial Investment $10,000

Class M Class A Class M-I Class A-I

Q2 Return (Gross) 1.43% 1.43% 1.43% 1.43%

Q2 Return (Net) 1.36% 1.20% 1.42% 1.37%

2016 YTD Return (Gross) 2.32% 2.32% 2.32% 2.32%

2016 YTD Return (Net) 2.10% 1.87% 2.31% 2.20%

Since Inception Return (Gross)2 7.54% 7.54% 8.80% 8.80%

Since Inception Return (Net)2 7.17% 6.55% 8.79% 8.53%

Q2 Distribution per Share (Net) $0.11206 $0.09381 $0.11876 $0.11329

YTD Distribution per Share (Net) $0.22387 $0.18805 $0.23750 $0.22535

NAV per Share4 (on 6/30/16) $11.21 $11.19 $11.22 $11.22

This report is current as of the date noted, is solely for informational purposes, and does not purport to address the financial objectives, situation, or specific need of any

individual reader. Opinions and estimates expressed herein are as of the date of the report and are subject to change without notice. Neither the information nor any opinion

expressed represents a solicitation for the purchase or sale of any security. Economic or financial forecasts are inherently limited and should not be relied on as an indicator

of future investment performance.

Past performance is no guarantee of future results. The returns shown in this document are intended to represent investment results for the Company for the period stated and

are not predictive of future results. Nothing herein should be construed as a solicitation of clients, or as an offer to sell or a solicitation of an offer to invest in the Company.

Such investments may be offered only pursuant to a prospectus. Certain information herein has been obtained from public and third party sources and, although believed to

be reliable, has not been independently verified and its accuracy, completeness or fairness cannot be guaranteed.

NOTES

The selling commission is a percentage of the NAV per share paid on Class A and A-I shares on the date of purchase and may be reduced or eliminated for certain categories

of purchasers. The dealer manager fee accrues daily in an amount equal to 1/365th of the percentage of the NAV for such day on a continuous basis. All share class specific

fees are paid to the dealer manager and may be reallowed to participating broker-dealers.

SUMMARY OF RISK FACTORS

You should read the prospectus carefully for a description of the risks associated with an investment in JLL Income Property Trust. Some of these risks include but are not

limited to the following:

Since there is no public trading market for shares of our common stock, repurchases of shares by us after a one-year minimum holding period will likely be the only way to

dispose of your shares.

After a required one-year holding period, we limit the amount of shares that may be repurchased under our repurchase plan to approximately 5% of our net asset value (NAV)

per quarter and 20% of our NAV per annum. Because our assets will consist primarily of properties that generally cannot be readily liquidated, we may not have sufficient

liquid resources to satisfy repurchase requests. Further, our board of directors may modify or suspend our repurchase plan if it deems such action to be in the best interest

of our stockholders. As a result, our shares have limited liquidity and at times may be illiquid.

The purchase and redemption price for shares of our common stock will be based on the NAV of each class of common stock and will not be based on any public trading

market. Because valuation of properties is inherently subjective, our NAV may not accurately reflect the actual price at which our assets could be liquidated on any given day.

We are dependent on our advisor to conduct our operations. We will pay substantial fees to our advisor, which increases your risk of loss.

We have a history of operating losses and cannot assure you that we will achieve profitability.

Our advisor will face conflicts of interest as a result of, among other things, time constraints, allocation of investment opportunities, and the fact that the fees it will receive

for services rendered to us will be based on our NAV, which it is responsible for calculating.

The amount of distributions we make is uncertain and there is no assurance that future distributions will be made. We may pay distributions from sources other than cash

flow from operations, including, without limitation, the sale of assets, borrowings, or offering proceeds.

Our use of leverage increases the risk of your investment.

If we fail to maintain our status as a REIT, and no relief provisions apply, we would be subject to serious adverse tax consequences that would cause a significant reduction

in our cash available for distribution to our stockholders and potentially have a negative impact on our NAV.

FORWARD-LOOKING STATEMENT DISCLOSURE

This literature contains forward-looking statements within the meaning of federal securities laws and regulations. These forward-looking statements are identified by their

use of terms such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” and other similar terms,

including references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance and involve known and unknown

risks, uncertainties, and other factors that may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. These

risks, uncertainties, and contingencies include, but are not limited to, the following: our ability to effectively raise capital in our offering; uncertainties relating to changes in

general economic and real estate conditions; uncertainties relating to the implementation of our investment strategy; and other risk factors as outlined in our registration

statement on Form S-11 (Registration No. 333-196886) and periodic reports filed with the Securities and Exchange Commission. Although we believe the expectations

reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurance that the expectations will be attained or that any deviation

will not be material. We undertake no obligation to update any forward-looking statement contained herein to conform the statement to actual results or changes in our

expectations.

Copyright © 2016 LaSalle Investment Management, Inc. All rights reserved. No part of this publication may be reproduced by any means, whether graphically, electronically,

mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system

without prior permission of LaSalle.

LS-QTR-0816ARSGRGC9

SHARE CLASS SPECIFIC FEES

Class A Shares Class A-I Shares Class M Shares Class M-I Shares

Availability

(Subject to suitability requirements) Through brokerage and transactional-based accounts

Through fee-based programs, wrap accounts, registered investment

advisors, and other institutional and fiduciary accounts

Minimum Initial Investment $10,000 $1,000,000 $10,000 $1,000,000

Selling Commission up to 3.50% up to 1.50% None None

Dealer Manager Fee 1.05% 0.30% 0.30% 0.05%

MANAGEMENT FEES

Description

Fixed Fee Accrues daily in an amount equal to 1/365th of 1.25% of the NAV for each share class

Performance Fee Calculated for each share class as 10% of the total return in excess of 7% per annum on a calendar-year basis