Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED BANKSHARES INC/WV | d235836d8k.htm |

| EX-99.1 - EX-99.1 - UNITED BANKSHARES INC/WV | d235836dex991.htm |

| EX-2.1 - EX-2.1 - UNITED BANKSHARES INC/WV | d235836dex21.htm |

EXHIBIT 99.2

Merger Between

United Bankshares, Inc.

and Cardinal Financial Corporation

Investor Presentation

August 18, 2016

United Bankshares, Inc. to Acquire

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements about United Bankshares, Inc., which we believe are within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of United including statements preceded by, followed by or that include the words “believes,” “expects,” “anticipates” or similar expressions. These forward-looking statements involve certain risks and uncertainties. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) competitive pressures among depository institutions increase significantly; (2) changes in interest rate environment reduce interest margins; (3) prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; (4) general economic conditions, either national or in the states in which United does business, are less favorable than expected; (5) legislative or regulatory changes adversely affect the businesses in which United is engaged; (6) changes in the securities markets. Further information on other factors, which could affect the financial results of United, are included in United’s filings with the Securities and Exchange Commission. These documents are available free of charge at the Commission’s website at www.sec.gov and/or from United. August 2016

TRANSACTION SUMMARY Continues United’s history of successful bank M&A transactions Cardinal Financial Corp. is UBSI’s 31st Acquisition; 10th in Washington, D.C. MSA Low-risk acquisition of a high-performing, in-market competitor Solidifies UBSI’s Position as “The Community Bank of the Nation’s Capital” Increases market share in highly attractive Washington, D.C. metro area Conservative assumptions produce a financially compelling transaction Pro forma 32nd largest banking company in the country based upon market cap

TRANSACTION RATIONALE Accretive to GAAP EPS in first full year Immediately accretive to TBV per share Conservative 25% cost savings assumption No revenue enhancements assumed Maintain “well-capitalized” regulatory capital ratios Further solidifies United as the largest community bank in the Metro D.C. area with approximately $20 billion in assets Strong Financial Transaction with Conservative Assumptions Maintains #1 deposit market share amongst independent community banks Solidifies market share rank in D.C. MSA (from #8 to #7 by deposits) Washington, D.C. MSA is home to 5 of the Top 10 wealthiest counties in the U.S., including the Top 31 Premier “Local” VA / Metro D.C. Franchise In market acquisition of a high-performing competitor High growth commercial loan portfolio and core deposit franchise 30 banking offices and $3.2 billion in deposits in demographically attractive D.C. Metro area 1.39% ROAA and 12.9% ROAE in 2016 Q2 Outstanding asset quality: no non-accrual loans 63% of CFNL branches are within one mile of UBSI branches Diversified fee income sources: George Mason Mortgage, LLC Top 25 in Retail Volume and Top 35 in Total Volume in the U.S. in 2015 The Right Partner in the Right Market Data per US Census Bureau as of December 2015.

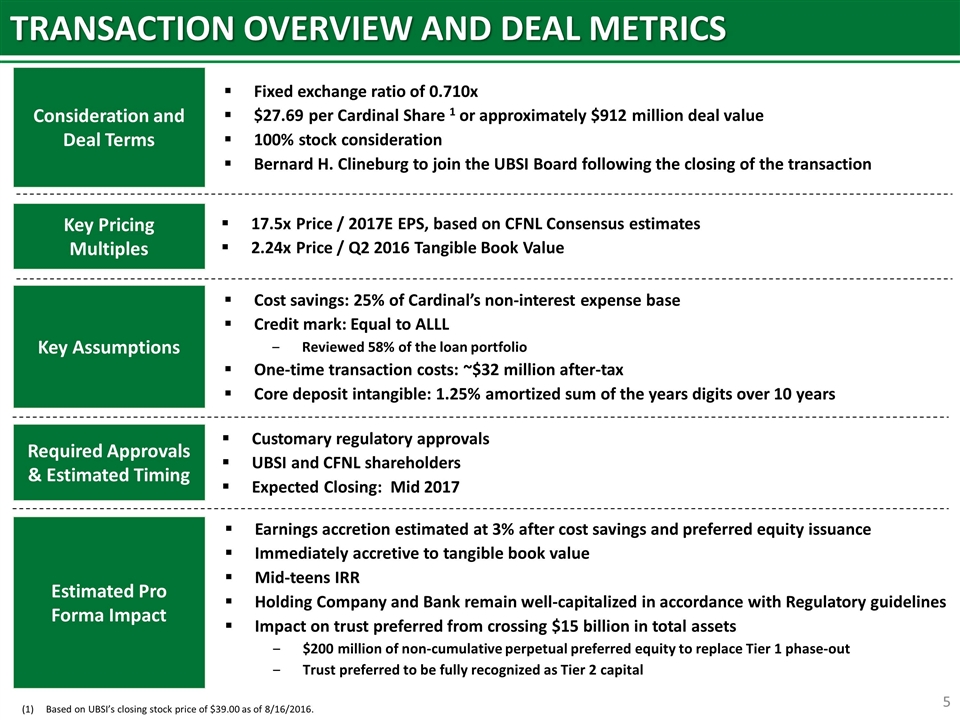

TRANSACTION OVERVIEW AND DEAL METRICS Fixed exchange ratio of 0.710x $27.69 per Cardinal Share 1 or approximately $912 million deal value 100% stock consideration Bernard H. Clineburg to join the UBSI Board following the closing of the transaction Consideration and Deal Terms Customary regulatory approvals UBSI and CFNL shareholders Expected Closing: Mid 2017 Required Approvals & Estimated Timing Based on UBSI’s closing stock price of $39.00 as of 8/16/2016. Key Assumptions Earnings accretion estimated at 3% after cost savings and preferred equity issuance Immediately accretive to tangible book value Mid-teens IRR Holding Company and Bank remain well-capitalized in accordance with Regulatory guidelines Impact on trust preferred from crossing $15 billion in total assets $200 million of non-cumulative perpetual preferred equity to replace Tier 1 phase-out Trust preferred to be fully recognized as Tier 2 capital Cost savings: 25% of Cardinal’s non-interest expense base Credit mark: Equal to ALLL Reviewed 58% of the loan portfolio One-time transaction costs: ~$32 million after-tax Core deposit intangible: 1.25% amortized sum of the years digits over 10 years Estimated Pro Forma Impact 17.5x Price / 2017E EPS, based on CFNL Consensus estimates 2.24x Price / Q2 2016 Tangible Book Value Key Pricing Multiples

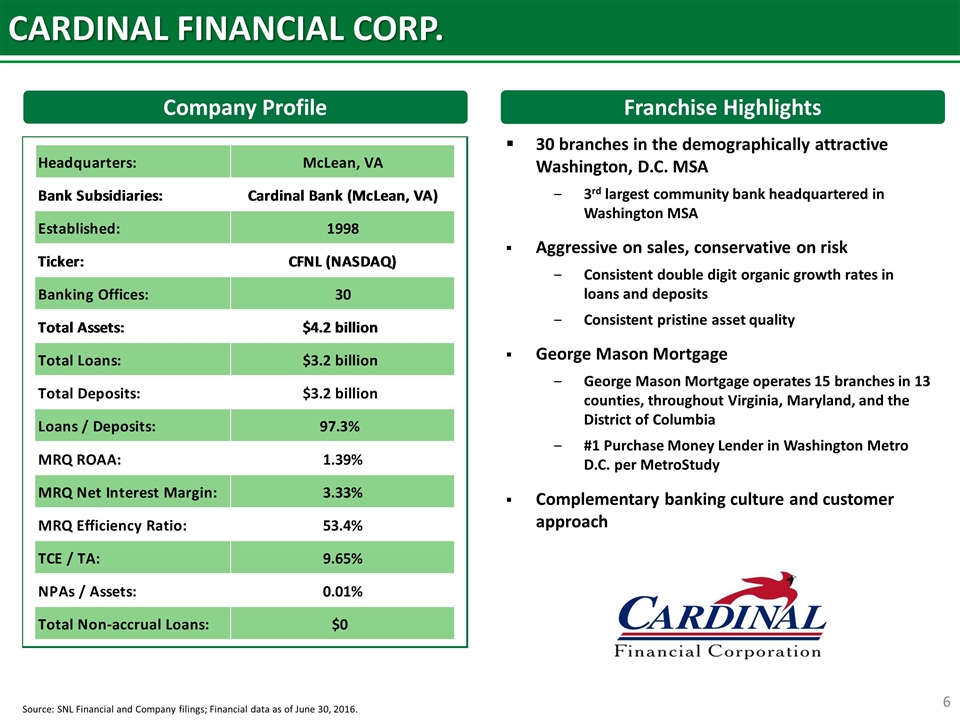

CARDINAL FINANCIAL CORP. Company Profile Franchise Highlights Source: SNL Financial and Company filings; Financial data as of June 30, 2016. 30 branches in the demographically attractive Washington, D.C. MSA 3rd largest community bank headquartered in Washington MSA Aggressive on sales, conservative on risk Consistent double digit organic growth rates in loans and deposits Consistent pristine asset quality George Mason Mortgage George Mason Mortgage operates 15 branches in 13 counties, throughout Virginia, Maryland, and the District of Columbia #1 Purchase Money Lender in Washington Metro D.C. per MetroStudy Complementary banking culture and customer approach

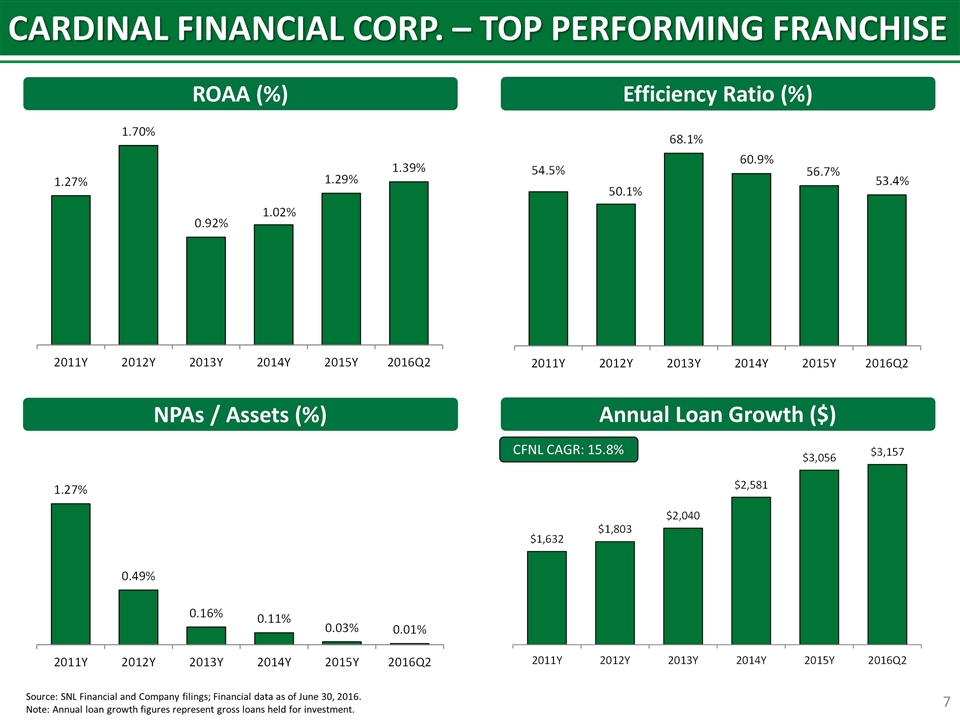

CARDINAL FINANCIAL CORP. – TOP PERFORMING FRANCHISE ROAA (%) Efficiency Ratio (%) NPAs / Assets (%) Annual Loan Growth ($) Source: SNL Financial and Company filings; Financial data as of June 30, 2016. Note: Annual loan growth figures represent gross loans held for investment. CFNL CAGR: 15.8%

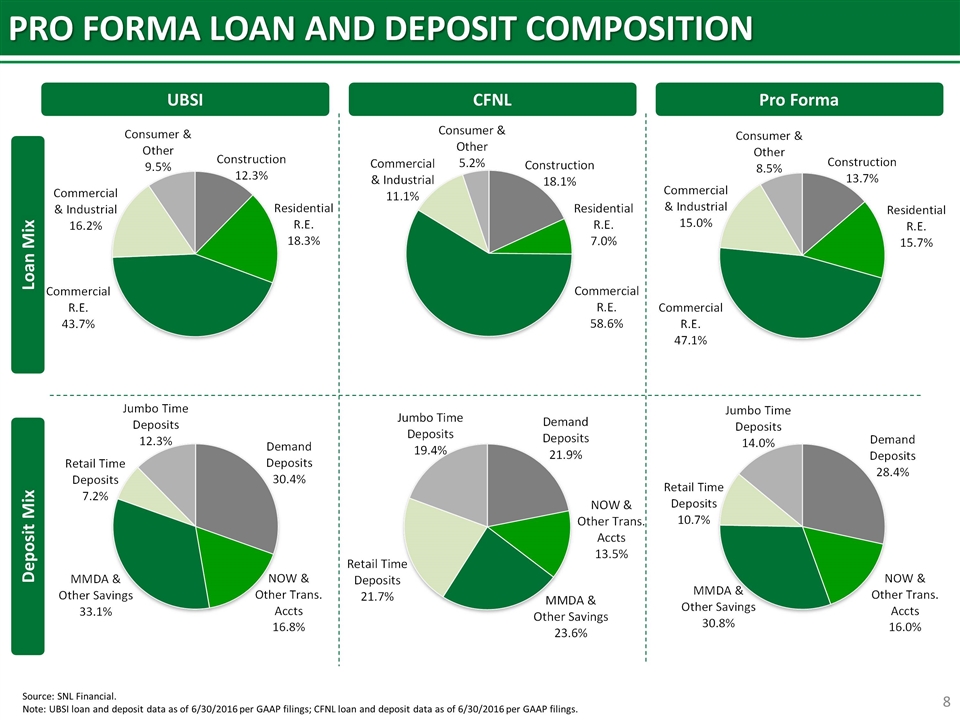

PRO FORMA LOAN AND DEPOSIT COMPOSITION UBSI CFNL Source: SNL Financial. Note: UBSI loan and deposit data as of 6/30/2016 per GAAP filings; CFNL loan and deposit data as of 6/30/2016 per GAAP filings. Pro Forma Loan Mix Deposit Mix

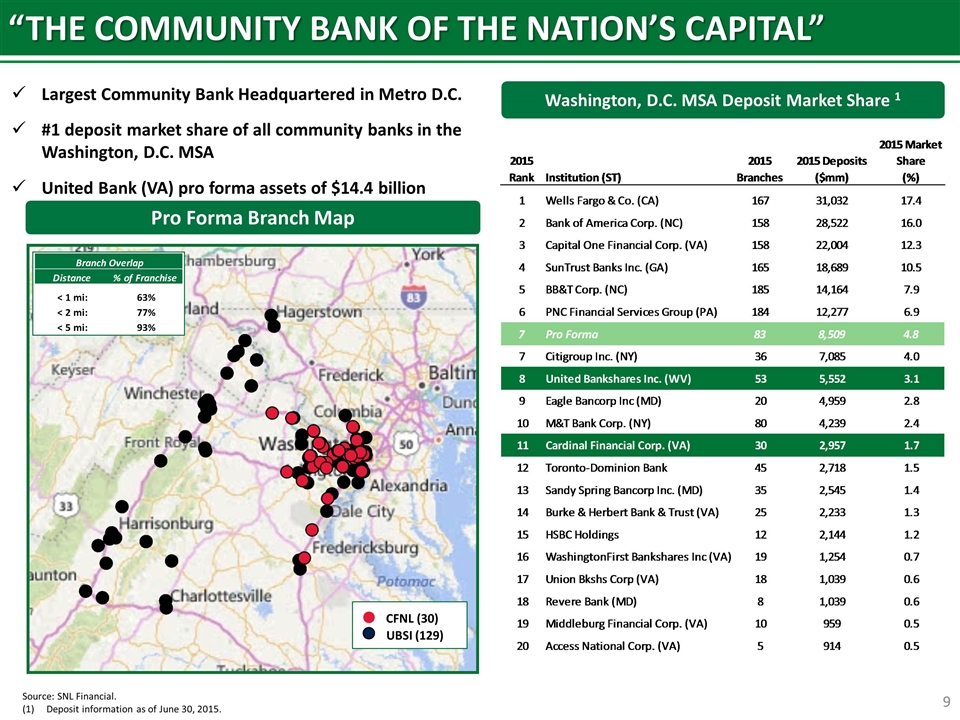

“THE COMMUNITY BANK OF THE NATION’S CAPITAL” Largest Community Bank Headquartered in Metro D.C. #1 deposit market share of all community banks in the Washington, D.C. MSA United Bank (VA) pro forma assets of $14.4 billion Pro Forma Branch Map Source: SNL Financial. Deposit information as of June 30, 2015. Washington, D.C. MSA Deposit Market Share 1 CFNL (30) UBSI (129)

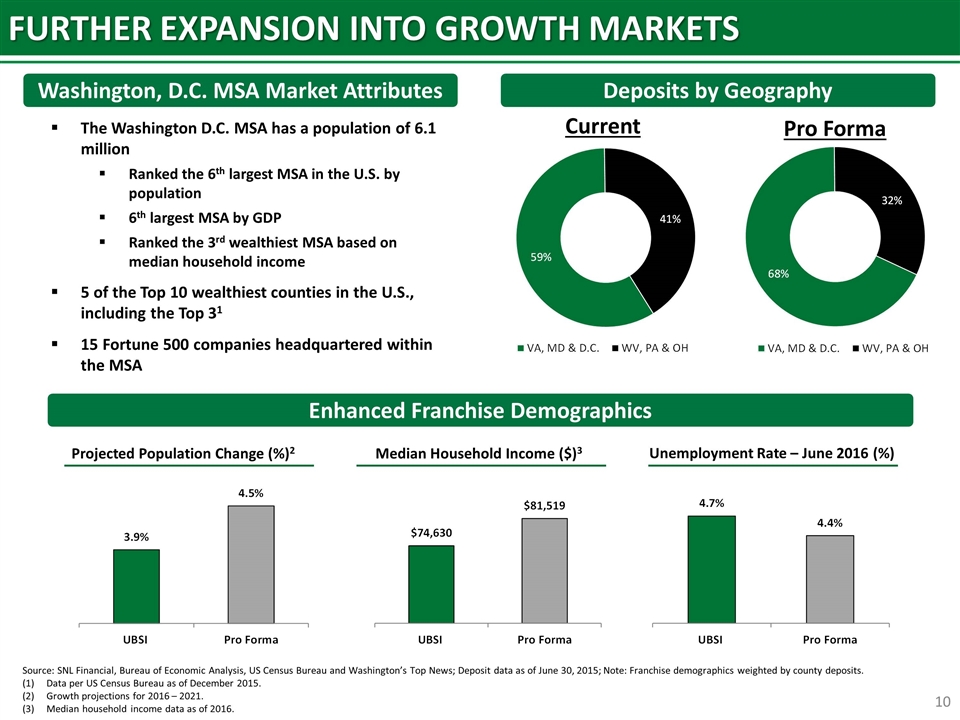

FURTHER EXPANSION INTO GROWTH MARKETS Washington, D.C. MSA Market Attributes Deposits by Geography Enhanced Franchise Demographics Source: SNL Financial, Bureau of Economic Analysis, US Census Bureau and Washington’s Top News; Deposit data as of June 30, 2015; Note: Franchise demographics weighted by county deposits. Data per US Census Bureau as of December 2015. Growth projections for 2016 – 2021. Median household income data as of 2016. The Washington D.C. MSA has a population of 6.1 million Ranked the 6th largest MSA in the U.S. by population 6th largest MSA by GDP Ranked the 3rd wealthiest MSA based on median household income 5 of the Top 10 wealthiest counties in the U.S., including the Top 31 15 Fortune 500 companies headquartered within the MSA Median Household Income ($)3 Unemployment Rate – June 2016 (%) Projected Population Change (%)2 Current Pro Forma